Deck 1: The Foreign Exchange Market

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/71

Play

Full screen (f)

Deck 1: The Foreign Exchange Market

1

A trader makes profit by buying a currency at a low price in one market and immediately selling it in another market.This activity is called:

A) Speculation

B) Arbitrage

C) Hedging

D) Squaring off

A) Speculation

B) Arbitrage

C) Hedging

D) Squaring off

Arbitrage

2

If the price of Japanese yen in terms of U.S.dollars is $0.01/yen,then the price of U.S.dollar in terms of Japanese yen is equal to ___________.

A) 0.01 yen per dollar

B) 10.0 yen per dollar

C) 100 yen per dollar

D) 110 yen per dollar

A) 0.01 yen per dollar

B) 10.0 yen per dollar

C) 100 yen per dollar

D) 110 yen per dollar

100 yen per dollar

3

The __________ exchange rate is the price for "immediate" currency exchange.

A) Current

B) Forward

C) Future

D) Spot

A) Current

B) Forward

C) Future

D) Spot

Spot

4

Suppose an exchange rate between Korean won and U.S.dollar is 1,000 Korean won per dollar.A hotel vacation package in Korea with a price of 500,000 Korean won will cost:

A) $50

B) $500.

C) $1,000.

D) $500,000,000

A) $50

B) $500.

C) $1,000.

D) $500,000,000

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

5

To "square off,"

A) a bank adjusts its buy and sell rates of a currency to receive "zero" spread.

B) a bank increases its buy rate, but decreases its sell rate.

C) a bank decreases its buy rate, but increases its sell rate.

D) a bank could raise both buy and sell rates or lower both buy and sell rates to return to its desired foreign currency holding position.

A) a bank adjusts its buy and sell rates of a currency to receive "zero" spread.

B) a bank increases its buy rate, but decreases its sell rate.

C) a bank decreases its buy rate, but increases its sell rate.

D) a bank could raise both buy and sell rates or lower both buy and sell rates to return to its desired foreign currency holding position.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

6

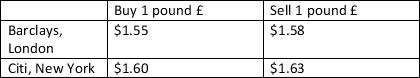

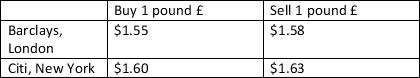

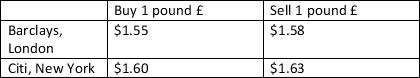

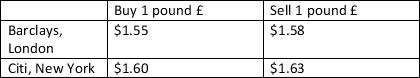

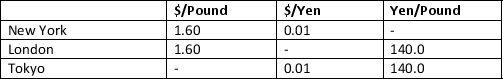

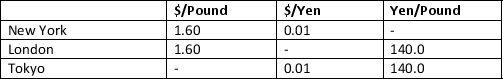

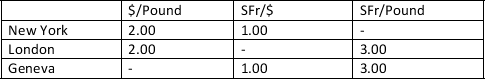

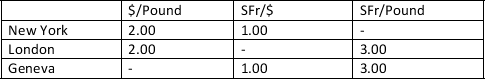

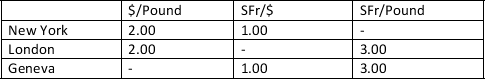

Use the following information about the spot exchange rates to answer the questions 18 - 20.

Suppose that the spot exchange rates for British pound quoted in two locations are:

Suppose that you have £1 million,you can make arbitrage profit by selling pounds for dollars in _________ and selling dollars for pounds in _______.

A) New York; London

B) New York; New York

C) London; New York

D) London; London

Suppose that the spot exchange rates for British pound quoted in two locations are:

Suppose that you have £1 million,you can make arbitrage profit by selling pounds for dollars in _________ and selling dollars for pounds in _______.

A) New York; London

B) New York; New York

C) London; New York

D) London; London

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

7

Suppose that Citibank buys a large amount of Japanese yen from Toyota and Citibank does not want to continue holding too much yen.How should Citibank adjust its buy rate and sell rate of the yen yen per dollar to "square off"?

A) Citibank has to raise both buy and sell rates.

B) Citibank has to raise the buy rate, but lower the sell rate.

C) Citibank has to lower the buy rate, but raise the sell rate.

D) Citibank has to lower both buy and sell rates.

A) Citibank has to raise both buy and sell rates.

B) Citibank has to raise the buy rate, but lower the sell rate.

C) Citibank has to lower the buy rate, but raise the sell rate.

D) Citibank has to lower both buy and sell rates.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

8

Suppose the dollar price of Thai baht THB is $0.025/THB.Thai Airways purchases a $10 million airplane from Boeing.This airplane would cost ___________ Thai baht to Thai Airways.

A) 0.25 million

B) 2.5 million

C) 40 million

D) 400 million

A) 0.25 million

B) 2.5 million

C) 40 million

D) 400 million

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

9

Rising income in China triggers an increase demand for U.S.imported goods by Chinese households.This causes ________ Chinese yuan and yuan should_________ against the dollar.

A) an increase in the demand for; appreciate

B) an increase in the demand for; depreciate

C) an increase in the supply of; appreciate

D) an increase in the supply of; depreciate

A) an increase in the demand for; appreciate

B) an increase in the demand for; depreciate

C) an increase in the supply of; appreciate

D) an increase in the supply of; depreciate

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

10

You have accessed the following spot rates:

U.S.dollar per pound = 1.50

Yen per U.S.dollar = 100.0

What is the exchange rate yen per pound?

A) 0.01 yen per pound

B) 0.015 yen per pound

C) 66.67 yen per pound

D) 150 yen per pound

U.S.dollar per pound = 1.50

Yen per U.S.dollar = 100.0

What is the exchange rate yen per pound?

A) 0.01 yen per pound

B) 0.015 yen per pound

C) 66.67 yen per pound

D) 150 yen per pound

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

11

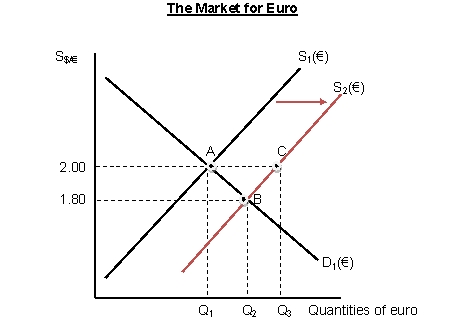

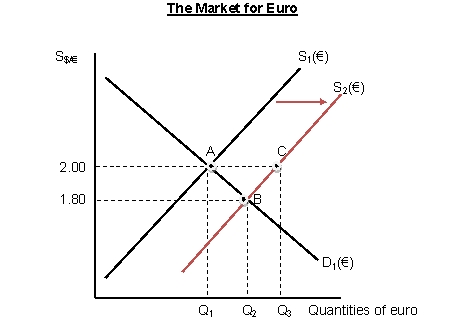

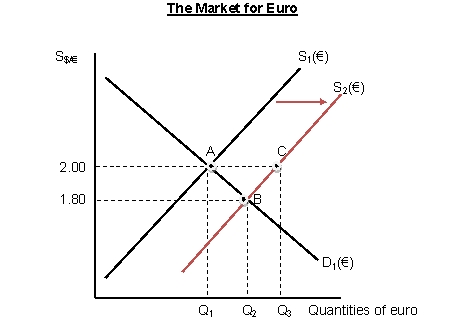

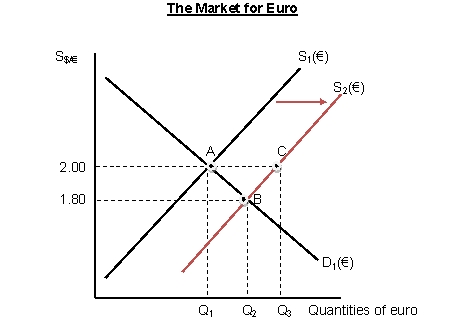

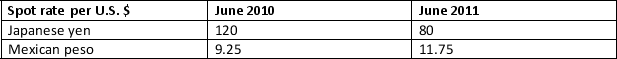

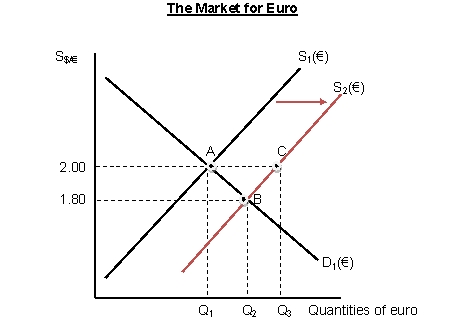

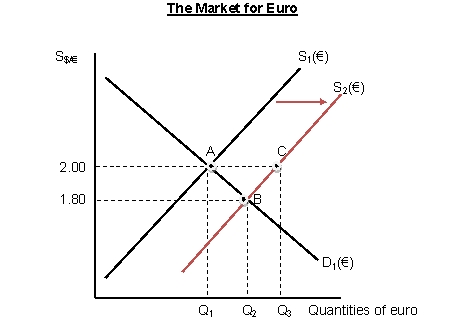

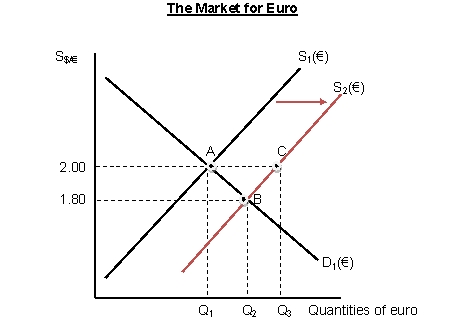

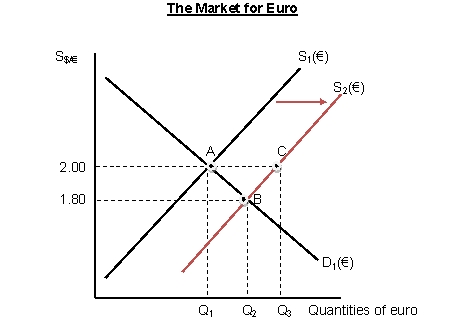

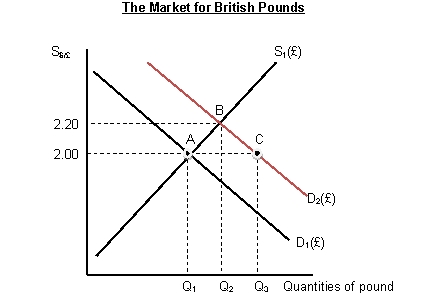

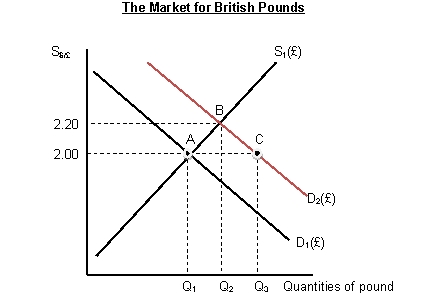

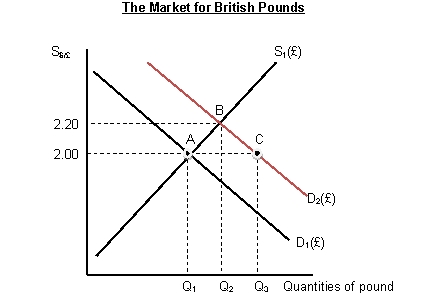

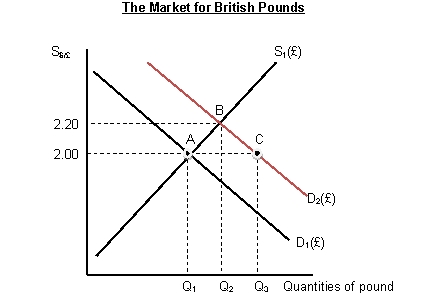

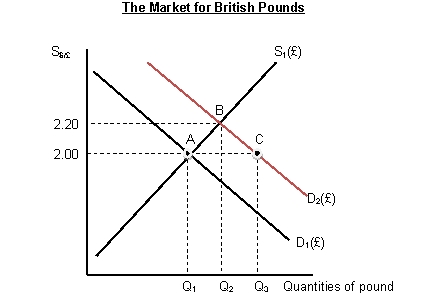

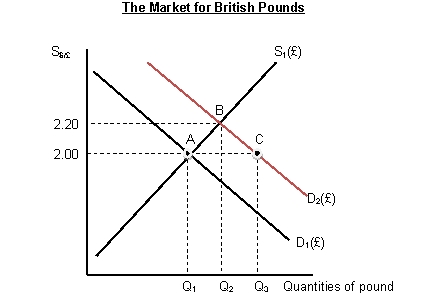

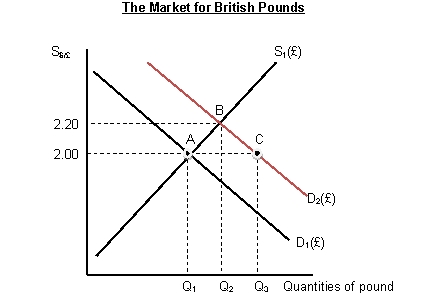

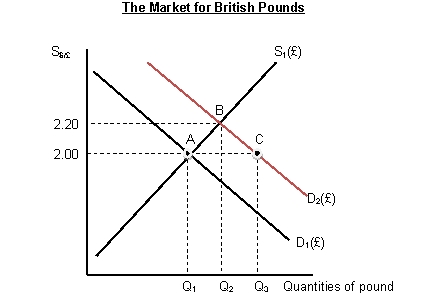

Use the graph below to answer questions 17- 20.

Figure 1.2

Refer to Figure 1.2.Suppose that the market for euro is initially in equilibrium at point A with the exchange rate $2.00 per euro.Then the supply curve shifts to S2.If the European central bank wants to fix the exchange rate at $2.00/euro,they have to:

A) buy euro and sell dollar by the amount of Q3 - Q1.

B) sell euro and buy dollar by the amount of Q3 - Q1.

C) sell only euro by the amount of Q3 - Q1 and leave dollar alone.

D) buy only euro by the amount of Q3 - Q1 and leave dollar alone.

Figure 1.2

Refer to Figure 1.2.Suppose that the market for euro is initially in equilibrium at point A with the exchange rate $2.00 per euro.Then the supply curve shifts to S2.If the European central bank wants to fix the exchange rate at $2.00/euro,they have to:

A) buy euro and sell dollar by the amount of Q3 - Q1.

B) sell euro and buy dollar by the amount of Q3 - Q1.

C) sell only euro by the amount of Q3 - Q1 and leave dollar alone.

D) buy only euro by the amount of Q3 - Q1 and leave dollar alone.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

12

Use the following information about the spot exchange rates to answer the questions 18 - 20.

Suppose that the spot exchange rates for British pound quoted in two locations are:

Suppose that you have £1 million,how much arbitrage profit can you make?

A) £-30,674.85

B) £12,658.23

C) £31,627.64

D) £51,612.90

Suppose that the spot exchange rates for British pound quoted in two locations are:

Suppose that you have £1 million,how much arbitrage profit can you make?

A) £-30,674.85

B) £12,658.23

C) £31,627.64

D) £51,612.90

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

13

Use the graph below to answer questions 17- 20.

Figure 1.2

Refer to Figure 1.2.Suppose that the market for euro is initially in equilibrium at point A with the exchange rate $2.00 per euro.Then the supply curve shifts to S2.If the European central bank wants to fix the exchange rate at $2.00/euro,there will be ________ of euro and the euro is __________.

A) excess supply; overvalued

B) excess supply; undervalued

C) excess demand; overvalued

D) excess demand; undervalued

Figure 1.2

Refer to Figure 1.2.Suppose that the market for euro is initially in equilibrium at point A with the exchange rate $2.00 per euro.Then the supply curve shifts to S2.If the European central bank wants to fix the exchange rate at $2.00/euro,there will be ________ of euro and the euro is __________.

A) excess supply; overvalued

B) excess supply; undervalued

C) excess demand; overvalued

D) excess demand; undervalued

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

14

Rising income in the United States triggers an increased demand for imports.This causes:

A) an increase in the demand for foreign currency

B) decrease in the demand for foreign currency

C) an increase in the supply of foreign currency

D) a decrease in the supply of foreign currency

A) an increase in the demand for foreign currency

B) decrease in the demand for foreign currency

C) an increase in the supply of foreign currency

D) a decrease in the supply of foreign currency

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

15

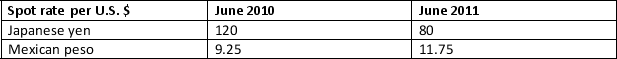

You have obtained the following spot rates:

From the above information,the U.S.dollar has ________ against the Japanese yen and it has ______ against the Mexican peso.

A) appreciated; appreciated

B) appreciates; depreciated

C) depreciated; appreciated

D) depreciated; depreciated

From the above information,the U.S.dollar has ________ against the Japanese yen and it has ______ against the Mexican peso.

A) appreciated; appreciated

B) appreciates; depreciated

C) depreciated; appreciated

D) depreciated; depreciated

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

16

Use the graph below to answer questions 17- 20.

Figure 1.2

Refer to Figure 1.2.Suppose that the market for euro is initially in equilibrium at point A with the exchange rate $2.00 per euro.Which of the following could shift the supply for euro from S1 to S2?

A) Americans want to buy German goods more than before.

B) Americans want to buy German goods less than before.

C) Germans want to buy American goods more than before.

D) Germans want to buy American goods less than before.

Figure 1.2

Refer to Figure 1.2.Suppose that the market for euro is initially in equilibrium at point A with the exchange rate $2.00 per euro.Which of the following could shift the supply for euro from S1 to S2?

A) Americans want to buy German goods more than before.

B) Americans want to buy German goods less than before.

C) Germans want to buy American goods more than before.

D) Germans want to buy American goods less than before.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

17

If the French demand for American exports rises,then

A) the euro should appreciate relative to the dollar.

B) the dollar should depreciate relative to the euro.

C) the dollar should appreciate relative to the euro.

D) it is not clear whether the euro should appreciate or depreciate relative to the dollar.

A) the euro should appreciate relative to the dollar.

B) the dollar should depreciate relative to the euro.

C) the dollar should appreciate relative to the euro.

D) it is not clear whether the euro should appreciate or depreciate relative to the dollar.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

18

Assume that Citibank quotes you a buy rate of $1.50 per pound and a sell rate of $1.60 per pound.How much will you receive in dollars,if you sell 1,000 pound to Citibank?

A) $625

B) $666.67

C) $1,500

D) $1,600

A) $625

B) $666.67

C) $1,500

D) $1,600

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

19

If the spot exchange rate goes from 0.80 euro per dollar to 0.60 euro per dollar,the dollar has ___________ against the euro by _________ percent.

A) appreciated; 25.0

B) appreciated; 33.3

C) depreciated; -25.0

D) depreciated; -33.3

A) appreciated; 25.0

B) appreciated; 33.3

C) depreciated; -25.0

D) depreciated; -33.3

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

20

Use the graph below to answer questions 17- 20.

Figure 1.2

Refer to Figure 1.2.Suppose that the market for euro is initially in equilibrium at point A with the exchange rate $2.00 per euro.When the supply curve shifts to S2,the euro ___________ and the quantities of euro traded in the market __________.

A) appreciates; increases

B) appreciates; decreases

C) depreciates; increases

D) depreciates, decreases

Figure 1.2

Refer to Figure 1.2.Suppose that the market for euro is initially in equilibrium at point A with the exchange rate $2.00 per euro.When the supply curve shifts to S2,the euro ___________ and the quantities of euro traded in the market __________.

A) appreciates; increases

B) appreciates; decreases

C) depreciates; increases

D) depreciates, decreases

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following countries has the highest daily trading volume of foreign exchange market?

A) The U.S.

B) The U.K

C) Japan

D) Hong Kong

A) The U.S.

B) The U.K

C) Japan

D) Hong Kong

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

22

The Citibank trading desk quotes a buy rate of 1.25 and a sell rate of 2.00 for the dollar/euro exchange rate S$/€.Suppose that traders are continually selling dollars to Citibank,leaving Citibank with a surplus of dollars.How should Citibank adjust its rates to "square off" its position?

A) Lower both buy and sell rates.

B) Raise both buy and sell rates.

C) Lower the buy rate, but raise the sell rate.

D) Raise the buy rate, but lower the sell rate.

A) Lower both buy and sell rates.

B) Raise both buy and sell rates.

C) Lower the buy rate, but raise the sell rate.

D) Raise the buy rate, but lower the sell rate.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

23

The exchange rate is

A) the price of one currency relative to gold.

B) the value of a currency relative to inflation.

C) the change in the value of money over time.

D) the price of one currency relative to another.

A) the price of one currency relative to gold.

B) the value of a currency relative to inflation.

C) the change in the value of money over time.

D) the price of one currency relative to another.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

24

If the price of British pounds in terms of U.S.dollars is $1.80 per pound,then the price of U.S.dollars in terms of British pounds is:

A) 1.80£ per dollar.

B) 0.555£ per dollar.

C) 0.90£ per dollar.

D) 3.60£ per dollar.

A) 1.80£ per dollar.

B) 0.555£ per dollar.

C) 0.90£ per dollar.

D) 3.60£ per dollar.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

25

Assume that the dollar value of a Swiss franc is 0.8600 dollar per franc,and that U.S.importers start to like Swiss watches more than they did in the past.The Swiss franc would:

A) appreciate, as the demand curve of Swiss franc shifts to the right.

B) depreciate, as the demand curve of Swiss franc shifts to the right.

C) depreciate, as the demand curve of Swiss franc shifts to the left.

D) appreciate, as the supply curve of Swiss franc shifts to the right.

A) appreciate, as the demand curve of Swiss franc shifts to the right.

B) depreciate, as the demand curve of Swiss franc shifts to the right.

C) depreciate, as the demand curve of Swiss franc shifts to the left.

D) appreciate, as the supply curve of Swiss franc shifts to the right.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

26

When the value of the dollar changes from 0.75 pounds to 0.5 pounds,then the pound has

A) appreciated against the dollar by 33.3%.

B) depreciated against the dollar by 33.3%.

C) appreciated against the dollar by 50.0%.

D) depreciated against the dollar by 50.0%.

A) appreciated against the dollar by 33.3%.

B) depreciated against the dollar by 33.3%.

C) appreciated against the dollar by 50.0%.

D) depreciated against the dollar by 50.0%.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

27

Assume that the dollar value of a Swiss franc is 0.8600 dollar per franc,and that U.S.importers start to like Swiss watches more than they did in the past.Assume that the Swiss Central Bank wants to keep the Swiss franc fixed at 0.8600.To intervene,they have to:

A) buy up Swiss francs and sell dollars.

B) buy up dollars and sell Swiss francs.

C) buy up both dollars Swiss francs.

D) sell both dollars and Swiss francs.

A) buy up Swiss francs and sell dollars.

B) buy up dollars and sell Swiss francs.

C) buy up both dollars Swiss francs.

D) sell both dollars and Swiss francs.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

28

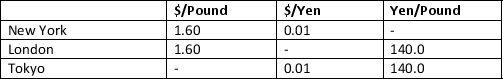

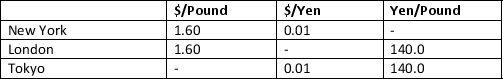

Use the following information to answer questions 24-25.

Assume that the following exchange rates exist for the U.S. dollar, Japanese Yen and the British Pound.

If you are an arbitrageur that starts with $1,000 in New York,

A) You will buy pound in New York, because pound is cheaper in New York.

B) You will buy yen in New York, because pound is more expensive in New York.

C) You will buy both pound and yen in New York to spread the risk.

D) There is no arbitrage opportunity in this case.

Assume that the following exchange rates exist for the U.S. dollar, Japanese Yen and the British Pound.

If you are an arbitrageur that starts with $1,000 in New York,

A) You will buy pound in New York, because pound is cheaper in New York.

B) You will buy yen in New York, because pound is more expensive in New York.

C) You will buy both pound and yen in New York to spread the risk.

D) There is no arbitrage opportunity in this case.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

29

Use the following information to answer questions 24-25.

Assume that the following exchange rates exist for the U.S. dollar, Japanese Yen and the British Pound.

If you are an arbitrageur that starts with $1,000 in New York,you will end up with the arbitrage profit of:

A) $0

B) $142.86

C) $446.43

D) $875.00

Assume that the following exchange rates exist for the U.S. dollar, Japanese Yen and the British Pound.

If you are an arbitrageur that starts with $1,000 in New York,you will end up with the arbitrage profit of:

A) $0

B) $142.86

C) $446.43

D) $875.00

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

30

In foreign exchange trading,arbitrage has ______ risk and speculation has ________ risk.

A) zero; zero

B) positive; positive

C) zero; positive

D) positive; zero

A) zero; zero

B) positive; positive

C) zero; positive

D) positive; zero

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

31

Today 1 euro can be purchased for $1.50.This is the

A) spot exchange rate.

B) forward exchange rate.

C) fixed exchange rate.

D) financial exchange rate.

A) spot exchange rate.

B) forward exchange rate.

C) fixed exchange rate.

D) financial exchange rate.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

32

One dollar is worth ¥80,and one Thai baht is worth ¥2.5.How many Thai baht do you need to buy a dollar?

A) 0.03125 baht

B) 0.005 baht

C) 32 baht

D) 200 baht

A) 0.03125 baht

B) 0.005 baht

C) 32 baht

D) 200 baht

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

33

Suppose that Bank of America quotes you a buy rate of $1.50 per pound and a sell rate of $1.60 per pound.If you sell 1,000 British pounds to Bank of America,Bank of America will have too many British pounds.To square off:

A) the bank has to increase both the buy and sell rates.

B) the bank has to increase the buy rate but lower the sell rate.

C) the bank has to lower the buy rate but increase the sell rate.

D) the bank has to lower both the buy and sell rates.

A) the bank has to increase both the buy and sell rates.

B) the bank has to increase the buy rate but lower the sell rate.

C) the bank has to lower the buy rate but increase the sell rate.

D) the bank has to lower both the buy and sell rates.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

34

Suppose that Bank of America quotes you a buy rate of $1.50 per pound and a sell rate of $1.60 per pound.How much dollars would you receive,if you sell 1,000 British pounds to Bank of America?

A) $100

B) $1,000

C) $1,500

D) $1,600

A) $100

B) $1,000

C) $1,500

D) $1,600

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

35

When the exchange rate changes from 0.9 euros per dollar to 1.0 euros per dollar,then

A) the euro has appreciated and the dollar has appreciated.

B) the euro has depreciated and the dollar has appreciated.

C) the euro has appreciated and the dollar has depreciated.

D) the euro has depreciated and the dollar has depreciated.

A) the euro has appreciated and the dollar has appreciated.

B) the euro has depreciated and the dollar has appreciated.

C) the euro has appreciated and the dollar has depreciated.

D) the euro has depreciated and the dollar has depreciated.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following currencies has the highest trading volume each day?

A) U.S. dollar

B) Euro

C) Yen

D) British pound

A) U.S. dollar

B) Euro

C) Yen

D) British pound

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

37

The biggest player in the foreign exchange market are:

A) tourists

B) import/export firms

C) drug dealers

D) financial institutions such as banks

A) tourists

B) import/export firms

C) drug dealers

D) financial institutions such as banks

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

38

An appreciation of a country's currency

A) decreases the relative price of its exports and lowers the relative price of its imports.

B) raises the relative price of its exports and raises the relative price of its imports.

C) lowers the relative price of its exports and raises the relative price of its imports.

D) raises the relative price of its exports and lowers the relative price of its imports.

A) decreases the relative price of its exports and lowers the relative price of its imports.

B) raises the relative price of its exports and raises the relative price of its imports.

C) lowers the relative price of its exports and raises the relative price of its imports.

D) raises the relative price of its exports and lowers the relative price of its imports.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following is not a possible bid/ask quotation for the Thai baht?

A) $.50/$.51

B) $.49/$.50

C) $.52/$.51

D) All of the above are possible bid/ask quotations

A) $.50/$.51

B) $.49/$.50

C) $.52/$.51

D) All of the above are possible bid/ask quotations

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

40

When the exchange rate for the Mexican peso changes from 8 pesos to the dollar to 10 pesos to the dollar,then

A) the peso has depreciated against the dollar by 20%.

B) the peso has appreciated against the dollar by 20%.

C) the peso has appreciated against the dollar by 25%.

D) the peso has depreciated against the dollar by 25%.

A) the peso has depreciated against the dollar by 20%.

B) the peso has appreciated against the dollar by 20%.

C) the peso has appreciated against the dollar by 25%.

D) the peso has depreciated against the dollar by 25%.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

41

___________ is the effect on exchange rates when traders alter quotes to maintain a balance between amounts of currency bought and sold to "square off" at the end of a day.

A) Inventory control effect

B) Inside information effect

C) Order flow effect

D) Asymmetric information effect

A) Inventory control effect

B) Inside information effect

C) Order flow effect

D) Asymmetric information effect

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

42

Other things equal,if American exports to Japan are higher than American imports from Japan,then,under a floating exchange rate system,we would expect the dollar to appreciate against the yen.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

43

An American tourist is planning to visit Mexico.The exchange rate at which the tourist can buy pesos in a retail bank is the ________.

A) bid price.

B) ask price.

C) flat rate.

D) cross rate.

A) bid price.

B) ask price.

C) flat rate.

D) cross rate.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

44

In foreign exchange trading,arbitrage activity could lead to ________.

A) risky trading transactions

B) either gain or loss on the trade.

C) only gain on the trade.

D) a and b are correct.

A) risky trading transactions

B) either gain or loss on the trade.

C) only gain on the trade.

D) a and b are correct.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

45

Given a system of floating exchange rates,assume that Boeing Inc.of the United States places a large order,payable in euros,with a German contractor for jet engine parts.The immediate effect of this transaction will be a shift in the:

A) supply curve of euros to the left which causes the dollar to appreciate against the euro.

B) supply curve of euros to the right which causes the dollar to depreciate against the euro.

C) demand curve for euros to the left which causes the dollar to appreciate against the euro

D) demand curve for euros to the right which causes the dollar to depreciate against the euro

A) supply curve of euros to the left which causes the dollar to appreciate against the euro.

B) supply curve of euros to the right which causes the dollar to depreciate against the euro.

C) demand curve for euros to the left which causes the dollar to appreciate against the euro

D) demand curve for euros to the right which causes the dollar to depreciate against the euro

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

46

Use the graph below to answer questions 9 - 12.

Figure 1.1

Refer to Figure 1.1.Suppose that the market for British pound is initially in equilibrium at point A with the exchange rate $2.00 per pound.Which of the following could shift the demand for pound from D1 to D2?

A) Americans want to buy British goods more than before.

B) Americans want to buy British goods less than before.

C) British want to buy American goods more than before.

D) British want to buy American goods less than before.

Figure 1.1

Refer to Figure 1.1.Suppose that the market for British pound is initially in equilibrium at point A with the exchange rate $2.00 per pound.Which of the following could shift the demand for pound from D1 to D2?

A) Americans want to buy British goods more than before.

B) Americans want to buy British goods less than before.

C) British want to buy American goods more than before.

D) British want to buy American goods less than before.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

47

In the trade flow model,U.S.imports of goods and services will create a supply of U.S.dollars and foreign imports of U.S.goods and services will create a demand for U.S.dollars.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

48

When foreign countries buy potatoes grown in the United States,they are generating a:

A) demand for U.S. dollars and a demand for a foreign currency.

B) demand for U.S. dollars and a supply of a foreign currency.

C) supply of U.S. dollars and a demand for a foreign currency.

D) supply of U.S. dollars and a supply of a foreign currency.

A) demand for U.S. dollars and a demand for a foreign currency.

B) demand for U.S. dollars and a supply of a foreign currency.

C) supply of U.S. dollars and a demand for a foreign currency.

D) supply of U.S. dollars and a supply of a foreign currency.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

49

________ is the rate at which banks sell a currency and ________is the rate at which banks buy the currency.

A) Bid; offer

B) Offer; bid

C) Spread; offer

D) Closing; spot

A) Bid; offer

B) Offer; bid

C) Spread; offer

D) Closing; spot

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

50

Assume that the current buy rate for the Japanese yen is 87.4100 yen per dollar and the current sell rate is 87.4400 yen per dollar.Assume that a bank buys and sells $1,000,000 in the yen market.How much would the bank collect as a spread in terms of yen?

A) 30,000 yen

B) -30,000 yen

C) -343.09 yen

D) 343.21 yen

A) 30,000 yen

B) -30,000 yen

C) -343.09 yen

D) 343.21 yen

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following will shift the demand curve for the Japanese yen to the right in a trade flow model?

A) There is a large increase in Japanese demand for U.S. exports as U.S. culture become more popular in Japan.

B) U.S. consumers no longer want to buy Japanese products after the Toyota lawsuit, leading Americans to question the quality of Japanese products.

C) Political uncertainties in Asia lead U.S. investors to shift their financial investment out of Japan, back to the United States.

D) U.S. demand for products imported from Japan increases significantly as Japanese culture becomes more popular in the U.S.

A) There is a large increase in Japanese demand for U.S. exports as U.S. culture become more popular in Japan.

B) U.S. consumers no longer want to buy Japanese products after the Toyota lawsuit, leading Americans to question the quality of Japanese products.

C) Political uncertainties in Asia lead U.S. investors to shift their financial investment out of Japan, back to the United States.

D) U.S. demand for products imported from Japan increases significantly as Japanese culture becomes more popular in the U.S.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

52

Assume that Citibank quotes you a buy rate of $1.95 per pound and a sell rate of $1.98 per pound.How much will you pay in dollars,if you buy 1,000 pound from Citibank?

A) $505.05

B) $512.82

C) $1,950

D) $1,980

A) $505.05

B) $512.82

C) $1,950

D) $1,980

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

53

If U.S dollar depreciates against foreign currency,the U.S.exports will become relatively more expensive to foreigners and the trade deficit will get worsen.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

54

Assume that Bank of America quotes you a buy rate of $1.95 per pound and a sell rate of $1.98 per pound.If you buy 1,000 pounds from Bank of America,the bank will have too few pounds.To "square off," Bank of America has to ________ the buy rate and ______ the sell rate.

A) raise; raise

B) raise; lower

C) lower; raise

D) lower; lower

A) raise; raise

B) raise; lower

C) lower; raise

D) lower; lower

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

55

Suppose Sumitomo Bank quotes the ¥/$ exchange rate as 110.30-.50 and Nomura Bank quotes 110.50-.70.In this case,

A) there is no arbitrage opportunity.

B) you can make money by buying dollars at Sumitomo Bank and selling dollars at Nomura.

C) you can make money by buying dollars at Nomura Bank and selling dollars at Sumitomo.

D) You can make money by buying dollars at Sumitomo Bank and selling yens at Nomura Bank.

A) there is no arbitrage opportunity.

B) you can make money by buying dollars at Sumitomo Bank and selling dollars at Nomura.

C) you can make money by buying dollars at Nomura Bank and selling dollars at Sumitomo.

D) You can make money by buying dollars at Sumitomo Bank and selling yens at Nomura Bank.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

56

If First American Bank quotes bid and offer rates for the Russian ruble at $.0350-.0360,the bank would realize profits of $1,000 on the purchase and sale of 1 million rubles.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

57

From 2000 to 2010,the yen/dollar exchange rate fell from 240 yen/dollar to 102 yen/dollar,while the dollar/pound exchange rate fell from 2.22 dollar/pound to 1.62 dollar/pound.As a result,

A) the dollar appreciated relative to the yen, but depreciated relative to the pound.

B) the dollar depreciated relative to the yen, but appreciated relative to the pound.

C) the dollar appreciated relative to both the yen and the pound.

D) the dollar depreciated relative to both the yen and the pound.

A) the dollar appreciated relative to the yen, but depreciated relative to the pound.

B) the dollar depreciated relative to the yen, but appreciated relative to the pound.

C) the dollar appreciated relative to both the yen and the pound.

D) the dollar depreciated relative to both the yen and the pound.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

58

A trader at a U.S.bank believes that the euro will strengthen substantially in exchange rate value during the next hour.Thus,she buys large amount of euro now and wait for the value of the euro to rise so that she can sell it later.This action is called:

A) arbitrage, because it is a risk-free activity.

B) arbitrage, because it is a risky activity.

C) speculation, because it is a risk-free activity.

D) speculation, because it is a risky activity.

A) arbitrage, because it is a risk-free activity.

B) arbitrage, because it is a risky activity.

C) speculation, because it is a risk-free activity.

D) speculation, because it is a risky activity.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

59

Suppose that the current buy rate for the Japanese yen is 87.410 yen/dollar and the current sell rate is 87.440 yen per dollar.If a bank buys and sells $1,000,000 in the yen market,it will make 30,000 yen from a spread.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

60

Exchange rates are 150 yen per dollar,0.8 euro per dollar,and 20 pesos per dollar.A bottle of beer in New York costs 6 dollars,1,200 yen in Tokyo,7 euro in Munich,and 100 pesos in Cancun.Where is the most expensive beer?

A) Tokyo

B) Munich

C) New York

D) Cancun

A) Tokyo

B) Munich

C) New York

D) Cancun

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

61

Bid price is the price at which a bank is ready to buy a foreign currency and ask price is the price at which a bank is ready to sell a foreign currency.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

62

If the Japanese yen was worth $.005 six months ago and is now worth $.007 today,the yen has appreciated by 40%.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

63

Use the graph below to answer questions 9 - 12.

Figure 1.1

Refer to Figure 1.1.Suppose that the market for British pound is initially in equilibrium at point A with the exchange rate $2.00 per pound.Then the demand curve shifts to D2.If the British central bank wants to fix the exchange rate at $2.00/pound,they have to:

A) buy pound and sell dollar by the amount of Q3 - Q1.

B) sell pound and buy dollar by the amount of Q3 - Q1.

C) sell only pound by the amount of Q3 - Q1 and leave dollar alone.

D) buy only pound by the amount of Q3 - Q1 and leave dollar alone.

Figure 1.1

Refer to Figure 1.1.Suppose that the market for British pound is initially in equilibrium at point A with the exchange rate $2.00 per pound.Then the demand curve shifts to D2.If the British central bank wants to fix the exchange rate at $2.00/pound,they have to:

A) buy pound and sell dollar by the amount of Q3 - Q1.

B) sell pound and buy dollar by the amount of Q3 - Q1.

C) sell only pound by the amount of Q3 - Q1 and leave dollar alone.

D) buy only pound by the amount of Q3 - Q1 and leave dollar alone.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

64

Use the graph below to answer questions 9 - 12.

Figure 1.1

Refer to Figure 1.1.Suppose that the market for British pound is initially in equilibrium at point A with the exchange rate $2.00 per pound.Then the demand curve shifts to D2.If the British central bank wants to fix the exchange rate at $2.00/pound,there will be ________ of pound and the pound is __________.

A) excess supply; overvalued

B) excess supply; undervalued

C) excess demand; overvalued

D) excess demand; undervalued

Figure 1.1

Refer to Figure 1.1.Suppose that the market for British pound is initially in equilibrium at point A with the exchange rate $2.00 per pound.Then the demand curve shifts to D2.If the British central bank wants to fix the exchange rate at $2.00/pound,there will be ________ of pound and the pound is __________.

A) excess supply; overvalued

B) excess supply; undervalued

C) excess demand; overvalued

D) excess demand; undervalued

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

65

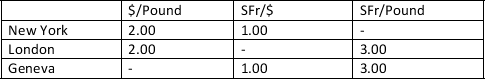

Use the following information to answer questions 13-14.

Assume that the following exchange rates exist.

Suppose that you are an arbitrageur that starts with $100 in New York.How much arbitrage profit can you make?

A) $0

B) $50

C) $100

D) $150

Assume that the following exchange rates exist.

Suppose that you are an arbitrageur that starts with $100 in New York.How much arbitrage profit can you make?

A) $0

B) $50

C) $100

D) $150

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

66

Use the graph below to answer questions 9 - 12.

Figure 1.1

Refer to Figure 1.1.Suppose that the market for British pound is initially in equilibrium at point A with the exchange rate $2.00 per pound.When the demand curve shifts to D2,the pound ___________ and the quantities of pound traded in the market __________.

A) appreciates; increases

B) appreciates; decreases

C) depreciates; increases

D) depreciates, decreases

Figure 1.1

Refer to Figure 1.1.Suppose that the market for British pound is initially in equilibrium at point A with the exchange rate $2.00 per pound.When the demand curve shifts to D2,the pound ___________ and the quantities of pound traded in the market __________.

A) appreciates; increases

B) appreciates; decreases

C) depreciates; increases

D) depreciates, decreases

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

67

The Citibank trading desk quotes a buy rate of 1.25 and a sell rate of 2.00 for the dollar/euro exchange rate S$/€.How much euros would you receive,if you sell $1,000 to Citibank?

A) 500 euros

B) 800 euros

C) 1,250 euros

D) 2,000 euros

A) 500 euros

B) 800 euros

C) 1,250 euros

D) 2,000 euros

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

68

Assume that the exchange rate is currently at $0.85 per Swiss franc and that U.S.importers start to like Swiss chocolates more than they did in the past.If the Swiss Central Bank wants to keep the Swiss franc fixed at $0.85 per Swiss franc,it will have to intervene by buying up Swiss Francs and selling dollars.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

69

If Citi in New York has a buy rate of $0.0127 per yen and Sumitomo Bank in Tokyo has a buy rate of $0.0157 per yen,an arbitrager could profit by buying yen in Tokyo and simultaneously sell them in New York.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

70

The goal of an arbitrage transaction between two currencies is to profit on difference in exchange rates in different markets by taking some risks of exchange rate movements.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

71

Use the following information to answer questions 13-14.

Assume that the following exchange rates exist.

Suppose that you are an arbitrageur that starts with $100 in New York.Which of the following paths is correct in order to make arbitrage profit?

A) Buy pound in New York → sell pound for SFr in New York → sell SFr for dollar in New York.

B) Buy SFr in New York → sell SFr for pound in New York → sell pound for dollar in New York.

C) Buy SFr in New York → sell SFr for pound in Geneva → sell pound for dollar in New York.

D) Buy pound in New York → sell pound for SFr in London → sell SFr for dollar in New York.

Assume that the following exchange rates exist.

Suppose that you are an arbitrageur that starts with $100 in New York.Which of the following paths is correct in order to make arbitrage profit?

A) Buy pound in New York → sell pound for SFr in New York → sell SFr for dollar in New York.

B) Buy SFr in New York → sell SFr for pound in New York → sell pound for dollar in New York.

C) Buy SFr in New York → sell SFr for pound in Geneva → sell pound for dollar in New York.

D) Buy pound in New York → sell pound for SFr in London → sell SFr for dollar in New York.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck