Deck 10: International Portfolio Investment

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/56

Play

Full screen (f)

Deck 10: International Portfolio Investment

1

Security A and Security B have a correlation coefficient of 0.If Security A's return is expected to increase by 10 percent,

A) Security B's return should also increase by 10 percent.

B) Security B's return should decrease by 10 percent.

C) Security B's return should be zero.

D) Security B's return is impossible to determine from the above information.

A) Security B's return should also increase by 10 percent.

B) Security B's return should decrease by 10 percent.

C) Security B's return should be zero.

D) Security B's return is impossible to determine from the above information.

Security B's return is impossible to determine from the above information.

2

A portfolio manager has decided to invest a total of $10 million on U.S.and Japanese portfolios.The expected returns are 12 percent on the U.S.portfolio and 20 percent on the Japanese portfolio.What is the expected return of an international portfolio with 40 percent invested in the U.S.portfolio and 60 percent invested in the Japanese portfolio?

A) 32.0%

B) 16.8%

C) 16.0%

D) 12.7%

A) 32.0%

B) 16.8%

C) 16.0%

D) 12.7%

16.8%

3

Capital market segmentation is a financial market imperfection caused mainly by:

A) Government regulations

B) High transactions costs

C) Political risk

D) All of the above contribute to the imperfection in financial markets.

A) Government regulations

B) High transactions costs

C) Political risk

D) All of the above contribute to the imperfection in financial markets.

All of the above contribute to the imperfection in financial markets.

4

Which of the following statements is TRUE?

I.Diversification is a process of removing systematic risk from a portfolio.

II.Diversification is a process of maximizing possible returns of a portfolio.

A) Only I is true.

B) Only II is true.

C) Both I and II are true.

D) Neither I nor II are true.

I.Diversification is a process of removing systematic risk from a portfolio.

II.Diversification is a process of maximizing possible returns of a portfolio.

A) Only I is true.

B) Only II is true.

C) Both I and II are true.

D) Neither I nor II are true.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

5

ADR is:

A) a type of Eurodollar loans.

B) international mutual funds

C) a certificate represents shares of a foreign stock issued by a U.S. bank.

D) international reserve created by the IMF.

A) a type of Eurodollar loans.

B) international mutual funds

C) a certificate represents shares of a foreign stock issued by a U.S. bank.

D) international reserve created by the IMF.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

6

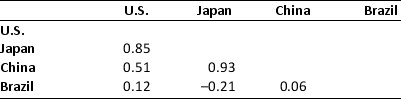

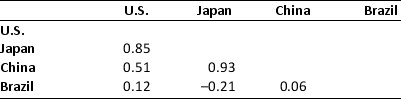

Based on this table of correlation coefficients of real dollar returns of assets in different countries,which two countries appear to provide the greatest amount of benefit from diversification?

A) The U.S. and Japan

B) China and Japan

C) Japan and Brazil

D) China and Brazil

A) The U.S. and Japan

B) China and Japan

C) Japan and Brazil

D) China and Brazil

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

7

Assume that the expected returns of the four portfolios are the same but their variances are as follows.Which of these four portfolios is the most risky?

A) 0.015

B) 0.020

C) 0.150

D) 0.095

A) 0.015

B) 0.020

C) 0.150

D) 0.095

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following would not be considered a source of systematic risk?

A) a hostile takeover of a firm

B) a rise in inflation

C) a fall in GDP

D) a panic on Wall Street

A) a hostile takeover of a firm

B) a rise in inflation

C) a fall in GDP

D) a panic on Wall Street

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

9

Company specific risk is also known as:

A) market risk.

B) systematic risk.

C) non-diversifiable risk.

D) nonsystematic risk.

A) market risk.

B) systematic risk.

C) non-diversifiable risk.

D) nonsystematic risk.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

10

Assume that the expected returns of the four portfolios are the same but their variances are as follows.Which of these four portfolios would you select?

A) 0.015

B) 0.020

C) 0.150

D) 0.095

A) 0.015

B) 0.020

C) 0.150

D) 0.095

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

11

When a country moves from segmented capital market to globalized capital market,a firm located in this country can achieve:

A) lower cost of capital

B) greater availability of capital

C) lower risk premium on domestic assets

D) All of the above are correct.

A) lower cost of capital

B) greater availability of capital

C) lower risk premium on domestic assets

D) All of the above are correct.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

12

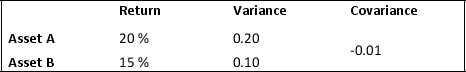

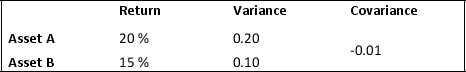

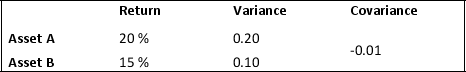

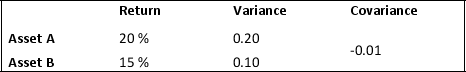

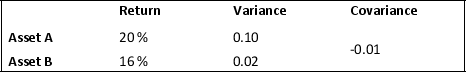

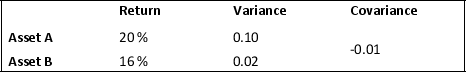

Assume that you are considering a portfolio of two assets,A and B,with 40% invested in asset A and invested 60% in asset B.Assume also that the assets have the following statistics:

The portfolio expected return is ________ and the variance of the portfolio is _______.

A) Return = 20%

B) Return = 18%

C) Return = 17%

D) Return = 16%

The portfolio expected return is ________ and the variance of the portfolio is _______.

A) Return = 20%

B) Return = 18%

C) Return = 17%

D) Return = 16%

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

13

Rather than directly issuing stock in the U.S.to obtain equity funds,foreign corporations can issue ___________,which are certificates representing underlying bundles of stock.

A) American Depositary Receipts

B) Special Drawing Rights

C) Mortgage backed securities

D) Put option

A) American Depositary Receipts

B) Special Drawing Rights

C) Mortgage backed securities

D) Put option

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

14

Use the following information to answer questions 8-9.

An investor is considering a portfolio consisting of 60% invested in Stock X and 40% invested in Stock Y. The expected returns for the stocks are 10% for Stock X and 8% for Stock Y. Variance of the stock returns are 0.04 for Stock X and 0.02 for Stock Y, and a covariance of -0.01 between the two stocks.

What is the variance of the proposed portfolio?

A) 0.0128

B) 0.0152

C) 0.0224

D) 0.0272

An investor is considering a portfolio consisting of 60% invested in Stock X and 40% invested in Stock Y. The expected returns for the stocks are 10% for Stock X and 8% for Stock Y. Variance of the stock returns are 0.04 for Stock X and 0.02 for Stock Y, and a covariance of -0.01 between the two stocks.

What is the variance of the proposed portfolio?

A) 0.0128

B) 0.0152

C) 0.0224

D) 0.0272

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

15

Security A and Security B have a correlation coefficient of - 1.0.If Security A's return is expected to increase by 10 percent,

A) Security B's return should also increase by 10 percent.

B) Security B's return should decrease by 10 percent.

C) Security B's return should be zero.

D) Security B's return is impossible to determine from the above information.

A) Security B's return should also increase by 10 percent.

B) Security B's return should decrease by 10 percent.

C) Security B's return should be zero.

D) Security B's return is impossible to determine from the above information.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

16

Use the following information to answer questions 8-9.

An investor is considering a portfolio consisting of 60% invested in Stock X and 40% invested in Stock Y. The expected returns for the stocks are 10% for Stock X and 8% for Stock Y. Variance of the stock returns are 0.04 for Stock X and 0.02 for Stock Y, and a covariance of -0.01 between the two stocks.

What is the expected return of the proposed portfolio?

A) 9.0%

B) 9.2%

C) 19.0%

D) 19.2%

An investor is considering a portfolio consisting of 60% invested in Stock X and 40% invested in Stock Y. The expected returns for the stocks are 10% for Stock X and 8% for Stock Y. Variance of the stock returns are 0.04 for Stock X and 0.02 for Stock Y, and a covariance of -0.01 between the two stocks.

What is the expected return of the proposed portfolio?

A) 9.0%

B) 9.2%

C) 19.0%

D) 19.2%

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

17

If interest rates are equalized between two countries,why would we still observe two-way capital flow between these two countries?

A) Investors are irrational.

B) Investors want to diversify their portfolios.

C) Immigrants always invest in their home country's assets.

D) Assets across countries are homogeneous.

A) Investors are irrational.

B) Investors want to diversify their portfolios.

C) Immigrants always invest in their home country's assets.

D) Assets across countries are homogeneous.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

18

The risk present in all investment opportunities is known as ________ risk.

A) Systematic

B) Nonsystematic

C) Portfolio

D) Diversification

A) Systematic

B) Nonsystematic

C) Portfolio

D) Diversification

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following statements regarding portfolio risk and number of stocks is generally true?

A) Adding more stocks increases risk.

B) Adding more stocks decreases risk but does not eliminate it.

C) Adding more stocks has no effect on risk.

D) Adding more stocks increases only systematic risk.

A) Adding more stocks increases risk.

B) Adding more stocks decreases risk but does not eliminate it.

C) Adding more stocks has no effect on risk.

D) Adding more stocks increases only systematic risk.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

20

Assume that you are considering a portfolio of two assets,A and B,with 40% invested in asset A and invested 60% in asset B.Assume also that the assets have the following statistics:

A) Variance = 0.0480

B) Variance = 0.0632

C) Variance = 0.0656

D) Variance = 0.0728

A) Variance = 0.0480

B) Variance = 0.0632

C) Variance = 0.0656

D) Variance = 0.0728

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following reasons does not support the home-bias theory?

A) Nationalism support of home stock

B) Knowledge about domestic firms

C) Knowledge about foreign firms

D) Stocks measured against local conditions

A) Nationalism support of home stock

B) Knowledge about domestic firms

C) Knowledge about foreign firms

D) Stocks measured against local conditions

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

22

Investors include various assets in the portfolio,to ________ the variability of the portfolio's returns.

A) Simplify

B) Increase

C) Decrease

D) Equalize

A) Simplify

B) Increase

C) Decrease

D) Equalize

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

23

When an investor prefers a portfolio that is diverse,has a smaller return than an alternative,and has a much smaller variance then the investor must be:

A) Risk seeking

B) Risk loving

C) Risk neutral

D) Risk averse

A) Risk seeking

B) Risk loving

C) Risk neutral

D) Risk averse

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

24

A foreign firm has stock that can be purchased in New York,London,and Tokyo.The firm must be using an:

A) GDR

B) ADR

C) Variant stock

D) Preferred stock

A) GDR

B) ADR

C) Variant stock

D) Preferred stock

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

25

A certificate that represents shares of a foreign stock issued by a U.S.bank is called an:

A) Letter of credit

B) American depository receipt

C) Foreign credit

D) Exchange contract

A) Letter of credit

B) American depository receipt

C) Foreign credit

D) Exchange contract

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

26

When the ________ of two assets is _______,then the two variables move in opposite directions: when one rises the other falls.

A) Covariance, negative

B) Covariance, positive

C) Variability, negative

D) Variability, positive

A) Covariance, negative

B) Covariance, positive

C) Variability, negative

D) Variability, positive

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

27

The return on the portfolio is a weighted average of the returns on the individual assets.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

28

According to the theory of capital flows,there should exist one-way capital flow which will stop when interest rates are:

A) Greater then international average in one country.

B) Low in country receiving capital, but high in the other.

C) Below the international average of interest rates.

D) Exactly the same.

A) Greater then international average in one country.

B) Low in country receiving capital, but high in the other.

C) Below the international average of interest rates.

D) Exactly the same.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

29

Portfolio diversification eliminates the systematic risk that is unique to an individual asset although nonsystematic risk will remain.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

30

The surprisingly low level of international assets in investment portfolios reflect investors' decisions to hold undiversified portfolios is known as the home-bias puzzle.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

31

The risk present in all investment opportunities is known as systematic risk.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

32

For an investor,nonsystematic risk can be eliminated through:

A) Portfolio diversification

B) Avoiding transaction costs

C) Increased variance

D) Sterilization

A) Portfolio diversification

B) Avoiding transaction costs

C) Increased variance

D) Sterilization

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

33

Risk premiums decrease for domestic assets when:

A) The domestic government prohibits foreign investors

B) Domestic investors fail to properly diversify internationally

C) A country moves from a global market to a segmented market

D) A country moves from a segmented market to a global market

A) The domestic government prohibits foreign investors

B) Domestic investors fail to properly diversify internationally

C) A country moves from a global market to a segmented market

D) A country moves from a segmented market to a global market

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following are possible explanations for incomplete portfolio diversification?

I.Transaction costs

II.Home bias

III.Information costs

IV.Taxes

A) I and II

B) II and III

C) II and IV

D) I, II, III, and IV

I.Transaction costs

II.Home bias

III.Information costs

IV.Taxes

A) I and II

B) II and III

C) II and IV

D) I, II, III, and IV

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

35

Consider two securities known as Security A and B.If returns on Security A decrease 10% while returns on Security B also decrease 10%,then the correlation coefficient is:

A) Positive

B) Negative

C) Zero

D) Impossible to determine

A) Positive

B) Negative

C) Zero

D) Impossible to determine

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

36

A stock market in which foreign investors are not allowed to buy domestic stocks and domestic investors are not allowed to buy foreign stocks is called a segmented market.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

37

The home-bias puzzle could be used to describe:

A) The gains investors earn when over investing in foreign markets.

B) The lack of international diversification in the United States.

C) The increased preference for high variance investments in the domestic market.

D) The surprisingly low level of domestic investment in the United States.

A) The gains investors earn when over investing in foreign markets.

B) The lack of international diversification in the United States.

C) The increased preference for high variance investments in the domestic market.

D) The surprisingly low level of domestic investment in the United States.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

38

The ________ the variance of variability of returns on a portfolio,the more ________ the returns on the portfolio.

A) Smaller, dangerous

B) Smaller, diversified

C) Larger, diversified

D) Larger, uncertain

A) Smaller, dangerous

B) Smaller, diversified

C) Larger, diversified

D) Larger, uncertain

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

39

Investors often hold ________ to reduce risk associated with investments.

A) Domestic currency contracts

B) Letters of credit

C) Diversified portfolios

D) Forward contracts only

A) Domestic currency contracts

B) Letters of credit

C) Diversified portfolios

D) Forward contracts only

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

40

ADRs are used by domestic investors because the certificates provide:

A) Greater returns than foreign stocks purchased in foreign markets.

B) A way to avoid transaction costs associated with currency exchange.

C) A tax-free investment.

D) A way to avoid foreign exchange risk

A) Greater returns than foreign stocks purchased in foreign markets.

B) A way to avoid transaction costs associated with currency exchange.

C) A tax-free investment.

D) A way to avoid foreign exchange risk

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

41

The risk present in all investment opportunities is known as systematic risk.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

42

A stock market in which foreign investors are not allowed to buy domestic stocks and domestic investors are not allowed to buy foreign stocks is called an:

A) International market

B) Segmented market

C) Domestic market

D) Globalized market

A) International market

B) Segmented market

C) Domestic market

D) Globalized market

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

43

When the covariance of two assets is negative,then the two variables move in opposite directions: when one rises the other falls.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

44

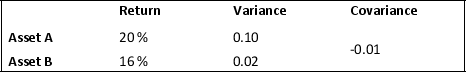

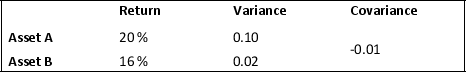

Use the following information for 14-15.

Assume that you have a choice of two assets, A and B, and a portfolio of an equal share of the two assets. Assume also that the assets have the following statistics:

Table 10.1:

See Table 10.1.The negative covariance between Asset A and Asset B means that when returns on Asset A decrease then,

A) The variance of Asset B tends to decreases

B) The returns on Asset B tend to decrease

C) The returns on Asset B tend to increase

D) The variance on Asset A tends to decreases

Assume that you have a choice of two assets, A and B, and a portfolio of an equal share of the two assets. Assume also that the assets have the following statistics:

Table 10.1:

See Table 10.1.The negative covariance between Asset A and Asset B means that when returns on Asset A decrease then,

A) The variance of Asset B tends to decreases

B) The returns on Asset B tend to decrease

C) The returns on Asset B tend to increase

D) The variance on Asset A tends to decreases

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

45

A globalized market is a stock market where domestic investors can hold both domestic and foreign stocks.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

46

The smaller the variance of variability of returns on a portfolio,the more uncertain the returns on the portfolio.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

47

Consider the following variances of different stocks all with the same expected returns.Which stock represents the riskiest choice?

A) Stock A: 0.03

B) Stock B: 0.25

C) Stock C: 0.005

D) Stock D: 0.22

A) Stock A: 0.03

B) Stock B: 0.25

C) Stock C: 0.005

D) Stock D: 0.22

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

48

When the ________ of two assets is _______,then the two variables rise together and fall together.

A) Covariance, negative

B) Covariance, positive

C) Variability, negative

D) Variability, positive

A) Covariance, negative

B) Covariance, positive

C) Variability, negative

D) Variability, positive

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

49

The weighted average of the returns on the individual assets is know as the

A) Diversification process

B) Covariance average

C) Return on the portfolio

D) Systematic risk

A) Diversification process

B) Covariance average

C) Return on the portfolio

D) Systematic risk

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following are possible explanations for incomplete portfolio diversification?

I.Risk aversion

II.Home bias

III.Foreign bias

IV.Political risk

A) I and II

B) II and IV

C) I, III, and IV

D) I, II, and IV

I.Risk aversion

II.Home bias

III.Foreign bias

IV.Political risk

A) I and II

B) II and IV

C) I, III, and IV

D) I, II, and IV

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

51

Consider the following variances of different stocks all with the same expected returns.Which stock represents the best choice for a risk averse investor?

A) Stock A: 0.03

B) Stock B: 0.25

C) Stock C: 0.005

D) Stock D: 0.22

A) Stock A: 0.03

B) Stock B: 0.25

C) Stock C: 0.005

D) Stock D: 0.22

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following are reasons for foreign firms to list their shares in the United States?

I.Ability to raise new capital in world's largest financial base

II.Enlarged investor base

III.Lower transactions costs

IV.Eliminate foreign exchange risk

A) I and II

B) I, III, and IV

C) I, II, and III

D) I, II, III, and IV

I.Ability to raise new capital in world's largest financial base

II.Enlarged investor base

III.Lower transactions costs

IV.Eliminate foreign exchange risk

A) I and II

B) I, III, and IV

C) I, II, and III

D) I, II, III, and IV

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

53

Use the following information for 14-15.

Assume that you have a choice of two assets, A and B, and a portfolio of an equal share of the two assets. Assume also that the assets have the following statistics:

Table 10.1:

See Table 10.1.If your portfolio includes a combination of 20% Asset A and 80% Asset B,then your expected return is:

A) 16.8 %

B) 18 %

C) 19.2 %

D) 24 %

Assume that you have a choice of two assets, A and B, and a portfolio of an equal share of the two assets. Assume also that the assets have the following statistics:

Table 10.1:

See Table 10.1.If your portfolio includes a combination of 20% Asset A and 80% Asset B,then your expected return is:

A) 16.8 %

B) 18 %

C) 19.2 %

D) 24 %

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

54

Portfolio diversification explains the two-way flow of capital between countries.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

55

Consider two securities known as Security A and B.If returns on Security A decrease 10% while returns on Security B increase 10%,then the correlation coefficient is:

A) Positive

B) Negative

C) Zero

D) Impossible to determine

A) Positive

B) Negative

C) Zero

D) Impossible to determine

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

56

A GDR is similar to the ADR except that it is:

A) Sold only to preferred investors

B) Available in more than one market

C) A high variance investment

D) A low variance investment

A) Sold only to preferred investors

B) Available in more than one market

C) A high variance investment

D) A low variance investment

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck