Deck 1: Federal Income Taxation - an Overview

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/151

Play

Full screen (f)

Deck 1: Federal Income Taxation - an Overview

1

Match each term with the correct statement below.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

Subtractions from gross income specifically allowed by the tax law.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

Subtractions from gross income specifically allowed by the tax law.

B

2

Match each term with the correct statement below.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

Based on the value of the property being taxed.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

Based on the value of the property being taxed.

A

3

Match each term with the correct statement below.

a.Average tax rate

b.Effective tax rate

c.Horizontal equity

d.Marginal tax rate

e.Progressive rate structure

f.Proportional rate structure

g.Regressive rate structure

h.Tax avoidance

i.Tax evasion

j.Vertical equity

A tax rate that increases as the tax base increases.

a.Average tax rate

b.Effective tax rate

c.Horizontal equity

d.Marginal tax rate

e.Progressive rate structure

f.Proportional rate structure

g.Regressive rate structure

h.Tax avoidance

i.Tax evasion

j.Vertical equity

A tax rate that increases as the tax base increases.

E

4

Match each term with the correct statement below.

a.Average tax rate

b.Effective tax rate

c.Horizontal equity

d.Marginal tax rate

e.Progressive rate structure

f.Proportional rate structure

g.Regressive rate structure

h.Tax avoidance

i.Tax evasion

j.Vertical equity

A tax rate that remains the same at all levels of the tax base.

a.Average tax rate

b.Effective tax rate

c.Horizontal equity

d.Marginal tax rate

e.Progressive rate structure

f.Proportional rate structure

g.Regressive rate structure

h.Tax avoidance

i.Tax evasion

j.Vertical equity

A tax rate that remains the same at all levels of the tax base.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

5

Match each term with the correct statement below.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

Used by persons who do not itemize deductions on their return.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

Used by persons who do not itemize deductions on their return.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

6

Match each term with the correct statement below.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

Based on a quantity of a product sold.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

Based on a quantity of a product sold.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

7

Match each term with the correct statement below.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

The excess of an asset's tax basis over its selling price.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

The excess of an asset's tax basis over its selling price.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

8

Match each term with the correct statement below.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

Current period expenditure incurred in order to earn income.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

Current period expenditure incurred in order to earn income.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

9

Match each term with the correct statement below.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

Land and any structures permanently attached to the land.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

Land and any structures permanently attached to the land.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

10

Match each term with the correct statement below.

a.Average tax rate

b.Effective tax rate

c.Horizontal equity

d.Marginal tax rate

e.Progressive rate structure

f.Proportional rate structure

g.Regressive rate structure

h.Tax avoidance

i.Tax evasion

j.Vertical equity

The tax rate obtained by dividing total tax liability by taxable income.

a.Average tax rate

b.Effective tax rate

c.Horizontal equity

d.Marginal tax rate

e.Progressive rate structure

f.Proportional rate structure

g.Regressive rate structure

h.Tax avoidance

i.Tax evasion

j.Vertical equity

The tax rate obtained by dividing total tax liability by taxable income.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

11

Match each term with the correct statement below.

a.Average tax rate

b.Effective tax rate

c.Horizontal equity

d.Marginal tax rate

e.Progressive rate structure

f.Proportional rate structure

g.Regressive rate structure

h.Tax avoidance

i.Tax evasion

j.Vertical equity

Tax planning using legal methods to minimize the tax liability.

a.Average tax rate

b.Effective tax rate

c.Horizontal equity

d.Marginal tax rate

e.Progressive rate structure

f.Proportional rate structure

g.Regressive rate structure

h.Tax avoidance

i.Tax evasion

j.Vertical equity

Tax planning using legal methods to minimize the tax liability.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

12

Match each term with the correct statement below.

a.Average tax rate

b.Effective tax rate

c.Horizontal equity

d.Marginal tax rate

e.Progressive rate structure

f.Proportional rate structure

g.Regressive rate structure

h.Tax avoidance

i.Tax evasion

j.Vertical equity

The result when two similarly situated taxpayers are taxed the same.

a.Average tax rate

b.Effective tax rate

c.Horizontal equity

d.Marginal tax rate

e.Progressive rate structure

f.Proportional rate structure

g.Regressive rate structure

h.Tax avoidance

i.Tax evasion

j.Vertical equity

The result when two similarly situated taxpayers are taxed the same.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

13

Match each term with the correct statement below.

a.Average tax rate

b.Effective tax rate

c.Horizontal equity

d.Marginal tax rate

e.Progressive rate structure

f.Proportional rate structure

g.Regressive rate structure

h.Tax avoidance

i.Tax evasion

j.Vertical equity

The tax rate obtained by dividing total tax liability by economic income.

a.Average tax rate

b.Effective tax rate

c.Horizontal equity

d.Marginal tax rate

e.Progressive rate structure

f.Proportional rate structure

g.Regressive rate structure

h.Tax avoidance

i.Tax evasion

j.Vertical equity

The tax rate obtained by dividing total tax liability by economic income.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

14

Match each term with the correct statement below.

a.Average tax rate

b.Effective tax rate

c.Horizontal equity

d.Marginal tax rate

e.Progressive rate structure

f.Proportional rate structure

g.Regressive rate structure

h.Tax avoidance

i.Tax evasion

j.Vertical equity

A tax rate that decreases as the tax base increases.

a.Average tax rate

b.Effective tax rate

c.Horizontal equity

d.Marginal tax rate

e.Progressive rate structure

f.Proportional rate structure

g.Regressive rate structure

h.Tax avoidance

i.Tax evasion

j.Vertical equity

A tax rate that decreases as the tax base increases.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

15

Match each term with the correct statement below.

a.Average tax rate

b.Effective tax rate

c.Horizontal equity

d.Marginal tax rate

e.Progressive rate structure

f.Proportional rate structure

g.Regressive rate structure

h.Tax avoidance

i.Tax evasion

j.Vertical equity

The result when two differently situated taxpayers are taxed differently but fairly.

a.Average tax rate

b.Effective tax rate

c.Horizontal equity

d.Marginal tax rate

e.Progressive rate structure

f.Proportional rate structure

g.Regressive rate structure

h.Tax avoidance

i.Tax evasion

j.Vertical equity

The result when two differently situated taxpayers are taxed differently but fairly.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

16

Match each term with the correct statement below.

a.Average tax rate

b.Effective tax rate

c.Horizontal equity

d.Marginal tax rate

e.Progressive rate structure

f.Proportional rate structure

g.Regressive rate structure

h.Tax avoidance

i.Tax evasion

j.Vertical equity

Fraudulent methods are used to reduce the actual tax liability.

a.Average tax rate

b.Effective tax rate

c.Horizontal equity

d.Marginal tax rate

e.Progressive rate structure

f.Proportional rate structure

g.Regressive rate structure

h.Tax avoidance

i.Tax evasion

j.Vertical equity

Fraudulent methods are used to reduce the actual tax liability.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

17

Match each term with the correct statement below.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

Any asset that is not real estate.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

Any asset that is not real estate.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

18

Match each term with the correct statement below.

a.Average tax rate

b.Effective tax rate

c.Horizontal equity

d.Marginal tax rate

e.Progressive rate structure

f.Proportional rate structure

g.Regressive rate structure

h.Tax avoidance

i.Tax evasion

j.Vertical equity

The tax rate that will apply to the next dollar of taxable income.

a.Average tax rate

b.Effective tax rate

c.Horizontal equity

d.Marginal tax rate

e.Progressive rate structure

f.Proportional rate structure

g.Regressive rate structure

h.Tax avoidance

i.Tax evasion

j.Vertical equity

The tax rate that will apply to the next dollar of taxable income.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

19

Match each term with the correct statement below.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

The value or amount that is subject to taxation.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

The value or amount that is subject to taxation.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

20

Match each term with the correct statement below.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

The excess of the selling price of an asset over its tax basis.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

The excess of the selling price of an asset over its tax basis.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

21

Gifts to qualified charitable organizations may be deducted as a contribution,but not to exceed 50% of an individual taxpayer's adjusted gross income.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

22

Match each term with the correct statement below.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

The payment of tax throughout the year as income is earned.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

The payment of tax throughout the year as income is earned.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

23

Self-employed people are required to make quarterly payments of their estimated tax liability.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

24

Horizontal equity exists when two similarly situated taxpayers are taxed the same.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

25

The statute of limitations is three years,six years if the taxpayer omits gross income in excess of 25%,and there is no statute of limitations if the taxpayer willfully defrauds the government.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

26

An annual loss results from an excess of allowable deductions for a tax year over the reported income.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

27

Tax avoidance occurs when a taxpayer uses fraudulent methods or deceptive behavior to hide actual tax liability.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

28

A regressive tax rate structure is defined as a tax in which the average tax rate decreases as the tax base increases.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

29

The marginal tax rate is the rate of tax that will be paid on the next dollar of income or the rate of tax that will be saved by the next dollar of deduction.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

30

Match each term with the correct statement below.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

The period of time during which a taxpayer and/or the IRS can correct a taxpayer's taxable income.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

The period of time during which a taxpayer and/or the IRS can correct a taxpayer's taxable income.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

31

Employers are required to pay a Federal Unemployment Tax of 6.2% of the first $10,000 in wages to each employee less a credit of up to 5.4% of state unemployment taxes paid.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

32

Match each term with the correct statement below.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

Increases in wealth and recoveries of capital that Congress has decided should not be subject to income tax.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

Increases in wealth and recoveries of capital that Congress has decided should not be subject to income tax.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

33

Match each term with the correct statement below.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

Direct reduction in the income tax liability often created by Congress to further a public purpose.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

Direct reduction in the income tax liability often created by Congress to further a public purpose.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

34

Adam Smith identified efficient,certainty,convenience,and economy as the four basic requirements for a good tax system.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

35

A deferral is like an exclusion in that it does not have a current tax effect,but it differs in that an exclusion is never subject to taxation,whereas a deferral will be subject to tax at some point of time in the future.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

36

All tax practitioners are governed by the AICPA's Code of Professional Conduct.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

37

Match each term with the correct statement below.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

A taxpayer is responsible for determining his/her tax liability and timely paying the tax due.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

A taxpayer is responsible for determining his/her tax liability and timely paying the tax due.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

38

Match each term with the correct statement below.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

The common,customary,recurring type of income earned by taxpayers.

a.Ad valorem tax

b.Deduction

c.Excise tax

d.Exclusion

e.Expense

f.Gain

g.Loss

h.Ordinary income

i.Pay-as-you-go concept

j.Personal property

k.Real property

l.Self-assessment

m.Standard deduction

n.Statute of limitations

o.Tax base

p.Tax credit

The common,customary,recurring type of income earned by taxpayers.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

39

A tax is an enforced contribution used to finance the functions of government.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

40

Congress is required to insure that the tax law has the following characteristics: equality,certainty,convenience,and economy.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following are included among Adam Smith's criteria for evaluating a tax?

I)Convenience.

II)Fairness.

III)Neutrality.

IV)Economy.

A)Statements I and II are correct.

B)Statements I, II, and III are correct.

C)Statements I and IV are correct.

D)Statements II and III are correct.

E)Statements I, II, III, and IV are correct.

I)Convenience.

II)Fairness.

III)Neutrality.

IV)Economy.

A)Statements I and II are correct.

B)Statements I, II, and III are correct.

C)Statements I and IV are correct.

D)Statements II and III are correct.

E)Statements I, II, III, and IV are correct.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

42

Which of Adam Smith's requirements for a good tax system best supports the argument that the federal income tax rate structure should be progressive?

A)Certainty.

B)Convenience.

C)Equality.

D)Neutrality.

E)Sufficiency.

A)Certainty.

B)Convenience.

C)Equality.

D)Neutrality.

E)Sufficiency.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

43

Based on the definition given in Chapter 1 of the text,which of the following is a tax?

I)A registration fee paid to the state to get a car license plate.

II)2% special sales tax for funding public education.

III)A special property tax assessment for installing sidewalks in the taxpayer's neighborhood.

IV)An income tax imposed by Chicago on persons living or working within the city limits.

A)Only statement I is correct.

B)Only statement III is correct.

C)Only statement IV is correct.

D)Statements I and IV are correct.

E)Statements II and IV are correct.

I)A registration fee paid to the state to get a car license plate.

II)2% special sales tax for funding public education.

III)A special property tax assessment for installing sidewalks in the taxpayer's neighborhood.

IV)An income tax imposed by Chicago on persons living or working within the city limits.

A)Only statement I is correct.

B)Only statement III is correct.

C)Only statement IV is correct.

D)Statements I and IV are correct.

E)Statements II and IV are correct.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

44

Jessica is single and has a 2013 taxable income of $199,800.She also received $15,000 of tax-exempt income.Jessica's marginal tax rate is:

A)22.8%

B)23.5%

C)25.0%

D)28.0%

E)33.0%

A)22.8%

B)23.5%

C)25.0%

D)28.0%

E)33.0%

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

45

Vertical equity

I)means that those taxpayers who have the greatest ability to pay the tax should pay the greatest proportion of the tax.

II)means that two similarly situated taxpayers are taxed the same.

III)is reflected in the progressive nature of the federal income tax system.

IV)exists when Avis,a single individual with 4 dependent children,and Art,a single individual with no dependents,both pay $2,400 income tax on equal $26,000 annual salaries.

A)Statements III and IV are correct.

B)Statements II and III are correct.

C)Statements I and III are correct.

D)Only statement IV is correct.

E)Statements I, II, III, and IV are correct.

I)means that those taxpayers who have the greatest ability to pay the tax should pay the greatest proportion of the tax.

II)means that two similarly situated taxpayers are taxed the same.

III)is reflected in the progressive nature of the federal income tax system.

IV)exists when Avis,a single individual with 4 dependent children,and Art,a single individual with no dependents,both pay $2,400 income tax on equal $26,000 annual salaries.

A)Statements III and IV are correct.

B)Statements II and III are correct.

C)Statements I and III are correct.

D)Only statement IV is correct.

E)Statements I, II, III, and IV are correct.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

46

A CPA may prepare tax returns using estimates provided by the taxpayer if it is impracticable to obtain exact data and the estimates are reasonable.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

47

Maria is single and has a 2013 taxable income of $199,800 She also received $15,000 of tax-exempt income.Maria's effective tax rate is:

A)22.8%

B)23.3%

C)25.3%

D)28.0%

E)33.0%

A)22.8%

B)23.3%

C)25.3%

D)28.0%

E)33.0%

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following statement is/are included in Adam Smith's four requirements for a good tax system?

I)Changes in the tax law should be made as needed to raise revenue and for proper administration.

II)A tax should be imposed in proportion to a taxpayer's ability to pay.

III)A taxpayer should be required to pay a tax when it is most likely to be convenient for the taxpayer to make the payment.

IV)The government must collect taxes equal to it's expenses.

A)Statements I and II are correct.

B)Statements I and IV are correct.

C)Statements II and III are correct.

D)Statements II and IV are correct.

E)Statements III and IV are correct.

I)Changes in the tax law should be made as needed to raise revenue and for proper administration.

II)A tax should be imposed in proportion to a taxpayer's ability to pay.

III)A taxpayer should be required to pay a tax when it is most likely to be convenient for the taxpayer to make the payment.

IV)The government must collect taxes equal to it's expenses.

A)Statements I and II are correct.

B)Statements I and IV are correct.

C)Statements II and III are correct.

D)Statements II and IV are correct.

E)Statements III and IV are correct.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following payments would not be considered a tax?

A)An assessment based on the selling price of the vehicle.

B)A local assessment for new sewers based on the amount of water used.

C)A local assessment for schools based on the value of the taxpayer's property.

D)A surcharge based upon the amount of income tax already calculated.

A)An assessment based on the selling price of the vehicle.

B)A local assessment for new sewers based on the amount of water used.

C)A local assessment for schools based on the value of the taxpayer's property.

D)A surcharge based upon the amount of income tax already calculated.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

50

Andrea is single and has a 2013 taxable income of $199,800 She also received $15,000 of tax-exempt income.Andrea's average tax rate is:

A)22.8%

B)23.5%

C)25.1%

D)28.5%

E)33.0%

A)22.8%

B)23.5%

C)25.1%

D)28.5%

E)33.0%

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following payments is a tax?

I)Artis paid the IRS a penalty of $475 (above his $11,184 income tax balance due)because he had significantly underpaid his estimated income tax.

II)Lindsey paid $135 to the State of Indiana to renew her CPA license.

III)Carrie paid a $3.50 toll to cross the Mississippi River.

IV)Darnell paid $950 to the County Treasurer's Office for an assessment on his business equipment.

A)Only statement IV is correct.

B)Only statement III is correct.

C)Statements II and IV are correct.

D)Statements I, II, and III are correct.

E)Statements I, II, III, and IV are correct.

I)Artis paid the IRS a penalty of $475 (above his $11,184 income tax balance due)because he had significantly underpaid his estimated income tax.

II)Lindsey paid $135 to the State of Indiana to renew her CPA license.

III)Carrie paid a $3.50 toll to cross the Mississippi River.

IV)Darnell paid $950 to the County Treasurer's Office for an assessment on his business equipment.

A)Only statement IV is correct.

B)Only statement III is correct.

C)Statements II and IV are correct.

D)Statements I, II, and III are correct.

E)Statements I, II, III, and IV are correct.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

52

Adam Smith's concept of vertical equity is found in a tax rate structure that is

A)Regressive.

B)Proportional.

C)Horizontal.

D)Progressive.

E)Economical.

A)Regressive.

B)Proportional.

C)Horizontal.

D)Progressive.

E)Economical.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

53

Pay-as-you-go withholding is consistent with Adam Smith's criteria of

A)Certainty.

B)Convenience.

C)Economy.

D)Fairness.

E)Transparency.

A)Certainty.

B)Convenience.

C)Economy.

D)Fairness.

E)Transparency.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

54

Bob and Linda are married and have a 2013 taxable income of $280,000.They also received $20,000 of tax-exempt income.Their marginal tax rate is:

A)23.1%

B)24.8%

C)28.0%

D)33.0%

E)35.0%

A)23.1%

B)24.8%

C)28.0%

D)33.0%

E)35.0%

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

55

If a taxpayer has a choice of receiving income in the current year versus the following year,which of the following tax rates is important in determining the year in which he should include the income?

A)Average.

B)Effective.

C)Composite.

D)Marginal.

A)Average.

B)Effective.

C)Composite.

D)Marginal.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

56

According to the IRS definition,which of the following is not a characteristic of a tax?

A)The payment to the governmental authority is required by law.

B)The payment relates to the receipt of a specific benefit.

C)The payment is required pursuant to the legislative power to tax.

D)The purpose of requiring the payment is to provide revenue to be used for the public or governmental purposes.

A)The payment to the governmental authority is required by law.

B)The payment relates to the receipt of a specific benefit.

C)The payment is required pursuant to the legislative power to tax.

D)The purpose of requiring the payment is to provide revenue to be used for the public or governmental purposes.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following payments meets the IRS definition of a tax?

A)A fee paid on the value of property transferred from one individual to another by gift.

B)A one-time additional property tax assessment to add a sidewalk to the neighborhood.

C)A fee paid on the purchase of aerosol producing products to fund ozone research.

D)A fee for a sticker purchased from a city that must be attached to garbage bags before the city garbage trucks will pick up the bags.

E)All of the above meet the definition of a tax.

A)A fee paid on the value of property transferred from one individual to another by gift.

B)A one-time additional property tax assessment to add a sidewalk to the neighborhood.

C)A fee paid on the purchase of aerosol producing products to fund ozone research.

D)A fee for a sticker purchased from a city that must be attached to garbage bags before the city garbage trucks will pick up the bags.

E)All of the above meet the definition of a tax.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

58

When planning for an investment that will extend over several years,the ability to predict how the results of the investment will be taxed is important.This statement is an example of

A)Certainty.

B)Transparency

C)Equality.

D)Neutrality.

E)Fairness.

A)Certainty.

B)Transparency

C)Equality.

D)Neutrality.

E)Fairness.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

59

Horizontal equity

I)means that those taxpayers who have the greatest ability to pay the tax should pay the greatest proportion of the tax.

II)means that two similarly situated taxpayers are taxed the same.

III)is reflected in the progressive nature of the federal income tax system.

IV)exists when Avis,a single individual with 4 dependent children,and Art,a single individual with no dependents,both pay $2,400 income tax on equal $26,000 annual salaries.

A)Statements III and IV are correct.

B)Statements II and III are correct.

C)Statements I and III are correct.

D)Only statement IV is correct.

E)Statements I, II, III, and IV are correct.

I)means that those taxpayers who have the greatest ability to pay the tax should pay the greatest proportion of the tax.

II)means that two similarly situated taxpayers are taxed the same.

III)is reflected in the progressive nature of the federal income tax system.

IV)exists when Avis,a single individual with 4 dependent children,and Art,a single individual with no dependents,both pay $2,400 income tax on equal $26,000 annual salaries.

A)Statements III and IV are correct.

B)Statements II and III are correct.

C)Statements I and III are correct.

D)Only statement IV is correct.

E)Statements I, II, III, and IV are correct.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following payments meets the IRS definition of a tax?

A)Sewer fee charged added to a city trash collection bill.

B)A special assessment paid to the county to pave a street.

C)A levy on the value of a deceased taxpayer's estate.

D)Payment of $300 to register an automobile. The $300 consists of a $50 registration fee and $250 based on the weight of the auto.

A)Sewer fee charged added to a city trash collection bill.

B)A special assessment paid to the county to pave a street.

C)A levy on the value of a deceased taxpayer's estate.

D)Payment of $300 to register an automobile. The $300 consists of a $50 registration fee and $250 based on the weight of the auto.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

61

Katie pays $10,000 in tax-deductible property taxes.Katie's marginal tax rate is 25%,average tax rate is 24%,and effective tax rate is 20%.Katie's tax savings from paying the property tax is:

A)$ 1,600

B)$ 2,000

C)$ 2,400

D)$ 2,500

E)$10,000

A)$ 1,600

B)$ 2,000

C)$ 2,400

D)$ 2,500

E)$10,000

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

62

A state sales tax levied on all goods and services sold is an example of a

A)progressive tax.

B)regressive tax.

C)proportional tax.

D)value added tax.

A)progressive tax.

B)regressive tax.

C)proportional tax.

D)value added tax.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

63

Shara's 2013 taxable income is $42,000 before considering charitable contributions.Shara is a single individual.She makes a donation of $5,000 to the American Heart Association in December 2013.By how much did Shara's marginal tax rate decline simply because of the donation?

A)0%

B)7%

C)3%

D)5%

E)10%

A)0%

B)7%

C)3%

D)5%

E)10%

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

64

A tax provision has been discussed that would add an additional marginal tax rate of 39% to be applied to an individual's taxable income in excess of $800,000.If this provision were to become law,what overall distributional impact would it have on our current income tax system?

A)Proportional.

B)Regressive.

C)Progressive.

D)Disproportional.

E)None of the above.

A)Proportional.

B)Regressive.

C)Progressive.

D)Disproportional.

E)None of the above.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

65

Jim and Anna are married and have a 2013 taxable income of $280,000.They also received $20,000 of tax-exempt income.Their effective tax rate is:

A)22.7%

B)22.9%

C)24.8%

D)33.0%

E)35.0%

A)22.7%

B)22.9%

C)24.8%

D)33.0%

E)35.0%

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

66

Terry is a worker in the country Pretoria.His salary is $46,000 and his taxable income is $52,000.Pretoria imposes a Worker Tax as follows:

Employers withhold a tax of 20% of all wages and salaries.If taxable income as reported on the employee's income tax return is greater than $50,000,an additional 10% tax is withheld on all income.Terry's marginal tax rate is:

A)0%

B)10%

C)20%

D)30%

Employers withhold a tax of 20% of all wages and salaries.If taxable income as reported on the employee's income tax return is greater than $50,000,an additional 10% tax is withheld on all income.Terry's marginal tax rate is:

A)0%

B)10%

C)20%

D)30%

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

67

Frank and Fran are married and have a 2013 taxable income of $280,000.They also received $20,000 of tax-exempt income.Their average tax rate is:

A)23.1%

B)24.5%

C)25.3%

D)33.0%

E)35.0%

A)23.1%

B)24.5%

C)25.3%

D)33.0%

E)35.0%

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

68

Katarina,a single taxpayer,has total income from all sources of $100,000 for 2013.Her taxable income after taking into consideration $25,000 in deductions and $10,000 in exclusions is $65,000.Katarina's tax liability is $12,179.What are Katarina's marginal,average,and effective tax rates?

A)28% marginal; 18.7% average; 18.7% effective.

B)25% marginal; 16.2% average; 16.2% effective.

C)25% marginal; 16.2% average; 18.7% effective.

D)25% marginal; 18.7% average; 16.2% effective.

E)28% marginal; 16.2% average; 18.7% effective.

A)28% marginal; 18.7% average; 18.7% effective.

B)25% marginal; 16.2% average; 16.2% effective.

C)25% marginal; 16.2% average; 18.7% effective.

D)25% marginal; 18.7% average; 16.2% effective.

E)28% marginal; 16.2% average; 18.7% effective.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

69

Taxpayer A pays tax of $3,300 on taxable income of $10,000 while taxpayer B pays tax of $6,600 on $20,000.The tax is a

A)proportional tax.

B)regressive tax.

C)progressive tax.

D)horizontal tax.

A)proportional tax.

B)regressive tax.

C)progressive tax.

D)horizontal tax.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

70

Jered and Samantha are married.Their 2013 taxable income is $90,000 before considering their mortgage interest deduction.If the mortgage interest totals $10,000 for 2013,what are the tax savings attributable to their interest deduction?

A)$ 1,500

B)$ 2,500

C)$ 2,800

D)$ 3,300

E)$10,000

A)$ 1,500

B)$ 2,500

C)$ 2,800

D)$ 3,300

E)$10,000

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

71

Employment taxes are

A)revenue neutral.

B)regressive .

C)value-added.

D)progressive.

E)proportional.

A)revenue neutral.

B)regressive .

C)value-added.

D)progressive.

E)proportional.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

72

The mythical country of Januvia imposes a tax based on the number of titanium coins each taxpayer owns at the end of each year per the following schedule:

Marvin,a resident of Januvia,owns 300 titanium coins at the end of the current year.

I.Marvin's titanium coins tax is $2,800.

II.Marvin's marginal tax rate is $6.

III.Marvin's average tax rate is $9.33.

IV.Marvin's average tax rate is $6.

A)Statements II and III are correct.

B)Statements I, II, and IV are correct.

C)Statements II and IV are correct.

D)Statements I, II and III are correct.

E)Only statement II is correct.

Marvin,a resident of Januvia,owns 300 titanium coins at the end of the current year.

I.Marvin's titanium coins tax is $2,800.

II.Marvin's marginal tax rate is $6.

III.Marvin's average tax rate is $9.33.

IV.Marvin's average tax rate is $6.

A)Statements II and III are correct.

B)Statements I, II, and IV are correct.

C)Statements II and IV are correct.

D)Statements I, II and III are correct.

E)Only statement II is correct.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

73

Lee's 2013 taxable income is $88,000 before considering charitable contributions.Lee is a single individual.She makes a donation of $10,000 to the American Heart Association in December 2013.By how much did Lee's marginal tax rate decline simply because of the donation?

A)0%

B)10%

C)3%

D)5%

E)8%

A)0%

B)10%

C)3%

D)5%

E)8%

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

74

The Federal income tax is a

A)revenue neutral tax.

B)regressive tax.

C)value-added tax.

D)progressive tax.

E)form of sales tax.

A)revenue neutral tax.

B)regressive tax.

C)value-added tax.

D)progressive tax.

E)form of sales tax.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

75

Indicate which of the following statements concerning the following tax rate structures is/are correct.

I.Tax Structure #1 is regressive.

II.Tax Structure #1 is proportional

III.Tax Structure #2 is progressive.

IV.Tax Structure #3 is progressive

A)Only statement I is correct.

B)Only statement III is correct.

C)Statements I and IV are correct.

D)Statements II and IV are correct.

E)Statements I, II, and IV are correct.

I.Tax Structure #1 is regressive.

II.Tax Structure #1 is proportional

III.Tax Structure #2 is progressive.

IV.Tax Structure #3 is progressive

A)Only statement I is correct.

B)Only statement III is correct.

C)Statements I and IV are correct.

D)Statements II and IV are correct.

E)Statements I, II, and IV are correct.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

76

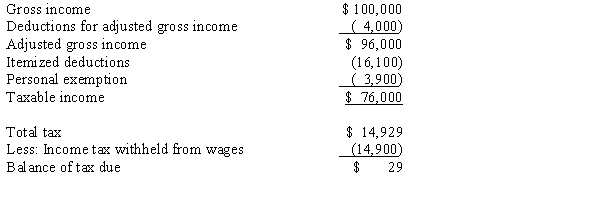

Betty is a single individual.In 2013,she receives $5,000 of tax-exempt income in addition to her salary and other investment income.Betty's 2013 tax return showed the following information:

Which of the following statements concerning Betty's tax rates is (are)correct?

I.Betty's average tax rate is 19.0%.

II.Betty's average tax rate is 17.7%.

III.Betty's effective tax rate is 19.0%.

IV.Betty's effective tax rate is 17.7%.

A)Statements I and III are correct.

B)Statements I and IV are correct.

C)Statements II and III are correct.

D)Statements II and IV are correct.

Which of the following statements concerning Betty's tax rates is (are)correct?

I.Betty's average tax rate is 19.0%.

II.Betty's average tax rate is 17.7%.

III.Betty's effective tax rate is 19.0%.

IV.Betty's effective tax rate is 17.7%.

A)Statements I and III are correct.

B)Statements I and IV are correct.

C)Statements II and III are correct.

D)Statements II and IV are correct.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

77

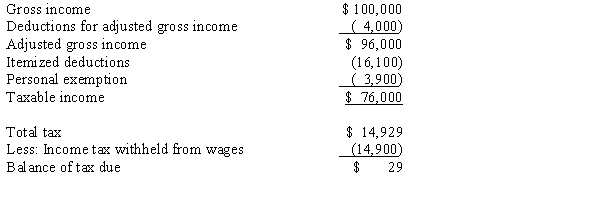

Sally is a single individual.In 2013,she receives $10,000 of tax-exempt income in addition to her salary and other investment income of $100,000.Sally's 2013 tax return showed the following information:

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

78

Alan is a single taxpayer with a gross income of $88,000,a taxable income of $66,000,and an income tax liability of $12,429.Josh also has $8,000 of tax-exempt interest income.What are Alan's marginal,average,and effective tax rates?

A)25% marginal; 16.8% average; 18.8% effective.

B)28% marginal; 15.9% average; 21.5% effective.

C)28% marginal; 16.8% average; 21.5% effective.

D)25% marginal; 18.8% average; 16.8% effective.

A)25% marginal; 16.8% average; 18.8% effective.

B)28% marginal; 15.9% average; 21.5% effective.

C)28% marginal; 16.8% average; 21.5% effective.

D)25% marginal; 18.8% average; 16.8% effective.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

79

Jaun plans to give $5,000 to the American Diabetes Association.Jaun's marginal tax rate is 28%.His average tax rate is 25%.Jaun's after-tax cost of the contribution is

A)$1,250

B)$1,400

C)$3,600

D)$3,750

E)$5,000

A)$1,250

B)$1,400

C)$3,600

D)$3,750

E)$5,000

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

80

Indicate which of the following statements concerning the following tax rate structures is/are correct.

I.Tax Structure #1 is proportional.

II.Tax Structure #1 is regressive

III.Tax Structure #2 is progressive.

IV.Tax Structure #3 is progressive

A)Only statement I is correct.

B)Only statement III is correct.

C)Statements I and II are correct.

D)Statements II and IV are correct.

E)Statements I, II, and IV are correct.

I.Tax Structure #1 is proportional.

II.Tax Structure #1 is regressive

III.Tax Structure #2 is progressive.

IV.Tax Structure #3 is progressive

A)Only statement I is correct.

B)Only statement III is correct.

C)Statements I and II are correct.

D)Statements II and IV are correct.

E)Statements I, II, and IV are correct.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck