Deck 17: The Capital Market

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/110

Play

Full screen (f)

Deck 17: The Capital Market

1

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 What is the main difference between common and preferred stocks?</strong> A)Common stocks pay interest whereas preferred stocks pay dividends. B)Preferred stocks carry voting rights whereas common stocks do not carry voting rights. C)Preferred stocks pay a guaranteed dividend, while common stocks may or may not pay dividends. D)In case of bankruptcy, preferred stockholders have a right to the company's asset, whereas common stockholders do not have such rights. E)Common stocks can be converted into preferred stocks while preferred stocks cannot be converted into common stocks.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

What is the main difference between common and preferred stocks?

A)Common stocks pay interest whereas preferred stocks pay dividends.

B)Preferred stocks carry voting rights whereas common stocks do not carry voting rights.

C)Preferred stocks pay a guaranteed dividend, while common stocks may or may not pay dividends.

D)In case of bankruptcy, preferred stockholders have a right to the company's asset, whereas common stockholders do not have such rights.

E)Common stocks can be converted into preferred stocks while preferred stocks cannot be converted into common stocks.

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 What is the main difference between common and preferred stocks?</strong> A)Common stocks pay interest whereas preferred stocks pay dividends. B)Preferred stocks carry voting rights whereas common stocks do not carry voting rights. C)Preferred stocks pay a guaranteed dividend, while common stocks may or may not pay dividends. D)In case of bankruptcy, preferred stockholders have a right to the company's asset, whereas common stockholders do not have such rights. E)Common stocks can be converted into preferred stocks while preferred stocks cannot be converted into common stocks.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

What is the main difference between common and preferred stocks?

A)Common stocks pay interest whereas preferred stocks pay dividends.

B)Preferred stocks carry voting rights whereas common stocks do not carry voting rights.

C)Preferred stocks pay a guaranteed dividend, while common stocks may or may not pay dividends.

D)In case of bankruptcy, preferred stockholders have a right to the company's asset, whereas common stockholders do not have such rights.

E)Common stocks can be converted into preferred stocks while preferred stocks cannot be converted into common stocks.

Preferred stocks pay a guaranteed dividend, while common stocks may or may not pay dividends.

2

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 In Figure 17.1, if the initial demand curve is D<sub>1</sub>, the equilibrium quantity of capital demanded is:</strong> A)Q<sub>1</sub>. B)Q<sub>3</sub>. C)0. D)Q<sub>4</sub>. E)Q<sub>2</sub>.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

In Figure 17.1, if the initial demand curve is D1, the equilibrium quantity of capital demanded is:

A)Q1.

B)Q3.

C)0.

D)Q4.

E)Q2.

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 In Figure 17.1, if the initial demand curve is D<sub>1</sub>, the equilibrium quantity of capital demanded is:</strong> A)Q<sub>1</sub>. B)Q<sub>3</sub>. C)0. D)Q<sub>4</sub>. E)Q<sub>2</sub>.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

In Figure 17.1, if the initial demand curve is D1, the equilibrium quantity of capital demanded is:

A)Q1.

B)Q3.

C)0.

D)Q4.

E)Q2.

Q2.

3

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 Stocks that offer a guaranteed fixed periodic payment or dividend are known as:</strong> A)common stock. B)restricted stock. C)close-ended stock. D)preferred stock. E)open-ended stock.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

Stocks that offer a guaranteed fixed periodic payment or dividend are known as:

A)common stock.

B)restricted stock.

C)close-ended stock.

D)preferred stock.

E)open-ended stock.

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 Stocks that offer a guaranteed fixed periodic payment or dividend are known as:</strong> A)common stock. B)restricted stock. C)close-ended stock. D)preferred stock. E)open-ended stock.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

Stocks that offer a guaranteed fixed periodic payment or dividend are known as:

A)common stock.

B)restricted stock.

C)close-ended stock.

D)preferred stock.

E)open-ended stock.

preferred stock.

4

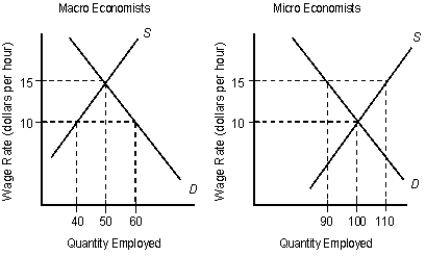

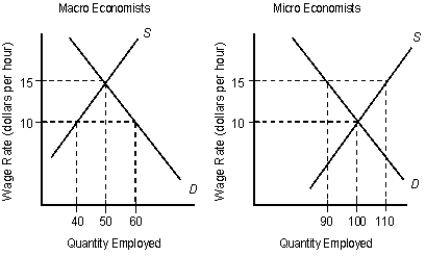

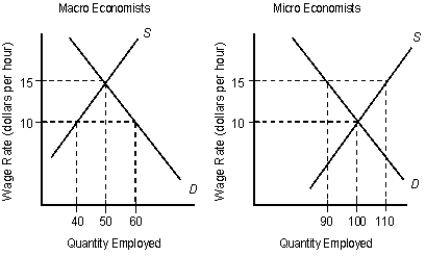

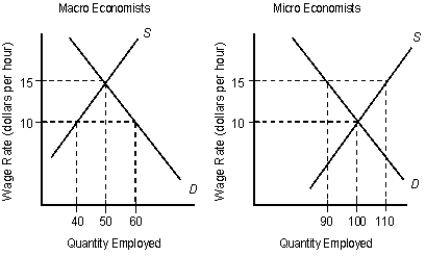

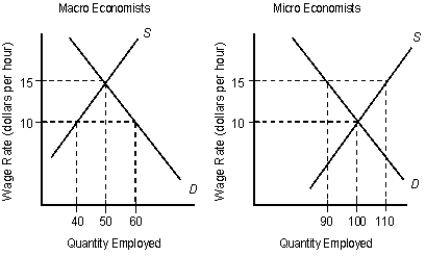

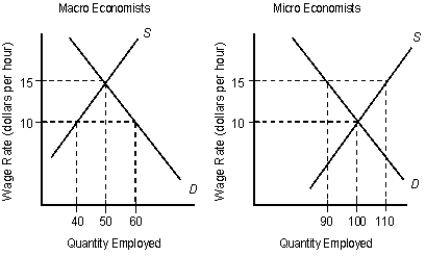

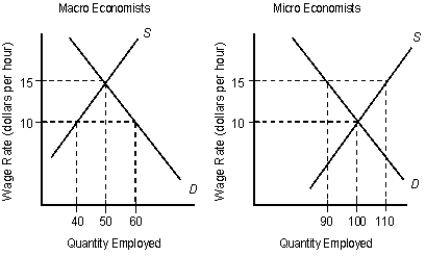

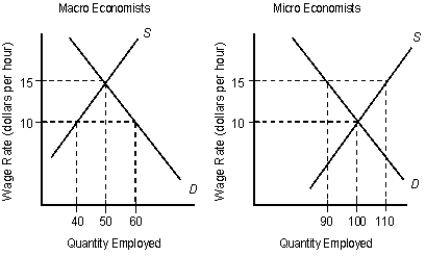

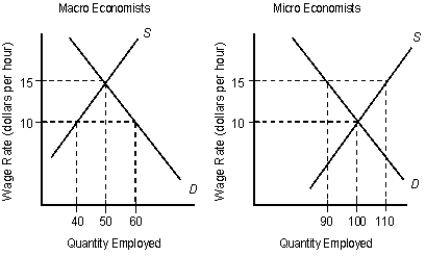

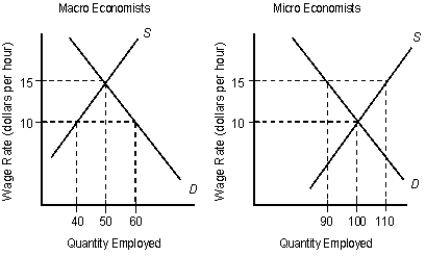

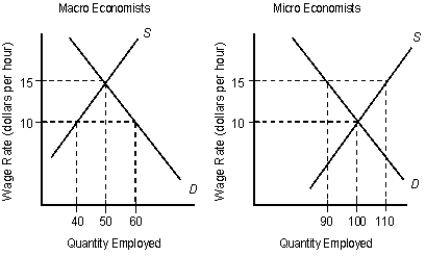

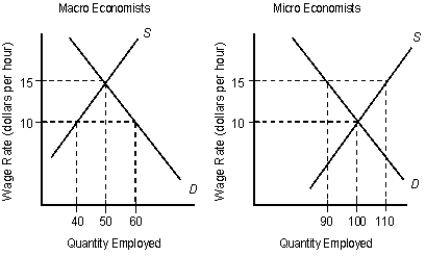

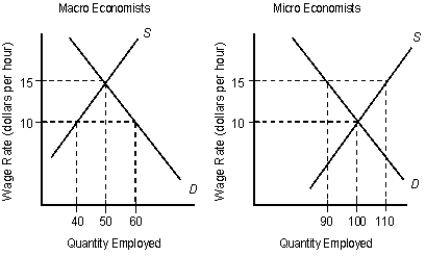

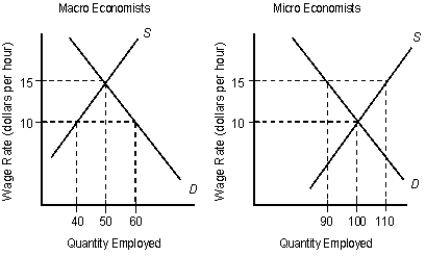

The following figures show the demand (D) and supply (S) curves of micro and macro economists.Figure 16.6

Which of the following will shift the demand curve for capital leftward?

A)Introduction of supercomputers in the resource market

B)A fall in the market interest rates

C)An increase in the price of capital

D)Business expectations of increased regulations

E)A rise in the equilibrium wage of labor

Which of the following will shift the demand curve for capital leftward?

A)Introduction of supercomputers in the resource market

B)A fall in the market interest rates

C)An increase in the price of capital

D)Business expectations of increased regulations

E)A rise in the equilibrium wage of labor

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

5

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 Dividend yield is:</strong> A)the annual dividend payment per share. B)the annual dividend per share divided by the price of each share. C)the current stock price divided by the dividend per share. D)the year-on-year change in the annual dividend payment. E)the dollar value change in the stock price from the previous day's closing price.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

Dividend yield is:

A)the annual dividend payment per share.

B)the annual dividend per share divided by the price of each share.

C)the current stock price divided by the dividend per share.

D)the year-on-year change in the annual dividend payment.

E)the dollar value change in the stock price from the previous day's closing price.

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 Dividend yield is:</strong> A)the annual dividend payment per share. B)the annual dividend per share divided by the price of each share. C)the current stock price divided by the dividend per share. D)the year-on-year change in the annual dividend payment. E)the dollar value change in the stock price from the previous day's closing price.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

Dividend yield is:

A)the annual dividend payment per share.

B)the annual dividend per share divided by the price of each share.

C)the current stock price divided by the dividend per share.

D)the year-on-year change in the annual dividend payment.

E)the dollar value change in the stock price from the previous day's closing price.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

6

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 In Figure 17.1, if the demand curve for capital shifts to D<sub>2</sub>, the equilibrium price and quantity of capital are:</strong> A)P<sub>1</sub> and Q<sub>1</sub>. B)P<sub>2</sub> and Q<sub>2</sub>. C)P<sub>5</sub> and Q<sub>1</sub>. D)P<sub>3</sub> and Q<sub>3</sub>. E)P<sub>4</sub> and Q<sub>4</sub>.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

In Figure 17.1, if the demand curve for capital shifts to D2, the equilibrium price and quantity of capital are:

A)P1 and Q1.

B)P2 and Q2.

C)P5 and Q1.

D)P3 and Q3.

E)P4 and Q4.

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 In Figure 17.1, if the demand curve for capital shifts to D<sub>2</sub>, the equilibrium price and quantity of capital are:</strong> A)P<sub>1</sub> and Q<sub>1</sub>. B)P<sub>2</sub> and Q<sub>2</sub>. C)P<sub>5</sub> and Q<sub>1</sub>. D)P<sub>3</sub> and Q<sub>3</sub>. E)P<sub>4</sub> and Q<sub>4</sub>.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

In Figure 17.1, if the demand curve for capital shifts to D2, the equilibrium price and quantity of capital are:

A)P1 and Q1.

B)P2 and Q2.

C)P5 and Q1.

D)P3 and Q3.

E)P4 and Q4.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

7

The following figures show the demand (D) and supply (S) curves of micro and macro economists.Figure 16.6

When the rate of interest rises, the resulting change in the demand for capital is shown graphically by:

A)a movement down along the demand curve.

B)a rightward shift of the demand curve.

C)a leftward shift of the demand curve.

D)a movement up along the demand curve.

E)an outward rotation of the demand curve.

When the rate of interest rises, the resulting change in the demand for capital is shown graphically by:

A)a movement down along the demand curve.

B)a rightward shift of the demand curve.

C)a leftward shift of the demand curve.

D)a movement up along the demand curve.

E)an outward rotation of the demand curve.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

8

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 In Figure 17.1, if the initial demand curve is D<sub>1</sub>, the equilibrium price of capital is:</strong> A)P<sub>2</sub>. B)P<sub>4</sub>. C)P<sub>1</sub>. D)P<sub>5</sub>. E)P<sub>3</sub>.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

In Figure 17.1, if the initial demand curve is D1, the equilibrium price of capital is:

A)P2.

B)P4.

C)P1.

D)P5.

E)P3.

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 In Figure 17.1, if the initial demand curve is D<sub>1</sub>, the equilibrium price of capital is:</strong> A)P<sub>2</sub>. B)P<sub>4</sub>. C)P<sub>1</sub>. D)P<sub>5</sub>. E)P<sub>3</sub>.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

In Figure 17.1, if the initial demand curve is D1, the equilibrium price of capital is:

A)P2.

B)P4.

C)P1.

D)P5.

E)P3.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

9

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 The largest stock exchange in the world is:</strong> A)the Munich Stock Exchange. B)the London Stock Exchange. C)the New York Stock Exchange. D)the Tokyo Stock Exchange. E)the Shanghai Stock Exchange.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

The largest stock exchange in the world is:

A)the Munich Stock Exchange.

B)the London Stock Exchange.

C)the New York Stock Exchange.

D)the Tokyo Stock Exchange.

E)the Shanghai Stock Exchange.

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 The largest stock exchange in the world is:</strong> A)the Munich Stock Exchange. B)the London Stock Exchange. C)the New York Stock Exchange. D)the Tokyo Stock Exchange. E)the Shanghai Stock Exchange.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

The largest stock exchange in the world is:

A)the Munich Stock Exchange.

B)the London Stock Exchange.

C)the New York Stock Exchange.

D)the Tokyo Stock Exchange.

E)the Shanghai Stock Exchange.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

10

The following figures show the demand (D) and supply (S) curves of micro and macro economists.Figure 16.6

The demand curve for capital:

A)shows the positive relation between capital usage and the quantity of capital demanded.

B)shows the positive relation between aggregate output and the quantity of capital demanded.

C)shows the negative relation between rate of inflation and the quantity of capital demanded.

D)shows the positive relation between technological change and the quantity of capital demanded.

E)shows the negative relation between price of capital and the quantity of capital demanded.

The demand curve for capital:

A)shows the positive relation between capital usage and the quantity of capital demanded.

B)shows the positive relation between aggregate output and the quantity of capital demanded.

C)shows the negative relation between rate of inflation and the quantity of capital demanded.

D)shows the positive relation between technological change and the quantity of capital demanded.

E)shows the negative relation between price of capital and the quantity of capital demanded.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

11

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 In Figure 17.1, if the initial demand curve is D<sub>1</sub>, the capital market is in equilibrium at:</strong> A) point a. B) point b. C) point c. D) point d. E) point f.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

In Figure 17.1, if the initial demand curve is D1, the capital market is in equilibrium at:

A) point a.

B) point b.

C) point c.

D) point d.

E) point f.

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 In Figure 17.1, if the initial demand curve is D<sub>1</sub>, the capital market is in equilibrium at:</strong> A) point a. B) point b. C) point c. D) point d. E) point f.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

In Figure 17.1, if the initial demand curve is D1, the capital market is in equilibrium at:

A) point a.

B) point b.

C) point c.

D) point d.

E) point f.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

12

The following figures show the demand (D) and supply (S) curves of micro and macro economists.Figure 16.6

When a new generation of computers, which are faster and more powerful than the previous generation, is introduced into the resource market:

A)many firms do not change their demand for capital.

B)many firms increase their demand for capital.

C)many firms decrease their demand for capital.

D)the quantity demanded of capital declines.

E)the quantity demanded of capital increases.

When a new generation of computers, which are faster and more powerful than the previous generation, is introduced into the resource market:

A)many firms do not change their demand for capital.

B)many firms increase their demand for capital.

C)many firms decrease their demand for capital.

D)the quantity demanded of capital declines.

E)the quantity demanded of capital increases.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

13

The following figures show the demand (D) and supply (S) curves of micro and macro economists.Figure 16.6

If the price of capital falls, _____.

A)the supply of capital increases

B)the quantity supplied of capital decreases

C)the quantity supplied of capital increases

D)the quantity supplied of capital remains unchanged

E)the supply of capital decreases

If the price of capital falls, _____.

A)the supply of capital increases

B)the quantity supplied of capital decreases

C)the quantity supplied of capital increases

D)the quantity supplied of capital remains unchanged

E)the supply of capital decreases

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

14

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 Which of the following is true of American Depository Receipts (ADRs)?</strong> A)ADRs cannot be sold over the counter. B)Each ADR is backed by a specific number of the issuer's local shares. C)An ADR is a stock that trades in foreign countries but represents a specified number of shares in a U.S. corporation. D)For foreign companies, ADRs are an easy way to purchase raw material from U.S. producers. E)ADRs are issued or sponsored in the United States by the federal government.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

Which of the following is true of American Depository Receipts (ADRs)?

A)ADRs cannot be sold "over the counter."

B)Each ADR is backed by a specific number of the issuer's local shares.

C)An ADR is a stock that trades in foreign countries but represents a specified number of shares in a U.S. corporation.

D)For foreign companies, ADRs are an easy way to purchase raw material from U.S. producers.

E)ADRs are issued or sponsored in the United States by the federal government.

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 Which of the following is true of American Depository Receipts (ADRs)?</strong> A)ADRs cannot be sold over the counter. B)Each ADR is backed by a specific number of the issuer's local shares. C)An ADR is a stock that trades in foreign countries but represents a specified number of shares in a U.S. corporation. D)For foreign companies, ADRs are an easy way to purchase raw material from U.S. producers. E)ADRs are issued or sponsored in the United States by the federal government.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

Which of the following is true of American Depository Receipts (ADRs)?

A)ADRs cannot be sold "over the counter."

B)Each ADR is backed by a specific number of the issuer's local shares.

C)An ADR is a stock that trades in foreign countries but represents a specified number of shares in a U.S. corporation.

D)For foreign companies, ADRs are an easy way to purchase raw material from U.S. producers.

E)ADRs are issued or sponsored in the United States by the federal government.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

15

The following figures show the demand (D) and supply (S) curves of micro and macro economists.Figure 16.6

All of the following will shift the demand curve for capital, except:

A)future expectations about the demand for the good produced by a firm.

B)technological changes.

C)the price of capital.

D)the entry of new firms into the market.

E)the change in the interest rate.

All of the following will shift the demand curve for capital, except:

A)future expectations about the demand for the good produced by a firm.

B)technological changes.

C)the price of capital.

D)the entry of new firms into the market.

E)the change in the interest rate.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

16

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 The unique alphabetic name that identifies a listed stock is known as the:</strong> A)stock's nickname. B)stock's alpha sign. C)ticker symbol. D)alternative name. E)fixed call number.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

The unique alphabetic name that identifies a listed stock is known as the:

A)stock's nickname.

B)stock's alpha sign.

C)ticker symbol.

D)alternative name.

E)fixed call number.

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 The unique alphabetic name that identifies a listed stock is known as the:</strong> A)stock's nickname. B)stock's alpha sign. C)ticker symbol. D)alternative name. E)fixed call number.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

The unique alphabetic name that identifies a listed stock is known as the:

A)stock's nickname.

B)stock's alpha sign.

C)ticker symbol.

D)alternative name.

E)fixed call number.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

17

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 In Figure 17.1, if the price set in the market is P<sub>3</sub> when the demand curve is D<sub>1</sub>, then:</strong> A)the market will be in equilibrium. B)there will be an excess demand for capital of the amount Q<sub>4</sub> - Q<sub>1</sub>. C)there will be a shortage of capital in the market by the amount Q<sub>4</sub> - Q<sub>2</sub>. D)there will be a surplus of capital in the market by the amount Q<sub>3</sub> - Q<sub>1</sub>. E)there will be a surplus of capital in the market by the amount Q<sub>3</sub> - Q<sub>2</sub>.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

In Figure 17.1, if the price set in the market is P3 when the demand curve is D1, then:

A)the market will be in equilibrium.

B)there will be an excess demand for capital of the amount Q4 - Q1.

C)there will be a shortage of capital in the market by the amount Q4 - Q2.

D)there will be a surplus of capital in the market by the amount Q3 - Q1.

E)there will be a surplus of capital in the market by the amount Q3 - Q2.

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 In Figure 17.1, if the price set in the market is P<sub>3</sub> when the demand curve is D<sub>1</sub>, then:</strong> A)the market will be in equilibrium. B)there will be an excess demand for capital of the amount Q<sub>4</sub> - Q<sub>1</sub>. C)there will be a shortage of capital in the market by the amount Q<sub>4</sub> - Q<sub>2</sub>. D)there will be a surplus of capital in the market by the amount Q<sub>3</sub> - Q<sub>1</sub>. E)there will be a surplus of capital in the market by the amount Q<sub>3</sub> - Q<sub>2</sub>.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

In Figure 17.1, if the price set in the market is P3 when the demand curve is D1, then:

A)the market will be in equilibrium.

B)there will be an excess demand for capital of the amount Q4 - Q1.

C)there will be a shortage of capital in the market by the amount Q4 - Q2.

D)there will be a surplus of capital in the market by the amount Q3 - Q1.

E)there will be a surplus of capital in the market by the amount Q3 - Q2.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

18

The following figures show the demand (D) and supply (S) curves of micro and macro economists.Figure 16.6

A firm decides to hire more equipment if:

A)the average revenue it earns by selling its output is equal to its average cost.

B)its total revenue is greater than the total cost of hiring the equipment.

C)the marginal revenue product of the additional unit of equipment is greater than the marginal factor cost.

D)its average revenue is greater than the average cost of hiring equipment.

E)the price of its product is greater than the average cost of production.

A firm decides to hire more equipment if:

A)the average revenue it earns by selling its output is equal to its average cost.

B)its total revenue is greater than the total cost of hiring the equipment.

C)the marginal revenue product of the additional unit of equipment is greater than the marginal factor cost.

D)its average revenue is greater than the average cost of hiring equipment.

E)the price of its product is greater than the average cost of production.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

19

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 If the P/E ratio is equal to 50, it implies that investors in the stock are willing to pay:</strong> A)$25 for every $2 of the earnings that the company generates during a period. B)$100 for every $1 of the earnings that the company generates during a period. C)$500 for every $1 of the earnings that the company generates during a period. D)$50 for every $1 of the earnings that the company generates during a period. E)$5 for every $1 of the earnings that the company generates during a period.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

If the P/E ratio is equal to 50, it implies that investors in the stock are willing to pay:

A)$25 for every $2 of the earnings that the company generates during a period.

B)$100 for every $1 of the earnings that the company generates during a period.

C)$500 for every $1 of the earnings that the company generates during a period.

D)$50 for every $1 of the earnings that the company generates during a period.

E)$5 for every $1 of the earnings that the company generates during a period.

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 If the P/E ratio is equal to 50, it implies that investors in the stock are willing to pay:</strong> A)$25 for every $2 of the earnings that the company generates during a period. B)$100 for every $1 of the earnings that the company generates during a period. C)$500 for every $1 of the earnings that the company generates during a period. D)$50 for every $1 of the earnings that the company generates during a period. E)$5 for every $1 of the earnings that the company generates during a period.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

If the P/E ratio is equal to 50, it implies that investors in the stock are willing to pay:

A)$25 for every $2 of the earnings that the company generates during a period.

B)$100 for every $1 of the earnings that the company generates during a period.

C)$500 for every $1 of the earnings that the company generates during a period.

D)$50 for every $1 of the earnings that the company generates during a period.

E)$5 for every $1 of the earnings that the company generates during a period.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

20

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 The financial capital of a firm includes the:</strong> A)service provided by its accountants. B)credit cards provided to its top executives. C)equity and bonds issued by it. D)loans accepted from banks. E)computers purchased for its office staff.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

The financial capital of a firm includes the:

A)service provided by its accountants.

B)credit cards provided to its top executives.

C)equity and bonds issued by it.

D)loans accepted from banks.

E)computers purchased for its office staff.

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 The financial capital of a firm includes the:</strong> A)service provided by its accountants. B)credit cards provided to its top executives. C)equity and bonds issued by it. D)loans accepted from banks. E)computers purchased for its office staff.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

The financial capital of a firm includes the:

A)service provided by its accountants.

B)credit cards provided to its top executives.

C)equity and bonds issued by it.

D)loans accepted from banks.

E)computers purchased for its office staff.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

21

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 If you invest $2,500 in a mutual fund with a 5 percent front-end load, _____.</strong> A)$50 will be used to pay for the sales charge and $2,000 will be invested in the fund B)there will be no sales charge and the entire $2,500 will be invested in the fund C)the fees for the fund manager will be paid only after a period of 20 years D)$125 will be paid to the fund manager and $2,375 will be invested in the fund E)a fixed amount of $250 will be paid to the fund manager every year](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

If you invest $2,500 in a mutual fund with a 5 percent front-end load, _____.

A)$50 will be used to pay for the sales charge and $2,000 will be invested in the fund

B)there will be no sales charge and the entire $2,500 will be invested in the fund

C)the fees for the fund manager will be paid only after a period of 20 years

D)$125 will be paid to the fund manager and $2,375 will be invested in the fund

E)a fixed amount of $250 will be paid to the fund manager every year

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 If you invest $2,500 in a mutual fund with a 5 percent front-end load, _____.</strong> A)$50 will be used to pay for the sales charge and $2,000 will be invested in the fund B)there will be no sales charge and the entire $2,500 will be invested in the fund C)the fees for the fund manager will be paid only after a period of 20 years D)$125 will be paid to the fund manager and $2,375 will be invested in the fund E)a fixed amount of $250 will be paid to the fund manager every year](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

If you invest $2,500 in a mutual fund with a 5 percent front-end load, _____.

A)$50 will be used to pay for the sales charge and $2,000 will be invested in the fund

B)there will be no sales charge and the entire $2,500 will be invested in the fund

C)the fees for the fund manager will be paid only after a period of 20 years

D)$125 will be paid to the fund manager and $2,375 will be invested in the fund

E)a fixed amount of $250 will be paid to the fund manager every year

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

22

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 Compute the actual investment in a mutual fund carrying a front-end load of 10 percent on a sum of $10,000 invested by an individual.</strong> A)$1,000 B)$10,000 C)$11,000 D)$9,000 E)$12,000](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

Compute the actual investment in a mutual fund carrying a front-end load of 10 percent on a sum of $10,000 invested by an individual.

A)$1,000

B)$10,000

C)$11,000

D)$9,000

E)$12,000

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 Compute the actual investment in a mutual fund carrying a front-end load of 10 percent on a sum of $10,000 invested by an individual.</strong> A)$1,000 B)$10,000 C)$11,000 D)$9,000 E)$12,000](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

Compute the actual investment in a mutual fund carrying a front-end load of 10 percent on a sum of $10,000 invested by an individual.

A)$1,000

B)$10,000

C)$11,000

D)$9,000

E)$12,000

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

23

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 A stock index measures the:</strong> A)change in dividend payments of a group of stocks. B)fluctuation in the price-to-earnings ratio of each share. C)change in the trading volume in the stock exchange. D)price movements of a group of stocks. E)change in the number of enlisted companies.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

A stock index measures the:

A)change in dividend payments of a group of stocks.

B)fluctuation in the price-to-earnings ratio of each share.

C)change in the trading volume in the stock exchange.

D)price movements of a group of stocks.

E)change in the number of enlisted companies.

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 A stock index measures the:</strong> A)change in dividend payments of a group of stocks. B)fluctuation in the price-to-earnings ratio of each share. C)change in the trading volume in the stock exchange. D)price movements of a group of stocks. E)change in the number of enlisted companies.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

A stock index measures the:

A)change in dividend payments of a group of stocks.

B)fluctuation in the price-to-earnings ratio of each share.

C)change in the trading volume in the stock exchange.

D)price movements of a group of stocks.

E)change in the number of enlisted companies.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

24

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 Consider a mutual fund with a 6 percent back-end load that decreases to 0 percent in the seventh year. How much of the load will an investor have to bear if she sells it off in the seventh year?</strong> A)1 percent of the load B)0 percent of the load C)2 percent of the load D)6 percent of the load E)4 percent of the load](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

Consider a mutual fund with a 6 percent back-end load that decreases to 0 percent in the seventh year. How much of the load will an investor have to bear if she sells it off in the seventh year?

A)1 percent of the load

B)0 percent of the load

C)2 percent of the load

D)6 percent of the load

E)4 percent of the load

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 Consider a mutual fund with a 6 percent back-end load that decreases to 0 percent in the seventh year. How much of the load will an investor have to bear if she sells it off in the seventh year?</strong> A)1 percent of the load B)0 percent of the load C)2 percent of the load D)6 percent of the load E)4 percent of the load](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

Consider a mutual fund with a 6 percent back-end load that decreases to 0 percent in the seventh year. How much of the load will an investor have to bear if she sells it off in the seventh year?

A)1 percent of the load

B)0 percent of the load

C)2 percent of the load

D)6 percent of the load

E)4 percent of the load

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

25

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 The fees paid to a mutual fund manager is called:</strong> A)fund fee. B)service fee. C)load. D)dividend. E)agency fee.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

The fees paid to a mutual fund manager is called:

A)fund fee.

B)service fee.

C)load.

D)dividend.

E)agency fee.

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 The fees paid to a mutual fund manager is called:</strong> A)fund fee. B)service fee. C)load. D)dividend. E)agency fee.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

The fees paid to a mutual fund manager is called:

A)fund fee.

B)service fee.

C)load.

D)dividend.

E)agency fee.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

26

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 If a company's market cap is $5,000,000 and the value of all stocks in the index is $100,000,000, then that company has a weight of _____ of the index.</strong> A)1 percent B)20 percent C)5 percent D)0.5 percent E)2 percent](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

If a company's market cap is $5,000,000 and the value of all stocks in the index is $100,000,000, then that company has a weight of _____ of the index.

A)1 percent

B)20 percent

C)5 percent

D)0.5 percent

E)2 percent

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 If a company's market cap is $5,000,000 and the value of all stocks in the index is $100,000,000, then that company has a weight of _____ of the index.</strong> A)1 percent B)20 percent C)5 percent D)0.5 percent E)2 percent](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

If a company's market cap is $5,000,000 and the value of all stocks in the index is $100,000,000, then that company has a weight of _____ of the index.

A)1 percent

B)20 percent

C)5 percent

D)0.5 percent

E)2 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

27

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 The acronym NAVPS in the mutual fund table denotes:</strong> A)the percentage change in the asset value of the mutual fund from the close of the previous day's trading. B)the highest and lowest values that the mutual fund has experienced over the last one year. C)the highest asset value at which the fund was sold during the past week. D)the percentage change in the asset value of the mutual fund from the previous week. E)the value of the mutual fund divided by the number of shares of the fund.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

The acronym NAVPS in the mutual fund table denotes:

A)the percentage change in the asset value of the mutual fund from the close of the previous day's trading.

B)the highest and lowest values that the mutual fund has experienced over the last one year.

C)the highest asset value at which the fund was sold during the past week.

D)the percentage change in the asset value of the mutual fund from the previous week.

E)the value of the mutual fund divided by the number of shares of the fund.

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 The acronym NAVPS in the mutual fund table denotes:</strong> A)the percentage change in the asset value of the mutual fund from the close of the previous day's trading. B)the highest and lowest values that the mutual fund has experienced over the last one year. C)the highest asset value at which the fund was sold during the past week. D)the percentage change in the asset value of the mutual fund from the previous week. E)the value of the mutual fund divided by the number of shares of the fund.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

The acronym NAVPS in the mutual fund table denotes:

A)the percentage change in the asset value of the mutual fund from the close of the previous day's trading.

B)the highest and lowest values that the mutual fund has experienced over the last one year.

C)the highest asset value at which the fund was sold during the past week.

D)the percentage change in the asset value of the mutual fund from the previous week.

E)the value of the mutual fund divided by the number of shares of the fund.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

28

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 Consider a mutual fund with a 6 percent back-end load that decreases to 0 percent in the seventh year. How much of the load will an investor have to bear if she sells it off in the second year?</strong> A)4 percent of the load B)3 percent of the load C)6 percent of the load D)5 percent of the load E)2 percent of the load](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

Consider a mutual fund with a 6 percent back-end load that decreases to 0 percent in the seventh year. How much of the load will an investor have to bear if she sells it off in the second year?

A)4 percent of the load

B)3 percent of the load

C)6 percent of the load

D)5 percent of the load

E)2 percent of the load

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 Consider a mutual fund with a 6 percent back-end load that decreases to 0 percent in the seventh year. How much of the load will an investor have to bear if she sells it off in the second year?</strong> A)4 percent of the load B)3 percent of the load C)6 percent of the load D)5 percent of the load E)2 percent of the load](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

Consider a mutual fund with a 6 percent back-end load that decreases to 0 percent in the seventh year. How much of the load will an investor have to bear if she sells it off in the second year?

A)4 percent of the load

B)3 percent of the load

C)6 percent of the load

D)5 percent of the load

E)2 percent of the load

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

29

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 Mutual funds that invest only in companies that meet certain criteria and usually exclude companies that produce tobacco, weapons, or alcoholic beverages are known as:</strong> A)socially responsible funds. B)global funds. C)equity funds. D)fixed-income funds. E)money market funds.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

Mutual funds that invest only in companies that meet certain criteria and usually exclude companies that produce tobacco, weapons, or alcoholic beverages are known as:

A)socially responsible funds.

B)global funds.

C)equity funds.

D)fixed-income funds.

E)money market funds.

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 Mutual funds that invest only in companies that meet certain criteria and usually exclude companies that produce tobacco, weapons, or alcoholic beverages are known as:</strong> A)socially responsible funds. B)global funds. C)equity funds. D)fixed-income funds. E)money market funds.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

Mutual funds that invest only in companies that meet certain criteria and usually exclude companies that produce tobacco, weapons, or alcoholic beverages are known as:

A)socially responsible funds.

B)global funds.

C)equity funds.

D)fixed-income funds.

E)money market funds.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

30

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 Mutual funds that attempt to mimic the performance of a broad market index, such as the Dow Jones Industrial Average, are known as:</strong> A)socially responsible funds. B)index funds. C)equity funds. D)fixed-income funds. E)money market funds.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

Mutual funds that attempt to mimic the performance of a broad market index, such as the Dow Jones Industrial Average, are known as:

A)socially responsible funds.

B)index funds.

C)equity funds.

D)fixed-income funds.

E)money market funds.

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 Mutual funds that attempt to mimic the performance of a broad market index, such as the Dow Jones Industrial Average, are known as:</strong> A)socially responsible funds. B)index funds. C)equity funds. D)fixed-income funds. E)money market funds.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

Mutual funds that attempt to mimic the performance of a broad market index, such as the Dow Jones Industrial Average, are known as:

A)socially responsible funds.

B)index funds.

C)equity funds.

D)fixed-income funds.

E)money market funds.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

31

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 The product of the stock price and the total outstanding shares of that stock is referred to as:</strong> A)market capitalization. B)floating capital. C)book value. D)financial value. E)face value.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

The product of the stock price and the total outstanding shares of that stock is referred to as:

A)market capitalization.

B)floating capital.

C)book value.

D)financial value.

E)face value.

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 The product of the stock price and the total outstanding shares of that stock is referred to as:</strong> A)market capitalization. B)floating capital. C)book value. D)financial value. E)face value.](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

The product of the stock price and the total outstanding shares of that stock is referred to as:

A)market capitalization.

B)floating capital.

C)book value.

D)financial value.

E)face value.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

32

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 Which of the following indexes includes the stocks of 500 companies that are widely owned and that represent all sectors of the U.S. economy?</strong> A)Standard & Poor's 500 B)Dow Jones Industrial Average C)BSE Sensex D)Mid-Cap-50 E)NSE 20 Share Index](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

Which of the following indexes includes the stocks of 500 companies that are widely owned and that represent all sectors of the U.S. economy?

A)Standard & Poor's 500

B)Dow Jones Industrial Average

C)BSE Sensex

D)Mid-Cap-50

E)NSE 20 Share Index

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 Which of the following indexes includes the stocks of 500 companies that are widely owned and that represent all sectors of the U.S. economy?</strong> A)Standard & Poor's 500 B)Dow Jones Industrial Average C)BSE Sensex D)Mid-Cap-50 E)NSE 20 Share Index](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

Which of the following indexes includes the stocks of 500 companies that are widely owned and that represent all sectors of the U.S. economy?

A)Standard & Poor's 500

B)Dow Jones Industrial Average

C)BSE Sensex

D)Mid-Cap-50

E)NSE 20 Share Index

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

33

The figure given below shows the demand curves [D1 and D2] and the supply curve [S1] of capital.Figure 17.1

![<strong>The figure given below shows the demand curves [D<sub>1</sub> and D<sub>2</sub>] and the supply curve [S<sub>1</sub>] of capital.Figure 17.1 Most stock indexes use which of the following measures to weight the companies that participate in the index?</strong> A)The company's sales volume B)The company's book value C)The current profits D)The available cash E)The market capitalization](https://d2lvgg3v3hfg70.cloudfront.net/TB1748/11ea8882_6256_4c4d_8903_87d4e8eb62a5_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00_TB1748_00.jpg)

Most stock indexes use which of the following measures to weight the companies that participate in the index?

A)The company's sales volume

B)The company's book value

C)The current profits

D)The available cash

E)The market capitalization