Deck 14: Decision Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/116

Play

Full screen (f)

Deck 14: Decision Analysis

1

Although modeling provides valuable insight to decision makers,decision making remains a difficult task.Which of the following is not a primary cause for this difficulty discussed in the Decision Analysis chapter?

A)Uncertainty regarding the future.

B)Models provide decisions for the decision maker.

C)Conflicting values.

D)Conflicting objectives.

A)Uncertainty regarding the future.

B)Models provide decisions for the decision maker.

C)Conflicting values.

D)Conflicting objectives.

B

2

The amount of opportunity lost in making a decision is called

A)loss.

B)frustration.

C)negative profit.

D)regret.

A)loss.

B)frustration.

C)negative profit.

D)regret.

D

3

Which of the following summarizes the final outcome for each decision alternative?

A)payoff matrix

B)outcome matrix

C)yield matrix

D)performance matrix

A)payoff matrix

B)outcome matrix

C)yield matrix

D)performance matrix

A

4

A course of action intended to solve a problem is called an)

A)alternative.

B)option.

C)decision.

D)criteria.

A)alternative.

B)option.

C)decision.

D)criteria.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

5

Every nonprobabilistic method has a weakness for decision making.Which of the following is incorrect regarding a method and its weakness?

A)The maximax method ignores potentially large losses.

B)The maximin method ignores potentially large payoffs.

C)The minimax regret method can lead to inconsistent decisions.

D)All of these are correct.

A)The maximax method ignores potentially large losses.

B)The maximin method ignores potentially large payoffs.

C)The minimax regret method can lead to inconsistent decisions.

D)All of these are correct.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

6

The decision rule which determines the minimum payoff for each alternative and then selects the alternative associated with the largest minimum payoff is the

A)maximax decision rule.

B)maximin decision rule.

C)minimax regret decision rule.

D)minimin decision rule.

A)maximax decision rule.

B)maximin decision rule.

C)minimax regret decision rule.

D)minimin decision rule.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

7

Decision analysis supports all but one of the following goals.Which goal is not supported?

A)Help make good decisions.

B)Help ensure selection of good outcomes.

C)Analyze decision problems logically.

D)Incorporate problem uncertainty.

A)Help make good decisions.

B)Help ensure selection of good outcomes.

C)Analyze decision problems logically.

D)Incorporate problem uncertainty.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

8

The category of decision rules that contains the maximax decision rule is the

A)optimistic category.

B)non-probabilistic category.

C)probabilistic category.

D)optimality category.

A)optimistic category.

B)non-probabilistic category.

C)probabilistic category.

D)optimality category.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

9

An)is a course of action intended to solve a problem.

A)decision

B)criteria

C)state of nature

D)alternative

A)decision

B)criteria

C)state of nature

D)alternative

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

10

The in a decision problem represent factors that are important to the decision maker.

A)payoffs

B)states of nature

C)criteria

D)alternatives

A)payoffs

B)states of nature

C)criteria

D)alternatives

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

11

The decision rule which determines the maximum payoff for each alternative and then selects the alternative associated with the largest payoff is the

A)maximax decision rule.

B)maximin decision rule.

C)minimax regret decision rule.

D)minimin decision rule.

A)maximax decision rule.

B)maximin decision rule.

C)minimax regret decision rule.

D)minimin decision rule.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

12

A payoff matrix depicts versus with payoffs for each intersection cell.

A)decision criteria;states of nature.

B)decision alternatives;potential outcomes.

C)decision alternatives;states of nature.

D)decision criteria;potential outcomes.

A)decision criteria;states of nature.

B)decision alternatives;potential outcomes.

C)decision alternatives;states of nature.

D)decision criteria;potential outcomes.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

13

Decision Analysis techniques provide modeling techniques to help decision makers make decisions.Which of the following is not typically a benefit of decision analysis?

A)Incorporating uncertainty via probabilities.

B)Incorporating risk via utility theory functions.

C)Incorporating uncertainty via exponential distributions.

D)Structuring decision strategies via decision trees.

A)Incorporating uncertainty via probabilities.

B)Incorporating risk via utility theory functions.

C)Incorporating uncertainty via exponential distributions.

D)Structuring decision strategies via decision trees.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is a goal of decision analysis?

A)Help individuals make good decisions.

B)Ensure decisions lead to good outcomes.

C)Avoiding decisions leading to bad outcomes.

D)Reduce the role of luck in a decision.

A)Help individuals make good decisions.

B)Ensure decisions lead to good outcomes.

C)Avoiding decisions leading to bad outcomes.

D)Reduce the role of luck in a decision.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

15

The decision rule which selects the alternative associated with the smallest maximum opportunity loss is the

A)maximax decision rule.

B)maximin decision rule.

C)minimax regret decision rule.

D)minimin decision rule.

A)maximax decision rule.

B)maximin decision rule.

C)minimax regret decision rule.

D)minimin decision rule.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

16

Which decision rule pessimistically assumes that nature will always be "against us" regardless of what decision we make?

A)maximax decision rule.

B)maximin decision rule.

C)minimax regret decision rule.

D)minimin decision rule.

A)maximax decision rule.

B)maximin decision rule.

C)minimax regret decision rule.

D)minimin decision rule.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

17

The correspond to future events that are not under the control of the decision maker.

A)payoffs

B)states of nature

C)criteria

D)alternatives

A)payoffs

B)states of nature

C)criteria

D)alternatives

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

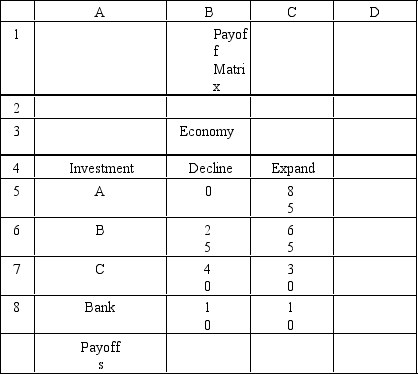

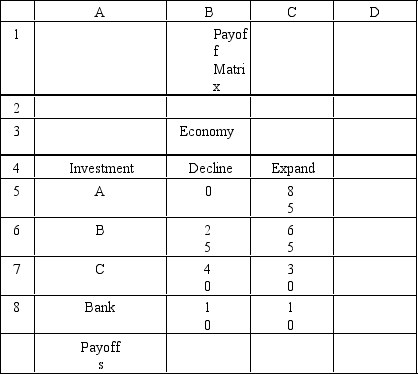

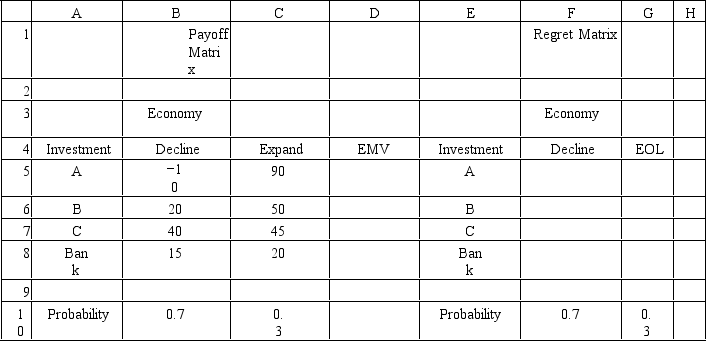

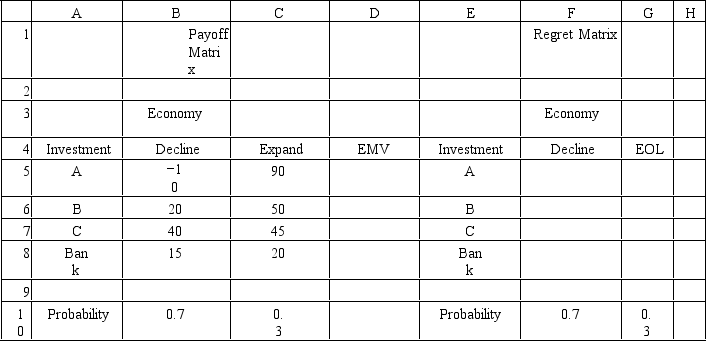

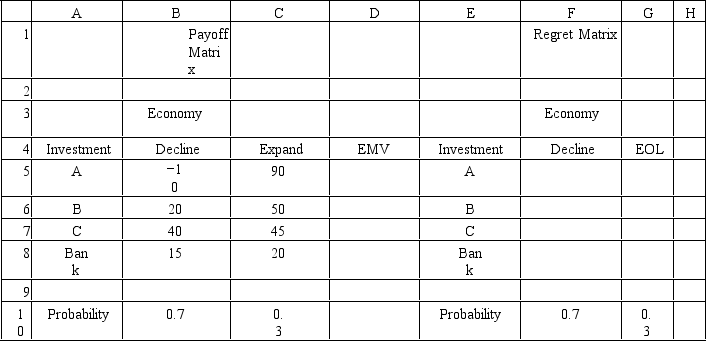

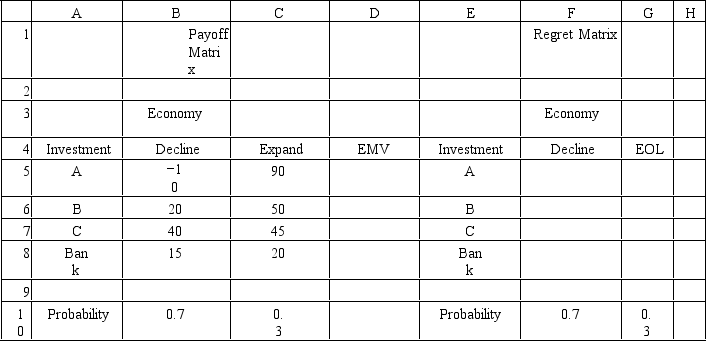

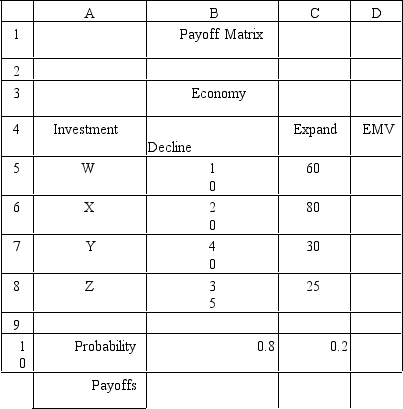

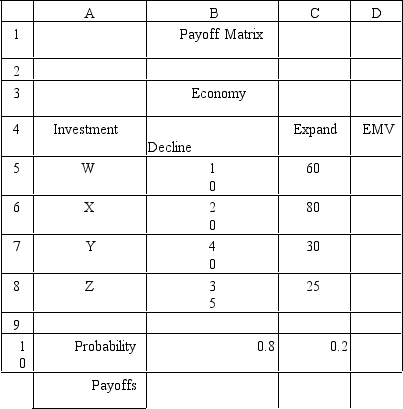

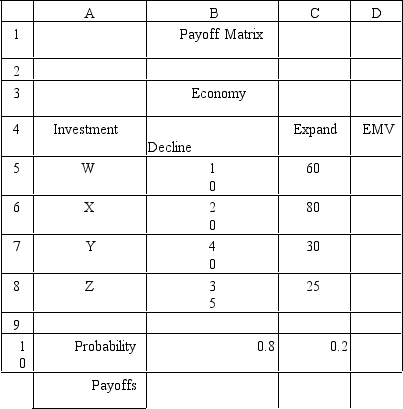

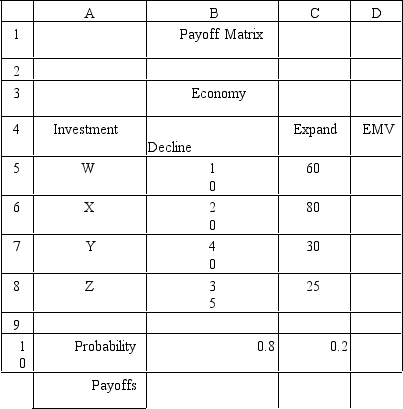

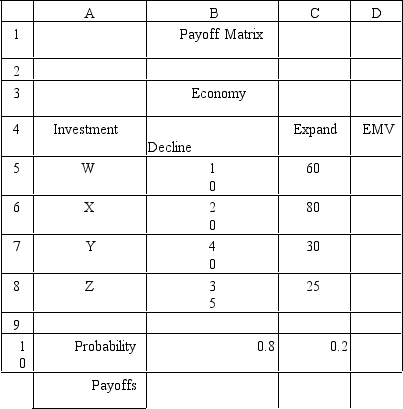

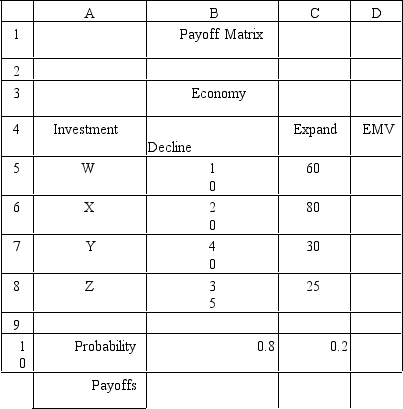

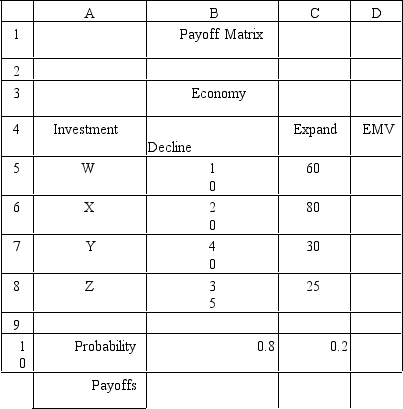

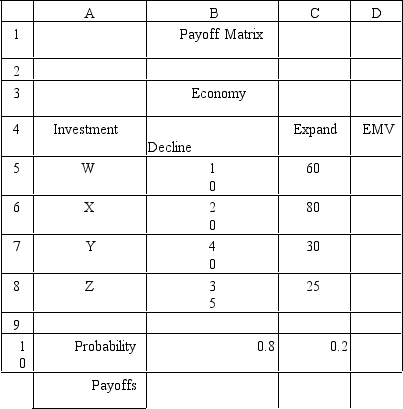

18

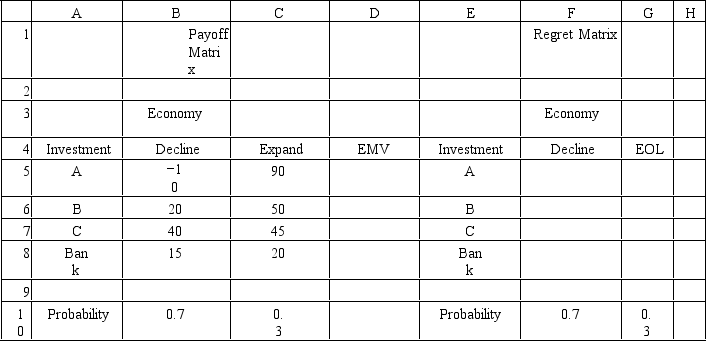

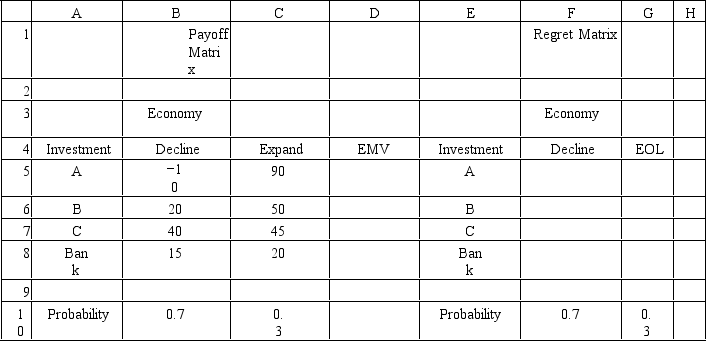

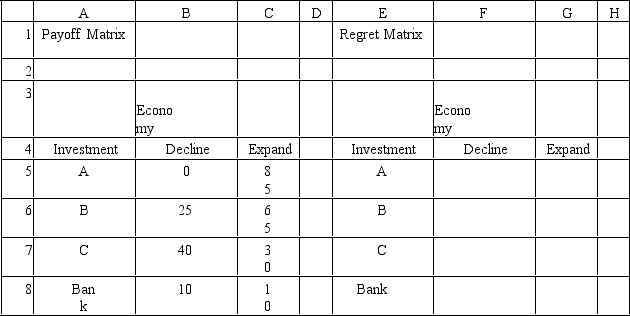

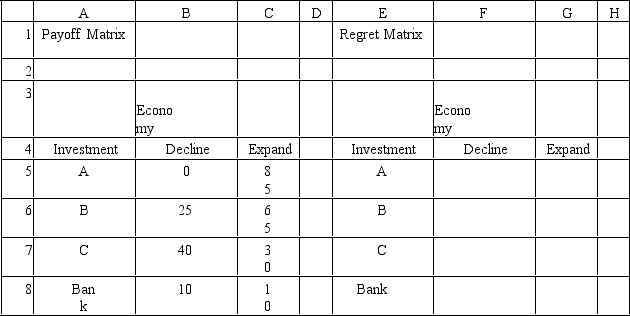

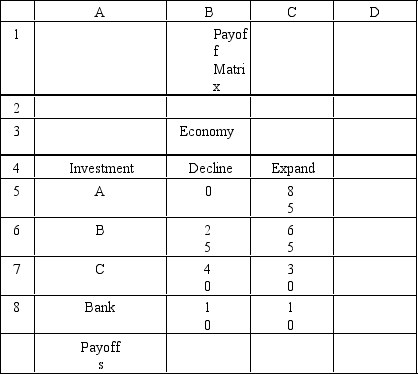

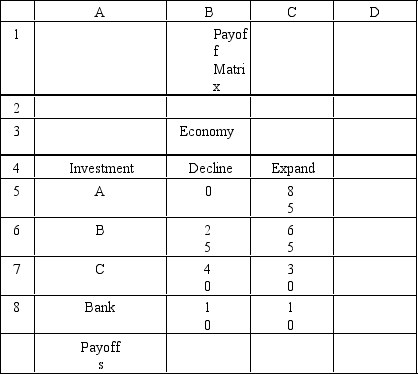

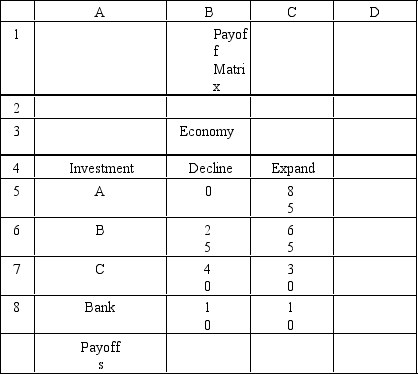

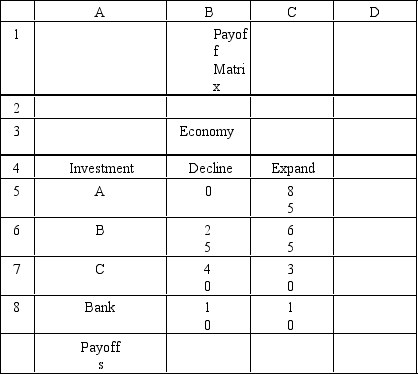

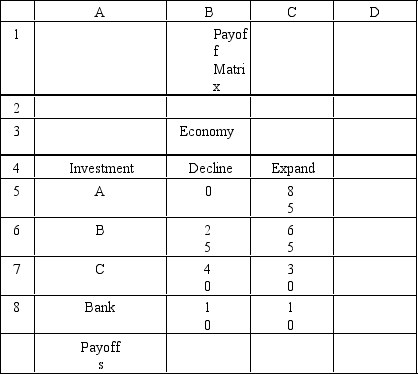

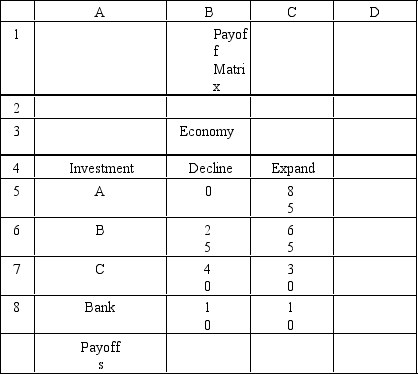

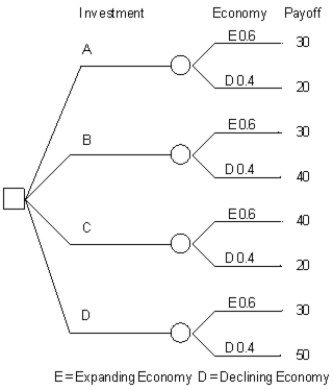

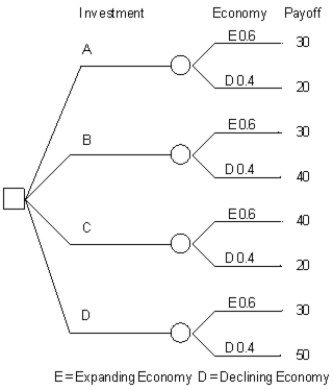

Exhibit 14.1

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.

Refer to Exhibit 14.1.What decision should be made according to the maximax decision rule?

A)A

B)B

C)C

D)Bank

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.

Refer to Exhibit 14.1.What decision should be made according to the maximax decision rule?

A)A

B)B

C)C

D)Bank

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

19

How are states of nature assigned probabilities?

A)Use historical data.

B)Use best judgements.

C)Use interview results.

D)All of these.

A)Use historical data.

B)Use best judgements.

C)Use interview results.

D)All of these.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

20

Which decision rule optimistically assumes that nature will always be "on our side" regardless of what decision we make?

A)maximax decision rule.

B)maximin decision rule.

C)minimax regret decision rule.

D)minimin decision rule.

A)maximax decision rule.

B)maximin decision rule.

C)minimax regret decision rule.

D)minimin decision rule.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

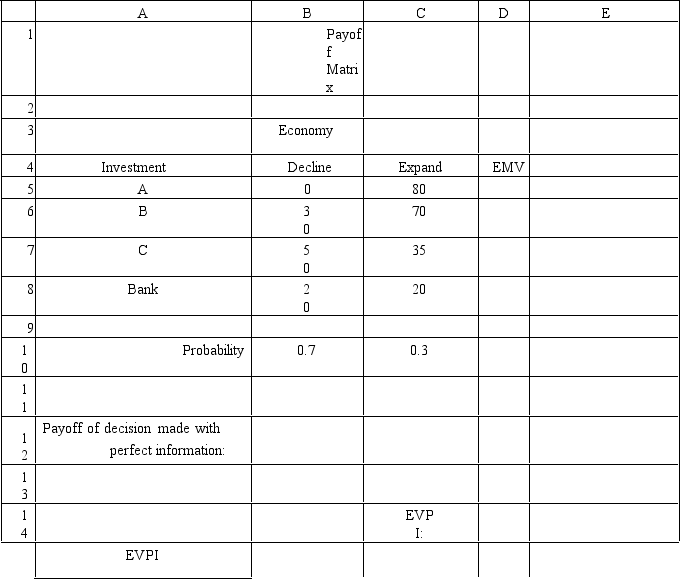

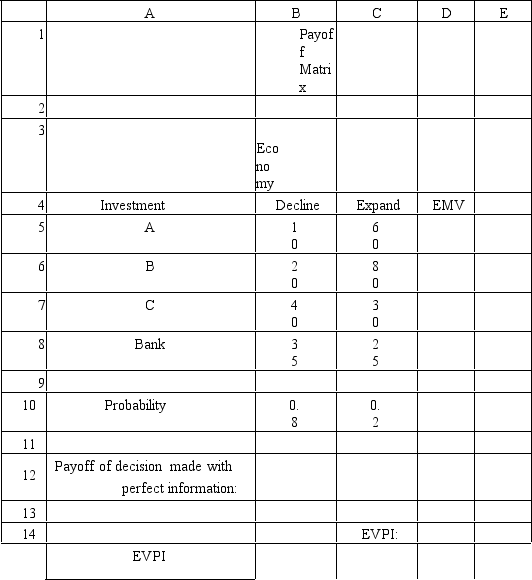

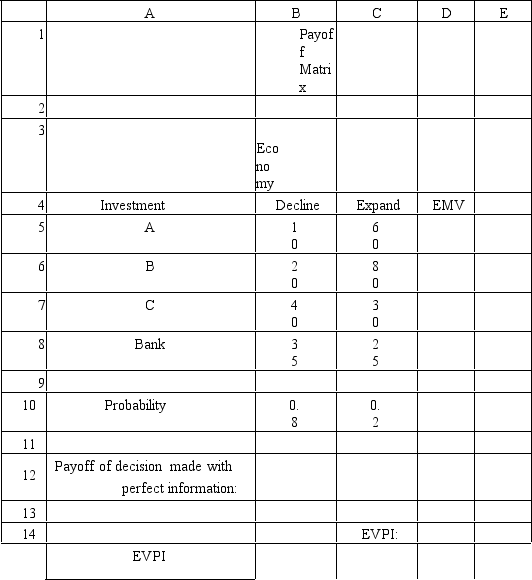

21

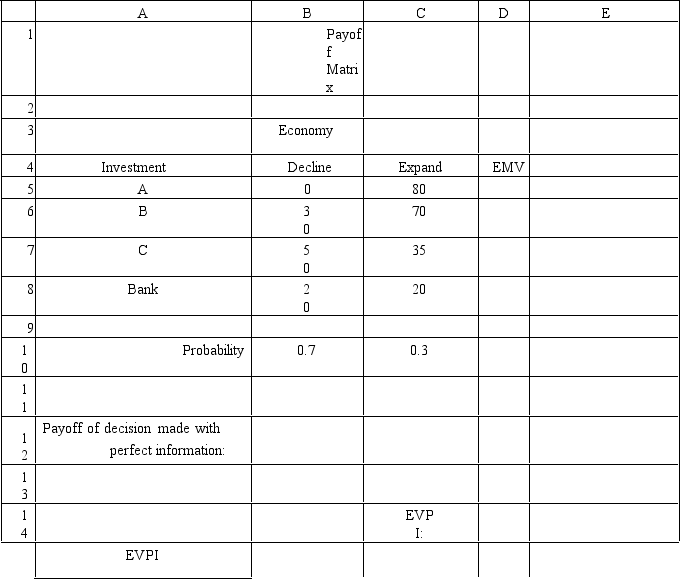

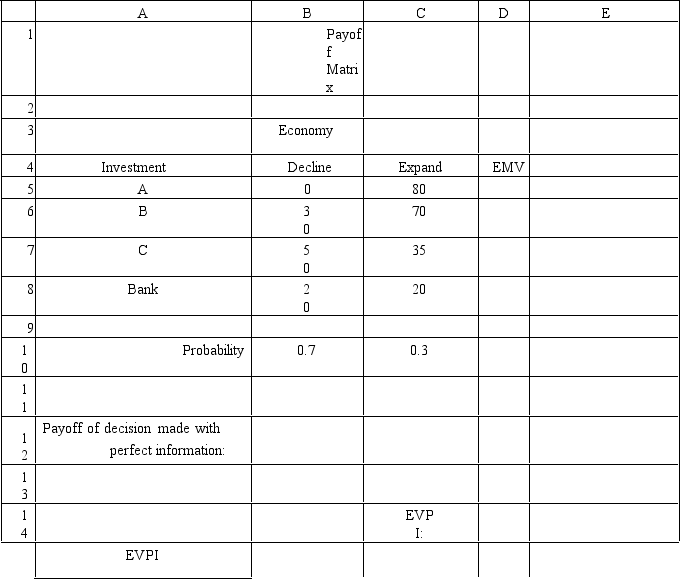

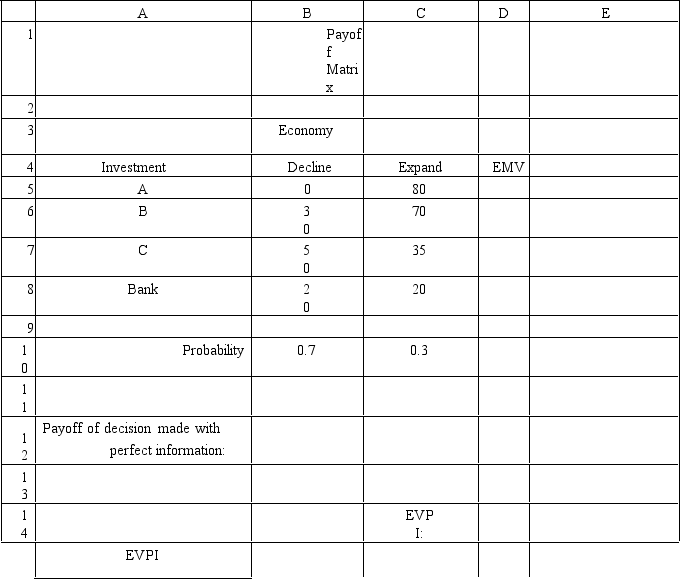

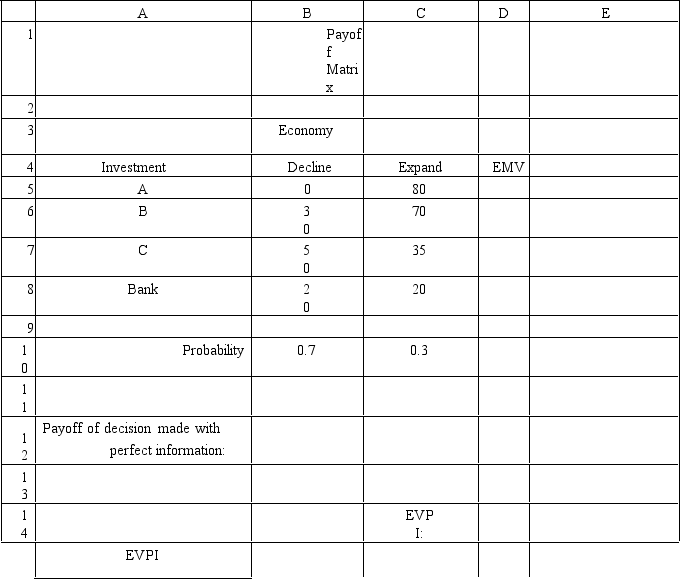

Exhibit 14.4

The following questions are based on the information below.

Refer to Exhibit 14.4.What is the expected value with perfect information for the investor?

A)13.5

B)45.5

C)59

D)80

The following questions are based on the information below.

Refer to Exhibit 14.4.What is the expected value with perfect information for the investor?

A)13.5

B)45.5

C)59

D)80

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

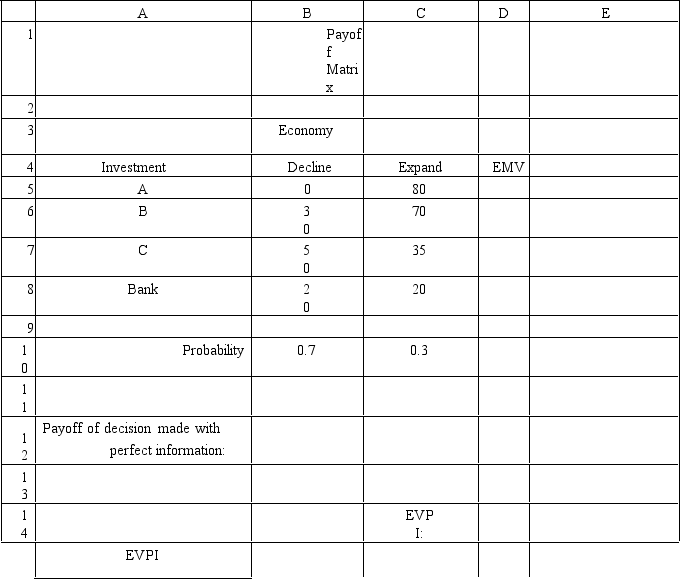

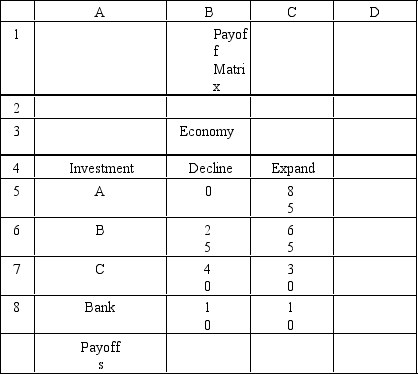

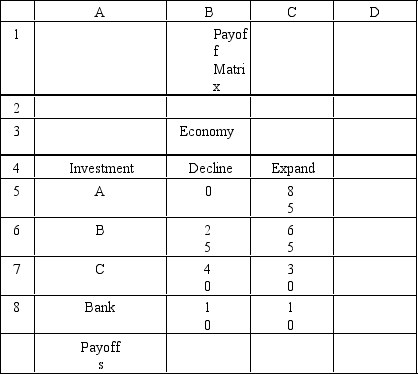

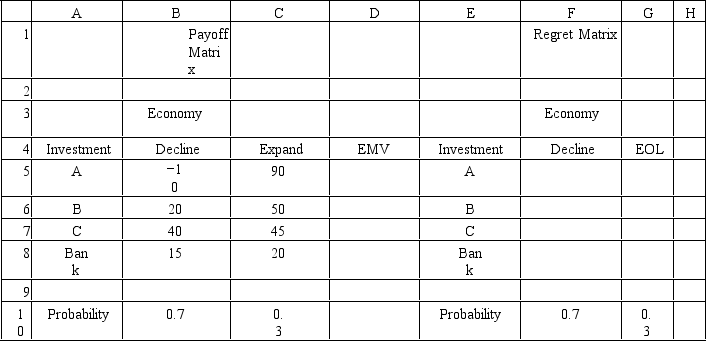

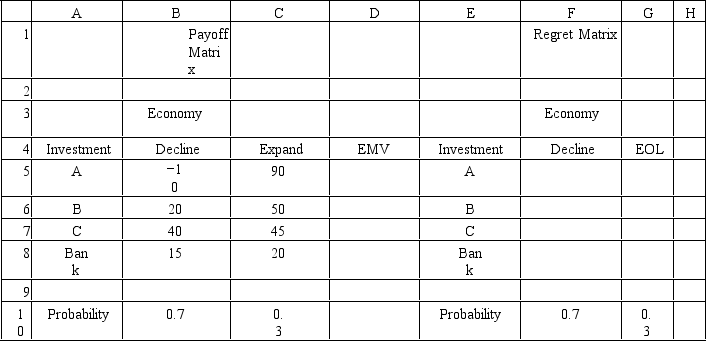

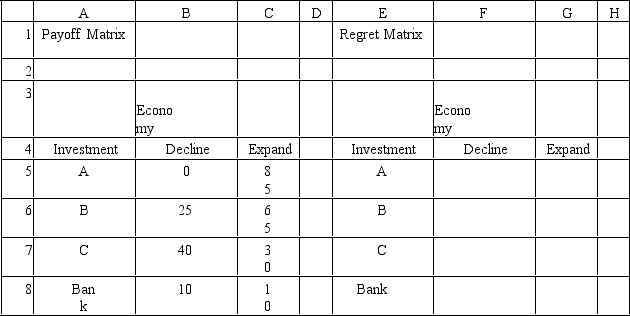

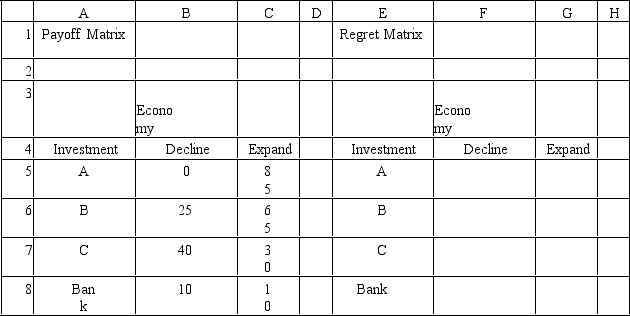

22

Exhibit 14.3

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.The investor has estimated the probability of a declining economy at 70% and an expanding economy at 30%.

Refer to Exhibit 14.3.What is the expected monetary value of Investment A?

A)34.

B)30.

C)20.

D)15.

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.The investor has estimated the probability of a declining economy at 70% and an expanding economy at 30%.

Refer to Exhibit 14.3.What is the expected monetary value of Investment A?

A)34.

B)30.

C)20.

D)15.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

23

Exhibit 14.1

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.

Refer to Exhibit 14.1.What decision should be made according to the minimax regret decision rule?

A)A

B)B

C)C

D)Bank

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.

Refer to Exhibit 14.1.What decision should be made according to the minimax regret decision rule?

A)A

B)B

C)C

D)Bank

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

24

Exhibit 14.3

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.The investor has estimated the probability of a declining economy at 70% and an expanding economy at 30%.

Refer to Exhibit 14.3.What decision should be made according to the expected regret decision rule?

A)A

B)B

C)C

D)Bank

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.The investor has estimated the probability of a declining economy at 70% and an expanding economy at 30%.

Refer to Exhibit 14.3.What decision should be made according to the expected regret decision rule?

A)A

B)B

C)C

D)Bank

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

25

Exhibit 14.4

The following questions are based on the information below.

Refer to Exhibit 14.4.What is the expected value of perfect information for the investor?

A)13.5

B)20

C)45.5

D)59

The following questions are based on the information below.

Refer to Exhibit 14.4.What is the expected value of perfect information for the investor?

A)13.5

B)20

C)45.5

D)59

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

26

The decision with the smallest expected opportunity loss EOL)will also have the

A)smallest EMV.

B)largest EMV.

C)smallest regret.

D)largest regret.

A)smallest EMV.

B)largest EMV.

C)smallest regret.

D)largest regret.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

27

A circular node in a decision tree is called an)node.

A)chance

B)random

C)decision

D)event

A)chance

B)random

C)decision

D)event

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

28

Leaves of a decision tree are also called nodes.

A)end

B)terminal

C)decision

D)payoff

A)end

B)terminal

C)decision

D)payoff

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

29

Exhibit 14.2

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.

Refer to Exhibit 14.2.What formula should go in cell F5 of the Regret Matrix above to compute the regret value?

A)=B$5-MAXB$5:B$8)

B)=MAXB$5:B$8)-MAXB5)

C)=MAXB$5:B$8)-MINB$5:B$8)

D)=MAXB$5:B$8)-B5

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.

Refer to Exhibit 14.2.What formula should go in cell F5 of the Regret Matrix above to compute the regret value?

A)=B$5-MAXB$5:B$8)

B)=MAXB$5:B$8)-MAXB5)

C)=MAXB$5:B$8)-MINB$5:B$8)

D)=MAXB$5:B$8)-B5

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

30

Exhibit 14.4

The following questions are based on the information below.

Refer to Exhibit 14.4.What formula should go in cell D14 of the spreadsheet to compute the EVPI?

A)MAXD5:D8)-D12

B)D12-MIND5:D8)

C)SUMPRODUCTB12:C12,B10:C10)-MAXD5:D8)

D)D12-MAXD5:D8)

The following questions are based on the information below.

Refer to Exhibit 14.4.What formula should go in cell D14 of the spreadsheet to compute the EVPI?

A)MAXD5:D8)-D12

B)D12-MIND5:D8)

C)SUMPRODUCTB12:C12,B10:C10)-MAXD5:D8)

D)D12-MAXD5:D8)

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

31

Probabilistic decision rules can be used if the states of nature in a decision problem can be assigned probabilities that represent their likelihood of occurrence.Which of the following is not true regarding the probabilities employed?

A)The probabilities are always obtained from historical data.

B)The probabilities must always be unbiased.

C)The probabilities can be assigned subjectively.

D)Subjective probabilities obtained can be accurate and unbiased.

A)The probabilities are always obtained from historical data.

B)The probabilities must always be unbiased.

C)The probabilities can be assigned subjectively.

D)Subjective probabilities obtained can be accurate and unbiased.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

32

Exhibit 14.1

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.

Refer to Exhibit 14.1.What decision should be made according to the maximin decision rule?

A)A

B)B

C)C

D)Bank

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.

Refer to Exhibit 14.1.What decision should be made according to the maximin decision rule?

A)A

B)B

C)C

D)Bank

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

33

Exhibit 14.3

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.The investor has estimated the probability of a declining economy at 70% and an expanding economy at 30%.

Refer to Exhibit 14.3.What decision should be made according to the expected monetary value decision rule?

A)A

B)B

C)C

D)Bank

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.The investor has estimated the probability of a declining economy at 70% and an expanding economy at 30%.

Refer to Exhibit 14.3.What decision should be made according to the expected monetary value decision rule?

A)A

B)B

C)C

D)Bank

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

34

Exhibit 14.1

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.

Refer to Exhibit 14.1.What formula should go in cell D5 to implement the maximax decision rule?

A)=MAXMAXB5:C5))

B)=MINB5:C5)

C)=AVERAGEB5:C5)

D)=MAXB5:C5)

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.

Refer to Exhibit 14.1.What formula should go in cell D5 to implement the maximax decision rule?

A)=MAXMAXB5:C5))

B)=MINB5:C5)

C)=AVERAGEB5:C5)

D)=MAXB5:C5)

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

35

Exhibit 14.1

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.

Refer to Exhibit 14.1.What formula should go in cell D5 to implement the maximin decision rule?

A)=MAXMINB5:C5))

B)=MINB5:C5)

C)=AVERAGEB5:C5)

D)=MAXB5:C5)

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.

Refer to Exhibit 14.1.What formula should go in cell D5 to implement the maximin decision rule?

A)=MAXMINB5:C5))

B)=MINB5:C5)

C)=AVERAGEB5:C5)

D)=MAXB5:C5)

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

36

A square node in a decision tree is called an)node.

A)chance

B)random

C)decision

D)event

A)chance

B)random

C)decision

D)event

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

37

Exhibit 14.3

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.The investor has estimated the probability of a declining economy at 70% and an expanding economy at 30%.

Refer to Exhibit 14.3.What formula should go in cell F5 and copied to F6:F8 of the spreadsheet if the expected regret decision rule is to be used?

A)=B$5-MAXB$5:B$8)

B)=MAXB$5:B$8)-MAXB5)

C)=MAXB$5:B$8)-MINB$5:B$8)

D)=MAXB$5:B$8)-B5

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.The investor has estimated the probability of a declining economy at 70% and an expanding economy at 30%.

Refer to Exhibit 14.3.What formula should go in cell F5 and copied to F6:F8 of the spreadsheet if the expected regret decision rule is to be used?

A)=B$5-MAXB$5:B$8)

B)=MAXB$5:B$8)-MAXB5)

C)=MAXB$5:B$8)-MINB$5:B$8)

D)=MAXB$5:B$8)-B5

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

38

Exhibit 14.2

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.

Refer to Exhibit 14.2.What formula should go in cell H5 and copied to H6:H8 of the Regret Table above to implement the minimax regret decision rule?

A)=MAXMAXF5:G5))

B)=MINF5:G5)

C)=AVERAGEF5:G5)

D)=MAXF5:G5)

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C and leaving his money in the bank.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.

Refer to Exhibit 14.2.What formula should go in cell H5 and copied to H6:H8 of the Regret Table above to implement the minimax regret decision rule?

A)=MAXMAXF5:G5))

B)=MINF5:G5)

C)=AVERAGEF5:G5)

D)=MAXF5:G5)

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

39

The minimum EOL in a decision problem will always

A)exceed the EVPI.

B)be less than the EVPI.

C)equal the EVPI.

D)equal the EMV.

A)exceed the EVPI.

B)be less than the EVPI.

C)equal the EVPI.

D)equal the EMV.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

40

Expected regret is also called

A)EMV.

B)EOL.

C)EPA.

D)EOQ.

A)EMV.

B)EOL.

C)EPA.

D)EOQ.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

41

The total worth,value or desirability of a decision alternative is called its

A)usefulness.

B)worthiness.

C)utility.

D)risk.

A)usefulness.

B)worthiness.

C)utility.

D)risk.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

42

Exhibit 14.5

The following questions are based on the information below.

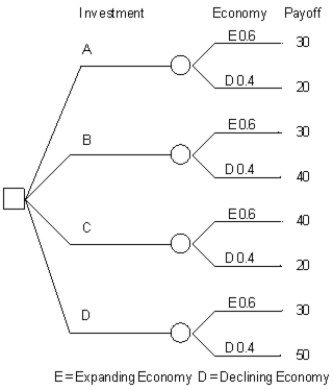

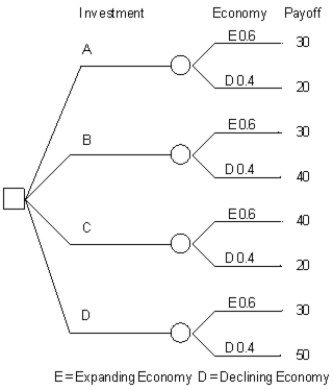

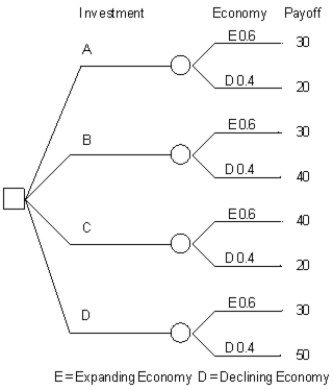

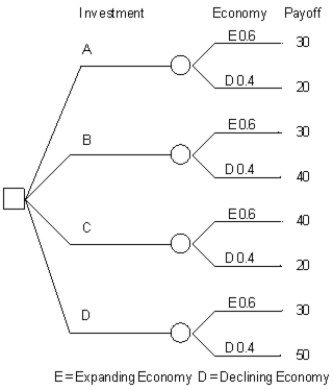

An investor is considering 4 investments,A,B,C,D.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following decision tree has been developed for the problem.The investor has estimated the probability of a declining economy at 40% and an expanding economy at 60%.

Refer to Exhibit 14.5.What is the correct decision for this investor based on an expected monetary value criteria?

A)A

B)B

C)C

D)D

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C,D.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following decision tree has been developed for the problem.The investor has estimated the probability of a declining economy at 40% and an expanding economy at 60%.

Refer to Exhibit 14.5.What is the correct decision for this investor based on an expected monetary value criteria?

A)A

B)B

C)C

D)D

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

43

What is the formula for the exponential utility function Ux)?

A)−e−x/R

B)1 + e−x/R

C)1 − ex/R

D)1 − e−x/R

A)−e−x/R

B)1 + e−x/R

C)1 − ex/R

D)1 − e−x/R

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

44

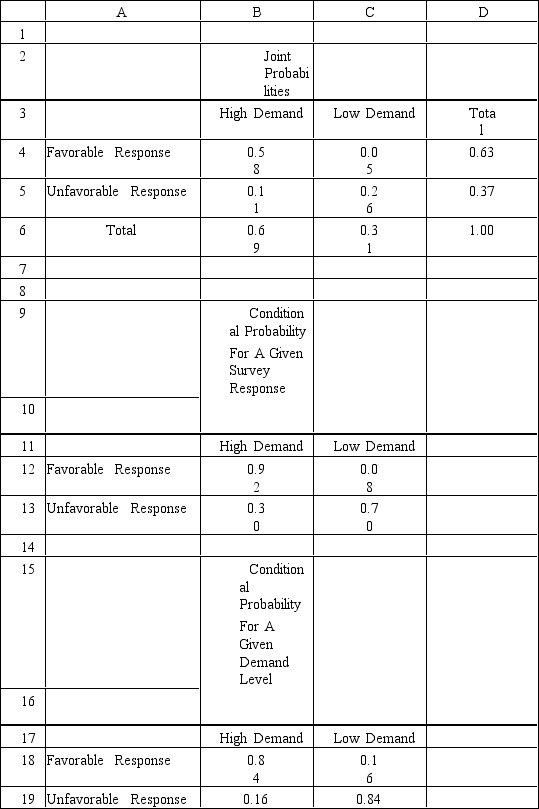

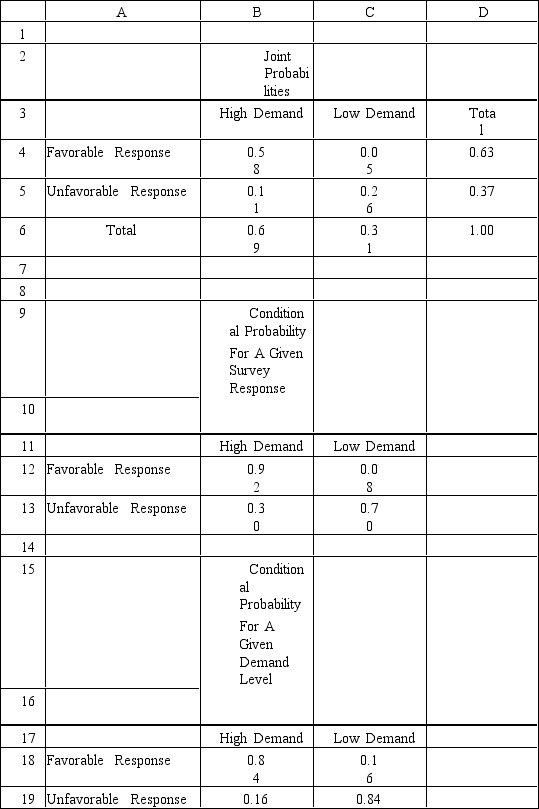

Exhibit 14.6

The following questions use the information below.

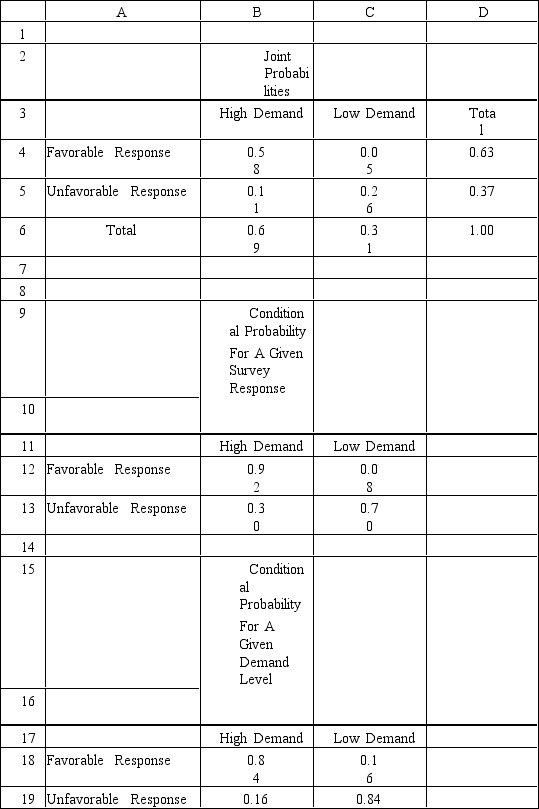

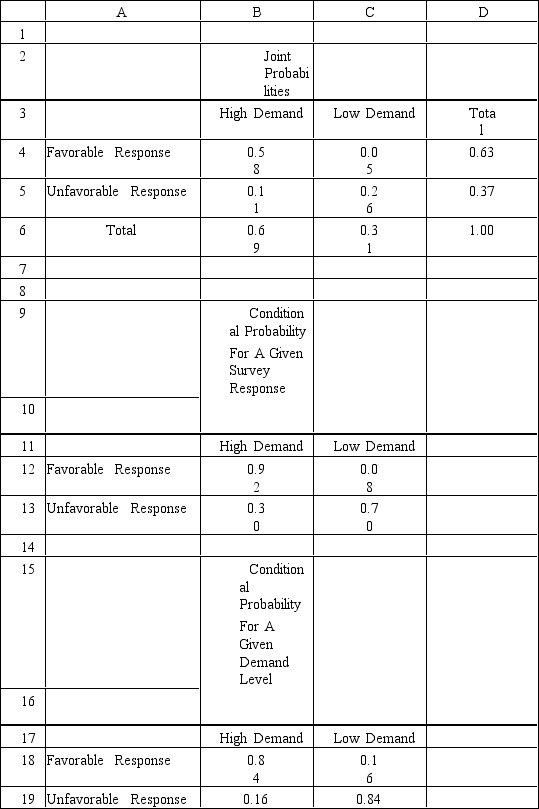

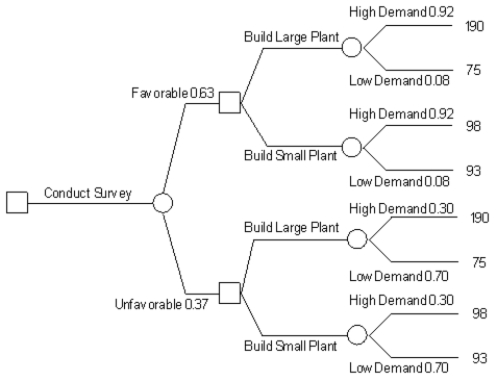

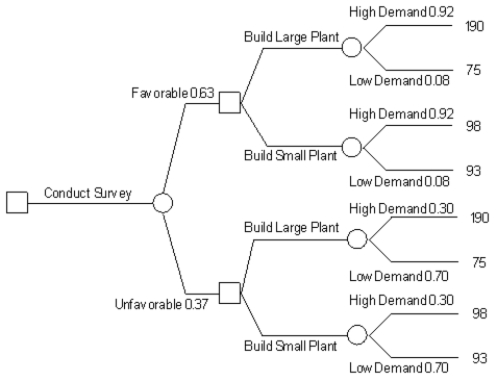

A company is planning a plant expansion.They can build a large or small plant.The payoffs for the plant depend on the level of consumer demand for the company's products.The company believes that there is an 69% chance that demand for their products will be high and a 31% chance that it will be low.The company can pay a market research firm to survey consumer attitudes towards the company's products.There is a 63% chance that the customers will like the products and a 37% chance that they won't.The payoff matrix and costs of the two plants are listed below.The company believes that if the survey is favorable there is a 92% chance that demand will be high for the products.If the survey is unfavorable there is only a 30% chance that the demand will be high.The following decision tree has been built for this problem.The company has computed that the expected monetary value of the best decision without sample information is 154.35 million.The company has developed the following conditional probability table for their decision problem.

Refer to Exhibit 14.6.What is PF∩H),where F = favorable response and H = high demand?

A).58

B).63

C).84

D).92

The following questions use the information below.

A company is planning a plant expansion.They can build a large or small plant.The payoffs for the plant depend on the level of consumer demand for the company's products.The company believes that there is an 69% chance that demand for their products will be high and a 31% chance that it will be low.The company can pay a market research firm to survey consumer attitudes towards the company's products.There is a 63% chance that the customers will like the products and a 37% chance that they won't.The payoff matrix and costs of the two plants are listed below.The company believes that if the survey is favorable there is a 92% chance that demand will be high for the products.If the survey is unfavorable there is only a 30% chance that the demand will be high.The following decision tree has been built for this problem.The company has computed that the expected monetary value of the best decision without sample information is 154.35 million.The company has developed the following conditional probability table for their decision problem.

Refer to Exhibit 14.6.What is PF∩H),where F = favorable response and H = high demand?

A).58

B).63

C).84

D).92

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

45

Exhibit 14.6

The following questions use the information below.

A company is planning a plant expansion.They can build a large or small plant.The payoffs for the plant depend on the level of consumer demand for the company's products.The company believes that there is an 69% chance that demand for their products will be high and a 31% chance that it will be low.The company can pay a market research firm to survey consumer attitudes towards the company's products.There is a 63% chance that the customers will like the products and a 37% chance that they won't.The payoff matrix and costs of the two plants are listed below.The company believes that if the survey is favorable there is a 92% chance that demand will be high for the products.If the survey is unfavorable there is only a 30% chance that the demand will be high.The following decision tree has been built for this problem.The company has computed that the expected monetary value of the best decision without sample information is 154.35 million.The company has developed the following conditional probability table for their decision problem.

Refer to Exhibit 14.6.What formula should go in cell C13 of the probability table?

A)=C5/$D4

B)=C5/C$6

C)=C5/$D5

D)=C4/$D4

The following questions use the information below.

A company is planning a plant expansion.They can build a large or small plant.The payoffs for the plant depend on the level of consumer demand for the company's products.The company believes that there is an 69% chance that demand for their products will be high and a 31% chance that it will be low.The company can pay a market research firm to survey consumer attitudes towards the company's products.There is a 63% chance that the customers will like the products and a 37% chance that they won't.The payoff matrix and costs of the two plants are listed below.The company believes that if the survey is favorable there is a 92% chance that demand will be high for the products.If the survey is unfavorable there is only a 30% chance that the demand will be high.The following decision tree has been built for this problem.The company has computed that the expected monetary value of the best decision without sample information is 154.35 million.The company has developed the following conditional probability table for their decision problem.

Refer to Exhibit 14.6.What formula should go in cell C13 of the probability table?

A)=C5/$D4

B)=C5/C$6

C)=C5/$D5

D)=C4/$D4

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

46

The scores in a scoring model range from

A)0 to 1

B)−1 to +1

C)0 to 5

D)0 to 10

A)0 to 1

B)−1 to +1

C)0 to 5

D)0 to 10

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

47

Exhibit 14.7

The following questions use the information below.

A decision maker is faced with two alternatives.The decision maker has determined that she is indifferent between the two alternatives when p = 0.45.

Alternative 1: Receive $82,000 with certainty

Alternative 2: Receive $143,000 with probability p and lose $15,000 with probability 1 − p).

Refer to Exhibit 14.7.What is the expected value of Alternative 2 for this decision maker?

A)$82,000

B)$56,100

C)$64,350

D)$72,600

The following questions use the information below.

A decision maker is faced with two alternatives.The decision maker has determined that she is indifferent between the two alternatives when p = 0.45.

Alternative 1: Receive $82,000 with certainty

Alternative 2: Receive $143,000 with probability p and lose $15,000 with probability 1 − p).

Refer to Exhibit 14.7.What is the expected value of Alternative 2 for this decision maker?

A)$82,000

B)$56,100

C)$64,350

D)$72,600

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

48

Exhibit 14.7

The following questions use the information below.

A decision maker is faced with two alternatives.The decision maker has determined that she is indifferent between the two alternatives when p = 0.45.

Alternative 1: Receive $82,000 with certainty

Alternative 2: Receive $143,000 with probability p and lose $15,000 with probability 1 − p).

Refer to Exhibit 14.7.What is the decision maker's risk premium for this problem?

A)−$20,000

B)−$25,900

C)$70,000

D)$80,000

The following questions use the information below.

A decision maker is faced with two alternatives.The decision maker has determined that she is indifferent between the two alternatives when p = 0.45.

Alternative 1: Receive $82,000 with certainty

Alternative 2: Receive $143,000 with probability p and lose $15,000 with probability 1 − p).

Refer to Exhibit 14.7.What is the decision maker's risk premium for this problem?

A)−$20,000

B)−$25,900

C)$70,000

D)$80,000

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

49

A company is planning a plant expansion.They can build a large or small plant.The payoffs for the plant depend on the level of consumer demand for the company's products.The company believes that there is an 69% chance that demand for their products will be high and a 31% chance that it will be low.The company can pay a market research firm to survey consumer attitudes towards the company's products.There is a 63% chance that the customers will like the products and a 37% chance that they won't.The payoff matrix and costs of the two plants are listed below.The company believes that if the survey is favorable there is a 92% chance that demand will be high for the products.If the survey is unfavorable there is only a 30% chance that the demand will be high.The following decision tree has been built for this problem.The company has computed that the expected monetary value of the best decision without sample information is 154.35 million.What is the EVSI for this problem in $ million)?

A)0.07

B)26.38

C)109.5

D)180.8

A)0.07

B)26.38

C)109.5

D)180.8

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

50

The scores in a scoring model can be thought of as subjective assessments of

A)usefulness.

B)worthiness.

C)utility.

D)payoff.

A)usefulness.

B)worthiness.

C)utility.

D)payoff.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

51

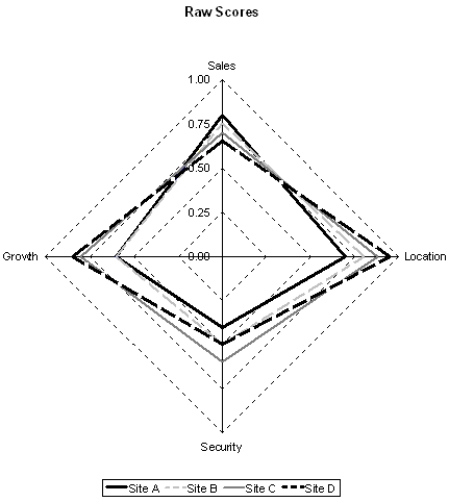

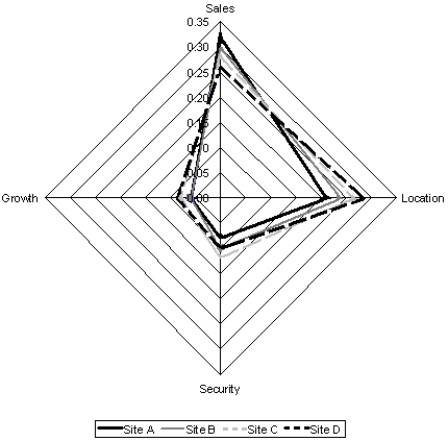

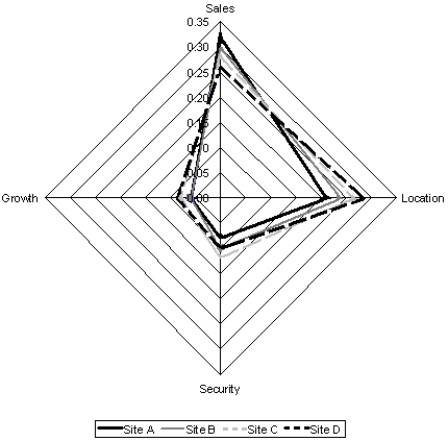

Based on the radar chart of raw scores provided below,why is this decision complex?

A)The chart is hard to read.

B)No site wins on all four criteria.

C)No site achieves a perfect score of 1.0 on a criteria.

D)No sites have sufficient security.

A)The chart is hard to read.

B)No site wins on all four criteria.

C)No site achieves a perfect score of 1.0 on a criteria.

D)No sites have sufficient security.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

52

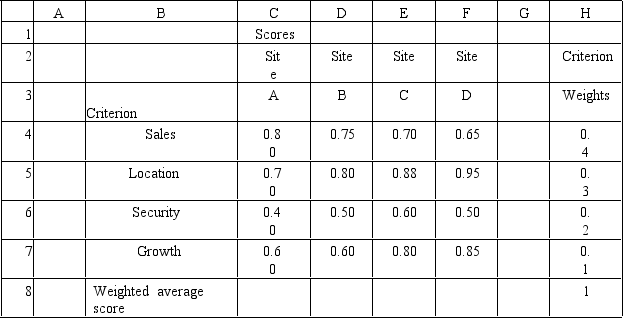

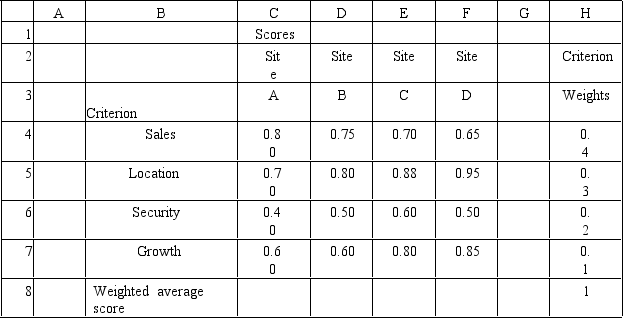

A fast food restaurant is considering opening a new store at one of four locations.They have developed the following multi-criteria scoring model for this problem.What location should they choose based on this information?

A)A

B)B

C)C

D)D

A)A

B)B

C)C

D)D

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

53

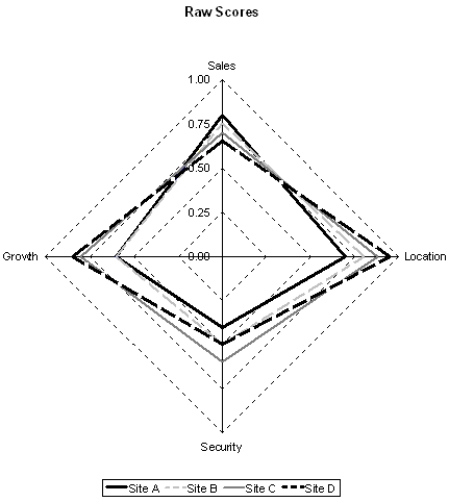

Based on the radar chart of the weighted scores provided below,which of the following interpretations is incorrect?

A)Site A wins on the Sales criteria but is last on the Location criteria.

B)Site C wins on the Security criteria and scores high on the remaining three criteria.

C)Site B scores lowest on each of the four criteria.

D)No site dominates on each of the four criteria.

A)Site A wins on the Sales criteria but is last on the Location criteria.

B)Site C wins on the Security criteria and scores high on the remaining three criteria.

C)Site B scores lowest on each of the four criteria.

D)No site dominates on each of the four criteria.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

54

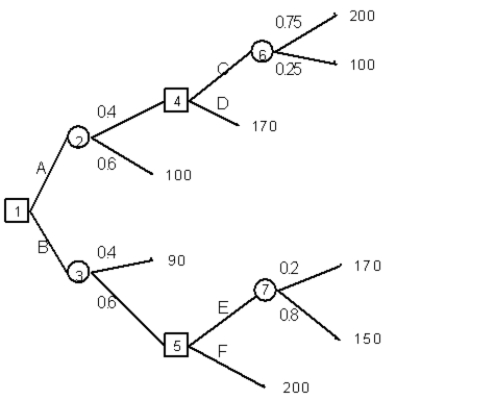

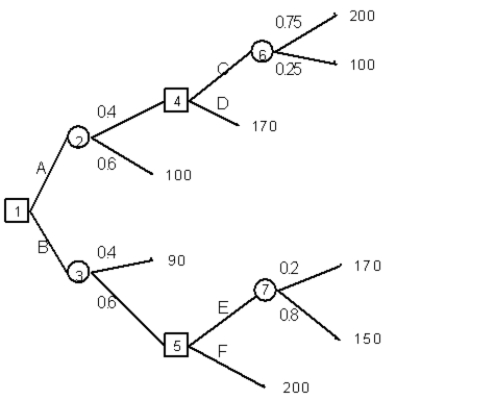

An investor is considering 2 investments,A,B,which can be made now.After these investments are made he can pursue choices C,D,E and F depending on whether he chose A or B originally.He has developed the following decision tree to aid in his selection process.What are the correct original and subsequent decisions based on an expected monetary value criteria?

A)A,C

B)A,D

C)B,E

D)B,F

A)A,C

B)A,D

C)B,E

D)B,F

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

55

Exhibit 14.5

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C,D.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following decision tree has been developed for the problem.The investor has estimated the probability of a declining economy at 40% and an expanding economy at 60%.

Refer to Exhibit 14.5.What is the expected monetary value for the investor's problem?

A)32

B)36

C)38

D)42

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C,D.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following decision tree has been developed for the problem.The investor has estimated the probability of a declining economy at 40% and an expanding economy at 60%.

Refer to Exhibit 14.5.What is the expected monetary value for the investor's problem?

A)32

B)36

C)38

D)42

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

56

Exhibit 14.7

The following questions use the information below.

A decision maker is faced with two alternatives.The decision maker has determined that she is indifferent between the two alternatives when p = 0.45.

Alternative 1: Receive $82,000 with certainty

Alternative 2: Receive $143,000 with probability p and lose $15,000 with probability 1 − p).

Refer to Exhibit 14.7.What is the decision maker's certainty equivalent for this problem?

A)−$15,000

B)$82,000

C)$56,100

D)$82,000

The following questions use the information below.

A decision maker is faced with two alternatives.The decision maker has determined that she is indifferent between the two alternatives when p = 0.45.

Alternative 1: Receive $82,000 with certainty

Alternative 2: Receive $143,000 with probability p and lose $15,000 with probability 1 − p).

Refer to Exhibit 14.7.What is the decision maker's certainty equivalent for this problem?

A)−$15,000

B)$82,000

C)$56,100

D)$82,000

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

57

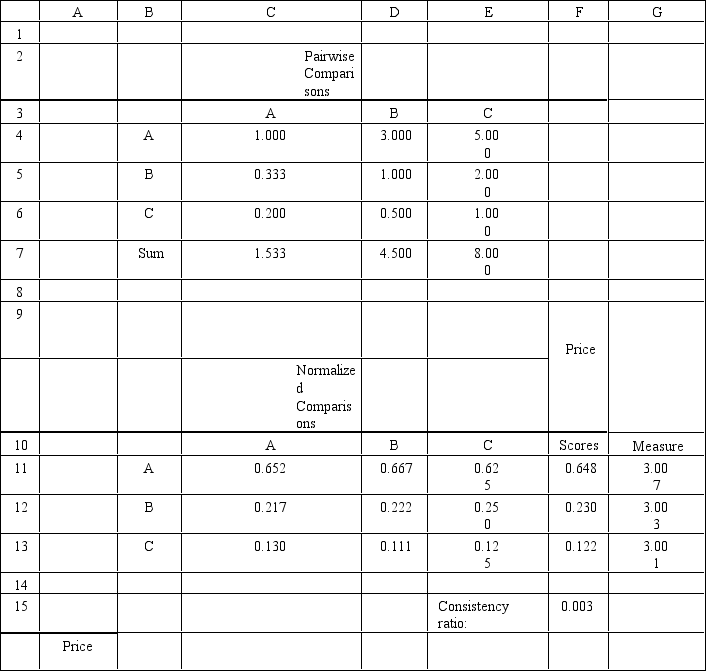

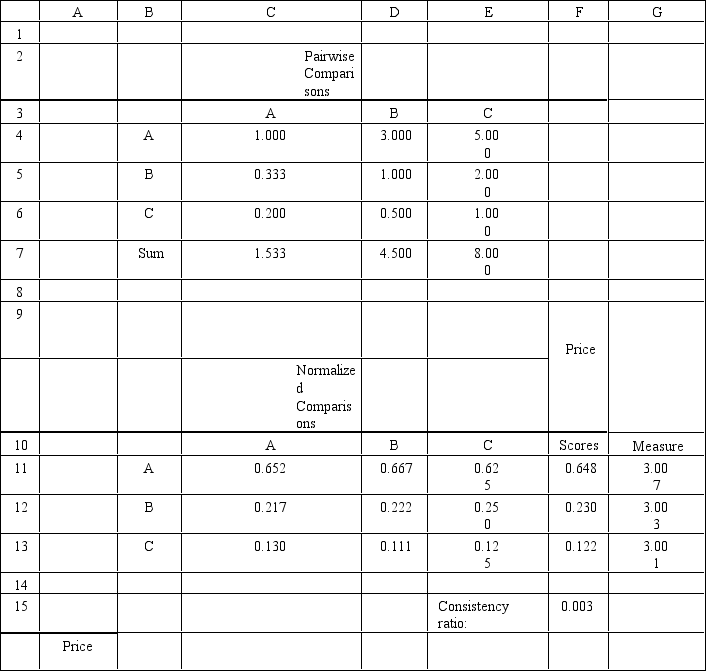

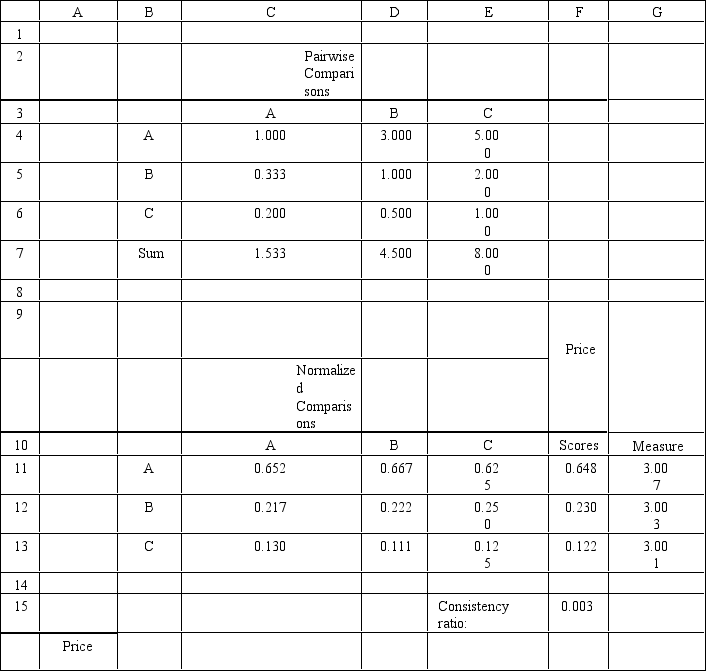

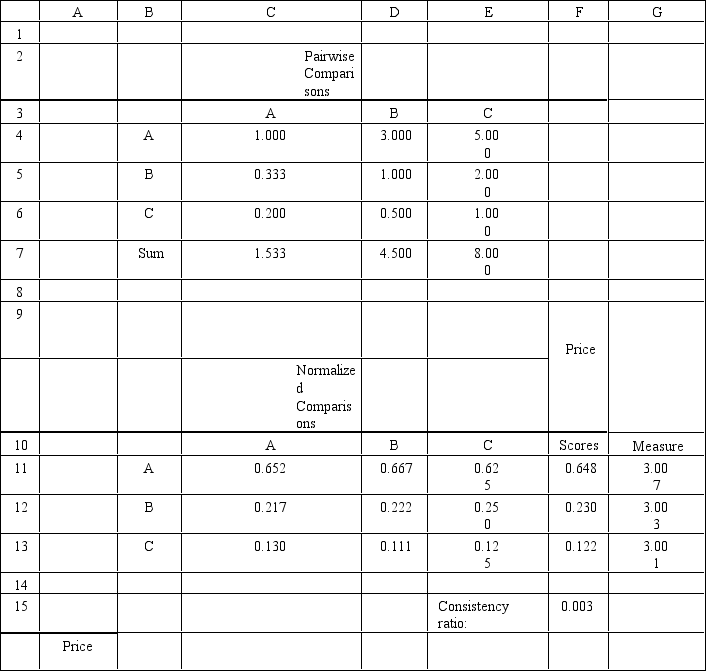

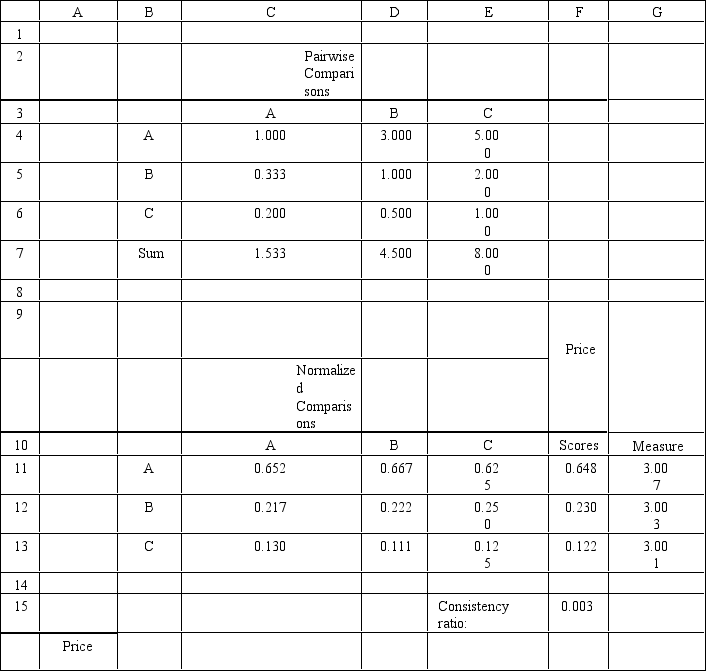

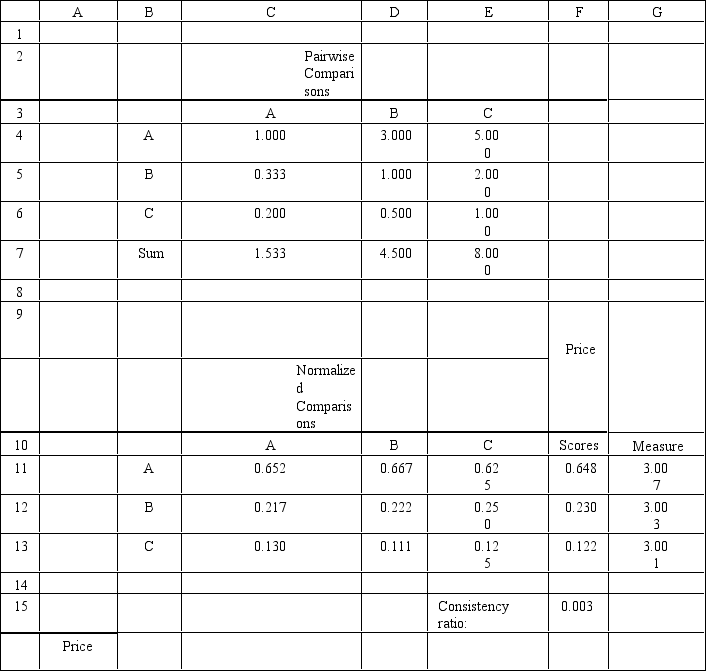

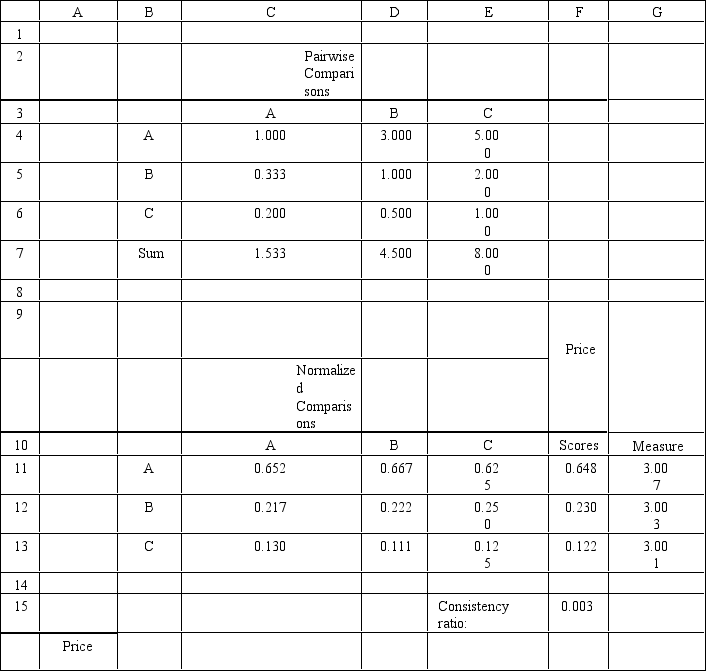

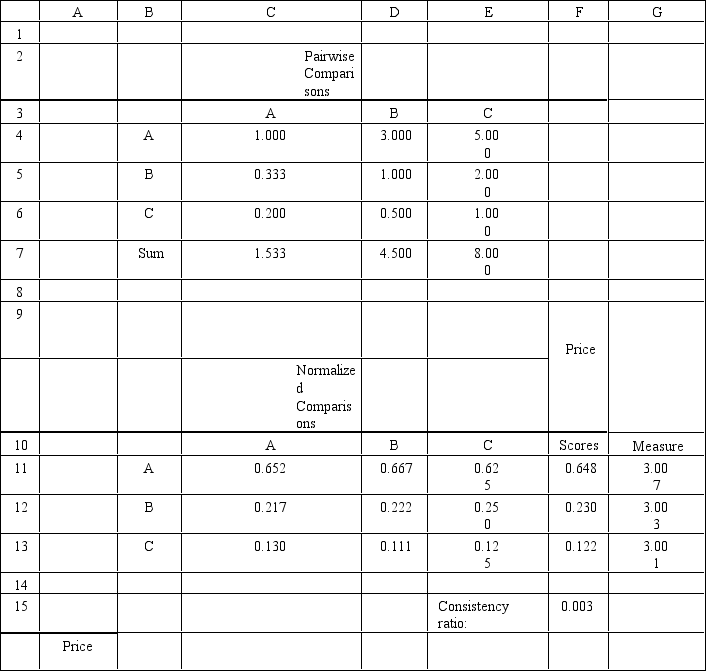

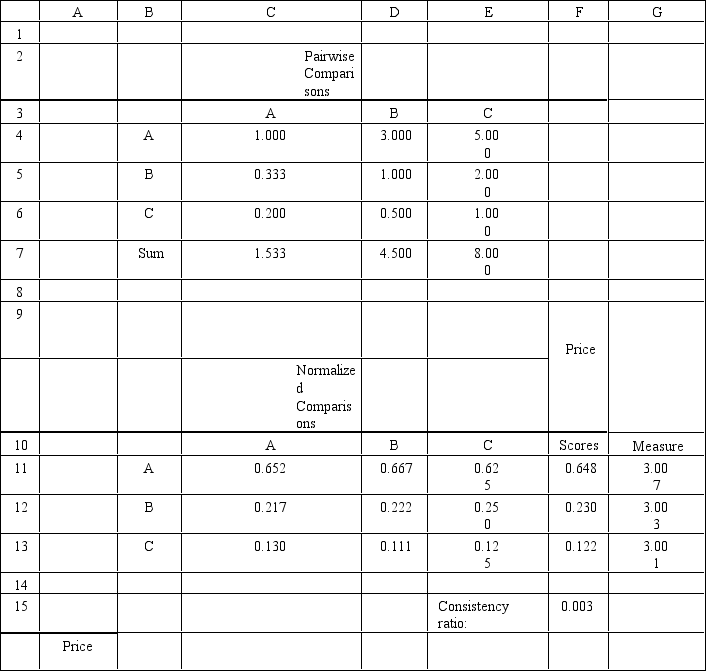

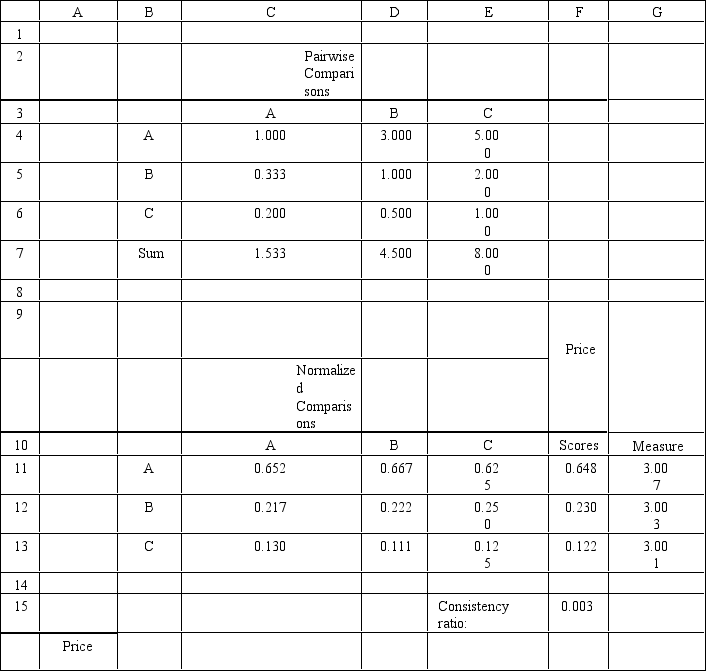

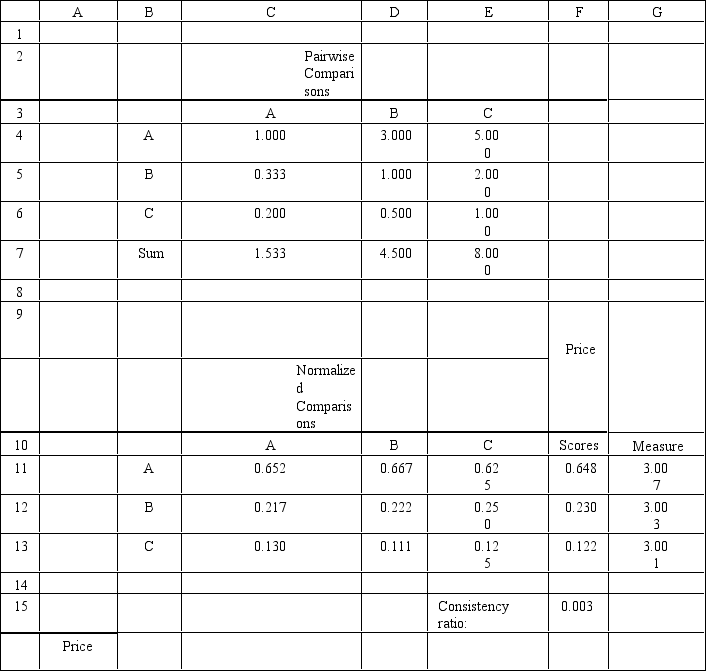

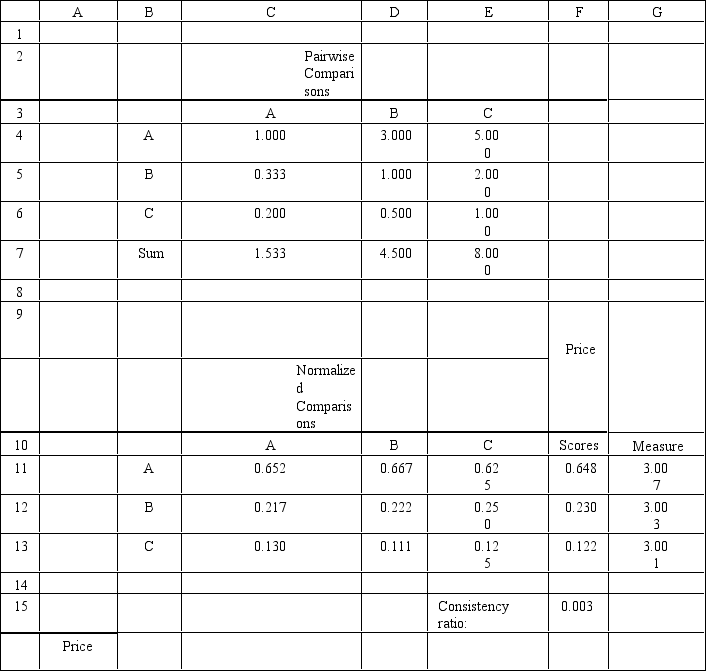

Exhibit 14.8

The following questions use the information below.

A company needs to buy a new insurance policy.They have three policies to choose from,A,B and C.The policies differ with respect to price,coverage and ease of billing.The company has developed the following AHP tables for price and summary.The other tables are not shown due to space limitations.

-Refer to Exhibit 14.8.What formula should go in cell F11 and get copied to F12:F13 of the Price worksheet to compute the Price Score?

A)=AVERAGEC4:C6)

B)=AVERAGEC11:E11)

C)=AVERAGEG11:G13)

D)=AVERAGEC7:E7)

The following questions use the information below.

A company needs to buy a new insurance policy.They have three policies to choose from,A,B and C.The policies differ with respect to price,coverage and ease of billing.The company has developed the following AHP tables for price and summary.The other tables are not shown due to space limitations.

-Refer to Exhibit 14.8.What formula should go in cell F11 and get copied to F12:F13 of the Price worksheet to compute the Price Score?

A)=AVERAGEC4:C6)

B)=AVERAGEC11:E11)

C)=AVERAGEG11:G13)

D)=AVERAGEC7:E7)

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

58

Exhibit 14.8

The following questions use the information below.

A company needs to buy a new insurance policy.They have three policies to choose from,A,B and C.The policies differ with respect to price,coverage and ease of billing.The company has developed the following AHP tables for price and summary.The other tables are not shown due to space limitations.

-Refer to Exhibit 14.8.What formula should go in cell G11 and get copied to G12:G13 of the Price worksheet to compute the Consistency Measure?

A)=MMULTC4:E4,$F$11:$F$13)

B)=SUMPRODUCTC4:E4,$F$11:$F$13)/F11

C)=MMULTC4:E4,$F$11:$F$13)/F11

D)=MMULTC7:E7,$F$11:$F$13)/F11

The following questions use the information below.

A company needs to buy a new insurance policy.They have three policies to choose from,A,B and C.The policies differ with respect to price,coverage and ease of billing.The company has developed the following AHP tables for price and summary.The other tables are not shown due to space limitations.

-Refer to Exhibit 14.8.What formula should go in cell G11 and get copied to G12:G13 of the Price worksheet to compute the Consistency Measure?

A)=MMULTC4:E4,$F$11:$F$13)

B)=SUMPRODUCTC4:E4,$F$11:$F$13)/F11

C)=MMULTC4:E4,$F$11:$F$13)/F11

D)=MMULTC7:E7,$F$11:$F$13)/F11

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

59

A "risk averse" decision maker assigns the relative utility to any payoff but has an)marginal utility for increased payoffs.

A)largest;increasing

B)largest;diminishing

C)smallest;diminishing

D)smallest;increasing

A)largest;increasing

B)largest;diminishing

C)smallest;diminishing

D)smallest;increasing

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

60

Exhibit 14.5

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C,D.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following decision tree has been developed for the problem.The investor has estimated the probability of a declining economy at 40% and an expanding economy at 60%.

Refer to Exhibit 14.5.How high can PE)go before the investor's decision,based on expected monetary value criteria,changes?

A)0.65

B)0.70

C)0.75

D)0.80

The following questions are based on the information below.

An investor is considering 4 investments,A,B,C,D.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following decision tree has been developed for the problem.The investor has estimated the probability of a declining economy at 40% and an expanding economy at 60%.

Refer to Exhibit 14.5.How high can PE)go before the investor's decision,based on expected monetary value criteria,changes?

A)0.65

B)0.70

C)0.75

D)0.80

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

61

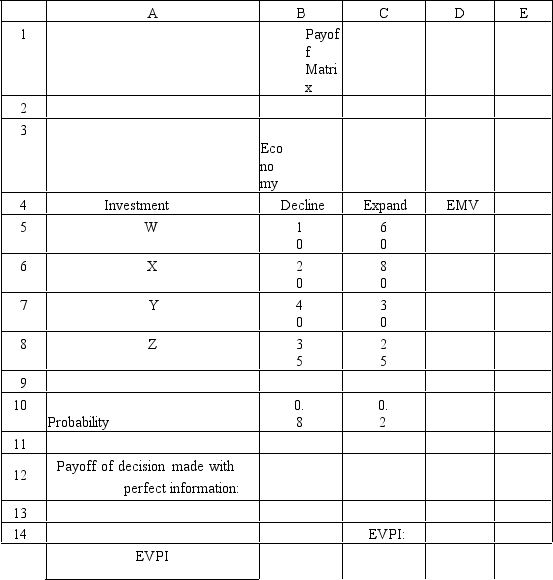

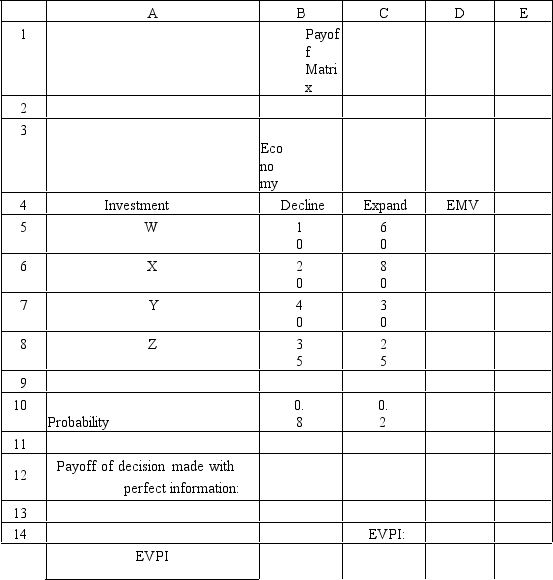

Exhibit 14.10

The following questions are based on the information below.

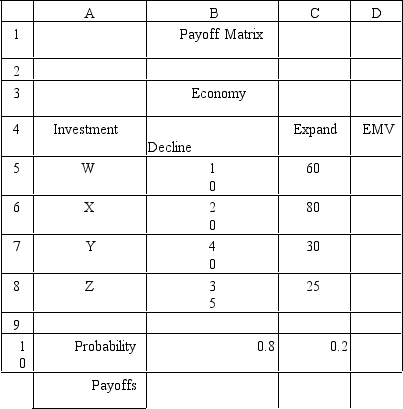

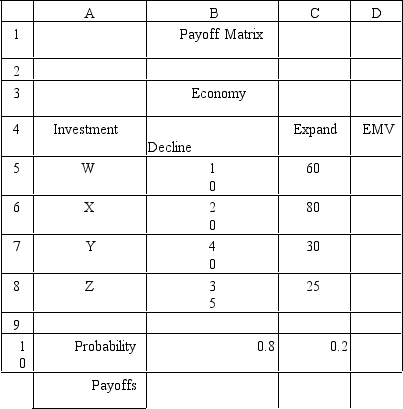

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.The investor has estimated the probability of a declining economy at 80% and an expanding economy at 20%.

-Refer to Exhibit 14.10.What formulas should go in cell D5:D14 and B12:C12 of the spreadsheet to compute the EVPI?

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.The investor has estimated the probability of a declining economy at 80% and an expanding economy at 20%.

-Refer to Exhibit 14.10.What formulas should go in cell D5:D14 and B12:C12 of the spreadsheet to compute the EVPI?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

62

Exhibit 14.9

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the investment decision problem.

-Refer to Exhibit 14.9.What formula should go in cell D5 and get copied to D6:D8 to implement the maximax decision rule?

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the investment decision problem.

-Refer to Exhibit 14.9.What formula should go in cell D5 and get copied to D6:D8 to implement the maximax decision rule?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

63

Exhibit 14.9

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the investment decision problem.

-Refer to Exhibit 14.9.What decision should be made according to the maximin decision rule?

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the investment decision problem.

-Refer to Exhibit 14.9.What decision should be made according to the maximin decision rule?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

64

Exhibit 14.10

The following questions are based on the information below.

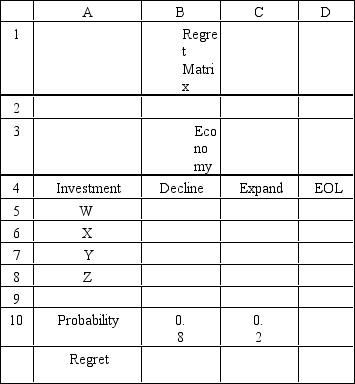

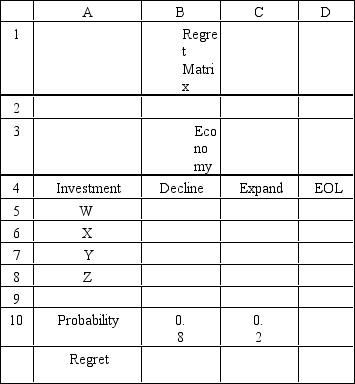

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.The investor has estimated the probability of a declining economy at 80% and an expanding economy at 20%.

Refer to Exhibit 14.10.Complete the Regret Table according to the expected regret decision rule.

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.The investor has estimated the probability of a declining economy at 80% and an expanding economy at 20%.

Refer to Exhibit 14.10.Complete the Regret Table according to the expected regret decision rule.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

65

An investor is considering 4 investments,A,B,C,D.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can be weak or strong.The investor has estimated the probability of a declining economy at 30% and an expanding economy at 70%.Draw the decision tree for this problem and determine the correct decision for this investor based on the expected monetary value criteria.

Payoff Matrix Economy

Payoff Matrix Economy

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

66

Exhibit 14.8

The following questions use the information below.

A company needs to buy a new insurance policy.They have three policies to choose from,A,B and C.The policies differ with respect to price,coverage and ease of billing.The company has developed the following AHP tables for price and summary.The other tables are not shown due to space limitations.

-Refer to Exhibit 14.8.What formula should go in cell G15 of the Price worksheet to compute the Consistency Ratio?

A)=AVERAGEG11:G13)-3)/2*0.58)

B)=AVERAGEG11:G13)-3)

C)=AVERAGEG11:G13))/2*0.58)

D)=AVERAGEG11:G13)-3)/0.58

The following questions use the information below.

A company needs to buy a new insurance policy.They have three policies to choose from,A,B and C.The policies differ with respect to price,coverage and ease of billing.The company has developed the following AHP tables for price and summary.The other tables are not shown due to space limitations.

-Refer to Exhibit 14.8.What formula should go in cell G15 of the Price worksheet to compute the Consistency Ratio?

A)=AVERAGEG11:G13)-3)/2*0.58)

B)=AVERAGEG11:G13)-3)

C)=AVERAGEG11:G13))/2*0.58)

D)=AVERAGEG11:G13)-3)/0.58

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

67

Exhibit 14.9

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the investment decision problem.

-Refer to Exhibit 14.9.Assume the formula =MAXB5:C5)was entered in cell D5 and copied to cells D6:D8.What formula should go in cell E5 and get copied to cells E6:E8 to place a "<==" to indicate the choice according to the maximax decision rule?

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the investment decision problem.

-Refer to Exhibit 14.9.Assume the formula =MAXB5:C5)was entered in cell D5 and copied to cells D6:D8.What formula should go in cell E5 and get copied to cells E6:E8 to place a "<==" to indicate the choice according to the maximax decision rule?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

68

Exhibit 14.9

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the investment decision problem.

-Refer to Exhibit 14.9.What decision should be made according to the maximax decision rule?

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the investment decision problem.

-Refer to Exhibit 14.9.What decision should be made according to the maximax decision rule?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

69

Exhibit 14.10

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.The investor has estimated the probability of a declining economy at 80% and an expanding economy at 20%.

Refer to Exhibit 14.10.Complete the following table to determine the expected value of perfect information for the investor.

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.The investor has estimated the probability of a declining economy at 80% and an expanding economy at 20%.

Refer to Exhibit 14.10.Complete the following table to determine the expected value of perfect information for the investor.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

70

Exhibit 14.8

The following questions use the information below.

A company needs to buy a new insurance policy.They have three policies to choose from,A,B and C.The policies differ with respect to price,coverage and ease of billing.The company has developed the following AHP tables for price and summary.The other tables are not shown due to space limitations.

-Refer to Exhibit 14.8.The Consistency Ratio indicates consistency in the pairwise comparison matrix if the ratio is

A) 0.05

B)0.10

C)0.20

D) 0.30

The following questions use the information below.

A company needs to buy a new insurance policy.They have three policies to choose from,A,B and C.The policies differ with respect to price,coverage and ease of billing.The company has developed the following AHP tables for price and summary.The other tables are not shown due to space limitations.

-Refer to Exhibit 14.8.The Consistency Ratio indicates consistency in the pairwise comparison matrix if the ratio is

A) 0.05

B)0.10

C)0.20

D) 0.30

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

71

Exhibit 14.8

The following questions use the information below.

A company needs to buy a new insurance policy.They have three policies to choose from,A,B and C.The policies differ with respect to price,coverage and ease of billing.The company has developed the following AHP tables for price and summary.The other tables are not shown due to space limitations.

-Refer to Exhibit 14.8.Which policy should the company choose based on the Summary worksheet?

A)A

B)B

C)C

D)None of these

The following questions use the information below.

A company needs to buy a new insurance policy.They have three policies to choose from,A,B and C.The policies differ with respect to price,coverage and ease of billing.The company has developed the following AHP tables for price and summary.The other tables are not shown due to space limitations.

-Refer to Exhibit 14.8.Which policy should the company choose based on the Summary worksheet?

A)A

B)B

C)C

D)None of these

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

72

Exhibit 14.9

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the investment decision problem.

-Refer to Exhibit 14.9.The original payoff data is in the worksheet called "Payoffs".What formula should go in cell B5 of this Regret Matrix to compute the regret value?

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the investment decision problem.

-Refer to Exhibit 14.9.The original payoff data is in the worksheet called "Payoffs".What formula should go in cell B5 of this Regret Matrix to compute the regret value?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

73

An investor is considering 4 investments,A,B,C,D.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following decision tree has been developed for the problem.The investor has estimated the probability of a declining economy at 25% and an expanding economy at 75%.What is the correct decision for this investor based on an expected monetary value criteria? Draw the decision tree for this problem.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

74

Exhibit 14.10

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.The investor has estimated the probability of a declining economy at 80% and an expanding economy at 20%.

Refer to Exhibit 14.10.The original payoff data is in the worksheet above called "Payoffs".What formula should go in cell B5 of the spreadsheet if the expected regret decision rule is to be used?

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.The investor has estimated the probability of a declining economy at 80% and an expanding economy at 20%.

Refer to Exhibit 14.10.The original payoff data is in the worksheet above called "Payoffs".What formula should go in cell B5 of the spreadsheet if the expected regret decision rule is to be used?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

75

Exhibit 14.9

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the investment decision problem.

-Refer to Exhibit 14.9.What formula should go in cell D5 of the following Regret Table to implement the minimax regret decision rule? Assume that cells B5:C8 contain the regret values for the problem.

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the investment decision problem.

-Refer to Exhibit 14.9.What formula should go in cell D5 of the following Regret Table to implement the minimax regret decision rule? Assume that cells B5:C8 contain the regret values for the problem.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

76

Exhibit 14.10

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.The investor has estimated the probability of a declining economy at 80% and an expanding economy at 20%.

Refer to Exhibit 14.10.Complete the table using the expected monetary value decision rule and indicate which decision should be made according to that rule.

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the decision problem.The investor has estimated the probability of a declining economy at 80% and an expanding economy at 20%.

Refer to Exhibit 14.10.Complete the table using the expected monetary value decision rule and indicate which decision should be made according to that rule.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

77

Exhibit 14.9

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the investment decision problem.

-Refer to Exhibit 14.9.What decision should be made according to the minimax regret decision rule?

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the investment decision problem.

-Refer to Exhibit 14.9.What decision should be made according to the minimax regret decision rule?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

78

Exhibit 14.9

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the investment decision problem.

-Refer to Exhibit 14.9.What formula should go in cell D5 and get copied to D6:D8 to implement the maximin decision rule?

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the investment decision problem.

-Refer to Exhibit 14.9.What formula should go in cell D5 and get copied to D6:D8 to implement the maximin decision rule?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

79

Exhibit 14.9

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the investment decision problem.

-Refer to Exhibit 14.9.Assume the formula =MINB5:C5)was entered in cell D5 and copied to cells D6:D8.What formula should go in cell E5 and get copied to cells E6:E8 to place a "<==" to indicate the choice according to the maximin decision rule?

The following questions are based on the information below.

An investor is considering 4 investments,W,X,Y,and Z.The payoff from each investment is a function of the economic climate over the next 2 years.The economy can expand or decline.The following payoff matrix has been developed for the investment decision problem.

-Refer to Exhibit 14.9.Assume the formula =MINB5:C5)was entered in cell D5 and copied to cells D6:D8.What formula should go in cell E5 and get copied to cells E6:E8 to place a "<==" to indicate the choice according to the maximin decision rule?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

80

Exhibit 14.8

The following questions use the information below.

A company needs to buy a new insurance policy.They have three policies to choose from,A,B and C.The policies differ with respect to price,coverage and ease of billing.The company has developed the following AHP tables for price and summary.The other tables are not shown due to space limitations.

-Refer to Exhibit 14.8.What formula should go in cell C7 and get copied to D7:E7 of the Summary worksheet to compute the Weighted Average Score?

A)=SUMPRODUCTC4:E4,$G$4:$G$6)

B)=SUMPRODUCTC4:C6,$C$5:$C$7)

C)=SUMPRODUCT$G$4,$G$6)

D)=SUMPRODUCTC4:C6,$G$4:$G$6)

The following questions use the information below.

A company needs to buy a new insurance policy.They have three policies to choose from,A,B and C.The policies differ with respect to price,coverage and ease of billing.The company has developed the following AHP tables for price and summary.The other tables are not shown due to space limitations.

-Refer to Exhibit 14.8.What formula should go in cell C7 and get copied to D7:E7 of the Summary worksheet to compute the Weighted Average Score?

A)=SUMPRODUCTC4:E4,$G$4:$G$6)

B)=SUMPRODUCTC4:C6,$C$5:$C$7)

C)=SUMPRODUCT$G$4,$G$6)

D)=SUMPRODUCTC4:C6,$G$4:$G$6)

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck