Deck 12: Capital Investment Decisions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/149

Play

Full screen (f)

Deck 12: Capital Investment Decisions

1

Two discounting models for capital investment decision making are net present value and internal rate of return.

True

2

Companies considering projects with shorter lives are interested in longer payback periods.

False

3

In practice, managers often choose a discount rate that is higher than the cost of capital.

True

4

Projects that if accepted preclude the acceptance of all other competing projects are called mutually exclusive projects.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

5

The difference between the present value of the cash inflows and outflows associated with a project is the internal rate of return model.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

6

The payback period considers the profitability of a project over its entire life span.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

7

A disadvantage of the payback period is that it ignores a project's total profitability.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

8

Sometimes firms require riskier projects to have longer payback periods.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

9

Projects that do not affect the cash flows of other projects are called mutually exclusive projects.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

10

If cash flows are uneven, the payback period assumes that the inflows during the last fraction of a year occur evenly.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

11

The process of planning, setting goals and priorities, arranging financing, and using certain criteria to select long-term assets is called capital investment decisions.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

12

In order to use the payback period model, the proposed investment must have even cash inflows.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

13

The two major categories of capital investment decision models are independent and mutually exclusive.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

14

A disadvantage of the payback period is that it ignores the time value of money.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

15

Taxes are important consideration in forecasting cash flows.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

16

In capital investment decision making, it is usually assumed that managers should select projects that attempt to maximize the wealth of the owners of the firm.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

17

Only accounting rate of return ignores the time value of money.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

18

One way to use the payback period is to set a maximum payback period for all projects and to reject any project that exceeds this level.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

19

The minimum acceptable rate of return for a project is the required rate of return.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

20

Before-tax cash flows must be forecasted and used in capital investment decision making.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

21

The internal audit staff is usually the best choice for performing a postaudit of a capital investment.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

22

Suppose that the actual cost of capital is 10%, but the firm chooses a discount rate of 18%.Managers of that company will be more likely to choose relatively short term investments.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

23

If the net present value of an investment is zero, the investment earns less than the minimum required rate of return.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

24

A postaudit evaluates the overall outcome of the investment and proposes corrective action if needed.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

25

The internal rate of return is the least widely used of the capital investment techniques.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

26

A disadvantage of postaudits is that they are costly.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

27

Less objective results are obtainable if an independent party performs the postaudit of a capital investment.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

28

An obvious problem with postaudits is that the assumptions driving the original analysis may often be invalidated by changes in the actual operating environment.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

29

In general, it is best if postaudits are done by company management, since they understand the actual operating conditions.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

30

Postaudits supply feedback to managers that should help improve future decision making.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

31

A key element in the capital investment process is called a postaudit.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

32

The internal rate of return is the most widely used of the capital investment techniques.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

33

Companies that perform postaudits of capital projects experience a number of benefits.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

34

A postaudit is an analysis of a capital project before it is implemented.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

35

Net present value analysis and internal rate of return analysis can sometimes produce erroneous choices because they ignore the time value of money.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

36

One drawback to the internal rate of return model is that cash inflows must occur evenly over the life of the investment.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

37

Because of the postaudit, managers are more likely to make capital investment decisions in the best interests of the firm.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

38

Postaudits ensure that resources are used wisely by evaluating profitability.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

39

The interest rate that sets the present value of a project's cash inflows equal to the present value of the project's cost is called the internal rate of return.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

40

For independent projects, net present value analysis and internal rate of return analysis yield the same decision.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

41

The ___________________ is the minimum acceptable rate of return.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

42

_____________________ explicitly consider the time value of money.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

43

The difference between the present value of the cash inflows and the outflows associated with a project is known as the ___________________.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

44

_______________________ are concerned with the process of planning, setting goals and priorities, arranging financing, and using certain criteria to select long-term assets.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

45

The _______________________ is defined as the interest rate that sets the present value of a project's cash inflows equal to the present value of the project's cost.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

46

_______________________ ignore the time value of money.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

47

The process of making capital investment decisions often is referred to as ________________.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

48

The two types of capital budgeting projects are ________________ and _______________.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

49

The amount that must be invested now to produce a future value is known as the ____________ of the future amount.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

50

______________________ are projects that, if accepted or rejected, do not affect the cash flows of other projects.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

51

When choosing among competing alternatives the ________________ model may choose an inferior project in terms of maximizing firm wealth.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

52

The ______________ is the time required for a firm to recover its original investment.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

53

When choosing among competing projects, the ___________________ model correctly identifies the best investment alternative.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

54

The major disadvantage of a postaudit is that it is ____________.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

55

A key element in the capital investment process is a follow-up analysis of a capital project once it is implemented; this analysis is a called a _____________.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

56

The _________________________ measures the return on a project in terms of income.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

57

If the internal rate of return (IRR) is less than the required rate of return, the project is __________.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

58

_______________________ are the future cash flows expressed in terms of their present value.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

59

The internal rate of return model does not consistently result in choices that maximize firm wealth.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

60

If the internal rate of return (IRR) is greater than the required rate, the project is deemed ___________.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following formulas is used to compute the accounting rate of return?

A) Average Income / Initial Investment

B) Initial Investment / Annual Cash Flow

C) Net Profit / Initial Cash Flow

D) Present Value of the Investment / Average Income

E) (Average Income + Initial Investment) / Initial Investment

A) Average Income / Initial Investment

B) Initial Investment / Annual Cash Flow

C) Net Profit / Initial Cash Flow

D) Present Value of the Investment / Average Income

E) (Average Income + Initial Investment) / Initial Investment

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

62

One disadvantage of the payback period is that

A) it is sometimes used as a crude measure of risk.

B) managers may choose investments with quick payback periods to maximize short term criteria on which their own bonuses, etc.may be based.

C) it cannot be used for investments with unequal cash inflows.

D) it cannot be used if the entire cost of the investment does not occur immediately.

E) All of these.

A) it is sometimes used as a crude measure of risk.

B) managers may choose investments with quick payback periods to maximize short term criteria on which their own bonuses, etc.may be based.

C) it cannot be used for investments with unequal cash inflows.

D) it cannot be used if the entire cost of the investment does not occur immediately.

E) All of these.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following capital investment decision models is based on the time required for a firm to recover its original investment?

A) The average rate of return

B) The internal rate of return

C) The net present value

D) The accounting rate of return

E) The payback period

A) The average rate of return

B) The internal rate of return

C) The net present value

D) The accounting rate of return

E) The payback period

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following is true while making a capital investment decision?

A) A manager should assess the risk of the project.

B) A manager should ignore the timing of the cash flows.

C) A manager should compute the competitor's return on investment.

D) A manager should ensure that the project cost is equal to the cash flow from investment.

E) All of these.

A) A manager should assess the risk of the project.

B) A manager should ignore the timing of the cash flows.

C) A manager should compute the competitor's return on investment.

D) A manager should ensure that the project cost is equal to the cash flow from investment.

E) All of these.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

65

An investment of $10,000 provides average net cash flows of $500 with zero salvage value.Depreciation is $15 per year.Calculate the accounting rate of return using the original investment.(Note: Round the answer to two decimal places.)

A) 3.41%

B) 5.19%

C) 4.85%

D) 3.29%

E) 6.47%

A) 3.41%

B) 5.19%

C) 4.85%

D) 3.29%

E) 6.47%

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

66

The value of an investment at the end of its life is called its ________________.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following is used to calculate the payback period?

A) Original Investment / Annual Cash Flow

B) Net Profit × Annual Cash Flow

C) Original Investment + Annual Cash Flow

D) Net Profit − Annual Cash Flow

E) (Net Profit + Annual Cash Flow) / Annual Cash Flow

A) Original Investment / Annual Cash Flow

B) Net Profit × Annual Cash Flow

C) Original Investment + Annual Cash Flow

D) Net Profit − Annual Cash Flow

E) (Net Profit + Annual Cash Flow) / Annual Cash Flow

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

68

A division manager was considering a project that required a significant initial investment.If accepted, the project could have a negative impact on certain financial ratios that the firm was required to maintain to satisfy debt contracts.To ensure that the ratios would not be adversely affected by the investment, the manager would use which of the following capital investment models?

A) payback period

B) accounting rate of return

C) net present value

D) internal rate of return

E) None of these.

A) payback period

B) accounting rate of return

C) net present value

D) internal rate of return

E) None of these.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

69

Tom has just invested $150,000 in a coffee shop.He expects to receive cash income of $10,000 a year.What is the payback period?

A) 19 years

B) 31 years

C) 22 years

D) 10 years

E) 15 years

A) 19 years

B) 31 years

C) 22 years

D) 10 years

E) 15 years

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

70

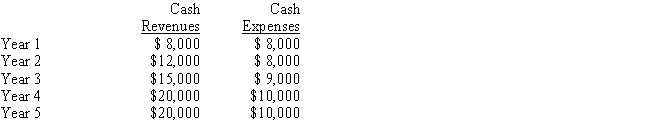

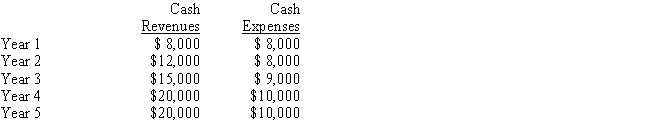

Buster Evans is considering investing $20,000 in a project with the following annual cash revenues and expenses:

Depreciation will be $4,000 per year.

What is the accounting rate of return on the investment?

A) 15%

B) 35%

C) 70%

D) 75%

E) None of these.

Depreciation will be $4,000 per year.

What is the accounting rate of return on the investment?

A) 15%

B) 35%

C) 70%

D) 75%

E) None of these.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

71

The disadvantage of a payback period is that it:

A) ignores the project's total profitability.

B) considers the time value of money.

C) considers total profitability, requiring the forecasting of all future cash flows.

D) uses an internal rate of return to calculate profitability.

E) uses operating income rather than cash flows.

A) ignores the project's total profitability.

B) considers the time value of money.

C) considers total profitability, requiring the forecasting of all future cash flows.

D) uses an internal rate of return to calculate profitability.

E) uses operating income rather than cash flows.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following is preferred by managers when the risk of obsolescence is high?

A) A short payback period

B) A high opportunity cost

C) A low accounting rate of return

D) All of these

E) None of these

A) A short payback period

B) A high opportunity cost

C) A low accounting rate of return

D) All of these

E) None of these

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

73

Neil Morrison has just invested $130,000 in a restaurant.He expects to receive income of $24,000 a year, and to have the investment for 8 years.What is the accounting rate of return?

A) 5.60%

B) 18.46%

C) 14.52%

D) 12.41%

E) 4.50%

A) 5.60%

B) 18.46%

C) 14.52%

D) 12.41%

E) 4.50%

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following is true of capital investment decision making?

A) It is used only for independent projects.

B) It is used only for mutually exclusive projects.

C) It requires that funding for a project must come from sources with the same opportunity cost of funds.

D) It is used to determine whether or not a firm should accept a special order.

E) None of these.

A) It is used only for independent projects.

B) It is used only for mutually exclusive projects.

C) It requires that funding for a project must come from sources with the same opportunity cost of funds.

D) It is used to determine whether or not a firm should accept a special order.

E) None of these.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

75

Elena Wallace invested $150,000 in a project that pays her an even amount per year for 10 years.The payback period is 6 years.What are Elena's yearly cash inflows from the project?

A) $150,000

B) $15,000

C) $25,000

D) $90,000

E) Cannot be determined from this information.

A) $150,000

B) $15,000

C) $25,000

D) $90,000

E) Cannot be determined from this information.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

76

Tina invested in a project with a payback period of 4 years.The project brings $20,000 per year for a period of 10 years.What was the initial investment?

A) $80,000

B) $107,500

C) $162,000

D) $240,000

E) Cannot be determined from this information.

A) $80,000

B) $107,500

C) $162,000

D) $240,000

E) Cannot be determined from this information.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

77

Kate is considering an investment in a retail shopping mall.The initial investment is $630,000.She expects to receive cash income of $90,000 a year.What is the payback period?

A) 2 years

B) 5 years

C) 7 years

D) 12 years

E) 15 years

A) 2 years

B) 5 years

C) 7 years

D) 12 years

E) 15 years

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

78

Managers may use the accounting rate of return to evaluate potential investment projects because

A) debt contracts require that a firm maintain certain ratios that are affected by income and long-term asset levels.

B) it serves as a screening measure to insure that new investments do not affect key financial ratios.

C) bonuses to managers may be based on accounting income and/or return on assets.

D) it can be tied to the manager's personal income.

E) All of these.

A) debt contracts require that a firm maintain certain ratios that are affected by income and long-term asset levels.

B) it serves as a screening measure to insure that new investments do not affect key financial ratios.

C) bonuses to managers may be based on accounting income and/or return on assets.

D) it can be tied to the manager's personal income.

E) All of these.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

79

In general terms, a sound capital investment will earn

A) back its original capital outlay.

B) a return greater than existing capital investments.

C) back its original capital outlay and provide a reasonable return on the original investment.

D) back its original capital outlay by the midpoint of its useful life.

E) None of these.

A) back its original capital outlay.

B) a return greater than existing capital investments.

C) back its original capital outlay and provide a reasonable return on the original investment.

D) back its original capital outlay by the midpoint of its useful life.

E) None of these.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

80

The payback period provides information to managers that can be used to help

A) control the risks associated with the uncertainty of future cash flows.

B) minimize the impact of an investment on a firm's liquidity problems.

C) control the risk of obsolescence.

D) control the effect of the investment on performance measures.

E) All of these.

A) control the risks associated with the uncertainty of future cash flows.

B) minimize the impact of an investment on a firm's liquidity problems.

C) control the risk of obsolescence.

D) control the effect of the investment on performance measures.

E) All of these.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck