Deck 4: Discounted Cash Flow Valuation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

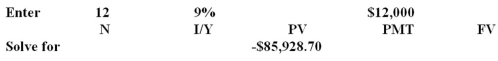

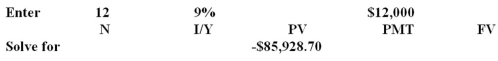

Question

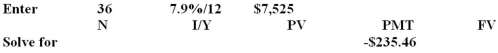

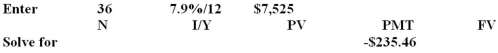

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/100

Play

Full screen (f)

Deck 4: Discounted Cash Flow Valuation

1

Which one of the following would have the greatest value assuming each has Year 1 annual cash flows of $100 and a discount rate of 8 percent,compounded annually?

A)Perpetuity

B)Annuity

C)Growing perpetuity

D)Growing annuity

E)Growing perpetuity or growing annuity,as they would have equal values

A)Perpetuity

B)Annuity

C)Growing perpetuity

D)Growing annuity

E)Growing perpetuity or growing annuity,as they would have equal values

Growing perpetuity

2

By federal law,lenders must disclose which one of these?

A)APR,excluding fees or other noninterest charges

B)EAR,excluding fees or other noninterest charges

C)APR,including fees and other noninterest charges

D)EAR,including fees and other noninterest charges

E)both the APR and EAR,excluding fees and other charges

A)APR,excluding fees or other noninterest charges

B)EAR,excluding fees or other noninterest charges

C)APR,including fees and other noninterest charges

D)EAR,including fees and other noninterest charges

E)both the APR and EAR,excluding fees and other charges

APR,including fees and other noninterest charges

3

The value of a firm is best defined as the:

A)sum of all of the firm's future cash flows.

B)current year's cash flow times (1 + g).

C)current year's cash flow divided by r.

D)total present value of all of the firm's future cash flows.

E)current year's cash flows divided by (g - r).

A)sum of all of the firm's future cash flows.

B)current year's cash flow times (1 + g).

C)current year's cash flow divided by r.

D)total present value of all of the firm's future cash flows.

E)current year's cash flows divided by (g - r).

total present value of all of the firm's future cash flows.

4

In which type of loan does the borrower initially receive the present value of the future lump sum loan repayment amount?

A)Pure discount loans

B)Both pure discount and interest-only loans

C)Amortized loans

D)Both interest-only and amortized loans

E)Interest-only loans

A)Pure discount loans

B)Both pure discount and interest-only loans

C)Amortized loans

D)Both interest-only and amortized loans

E)Interest-only loans

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

5

The interest rate expressed as if it were compounded once per year is called the:

A)periodic interest rate.

B)compound interest rate.

C)stated annual rate.

D)daily interest rate.

E)effective annual rate.

A)periodic interest rate.

B)compound interest rate.

C)stated annual rate.

D)daily interest rate.

E)effective annual rate.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

6

You are comparing two investments,A and B,with unequal annual cash flows and varying numbers of years.Which one of these statements is correct regarding this comparison?

A)If A has a higher present value at one discount rate,then A will have the higher present value at any other discount rate.

B)If B has a higher present value,then B will have the higher future value at any point in time,given a stated discount rate.

C)If B has a higher future value at one discount rate,then B will have the higher present value at any discount rate.

D)The two projects cannot be compared since they are of varying lengths.

E)The project with the greatest number of years will have the higher present value.

A)If A has a higher present value at one discount rate,then A will have the higher present value at any other discount rate.

B)If B has a higher present value,then B will have the higher future value at any point in time,given a stated discount rate.

C)If B has a higher future value at one discount rate,then B will have the higher present value at any discount rate.

D)The two projects cannot be compared since they are of varying lengths.

E)The project with the greatest number of years will have the higher present value.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

7

Which of these are basic assumptions of the growing perpetuity present value formula?

I.The cash flow is the Time 0 cash flow.

II.The time periods are regular and discrete.

III.g < r

IV.The number of time periods is finite.

A)I and II only

B)II and III only

C)I,II,and III only

D)II,III,and IV only

E)I,II,III,and IV

I.The cash flow is the Time 0 cash flow.

II.The time periods are regular and discrete.

III.g < r

IV.The number of time periods is finite.

A)I and II only

B)II and III only

C)I,II,and III only

D)II,III,and IV only

E)I,II,III,and IV

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

8

Lew's Tours is just about to pay an annual dividend of $1.20 a share.The dividend is expected to increase by 2 percent annually and the applicable discount rate is 13 percent.Which one of these is the correct formula for computing the current value of this stock?

A)$1.20 + [$1.20/1.13 + .02]

B)($1.20 × 1.02)/1.13

C)($1.20 × 1.02)/.13

D)($1.20 × 1.02)/(.13 - .02)

E)$1.20 + ($1.20 × 1.02)/(.13 - .02)

A)$1.20 + [$1.20/1.13 + .02]

B)($1.20 × 1.02)/1.13

C)($1.20 × 1.02)/.13

D)($1.20 × 1.02)/(.13 - .02)

E)$1.20 + ($1.20 × 1.02)/(.13 - .02)

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

9

Which term applies to a set of cash flows that are finite in number and increase in amount at a steady rate?

A)Perpetuity

B)Growing annuity

C)Growing perpetuity

D)Annuity

E)Lump sum payment

A)Perpetuity

B)Growing annuity

C)Growing perpetuity

D)Annuity

E)Lump sum payment

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

10

Given a firm with positive annual cash flows,which one of the following will increase the current value of that firm?

A)Increasing the annual growth rate of the cash flows

B)Increasing the discount rate

C)Decreasing the amount of each cash flow

D)Decreasing the life of the firm

E)Increasing either the growth rate of the cash flows or the discount rate

A)Increasing the annual growth rate of the cash flows

B)Increasing the discount rate

C)Decreasing the amount of each cash flow

D)Decreasing the life of the firm

E)Increasing either the growth rate of the cash flows or the discount rate

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

11

An annuity stream where the payments occur forever is called a(n):

A)annuity due.

B)indemnity.

C)perpetuity.

D)amortized cash flow stream.

E)ordinary annuity.

A)annuity due.

B)indemnity.

C)perpetuity.

D)amortized cash flow stream.

E)ordinary annuity.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following will increase the effective annual rate (EAR)of a loan?

A)Decreasing the frequency of the interest rate compounding

B)Applying only simple interest

C)Decreasing the annual percentage rate (APR)

D)Increasing either the annual percentage rate (APR)or the compounding frequency

E)Changing from continuous compounding to daily compounding of interest

A)Decreasing the frequency of the interest rate compounding

B)Applying only simple interest

C)Decreasing the annual percentage rate (APR)

D)Increasing either the annual percentage rate (APR)or the compounding frequency

E)Changing from continuous compounding to daily compounding of interest

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

13

The interest rate charged per period multiplied by the number of periods per year is called the:

A)effective annual rate.

B)compound interest rate.

C)periodic interest rate.

D)annual percentage rate.

E)daily interest rate.

A)effective annual rate.

B)compound interest rate.

C)periodic interest rate.

D)annual percentage rate.

E)daily interest rate.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

14

Annuities with payments occurring at the end of each time period are called _____,whereas annuities with payments occurring at the beginning of each time period are called _____.

A)ordinary annuities;early annuities

B)ordinary annuities;annuities due

C)annuities due;ordinary annuities

D)straight annuities;deferred annuities

E)deferred annuities;straight annuities

A)ordinary annuities;early annuities

B)ordinary annuities;annuities due

C)annuities due;ordinary annuities

D)straight annuities;deferred annuities

E)deferred annuities;straight annuities

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

15

Which type(s)of loan can be repaid with annuity payments?

A)Pure discount loan

B)Both pure discount and interest-only loans

C)Amortized loan

D)Both interest-only and amortized loans

E)Interest-only loan

A)Pure discount loan

B)Both pure discount and interest-only loans

C)Amortized loan

D)Both interest-only and amortized loans

E)Interest-only loan

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

16

Assume you start saving for retirement today.Which one of these is most apt to decrease the amount you have saved by the day you retire?

A)Delaying your retirement by one year

B)Increasing your investment's average rate of return

C)Increasing the amount you save each year

D)Selecting an investment that compounds continuously

E)Delaying any additions to your savings by one year

A)Delaying your retirement by one year

B)Increasing your investment's average rate of return

C)Increasing the amount you save each year

D)Selecting an investment that compounds continuously

E)Delaying any additions to your savings by one year

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

17

Which type(s)of loan repays the interest as an annuity and the principal as a lump sum?

A)Pure discount loans

B)Both amortized and interest-only loans

C)Amortized loans

D)Both interest-only and amortized loans

E)Interest-only loans

A)Pure discount loans

B)Both amortized and interest-only loans

C)Amortized loans

D)Both interest-only and amortized loans

E)Interest-only loans

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

18

Which one of these statements concerning two annuities is correct? Assume both annuities have $1,000 annual cash flows for four years.

A)The ordinary annuity will pay on the first day of each time period.

B)The annuity due is more valuable than the ordinary annuity.

C)The annuity due will pay one more payment than the ordinary annuity.

D)The ordinary annuity will have the highest value at the end of Year 4.

E)Both annuities are of equal value given any discount rate.

A)The ordinary annuity will pay on the first day of each time period.

B)The annuity due is more valuable than the ordinary annuity.

C)The annuity due will pay one more payment than the ordinary annuity.

D)The ordinary annuity will have the highest value at the end of Year 4.

E)Both annuities are of equal value given any discount rate.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

19

Jennings Lumber just paid an annual dividend of $1.20 a share.The dividend is expected to increase by 2 percent annually and the applicable discount rate is 13 percent.Which one of these is the correct formula for computing the current value of this stock?

A)$1.20 + [$1.20/1.13 + .02]

B)($1.20 × 1.02)/1.13

C)($1.20 × 1.02)/.13

D)($1.20 × 1.02)/(.13 - .02)

E)$1.20 + ($1.20 × 1.02)/(.13 - .02)

A)$1.20 + [$1.20/1.13 + .02]

B)($1.20 × 1.02)/1.13

C)($1.20 × 1.02)/.13

D)($1.20 × 1.02)/(.13 - .02)

E)$1.20 + ($1.20 × 1.02)/(.13 - .02)

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

20

A growing annuity is a set of:

A)arbitrary cash flows occurring each time period for no more than ten years.

B)level cash flows occurring each time period forever.

C)steadily increasing cash flows occurring each time period for a fixed number of periods.

D)increasing cash flows occurring each time period forever.

E)level cash flows occurring each time period for a fixed period of time.

A)arbitrary cash flows occurring each time period for no more than ten years.

B)level cash flows occurring each time period forever.

C)steadily increasing cash flows occurring each time period for a fixed number of periods.

D)increasing cash flows occurring each time period forever.

E)level cash flows occurring each time period for a fixed period of time.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

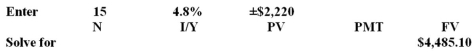

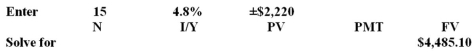

21

This morning you invested your tax refund of $2,220 at an interest rate of 4.8 percent,compounded annually.How much will this investment be worth 15 years from now?

A)$3,818.40

B)$2,175.57

C)$4,094.15

D)$4,485.10

E)$5,121.60

A)$3,818.40

B)$2,175.57

C)$4,094.15

D)$4,485.10

E)$5,121.60

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

22

Angela expects to save $4,000 a year and earn an average annual return of 7.5 percent.How much will her savings be worth 25 years from now?

A)$259,317.82

B)$260,702.57

C)$271,911.45

D)$274,868.92

E)$286,063.66

A)$259,317.82

B)$260,702.57

C)$271,911.45

D)$274,868.92

E)$286,063.66

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

23

Which one of the following statements concerning the annual percentage rate is correct?

A)The annual percentage rate considers interest on interest.

B)The rate of interest you actually pay on a loan is called the annual percentage rate.

C)The effective annual rate is lower than the annual percentage rate when an interest rate is compounded quarterly.

D)When firms advertise the annual percentage rate they are violating U.S.truth-in-lending laws.

E)The annual percentage rate equals the effective annual rate when the rate on an account is designated as simple interest.

A)The annual percentage rate considers interest on interest.

B)The rate of interest you actually pay on a loan is called the annual percentage rate.

C)The effective annual rate is lower than the annual percentage rate when an interest rate is compounded quarterly.

D)When firms advertise the annual percentage rate they are violating U.S.truth-in-lending laws.

E)The annual percentage rate equals the effective annual rate when the rate on an account is designated as simple interest.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

24

Which term is defined as the present value of all future cash flows minus the initial cost?

A)Future value

B)Compounded value

C)Simple value

D)Net present value

E)Present value

A)Future value

B)Compounded value

C)Simple value

D)Net present value

E)Present value

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

25

Cast Out Co.invested $16,200 in a project.At the end of two years,the company sold the project for $23,800.What annual rate of return did the firm earn on this project?

A)46.91%

B)38.20%

C)21.21%

D)18.67%

E)31.93%

A)46.91%

B)38.20%

C)21.21%

D)18.67%

E)31.93%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

26

Discounting cash flows involves:

A)taking the cash discount offered on trade merchandise.

B)estimating only the cash flows that occur in the first four years of a project.

C)discounting only those cash flows that occur at least ten years in the future.

D)multiplying expected future cash flows by the cost of capital.

E)adjusting all expected future cash flows to their current value.

A)taking the cash discount offered on trade merchandise.

B)estimating only the cash flows that occur in the first four years of a project.

C)discounting only those cash flows that occur at least ten years in the future.

D)multiplying expected future cash flows by the cost of capital.

E)adjusting all expected future cash flows to their current value.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

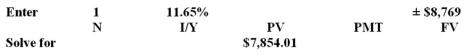

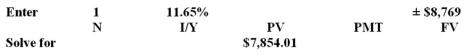

27

You will be receiving $8,769 one year from now.What is the present value of this amount at a discount rate of 11.65 percent?

A)$7,854.01

B)$7,747.41

C)$8,201.16

D)$8,414.32

E)$10,215.89

A)$7,854.01

B)$7,747.41

C)$8,201.16

D)$8,414.32

E)$10,215.89

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

28

Given a positive rate of return and multiple time periods,compound interest:

A)increases in an exponential manner.

B)increases in a linear manner.

C)produces the same future values as simple interest.

D)provides future values that are less than those provided by simple interest.

E)increases at a decreasing rate.

A)increases in an exponential manner.

B)increases in a linear manner.

C)produces the same future values as simple interest.

D)provides future values that are less than those provided by simple interest.

E)increases at a decreasing rate.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

29

Which one of the following will increase the future value of a finite stream of uneven cash flows? Assume a positive rate of return.

A)Moving every cash flow one time period further into the future

B)Decreasing the amount of each cash flow

C)Increasing the first cash flow by $100 and lowering the last cash flow by $100

D)Moving the Time 0 cash inflow to Time 1

E)Decreasing the total number of cash flows

A)Moving every cash flow one time period further into the future

B)Decreasing the amount of each cash flow

C)Increasing the first cash flow by $100 and lowering the last cash flow by $100

D)Moving the Time 0 cash inflow to Time 1

E)Decreasing the total number of cash flows

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

30

Your grandmother has promised to give you $100 every three months for four years,with the first payment occurring three months from today.How much is this gift worth to you today at a discount rate of 3.8 percent,compounded quarterly?

A)$1,129.07

B)$1,633.25

C)$1,660.80

D)$1,477.84

E)$1,479.32

A)$1,129.07

B)$1,633.25

C)$1,660.80

D)$1,477.84

E)$1,479.32

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

31

Which one of the following statements concerning interest rates is correct?

A)The stated rate is the same as the effective annual rate.

B)Banks prefer more frequent compounding on their savings accounts.

C)The annual percentage rate increases as the number of compounding periods per year increases.

D)An effective annual rate is the rate that applies if interest were charged annually.

E)For any positive rate of interest,the effective annual rate will always exceed the annual percentage rate.

A)The stated rate is the same as the effective annual rate.

B)Banks prefer more frequent compounding on their savings accounts.

C)The annual percentage rate increases as the number of compounding periods per year increases.

D)An effective annual rate is the rate that applies if interest were charged annually.

E)For any positive rate of interest,the effective annual rate will always exceed the annual percentage rate.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

32

You just won the lottery! As your prize you will receive $1,500 a month for 100 months starting at the end of this month.If you can earn 8 percent,compounded monthly,what is this prize worth to you today?

A)$64,647.53

B)$65,940.48

C)$109,953.46

D)$109,225.29

E)$118,741.48

A)$64,647.53

B)$65,940.48

C)$109,953.46

D)$109,225.29

E)$118,741.48

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

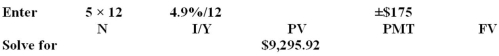

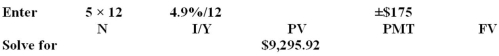

33

Walt can afford monthly car payments of $175 for five years,starting one month from now.The interest rate is 4.9 percent,compounded monthly.How much can he afford to borrow to buy a car?

A)$6,961.36

B)$8,499.13

C)$8,533.8

D)$9,333.88

E)$9,295.92

A)$6,961.36

B)$8,499.13

C)$8,533.8

D)$9,333.88

E)$9,295.92

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

34

An annuity:

A)has less value than a comparable perpetuity.

B)is either an equal or an unequal stream of payments that occur in equal time periods for a finite period.

C)is a stream of payments that fluctuate with current market interest rates.

D)is a stream of equal payments that occur in equal periods of time for a finite period.

E)has a longer life span than a perpetuity.

A)has less value than a comparable perpetuity.

B)is either an equal or an unequal stream of payments that occur in equal time periods for a finite period.

C)is a stream of payments that fluctuate with current market interest rates.

D)is a stream of equal payments that occur in equal periods of time for a finite period.

E)has a longer life span than a perpetuity.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

35

You are comparing two investment options.The cost to invest in either option is the same today.Both options will provide $20,000 of income.Option A pays five annual payments starting with $8,000 the first year followed by four annual payments of $3,000 each.Option B pays five annual payments of $4,000 each.Which one of the following statements is correct given these two investment options?

A)Option A is preferable because it is an annuity due.

B)Option A is the better choice of the two given any positive rate of return.

C)Option B has a higher present value than option A given a positive rate of return.

D)Option B has a lower future value at Year 5 than option A given a zero rate of return.

E)Both options are of equal value given that they both provide $20,000 of income.

A)Option A is preferable because it is an annuity due.

B)Option A is the better choice of the two given any positive rate of return.

C)Option B has a higher present value than option A given a positive rate of return.

D)Option B has a lower future value at Year 5 than option A given a zero rate of return.

E)Both options are of equal value given that they both provide $20,000 of income.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

36

The highest effective annual rate that can be derived from an annual percentage rate of 9 percent is computed as:

A).09e - 1.

B)e.09 × q.

C)e.09 - 1.

D)e × (1 + .09).

E)(1 + .09)q.

A).09e - 1.

B)e.09 × q.

C)e.09 - 1.

D)e × (1 + .09).

E)(1 + .09)q.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

37

A perpetuity differs from an annuity because:

A)perpetuity payments vary with the rate of inflation.

B)perpetuity payments vary with the market rate of interest.

C)perpetuity payments are variable while annuity payments are constant.

D)annuity payments never cease.

E)perpetuity payments never cease.

A)perpetuity payments vary with the rate of inflation.

B)perpetuity payments vary with the market rate of interest.

C)perpetuity payments are variable while annuity payments are constant.

D)annuity payments never cease.

E)perpetuity payments never cease.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

38

The stated rate of interest is 8 percent.Which form of compounding will produce the highest effective rate of interest?

A)Daily

B)Annual

C)Continuous

D)Monthly

E)Semiannual

A)Daily

B)Annual

C)Continuous

D)Monthly

E)Semiannual

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

39

The discount rate assigned to a proposed project is the rate:

A)the firm must expect to earn before committing funding for the project.

B)the firm can earn on a riskless investment,such as U.S.Treasury bills.

C)that will create a zero average accounting rate of return.

D)of return the company desires prior to considering the risks of the project.

E)that exceeds the economic opportunity cost of investing by the required profit margin.

A)the firm must expect to earn before committing funding for the project.

B)the firm can earn on a riskless investment,such as U.S.Treasury bills.

C)that will create a zero average accounting rate of return.

D)of return the company desires prior to considering the risks of the project.

E)that exceeds the economic opportunity cost of investing by the required profit margin.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

40

Which one of these statements related to the time value of money is correct? Assume a positive rate of interest.

A)A dollar increases in value the further into the future it is received.

B)The future value of an invested dollar is inversely related to the rate of interest.

C)The present value of a dollar to be received in one year is directly related to the interest rate.

D)A dollar received today is more valuable than a dollar received next month.

E)A dollar invested today will increase in value in a linear manner if interest earned is reinvested.

A)A dollar increases in value the further into the future it is received.

B)The future value of an invested dollar is inversely related to the rate of interest.

C)The present value of a dollar to be received in one year is directly related to the interest rate.

D)A dollar received today is more valuable than a dollar received next month.

E)A dollar invested today will increase in value in a linear manner if interest earned is reinvested.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

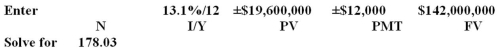

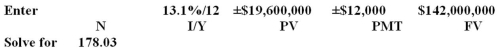

41

Jensen's Shipping wants to expand as soon as it can save $142 million.Towards that goal,the firm started saving three years ago and currently has $19.6 million saved.Starting today,the firm will add $12,000 a month to this savings account.The rate of return is 13.1 percent,compounded monthly.How long will it be from now before the company can expand?

A)178.03 months

B)178.07 months

C)191.23 months

D)191.27 months

E)191.30 months

A)178.03 months

B)178.07 months

C)191.23 months

D)191.27 months

E)191.30 months

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

42

You desperately need some money and only your 'miserly' friend has any.He agrees to loan you the money you need,if you make payments of $20 a month for the next six months.In keeping with his reputation,he requires that the first payment be paid today.He also charges you 1.5 percent interest per month.How much money are you borrowing?

A)$115.65

B)$116.56

C)$113.94

D)$126.46

E)$114.96

A)$115.65

B)$116.56

C)$113.94

D)$126.46

E)$114.96

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

43

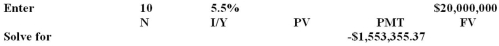

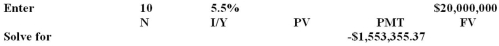

Westover Ridge has a management contract with its president that requires a lump sum payment of $20 million to be paid upon the completion of the president's first ten years of service.The company can earn 5.5 percent on its investments and wants to set aside an equal amount of money each year over the next ten years to fund this obligation.How much money must the firm save each year?

A)$1,895,734.60

B)$1,398,346.17

C)$1,401,033.67

D)$1,553,355.37

E)$1,848,018.22

A)$1,895,734.60

B)$1,398,346.17

C)$1,401,033.67

D)$1,553,355.37

E)$1,848,018.22

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

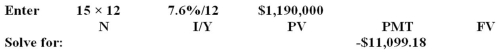

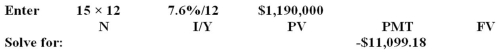

44

Wings and More purchased a piece of property for $1.4 million.It paid a down payment of 15 percent in cash and financed the balance.The loan terms require monthly payments for 15 years at an annual percentage rate of 7.60 percent,compounded monthly.What is the amount of each mortgage payment?

A)$12,440.01

B)$11,029.33

C)$10,236.25

D)$10,799.18

E)$11,099.18

A)$12,440.01

B)$11,029.33

C)$10,236.25

D)$10,799.18

E)$11,099.18

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

45

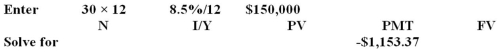

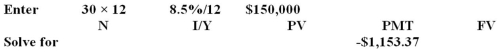

You borrow $150,000 to buy a house.The mortgage rate is 8.5 percent and the loan period is 30 years.Payments are made monthly.If you pay for the house according to the loan agreement,how much total interest will you pay? (Round the payment to two decimal places when computing the total interest. )

A)$138,086.67

B)$228,161.08

C)$265,213.20

D)$277,086.67

E)$382,500.00

A)$138,086.67

B)$228,161.08

C)$265,213.20

D)$277,086.67

E)$382,500.00

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

46

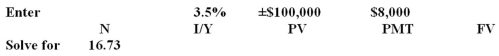

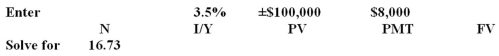

You have $100,000 saved today and plan to withdraw $8,000 a year.How long can you make these withdrawals if you earn an annual percentage rate of 3.5 percent?

A)14.96 years

B)15.48 years

C)16.73 years

D)18.08 years

E)19.00 years

A)14.96 years

B)15.48 years

C)16.73 years

D)18.08 years

E)19.00 years

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

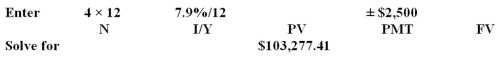

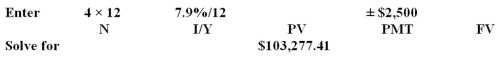

47

Rodget's is saving for an expansion project and has decided to save $2,500 a month,starting today and continuing for four years.The firm expects to earn 7.9 percent,compounded monthly.If the company had wanted to deposit an equivalent lump sum today,how much would it have had to deposit?

A)$104,964.59

B)$102,601.95

C)$105,330.60

D)$103,277.41

E)$101,998.01

A)$104,964.59

B)$102,601.95

C)$105,330.60

D)$103,277.41

E)$101,998.01

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

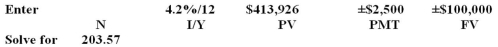

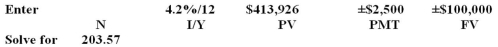

48

Today,you are retiring.You have a total of $413,926 in your retirement savings and have the funds invested at 4.2 percent,compounded monthly.You want to withdraw $2,500 at the beginning of every month,starting today.You also want the withdrawals to stop when your account balance declines to $100,000.For how many years can you make withdrawals?

A)17.07 years

B)16.96 years

C)15.22 years

D)18.24 years

E)13.81 years

A)17.07 years

B)16.96 years

C)15.22 years

D)18.24 years

E)13.81 years

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

49

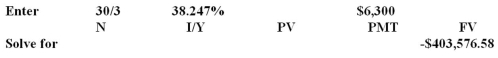

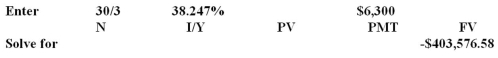

An investment will pay $6,300 every three years for the next 30 years.The annual rate of interest is 11.4 percent.What is the value of this investment at the end of Year 30?

A)$330,590.34

B)$396,222.20

C)$1,206,504.11

D)$1,353,997.81

E)$403,576.58

A)$330,590.34

B)$396,222.20

C)$1,206,504.11

D)$1,353,997.81

E)$403,576.58

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

50

Today,the Corner Store borrowed $5,250 at 7.2 percent,compounded monthly.The loan payment is $114.11 a month.How many loan payments must the firm make before the loan is paid in full?

A)36 months

B)42 months

C)48 months

D)54 months

E)60 months

A)36 months

B)42 months

C)48 months

D)54 months

E)60 months

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

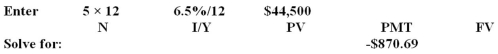

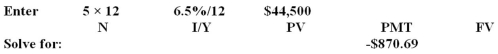

51

You estimate that you will have $44,500 in student loans by the time you graduate.The interest rate is 6.5 percent,compounded monthly.If you want to have this debt paid in full within five years,how much must you pay each month?

A)$745.69

B)$873.65

C)$870.69

D)$741.67

E)$880.40

A)$745.69

B)$873.65

C)$870.69

D)$741.67

E)$880.40

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

52

Rowynn just signed loan papers to buy a new car.The loan is for $26,700 for four years at an interest rate of 5.8 percent,compounded monthly.What is the amount of each monthly loan payment?

A)$627.62

B)$621.60

C)$630.62

D)$624.60

E)$633.04

A)$627.62

B)$621.60

C)$630.62

D)$624.60

E)$633.04

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

53

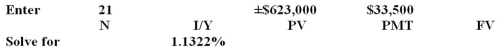

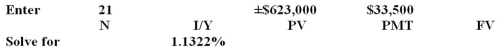

Erickson's is considering a project with an initial cost of $623,000.The project will produce cash inflows of $33,500 monthly for 21 months.What is the annual rate of return on this project?

A)11.57%

B)13.59%

C)16.59%

D)17.47%

E)18.44%

A)11.57%

B)13.59%

C)16.59%

D)17.47%

E)18.44%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

54

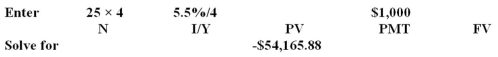

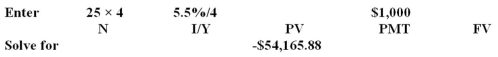

Charley wants to sell you an investment that will pay $1,000 per quarter for 25 years.You desire an annual rate of return of 5.5 percent,compounded quarterly.What is the most you would be willing to pay as a lump sum today for this investment?

A)$54,165.88

B)$57,082.94

C)$51,152.59

D)$212,232.81

E)$218,806.30

A)$54,165.88

B)$57,082.94

C)$51,152.59

D)$212,232.81

E)$218,806.30

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

55

Theo just won a prize that will pay him $12,000 a year for 12 years,starting at the end of Year 12.What is the current value of this prize if the discount rate is 9 percent,compounded annually?

A)$34,282.98

B)$30,550.64

C)$33,300.20

D)$86,191.91

E)$85,928.70

A)$34,282.98

B)$30,550.64

C)$33,300.20

D)$86,191.91

E)$85,928.70

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

56

You are buying a previously owned car today at a price of $8,125.You are paying $600 down in cash and financing the balance for 36 months at 7.9 percent,compounded monthly.What is the amount of each loan payment?

A)$198.64

B)$199.94

C)$202.02

D)$214.78

E)$235.46

A)$198.64

B)$199.94

C)$202.02

D)$214.78

E)$235.46

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

57

You are comparing two annuities with equal present values.The applicable discount rate is 7.25 percent,compounded annually.One annuity pays $6,500 on the first day of each year for 20 years.How much does the second annuity pay each year for 20 years if it pays at the end of each year?

A)$5,581.40

B)$6,060.61

C)$6,028.75

D)$6,971.25

E)$7,086.50

A)$5,581.40

B)$6,060.61

C)$6,028.75

D)$6,971.25

E)$7,086.50

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

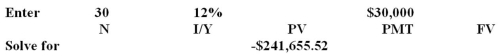

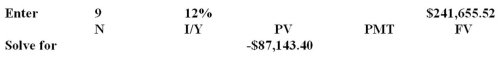

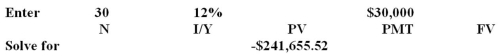

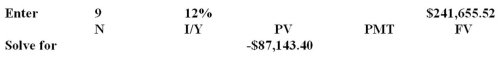

58

Clint just won a prize that will pay him $30,000 a year for 30 years,starting at the end of Year 10.What is the current value of this prize if the discount rate is 12 percent,compounded annually?

A)$241,655.52

B)$240,550.64

C)$87,143.40

D)$86,191.91

E)$77,806.61

A)$241,655.52

B)$240,550.64

C)$87,143.40

D)$86,191.91

E)$77,806.61

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

59

You retire at age 65 and expect to live another 30 years.On the day you retire,you have $564,500 saved.You expect to earn 3.5 percent,compounded monthly.How much can you withdraw from your savings each month if you plan to die on the day you spend your last penny?

A)$2,001.96

B)$2,192.05

C)$2,298.17

D)$2,372.00

E)$2,534.86

A)$2,001.96

B)$2,192.05

C)$2,298.17

D)$2,372.00

E)$2,534.86

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

60

Martha receives $100 on the first of each month.Stewart receives $100 on the last day of each month.Both Martha and Stewart will receive payments for five years.The discount rate is 8 percent,compounded monthly.What is the difference in the present value of these two sets of payments?

A)$32.88

B)$34.29

C)$92.60

D)$108.00

E)$112.50

A)$32.88

B)$34.29

C)$92.60

D)$108.00

E)$112.50

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

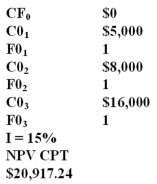

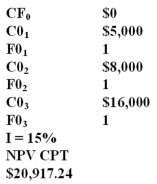

61

A project is expected to produce cash flows of $5,000,$8,000,and $16,000 over the next three years,respectively.After three years,the project will be discontinued.What is this project worth today at a discount rate of 15 percent?

A)$19,201.76

B)$19,435.74

C)$20,917.24

D)$21,808.17

E)$22,758.00

A)$19,201.76

B)$19,435.74

C)$20,917.24

D)$21,808.17

E)$22,758.00

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

62

Rose Stores has been investing $135,000 a year for the past 5 years into a business venture.Today,that venture was sold for $925,000.What rate of return was earned on this investment?

A)12.43%

B)14.06%

C)15.59%

D)15.67%

E)15.81%

A)12.43%

B)14.06%

C)15.59%

D)15.67%

E)15.81%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

63

A 4.25 percent preferred stock has a liquidating value of $100 a share.What is one share of this stock currently worth to an investor who desires a 14.5 percent annual rate of return?

A)$31.09

B)$24.25

C)$29.31

D)$34.12

E)$28.16

A)$31.09

B)$24.25

C)$29.31

D)$34.12

E)$28.16

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

64

You just paid $150,000 for a policy that will pay you and your heirs $5,000 a year forever.What rate of return are you earning on this policy?

A)3.25%

B)3.33%

C)3.43%

D)3.50%

E)3.67%

A)3.25%

B)3.33%

C)3.43%

D)3.50%

E)3.67%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

65

What is the annual percentage rate on a loan with a stated rate of 2.614 percent per quarter?

A)10.54%

B)10.87%

C)10.62%

D)10.18%

E)10.46%

A)10.54%

B)10.87%

C)10.62%

D)10.18%

E)10.46%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

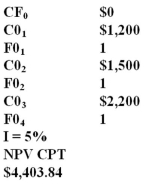

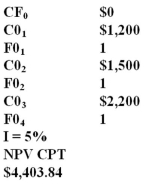

66

Rita plans to save $1,200,$1,500,and $2,200 a year over the next three years,respectively.How much would you need to deposit in one lump sum today to have the same amount as Rita three years from now if you both earn 5 percent,compounded annually?

A)$4,403.84

B)$4,491.42

C)$4,551.78

D)$4,607.23

E)$4,857.92

A)$4,403.84

B)$4,491.42

C)$4,551.78

D)$4,607.23

E)$4,857.92

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

67

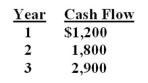

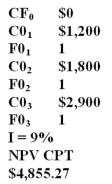

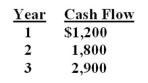

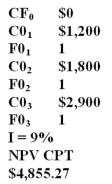

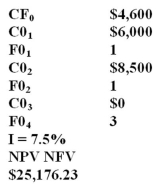

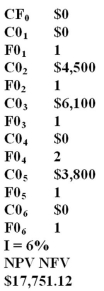

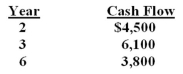

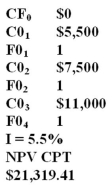

You are considering a project with the following cash flows:

What is the present value of these cash flows at a discount rate of 9 percent?

A)$4,713.62

B)$4,855.27

C)$5,103.18

D)$5,292.25

E)$6,853.61

What is the present value of these cash flows at a discount rate of 9 percent?

A)$4,713.62

B)$4,855.27

C)$5,103.18

D)$5,292.25

E)$6,853.61

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

68

Beatrice invests $2,500 in an account that pays 4 percent simple interest.How much more could she have earned over a 5-year period if the interest had compounded annually?

A)$100.00

B)$0

C)$185.65

D)$41.63

E)$190.70

A)$100.00

B)$0

C)$185.65

D)$41.63

E)$190.70

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

69

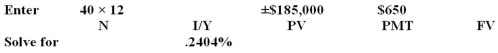

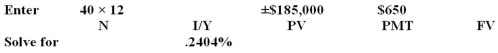

An annuity costs $185,000 today and provides monthly payments of $650 for 40 years.The first payment occurs one month from today.What annual rate of return does this annuity offer?

A)2.40%

B)2.88%

C)3.16%

D)4.22%

E)4.55%

A)2.40%

B)2.88%

C)3.16%

D)4.22%

E)4.55%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

70

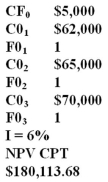

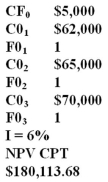

You are considering a job which offers a starting bonus of $5,000 immediately and an annual salary of $62,000,$65,000,and $70,000 for the next three years,respectively.What is this offer worth today at a discount rate of 6 percent?

A)$178,283.49

B)$178,383.56

C)$179,283.56

D)$180,113.68

E)$182,983.56

A)$178,283.49

B)$178,383.56

C)$179,283.56

D)$180,113.68

E)$182,983.56

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

71

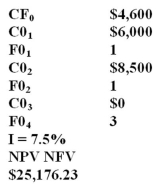

One year ago,the Jenkins Center opened an investment account and deposited $4,600.Today,it is depositing another $6,000 and will make a final deposit of $8,500 one year from now.How much will the firm have saved four years from now if it earns an average annual return of 7.5 percent?

A)$19,159.6

B)$22,430.84

C)$23,683.25

D)$24,194.5

E)$25,176.23

A)$19,159.6

B)$22,430.84

C)$23,683.25

D)$24,194.5

E)$25,176.23

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

72

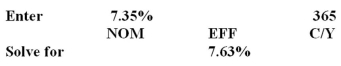

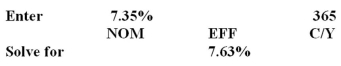

What is the effective annual rate if a bank charges you 7.35 percent,compounded daily?

A)7.24%

B)7.59%

C)7.63%

D)7.51%

E)7.29%

A)7.24%

B)7.59%

C)7.63%

D)7.51%

E)7.29%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

73

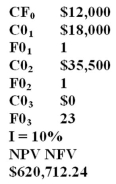

Antonio is going to receive $12,000 today as an insurance settlement.In addition,he will receive $18,000 one year from today and $35,000 two years from today.If he invests these funds,how much will he have saved when he retires 25 years from now if he earns an average annual return of 10 percent?

A)$556,124.93

B)$561,414.14

C)$595,072.9

D)$607,008.77

E)$620,712.24

A)$556,124.93

B)$561,414.14

C)$595,072.9

D)$607,008.77

E)$620,712.24

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

74

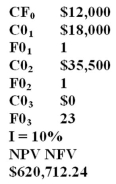

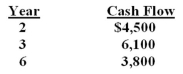

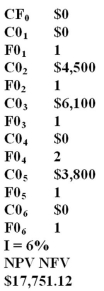

What is the future value of the following cash flows at the end of year 7 if the interest rate is 6 percent,compounded annually? The cash flows occur at the end of each year.

A)$15,916.78

B)$18,109.08

C)$17,751.12

D)$19,341.02

E)$19,608.07

A)$15,916.78

B)$18,109.08

C)$17,751.12

D)$19,341.02

E)$19,608.07

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

75

Your insurance agent is offering you a policy that will pay you and your heirs $7,500 a year forever.The current cost of the policy is $175,000.What is the rate of return on this policy?

A)3.85%

B)4.29%

C)4.36%

D)4.48%

E)4.60%

A)3.85%

B)4.29%

C)4.36%

D)4.48%

E)4.60%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

76

Maxwell Foods established a trust fund that will provide $225,000 in scholarships each year forever.The trust fund earns a 4.63 percent rate of return.How much money did the firm contribute to the fund 20 years ago,assuming that only the interest income is distributed?

A)$5,291,613.13

B)$4,859,611.23

C)$556,297.39

D)$532,897.04

E)$9,100,348.24

A)$5,291,613.13

B)$4,859,611.23

C)$556,297.39

D)$532,897.04

E)$9,100,348.24

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

77

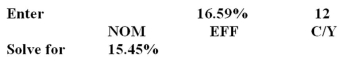

You are paying an effective annual rate of 16.59 percent on your credit card.The interest is compounded monthly.What is the annual percentage rate?

A)11.50%

B)15.45%

C)11.79%

D)17.91%

E)7.31%

A)11.50%

B)15.45%

C)11.79%

D)17.91%

E)7.31%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

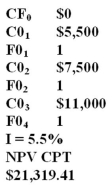

78

You are considering two insurance settlement offers.The first offer includes annual payments of $5,500,$7,500,and $11,000 over the next three years,respectively.The other offer is a lump sum amount today.The applicable discount rate is 5.5 percent.What is the minimum amount you will accept today in lieu of the annual payments?

A)$20,877.67

B)$21,319.41

C)$22,213.15

D)$23,387.50

E)$24,556.88

A)$20,877.67

B)$21,319.41

C)$22,213.15

D)$23,387.50

E)$24,556.88

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

79

You have been investing $10 a week for the past 15 years.Today,your investment account is worth $60,762.53.Interest is compounded weekly.What is the annual rate of return?

A)8.80%

B)18.47%

C)42.16%

D)39.62%

E)21.92%

A)8.80%

B)18.47%

C)42.16%

D)39.62%

E)21.92%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

80

You are the recipient of an inheritance that will pay you and your heirs $5,000 a year forever.What is this inheritance worth today at a discount rate of 7.85 percent?

A)$63,694.27

B)$39,250.00

C)$71,953.94

D)$72,942.42

E)$54,083.17

A)$63,694.27

B)$39,250.00

C)$71,953.94

D)$72,942.42

E)$54,083.17

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck