Deck 10: Accounting Systems for Manufacturing Businesses

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/116

Play

Full screen (f)

Deck 10: Accounting Systems for Manufacturing Businesses

1

If the cost of materials is NOT a significant portion of the total product cost,the materials may be classified as part of factory overhead cost.

True

2

If the cost of employee wages is NOT a significant portion of the total product cost,the wages are classified as factory overhead cost.

True

3

Indirect labor would be included in factory overhead.

True

4

A job order cost system accumulates costs for each of the departments or processes within the factory.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

5

When the goods are completed,their costs are transferred from Work in Process to Finished Goods.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

6

Direct materials costs are included in the conversion costs of a product.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

7

Sales commissions is an example of factory overhead cost.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

8

Factory overhead is an example of a product cost.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

9

If factory overhead applied exceeds the actual costs,overhead is said to be overapplied.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

10

For a construction contractor,the wages of carpenters would be classified as direct labor cost.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

11

For an automotive repair shop,the wages of mechanics would be classified as direct labor cost.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

12

Perpetual inventory controlling accounts and subsidiary ledgers are maintained for materials,work in process,and finished goods in cost accounting systems.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

13

The costs of materials and labor that do NOT enter directly into the finished product are classified as cost of goods sold.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

14

A job order cost accounting system provides for a separate record of the cost of each particular quantity of product that passes through the factory.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

15

Conversion cost is the combination of direct labor cost and factory overhead cost.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

16

The cost of materials entering directly into the manufacturing process is classified as factory overhead cost.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

17

The cost of a manufactured product generally consists of direct materials cost,direct labor cost,and factory overhead cost.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

18

Inventories of finished products are reported as current assets on the manufacturer's

balance sheet.

balance sheet.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

19

Materials are transferred from the storeroom to the factory in response to materials requisitions.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

20

A manufacturing business converts materials into finished products through the use of machinery and labor.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

21

The summary of the time tickets at the end of each month is the basis for recording the direct and indirect labor costs incurred in production.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

22

Companies recognizing the need to simultaneously produce products with high quality,low cost,and instant availability can adopt a just- in-time processing philosophy.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

23

If factory overhead applied is less than the actual costs,overhead is said to be underapplied.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

24

As product costs are incurred in the manufacturing process,they are accounted for as assets and reported on the balance sheet as inventory.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

25

Period costs are costs that are incurred for the production requirements of a certain period.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

26

Activity-based costing is a method of accumulating and allocating costs by department.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

27

Nonmanufacturing costs are generally classified into two categories: selling and administrative.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

28

The direct labor and overhead costs of providing services to clients are accumulated in a work-in-process account.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

29

Materials inventory contains the costs of direct and indirect materials that have NOT yet entered the manufacturing process.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

30

A manufacturing business reports three types of inventory on its balance sheet: direct materials inventory,work in process inventory and finished goods inventory.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

31

Factory overhead is applied to production using a predetermined overhead rate.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

32

In a job order cost accounting system for a service business,materials costs are normally included as part of overhead.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

33

Using the job order cost system,service organizations are able to bill customers on a weekly or monthly basis,even when the job has not been completed.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

34

Depreciation expense on factory equipment is part of factory overhead cost.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

35

Job order cost accounting systems can be used only for companies that manufacture a product.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

36

Service companies can effectively use activity-based costing to compute product (service)costs.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

37

The current year's advertising costs are normally considered product costs.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

38

The underapplied factory overhead amount may be transferred to Cost of Goods Sold at the end of the fiscal year.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

39

Job order cost systems can be used to compare unit costs of similar jobs to determine if costs are staying within expected ranges.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

40

Direct labor cost is an example of a product cost.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following manufacturing costs is an indirect cost of producing a product?

A)Oil lubricants used for factory machinery

B)Commissions for sales personnel

C)Hourly wages of an assembly worker

D)Memory chips for a microcomputer manufacturer

A)Oil lubricants used for factory machinery

B)Commissions for sales personnel

C)Hourly wages of an assembly worker

D)Memory chips for a microcomputer manufacturer

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

42

For which of the following businesses would the job order cost system be appropriate?

A)Custom cabinet manufacturer

B)Automobile manufacturer

C)Lumber mill

D)Meat processor

A)Custom cabinet manufacturer

B)Automobile manufacturer

C)Lumber mill

D)Meat processor

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

43

The cost of wages paid to employees directly involved in the manufacturing process in converting materials into finished product is classified as

A)factory overhead cost.

B)direct labor cost.

C)wages expense.

D)direct materials cost.

A)factory overhead cost.

B)direct labor cost.

C)wages expense.

D)direct materials cost.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following costs are NOT included in finished goods inventory?

A)Direct labor

B)Factory overhead

C)Company president's salary

D)Direct materials

A)Direct labor

B)Factory overhead

C)Company president's salary

D)Direct materials

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following are the two main types of cost accounting systems for manufacturing operations?

A)Process cost and general accounting systems

B)Job order cost and process cost systems

C)Job order cost and general accounting systems

D)Process cost and replacement cost systems

A)Process cost and general accounting systems

B)Job order cost and process cost systems

C)Job order cost and general accounting systems

D)Process cost and replacement cost systems

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

46

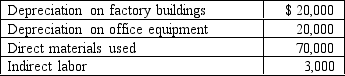

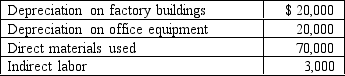

Compute factory overhead cost from the following costs:

A)$23,000

B)$43,000

C)$70,000

D)$113,000

A)$23,000

B)$43,000

C)$70,000

D)$113,000

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following is an example of direct labor cost for an airplane manufacturer?

A)Cost of oil lubricants for factory machinery

B)Cost of wages of assembly worker

C)Salary of plant supervisor

D)Cost of jet engines

A)Cost of oil lubricants for factory machinery

B)Cost of wages of assembly worker

C)Salary of plant supervisor

D)Cost of jet engines

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following products probably would be manufactured using a job order costing system?

A)Number 2 pencils

B)Computer monitors

C)Wedding invitations

D)Paper

A)Number 2 pencils

B)Computer monitors

C)Wedding invitations

D)Paper

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

49

The cost of a manufactured product generally consists of which of the following costs?

A)Direct materials cost and factory overhead cost

B)Direct labor cost and factory overhead cost

C)Direct labor cost,direct materials cost,and factory overhead cost

D)Direct materials cost and direct labor cost

A)Direct materials cost and factory overhead cost

B)Direct labor cost and factory overhead cost

C)Direct labor cost,direct materials cost,and factory overhead cost

D)Direct materials cost and direct labor cost

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

50

The following are all product costs EXCEPT

A)direct materials.

B)sales and administrative expenses.

C)direct labor.

D)factory overhead.

A)direct materials.

B)sales and administrative expenses.

C)direct labor.

D)factory overhead.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

51

If the cost of direct materials is a small portion of total production cost,it may be classified as part of

A)direct labor cost.

B)selling and administrative costs.

C)miscellaneous costs.

D)factory overhead cost.

A)direct labor cost.

B)selling and administrative costs.

C)miscellaneous costs.

D)factory overhead cost.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following items would NOT be classified as part of factory overhead?

A)Direct labor used

B)Amortization of manufacturing patents

C)Production supervisors' salaries

D)Factory supplies used

A)Direct labor used

B)Amortization of manufacturing patents

C)Production supervisors' salaries

D)Factory supplies used

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

53

For which of the following businesses would the process cost system be appropriate?

A)Custom cabinet manufacturer

B)Dress designer

C)Lumber mill

D)Printing firm

A)Custom cabinet manufacturer

B)Dress designer

C)Lumber mill

D)Printing firm

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following is considered a part of factory overhead cost?

A)Sales commissions

B)Depreciation of factory buildings

C)Depreciation of office equipment

D)Direct materials used

A)Sales commissions

B)Depreciation of factory buildings

C)Depreciation of office equipment

D)Direct materials used

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following is an example of a factory overhead cost?

A)Repair and maintenance cost on the administrative building

B)Factory heating and lighting cost

C)Insurance premiums on salespersons' automobiles

D)President's salary

A)Repair and maintenance cost on the administrative building

B)Factory heating and lighting cost

C)Insurance premiums on salespersons' automobiles

D)President's salary

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

56

The cost of materials entering directly into the manufacturing process is classified as

A)direct labor cost.

B)factory overhead cost.

C)burden cost.

D)direct materials cost.

A)direct labor cost.

B)factory overhead cost.

C)burden cost.

D)direct materials cost.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following is an example of direct materials cost for an automobile manufacturer?

A)Cost of oil lubricants for factory machinery

B)Cost of wages of assembly worker

C)Salary of production supervisor

D)Cost of interior upholstery

A)Cost of oil lubricants for factory machinery

B)Cost of wages of assembly worker

C)Salary of production supervisor

D)Cost of interior upholstery

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following would most likely use a job order costing system?

A)A paper mill

B)A swimming pool installer

C)A company that manufactures chlorine for swimming pools

D)An oil refinery

A)A paper mill

B)A swimming pool installer

C)A company that manufactures chlorine for swimming pools

D)An oil refinery

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following is FALSE in regards to direct materials for an auto manufacturer?

A)Steel would probably be a direct material.

B)Upholstery fabric would probably be a direct material.

C)Oil to lubricate factory machines would not be a direct material.

D)Small plastic clips to hold on door panels,because they become part of the auto,must be accounted for as direct materials.

A)Steel would probably be a direct material.

B)Upholstery fabric would probably be a direct material.

C)Oil to lubricate factory machines would not be a direct material.

D)Small plastic clips to hold on door panels,because they become part of the auto,must be accounted for as direct materials.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

60

The document authorizing the issuance of materials from the storeroom is the

A)materials requisition.

B)purchase requisition.

C)receiving report.

D)purchase order.

A)materials requisition.

B)purchase requisition.

C)receiving report.

D)purchase order.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

61

The basis for recording direct and indirect labor costs incurred is a summary of the period's

A)job order cost sheets.

B)time tickets.

C)employees' earnings records.

D)clock cards.

A)job order cost sheets.

B)time tickets.

C)employees' earnings records.

D)clock cards.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

62

A summary of the materials requisitions completed during a period serves as the basis for transferring the cost of the materials from the materials account to

A)work in process and cost of goods sold.

B)work in process and factory overhead.

C)finished goods and cost of goods sold.

D)work in process and finished goods.

A)work in process and cost of goods sold.

B)work in process and factory overhead.

C)finished goods and cost of goods sold.

D)work in process and finished goods.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

63

The recording of the jobs shipped and customers billed would increase

A)Accounts Payable.

B)Cash.

C)Finished Goods.

D)Cost of Goods Sold.

A)Accounts Payable.

B)Cash.

C)Finished Goods.

D)Cost of Goods Sold.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

64

Recording direct labor costs in a job order cost accounting system

A)increases Factory Overhead,decreases Work in Process.

B)increases Finished Goods,increases Wages Payable.

C)increases Work in Process,increases Wages Payable.

D)increases Factory Overhead,increases Wages Payable.

A)increases Factory Overhead,decreases Work in Process.

B)increases Finished Goods,increases Wages Payable.

C)increases Work in Process,increases Wages Payable.

D)increases Factory Overhead,increases Wages Payable.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

65

The recording of the jobs completed would decrease

A)Factory Overhead.

B)Finished Goods.

C)Work in Process.

D)Cost of Goods Sold.

A)Factory Overhead.

B)Finished Goods.

C)Work in Process.

D)Cost of Goods Sold.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

66

The finished goods account is the controlling account for the

A)sales ledger.

B)materials ledger.

C)work in process ledger.

D)stock ledger.

A)sales ledger.

B)materials ledger.

C)work in process ledger.

D)stock ledger.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

67

The Cranford Company forecasts that total overhead for the current year will be $15,000,000 and that total machine hours will be 200,000 hours.Year to date,the actual overhead is $8,000,000 and the actual machine hours are 100,000 hours.If the Crawford Company uses

A predetermined overhead rate based on machine hours for applying overhead,what is that overhead rate?

A)$80 per machine hour

B)$150 per machine hour

C)$75 per machine hour

D)$40 per machine hour

A predetermined overhead rate based on machine hours for applying overhead,what is that overhead rate?

A)$80 per machine hour

B)$150 per machine hour

C)$75 per machine hour

D)$40 per machine hour

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following is NOT true about why a service firm will use the job order costing system?

A)To help control costs

B)To determine client billing

C)To determine department costs within the firm

D)To determine profit

A)To help control costs

B)To determine client billing

C)To determine department costs within the firm

D)To determine profit

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

69

When Job 711 was completed,direct materials totaled $3,000;direct labor,$3,500;and factory overhead,$1,500.Units produced totaled 1,000.Unit costs are

A)$8,000.

B)$6,500.

C)$6.50.

D)$8.

A)$8,000.

B)$6,500.

C)$6.50.

D)$8.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

70

The recording of the application of factory overhead costs to jobs would decrease

A)Factory Overhead.

B)Wages Payable.

C)Work in Process.

D)Cost of Goods Sold.

A)Factory Overhead.

B)Wages Payable.

C)Work in Process.

D)Cost of Goods Sold.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

71

Bell Manufacturers Inc.has estimated total factory overhead costs of $60,000 and 10,000 direct labor hours for the current fiscal year.If job number 117 incurred 2,000 direct labor hours,the work in process account will be increased and factory overhead will be

Decreased for

A)$10,000.

B)$0.

C)$12,000.

D)$2,000.

Decreased for

A)$10,000.

B)$0.

C)$12,000.

D)$2,000.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

72

At the end of the fiscal year,the balance in Factory Overhead is small.This balance would normally be

A)transferred to Work in Process.

B)transferred to Cost of Goods Sold.

C)transferred to Finished Goods.

D)allocated between Work in Process and Finished Goods.

A)transferred to Work in Process.

B)transferred to Cost of Goods Sold.

C)transferred to Finished Goods.

D)allocated between Work in Process and Finished Goods.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

73

Increases in the Work in Process account occur when

A)materials are received into the storeroom.

B)factory overhead costs are incurred.

C)direct labor is recorded from the time sheets.

D)All of these increase work in process.

A)materials are received into the storeroom.

B)factory overhead costs are incurred.

C)direct labor is recorded from the time sheets.

D)All of these increase work in process.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

74

In a job order cost accounting system,when goods that have been ordered are received,the receiving department personnel count,inspect the goods,and complete a

A)purchase order.

B)sales invoice.

C)receiving report.

D)purchase requisition.

A)purchase order.

B)sales invoice.

C)receiving report.

D)purchase requisition.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

75

The recording of the jobs completed would increase

A)Factory Overhead.

B)Finished Goods.

C)Work in Process.

D)Cost of Goods Sold.

A)Factory Overhead.

B)Finished Goods.

C)Work in Process.

D)Cost of Goods Sold.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

76

The recording of the factory labor incurred for general factory use would increase

A)Factory Overhead.

B)Wages Payable.

C)Wages Expense.

D)Cost of Goods Sold.

A)Factory Overhead.

B)Wages Payable.

C)Wages Expense.

D)Cost of Goods Sold.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

77

Each account in the work in process subsidiary ledger is called a

A)finished goods sheet.

B)stock record.

C)materials requisition.

D)job cost sheet.

A)finished goods sheet.

B)stock record.

C)materials requisition.

D)job cost sheet.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

78

In a job order cost accounting system,the effect of the flow of direct materials into production is to

A)increase Work in Process,decrease Materials Inventory.

B)increase Materials,decrease Work in Process.

C)increase Factory Overhead,decrease Materials Inventory.

D)increase Work in Process,decrease Supplies.

A)increase Work in Process,decrease Materials Inventory.

B)increase Materials,decrease Work in Process.

C)increase Factory Overhead,decrease Materials Inventory.

D)increase Work in Process,decrease Supplies.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

79

Job order costing and process costing are

A)pricing systems.

B)cost accounting systems.

C)cost flow systems.

D)inventory tracking systems.

A)pricing systems.

B)cost accounting systems.

C)cost flow systems.

D)inventory tracking systems.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

80

The amount of time spent by each employee and the labor cost incurred for each individual job or for factory overhead are recorded on

A)employees' earnings records.

B)in-and-out board.

C)time tickets.

D)all of these.

A)employees' earnings records.

B)in-and-out board.

C)time tickets.

D)all of these.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck