Deck 10: Decentralization: Responsibility Accounting, Performance Evaluation, and Transfer Pricing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

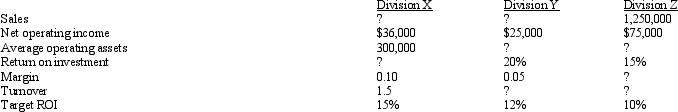

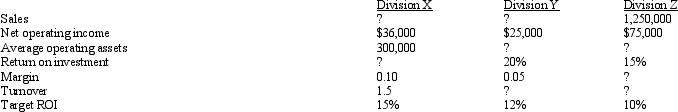

Question

Question

Question

Question

Question

Question

Question

Question

Question

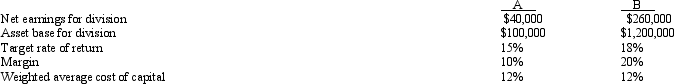

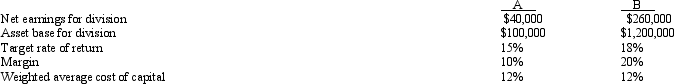

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/139

Play

Full screen (f)

Deck 10: Decentralization: Responsibility Accounting, Performance Evaluation, and Transfer Pricing

1

In an investment responsibility center, the manager is only responsible for costs.

False

2

Goal congruence means that the goals of managers are aligned with the goals of the company.

True

3

Firms encourage goal congruence by constructing management early retirement programs.

False

4

Margin is the ratio of operating income to sales.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

5

Return on investment (ROI) refers to earnings before interest and income taxes.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

6

Transfer pricing exists when one division of a company produces a product that can be used in the production by a different division.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

7

Cognitive limitations mean it is difficult for central managers to be fully knowledgeable about all products and markets.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

8

Economic value added (EVA) is after-tax operating income minus the total annual cost of capital.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

9

A responsibility center is a part of a business whose workers are accountable for specified activities.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

10

The transfer price is revenue to the selling division and cost to the buying division.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

11

Decentralization is the practice of delegating decision-making authority to the lower levels of management.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

12

Responsibility accounting is a system that measures the results of each responsibility center and compares those results with some expected or budgeted outcome.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

13

Decentralization stimulates competition among the divisions of a firm.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

14

One disadvantage of ROI in evaluating performance is that it encourages managers to slack off.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

15

In centralized organizations, lower-level managers are responsible only for implementing decisions.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

16

Local managers can make better decisions using distant information and outside managers can provide more timely responses to changing conditions.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

17

The transfer pricing problem concerns finding a system that simultaneously satisfies the three objectives of the transfer pricing system.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

18

The minimum transfer price is the absolute maximum price that can be accepted.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

19

A transfer price is the price charged by one division of a company to another company.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

20

It is important for the multinational firm to separate the evaluation of a division manager from the division.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

21

A manufacturing division of a company would most likely be evaluated as a(n)

A) cost center.

B) investment center.

C) revenue center.

D) asset center.

A) cost center.

B) investment center.

C) revenue center.

D) asset center.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

22

The price charged for goods produced in one division to another division within the company is called the __________ price.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

23

The delegation of decision-making authority to successively lower management levels is called __________ .

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

24

__________ are a noncash benefit received over and above salary.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

25

Both revenue center and profit center managers are responsible for achieving

A) budgeted revenues.

B) budgeted net income.

C) budgeted costs.

D) budgeted contribution margin.

A) budgeted revenues.

B) budgeted net income.

C) budgeted costs.

D) budgeted contribution margin.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

26

The manager of an investment center is responsible for

A) decisions regarding costs.

B) decisions regarding revenues.

C) decisions to invest in assets.

D) all of these.

A) decisions regarding costs.

B) decisions regarding revenues.

C) decisions to invest in assets.

D) all of these.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following departments would NOT be classified as a profit center?

A) hardware department

B) men's shoes department

C) accounting department

D) automotive department

A) hardware department

B) men's shoes department

C) accounting department

D) automotive department

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

28

A manager of a profit center does not control:

A) Revenues

B) Costs

C) Profits

D) Investments

A) Revenues

B) Costs

C) Profits

D) Investments

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

29

Responsibility accounting is defined as a system that

A) defines responsibility by function only.

B) measures actual results against a flexible budget.

C) measures the results of a manager responsible for revenues and costs.

D) measures the results of each responsibility center and compares those results with some measure of expected or budgeted outcome.

A) defines responsibility by function only.

B) measures actual results against a flexible budget.

C) measures the results of a manager responsible for revenues and costs.

D) measures the results of each responsibility center and compares those results with some measure of expected or budgeted outcome.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

30

Investments are not controlled by managers of a __________ center.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

31

__________ is after-tax operating profit minus the total annual cost of capital.

or

or

or

or

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following responsibility centers would have a manager responsible for revenues, costs, and investments?

A) cost center

B) investment center

C) profit center

D) expense center

A) cost center

B) investment center

C) profit center

D) expense center

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

33

The __________ transfer price is the minimum price acceptable when transferring a product.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

34

In a multinational firm, it is important to separate the evaluation of a division manager from the __________ .

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following departments is likely to be an investment center?

A) machining department

B) food products division

C) personnel department

D) accounting department

A) machining department

B) food products division

C) personnel department

D) accounting department

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

36

__________ managers can make better decisions using __________ information.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

37

When the major functions of a company are controlled by top management, it is called __________ .

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

38

__________ limitations make it difficult for any central manager to know everything about all products and markets.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

39

The manager of a cost center is responsible for

A) decisions regarding costs.

B) decisions regarding revenues.

C) decisions to invest in assets.

D) both a and b.

A) decisions regarding costs.

B) decisions regarding revenues.

C) decisions to invest in assets.

D) both a and b.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

40

The manager of a profit center is responsible for

A) delivering a quality product or service at reasonable but minimal cost.

B) decisions to invest in capital equipment.

C) decisions regarding revenue generation.

D) both a and c.

A) delivering a quality product or service at reasonable but minimal cost.

B) decisions to invest in capital equipment.

C) decisions regarding revenue generation.

D) both a and c.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

41

Lowellson Company had sales of $200,000, net income of $10,000, and an asset base of $300,000. Its margin is

A) 66.7%.

B) 5.0%.

C) 3.3%.

D) 150.0%.

A) 66.7%.

B) 5.0%.

C) 3.3%.

D) 150.0%.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

42

If a company has sales of $2,500,000, net income of $250,000, and an asset base of $1,250,000, its return on investment is

A) 20%.

B) 10%.

C) 500%.

D) 200%.

A) 20%.

B) 10%.

C) 500%.

D) 200%.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following changes would NOT change return on investment (ROI)?

A) Decrease sales and expenses by the same percentage.

B) Increase total assets.

C) Increase sales dollars by the same amount as total assets.

D) Decrease sales and expenses by the same dollar amount.

A) Decrease sales and expenses by the same percentage.

B) Increase total assets.

C) Increase sales dollars by the same amount as total assets.

D) Decrease sales and expenses by the same dollar amount.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

44

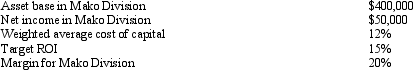

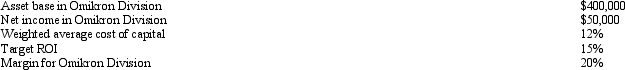

Mako Division had the following information:  What is the turnover ratio for Mako Division?

What is the turnover ratio for Mako Division?

A) 0.200

B) 0.625

C) 0.125

D) 8.000

What is the turnover ratio for Mako Division?

What is the turnover ratio for Mako Division?A) 0.200

B) 0.625

C) 0.125

D) 8.000

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

45

When top management controls the major functions of an organization it is called:

A) Centralization

B) Decentralization

C) Optimization

D) An unfavorable overhead variance

A) Centralization

B) Decentralization

C) Optimization

D) An unfavorable overhead variance

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following changes would increase return on investment (ROI)?

A) Decrease sales and expenses by the same percentage.

B) Increase total assets.

C) Increase sales and expenses by the same percentage.

D) Decrease sales and expenses by the same dollar amount.

A) Decrease sales and expenses by the same percentage.

B) Increase total assets.

C) Increase sales and expenses by the same percentage.

D) Decrease sales and expenses by the same dollar amount.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following departments would NOT be a cost center?

A) advertising department

B) city police department

C) building and grounds department

D) sales department

A) advertising department

B) city police department

C) building and grounds department

D) sales department

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

48

Patron Corporation had sales of $350,000, income of $10,000, and an asset base of $100,000. The turnover is

A) 0.035.

B) 0.35.

C) 3.00.

D) 3.50.

A) 0.035.

B) 0.35.

C) 3.00.

D) 3.50.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

49

An example of an investment center is a

A) production department.

B) company.

C) marketing department.

D) credit department.

A) production department.

B) company.

C) marketing department.

D) credit department.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following would NOT be a reason for decentralization?

A) Managers will make decisions for their own benefit, rather than the organization's benefit.

B) Lower level managers have better access to information.

C) Upper management can spend more time focusing on strategic planning and decision making.

D) Lower level managers with decision-making ability are more motivated.

A) Managers will make decisions for their own benefit, rather than the organization's benefit.

B) Lower level managers have better access to information.

C) Upper management can spend more time focusing on strategic planning and decision making.

D) Lower level managers with decision-making ability are more motivated.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

51

One of the reasons for decentralization is more timely response. This means

A) lower-level managers being more in contact with immediate operating conditions.

B) central management can be free to focus on strategic planning.

C) allowing an organization to determine each division's contribution to profit and expose each division to market forces.

D) local management both makes and implements decisions.

A) lower-level managers being more in contact with immediate operating conditions.

B) central management can be free to focus on strategic planning.

C) allowing an organization to determine each division's contribution to profit and expose each division to market forces.

D) local management both makes and implements decisions.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

52

The delegation of decision-making authority to successively lower management levels in an organization is called:

A) Centralization

B) Decentralization

C) Optimization

D) An unfavorable overhead variance

A) Centralization

B) Decentralization

C) Optimization

D) An unfavorable overhead variance

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

53

Responsibility accounting is a system that does NOT consider

A) responsibility.

B) accountability.

C) performance evaluation.

D) static budgeting.

A) responsibility.

B) accountability.

C) performance evaluation.

D) static budgeting.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

54

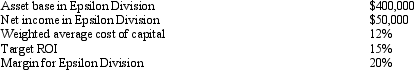

Epsilon Division had the following information:  If the asset base is decreased by $100,000, with no other changes, the return on investment of Epsilon Division will be

If the asset base is decreased by $100,000, with no other changes, the return on investment of Epsilon Division will be

A) 100.0%.

B) 600.0%.

C) 16.7%.

D) 62.5%.

If the asset base is decreased by $100,000, with no other changes, the return on investment of Epsilon Division will be

If the asset base is decreased by $100,000, with no other changes, the return on investment of Epsilon Division will beA) 100.0%.

B) 600.0%.

C) 16.7%.

D) 62.5%.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

55

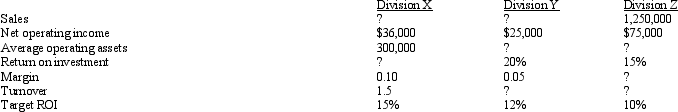

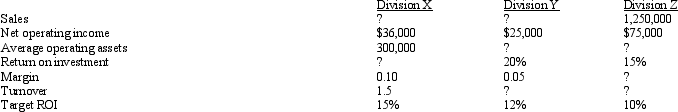

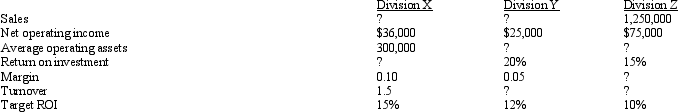

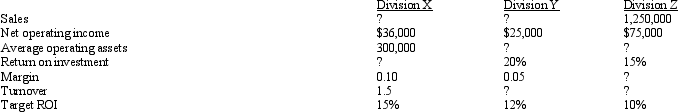

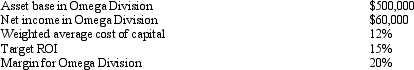

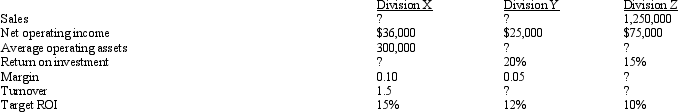

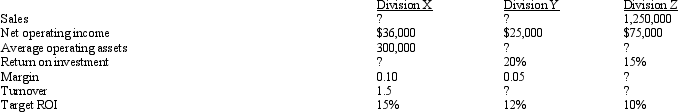

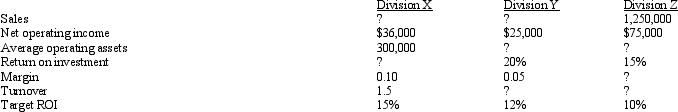

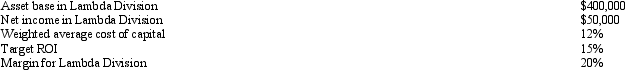

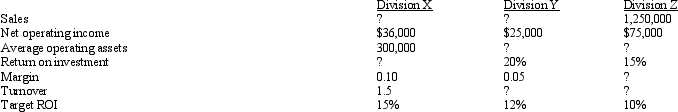

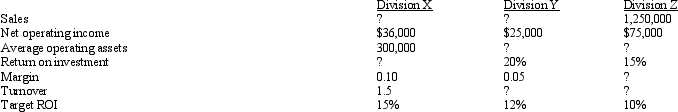

The following information pertains to the three divisions of Merrymount Company:  What is the turnover for Division Z?

What is the turnover for Division Z?

A) 1.500

B) 0.150

C) 6.670

D) 2.500

What is the turnover for Division Z?

What is the turnover for Division Z?A) 1.500

B) 0.150

C) 6.670

D) 2.500

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

56

The following information pertains to the three divisions of Merrymount Company:  What is the margin for Division Z?

What is the margin for Division Z?

A) 1.5%

B) 100.0%

C) 6.0%

D) 15.0%

What is the margin for Division Z?

What is the margin for Division Z?A) 1.5%

B) 100.0%

C) 6.0%

D) 15.0%

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

57

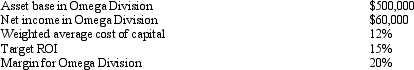

Omega Division had the following information:  What is the return on investment of Omega Division?

What is the return on investment of Omega Division?

A) 12.0%

B) 25.0%

C) 88.0%

D) 833.0%

What is the return on investment of Omega Division?

What is the return on investment of Omega Division?A) 12.0%

B) 25.0%

C) 88.0%

D) 833.0%

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

58

The return on investment is computed as

A) operating income divided by sales.

B) operating income divided by average operating assets.

C) sales divided by average operating assets.

D) operating asset turnover divided by the operating income margin.

A) operating income divided by sales.

B) operating income divided by average operating assets.

C) sales divided by average operating assets.

D) operating asset turnover divided by the operating income margin.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

59

The following information pertains to the three divisions of Merrymount Company:  What are the average operating assets for Division Z?

What are the average operating assets for Division Z?

A) $75,000

B) $500,000

C) $1,250,000

D) $187,500

What are the average operating assets for Division Z?

What are the average operating assets for Division Z?A) $75,000

B) $500,000

C) $1,250,000

D) $187,500

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

60

The following information pertains to the three divisions of Merrymount Company:  What are the sales for Division Y?

What are the sales for Division Y?

A) $500,000

B) $125,000

C) $208,333

D) $25,000

What are the sales for Division Y?

What are the sales for Division Y?A) $500,000

B) $125,000

C) $208,333

D) $25,000

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

61

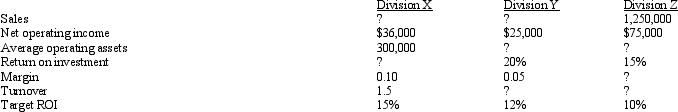

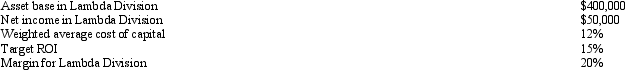

Lambda Division had the following information:  What is the residual income for Lambda Division?

What is the residual income for Lambda Division?

A) $(10,000)

B) $48,000

C) $7,500

D) $60,000

What is the residual income for Lambda Division?

What is the residual income for Lambda Division?A) $(10,000)

B) $48,000

C) $7,500

D) $60,000

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

62

The following information pertains to the three divisions of Merrymount Company:  What are the average operating assets for Division Y?

What are the average operating assets for Division Y?

A) $25,000

B) $208,333

C) $5,000

D) $125,000

What are the average operating assets for Division Y?

What are the average operating assets for Division Y?A) $25,000

B) $208,333

C) $5,000

D) $125,000

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

63

If the margin of 0.3 stayed the same and the turnover ratio of 5.0 increased by 10 percent, the ROI would

A) increase by 10 percent.

B) decrease by 10 percent.

C) increase by 15 percent.

D) remain the same.

A) increase by 10 percent.

B) decrease by 10 percent.

C) increase by 15 percent.

D) remain the same.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

64

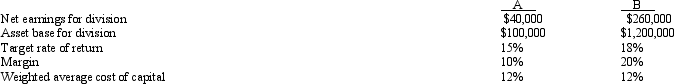

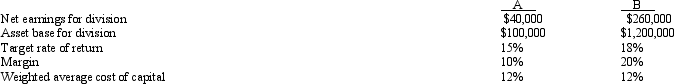

Cornwall Company has two divisions, A and

A) 18%

B) 40%

B) Information for each division is as follows: What is the return on investment for A?

What is the return on investment for A?

C) 20%

D) 15%

A) 18%

B) 40%

B) Information for each division is as follows:

What is the return on investment for A?

What is the return on investment for A?C) 20%

D) 15%

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

65

Cornwall Company has two divisions, A and

A) $666,667

B) $800,000

B) Information for each division is as follows: What is the total sales amount for B?

What is the total sales amount for B?

C) $1,300,000

D) $1,200,000

A) $666,667

B) $800,000

B) Information for each division is as follows:

What is the total sales amount for B?

What is the total sales amount for B?C) $1,300,000

D) $1,200,000

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

66

Return on investment can be divided into two separate components

A) margin and profit.

B) margin and turnover.

C) value and turnover.

D) liquidity and margin.

A) margin and profit.

B) margin and turnover.

C) value and turnover.

D) liquidity and margin.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

67

The following information pertains to the three divisions of Merrymount Company:  What is the residual income for Division X?

What is the residual income for Division X?

A) $36,000

B) $45,000

C) $(9,000)

D) $(36,000)

What is the residual income for Division X?

What is the residual income for Division X?A) $36,000

B) $45,000

C) $(9,000)

D) $(36,000)

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following is NOT a disadvantage of the ROI performance measure?

A) It encourages managers to focus on the long run rather than the short run.

B) It discourages managers from investing in projects that would decrease divisional ROI but increase the profitability of the company as a whole.

C) It encourages myopic behavior.

D) All are disadvantages of the ROI measure.

A) It encourages managers to focus on the long run rather than the short run.

B) It discourages managers from investing in projects that would decrease divisional ROI but increase the profitability of the company as a whole.

C) It encourages myopic behavior.

D) All are disadvantages of the ROI measure.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

69

Olden Company has a tax rate of 40 percent. Information for the company is as follows:  What is the EVA if the before-tax operating income is $1,500,000?

What is the EVA if the before-tax operating income is $1,500,000?

A) $(198,000)

B) $402,000

C) $534,000

D) $1,134,000

What is the EVA if the before-tax operating income is $1,500,000?

What is the EVA if the before-tax operating income is $1,500,000?A) $(198,000)

B) $402,000

C) $534,000

D) $1,134,000

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following is a disadvantage of both residual income and ROI?

A) They are both absolute measures of return.

B) They are both difficult to calculate.

C) They both do not discourage myopic behavior.

D) All of these are disadvantages of both ROI and residual income.

A) They are both absolute measures of return.

B) They are both difficult to calculate.

C) They both do not discourage myopic behavior.

D) All of these are disadvantages of both ROI and residual income.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

71

The emphasis on short-run results at the expense of the long run is

A) efficient behavior.

B) effective behavior.

C) optimal behavior.

D) myopic behavior.

A) efficient behavior.

B) effective behavior.

C) optimal behavior.

D) myopic behavior.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

72

If the Southern Division of American Products Company had a turnover ratio of 4.2 and a margin of 0.10, the return on investment would be

A) 23.8%.

B) 42.0%.

C) 420.0%.

D) 238.0%.

A) 23.8%.

B) 42.0%.

C) 420.0%.

D) 238.0%.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

73

If the operating asset turnover ratio increased by 40 percent and the margin increased by 30 percent, the divisional ROI

A) would decrease by 70 percent.

B) would increase by 82 percent.

C) would increase by 30 percent.

D) cannot be determined.

A) would decrease by 70 percent.

B) would increase by 82 percent.

C) would increase by 30 percent.

D) cannot be determined.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

74

The Women's Wear of Bigelow Department Store had a net income of $560,000, a net asset base of $4,000,000, and a required rate of return of 12 percent. Sales for the period totaled $3,000,000. The residual income for the period is

A) $480,000.

B) $80,000.

C) $120,000.

D) $360,000.

A) $480,000.

B) $80,000.

C) $120,000.

D) $360,000.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

75

The after-tax operating profit minus the total annual cost of capital equals the:

A) Residual income

B) EVA

C) ROI

D) Net income

A) Residual income

B) EVA

C) ROI

D) Net income

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

76

If the turnover increased by 30 percent and the margin decreased by 30 percent, the ROI would

A) decrease by 9 percent.

B) increase by 69 percent.

C) increase by 91 percent.

D) stay the same.

A) decrease by 9 percent.

B) increase by 69 percent.

C) increase by 91 percent.

D) stay the same.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

77

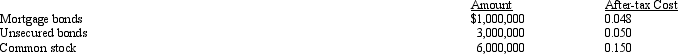

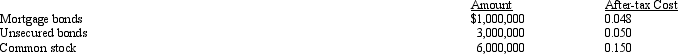

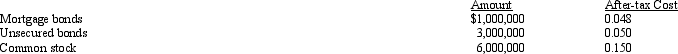

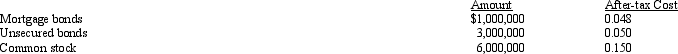

Olden Company has a tax rate of 40 percent. Information for the company is as follows:  What is the weighted average cost of capital?

What is the weighted average cost of capital?

A) 0.0827

B) 0.2480

C) 0.1098

D) 0.0366

What is the weighted average cost of capital?

What is the weighted average cost of capital?A) 0.0827

B) 0.2480

C) 0.1098

D) 0.0366

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

78

If the operating asset turnover increased by 50 percent and the margin increased by 50 percent, the ROI would increase by

A) 50 percent.

B) 25 percent.

C) 100 percent.

D) 125 percent.

A) 50 percent.

B) 25 percent.

C) 100 percent.

D) 125 percent.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following is NOT an advantage of ROI?

A) It encourages managers of departments with high ROIs to invest in average ROI projects.

B) It encourages managers to pay careful attention to the relationships among sales, expenses, and investment.

C) It encourages cost efficiency.

D) It discourages excessive investment in operating assets.

A) It encourages managers of departments with high ROIs to invest in average ROI projects.

B) It encourages managers to pay careful attention to the relationships among sales, expenses, and investment.

C) It encourages cost efficiency.

D) It discourages excessive investment in operating assets.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

80

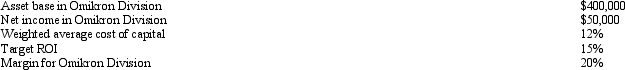

Omikron Division had the following information:  What is EVA for Omikron Division?

What is EVA for Omikron Division?

A) $2,000

B) $7,500

C) $48,000

D) $60,000

What is EVA for Omikron Division?

What is EVA for Omikron Division?A) $2,000

B) $7,500

C) $48,000

D) $60,000

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck