Deck 16: Money, banks, and the Federal Reserve System

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

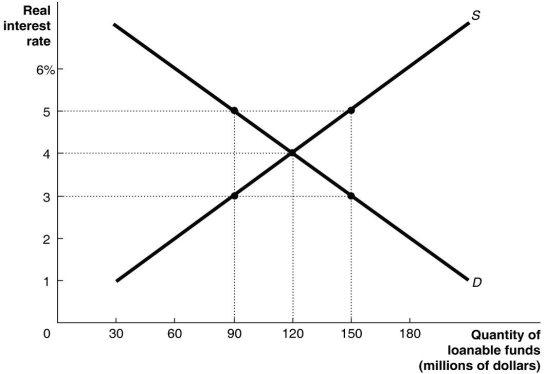

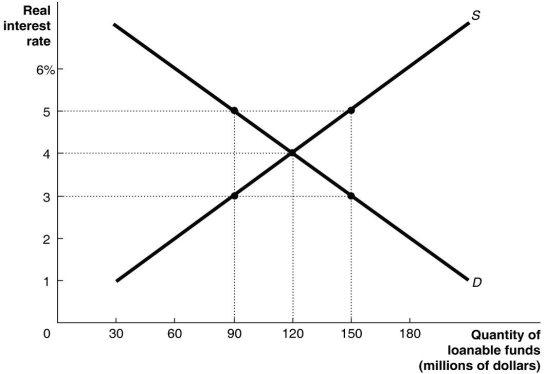

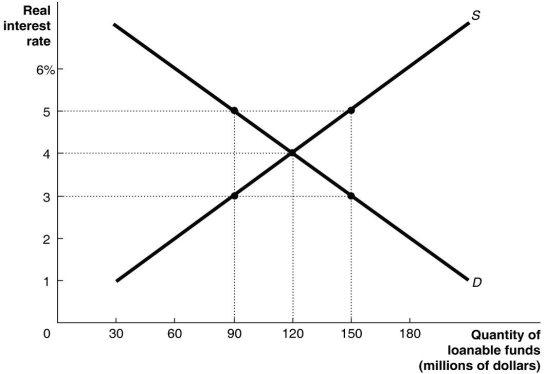

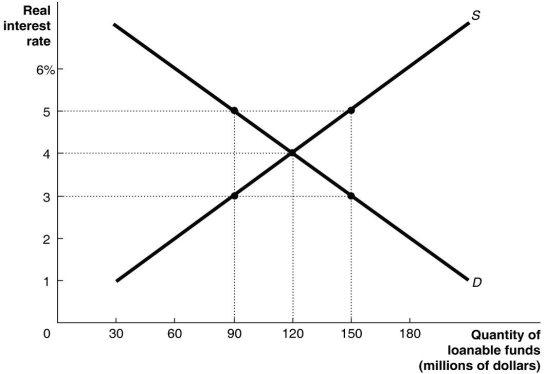

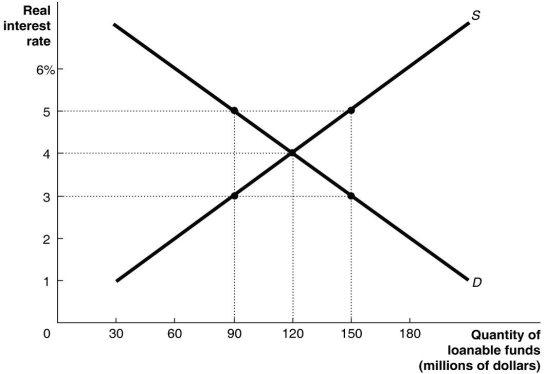

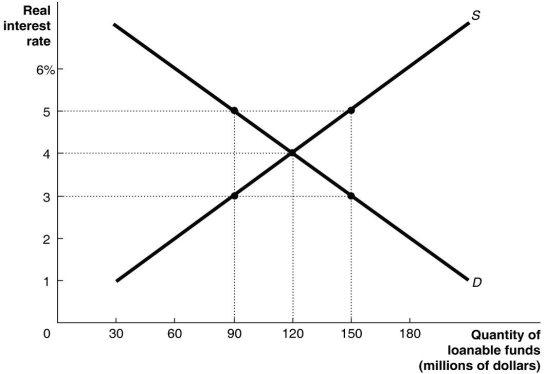

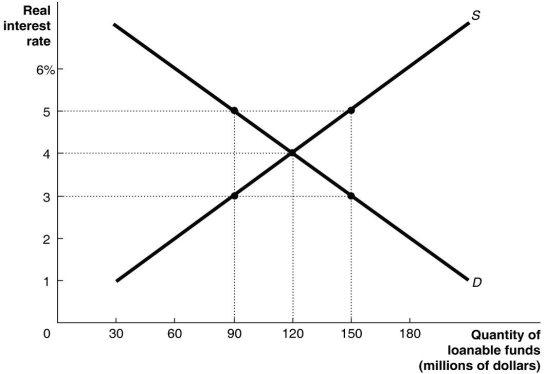

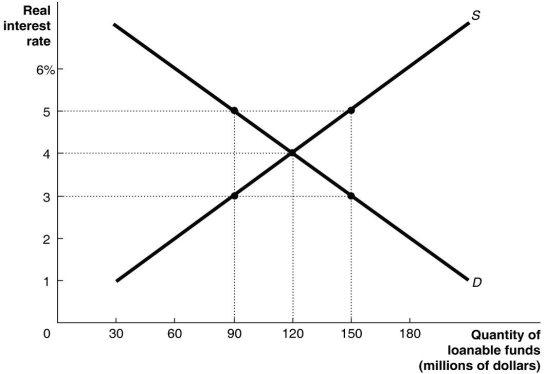

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/139

Play

Full screen (f)

Deck 16: Money, banks, and the Federal Reserve System

1

The policy aimed at managing interest rates to pursue macroeconomic objectives is called

A) fiscal policy.

B) interest rate policy.

C) monetary policy.

D) exchange rate policy.

A) fiscal policy.

B) interest rate policy.

C) monetary policy.

D) exchange rate policy.

monetary policy.

2

Inflation targeting is when the Reserve Bank of Australia uses monetary policy with the aim of keeping the inflation rate at an annual average of between 2 per cent and 3 per cent in the medium term.

True

3

According to the Reserve Bank of Australia,inflation targeting refers to monetary policy that aims to

A) achieve a particular annual rate of inflation on average over the business cycle.

B) achieve the same low rate of inflation every year.

C) control the money supply to achieve a target rate of inflation.

D) control the money supply to achieve a target rate of interest that will ensure a low rate of inflation.

A) achieve a particular annual rate of inflation on average over the business cycle.

B) achieve the same low rate of inflation every year.

C) control the money supply to achieve a target rate of inflation.

D) control the money supply to achieve a target rate of interest that will ensure a low rate of inflation.

achieve a particular annual rate of inflation on average over the business cycle.

4

If the interest rate increases,then

A) there will be an upward movement along the money demand curve.

B) there will be a downward movement along the money demand curve.

C) the money demand curve will shift to the right.

D) the money demand curve will shift to the left.

A) there will be an upward movement along the money demand curve.

B) there will be a downward movement along the money demand curve.

C) the money demand curve will shift to the right.

D) the money demand curve will shift to the left.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

5

According to the Reserve Bank Act (1959),which of the following is not a goal of monetary policy?

A) Price stability

B) Economic growth

C) Maximising the value of the dollar relative to other currencies

D) Low rate of unemployment

A) Price stability

B) Economic growth

C) Maximising the value of the dollar relative to other currencies

D) Low rate of unemployment

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

6

The money demand curve has a

A) negative slope.

B) positive slope.

C) zero slope and is perfectly elastic.

D) positive slope for low levels of money demand and a negative slope for high levels of money demand.

A) negative slope.

B) positive slope.

C) zero slope and is perfectly elastic.

D) positive slope for low levels of money demand and a negative slope for high levels of money demand.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following are goals of monetary policy?

A) Maximising the value of the dollar relative to other currencies, economic growth, and high employment.

B) Price stability, maximising the value of the dollar relative to other currencies, and high employment.

C) Price stability, economic growth, and high employment.

D) Price stability, economic growth, and maximising the value of the dollar relative to other currencies.

A) Maximising the value of the dollar relative to other currencies, economic growth, and high employment.

B) Price stability, maximising the value of the dollar relative to other currencies, and high employment.

C) Price stability, economic growth, and high employment.

D) Price stability, economic growth, and maximising the value of the dollar relative to other currencies.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

8

Rising prices erode the value of money as a ________ and a ________.

A) unit of barter; unit of account

B) store of value; unit of liquidity

C) medium of exchange; store of value

D) store of value; unit of barter

A) unit of barter; unit of account

B) store of value; unit of liquidity

C) medium of exchange; store of value

D) store of value; unit of barter

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

9

What economic objectives are the Reserve Bank of Australia required to pursue in its conduct of monetary policy,and what relative importance is placed on these objectives?

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

10

The money demand curve is downward sloping because

A) lower interest rates cause households and firms to switch from money to financial assets.

B) lower interest rates cause households and firms to switch from financial assets to money.

C) lower interest rates cause households and firms to switch from money to shares.

D) lower interest rates cause households and firms to switch from money to bonds.

A) lower interest rates cause households and firms to switch from money to financial assets.

B) lower interest rates cause households and firms to switch from financial assets to money.

C) lower interest rates cause households and firms to switch from money to shares.

D) lower interest rates cause households and firms to switch from money to bonds.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

11

The Reserve Bank of Australia targets a per annum inflation rate,on average over the business cycle,of between

A) 1 per cent and 2 per cent.

B) 2 per cent and 4 per cent.

C) 3 per cent and 4 per cent.

D) 2 per cent and 3 per cent.

A) 1 per cent and 2 per cent.

B) 2 per cent and 4 per cent.

C) 3 per cent and 4 per cent.

D) 2 per cent and 3 per cent.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

12

Give an example of a monetary policy target.Explain which monetary policy target the Reserve Bank of Australia (RBA)uses and why the RBA uses a policy target.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

13

The Board of the Reserve Bank of Australia has stated that it focuses on which of the following as its main goal of monetary policy?

A) Stability of financial markets

B) Low inflation

C) Economic growth

D) High labour force participation rate

A) Stability of financial markets

B) Low inflation

C) Economic growth

D) High labour force participation rate

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

14

An increase in real GDP

A) increases the buying and selling of goods and services, and increases the demand for money as a medium of exchange.

B) increases the buying and selling of goods and services, and decreases the demand for money as a medium of exchange.

C) decreases the buying and selling of goods and services, and increases the demand for money as a medium of exchange.

D) decreases the buying and selling of goods and services, and decreases the demand for money as a medium of exchange.

A) increases the buying and selling of goods and services, and increases the demand for money as a medium of exchange.

B) increases the buying and selling of goods and services, and decreases the demand for money as a medium of exchange.

C) decreases the buying and selling of goods and services, and increases the demand for money as a medium of exchange.

D) decreases the buying and selling of goods and services, and decreases the demand for money as a medium of exchange.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

15

What is inflation targeting?

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is the main goal of monetary policy in Australia?

A) Lowering the rate of unemployment

B) Increasing the value of the Australian dollar relative to other currencies

C) Economic growth

D) Price stability

A) Lowering the rate of unemployment

B) Increasing the value of the Australian dollar relative to other currencies

C) Economic growth

D) Price stability

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

17

Money demand will increase if the price level ________ or if real GDP ________.

A) increases; decreases

B) decreases; decreases

C) increases; increases

D) decreases; increases

A) increases; decreases

B) decreases; decreases

C) increases; increases

D) decreases; increases

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

18

Maintaining a strong dollar in international currency markets is not one of the monetary policy goals of the Reserve Bank of Australia.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

19

The main goal of monetary policy in Australia is full employment of the labour force.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

20

The Reserve Bank of Australia's main monetary policy target is

A) the money supply.

B) the inflation rate.

C) real GDP.

D) the unemployment rate.

A) the money supply.

B) the inflation rate.

C) real GDP.

D) the unemployment rate.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

21

Open market operations occur when the Reserve Bank of Australia

A) purchases or sells corporate shares in the market to control interest rates.

B) controls the money supply.

C) makes loans to foreign banks.

D) purchases or sells short-dated financial instruments.

A) purchases or sells corporate shares in the market to control interest rates.

B) controls the money supply.

C) makes loans to foreign banks.

D) purchases or sells short-dated financial instruments.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

22

The money supply curve would be vertical if

A) banks and the RBA jointly determine the money supply.

B) the RBA is able to completely fix the money supply.

C) banks and households determine the money supply.

D) households and the RBA jointly determine the money supply.

A) banks and the RBA jointly determine the money supply.

B) the RBA is able to completely fix the money supply.

C) banks and households determine the money supply.

D) households and the RBA jointly determine the money supply.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following correctly describes what the Reserve Bank of Australia (RBA)used as monetary targets in the past?

A) The RBA used M3 as its main target after 1993.

B) The RBA focused on base money as a target after the deregulation of the financial system.

C) The RBA increased its reliance on interest rate targets in the early 1990s.

D) After 1996, the RBA focused on monetary targeting.

A) The RBA used M3 as its main target after 1993.

B) The RBA focused on base money as a target after the deregulation of the financial system.

C) The RBA increased its reliance on interest rate targets in the early 1990s.

D) After 1996, the RBA focused on monetary targeting.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

24

Accounts held with the Reserve Bank of Australia (RBA)which are used by financial institutions to settle payments between each other and with the RBA are called

A) credit accounts.

B) real-time gross settlement accounts.

C) debit accounts.

D) exchange settlement accounts.

A) credit accounts.

B) real-time gross settlement accounts.

C) debit accounts.

D) exchange settlement accounts.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

25

In the 1970s and 1980s,which method of conducting monetary policy did the Reserve Bank of Australia use?

A) Interest rate targeting

B) Inflation targeting

C) Monetary targeting

D) Employment rate targeting

A) Interest rate targeting

B) Inflation targeting

C) Monetary targeting

D) Employment rate targeting

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

26

The Reserve Bank of Australia uses open market operations

A) usually every day.

B) once a month when the Reserve Bank Board meets to discuss monetary policy.

C) only when it wants to increase or decrease the cash rate.

D) only when it is conducting monetary policy.

A) usually every day.

B) once a month when the Reserve Bank Board meets to discuss monetary policy.

C) only when it wants to increase or decrease the cash rate.

D) only when it is conducting monetary policy.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

27

A decrease in real GDP can

A) increase money demand and decrease the interest rate.

B) increase money demand and increase the interest rate.

C) decrease money demand and decrease the interest rate.

D) decrease money demand and increase the interest rate.

A) increase money demand and decrease the interest rate.

B) increase money demand and increase the interest rate.

C) decrease money demand and decrease the interest rate.

D) decrease money demand and increase the interest rate.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

28

The overnight cash rate is determined

A) administratively by the Reserve Bank of Australia.

B) by the supply of and demand for cash.

C) directly by household demand for funds.

D) directly by firm demand for funds.

A) administratively by the Reserve Bank of Australia.

B) by the supply of and demand for cash.

C) directly by household demand for funds.

D) directly by firm demand for funds.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

29

The money market model is concerned with ________ and the loanable funds market model is concerned with ________.

A) short-term real interest rates; long-term nominal interest rates

B) short-term nominal interest rates; long-term nominal interest rates

C) short-term real interest rates; long-term real interest rates

D) short-term nominal interest rates; long-term real interest rates

A) short-term real interest rates; long-term nominal interest rates

B) short-term nominal interest rates; long-term nominal interest rates

C) short-term real interest rates; long-term real interest rates

D) short-term nominal interest rates; long-term real interest rates

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

30

An increase in real GDP can

A) increase money demand and decrease the interest rate.

B) increase money demand and increase the interest rate.

C) decrease money demand and decrease the interest rate.

D) decrease money demand and increase the interest rate.

A) increase money demand and decrease the interest rate.

B) increase money demand and increase the interest rate.

C) decrease money demand and decrease the interest rate.

D) decrease money demand and increase the interest rate.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

31

Increases in the price level

A) increase the opportunity cost of holding money.

B) decrease the opportunity cost of holding money.

C) increase the quantity of money needed for buying and selling.

D) decrease the quantity of money needed for buying and selling.

A) increase the opportunity cost of holding money.

B) decrease the opportunity cost of holding money.

C) increase the quantity of money needed for buying and selling.

D) decrease the quantity of money needed for buying and selling.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

32

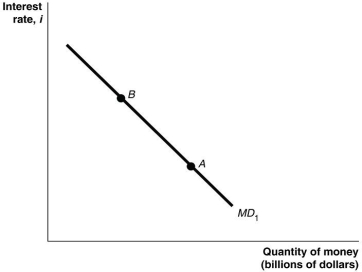

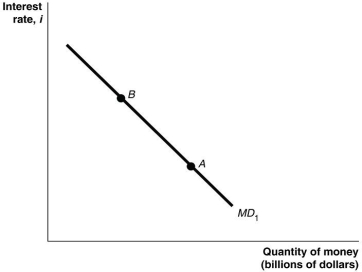

Figure 16.2

Refer to Figure 16.2.In this figure,a movement from point A to point B would be caused by

A) a decrease in real GDP.

B) an increase in the price level.

C) a decrease in the price level.

D) an increase in the interest rate.

Refer to Figure 16.2.In this figure,a movement from point A to point B would be caused by

A) a decrease in real GDP.

B) an increase in the price level.

C) a decrease in the price level.

D) an increase in the interest rate.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

33

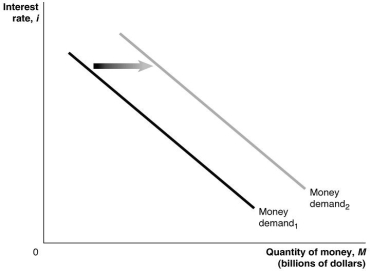

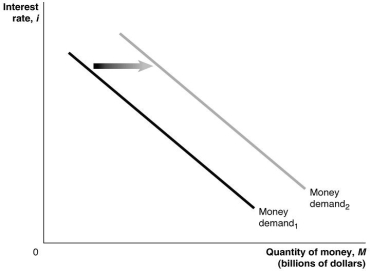

Figure 16.1

Refer to Figure 16.1.In this figure,the money demand curve would move from Money demand1 to Money demand2 if

A) real GDP decreased.

B) the price level increased.

C) the interest rate increased.

D) the Reserve Bank of Australia sold government securities.

Refer to Figure 16.1.In this figure,the money demand curve would move from Money demand1 to Money demand2 if

A) real GDP decreased.

B) the price level increased.

C) the interest rate increased.

D) the Reserve Bank of Australia sold government securities.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following does the Reserve Bank of Australia use as its main measure of monetary movements in Australia?

A) Credit

B) The cash rate

C) The money supply

D) The demand for money

A) Credit

B) The cash rate

C) The money supply

D) The demand for money

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

35

The Reserve Bank of Australia can increase the cash rate by

A) borrowing from the banks using reverse repurchase agreements.

B) purchasing bonds and securities, which increases banks' reserves.

C) lending cash to banks using repurchase agreements.

D) purchasing bonds and securities, which decreases banks' reserves.

A) borrowing from the banks using reverse repurchase agreements.

B) purchasing bonds and securities, which increases banks' reserves.

C) lending cash to banks using repurchase agreements.

D) purchasing bonds and securities, which decreases banks' reserves.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

36

The Reserve Bank of Australia manages the supply of cash on a daily basis to

A) ensure that banks have sufficient cash to meet the demand for funds.

B) sterilise deficits and surpluses of cash in the financial system.

C) ensure that there are no large injections of cash into or withdrawals of cash out of the financial system.

D) ensure that the interest rate changes to create equilibrium in the money market.

A) ensure that banks have sufficient cash to meet the demand for funds.

B) sterilise deficits and surpluses of cash in the financial system.

C) ensure that there are no large injections of cash into or withdrawals of cash out of the financial system.

D) ensure that the interest rate changes to create equilibrium in the money market.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

37

Monetary policy targets the

A) long-term real rate of interest.

B) long-term nominal rate of interest.

C) short-term real rate of interest.

D) short-term nominal rate of interest.

A) long-term real rate of interest.

B) long-term nominal rate of interest.

C) short-term real rate of interest.

D) short-term nominal rate of interest.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

38

Under the current operation of monetary policy in Australia,the money supply is

A) perfectly inelastic at the current interest rate.

B) targeted by the use of open market operations.

C) fixed by the Reserve Bank of Australia.

D) perfectly elastic at the current interest rate.

A) perfectly inelastic at the current interest rate.

B) targeted by the use of open market operations.

C) fixed by the Reserve Bank of Australia.

D) perfectly elastic at the current interest rate.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

39

If real GDP decreases

A) there will be an upward movement along the money demand curve.

B) there will be a downward movement along the money demand curve.

C) the money demand curve will shift to the right.

D) the money demand curve will shift to the left.

A) there will be an upward movement along the money demand curve.

B) there will be a downward movement along the money demand curve.

C) the money demand curve will shift to the right.

D) the money demand curve will shift to the left.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

40

The cash rate is the interest rate

A) the Reserve Bank of Australia charges commercial banks.

B) banks charge their largest customers.

C) banks charge each other for overnight loans.

D) on a government bond or security.

A) the Reserve Bank of Australia charges commercial banks.

B) banks charge their largest customers.

C) banks charge each other for overnight loans.

D) on a government bond or security.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

41

The demand for loanable funds is determined by the willingness of ________ to borrow money to engage in new investment projects.

A) the government

B) households

C) banks

D) firms

A) the government

B) households

C) banks

D) firms

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

42

An increase in the real interest rate does which of the following?

A) Reduces the demand for loanable funds

B) Reduces saving

C) Reduces consumption spending

D) Increases the demand for loanable funds

A) Reduces the demand for loanable funds

B) Reduces saving

C) Reduces consumption spending

D) Increases the demand for loanable funds

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

43

An increase in the real interest rate results in which of the following?

A) An increase in the demand for loanable funds.

B) A decrease in the demand for loanable funds.

C) An increase in the quantity of loanable funds supplied.

D) Both B and C will occur as a result of an increase in the real interest rate.

A) An increase in the demand for loanable funds.

B) A decrease in the demand for loanable funds.

C) An increase in the quantity of loanable funds supplied.

D) Both B and C will occur as a result of an increase in the real interest rate.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

44

The demand for loanable funds has a ________ slope because,the lower the interest rate,the ________ number of investment projects are profitable,and the ________ the quantity of loanable funds demanded.

A) negative; greater; greater

B) negative; greater; lesser

C) negative; lesser; greater

D) positive; lesser; lesser

A) negative; greater; greater

B) negative; greater; lesser

C) negative; lesser; greater

D) positive; lesser; lesser

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

45

A government budget surplus will shift the ________ curve for loanable funds to the ________ and the equilibrium real interest rate will ________.

A) supply; right; fall

B) supply; left; rise

C) demand; right; rise

D) demand; left; fall

A) supply; right; fall

B) supply; left; rise

C) demand; right; rise

D) demand; left; fall

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

46

In the model of the market for loanable funds,which of the following will not shift the supply curve for loanable funds?

A) Expectations of high returns on investments.

B) A decrease in taxation on interest earned on savings accounts.

C) A government budget surplus.

D) A government budget deficit.

A) Expectations of high returns on investments.

B) A decrease in taxation on interest earned on savings accounts.

C) A government budget surplus.

D) A government budget deficit.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

47

Using the market for loanable funds,which of the following has the potential to raise the real interest rate?

A) An increase in the demand for loanable funds.

B) An increase in the quantity demanded of loanable funds.

C) An increase in the supply of loanable funds.

D) An increase in the quantity supplied of loanable funds.

A) An increase in the demand for loanable funds.

B) An increase in the quantity demanded of loanable funds.

C) An increase in the supply of loanable funds.

D) An increase in the quantity supplied of loanable funds.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

48

A government budget deficit will shift the ________ curve for loanable funds to the ________ and the equilibrium real interest rate will ________.

A) supply; right; fall

B) supply; left; rise

C) demand; right; rise

D) demand; left; fall

A) supply; right; fall

B) supply; left; rise

C) demand; right; rise

D) demand; left; fall

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

49

Equilibrium in the loanable funds market determines the

A) nominal interest rate.

B) current interest rate.

C) real interest rate.

D) expected interest rate.

A) nominal interest rate.

B) current interest rate.

C) real interest rate.

D) expected interest rate.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

50

The supply of loanable funds has a ________ slope because,the greater the interest rate,the ________ the reward to savings,and the ________ the quantity of loanable funds supplied.

A) positive; lesser; lesser

B) positive; greater; lesser

C) negative; lesser; greater

D) positive; greater; greater

A) positive; lesser; lesser

B) positive; greater; lesser

C) negative; lesser; greater

D) positive; greater; greater

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

51

Figure 16.3

Refer to Figure 16.3.An increase in the supply of loanable funds could result in which of the following combinations of the real interest rate and quantity of loanable funds at a new equilibrium?

A) The real interest rate is 5 per cent, and the quantity of loanable funds is $150 million.

B) The real interest rate is 5 per cent, and the quantity of loanable funds is $90 million.

C) The real interest rate is 3 per cent, and the quantity of loanable funds is $150 million.

D) The real interest rate is 3 per cent, and the quantity of loanable funds is $90 million.

Refer to Figure 16.3.An increase in the supply of loanable funds could result in which of the following combinations of the real interest rate and quantity of loanable funds at a new equilibrium?

A) The real interest rate is 5 per cent, and the quantity of loanable funds is $150 million.

B) The real interest rate is 5 per cent, and the quantity of loanable funds is $90 million.

C) The real interest rate is 3 per cent, and the quantity of loanable funds is $150 million.

D) The real interest rate is 3 per cent, and the quantity of loanable funds is $90 million.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

52

If firms are anticipating that the profitability of new investments will be lower in the future,then the ________ curve for loanable funds will shift to the ________.

A) supply; right

B) supply; left

C) demand; right

D) demand; left

A) supply; right

B) supply; left

C) demand; right

D) demand; left

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

53

In the model of the market for loanable funds,which of the following will not shift the demand curve for loanable funds?

A) Expectations of high returns on investments.

B) The effect of technological change on profitability.

C) Lower interest rates.

D) The expectation of a recession by businesses.

A) Expectations of high returns on investments.

B) The effect of technological change on profitability.

C) Lower interest rates.

D) The expectation of a recession by businesses.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

54

An increase in public saving has what impact on the market for loanable funds?

A) The supply of loanable funds increases.

B) The demand for loanable funds increases.

C) The supply of loanable funds decreases.

D) The demand for loanable funds decreases.

A) The supply of loanable funds increases.

B) The demand for loanable funds increases.

C) The supply of loanable funds decreases.

D) The demand for loanable funds decreases.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

55

If technological change increases the profitability of new investment for firms,then the ________ curve for loanable funds will shift to the ________ and the equilibrium real interest rate will ________.

A) supply; right; fall

B) supply; left; rise

C) demand; right; rise

D) demand; left; fall

A) supply; right; fall

B) supply; left; rise

C) demand; right; rise

D) demand; left; fall

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

56

A decrease in the real interest rate will

A) increase consumption and reduce investment.

B) increase saving and investment.

C) decrease investment and government spending.

D) increase consumption and investment.

A) increase consumption and reduce investment.

B) increase saving and investment.

C) decrease investment and government spending.

D) increase consumption and investment.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

57

If you spend more of your income on consumption goods,which of the following will occur?

A) The production of investment goods will fall.

B) Economic growth will be stimulated.

C) Investments in education will rise.

D) For every dollar you spend on consumption, real GDP will fall by a dollar.

A) The production of investment goods will fall.

B) Economic growth will be stimulated.

C) Investments in education will rise.

D) For every dollar you spend on consumption, real GDP will fall by a dollar.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

58

Figure 16.3

Refer to Figure 16.3.Beginning at equilibrium,if the government budget deficit rises,which of the following would you expect to see?

A) The quantity of loanable funds demanded by firms will rise above $120 million.

B) The quantity of loanable funds demanded by firms will fall below $120 million.

C) The budget deficit will have no impact on the quantity of loanable funds demanded by firms.

D) The interest rate will fall below 4 per cent.

Refer to Figure 16.3.Beginning at equilibrium,if the government budget deficit rises,which of the following would you expect to see?

A) The quantity of loanable funds demanded by firms will rise above $120 million.

B) The quantity of loanable funds demanded by firms will fall below $120 million.

C) The budget deficit will have no impact on the quantity of loanable funds demanded by firms.

D) The interest rate will fall below 4 per cent.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

59

Figure 16.3

Refer to Figure 16.3.As a result of an increase in the government budget deficit,the ________ for loanable funds will ________,thereby ________ the equilibrium real interest rate and ________ the equilibrium quantity of loanable funds.

A) demand; rise; increasing; decreasing

B) supply; rise; decreasing; increasing

C) demand; fall; decreasing; decreasing

D) supply; fall; increasing; decreasing

Refer to Figure 16.3.As a result of an increase in the government budget deficit,the ________ for loanable funds will ________,thereby ________ the equilibrium real interest rate and ________ the equilibrium quantity of loanable funds.

A) demand; rise; increasing; decreasing

B) supply; rise; decreasing; increasing

C) demand; fall; decreasing; decreasing

D) supply; fall; increasing; decreasing

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

60

Figure 16.3

Refer to Figure 16.3.If the current real interest rate is 5 per cent,which of the following is true?

A) The loanable funds market is in equilibrium.

B) There is a surplus of loanable funds in the market.

C) There is a shortage of loanable funds in the market.

D) The quantity of loanable funds being demanded in the market is less than $90 million.

Refer to Figure 16.3.If the current real interest rate is 5 per cent,which of the following is true?

A) The loanable funds market is in equilibrium.

B) There is a surplus of loanable funds in the market.

C) There is a shortage of loanable funds in the market.

D) The quantity of loanable funds being demanded in the market is less than $90 million.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

61

Rising nominal GDP will increase the demand for money and short-term interest rates.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

62

What is the function of exchange settlement accounts?

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

63

Explain how a decrease in the tax rate on interest earned on savings would affect savings,investment,the interest rate,and economic growth.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

64

The effect of monetary policy on long-term interest rates is usually

A) larger than its effect on short-term interest rates.

B) smaller than its effect on short-term interest rates.

C) immediate, as long-term rates are closely linked to the cash rate.

D) larger than its effect on short-term rates, but the effect occurs with a lag.

A) larger than its effect on short-term interest rates.

B) smaller than its effect on short-term interest rates.

C) immediate, as long-term rates are closely linked to the cash rate.

D) larger than its effect on short-term rates, but the effect occurs with a lag.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

65

For over a decade,monetary policy in Australia has been carried out mainly by using repurchase agreements rather than the outright purchase of government securities.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

66

The Reserve Bank of Australia engages in open market operations only when it wants to change interest rates.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

67

The Reserve Bank of Australia currently conducts monetary policy by controlling the money supply.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

68

Describe how the Reserve Bank of Australia uses open market operations to change short-term and long-term interest rates.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

69

Explain why the money demand curve is downward sloping.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

70

Explain and show graphically how a decrease in household saving affects the equilibrium interest rate and the equilibrium quantity of loanable funds.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

71

A rise in the rate of interest on financial securities will lead to a movement downward along the money demand curve.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

72

Empirical evidence shows that the impact of government budget deficits and surpluses on the equilibrium interest rate is quite large.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

73

Explain why the demand for loanable funds curve has a negative slope.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

74

An increase in interest rates will usually,ceteris paribus,

A) increase investment spending.

B) decrease consumption spending.

C) increase government spending.

D) increase net exports.

A) increase investment spending.

B) decrease consumption spending.

C) increase government spending.

D) increase net exports.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

75

Assume that the government reduces taxation on earnings from dividends on shares.Use the model of the loanable funds market to describe what will happen to savings,investment,economic growth,the real interest rate,and the quantity of loanable funds exchanged.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

76

How does the Reserve Bank of Australia affect the supply of cash?

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

77

Explain how the Reserve Bank of Australia maintains its targeted cash rate on a daily basis.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

78

Economist Steve Landsburg has pointed out that Ebenezer Scrooge's change in behaviour from miser to spender might actually be detrimental to the economy because

A) Scrooge's miserly saving helped contribute to the production of investment goods rather than consumption goods.

B) Scrooge was happiest when he was saving money, and happiness is the key to economic growth.

C) saving has to be greater than consumption for the economy to grow.

D) Scrooge's consumption habits were more detrimental to the environment than were his earlier saving habits.

A) Scrooge's miserly saving helped contribute to the production of investment goods rather than consumption goods.

B) Scrooge was happiest when he was saving money, and happiness is the key to economic growth.

C) saving has to be greater than consumption for the economy to grow.

D) Scrooge's consumption habits were more detrimental to the environment than were his earlier saving habits.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

79

Government budget surpluses and deficits affect the supply of loanable funds,and therefore affect interest rates.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

80

Explain and show graphically how a decrease in government spending,ceteris paribus,affects the equilibrium interest rate and equilibrium quantity of loanable funds in the market for loanable funds.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck