Deck 5: Gross Income: Exclusions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/116

Play

Full screen (f)

Deck 5: Gross Income: Exclusions

1

If a scholarship does not satisfy the requirements for a gift,the scholarship must be included in gross income.

False

2

Brooke works part-time as a waitress in a restaurant.For groups of 7 or more customers,the customer is charged 15% of the bill for Brooke's services.For parties of less than 7,the tips are voluntary.Brooke received $12,000 from the groups of 7 or more and $6,000 in voluntary tips from all other customers.Brooke must include $18,000 ($12,000 + $6,000)in gross income.

True

3

In December 2010,Emily,a cash basis taxpayer,received a $2,500 cash scholarship for the Spring semester of 2011.However,she did not use the funds to pay the tuition until January 2011.Emily can exclude the $2,500 from her gross income in 2010...........

True

4

In 2010,Theresa was in an automobile accident and suffered physical injuries.The accident was caused by Ramon's negligence.In 2011,Theresa collected from his insurance company.She received $15,000 for loss of income,$25,000 punitive damages,and $8,000 for medical expenses which she had deducted on her 2010 tax return (the amount in excess of 7.5% of adjusted gross income).As a result of the above,Theresa's 2011 gross income is increased by $33,000.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

5

Gary cashed in an insurance policy on his life.He needed the funds to pay for his terminally ill wife's medical expenses.He had paid $15,000 in premiums and he collected $30,000 from the insurance company.Gary is required to include the gain of $15,000 ($30,000 - $15,000)in gross income.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

6

If an employer pays for the employee's long-term care insurance premiums,the employee can exclude from gross income the premiums and all of the benefits collected.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

7

Meg's employer carries insurance on its employees that will pay an employee his or her regular salary while the employee is away from work due to illness.The premiums for Meg's coverage were $1,200.Meg was absent from work for two months as a result of a kidney infection.Meg's employer's insurance company paid Meg's regular salary of $8,000 while she was away from work.Meg also collected $2,000 on a wage continuation policy she had purchased.Meg is not taxed on any of the above amounts.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

8

Marvin was the beneficiary of a $50,000 group term life insurance policy on his wife.His wife's employer paid all of the premiums on the policy.Marvin used the life insurance proceeds to purchase a United States Government bond,which paid him $2,000 interest during the current year.Marvin's Federal gross income from the above is $2,000.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

9

Agnes receives a $5,000 scholarship which covers her tuition at Parochial High School.She may exclude the $5,000 scholarship she received for tuition at the private high school.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

10

Sarah's employer pays the hospitalization insurance premiums for a policy that covers all employees and their family members.Sarah can exclude from her gross income the premiums for herself and her family members.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

11

In his will,John named his nephew Steve as executor of the estate.Steve is to receive a fee of $12,000 for serving as executor.When John died,Steve performed the executorial services and received the fee.Steve can exclude the $12,000 from gross income as an inheritance from his uncle's estate.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

12

Amber received a scholarship to be used as follows: tuition $6,000;room and board $4,000;and books and laboratory supplies $1,000.Amber is required to include only $4,000 in her gross income.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

13

When Betty was diagnosed as having a terminal illness,she sold her life insurance policy to Insurance Purchase,Inc. ,a company that is licensed to invest in these types of contracts.Betty sold the policy for $32,000 and Insurance Purchase,Inc. ,became the beneficiary.She had paid total premiums of $19,000.Betty died 8 months after the sale.Insurance Purchase,Inc. ,collected $50,000 on the policy.The company had paid additional premiums of $4,000 on the policy.Insurance Purchase,Inc. ,is required to recognize income from the above transactions,but Betty is not required to include her gain in gross income.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

14

Melody works for a company with only 22 employees.Her employer contributed $2,000 to her health savings account (HSA),and the account earned $100 in interest during the year.Melody withdrew only $1,200 to pay medical expenses during the year.Melody is not required to recognize any gross income from the HSA for the year.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

15

Ed died while employed by Violet Company.His wife collected $50,000 on a group-term life insurance policy that Violet provided its employees,and $5,000 of accrued salary Ed had earned prior to his death.Ed's wife is not required to recognize any income from the receipt of the $55,000.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

16

For a person who is in the 35% marginal tax bracket,$1,000 of tax-exempt income is equivalent to over $1,500 of income that is subject to tax.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

17

Zack was the beneficiary of a life insurance policy on his wife.Zack had paid $20,000 in premiums on the policy.He collected $50,000 on the policy when his wife died from a terminal illness.Because it took several months to process the claim,the insurance company paid Zack $52,000,the face amount of the policy plus $2,000 interest.Zack is not required to recognize any income from the above transactions.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

18

Sam was unemployed for the first two months of 2010.During that time,he received $3,000 of state unemployment benefits.He worked for the next six months and earned $12,000.In September he was injured on the job and collected $4,000 of worker's compensation benefits.Sam's Federal gross income from the above is $15,000.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

19

Worker's compensation benefits are excluded from gross income.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

20

Because graduate teaching assistantships are awarded on the basis of academic achievement,the payments are generally scholarships and therefore are excluded from gross income.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

21

Carla is a deputy sheriff.Her employer requires that she live in the county where she is employed.Housing is very expensive;so the county agreed to pay her $4,800 per year to cover the higher cost of housing.Carla must include the $4,800 housing supplement in gross income.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

22

Mauve Company permits employees to occasionally use the copying machine for personal purposes.The copying machine is located in the office where the higher paid executives work.So they frequently use the machine.However,the machine is not convenient for use by the lower paid warehouse employees.Because this fringe benefit benefits the higher paid employees but not the lower paid warehouse employees,the plan is discriminatory and thus the benefit is taxable to the executives.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

23

Nicole's employer pays her $150 per month towards the cost of parking near a railway station where Nicole catches the train to work.The employer also pays the cost of the rail pass,$75 per month.Nicole can exclude both of these payments from her gross income.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

24

Members of a research team can exclude from gross income the value of their lodging furnished at the research base located at the South Pole.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

25

A cash basis taxpayer took an itemized deduction of $5,500 for state income tax paid in 2010.His total itemized deductions in 2010 were $18,000.In 2011,he received a $900 refund of his 2010 state income tax.The taxpayer must include the $900 refund in his 2011 Federal gross income in accordance with the tax benefit rule.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

26

Mother participated in a qualified state tuition program for the benefit of her son.She contributed $14,000.When the son entered college,the balance in the fund satisfied the tuition charge of $20,000.When the funds were withdrawn to pay the college tuition for her son,the son must include $6,000 in his gross income.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

27

A U.S.citizen who works in France from February 1,2010 until January 31,2011 is eligible for the foreign earned income exclusion in 2010 and 2011.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

28

Carin,a widow,elected to receive the proceeds of a $100,000 life insurance policy on the life of her deceased husband in 10 installments of $15,000 each.Her husband had paid premiums of $75,000 on the policy.In the first year,Carin collected $15,000 from the insurance company.She must include in gross income:

A)$0.

B)$5,000.

C)$10,000.

D)$15,000.

E)None of the above.

A)$0.

B)$5,000.

C)$10,000.

D)$15,000.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

29

Sharon's automobile slid into a ditch.A stranger pulled her out.Sharon offered to pay $25,but the stranger refused.Sharon slipped the $25 in the stranger's truck when he was not looking.

A)The $25 is a nontaxable gift received by the stranger because Sharon was not legally required to pay him.

B)The $25 is a nontaxable gift because the stranger did not ask to receive it.

C)The $25 is taxable compensation for services rendered.

D)The $25 is a nontaxable service award.

E)None of the above.

A)The $25 is a nontaxable gift received by the stranger because Sharon was not legally required to pay him.

B)The $25 is a nontaxable gift because the stranger did not ask to receive it.

C)The $25 is taxable compensation for services rendered.

D)The $25 is a nontaxable service award.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

30

The earnings from a qualified state tuition program account are deferred from taxation until they are used for qualified higher education expenses.At that time,the amount taken from the fund must be included in the gross income of the person who contributed to the account.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

31

The taxpayer's marginal tax bracket is 35%.Which would the taxpayer prefer?

A)$1.35 taxable income rather than $1.00 tax-exempt income.

B)$.65 tax-exempt income rather than $1.00 taxable income.

C)$1.50 taxable income rather than $1.00 tax-exempt income.

D)$1.65 taxable income rather than $1.00 tax-exempt income.

E)None of the above.

A)$1.35 taxable income rather than $1.00 tax-exempt income.

B)$.65 tax-exempt income rather than $1.00 taxable income.

C)$1.50 taxable income rather than $1.00 tax-exempt income.

D)$1.65 taxable income rather than $1.00 tax-exempt income.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

32

A debtor undergoing a Chapter 11 reorganization under the bankruptcy laws who receives a discharge of his or her liabilities has realized income but can exclude the debt reduction from gross income.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

33

Roger is in the 35% marginal tax bracket.Roger's employer has created a flexible spending account for medical and dental expenses that are not covered by the company's health insurance plan.Roger had his salary reduced by $1,200 during the year for contributions to the flexible spending plan.However,Roger incurred only $1,100 in actual expenses for which he was reimbursed.Under the plan,he must forfeit the $100 unused amount.His after-tax cost of overfunding the plan is $65.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

34

The taxpayer incorrectly took a $5,000 deduction (e.g. ,incorrectly calculated depreciation)in 2010 and as a result his taxable income was reduced by $5,000.The taxpayer discovered his error in 2011.The taxpayer can add $5,000 to his 2011 gross income in accordance with the tax benefit rule to correct for the 2010 error.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

35

Fresh Bakery often has unsold donuts at the end of the day.The bakery allows employees to take the leftovers home.The employees are not required to recognize gross income because the bakery does not incur any additional cost.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

36

Tom loaned $20,000 to his controlled corporation.When it became apparent the corporation would not be able to repay the loan in the near future,Tom canceled the debt.The corporation should treat the cancellation as a nontaxable contribution to capital.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

37

Ted's property was taken by the State of Virginia to build a highway overpass.He disputed the amount of the condemnation award he was to receive and ultimately collected an amount for the property plus $12,000 interest on the award.Ted can exclude from gross income the interest he received from the State of Virginia associated with the condemnation award.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

38

Amber Machinery Company purchased a building from Ted for $250,000 cash and a mortgage of $750,000.One year after the transaction,the mortgage had been reduced to $725,000 by principal payments by Amber,but it was apparent that Amber would not be able to continue to make the monthly payments on the mortgage.Ted reduced the amount owed by Amber to $600,000.This reduced the monthly payments to a level that Amber could pay.Amber must recognize $125,000 income from the reduction in the debt by Ted.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

39

Generally,a U.S.citizen is not required to include in gross income the salary and wages earned while working in a foreign country if the foreign country taxes the income.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

40

Cash received by an individual:

A)May be included in gross income although the payor is not legally obligated to make the payment.

B)Is not taxable unless the payor is legally obligated to make the payment.

C)Must always be included in gross income.

D)Is not included in gross income if it was not earned.

E)None of the above.

A)May be included in gross income although the payor is not legally obligated to make the payment.

B)Is not taxable unless the payor is legally obligated to make the payment.

C)Must always be included in gross income.

D)Is not included in gross income if it was not earned.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

41

A scholarship recipient at City University must include in gross income the scholarship proceeds used to pay for:

A)Only tuition.

B)Tuition,books,and supplies,but not meals and lodging.

C)Books,supplies,meals,and lodging.

D)Meals and lodging.

E)None of the above.

A)Only tuition.

B)Tuition,books,and supplies,but not meals and lodging.

C)Books,supplies,meals,and lodging.

D)Meals and lodging.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

42

Iris collected $100,000 on her deceased husband's life insurance policy.The policy was purchased by the husband's employer under a group policy.Iris's husband had included $5,000 in gross income from the group term life insurance premiums during the years he worked for the employer.She elected to collect the policy in 10 equal annual payments of $12,500 each.

A)None of the payments must be included in Iris's gross income.

B)The first 8 payments are a return of her capital and thus Iris is not required to recognize any income from the policy until she receives the ninth payment.

C)For each $12,500 payment that Iris receives,she can exclude $10,000 ($100,000/$125,000 ´ $12,500)from gross income.

D)For each $12,500 that Iris receives,she can exclude from gross income $500 ($5,000/$125,000 ´ $12,500).

E)None of the above.

A)None of the payments must be included in Iris's gross income.

B)The first 8 payments are a return of her capital and thus Iris is not required to recognize any income from the policy until she receives the ninth payment.

C)For each $12,500 payment that Iris receives,she can exclude $10,000 ($100,000/$125,000 ´ $12,500)from gross income.

D)For each $12,500 that Iris receives,she can exclude from gross income $500 ($5,000/$125,000 ´ $12,500).

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

43

Jack received a court award for $100,000 for damages to his personal reputation by the National Gossip.He also received $50,000 in punitive damages.Jack must include in his gross income as a damage award:

A)$0.

B)$50,000.

C)$100,000.

D)$150,000.

E)None of the above.

A)$0.

B)$50,000.

C)$100,000.

D)$150,000.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

44

Jena is a full-time student at State University and is claimed by her parents as a dependent.Her only source of income is an $8,000 scholarship ($800 for books,$3,800 tuition,$200 student activity fee,and $3,200 room and board).Jena's gross income for the year is:

A)$0.

B)$200.

C)$3,200.

D)$3,400.

E)None of the above.

A)$0.

B)$200.

C)$3,200.

D)$3,400.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

45

The exclusion for health insurance premiums paid by the employer applies to:

A)Only current employees.

B)Only current employees and their spouses and children.

C)Only current and retired former employees.

D)Present employees,retired former employees,and their spouses and children.

E)None of the above.

A)Only current employees.

B)Only current employees and their spouses and children.

C)Only current and retired former employees.

D)Present employees,retired former employees,and their spouses and children.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

46

Matilda works for a company with 1,000 employees.The company has a hospitalization insurance plan that covers all employees.However,the employee must pay the first $3,000 of his or her medical expenses each year.Each year,the employer contributes $1,500 to each employee's health savings account (HSA).Matilda's employer made the contributions in 2009 and 2010,and the account earned $100 interest in 2010.At the end of 2010,Matilda withdrew $3,100 from the account to pay the deductible portion of her medical expenses for the year and other medical expenses not covered by the hospitalization insurance policy.As a result,Matilda must include in her 2010 gross income:

A)$0.

B)$100.

C)$1,600.

D)$3,100.

E)None of the above.

A)$0.

B)$100.

C)$1,600.

D)$3,100.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

47

Theresa sued her former employer for age,race,and gender discrimination.She claimed $250,000 in damages for loss of income and $500,000 in punitive damages.She settled the claim for $600,000.As a result of the settlement,Theresa must include in gross income:

A)$0.

B)$400,000 [$500,000/($250,000 + $500,000)´ $600,000].

C)$500,000.

D)$600,000.

E)None of the above.

A)$0.

B)$400,000 [$500,000/($250,000 + $500,000)´ $600,000].

C)$500,000.

D)$600,000.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

48

Barney,a full-time graduate student,receives a full tuition waiver ($6,000 during the year)and a monthly stipend for 9 months of $600 ($5,400 for the year)from State University for performing research for the university as a graduate assistant.In addition,he receives a $1,500 research grant to pursue his own research and studies.Barney's gross income from the above is:

A)$0.

B)$5,400.

C)$11,400.

D)$12,900.

E)None of the above.

A)$0.

B)$5,400.

C)$11,400.

D)$12,900.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

49

Albert had a terminal illness which required almost constant nursing care for the remaining two years of his estimated life,according to his doctor.Albert had a life insurance policy with a face amount of $100,000.Albert had paid $10,000 of premiums on the policy.The insurance company has offered to pay him $75,000 to cancel the policy,although its cash surrender value was only $60,000.Albert accepted the $75,000.Albert used $5,000 to pay his medical expenses.Albert made a miraculous recovery and lived another 20 years.As a result of cashing in the policy:

A)Albert is not required to recognize any gross income because of his terminal illness.

B)Albert must recognize $65,000 ($75,000 - $10,000)of gross income.

C)Albert must recognize $10,000 ($75,000 - $60,000 - $5,000)of gross income.

D)Albert must recognize $75,000 of gross income,but he has $5,000 of deductible medical expenses.

E)None of the above.

A)Albert is not required to recognize any gross income because of his terminal illness.

B)Albert must recognize $65,000 ($75,000 - $10,000)of gross income.

C)Albert must recognize $10,000 ($75,000 - $60,000 - $5,000)of gross income.

D)Albert must recognize $75,000 of gross income,but he has $5,000 of deductible medical expenses.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

50

The taxpayer is a Ph.D.student in accounting at State University.The student is paid $1,000 per month for teaching two classes.The total amount received for the year is $9,000.

A)The $9,000 is excludible if the money is used to pay for tuition and books.

B)The $9,000 is taxable compensation.

C)The $9,000 is considered a scholarship and,therefore,is excluded.

D)The $9,000 is excluded because the total amount received for the year is less than her standard deduction and personal exemption.

E)None of the above.

A)The $9,000 is excludible if the money is used to pay for tuition and books.

B)The $9,000 is taxable compensation.

C)The $9,000 is considered a scholarship and,therefore,is excluded.

D)The $9,000 is excluded because the total amount received for the year is less than her standard deduction and personal exemption.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

51

Christie sued her former employer for a back injury she suffered on the job in 2009.As a result of the injury,she was partially disabled.In 2010,she received $250,000 for her loss of future income,$150,000 in punitive damages because of the employer's flagrant disregard for the employee's safety,and $10,000 for medical expenses.Christie took the standard deduction in 2009 and 2010.Christie's 2010 gross income from the above is:

A)$410,000.

B)$400,000.

C)$250,000.

D)$150,000.

E)None of the above.

A)$410,000.

B)$400,000.

C)$250,000.

D)$150,000.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

52

Turquoise Company purchased a life insurance policy on the company's chief executive officer,Joe.After the company had paid $400,000 in premiums,Joe died and the company collected the $1.5 million face amount of the policy.The company also purchased group term life insurance on all its employees.Joe had included $16,000 in gross income for the group term life insurance premiums.Joe's widow,Rebecca,received the $100,000 proceeds from the group term life insurance policy.

A)Rebecca can exclude the life insurance proceeds of $100,000,but Turquoise Company must include $1,100,000 ($1,500,000 - $400,000)in gross income.

B)Turquoise Company and Rebecca can exclude the life insurance proceeds of $1,500,000 and $100,000,respectively,from gross income.

C)Turquoise Company can exclude $1,100,000 ($1,500,000 - $400,000)from gross income,but Rebecca must include $84,000 in gross income.

D)Turquoise Company must include $1,100,000 ($1,500,000 - $400,000)in gross income and Rebecca must include $100,000 in gross income.

E)None of the above.

A)Rebecca can exclude the life insurance proceeds of $100,000,but Turquoise Company must include $1,100,000 ($1,500,000 - $400,000)in gross income.

B)Turquoise Company and Rebecca can exclude the life insurance proceeds of $1,500,000 and $100,000,respectively,from gross income.

C)Turquoise Company can exclude $1,100,000 ($1,500,000 - $400,000)from gross income,but Rebecca must include $84,000 in gross income.

D)Turquoise Company must include $1,100,000 ($1,500,000 - $400,000)in gross income and Rebecca must include $100,000 in gross income.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

53

As an executive of Cherry,Inc. ,Ollie receives a fringe benefit in the form of annual tuition scholarships of $10,000 to each of his three children.The scholarships are paid by the company directly to each child's educational institution and are payable only if the student maintains a B average.

A)The tuition payments of $30,000 may be excluded from Ollie's gross income as a scholarship.

B)The tuition payments of $10,000 each must be included in the child's gross income.

C)The tuition payments of $30,000 may be excluded from Ollie's gross income because the payments are for the academic achievements of the children.

D)The tuition payments of $30,000 must be included in Ollie's gross income.

E)None of the above.

A)The tuition payments of $30,000 may be excluded from Ollie's gross income as a scholarship.

B)The tuition payments of $10,000 each must be included in the child's gross income.

C)The tuition payments of $30,000 may be excluded from Ollie's gross income because the payments are for the academic achievements of the children.

D)The tuition payments of $30,000 must be included in Ollie's gross income.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

54

In 2010,Khalid was in an automobile accident and suffered physical injuries.The accident was caused by Rashad's negligence.Khalid threatened to file a lawsuit against Amber Trucking Company,Rashad's employer,claiming $50,000 for pain and suffering,$25,000 for loss of income,and $100,000 in punitive damages.Amber's insurance company will not pay punitive damages;therefore,Amber has offered to settle the case for $120,000 for pain and suffering,$25,000 for loss of income,and nothing for punitive damages.Khalid is in the 35% marginal tax bracket.What is the after-tax difference to Khalid between Khalid's original claim and Amber's offer?

A)Amber's offer is $30,000 less.(- $100,000 punitive damages + $70,000 increased pain and suffering. )

B)Amber's offer is $10,500 less.[($30,000 ´ .35)= $10,500].

C)Amber's offer is $19,500 less.[$30,000(1 - .35)= $19,500].

D)Amber's offer is $5,000 more.[$70,000 - (1 - .35)($100,000)= $65,000].

E)None of the above.

A)Amber's offer is $30,000 less.(- $100,000 punitive damages + $70,000 increased pain and suffering. )

B)Amber's offer is $10,500 less.[($30,000 ´ .35)= $10,500].

C)Amber's offer is $19,500 less.[$30,000(1 - .35)= $19,500].

D)Amber's offer is $5,000 more.[$70,000 - (1 - .35)($100,000)= $65,000].

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

55

Julie was suffering from a viral infection that caused her to miss work for 90 days.During the first 30 days of her absence,she received her regular salary of $5,000 from her employer.For the next 60 days,she received $10,000 under an accident and health insurance policy that she had purchased for premium payments totaling $6,000.Of the $15,000 she received,Julie must include in gross income:

A)$0.

B)$4,000.

C)$5,000

D)$9,000.

E)None of the above.

A)$0.

B)$4,000.

C)$5,000

D)$9,000.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

56

Olaf was injured in an automobile accident and received $25,000 for his physical injury,$10,000 for his loss of income,and $50,000 punitive damages.As a result of the award,the amount Olaf must include in gross income is:

A)$10,000.

B)$50,000.

C)$60,000.

D)$85,000.

E)None of the above.

A)$10,000.

B)$50,000.

C)$60,000.

D)$85,000.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

57

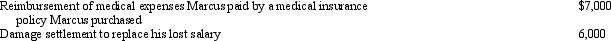

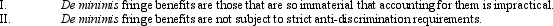

Early in the year,Marcus was in an automobile accident during the course of his employment.As a result of the physical injuries he sustained,he received the following payments during the year:  What is the amount that Marcus must include in gross income for the current year?

What is the amount that Marcus must include in gross income for the current year?

A)$20,000.

B)$13,000.

C)$7,000.

D)$6,000.

E)$0.

What is the amount that Marcus must include in gross income for the current year?

What is the amount that Marcus must include in gross income for the current year?A)$20,000.

B)$13,000.

C)$7,000.

D)$6,000.

E)$0.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

58

Swan Finance Company,an accrual method taxpayer,requires all of its customers to carry credit life insurance.If a customer dies,the company receives from the insurance company the balance due on the customer's loan.Ali,a customer,died owing the company $1,000.The balance due included $100 accrued interest that Swan had included in income.When Swan collects $1,000 from the insurance company,Swan:

A)Does not recognize income because life insurance proceeds are tax-exempt.

B)Must recognize $900 income from the life insurance proceeds.

C)Must recognize $1,000 income from the life insurance proceeds.

D)Does not recognize income from the life insurance because the entire amount is a recovery of capital.

E)None of the above.

A)Does not recognize income because life insurance proceeds are tax-exempt.

B)Must recognize $900 income from the life insurance proceeds.

C)Must recognize $1,000 income from the life insurance proceeds.

D)Does not recognize income from the life insurance because the entire amount is a recovery of capital.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

59

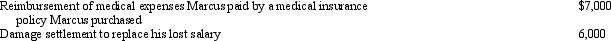

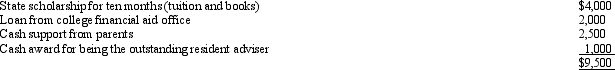

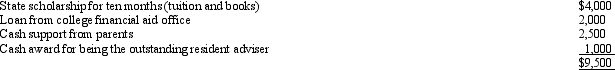

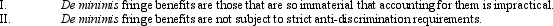

Ron,age 19,is a full-time graduate student at City University.During 2010,he received the following payments:  Ron served as a resident advisor in a dormitory and,therefore,the university waived the $2,500 charge for the room he occupied.What is Ron's adjusted gross income for 2010?

Ron served as a resident advisor in a dormitory and,therefore,the university waived the $2,500 charge for the room he occupied.What is Ron's adjusted gross income for 2010?

A)$1,000.

B)$3,500.

C)$5,000.

D)$12,000.

E)None of the above.

Ron served as a resident advisor in a dormitory and,therefore,the university waived the $2,500 charge for the room he occupied.What is Ron's adjusted gross income for 2010?

Ron served as a resident advisor in a dormitory and,therefore,the university waived the $2,500 charge for the room he occupied.What is Ron's adjusted gross income for 2010?A)$1,000.

B)$3,500.

C)$5,000.

D)$12,000.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

60

Ben was diagnosed with a terminal illness.His physician estimated that Ben would live no more than 18 months.After he received the doctor's diagnosis,Ben cashed in his life insurance policy to pay some medical bills.Ben had paid $12,000 in premiums on the policy,and he collected $50,000,the cash surrender value of the policy.Henry enjoys excellent health,but he cashed in his life insurance policy to purchase a new home.He had paid premiums of $12,000 and collected $50,000 from the insurance company.

A)Neither Ben nor Henry is required to recognize gross income.

B)Both Ben and Henry must recognize $38,000 ($50,000 - $12,000)of gross income.

C)Henry must recognize $38,000 ($50,000 - $12,000)of gross income,but Ben does not recognize any gross income.

D)Ben must recognize $38,000 ($50,000 - $12,000)of gross income,but Henry does not recognize any gross income.

E)None of the above.

A)Neither Ben nor Henry is required to recognize gross income.

B)Both Ben and Henry must recognize $38,000 ($50,000 - $12,000)of gross income.

C)Henry must recognize $38,000 ($50,000 - $12,000)of gross income,but Ben does not recognize any gross income.

D)Ben must recognize $38,000 ($50,000 - $12,000)of gross income,but Henry does not recognize any gross income.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

61

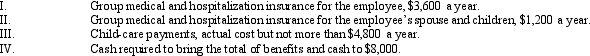

Under the Swan Company's cafeteria plan,all full-time employees are allowed to select any combination of the benefits below,but the total received by the employee cannot exceed $8,000 a year.  Which of the following statements is true?

Which of the following statements is true?

A)Sam,a full-time employee,selects choices II and III and $2,000 cash.His gross income must include the $2,000.

B)Paul,a full-time employee,elects to receive $8,000 cash because his wife's employer provided these same insurance benefits for him.Paul is required to include the $8,000 in gross income.

C)Sue,a full-time employee,elects to receive choices I,II and $3,200 for III.Sue is not required to include any of the above in gross income.

D)All of the above.

E)None of the above.

Which of the following statements is true?

Which of the following statements is true?A)Sam,a full-time employee,selects choices II and III and $2,000 cash.His gross income must include the $2,000.

B)Paul,a full-time employee,elects to receive $8,000 cash because his wife's employer provided these same insurance benefits for him.Paul is required to include the $8,000 in gross income.

C)Sue,a full-time employee,elects to receive choices I,II and $3,200 for III.Sue is not required to include any of the above in gross income.

D)All of the above.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

62

The employees of Mauve Accounting Services are permitted to use the copy machine for personal purposes,provided the privilege is not abused.Ed is the president of a civic organization and uses the copier to make several copies of the organization's agenda for its meetings.The copies made during the year would have cost $125 at a local office supply.

A)Ed must include $125 in his gross income.

B)Ed may exclude the cost of the copies as a no-additional cost fringe benefit.

C)Ed may exclude the cost of the copies only if the organization is a client of Mauve.

D)Ed may exclude the cost of the copies as a de minimis fringe benefit.

E)None of the above.

A)Ed must include $125 in his gross income.

B)Ed may exclude the cost of the copies as a no-additional cost fringe benefit.

C)Ed may exclude the cost of the copies only if the organization is a client of Mauve.

D)Ed may exclude the cost of the copies as a de minimis fringe benefit.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

63

Ridge is the manager of a motel.As a condition of his employment,Ridge is required to live in a room on the premises so that he would be there in case of emergencies.Ridge considered this a fringe benefit,since he would otherwise be required to pay $600 per month rent.The room that Ridge occupied normally rented for $60 per night,or $1,500 per month.On the average,90% of the motel rooms were occupied.As a result of this rent-free use of a room,Ridge is required to include in gross income.

A)$0.

B)$600 per month.

C)$1,500 per month.

D)$1,350 ($1,500 ´ .90 = $1,350).

E)None of the above.

A)$0.

B)$600 per month.

C)$1,500 per month.

D)$1,350 ($1,500 ´ .90 = $1,350).

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

64

All employees of United Company are covered by a group hospitalization insurance plan,but the employees must pay the premiums ($8,000 for each employee).None of the employees has sufficient medical expenses to deduct the premiums.Instead of giving raises next year,United is considering paying the employee's hospitalization insurance premiums.If the change is made,the employee's after-tax and insurance pay will:

A)Increase by the same amount for all employees.

B)Increase more for the highly paid employees (35% marginal tax bracket).

C)Increase more for the low income (10% and 15% marginal tax bracket)employees.

D)Decrease by the same amount for all employees.

E)None of the above.

A)Increase by the same amount for all employees.

B)Increase more for the highly paid employees (35% marginal tax bracket).

C)Increase more for the low income (10% and 15% marginal tax bracket)employees.

D)Decrease by the same amount for all employees.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

65

Section 119 excludes the value of meals from the employee's gross income:

A)Whenever the employee is working during the normal mealtimes.

B)When the employer pays for the meals,if the employee makes an accounting to the employer.

C)When the meals are provided for the employee,on the employer's business premises,and as a convenience to the employer.

D)When the meals are provided for the employee on the employer's business premises as a convenience to the employee.

E)None of the above.

A)Whenever the employee is working during the normal mealtimes.

B)When the employer pays for the meals,if the employee makes an accounting to the employer.

C)When the meals are provided for the employee,on the employer's business premises,and as a convenience to the employer.

D)When the meals are provided for the employee on the employer's business premises as a convenience to the employee.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

66

A U.S.citizen worked in a foreign country for the period July 1,2009 through August 1,2010.Her salary was $10,000 per month.Also,in 2009 she received $5,000 in dividends from foreign corporations (not qualified dividends).No dividends were received in 2010.Which of the following is correct?

A)The taxpayer can exclude $60,000 from U.S.gross income for 2009 because the total salary earned in the foreign country in 2009 was less than the annual foreign earned income exclusion,but the dividends of $5,000 must be included in gross income.

B)The taxpayer can exclude a portion of the compensation income from U.S.gross income in 2009 and 2010,but must include the dividend income of $5,000 in gross income.

C)The taxpayer can exclude from U.S.gross income $60,000 salary in 2009,but in 2009 the taxpayer will exceed the twelve month limitation and,therefore,all of the 2010 compensation must be included in gross income.All of the dividends must be included in 2009 gross income.

D)The taxpayer can exclude a portion of the salary from U.S.gross income in 2009 and 2010,and all of the dividend income.

E)None of the above.

A)The taxpayer can exclude $60,000 from U.S.gross income for 2009 because the total salary earned in the foreign country in 2009 was less than the annual foreign earned income exclusion,but the dividends of $5,000 must be included in gross income.

B)The taxpayer can exclude a portion of the compensation income from U.S.gross income in 2009 and 2010,but must include the dividend income of $5,000 in gross income.

C)The taxpayer can exclude from U.S.gross income $60,000 salary in 2009,but in 2009 the taxpayer will exceed the twelve month limitation and,therefore,all of the 2010 compensation must be included in gross income.All of the dividends must be included in 2009 gross income.

D)The taxpayer can exclude a portion of the salary from U.S.gross income in 2009 and 2010,and all of the dividend income.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

67

Tommy,a senior at State College,receives free room and board as full compensation for working as a resident advisor at the university dormitory.The regular housing contract is $1,800 a year in total,$1,000 for lodging and $800 for meals in the dormitory.Tommy had the option of receiving the meals or $800 in cash.Tommy accepted the meals.What is Tommy's gross income from working as a resident advisor?

A)$0,the entire value of the contract is excluded from gross income.

B)$800,only the meal contract must be included in gross income.

C)$1,000,only the lodging contract must be included in gross income.

D)$1,800,the entire value of the contract is compensation.

E)None of the above.

A)$0,the entire value of the contract is excluded from gross income.

B)$800,only the meal contract must be included in gross income.

C)$1,000,only the lodging contract must be included in gross income.

D)$1,800,the entire value of the contract is compensation.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

68

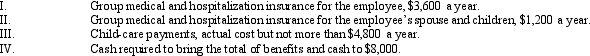

Evaluate the following statements:

A)I and II are true.

B)I is true,but II is false.

C)I and II are false.

D)I is false,but II is true.

E)None of the above.

A)I and II are true.

B)I is true,but II is false.

C)I and II are false.

D)I is false,but II is true.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

69

The Royal Motor Company manufactures automobiles.Employees of the company can buy a new automobile for Royal's cost plus 2%.The automobiles are sold to dealers at cost plus 20%.Generally,employees of Local Dealer,Inc. ,are allowed to buy a new automobile from the company at the dealer's cost.Officers of Local Dealer are allowed to use a company vehicle (for personal use)at no cost.

A)None of the employees who take advantage of the fringe benefits described above are required to recognize income.

B)Employees of Royal are required to recognize as gross income 18% (20% - 2%)of the cost of the automobile purchased.

C)Employees of Local Dealer are required to recognize as gross income the gross profit Local Dealer loses as a result of the sale to the employees.

D)Local Dealer officers must recognize gross income from the personal use of the company vehicles.

E)None of the above.

A)None of the employees who take advantage of the fringe benefits described above are required to recognize income.

B)Employees of Royal are required to recognize as gross income 18% (20% - 2%)of the cost of the automobile purchased.

C)Employees of Local Dealer are required to recognize as gross income the gross profit Local Dealer loses as a result of the sale to the employees.

D)Local Dealer officers must recognize gross income from the personal use of the company vehicles.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

70

In the case of a fringe benefit plan that is discriminatory (e.g. ,the plan favors officers over other employees),

A)All employees must include all benefits received in gross income.

B)De minimis fringes may be excluded from gross income.

C)The value of a parking space provided (value of $100 per month)must be included in gross income.

D)Those who are being discriminated against can exclude a certain portion of their cash compensation from gross income to achieve parity.

E)None of the above.

A)All employees must include all benefits received in gross income.

B)De minimis fringes may be excluded from gross income.

C)The value of a parking space provided (value of $100 per month)must be included in gross income.

D)Those who are being discriminated against can exclude a certain portion of their cash compensation from gross income to achieve parity.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

71

The president of Silver Corporation is assigned a secretary.When the secretary has completed work on company matters,the secretary is available to do the president's personal matters (pick up laundry,buy groceries)so long as the privilege is not abused.No other employee has a personal secretary.

A)The value of the secretary's services provided to the president may be excluded as no-additional-cost services.

B)The value of the secretary's services provided to the president may be excluded because the president did not receive cash.

C)The value of the secretary's services provided to the president may be excluded as no-additional-cost services because the services are not available to all employees.

D)If the value of secretary's services are considered de minimis,the president may exclude the benefit from gross income even through other employees are not provided the same benefit.

E)None of the above.

A)The value of the secretary's services provided to the president may be excluded as no-additional-cost services.

B)The value of the secretary's services provided to the president may be excluded because the president did not receive cash.

C)The value of the secretary's services provided to the president may be excluded as no-additional-cost services because the services are not available to all employees.

D)If the value of secretary's services are considered de minimis,the president may exclude the benefit from gross income even through other employees are not provided the same benefit.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

72

Kristen's employer owns its building and provides parking space for its employees.The value of the free parking is $150 per month.Karen's employer does not have parking facilities,but reimburses its employee for the cost of parking in a nearby garage,up to $150 per month.

A)Kristen and Karen must recognize gross income from the parking services.

B)Kristen can exclude the employer provided parking from gross income,but Karen must include her reimbursement in gross income.

C)Kristen must include the value of the employer provided parking from her gross income,but Karen can exclude her reimbursement from gross income.

D)Neither Kristen nor Karen is required to include the cost of parking in gross income.

E)None of the above.

A)Kristen and Karen must recognize gross income from the parking services.

B)Kristen can exclude the employer provided parking from gross income,but Karen must include her reimbursement in gross income.

C)Kristen must include the value of the employer provided parking from her gross income,but Karen can exclude her reimbursement from gross income.

D)Neither Kristen nor Karen is required to include the cost of parking in gross income.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

73

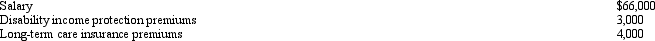

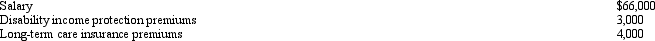

James,a cash basis taxpayer,received the following compensation and fringe benefits in 2010:  His actual salary was $72,000.He received only $66,000 because his salary was garnished and the employer paid $6,000 on James's credit card debt he owed.The wage continuation insurance is available to all employees and pays the employee three-fourths of the regular salary if the employee is sick or disabled.The long-term care insurance is available to all employees and pays $150 per day towards a nursing home or similar facility.What is James's gross income from the above?

His actual salary was $72,000.He received only $66,000 because his salary was garnished and the employer paid $6,000 on James's credit card debt he owed.The wage continuation insurance is available to all employees and pays the employee three-fourths of the regular salary if the employee is sick or disabled.The long-term care insurance is available to all employees and pays $150 per day towards a nursing home or similar facility.What is James's gross income from the above?

A)$66,000.

B)$72,000.

C)$73,000.

D)$75,000.

E)None of the above.

His actual salary was $72,000.He received only $66,000 because his salary was garnished and the employer paid $6,000 on James's credit card debt he owed.The wage continuation insurance is available to all employees and pays the employee three-fourths of the regular salary if the employee is sick or disabled.The long-term care insurance is available to all employees and pays $150 per day towards a nursing home or similar facility.What is James's gross income from the above?

His actual salary was $72,000.He received only $66,000 because his salary was garnished and the employer paid $6,000 on James's credit card debt he owed.The wage continuation insurance is available to all employees and pays the employee three-fourths of the regular salary if the employee is sick or disabled.The long-term care insurance is available to all employees and pays $150 per day towards a nursing home or similar facility.What is James's gross income from the above?A)$66,000.

B)$72,000.

C)$73,000.

D)$75,000.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

74

Heather is a full-time employee of the Drake Company and participates in the company's flexible spending plan that is available to all employees.Which of the following is correct?

A)Heather reduced her salary by $1,200,actually spent $1,500,and received only $1,200 as reimbursement for her medical expenses.Heather's gross income will be reduced by $1,500.

B)Heather reduced her salary by $1,200,and received only $900 as reimbursement for her actual medical expenses.She is not refunded the $300 remaining balance,but her gross income is reduced by $1,200.

C)Heather reduced her salary by $1,200,and received only $800 as reimbursement for her medical expenses.She is not refunded the $400.Her gross income is reduced by $800.

D)Heather reduced her salary by $1,200,and received only $900 as reimbursement for her medical expenses.She forfeits the $300.Her gross income is reduced by $300.

E)None of the above.

A)Heather reduced her salary by $1,200,actually spent $1,500,and received only $1,200 as reimbursement for her medical expenses.Heather's gross income will be reduced by $1,500.

B)Heather reduced her salary by $1,200,and received only $900 as reimbursement for her actual medical expenses.She is not refunded the $300 remaining balance,but her gross income is reduced by $1,200.

C)Heather reduced her salary by $1,200,and received only $800 as reimbursement for her medical expenses.She is not refunded the $400.Her gross income is reduced by $800.

D)Heather reduced her salary by $1,200,and received only $900 as reimbursement for her medical expenses.She forfeits the $300.Her gross income is reduced by $300.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

75

The First Chance Casino has gambling facilities,a bar,a restaurant,and a hotel.All employees are allowed to obtain food from the restaurant at no charge during working hours.In the case of the employees who operate the gambling facilities,bar,and restaurant,60% of all of Casino's employees,the meals are provided for the convenience of the Casino.However,the hotel workers,demanded equal treatment and therefore were also allowed to eat in the restaurant at no charge while they are at work.Which of the following is correct?

A)All the employees are required to include the value of the meals in their gross income.

B)Only the restaurant employees may exclude the value of their meals from gross income.

C)Only the employees who work in gambling,the bar,and the restaurant may exclude the meals from gross income.

D)All of the employees may exclude the value of the meals from gross income.

E)None of the above.

A)All the employees are required to include the value of the meals in their gross income.

B)Only the restaurant employees may exclude the value of their meals from gross income.

C)Only the employees who work in gambling,the bar,and the restaurant may exclude the meals from gross income.

D)All of the employees may exclude the value of the meals from gross income.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

76

The plant union is negotiating with the Eagle Company,which is on the verge of bankruptcy.Eagle has offered to pay for the employees' hospitalization insurance in exchange for a wage reduction.The employees each currently pay premiums of $4,000 a year for their insurance.

A)If an employee's wages are reduced by $5,000 and the employee is in the 28% marginal tax bracket,the employee would benefit from the offer.

B)If an employee's wages are reduced by $4,000 and the employee is in the 15% marginal tax bracket,the employee would benefit from the offer.

C)If an employee's wages are reduced by $6,000 and the employee is in the 35% marginal tax bracket,the employee would benefit from the offer.

D)a. ,b. ,and c.

E)None of the above.

A)If an employee's wages are reduced by $5,000 and the employee is in the 28% marginal tax bracket,the employee would benefit from the offer.

B)If an employee's wages are reduced by $4,000 and the employee is in the 15% marginal tax bracket,the employee would benefit from the offer.

C)If an employee's wages are reduced by $6,000 and the employee is in the 35% marginal tax bracket,the employee would benefit from the offer.

D)a. ,b. ,and c.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

77

The Perfection Tax Service gives employees $10 as "supper money" when they are required to work overtime,approximately 20 days each year.The supper money received:

A)Must be included in the employee's gross income.

B)Must be included in the employee's gross income if the employee does not spend it for supper.

C)May be excluded from the employee's gross income as a "no-additional cost" fringe benefit.

D)May be excluded from the employee's gross income as a de minimis fringe benefit.

E)None of the above.

A)Must be included in the employee's gross income.

B)Must be included in the employee's gross income if the employee does not spend it for supper.

C)May be excluded from the employee's gross income as a "no-additional cost" fringe benefit.

D)May be excluded from the employee's gross income as a de minimis fringe benefit.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

78

Adam repairs power lines for the Egret Utilities Company.He is generally working on a power line during the lunch hour.He must eat when and where he can and still get his work done.He usually purchases something at a convenience store and eats in his truck.Egret reimburses Adam for the cost of his meals.

A)Adam must include the reimbursement in his gross income.

B)Adam can exclude the reimbursement from his gross income since the meals are provided for the convenience of the employer.

C)Adam can exclude the reimbursement from his gross income because he eats the meals on the employer's business premises (the truck).

D)Adam may exclude from his gross income the difference between what he paid for the meals and what it would have cost him to eat at home.

E)None of the above.

A)Adam must include the reimbursement in his gross income.

B)Adam can exclude the reimbursement from his gross income since the meals are provided for the convenience of the employer.

C)Adam can exclude the reimbursement from his gross income because he eats the meals on the employer's business premises (the truck).

D)Adam may exclude from his gross income the difference between what he paid for the meals and what it would have cost him to eat at home.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

79

Employers of the Family Bowling Alley allow their employees to bowl without charge after the employee's working hours and when there are adequate idle bowling lanes.Tom bowled 12 games during the month at no charge when the non-employee charge was $3.00 per game.

A)Tom must include $36 in gross income.

B)Tom must include in gross income the employer's marginal cost of providing the bowling lanes and equipment.

C)Tom is not required to include anything in gross income because this is a "no-additional-cost service" fringe benefit.

D)Tom is not required to include the $36 in gross income if the arrangement is for the convenience of the employer.

E)None of the above.

A)Tom must include $36 in gross income.

B)Tom must include in gross income the employer's marginal cost of providing the bowling lanes and equipment.

C)Tom is not required to include anything in gross income because this is a "no-additional-cost service" fringe benefit.

D)Tom is not required to include the $36 in gross income if the arrangement is for the convenience of the employer.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

80

Peggy is an executive for the Tan Furniture Manufacturing Company.Peggy purchased furniture from the company for $7,000.The price Tan ordinarily charges a wholesaler is $8,500.The retail price of the furniture was $12,000,and Tan's cost was $8,000.The company also paid for Peggy's parking space in a garage near the office.The parking fee was $1,200 for the year.All employees are allowed to buy furniture at a discounted price comparable to that charged to Peggy.However,the company does not pay other employees' parking fees.Peggy's gross income from the above is:

A)$0.

B)$1,000.

C)$5,000.

D)$6,200.

E)None of the above.

A)$0.

B)$1,000.

C)$5,000.

D)$6,200.

E)None of the above.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck