Deck 7: Deductions and Losses: Certain Business Expenses and Losses

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/90

Play

Full screen (f)

Deck 7: Deductions and Losses: Certain Business Expenses and Losses

1

In determining whether a debt is a business or nonbusiness bad debt,the debtor's use of the borrowed funds is important.

False

2

A business bad debt can offset an unlimited amount of ordinary income.

True

3

James is in the business of debt collection.He purchased a $20,000 account receivable from Green Corporation for $15,000.During the year,James collected $17,000 in final settlement of the account.James can take a $3,000 bad debt deduction in the current year.

False

4

A nonbusiness bad debt is a debt unrelated to the taxpayer's trade or business either when it was created or when it became worthless.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

5

A bond held by an investor that is uncollectible will be treated as a worthless security and hence,produce a capital loss.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

6

A loss is allowed for a security that declines in value.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

7

Several years ago,John purchased 2,000 shares of § 1244 stock from Red Corporation for $40,000.Last year,John sold one-half of his Red Corporation stock to Mike for $12,000.During the current year,Mike sold the Red Corporation stock for $3,000.Mike has a $9,000 ($3,000 - $12,000)ordinary loss for the current year.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

8

If an account receivable written off during the current year is subsequently collected during the current year,the write-off entry is reversed.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

9

Bankruptcy is generally an indication that a debt is worthless.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

10

The amount of complete worthlessness on a nonbusiness bad debt is deducted at final settlement.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

11

A bona fide debt arises from a debtor-creditor relationship based on a valid and enforceable obligation to pay a fixed sum of money.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

12

Taxpayers must sell or exchange their § 1244 stock in order to recognize an ordinary loss (does not apply to stock becoming worthless).

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

13

A loss from a worthless security is always treated as a long-term capital loss.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

14

An individual may deduct a loss on rental property only if it meets the definition of a casualty loss.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

15

If a business debt previously deducted as partially worthless becomes totally worthless this year,only the amount not previously deducted can be deducted this year.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

16

Accrual basis taxpayers can use the reserve method for computing deductions for bad debts.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

17

Last year,taxpayer had a $10,000 business loan that was written off.Last year,taxpayer also had an NOL which taxpayer carried back two years and used in its entirety.If taxpayer collects the entire $10,000 during the current year,$10,000 needs to be included in gross income.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

18

Al,who is single,has a gain of $20,000 on the sale of §1244 stock (small business stock)and a loss of $80,000 on the sale of § 1244 stock.As a result,Al has a $10,000 net capital loss and a $50,000 ordinary loss.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

19

A corporation which makes a loan to a shareholder can have a nonbusiness bad debt deduction.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

20

"Other casualty" means casualties similar to those associated with fires,storms,or shipwrecks.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

21

A theft loss is taken in the year the theft occurred.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

22

The cost of repairs to damaged property may be acceptable as a measure of the loss in value of the property.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

23

If a taxpayer receives reimbursement for a casualty loss sustained and deducted in a previous year,the total reimbursement must be included in gross income on the return for the year in which the reimbursement is received.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

24

If an election is made to defer deduction of research expenditures,the amortization period is based on the expected life of the research project.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

25

Losses on rental property are classified as deductions for AGI.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

26

The domestic production activities deduction (DPAD)for 2010 cannot exceed 50% of all W-2 wages paid to employees engaged in qualified domestic production activities by the taxpayer during the tax year.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

27

Research and experimental expenditures do not include expenditures for ordinary testing of materials for quality control.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

28

For tax years beginning in 2010,the domestic production activities deduction (DPAD)for a sole proprietor is calculated by multiplying 9% times the lesser of (1)qualified production activities income (QPAI)or (2)taxable income or alternative minimum taxable income.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

29

A theft loss of investment property is a miscellaneous itemized deduction subject to the 2%-of-AGI floor.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

30

The amount of a loss on insured business use property is reduced by the insurance coverage if no claim is made against the insurer.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

31

If personal casualty losses (after deducting the $100 floor)exceed personal casualty gains in 2010,the itemized deduction is always equal to the losses,to the extent they exceed 10% of adjusted gross income.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

32

If rental property is completely destroyed,the amount of the loss is the adjusted basis of the property at the time of the destruction reduced by $100 ($500 in 2009)and 10% of AGI.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

33

A casualty loss deduction is not allowed for losses resulting from a decline in value rather than an actual loss of property.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

34

Expenses in connection with the acquisition of land are not research and experimental expenditures.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

35

A father cannot claim a casualty on his daughter's personal use property.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

36

If the amount of the insurance recovery for a theft of business property is greater than the asset's fair market value but less than it's adjusted basis,a loss is recognized.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

37

When a nonbusiness casualty loss is spread between two taxable years,the loss in the second year is reduced by 10% of adjusted gross income for the first year.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

38

If qualified production activities income (QPAI)cannot be used in the calculation of the domestic production activities deduction in 2010 because of the taxable income limitation,the product of the amount not allowed multiplied by 9% can be carried over for 5 years.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

39

The amount of loss for partial destruction of business property is the lesser of the adjusted basis or the decline in fair market value.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

40

Taxpayer's home was destroyed by a storm in the current year and the area was declared a disaster area.If the taxpayer elects to treat the loss as having occurred in the prior year,it will still be subject to the 10%-of-AGI reduction based on the AGI of the current year.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

41

On September 3,2009,Able purchased § 1244 stock in Red Corporation for $6,000.On December 31,2009,the stock was worth $8,500.On August 15,2010,Able was notified that the stock was worthless.How should Able report this item on his 2009 and 2010 tax returns?

A)2009-$0;2010-$6,000 ordinary loss.

B)2009-$0;2010-$6,000 long-term capital loss.

C)2009-$2,500 short-term capital loss;2010-$8,500 short-term capital loss.

D)2009-$2,500 short-term capital gain;2010-$3,800 ordinary loss.

E)None of the above.

A)2009-$0;2010-$6,000 ordinary loss.

B)2009-$0;2010-$6,000 long-term capital loss.

C)2009-$2,500 short-term capital loss;2010-$8,500 short-term capital loss.

D)2009-$2,500 short-term capital gain;2010-$3,800 ordinary loss.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

42

On June 2,2009,Fred's TV Sales sold Mark a large HD TV,on account,for $12,000.Fred's TV Sales uses the accrual method.In 2010,when the balance on the account was $8,000,Mark filed for bankruptcy.Fred was notified that he could expect to receive 60 cents on the dollar of the amount owed to him.In 2011,final settlement was made and Fred received $5,000.How much bad debt loss can Fred deduct and in which years?

A)2009-$12,000.

B)2009-$0;2010-$8,000.

C)2009-$0;2010-$3,200;2011-$0.

D)2010-$4,800.

E)None of the above.

A)2009-$12,000.

B)2009-$0;2010-$8,000.

C)2009-$0;2010-$3,200;2011-$0.

D)2010-$4,800.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

43

Jim had a car accident in 2010 in which his car was completely destroyed.At the time of the accident,the car had a fair market value of $30,000 and an adjusted basis of $40,000.Jim used the car 100% of the time for personal use.Jim received an insurance recovery of 80% of the value of the car at the time of the accident.If Jim's AGI for the year is $50,000,determine his deductible loss on the car.

A)$900.

B)$6,000.

C)$10,500.

D)$30,000.

E)None of the above.

A)$900.

B)$6,000.

C)$10,500.

D)$30,000.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

44

A taxpayer must carry any NOL incurred back two years.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

45

On February 20,2009,Bill purchased stock in Pink Corporation (the stock is not small business stock)for $1,000.On May 1,2010,the stock became worthless.During 2010,Bill also had an $8,000 loss on § 1244 small business stock purchased two years ago,a $9,000 loss on a nonbusiness bad debt,and a $5,000 long-term capital gain.How should Bill treat these items on his 2010 tax return?

A)$4,000 long-term capital loss and $9,000 short-term capital loss.

B)$4,000 long-term capital loss and $3,000 short-term capital loss.

C)$8,000 ordinary loss and $3,000 short-term capital loss.

D)$8,000 ordinary loss and $5,000 short-term capital loss.

E)$8,000 long-term capital loss and $6,000 short-term capital loss.

A)$4,000 long-term capital loss and $9,000 short-term capital loss.

B)$4,000 long-term capital loss and $3,000 short-term capital loss.

C)$8,000 ordinary loss and $3,000 short-term capital loss.

D)$8,000 ordinary loss and $5,000 short-term capital loss.

E)$8,000 long-term capital loss and $6,000 short-term capital loss.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

46

Last year,Lucy purchased a $100,000 account receivable for $90,000.During the current year,Lucy collected $87,000 on the account.What are the tax consequences to Lucy associated with the collection of the account receivable? No subsequent collections are expected.

A)$0.

B)$2,000 gain.

C)$3,000 loss.

D)$13,000 loss.

E)None of the above.

A)$0.

B)$2,000 gain.

C)$3,000 loss.

D)$13,000 loss.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

47

Red Corporation incurred a $12,000 bad debt last year.Red Corporation also had an $8,000 long-term capital gain last year.Red's taxable income for last year was $28,000.During the current year,Red Corporation,unexpectedly,collected $5,000 on the debt.How should Red Corporation account for the $5,000 collection?

A)$0 income.

B)$3,000 income.

C)$4,000 income.

D)$5,000 income.

E)None of the above.

A)$0 income.

B)$3,000 income.

C)$4,000 income.

D)$5,000 income.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

48

A theft or other casualty of personal use property can create an NOL for an individual.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

49

A farming NOL may be carried back 5 years.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

50

Jed is an electrician.Jed and his wife are cash basis taxpayers and file a joint return.Jed wired a new house for Alison and billed her $15,000.Alison paid Jed $10,000 and refused to pay the remainder of the bill,claiming the fee to be exorbitant.Jed took Alison to Small Claims Court for the unpaid amount and was awarded a $2,000 judgement.Jed was never able to collect the judgement nor the remainder of the bill from Alison.What amount of loss may Jed deduct in the current year?

A)$0.

B)$2,000.

C)$3,000.

D)$5,000.

E)None of the above.

A)$0.

B)$2,000.

C)$3,000.

D)$5,000.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

51

The amount of a farming loss cannot exceed the amount of the taxpayer's NOL for the taxable year.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

52

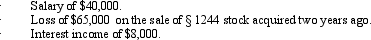

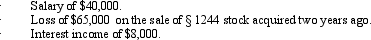

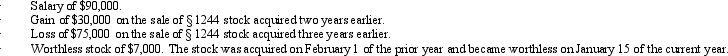

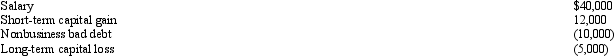

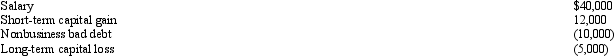

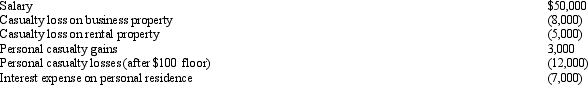

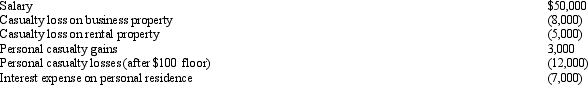

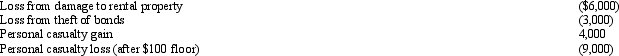

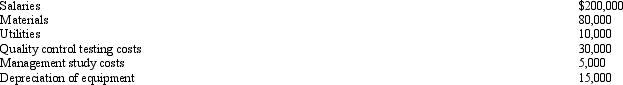

John files a return as a single taxpayer.In 2010,he had the following items:  Determine John's AGI for 2010.

Determine John's AGI for 2010.

A)($5,000).

B)$0.

C)$45,000.

D)$48,000.

E)None of the above.

Determine John's AGI for 2010.

Determine John's AGI for 2010.A)($5,000).

B)$0.

C)$45,000.

D)$48,000.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

53

On July 20,2008,Matt (who files a joint return)purchased 3,000 shares of Orange Corporation stock (the stock is § 1244 small business stock)for $24,000.On November 10,2009,Matt purchased an additional 1,000 shares of Orange Corporation stock for $150,000.On September 15,2010,Matt sold the 4,000 shares of stock for $80,000.How should Matt treat the sale of the stock on his 2010 return?

A)$94,000 ordinary loss.

B)$100,000 ordinary loss;$6,000 net capital gain.

C)$100,000 ordinary loss;$30,000 STCL.

D)$130,000 ordinary loss;$36,000 LTCG.

E)None of the above.

A)$94,000 ordinary loss.

B)$100,000 ordinary loss;$6,000 net capital gain.

C)$100,000 ordinary loss;$30,000 STCL.

D)$130,000 ordinary loss;$36,000 LTCG.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

54

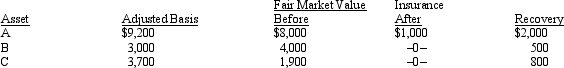

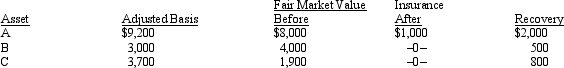

In 2010,Wally had the following insured personal casualty losses (arising from one casualty).Wally also had $48,000 AGI for the year.  Wally's casualty loss deduction is:

Wally's casualty loss deduction is:

A)$4,100.

B)$4,500.

C)$8,600.

D)$9,500.

E)None of the above.

Wally's casualty loss deduction is:

Wally's casualty loss deduction is:A)$4,100.

B)$4,500.

C)$8,600.

D)$9,500.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

55

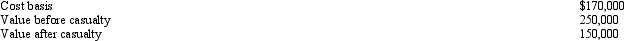

Bruce,who is single,had the following items for the current year:  Determine Bruce's AGI for the current year.

Determine Bruce's AGI for the current year.

A)$37,000.

B)$38,000.

C)$42,000.

D)$47,000.

E)None of the above.

Determine Bruce's AGI for the current year.

Determine Bruce's AGI for the current year.A)$37,000.

B)$38,000.

C)$42,000.

D)$47,000.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

56

Peggy is in the business of factoring accounts receivable.Last year,she purchased a $30,000 account receivable for $25,000.This year,the account was settled for $18,000.How much loss can Peggy deduct and in which year?

A)$5,000 for the current year.

B)$5,000 for the prior year and $7,000 for the current year.

C)$7,000 for the current year.

D)$12,000 for the current year.

E)None of the above.

A)$5,000 for the current year.

B)$5,000 for the prior year and $7,000 for the current year.

C)$7,000 for the current year.

D)$12,000 for the current year.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

57

Two years ago,Gina loaned Tom $50,000.Tom signed a note the terms of which called for monthly payments of $2,000 plus 6% interest on the outstanding balance.Last year,when the balance owing on the loan was $18,000,Tom defaulted on the note.As of the end of last year,there appeared to be no reasonable prospect of Gina recovering the $18,000.As a consequence,Gina claimed the $18,000 as a nonbusiness bad debt.Last year,Gina had AGI of $60,000 which included $5,000 net long-term capital gains and $4,000 of qualified dividends.Gina did not itemize her deductions.During the current year,Tom paid Gina $13,000 in final settlement of the loan.How should Gina account for the payment in the current year?

A)File an amended tax return for last year.

B)Report no income for the current year.

C)Report $8,000 of income for the current year.

D)Report $12,000 of income for the current year.

E)Report $13,000 of income for the current year.

A)File an amended tax return for last year.

B)Report no income for the current year.

C)Report $8,000 of income for the current year.

D)Report $12,000 of income for the current year.

E)Report $13,000 of income for the current year.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

58

Five years ago,Tom loaned his son John $20,000 to start a business.A note was executed with an interest rate of 8%,which is the Federal rate.The note required monthly payments of the interest with the $20,000 due at the end of ten years.John always made the interest payments until last year.During the current year,John notified his father that he was bankrupt and would not be able to repay the $20,000 or the accrued interest of $1,800.Tom is a cash basis taxpayer whose only income is salary and interest income.The proper treatment for the nonpayment of the note is:

A)No deduction.

B)$3,000 deduction.

C)$20,000 deduction.

D)$21,800 deduction.

E)None of the above.

A)No deduction.

B)$3,000 deduction.

C)$20,000 deduction.

D)$21,800 deduction.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following events would produce a deductible loss?

A)Erosion of personal use land due to rain or wind.

B)Termite infestation of a personal residence over a several year period.

C)Damages to personal automobile resulting from a taxpayer's willful negligence.

D)A misplaced diamond ring.

E)None of the above.

A)Erosion of personal use land due to rain or wind.

B)Termite infestation of a personal residence over a several year period.

C)Damages to personal automobile resulting from a taxpayer's willful negligence.

D)A misplaced diamond ring.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

60

Three years ago,Sharon loaned her sister $30,000 to buy a car.A note was issued for the loan with the provision for monthly payments of principal and interest.Last year,Sharon purchased a car from the same dealer,Hank's Auto.As partial payment for the car,the dealer accepted the note from Sharon's sister.At the time Sharon purchased the car,the note had a balance of $18,000.During the current year,Sharon's sister died.Hank's Auto was notified that no further payments on the note would be received.At the time of the notification,the note had a balance due of $15,500.What is the amount of loss,with respect to the note,that Hank's Auto may claim on the current year tax return?

A)$0.

B)$3,000.

C)$15,500.

D)$18,000.

E)None of the above.

A)$0.

B)$3,000.

C)$15,500.

D)$18,000.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

61

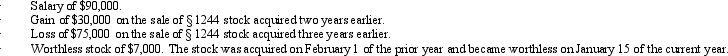

In 2010,Mary had the following items:  Assuming that Mary files as head of household (has one dependent child),determine her taxable income for the current year.

Assuming that Mary files as head of household (has one dependent child),determine her taxable income for the current year.

A)$14,300.

B)$14,700.

C)$19,000.

D)$24,300.

E)None of the above.

Assuming that Mary files as head of household (has one dependent child),determine her taxable income for the current year.

Assuming that Mary files as head of household (has one dependent child),determine her taxable income for the current year.A)$14,300.

B)$14,700.

C)$19,000.

D)$24,300.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

62

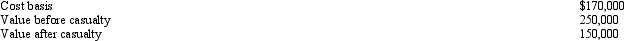

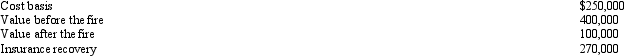

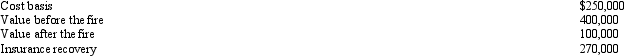

In 2010,Grant's personal residence was damaged by fire.Grant was insured for 90% of his actual loss,and he received the insurance settlement.Grant had adjusted gross income,before considering the casualty item,of $30,000.Pertinent data with respect to the residence follows:  What is Grant's allowable casualty loss deduction?

What is Grant's allowable casualty loss deduction?

A)$0.

B)$6,500.

C)$6,900.

D)$10,000.

E)$80,000.

What is Grant's allowable casualty loss deduction?

What is Grant's allowable casualty loss deduction?A)$0.

B)$6,500.

C)$6,900.

D)$10,000.

E)$80,000.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

63

Norm's car,which he uses 100% for personal purposes,was completely destroyed in an accident in 2010.The car's adjusted basis at the time of the accident was $13,000.Its fair market value was $11,500.The car was covered by a $2,000 deductible insurance policy.Norm did not file a claim against the insurance policy because of a fear that reporting the accident would result in a substantial increase in his insurance rates.His adjusted gross income was $14,000 (before considering the loss).What is Norm's deductible loss?

A)$0.

B)$100.

C)$500.

D)$9,500.

E)None of the above.

A)$0.

B)$100.

C)$500.

D)$9,500.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

64

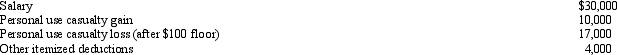

Maria,who is single,had the following items for 2010:

Determine Maria's adjusted gross income for 2010.

Determine Maria's adjusted gross income for 2010.

Determine Maria's adjusted gross income for 2010.

Determine Maria's adjusted gross income for 2010.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

65

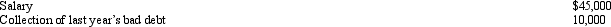

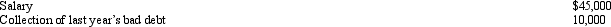

Tonya had the following items for last year:

For the current year,Tonya had the following items:

For the current year,Tonya had the following items:

Determine Tonya's adjusted gross income for the current year.

Determine Tonya's adjusted gross income for the current year.

For the current year,Tonya had the following items:

For the current year,Tonya had the following items: Determine Tonya's adjusted gross income for the current year.

Determine Tonya's adjusted gross income for the current year.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

66

Amber operates her business as a sole proprietorship during 2010.Her domestic production activities deduction (DPAD)before any effect of the wage expense limitation is $70,000.The total W-2 wages that her sole proprietorship pays for the tax year are $110,000.The wages paid to employees not engaged in qualified domestic production activities are $20,000.Amber's DPAD for 2010 is:

A)$0.

B)$45,000.

C)$55,000.

D)$70,000.

E)None of the above.

A)$0.

B)$45,000.

C)$55,000.

D)$70,000.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

67

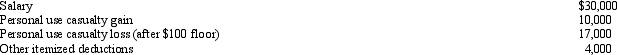

Neal,single and age 37,has the following items for 2010:

Determine Neal's taxable income for 2010.

Determine Neal's taxable income for 2010.

Determine Neal's taxable income for 2010.

Determine Neal's taxable income for 2010.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

68

Ivory,Inc. ,has taxable income of $600,000 and qualified production activities income (QPAI)of $400,000 in 2010.Ivory's domestic production activities deduction is:

A)$24,000.

B)$36,000.

C)$40,000.

D)$54,000.

E)None of the above.

A)$24,000.

B)$36,000.

C)$40,000.

D)$54,000.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

69

Alma is in the business of dairy farming.During the year,one of her barns was completely destroyed by fire.The adjusted basis of the barn was $90,000.The fair market value of the barn before the fire was $75,000.The barn was insured for 95% of its fair market value,and Alma recovered this amount under the insurance policy.Alma has adjusted gross income for the year of $40,000 (before considering the casualty).Determine the amount of loss she can deduct on her tax return for the current year.

A)$3,750.

B)$14,650.

C)$14,750.

D)$18,750.

E)None of the above.

A)$3,750.

B)$14,650.

C)$14,750.

D)$18,750.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

70

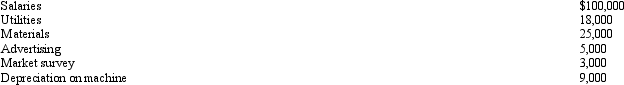

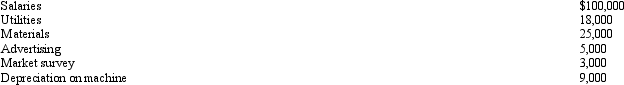

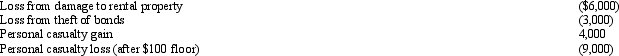

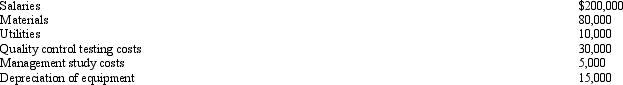

Blue Corporation incurred the following expenses in connection with the development of a new product:  Blue expects to begin selling the product next year.If Blue elects to expense research and experimental expenditures,determine the amount of the deduction for research and experimental expenditures for the current year.

Blue expects to begin selling the product next year.If Blue elects to expense research and experimental expenditures,determine the amount of the deduction for research and experimental expenditures for the current year.

A)$0.

B)$118,000.

C)$143,000.

D)$152,000.

E)$160,000.

Blue expects to begin selling the product next year.If Blue elects to expense research and experimental expenditures,determine the amount of the deduction for research and experimental expenditures for the current year.

Blue expects to begin selling the product next year.If Blue elects to expense research and experimental expenditures,determine the amount of the deduction for research and experimental expenditures for the current year.A)$0.

B)$118,000.

C)$143,000.

D)$152,000.

E)$160,000.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

71

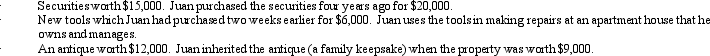

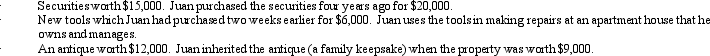

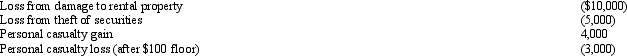

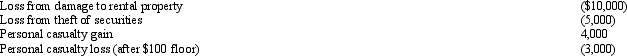

In 2010,Juan's home was burglarized.Juan had the following items stolen:  Juan's homeowner's policy had a $50,000 deductible clause for thefts.If Juan's salary for the year is $60,000,determine the amount of his itemized deductions as a result of the theft.

Juan's homeowner's policy had a $50,000 deductible clause for thefts.If Juan's salary for the year is $60,000,determine the amount of his itemized deductions as a result of the theft.

A)$3,100.

B)$6,000.

C)$23,100.

D)$23,500.

E)None of the above.

Juan's homeowner's policy had a $50,000 deductible clause for thefts.If Juan's salary for the year is $60,000,determine the amount of his itemized deductions as a result of the theft.

Juan's homeowner's policy had a $50,000 deductible clause for thefts.If Juan's salary for the year is $60,000,determine the amount of his itemized deductions as a result of the theft.A)$3,100.

B)$6,000.

C)$23,100.

D)$23,500.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

72

Alicia was involved in an automobile accident in 2010.Her car was used 50% for business and 50% for personal use.The car had originally cost $40,000.At the time of the accident,the car was worth $20,000 and Alicia had taken $8,000 of depreciation.The car was totally destroyed and Alicia had let her car insurance expire.If Alicia's AGI is $50,000 (before considering the loss),determine her itemized deduction for the casualty loss.

A)$2,100.

B)$5,700.

C)$6,100.

D)$16,500.

E)None of the above.

A)$2,100.

B)$5,700.

C)$6,100.

D)$16,500.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

73

In 2010,Theo had a salary of $30,000 and experienced the following losses:  Determine the amount of Theo's itemized deduction from these losses.

Determine the amount of Theo's itemized deduction from these losses.

A)$0.

B)$2,800.

C)$2,900.

D)$4,580.

E)None of the above.

Determine the amount of Theo's itemized deduction from these losses.

Determine the amount of Theo's itemized deduction from these losses.A)$0.

B)$2,800.

C)$2,900.

D)$4,580.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

74

In 2010,Morley,a single taxpayer,had an AGI of $30,000 before considering the following items:  Determine the amount of Morley's itemized deduction from the losses.

Determine the amount of Morley's itemized deduction from the losses.

A)$0.

B)$2,900.

C)$5,120.

D)$5,600.

E)None of the above.

Determine the amount of Morley's itemized deduction from the losses.

Determine the amount of Morley's itemized deduction from the losses.A)$0.

B)$2,900.

C)$5,120.

D)$5,600.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

75

Regarding research and experimental expenditures,which of the following are not qualified expenditures?

A)Costs of improving an existing pilot model.

B)Costs to develop a plant process.

C)Costs of developing a formula.

D)Costs of purchasing a building to be used for research.

E)None of the above.

A)Costs of improving an existing pilot model.

B)Costs to develop a plant process.

C)Costs of developing a formula.

D)Costs of purchasing a building to be used for research.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

76

Last year,Green Corporation incurred the following expenditures in the development of a new plant process:  During the current year,benefits from the project began being realized in March.If Green Corporation elects a 60 month deferral and amortization period,determine the amount of the deduction for the current year.

During the current year,benefits from the project began being realized in March.If Green Corporation elects a 60 month deferral and amortization period,determine the amount of the deduction for the current year.

A)$50,833.

B)$55,833.

C)$56,667.

D)$61,000.

E)None of the above.

During the current year,benefits from the project began being realized in March.If Green Corporation elects a 60 month deferral and amortization period,determine the amount of the deduction for the current year.

During the current year,benefits from the project began being realized in March.If Green Corporation elects a 60 month deferral and amortization period,determine the amount of the deduction for the current year.A)$50,833.

B)$55,833.

C)$56,667.

D)$61,000.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

77

Last year,Sarah (who files as single)had silverware worth $10,000 (basis $6,000)stolen from her home.Sarah's insurance company told her that her policy did not cover the theft.Sarah's other itemized deductions last year were $10,000.She had AGI of $30,000 last year.In August of the current year,Sarah's insurance company decided that Sarah's policy did cover the theft of the silverware and they paid Sarah $5,000.Determine the tax treatment of the $5,000 received by Sarah during the current year.

A)None of the $5,000 should be included in gross income.

B)$2,900 should be included in gross income.

C)$5,000 should be included in gross income.

D)Last year's return should be amended to include the $5,000.

E)None of the above.

A)None of the $5,000 should be included in gross income.

B)$2,900 should be included in gross income.

C)$5,000 should be included in gross income.

D)Last year's return should be amended to include the $5,000.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

78

Cream,Inc.'s taxable income for 2010 before any deduction for an NOL carryforward of $30,000 is $70,000.Cream's qualified production activities income (QPAI)is $60,000.What is the amount of Cream's domestic production activities deduction (DPAD)for 2010?

A)$1,200.

B)$1,800.

C)$2,400.

D)$3,600.

E)None of the above.

A)$1,200.

B)$1,800.

C)$2,400.

D)$3,600.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

79

If a taxpayer has an NOL in 2010 of $20,000,of which $8,000 is attributable to a theft of personal use property,the taxpayer may:

A)Carry all of the NOL of $20,000 back 5 years.

B)Carry all of the NOL of $20,000 back 3 years.

C)Carry $8,000 of the NOL back 3 years and the remainder of the NOL of $12,000 back 2 years.

D)All of the above.

E)None of the above.

A)Carry all of the NOL of $20,000 back 5 years.

B)Carry all of the NOL of $20,000 back 3 years.

C)Carry $8,000 of the NOL back 3 years and the remainder of the NOL of $12,000 back 2 years.

D)All of the above.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

80

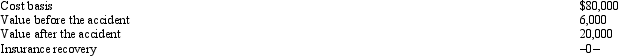

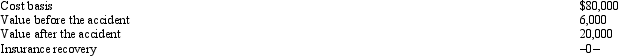

John had adjusted gross income of $60,000.During the year his personal use summer home was damaged by a fire.Pertinent data with respect to the home follows:  John had an accident with his personal use car.As a result of the accident,John was cited with reckless driving and willful negligence.Pertinent data with respect to the car follows:

John had an accident with his personal use car.As a result of the accident,John was cited with reckless driving and willful negligence.Pertinent data with respect to the car follows:

What is John's deductible casualty loss?

What is John's deductible casualty loss?

A)$0.

B)$15,800.

C)$15,900.

D)$35,900.

E)None of the above.

John had an accident with his personal use car.As a result of the accident,John was cited with reckless driving and willful negligence.Pertinent data with respect to the car follows:

John had an accident with his personal use car.As a result of the accident,John was cited with reckless driving and willful negligence.Pertinent data with respect to the car follows: What is John's deductible casualty loss?

What is John's deductible casualty loss?A)$0.

B)$15,800.

C)$15,900.

D)$35,900.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck