Deck 11: Investor Losses

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/94

Play

Full screen (f)

Deck 11: Investor Losses

1

In the current year,Rich has a $40,000 loss from a business he owns.His at-risk amount at the end of the year,prior to considering the current year loss,is $24,000.He will be allowed to deduct the $40,000 loss this year if he is a material participant in the business.

False

2

Judy owns a 20% interest in a partnership (not real estate)in which her at-risk amount was $35,000 at the beginning of the year.The partnership borrowed $50,000 on a recourse note and made a $40,000 profit during the year.Her at-risk amount at the end of the year is $53,000.

True

3

All of a taxpayer's tax credits relating to a passive activity can be utilized when the activity is sold at a loss.

False

4

Dick participates in an activity for 90 hours during the year.He has no employees and there are no other participants.Dick is a material participant.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

5

Sherri owns an interest in a business that is not a passive activity and in which she has $20,000 at risk.If the business incurs a $32,000 loss from operations during the year,this loss will be fully deductible.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

6

Nathan owns Activity A,which produces income,and Activity B,which produces passive losses.From a tax planning perspective,Nathan will be better off if Activity A is passive.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

7

Jack owns a 10% interest in a partnership (not real estate)in which his at-risk amount is $42,000 at the beginning of the year.During the year,the partnership borrows $80,000 on a nonrecourse note and incurs a loss of $60,000 from operations.Jack's at-risk amount at the end of the year is $44,000.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

8

Lucy participates for 405 hours in Activity A and 100 hours in Activity B,both of which are nonrental businesses.Both activities are passive.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

9

Tom participates for 300 hours in Activity A and 250 hours in Activity B,both of which are nonrental businesses.Both activities are active.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

10

Anita owns Activity A which produces active income and Activity B which produces losses.From a tax planning perspective,Anita will be better off if Activity B is a passive activity.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

11

During the year,Bear Company incurs a $25,000 loss on a passive activity,has active income of $17,000,and portfolio income of $12,000.If Bear is a personal service corporation,it may deduct all of the $25,000 passive loss.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

12

In the current year,Louise invests $50,000 for a 10% interest in a passive activity.Her share of the loss this year is $10,000.If this is her only passive activity,the $10,000 loss is suspended for use in a future year.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

13

Kelly,who earns a yearly salary of $120,000,sold an activity with a suspended passive loss of $44,000.The activity was sold at a loss and Kelly has no other passive activities.The suspended loss is not deductible.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

14

Wolf Corporation has active income of $55,000 and a passive loss of $33,000 in the current year.Wolf cannot deduct the $33,000 loss if it is a closely held C corporation that is not a personal service corporation.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

15

Coyote Corporation has active income of $45,000 and a passive loss of $23,000 in the current year.Coyote cannot deduct the $23,000 loss if it is a personal service corporation.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

16

From January through November,Vern participated for 420 hours as a salesman in a partnership in which he owns a 50% interest.The partnership has four full-time employees.During December,Vern spends 110 hours cleaning the store and painting the walls in order to meet the material participation standards.Vern qualifies as a material participant.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

17

A taxpayer is considered to be a material participant in a significant participation activity if he or she spends at least 400 hours in the activity.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

18

Gray Company,a closely held C corporation,incurs a $50,000 loss on a passive activity during the year.The company has active income of $34,000 and portfolio income of $24,000.If Gray is a not a personal service corporation,it may deduct $34,000 of the passive loss.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

19

A taxpayer is considered to be a material participant if he or she spends more than 500 hours in the activity.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

20

Rhonda participates for 95 hours during the year in an activity she owns.She has no employees and is the only participant in the activity.The activity is a significant participation activity.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

21

Kim dies owning a passive activity with a basis of $75,000,a fair market value of $140,000,and suspended losses of $80,000.An $80,000 passive loss can be deducted on Kim's final income tax return.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

22

Lucy owns and actively participates in the operations of an apartment complex that produces a $50,000 loss during the year.Her modified AGI is $125,000 from an active business.Disregarding any at-risk limitation,she may deduct $25,000 of the loss,and the remaining $25,000 is a suspended passive loss.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

23

During the year,Eric earned investment income of $20,000,incurred investment interest expense of $12,500,and incurred other investment expenses of $9,000.Eric may deduct $12,500 of investment interest this year.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

24

Services performed by an employee are treated as being related to a real estate trade or business if the employee performing the services has more than a 5% ownership interest in the employer.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

25

Individuals can deduct from active or portfolio income losses of up to $25,000 from real estate rental activities in which they actively participate.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

26

Bob realized a long-term capital gain of $8,000.In calculating his net investment income,Bob may elect to include the gain in investment income.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

27

Chris receives a gift of a passive activity from his father whose basis was $60,000.Suspended losses related to the activity are $18,000.Chris will be allowed to offset the $18,000 suspended losses against future passive income.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

28

Jerry is a limited partner in a partnership that owns an amusement park.Although he participates for more than 500 hours in the park's operations,he is not considered a material participant.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

29

Bruce owns a small apartment building that produces a $25,000 loss during the year.His AGI before considering the rental loss is $85,000.Bruce must be an active participant with respect to the rental activity in order to deduct the $25,000 loss under the real estate rental exception.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

30

Gail exchanges passive Activity A,which has suspended losses of $15,000,for passive Activity B in a nontaxable exchange.The new owner of passive Activity A can offset the $15,000 suspended losses against passive income in the future.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

31

Paul owns and actively participates in the operations of an apartment building which produces a $40,000 loss during the year.He has AGI of $150,000 from an active business.He may not deduct any of the loss.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

32

Wayne owns a small apartment building that produces a $45,000 loss during the year.His AGI before considering the rental loss is $85,000.Because Wayne is an active participant with respect to the rental activity,he may deduct the $45,000 loss.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

33

Kathy is a full-time educator,but she owns an apartment building and devotes 550 hours to managing the activity.All losses from the rental activity will be considered nonpassive and deductible against active income because she is a real estate professional.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

34

Investment income includes gross income from interest,dividends,annuities,and royalties not derived in the ordinary course of a trade or business;income from a passive activity;and income from a real estate activity in which the taxpayer actively participates.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

35

Joyce owns an activity (not real estate)in which she participates for 100 hours a year;her husband participates for 450 hours.Joyce qualifies as a material participant.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

36

Individuals with modified AGI of $100,000 can deduct against active or portfolio income losses of up to $25,000 from real estate rental activities in which they actively participate.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

37

During the year,Earl earned investment income of $13,500,incurred investment interest expense of $7,700,and other investment expenses of $9,000.Earl may carry over $3,200 of investment interest and deduct it in the future.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

38

Eric makes an installment sale of a passive activity having suspended losses of $40,000.He collects 25% of the sales price in the current year,and will collect 25% in each of the next three years.Eric can deduct $10,000 of the passive loss this year.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

39

In the current year,Abby has AGI of $95,000 and a $40,000 loss from a real estate rental activity in which she is a 15% owner.If she is an active participant,she can deduct $25,000 of the loss.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

40

In 2010,Cindy invested $100,000 for a 25% interest in a limited liability company (LLC)involved in an activity in which she is a material participant.The LLC reported losses of $340,000 in 2010 and $180,000 in 2011 with Cindy's share being $85,000 in 2010 and $45,000 in 2011.How much of the losses can Cindy deduct?

A)$0 in 2010;$0 in 2011.

B)$85,000 in 2010;$0 in 2011.

C)$85,000 in 2010;$15,000 in 2011.

D)$85,000 in 2010;$45,000 in 2011.

E)None of the above.

A)$0 in 2010;$0 in 2011.

B)$85,000 in 2010;$0 in 2011.

C)$85,000 in 2010;$15,000 in 2011.

D)$85,000 in 2010;$45,000 in 2011.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

41

Josh has investments in two passive activities.Activity A,acquired three years ago,produces income in the current year of $60,000.Activity B,acquired last year,produces a loss of $100,000 in the current year.At the beginning of this year,Josh's at-risk amounts in Activities A and B are $10,000 and $100,000,respectively.What is the amount of Josh's suspended passive loss with respect to these activities at the end of the current year?

A)$0.

B)$36,000.

C)$40,000.

D)$100,000.

E)None of the above.

A)$0.

B)$36,000.

C)$40,000.

D)$100,000.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

42

Jed spends 32 hours a week,50 weeks a year,operating a DVD rental store that he owns.He also owns a music store in another city that is operated by a full-time employee.He elects not to group them together as a single activity under the "appropriate economic unit" standard.Jed spends 40 hours per year working at the music store.

A)Neither store is a passive activity.

B)Both stores are passive activities.

C)Only the DVD rental store is a passive activity.

D)Only the music store is a passive activity.

E)None of the above.

A)Neither store is a passive activity.

B)Both stores are passive activities.

C)Only the DVD rental store is a passive activity.

D)Only the music store is a passive activity.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following factors should be considered in determining whether an activity is treated as an appropriate economic unit?

A)The similarities and differences in types of business.

B)The extent of common control.

C)The extent of common ownership.

D)The geographic location.

E)All of the above.

A)The similarities and differences in types of business.

B)The extent of common control.

C)The extent of common ownership.

D)The geographic location.

E)All of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

44

Leigh,who owns a 50% interest in a sporting goods store,was a material participant in the activity for the last fifteen years.She retired from the sporting goods store at the end of last year and will not participate in the activity in the future.However,she continues to be a material participant in an office supply store in which she is a 50% partner.The operations of the sporting goods store resulted in a loss for the current year and Leigh's share of the loss is $40,000.Leigh's share of the income from the office supply store is $75,000.She does not own interests in any other activities.

A)Leigh cannot deduct the $40,000 loss from the sporting goods store because she is not a material participant.

B)Leigh can offset the $40,000 loss from the sporting goods store against the $75,000 of income from the office supply store.

C)Leigh will not be able to deduct any losses from the sporting goods store until future years.

D)Leigh will not be able to deduct any losses from the sporting goods store until she has been retired for at least four years.

E)None of the above.

A)Leigh cannot deduct the $40,000 loss from the sporting goods store because she is not a material participant.

B)Leigh can offset the $40,000 loss from the sporting goods store against the $75,000 of income from the office supply store.

C)Leigh will not be able to deduct any losses from the sporting goods store until future years.

D)Leigh will not be able to deduct any losses from the sporting goods store until she has been retired for at least four years.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

45

Jenny spends 32 hours a week,50 weeks a year,operating a DVD rental store that she owns.She also owns a music store in another city that is operated by a full-time employee.Jenny spends 140 hours per year working at the music store.She elects not to group them together as a single activity under the "appropriate economic unit" standard.

A)Neither store is a passive activity.

B)Both stores are passive activities.

C)Only the DVD rental store is a passive activity.

D)Only the music store is a passive activity.

E)None of the above.

A)Neither store is a passive activity.

B)Both stores are passive activities.

C)Only the DVD rental store is a passive activity.

D)Only the music store is a passive activity.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

46

Maria,who owns a 50% interest in a restaurant,has been a material participant in the restaurant activity for the last 20 years.She retired from the restaurant at the end of last year and will not participate in the restaurant activity in the future.However,she continues to be a material participant in a retail store in which she is a 50% partner.The restaurant operations produce a loss for the current year,and Maria's share of the loss is $80,000.Her share of the income from the retail store is $150,000.She does not own interests in any other activities.

A)Maria cannot deduct the $80,000 loss from the restaurant because she is not a material participant.

B)Maria can offset the $80,000 loss against the $150,000 of income from the retail store.

C)Maria will not be able to deduct any losses from the restaurant until she has been retired for at least three years.

D)Assuming Maria continues to hold the interest in the restaurant,she will always treat the losses as active.

E)None of the above.

A)Maria cannot deduct the $80,000 loss from the restaurant because she is not a material participant.

B)Maria can offset the $80,000 loss against the $150,000 of income from the retail store.

C)Maria will not be able to deduct any losses from the restaurant until she has been retired for at least three years.

D)Assuming Maria continues to hold the interest in the restaurant,she will always treat the losses as active.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

47

Tess owns a building in which she rents apartments to tenants and operates a restaurant.Which of the following statements is incorrect?

A)If 60% of Tess's gross income is from apartment rentals and 40% is from the restaurant,the rental operation and the restaurant business must be treated as separate activities.

B)If 95% of Tess's gross income is from apartment rentals and 5% is from the restaurant,she may treat the rental operation and the restaurant business as a single activity that is a rental activity.

C)If 5% of Tess's gross income is from apartment rentals and 95% is from the restaurant,she may treat the rental operation and the restaurant business as a single activity that is not a rental activity.

D)If 98% of Tess's gross income is from apartment rentals and 2% is from the restaurant,the rental operation and the restaurant business must be treated as a single activity that is not a rental activity.

E)None of the above.

A)If 60% of Tess's gross income is from apartment rentals and 40% is from the restaurant,the rental operation and the restaurant business must be treated as separate activities.

B)If 95% of Tess's gross income is from apartment rentals and 5% is from the restaurant,she may treat the rental operation and the restaurant business as a single activity that is a rental activity.

C)If 5% of Tess's gross income is from apartment rentals and 95% is from the restaurant,she may treat the rental operation and the restaurant business as a single activity that is not a rental activity.

D)If 98% of Tess's gross income is from apartment rentals and 2% is from the restaurant,the rental operation and the restaurant business must be treated as a single activity that is not a rental activity.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following is not a factor that should be considered in determining whether an activity is treated as an appropriate economic unit?

A)The interdependencies between the activities.

B)The extent of common control.

C)The extent of common ownership.

D)The geographical location.

E)All of the above are relevant factors.

A)The interdependencies between the activities.

B)The extent of common control.

C)The extent of common ownership.

D)The geographical location.

E)All of the above are relevant factors.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

49

Carl,a physician,earns $200,000 from his medical practice in the current year.He receives $45,000 in dividends and interest during the year as well as $5,000 of income from a passive activity.In addition,he incurs a loss of $50,000 from an investment in a passive activity.What is Carl's AGI for the current year after considering the passive investment?

A)$195,000.

B)$200,000.

C)$240,000.

D)$245,000.

E)None of the above.

A)$195,000.

B)$200,000.

C)$240,000.

D)$245,000.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

50

Tara owns a shoe store and a bookstore.Both businesses are operated in a mall.She also owns a restaurant across the street and a jewelry store several blocks away.

A)All four businesses can be treated as a single activity if Tara elects to do so.

B)Only the shoe store and bookstore can be treated as a single activity,the restaurant must be treated as a separate activity,and the jewelry store must be treated as a separate activity.

C)The shoe store,bookstore,and restaurant can be treated as a single activity,and the jewelry store must be treated as a separate activity.

D)All four businesses must be treated as separate activities.

E)None of the above.

A)All four businesses can be treated as a single activity if Tara elects to do so.

B)Only the shoe store and bookstore can be treated as a single activity,the restaurant must be treated as a separate activity,and the jewelry store must be treated as a separate activity.

C)The shoe store,bookstore,and restaurant can be treated as a single activity,and the jewelry store must be treated as a separate activity.

D)All four businesses must be treated as separate activities.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

51

White Corporation,a closely held personal service corporation,has $150,000 of passive losses,$120,000 of active business income,and $30,000 of portfolio income.How much of the passive loss may White Corporation deduct?

A)$0.

B)$30,000.

C)$120,000.

D)$150,000.

E)None of the above.

A)$0.

B)$30,000.

C)$120,000.

D)$150,000.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

52

Nell sells a passive activity with an adjusted basis of $45,000 for $105,000.Suspended losses attributable to this property total $45,000.The total gain and the taxable gain are:

A)$60,000 total gain;$105,000 taxable gain.

B)$10,000 total gain;$15,000 taxable gain.

C)$60,000 total gain;$0 taxable gain.

D)$60,000 total gain;$15,000 taxable gain.

E)None of the above.

A)$60,000 total gain;$105,000 taxable gain.

B)$10,000 total gain;$15,000 taxable gain.

C)$60,000 total gain;$0 taxable gain.

D)$60,000 total gain;$15,000 taxable gain.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

53

Josh has investments in two passive activities.Activity A (acquired three years ago)produces income of $30,000 this year,while Activity B (acquired two years ago)produces a loss of $50,000.What is the amount of Josh's suspended loss for the year?

A)$0.

B)$18,000.

C)$20,000.

D)$50,000.

E)None of the above.

A)$0.

B)$18,000.

C)$20,000.

D)$50,000.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

54

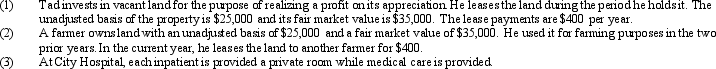

Irving invests in vacant land for the purpose of realizing a profit on its appreciation.He leases the land during the period he holds it.The unadjusted basis of the property is $25,000 and its fair market value is $35,000.The lease payments are $400 per year.

A)The leasing activity will be treated as a rental activity and will be treated as a passive activity regardless of how many hours Irving participates.

B)The leasing activity will be treated as a rental activity and will not be treated as a passive activity if Irving qualifies as a real estate professional.

C)The leasing activity will not be treated as a rental activity.

D)The leasing activity will be treated as a rental activity and will not be treated as a passive activity if Irving devotes more than 500 hours to the activity.

E)None of the above.

A)The leasing activity will be treated as a rental activity and will be treated as a passive activity regardless of how many hours Irving participates.

B)The leasing activity will be treated as a rental activity and will not be treated as a passive activity if Irving qualifies as a real estate professional.

C)The leasing activity will not be treated as a rental activity.

D)The leasing activity will be treated as a rental activity and will not be treated as a passive activity if Irving devotes more than 500 hours to the activity.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

55

In the current year,Crow Corporation,a closely held C corporation that is not a personal service corporation,has $100,000 of passive losses,$80,000 of active business income,and $20,000 of portfolio income.How much of the passive loss may Crow deduct in the current year?

A)$0.

B)$20,000.

C)$80,000.

D)$100,000.

E)None of the above

A)$0.

B)$20,000.

C)$80,000.

D)$100,000.

E)None of the above

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

56

In 2010,Joanne invested $90,000 for a 20% interest in a limited liability company (LLC)in which she is a material participant.The LLC reported losses of $340,000 in 2010 and $180,000 in 2011.Joanne's share of the LLC's losses was $68,000 in 2010 and $36,000 in 2011.How much of these losses can Joanne deduct?

A)$68,000 in 2010,$36,000 in 2011.

B)$68,000 in 2010,$22,000 in 2011.

C)$0 in 2010,$0 in 2011.

D)$68,000 in 2010,$0 in 2011.

E)None of the above.

A)$68,000 in 2010,$36,000 in 2011.

B)$68,000 in 2010,$22,000 in 2011.

C)$0 in 2010,$0 in 2011.

D)$68,000 in 2010,$0 in 2011.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

57

In 2010,Kipp invested $65,000 for a 30% interest in a partnership conducting a passive activity.The partnership reported losses of $200,000 in 2010 and $100,000 in 2011,Kipp's share being $60,000 in 2010 and $30,000 in 2011.How much of the losses from the partnership can Kipp deduct assuming he owns no other investments and does not participate in the partnership's operations?

A)$0 in 2010;$30,000 in 2011.

B)$60,000 in 2010;$30,000 in 2011.

C)$60,000 in 2010;$5,000 in 2011.

D)$60,000 in 2010;$0 in 2011.

E)None of the above.

A)$0 in 2010;$30,000 in 2011.

B)$60,000 in 2010;$30,000 in 2011.

C)$60,000 in 2010;$5,000 in 2011.

D)$60,000 in 2010;$0 in 2011.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

58

Ned,a college professor,owns a separate business (not real estate)in which he participates in the current year.He has one employee who works part-time in the business.

A)If Ned participates for 120 hours and the employee participates for 120 hours during the year,Ned does not qualify as a material participant.

B)If Ned participates for 95 hours and the employee participates for 5 hours during the year,Ned probably does not qualify as material participant.

C)If Ned participates for 500 hours and the employee participates for 520 hours during the year,Ned qualifies as material participant.

D)If Ned participates for 600 hours and the employee participates for 2,000 hours during the year,Ned qualifies as a material participant.

E)None of the above.

A)If Ned participates for 120 hours and the employee participates for 120 hours during the year,Ned does not qualify as a material participant.

B)If Ned participates for 95 hours and the employee participates for 5 hours during the year,Ned probably does not qualify as material participant.

C)If Ned participates for 500 hours and the employee participates for 520 hours during the year,Ned qualifies as material participant.

D)If Ned participates for 600 hours and the employee participates for 2,000 hours during the year,Ned qualifies as a material participant.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following decreases a taxpayer's at-risk amount?

A)Cash and the adjusted basis of property contributed to the activity.

B)Amounts borrowed for use in the activity for which the taxpayer is personally liable or has pledged as security property not used in the activity.

C)Taxpayer's share of amounts borrowed for use in the activity that is qualified nonrecourse financing.

D)Taxpayer's share of the activity's income.

E)None of the above.

A)Cash and the adjusted basis of property contributed to the activity.

B)Amounts borrowed for use in the activity for which the taxpayer is personally liable or has pledged as security property not used in the activity.

C)Taxpayer's share of amounts borrowed for use in the activity that is qualified nonrecourse financing.

D)Taxpayer's share of the activity's income.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

60

Nick,an attorney,owns a separate business (not real estate)in which he participates.He has one employee who works part-time in the business.

A)If Nick participates for 500 hours and the employee participates for 520 hours during the year,Nick qualifies as a material participant.

B)If Nick participates for 600 hours and the employee participates for 1,000 hours during the year,Nick qualifies as a material participant.

C)If Nick participates for 120 hours and the employee participates for 120 hours during the year,Nick does not qualify as a material participant.

D)If Nick participates for 95 hours and the employee participates for 5 hours during the year,Nick probably does not qualify as a material participant.

E)None of the above.

A)If Nick participates for 500 hours and the employee participates for 520 hours during the year,Nick qualifies as a material participant.

B)If Nick participates for 600 hours and the employee participates for 1,000 hours during the year,Nick qualifies as a material participant.

C)If Nick participates for 120 hours and the employee participates for 120 hours during the year,Nick does not qualify as a material participant.

D)If Nick participates for 95 hours and the employee participates for 5 hours during the year,Nick probably does not qualify as a material participant.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

61

Wes's at-risk amount in a passive activity is $25,000 at the beginning of the current year.His current loss from the activity is $35,000 and he has no passive activity income.At the end of the current year,which of the following statements is incorrect?

A)Wes has a loss of $25,000 suspended under the passive loss rules.

B)Wes has an at-risk amount in the activity of $0.

C)Wes has a loss of $10,000 suspended under the at-risk rules.

D)Wes has a loss of $35,000 suspended under the passive loss rules.

E)None of the above is incorrect.

A)Wes has a loss of $25,000 suspended under the passive loss rules.

B)Wes has an at-risk amount in the activity of $0.

C)Wes has a loss of $10,000 suspended under the at-risk rules.

D)Wes has a loss of $35,000 suspended under the passive loss rules.

E)None of the above is incorrect.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

62

Anne sells a rental house for $100,000 that has an adjusted basis of $55,000.During the years of her ownership,$60,000 of losses have been incurred that were suspended under the passive activity loss rules.Determine the tax treatment to Anne on the disposition of the property.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

63

Josie,an unmarried taxpayer,has $155,000 in salary,$10,000 in income from a limited partnership,and a $26,000 passive loss from a real estate rental activity in which she actively participates.If her modified adjusted gross income is $155,000,how much of the $26,000 loss is deductible?

A)$0.

B)$10,000.

C)$25,000.

D)$26,000.

E)None of the above.

A)$0.

B)$10,000.

C)$25,000.

D)$26,000.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

64

Identify from the list below the type of disposition of a passive activity where the taxpayer keeps the suspended losses of the disposed activity and utilizes them on a subsequent taxable disposition.

A)Disposition of a passive activity by gift.

B)Nontaxable exchange of a passive activity.

C)Disposition of a passive activity at death.

D)Installment sale of a passive activity.

E)None of the above.

A)Disposition of a passive activity by gift.

B)Nontaxable exchange of a passive activity.

C)Disposition of a passive activity at death.

D)Installment sale of a passive activity.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

65

Tony is married and files a joint tax return.He has investment interest expense of $190,000 on a loan made to him to purchase a parcel of unimproved land.His income from investments (interest and annuities)totaled $36,000.After reducing his miscellaneous deductions by the applicable 2% floor,the deductible portion amounted to $5,600.In addition to $2,800 of investment expenses included in miscellaneous deductions,Tony paid $7,200 of real estate taxes on the unimproved land.Tony also has a $9,000 net capital gain from the sale of another parcel of unimproved land.Calculate Tony's maximum investment interest deduction for the year.

A)$190,000.

B)$36,000.

C)$35,000.

D)$26,000.

E)None of the above.

A)$190,000.

B)$36,000.

C)$35,000.

D)$26,000.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

66

Kim made a gift to Sam of a passive activity (adjusted basis of $50,000,suspended losses of $20,000,and a fair market value of $80,000).No gift tax resulted from the transfer.

A)Sam's adjusted basis is $80,000.

B)Sam's adjusted basis is $50,000,and Sam can deduct the $20,000 of suspended losses in the future.

C)Sam's adjusted basis is $80,000,and Sam can deduct the $20,000 of suspended losses in the future.

D)Sam's adjusted basis is $50,000,and the suspended losses are lost.

E)None of the above.

A)Sam's adjusted basis is $80,000.

B)Sam's adjusted basis is $50,000,and Sam can deduct the $20,000 of suspended losses in the future.

C)Sam's adjusted basis is $80,000,and Sam can deduct the $20,000 of suspended losses in the future.

D)Sam's adjusted basis is $50,000,and the suspended losses are lost.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

67

In 2010,Emily invests $100,000 in a limited partnership that is not a passive activity.During 2010,her share of the partnership loss is $70,000.In 2011,her share of the partnership loss is $50,000.How much can Emily deduct in 2010 and 2011?

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

68

Kate dies owning a passive activity with an adjusted basis of $100,000.Its fair market value at that date is $130,000.Suspended losses relating to the property were $45,000.

A)The heir's adjusted basis is $130,000,and Kate's final deduction is $15,000.

B)The heir's adjusted basis is $130,000,and Kate's final deduction is $45,000.

C)The heir's adjusted basis is $100,000,and Kate's final deduction is $45,000.

D)The heir's adjusted basis is $175,000,and Kate has no final deduction.

E)None of the above.

A)The heir's adjusted basis is $130,000,and Kate's final deduction is $15,000.

B)The heir's adjusted basis is $130,000,and Kate's final deduction is $45,000.

C)The heir's adjusted basis is $100,000,and Kate's final deduction is $45,000.

D)The heir's adjusted basis is $175,000,and Kate has no final deduction.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

69

Jon owns an apartment building in which he is a material participant and a computer consulting business.Of the 2,000 hours he spends on these activities during the year,55% of the time is spent operating the apartment building and 45% of the time is spent in the computer consulting business.

A)The computer consulting business is a passive activity but the apartment building is not.

B)The apartment building is a passive activity but the computer consulting business is not.

C)Both the apartment building and the computer consulting business are passive activities.

D)Neither the apartment building nor the computer consulting business is a passive activity.

E)None of the above.

A)The computer consulting business is a passive activity but the apartment building is not.

B)The apartment building is a passive activity but the computer consulting business is not.

C)Both the apartment building and the computer consulting business are passive activities.

D)Neither the apartment building nor the computer consulting business is a passive activity.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

70

Vic's at-risk amount in a passive activity is $200,000 at the beginning of the current year.His current loss from the activity is $80,000.Vic had no passive activity income during the year.At the end of the current year:

A)Vic has an at-risk amount in the activity of $120,000 and a suspended passive loss of $80,000.

B)Vic has an at-risk amount in the activity of $200,000 and a suspended passive loss of $80,000.

C)Vic has an at-risk amount in the activity of $120,000 and no suspended passive loss.

D)Vic has an at-risk amount in the activity of $200,000 and no suspended passive loss.

E)None of the above.

A)Vic has an at-risk amount in the activity of $120,000 and a suspended passive loss of $80,000.

B)Vic has an at-risk amount in the activity of $200,000 and a suspended passive loss of $80,000.

C)Vic has an at-risk amount in the activity of $120,000 and no suspended passive loss.

D)Vic has an at-risk amount in the activity of $200,000 and no suspended passive loss.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

71

Several years ago,Joy acquired a passive activity.Until 2008,the activity was profitable.Joy's at-risk amount at the beginning of 2008 was $250,000.The activity produced losses of $100,000 in 2008,$80,000 in 2009,and $90,000 in 2010.During the same period,no passive income was recognized.How much is suspended under the at-risk rules and the passive loss rules at the beginning of 2011? At-risk Passive loss

A)$0 $270,000.

B)$20,000 $250,000.

C)$30,000 $240,000.

D)$260,000 $10,000.

E)None of the above.

A)$0 $270,000.

B)$20,000 $250,000.

C)$30,000 $240,000.

D)$260,000 $10,000.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

72

Carmen,a single taxpayer,has $80,000 in salary,$10,000 in income from a limited partnership,and a $30,000 passive loss from a real estate rental activity in which she actively participates.Her modified adjusted gross income is $80,000.Of the $30,000 loss,Carmen may deduct:

A)$0.

B)$10,000.

C)$25,000.

D)$30,000.

E)Some other amount.

A)$0.

B)$10,000.

C)$25,000.

D)$30,000.

E)Some other amount.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

73

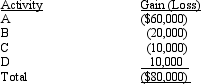

Hugh has four passive activities.The following income and losses are generated in the current year.

How much of the $80,000 net passive loss can Hugh deduct this year? Calculate the suspended losses (by activity).

How much of the $80,000 net passive loss can Hugh deduct this year? Calculate the suspended losses (by activity).

How much of the $80,000 net passive loss can Hugh deduct this year? Calculate the suspended losses (by activity).

How much of the $80,000 net passive loss can Hugh deduct this year? Calculate the suspended losses (by activity).

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

74

In 2010,Jean earns a salary of $150,000 and invests $20,000 for a 20% interest in a partnership not subject to the passive loss rules.Through the use of $400,000 of nonrecourse financing,the partnership acquires assets worth $500,000.The activity produces a loss of $75,000,of which Jean's share is $15,000.In 2011,Jean's share of the loss from the partnership is $7,500.How much of the loss from the partnership can Jean deduct?

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

75

In 2009,Kelly,who earns a salary of $200,000,invests $40,000 for a 20% interest in a partnership not subject to the passive loss rules.Through the use of $800,000 of nonrecourse financing,the partnership acquires assets worth $1 million.Depreciation,interest,and other deductions related to the activity produce a loss of $150,000,of which Kelly's share is $30,000.In 2010,Kelly's share of the loss from the partnership is $15,000.How much of the loss from the partnership can Kelly deduct?

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

76

Joyce,an attorney,earns $100,000 from her law practice in the current year.In addition,she receives $35,000 in dividends and interest during the year.Further,she incurs a loss of $35,000 from an investment in a passive activity.What is Joyce's AGI for the year after considering the passive investment?

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

77

Rita earns a salary of $150,000,and invests $40,000 for a 20% interest in a passive activity.Operations of the activity result in a loss of $250,000,of which Rita's share is $50,000.How is her loss characterized?

A)$40,000 is suspended under the passive loss rules and $10,000 is suspended under the at-risk rules.

B)$40,000 is suspended under the at-risk rules and $10,000 is suspended under the passive loss rules.

C)$50,000 is suspended under the passive loss rules.

D)$50,000 is suspended under the at-risk rules.

E)None of the above.

A)$40,000 is suspended under the passive loss rules and $10,000 is suspended under the at-risk rules.

B)$40,000 is suspended under the at-risk rules and $10,000 is suspended under the passive loss rules.

C)$50,000 is suspended under the passive loss rules.

D)$50,000 is suspended under the at-risk rules.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

78

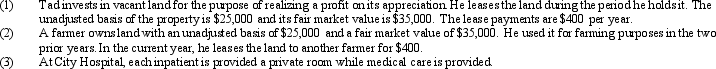

Consider the following three statements:  In which of the three cases above could the rental activity automatically be considered a passive activity?

In which of the three cases above could the rental activity automatically be considered a passive activity?

A)Case 1 only.

B)Case 2 only.

C)Case 3 only.

D)Cases 1,2,and 3.

E)None of the above.

In which of the three cases above could the rental activity automatically be considered a passive activity?

In which of the three cases above could the rental activity automatically be considered a passive activity?A)Case 1 only.

B)Case 2 only.

C)Case 3 only.

D)Cases 1,2,and 3.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

79

Rachel acquired a passive activity several years ago.Until 2007,the activity was profitable,and Rachel's at-risk amount at the beginning of 2007 was $300,000.The activity produced losses for Rachel of $80,000 in 2007,$50,000 in 2008,and $70,000 in 2009.In 2010,the activity produced income of $90,000.How much is Rachel's suspended passive loss at the beginning of 2011?

A)$150,000.

B)$110,000.

C)$60,000.

D)$0.

E)None of the above.

A)$150,000.

B)$110,000.

C)$60,000.

D)$0.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

80

Ramon incurs $55,400 of interest expense this year related to his investments.His investment income includes $23,000 of interest and a $25,000 net capital gain on the sale of securities.Ramon has asked you to compute the amount of his deduction for investment interest,taking into consideration any options he might have.The maximum amount of Ramon's investment interest expense deduction for the year is:

A)$13,000.

B)$23,000.

C)$48,000.

D)$55,400.

E)None of the above.

A)$13,000.

B)$23,000.

C)$48,000.

D)$55,400.

E)None of the above.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck