Deck 16: Accounting Periods and Methods

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/86

Play

Full screen (f)

Deck 16: Accounting Periods and Methods

1

Snow Corporation was a calendar year corporation that sold all of its assets and liquidated as of April 30,2010.The corporation is not required to annualize its income for its final year of operations.

True

2

A partnership can elect to use a tax year other than a calendar year if the partnership's CPA is too busy to prepare a calendar year return.

False

3

A retailer must actually receive a claim for refund from the customer before a deduction can be taken for the refund.

True

4

A CPA practice that is incorporated earns two-thirds of its annual revenues in the months of February,March,and April.Because the CPA practice is a professional services corporation (PSC),it must use a calendar year to report its income.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

5

A C corporation provides office janitorial services to various businesses.The corporation has average annual gross receipts of $2,500,000.The corporation can use the cash method of accounting.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

6

The DEF Partnership had three equal partners when it was formed.Partners D and E were calendar year taxpayers and Partner F's tax year ended on June 30th before he joined the partnership.Partner F was required to change his tax year to end on December 31st upon joining the partnership.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

7

Laura Corporation changed its tax year-end from June 30th to December 31st in 2010.The income for the period July 1,2010 through December 31,2010 was $45,000.The corporate tax rate is 15% on the first $50,000 of income,25% on income from $50,001 to $75,000,and 34% on income from $75,001 to $100,000.A portion of Laura's July - December 2010 income will be taxed at 34%.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

8

In 2010,T Corporation changed its tax year from ending each September 30th to ending each December 31st.The corporation earned $25,000 during the period October 1,2010 through December 31,2010.The tax on the annualized income for the short period will be greater than the tax on $25,000 when the tax rates are progressive.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

9

A calendar year,cash basis corporation began business on October 1,2010 and paid $2,400 for a 12-month liability insurance policy.The corporation can deduct $2,400 as insurance expense for its first tax year ending on December 31,2010.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

10

A disadvantage to using the accrual method of accounting,as compared to the cash method,is that under the accrual method the income may be recognized before it is actually collected.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

11

Ted,a cash basis taxpayer,received a $100,000 bonus in 2010 when he was in the 35% marginal tax bracket.In 2011,when Ted was in the 28% marginal tax bracket,it was discovered that the bonus was incorrectly computed,and Ted was required to refund $25,000 to his employer.As a result of the refund,Ted can reduce his 2011 tax liability by $8,750 (.35 ´ $25,000).

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

12

The Seagull Partnership has three equal partners.Partner A's tax year ends June 30th,and Partners B and C use a calendar year.If the partnership uses the calendar year to report its income,when Partner A files his tax return for his tax year ending June 30,2011,he will include his share of partnership income for the period July 1,2010 through June 30,2011.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

13

A C corporation must use a calendar year as its tax year unless the corporation has a business reason for using a tax year that is not a calendar year.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

14

For purposes of determining the partnership's tax year,there may be more than one principal partner.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

15

Red Corporation and Green Corporation are equal partners in the R & G Partnership.Red Corporation's tax year ends September 30th,and Green Corporation is a calendar year taxpayer.R & G Partnership must use September 30th as its tax year,unless it has a business purpose for using a different tax year.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

16

An S corporation's tax year,generally,is determined by the tax year of its principal shareholders.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

17

Alice,Inc. ,is an S corporation that has been in business for five years.Its annual gross receipts have never exceeded $1 million.The corporation operates a retail store and also owns rental property.The sales from the retail store and the rental income may be reported by the cash method,unless Alice previously elected the accrual method.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

18

In 2003,a medical doctor who incorporated his practice elected a fiscal year ending September 30th.During the fiscal year ended September 30,2010,he received a salary of $180,000.During the period from October 1,2010 to December 31,2010 the corporation paid the doctor a total salary of $40,000,and paid him $200,000 of salary in the following 9 months.The corporation's salary deduction for the fiscal year ending September 30,2011,is $240,000.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

19

A doctor's incorporated medical practice,generally,must have a business purpose for using a tax year that does not end on December 31.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

20

Franklin Company began business in 2008 and has consistently used the cash method to report income from the sale of inventory in income tax returns filed for 2008 through 2010.As a result of an audit by the IRS,Franklin was required to change to the accrual method of accounting beginning with 2011.The accounts receivable and inventory on hand at the end of 2010 are treated as a positive adjustment to income and the accounts payable for inventory at the end of 2010 is a negative adjustment to income.These adjustments result from changing accounting methods and must be included in the 2010 taxable income.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

21

If an installment sale contract does not charge interest on the sale of a capital asset,the IRS will impute interest and thereby increase the taxpayer's capital gain and interest income.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following taxpayers is required to use the accrual method of accounting?

A)A retail business with average annual gross receipts of $800,000.

B)A medical doctor with average annual gross receipts of $2 million.

C)An insurance agency with average annual gross receipts of $2 million.

D)All of the above are required to use the accrual method.

E)None of the above is required to use the accrual method.

A)A retail business with average annual gross receipts of $800,000.

B)A medical doctor with average annual gross receipts of $2 million.

C)An insurance agency with average annual gross receipts of $2 million.

D)All of the above are required to use the accrual method.

E)None of the above is required to use the accrual method.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

23

For a taxpayer who is required to use the percentage of completion method,the taxpayer can elect to defer the recognition of income and the related costs until the taxable year in which cumulative contract costs are at least 10 percent of the estimated contract costs.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following statements regarding a 52-53 week tax year is not correct?

A)The year-end must be the same day of the week in all years.

B)Some tax years will include more than 366 calendar days.

C)Whether the particular tax year includes 52 weeks or 53 weeks is not elective.

D)All of the above are correct.

E)None of the above is correct.

A)The year-end must be the same day of the week in all years.

B)Some tax years will include more than 366 calendar days.

C)Whether the particular tax year includes 52 weeks or 53 weeks is not elective.

D)All of the above are correct.

E)None of the above is correct.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

25

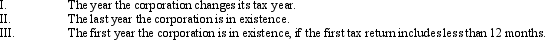

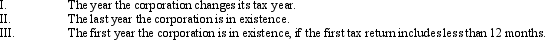

A C corporation is required to annualize its income:

A)Only I is true.

B)Only III is true.

C)Only I and II are true.

D)Only II and III are true.

E)I,II,and II are true.

A)Only I is true.

B)Only III is true.

C)Only I and II are true.

D)Only II and III are true.

E)I,II,and II are true.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

26

In 2010,Cashmere Construction Company enters into a contract to build a beach cottage for Martha and Rob for a total price of $500,000.Cashmere estimates the total cost to complete the cottage to be $400,000.In 2010,Cashmere incurred $300,000 of costs on the contract,and in 2011 the contract was completed at a total cost of $425,000.Cashmere is not required to recognize any income from the contract until 2011.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

27

Gold Corporation,Silver Corporation,and Platinum Corporation are equal partners in the GSP Partnership,which was formed on July 1,2010.Gold and Silver uses a calendar tax year,and Platinum's tax year ends September 30.GSP is not a seasonal business.

A)GSP may elect its tax year without regard to the partners' tax years.

B)GSP must use a tax year ending June 30th,and the partners must change their tax years to end on June 30th.

C)GSP must use a tax year ending December 31st and Platinum must change its tax year to December 31st.

D)GSP must use a tax year ending December 31st,and Platinum can retain its tax year ending September 30th.

E)None of the above.

A)GSP may elect its tax year without regard to the partners' tax years.

B)GSP must use a tax year ending June 30th,and the partners must change their tax years to end on June 30th.

C)GSP must use a tax year ending December 31st and Platinum must change its tax year to December 31st.

D)GSP must use a tax year ending December 31st,and Platinum can retain its tax year ending September 30th.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

28

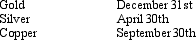

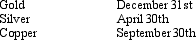

Gold Corporation,Silver Corporation,and Copper Corporation are equal partners in the GSC Partnership.The partners' tax year-ends are as follows:

A)The partnership is free to elect any tax year.

B)The partnership may use any of the 3 year-end dates that its partners use.

C)The partnership must use a September 30th year-end.

D)The partnership must use a April 30th year-end.

E)None of the above.

A)The partnership is free to elect any tax year.

B)The partnership may use any of the 3 year-end dates that its partners use.

C)The partnership must use a September 30th year-end.

D)The partnership must use a April 30th year-end.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

29

Purple Corporation,a personal service corporation (PSC),adopted a fiscal year ending September 30th.The sole shareholder of the corporation is a calendar year taxpayer.During the fiscal year ending September 30,2010,the shareholder-employee received $120,000 salary.The corporation paid the shareholder-employee a salary of $15,000 during the period beginning October 1,2010 through December 31,2010.

A)The corporation salary expense for the fiscal year ending September 30,2011 is limited to $120,000.

B)The corporation salary expense for the fiscal year ending September 30,2011 is limited to $135,000.

C)The corporation salary expense for the fiscal year ending September 30,2011 is limited to $60,000.

D)The corporation must switch to a calendar year.

E)None of the above.

A)The corporation salary expense for the fiscal year ending September 30,2011 is limited to $120,000.

B)The corporation salary expense for the fiscal year ending September 30,2011 is limited to $135,000.

C)The corporation salary expense for the fiscal year ending September 30,2011 is limited to $60,000.

D)The corporation must switch to a calendar year.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

30

Sandstone,Inc. ,has consistently included some factory overhead as a current expense,rather than as a cost of producing goods.As a result,the beginning inventory for 2010 is understated by $30,000.If Sandstone voluntarily changes accounting methods effective January 1,2010,the adjustment to the inventory is a § 481 adjustment and $7,500 must be added to taxable income for each year 2010,2011,2012,and 2013.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

31

For 2009,Godfrey had $5,000 in itemized deductions for state income taxes paid.In 2011,Godfrey's 2009 state income tax return was audited and he was required to pay an additional $4,000 of state income taxes.Godfrey was in the 35% tax bracket in 2009,but his marginal tax bracket in 2011 is 15%.He will itemize his deductions on his 2011 return.

A)The $4,000 payment in 2011 is not deductible.

B)Godfrey must amend his 2009 return.

C)The $4,000 payment in 2011 will reduce his 2011 Federal income tax by $600 ($4,000 ´ 15%).

D)Godfrey can reduce his 2011 Federal income tax by $1,400 ($4,000 ´ 35%).

E)None of the above.

A)The $4,000 payment in 2011 is not deductible.

B)Godfrey must amend his 2009 return.

C)The $4,000 payment in 2011 will reduce his 2011 Federal income tax by $600 ($4,000 ´ 15%).

D)Godfrey can reduce his 2011 Federal income tax by $1,400 ($4,000 ´ 35%).

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

32

Andrew owns 100% of the stock of Crow's Farm Inc. ,an S corporation,that raises cattle and corn.The farm's annual gross receipts have never exceeded $3,000,000 and the farm is not considered a tax shelter.

A)The farm must report its sales and cost of goods sold by the accrual method because inventories are material to the business.

B)The income from the farm may be reported by the cash method.

C)The income from the sales of cattle may be reported by the cash method,but the income from the sales of corn must be reported by the accrual method.

D)The income from the sales of corn may be reported by the cash method,but the income from cattle sales must be reported by the accrual method.

E)None of the above.

A)The farm must report its sales and cost of goods sold by the accrual method because inventories are material to the business.

B)The income from the farm may be reported by the cash method.

C)The income from the sales of cattle may be reported by the cash method,but the income from the sales of corn must be reported by the accrual method.

D)The income from the sales of corn may be reported by the cash method,but the income from cattle sales must be reported by the accrual method.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

33

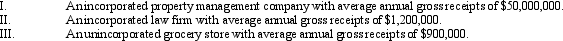

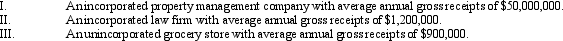

Which of the following must use the accrual method of accounting?

A)All of the above must use the accrual method.

B)None of the above must use the accrual method.

C)Only I and III must use the accrual method.

D)Only I must use the accrual method.

E)Only III must use the accrual method.

A)All of the above must use the accrual method.

B)None of the above must use the accrual method.

C)Only I and III must use the accrual method.

D)Only I must use the accrual method.

E)Only III must use the accrual method.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

34

If interest paid is attributed to the taxpayer's building which is under construction,the taxpayer must add the interest to the cost of the building.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

35

The accrual method generally must be used to report income:

A)From long-term construction contracts.

B)Earned by an incorporated public accounting firm with gross receipts in excess of $5 million.

C)Earned by partnership that has a partner that is a C corporation.

D)A grocery store with average annual gross receipts of $900,000.

E)None of the above.

A)From long-term construction contracts.

B)Earned by an incorporated public accounting firm with gross receipts in excess of $5 million.

C)Earned by partnership that has a partner that is a C corporation.

D)A grocery store with average annual gross receipts of $900,000.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

36

A cash basis taxpayer sold investment land in 2010.He received $35,000 in the year of sale and $105,000 in 2011.The cost of the land was $100,000.Under the installment method,the taxpayer would report a $10,000 gain in 2010.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

37

In the case of a sale reported under the installment method,no gain is reported until the seller has recovered the entire cost of the property sold.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

38

Karen,an accrual basis taxpayer,sold goods in October 2010 for $10,000.The customer was unable to pay cash.So the customer gave Karen a note for $10,000 that was payable in April 2011.The note bore interest at the Federal rate.The fair market value of the note at the end of 2010 was $9,000.Karen collected $10,000 from the customer in April 2011.Under the accrual method:

A)Karen must recognize $10,000 of income in 2010.

B)Karen must recognize $9,000 of income in 2010.

C)Karen must recognize $10,000 of income in 2011.

D)Karen must recognize $1,000 of income in 2011.

E)None of the above.

A)Karen must recognize $10,000 of income in 2010.

B)Karen must recognize $9,000 of income in 2010.

C)Karen must recognize $10,000 of income in 2011.

D)Karen must recognize $1,000 of income in 2011.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

39

In regard to choosing a tax year for a business owned by individuals,which form of business provides the greater number of options in regard to the tax year?

A)A C corporation formed by medical doctors to conduct their practice.

B)A C corporation that is in the retail grocery business.

C)A real estate partnership.

D)An S corporation engaged in manufacturing.

E)All of the above have the same options.

A)A C corporation formed by medical doctors to conduct their practice.

B)A C corporation that is in the retail grocery business.

C)A real estate partnership.

D)An S corporation engaged in manufacturing.

E)All of the above have the same options.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

40

In the case of a partnership whose partners all use a calendar year,a reason that is acceptable to the IRS for using a tax year ending June 30th would be:

A)The accountant is already overburdened with calendar year tax returns and could not timely file the partnership's return.

B)A December 31st inventory would be required if a calendar year was used,and the employees do not want to work on New Year's Eve.

C)The company's income does not fluctuate a great deal from year to year.

D)The business has a natural business year that ends June 30th.

E)None of the above.

A)The accountant is already overburdened with calendar year tax returns and could not timely file the partnership's return.

B)A December 31st inventory would be required if a calendar year was used,and the employees do not want to work on New Year's Eve.

C)The company's income does not fluctuate a great deal from year to year.

D)The business has a natural business year that ends June 30th.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

41

Pink Corporation is an accrual basis taxpayer that uses the recurring item exception to the economic performance test for all relevant years.For 2011,the corporation's income subject to state income tax was $400,000 and the state corporate tax rate was 6%.During 2011,the corporation paid $18,000 on its estimated state income tax liability for that year.The remaining $6,000 of 2011 state income tax was paid in April 2012.In June 2011,the corporation paid $9,000 on its year 2010 state income tax liability,as a result of an audit of the 2010 return that was conducted in 2011.As a result of the above:

A)Pink should deduct $33,000 as state income taxes for 2011.

B)Pink should deduct $27,000 as state income taxes for 2011.

C)Pink should deduct $24,000 as state income taxes for 2011 and amend its 2010 return to claim an additional $9,000 state income tax expense.

D)Pink should deduct $18,000 as state income taxes for 2011,amend its 2010 return to claim an additional $9,000 state income tax expense,and deduct $6,000 in 2012.

E)None of the above.

A)Pink should deduct $33,000 as state income taxes for 2011.

B)Pink should deduct $27,000 as state income taxes for 2011.

C)Pink should deduct $24,000 as state income taxes for 2011 and amend its 2010 return to claim an additional $9,000 state income tax expense.

D)Pink should deduct $18,000 as state income taxes for 2011,amend its 2010 return to claim an additional $9,000 state income tax expense,and deduct $6,000 in 2012.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

42

Gray Company,a calendar year taxpayer,allows customers to return defective merchandise for a full refund within 30 days of the purchase.In 2010,the company refunded $400,000 for claims involving sales.The $400,000 consisted of $350,000 in refunds from 2010 sales and $50,000 in refunds from 2009 sales.All of the refunds from 2009 sales were for claims filed in 2009 and were paid in January and February 2010.At the end of 2010,the company had $12,000 in refund claims for sales in 2010 for which payment had been approved.These claims were paid in January 2011.Also in January 2011,the company received an additional $30,000 in claims for sales in 2010.This $30,000 was paid by Gray in February 2011.With respect to the above,Gray can deduct:

A)$350,000 in 2010.

B)$362,000 in 2010.

C)$392,000 in 2010.

D)$442,000 in 2010.

E)None of the above.

A)$350,000 in 2010.

B)$362,000 in 2010.

C)$392,000 in 2010.

D)$442,000 in 2010.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

43

Abby sold her unincorporated business which consisted of equipment and goodwill.The equipment had an original cost of $150,000 and Abby had claimed $90,000 in depreciation (adjusted basis = $60,000).Abby had no basis in the goodwill.The sales price for the business was $280,000,with $120,000 for the equipment and $160,000 for the goodwill.The buyer agreed to pay $70,000 on June 30,2010,and $210,000 (plus interest at the Federal rate)in two years.Abby's gain to be reported in 2010 (exclusive of interest)is:

A)$40,000.

B)$55,000.

C)$60,000.

D)$100,000.

E)None,because she had not recovered her cost as of the end of 2010.

A)$40,000.

B)$55,000.

C)$60,000.

D)$100,000.

E)None,because she had not recovered her cost as of the end of 2010.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

44

Ivory Fast Delivery Company,an accrual basis taxpayer,frequently has claims for damages to property the company delivered.Often the claim is not filed until a month after the delivery.In the past,approximately 80% of the claims are paid by Ivory.At the end of 2010,$19,000 in claims had been filed.The company refused to pay $4,000 of the claims,and paid the other $15,000 of claims in January 2011.Also,in January 2011,claims for $13,000 were filed for deliveries made in 2010,and $10,000 was paid on these claims by March 2011.Ivory has elected to use the recurring item exception to economic performance.Under the all-events test,Ivory can accrue as an expense for 2010:

A)$32,000.

B)$28,000.

C)$25,000.

D)$15,000.

E)None of the above.

A)$32,000.

B)$28,000.

C)$25,000.

D)$15,000.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

45

Todd,a CPA,sold land for $200,000 plus a note for $400,000.The interest rate on the note was equal to the Federal rate.The fair market value of the note was $360,000.Todd's basis in the land was $75,000.

A)If Todd uses the accrual basis to report the income from his practice,he cannot use the installment method to report the gain on the sale of the land.

B)If Todd uses the cash basis to report the income from his practice,he cannot use the installment method to report the gain from the sale of the land.

C)If Todd uses the installment method to report the gain,the contract price is $600,000.

D)If Todd does not use the installment method,his gain in the year of sale is $125,000 ($200,000 - $75,000).

E)None of the above.

A)If Todd uses the accrual basis to report the income from his practice,he cannot use the installment method to report the gain on the sale of the land.

B)If Todd uses the cash basis to report the income from his practice,he cannot use the installment method to report the gain from the sale of the land.

C)If Todd uses the installment method to report the gain,the contract price is $600,000.

D)If Todd does not use the installment method,his gain in the year of sale is $125,000 ($200,000 - $75,000).

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

46

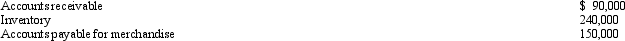

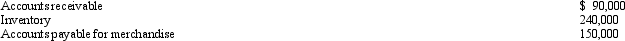

At the beginning of 2010,the taxpayer voluntarily changed from the cash to the accrual method of accounting.The relevant account balances as of January 1,2010,were as follows:

A)The company has a positive adjustment to income of $240,000 that must be recognized in 2010.

B)The company has a positive adjustment to income of $180,000 that can be allocated equally to years 2010-2013.

C)The company has a positive adjustment to income that can be allocated as follows: $47,500 to 2010 income,and $47,500 to each year's income,2011-2013.

D)No adjustment is required,but the company cannot use the cash method to report income and expenses for 2010.

E)None of the above.

A)The company has a positive adjustment to income of $240,000 that must be recognized in 2010.

B)The company has a positive adjustment to income of $180,000 that can be allocated equally to years 2010-2013.

C)The company has a positive adjustment to income that can be allocated as follows: $47,500 to 2010 income,and $47,500 to each year's income,2011-2013.

D)No adjustment is required,but the company cannot use the cash method to report income and expenses for 2010.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

47

When the IRS requires a taxpayer to change accounting methods:

A)The taxpayer may be subject to penalties and interest.

B)The taxpayer generally is required to make the change as of the beginning of the earliest open year.

C)The adjustments due to the change cannot be spread over subsequent years.

D)All of the above are correct.

E)None of the above is correct.

A)The taxpayer may be subject to penalties and interest.

B)The taxpayer generally is required to make the change as of the beginning of the earliest open year.

C)The adjustments due to the change cannot be spread over subsequent years.

D)All of the above are correct.

E)None of the above is correct.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

48

Generally,deductions for additions to reserves for estimated future costs (e.g. ,an allowance for estimated warranty costs)are not allowed for Federal income tax purposes because allowing the deduction would:

A)Violate the of claim of right doctrine.

B)Violate the economic performance requirement.

C)Result in a mismatching of revenues and expenses.

D)Result in deducting future costs that cannot be accurately estimated.

E)None of the above.

A)Violate the of claim of right doctrine.

B)Violate the economic performance requirement.

C)Result in a mismatching of revenues and expenses.

D)Result in deducting future costs that cannot be accurately estimated.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

49

The accrual basis taxpayer sold land for $100,000 on December 31,2010.He did not collect the $100,000 until January 2,2011.The land was held as an investment.

A)If the accrual basis taxpayer's basis in the land was $110,000,the loss would be recognized in 2011.

B)If the accrual basis taxpayer's basis in the land was $40,000,the gain must be reported in 2010.

C)If the accrual basis taxpayer's basis in the land was $40,000,the gain must be reported in 2011,unless the taxpayer elects to not use the installment method.

D)The accrual basis taxpayer must recognize the gain or loss in the year of sale.

E)None of the above.

A)If the accrual basis taxpayer's basis in the land was $110,000,the loss would be recognized in 2011.

B)If the accrual basis taxpayer's basis in the land was $40,000,the gain must be reported in 2010.

C)If the accrual basis taxpayer's basis in the land was $40,000,the gain must be reported in 2011,unless the taxpayer elects to not use the installment method.

D)The accrual basis taxpayer must recognize the gain or loss in the year of sale.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following statements regarding the matching principle is correct?

A)The matching principle is never relevant to tax accounting.

B)The matching principle of financial accounting is an important component of the cash method of accounting.

C)The matching principle of financial accounting is the cornerstone of accrual basis tax accounting.

D)The matching principle of financial accounting is sometimes relevant to timing deductions for an accrual basis taxpayer's recurring items.

E)None of the above.

A)The matching principle is never relevant to tax accounting.

B)The matching principle of financial accounting is an important component of the cash method of accounting.

C)The matching principle of financial accounting is the cornerstone of accrual basis tax accounting.

D)The matching principle of financial accounting is sometimes relevant to timing deductions for an accrual basis taxpayer's recurring items.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

51

The installment method applies to which of the following sales with payments being made in the year following the year of sale?

A)An automobile dealer's sale of an SUV.

B)A cash basis individual's sale of General Electric common stock.

C)A manufacturer's sale of fully-depreciated equipment.

D)All of the above.

E)None of the above.

A)An automobile dealer's sale of an SUV.

B)A cash basis individual's sale of General Electric common stock.

C)A manufacturer's sale of fully-depreciated equipment.

D)All of the above.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

52

The installment method applies where a payment will be received after the tax year of the sale:

A)By an investor who sold real estate at a gain.

B)By an investor who sold real estate at a loss.

C)By an appliance dealer who sold inventory.

D)By an investor who sold IBM Corporation common stock.

E)None of the above.

A)By an investor who sold real estate at a gain.

B)By an investor who sold real estate at a loss.

C)By an appliance dealer who sold inventory.

D)By an investor who sold IBM Corporation common stock.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

53

Color,Inc. ,is an accrual basis taxpayer.In December 2011,the company received from a customer a $500 claim for defective merchandise.Color paid the customer in January 2012.Also,in December 2011,the company received a bill of $800 for office supplies that had been purchased and used in November 2011.The bill was not paid until January 2012.In January 2012,the company received a claim for $600 for defective merchandise purchased in 2011.Color paid the customer the $600 in February 2012.Assuming Color uses the recurring item exception to economic performance,the company's deductions for 2011 as a result of the above are:

A)$500.

B)$600.

C)$800.

D)$1,300.

E)$1,900.

A)$500.

B)$600.

C)$800.

D)$1,300.

E)$1,900.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

54

The taxpayer has consistently,but incorrectly,used an allowance for bad debts.At the beginning of the year,the balance in the allowance account is $90,000.

A)If the IRS examines the taxpayer's return and requires the taxpayer to change accounting methods,the taxpayer will be required to recognize an additional $90,000 of income (one-half in the current year and one-half in the following year)as the adjustment due to the change in accounting methods.

B)If the taxpayer voluntarily changes methods,the $90,000 adjustment can be spread over the current and three following years.

C)If the taxpayer voluntarily changes methods,the $90,000 reserve can be used to absorb bad debts until the account balance is zero.

D)If the IRS examines the taxpayer's return,no adjustment to the reserve account will be required if the balance is consistent with prior bad debt experience.

E)None of the above.

A)If the IRS examines the taxpayer's return and requires the taxpayer to change accounting methods,the taxpayer will be required to recognize an additional $90,000 of income (one-half in the current year and one-half in the following year)as the adjustment due to the change in accounting methods.

B)If the taxpayer voluntarily changes methods,the $90,000 adjustment can be spread over the current and three following years.

C)If the taxpayer voluntarily changes methods,the $90,000 reserve can be used to absorb bad debts until the account balance is zero.

D)If the IRS examines the taxpayer's return,no adjustment to the reserve account will be required if the balance is consistent with prior bad debt experience.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

55

In the case of an accrual basis taxpayer,an item of income:

A)Is not recognized until cash is received.

B)From services is never recognized until the services are performed.

C)Is not recognized if the customer can return the goods.

D)Is recognized when all the events have occurred to fix the taxpayer's right to receive the income and the amount of the income can be determined with reasonable accuracy.

E)None of the above.

A)Is not recognized until cash is received.

B)From services is never recognized until the services are performed.

C)Is not recognized if the customer can return the goods.

D)Is recognized when all the events have occurred to fix the taxpayer's right to receive the income and the amount of the income can be determined with reasonable accuracy.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

56

The taxpayer voluntarily changed from the cash to the accrual method of accounting,because inventories were material to the taxpayer's business.The change resulted in a positive $60,000 adjustment to income.

A)The taxpayer must add the $60,000 to income for the year of the change.

B)The taxpayer must amend all prior open years and compute income by the accrual method and pay the additional tax.

C)The taxpayer must add $15,000 to income for the year of the change and add $15,000 to the incomes for each of the three preceding years.

D)The taxpayer may add $15,000 to the income for the year of the change and to the incomes for each of the three following years.

E)None of the above.

A)The taxpayer must add the $60,000 to income for the year of the change.

B)The taxpayer must amend all prior open years and compute income by the accrual method and pay the additional tax.

C)The taxpayer must add $15,000 to income for the year of the change and add $15,000 to the incomes for each of the three preceding years.

D)The taxpayer may add $15,000 to the income for the year of the change and to the incomes for each of the three following years.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

57

In 2010,Helen sold property and reported her gain by the installment method.Her basis in the property was $250,000 ($400,000 cost less $150,000 of depreciation).Helen sold the property for $700,000,with $140,000 due on the date of the sale and $560,000 (plus interest at the Federal rate)due in 2011.Helen's recognized installment sale gain in 2010 is:

A)$0.

B)$60,000.

C)$150,000.

D)$210,000.

E)None of the above.

A)$0.

B)$60,000.

C)$150,000.

D)$210,000.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

58

In 2010,Swan Company discovered that it had for the past 10 years capitalized as a production cost certain expenses that are properly classified as administrative expenses.The total amount of the expense for 2009 was $200,000,but $50,000 of the item was included in the ending inventory that year.

A)The company should amend its 2009 tax return and reduce its income by $150,000.

B)The company should change its accounting method in 2010,with a $200,000 positive § 481 adjustment which increases its 2010 taxable income.

C)The company should change its accounting method in 2010,and reduce its 2010 income by $50,000,the amount of the negative § 481 adjustment to income.

D)The company should change its accounting method in 2010 and recognize a $200,000 positive § 481 adjustment that will be spread over four years.

E)None of the above.

A)The company should amend its 2009 tax return and reduce its income by $150,000.

B)The company should change its accounting method in 2010,with a $200,000 positive § 481 adjustment which increases its 2010 taxable income.

C)The company should change its accounting method in 2010,and reduce its 2010 income by $50,000,the amount of the negative § 481 adjustment to income.

D)The company should change its accounting method in 2010 and recognize a $200,000 positive § 481 adjustment that will be spread over four years.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

59

Hal sold land held as an investment with a fair market value of $100,000 for $36,000 cash and a note for $64,000 that was due in two years.The note bore interest of 11% when the applicable Federal rate was 7%.Hal's cost of the land was $40,000.Because of the buyer's good credit record and the high interest rate on the note,Hal thought the fair market value of the note was at least $74,000.

A)Hal can elect to treat the $36,000 as a recovery of capital.

B)Hal must recognize $70,000 gain in the year of sale.

C)Hal must recognize $60,000 gain in the year of sale.

D)Unless Hal elects not to use the installment method,Hal must recognize $21,600 gain in the year of sale.

E)None of the above.

A)Hal can elect to treat the $36,000 as a recovery of capital.

B)Hal must recognize $70,000 gain in the year of sale.

C)Hal must recognize $60,000 gain in the year of sale.

D)Unless Hal elects not to use the installment method,Hal must recognize $21,600 gain in the year of sale.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

60

Juan,not a dealer in real property,sold land that he owned.His adjusted basis in the land was $500,000 and it was encumbered by a mortgage for $150,000.The terms of the sale required the buyer to pay Juan $100,000 on the date of the sale.The buyer assumed Juan's mortgage and gave Juan a note for $550,000 (plus interest at the Federal rate)due in the following year.What is the gross profit percentage?

A)50/550 = 9.09%.

B)300/650 = 46.15%.

C)700/800 = 87.5%.

D)500/550 = 99.09%.

E)None of the above.

A)50/550 = 9.09%.

B)300/650 = 46.15%.

C)700/800 = 87.5%.

D)500/550 = 99.09%.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

61

Charlotte sold her unincorporated business for $360,000 in 2010.The sales contract allocated $150,000 to equipment,$110,000 to land,and $100,000 to goodwill.Charlotte had a $0 basis in the goodwill,the land cost $60,000,and the equipment originally cost $250,000 but it was fully depreciated.What is the amount of the gain eligible for installment sales treatment?

A)$0.

B)$150,000.

C)$145,000.

D)$255,000.

E)None of the above.

A)$0.

B)$150,000.

C)$145,000.

D)$255,000.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

62

In 2010,Kathy sold an apartment building to her 100 percent controlled corporation,Kathy,Inc.The apartment building cost $500,000 and the balance in the accumulated depreciation account was $400,000.Kathy,Inc.paid $100,000 in the year of sale and gave Kathy a note for $900,000 plus adequate interest due in 2012.

A)Kathy can use the installment method only if tax avoidance was not a principal purpose of the transaction.

B)Kathy generally cannot report the gain by the installment method.

C)a.and b.are true.

D)a.and b.are false.

E)None of the above.

A)Kathy can use the installment method only if tax avoidance was not a principal purpose of the transaction.

B)Kathy generally cannot report the gain by the installment method.

C)a.and b.are true.

D)a.and b.are false.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

63

Robin Construction Company began a long-term contract in 2010.The contract price was $600,000.The estimated cost of the contract at the time it was begun was $450,000.The actual cost incurred in 2010 was $300,000.The contract was completed in 2011 and the cost incurred that year was $180,000.Under the percentage of completion method:

A)Robin should report $300,000 of income in 2010.

B)Robin should report a $30,000 loss in 2011.

C)Robin must pay interest (under the look-back method)on the overpayment of taxes in 2010.

D)Robin should report $60,000 profit on the contract in 2011.

E)Robin will receive interest (under the look-back method)on the overpayment of taxes in 2010.

A)Robin should report $300,000 of income in 2010.

B)Robin should report a $30,000 loss in 2011.

C)Robin must pay interest (under the look-back method)on the overpayment of taxes in 2010.

D)Robin should report $60,000 profit on the contract in 2011.

E)Robin will receive interest (under the look-back method)on the overpayment of taxes in 2010.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

64

Gold Corporation sold its 40% of the Ruby Corporation common stock.Gold received $8,000,000 in the year of the sale and a note for $12,000,000,payable in three years with interest at the Federal rate.Gold's basis in the stock was $2,000,000.Assume that Gold Corporation will report the gain by the installment method where the method is permitted.

A)If the Ruby Corporation stock is traded on a national exchange,Gold must recognize $18,000,000 gain in the year of sale.

B)If the Ruby Corporation stock is not traded on an established market,Gold must recognize a $7,200,000 gain in the year of sale.

C)If the Ruby Corporation stock is not traded on a national exchange,Gold must pay interest on a portion of the deferred taxes.

D)All of the above are true.

E)None of the above is true.

A)If the Ruby Corporation stock is traded on a national exchange,Gold must recognize $18,000,000 gain in the year of sale.

B)If the Ruby Corporation stock is not traded on an established market,Gold must recognize a $7,200,000 gain in the year of sale.

C)If the Ruby Corporation stock is not traded on a national exchange,Gold must pay interest on a portion of the deferred taxes.

D)All of the above are true.

E)None of the above is true.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

65

In 2010,Norma sold Zinc,Inc. ,common stock for $100,000 cash and a note receivable for $900,000.The note was due in 2011 with accrued interest at the Federal rate.Norma's basis in the stock was $250,000.This was Norma's only installment sale transaction.Which of the following statements is correct?

A)Norma cannot use the installment method to report her gain if the stock is listed on the New York Stock Exchange.

B)Norma must recognize $75,000 gain in 2010 and she will be liable for interest on taxes deferred under the installment method.

C)Norma must recognize $75,000 gain in 2010 and she will not be liable for interest on the taxes deferred under the installment method if the stock is not publicly traded.

D)Norma should treat the $100,000 received as a recovery of capital.

E)None of the above.

A)Norma cannot use the installment method to report her gain if the stock is listed on the New York Stock Exchange.

B)Norma must recognize $75,000 gain in 2010 and she will be liable for interest on taxes deferred under the installment method.

C)Norma must recognize $75,000 gain in 2010 and she will not be liable for interest on the taxes deferred under the installment method if the stock is not publicly traded.

D)Norma should treat the $100,000 received as a recovery of capital.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

66

Camelia Company is a large commercial real estate contractor that reports its income by the percentage of completion method.In 2010,the company entered into a contract to construct a building for $960,000.Camelia estimated that the cost of constructing the building would be $720,000.In 2010,the company incurred $240,000 in costs under the contract.In 2011,the company incurred an additional $450,000 in costs to complete the contract.The company's marginal tax rate in all years was 35%.

A)Camelia is not required to report any income from the contract until 2011 when the contract is completed.

B)Camelia must report $80,000 gross profit on the contract in 2010,but must pay interest in 2011 under the lookback rules.

C)Camelia does not recognize any profit from the contract in 2011 and the company will receive interest from the overpayment of tax on 2010 reported profit from the contract.

D)Camelia should amend its 2010 tax return to decrease the profit on the contract for that year.

E)None of the above.

A)Camelia is not required to report any income from the contract until 2011 when the contract is completed.

B)Camelia must report $80,000 gross profit on the contract in 2010,but must pay interest in 2011 under the lookback rules.

C)Camelia does not recognize any profit from the contract in 2011 and the company will receive interest from the overpayment of tax on 2010 reported profit from the contract.

D)Camelia should amend its 2010 tax return to decrease the profit on the contract for that year.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

67

Albert is in the 35% marginal tax bracket.He sold a building in the current year for $450,000.Albert received $110,000 cash at closing,the buyer assumed Albert's mortgage for $120,000,and the buyer gave Albert a 6% note for $220,000 due in two years.The Federal rate was 6%.Albert's basis in the building was $180,000 ($500,000 cost - $320,000 accumulated straight-line depreciation).Assuming he did not elect out of the installment method,Albert's § 1231 gain and gain taxed at the 25% rate in the year of sale are what amounts? Section 1231 Gain Unrecaptured § 1250 Gain Taxed at 25%

A)$66,000 $0

B)$0 $66,000

C)$90,000 $90,000

D)$90,000 $0

E)$0 $110,000

A)$66,000 $0

B)$0 $66,000

C)$90,000 $90,000

D)$90,000 $0

E)$0 $110,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

68

Under the percentage of completion method,if the actual costs are ____ the estimated costs,the taxpayer must pay interest on the underpayment of prior years' taxes.

A)Greater than.

B)Less than.

C)Equal to or greater than.

D)Equal to.

E)None of the above.

A)Greater than.

B)Less than.

C)Equal to or greater than.

D)Equal to.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

69

Pedro,not a dealer,sold real property that he owned with an adjusted basis of $60,000 and encumbered by a mortgage for $28,000 to Pat in 2009.The terms of the sale required Pat to pay $14,000 cash,assume the $28,000 mortgage,and give Pedro eleven notes for $6,000 each (plus interest at the Federal rate).The first note was payable two years from the date of sale and each succeeding note became due at two-year intervals.Pedro did not "elect out" of the installment method for reporting the transaction.If Pat pays the 2012 note as promised,what is the recognized gain to Pedro in 2011 (exclusive of interest)?

A)$6,000.

B)$3,600.

C)$2,400.

D)$0.

E)None of the above.

A)$6,000.

B)$3,600.

C)$2,400.

D)$0.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

70

Ron sold land (a capital asset)to an unrelated party for $50,000 cash and a 4% note for $150,000 due in three years.His basis in the land was $40,000.Ron and the purchaser are cash basis taxpayers.Which of the following statements is correct?

A)If the Federal rate is 5%,interest will be imputed at that rate.

B)If the Federal rate is 7%,interest will be imputed at that rate.

C)If the Federal rate is 3%,interest will not be imputed.

D)All of the above.

E)None of the above.

A)If the Federal rate is 5%,interest will be imputed at that rate.

B)If the Federal rate is 7%,interest will be imputed at that rate.

C)If the Federal rate is 3%,interest will not be imputed.

D)All of the above.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

71

In 2010,Father sold land to Son for $75,000 cash and an installment note for $225,000.Father's basis was $120,000.In 2011,after paying $24,000 interest but nothing on the principal,Son sold the land for $300,000 cash.As a result of the second disposition,what gain must Father recognize in 2011?

A)$180,000.

B)$135,000.

C)$120,000.

D)$60,000.

E)None of the above.

A)$180,000.

B)$135,000.

C)$120,000.

D)$60,000.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

72

Father sold land to Son for $150,000 in 2010.Father's basis in the land was $60,000.Son paid Father $25,000 and gave Father a note for $125,000 due in 2013.In 2011,Son sold the land for $200,000 cash.The note bore interest at the appropriate Federal rate and both Father and Son held the land as an investment.

A)Father must recognize $90,000 of income in 2010.

B)Father must recognize a $75,000 gain in 2011.

C)Father's gain is all ordinary income.

D)Son is not permitted to use the installment method to report his gain.

E)None of the above.

A)Father must recognize $90,000 of income in 2010.

B)Father must recognize a $75,000 gain in 2011.

C)Father's gain is all ordinary income.

D)Son is not permitted to use the installment method to report his gain.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

73

Dr.Stone incorporated her medical practice and elected to use a fiscal year ending September 30th.For the fiscal year ending September 30,2010,the corporation earned $20,000 profits each month,before Dr.Stone's salary and income tax.Dr.Stone received a salary that averaged $15,000 per month.Next year (fiscal year ending September 30,2011),Dr.Stone expects the average monthly profits before salary and taxes to be $24,000.What is the minimum salary Dr.Stone can receive for the last three months of calendar year 2010 to ensure that the corporation can deduct salary equal to the corporation's before salary income for the fiscal year ending September 30,2011?

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

74

Related-party installment sales include all of the following except the first seller's:

A)Brothers and sisters.

B)Controlled corporations.

C)Lineal descendants.

D)Partnerships in which the seller has an interest.

E)All of the above would be considered related parties.

A)Brothers and sisters.

B)Controlled corporations.

C)Lineal descendants.

D)Partnerships in which the seller has an interest.

E)All of the above would be considered related parties.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

75

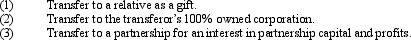

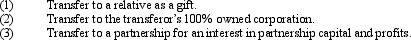

Which of the following is (are)a taxable disposition of an installment obligation?

A)(1)only.

B)(1)and (2).

C)(1), (2),and (3).

D)(2)and (3).

E)None of the above.

A)(1)only.

B)(1)and (2).

C)(1), (2),and (3).

D)(2)and (3).

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

76

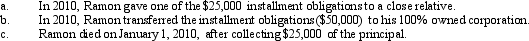

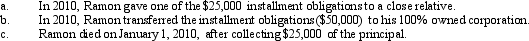

Ramon sold land in 2010 with a cost of $60,000 for $100,000.The sales agreement called for a $25,000 down payment and a $25,000 payment on the first day of each year plus 8% interest.What would be the consequences of the following (treat each part independently and assume Ramon uses the installment method whenever possible):

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

77

In the case of a small home construction company that builds under long-term contracts,generally:

A)The percentage of completion method must be used.

B)The percentage of completion method should be used to defer income.

C)The completed contract method must be used.

D)The completed contract method defers income recognition.

E)None of the above is true.

A)The percentage of completion method must be used.

B)The percentage of completion method should be used to defer income.

C)The completed contract method must be used.

D)The completed contract method defers income recognition.

E)None of the above is true.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

78

Taylor sold a capital asset on the installment basis and did not charge interest on the deferred payment due in three years.

A)Interest will be imputed,thus increasing the capital gain.

B)Interest will be imputed,thus creating ordinary income.

C)Interest will not be imputed because the contract is for less than five years.

D)Interest will be imputed,thus reducing the seller's total income from the transactions.

E)None of the above.

A)Interest will be imputed,thus increasing the capital gain.

B)Interest will be imputed,thus creating ordinary income.

C)Interest will not be imputed because the contract is for less than five years.

D)Interest will be imputed,thus reducing the seller's total income from the transactions.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

79

Brown Corporation had consistently reported its income by the cash method.The corporation should have used the accrual method because inventories are material to the business.In 2010,Brown timely filed a request to change to the accrual method.At the beginning of 2010,Brown had accounts receivable of $60,000.Also,Brown had merchandise on hand with a cost of $80,000 and accounts payable for merchandise of $25,000.The accounts receivable,inventory,and accounts payable balance per books were zero.Determine the adjustment to income due to the change in accounting method and the amount that is allocated to 2010.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

80

Wendy sold property on the installment basis in 2009 for more than her basis in the property.Wendy was to receive installment payments at the end of each year for the next five years.In 2010,before she collected on the installment obligation for that year,Wendy gave to her daughter (Wilma)the installment obligation so that she could collect the four remaining installments.

A)Wilma must recognize the gain from all the amounts collected on the installment obligation in 2010 and subsequent years.

B)Wendy must recognize the gain each year when Wilma collects on the installment obligation.

C)Wilma must recognize the remaining installment sale gain in 2010.

D)Wendy must recognize the remaining installment sale gain in 2010 and Wilma will not recognize gain from collecting on the installment obligation.

E)None of the above.

A)Wilma must recognize the gain from all the amounts collected on the installment obligation in 2010 and subsequent years.

B)Wendy must recognize the gain each year when Wilma collects on the installment obligation.

C)Wilma must recognize the remaining installment sale gain in 2010.

D)Wendy must recognize the remaining installment sale gain in 2010 and Wilma will not recognize gain from collecting on the installment obligation.

E)None of the above.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck