Deck 21: toward a Fuller Understanding of Present Value

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/36

Play

Full screen (f)

Deck 21: toward a Fuller Understanding of Present Value

1

The net present value of a project is the difference between:

A)current benefits and the present value of future costs.

B)the present value of current benefits and the current value of future costs.

C)the present value of future benefits and the present value of future costs.

D)the present value of current and future benefits and the present value of current and future costs.

A)current benefits and the present value of future costs.

B)the present value of current benefits and the current value of future costs.

C)the present value of future benefits and the present value of future costs.

D)the present value of current and future benefits and the present value of current and future costs.

D

2

The _____ the future payment, the _____ its present value, all other things held constant.

A)less; the more uncertain is

B)more; less

C)more; more

D)sooner; less

A)less; the more uncertain is

B)more; less

C)more; more

D)sooner; less

C

3

The present value of a future payment will be smaller the:

A)sooner the payment is due.

B)lower the interest rate.

C)higher the interest rate.

D)higher the interest rate and the later the payment is due.

A)sooner the payment is due.

B)lower the interest rate.

C)higher the interest rate.

D)higher the interest rate and the later the payment is due.

D

4

You win a prize at your sorority, and you are given the following two payoff options: Option 1 is to receive $100 one year from today and $100 two years from today. Option 2 is to receive $180 today. If the annual interest rate is 10%, the present value of option 1 is:

A)$173.56.

B)$190.91.

C)$182.65.

D)$181.80.

A)$173.56.

B)$190.91.

C)$182.65.

D)$181.80.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

5

You have won the lottery and have been given the choice of receiving $5 million today or $10 million after 10 years. Assume that the interest rate remains fixed at 10% per year for the entire 10-year period. You should choose:

A)$10 million after 10 years, since this is more than you would get if you invested $5 million for 10 years at an annual rate of interest of 10%.

B)$10 million after 10 years, since that is a larger amount than the present value of $5 million paid after 10 years.

C)$5 million today, since it would be worth more than $10 million after 10 years if the $5 million earned interest at the rate of 10% per year.

D)$10 million after 10 years, since it is the larger amount.

A)$10 million after 10 years, since this is more than you would get if you invested $5 million for 10 years at an annual rate of interest of 10%.

B)$10 million after 10 years, since that is a larger amount than the present value of $5 million paid after 10 years.

C)$5 million today, since it would be worth more than $10 million after 10 years if the $5 million earned interest at the rate of 10% per year.

D)$10 million after 10 years, since it is the larger amount.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following statements is INCORRECT?

A)The dollar amount of a future payment is more than its present value.

B)The present value of a future payment is approximately the same as its future dollar amount.

C)The present value of a future payment is less than its future dollar amount.

D)The bigger the future payment, the more its present value, all other things held constant.

A)The dollar amount of a future payment is more than its present value.

B)The present value of a future payment is approximately the same as its future dollar amount.

C)The present value of a future payment is less than its future dollar amount.

D)The bigger the future payment, the more its present value, all other things held constant.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

7

The present value (PV) of a payment n years in the future (FV), given an interest rate (r), is given by the equation:

A)PV = FVn.

B)PV = 1 / FVn.

C)PV = FV / (1 + r).

D)PV = FV / (1 + r)n.

A)PV = FVn.

B)PV = 1 / FVn.

C)PV = FV / (1 + r).

D)PV = FV / (1 + r)n.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following statements is TRUE?

A)People generally prefer to receive money later rather than sooner.

B)Interest is a payment made by lenders to borrowers.

C)The present value of a future payment will be lower the smaller the payment, the later it is due, and the higher the interest rate.

D)The future value of a payment will be more if the interest rate is lower.

A)People generally prefer to receive money later rather than sooner.

B)Interest is a payment made by lenders to borrowers.

C)The present value of a future payment will be lower the smaller the payment, the later it is due, and the higher the interest rate.

D)The future value of a payment will be more if the interest rate is lower.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

9

If a firm considering the purchase of an asset determines that the asset's net present value is greater than zero, then _____ the asset will _____ profits.

A)not buying; increase

B)purchasing; increase

C)purchasing; decrease

D)not buying; decrease

A)not buying; increase

B)purchasing; increase

C)purchasing; decrease

D)not buying; decrease

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

10

You win a prize at your sorority and you are given the following two payoff options: Option 1 is to receive $100 one year from today and $100 two years from today. Option 2 is to receive $180 today. If the annual interest rate is 5%, the present value of option 1 is:

A)$176.56.

B)$185.94.

C)$190.48.

D)$195.24.

A)$176.56.

B)$185.94.

C)$190.48.

D)$195.24.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

11

Other things equal, the _____ the loan period, the _____ the present value.

A)shorter; lower

B)longer; higher

C)longer; lower

D)shorter; more variable

A)shorter; lower

B)longer; higher

C)longer; lower

D)shorter; more variable

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

12

The _____ the period, the _____ is the present value of a given future payment, all other things held constant.

A)longer; less

B)shorter; less

C)longer; more

D)shorter; the more uncertain

A)longer; less

B)shorter; less

C)longer; more

D)shorter; the more uncertain

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

13

The present value of a future payment increases if the:

A)period between the present and the future increases.

B)future payment decreases.

C)interest rate decreases.

D)stock market falls.

A)period between the present and the future increases.

B)future payment decreases.

C)interest rate decreases.

D)stock market falls.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

14

As the manager of a professional football team, you just offered the kicker a two-year contract that pays $2 million at the end of each of the next two years. The kicker refuses the contract, stating he wants $3 million at the end of this year. If you offer $3 million at the end of this year, about how much will you have to offer at the end of next year to keep the present value of the contract the same as your original offer? Assume a 10% annual interest rate.

A)$1 million

B)$900,000

C)$808,080

D)$743,800

A)$1 million

B)$900,000

C)$808,080

D)$743,800

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

15

The net present value (NPV) of an activity or project is equal to the _____ value of all of the revenues minus the _____ value of all of the costs associated with it.

A)future; present

B)present; present

C)present; future

D)future; future

A)future; present

B)present; present

C)present; future

D)future; future

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

16

A semiconductor firm is considering opening a new plant. The plant will generate profits of $100 million at the end of each of three years after the first year of production and then no profits after that. If the interest rate is 10%, what is the maximum cost (to the nearest million) the firm is willing to pay now for the plant?

A)$300 million

B)$249 million

C)$273 million

D)$100 million

A)$300 million

B)$249 million

C)$273 million

D)$100 million

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

17

The present value of a future payment _____if the _____.

A)increases; wait period increases.

B)decreases; future payment increases.

C)increases; interest rate decreases.

D)decreases; stock market rises.

A)increases; wait period increases.

B)decreases; future payment increases.

C)increases; interest rate decreases.

D)decreases; stock market rises.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

18

The present value (PV) of a payment one year in the future (FV), given an interest rate (r), is given by the equation:

A)PV = 1 / FV.

B)PV = FV / 1.

C)PV = FV / (1 + r).

D)PV = FV × (1 + r).

A)PV = 1 / FV.

B)PV = FV / 1.

C)PV = FV / (1 + r).

D)PV = FV × (1 + r).

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

19

Your friend wants to borrow $2,000 and pay it back in one year. She is someone who keeps her word. She agrees to repay you $2,080 in one year. The bank annual interest rate is 5%. Which of the following statements is TRUE?

A)You will be financially worse off if you make the loan rather than deposit $2,000 in the bank.

B)You will be financially better off if you make the loan rather than deposit $2,000 in the bank.

C)The present value of $2,080 payable in one year with an interest rate of 5% is $1,904.76, which is less than the value of the $2,000 you have been asked to lend.

D)None of the statements is true.

A)You will be financially worse off if you make the loan rather than deposit $2,000 in the bank.

B)You will be financially better off if you make the loan rather than deposit $2,000 in the bank.

C)The present value of $2,080 payable in one year with an interest rate of 5% is $1,904.76, which is less than the value of the $2,000 you have been asked to lend.

D)None of the statements is true.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

20

The present value of a future payment decreases if the:

A)period between the present and the future increases.

B)future payment increases.

C)interest rate decreases.

D)stock market rises.

A)period between the present and the future increases.

B)future payment increases.

C)interest rate decreases.

D)stock market rises.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

21

You have recently graduated from high school and are debating whether to attend college or get a job. Assume that you can spend a certain amount today for tuition and receive your college degree in only one year. When you graduate, you will receive a job that pays you $100,000 immediately and $100,000 the following year. If you begin working immediately, you can earn $35,000 today and each of the next two years. If the interest rate is 10%, solve for the amount of tuition that would make you indifferent between going to college and working immediately.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

22

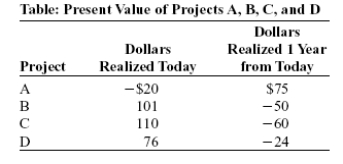

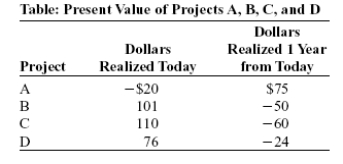

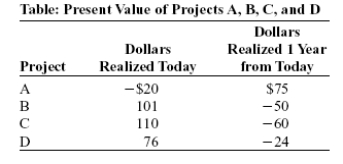

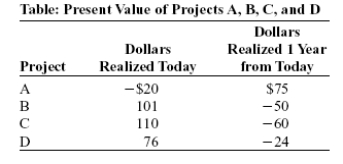

Use the following to answer questions 22-23:

(Table: Present Value of Projects A, B, C, and D) Look at the table Present Value of Projects A, B, C, and D. If the annual interest rate is 2%, which project do you choose?

A)A

B)B

C)C

D)D

(Table: Present Value of Projects A, B, C, and D) Look at the table Present Value of Projects A, B, C, and D. If the annual interest rate is 2%, which project do you choose?

A)A

B)B

C)C

D)D

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

23

Your grandmother has promised you $1,000 when you graduate in two years. At a 6% annual interest rate, you can borrow $890 and pay it all back with your grandmother's gift at graduation.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

24

A firm is considering a new capital expenditure of $2 million. This expenditure is expected to yield $1 million in annual profits for each of two years. Given this information, the firm should _____ the project, _____

A)refuse; since the costs are not offset by the profits.

B)undertake; since the profits will be greater than the costs.

C)undertake; only if the interest rate is zero.

D)undertake; regardless of the interest rate.

A)refuse; since the costs are not offset by the profits.

B)undertake; since the profits will be greater than the costs.

C)undertake; only if the interest rate is zero.

D)undertake; regardless of the interest rate.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

25

To finance your education, you borrow $10,000 from a relative at an annual interest rate of 5%. You promise to pay her back in eight years. Which formula will provide the correct formula for calculating the value of your payment in eight years?

A)$10,000(1 + 0.05)

B)$10,000(1 + 5)

C)$10,000(1 + 0.05)8

D)$10,000(1 + 0.5)8

A)$10,000(1 + 0.05)

B)$10,000(1 + 5)

C)$10,000(1 + 0.05)8

D)$10,000(1 + 0.5)8

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

26

If the friend offers to pay you $1 five years from today, the present value will:

A)be higher than $1.

B)depend upon the prevailing interest rate.

C)be equal to zero, since you don't have the dollar.

D)not be important in understanding the time value of money.

A)be higher than $1.

B)depend upon the prevailing interest rate.

C)be equal to zero, since you don't have the dollar.

D)not be important in understanding the time value of money.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

27

To finance your education, you borrow $10,000 from your aunt at an annual interest rate of 5%. If your cousin offers to lend you the same amount but suggests a lower interest rate and you take the offer, you will end up repaying your cousin _____ you would have to your aunt.

A)more than.

B)less than

C)the same amount as

D)more now but less later than

A)more than.

B)less than

C)the same amount as

D)more now but less later than

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

28

Suppose the university offers the following payment plan: Either you pay $80,000 when enrolling as a freshman or you pay $25,000 at the beginning of your freshman year and $25,000 at the beginning of every year for the next three years. If the annual interest rate is 5%, then you should take option 1 and pay $80,000 at the beginning of your first year.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

29

If a firm finds that the net present value of a project is _____ for a given interest rate, it will _____ the project.

A)positive; undertake

B)positive; not undertake

C)negative; undertake

D)positive or negative; undertake

A)positive; undertake

B)positive; not undertake

C)negative; undertake

D)positive or negative; undertake

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

30

The present value of a future payment:

A)decreases when the interest rate rises.

B)decreases when the interest rate falls.

C)decreases when the interest rate stays the same.

D)never changes regardless of the interest rate.

A)decreases when the interest rate rises.

B)decreases when the interest rate falls.

C)decreases when the interest rate stays the same.

D)never changes regardless of the interest rate.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

31

The present value of a painting that you expect to sell for $500 in three years is $405.22 if the annual interest rate is 5%.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

32

If a friend offers to pay you $1 five years from now, when the prevailing annual interest rate is 5%, what is the net present value of that $1 today?

A)$0.95

B)$1.05

C)$0.78

D)$1.50

A)$0.95

B)$1.05

C)$0.78

D)$1.50

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

33

Use the following to answer questions 22-23:

(Table: Present Value of Projects A, B, C, and D) Look at the table Present Value of Projects A, B, C, and D. If the annual interest rate is 10%, which project do you choose?

A)A

B)B

C)C

D)D

(Table: Present Value of Projects A, B, C, and D) Look at the table Present Value of Projects A, B, C, and D. If the annual interest rate is 10%, which project do you choose?

A)A

B)B

C)C

D)D

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

34

You have recently graduated from high school and are debating whether to attend college or get a job. Assume that you can spend $50,000 today for tuition and receive your college degree in only one year. When you graduate, you will receive a job that pays you $100,000 immediately and $100,000 the following year. If you begin working immediately, you can earn $35,000 today and each of the next two years. If the annual interest rate is 10%, should you go to college?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

35

A soft-drink bottling firm is thinking of opening a new distribution center. The center will cost $2.5 million to build today, and it will generate profits of $1 million one year from now, two years from now, and three years from now. The firm should build the distribution center if the interest rate is 9% or lower.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

36

You have heard about a new light bulb that is costly to purchase but uses little electricity and thus allows you to save money on your utility bill. Suppose the new light bulb costs $10 today but next year your electricity bill will be $50 lower. If the interest rate is 10%, what is the net present value of buying this new light bulb and using it for one year?

A)$40

B)-$45.45

C)$55

D)$35.45

A)$40

B)-$45.45

C)$55

D)$35.45

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck