Deck 19: Capital Investment

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/97

Play

Full screen (f)

Deck 19: Capital Investment

1

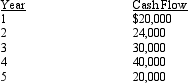

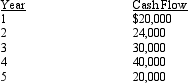

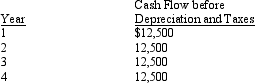

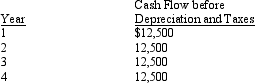

Mitchell Services is considering an investment of $25,000.Data related to the investment are as follows:  Cost of capital is 14 percent.

Cost of capital is 14 percent.

What is the payback period in years approximated to two decimal points, assuming no taxes are paid?

A) 2.12

B) 4.00

C) 2.50

D) 3.00

Cost of capital is 14 percent.

Cost of capital is 14 percent.What is the payback period in years approximated to two decimal points, assuming no taxes are paid?

A) 2.12

B) 4.00

C) 2.50

D) 3.00

C

2

Julius Company is considering the purchase of a new machine for $100,000.The machine generates annual revenues of $62,500 and annual expenses of $37,500, which includes $7,500 of depreciation.What is the payback period in years on the machine approximated to one decimal point?

A) 1.6

B) 3.1

C) 4.0

D) 1.7

A) 1.6

B) 3.1

C) 4.0

D) 1.7

B

3

_______________ are projects that, if accepted, preclude the acceptance of all other competing projects.

A) Independent projects

B) Mutually exclusive projects

C) Dependent projects

D) Both b and c

A) Independent projects

B) Mutually exclusive projects

C) Dependent projects

D) Both b and c

B

4

Which of the following is NOT an example of information the payback period can provide to management?

A) Minimize the impact of an investment on a firm's liquidity performance.

B) Help control the risks associated with the uncertainty of future cash flows.

C) Help control the risk of obsolescence.

D) Helps determine the project's total profitability.

A) Minimize the impact of an investment on a firm's liquidity performance.

B) Help control the risks associated with the uncertainty of future cash flows.

C) Help control the risk of obsolescence.

D) Helps determine the project's total profitability.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

5

A project requires an investment of $40,000 in equipment.Annual cash flows of $8,000 are expected to occur for the next eight years.No salvage value is expected.The company uses the straight-line method of depreciation with no mid-year convention.Ignore income taxes. The accounting rate of return on the original investment for the project is

A) 6.25%.

B) 7.50%.

C) 16.00%.

D) 20.00%.

A) 6.25%.

B) 7.50%.

C) 16.00%.

D) 20.00%.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

6

Meulo Company is considering the purchase of production equipment that costs $800,000.The equipment is expected to generate an annual cash flow of $250,000 and have a useful life of five years with no salvage value.The firm's cost of capital is 12 percent.The company uses the straight-line method of depreciation with no mid-year convention.There are no income taxes. The payback period in years for the project is

A) 2.90 years.

B) 3.20 years.

C) 3.25 years.

D) 4.20 years.

A) 2.90 years.

B) 3.20 years.

C) 3.25 years.

D) 4.20 years.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

7

Houston Corporation is considering an investment in equipment for $45,000.Data related to the investment are as follows:  Cost of capital is 18 percent.

Cost of capital is 18 percent.

Houston uses the straight-line method of depreciation with no mid-year convention.In addition, its tax rate is 40 percent, and the life of the equipment is five years with no salvage value.

What is the payback period in years approximated to two decimal points?

A) 1.00

B) 0.67

C) 2.08

D) 1.50

Cost of capital is 18 percent.

Cost of capital is 18 percent.Houston uses the straight-line method of depreciation with no mid-year convention.In addition, its tax rate is 40 percent, and the life of the equipment is five years with no salvage value.

What is the payback period in years approximated to two decimal points?

A) 1.00

B) 0.67

C) 2.08

D) 1.50

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

8

_______________ are projects that if accepted or rejected, do NOT affect the cash flows of projects.

A) Independent projects

B) Mutually exclusive projects

C) Dependent projects

D) Both b and c

A) Independent projects

B) Mutually exclusive projects

C) Dependent projects

D) Both b and c

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

9

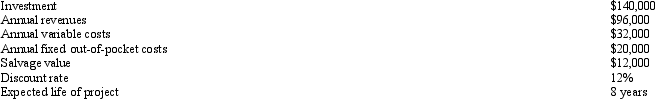

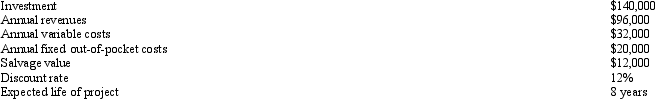

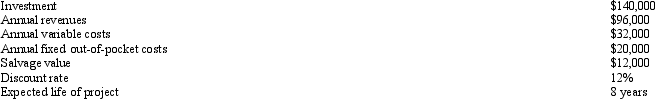

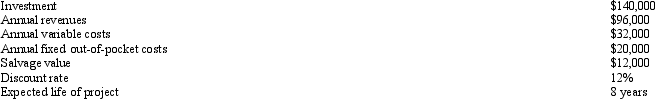

Hunziker Company is considering the purchase of wood cutting equipment.Data on the equipment are as follows:  The company uses the straight-line method of depreciation with no mid-year convention.

The company uses the straight-line method of depreciation with no mid-year convention.

What is the accounting rate of return on original investment rounded to the nearest percent, assuming no taxes are paid?

A) 40%

B) 73%

C) 22%

D) 24%

The company uses the straight-line method of depreciation with no mid-year convention.

The company uses the straight-line method of depreciation with no mid-year convention.What is the accounting rate of return on original investment rounded to the nearest percent, assuming no taxes are paid?

A) 40%

B) 73%

C) 22%

D) 24%

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

10

Maple Management Services is considering an investment of $60,000.Data related to the investment are as follows:  Cost of capital is 18 percent.

Cost of capital is 18 percent.

What is the payback period in years approximated to two decimal points, assuming no taxes are paid?

A) 3.00

B) 2.00

C) 2.53

D) 2.22

Cost of capital is 18 percent.

Cost of capital is 18 percent.What is the payback period in years approximated to two decimal points, assuming no taxes are paid?

A) 3.00

B) 2.00

C) 2.53

D) 2.22

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

11

Reece Manufacturing Company is considering the following investment proposal:  The firm uses the straight-line method of depreciation with no mid-year convention.

The firm uses the straight-line method of depreciation with no mid-year convention.

What is the payback period in years approximated to two decimal points, assuming no taxes are paid?

A) 3.33

B) 1.50

C) 1.70

D) 3.78

The firm uses the straight-line method of depreciation with no mid-year convention.

The firm uses the straight-line method of depreciation with no mid-year convention.What is the payback period in years approximated to two decimal points, assuming no taxes are paid?

A) 3.33

B) 1.50

C) 1.70

D) 3.78

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is an example of an independent project?

A) A manufacturing plant considering a major overhaul of an existing machine or replacing the existing machine with a new model.

B) A hospital considering the purchase of a new MRI machine and a new cardiac monitoring system.

C) A bank deciding between keeping a manual check sorting process or an automated sort process.

D) A retailer deciding between an inventory management system offered by two different vendors.

A) A manufacturing plant considering a major overhaul of an existing machine or replacing the existing machine with a new model.

B) A hospital considering the purchase of a new MRI machine and a new cardiac monitoring system.

C) A bank deciding between keeping a manual check sorting process or an automated sort process.

D) A retailer deciding between an inventory management system offered by two different vendors.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

13

_______________ decisions are concerned with the process of planning, setting goals and priorities, arranging financing, and using certain criteria to select long-term assets.

A) Limited resources

B) Sell now or process further

C) Capital investment

D) Make-or-buy

A) Limited resources

B) Sell now or process further

C) Capital investment

D) Make-or-buy

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

14

Harrison Company was considering the purchase of equipment.Details on the equipment are as follows:  What is the payback period in years, assuming no taxes are paid?

What is the payback period in years, assuming no taxes are paid?

A) 4.00

B) 4.33

C) 5.00

D) 3.85

What is the payback period in years, assuming no taxes are paid?

What is the payback period in years, assuming no taxes are paid?A) 4.00

B) 4.33

C) 5.00

D) 3.85

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

15

Russell Corp.is considering the purchase of a new machine for $76,000.The machine would generate an annual cash flow of $23,214 for five years.At the end of five years, the machine would have no salvage value.The company's cost of capital is 12 percent.The company uses straight-line depreciation with no mid-year convention. What is the payback period in years for the machine approximated to two decimal points, assuming no taxes are paid?

A) 3.00

B) 9.48

C) 3.27

D) 4.00

A) 3.00

B) 9.48

C) 3.27

D) 4.00

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

16

Flynn Company is considering an investment in equipment for $60,000.Flynn uses the straight-line method of depreciation with no mid-year convention.In addition, its tax rate is 40 percent and the life of the equipment is five years with no salvage value.The expected income before depreciation and taxes is projected to be $30,000 per year. What is the payback period in years approximated to two decimal points?

A) 1.00

B) 2.00

C) 2.63

D) 4.00

A) 1.00

B) 2.00

C) 2.63

D) 4.00

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

17

The accounting rate of return on original investment is calculated as

A) original investment/net income.

B) net income/debt.

C) average income/original investment.

D) assets/debt.

A) original investment/net income.

B) net income/debt.

C) average income/original investment.

D) assets/debt.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

18

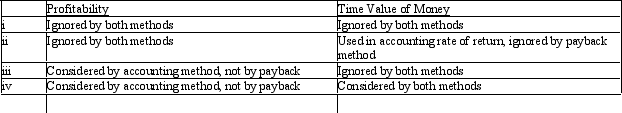

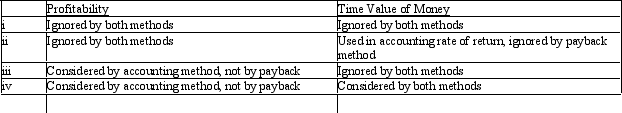

When comparing the payback method and the accounting rate of return methods, which of the following is true?

A) i

B) ii

C) iii

D) iv

A) i

B) ii

C) iii

D) iv

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

19

Dunkin, Inc., is considering the purchase of production equipment that costs $300,000.The equipment is expected to generate an annual cash flow of $100,000 and have a useful life of five years with no salvage value.The firm's cost of capital is 14 percent.The company uses the straight-line method of depreciation with no mid-year convention.Ignore income taxes. Payback for the project is

A) 5.00 years.

B) 3.50 years.

C) 3.00 years.

D) 2.38 years.

A) 5.00 years.

B) 3.50 years.

C) 3.00 years.

D) 2.38 years.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

20

Jolly Corporation is considering an investment in equipment for $25,000.Data related to the investment are as follows:  Jolly uses the straight-line method of depreciation with no mid-year convention.In addition, its tax rate is 40 percent and the life of the equipment is four years with no salvage value.Cost of capital is 12 percent.

Jolly uses the straight-line method of depreciation with no mid-year convention.In addition, its tax rate is 40 percent and the life of the equipment is four years with no salvage value.Cost of capital is 12 percent.

What is the payback period in years approximated to two decimal points?

A) 2.00

B) 0.40

C) 3.33

D) 2.50

Jolly uses the straight-line method of depreciation with no mid-year convention.In addition, its tax rate is 40 percent and the life of the equipment is four years with no salvage value.Cost of capital is 12 percent.

Jolly uses the straight-line method of depreciation with no mid-year convention.In addition, its tax rate is 40 percent and the life of the equipment is four years with no salvage value.Cost of capital is 12 percent.What is the payback period in years approximated to two decimal points?

A) 2.00

B) 0.40

C) 3.33

D) 2.50

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

21

Russell Corp.is considering the purchase of a new machine for $76,000.The machine would generate an annual cash flow of $23,214 per year for five years.At the end of five years, the machine would have no salvage value.The company's cost of capital is 12 percent.The company uses straight-line depreciation with no mid-year convention. What is the net present value for the machine, assuming no taxes are paid?

A) $7,686

B) $-0-

C) $76,000

D) $(185,500)

A) $7,686

B) $-0-

C) $76,000

D) $(185,500)

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following methods uses income instead of cash flows?

A) payback

B) accounting rate of return

C) internal rate of return

D) net present value

A) payback

B) accounting rate of return

C) internal rate of return

D) net present value

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

23

Sargent Corporation is considering an investment in equipment for $20,000.Sargent uses the straight-line method of depreciation with no mid-year convention.In addition, its tax rate is 40 percent, and the life of the equipment is five years with no salvage value.The expected income before depreciation and taxes is projected to be $10,000 per year.The cost of capital is 18 percent. What is the net present value of the investment?

A) $3,765

B) $(1,238)

C) $23,765

D) $18,762

A) $3,765

B) $(1,238)

C) $23,765

D) $18,762

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

24

A firm is evaluating a project that has a net present value of $0 when a discount rate of 8 percent is used.A discount rate of 6 percent will result in a

A) negative net present value.

B) positive net present value.

C) net present value of $0.

D) the question cannot be answered based upon the information provided.

A) negative net present value.

B) positive net present value.

C) net present value of $0.

D) the question cannot be answered based upon the information provided.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

25

Oakland Shop is considering the purchase of a used printing press costing $9,600.The printing press would generate a net cash inflow of $4,000 per year for three years.At the end of three years, the press would have no salvage value.The company's cost of capital is 10 percent.The company uses straight-line depreciation with no mid-year convention. What is the accounting rate of return on the original investment in the press to the nearest percent, assuming no taxes are paid?

A) 41.67%

B) 8.33%

C) 75.00%

D) 10.00%

A) 41.67%

B) 8.33%

C) 75.00%

D) 10.00%

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

26

The present value of $10,000 to be received ten years from now and earning a 12 percent return (rounded) is

A) $2,200.

B) $2,484.

C) $3,160.

D) $3,220.

A) $2,200.

B) $2,484.

C) $3,160.

D) $3,220.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

27

A firm is evaluating a project that has a net present value of $0 when a discount rate of 8 percent is used.A discount rate of 6 percent will result in a

A) negative net present value.

B) positive net present value.

C) net present value of $0.

D) the question cannot be answered based upon the information provided.

A) negative net present value.

B) positive net present value.

C) net present value of $0.

D) the question cannot be answered based upon the information provided.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

28

The present value of $10,000 to be received each year for ten years and earning a 14 percent return (rounded) is

A) $11,600.

B) $26,000.

C) $52,160.

D) $52,436.

A) $11,600.

B) $26,000.

C) $52,160.

D) $52,436.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

29

Jolly Corporation is considering an investment in equipment for $25,000.Data related to the investment are as follows:  Jolly uses the straight-line method of depreciation with no mid-year convention.In addition, its tax rate is 40 percent, and the life of the equipment is four years with no salvage value.Cost of capital is 12 percent.

Jolly uses the straight-line method of depreciation with no mid-year convention.In addition, its tax rate is 40 percent, and the life of the equipment is four years with no salvage value.Cost of capital is 12 percent.

What is the net present value of the investment?

A) $30,370

B) $(2,222)

C) $12,962

D) $5,370

Jolly uses the straight-line method of depreciation with no mid-year convention.In addition, its tax rate is 40 percent, and the life of the equipment is four years with no salvage value.Cost of capital is 12 percent.

Jolly uses the straight-line method of depreciation with no mid-year convention.In addition, its tax rate is 40 percent, and the life of the equipment is four years with no salvage value.Cost of capital is 12 percent.What is the net present value of the investment?

A) $30,370

B) $(2,222)

C) $12,962

D) $5,370

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

30

Holloway Company is considering the purchase of a new machine for $40,000.The machine would generate an annual cash flow before depreciation and taxes of $15,647 for four years.At the end of four years, the machine would have no salvage value.The company's cost of capital is 12 percent.The company uses straight-line depreciation with no mid-year convention and has a 40 percent tax rate. What is the accounting rate of return on the original investment in the machine approximated to two decimal points?

A) 14.12%

B) 8.47%

C) 39.12%

D) 16.92%

A) 14.12%

B) 8.47%

C) 39.12%

D) 16.92%

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

31

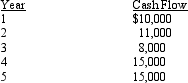

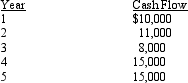

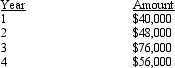

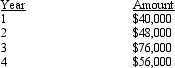

Jackson Company invests in a new piece of equipment costing $40,000.The equipment is expected to yield the following amounts per year for the equipment's four-year useful life:  What is the net present value of this investment in equipment, assuming no taxes are paid?

What is the net present value of this investment in equipment, assuming no taxes are paid?

A) $81,592

B) $41,592

C) $(4,480)

D) $52,452

What is the net present value of this investment in equipment, assuming no taxes are paid?

What is the net present value of this investment in equipment, assuming no taxes are paid?A) $81,592

B) $41,592

C) $(4,480)

D) $52,452

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

32

The accounting rate of return on original investment is calculated as

A) original investment/net income.

B) net income/debt.

C) average income/original investment.

D) assets/debt.

A) original investment/net income.

B) net income/debt.

C) average income/original investment.

D) assets/debt.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

33

Springer Company is considering the purchase of a new machine for $80,000.The machine would generate an annual cash flow before depreciation and taxes of $28,778 for five years.At the end of five years, the machine would have no salvage value.The company's cost of capital is 12 percent.The company uses straight-line depreciation with no mid-year convention and has a 40 percent tax rate. What is the accounting rate of return on the original investment in the machine approximated to two decimal points?

A) 35.97%

B) 19.17%

C) 15.97%

D) 9.58%

A) 35.97%

B) 19.17%

C) 15.97%

D) 9.58%

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

34

Reece Manufacturing Company is considering the following investment proposal:  The firm uses the straight-line method of depreciation with no mid-year convention.

The firm uses the straight-line method of depreciation with no mid-year convention.

What is the net present value for the investment, assuming no taxes are paid?

A) $(500)

B) $15,000

C) $14,948

D) $(52)

The firm uses the straight-line method of depreciation with no mid-year convention.

The firm uses the straight-line method of depreciation with no mid-year convention.What is the net present value for the investment, assuming no taxes are paid?

A) $(500)

B) $15,000

C) $14,948

D) $(52)

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

35

Oakland Shop is considering the purchase of a used printing press costing $9,600.The printing press would generate an annual cash flow of $4,000 per year for three years.At the end of three years, the press would have no salvage value.The company's cost of capital is 10 percent.The company uses straight-line depreciation with no mid-year convention. What is the net present value for the press, assuming no taxes are paid?

A) $2,400

B) $9,948

C) $9,600

D) $348

A) $2,400

B) $9,948

C) $9,600

D) $348

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

36

Mitchell Services is considering an investment of $25,000.Data related to the investment are as follows:  Cost of capital is 14 percent.

Cost of capital is 14 percent.

What is the net present value of the investment, assuming no taxes are paid?

A) $14,825

B) $39,294

C) $25,000

D) $14,294

Cost of capital is 14 percent.

Cost of capital is 14 percent.What is the net present value of the investment, assuming no taxes are paid?

A) $14,825

B) $39,294

C) $25,000

D) $14,294

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

37

Grand Company is considering an investment of $45,000.Data related to the investment are as follows:  Cost of capital is 18 percent.

Cost of capital is 18 percent.

What is the net present value of the investment, assuming no taxes are paid?

A) $10,500

B) $16,367

C) $61,366

D) $55,500

Cost of capital is 18 percent.

Cost of capital is 18 percent.What is the net present value of the investment, assuming no taxes are paid?

A) $10,500

B) $16,367

C) $61,366

D) $55,500

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

38

Houston Corporation is considering an investment in equipment for $45,000.Data related to the investment are as follows:  Cost of capital is 18 percent.

Cost of capital is 18 percent.

Houston uses the straight-line method of depreciation with no mid-year convention.In addition, their tax rate is 40 percent, and the life of the equipment is five years with no salvage value.

What is the net present value of the investment?

A) $67,543

B) $22,543

C) $48,810

D) $11,286

Cost of capital is 18 percent.

Cost of capital is 18 percent.Houston uses the straight-line method of depreciation with no mid-year convention.In addition, their tax rate is 40 percent, and the life of the equipment is five years with no salvage value.

What is the net present value of the investment?

A) $67,543

B) $22,543

C) $48,810

D) $11,286

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

39

If the net present value is positive, it could signal

A) a return in excess of the initial investment or required rate of return has been received.

B) the required rate of return has not been achieved.

C) the initial investment has not been recovered.

D) a decrease in wealth for the firm.

A) a return in excess of the initial investment or required rate of return has been received.

B) the required rate of return has not been achieved.

C) the initial investment has not been recovered.

D) a decrease in wealth for the firm.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

40

The present value of $5,000 to be received each year for five years and earning an 8 percent return (rounded) is

A) $19,965.

B) $20,098.

C) $22,270.

D) $31,080.

A) $19,965.

B) $20,098.

C) $22,270.

D) $31,080.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

41

A firm is considering a project with an annual cash flow of $200,000.The project would have a 7-year life, and the company uses a discount rate of 10 percent.Ignoring income taxes, what is the maximum amount the company could invest in the project and have the project still be acceptable?

A) $718,200

B) $1,400,000

C) $973,600

D) $200,000

A) $718,200

B) $1,400,000

C) $973,600

D) $200,000

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

42

The following information pertains to an investment:  Ignoring income taxes, the present value of the salvage value (rounded) is

Ignoring income taxes, the present value of the salvage value (rounded) is

A) $31,346.

B) $35,500.

C) $34,614.

D) $46,440.

Ignoring income taxes, the present value of the salvage value (rounded) is

Ignoring income taxes, the present value of the salvage value (rounded) isA) $31,346.

B) $35,500.

C) $34,614.

D) $46,440.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

43

The present value of $4,000 to be received each year for three years and earning a 10 percent return (rounded) is

A) $11,120.

B) $9,948.

C) $9,822.

D) $9,200.

A) $11,120.

B) $9,948.

C) $9,822.

D) $9,200.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

44

The present value of $4,000 to be received three years from now and earning a 12 percent return (rounded) is

A) $2,848.

B) $2,520.

C) $4,880.

D) $5,440.

A) $2,848.

B) $2,520.

C) $4,880.

D) $5,440.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

45

The following information pertains to an investment:  Ignore income taxes.The present value of the annual cash flow (rounded) is

Ignore income taxes.The present value of the annual cash flow (rounded) is

A) $136,822.

B) $152,538.

C) $204,884.

D) $218,592.

Ignore income taxes.The present value of the annual cash flow (rounded) is

Ignore income taxes.The present value of the annual cash flow (rounded) isA) $136,822.

B) $152,538.

C) $204,884.

D) $218,592.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

46

Valley Company is considering the purchase of production equipment that costs $800,000.The equipment is expected to generate an annual cash flow of $250,000 and have a useful life of five years with no salvage value.The firm's cost of capital is 12 percent.The straight-line method with no mid-year convention is used. Ignoring income taxes, the net present value of the project is

A) $80,960.

B) $97,250.

C) $101,250.

D) $108,900.

A) $80,960.

B) $97,250.

C) $101,250.

D) $108,900.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

47

A firm is considering a project with an annual cash flow of $80,000.The project would have a 10-year life, and the company uses a discount rate of 8 percent.Ignoring income taxes, what is the maximum amount the company could invest in the project and have the project still be acceptable (rounded)?

A) $800,000

B) $536,800

C) $406,420

D) $727,208

A) $800,000

B) $536,800

C) $406,420

D) $727,208

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

48

Jones Company is considering the purchase of a new machine for $57,000.The machine would generate an annual cash flow of $17,411 for five years.At the end of five years, the machine would have no salvage value.The company's cost of capital is 12 percent.The company uses straight-line depreciation with no mid-year convention. What is the internal rate of return for the machine rounded to the nearest percent, assuming no taxes are paid?

A) 12%

B) 18%

C) 14%

D) 16%

A) 12%

B) 18%

C) 14%

D) 16%

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

49

Clemens Company is considering the purchase of a new machine for $160,000.The machine would generate an annual cash flow before depreciation and taxes of $62,588 for four years.At the end of four years, the machine would have no salvage value.The company's cost of capital is 12 percent.The company uses straight-line depreciation with no mid-year convention and has a 40 percent tax rate. What is the internal rate of return for the machine rounded to the nearest percent?

A) below 12%

B) between 12 and 14%

C) between 14 and 16%

D) between 16 and 18%

A) below 12%

B) between 12 and 14%

C) between 14 and 16%

D) between 16 and 18%

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

50

The internal rate of return is defined as

A) a blend of the costs of capital from all sources.

B) the minimal acceptable interest rate on investments.

C) the difference between the present value of the cash inflows and outflows associated with a project.

D) the interest rate that sets the present value of a project's cash inflows equal to the present value of a project's cost.

A) a blend of the costs of capital from all sources.

B) the minimal acceptable interest rate on investments.

C) the difference between the present value of the cash inflows and outflows associated with a project.

D) the interest rate that sets the present value of a project's cash inflows equal to the present value of a project's cost.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

51

Springer Company is considering the purchase of a new machine for $80,000.The machine would generate an annual cash flow before depreciation and taxes of $28,778 for five years.At the end of five years, the machine would have no salvage value.The company's cost of capital is 12 percent.The company uses straight-line depreciation with no mid-year convention and has a 40 percent tax rate. What is the internal rate of return for the machine rounded to the nearest percent?

A) below 12%

B) between 12 and 14%

C) between 14 and 16%

D) between 16 and 18%

A) below 12%

B) between 12 and 14%

C) between 14 and 16%

D) between 16 and 18%

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

52

Cooper Industries is considering a project that would require an initial investment of $101,000.The project would result in cost savings of $62,000 in year 1 and $70,000 in year 2.The internal rate of return is

A) between 16% and 17%.

B) between 18% and 20%.

C) under 15%.

D) none of these.

A) between 16% and 17%.

B) between 18% and 20%.

C) under 15%.

D) none of these.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

53

A capital investment project requires an investment of $100,000 and has an expected life of four years.Annual cash flows at the end of each year are expected to be as follows:  Ignoring income taxes, the net present value of the project using a 6 percent discount rate is

Ignoring income taxes, the net present value of the project using a 6 percent discount rate is

A) $88,632.

B) $24,792.

C) $68,296.

D) $(28,296).

Ignoring income taxes, the net present value of the project using a 6 percent discount rate is

Ignoring income taxes, the net present value of the project using a 6 percent discount rate isA) $88,632.

B) $24,792.

C) $68,296.

D) $(28,296).

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

54

The present value of $20,000 to be received five years from now and earning a 6 percent return (rounded) is

A) $14,000.

B) $14,940.

C) $15,784.

D) $16,420.

A) $14,000.

B) $14,940.

C) $15,784.

D) $16,420.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

55

A firm is considering a project with an annual cash flow of $240,000.The project would have an 8-year life, and the company uses a discount rate of 12 percent.Ignoring income taxes, what is the maximum amount the company could invest in the project and have the project still be acceptable (rounded)?

A) $977,480

B) $1,125,228

C) $1,160,582

D) $1,192,320

A) $977,480

B) $1,125,228

C) $1,160,582

D) $1,192,320

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following methods consider the time value of money?

A) payback and accounting rate of return

B) payback and internal rate of return

C) internal rate of return and accounting rate of return

D) internal rate of return and net present value

A) payback and accounting rate of return

B) payback and internal rate of return

C) internal rate of return and accounting rate of return

D) internal rate of return and net present value

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

57

The following information pertains to an investment:  Ignore income taxes.The present value of the salvage value (rounded) is

Ignore income taxes.The present value of the salvage value (rounded) is

A) $4,848.

B) $5,738.

C) $6,228.

D) $6,448.

Ignore income taxes.The present value of the salvage value (rounded) is

Ignore income taxes.The present value of the salvage value (rounded) isA) $4,848.

B) $5,738.

C) $6,228.

D) $6,448.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

58

Springer Company is considering the purchase of a new machine for $80,000.The machine would generate an annual cash flow before depreciation and taxes of $28,778 for five years.At the end of five years, the machine would have no salvage value.The company's cost of capital is 12 percent.The company uses straight-line depreciation with no mid-year convention and has a 40 percent tax rate. What is the net present value for the machine?

A) $5,318

B) $-0-

C) $85,318

D) $23,744

A) $5,318

B) $-0-

C) $85,318

D) $23,744

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

59

Hogge Print Shop is considering the purchase of a used printing press costing $38,400.The printing press would generate an annual cash flow of $16,000 for three years.At the end of three years, the press would have no salvage value.The company's cost of capital is 10 percent.The company uses straight-line depreciation with no mid-year convention. What is the internal rate of return to the nearest percent for the press, assuming no taxes are paid?

A) 10%

B) 12%

C) 42%

D) 8%

A) 10%

B) 12%

C) 42%

D) 8%

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

60

Clemens Company is considering the purchase of a new machine for $160,000.The machine would generate an annual cash flow before depreciation and taxes of $62,588 for four years.At the end of four years, the machine would have no salvage value.The company's cost of capital is 12 percent.The company uses straight-line depreciation with no mid-year convention and has a 40 percent tax rate. What is the net present value for the machine?

A) $162,640

B) $2,640

C) $30,080

D) ($45,952)

A) $162,640

B) $2,640

C) $30,080

D) ($45,952)

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

61

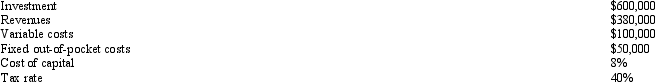

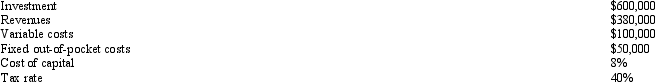

Information about a project Wagner Company is considering is as follows:  The property is considered 5-year property for tax purposes.The company plans to use MACRS and dispose of the property at the end of the sixth year; no salvage value is expected.Assume all cash flows occur at the end of the year.Round amounts to dollars.

The property is considered 5-year property for tax purposes.The company plans to use MACRS and dispose of the property at the end of the sixth year; no salvage value is expected.Assume all cash flows occur at the end of the year.Round amounts to dollars.

The tax savings from depreciation in Year 2 would be

A) $48,000.

B) $64,800.

C) $76,800.

D) $82,400.

The property is considered 5-year property for tax purposes.The company plans to use MACRS and dispose of the property at the end of the sixth year; no salvage value is expected.Assume all cash flows occur at the end of the year.Round amounts to dollars.

The property is considered 5-year property for tax purposes.The company plans to use MACRS and dispose of the property at the end of the sixth year; no salvage value is expected.Assume all cash flows occur at the end of the year.Round amounts to dollars.The tax savings from depreciation in Year 2 would be

A) $48,000.

B) $64,800.

C) $76,800.

D) $82,400.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

62

A firm is considering a project requiring an investment of $200,000.The project would generate an annual cash flow of $55,478 for the next five years.The company uses the straight-line method of depreciation with no mid-year convention.Ignore income taxes.The approximate internal rate of return for the project is

A) 9%.

B) 10%.

C) 12%.

D) 16%.

A) 9%.

B) 10%.

C) 12%.

D) 16%.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

63

Clemens Company is considering the purchase of a new machine for $160,000.The machine would generate an annual cash flow before depreciation and taxes of $62,588 for four years.At the end of four years, the machine would have no salvage value.The company's cost of capital is 12 percent.The company uses straight-line depreciation with no mid-year convention and has a 40 percent tax rate. What is the annual net after-tax cash flow per year?

A) $62,588

B) $16,000

C) $37,552

D) $53,553

A) $62,588

B) $16,000

C) $37,552

D) $53,553

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

64

Van Meter Company is considering the purchase of the following computer equipment, which is considered 5-year property for tax purposes:

- Van Meter plans to use MACRS and keep the production equipment for seven years.(Round amounts to dollars.)

The MACRS deduction in Year 2 would be

A) $172,000.

B) $170,000.

C) $160,000.

D) $140,000.

- Van Meter plans to use MACRS and keep the production equipment for seven years.(Round amounts to dollars.)

The MACRS deduction in Year 2 would be

A) $172,000.

B) $170,000.

C) $160,000.

D) $140,000.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

65

A corporation with taxable income of $400,000 and a 40 percent tax rate is considering the sale of an asset.The original cost of the asset is $20,000, with $12,000 of it depreciated.How much total after-tax cash will be produced from the sale of the asset for $24,000?

A) $17,600

B) $24,000

C) $22,400

D) ($6,400)

A) $17,600

B) $24,000

C) $22,400

D) ($6,400)

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

66

A firm is considering a project requiring an investment of $27,000.The project would generate an annual cash flow of $6,296 for the next seven years.The company uses the straight-line method of depreciation with no mid-year convention.Ignore income taxes.The approximate internal rate of return for the project is

A) 6%.

B) 8%.

C) 12%.

D) 14%.

A) 6%.

B) 8%.

C) 12%.

D) 14%.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

67

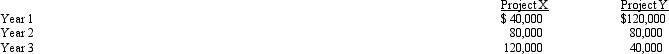

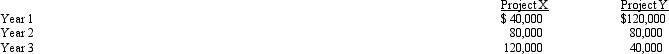

A firm is considering two mutually exclusive projects with the following cash flows:  Each project requires an investment of $100,000.The cost of capital is 10 percent.

Each project requires an investment of $100,000.The cost of capital is 10 percent.

Which project will have the higher net present value?

A) Project X

B) Project Y

C) Project X and Project Y will have the same net present value.

D) It is not possible to answer the question based upon the information provided.

Each project requires an investment of $100,000.The cost of capital is 10 percent.

Each project requires an investment of $100,000.The cost of capital is 10 percent.Which project will have the higher net present value?

A) Project X

B) Project Y

C) Project X and Project Y will have the same net present value.

D) It is not possible to answer the question based upon the information provided.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

68

Chocolate Company is considering an investment in equipment for $60,000.Chocolate uses the straight-line method of depreciation with no mid-year convention.In addition, its tax rate is 40 percent, and the life of the equipment is five years with no salvage value.The expected income before depreciation and taxes is projected to be $30,000 per year. What is the annual cash flow for Year 1?

A) $30,000

B) $18,000

C) $22,800

D) $12,000

A) $30,000

B) $18,000

C) $22,800

D) $12,000

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

69

Menace Corporation is considering an investment in equipment for $50,000.Data related to the investment is as follows:  Menace uses the straight-line method of depreciation with no mid-year convention.In addition, its tax rate is 40 percent and the life of the equipment is four years with no salvage value.Cost of capital is 12 percent.

Menace uses the straight-line method of depreciation with no mid-year convention.In addition, its tax rate is 40 percent and the life of the equipment is four years with no salvage value.Cost of capital is 12 percent.

What is the annual cash flow for Year 1?

A) $20,000

B) $15,000

C) $25,000

D) $5,000

Menace uses the straight-line method of depreciation with no mid-year convention.In addition, its tax rate is 40 percent and the life of the equipment is four years with no salvage value.Cost of capital is 12 percent.

Menace uses the straight-line method of depreciation with no mid-year convention.In addition, its tax rate is 40 percent and the life of the equipment is four years with no salvage value.Cost of capital is 12 percent.What is the annual cash flow for Year 1?

A) $20,000

B) $15,000

C) $25,000

D) $5,000

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

70

If the tax rate is 40 percent and a company has $800,000 of income, a depreciation deduction of $100,000 would result in a tax savings of

A) $34,000.

B) $40,000.

C) $30,000.

D) $66,000.

A) $34,000.

B) $40,000.

C) $30,000.

D) $66,000.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

71

Springer Company is considering the purchase of a new machine for $80,000.The machine would generate an annual cash flow before depreciation and taxes of $28,778 for five years.At the end of five years, the machine would have no salvage value.The company's cost of capital is 12 percent.The company uses straight-line depreciation with no mid-year convention and has a 40 percent tax rate. What is the annual net after-tax cash flow (rounded)?

A) $28,778

B) $8,633

C) $6,400

D) $23,667

A) $28,778

B) $8,633

C) $6,400

D) $23,667

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

72

A machine with a book value of $60,000 could be sold for $80,000.The corporation that owns the machine has taxable income of $670,000 and a 40 percent tax rate.What would be the tax on the sale of the machine?

A) $-0-

B) $20,000

C) $12,000

D) $8,000

A) $-0-

B) $20,000

C) $12,000

D) $8,000

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

73

If the tax rate is 40 percent and a company has $800,000 of income, a depreciation deduction of $160,000 would result in a tax savings of

A) $105,600.

B) $96,000.

C) $64,000.

D) $54,400.

A) $105,600.

B) $96,000.

C) $64,000.

D) $54,400.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

74

Five mutually exclusive projects had the following information:  Which project is preferred?

Which project is preferred?

A) Project A

B) Project B

C) Project C

D) Project D

Which project is preferred?

Which project is preferred?A) Project A

B) Project B

C) Project C

D) Project D

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

75

NPV differs from IRR:

A) NPV measures profitability in absolute terms, whereas the IRR method measures profitability in relative terms.

B) IRR should be used for choosing among competing, mutually exclusive projects.

C) NPV considers the time value of money and IRR does not.

D) Both NPV and IRR will generate the same decisions.

A) NPV measures profitability in absolute terms, whereas the IRR method measures profitability in relative terms.

B) IRR should be used for choosing among competing, mutually exclusive projects.

C) NPV considers the time value of money and IRR does not.

D) Both NPV and IRR will generate the same decisions.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

76

Van Meter Company is considering the purchase of the following computer equipment, which is considered 5-year property for tax purposes:

-Van Meter plans to use MACRS and keep the production equipment for seven years.(Round amounts to dollars.)

The tax savings from depreciation in Year 3 would be

A) $28,570.

B) $38,400.

C) $71,428.

D) $96,000.

-Van Meter plans to use MACRS and keep the production equipment for seven years.(Round amounts to dollars.)

The tax savings from depreciation in Year 3 would be

A) $28,570.

B) $38,400.

C) $71,428.

D) $96,000.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

77

Five mutually exclusive projects had the following information:  Which project is preferred?

Which project is preferred?

A) Project V

B) Project W

C) Project X

D) Project Y

Which project is preferred?

Which project is preferred?A) Project V

B) Project W

C) Project X

D) Project Y

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following capital investment models would be preferred when choosing among mutually exclusive alternatives?

A) payback period

B) accounting rate of return

C) IRR

D) NPV

A) payback period

B) accounting rate of return

C) IRR

D) NPV

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

79

Under the current tax law, an asset that is classified as 5-year property and has a cost of $100,000 would result in a depreciation deduction in Year 2 of

A) $32,000.

B) $25,000.

C) $20,000.

D) $19,200.

A) $32,000.

B) $25,000.

C) $20,000.

D) $19,200.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

80

Under the current tax law, an asset that is classified as 7-year property and has a cost of $400,000 would result in a depreciation deduction in Year 3 of

A) $97,920.

B) $69,960.

C) $66,667.

D) $57,140.

A) $97,920.

B) $69,960.

C) $66,667.

D) $57,140.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck