Deck 2: Investments in Equity Securities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/58

Play

Full screen (f)

Deck 2: Investments in Equity Securities

1

Under which of the following scenarios would Foreign Currency translation of an Associate NOT be required?

A)The Associate is located in a different country.

B)The Associate prepares its financial statements in a foreign currency.

C)The investing Company has borrowings denominated in a Foreign Currency.

D)The Associate prepares its financial statements using the same currency as the Investing Company.

A)The Associate is located in a different country.

B)The Associate prepares its financial statements in a foreign currency.

C)The investing Company has borrowings denominated in a Foreign Currency.

D)The Associate prepares its financial statements using the same currency as the Investing Company.

D

2

Since its inception Company X has had earnings of $800,000 and paid out dividends of $900,000.Which of the following statements is correct with respect to Company X?

A)The Company has been subject to a hostile takeover.

B)The Company's share price will likely increase when investors become aware of this.

C)A liquidating dividend has occurred.

D)Company X's total Shareholder Equity has increased since its inception.

A)The Company has been subject to a hostile takeover.

B)The Company's share price will likely increase when investors become aware of this.

C)A liquidating dividend has occurred.

D)Company X's total Shareholder Equity has increased since its inception.

C

3

Gains and losses on fair-value-through-profit-or-loss securities:

A)are included in net income,regardless of whether they are realized or not.

B)are included in net income only when the investment has become permanently impaired.

C)are included in net income only when realized.

D)are never recorded until the securities are sold.

A)are included in net income,regardless of whether they are realized or not.

B)are included in net income only when the investment has become permanently impaired.

C)are included in net income only when realized.

D)are never recorded until the securities are sold.

A

4

A significant influence investment is one that:

A)allows the investor to exercise significant influence over the strategic,operating and financing policies of the Associate.

B)allows the investor to exercise significant influence over the operating and financing policies of the Associate.

C)allows the investor to exercise significant influence over the strategic and financing policies of the Associate.

D)allows the investor to exercise significant influence over the strategic and operating policies of the Associate.

A)allows the investor to exercise significant influence over the strategic,operating and financing policies of the Associate.

B)allows the investor to exercise significant influence over the operating and financing policies of the Associate.

C)allows the investor to exercise significant influence over the strategic and financing policies of the Associate.

D)allows the investor to exercise significant influence over the strategic and operating policies of the Associate.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following statements is CORRECT?

A)A Comprehensive Revaluation of Assets and Liabilities is mandatory when there has been a change in control.

B)A Comprehensive Revaluation of Assets and Liabilities is optional when there has been a change in control.

C)A Comprehensive Revaluation of Assets and Liabilities is optional when the company was subject to a Financial Reorganization.

D)A Comprehensive Revaluation of Assets and Liabilities is mandatory when there has been a change in control and/or the company has been subject to a Financial Reorganization.

A)A Comprehensive Revaluation of Assets and Liabilities is mandatory when there has been a change in control.

B)A Comprehensive Revaluation of Assets and Liabilities is optional when there has been a change in control.

C)A Comprehensive Revaluation of Assets and Liabilities is optional when the company was subject to a Financial Reorganization.

D)A Comprehensive Revaluation of Assets and Liabilities is mandatory when there has been a change in control and/or the company has been subject to a Financial Reorganization.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is NOT a possible indicator of significant influence?

A)The investor has the ability to elect members to the Board of Directors.

B)The investor has the right to participate in the policymaking process.

C)The investor has engaged in numerous intercompany transactions with the Associate.

D)The Associate's new CEO was previously CEO of the investor company.

A)The investor has the ability to elect members to the Board of Directors.

B)The investor has the right to participate in the policymaking process.

C)The investor has engaged in numerous intercompany transactions with the Associate.

D)The Associate's new CEO was previously CEO of the investor company.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

7

Any unallocated positive Acquisition Differential is normally:

A)pro-rated across the Associate's identifiable net assets.

B)charged to Retained Earnings.

C)recorded as Goodwill.

D)expensed during the year following the acquisition.

A)pro-rated across the Associate's identifiable net assets.

B)charged to Retained Earnings.

C)recorded as Goodwill.

D)expensed during the year following the acquisition.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

8

The difference between the Investor's cost and the Investor's percentage of the net identifiable assets of the Associate is known as:

A)goodwill.

B)the Acquisition Differential.

C)the Fair Value Increment.

D)the Excess Book Value.

A)goodwill.

B)the Acquisition Differential.

C)the Fair Value Increment.

D)the Excess Book Value.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following types of share investment does not qualify as a strategic investment?

A)Significant influence investments.

B)Joint Control investments.

C)Held for Trading.

D)Control investments.

A)Significant influence investments.

B)Joint Control investments.

C)Held for Trading.

D)Control investments.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following does NOT constitute a Business Combination under IFRS 3?

A)A Corp purchases the net assets of B Corp.

B)A Corp enters into a Joint Venture with B Corp.

C)A Corp acquires 51% of B Corp's voting shares for $1,000,000 in Cash.

D)A Corp acquires 51% of B Corp's voting shares for future considerations.

A)A Corp purchases the net assets of B Corp.

B)A Corp enters into a Joint Venture with B Corp.

C)A Corp acquires 51% of B Corp's voting shares for $1,000,000 in Cash.

D)A Corp acquires 51% of B Corp's voting shares for future considerations.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

11

What is the dominant factor used to distinguish portfolio from significant influence investments?

A)Use of the Cost Method.

B)Use of the Equity Method.

C)The investor intends to establish or maintain a long term relationship.

D)Ownership guidelines are the dominant factor.

A)Use of the Cost Method.

B)Use of the Equity Method.

C)The investor intends to establish or maintain a long term relationship.

D)Ownership guidelines are the dominant factor.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following statement(s)pertaining to Joint Ventures is TRUE?

A)A joint venture must have a contractual arrangement establishing joint control over the venture.

B)It must be accounted for using the Cost Method.

C)It must be accounted for using the Equity Method.

D)One of the parties of the joint venture must have unilateral control over the venture.

A)A joint venture must have a contractual arrangement establishing joint control over the venture.

B)It must be accounted for using the Cost Method.

C)It must be accounted for using the Equity Method.

D)One of the parties of the joint venture must have unilateral control over the venture.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

13

The reporting method used when the Investor has control over its the corporation that it has invested in is:

A)the fair value method.

B)the cost method.

C)proportionate consolidation.

D)consolidation.

A)the fair value method.

B)the cost method.

C)proportionate consolidation.

D)consolidation.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following statements is TRUE under IAS 39?

A)All unrealized gains and losses on equity investments are flow through Other Comprehensive Income.

B)Unrealized gains and losses on held-for-trading securities are included in Other Comprehensive Income.

C)Unrealized gains and losses on available-for-sale investments are included in Other Comprehensive Income.

D)Other Comprehensive Income is included in Retained Earnings.

A)All unrealized gains and losses on equity investments are flow through Other Comprehensive Income.

B)Unrealized gains and losses on held-for-trading securities are included in Other Comprehensive Income.

C)Unrealized gains and losses on available-for-sale investments are included in Other Comprehensive Income.

D)Other Comprehensive Income is included in Retained Earnings.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

15

Private enterprise gap is permitted in certain instances for:

A)all privately held companies.

B)all publicly held companies.

C)all Canadian companies.

D)Canadian companies consolidating its foreign subsidiaries.

A)all privately held companies.

B)all publicly held companies.

C)all Canadian companies.

D)Canadian companies consolidating its foreign subsidiaries.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

16

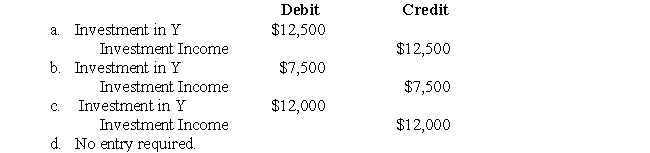

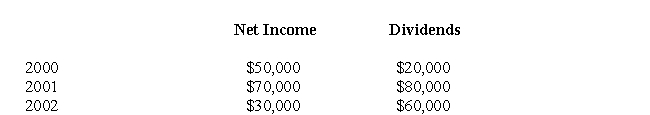

The following information pertains to questions

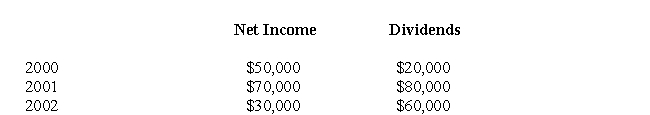

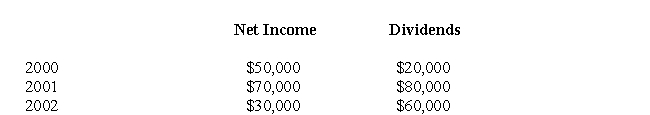

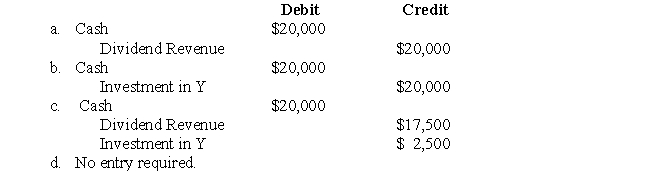

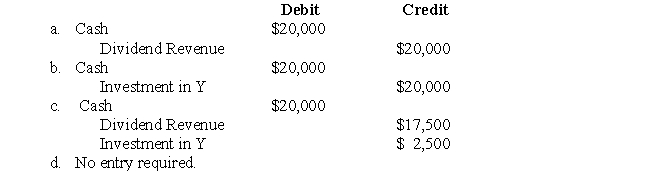

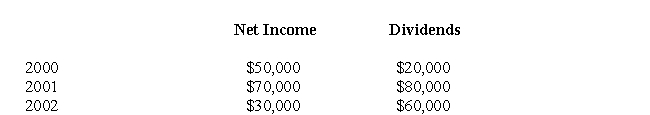

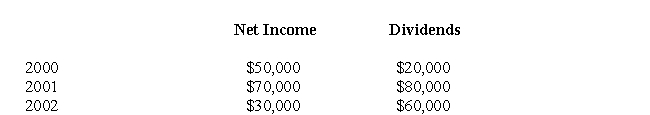

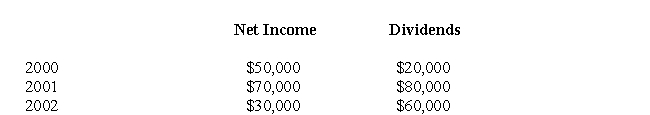

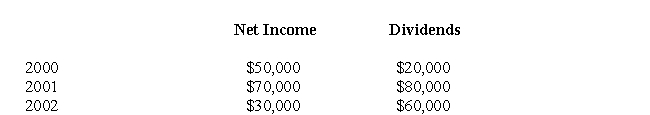

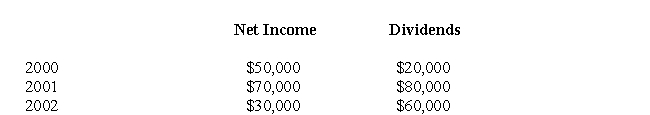

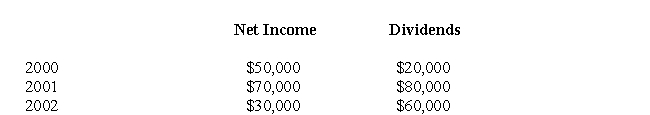

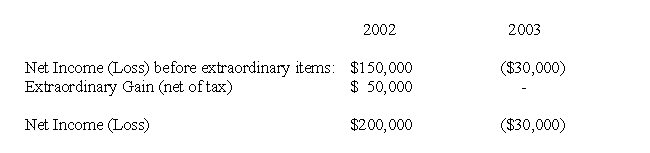

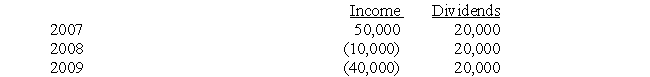

On January 1,2000,X Inc.purchased 12% of the voting shares of Y Inc for $100,000.The investment is reported at cost.X does not have significant influence over Y.Y's net income and paid dividends for the following three years are as follows:

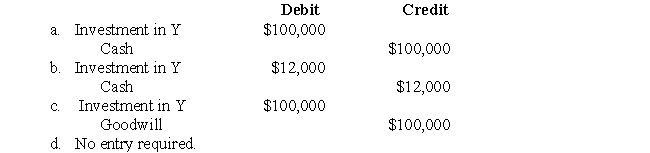

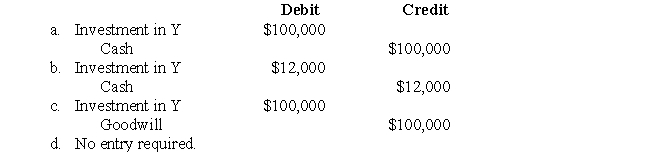

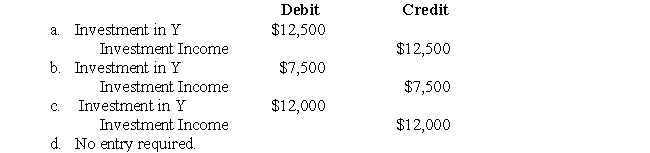

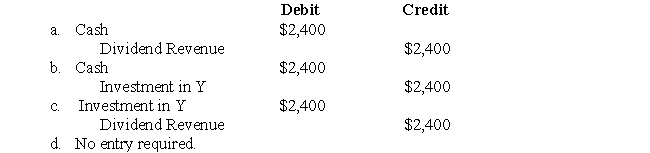

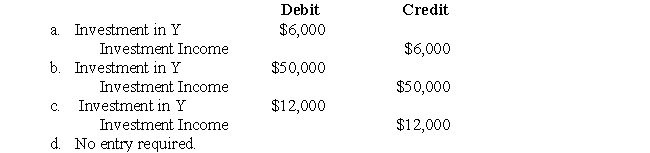

Which of the following journal entries would have to be made to record X's purchase of Y's shares?

On January 1,2000,X Inc.purchased 12% of the voting shares of Y Inc for $100,000.The investment is reported at cost.X does not have significant influence over Y.Y's net income and paid dividends for the following three years are as follows:

Which of the following journal entries would have to be made to record X's purchase of Y's shares?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following statements is correct?

A)Under the Cost Method,Consolidated Net Income is equal to the sum of the income of the parent and it's pro rata share of the net incomes of each of its subsidiaries.

B)Under the Cost Method,Consolidated Net Income is equal to the sum of the income of the parent and the total of the net incomes of each of its subsidiaries.

C)Under the Equity Method,Consolidated Net Income is equal to the sum of the income of the parent and it's pro rata share of the net incomes of each of its subsidiaries.

D)Consolidated Net Income should be equal to the Investor's total income when the Equity method is used.

A)Under the Cost Method,Consolidated Net Income is equal to the sum of the income of the parent and it's pro rata share of the net incomes of each of its subsidiaries.

B)Under the Cost Method,Consolidated Net Income is equal to the sum of the income of the parent and the total of the net incomes of each of its subsidiaries.

C)Under the Equity Method,Consolidated Net Income is equal to the sum of the income of the parent and it's pro rata share of the net incomes of each of its subsidiaries.

D)Consolidated Net Income should be equal to the Investor's total income when the Equity method is used.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following statements is CORRECT?

A)Control is still possible if the Investor owns less than 50% of the voting shares of the Associate.

B)An ownership interest between 20% and 50% always implies significant influence.

C)An ownership interest between 0 and 10% can never imply significant influence.

D)Significant influence is still possible if the Investor owns less than 20% of the voting shares of the Associate.

A)Control is still possible if the Investor owns less than 50% of the voting shares of the Associate.

B)An ownership interest between 20% and 50% always implies significant influence.

C)An ownership interest between 0 and 10% can never imply significant influence.

D)Significant influence is still possible if the Investor owns less than 20% of the voting shares of the Associate.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following statements is correct with respect to the Goodwill implied from an Investment accounted for using the Equity Method?

A)The Goodwill is tested annually for impairment.

B)The Goodwill is amortized over 40 years.

C)Impairment is deemed to have occurred if the market value of the Investment has permanently declined below the investor's carrying value.

D)An adjustment is made to the Investment account only if the market value of the Investment drops significantly below the investor's carrying value,regardless of whether such a drop is permanent in nature.

A)The Goodwill is tested annually for impairment.

B)The Goodwill is amortized over 40 years.

C)Impairment is deemed to have occurred if the market value of the Investment has permanently declined below the investor's carrying value.

D)An adjustment is made to the Investment account only if the market value of the Investment drops significantly below the investor's carrying value,regardless of whether such a drop is permanent in nature.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

20

What percentage of ownership is used as a guideline to determine that significant influence exists under IAS 28?

A)20% or less.

B)Less than 20%.

C)Between 20% and 50%.

D)25% or more.

A)20% or less.

B)Less than 20%.

C)Between 20% and 50%.

D)25% or more.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

21

ABC Inc.acquired 40% of the voting shares of DEF Inc.for $200,000 on January 1,2001.On that date,DEF's Common Shares and Retained Earnings were worth $240,000 and $60,000 respectively.On that date,DEF's Book Values approximated their Fair Values except for DEF's Inventory,which had a market value $50,000 higher than book value,and DEF's Plant & Equipment,which was said to have a market value that was $80,000 higher than its book value.The inventory was subsequently sold to outsiders during the year.The Plant and Equipment had a remaining useful life of ten years from the acquisition date.During the year,DEF earned net income and paid Dividends in the amount of $100,000 and $10,000,respectively.

What is the amount of the Acquisition Differential?

A)($100,000)

B)$ 28,000

C)$ 80,000

D)$100,000

What is the amount of the Acquisition Differential?

A)($100,000)

B)$ 28,000

C)$ 80,000

D)$100,000

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

22

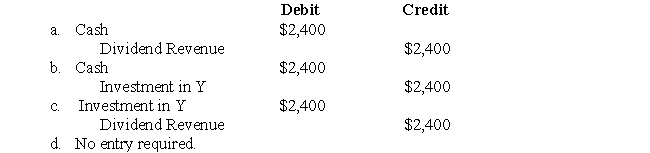

assume the same data that was used to answer question 20 through 25 with the following exceptions:

X owns 25% of Y's voting shares.

X has significant influence over Y

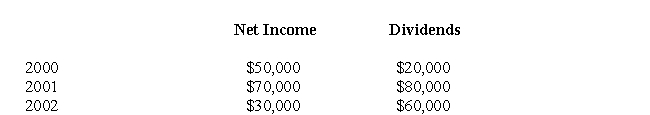

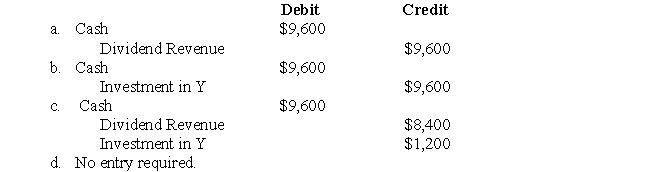

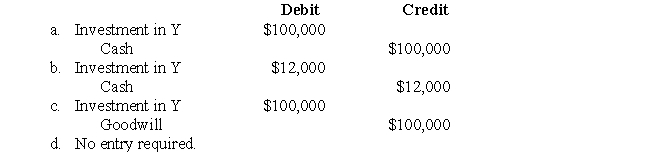

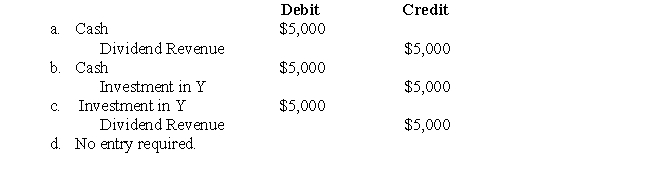

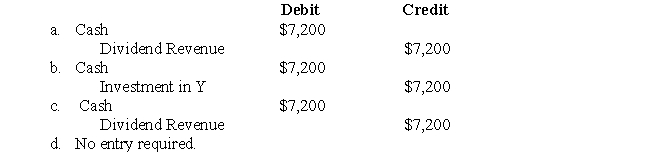

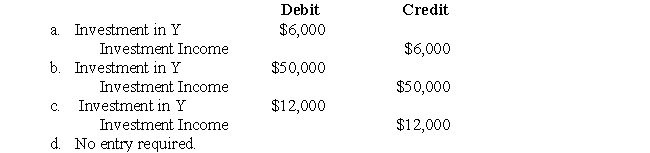

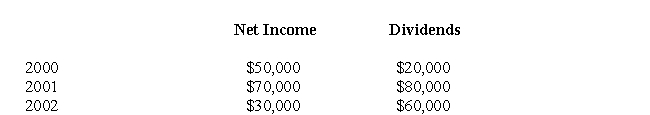

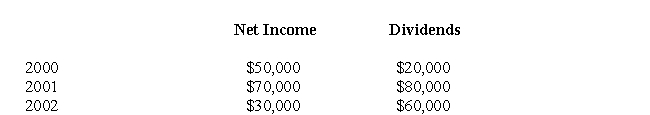

-Which of the following journal entries would have to be made to record X's share of Y's dividends paid for 2001?

X owns 25% of Y's voting shares.

X has significant influence over Y

-Which of the following journal entries would have to be made to record X's share of Y's dividends paid for 2001?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

23

The following information pertains to questions

Jones Corp owns 30% of Klein Inc for $250,000.During 2002,there were numerous intercompany inventory sales.During the year,Jones sold Inventory for $50,000 to Klein.At year-end,half of this Inventory was still in Klein's possession.Also during 2002,Klein sold Inventory for $60,000 to Jones.At year-end,20% of this Inventory was still in Jones' possession.During the year,Klein declared a net income and paid dividends in the amount of $20,000 and $5,000 respectively.Klein's fair values approximated its book values on the date of acquisition.Both companies price all sales at a 25% mark-up above cost.In addition,both companies are subject to an effective tax rate of 40%.

What is the amount of unrealized after-tax profit from downstream sales during 2002?

A)$8,000

B)$3,000

C)$5,000

D)$4,000

Jones Corp owns 30% of Klein Inc for $250,000.During 2002,there were numerous intercompany inventory sales.During the year,Jones sold Inventory for $50,000 to Klein.At year-end,half of this Inventory was still in Klein's possession.Also during 2002,Klein sold Inventory for $60,000 to Jones.At year-end,20% of this Inventory was still in Jones' possession.During the year,Klein declared a net income and paid dividends in the amount of $20,000 and $5,000 respectively.Klein's fair values approximated its book values on the date of acquisition.Both companies price all sales at a 25% mark-up above cost.In addition,both companies are subject to an effective tax rate of 40%.

What is the amount of unrealized after-tax profit from downstream sales during 2002?

A)$8,000

B)$3,000

C)$5,000

D)$4,000

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

24

ABC Inc.acquired 40% of the voting shares of DEF Inc.for $200,000 on January 1,2001.On that date,DEF's Common Shares and Retained Earnings were worth $240,000 and $60,000 respectively.On that date,DEF's Book Values approximated their Fair Values except for DEF's Inventory,which had a market value $50,000 higher than book value,and DEF's Plant & Equipment,which was said to have a market value that was $80,000 higher than its book value.The inventory was subsequently sold to outsiders during the year.The Plant and Equipment had a remaining useful life of ten years from the acquisition date.During the year,DEF earned net income and paid Dividends in the amount of $100,000 and $10,000,respectively.

What would be the amount of the Acquisition Differential amortization for 2002?

A)$3,200

B)$32,000

C)$28,000

D)$2,800

What would be the amount of the Acquisition Differential amortization for 2002?

A)$3,200

B)$32,000

C)$28,000

D)$2,800

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

25

What would be the carrying value of X's Investment in Y at the end of 2002?

A)$100,000

B)$ 97,500

C)$ 98,800

D)$ 91,200

A)$100,000

B)$ 97,500

C)$ 98,800

D)$ 91,200

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

26

The following information pertains to questions

Jones Corp owns 30% of Klein Inc for $250,000.During 2002,there were numerous intercompany inventory sales.During the year,Jones sold Inventory for $50,000 to Klein.At year-end,half of this Inventory was still in Klein's possession.Also during 2002,Klein sold Inventory for $60,000 to Jones.At year-end,20% of this Inventory was still in Jones' possession.During the year,Klein declared a net income and paid dividends in the amount of $20,000 and $5,000 respectively.Klein's fair values approximated its book values on the date of acquisition.Both companies price all sales at a 25% mark-up above cost.In addition,both companies are subject to an effective tax rate of 40%.

What is the amount of unrealized after-tax profit from upstream sales during 2002?

A)$1,440

B)$1,920

C)$5,760

D)$7,200

Jones Corp owns 30% of Klein Inc for $250,000.During 2002,there were numerous intercompany inventory sales.During the year,Jones sold Inventory for $50,000 to Klein.At year-end,half of this Inventory was still in Klein's possession.Also during 2002,Klein sold Inventory for $60,000 to Jones.At year-end,20% of this Inventory was still in Jones' possession.During the year,Klein declared a net income and paid dividends in the amount of $20,000 and $5,000 respectively.Klein's fair values approximated its book values on the date of acquisition.Both companies price all sales at a 25% mark-up above cost.In addition,both companies are subject to an effective tax rate of 40%.

What is the amount of unrealized after-tax profit from upstream sales during 2002?

A)$1,440

B)$1,920

C)$5,760

D)$7,200

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

27

The following information pertains to questions

Jones Corp owns 30% of Klein Inc for $250,000.During 2002,there were numerous intercompany inventory sales.During the year,Jones sold Inventory for $50,000 to Klein.At year-end,half of this Inventory was still in Klein's possession.Also during 2002,Klein sold Inventory for $60,000 to Jones.At year-end,20% of this Inventory was still in Jones' possession.During the year,Klein declared a net income and paid dividends in the amount of $20,000 and $5,000 respectively.Klein's fair values approximated its book values on the date of acquisition.Both companies price all sales at a 25% mark-up above cost.In addition,both companies are subject to an effective tax rate of 40%.

What is the amount of after-tax profit realized from upstream sales during 2002?

A)$7,200

B)$5,760

C)$1,440

D)$1,920

Jones Corp owns 30% of Klein Inc for $250,000.During 2002,there were numerous intercompany inventory sales.During the year,Jones sold Inventory for $50,000 to Klein.At year-end,half of this Inventory was still in Klein's possession.Also during 2002,Klein sold Inventory for $60,000 to Jones.At year-end,20% of this Inventory was still in Jones' possession.During the year,Klein declared a net income and paid dividends in the amount of $20,000 and $5,000 respectively.Klein's fair values approximated its book values on the date of acquisition.Both companies price all sales at a 25% mark-up above cost.In addition,both companies are subject to an effective tax rate of 40%.

What is the amount of after-tax profit realized from upstream sales during 2002?

A)$7,200

B)$5,760

C)$1,440

D)$1,920

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

28

The following information pertains to questions

On January 1,2000,X Inc.purchased 12% of the voting shares of Y Inc for $100,000.The investment is reported at cost.X does not have significant influence over Y.Y's net income and paid dividends for the following three years are as follows:

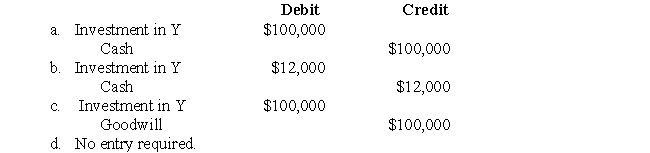

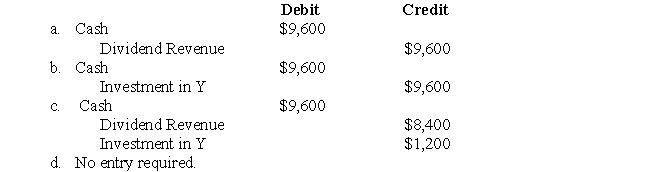

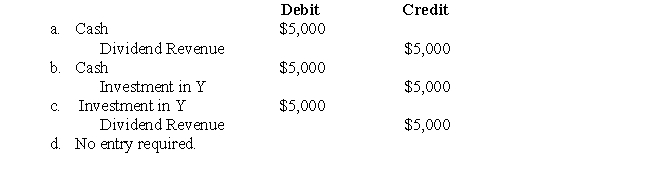

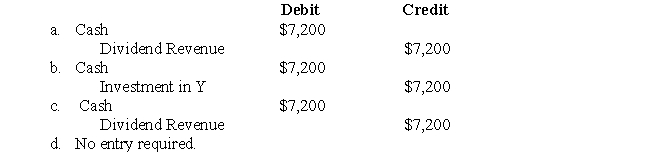

Which of the following journal entries would have to be made to record X's share of Y's dividends paid for 2001?

On January 1,2000,X Inc.purchased 12% of the voting shares of Y Inc for $100,000.The investment is reported at cost.X does not have significant influence over Y.Y's net income and paid dividends for the following three years are as follows:

Which of the following journal entries would have to be made to record X's share of Y's dividends paid for 2001?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

29

assume the same data that was used to answer question 20 through 25 with the following exceptions:

X owns 25% of Y's voting shares.

X has significant influence over Y

-Which of the following journal entries would have to be made to record X's purchase of Y's shares?

X owns 25% of Y's voting shares.

X has significant influence over Y

-Which of the following journal entries would have to be made to record X's purchase of Y's shares?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

30

assume the same data that was used to answer question 20 through 25 with the following exceptions:

X owns 25% of Y's voting shares.

X has significant influence over Y

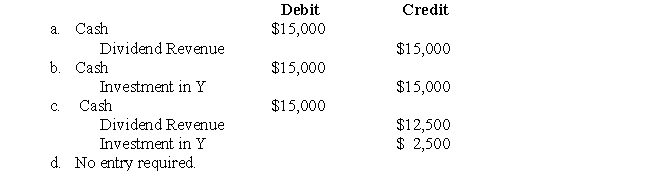

-Which of the following journal entries would have to be made to record X's share of Y's dividends paid for 2000?

X owns 25% of Y's voting shares.

X has significant influence over Y

-Which of the following journal entries would have to be made to record X's share of Y's dividends paid for 2000?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

31

assume the same data that was used to answer question 20 through 25 with the following exceptions:

X owns 25% of Y's voting shares.

X has significant influence over Y

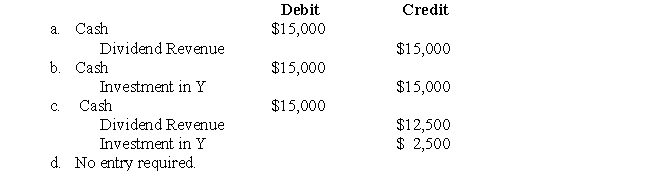

-Which of the following journal entries would have to be made to record X's share of Y's dividends paid for 2002?

X owns 25% of Y's voting shares.

X has significant influence over Y

-Which of the following journal entries would have to be made to record X's share of Y's dividends paid for 2002?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

32

assume the same data that was used to answer question 20 through 25 with the following exceptions:

X owns 25% of Y's voting shares.

X has significant influence over Y

-Which of the following journal entries would have to be made to record X's share of Y's net income for 2000?

X owns 25% of Y's voting shares.

X has significant influence over Y

-Which of the following journal entries would have to be made to record X's share of Y's net income for 2000?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

33

The following information pertains to questions

On January 1,2000,X Inc.purchased 12% of the voting shares of Y Inc for $100,000.The investment is reported at cost.X does not have significant influence over Y.Y's net income and paid dividends for the following three years are as follows:

Which of the following journal entries would have to be made to record X's share of Y's dividends paid for 2000?

On January 1,2000,X Inc.purchased 12% of the voting shares of Y Inc for $100,000.The investment is reported at cost.X does not have significant influence over Y.Y's net income and paid dividends for the following three years are as follows:

Which of the following journal entries would have to be made to record X's share of Y's dividends paid for 2000?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

34

The following information pertains to questions

On January 1,2000,X Inc.purchased 12% of the voting shares of Y Inc for $100,000.The investment is reported at cost.X does not have significant influence over Y.Y's net income and paid dividends for the following three years are as follows:

Which of the following journal entries would have to be made to record X's share of Y's dividends paid for 2002?

On January 1,2000,X Inc.purchased 12% of the voting shares of Y Inc for $100,000.The investment is reported at cost.X does not have significant influence over Y.Y's net income and paid dividends for the following three years are as follows:

Which of the following journal entries would have to be made to record X's share of Y's dividends paid for 2002?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

35

ABC Inc.acquired 40% of the voting shares of DEF Inc.for $200,000 on January 1,2001.On that date,DEF's Common Shares and Retained Earnings were worth $240,000 and $60,000 respectively.On that date,DEF's Book Values approximated their Fair Values except for DEF's Inventory,which had a market value $50,000 higher than book value,and DEF's Plant & Equipment,which was said to have a market value that was $80,000 higher than its book value.The inventory was subsequently sold to outsiders during the year.The Plant and Equipment had a remaining useful life of ten years from the acquisition date.During the year,DEF earned net income and paid Dividends in the amount of $100,000 and $10,000,respectively.

What would be the amount of the Acquisition Differential amortization for 2001?

A)$28,000

B)$26,000

C)$130,000

D)$23,200

What would be the amount of the Acquisition Differential amortization for 2001?

A)$28,000

B)$26,000

C)$130,000

D)$23,200

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

36

The following information pertains to questions

On January 1,2000,X Inc.purchased 12% of the voting shares of Y Inc for $100,000.The investment is reported at cost.X does not have significant influence over Y.Y's net income and paid dividends for the following three years are as follows:

Which of the following journal entries would have to be made to record X's share of Y's net income for 2000?

On January 1,2000,X Inc.purchased 12% of the voting shares of Y Inc for $100,000.The investment is reported at cost.X does not have significant influence over Y.Y's net income and paid dividends for the following three years are as follows:

Which of the following journal entries would have to be made to record X's share of Y's net income for 2000?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

37

ABC Inc.acquired 40% of the voting shares of DEF Inc.for $200,000 on January 1,2001.On that date,DEF's Common Shares and Retained Earnings were worth $240,000 and $60,000 respectively.On that date,DEF's Book Values approximated their Fair Values except for DEF's Inventory,which had a market value $50,000 higher than book value,and DEF's Plant & Equipment,which was said to have a market value that was $80,000 higher than its book value.The inventory was subsequently sold to outsiders during the year.The Plant and Equipment had a remaining useful life of ten years from the acquisition date.During the year,DEF earned net income and paid Dividends in the amount of $100,000 and $10,000,respectively.

What would be the carrying value of ABC's Investment in DEF on January 31,2001?

A)$200,000

B)$300,000

C)$290,000

D)$212,800

What would be the carrying value of ABC's Investment in DEF on January 31,2001?

A)$200,000

B)$300,000

C)$290,000

D)$212,800

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

38

ABC Inc.acquired 40% of the voting shares of DEF Inc.for $200,000 on January 1,2001.On that date,DEF's Common Shares and Retained Earnings were worth $240,000 and $60,000 respectively.On that date,DEF's Book Values approximated their Fair Values except for DEF's Inventory,which had a market value $50,000 higher than book value,and DEF's Plant & Equipment,which was said to have a market value that was $80,000 higher than its book value.The inventory was subsequently sold to outsiders during the year.The Plant and Equipment had a remaining useful life of ten years from the acquisition date.During the year,DEF earned net income and paid Dividends in the amount of $100,000 and $10,000,respectively.

What is the amount of Goodwill arising from ABC's acquisition of DEF?

A)($100,000)

B)$ 28,000

C)$ 80,000

D)$100,000

What is the amount of Goodwill arising from ABC's acquisition of DEF?

A)($100,000)

B)$ 28,000

C)$ 80,000

D)$100,000

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

39

The following information pertains to questions

Jones Corp owns 30% of Klein Inc for $250,000.During 2002,there were numerous intercompany inventory sales.During the year,Jones sold Inventory for $50,000 to Klein.At year-end,half of this Inventory was still in Klein's possession.Also during 2002,Klein sold Inventory for $60,000 to Jones.At year-end,20% of this Inventory was still in Jones' possession.During the year,Klein declared a net income and paid dividends in the amount of $20,000 and $5,000 respectively.Klein's fair values approximated its book values on the date of acquisition.Both companies price all sales at a 25% mark-up above cost.In addition,both companies are subject to an effective tax rate of 40%.

What is the amount of after-tax profit realized from downstream sales during 2002?

A)$8,000

B)$5,000

C)$3,000

D)$4,000

Jones Corp owns 30% of Klein Inc for $250,000.During 2002,there were numerous intercompany inventory sales.During the year,Jones sold Inventory for $50,000 to Klein.At year-end,half of this Inventory was still in Klein's possession.Also during 2002,Klein sold Inventory for $60,000 to Jones.At year-end,20% of this Inventory was still in Jones' possession.During the year,Klein declared a net income and paid dividends in the amount of $20,000 and $5,000 respectively.Klein's fair values approximated its book values on the date of acquisition.Both companies price all sales at a 25% mark-up above cost.In addition,both companies are subject to an effective tax rate of 40%.

What is the amount of after-tax profit realized from downstream sales during 2002?

A)$8,000

B)$5,000

C)$3,000

D)$4,000

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

40

The following information pertains to questions

On January 1,2000,X Inc.purchased 12% of the voting shares of Y Inc for $100,000.The investment is reported at cost.X does not have significant influence over Y.Y's net income and paid dividends for the following three years are as follows:

What would be the carrying value of X's Investment in Y at the end of 2002?

A)$100,000

B)$98,800

C)$90,000

D)$91,200

On January 1,2000,X Inc.purchased 12% of the voting shares of Y Inc for $100,000.The investment is reported at cost.X does not have significant influence over Y.Y's net income and paid dividends for the following three years are as follows:

What would be the carrying value of X's Investment in Y at the end of 2002?

A)$100,000

B)$98,800

C)$90,000

D)$91,200

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

41

On January 1,2001,Joyce Inc.paid $600,000 to purchase 25% of Mark Inc's outstanding voting shares.Joyce has significant influence over Mark.On the date of acquisition,Mark's net assets were valued at $2,000,000.Any Acquisition Differential was allocated to Plant & Equipment,with a remaining useful life of 5 years.Mark's earnings for 2001 and 2002 were $100,000 and $200,000 respectively.Mark paid dividends in the amount of $20,000 and $10,000 during 2001 and 2002,respectively.

Required:

Calculate the balance in Joyce's Investment account as at December 31,2002.

Required:

Calculate the balance in Joyce's Investment account as at December 31,2002.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

42

Assuming that X's Investment in Y qualifies as a portfolio investment,what journal entry should be made at the end of the year?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

43

Prepare X's journal entries for 2002 and 2003,assuming that this is a significant influence investment.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

44

The following information pertains to questions

Jones Corp owns 30% of Klein Inc for $250,000.During 2002,there were numerous intercompany inventory sales.During the year,Jones sold Inventory for $50,000 to Klein.At year-end,half of this Inventory was still in Klein's possession.Also during 2002,Klein sold Inventory for $60,000 to Jones.At year-end,20% of this Inventory was still in Jones' possession.During the year,Klein declared a net income and paid dividends in the amount of $20,000 and $5,000 respectively.Klein's fair values approximated its book values on the date of acquisition.Both companies price all sales at a 25% mark-up above cost.In addition,both companies are subject to an effective tax rate of 40%.

What would be the carrying value of Jones' Investment in Klein on January 31,2002?

A)$250,000

B)$265,000

C)$251,068

D)$259,240

Jones Corp owns 30% of Klein Inc for $250,000.During 2002,there were numerous intercompany inventory sales.During the year,Jones sold Inventory for $50,000 to Klein.At year-end,half of this Inventory was still in Klein's possession.Also during 2002,Klein sold Inventory for $60,000 to Jones.At year-end,20% of this Inventory was still in Jones' possession.During the year,Klein declared a net income and paid dividends in the amount of $20,000 and $5,000 respectively.Klein's fair values approximated its book values on the date of acquisition.Both companies price all sales at a 25% mark-up above cost.In addition,both companies are subject to an effective tax rate of 40%.

What would be the carrying value of Jones' Investment in Klein on January 31,2002?

A)$250,000

B)$265,000

C)$251,068

D)$259,240

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

45

Assuming that a company's ownership interest in the Associate increases or decreases,how are changes from the Cost to the Equity Method (or vice-versa)to be handled?

A)Changes from the Cost Method to the Equity Method are to be handled prospectively,while changes from the Equity Method to the Cost Method are to be handled retroactively.

B)Changes from the Cost Method to the Equity Method are to be handled retroactively,while changes from the Equity Method to the Cost Method are to be handled prospectively.

C)Any change is to be handled retroactively.

D)Any change is to be handled prospectively.

A)Changes from the Cost Method to the Equity Method are to be handled prospectively,while changes from the Equity Method to the Cost Method are to be handled retroactively.

B)Changes from the Cost Method to the Equity Method are to be handled retroactively,while changes from the Equity Method to the Cost Method are to be handled prospectively.

C)Any change is to be handled retroactively.

D)Any change is to be handled prospectively.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

46

Assuming that X's Investment in Y qualifies as a significant influence investment,what journal entry should be made at the end of the year?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

47

The following information pertains to questions

X purchased 30% of Y of Y on January 1,2002 for $300,000.On the date,Y's net assets of Y had a book value of $500,000.Any Acquisition Differential on the acquisition date is to be allocated to Y's Equipment,which had a remaining useful life of 5 years from the date of acquisition.Y paid dividends of $20,000 in each year.

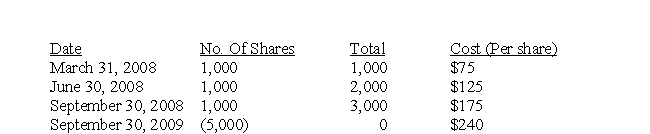

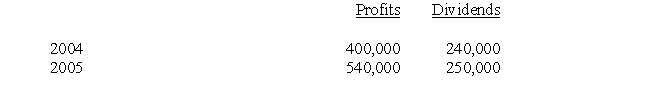

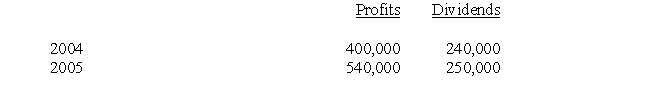

Y's income statements for 2002 and 2003 showed the following:

UNI Inc.owns 30% of the outstanding voting shares of IOU Inc.UNI has significant influence over IOU.UNI's Investment in IOU Account had a balance of $500,000 on January 1,2003.Amortization of the Acquisition Differential amounted to $20,000 per year.On December 31,2003 UNI reported a Net Income of $150,000 and paid dividends in the amount of $15,000.In 2002 IOU had sold Inventory to UNI for $30,000,which was a 50% mark-up above IOU's cost.This inventory was sold to outsiders during 2003.During 2003,UNI sold inventory to IOU and recorded a profit of $30,000 on the sale.Half of this inventory was still on hand at the end of 2003.Both companies are subject to a tax rate of 30%.UNI's Income statement for 2003 showed Sales and Operating Expenses (including Income Taxes)of $800,000 and $600,000 respectively before the equity method journal entries were prepared with respect to the Investment in UNI.

Required:

Prepare an abbreviated income statement for UNI Inc.one the Investment in IOU has been correctly accounted for in accordance with GAAP.

X purchased 30% of Y of Y on January 1,2002 for $300,000.On the date,Y's net assets of Y had a book value of $500,000.Any Acquisition Differential on the acquisition date is to be allocated to Y's Equipment,which had a remaining useful life of 5 years from the date of acquisition.Y paid dividends of $20,000 in each year.

Y's income statements for 2002 and 2003 showed the following:

UNI Inc.owns 30% of the outstanding voting shares of IOU Inc.UNI has significant influence over IOU.UNI's Investment in IOU Account had a balance of $500,000 on January 1,2003.Amortization of the Acquisition Differential amounted to $20,000 per year.On December 31,2003 UNI reported a Net Income of $150,000 and paid dividends in the amount of $15,000.In 2002 IOU had sold Inventory to UNI for $30,000,which was a 50% mark-up above IOU's cost.This inventory was sold to outsiders during 2003.During 2003,UNI sold inventory to IOU and recorded a profit of $30,000 on the sale.Half of this inventory was still on hand at the end of 2003.Both companies are subject to a tax rate of 30%.UNI's Income statement for 2003 showed Sales and Operating Expenses (including Income Taxes)of $800,000 and $600,000 respectively before the equity method journal entries were prepared with respect to the Investment in UNI.

Required:

Prepare an abbreviated income statement for UNI Inc.one the Investment in IOU has been correctly accounted for in accordance with GAAP.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

48

The following information pertains to questions

Jones Corp owns 30% of Klein Inc for $250,000.During 2002,there were numerous intercompany inventory sales.During the year,Jones sold Inventory for $50,000 to Klein.At year-end,half of this Inventory was still in Klein's possession.Also during 2002,Klein sold Inventory for $60,000 to Jones.At year-end,20% of this Inventory was still in Jones' possession.During the year,Klein declared a net income and paid dividends in the amount of $20,000 and $5,000 respectively.Klein's fair values approximated its book values on the date of acquisition.Both companies price all sales at a 25% mark-up above cost.In addition,both companies are subject to an effective tax rate of 40%.

What is the amount of unrealized after-tax profit from upstream deducted from the Investment in Klein account during 2002?

A)$1,440

B)$1,920

C)$5,760

D)$432

Jones Corp owns 30% of Klein Inc for $250,000.During 2002,there were numerous intercompany inventory sales.During the year,Jones sold Inventory for $50,000 to Klein.At year-end,half of this Inventory was still in Klein's possession.Also during 2002,Klein sold Inventory for $60,000 to Jones.At year-end,20% of this Inventory was still in Jones' possession.During the year,Klein declared a net income and paid dividends in the amount of $20,000 and $5,000 respectively.Klein's fair values approximated its book values on the date of acquisition.Both companies price all sales at a 25% mark-up above cost.In addition,both companies are subject to an effective tax rate of 40%.

What is the amount of unrealized after-tax profit from upstream deducted from the Investment in Klein account during 2002?

A)$1,440

B)$1,920

C)$5,760

D)$432

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

49

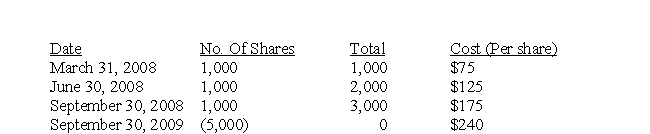

Telnor Corporation (whose year end is December 31 of each year)has made a series of investments in Pineapple Corp. ,one of their major customers.The management of Telnor has been impressed by the products produced and sold by Pineapple and their market success.These investments have been classified as available-for-sale and are only going to be held for a short period of time.The market price of Pineapple stock on December 31,2008 and 2009 was $200 and $250 respectively per share.Dividends of $1.00 per share were declared and paid on December 31 of each year.The following are the purchases and sales that Telnor entered into in 2008 and 2009:

Required:

(a)Prepare the journal entries to record the transactions in 2008 and 2009 with respect to Telnor's investment in Pineapple.

(b)How would Telnor disclose the investment in Pineapple on its balance sheet?

Required:

(a)Prepare the journal entries to record the transactions in 2008 and 2009 with respect to Telnor's investment in Pineapple.

(b)How would Telnor disclose the investment in Pineapple on its balance sheet?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

50

If the Investor sells part of its stake in the Associate,the gain or loss on the sale of these shares is calculated using which of the following?

A)The average carrying value of the Investment.

B)FIFO.

C)LIFO.

D)Specific Identification.

A)The average carrying value of the Investment.

B)FIFO.

C)LIFO.

D)Specific Identification.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

51

How is an Associate's Income from non-operating sources such as extraordinary gains and losses to be accounted for?

A)Any such gains or losses are to be charged directly to Retained Earnings net of tax.

B)Any such gains or losses are combined with revenue and expenses from operations.The investor's pro rata share of these after-tax gains and losses are added to or deducted from the Investment account.

C)Any such gains or losses are shown separately,net of tax below income from operations on the Associate's Income statement.The investor's pro rata share of these after-tax gains and losses are added to or deducted from the Investment account.

D)No specific accounting treatment is required.These extraordinary items simply have to be disclosed in a note to the financial statements.

A)Any such gains or losses are to be charged directly to Retained Earnings net of tax.

B)Any such gains or losses are combined with revenue and expenses from operations.The investor's pro rata share of these after-tax gains and losses are added to or deducted from the Investment account.

C)Any such gains or losses are shown separately,net of tax below income from operations on the Associate's Income statement.The investor's pro rata share of these after-tax gains and losses are added to or deducted from the Investment account.

D)No specific accounting treatment is required.These extraordinary items simply have to be disclosed in a note to the financial statements.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

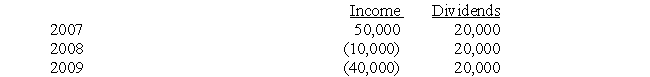

52

Dragon Corporation acquired a 7% interest in the outstanding shares of Slayer Inc.on January 1,2007 at a cost of $200,000.Slayer reported net income and made dividend payments to its shareholders at noted below.On December 31,2009 Slayer declared bankruptcy as a result of a series of losses as noted.

Required:

(a)Prepare the journal entries that Dragon would make in each year.

(b)Prepare the general ledger account for Dragon's investment in Slayer.

Required:

(a)Prepare the journal entries that Dragon would make in each year.

(b)Prepare the general ledger account for Dragon's investment in Slayer.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

53

The following information pertains to questions

X purchased 30% of Y of Y on January 1,2002 for $300,000.On the date,Y's net assets of Y had a book value of $500,000.Any Acquisition Differential on the acquisition date is to be allocated to Y's Equipment,which had a remaining useful life of 5 years from the date of acquisition.Y paid dividends of $20,000 in each year.

Y's income statements for 2002 and 2003 showed the following:

On January 1,2004,Black Corporation purchased 15 per cent of the outstanding shares of White Corporation for $498,000.From Black's perspective,White was a FVTPL investment.The fair value of Black's investment was $520,000 at December 31,2004.

On January 1,2005,Black purchased an additional 30 per cent of White's shares for $750,000.The second share purchase allows Black to exert significant influence over White There was an acquisition differential of 30 per cent on the date of acquisition.

During the two years White reported the following results:

Required:

With respect to this investment,prepare Black's journal entries for both 2004 and 2005.

X purchased 30% of Y of Y on January 1,2002 for $300,000.On the date,Y's net assets of Y had a book value of $500,000.Any Acquisition Differential on the acquisition date is to be allocated to Y's Equipment,which had a remaining useful life of 5 years from the date of acquisition.Y paid dividends of $20,000 in each year.

Y's income statements for 2002 and 2003 showed the following:

On January 1,2004,Black Corporation purchased 15 per cent of the outstanding shares of White Corporation for $498,000.From Black's perspective,White was a FVTPL investment.The fair value of Black's investment was $520,000 at December 31,2004.

On January 1,2005,Black purchased an additional 30 per cent of White's shares for $750,000.The second share purchase allows Black to exert significant influence over White There was an acquisition differential of 30 per cent on the date of acquisition.

During the two years White reported the following results:

Required:

With respect to this investment,prepare Black's journal entries for both 2004 and 2005.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

54

Prepare X's journal entries for 2002 and 2003,assuming that this is a Portfolio Investment.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

55

On January 1,2002,James Inc.paid $500,000 to purchase 40% of Joyce Inc's outstanding voting shares.James has significant influence over Joyce.On the date of acquisition,Joyce's net assets were valued at $1,000,000.Any Acquisition Differential was allocated to a Trademark a remaining useful life of 20 years.Joyce's earnings for 2002 and 2003 were $60,000 and $100,000 respectively.Joyce paid dividends in the amount of $15,000 and $20,000 during 2002 and 2003,respectively.

Required:

Calculate the balance in James' Investment account as at December 31,2003.

Required:

Calculate the balance in James' Investment account as at December 31,2003.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

56

Ronen Corporation owns 35% of the outstanding voting shares of Western Communications Inc.Over which it exerts significant influence.The carrying value of its investment as at October 31,2009 was $3,750,000.Ronen has now designated its investment in Western as FVTPL as a result of the open market purchase of a 51% interest in Western by Overhaul Corp.Western is in financial distress.The market value of Ronen's 35% interest is now $2,000,000.

Required:

(a)What is the accounting result of a change from the equity method of accounting to FVTPL;

(b)Do any journal entries need to be recorded by Ronen as a result of this change? If so,what is the entry?

Required:

(a)What is the accounting result of a change from the equity method of accounting to FVTPL;

(b)Do any journal entries need to be recorded by Ronen as a result of this change? If so,what is the entry?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

57

The following information pertains to questions

Jones Corp owns 30% of Klein Inc for $250,000.During 2002,there were numerous intercompany inventory sales.During the year,Jones sold Inventory for $50,000 to Klein.At year-end,half of this Inventory was still in Klein's possession.Also during 2002,Klein sold Inventory for $60,000 to Jones.At year-end,20% of this Inventory was still in Jones' possession.During the year,Klein declared a net income and paid dividends in the amount of $20,000 and $5,000 respectively.Klein's fair values approximated its book values on the date of acquisition.Both companies price all sales at a 25% mark-up above cost.In addition,both companies are subject to an effective tax rate of 40%.

What is the amount of unrealized after-tax profit from downstream sales deducted from the Investment in Klein account during 2002?

A)$8,000

B)$5,000

C)$3,000

D)Nil

Jones Corp owns 30% of Klein Inc for $250,000.During 2002,there were numerous intercompany inventory sales.During the year,Jones sold Inventory for $50,000 to Klein.At year-end,half of this Inventory was still in Klein's possession.Also during 2002,Klein sold Inventory for $60,000 to Jones.At year-end,20% of this Inventory was still in Jones' possession.During the year,Klein declared a net income and paid dividends in the amount of $20,000 and $5,000 respectively.Klein's fair values approximated its book values on the date of acquisition.Both companies price all sales at a 25% mark-up above cost.In addition,both companies are subject to an effective tax rate of 40%.

What is the amount of unrealized after-tax profit from downstream sales deducted from the Investment in Klein account during 2002?

A)$8,000

B)$5,000

C)$3,000

D)Nil

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

58

On January 1,2002,Jonson Inc.paid $400,000 to purchase 20% of Mike Inc's outstanding voting shares.Jonson has significant influence over Mike.On the date of acquisition,Mike's net assets were valued at $1,200,000.Any Acquisition Differential was allocated to a Patent a remaining useful life of 10 years.Mike's earnings for 2002 and 2003 were $50,000 and $80,000 respectively.Mike paid dividends in the amount of $10,000 and $15,000 during 2002 and 2003,respectively.

Required:

Calculate the balance in Jonson's Investment account as at December 31,2003.

Required:

Calculate the balance in Jonson's Investment account as at December 31,2003.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck