Deck 16: Multistate Corporate Taxation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/102

Play

Full screen (f)

Deck 16: Multistate Corporate Taxation

1

States use a common apportionment formula and set of factors,known as the Streamlined Sales Tax Method.

False

2

In most states,a taxpayer's income is apportioned on the basis of a formula measuring the extent of business contact,and allocated according to the location of property owned or used.

True

3

Roughly one-fifth of all taxes paid by businesses in the U.S.are to state,local,and municipal jurisdictions.

False

4

Politicians use tax devices to create economic development incentives.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

5

A state or local tax on a corporation's income might be called a franchise tax or a business privilege tax.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

6

A typical state taxable income addition modification is the income tax paid to the state for the year.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

7

All but a few states have adopted a tax based on net taxable income.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

8

A typical state taxable income addition modification is the Federal income tax expense.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

9

Most states begin the computation of taxable income with an amount from the Federal income tax return.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

10

Only a few states have adopted an alternative minimum tax,similar to the Federal system.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

11

States collect the most tax dollars from the sales/use tax.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

12

Typical indicators of nexus include the presence of employees based in the state,and the ownership or lease of realty there.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

13

If a state follows Federal income tax rules,tax compliance and enforcement become easier to accomplish.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

14

State and local politicians tend to apply new and increased taxes to taxpayers who are visitors to the jurisdiction and cannot vote to reelect the lawmaker.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

15

Double weighting the sales factor effectively increases the tax burden on taxpayers based in the state,such as corporations with in-state headquarters.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

16

A state cannot levy a tax on a business unless the business was incorporated in the state.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

17

Under P.L.86-272,the taxpayer is exempt from state taxes on income resulting from the mere solicitation of orders for the sale of tangible personal property in the state.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

18

The corporate income tax provides about one-half of the annual tax revenues for the typical U.S.state.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

19

Nonbusiness income includes rentals of investment property.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

20

Usually a business chooses a location where it will build a new plant based chiefly on tax considerations.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

21

S corporations must withhold taxes on the portions of the entity's income allocated to its shareholders.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

22

The property factor includes assets that the taxpayer owns,but not those merely used under a lease agreement.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

23

Typically exempt from the sales/use tax base is the purchase of lumber by a do-it-yourself homeowner,when she builds a deck onto her patio.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

24

By making a water's edge election,the multinational taxpayer can limit the reach of the unitary theory to U.S.-based factors and income.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

25

The property factor includes real property and construction in progress.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

26

A taxpayer has nexus with a state for sales and use tax purposes if it has a physical presence in the state.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

27

A few states recognize an entity's S corporation status,such that taxable income flows through directly to shareholders,but they also assess a state-level tax on the entity.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

28

A unitary business is treated as a single entity for state tax purposes,with a combined apportionment formula including data from all of the operations of the business.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

29

Typically exempt from the sales/use tax base is the purchase of computer and cell phone equipment by a large consulting firm that is incorporated in the state.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

30

Typically exempt from the sales/use tax base is the purchase of seed and feed by a farmer.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

31

A service engineer spends 60% of her time maintaining the employer's productive business property and 40% maintaining the employer's nonbusiness rental properties.This year,her compensation totaled $90,000.The payroll factor assigns $90,000 to the state in which the employer is based.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

32

An LLC apportions and allocates its annual taxable income in the same manner used by any other business operating in the state.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

33

Almost all of the states assess some form of consumer-level sales tax.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

34

Typically exempt from the sales/use tax base is the purchase of prescription medicines by an individual.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

35

Only a few states require that Federal S corporations make a separate state-level election of the flow-through status.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

36

Most states waive the collection of sales tax on groceries.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

37

Typically exempt from the sales/use tax base is the purchase by a church of printed music for its choir.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

38

Most states' consumer sales taxes apply directly to the final purchaser of the taxable asset,with the purchaser remitting the tax to the state treasury.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

39

An assembly worker earns a $30,000 salary and receives a fringe benefit package worth $15,000.The payroll factor assigns $45,000 for this employee.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

40

The use tax is designed to complement the sales tax.A use tax typically covers purchases made out of state and brought into the jurisdiction.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

41

The throwback rule requires that:

A)Sales of services are attributed to the state of commercial domicile.

B)Capital gain/loss is attributed to the state of commercial domicile.

C)Services are attributed to the state of commercial domicile of the taxpayer,and are not taxable in the state where they were performed.

D)Sales of tangible personal property are attributed to the state where they originated,if the taxpayer is not taxable in the state of destination.

A)Sales of services are attributed to the state of commercial domicile.

B)Capital gain/loss is attributed to the state of commercial domicile.

C)Services are attributed to the state of commercial domicile of the taxpayer,and are not taxable in the state where they were performed.

D)Sales of tangible personal property are attributed to the state where they originated,if the taxpayer is not taxable in the state of destination.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

42

Dough Company sold an asset on the first day of the tax year for $500,000.Dough's Federal tax basis for the asset was $300,000.Because of differences in cost recovery schedules,the state regular-tax basis in the asset was $350,000.What adjustment,if any,should be made to Federal taxable income in determining the correct taxable income for the typical state?

A)($50,000).

B)$35,000.

C)$50,000.

D)$0.

A)($50,000).

B)$35,000.

C)$50,000.

D)$0.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

43

Sales/use tax nexus is established for the taxpayer by the sales-solicitation activities of an independent contractor acting on the taxpayer's behalf.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

44

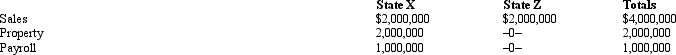

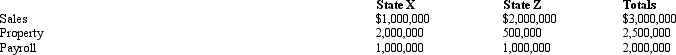

Kurt Corporation realized $600,000 taxable income from the sales of its products in States X and Z.Kurt's activities establish nexus for income tax purposes in both states.Kurt's sales,payroll,and property among the states include the following.

Z utilizes an equally weighted three-factor apportionment formula.Kurt is incorporated in X.How much of Kurt's taxable income is apportioned to Z?

A)$2,000,000.

B)$600,000.

C)$300,000.

D)$100,000.

E)$0.

Z utilizes an equally weighted three-factor apportionment formula.Kurt is incorporated in X.How much of Kurt's taxable income is apportioned to Z?

A)$2,000,000.

B)$600,000.

C)$300,000.

D)$100,000.

E)$0.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

45

Under most local property tax laws,the value of an asset is fixed after an appraisal by the taxing jurisdiction.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following is not immune from state income taxation,even if P.L.86-272 is in effect?

A)Sale of a share of corporate stock.

B)Sale of office equipment that constitutes inventory to the purchaser.

C)Sale of office equipment to be used in the taxpayer's business.

D)All of the above are protected by P.L.86-272 immunity provisions.

A)Sale of a share of corporate stock.

B)Sale of office equipment that constitutes inventory to the purchaser.

C)Sale of office equipment to be used in the taxpayer's business.

D)All of the above are protected by P.L.86-272 immunity provisions.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

47

Wailes Corporation is subject to a corporate income tax only in State X.The starting point in computing X taxable income is Federal taxable income.Wailes' Federal taxable income is $750,000,which includes a $75,000 deduction for state income taxes.During the year,Wailes received $20,000 interest on Federal obligations.X tax law does not allow a deduction for state income tax payments.

Wailes' taxable income for X purposes is:

A)$825,000.

B)$805,000.

C)$750,000.

D)$680,000.

Wailes' taxable income for X purposes is:

A)$825,000.

B)$805,000.

C)$750,000.

D)$680,000.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

48

In determining state taxable income,all of the following are adjustments to Federal income except:

A)Net operating loss.

B)Federal income tax expense.

C)Cost of goods sold.

D)State income tax refunds.

A)Net operating loss.

B)Federal income tax expense.

C)Cost of goods sold.

D)State income tax refunds.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

49

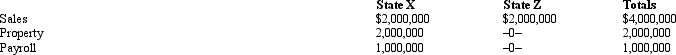

José Corporation realized $600,000 taxable income from the sales of its products in States X and Z.José's activities in both states establish nexus for income tax purposes.José's sales,payroll,and property among the states include the following.

Z utilizes a double-weighted sales factor in its three-factor apportionment formula.How much of José's taxable income is apportioned to Z?

A)$1,000,000.

B)$600,000.

C)$120,000.

D)$80,000.

E)$0.

Z utilizes a double-weighted sales factor in its three-factor apportionment formula.How much of José's taxable income is apportioned to Z?

A)$1,000,000.

B)$600,000.

C)$120,000.

D)$80,000.

E)$0.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

50

A capital stock tax usually is structured as an excise tax imposed on a corporation's "net worth," using balance sheet data to compute the tax.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

51

Norman Corporation owns and operates two manufacturing facilities,one in State X and the other in State Y.Due to a temporary decline in the corporation's sales,Norman has rented 20% of its Y facility to an unaffiliated corporation.Norman generated $1,000,000 net rental income and $2,000,000 income from manufacturing.

Norman is incorporated in Y.For X and Y purposes,rental income is classified as allocable nonbusiness income.By applying the statutes of each state,Norman determined that its apportionment factors are .75 for X and .25 for Y.

Norman's income attributed to X is:

A)$0.

B)$1,000,000.

C)$1,500,000.

D)$2,000,000.

E)$3,000,000.

Norman is incorporated in Y.For X and Y purposes,rental income is classified as allocable nonbusiness income.By applying the statutes of each state,Norman determined that its apportionment factors are .75 for X and .25 for Y.

Norman's income attributed to X is:

A)$0.

B)$1,000,000.

C)$1,500,000.

D)$2,000,000.

E)$3,000,000.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

52

Federal taxable income is used as the starting point in computing the state's income tax base,but numerous state adjustments or modifications generally are required to:

A)Reflect differences between state and Federal tax statutes.

B)Remove income that a state is constitutionally prohibited from taxing.

C)Allow for all of the states to use the same definition of taxable income.

D)a.and b.

A)Reflect differences between state and Federal tax statutes.

B)Remove income that a state is constitutionally prohibited from taxing.

C)Allow for all of the states to use the same definition of taxable income.

D)a.and b.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

53

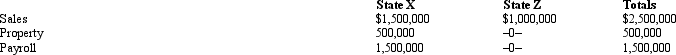

Mandy Corporation realized $1,000,000 taxable income from the sales of its products in States X and Z.Mandy's activities establish nexus for income tax purposes only in Z.Mandy's sales,payroll,and property among the states include the following.

X utilizes a double-weighted sales factor in its three-factor apportionment formula.How much of Mandy's taxable income is apportioned to X?

A)$1,000,000.

B)$543,333.

C)$490,000.

D)$0.

X utilizes a double-weighted sales factor in its three-factor apportionment formula.How much of Mandy's taxable income is apportioned to X?

A)$1,000,000.

B)$543,333.

C)$490,000.

D)$0.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

54

The typical state sales/use tax falls on sales of both products and services.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

55

The typical local property tax falls on both an investor's real estate and her stock portfolio.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

56

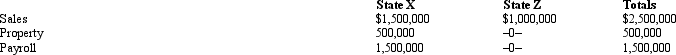

José Corporation realized $600,000 taxable income from the sales of its products in States X and Z.José's activities in both states establish nexus for income tax purposes.José's sales,payroll,and property among the states include the following.

X utilizes an equally weighted three-factor apportionment formula.How much of José's taxable income is apportioned to X?

A)$600,000.

B)$520,200.

C)$200,000.

D)$79,800.

X utilizes an equally weighted three-factor apportionment formula.How much of José's taxable income is apportioned to X?

A)$600,000.

B)$520,200.

C)$200,000.

D)$79,800.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

57

A city might assess a professional occupation tax on an architect.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

58

In determining a corporation's taxable income for state income tax purposes,which of the following does not constitute a subtraction from Federal income?

A)Interest on U.S.obligations.

B)Expenses that are directly or indirectly related to state and municipal interest that is taxable for state purposes.

C)The amount by which the Federal deduction for depreciation exceeds the depreciation deduction permitted for state tax purposes.

D)The amount by which the state loss from the disposal of assets exceeds the Federal loss from such disposal.

A)Interest on U.S.obligations.

B)Expenses that are directly or indirectly related to state and municipal interest that is taxable for state purposes.

C)The amount by which the Federal deduction for depreciation exceeds the depreciation deduction permitted for state tax purposes.

D)The amount by which the state loss from the disposal of assets exceeds the Federal loss from such disposal.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

59

Typically exempt from the sales/use tax base is the purchase of inventory from a competitor who is closing down a long-lived business.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

60

The model law relating to the assignment of income among the states for corporations is:

A)The Uniform Division of Income for Tax Purposes Act (UDITPA).

B)The Multistate Tax Treaty.

C)Public Law 86-272.

D)The Multistate Tax Commission (MTC).

A)The Uniform Division of Income for Tax Purposes Act (UDITPA).

B)The Multistate Tax Treaty.

C)Public Law 86-272.

D)The Multistate Tax Commission (MTC).

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

61

In most states,a limited liability company (LLC)is subject to the state income tax:

A)As though it were a C corporation.

B)As though it were a business trust.

C)As a flow-through entity,similar to its Federal income tax treatment.

D)LLCs typically are exempted from state income taxation.

A)As though it were a C corporation.

B)As though it were a business trust.

C)As a flow-through entity,similar to its Federal income tax treatment.

D)LLCs typically are exempted from state income taxation.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

62

In conducting multistate tax planning,the taxpayer should:

A)Review tax opportunities in light of their effect on the overall business.

B)Consider additional administrative costs generated by the plan.

C)Exploit inconsistencies among the statutes and formulas of the states.

D)Recognize that minimizing state tax costs may not always be prudent.

E)All of the above are true.

A)Review tax opportunities in light of their effect on the overall business.

B)Consider additional administrative costs generated by the plan.

C)Exploit inconsistencies among the statutes and formulas of the states.

D)Recognize that minimizing state tax costs may not always be prudent.

E)All of the above are true.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

63

Parent and Junior form a unitary group of corporations.Parent is located in a state with an effective tax rate of 3%,while Junior's effective tax rate is 9%.Acting in concert to reduce overall tax liabilities,the group should:

A)Execute an intercompany loan,such that Junior pays deductible interest to Parent.

B)Have Parent charge Junior an annual management fee.

C)Shift Parent's high-cost assembly and distribution operations to Junior.

D)All of the above are effective income-shifting techniques for a unitary group.

E)None of the above is an effective income-shifting technique for a unitary group.

A)Execute an intercompany loan,such that Junior pays deductible interest to Parent.

B)Have Parent charge Junior an annual management fee.

C)Shift Parent's high-cost assembly and distribution operations to Junior.

D)All of the above are effective income-shifting techniques for a unitary group.

E)None of the above is an effective income-shifting technique for a unitary group.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

64

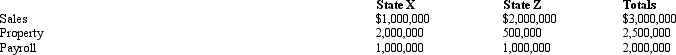

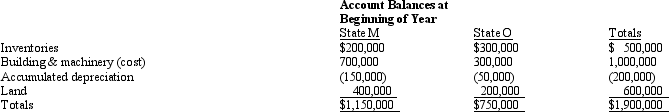

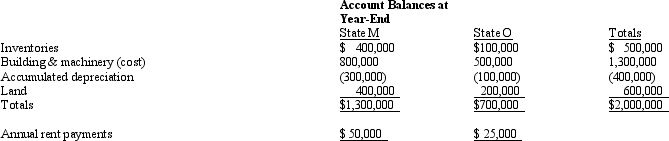

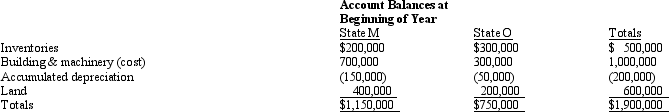

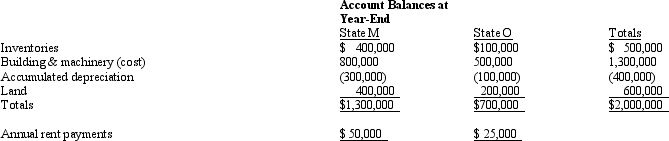

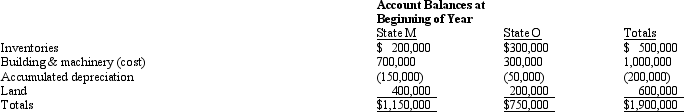

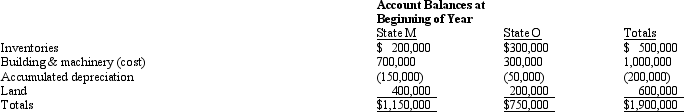

Bert Corporation,a calendar-year taxpayer,owns property in States M and O.Both M and O require that the average value of assets be included in the property factor.M requires that the property be valued at its historical cost,and O requires that the property be included in the property factor at its net depreciated book value.

Bert's M property factor is:

A)75.0%.

B)66.7%.

C)64.9%.

D)64.5%.

Bert's M property factor is:

A)75.0%.

B)66.7%.

C)64.9%.

D)64.5%.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

65

Parent and Junior form a non-unitary group of corporations.Parent is located in a state with an effective tax rate of 3%,while Junior's effective tax rate is 9%.Acting in concert to reduce overall tax liabilities,the group should:

A)Execute an intercompany loan,such that Junior pays deductible interest to Parent.

B)Have Parent charge Junior an annual management fee.

C)Shift Parent's high-cost assembly and distribution operations to Junior.

D)All of the above are effective income-shifting techniques for a non-unitary group.

E)None of the above is an effective income-shifting technique for a non-unitary group.

A)Execute an intercompany loan,such that Junior pays deductible interest to Parent.

B)Have Parent charge Junior an annual management fee.

C)Shift Parent's high-cost assembly and distribution operations to Junior.

D)All of the above are effective income-shifting techniques for a non-unitary group.

E)None of the above is an effective income-shifting technique for a non-unitary group.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

66

A taxpayer wishing to reduce the negative tax effects of the application of the unitary theory might:

A)Affiliate with a service division that shows an operating loss,like one in marketing.

B)Disengage unitary operations with the most profitable affiliates.

C)Add a profitable entity to the unitary group.

D)a.and b.

A)Affiliate with a service division that shows an operating loss,like one in marketing.

B)Disengage unitary operations with the most profitable affiliates.

C)Add a profitable entity to the unitary group.

D)a.and b.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

67

A use tax:

A)Applies when a State A resident purchases a new automobile from a State A dealership.

B)Applies when a State A resident purchases a new automobile from a State B dealership,then driving the car home.

C)Applies when a State A resident purchases groceries from a neighborhood store.

D)Applies when a State A resident purchases hardware from sears.com rather than at the Best Buy store at the local mall.

A)Applies when a State A resident purchases a new automobile from a State A dealership.

B)Applies when a State A resident purchases a new automobile from a State B dealership,then driving the car home.

C)Applies when a State A resident purchases groceries from a neighborhood store.

D)Applies when a State A resident purchases hardware from sears.com rather than at the Best Buy store at the local mall.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

68

When the taxpayer has exposure to a capital stock tax:

A)Expansions should be funded with retained earnings.

B)Subsidiary operations should be funded through direct capital contributions.

C)Dividends should be paid regularly to a parent based in a low-tax state.

D)Cost of sales should reflect no more than inflation increases.

E)None of the above is true.

A)Expansions should be funded with retained earnings.

B)Subsidiary operations should be funded through direct capital contributions.

C)Dividends should be paid regularly to a parent based in a low-tax state.

D)Cost of sales should reflect no more than inflation increases.

E)None of the above is true.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

69

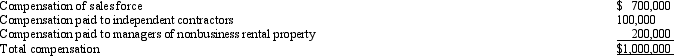

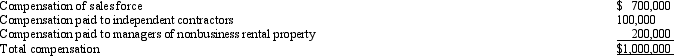

State D has adopted the principles of UDITPA.Given the following transactions for the year,determine Comp Corporation's D payroll factor denominator.

A)$700,000.

B)$800,000.

C)$900,000.

D)$1,000,000.

A)$700,000.

B)$800,000.

C)$900,000.

D)$1,000,000.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

70

In the broadest application of the unitary theory,the U.S.unitary business files a combined tax return using factors and income amounts for all affiliates:

A)Organized in the U.S.

B)Organized anywhere in the world.

C)Organized in NAFTA countries.

D)Owned more than 50% by other affiliates in the group.

A)Organized in the U.S.

B)Organized anywhere in the world.

C)Organized in NAFTA countries.

D)Owned more than 50% by other affiliates in the group.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

71

The benefits of a passive investment company typically include:

A)Reduced state income taxes.

B)Isolation of the entity's portfolio income from taxation in other nonunitary states.

C)Exclusion of the subsidiary's portfolio income from the parent corporation's apportionment formula denominator in other nonunitary states.

D)All of the above are benefits.

A)Reduced state income taxes.

B)Isolation of the entity's portfolio income from taxation in other nonunitary states.

C)Exclusion of the subsidiary's portfolio income from the parent corporation's apportionment formula denominator in other nonunitary states.

D)All of the above are benefits.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

72

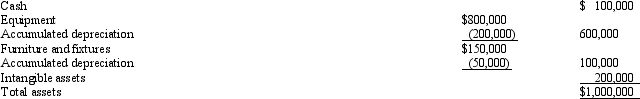

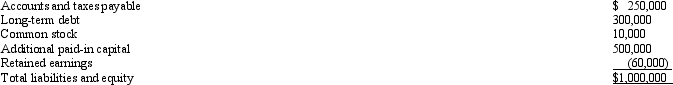

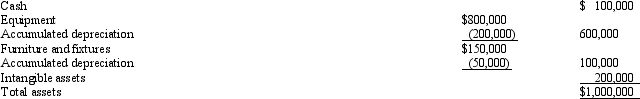

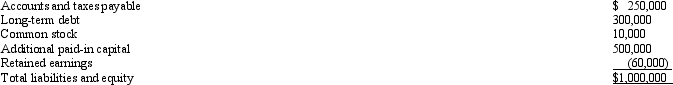

Peete Corporation is subject to franchise tax in State Z.The tax is imposed at a rate of 2% of the taxpayer's net worth that is apportioned to the state by use of a two factor (sales and property equally weighted)formula.The property factor includes real and tangible personal property,valued at net book value at the end of the taxable year.

Eighty percent of Peete's sales are attributable to Z,and $200,000 of the net book value of Peete's tangible personal property is located in Z.

Determine the Z franchise tax payable by Peete this year,given the following end-of-the year balance sheet.

A)$0,due to the negative retained earnings.

B)$20,000.

C)$7,200.

D)$4,860.

Eighty percent of Peete's sales are attributable to Z,and $200,000 of the net book value of Peete's tangible personal property is located in Z.

Determine the Z franchise tax payable by Peete this year,given the following end-of-the year balance sheet.

A)$0,due to the negative retained earnings.

B)$20,000.

C)$7,200.

D)$4,860.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

73

A state sales tax usually falls upon:

A)The sale of a used dinette set sold at a rummage sale.

B)The sale of a dinette set by the manufacturer to the retailer.

C)The purchase of a Bible by a member at the church's bookstore.

D)The sale of a case of Bibles by the publisher to a church bookstore.

E)All of the above are exempt transactions.

A)The sale of a used dinette set sold at a rummage sale.

B)The sale of a dinette set by the manufacturer to the retailer.

C)The purchase of a Bible by a member at the church's bookstore.

D)The sale of a case of Bibles by the publisher to a church bookstore.

E)All of the above are exempt transactions.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

74

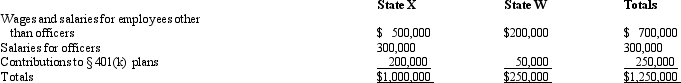

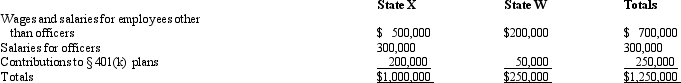

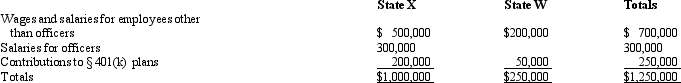

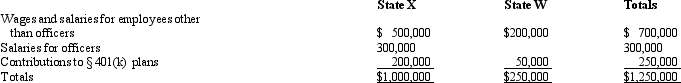

Trayne Corporation's sales office and manufacturing plant are located in State X.Trayne also maintains a manufacturing plant and sales office in State W.For purposes of apportionment,X defines payroll as all compensation paid to employees,including elective contributions to § 401(k)deferred compensation plans.Under the statutes of W,neither compensation paid to officers nor contributions to § 401(k)plans are included in the payroll factor.Trayne incurred the following personnel costs.

Trayne's payroll factor for State X is:

A)100.00%.

B)80.00%.

C)73.68%.

D)71.43%.

E)50.00%.

Trayne's payroll factor for State X is:

A)100.00%.

B)80.00%.

C)73.68%.

D)71.43%.

E)50.00%.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

75

Valdez Corporation,a calendar-year taxpayer,owns property in States M and O.Both M and O require that the average value of assets be included in the property factor.M requires that the property be valued at its historical cost,and O requires that the property be included in the property factor at its net depreciated book value.

Valdez's O property factor is:

A)35.0%.

B)37.2%.

C)39.5%.

D)53.8%.

Valdez's O property factor is:

A)35.0%.

B)37.2%.

C)39.5%.

D)53.8%.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

76

When the taxpayer operates in one or more unitary states:

A)Apportionment factors are computed on a group-wide basis.

B)The tax incentive of creating nexus in a low-tax state is enhanced.

C)The tax benefit of a passive investment subsidiary holding company is neutralized.

D)The use of a water's edge election should be considered.

E)All of the above are true.

A)Apportionment factors are computed on a group-wide basis.

B)The tax incentive of creating nexus in a low-tax state is enhanced.

C)The tax benefit of a passive investment subsidiary holding company is neutralized.

D)The use of a water's edge election should be considered.

E)All of the above are true.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

77

A state sales tax usually falls upon:

A)Sales of groceries.

B)Sales made to out-of-state customers.

C)Sales made to the U.S.Department of Education.

D)Sales made to the ultimate consumer of the product or service.

A)Sales of groceries.

B)Sales made to out-of-state customers.

C)Sales made to the U.S.Department of Education.

D)Sales made to the ultimate consumer of the product or service.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

78

Net Corporation's sales office and manufacturing plant are located in State X.Net also maintains a manufacturing plant and sales office in State W.For purposes of apportionment,X defines payroll as all compensation paid to employees,including contributions to § 401(k)deferred compensation plans.Under the statutes of W,neither compensation paid to officers nor contributions to § 401(k)plans are included in the payroll factor.Net incurred the following personnel costs.

Net's payroll factor for State W is:

A)50.00%.

B)28.57%.

C)26.32%.

D)20.00%.

E)0%.

Net's payroll factor for State W is:

A)50.00%.

B)28.57%.

C)26.32%.

D)20.00%.

E)0%.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

79

For most taxpayers,which of the traditional apportionment factors yields the greatest opportunities for tax reduction?

A)Payroll.

B)Property.

C)Unitary.

D)Sales (gross receipts).

A)Payroll.

B)Property.

C)Unitary.

D)Sales (gross receipts).

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

80

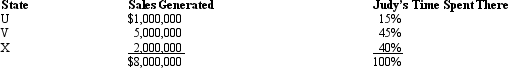

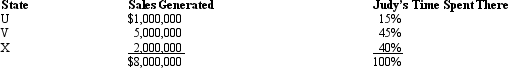

Judy,a regional sales manager,has her office in State X.Her region includes several states,as indicated in the sales report below.Determine how much of Judy's $200,000 compensation is assigned to the payroll factor of State X.

A)$0.

B)$50,000.

C)$60,000.

D)$80,000.

E)$200,000.

A)$0.

B)$50,000.

C)$60,000.

D)$80,000.

E)$200,000.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck