Deck 9: Real Estate Appraisal

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/40

Play

Full screen (f)

Deck 9: Real Estate Appraisal

1

Land is valued at $80,000. New construction cost for a minimum quality home 35 feet by 45 feet is $100 per square foot. For a garage 25 feet by 25 feet, the cost is $40 per square foot. Depreciation is 10% of new replacement cost. What is the value estimate?

(a) $262,500

(b) $182,500

(c) $164,250

(d) $244,250

(a) $262,500

(b) $182,500

(c) $164,250

(d) $244,250

D 11EA8EF6_E580_21F3_937E_A3A79EE52C0A

2

A loan made by a lender who intends to keep the loan until paid is a:

(a) conforming loan

(b) jumbo loan

(c) portfolio loan

(d) domestic loan

(a) conforming loan

(b) jumbo loan

(c) portfolio loan

(d) domestic loan

C

3

A secondary mortgage market is where:

(a) existing lenders sell to other lenders and investors

(b) a seller carries a junior trust deed

(c) the supply of funds available for real estate loans is decreased

(d) the Federal Reserve tightens mortgage interest rates

(a) existing lenders sell to other lenders and investors

(b) a seller carries a junior trust deed

(c) the supply of funds available for real estate loans is decreased

(d) the Federal Reserve tightens mortgage interest rates

A

4

The cost approach would be given the least weight if appraising a:

(a) new home

(b) new apartment

(c) old home

(d) special purpose property

(a) new home

(b) new apartment

(c) old home

(d) special purpose property

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following types of loans are made only to individuals who are intending to occupy the property as a personal residence?

(a) VA

(b) conventional

(c) purchase money

(d) jumbo

(a) VA

(b) conventional

(c) purchase money

(d) jumbo

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

6

The most important consideration in an appraisal is the:

(a) methods used

(b) experience, license, and integrity of the appraiser

(c) data gathered

(d) inspection of the title records

(a) methods used

(b) experience, license, and integrity of the appraiser

(c) data gathered

(d) inspection of the title records

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

7

The appraisal principle that states that the value of a property tends to be influenced by the price of acquiring an equally desirable property:

(a) principle of supply and demand

(b) principle of highest and best use

(c) principle of substitution

(d) principle of change

(a) principle of supply and demand

(b) principle of highest and best use

(c) principle of substitution

(d) principle of change

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

8

Private mortgage insurance (PMI):

(a) makes the payments if the borrower gets disabled

(b) is paid for by the lender

(c) pays the loan off if the borrower dies

(d) insures the lender for the top portion of the loan

(a) makes the payments if the borrower gets disabled

(b) is paid for by the lender

(c) pays the loan off if the borrower dies

(d) insures the lender for the top portion of the loan

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

9

Find the value by use of the income approach. (round to the nearest $100)

1) an older three-unit apartment rents for $1,000 per month per unit

2) vacancy factor of 5%

3) annual operating expenses $10,000

4) capitalization rate of 8%

(a) $302,500

(b) $288,000

(c) $276,500

(d) $275,000

1) an older three-unit apartment rents for $1,000 per month per unit

2) vacancy factor of 5%

3) annual operating expenses $10,000

4) capitalization rate of 8%

(a) $302,500

(b) $288,000

(c) $276,500

(d) $275,000

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

10

Discount points are typically found in

(a) VA loans

(b) FHA loans

(c) conventional loans

(d) Cal-Vet loans

(a) VA loans

(b) FHA loans

(c) conventional loans

(d) Cal-Vet loans

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

11

A loss in value because of a poor floor plan is an example of:

(a) economic obsolescence

(b) accrual for depreciation

(c) functional obsolescence

(d) physical deterioration

(a) economic obsolescence

(b) accrual for depreciation

(c) functional obsolescence

(d) physical deterioration

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

12

The market (sales comparison) approach to value is most important for determining the value of:

(a) special purpose properties

(b) commercial property

(c) existing residential homes

(d) income-producing property

(a) special purpose properties

(b) commercial property

(c) existing residential homes

(d) income-producing property

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

13

All of the following are non-institutional lenders, except:

(a) credit union

(b) mortgage company

(c) life insurance company

(d) pension fund

(a) credit union

(b) mortgage company

(c) life insurance company

(d) pension fund

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following are major types of California lenders:

(a) Commercial banks

(b) Savings banks.

(c) Life insurance companies

(d) all of the above.

(a) Commercial banks

(b) Savings banks.

(c) Life insurance companies

(d) all of the above.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

15

For gross income purposes, most lenders want the borrower to have at least a:

(a) 1-year work history

(b) 2-year work history

(c) 3-year work history

(d) 4-year work history

(a) 1-year work history

(b) 2-year work history

(c) 3-year work history

(d) 4-year work history

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

16

The essentials of value include all of the following, except:

(a) age

(b) utility

(c) scarcity

(d) demand

(a) age

(b) utility

(c) scarcity

(d) demand

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

17

Which government program carries a prepayment penalty if the loan is paid off in less than 5 years?

(a) VA

(b) Cal-Vet

(c) FHA

(d) FNMA

(a) VA

(b) Cal-Vet

(c) FHA

(d) FNMA

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is a political force that influences value?

(a) rate of changes in population

(b) income levels

(c) size and shape of the parcel

(d) zoning changes

(a) rate of changes in population

(b) income levels

(c) size and shape of the parcel

(d) zoning changes

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

19

Who is not a player in the secondary mortgage market

(a) Fannie Mae

(b) Ginnie Mae

(c) Freddie Mac

(d) Fannie Mac

(a) Fannie Mae

(b) Ginnie Mae

(c) Freddie Mac

(d) Fannie Mac

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

20

The difference between the current replacement cost new and the estimated value of the building as of the date of the appraisal:

(a) market depreciation

(b) remainder depreciation

(c) past or accrued depreciation

(d) future or accrual for depreciation

(a) market depreciation

(b) remainder depreciation

(c) past or accrued depreciation

(d) future or accrual for depreciation

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

21

In a small country town, an appraiser was asked to place a value on the Town Hall. It was a beautiful building with unique Roman architecture. Which approach would the appraiser most likely emphasize?

(a) cost

(b) capitalization

(c) comparison

(d) gross rent multiplier

(a) cost

(b) capitalization

(c) comparison

(d) gross rent multiplier

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

22

Objective value is also known as:

(a) value in use

(b) market value

(c) utility value

(d) emotional value

(a) value in use

(b) market value

(c) utility value

(d) emotional value

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

23

With a gross monthly multiplier of 150, a duplex that rents one unit for $575 per month and the other for $625 should have an estimated value of:

(a) $173,000

(b) $176,000

(c) $180,000

(d) $197,000

(a) $173,000

(b) $176,000

(c) $180,000

(d) $197,000

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

24

The acronym OREA stands for:

(a) Office of Real Estate Appraisers.

(b) Organization of Real Estate Appraisers.

(c) Office of Real Estate Alliance.

(d) Organization for Real Estate Appraisers.

(a) Office of Real Estate Appraisers.

(b) Organization of Real Estate Appraisers.

(c) Office of Real Estate Alliance.

(d) Organization for Real Estate Appraisers.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

25

Licensed by the Office of Real Estate Appraisers to do only non-complex 1-4 residential property appraisals:

(a) real estate agents

(b) certified-residential appraisers

(c) certified-general appraisers

(d) licensed appraisers

(a) real estate agents

(b) certified-residential appraisers

(c) certified-general appraisers

(d) licensed appraisers

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

26

"Value in use" refers to:

(a) how a particular property can be used.

(b) the value of a particular property to a particular owner or user of real estate.

(c) what the property is worth.

(d) market value.

(a) how a particular property can be used.

(b) the value of a particular property to a particular owner or user of real estate.

(c) what the property is worth.

(d) market value.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

27

While making a rule of thumb appraisal of an apartment building, a broker estimated the price to be 10 times gross annual income. The broker is using a:

(a) coordinate factor

(b) gross rent multiplier

(c) cap rate

(d) net factor

(a) coordinate factor

(b) gross rent multiplier

(c) cap rate

(d) net factor

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

28

All things being equal, the higher the cap rate, the:

(a) higher the value

(b) lower the return

(c) higher the rent

(d) lower the value

(a) higher the value

(b) lower the return

(c) higher the rent

(d) lower the value

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

29

In the cost approach, the most difficult item to measure accurately is:

(a) square footage

(b) accrued depreciation

(c) lot size

(d) replacement cost

(a) square footage

(b) accrued depreciation

(c) lot size

(d) replacement cost

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is not an annual operating expense?

(a) real property taxes

(b) deferred maintenance

(c) janitor's wages

(d) utility expenses

(a) real property taxes

(b) deferred maintenance

(c) janitor's wages

(d) utility expenses

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

31

The type of appraisal report required by most lenders is the:

(a) loan report

(b) self-contained report

(c) summary report

(d) letter form report

(a) loan report

(b) self-contained report

(c) summary report

(d) letter form report

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

32

Real estate appraisers are needed to:

(a) determine values for real property taxes.

(b) help set premiums on fire policies.

(c) estimate real estate loan values.

(d) all of the above.

(a) determine values for real property taxes.

(b) help set premiums on fire policies.

(c) estimate real estate loan values.

(d) all of the above.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

33

Real estate loan payments and income tax depreciation deductions are not considered operating expenses.

(a) True

(b) False

(c) It depends if the property is held as an LLC.

(d) Only on state income tax not federal income tax.

(a) True

(b) False

(c) It depends if the property is held as an LLC.

(d) Only on state income tax not federal income tax.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

34

Accrued depreciation is used in what appraisal technique?

(a) Market approach.

(b) Cost approach.

(c) Income approach.

(d) All of the above.

(a) Market approach.

(b) Cost approach.

(c) Income approach.

(d) All of the above.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

35

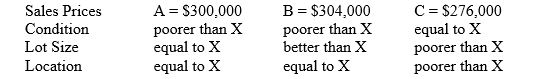

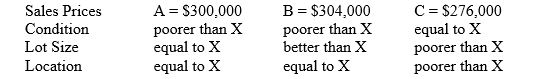

You are appraising Home X in an affordable area. You find comparables A, B, and C, which have sold recently.  Adjustment Figures

Adjustment Figures

Difference in condition use $8,000

Difference in lot size use $4,000

Difference in location use $8,000

Home X should have a value of:

(a) $300,000

(b) $304,000

(c) $308,000

(d) $312,000

Adjustment Figures

Adjustment FiguresDifference in condition use $8,000

Difference in lot size use $4,000

Difference in location use $8,000

Home X should have a value of:

(a) $300,000

(b) $304,000

(c) $308,000

(d) $312,000

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

36

The floor in the kitchen has a slight slope. The cost to fix it is estimated to be $20,000 and the value a level floor will add to the $350,000 home is projected to be $10,000. This is an example of:

(a) curable depreciation

(b) incurable depreciation

(c) functional obsolescence

(d) two of the above are correct

(a) curable depreciation

(b) incurable depreciation

(c) functional obsolescence

(d) two of the above are correct

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

37

In evaluating a house that has an actual age of 15 years, the appraiser assigned it an age of only 10 years because of the home's excellent condition. This is an example of:

(a) effective age

(b) chronological age

(c) economic age

(d) physical age

(a) effective age

(b) chronological age

(c) economic age

(d) physical age

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

38

The principle that states that land should be applied to generate its greatest net return:

(a) highest and best use

(b) conformity

(c) supply and demand

(d) substitution

(a) highest and best use

(b) conformity

(c) supply and demand

(d) substitution

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

39

Capitalization is a process of:

(a) establishing the cost of capital

(b) converting an income flow into value

(c) computing gross income

(d) determining reserves for depreciation

(a) establishing the cost of capital

(b) converting an income flow into value

(c) computing gross income

(d) determining reserves for depreciation

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

40

All things being equal, the higher the market gross rent multiplier compared to the subject property gross rent multiplier, the:

(a) better the buy

(b) lower the expenses

(c) higher the vacancy

(d) worse the buy

(a) better the buy

(b) lower the expenses

(c) higher the vacancy

(d) worse the buy

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck