Deck 11: Federal Government Accounting and Reporting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Match between columns

Premises:

Obligations are recorded in budgetary accounts,but not in proprietary accounts.

Obligations are recorded in budgetary accounts,but not in proprietary accounts.

In budgetary accounting,entries are made to record the expending of appropriations when supplies are consumed.

In budgetary accounting,entries are made to record the expending of appropriations when supplies are consumed.

Responses:

True

False

True

False

True

False

True

False

True

False

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/21

Play

Full screen (f)

Deck 11: Federal Government Accounting and Reporting

1

In the federal government,which organizations make appropriations and which make apportionments?

A)The Congress makes appropriations,and department heads apportion the appropriations to individual agencies or divisions within the department.

B)The Congress makes appropriations,and the Treasury Department appropriates to individual departments the total amount apportioned by the Congress.

C)The President makes appropriations,and department heads periodically apportion parts of the appropriations to agencies in the department.

D)The Congress makes appropriations,and the Office of Management and Budget periodically apportions parts of the appropriations to departments.

A)The Congress makes appropriations,and department heads apportion the appropriations to individual agencies or divisions within the department.

B)The Congress makes appropriations,and the Treasury Department appropriates to individual departments the total amount apportioned by the Congress.

C)The President makes appropriations,and department heads periodically apportion parts of the appropriations to agencies in the department.

D)The Congress makes appropriations,and the Office of Management and Budget periodically apportions parts of the appropriations to departments.

D

2

Which of the following is the correct sequence of activities within the federal budgetary accounting cycle?

A)appropriation,apportionment,allotment,obligation

B)obligation,allotment,apportionment,appropriation

C)allotment,obligation,appropriation,apportionment

D)apportionment,allotment,obligation,appropriation

A)appropriation,apportionment,allotment,obligation

B)obligation,allotment,apportionment,appropriation

C)allotment,obligation,appropriation,apportionment

D)apportionment,allotment,obligation,appropriation

A

3

What is the federal counterpart of the state and local government "encumbrance"?

A)obligation

B)allotment

C)outlay

D)apportionment

A)obligation

B)allotment

C)outlay

D)apportionment

A

4

At what point in the budgetary cycle does an agency record a decrease (a debit)to the account "Allotments - realized resources"?

A)When the Office of Management and Budget makes an apportionment.

B)When the Department makes a quarterly allotment to the agency.

C)When the agency uses commitment accounting and makes a commitment for supplies.

D)When the agency uses supplies from its inventory.

A)When the Office of Management and Budget makes an apportionment.

B)When the Department makes a quarterly allotment to the agency.

C)When the agency uses commitment accounting and makes a commitment for supplies.

D)When the agency uses supplies from its inventory.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

5

What does a credit balance in the account "Allotments - realized resources" show?

A)The agency's cash balance with the Treasury.

B)The amount available to a department for allotment to an agency

C)The amount of goods or services ordered by an agency but not received.

D)The amount of resources available to an agency for obligation or commitment.

A)The agency's cash balance with the Treasury.

B)The amount available to a department for allotment to an agency

C)The amount of goods or services ordered by an agency but not received.

D)The amount of resources available to an agency for obligation or commitment.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

6

A federal agency that uses commitment accounting makes a commitment for supplies in the amount of $40,000.When it places the purchase order,however,the cost of the supplies is only $38,000.How is the $2,000 difference accounted for in the budgetary accounts?

A)No budgetary entry is needed at this point in the budgetary accounting cycle.

B)Commitments is debited for $40,000,Allotments - realized resources is credited for $2,000,and Undelivered orders - obligations,unpaid is credited for $40,000.

C)Commitments is debited for $38,000 and Undelivered orders - unpaid is credited for $38,000.

D)Allotments - realized resources is debited for $2,000 and Commitments is credited for $2,000.

A)No budgetary entry is needed at this point in the budgetary accounting cycle.

B)Commitments is debited for $40,000,Allotments - realized resources is credited for $2,000,and Undelivered orders - obligations,unpaid is credited for $40,000.

C)Commitments is debited for $38,000 and Undelivered orders - unpaid is credited for $38,000.

D)Allotments - realized resources is debited for $2,000 and Commitments is credited for $2,000.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

7

A federal agency received allotments of $95,000.It does not use commitment accounting.It placed three orders totaling $70,000,received all the supplies ordered,and approved invoices totaling $73,000 for the three orders.It then consumed $55,000 of those supplies.It then placed another order for $12,000,but the agency has not yet received delivery.How much of the agency's allotment is available for additional obligation?

A)$13,000

B)$33,000

C)$10,000

D)$40,000

A)$13,000

B)$33,000

C)$10,000

D)$40,000

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

8

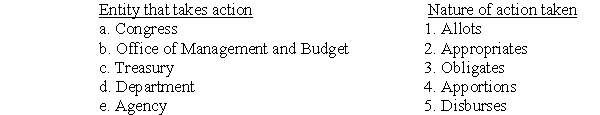

(Matching)

Match the entity that takes the action with the nature of the action taken by putting the number of the action taken (second column)next to the letter for the entity (first column).

Match the entity that takes the action with the nature of the action taken by putting the number of the action taken (second column)next to the letter for the entity (first column).

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

9

When a federal agency receives supplies that have been ordered previously,what kind of entry (or entries)is (or are)required?

A)both a budgetary and a proprietary entry

B)only a proprietary entry

C)only a budgetary entry

D)neither a budgetary nor a proprietary entry

A)both a budgetary and a proprietary entry

B)only a proprietary entry

C)only a budgetary entry

D)neither a budgetary nor a proprietary entry

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

10

If a federal agency were to take a trial balance of the budgetary accounts at any point in time,what would the right side of the trial balance show?

A)the cumulative results of the agency's appropriations

B)the status of the agency's budgetary resources

C)the agency's fund balance with Treasury

D)the total amount appropriated to the agency

A)the cumulative results of the agency's appropriations

B)the status of the agency's budgetary resources

C)the agency's fund balance with Treasury

D)the total amount appropriated to the agency

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

11

What is the name of the entity that recommends accounting standards for the federal government?

A)the Governmental Accounting Standards Board

B)the Federal Accounting Standards Advisory Board

C)the Financial Accounting Standards Board

D)the American Institute of Certified Public Accountants

A)the Governmental Accounting Standards Board

B)the Federal Accounting Standards Advisory Board

C)the Financial Accounting Standards Board

D)the American Institute of Certified Public Accountants

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

12

When do federal agencies make an entry to record "Fund Balance with the Treasury"?

A)when the Treasury tells the agency the Federal government has sufficient cash to pay bills

B)each time the department of which the agency is a part allots funds to the agency

C)when the Office of Management and Budget apportions funds to the department of which the agency is a part

D)when the Congress makes and the President approves an appropriation

A)when the Treasury tells the agency the Federal government has sufficient cash to pay bills

B)each time the department of which the agency is a part allots funds to the agency

C)when the Office of Management and Budget apportions funds to the department of which the agency is a part

D)when the Congress makes and the President approves an appropriation

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

13

Name the two major categories of funds reported in the U.S.Government consolidated statement of operations and changes in net position?

A)budgetary funds and proprietary funds

B)General Fund and Trust Funds

C)non-earmarked funds and earmarked funds

D)appropriated funds and non-appropriated funds

A)budgetary funds and proprietary funds

B)General Fund and Trust Funds

C)non-earmarked funds and earmarked funds

D)appropriated funds and non-appropriated funds

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following actions will reduce the balance in the budgetary account "Allotments - realized resources"?

A)Administering department makes a quarterly allotment to the agency.

B)Agency,which uses commitment accounting,makes a commitment to acquire materials.

C)Agency sends disbursement schedule to Treasury requesting payment of invoice.

D)Agency makes year-end accrual for unbudgeted,but accrued vacation pay,

A)Administering department makes a quarterly allotment to the agency.

B)Agency,which uses commitment accounting,makes a commitment to acquire materials.

C)Agency sends disbursement schedule to Treasury requesting payment of invoice.

D)Agency makes year-end accrual for unbudgeted,but accrued vacation pay,

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

15

When are expenses and liabilities recognized for the federal social security program?

A)when benefits are paid to the recipients

B)when benefits are earned by the recipients

C)when benefits are due and payable at the end of a reporting period

D)when the social security trust fund receives cash from employees and employers

A)when benefits are paid to the recipients

B)when benefits are earned by the recipients

C)when benefits are due and payable at the end of a reporting period

D)when the social security trust fund receives cash from employees and employers

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

16

What is the rule regarding depreciation of federal capital assets classified as general property plant and equipment (General PP&E)?

A)All General PP&E is capitalized and depreciated.

B)General PP&E is capitalized and depreciated only for federal business-type activities.

C)All General PP&E is expensed at the time of acquisition.

D)Federal agencies have the option of depreciating or not depreciating General PP&E.

A)All General PP&E is capitalized and depreciated.

B)General PP&E is capitalized and depreciated only for federal business-type activities.

C)All General PP&E is expensed at the time of acquisition.

D)Federal agencies have the option of depreciating or not depreciating General PP&E.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

17

Which one of the following actions requires both budgetary accounting and proprietary accounting entries in an agency's accounts?

A)agency records obligation based on a contract for supplies

B)agency records year-end accrual for funded salaries

C)agency asks Treasury to pay invoice for supplies

D)agency uses supplies previously recorded as supplies inventory

A)agency records obligation based on a contract for supplies

B)agency records year-end accrual for funded salaries

C)agency asks Treasury to pay invoice for supplies

D)agency uses supplies previously recorded as supplies inventory

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

18

What basis of accounting is used in the Statement of Net Costs prepared by a federal agency?

A)the budgetary basis

B)the accrual basis

C)the cash basis

D)the modified accrual basis

A)the budgetary basis

B)the accrual basis

C)the cash basis

D)the modified accrual basis

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following does not account for the differences between budgetary resources used by a Federal agency and the agency's net cost of operations?

A)depreciation of equipment acquired in a previous year

B)requisitions for supplies needed but not ordered

C)supplies received during the year but not used

D)accrual of a liability that had not been funded

A)depreciation of equipment acquired in a previous year

B)requisitions for supplies needed but not ordered

C)supplies received during the year but not used

D)accrual of a liability that had not been funded

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following statements is false?

A)Depreciation is recorded as an expense in an agency's proprietary accounts.

B)Vacation leave cannot be accrued at year-end unless the agency has sufficient appropriated funds to pay for it.

C)The account Undelivered orders - obligations,unpaid remains open at year-end until it is paid in the following year.

D)If the agency receives an invoice in an amount greater than the amount of the purchase order and agrees that invoice amount is correct,an adjustment is needed to the account "Allotments - realized resources."

A)Depreciation is recorded as an expense in an agency's proprietary accounts.

B)Vacation leave cannot be accrued at year-end unless the agency has sufficient appropriated funds to pay for it.

C)The account Undelivered orders - obligations,unpaid remains open at year-end until it is paid in the following year.

D)If the agency receives an invoice in an amount greater than the amount of the purchase order and agrees that invoice amount is correct,an adjustment is needed to the account "Allotments - realized resources."

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

21

Match between columns

Premises:

Obligations are recorded in budgetary accounts,but not in proprietary accounts.

Obligations are recorded in budgetary accounts,but not in proprietary accounts.

In budgetary accounting,entries are made to record the expending of appropriations when supplies are consumed.

In budgetary accounting,entries are made to record the expending of appropriations when supplies are consumed.

Responses:

True

False

True

False

True

False

True

False

True

False

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck