Deck 3: Budgetary Considerations in Governmental Accounting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/28

Play

Full screen (f)

Deck 3: Budgetary Considerations in Governmental Accounting

1

For a typical city government,the budget has an important influence on the determination of the annual

A)income tax rate

B)hotel/motel tax rate

C)sales tax rate

D)property tax rate

A)income tax rate

B)hotel/motel tax rate

C)sales tax rate

D)property tax rate

D

2

If the balance in the Estimated revenues account exceeds the balance in the Appropriations account

A)the Budgetary fund balance account will have a credit balance

B)expenditures will be less than revenues

C)revenues will be less than expenditures

D)the Budgetary fund balance account will have a debit balance

A)the Budgetary fund balance account will have a credit balance

B)expenditures will be less than revenues

C)revenues will be less than expenditures

D)the Budgetary fund balance account will have a debit balance

A

3

Which of the following approaches to budgeting requires each activity to be justified each year?

A)object-of-expenditure approach

B)performance approach

C)planning-programming-budgeting approach

D)zero-based budgeting approach

A)object-of-expenditure approach

B)performance approach

C)planning-programming-budgeting approach

D)zero-based budgeting approach

D

4

The Governmental Accounting Standards Board requires governments to include budgetary comparison schedules or statements for which of the following funds?

A)All governmental funds

B)All funds

C)General fund,major special revenue funds,and major capital projects funds

D)General Fund and major special revenue funds

E)none of the above

A)All governmental funds

B)All funds

C)General fund,major special revenue funds,and major capital projects funds

D)General Fund and major special revenue funds

E)none of the above

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

5

The largest revenue source in a city government's General Fund normally is

A)fines and forfeits

B)property taxes

C)interest on investments

D)charges for building inspections

A)fines and forfeits

B)property taxes

C)interest on investments

D)charges for building inspections

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

6

If actual revenues are less than estimated revenues and expenditures are less than appropriations (by the same amount),at the end of the fiscal year

A)the actual change in fund balance will equal the budgeted change in fund balance

B)the actual change in fund balance will exceed the budgeted change in fund balance

C)the actual change in fund balance will be less than the budgeted change in fund balance

D)actual fund balance will remain unchanged

A)the actual change in fund balance will equal the budgeted change in fund balance

B)the actual change in fund balance will exceed the budgeted change in fund balance

C)the actual change in fund balance will be less than the budgeted change in fund balance

D)actual fund balance will remain unchanged

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

7

A property tax millage rate is calculated by:

A)dividing the required tax levy by the total assessed value of property

B)multiplying the required tax levy by the total assessed value of property

C)dividing the required tax levy by the net assessed value of property

D)multiplying the required tax levy by the net assessed value of property

A)dividing the required tax levy by the total assessed value of property

B)multiplying the required tax levy by the total assessed value of property

C)dividing the required tax levy by the net assessed value of property

D)multiplying the required tax levy by the net assessed value of property

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

8

When the chief executive of a governmental unit submits a "balanced budget" to the legislative body,it usually means that:

A)the budget is balanced on the full accrual basis of accounting

B)the budget is balanced in accordance with generally accepted accounting principles

C)proposed expenditures do not exceed estimated monies available for the year

D)proposed expenditures do not exceed estimated tax revenues to be raised during the year

A)the budget is balanced on the full accrual basis of accounting

B)the budget is balanced in accordance with generally accepted accounting principles

C)proposed expenditures do not exceed estimated monies available for the year

D)proposed expenditures do not exceed estimated tax revenues to be raised during the year

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

9

Which statement most accurately describes the use of cash forecasts in government?

A)cash forecasts are not needed because legislatively-approved budgets are sufficient to manage the use of governmental resources

B)cash forecasts are needed to plan for borrowing and investing because the timing of cash inflows does not necessarily match the timing of cash outflows

C)cash forecasts are not needed because they do not require the approval of legislative bodies

D)cash forecasts are needed because they provide the details necessary to support certain approaches to budgeting like performance budgeting

A)cash forecasts are not needed because legislatively-approved budgets are sufficient to manage the use of governmental resources

B)cash forecasts are needed to plan for borrowing and investing because the timing of cash inflows does not necessarily match the timing of cash outflows

C)cash forecasts are not needed because they do not require the approval of legislative bodies

D)cash forecasts are needed because they provide the details necessary to support certain approaches to budgeting like performance budgeting

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following activities occurs closest to the completion of the budgetary process?

A)preparing revenue estimates

B)holding public budget hearings

C)preparing the capital outlay request summary

D)revising the budget calendar

A)preparing revenue estimates

B)holding public budget hearings

C)preparing the capital outlay request summary

D)revising the budget calendar

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

11

When preparing a fund budget for the next fiscal year,which of the following are important to consider when projecting the amount of resources that will be available for spending in the next year?

A)the projected fund expenditures for next year

B)the probable fund balance at the end of the current year

C)the projected transfers out of the fund for the next year

D)the projected fund revenues to be realized for the next year

E)both b and d

A)the projected fund expenditures for next year

B)the probable fund balance at the end of the current year

C)the projected transfers out of the fund for the next year

D)the projected fund revenues to be realized for the next year

E)both b and d

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

12

Which type of budget is concerned with day-to-day spending and financing activities?

A)general budget

B)operating budget

C)capital budget

D)balanced budget

A)general budget

B)operating budget

C)capital budget

D)balanced budget

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following classifications will not appear in the annual budget for a General Fund?

A)depreciation

B)capital outlay

C)debt service

D)current operating

A)depreciation

B)capital outlay

C)debt service

D)current operating

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following approaches to budgeting is most likely to contain the details of salaries (such as number of personnel within each position)as well as the details of each type of expenditure other than salaries (such as supplies and travel)?

A)object-of-expenditure approach

B)performance approach

C)planning-programming-budgeting approach

D)zero-based budgeting approach

A)object-of-expenditure approach

B)performance approach

C)planning-programming-budgeting approach

D)zero-based budgeting approach

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is an estimated amount?

A)encumbrance

B)appropriation

C)expenditure

D)tax levy

A)encumbrance

B)appropriation

C)expenditure

D)tax levy

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

16

If a City Manager is looking at the cash forecast,he or she is most likely concerned about which of the following issues?

A)anticipated police overtime pay resulting from the 4th of July parade next summer

B)the expected cost of bridge repairs in the coming five years

C)anticipated short-term borrowing to cover the end of month payroll

D)the total amount to be spent for Fire Department operations in the current year

A)anticipated police overtime pay resulting from the 4th of July parade next summer

B)the expected cost of bridge repairs in the coming five years

C)anticipated short-term borrowing to cover the end of month payroll

D)the total amount to be spent for Fire Department operations in the current year

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following factors is the most important consideration in estimating sales tax collections for the year?

A)the projected volume of sales subject to the sales tax

B)the projected elementary school enrollment

C)the projected number of housing starts

D)the amount expected to be budgeted on the highway maintenance program

A)the projected volume of sales subject to the sales tax

B)the projected elementary school enrollment

C)the projected number of housing starts

D)the amount expected to be budgeted on the highway maintenance program

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

18

The City of Kent has estimated that it will spend $4,500,000 and have revenues of $4,800,000 next year.At the beginning of its new fiscal year,it will need to:

A)debit estimated expenditures for $4,500,000

B)debit estimated revenues for $4,800,000

C)debit budgetary fund balance for $300,000

D)debit appropriations for $4,500,000

E)none of the above.

A)debit estimated expenditures for $4,500,000

B)debit estimated revenues for $4,800,000

C)debit budgetary fund balance for $300,000

D)debit appropriations for $4,500,000

E)none of the above.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is expected to occur first in the budget process?

A)determine the property tax (millage)rate

B)hold public hearings on the budget

C)prepare revenue estimates

D)prepare departmental expenditure requests

A)determine the property tax (millage)rate

B)hold public hearings on the budget

C)prepare revenue estimates

D)prepare departmental expenditure requests

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

20

The document that lists the steps of the budget process is the

A)budget request

B)budget summary

C)budget calendar

D)budget worksheet

A)budget request

B)budget summary

C)budget calendar

D)budget worksheet

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following sequences correctly portrays expenditure account coding from the highest to lowest level of summarization?

A)program,department,activity,object

B)department,object,activity,program

C)activity,department,object,program

D)object,activity,department,program

A)program,department,activity,object

B)department,object,activity,program

C)activity,department,object,program

D)object,activity,department,program

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

22

The term "line item" refers to which of the following budget/expenditure classifications?

A)function/program

B)object

C)organizational unit

D)fund

A)function/program

B)object

C)organizational unit

D)fund

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

23

The legal level of budgetary control is best described as

A)the maximum amount that can be spent without incurring an unfavorable variance

B)the classification or subclassification at which expenditures cannot exceed appropriations

C)the status of the budget officer within the hierarchy of top government officials

D)the sum of favorable budget variances minus the sum of unfavorable budget variances

A)the maximum amount that can be spent without incurring an unfavorable variance

B)the classification or subclassification at which expenditures cannot exceed appropriations

C)the status of the budget officer within the hierarchy of top government officials

D)the sum of favorable budget variances minus the sum of unfavorable budget variances

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is not a "character" classification?

A)activity

B)current operating

C)capital outlay

D)debt service

A)activity

B)current operating

C)capital outlay

D)debt service

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following classifications represents the lowest legal level of budgetary control?

A)function/program

B)department

C)object

D)activity

A)function/program

B)department

C)object

D)activity

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

26

The City of Kent's police department needs a new police car.A police car is ordered at an estimated cost of $34,000 and the appropriate budgetary control journal entry is made.When the car is received,the actual cost is $35,000.Which of the following is a part of the budgetary entry that should be made when the police car is received?

A)debit encumbrances for $34,000

B)credit encumbrances for $34,000

C)debit encumbrances for $35,000

D)credit encumbrances for $35,000

A)debit encumbrances for $34,000

B)credit encumbrances for $34,000

C)debit encumbrances for $35,000

D)credit encumbrances for $35,000

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

27

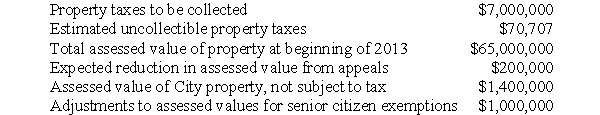

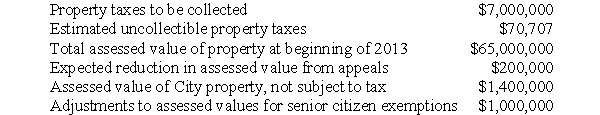

(Determination of property tax rate)

The City of Weston is preparing its budget for calendar year 2013.After estimating revenues from all other sources,the City calculates that it must raise $7,000,000 from property taxes.You are given the following information regarding the tax rate:

Required:

a.Compute the gross amount of property taxes required to be levied.

b.Compute the tax rate per $100 of net assessed valuation.

c.Determine the amount of property tax that a home owner whose property is assessed at $35,000 will have to pay.

The City of Weston is preparing its budget for calendar year 2013.After estimating revenues from all other sources,the City calculates that it must raise $7,000,000 from property taxes.You are given the following information regarding the tax rate:

Required:

a.Compute the gross amount of property taxes required to be levied.

b.Compute the tax rate per $100 of net assessed valuation.

c.Determine the amount of property tax that a home owner whose property is assessed at $35,000 will have to pay.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following classifications represents the highest legal level of budgetary control?

A)fund

B)department

C)object

D)activity

A)fund

B)department

C)object

D)activity

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck