Deck 11: Investment Center Performance Evaluation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

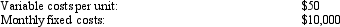

Question

Question

Question

Question

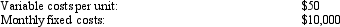

Question

Question

Question

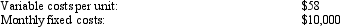

Question

Question

Question

Question

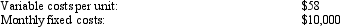

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/126

Play

Full screen (f)

Deck 11: Investment Center Performance Evaluation

1

When establishing transfer prices,the objective is to maximize the company's profit by

A)transferring at the differential outlay cost to the selling division (typically variable costs).

B)transferring at the opportunity cost to the company of making the internal transfers ($0 if the seller has idle capacity or selling price minus variable costs if the seller is operating at capacity).

C)transferring at the differential outlay cost to the selling division plus the opportunity cost to the company of making the internal transfers.

D)None of the answers is correct.

A)transferring at the differential outlay cost to the selling division (typically variable costs).

B)transferring at the opportunity cost to the company of making the internal transfers ($0 if the seller has idle capacity or selling price minus variable costs if the seller is operating at capacity).

C)transferring at the differential outlay cost to the selling division plus the opportunity cost to the company of making the internal transfers.

D)None of the answers is correct.

C

2

What is generally considered the best transfer pricing basis when there is a competitive market for the product and market prices are readily available?

A)Market price-based transfer pricing

B)Variable cost-based transfer pricing

C)Fixed price-based transfer pricing

D)Fixed cost-based transfer pricing

A)Market price-based transfer pricing

B)Variable cost-based transfer pricing

C)Fixed price-based transfer pricing

D)Fixed cost-based transfer pricing

A

3

To encourage division managers to act in ways consistent with organizational goals,divisional planning and control systems attempt to create

A)profit maximization.

B)centralization.

C)behavior congruence.

D)non-goal-congruent behavior.

A)profit maximization.

B)centralization.

C)behavior congruence.

D)non-goal-congruent behavior.

C

4

What is a disadvantage of top management intervention in setting transfer prices between divisions?

A)Top management may become swamped with pricing disputes.

B)Division managers will lose the flexibility and other advantages of autonomous decision making.

C)The approach reduces the benefits of decentralization.

D)All of the answers are correct.

A)Top management may become swamped with pricing disputes.

B)Division managers will lose the flexibility and other advantages of autonomous decision making.

C)The approach reduces the benefits of decentralization.

D)All of the answers are correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is management's challenge when setting transfer prices?

A)Ensuring the buyer has goal congruence with respect to the organization's goals.

B)Ensuring the seller has goal congruence with respect to the organization's goals.

C)Ensuring either the buyer or the seller,but not both,has goal congruence with respect to the organization's goals.

D)Ensuring both the buyer and seller have goal congruence with respect to the organization's goals.

A)Ensuring the buyer has goal congruence with respect to the organization's goals.

B)Ensuring the seller has goal congruence with respect to the organization's goals.

C)Ensuring either the buyer or the seller,but not both,has goal congruence with respect to the organization's goals.

D)Ensuring both the buyer and seller have goal congruence with respect to the organization's goals.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is the correct calculation for Division return on investment?

A)Divide division profit margin by division investment.

B)Divide profit margin by division investment.

C)Divide profit margin by division revenue.

D)Divide division revenue by division investment.

A)Divide division profit margin by division investment.

B)Divide profit margin by division investment.

C)Divide profit margin by division revenue.

D)Divide division revenue by division investment.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

7

What transfer pricing basis is considered a good estimation of differential cost plus opportunity cost?

A)Market price-based transfer pricing

B)Variable cost-based transfer pricing

C)Fixed price-based transfer pricing

D)Fixed cost-based transfer pricing

A)Market price-based transfer pricing

B)Variable cost-based transfer pricing

C)Fixed price-based transfer pricing

D)Fixed cost-based transfer pricing

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

8

The value assigned to a transaction where goods are bought by one unit of an organization from another unit of the same organization known as which of the following?

A)sales price.

B)intercompany cost basis.

C)transfer price.

D)generally accepted price.

A)sales price.

B)intercompany cost basis.

C)transfer price.

D)generally accepted price.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following transfer pricing procedures maximizes the company's profit by transferring at the differential outlay cost to the selling division plus the opportunity cost to the company of making the internal transfers?

A)economic transfer pricing rule.

B)effective transfer pricing rule.

C)efficient transfer pricing rule.

D)None of the answers is correct.

A)economic transfer pricing rule.

B)effective transfer pricing rule.

C)efficient transfer pricing rule.

D)None of the answers is correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following statements is true concerning decentralization?

A)Decentralization helps train managers.

B)Decentralization provides a basis for evaluating manager performance.

C)Decentralization motivates managers.

D)All of the answers are correct.

A)Decentralization helps train managers.

B)Decentralization provides a basis for evaluating manager performance.

C)Decentralization motivates managers.

D)All of the answers are correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

11

Which statement is true concerning the establishment of transfer prices?

A)If the selling division is operating at capacity,the transfer price should be the sum of fixed and variable costs of production.

B)If the selling division has idle capacity,and the idle facilities cannot be used for other purposes,the transfer price should be at least the variable costs of production.

C)If the selling division is operating below capacity,the transfer price should be discounted.

D)None of the answers is correct.

A)If the selling division is operating at capacity,the transfer price should be the sum of fixed and variable costs of production.

B)If the selling division has idle capacity,and the idle facilities cannot be used for other purposes,the transfer price should be at least the variable costs of production.

C)If the selling division is operating below capacity,the transfer price should be discounted.

D)None of the answers is correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

12

Management's challenge is to set transfer prices so that both the buyer and seller have goal congruence with respect to the organization's goals.How is this accomplished?

A)With no intervention from top management to set the transfer price for each transaction between divisions.

B)With top management establishing transfer price policies that divisions follow.

C)With division managers not engaging in negotiation to set transfer prices among themselves.

D)All of the answers are correct.

A)With no intervention from top management to set the transfer price for each transaction between divisions.

B)With top management establishing transfer price policies that divisions follow.

C)With division managers not engaging in negotiation to set transfer prices among themselves.

D)All of the answers are correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

13

To encourage division managers to act in ways consistent with organizational goals,divisional planning and control systems attempt to create

A)profit maximization.

B)centralization.

C)goal congruence.

D)non-goal-congruent behavior.

A)profit maximization.

B)centralization.

C)goal congruence.

D)non-goal-congruent behavior.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

14

A division manager may decide to purchase materials from an outside supplier even though another division of the firm could produce the materials at a lower incremental cost using currently idle facilities.This is an example of

A)profit maximization.

B)centralization.

C)goal-congruent behavior.

D)non-goal-congruent behavior.

A)profit maximization.

B)centralization.

C)goal-congruent behavior.

D)non-goal-congruent behavior.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is a disadvantage of decentralization?

A)Decentralization helps train managers.

B)Decentralization provides a basis for evaluating performance.

C)Decentralization motivates managers.

D)Decentralization may promote non-goal-congruent behavior.

A)Decentralization helps train managers.

B)Decentralization provides a basis for evaluating performance.

C)Decentralization motivates managers.

D)Decentralization may promote non-goal-congruent behavior.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

16

Which statement is true concerning decentralization?

A)Decentralization impedes local personnel response to a changing environment.

B)Decentralization requires significant oversight from top management.

C)Decentralization divides large,complex problems into manageable pieces.

D)All of the answers are correct.

A)Decentralization impedes local personnel response to a changing environment.

B)Decentralization requires significant oversight from top management.

C)Decentralization divides large,complex problems into manageable pieces.

D)All of the answers are correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is an advantage(s)of using market prices in a competitive market?

A)Both buying and selling divisions can buy and sell as many units as they want at market price.

B)Managers of both buying and selling divisions are indifferent between trading with each other or with outsiders.

C)From the company's perspective,this arrangement is fine as long as the selling division is operating at capacity.

D)All of the answers are correct.

A)Both buying and selling divisions can buy and sell as many units as they want at market price.

B)Managers of both buying and selling divisions are indifferent between trading with each other or with outsiders.

C)From the company's perspective,this arrangement is fine as long as the selling division is operating at capacity.

D)All of the answers are correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

18

Before applying ROI as a control measure,the manager must answer the following question(s):

A)How does the firm measure revenues?

B)What costs does the firm deduct in measuring divisional operating costs?

C)How does the firm measure investment?

D)All of the answers are correct.

A)How does the firm measure revenues?

B)What costs does the firm deduct in measuring divisional operating costs?

C)How does the firm measure investment?

D)All of the answers are correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

19

Which statement is true concerning the establishment of transfer prices?

A)If the selling division is operating at capacity,it should transfer at market price.

B)If the selling division is operating below capacity,it should transfer at a discount.

C)if the selling division is operating below capacity,it should transfer at market price.

D)None of the answers is correct.

A)If the selling division is operating at capacity,it should transfer at market price.

B)If the selling division is operating below capacity,it should transfer at a discount.

C)if the selling division is operating below capacity,it should transfer at market price.

D)None of the answers is correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

20

To achieve organizational goal congruence,how should management set transfer prices?

A)To allow for divisional autonomy and encourage managers to pursue corporate goals consistent with their own personal goals.

B)Top management should set the selling division's revenue and the buying division's cost.

C)Transfer prices should be compatible with the company's performance evaluation system.

D)All of the answers are correct.

A)To allow for divisional autonomy and encourage managers to pursue corporate goals consistent with their own personal goals.

B)Top management should set the selling division's revenue and the buying division's cost.

C)Transfer prices should be compatible with the company's performance evaluation system.

D)All of the answers are correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

21

What transfer pricing mechanism generally applies a normal markup to costs as a surrogate for market prices when intermediate market prices are not available?

A)Fixed price-based transfer pricing

B)Full-absorption costing

C)Activity-based costing

D)Cost-plus transfer pricing

A)Fixed price-based transfer pricing

B)Full-absorption costing

C)Activity-based costing

D)Cost-plus transfer pricing

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

22

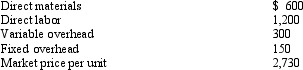

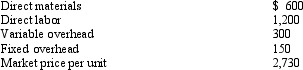

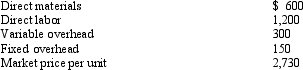

Engine Division

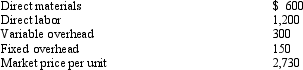

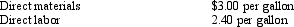

The Engine Division provides engines for the Tractor Division of a company.The standard unit costs for Engine Division are as follows:

Refer to the Engine Division.What is the transfer price based on full cost plus a markup of 30 percent?

A)$2,925.

B)$585.

C)$2,760.

D)$2,730.

The Engine Division provides engines for the Tractor Division of a company.The standard unit costs for Engine Division are as follows:

Refer to the Engine Division.What is the transfer price based on full cost plus a markup of 30 percent?

A)$2,925.

B)$585.

C)$2,760.

D)$2,730.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

23

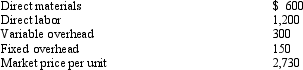

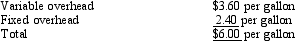

Chemical Company has two divisions,the Mixing Division and Bottling Division.The Mixing Division sells chemicals to the Bottling Division.

Standard costs for the Mixing Division are as follows:

The Bottling Division uses the following predetermined overhead rate:

What is the transfer price for the chemicals per gallon based on standard variable cost?

A)$3.00

B)$5.40

C)$9.00

D)$11.40

Standard costs for the Mixing Division are as follows:

The Bottling Division uses the following predetermined overhead rate:

What is the transfer price for the chemicals per gallon based on standard variable cost?

A)$3.00

B)$5.40

C)$9.00

D)$11.40

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

24

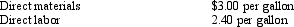

Dukes Computing Systems

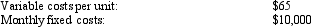

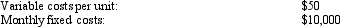

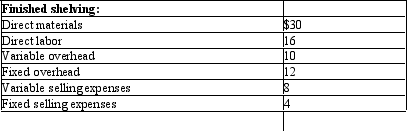

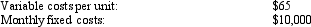

Dukes Computing Systems manufactures and sells various computer products and has two decentralized divisions: (1)Production and (2)Marketing.The Marketing Division has always purchased a particular motherboard from Production at $65 per unit.The Production Division is considering raising the price to $75 per unit.The Production Division's costs related to the motherboard production is as follows:

The Marketing Division handles the promotion and distribution of the motherboard purchases from the Production Division and sells each motherboard for $125.Marketing Division incurs monthly fixed costs of $5,000.Marketing Division sells 2,000 units per month.Marketing Division can buy the same motherboard from outside suppliers for $75.

Refer to Dukes Computing Systems.If the Marketing Division purchases the motherboard from outside suppliers,the facilities the Production Division uses to manufacture the motherboard would remain idle.The Production Division is operating below capacity because of weak global demand for the product.

What should be the motherboard transfer price be between the Production Division and Marketing Division in order for Dukes' to optimize profits?

A)$ 55

B)$ 65

C)$ 75

D)$125

Dukes Computing Systems manufactures and sells various computer products and has two decentralized divisions: (1)Production and (2)Marketing.The Marketing Division has always purchased a particular motherboard from Production at $65 per unit.The Production Division is considering raising the price to $75 per unit.The Production Division's costs related to the motherboard production is as follows:

The Marketing Division handles the promotion and distribution of the motherboard purchases from the Production Division and sells each motherboard for $125.Marketing Division incurs monthly fixed costs of $5,000.Marketing Division sells 2,000 units per month.Marketing Division can buy the same motherboard from outside suppliers for $75.

Refer to Dukes Computing Systems.If the Marketing Division purchases the motherboard from outside suppliers,the facilities the Production Division uses to manufacture the motherboard would remain idle.The Production Division is operating below capacity because of weak global demand for the product.

What should be the motherboard transfer price be between the Production Division and Marketing Division in order for Dukes' to optimize profits?

A)$ 55

B)$ 65

C)$ 75

D)$125

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

25

Colorado Furniture

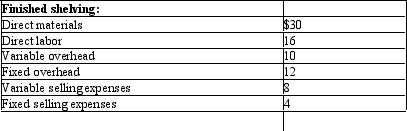

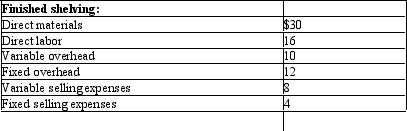

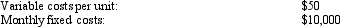

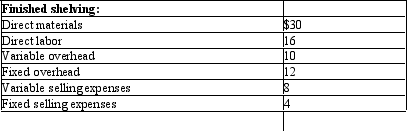

Colorado Furniture had the following historical accounting data,per hundred board feet,concerning one of its products:

The shelving is normally transferred internally from the Cutting Division to the Finishing Division.It also may be sold externally for $110 per hundred board feet.The minimum profit level accepted by the company is a markup of 20 percent.

Refer to Colorado Furniture.If the negotiated price is used,Colorado Furniture's transfer price should be a

A)maximum of $100.80.

B)minimum of $84.00.

C)maximum of $110.00.

D)minimum of $80.00.

Colorado Furniture had the following historical accounting data,per hundred board feet,concerning one of its products:

The shelving is normally transferred internally from the Cutting Division to the Finishing Division.It also may be sold externally for $110 per hundred board feet.The minimum profit level accepted by the company is a markup of 20 percent.

Refer to Colorado Furniture.If the negotiated price is used,Colorado Furniture's transfer price should be a

A)maximum of $100.80.

B)minimum of $84.00.

C)maximum of $110.00.

D)minimum of $80.00.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

26

Engine Division

The Engine Division provides engines for the Tractor Division of a company.The standard unit costs for Engine Division are as follows:

Refer to the Engine Department.The division has excess capacity.What is the best transfer price to avoid transfer price problems?

A)$1,350

B)$300

C)$900

D)$2,100

The Engine Division provides engines for the Tractor Division of a company.The standard unit costs for Engine Division are as follows:

Refer to the Engine Department.The division has excess capacity.What is the best transfer price to avoid transfer price problems?

A)$1,350

B)$300

C)$900

D)$2,100

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

27

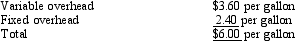

Colonial Computing Systems

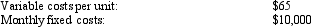

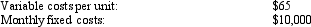

Colonial Computing Systems manufactures and sells various computer products and has two decentralized divisions: (1)Production and (2)Marketing.The Marketing Division has always purchased a particular mouse from Production at $50 per unit.The Production Division is considering raising the price to $60 per unit.The Production Division's costs related to the mouse production is as follows:

The Marketing Division handles the promotion and distribution of the mouse purchases from the Production Division and sells each mouse for $100.Marketing Division incurs monthly fixed costs of $5,000.Marketing Division sells 1,500 units per month.Marketing Division can buy the same mouse from outside suppliers for $60.If the Marketing Division purchases the mouse from outside suppliers,the facilities the Production Division uses to manufacture the mouse would remain idle.

Refer to Colonial Computing Systems.The Production Division is operating below capacity because of weak global demand for the product.What should be the mouse transfer price between the Production Division and Marketing Division in order for Colonial to optimize profits?

A)$ 50

B)$ 55

C)$ 60

D)$100

Colonial Computing Systems manufactures and sells various computer products and has two decentralized divisions: (1)Production and (2)Marketing.The Marketing Division has always purchased a particular mouse from Production at $50 per unit.The Production Division is considering raising the price to $60 per unit.The Production Division's costs related to the mouse production is as follows:

The Marketing Division handles the promotion and distribution of the mouse purchases from the Production Division and sells each mouse for $100.Marketing Division incurs monthly fixed costs of $5,000.Marketing Division sells 1,500 units per month.Marketing Division can buy the same mouse from outside suppliers for $60.If the Marketing Division purchases the mouse from outside suppliers,the facilities the Production Division uses to manufacture the mouse would remain idle.

Refer to Colonial Computing Systems.The Production Division is operating below capacity because of weak global demand for the product.What should be the mouse transfer price between the Production Division and Marketing Division in order for Colonial to optimize profits?

A)$ 50

B)$ 55

C)$ 60

D)$100

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

28

When there is an outside market for an intermediate product which is perfectly competitive,the most equitable method of transfer pricing is

A)market price.

B)production cost pricing.

C)variable cost pricing.

D)cost plus markup pricing.

A)market price.

B)production cost pricing.

C)variable cost pricing.

D)cost plus markup pricing.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

29

Which statement is true concerning a dual transfer pricing system?

A)It provides the selling division with a profit but charges the buying division with costs.

B)It provides the buying division with a profit but charges the selling division with costs.

C)It is required by generally accepted accounting principles.

D)None of the answers is correct.

A)It provides the selling division with a profit but charges the buying division with costs.

B)It provides the buying division with a profit but charges the selling division with costs.

C)It is required by generally accepted accounting principles.

D)None of the answers is correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

30

Colorado Furniture

Colorado Furniture had the following historical accounting data,per hundred board feet,concerning one of its products:

The shelving is normally transferred internally from the Cutting Division to the Finishing Division.It also may be sold externally for $110 per hundred board feet.The minimum profit level accepted by the company is a markup of 20 percent.

Refer to Colorado Furniture.If the variable manufacturing cost transfer price method is used without a fixed fee,Colorado Furniture's transfer price will be

A)$68.

B)$84.

C)$56.

D)$64.

Colorado Furniture had the following historical accounting data,per hundred board feet,concerning one of its products:

The shelving is normally transferred internally from the Cutting Division to the Finishing Division.It also may be sold externally for $110 per hundred board feet.The minimum profit level accepted by the company is a markup of 20 percent.

Refer to Colorado Furniture.If the variable manufacturing cost transfer price method is used without a fixed fee,Colorado Furniture's transfer price will be

A)$68.

B)$84.

C)$56.

D)$64.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

31

Colonial Computing Systems

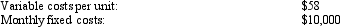

Colonial Computing Systems manufactures and sells various computer products and has two decentralized divisions: (1)Production and (2)Marketing.The Marketing Division has always purchased a particular mouse from Production at $50 per unit.The Production Division is considering raising the price to $60 per unit.The Production Division's costs related to the mouse production is as follows:

The Marketing Division handles the promotion and distribution of the mouse purchases from the Production Division and sells each mouse for $100.Marketing Division incurs monthly fixed costs of $5,000.Marketing Division sells 1,500 units per month.Marketing Division can buy the same mouse from outside suppliers for $60.If the Marketing Division purchases the mouse from outside suppliers,the facilities the Production Division uses to manufacture the mouse would remain idle.

Refer to Colonial Computing Systems.The Production Division is operating at maximum capacity because of strong worldwide demand for the product.What should be the mouse transfer price between the Production Division and Marketing Division in order for Colonial to optimize profits?

A)$ 50

B)$ 55

C)$ 60

D)$100

Colonial Computing Systems manufactures and sells various computer products and has two decentralized divisions: (1)Production and (2)Marketing.The Marketing Division has always purchased a particular mouse from Production at $50 per unit.The Production Division is considering raising the price to $60 per unit.The Production Division's costs related to the mouse production is as follows:

The Marketing Division handles the promotion and distribution of the mouse purchases from the Production Division and sells each mouse for $100.Marketing Division incurs monthly fixed costs of $5,000.Marketing Division sells 1,500 units per month.Marketing Division can buy the same mouse from outside suppliers for $60.If the Marketing Division purchases the mouse from outside suppliers,the facilities the Production Division uses to manufacture the mouse would remain idle.

Refer to Colonial Computing Systems.The Production Division is operating at maximum capacity because of strong worldwide demand for the product.What should be the mouse transfer price between the Production Division and Marketing Division in order for Colonial to optimize profits?

A)$ 50

B)$ 55

C)$ 60

D)$100

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

32

What transfer pricing mechanism is used when a company does not have a measure of differential or variable cost?

A)Market price-based transfer pricing

B)Full-absorption costing

C)Activity-based costing

D)Actual cost-based transfer pricing

A)Market price-based transfer pricing

B)Full-absorption costing

C)Activity-based costing

D)Actual cost-based transfer pricing

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

33

Transfer prices are the prices charged

A)for distributing goods from one warehouse to another.

B)for the goods produced by one division to another division that needs those goods.

C)when delivering goods to the customer.

D)when transferring goods to international divisions.

A)for distributing goods from one warehouse to another.

B)for the goods produced by one division to another division that needs those goods.

C)when delivering goods to the customer.

D)when transferring goods to international divisions.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

34

Terrapin Computing Systems

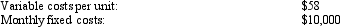

Terrapin Computing Systems manufactures and sells various computer products and has two decentralized divisions: (1)Production and (2)Marketing.The Marketing Division has always purchased a particular large tower case from Production at $58 per unit.The Production Division is considering raising the price to $75 per unit.The Production Division's costs related to the large tower case production is as follows:

The Marketing Division handles the promotion and distribution of the large tower case purchases from the Production Division and sells each large tower case for $100.Marketing Division incurs monthly fixed costs of $5,000.Marketing Division sells 2,000 units per month.Marketing Division can buy the same large tower case from outside suppliers for $75.

Refer to Terrapin Computing Systems.The Production Division is operating at maximum capacity because of strong worldwide demand for the product and the Production Division can sell all it produces to outside customers for $75 per large tower case.

What should be the large tower case transfer price between the Production Division and Marketing Division in order for Terrapin to optimize profits?

A)$ 55

B)$ 58

C)$ 75

D)$100

Terrapin Computing Systems manufactures and sells various computer products and has two decentralized divisions: (1)Production and (2)Marketing.The Marketing Division has always purchased a particular large tower case from Production at $58 per unit.The Production Division is considering raising the price to $75 per unit.The Production Division's costs related to the large tower case production is as follows:

The Marketing Division handles the promotion and distribution of the large tower case purchases from the Production Division and sells each large tower case for $100.Marketing Division incurs monthly fixed costs of $5,000.Marketing Division sells 2,000 units per month.Marketing Division can buy the same large tower case from outside suppliers for $75.

Refer to Terrapin Computing Systems.The Production Division is operating at maximum capacity because of strong worldwide demand for the product and the Production Division can sell all it produces to outside customers for $75 per large tower case.

What should be the large tower case transfer price between the Production Division and Marketing Division in order for Terrapin to optimize profits?

A)$ 55

B)$ 58

C)$ 75

D)$100

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

35

Dukes Computing Systems

Dukes Computing Systems manufactures and sells various computer products and has two decentralized divisions: (1)Production and (2)Marketing.The Marketing Division has always purchased a particular motherboard from Production at $65 per unit.The Production Division is considering raising the price to $75 per unit.The Production Division's costs related to the motherboard production is as follows:

The Marketing Division handles the promotion and distribution of the motherboard purchases from the Production Division and sells each motherboard for $125.Marketing Division incurs monthly fixed costs of $5,000.Marketing Division sells 2,000 units per month.Marketing Division can buy the same motherboard from outside suppliers for $75.

Refer to Dukes Computing Systems.The Production Division is operating at maximum capacity because of strong worldwide demand for the product and the Production Division can sell all it produces to outside customers for $75 per motherboard.

What should be the motherboard transfer price between the Production Division and Marketing Division in order for Dukes' to optimize profits?

A)$ 55

B)$ 65

C)$ 75

D)$125

Dukes Computing Systems manufactures and sells various computer products and has two decentralized divisions: (1)Production and (2)Marketing.The Marketing Division has always purchased a particular motherboard from Production at $65 per unit.The Production Division is considering raising the price to $75 per unit.The Production Division's costs related to the motherboard production is as follows:

The Marketing Division handles the promotion and distribution of the motherboard purchases from the Production Division and sells each motherboard for $125.Marketing Division incurs monthly fixed costs of $5,000.Marketing Division sells 2,000 units per month.Marketing Division can buy the same motherboard from outside suppliers for $75.

Refer to Dukes Computing Systems.The Production Division is operating at maximum capacity because of strong worldwide demand for the product and the Production Division can sell all it produces to outside customers for $75 per motherboard.

What should be the motherboard transfer price between the Production Division and Marketing Division in order for Dukes' to optimize profits?

A)$ 55

B)$ 65

C)$ 75

D)$125

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following is(are)the transfer price that would leave the selling division no worse off if the good is sold to an internal division?

A)The negotiated transfer price.

B)The minimum transfer price.

C)The maximum transfer price.

D)Both a.and c.

A)The negotiated transfer price.

B)The minimum transfer price.

C)The maximum transfer price.

D)Both a.and c.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is a transfer pricing system that provides the selling division with a profit but charges the buying division with costs only?

A)hybrid.

B)dual.

C)bifurcated.

D)split-off.

A)hybrid.

B)dual.

C)bifurcated.

D)split-off.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

38

Terrapin Computing Systems

Terrapin Computing Systems manufactures and sells various computer products and has two decentralized divisions: (1)Production and (2)Marketing.The Marketing Division has always purchased a particular large tower case from Production at $58 per unit.The Production Division is considering raising the price to $75 per unit.The Production Division's costs related to the large tower case production is as follows:

The Marketing Division handles the promotion and distribution of the large tower case purchases from the Production Division and sells each large tower case for $100.Marketing Division incurs monthly fixed costs of $5,000.Marketing Division sells 2,000 units per month.Marketing Division can buy the same large tower case from outside suppliers for $75.

Refer to Terrapin Computing Systems.If the Marketing Division purchases the large tower case from outside suppliers,the facilities the Production Division uses to manufacture the large tower case would remain idle.The Production Division is operating below capacity because of weak global demand for the product.

What should be the large tower case transfer price between the Production Division and Marketing Division in order for Terrapin to optimize profits?

A)$ 55

B)$ 58

C)$ 75

D)$100

Terrapin Computing Systems manufactures and sells various computer products and has two decentralized divisions: (1)Production and (2)Marketing.The Marketing Division has always purchased a particular large tower case from Production at $58 per unit.The Production Division is considering raising the price to $75 per unit.The Production Division's costs related to the large tower case production is as follows:

The Marketing Division handles the promotion and distribution of the large tower case purchases from the Production Division and sells each large tower case for $100.Marketing Division incurs monthly fixed costs of $5,000.Marketing Division sells 2,000 units per month.Marketing Division can buy the same large tower case from outside suppliers for $75.

Refer to Terrapin Computing Systems.If the Marketing Division purchases the large tower case from outside suppliers,the facilities the Production Division uses to manufacture the large tower case would remain idle.The Production Division is operating below capacity because of weak global demand for the product.

What should be the large tower case transfer price between the Production Division and Marketing Division in order for Terrapin to optimize profits?

A)$ 55

B)$ 58

C)$ 75

D)$100

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

39

Engine Division

The Engine Division provides engines for the Tractor Division of a company.The standard unit costs for Engine Division are as follows:

Refer to the Engine Division.What is the transfer price based on variable product costs plus a fixed fee of $210?

A)$210.

B)$1,800.

C)$2,100

D)$2,310.

The Engine Division provides engines for the Tractor Division of a company.The standard unit costs for Engine Division are as follows:

Refer to the Engine Division.What is the transfer price based on variable product costs plus a fixed fee of $210?

A)$210.

B)$1,800.

C)$2,100

D)$2,310.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following is(are)the transfer price that would leave the buying division no worse off if an input is purchased from an internal division.

A)The negotiated transfer price.

B)The minimum transfer price.

C)The maximum transfer price.

D)Both a.and c.

A)The negotiated transfer price.

B)The minimum transfer price.

C)The maximum transfer price.

D)Both a.and c.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

41

Is there an optimal transfer pricing policy that dominates all others?

A)Yes,managers strive to devise a textbook-perfect system regardless of cost-benefit considerations.

B)Yes,managers strive to devise a textbook-perfect system taking into consideration cost and benefits.

C)No,managers tend to settle for a system that seems to work reasonably well rather than devise a textbook-perfect system.

D)No,managers tend to settle for a textbook-perfect system,rather than devise a system that seems to work reasonably well.

A)Yes,managers strive to devise a textbook-perfect system regardless of cost-benefit considerations.

B)Yes,managers strive to devise a textbook-perfect system taking into consideration cost and benefits.

C)No,managers tend to settle for a system that seems to work reasonably well rather than devise a textbook-perfect system.

D)No,managers tend to settle for a textbook-perfect system,rather than devise a system that seems to work reasonably well.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

42

Which of these is a transfer pricing methodology that preserves the autonomy of the division managers?

A)cost-plus.

B)actual costs.

C)negotiated.

D)predetermined.

A)cost-plus.

B)actual costs.

C)negotiated.

D)predetermined.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

43

When measuring a division's operating costs,indirect controllable operating costs include

A)labor used in the division's production.

B)salary of the division manager (controlled by top management)

C)costs of providing centralized services,such as data processing and employee training.

D)company president's salary.

A)labor used in the division's production.

B)salary of the division manager (controlled by top management)

C)costs of providing centralized services,such as data processing and employee training.

D)company president's salary.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

44

Surveys of global corporate transfer pricing practices indicate that nearly half use

A)cost,about one-third use market price,and the rest use negotiations.

B)market price,about one-third use cost,and the rest use negotiations.

C)negotiations,about one-third use cost,and the rest use market price.

D)negotiations,about one-third use market price,and the rest use cost.

A)cost,about one-third use market price,and the rest use negotiations.

B)market price,about one-third use cost,and the rest use negotiations.

C)negotiations,about one-third use cost,and the rest use market price.

D)negotiations,about one-third use market price,and the rest use cost.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

45

Transfer pricing systems based on costs include which of the following?

A)activity-based costing.

B)cost-plus.

C)standard costs.

D)All of the answers are correct.

A)activity-based costing.

B)cost-plus.

C)standard costs.

D)All of the answers are correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

46

What has spawned a major political issue concerning the estimated cost to the United States Treasury of as much as $9 billion to $13 billion per year in lost taxes that could presumably be collected if transfer prices were calculated according to U.S.tax laws?

A)Tax avoidance by foreign companies using inflated transfer prices to reduce the profit of U.S.subsidiaries.

B)Tax avoidance by domestic,United States,companies using inflated transfer prices to reduce the foreign profit of U.S.subsidiaries.

C)Tax avoidance by foreign companies using deflated transfer prices to reduce the profit of U.S.subsidiaries.

D)Tax avoidance by domestic,United States,companies using deflated transfer prices to reduce the profit of foreign subsidiaries.

A)Tax avoidance by foreign companies using inflated transfer prices to reduce the profit of U.S.subsidiaries.

B)Tax avoidance by domestic,United States,companies using inflated transfer prices to reduce the foreign profit of U.S.subsidiaries.

C)Tax avoidance by foreign companies using deflated transfer prices to reduce the profit of U.S.subsidiaries.

D)Tax avoidance by domestic,United States,companies using deflated transfer prices to reduce the profit of foreign subsidiaries.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

47

Which statement is true concerning negotiated transfer pricing?

A)It preserves the autonomy of the division managers.

B)It does not preserve the autonomy of the division managers.

C)It violates generally accepted accounting principles.

D)It is the same as centrally administered transfer pricing.

A)It preserves the autonomy of the division managers.

B)It does not preserve the autonomy of the division managers.

C)It violates generally accepted accounting principles.

D)It is the same as centrally administered transfer pricing.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

48

When measuring a division's operating costs,thecost of the company president's salary is

A)direct,controllable.

B)indirect,controllable.

C)direct,noncontrollable.

D)indirect,noncontrollable.

A)direct,controllable.

B)indirect,controllable.

C)direct,noncontrollable.

D)indirect,noncontrollable.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

49

Because tax rates are different in various states within the United States,companies have incentives to set transfer prices that will

A)increase revenues in low-tax states.

B)decrease costs in high-tax states.

C)decrease revenues in low-tax states.

D)None of the answers is correct.

A)increase revenues in low-tax states.

B)decrease costs in high-tax states.

C)decrease revenues in low-tax states.

D)None of the answers is correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

50

Because tax rates are different in different countries,companies have incentives to set transfer prices that will

A)increase revenues in low-tax countries.

B)decrease costs in high-tax countries.

C)decrease revenues in low-tax countries.

D)None of the answers is correct.

A)increase revenues in low-tax countries.

B)decrease costs in high-tax countries.

C)decrease revenues in low-tax countries.

D)None of the answers is correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

51

Because tax rates are different in different countries,companies have incentives to set transfer prices that will

A)increase revenues in low-tax countries and increase costs in high-tax countries.

B)increase costs in low-tax countries and increase revenues in high-tax countries.

C)decrease costs in high-tax countries and decrease revenues in low-tax countries.

D)None of the answers is correct.

A)increase revenues in low-tax countries and increase costs in high-tax countries.

B)increase costs in low-tax countries and increase revenues in high-tax countries.

C)decrease costs in high-tax countries and decrease revenues in low-tax countries.

D)None of the answers is correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

52

When measuring a division's operating costs,labor used in the division's production is

A)direct,controllable.

B)indirect,controllable.

C)direct,noncontrollable.

D)indirect,noncontrollable.

A)direct,controllable.

B)indirect,controllable.

C)direct,noncontrollable.

D)indirect,noncontrollable.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

53

When measuring a division's operating costs,indirect noncontrollable operating costs include

A)labor used in the division's production.

B)salary of the division manager (controlled by top management).

C)costs of providing centralized services,such as data processing and employee training.

D)company president's salary.

A)labor used in the division's production.

B)salary of the division manager (controlled by top management).

C)costs of providing centralized services,such as data processing and employee training.

D)company president's salary.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

54

When measuring a division's operating costs,thesalary of the division manager (controlled by top management)is

A)direct,controllable.

B)indirect,controllable.

C)direct,noncontrollable.

D)indirect,noncontrollable.

A)direct,controllable.

B)indirect,controllable.

C)direct,noncontrollable.

D)indirect,noncontrollable.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

55

In calculating return on investment (ROI),the use of book values of assets-particularly fixed assets-in the ROI denominator

A)is the preferable method.

B)may cause a manager of a division with fully depreciated assets to be reluctant to replace the assets with more costly assets.

C)is required by generally accepted accounting principles.

D)may cause a manager of a division with fully depreciated assets to replace the assets with newer,more efficient,but more costly assets.

A)is the preferable method.

B)may cause a manager of a division with fully depreciated assets to be reluctant to replace the assets with more costly assets.

C)is required by generally accepted accounting principles.

D)may cause a manager of a division with fully depreciated assets to replace the assets with newer,more efficient,but more costly assets.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following describes a transfer pricing system based on either variable costs or full-absorption costs,and applies a normal markup to costs as a surrogate for market prices when intermediate market prices are not available?

A)hybrid.

B)dual.

C)cost-plus.

D)mark-to-market.

A)hybrid.

B)dual.

C)cost-plus.

D)mark-to-market.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

57

When measuring a division's operating costs,direct controllable operating costs include

A)labor used in the division's production.

B)salary of the division manager (controlled by top management).

C)costs of providing centralized services,such as data processing and employee training.

D)company president's salary.

A)labor used in the division's production.

B)salary of the division manager (controlled by top management).

C)costs of providing centralized services,such as data processing and employee training.

D)company president's salary.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

58

In calculating return on investment (ROI),when measuring the investment base most firms use

A)acquisition cost.

B)net book value.

C)replacement cost.

D)MCRS depreciated value.

A)acquisition cost.

B)net book value.

C)replacement cost.

D)MCRS depreciated value.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

59

When measuring a division's operating costs,direct noncontrollable operating costs include

A)labor used in the division's production.

B)salary of the division manager (controlled by top management).

C)costs of providing centralized services,such as data processing and employee training.

D)company president's salary.

A)labor used in the division's production.

B)salary of the division manager (controlled by top management).

C)costs of providing centralized services,such as data processing and employee training.

D)company president's salary.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

60

When measuring divisional operating costs,direct versus indirect refers to whether

A)the costs associate directly with the division.

B)the division manager can affect the cost.

C)the costs are fixed.

D)the costs are variable.

A)the costs associate directly with the division.

B)the division manager can affect the cost.

C)the costs are fixed.

D)the costs are variable.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

61

Marlow Company

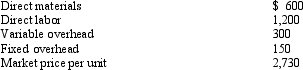

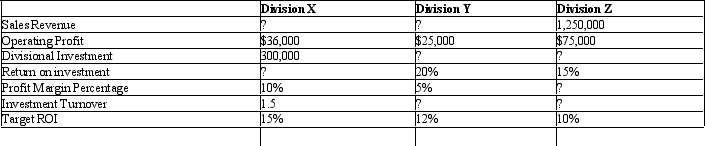

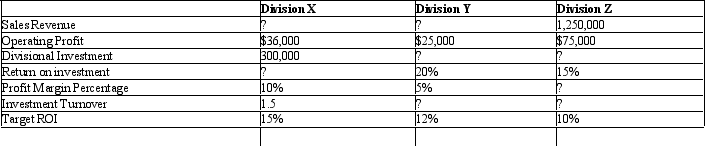

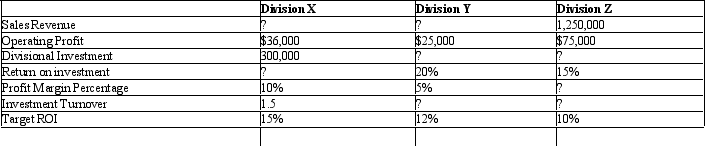

The following information pertains to the three divisions of Marlow Company:

Refer to Marlow Company.What is the division investment for Division Z?

A)$75,000

B)$500,000

C)$1,250,000

D)$187,500

The following information pertains to the three divisions of Marlow Company:

Refer to Marlow Company.What is the division investment for Division Z?

A)$75,000

B)$500,000

C)$1,250,000

D)$187,500

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

62

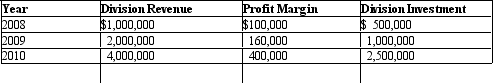

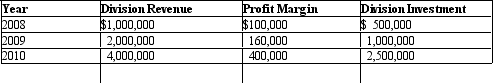

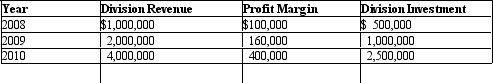

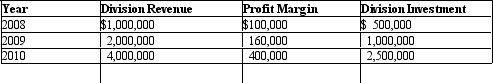

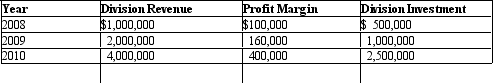

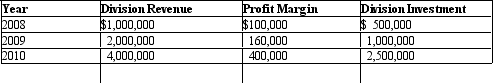

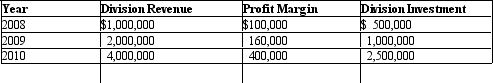

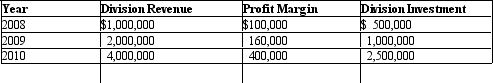

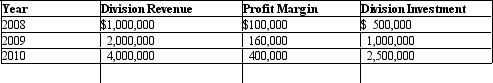

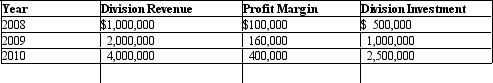

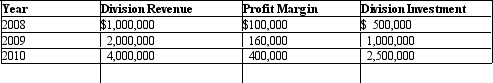

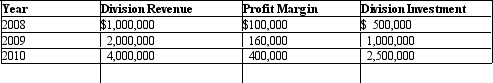

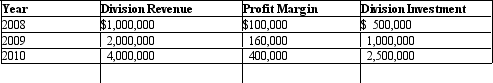

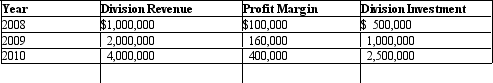

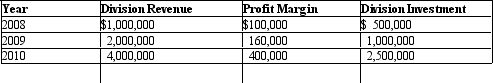

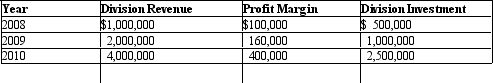

Framing Division

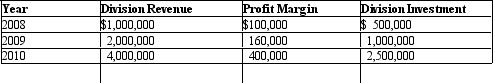

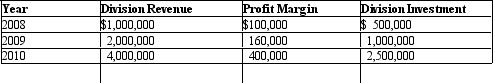

The Framing Division had the following data:

Refer to the Framing Division.What is the profit margin percentage for Year 2008?

A)6%.

B)8%.

C)10%.

D)12%.

The Framing Division had the following data:

Refer to the Framing Division.What is the profit margin percentage for Year 2008?

A)6%.

B)8%.

C)10%.

D)12%.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

63

Framing Division

The Framing Division had the following data:

Refer to the Framing Division.What is the profit margin percentage for Year 2010?

A)6%

B)8%

C)10%

D)12%

The Framing Division had the following data:

Refer to the Framing Division.What is the profit margin percentage for Year 2010?

A)6%

B)8%

C)10%

D)12%

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

64

Framing Division

The Framing Division had the following data:

Refer to the Framing Division.What is the return on investment for Year 2009?

A)10%.

B)16%.

C)20%.

D)24%.

The Framing Division had the following data:

Refer to the Framing Division.What is the return on investment for Year 2009?

A)10%.

B)16%.

C)20%.

D)24%.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

65

Marlow Company

The following information pertains to the three divisions of Marlow Company:

Refer to Marlow Company.What is the profit margin percentage for Division Z?

A)1.5%

B)100.0%

C)15.0%

D)6.0%

The following information pertains to the three divisions of Marlow Company:

Refer to Marlow Company.What is the profit margin percentage for Division Z?

A)1.5%

B)100.0%

C)15.0%

D)6.0%

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

66

Framing Division

The Framing Division had the following data:

Refer to the Framing Division.What is the return on investment for Year 2008?

A)10%.

B)16%.

C)20%.

D)24%.

The Framing Division had the following data:

Refer to the Framing Division.What is the return on investment for Year 2008?

A)10%.

B)16%.

C)20%.

D)24%.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

67

A shortcoming of return on investment (ROI)is that it may not lead managers to accept good investment opportunities if

A)ROI of the investment is higher than the present ROI of the division.

B)the ROI of the investment is the same as the present ROI of the division.

C)the ROI of the investment is lower than the present ROI of the division.

D)None of the answers is correct.

A)ROI of the investment is higher than the present ROI of the division.

B)the ROI of the investment is the same as the present ROI of the division.

C)the ROI of the investment is lower than the present ROI of the division.

D)None of the answers is correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

68

The rate of return on investment (ROI)has two components:

A)Profit margin percentage and investment turnover ratio.

B)Sales margin percentage and investment turnover ratio.

C)Profit margin percentage and accounts receivable turnover ratio.

D)Sales margin percentage and accounts receivable turnover ratio.

A)Profit margin percentage and investment turnover ratio.

B)Sales margin percentage and investment turnover ratio.

C)Profit margin percentage and accounts receivable turnover ratio.

D)Sales margin percentage and accounts receivable turnover ratio.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

69

Framing Division

The Framing Division had the following data:

Refer to the Framing Division.What is the investment turnover ratio for Year 2010?

A)1.0

B)1.5

C)1.6

D)2.0

The Framing Division had the following data:

Refer to the Framing Division.What is the investment turnover ratio for Year 2010?

A)1.0

B)1.5

C)1.6

D)2.0

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

70

Patterson Division had sales revenue of $200,000,operating profit of $10,000,and a division investment of $300,000.Its profit margin percentage is

A)66.7%

B)150.0%

C)3.3%

D)5.0%

A)66.7%

B)150.0%

C)3.3%

D)5.0%

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

71

The following is a measure for assessing how effectively management used the funds invested and is the ratio of divisional sales to the investment in divisional assets.

A)profit margin percentage.

B)return on investment.

C)investment turnover ratio.

D)investment realization ratio.

A)profit margin percentage.

B)return on investment.

C)investment turnover ratio.

D)investment realization ratio.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

72

If a division has sales of $2,500,000,operating profit of $250,000,and a division investment of $1,250,000,its return on investment is

A)20%

B)10%

C)500%

D)200%

A)20%

B)10%

C)500%

D)200%

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

73

Management uses the following as a measure for assessing efficiency in producing and selling goods and services because it indicates the portion of each dollar of revenue that is profit.

A)Profit margin percentage.

B)Return on investment

C)Investment turnover ratio.

D)Revenue realization ratio.

A)Profit margin percentage.

B)Return on investment

C)Investment turnover ratio.

D)Revenue realization ratio.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

74

Framing Division

The Framing Division had the following data:

Refer to the Framing Division.What is the profit margin percentage for Year 2009?

A)6%

B)8%

C)10%

D)12%

The Framing Division had the following data:

Refer to the Framing Division.What is the profit margin percentage for Year 2009?

A)6%

B)8%

C)10%

D)12%

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

75

Parker Division had revenue of $250,000,operating profit of $10,000,and a division investment of $100,000.The investment turnover is

A)0.04

B)2.50

C)4.00

D)0.25

A)0.04

B)2.50

C)4.00

D)0.25

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

76

Framing Division

The Framing Division had the following data:

Refer to the Framing Division.What is the investment turnover ratio for Year 2009?

A)1.0

B)1.5

C)1.6

D)2.0

The Framing Division had the following data:

Refer to the Framing Division.What is the investment turnover ratio for Year 2009?

A)1.0

B)1.5

C)1.6

D)2.0

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

77

Framing Division

The Framing Division had the following data:

Refer to the Framing Division.What is the investment turnover ratio for Year 2008?

A)1.0

B)1.5

C)1.6

D)2.0

The Framing Division had the following data:

Refer to the Framing Division.What is the investment turnover ratio for Year 2008?

A)1.0

B)1.5

C)1.6

D)2.0

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

78

Framing Division

The Framing Division had the following data:

Refer to the Framing Division.What is the return on investment for Year 2010?

A)10%.

B)16%.

C)20%.

D)24%.

The Framing Division had the following data:

Refer to the Framing Division.What is the return on investment for Year 2010?

A)10%.

B)16%.

C)20%.

D)24%.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

79

Return on Investment (ROI)is equal to the

A)Profit Margin Percentage ´ Investment Turnover Ratio.

B)Sales Margin Percentage ´ Investment Turnover Ratio.

C)Profit Margin Percentage ´ Accounts Receivable Turnover Ratio.

D)Sales Margin Percentage ´ Accounts Receivable Turnover Ratio.

A)Profit Margin Percentage ´ Investment Turnover Ratio.

B)Sales Margin Percentage ´ Investment Turnover Ratio.

C)Profit Margin Percentage ´ Accounts Receivable Turnover Ratio.

D)Sales Margin Percentage ´ Accounts Receivable Turnover Ratio.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

80

Return on Investment (ROI)is equal to the

A)(Profit Margin/Division Costs)´ (Division Costs/Division Investment).

B)(Profit Margin/Division Revenues)´ (Division Revenues/Division Investment).

C)(Sales Margin/Division Revenues)´ (Division Revenues/Division Investment).

D)(Sales Margin/Division Costs)´ (Division Costs/Division Investment).

A)(Profit Margin/Division Costs)´ (Division Costs/Division Investment).

B)(Profit Margin/Division Revenues)´ (Division Revenues/Division Investment).

C)(Sales Margin/Division Revenues)´ (Division Revenues/Division Investment).

D)(Sales Margin/Division Costs)´ (Division Costs/Division Investment).

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck