Deck 5: Itemized Deductions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/115

Play

Full screen (f)

Deck 5: Itemized Deductions

1

In order to deduct a charitable contribution, taxpayers must itemize on their return.

True

2

For 2015, the investment interest expense deduction is limited to the taxpayer's gross investment income.

False

3

Loan fees that are not "points", or prepaid interest, are deductible as interest on Schedule A.

False

4

In 2014, Roxanne's nephew was her dependent. For 2015, he no longer qualifies as her dependent. However, she paid $650 in 2015 for medical expenses she incurred in 2014 when he was her dependent. Roxanne can include the $650 in figuring her medical expense deduction in 2015.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

5

Rick and Claudia live in an apartment and have purchased land where they plan to build their home. They have a mortgage on the lot and have received a Form 1098 from the lender showing the interest paid on the note. Interest paid on this loan is deductible as home mortgage interest on their Schedule A.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

6

Personal casualty losses resulting from termite damage are deductible.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

7

A taxpayer generally has the option of deducting foreign taxes paid on Schedule A or taking a foreign tax credit.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

8

Cynthia makes weekly cash contributions of $30 to her church. She pays by check. Since her annual contributions to the church are more than $250, she must obtain a written acknowledgment from the church to support her contribution deduction.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

9

Personal property taxes paid on personal-use assets, such as the family car, are deductible on Schedule A.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

10

The cost of aspirin and over-the-counter cough medicine is a deductible medical expense even though they are nonprescription drugs.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

11

For 2015, sales taxes are deductible as an itemized deduction based only on the actual amount of sales taxes paid.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

12

Taxpayers can deduct qualified residence interest on their principal residence and on a second residence selected by the taxpayer.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

13

If donated appreciated capital gain property is put to a use that is unrelated to the purpose or function of a charity's tax-exempt status, the contribution must be reduced by the amount of any long-term capital gain that would have been realized if the property had been sold at its fair market value at the time of the contribution.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

14

For 2015, taxpayers may take an above-the-line deduction for the amount of mortgage insurance premium paid in 2015.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

15

Theft losses are deducted in the tax year in which the theft was discovered, rather than the year of theft, if the discovery comes later.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

16

A taxpayer receives a deduction for services rendered to a charitable organization.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

17

Premiums paid for long-term care insurance policies may be deductible as medical expenses.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

18

Individual taxpayers may carry forward for five years charitable contributions that are not allowed as a deduction in the current year due to the adjusted gross income limitation.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

19

Prescription drugs obtained outside the United States, such as from Canada, are never deductible on a U.S. tax return.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

20

For medical expenses, only expenses in excess of 7.5 percent of adjusted gross income are deductible.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

21

On December 31, 2015, Roger charged a $1,800 contribution to a qualified charitable organization to his credit card. He will not pay the credit card bill until January 2016. The $2,200 contribution is deductible on Roger's 2015 tax return.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

22

Melissa earned net investment income of $11,000 during 2015 and incurred investment interest expense of $3,000 during the year related to a stock purchase. She incurred other investment interest expenses of $7,000 during the year. Melissa is limited to a deduction of $3,000 of investment interest expense in 2015.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

23

For determination of deductibility, all personal casualty losses incurred during the year are added together and only one $100 floor amount is used to reduce the casualty deduction.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

24

The cost of a chiropractor's services does not qualify as a medical deduction.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

25

The adjusted gross income limitation on casualty losses is 7.5 percent.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

26

Moesha paid $60 for Girl Scout cookies and $50 for Cub Scout cracker jacks. Moesha may claim the full $110 as a charitable contribution deduction.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

27

For 2015, high-income taxpayers do not have to forfeit part of their itemized deductions.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

28

Taxpayers must itemize their deductions to be allowed a charitable contribution deduction.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

29

In the past, high-income taxpayers' itemized deductions have been reduced by the lower of 3% of the excess of AGI over the applicable amount or 80% of the itemized deductions otherwise allowable for the tax year. For 2015, this limitation on the amount of itemized deductions for high-income taxpayers is back in effect.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

30

For purposes of computing the deduction for qualified residence interest, a qualified residence includes the taxpayer's principal residence and one other residence of the taxpayer or spouse.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

31

For 2015, sales taxes paid may be deducted as an itemized deduction on Schedule A.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

32

If a taxpayer's personal property is completely destroyed, the casualty loss deduction is still reduced by a required floor amount.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

33

In 2015, federal income taxes may not be deducted as an itemized deduction on Schedule A.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

34

In 2015, Alan was required by his employer to use his car for work. His employer's mileage reimbursement was $0.25 per mile. If Alan's actual expenses are more than the reimbursement, he can deduct the excess amount on Schedule C.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

35

Taxes assessed for local benefits, such as a new sidewalk, are deductible as real property taxes.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

36

The standard business mileage rate for automobiles for all of 2015 is 57.5 cents per mile.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

37

If an accountant in public accounting seeks work as a controller in private industry, the expenses of job hunting may be deductible.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

38

Unreimbursed employee business expenses for travel qualify as itemized deductions subject to the 2% floor.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

39

Premiums paid for long-term care insurance are not deductible as medical expenses.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

40

The interest paid on a loan used to acquire municipal bonds is deductible as investment interest expense.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

41

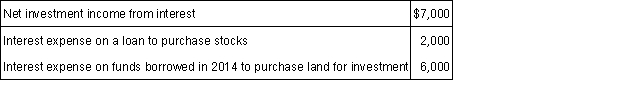

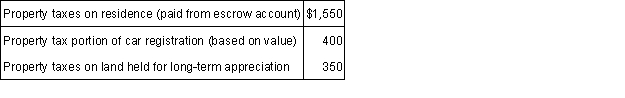

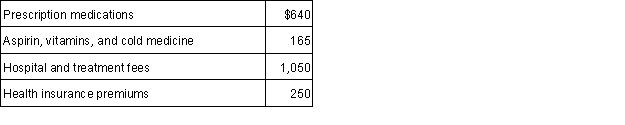

For 2015, Jorge, a single father, reported the following amounts relating to his investments:  What is the maximum amount that Jorge can deduct in 2015 as investment interest expense?

What is the maximum amount that Jorge can deduct in 2015 as investment interest expense?

A) $1,000.

B) $2,000.

C) $6,000.

D)$7,000.

What is the maximum amount that Jorge can deduct in 2015 as investment interest expense?

What is the maximum amount that Jorge can deduct in 2015 as investment interest expense?A) $1,000.

B) $2,000.

C) $6,000.

D)$7,000.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

42

In 2015, Allen's pleasure boat was destroyed by a flood. He had purchased the boat in 2012 for $45,000. On what form(s) will Allen report this loss?

A) Form 4684, Casualties and Thefts, and Schedule A, Itemized Deductions.

B) Form 4684, Casualties and Theft, and Schedule D, Capital Gains and Losses.

C) Form 4797, Sales of Business Property and Involuntary Conversions, and Schedule D, Capital Gains and Losses.

D)On the first page of Form 1040.

A) Form 4684, Casualties and Thefts, and Schedule A, Itemized Deductions.

B) Form 4684, Casualties and Theft, and Schedule D, Capital Gains and Losses.

C) Form 4797, Sales of Business Property and Involuntary Conversions, and Schedule D, Capital Gains and Losses.

D)On the first page of Form 1040.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following costs are deductible on Form 1040, Schedule A, as taxes?

1) Real estate taxes on property owned in Mexico.

2) Property tax portion of vehicle registration, based on the value of the auto.

3) Fine for speeding.

4) Personal property tax on a pleasure boat.

A) 1, 2, and 4.

B) 3 and 4.

C) None of the items are deductible.

D)All of the items are deductible.

1) Real estate taxes on property owned in Mexico.

2) Property tax portion of vehicle registration, based on the value of the auto.

3) Fine for speeding.

4) Personal property tax on a pleasure boat.

A) 1, 2, and 4.

B) 3 and 4.

C) None of the items are deductible.

D)All of the items are deductible.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

44

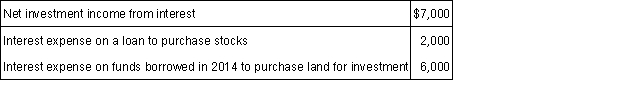

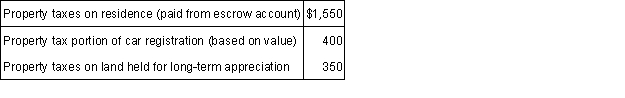

During 2015, Sam paid the following taxes:  What amount can Sam deduct as property taxes in calculating his itemized deductions for 2015?

What amount can Sam deduct as property taxes in calculating his itemized deductions for 2015?

A) $350.

B) $750.

C) $1,950.

D)$2,300.

What amount can Sam deduct as property taxes in calculating his itemized deductions for 2015?

What amount can Sam deduct as property taxes in calculating his itemized deductions for 2015?A) $350.

B) $750.

C) $1,950.

D)$2,300.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

45

For the current year, Sheila Jones had adjusted gross income of $100,000. During the year, she contributed $6,000 to her church and an additional $3,000 to qualified charities. She also contributed religious artwork with a fair market value of $60,000 and a basis of $20,000 to her church. The church intends to display the religious artwork in the church foyer. What is the amount of the charitable contribution carry forward for Sheila Jones?

A) $30,000.

B) $20,000.

C) $10,000.

D)$0.

A) $30,000.

B) $20,000.

C) $10,000.

D)$0.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

46

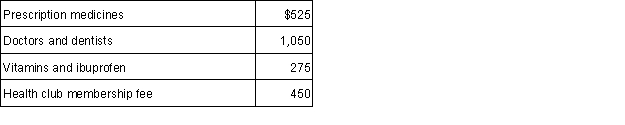

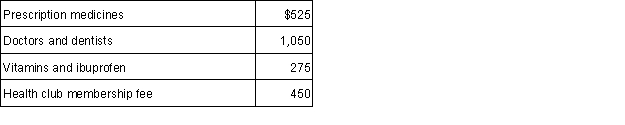

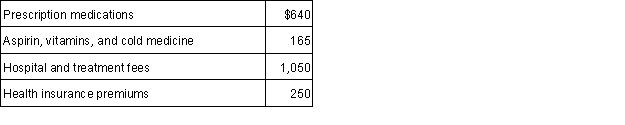

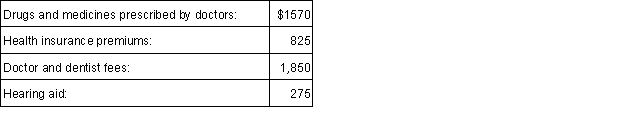

During 2015 Shakira paid the following expenses:  What is the total amount of medical expenses (before application of the adjusted gross income limitation) that would enter into the calculation of itemized deductions on Shakira's 2015 income tax return?

What is the total amount of medical expenses (before application of the adjusted gross income limitation) that would enter into the calculation of itemized deductions on Shakira's 2015 income tax return?

A) $525.

B) $1,325.

C) $1,500.

D)$1,575.

What is the total amount of medical expenses (before application of the adjusted gross income limitation) that would enter into the calculation of itemized deductions on Shakira's 2015 income tax return?

What is the total amount of medical expenses (before application of the adjusted gross income limitation) that would enter into the calculation of itemized deductions on Shakira's 2015 income tax return?A) $525.

B) $1,325.

C) $1,500.

D)$1,575.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

47

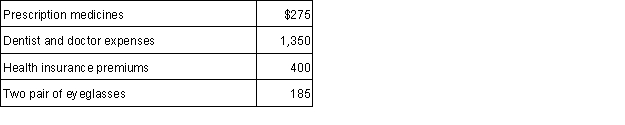

Maria is single and age 32. In 2015, she had AGI of $35,000. During the year, she incurred and paid the following medical costs:  What is Maria's medical expense deduction (afterapplicationoftheadjustedgrossincomelimitation) for her 2015 tax return?

What is Maria's medical expense deduction (afterapplicationoftheadjustedgrossincomelimitation) for her 2015 tax return?

A) $3,500.

B) $3,215.

C) $2,615.

D)$0.

What is Maria's medical expense deduction (afterapplicationoftheadjustedgrossincomelimitation) for her 2015 tax return?

What is Maria's medical expense deduction (afterapplicationoftheadjustedgrossincomelimitation) for her 2015 tax return?A) $3,500.

B) $3,215.

C) $2,615.

D)$0.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

48

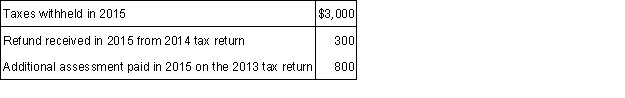

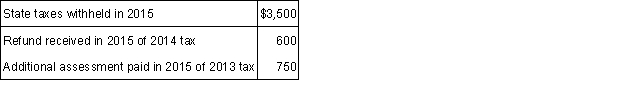

Cynthia lives in California, a state that imposes a tax on income. The following information relates to Cynthia's state income taxes for 2015:  Assuming she elects to deduct state and local income taxes, what amount should Cynthia use as an itemized deduction for state and local income taxes for her 2015 federal income tax return?

Assuming she elects to deduct state and local income taxes, what amount should Cynthia use as an itemized deduction for state and local income taxes for her 2015 federal income tax return?

A) $1,100.

B) $2,700.

C) $3,800.

D)$4,100.

Assuming she elects to deduct state and local income taxes, what amount should Cynthia use as an itemized deduction for state and local income taxes for her 2015 federal income tax return?

Assuming she elects to deduct state and local income taxes, what amount should Cynthia use as an itemized deduction for state and local income taxes for her 2015 federal income tax return?A) $1,100.

B) $2,700.

C) $3,800.

D)$4,100.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following expenses is not deductible as medical expense?

A) Insulin used for diabetes.

B) Wig purchased upon the advice of a physician for the mental health of a patient who has lost all of his/her hair from disease.

C) Swimming lessons, recommended by a doctor for improvement of general health.

D)Acupuncture used to treat migraines.

A) Insulin used for diabetes.

B) Wig purchased upon the advice of a physician for the mental health of a patient who has lost all of his/her hair from disease.

C) Swimming lessons, recommended by a doctor for improvement of general health.

D)Acupuncture used to treat migraines.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

50

Mrs. Gonzales must use a wheelchair. Upon advice from her physician, she installed an elevator and widened the front entrance of her house in 2015, incurring $15,000 and $4,000 in costs, respectively. Mrs. Gonzales originally purchased her house for $152,000. An appraisal showed the fair market value of Mrs. Gonzales' house immediately after these modifications at $162,000. Compute her currently deductible medical expense in regards to these improvements before AGI limitations.

A) $19,000.

B) $15,000.

C) $9,000.

D)$4,000.

A) $19,000.

B) $15,000.

C) $9,000.

D)$4,000.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following may not be deducted either totally or partially as medical expenses? (Disregard any limitations which may apply.)

A) $3,000 to a family physician for medical care.

B) $1,000 long-term care insurance.

C) $600 for eyeglasses.

D)$300 for maternity clothes.

A) $3,000 to a family physician for medical care.

B) $1,000 long-term care insurance.

C) $600 for eyeglasses.

D)$300 for maternity clothes.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

52

For the current year, Sheila Jones had adjusted gross income of $100,000. During the year, she contributed $6,000 to her church and an additional $3,000 to qualified charities. She also contributed religious artwork with a fair market value of $60,000 and a basis of $20,000 to her church. The church intends to display the religious artwork in the church foyer. If Sheila chooses to itemize her deductions, what is the amount of her deductible charitable contribution?

A) $9,000.

B) $20,000.

C) $39,000.

D)$49,000.

A) $9,000.

B) $20,000.

C) $39,000.

D)$49,000.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

53

Abel's car was completely destroyed in an accident that was his fault. His loss was $8,500 and his insurance company reimbursed him $6,500. What amount of casualty loss can Abel claim on his return (beforedeductionlimitations)?

A) $0

B) $2,000

C) $6,500

D)$8,500

A) $0

B) $2,000

C) $6,500

D)$8,500

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following interest expenses incurred by Amanda is treated as personal interest expense and, therefore, not deductible as an itemized deduction?

A) Interest expense on personal credit cards.

B) Bonds purchased with accrued interest.

C) Interest on a home mortgage acquired in 2006.

D)Interest expense incurred by a partnership in which Amanda is a limited partner.

A) Interest expense on personal credit cards.

B) Bonds purchased with accrued interest.

C) Interest on a home mortgage acquired in 2006.

D)Interest expense incurred by a partnership in which Amanda is a limited partner.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

55

Taxes deductible as an itemized deduction include all of the following except:

A) Personal property taxes based on the value of the property.

B) Taxes that the taxpayer paid on property owned by his/her parents or children.

C) State and local income taxes.

D)Real estate taxes based on the assessed value of the property.

A) Personal property taxes based on the value of the property.

B) Taxes that the taxpayer paid on property owned by his/her parents or children.

C) State and local income taxes.

D)Real estate taxes based on the assessed value of the property.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

56

Some charitable contributions are limited to 50% of the taxpayer's AGI, others may be limited to a lower % of AGI. Deductions to which of the following organizations are subject to the 50% limitation on deductible contributions?

A) Churches and conventions of organizations of churches and educational organizations.

B) Hospitals and certain medical research organizations associated with these hospitals.

C) Rotary, Elks, and Lions Clubs who raise money for public causes.

D)Both churches and conventions of organizations of churches and educational organizations and hospitals and certain medical research organizations associated with these hospitals.

A) Churches and conventions of organizations of churches and educational organizations.

B) Hospitals and certain medical research organizations associated with these hospitals.

C) Rotary, Elks, and Lions Clubs who raise money for public causes.

D)Both churches and conventions of organizations of churches and educational organizations and hospitals and certain medical research organizations associated with these hospitals.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following organizations do not qualify for deductible charitable contributions?

A) The Red Cross.

B) A political party.

C) Religious organizations.

D)All of these.

A) The Red Cross.

B) A political party.

C) Religious organizations.

D)All of these.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

58

In 2015, the U.S. President declared a federal disaster in California due to wild fires. Helen lives in the affected area and lost her home in the fires. What choice does she have regarding when she can claim the loss on her tax return?

A) It must be claimed in 2014 if the return has not been filed by the date of the loss.

B) It must be claimed in 2015 if the loss is greater than Helen's modified adjusted gross income.

C) It may be claimed in 2016 if an election is filed with Helen's 2015 return.

D)It may be claimed in either 2014 or 2015.

A) It must be claimed in 2014 if the return has not been filed by the date of the loss.

B) It must be claimed in 2015 if the loss is greater than Helen's modified adjusted gross income.

C) It may be claimed in 2016 if an election is filed with Helen's 2015 return.

D)It may be claimed in either 2014 or 2015.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

59

For investment interest expense in 2015, the deduction by a taxpayer is:

A) Limited to the investment interest expense paid in 2015.

B) Limited to the taxpayer's net investment income for 2015.

C) Not limited.

D)Limited to the taxpayer's gross investment income for 2015.

A) Limited to the investment interest expense paid in 2015.

B) Limited to the taxpayer's net investment income for 2015.

C) Not limited.

D)Limited to the taxpayer's gross investment income for 2015.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

60

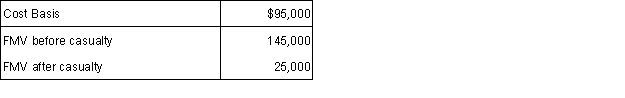

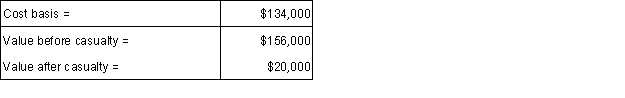

In 2015, the Chens' pleasure boat was severely damaged by a hurricane in an area that was declared a federal disaster area. They had AGI of $110,000 in 2015. The following information relates to the craft:  The Chens had insurance and received an $80,000 insurance settlement.

The Chens had insurance and received an $80,000 insurance settlement.

What is the allowable casualty loss deduction for the Chens in 2015?

A) $50,000.

B) $15,000.

C) $3,900.

D)$3,000.

The Chens had insurance and received an $80,000 insurance settlement.

The Chens had insurance and received an $80,000 insurance settlement.What is the allowable casualty loss deduction for the Chens in 2015?

A) $50,000.

B) $15,000.

C) $3,900.

D)$3,000.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following organizations qualify for deductible charitable contributions?

A) Churches.

B) State political organizations.

C) Churches and State political organizations.

D)None of these.

A) Churches.

B) State political organizations.

C) Churches and State political organizations.

D)None of these.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following miscellaneous itemized deductions is not subject to the 2% of adjusted gross income limitation?

A) Unreimbursed employee business expenses.

B) Gambling losses up to the amount of gambling winnings.

C) Union or professional dues and subscriptions.

D)Tax return preparation fees.

A) Unreimbursed employee business expenses.

B) Gambling losses up to the amount of gambling winnings.

C) Union or professional dues and subscriptions.

D)Tax return preparation fees.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

63

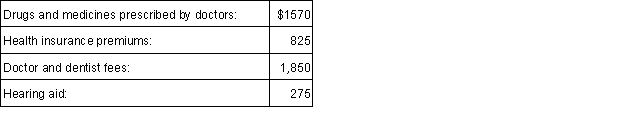

During 2015, Carlos paid the following expenses:  What is the total amount of medical expenses (before considering the limitation based on adjusted gross income) that would enter into the calculation of itemized deductions on Carlos's 2015 income tax return?

What is the total amount of medical expenses (before considering the limitation based on adjusted gross income) that would enter into the calculation of itemized deductions on Carlos's 2015 income tax return?

A) $0.

B) $1,885.

C) $1,940.

D)$2,105.

What is the total amount of medical expenses (before considering the limitation based on adjusted gross income) that would enter into the calculation of itemized deductions on Carlos's 2015 income tax return?

What is the total amount of medical expenses (before considering the limitation based on adjusted gross income) that would enter into the calculation of itemized deductions on Carlos's 2015 income tax return?A) $0.

B) $1,885.

C) $1,940.

D)$2,105.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following miscellaneous deductions are subject to the 2% of adjusted gross income limitation?

A) Unreimbursed employee business expenses.

B) Investment counsel and advisory fees.

C) Safe deposit box fees.

D)All of these.

A) Unreimbursed employee business expenses.

B) Investment counsel and advisory fees.

C) Safe deposit box fees.

D)All of these.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

65

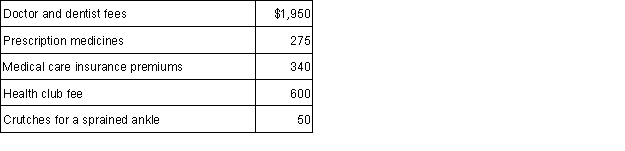

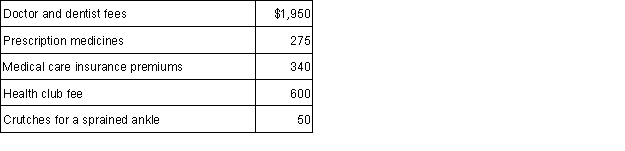

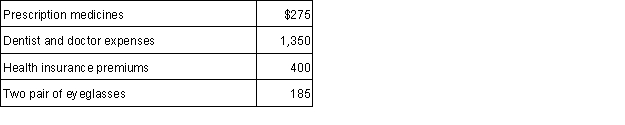

In 2015, Maria who is 43, had adjusted gross income of $27,000, paid the following medical expenses:  What amount can Maria deduct as medical expenses (after the adjusted gross income limitation) in calculating her itemized deductions for 2015?

What amount can Maria deduct as medical expenses (after the adjusted gross income limitation) in calculating her itemized deductions for 2015?

A) $2,710.

B) $2,025.

C) $685.

D)$0.

What amount can Maria deduct as medical expenses (after the adjusted gross income limitation) in calculating her itemized deductions for 2015?

What amount can Maria deduct as medical expenses (after the adjusted gross income limitation) in calculating her itemized deductions for 2015?A) $2,710.

B) $2,025.

C) $685.

D)$0.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following miscellaneous itemized deductions is not subject to the 2% of AGI threshold?

A) Tax preparation fees.

B) Gambling losses.

C) Unreimbursed employee expenses.

D)Investment expenses.

A) Tax preparation fees.

B) Gambling losses.

C) Unreimbursed employee expenses.

D)Investment expenses.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

67

Malika and Henry's vacation home was completely destroyed by fire. They had no insurance to the cover the loss. On which of the following forms would they report their loss?

A) Form 4684, Casualties and Thefts, and Form 1040, U.S. Individual Income Tax Return, as an adjustment to gross income.

B) Schedule A, Itemized Deductions, only.

C) Form 4684, Casualties and Thefts, and Schedule A, Itemized Deductions.

D)Form 4684, Casualties and Thefts, only.

A) Form 4684, Casualties and Thefts, and Form 1040, U.S. Individual Income Tax Return, as an adjustment to gross income.

B) Schedule A, Itemized Deductions, only.

C) Form 4684, Casualties and Thefts, and Schedule A, Itemized Deductions.

D)Form 4684, Casualties and Thefts, only.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

68

Tyrell, who is 45, had adjusted gross income of $35,000 in 2015. During the year, he incurred and paid the following medical expenses:  Tyrell received $600 in 2015 as a reimbursement for a portion of the doctors' fees. If he were to itemize his deductions, what would be his allowable medical expense deduction after the adjusted gross income limitation is taken into account?

Tyrell received $600 in 2015 as a reimbursement for a portion of the doctors' fees. If he were to itemize his deductions, what would be his allowable medical expense deduction after the adjusted gross income limitation is taken into account?

A) $420.

B) $1,020.

C) $3,920.

D)$4,520.

Tyrell received $600 in 2015 as a reimbursement for a portion of the doctors' fees. If he were to itemize his deductions, what would be his allowable medical expense deduction after the adjusted gross income limitation is taken into account?

Tyrell received $600 in 2015 as a reimbursement for a portion of the doctors' fees. If he were to itemize his deductions, what would be his allowable medical expense deduction after the adjusted gross income limitation is taken into account?A) $420.

B) $1,020.

C) $3,920.

D)$4,520.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

69

The threshold amount for the deductibility of allowable medical expenses for those under 65 in 2015 is:

A) 10% of AGI.

B) 10% of taxable income.

C) 7.5% of AGI.

D)7.5% of taxable income.

A) 10% of AGI.

B) 10% of taxable income.

C) 7.5% of AGI.

D)7.5% of taxable income.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following expenses is deductible, but subject to the 2% limitation on Form 1040, Schedule A, Job Expenses and Most Other Miscellaneous Itemized Deductions?

A) A blue suit for an accountant.

B) Appraisal fees on the sale of a personal residence.

C) Uniforms for a UPS delivery person.

D)The cost of hauling tools to work in the trunk of a car.

A) A blue suit for an accountant.

B) Appraisal fees on the sale of a personal residence.

C) Uniforms for a UPS delivery person.

D)The cost of hauling tools to work in the trunk of a car.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

71

To qualify for a medical expense deduction as taxpayer's dependent, a person must be a dependent either at the time the medical services were provided or at the time the expenses were paid. A person generally qualifies as a dependent for purposes of the medical expense deduction if the person:

A) Would qualify as a dependent except for the amount of gross income.

B) Was a foreign student staying briefly at taxpayer's home.

C) Is an unmarried adult child of taxpayer's sibling.

D)Is the unrelated caregiver for taxpayer's elderly parents.

A) Would qualify as a dependent except for the amount of gross income.

B) Was a foreign student staying briefly at taxpayer's home.

C) Is an unmarried adult child of taxpayer's sibling.

D)Is the unrelated caregiver for taxpayer's elderly parents.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

72

Marty and Cindy are married and both are professors at a local college. They contribute money to various organizations each year and file a joint return. Their adjusted gross income for 2015 is $100,000. They contributed to the following organizations in 2015:

• $3,500 to the Sierra club

• $10,000 to the Red Cross

• $2,000 to a local political candidate

• $11,000 to cancer research foundation

• Donated clothing to Goodwill. (Marty purchased the items for $850, but the thrift shop value of the same items at a local second-hand store is equal to $60.)

How much can Cindy and Marty deduct as charitable contributions for the year 2015?

A) $26,560.

B) $26,500.

C) $25,710.

D)$24,560.

• $3,500 to the Sierra club

• $10,000 to the Red Cross

• $2,000 to a local political candidate

• $11,000 to cancer research foundation

• Donated clothing to Goodwill. (Marty purchased the items for $850, but the thrift shop value of the same items at a local second-hand store is equal to $60.)

How much can Cindy and Marty deduct as charitable contributions for the year 2015?

A) $26,560.

B) $26,500.

C) $25,710.

D)$24,560.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

73

Generally, the taxpayer may deduct the cost of medical expenses on Schedule A for which of the following?

A) Doctor prescribed birth control pills.

B) Controlled substances like marijuana that are in violation of federal law.

C) Trips for general health improvement.

D)Marriage counseling.

A) Doctor prescribed birth control pills.

B) Controlled substances like marijuana that are in violation of federal law.

C) Trips for general health improvement.

D)Marriage counseling.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following statements is true regarding documentation requirements for charitable contributions?

A) If the total deduction for all noncash contributions for the year is more than $500, Section A of Form 8283, Noncash Charitable Contributions, must be completed.

B) A noncash contribution of less than $250 must be supported by a cancelled check, or a receipt, or other written acknowledgement from the charitable organization.

C) A contribution charged to a credit card is considered a cash contribution for purposes of documentation requirements.

D)All of these are true.

A) If the total deduction for all noncash contributions for the year is more than $500, Section A of Form 8283, Noncash Charitable Contributions, must be completed.

B) A noncash contribution of less than $250 must be supported by a cancelled check, or a receipt, or other written acknowledgement from the charitable organization.

C) A contribution charged to a credit card is considered a cash contribution for purposes of documentation requirements.

D)All of these are true.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

75

What is the maximum amount of personal residence acquisition debt on which interest is fully deductible?

A) $1,000,000.

B) $500,000.

C) $250,000.

D)$0.

A) $1,000,000.

B) $500,000.

C) $250,000.

D)$0.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

76

Juan paid the following amounts of interest in 2015:

$150 on his personal credit card

$9,500 on his home mortgage

$750 on a personal car loan, which was not used for business

$350 on funds borrowed to purchase tax-exempt securities

What is his deductible interest for 2015?

A) $350.

B) $1,250.

C) $9,500.

D)$9,850.

$150 on his personal credit card

$9,500 on his home mortgage

$750 on a personal car loan, which was not used for business

$350 on funds borrowed to purchase tax-exempt securities

What is his deductible interest for 2015?

A) $350.

B) $1,250.

C) $9,500.

D)$9,850.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

77

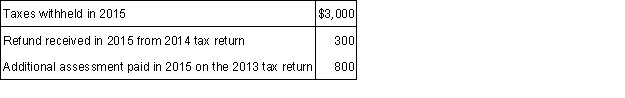

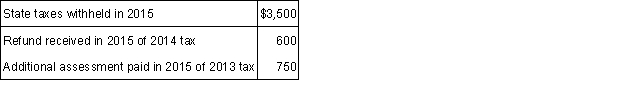

Shanika lives in California which imposes a state tax on income. For 2015, Shanika had the following transactions related to her state income taxes:  Shanika plans to itemize on her 2015 return. What amount of state and local taxes should Shanika deduct in calculating itemized deductions for her 2015 federal income tax return?

Shanika plans to itemize on her 2015 return. What amount of state and local taxes should Shanika deduct in calculating itemized deductions for her 2015 federal income tax return?

A) $750.

B) $3,500.

C) $4,250.

D)$4,850.

Shanika plans to itemize on her 2015 return. What amount of state and local taxes should Shanika deduct in calculating itemized deductions for her 2015 federal income tax return?

Shanika plans to itemize on her 2015 return. What amount of state and local taxes should Shanika deduct in calculating itemized deductions for her 2015 federal income tax return?A) $750.

B) $3,500.

C) $4,250.

D)$4,850.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following costs are potentially deductible on Form 1040, Schedule A as taxes for 2015?

1) Property tax on principal residence.

2) Garbage pickup itemized on the real estate bill.

3) Real estate tax on property owned as an investment.

4) Sales tax paid on the purchase of a personal car.

A) None of the items.

B) 2 and 4.

C) 1, 3, & 4.

D)All of the items.

1) Property tax on principal residence.

2) Garbage pickup itemized on the real estate bill.

3) Real estate tax on property owned as an investment.

4) Sales tax paid on the purchase of a personal car.

A) None of the items.

B) 2 and 4.

C) 1, 3, & 4.

D)All of the items.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

79

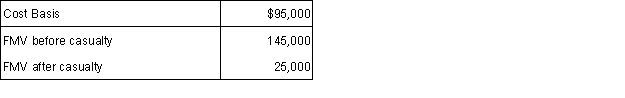

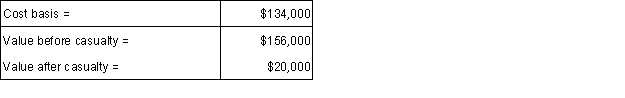

The Frazins had adjusted gross income of $140,000 in 2015. During the year, their principal residence was severely damaged by a house fire. The pertinent financial information is as follows:  The Frazins had some insurance and in 2015 reached a settlement with the insurance company for $110,000 insurance settlement. What is their allowable casualty loss deduction for 2015?

The Frazins had some insurance and in 2015 reached a settlement with the insurance company for $110,000 insurance settlement. What is their allowable casualty loss deduction for 2015?

A) $9,900.

B) $23,900.

C) $36,000.

D)None of these.

The Frazins had some insurance and in 2015 reached a settlement with the insurance company for $110,000 insurance settlement. What is their allowable casualty loss deduction for 2015?

The Frazins had some insurance and in 2015 reached a settlement with the insurance company for $110,000 insurance settlement. What is their allowable casualty loss deduction for 2015?A) $9,900.

B) $23,900.

C) $36,000.

D)None of these.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following is deductible as a miscellaneous itemized deduction?

A) Job-hunting expenses.

B) Union dues.

C) Professional dues and subscriptions.

D)All of these are considered miscellaneous deductions.

A) Job-hunting expenses.

B) Union dues.

C) Professional dues and subscriptions.

D)All of these are considered miscellaneous deductions.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck