Deck 20: Accounting for Leases

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/149

Play

Full screen (f)

Deck 20: Accounting for Leases

1

If the fair value of land is less than 25% of the total fair value of the leased property at the inception of the lease then the land is considered to be immaterial which means both the lessee and the lessor treat the land and building as a single unit.

True

2

A lessee reports noncash investing and financing activity on the statement of cash flows when recording a capital lease.

True

3

A capital lease is a lease where by risks and benefits of ownership is in economic substance a purchase by the lessee and a sale or financing arrangement by the lessor.

True

4

An advantage of an operating lease is that is does not add a liability or an asset to the lessee's balance sheet, thereby not affecting certain liquidity and financial leverage ratio's.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

5

If a lease qualifies as a capital lease, which of the following combinations of payments would be included?

A) minimum periodic rental payments plus executory costs

B) minimum periodic rental payments plus the payment required for a bargain purchase option

C) minimum periodic rental payments minus any payment required for a guarantee of the residual value

D) minimum periodic rental payments minus any payments required for failure to renew or extend the lease

A) minimum periodic rental payments plus executory costs

B) minimum periodic rental payments plus the payment required for a bargain purchase option

C) minimum periodic rental payments minus any payment required for a guarantee of the residual value

D) minimum periodic rental payments minus any payments required for failure to renew or extend the lease

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

6

If at any time the lessee and lessor change a lease so that the lease would have been classified differently, the revised agreement is considered a change in the agreement and business proceeds as if the change never occurred.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

7

Because the risks and benefits of ownership transfer to the lessor with a capital lease, the executed costs incurred do not get included when determining the present value of the minimum lease payments.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

8

Presentation of the lease on the lessor's cash flow statement is dependent upon the classification of the lease.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

9

A required disclosure of a direct financing lease is that the cost and carrying amount, if different, of property on lease or held for leasing by major classes of property and the amount of the total accumulated depreciation must be disclosed in the company's financial statements.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following correctly states a lease capitalization criterion from the point of view of the lessee?

A) Collectibility of the lease payments is reasonably certain.

B) The present value of the minimum lease payments is equal to 75% or more of the fair value of the leased property.

C) The lease contains a bargain purchase option.

D) The lease term is equal to at least 85% of the estimated economic life of the leased asset.

A) Collectibility of the lease payments is reasonably certain.

B) The present value of the minimum lease payments is equal to 75% or more of the fair value of the leased property.

C) The lease contains a bargain purchase option.

D) The lease term is equal to at least 85% of the estimated economic life of the leased asset.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

11

A direct financing capital lease results in a manufacturers or dealers profit or loss and meets one or more of the capitalization criteria and both of the recognition criteria.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

12

The lessee should classify a lease as a capital lease if

A) there is a purchase option at the end of the lease term

B) the present value of the minimum lease payments is at least 75% of the fair value of the leased property

C) the present value of the minimum lease payments is at least 90% of the fair market value of the leased property to the lessor

D) the estimated residual value of the leased property at the termination of the lease is equal to 90% of the lessee's guaranteed residual value

A) there is a purchase option at the end of the lease term

B) the present value of the minimum lease payments is at least 75% of the fair value of the leased property

C) the present value of the minimum lease payments is at least 90% of the fair market value of the leased property to the lessor

D) the estimated residual value of the leased property at the termination of the lease is equal to 90% of the lessee's guaranteed residual value

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

13

The existence and term of renewal or purchase options and escalation clauses are disclosed for capital leases only

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

14

A sales type lease is similar to a direct financing lease, but the lessor sells the asset and records a receivable. It differs in that its cost or carrying value is less than the fair value of the asset which results in a profit or loss for the manufacturer or dealer.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

15

If a lease is structured so that the lessee pays a set rental payment each period plus an additional amount based upon usage or determined by a change in an index, these are contingent rental payments which if included in the lease agreement the rental payments should be expensed when the contingency is likely to be met.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

16

A lessor acquires the right to use the leased asset in exchange for making future lease payments.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

17

From the lessee's point of view leasing provides a method of making a sale while still maintaining the advantages of ownership, including security in the asset and tax benefits.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

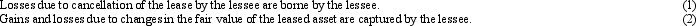

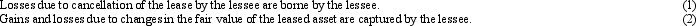

18

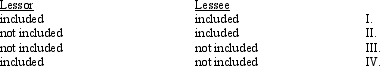

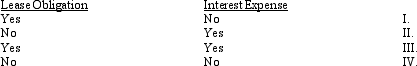

According to current GAAP, leased property recorded as a capital lease normally should be reported as a long-term or intangible asset on the balance sheet of the lessee and the lessor as follows:

A) I

B) II

C) III

D) IV

A) I

B) II

C) III

D) IV

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following criteria would not apply in determining if a lease is a capital lease if the beginning of the lease term falls within the last 25% of the total estimated economic life of the leased asset?

A) the lease is non-cancelable

B) the lease contains a bargain purchase option

C) the lease transfers ownership of the property to the lessee by the end of the lease term

D) the lease term is equal to 75% or more of the estimated economic life of the leased property

A) the lease is non-cancelable

B) the lease contains a bargain purchase option

C) the lease transfers ownership of the property to the lessee by the end of the lease term

D) the lease term is equal to 75% or more of the estimated economic life of the leased property

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

20

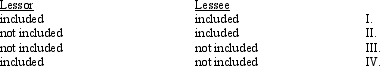

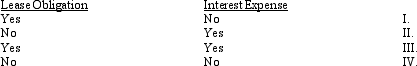

According to current GAAP, leased property could be reported as an asset on the balance sheet of the lessee and the lessor as follows:

A) I

B) II

C) III

D) all of the above

A) I

B) II

C) III

D) all of the above

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

21

Exhibit 20-1 On January 1, 2014, Pearson Company signed a lease agreement requiring six annual payments of $60,000, beginning December 31, 2014. The lease qualifies as a capital lease. Pearson's incremental borrowing rate was 9% and the lessor's implicit rate, known by Pearson, was 10%. The present value factors of an ordinary annuity of $1 for six periods for interest rates of 9% and 10% are 4.48592 and 4.35526, respectively.

-Refer to Exhibit 20-1. The interest expense for 2014 would be (round answers to the nearest dollar)

A) $21,003

B) $22,746

C) $24,224

D) $26,133

-Refer to Exhibit 20-1. The interest expense for 2014 would be (round answers to the nearest dollar)

A) $21,003

B) $22,746

C) $24,224

D) $26,133

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

22

As a generalized statement regarding lease accounting, which statement best describes U.S. versus international accounting principles?

A) IFRS for leases are more principles-based than GAAP.

B) IFRS for leases are more rules-based than GAAP.

C) IFRS and GAAP are similarly rules-based.

D) IFRS and GAAP are similarly principles-based.

A) IFRS for leases are more principles-based than GAAP.

B) IFRS for leases are more rules-based than GAAP.

C) IFRS and GAAP are similarly rules-based.

D) IFRS and GAAP are similarly principles-based.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

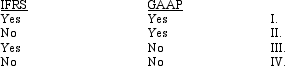

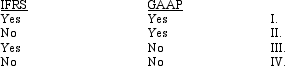

23

The following are indicators in the terms of a lease that cause it to be treated as a capital lease. The indicators are:

These indicators are criteria that trigger lease capitalization under

A) I

B) II

C) III

D) IV

These indicators are criteria that trigger lease capitalization under

A) I

B) II

C) III

D) IV

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

24

An operating lease should be recorded in the lessee's accounts at the inception of the lease at an amount equal to

A) the present value of the minimum lease payments less the executory costs included in the minimum lease payments

B) the total value of the future rental payments less any estimated contingent payments

C) the total value of the future rental payments less any executory payments included in the future payments

D) none of these

A) the present value of the minimum lease payments less the executory costs included in the minimum lease payments

B) the total value of the future rental payments less any estimated contingent payments

C) the total value of the future rental payments less any executory payments included in the future payments

D) none of these

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

25

Which is an advantage of leasing from a lessee's viewpoint?

A) The asset can be acquired without having to make a substantial down payment.

B) The lease is a way of indirectly making a sale.

C) "Off-balance-sheet financing" may be avoided.

D) The risk of obsolescence may be increased.

A) The asset can be acquired without having to make a substantial down payment.

B) The lease is a way of indirectly making a sale.

C) "Off-balance-sheet financing" may be avoided.

D) The risk of obsolescence may be increased.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

26

For a lease that contains a bargain purchase option, minimum lease payments include

A) any guarantee by the lessee of the residual value

B) any payments on failure to renew or extend the lease

C) executory costs

D) minimum periodic rental payments required by the lease over the lease term

A) any guarantee by the lessee of the residual value

B) any payments on failure to renew or extend the lease

C) executory costs

D) minimum periodic rental payments required by the lease over the lease term

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following indicators relating to lease capitalization is an example of IFRS criteria being more principles-based than GAAP with respect to lease accounting?

A) The title must transfer to the lessee at the end of the lease term.

B) The present value of the payments must be at least 90% of the fair value of the asset.

C) The lease term must be a major part of the economic life of the asset.

D) The lease agreement must contain a bargain purchase option.

A) The title must transfer to the lessee at the end of the lease term.

B) The present value of the payments must be at least 90% of the fair value of the asset.

C) The lease term must be a major part of the economic life of the asset.

D) The lease agreement must contain a bargain purchase option.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

28

The lease term includes the fixed non-cancelable term of the lease plus

A) any periods covered by an ordinary renewal options preceding the exercise date of a bargain purchase option

B) any periods covered by a bargain renewal option

C) any periods for which failure to renew the lease imposes a significant penalty on the lessee

D) all of these

A) any periods covered by an ordinary renewal options preceding the exercise date of a bargain purchase option

B) any periods covered by a bargain renewal option

C) any periods for which failure to renew the lease imposes a significant penalty on the lessee

D) all of these

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

29

On January 1, 2014, Denise Company signed a lease agreement requiring ten annual payments of $14,000, beginning December 31, 2014. The agreement was classified as a capital lease. When reviewing Denise's accounting records, which of the following would not be expected?

A) Leased Equipment 105,210

Capital Lease Obligation 105,210

B) Interest Expense 7,365

Obligation Under Capital Leases 6,635

Cash 14,000

C) Depreciation Expense: Leased Equipment 10,521

Accumulated Depreciation:

Leased Equipment 10,521

D) Rent Expense 14,000

Cash 14,000

A) Leased Equipment 105,210

Capital Lease Obligation 105,210

B) Interest Expense 7,365

Obligation Under Capital Leases 6,635

Cash 14,000

C) Depreciation Expense: Leased Equipment 10,521

Accumulated Depreciation:

Leased Equipment 10,521

D) Rent Expense 14,000

Cash 14,000

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

30

Which is not an advantage of leasing from a lessee's viewpoint?

A) The asset can be acquired without having to make a substantial down payment.

B) The lease is a way of indirectly making a sale.

C) "Off-balance-sheet financing" may be practiced.

D) The risk of obsolescence may be reduced.

A) The asset can be acquired without having to make a substantial down payment.

B) The lease is a way of indirectly making a sale.

C) "Off-balance-sheet financing" may be practiced.

D) The risk of obsolescence may be reduced.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following correctly states a lessee criterion for classifying a lease as a capital lease?

A) The lessee guarantees the residual value.

B) The sum of the lease payments exceeds 90% of the fair value of the asset.

C) The asset is the property of the lessor at the end of the lease term.

D) The lease term is equal to 75% or more of the estimated economic life of the leased asset.

A) The lessee guarantees the residual value.

B) The sum of the lease payments exceeds 90% of the fair value of the asset.

C) The asset is the property of the lessor at the end of the lease term.

D) The lease term is equal to 75% or more of the estimated economic life of the leased asset.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

32

When a lessee makes periodic cash payments for an operating lease, which of the following accounts is increased?

A) Rent Expense

B) Leased Equipment

C) Capital Lease Obligation

D) Interest Expense

A) Rent Expense

B) Leased Equipment

C) Capital Lease Obligation

D) Interest Expense

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following facts would require a lessee to classify a lease as a capital lease?

A) The lease term is 85% of the estimated economic life of the leased property.

B) The present value of the minimum lease payments is 85% of the fair market value of the leased property to the lessor, less any investment tax credit accruing to the lessor.

C) The lease contains a purchase option.

D) The lease does not transfer ownership of the leased property.

A) The lease term is 85% of the estimated economic life of the leased property.

B) The present value of the minimum lease payments is 85% of the fair market value of the leased property to the lessor, less any investment tax credit accruing to the lessor.

C) The lease contains a purchase option.

D) The lease does not transfer ownership of the leased property.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

34

If a lease is classified as a capital lease because the lease agreement contains a bargain purchase option, the time period to be used by the lessee to amortize the leased property is

A) the lease term

B) the expected economic life of the property

C) the lease term or the expected economic life of the property, whichever is shorter

D) the maximum amortization period for intangible assets

A) the lease term

B) the expected economic life of the property

C) the lease term or the expected economic life of the property, whichever is shorter

D) the maximum amortization period for intangible assets

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

35

From the lessee's viewpoint, all of the following are advantages of leasing except that

A) if a lease is recorded as a capital lease, the calculated rate of return on the total assets ratio and the current ratio will be improved

B) a lease agreement may reduce the risk of obsolescence for a lessee

C) in many cases, an asset may be leased without requiring the lessee to make a substantial down payment

D) the lessee may be able to claim larger tax deductions through leasing the asset than if the asset were purchased

A) if a lease is recorded as a capital lease, the calculated rate of return on the total assets ratio and the current ratio will be improved

B) a lease agreement may reduce the risk of obsolescence for a lessee

C) in many cases, an asset may be leased without requiring the lessee to make a substantial down payment

D) the lessee may be able to claim larger tax deductions through leasing the asset than if the asset were purchased

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

36

If a lease is classified as a capital lease because the present value of the minimum lease payments is equal to 90% or more of the fair value of the leased property, the time period to be used by the lessee to amortize the leased property is the

A) lease term

B) expected economic life of the property

C) lease term or the expected economic life of the property, whichever is longer

D) expected economic life of the property or the lease term, whichever is shorter

A) lease term

B) expected economic life of the property

C) lease term or the expected economic life of the property, whichever is longer

D) expected economic life of the property or the lease term, whichever is shorter

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

37

Exhibit 20-1 On January 1, 2014, Pearson Company signed a lease agreement requiring six annual payments of $60,000, beginning December 31, 2014. The lease qualifies as a capital lease. Pearson's incremental borrowing rate was 9% and the lessor's implicit rate, known by Pearson, was 10%. The present value factors of an ordinary annuity of $1 for six periods for interest rates of 9% and 10% are 4.48592 and 4.35526, respectively.

-Refer to Exhibit 20-1. The balance of the lease obligation on January 1, 2015, for financial reporting purposes after the lease payment would be (round answers to the nearest dollar)

A) $ 0

B) $166,779

C) $227,448

D) $233,379

-Refer to Exhibit 20-1. The balance of the lease obligation on January 1, 2015, for financial reporting purposes after the lease payment would be (round answers to the nearest dollar)

A) $ 0

B) $166,779

C) $227,448

D) $233,379

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

38

Executory costs

A) are included in the minimum lease payments by the lessee

B) should normally be borne by the party that is, in substance, the owner of the asset

C) are the costs incurred by the lessor that are directly associated with negotiating and completing the lease transaction

D) are always paid by the lessee

A) are included in the minimum lease payments by the lessee

B) should normally be borne by the party that is, in substance, the owner of the asset

C) are the costs incurred by the lessor that are directly associated with negotiating and completing the lease transaction

D) are always paid by the lessee

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

39

Minimum lease payments do not include

A) any guarantee by the lessee of the residual value

B) any payments on failure to renew or extend the lease

C) executory costs

D) minimum periodic rental payments

A) any guarantee by the lessee of the residual value

B) any payments on failure to renew or extend the lease

C) executory costs

D) minimum periodic rental payments

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

40

From the lessor's standpoint, all of the following statements are true regarding leasing except that

A) the lease provides a method of indirectly making a sale

B) if the residual value of the asset is not guaranteed, the lessor has transferred the risks of residual value decreases to the lessee

C) for sales-type lease agreements, the lessor earns interest in addition to profit from the transfer of the asset

D) the accounting procedures used by a lessor for a sales-type lease are similar to the accounting procedures used for a normal sale of merchandise under a perpetual inventory system

A) the lease provides a method of indirectly making a sale

B) if the residual value of the asset is not guaranteed, the lessor has transferred the risks of residual value decreases to the lessee

C) for sales-type lease agreements, the lessor earns interest in addition to profit from the transfer of the asset

D) the accounting procedures used by a lessor for a sales-type lease are similar to the accounting procedures used for a normal sale of merchandise under a perpetual inventory system

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following items would not be included in the calculation of the capital lease obligation?

A) bargain purchase option

B) guaranteed residual value

C) executory costs

D) any payments required for failure to renew or extend the lease

A) bargain purchase option

B) guaranteed residual value

C) executory costs

D) any payments required for failure to renew or extend the lease

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

42

If a lessee classifies a lease as a capital lease and uses the straight-line method of depreciation, the amount to be amortized over the lease term is

A) the original amount capitalized less the present value of the guaranteed residual value (if applicable)

B) the original amount capitalized less the unguaranteed residual value

C) the original amount capitalized less the guaranteed residual value (if applicable)

D) fair value of the leased property

A) the original amount capitalized less the present value of the guaranteed residual value (if applicable)

B) the original amount capitalized less the unguaranteed residual value

C) the original amount capitalized less the guaranteed residual value (if applicable)

D) fair value of the leased property

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

43

A capital lease should be recorded in the lessee's accounts at the inception of the lease in an amount equal to

A) the present value of the minimum lease payments less the executory costs included in the minimum lease payments

B) the total value of the future rental payments less any estimated contingent payments

C) the total value of future rental payments less any executory payments included in the future payments

D) the total value of the minimum lease payments less executory costs, if any

A) the present value of the minimum lease payments less the executory costs included in the minimum lease payments

B) the total value of the future rental payments less any estimated contingent payments

C) the total value of future rental payments less any executory payments included in the future payments

D) the total value of the minimum lease payments less executory costs, if any

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

44

When a lessee makes periodic cash payments for a capital lease, which of the following accounts is increased?

A) Lease Rental Expense

B) Leased Equipment

C) Capital Lease Obligation

D) Interest Expense

A) Lease Rental Expense

B) Leased Equipment

C) Capital Lease Obligation

D) Interest Expense

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

45

Exhibit 20-1 On January 1, 2014, Pearson Company signed a lease agreement requiring six annual payments of $60,000, beginning December 31, 2014. The lease qualifies as a capital lease. Pearson's incremental borrowing rate was 9% and the lessor's implicit rate, known by Pearson, was 10%. The present value factors of an ordinary annuity of $1 for six periods for interest rates of 9% and 10% are 4.48592 and 4.35526, respectively.

-Refer to Exhibit 20-1. The balance of the lease obligation for financial reporting purposes on December 31, 2015, after the lease payment would be (round answers to the nearest dollar)

A) $ 38,996

B) $167,979

C) $194,383

D) $233,379

-Refer to Exhibit 20-1. The balance of the lease obligation for financial reporting purposes on December 31, 2015, after the lease payment would be (round answers to the nearest dollar)

A) $ 38,996

B) $167,979

C) $194,383

D) $233,379

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

46

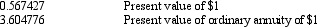

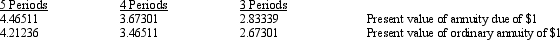

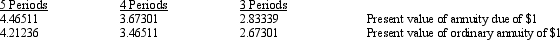

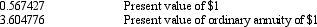

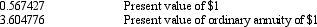

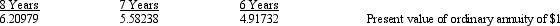

Exhibit 20-2 On January 1, 2014, Mary Company leased equipment, signing a five-year lease that requires annual lease payments of $20,000. The lease qualifies as a capital lease. The payments are made at year-end, and the first payment will be made at December 31, 2014. In addition, Mary guarantees the residual value to be $8,000 at the end of the lease term. Mary correctly uses the lessor's implicit interest rate, which is 12%. The present value factors for five periods at 12% are as follows:

-Refer to Exhibit 20-2. What is the correct interest expense for the year ending December 31, 2015, for the lease obligation? (Round answers to the nearest dollar.)

A) $20,000

B) $10,804

C) $ 7,900

D) $ 7,290

-Refer to Exhibit 20-2. What is the correct interest expense for the year ending December 31, 2015, for the lease obligation? (Round answers to the nearest dollar.)

A) $20,000

B) $10,804

C) $ 7,900

D) $ 7,290

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

47

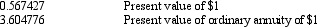

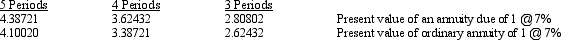

On January 1, 2014, Watson Company signed a four-year lease requiring annual payments of $45,000, with the first payment due on January 1, 2014. Watson's incremental borrowing rate was 7%. Actuarial information for 7% follows:

Assuming the lease qualifies as a capital lease, what amount should be recorded as leased equipment under capital leases on January 1, 2014 (rounded to the nearest dollar)?

A) $197,424

B) $163,094

C) $152,424

D) $184,509

Assuming the lease qualifies as a capital lease, what amount should be recorded as leased equipment under capital leases on January 1, 2014 (rounded to the nearest dollar)?

A) $197,424

B) $163,094

C) $152,424

D) $184,509

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

48

Exhibit 20-2 On January 1, 2014, Mary Company leased equipment, signing a five-year lease that requires annual lease payments of $20,000. The lease qualifies as a capital lease. The payments are made at year-end, and the first payment will be made at December 31, 2014. In addition, Mary guarantees the residual value to be $8,000 at the end of the lease term. Mary correctly uses the lessor's implicit interest rate, which is 12%. The present value factors for five periods at 12% are as follows:

- Refer to Exhibit 20-2. What would be the debit to Leased Equipment under Capital Leases on January 1, 2014? (Round amounts to the nearest dollar.)

A) $ 72,096

B) $ 76,635

C) $100,000

D) $110,000

- Refer to Exhibit 20-2. What would be the debit to Leased Equipment under Capital Leases on January 1, 2014? (Round amounts to the nearest dollar.)

A) $ 72,096

B) $ 76,635

C) $100,000

D) $110,000

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

49

Exhibit 20-2 On January 1, 2014, Mary Company leased equipment, signing a five-year lease that requires annual lease payments of $20,000. The lease qualifies as a capital lease. The payments are made at year-end, and the first payment will be made at December 31, 2014. In addition, Mary guarantees the residual value to be $8,000 at the end of the lease term. Mary correctly uses the lessor's implicit interest rate, which is 12%. The present value factors for five periods at 12% are as follows:

-Refer to Exhibit 20-2. The interest expense associated with the leased equipment for the year ending December 31, 2014, is

A) $ 2,400

B) $ 8,651

C) $ 9,196

D) $20,000

-Refer to Exhibit 20-2. The interest expense associated with the leased equipment for the year ending December 31, 2014, is

A) $ 2,400

B) $ 8,651

C) $ 9,196

D) $20,000

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

50

On January 1, 2014, Madison Company signed a four-year lease requiring annual payments of $15,000 with the first payment due on January 1, 2014. The fair value of the equipment leased was $50,000. Madison's incremental borrowing rate was 6%. Actuarial information for 6% follows:

Assuming the lease qualifies as a capital lease, what amount should be recorded as leased equipment under capital leases on January 1, 2014 (rounded to the nearest dollar)?

A) $48,185

B) $50,000

C) $51,977

D) $55,095

Assuming the lease qualifies as a capital lease, what amount should be recorded as leased equipment under capital leases on January 1, 2014 (rounded to the nearest dollar)?

A) $48,185

B) $50,000

C) $51,977

D) $55,095

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

51

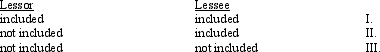

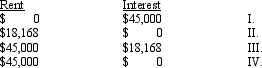

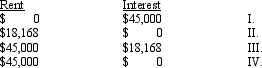

On January 1, 2014, Becky Company signed a lease agreement requiring six annual payments of $45,000, beginning December 31, 2014. The lease qualifies as an operating lease. Becky's incremental borrowing rate was 9% and the lessor's implicit rate, known by Becky, was 10%. The present value factors of an ordinary annuity of $1 for six periods for interest rates of 9% and 10% are 4.485919 and 4.355261, respectively. Rounded to the nearest dollar, interest and rent expenses for 2014 would be

A) I

B) II

C) III

D) IV

A) I

B) II

C) III

D) IV

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

52

On January 1, 2014, Mark Company leased equipment by signing a five-year lease that required five payments of $85,000 due on December 31 of each year. The equipment remains the property of the lessor at the end of the lease, and Mark does not guarantee any residual value. Using a rate of 11%, Mark capitalized the lease on January 1, 2014, in the amount of $314,152. What is the amount of the lease obligation on December 31, 2015?

A) $263,709

B) $207,717

C) $279,595

D) $225,350

A) $263,709

B) $207,717

C) $279,595

D) $225,350

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

53

On January 1, 2014, Rhyme Co. leased equipment by signing a six-year lease that required six payments of $30,000 due on January 1 of each year with the first payment due January 1, 2014. The equipment remains the property of the lessor at the end of the lease, and Rhyme does not guarantee any residual value. Using an 8% cost of capital, Rhyme capitalized the lease on January 1, 2014, in the amount of $149,781. What is the total amount of lease liability (including interest) Rhyme should report as of December 31, 2015?

A) $ 99,364

B) $107,313

C) $119,781

D) $121,415

A) $ 99,364

B) $107,313

C) $119,781

D) $121,415

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

54

Exhibit 20-2 On January 1, 2014, Mary Company leased equipment, signing a five-year lease that requires annual lease payments of $20,000. The lease qualifies as a capital lease. The payments are made at year-end, and the first payment will be made at December 31, 2014. In addition, Mary guarantees the residual value to be $8,000 at the end of the lease term. Mary correctly uses the lessor's implicit interest rate, which is 12%. The present value factors for five periods at 12% are as follows:

-Refer to Exhibit 20-2. If the Mary Company uses the straight-line method of depreciation for its assets, the depreciation expense for the leased equipment for the year ending December 31, 2014, is

A) $15,554

B) $14,419

C) $13,727

D) $12,419

-Refer to Exhibit 20-2. If the Mary Company uses the straight-line method of depreciation for its assets, the depreciation expense for the leased equipment for the year ending December 31, 2014, is

A) $15,554

B) $14,419

C) $13,727

D) $12,419

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

55

On January 1, 2014, Kathy Corp. leased equipment by signing a five-year lease that required five payments of $60,000 due on December 31 of each year. Kathy has a 9% cost of capital and capitalized the lease on January 1, 2014, in the amount of $233,379. As of December 31, 2014, what amount is reported as the current portion of the lease obligation?

A) $60,000

B) $46,331

C) $42,506

D) $13,669

A) $60,000

B) $46,331

C) $42,506

D) $13,669

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

56

On January 1, 2014, Renee Corp., a lessee, signed a five-year capital lease for new equipment. The lease requires annual payments of $8,000. The first payment is due on December 31, 2014. Renee guaranteed a residual value of $2,000. On December 31, 2018, Renee returned the asset to the lessor, and the asset was appraised at a value of $1,500. Renee should record which of the following on December 31, 2018?

A) a $1,500 credit to leased equipment

B) a $ 500 debit to loss on disposal of leased equipment

C) a $ 500 debit to cash

D) a $1,500 credit to cash

A) a $1,500 credit to leased equipment

B) a $ 500 debit to loss on disposal of leased equipment

C) a $ 500 debit to cash

D) a $1,500 credit to cash

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

57

On January 1, 2014, Donna Company leased equipment by signing a five-year lease that required five payments of $30,000 due on December 31 of each year. The equipment remains the property of the lessor at the end of the lease, and Donna does not guarantee any residual value. Using a rate of 8%, Donna capitalized the lease on January 1, 2014, in the amount of $119,781. What is the amount of interest expense Donna should report on its 2015 income statement?

A) $ 9,582

B) $ 7,949

C) $20,418

D) $22,051

A) $ 9,582

B) $ 7,949

C) $20,418

D) $22,051

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

58

When a lessee makes periodic cash payments for a capital lease, which of the following accounts is decreased?

A) Lease Rental Expense

B) Leased Equipment

C) Capital Lease Obligation

D) Interest Expense

A) Lease Rental Expense

B) Leased Equipment

C) Capital Lease Obligation

D) Interest Expense

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

59

On January 1, 2014, Reynolda Co. leased equipment by signing a five-year lease that required five payments of $30,000 due on January 1 of each year with the first payment due January 1, 2014. The equipment remains the property of the lessor at the end of the lease and Reynolda does not guarantee any residual value. Using a 10% cost of capital, Reynolda capitalized the lease on January 1, 2014, in the amount of $125,096. What is the amount of current portion of the lease obligation Reynolda should report on the December 31, 2015, balance sheet?

A) $ 7,461

B) $20,490

C) $22,539

D) $30,000

A) $ 7,461

B) $20,490

C) $22,539

D) $30,000

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following statements regarding the calculation of the lessee's depreciation expense for a capital lease is true?

A) The bargain purchase option price is deducted from the original cost capitalized, and the difference is allocated over the estimated economic life of the asset.

B) The guaranteed residual value is deducted from the original cost capitalized, and the difference is allocated over the estimated economic life of the asset.

C) The unguaranteed residual value is deducted from the original cost capitalized, and the difference is allocated over the term of the lease.

D) The guaranteed residual value is deducted from the original cost capitalized, and the difference is allocated over the term of the lease.

A) The bargain purchase option price is deducted from the original cost capitalized, and the difference is allocated over the estimated economic life of the asset.

B) The guaranteed residual value is deducted from the original cost capitalized, and the difference is allocated over the estimated economic life of the asset.

C) The unguaranteed residual value is deducted from the original cost capitalized, and the difference is allocated over the term of the lease.

D) The guaranteed residual value is deducted from the original cost capitalized, and the difference is allocated over the term of the lease.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

61

For a sales-type lease, cost of asset leased is valued by the lessor at

A) the recorded cost assigned to the inventory less the present value of the guaranteed residual value of the leased property accruing to the benefit of the lessor

B) the recorded cost assigned to the inventory less the undiscounted value of the unguaranteed residual value of the leased property accruing to the benefit of the lessor

C) the recorded cost assigned to the inventory less the present value of the unguaranteed residual value of the leased property accruing to the benefit of the lessor

D) the recorded cost assigned to the inventory less the undiscounted value of the guaranteed residual value of the leased property accruing to the benefit of the lessor

A) the recorded cost assigned to the inventory less the present value of the guaranteed residual value of the leased property accruing to the benefit of the lessor

B) the recorded cost assigned to the inventory less the undiscounted value of the unguaranteed residual value of the leased property accruing to the benefit of the lessor

C) the recorded cost assigned to the inventory less the present value of the unguaranteed residual value of the leased property accruing to the benefit of the lessor

D) the recorded cost assigned to the inventory less the undiscounted value of the guaranteed residual value of the leased property accruing to the benefit of the lessor

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

62

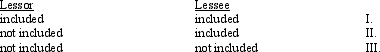

Jennifer, Inc. entered into a five-year capital lease on December 31, 2014. This lease requires five minimum annual lease payments due on December 31 of each year. The first minimum payment was paid on December 31, 2014. This payment included which of the following?

A) I

B) II

C) III

D) IV

A) I

B) II

C) III

D) IV

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

63

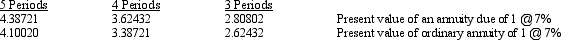

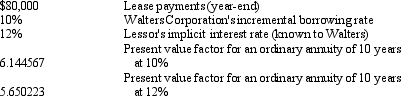

Davis Co., a lessor, signed a direct financing lease on January 1. The cost and fair value of the machine that was leased was $60,000. The implicit interest rate was 6%. The lease period was seven years, with the first payment due immediately. Actuarial information for 6% follows:

What is the annual lease payment to be collected by Davis?

A) $ 8,571.43

B) $ 9,115.25

C) $10,139.72

D) $11,516.78

What is the annual lease payment to be collected by Davis?

A) $ 8,571.43

B) $ 9,115.25

C) $10,139.72

D) $11,516.78

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

64

On January 1, 2014, Stacie signed a lease agreement with Amy. Amy will use the equipment and make ten annual payments of $25,000 beginning December 31, 2014. The lease is considered to be a capital lease. When reading the Amy income statement, you would expect to find which of the following accounts?

A) Rent Revenue

B) Interest Revenue

C) Rental Expense

D) Interest Expense

A) Rent Revenue

B) Interest Revenue

C) Rental Expense

D) Interest Expense

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

65

Depreciation expense will be recorded in the accounts of the

A) lessee for operating leases

B) lessor for operating leases

C) lessor for direct financing leases

D) lessor for sales-type leases

A) lessee for operating leases

B) lessor for operating leases

C) lessor for direct financing leases

D) lessor for sales-type leases

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

66

On January 1, 2014, Luke, Inc. leased equipment, signing a five-year lease that requires five payments of $40,000 due on January 1 of each year with the first payment due January 1, 2014. Luke accounted for the lease as a capital lease. Using a rate of 9%, Luke determined the present value on January 1, 2014, to be $169,589. What is the amount of the long-term lease obligation that Luke should report on its December 31, 2015 balance sheet?

A) $ 70,364

B) $101,252

C) $112,915

D) $129,589

A) $ 70,364

B) $101,252

C) $112,915

D) $129,589

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

67

The Roger Company leased a machine at the beginning of 2014. The machine was properly capitalized by Roger at $73,734.84. A lease payment of $16,563 is due at the end of each year. The expected life of the machine is seven years, and the term of the lease is five years. At the beginning of 2019, the machine will be returned to the lessor. Both Roger and the lessor use the straight-line method of depreciation. What amount of depreciation expense should Roger record in 2014 for the machine (round calculations up to the nearest dollar)?

A) $14,600

B) $14,747

C) $16,563

D) $17,000

A) $14,600

B) $14,747

C) $16,563

D) $17,000

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following facts would require a lessor to classify a lease as an operating lease?

A) No important uncertainties exist about unreimbursable costs yet to be incurred by the lessor.

B) The collectibility of the minimum lease payments is reasonably assured.

C) The lease term is 75% of the estimated economic life of the leased property.

D) The sum of the minimum lease payments is 90% of the fair value of the leased property to the lessor.

A) No important uncertainties exist about unreimbursable costs yet to be incurred by the lessor.

B) The collectibility of the minimum lease payments is reasonably assured.

C) The lease term is 75% of the estimated economic life of the leased property.

D) The sum of the minimum lease payments is 90% of the fair value of the leased property to the lessor.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

69

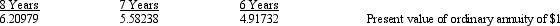

On January 3, 2014, the Walters Corporation signed a 10-year non-cancelable lease for manufacturing equipment. The fair value of the equipment at that time was $550,000. At the end of the lease period, the equipment, which has an estimated life of 15 years, will be returned to the lessor. Additional information is below:

Walters should

A) capitalize the equipment at $550,000

B) capitalize the equipment at $491,565

C) capitalize the equipment at $452,018

D) not capitalize the equipment

Walters should

A) capitalize the equipment at $550,000

B) capitalize the equipment at $491,565

C) capitalize the equipment at $452,018

D) not capitalize the equipment

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

70

A direct financing lease differs from a sales-type lease in that

A) the direct financing lease does not have a dealer profit, although it could have a dealer loss

B) the direct financing lease provisions do not include a bargain purchase option

C) the sales-type lease does not have unearned interest income at the inception of the lease

D) the direct financing lease does not have a dealer profit or loss

A) the direct financing lease does not have a dealer profit, although it could have a dealer loss

B) the direct financing lease provisions do not include a bargain purchase option

C) the sales-type lease does not have unearned interest income at the inception of the lease

D) the direct financing lease does not have a dealer profit or loss

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

71

A lease must be treated as a direct financing lease by the lessor when

A) the lessor is a financial institution

B) the interest revenue element is determined in such a manner as to produce a constant rate of return on the net investment of the lease

C) at least one of the four basic criteria is met, collectibility of the minimum lease payments is reasonably assured, no uncertainties surround the amount of the unreimbursable costs, and the lessor does not have a dealer profit or loss

D) the lease agreement contains a provision for unguaranteed residual value

A) the lessor is a financial institution

B) the interest revenue element is determined in such a manner as to produce a constant rate of return on the net investment of the lease

C) at least one of the four basic criteria is met, collectibility of the minimum lease payments is reasonably assured, no uncertainties surround the amount of the unreimbursable costs, and the lessor does not have a dealer profit or loss

D) the lease agreement contains a provision for unguaranteed residual value

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

72

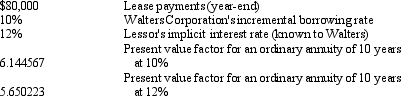

On January 1, 2014, Stephen Corp., a lessor, signed a direct financing lease. Stephen was to receive annual year-end payments of $10,000 for ten years, after which there was a guaranteed residual value of $8,000. The implicit interest rate was 8%. Actuarial information for 8%, ten periods follows: (round to the nearest whole dollar)

On January 1, 2014, Stephen should record a debit to Lease Receivable for

A) $67,100

B) $70,814

C) $100,000

D) $108,000

On January 1, 2014, Stephen should record a debit to Lease Receivable for

A) $67,100

B) $70,814

C) $100,000

D) $108,000

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

73

When is it appropriate for the lessee to use the lessor's implicit rate to discount the minimum lease payments?

A) whenever the lessee knows what the lessor's rate is

B) when the lessor's rate is higher than the lessee's incremental borrowing rate

C) when the lessee's incremental borrowing rate is lower than the lessor's rate

D) when the lessor's implicit rate is lower than the lessee's incremental borrowing rate

A) whenever the lessee knows what the lessor's rate is

B) when the lessor's rate is higher than the lessee's incremental borrowing rate

C) when the lessee's incremental borrowing rate is lower than the lessor's rate

D) when the lessor's implicit rate is lower than the lessee's incremental borrowing rate

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following statements is true about initial direct costs?

A) Initial direct costs should always be debited against income by the lessor in the period of the inception of the lease.

B) Initial direct costs are ownership-type costs such as insurance, maintenance, and taxes.

C) Initial direct costs of an operating lease should be recorded by the lessor as a prepaid asset.

D) Initial direct costs of a sales-type lease should be expensed as incurred, and an equal amount of the unearned income should be recognized as income in the same period.

A) Initial direct costs should always be debited against income by the lessor in the period of the inception of the lease.

B) Initial direct costs are ownership-type costs such as insurance, maintenance, and taxes.

C) Initial direct costs of an operating lease should be recorded by the lessor as a prepaid asset.

D) Initial direct costs of a sales-type lease should be expensed as incurred, and an equal amount of the unearned income should be recognized as income in the same period.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following is a required disclosure by a lessee of a capital lease?

A) total contingent rentals incurred for each period

B) lease assets, accumulated amortization, amortization expense, and liabilities

C) future minimum lease payments in total as of the balance sheet date and for each of the five succeeding fiscal years

D) all of these

A) total contingent rentals incurred for each period

B) lease assets, accumulated amortization, amortization expense, and liabilities

C) future minimum lease payments in total as of the balance sheet date and for each of the five succeeding fiscal years

D) all of these

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

76

On January 1, 2014, Stacie signed a lease agreement with Amy. Amy will use the equipment and make ten annual payments of $15,000 beginning December 31, 2014. The lease is considered to be a sales-type lease. When reading the Stacie income statement, you would expect to find which of the following accounts?

A) Rent Revenue

B) Interest Revenue

C) Rental Expense

D) Interest Expense

A) Rent Revenue

B) Interest Revenue

C) Rental Expense

D) Interest Expense

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

77

The lessee's disclosures should include the future minimum rental payments as of the date of the latest balance sheet presented, in the aggregate and for a certain number of succeeding fiscal years. This number of years is

A) 5

B) 10

C) 8

D) 7

A) 5

B) 10

C) 8

D) 7

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

78

When a lessor receives cash on an operating lease, which of the following accounts is increased?

A) Interest Revenue: Leases

B) Lease Rental Revenue

C) Lease Payable

D) Unearned Interest: Leases

A) Interest Revenue: Leases

B) Lease Rental Revenue

C) Lease Payable

D) Unearned Interest: Leases

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following is not a required disclosure by a lessee of an operating lease?

A) rental expense for the period

B) total contingent rentals

C) the amount of any sublease rentals

D) the gross amount of assets under operating leases

A) rental expense for the period

B) total contingent rentals

C) the amount of any sublease rentals

D) the gross amount of assets under operating leases

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

80

The lessee should report capital lease obligations on the balance sheet as

A) a current liability

B) a long-term liability

C) a current liability for the current portion and a long-term liability for the remaining amount

D) a note to the financial statements only

A) a current liability

B) a long-term liability

C) a current liability for the current portion and a long-term liability for the remaining amount

D) a note to the financial statements only

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck