Deck 19: Accounting for Postretirement Benefits

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

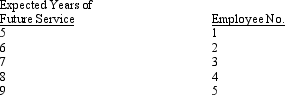

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

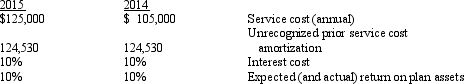

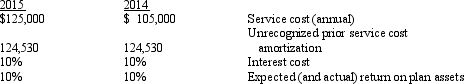

Question

Question

Question

Question

Question

Question

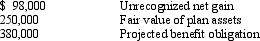

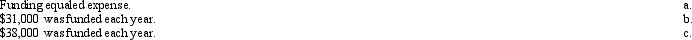

Question

Question

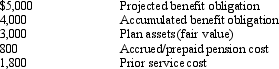

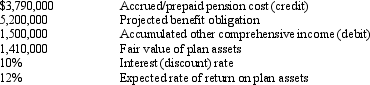

Question

Question

Question

Question

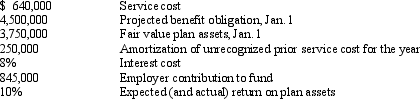

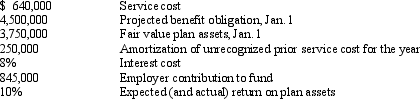

Question

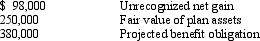

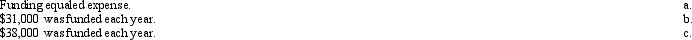

Question

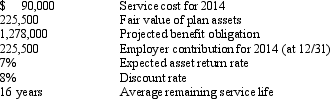

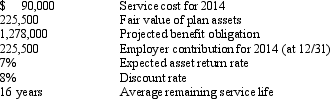

Question

Question

Question

Question

Question

Question

Question

Question

Question

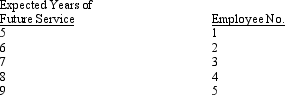

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/98

Play

Full screen (f)

Deck 19: Accounting for Postretirement Benefits

1

The vested benefit obligation is the benefits employees are entitled to receive even if they are no longer employed by the company.

True

2

In June of 2011 IASB amended IAS 19, Employee Benefits, changing its method of accounting for pensions in order to make the accounting for pensions similar under U.S. GAAP and IFRS.

False

3

To improve usefulness of defined pension plans, GAAP requires disclosure of reconciliations of the beginning and ending amounts of the projected benefit obligation and fair value of the plan assets.

True

4

Vested benefits are

A) estimated benefits

B) to be received as a lump-sum payment

C) lost when employment is terminated

D) right to receive even if the employment is terminated

A) estimated benefits

B) to be received as a lump-sum payment

C) lost when employment is terminated

D) right to receive even if the employment is terminated

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

5

Other postretirement benefits are provided to former employees after employment for retirement.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following statements is true regarding a defined contribution pension plan?

A) The pension benefits to be received by the employee during retirement are defined in the plan.

B) Defined contribution plans have the more complex accounting issues than defined benefit plans.

C) Defined contribution plans do not define the required benefits that must be paid to retired employees.

D) Employers that use defined contribution plans are assuming more risks than employers that use defined benefit plans.

A) The pension benefits to be received by the employee during retirement are defined in the plan.

B) Defined contribution plans have the more complex accounting issues than defined benefit plans.

C) Defined contribution plans do not define the required benefits that must be paid to retired employees.

D) Employers that use defined contribution plans are assuming more risks than employers that use defined benefit plans.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is NOT one of the pension expense components that a company recognizes?

A) expected return on plan assets

B) service cost

C) amortization of prior service cost

D) administrative cost

A) expected return on plan assets

B) service cost

C) amortization of prior service cost

D) administrative cost

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

8

GAAP for pension plans requires companies with defined benefit pension plans to

A) recognize pension expense based on accrual-basis concepts

B) recognize pension expense as an amount equal to the actual cash paid to retired employees for the current year

C) recognize a pension liability based on the projected benefit obligation concept

D) disclose annual pension cost in a footnote only; pension cost was not required to be reported on the income statement

A) recognize pension expense based on accrual-basis concepts

B) recognize pension expense as an amount equal to the actual cash paid to retired employees for the current year

C) recognize a pension liability based on the projected benefit obligation concept

D) disclose annual pension cost in a footnote only; pension cost was not required to be reported on the income statement

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

9

Under contributory plans the employees bear the majority of the costs of the plan and contribute towards the plan with deductions from their salaries.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

10

The defined benefit plan is a type of plan in which the employer's contribution into the pension fund is based on a formula.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

11

A pension plan provides for future retirement income based on the employee's earnings and length of service with the company. This type of pension plan is termed a

A) contributory plan

B) defined contribution plan

C) noncontributory plan

D) defined benefit plan

A) contributory plan

B) defined contribution plan

C) noncontributory plan

D) defined benefit plan

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following statements is true concerning prior service cost?

A) Prior service costs are the costs of retroactive benefits.

B) Prior service cost is reported as a liability at the date of the plan amendment.

C) Prior service cost is reported as a negative element of other comprehensive income at the date of the plan amendment.

D) All of the choices

A) Prior service costs are the costs of retroactive benefits.

B) Prior service cost is reported as a liability at the date of the plan amendment.

C) Prior service cost is reported as a negative element of other comprehensive income at the date of the plan amendment.

D) All of the choices

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

13

The corridor is defined as 10% of the greater of the beginning of the year projected benefit obligation or the end of the year fair value of the plan.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

14

The projected benefit obligation is equal to the

A) actuarial present value of all benefits earned as of a specified date, both vested and nonvested, by employees using current salary levels in the pension plan formula

B) difference between the annual pension expense and the amount actually funded during the year

C) actuarial present value of all benefits earned as of a specified date, both vested and nonvested, by employees using anticipated future salary levels in the pension plan formula

D) actuarial present value of benefits attributed by the pension plan formula to services rendered by employees during the current year

A) actuarial present value of all benefits earned as of a specified date, both vested and nonvested, by employees using current salary levels in the pension plan formula

B) difference between the annual pension expense and the amount actually funded during the year

C) actuarial present value of all benefits earned as of a specified date, both vested and nonvested, by employees using anticipated future salary levels in the pension plan formula

D) actuarial present value of benefits attributed by the pension plan formula to services rendered by employees during the current year

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

15

The accumulated benefit obligation is equal to the

A) actuarial present value of all benefits earned as of a specified date, both vested and nonvested, by employees using current salary levels in the pension plan formula

B) actuarial present value of all benefits earned as of a specified date, both vested and nonvested, by employees using anticipated future salary levels in the pension plan formula

C) difference between the annual pension expense and the amount actually funded during the year

D) actuarial present value of benefits attributed by the pension plan formula to services rendered by employees during the current year

A) actuarial present value of all benefits earned as of a specified date, both vested and nonvested, by employees using current salary levels in the pension plan formula

B) actuarial present value of all benefits earned as of a specified date, both vested and nonvested, by employees using anticipated future salary levels in the pension plan formula

C) difference between the annual pension expense and the amount actually funded during the year

D) actuarial present value of benefits attributed by the pension plan formula to services rendered by employees during the current year

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

16

An Internal Revenue Code rule that impacts the design of pension plans is

A) employee contributions to the pension fund are not taxable until pension benefits are actually received

B) pension fund earnings are taxable

C) employer contributions to the pension fund are not taxable to the employee when pension benefits are actually received

D) all employer pension expenses are deductible for income tax purposes

A) employee contributions to the pension fund are not taxable until pension benefits are actually received

B) pension fund earnings are taxable

C) employer contributions to the pension fund are not taxable to the employee when pension benefits are actually received

D) all employer pension expenses are deductible for income tax purposes

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

17

GAAP requires that a company accrue the cost of OPRB's during the periods in which its employees earn the benefits.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following statements is true regarding a defined benefit pension plan?

A) Defined benefit plans are relatively easy to handle from an accounting perspective.

B) Employers that use defined benefit plans are assuming more risks than employers that use defined contribution plans.

C) Defined benefit plans require an employer to contribute a defined sum each period to a pension fund.

D) A defined benefit plan requires the employer to fund the plan each year for an amount equal to the pension expense.

A) Defined benefit plans are relatively easy to handle from an accounting perspective.

B) Employers that use defined benefit plans are assuming more risks than employers that use defined contribution plans.

C) Defined benefit plans require an employer to contribute a defined sum each period to a pension fund.

D) A defined benefit plan requires the employer to fund the plan each year for an amount equal to the pension expense.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

19

Accounting regulators opted to recognize the liability and reduce other comprehensive income, then amortize the prior service cost as a component of pension expense. The liability is reduced and other comprehensive income is increased as the prior service amount is amortized. This method was chosen even though it violates the matching concept due to constituent arguments.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

20

Accounting for prior service cost prospectively would violate the matching concept because all the services performed by the employees were completed in previous periods.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

21

A company's pension expense includes all of the following items except

A) service cost

B) employer's contribution to the pension fund

C) amortization of unrecognized prior service cost

D) interest cost on the projected benefit obligation

A) service cost

B) employer's contribution to the pension fund

C) amortization of unrecognized prior service cost

D) interest cost on the projected benefit obligation

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

22

In the computation of pension expense, interest cost is the

A) expected increase in the plan assets due to investing activities

B) increase in the projected benefit obligation due to the passage of time

C) actuarial present value of benefits

D) expected return on plan assets

A) expected increase in the plan assets due to investing activities

B) increase in the projected benefit obligation due to the passage of time

C) actuarial present value of benefits

D) expected return on plan assets

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

23

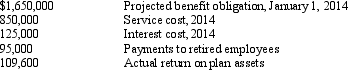

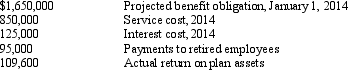

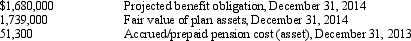

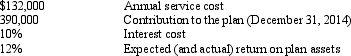

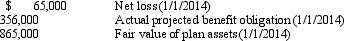

The Maggie Company has a defined benefit pension plan for its employees. The following information pertains to the pension plan as of December 31, 2014:

The amount of the December 31, 2014, projected benefit obligation is

A) $2,515,400

B) $2,270,400

C) $2,530,000

D) $2,420,400

The amount of the December 31, 2014, projected benefit obligation is

A) $2,515,400

B) $2,270,400

C) $2,530,000

D) $2,420,400

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

24

Amortization of any net gain or loss is included in pension expense of a given year if at the

A) end of the year, the cumulative net gain or loss exceeds 10% of the greater of the actual projected benefit obligation or the fair value of the plan assets

B) beginning of the year, the cumulative net gain or loss exceeds 10% of the greater of the actual accumulated benefit obligation or the fair value of the plan assets

C) end of the year, the cumulative gain or loss exceeds 10% of the greater of the actual accumulated benefit obligation or the fair value of the plan assets

D) beginning of the year, the cumulative gain or loss exceeds 10% of the greater of the actual projected benefit obligation or the fair value of the plan assets

A) end of the year, the cumulative net gain or loss exceeds 10% of the greater of the actual projected benefit obligation or the fair value of the plan assets

B) beginning of the year, the cumulative net gain or loss exceeds 10% of the greater of the actual accumulated benefit obligation or the fair value of the plan assets

C) end of the year, the cumulative gain or loss exceeds 10% of the greater of the actual accumulated benefit obligation or the fair value of the plan assets

D) beginning of the year, the cumulative gain or loss exceeds 10% of the greater of the actual projected benefit obligation or the fair value of the plan assets

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

25

Which statement is false?

A) In the computation of pension expense, a negative return on plan assets can be added.

B) The amount of prior service cost is not included as an asset or a liability.

C) Interest cost is equal to the projected benefit obligation at the end of the period multiplied by the discount rate used by the company.

D) A lower-than-expected mortality rate creates a pension loss to a company.

A) In the computation of pension expense, a negative return on plan assets can be added.

B) The amount of prior service cost is not included as an asset or a liability.

C) Interest cost is equal to the projected benefit obligation at the end of the period multiplied by the discount rate used by the company.

D) A lower-than-expected mortality rate creates a pension loss to a company.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

26

Accounting principles for defined benefit pension plans under IFRS differ from U.S. GAAP in all of the following areas except that under IFRS

A) certain components of pension expense may be reported as a part of different line items in the income statement

B) actuarial gains and losses may be recognized in full in the period in which they occur directly into equity

C) any portion of prior service cost that is not vested must be recognized on the balance sheet as a component of other comprehensive income

D) any portion of prior service cost that is immediately vested must be expensed

A) certain components of pension expense may be reported as a part of different line items in the income statement

B) actuarial gains and losses may be recognized in full in the period in which they occur directly into equity

C) any portion of prior service cost that is not vested must be recognized on the balance sheet as a component of other comprehensive income

D) any portion of prior service cost that is immediately vested must be expensed

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following is not a component of pension expense to be reported on a company's income statement?

A) interest cost

B) unrecognized past service cost

C) service cost

D) expected return on plan assets

A) interest cost

B) unrecognized past service cost

C) service cost

D) expected return on plan assets

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

28

The Lucas Company offers employees a defined contribution pension plan. In 2014, Lucas contributed $175,000 to the plan, which paid $195,000 to retired employees. Which of the following statements is true?

A) Lucas will record an accrued liability of $20,000.

B) Lucas will report pension expense of $175,000.

C) Lucas will recognize prior service cost of $20,000.

D) Lucas will recognize actuarial gains and losses on the plan over current and future periods.

A) Lucas will record an accrued liability of $20,000.

B) Lucas will report pension expense of $175,000.

C) Lucas will recognize prior service cost of $20,000.

D) Lucas will recognize actuarial gains and losses on the plan over current and future periods.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following would not be a component of pension expense?

A) prior service cost amortization

B) interest cost

C) deferred compensation

D) return on assets

A) prior service cost amortization

B) interest cost

C) deferred compensation

D) return on assets

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

30

Code:

A =amortization of unrecognized prior service cost

B =interest cost

C =gain or loss (to the extent recognized)

D =service cost

E =expected return on plan assets

F =pension expense

Which equation would be correct for the calculation of pension expense?

A) F = D + B - E + A C

B) F = B + D A C + E

C) F = D - B C - E A

D) F = B C - E - D A

A =amortization of unrecognized prior service cost

B =interest cost

C =gain or loss (to the extent recognized)

D =service cost

E =expected return on plan assets

F =pension expense

Which equation would be correct for the calculation of pension expense?

A) F = D + B - E + A C

B) F = B + D A C + E

C) F = D - B C - E A

D) F = B C - E - D A

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

31

Current GAAP regarding employers' accounting for defined benefit pension plans defines an underfunded plan at the end of the period when the

A) fair value of plan assets exceeds the projected benefit obligation

B) projected benefit obligation exceeds the fair value of plan assets

C) accumulated benefit obligation exceeds the fair value of the plan assets

D) fair value of the plan assets exceed the accumulated benefit obligation

A) fair value of plan assets exceeds the projected benefit obligation

B) projected benefit obligation exceeds the fair value of plan assets

C) accumulated benefit obligation exceeds the fair value of the plan assets

D) fair value of the plan assets exceed the accumulated benefit obligation

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

32

Benefits for which the employee's right to receive a present or future pension benefit is no longer contingent on remaining in the service of the employer are called

A) vested benefits

B) accumulated benefits

C) periodic benefits

D) prior service benefits

A) vested benefits

B) accumulated benefits

C) periodic benefits

D) prior service benefits

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

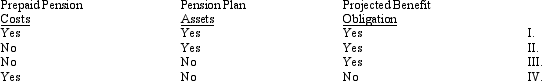

33

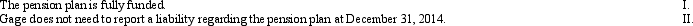

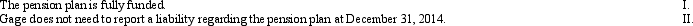

Gage began a defined benefit pension plan on January 1, 2014. During 2014, the service cost was $450,000. Gage contributed $450,000 to the pension plan for 2014. The actuary said the projected benefit obligation at December 31, 2014 was $450,000. As of December 31, 2014, what statements can Gage make about the pension plan?

A) I

B) II

C) both I and II

D) neither I nor II

A) I

B) II

C) both I and II

D) neither I nor II

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

34

In 2014, the Rachel Company initiated a defined benefit pension plan. It recorded $240,000 as pension expense and paid $280,000 to a funding agency. As a result, Rachel will report

A) pension assets of $280,000 and pension liabilities of $240,000

B) an accrued liability of $50,000

C) service cost of $280,000 and unfunded prior service cost of $40,000

D) prepaid pension cost of $40,000

E) None of these choices

A) pension assets of $280,000 and pension liabilities of $240,000

B) an accrued liability of $50,000

C) service cost of $280,000 and unfunded prior service cost of $40,000

D) prepaid pension cost of $40,000

E) None of these choices

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

35

If a pension plan amendment is adopted and retroactive benefits are granted to employees, the amount of the prior service cost at the date of grant is accounted for

A) as an intangible asset and liability that are recognized on the plan amendment date

B) as a prior period adjustment for the total amount of the prior service cost that is reported on the statement of retained earnings

C) as the total amount of the prior service cost that is recognized as an expense on the current period's income statement

D) initially as an unamortized amount to be included in the computation of pension expense over future periods

A) as an intangible asset and liability that are recognized on the plan amendment date

B) as a prior period adjustment for the total amount of the prior service cost that is reported on the statement of retained earnings

C) as the total amount of the prior service cost that is recognized as an expense on the current period's income statement

D) initially as an unamortized amount to be included in the computation of pension expense over future periods

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

36

The corridor is defined as

A) 1% of the greater of the actual projected benefit obligation or the fair value of the plan assets.

B) 5% of the greater of the actual projected benefit obligation or the fair value of the plan assets.

C) 10% of the greater of the actual projected benefit obligation or the fair value of the plan assets.

D) 15% of the greater of the actual projected benefit obligation or the fair value of the plan assets.

A) 1% of the greater of the actual projected benefit obligation or the fair value of the plan assets.

B) 5% of the greater of the actual projected benefit obligation or the fair value of the plan assets.

C) 10% of the greater of the actual projected benefit obligation or the fair value of the plan assets.

D) 15% of the greater of the actual projected benefit obligation or the fair value of the plan assets.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

37

If an employer were to account for a defined benefit pension plan on the cash basis, it would be a violation of the

A) going-concern assumption

B) accrual concept

C) separate entity concept

D) historical accounting

A) going-concern assumption

B) accrual concept

C) separate entity concept

D) historical accounting

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

38

The cost of retroactive benefits granted in a plan amendment or at the initial adoption of a pension plan is called

A) accumulated benefit cost

B) service cost benefits

C) prior service cost

D) vested benefits

A) accumulated benefit cost

B) service cost benefits

C) prior service cost

D) vested benefits

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

39

Disclosures for a defined benefit pension plan should include which of the following?

I.number of beneficiaries

II.reconciliation of the ending value of the projected benefit obligation

III.reconciliation of the ending fair value of the plan assets

IV.the composition of plan assets

V.the discount rate used

VI.expected long-term rate of return on plan assets

A) I, II, III, IV

B) I, III, V, VI

C) II, III, V, VI

D) III, IV, V, VI

I.number of beneficiaries

II.reconciliation of the ending value of the projected benefit obligation

III.reconciliation of the ending fair value of the plan assets

IV.the composition of plan assets

V.the discount rate used

VI.expected long-term rate of return on plan assets

A) I, II, III, IV

B) I, III, V, VI

C) II, III, V, VI

D) III, IV, V, VI

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following pension-related definitions is not correct?

A) Vested benefits are payments that are not contingent on the employee's continuing in the service of the employer.

B) Present value is the current worth of an amount or amounts payable or receivable in the future.

C) Actuarial assumptions are those made by actuaries concerning future events affecting pension costs.

D) Service cost is the amount paid annually to a funding agency under an unfunded pension plan.

A) Vested benefits are payments that are not contingent on the employee's continuing in the service of the employer.

B) Present value is the current worth of an amount or amounts payable or receivable in the future.

C) Actuarial assumptions are those made by actuaries concerning future events affecting pension costs.

D) Service cost is the amount paid annually to a funding agency under an unfunded pension plan.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

41

Disclosures for vested benefits

A) are not required

B) are related to the projected benefit obligation

C) are related to the accumulated benefit obligation

D) are related to the plan assets

A) are not required

B) are related to the projected benefit obligation

C) are related to the accumulated benefit obligation

D) are related to the plan assets

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following statements is true?

A) Funding for postretirement health care benefits is legally required, and contributions are tax deductible.

B) Funding for postretirement health care benefits is legally required, but contributions are not tax deductible.

C) Funding for postretirement health care benefits is not legally required, and contributions are not tax deductible.

D) Funding for postretirement health care benefits is not legally required, but contributions are tax deductible.

A) Funding for postretirement health care benefits is legally required, and contributions are tax deductible.

B) Funding for postretirement health care benefits is legally required, but contributions are not tax deductible.

C) Funding for postretirement health care benefits is not legally required, and contributions are not tax deductible.

D) Funding for postretirement health care benefits is not legally required, but contributions are tax deductible.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

43

Current GAAP requires that the net gain or loss from a settlement or curtailment be included in the

A) statement of retained earnings

B) income statement

C) balance sheet

D) statement of cash flows

A) statement of retained earnings

B) income statement

C) balance sheet

D) statement of cash flows

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

44

Exhibit 19-01 Marley Co. has an underfunded prepaid/accrued pension cost of $2,000 (debit balance) at December 31, 2014. The following information pertains to 2015:

-Refer to Exhibit 19-1. The December 31, 2015, adjusting entry should be

A) Other Comprehensive Income 30,000

Accrued/Prepaid Pension Cost 30,000

B) Accrued/Prepaid Pension Cost 30,000

Other Comprehensive Income 30,000

C) Other Comprehensive Income 42,000

Accrued/Prepaid Pension Cost 42,000

D) Accrued/Prepaid Pension Cost 40,000

Other Comprehensive Income 40,000

-Refer to Exhibit 19-1. The December 31, 2015, adjusting entry should be

A) Other Comprehensive Income 30,000

Accrued/Prepaid Pension Cost 30,000

B) Accrued/Prepaid Pension Cost 30,000

Other Comprehensive Income 30,000

C) Other Comprehensive Income 42,000

Accrued/Prepaid Pension Cost 42,000

D) Accrued/Prepaid Pension Cost 40,000

Other Comprehensive Income 40,000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

45

ERISA (Pension Reform Act of 1974) provides guidance for

A) accumulated benefit obligation

B) actual return on plan assets

C) minimum funding during the year

D) projected benefit obligations

A) accumulated benefit obligation

B) actual return on plan assets

C) minimum funding during the year

D) projected benefit obligations

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

46

The expense for other postretirement benefits, such as health care benefits, dental benefits, and eye care benefits, currently is accounted for

A) on an accrual basis

B) on a cash basis

C) on either a cash basis or an accrual basis; both methods are acceptable

D) by footnote disclosure only

A) on an accrual basis

B) on a cash basis

C) on either a cash basis or an accrual basis; both methods are acceptable

D) by footnote disclosure only

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

47

On January 1, 2014, a company had $84,000 of unrecognized prior service cost. The years-of-future-service method of amortization is used. The company has seven employees, as indicated below:

What amount of prior service cost should be included in pension expense for 2014?

A) $ 2,000

B) $ 9,333

C) $12,000

D) $14,000

What amount of prior service cost should be included in pension expense for 2014?

A) $ 2,000

B) $ 9,333

C) $12,000

D) $14,000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

48

The Peanut Company has a defined benefit pension plan for its employees. The following information pertains to the pension plan:

The December 31, 2014 adjusting journal entries include a

A) debit to Accrued/Prepaid Pension Cost for $7,700

B) debit to Other Comprehensive Income for $7,700

C) credit to Other Comprehensive Income for $110,300

D) credit to Accrued/Prepaid Pension Cost for $110,300

The December 31, 2014 adjusting journal entries include a

A) debit to Accrued/Prepaid Pension Cost for $7,700

B) debit to Other Comprehensive Income for $7,700

C) credit to Other Comprehensive Income for $110,300

D) credit to Accrued/Prepaid Pension Cost for $110,300

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

49

A company must fund its pension plan each year at an amount that at least equals service cost for the year plus the amount needed to amortize an underfunding over a

A) maximum of three years

B) maximum of five years

C) minimum of three years but not more than six years

D) maximum of seven years

A) maximum of three years

B) maximum of five years

C) minimum of three years but not more than six years

D) maximum of seven years

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

50

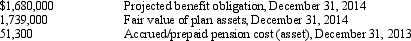

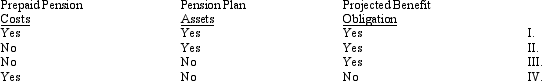

Which of the following items attributable to a defined benefit pension plan would be recognized on a company's balance sheet?

A) I

B) II

C) III

D) IV

A) I

B) II

C) III

D) IV

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

51

The Pension Benefit Guaranty Corporation's purpose is to

A) allow companies to exit bankruptcy.

B) insure defined contribution pension plans.

C) insure defined benefit pension plans.

D) guarantee taxpayers that the federal government will pay pension benefits.

A) allow companies to exit bankruptcy.

B) insure defined contribution pension plans.

C) insure defined benefit pension plans.

D) guarantee taxpayers that the federal government will pay pension benefits.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

52

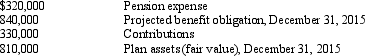

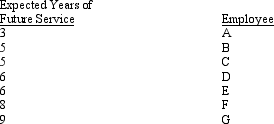

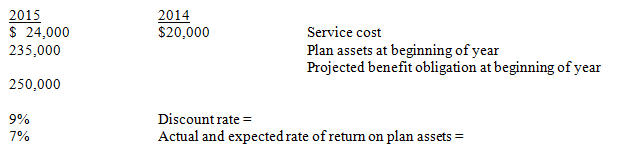

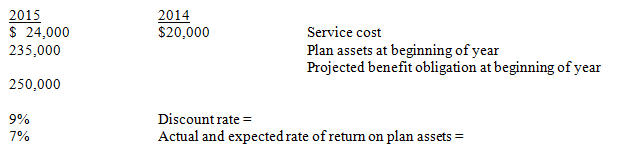

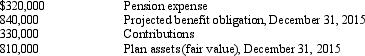

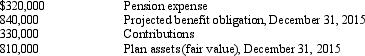

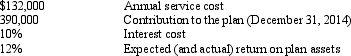

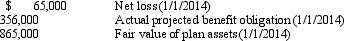

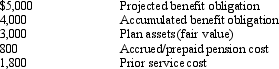

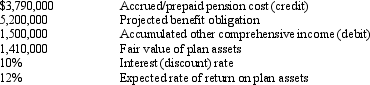

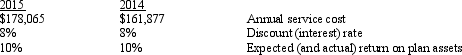

Given the following information

What is pension expense for 2015?

A) $17,950

B) $30,050

C) $16,850

D) $24,000

What is pension expense for 2015?

A) $17,950

B) $30,050

C) $16,850

D) $24,000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

53

Exhibit 19-01 Marley Co. has an underfunded prepaid/accrued pension cost of $2,000 (debit balance) at December 31, 2014. The following information pertains to 2015:

-Refer to Exhibit 19-1. The balance in Prepaid/Accrued Pension Cost at December 31, 2015, should be

A) $30,000 debit

B) $30,000 credit

C) $ 8,000 credit

D) $10,000 credit

-Refer to Exhibit 19-1. The balance in Prepaid/Accrued Pension Cost at December 31, 2015, should be

A) $30,000 debit

B) $30,000 credit

C) $ 8,000 credit

D) $10,000 credit

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

54

GAAP requires that a company record a loss and liability termination benefits when

A) the amount can be reasonably estimated

B) the employee accepts the offer

C) the corporation extends the offer

D) Both a and b

A) the amount can be reasonably estimated

B) the employee accepts the offer

C) the corporation extends the offer

D) Both a and b

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

55

ACE has a defined benefit pension plan. ACE is preparing the December 31, 2014 financial statement disclosures related to the plan assets. It should disclose which of the following?

A) I

B) II

C) both I and II

D) neither I nor II

A) I

B) II

C) both I and II

D) neither I nor II

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

56

If a company uses the indirect method to report cash flows, it

A) subtracts any increase in its accrued pension cost from net income

B) subtracts any increase in accrued pension cost as an investing activity

C) adds any increase in its accrued pension cost to net income

D) adds any increase in accrued pension cost as a financing activity

A) subtracts any increase in its accrued pension cost from net income

B) subtracts any increase in accrued pension cost as an investing activity

C) adds any increase in its accrued pension cost to net income

D) adds any increase in accrued pension cost as a financing activity

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

57

Exhibit 19-02 The Sophia Company adopted a defined benefit pension plan on January 1, 2014, and prior service credit was granted to employees. The present value of those benefits was calculated to be $1,245,300 at that date. The service cost is funded in full at the end of each year, plus an additional amount of $225,000 is funded each year-end. The unrecognized prior service cost is being amortized by the straight-line method over the remaining 10-year service life of the company's active employees. Additional information relating to the company's pension plan is presented below:

- Refer to Exhibit 19-02. What is the pension expense for 2014?

A) $105,000

B) $229,530

C) $315,000

D) $354,060

- Refer to Exhibit 19-02. What is the pension expense for 2014?

A) $105,000

B) $229,530

C) $315,000

D) $354,060

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following statements regarding postretirement benefits other than pensions is true?

A) A liability for postretirement benefits other than pensions is not required to be reported on the balance sheet.

B) The interest component of the net postretirement benefit expense is based on the accumulated postretirement benefit obligation (APBO).

C) The interest component of the net postretirement benefit expense is based on the expected postretirement benefit obligation (EPBO).

D) An intangible asset for other postemployment benefits (OPEB) is required to be reported on a company's balance sheet.

A) A liability for postretirement benefits other than pensions is not required to be reported on the balance sheet.

B) The interest component of the net postretirement benefit expense is based on the accumulated postretirement benefit obligation (APBO).

C) The interest component of the net postretirement benefit expense is based on the expected postretirement benefit obligation (EPBO).

D) An intangible asset for other postemployment benefits (OPEB) is required to be reported on a company's balance sheet.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

59

Vested benefits are

A) estimated benefits

B) not contingent on future service to a company

C) to be received as a lump sum payment

D) lost when employment is terminated

A) estimated benefits

B) not contingent on future service to a company

C) to be received as a lump sum payment

D) lost when employment is terminated

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

60

John Company adopted a defined benefit pension plan on January 1, 2014, and prior service credit was granted to employees. The present value of that prior service obligation as of January 1, 2014 was $1,400,000 and is being amortized by the straight-line method over the remaining 20-year service life of the company's active employees. Additional information relating to the company's pension plan for 2014 is presented below:

What amount should be recorded in Prepaid/Accrued Pension Cost when recording the 2014 pension expense and funding at December 31, 2014?

A) $ 1,200

B) $48,000

C) $87,000

D) $94,800

What amount should be recorded in Prepaid/Accrued Pension Cost when recording the 2014 pension expense and funding at December 31, 2014?

A) $ 1,200

B) $48,000

C) $87,000

D) $94,800

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

61

Attribution period starts on the

A) hiring date

B) vesting date

C) termination date

D) retirement date

A) hiring date

B) vesting date

C) termination date

D) retirement date

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

62

The attribution period ends at

A) the expected retirement date

B) the actual retirement date

C) the full eligibility date

D) either a or b

A) the expected retirement date

B) the actual retirement date

C) the full eligibility date

D) either a or b

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

63

During 2013, the Electric Company experienced a difference between its expected and actual projected benefit obligation. At the beginning of 2014, Electric's actuary notified them of the following accumulated information related to their plan:  On December 31, 2014, Electric is in the process of calculating the net gain or loss to include in its pension expense for 2014. The average remaining service life of its employees is 10 years and there are no differences between the company's expected and annual rate of return on plan assets in 2014.

On December 31, 2014, Electric is in the process of calculating the net gain or loss to include in its pension expense for 2014. The average remaining service life of its employees is 10 years and there are no differences between the company's expected and annual rate of return on plan assets in 2014.

Required:

Compute the amount of the net gain or loss to include in the pension expense for 2014. Note whether it is an addition or subtraction to the pension expense.

On December 31, 2014, Electric is in the process of calculating the net gain or loss to include in its pension expense for 2014. The average remaining service life of its employees is 10 years and there are no differences between the company's expected and annual rate of return on plan assets in 2014.

On December 31, 2014, Electric is in the process of calculating the net gain or loss to include in its pension expense for 2014. The average remaining service life of its employees is 10 years and there are no differences between the company's expected and annual rate of return on plan assets in 2014.Required:

Compute the amount of the net gain or loss to include in the pension expense for 2014. Note whether it is an addition or subtraction to the pension expense.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

64

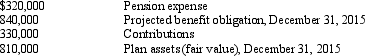

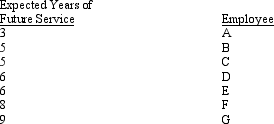

In 2014, the Electrician Company decided to amend its defined benefit pension plan. The amendment gave 7 employees the right to receive future benefits based upon their prior service. Electrician's actuary determined that the prior service cost for this amendment amounts to $550,000. Employee A will retire in 1 year, employee's B & C expect to retire in 2 years, employee D in three years, employee E in 4 years, and employee's F & G in five years.

Required:

Using the years-of-future service method, prepare the schedules to determine:

1) the amortization fraction for each year

2) the amortization of the prior service cost

Required:

Using the years-of-future service method, prepare the schedules to determine:

1) the amortization fraction for each year

2) the amortization of the prior service cost

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

65

The following information is related to a company's pension plan:

Required:

a.Prepare the adjusting journal entry to update the pension liability.

b.Assume that instead of Accrued/Prepaid Pension Cost having a credit balance of $800, it had a $600 debit balance. Prepare the adjusting journal entry to record the pension liability.

Required:

a.Prepare the adjusting journal entry to update the pension liability.

b.Assume that instead of Accrued/Prepaid Pension Cost having a credit balance of $800, it had a $600 debit balance. Prepare the adjusting journal entry to record the pension liability.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

66

In 2014, the Ballaster Company decided to amend its defined benefit pension plan. The amendment gave 7 employees the right to receive future benefits based upon their prior service. Ballaster's actuary determined that the prior service cost for this amendment amounts to $550,000. One employee will retire in 1 year, 2 expect to retire in 2 years, 1 in three years, 1 in 4 years, and 2 in five years.

Required:

Using the straight line method compute the following:

1) the remaining service life (round to 5 decimals)

2) prepare an amortization schedule to amortize the prior service cost

Required:

Using the straight line method compute the following:

1) the remaining service life (round to 5 decimals)

2) prepare an amortization schedule to amortize the prior service cost

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

67

Jennifer Corp's defined benefit pension plan had an amendment as of January 1, 2014, that retroactively included benefits of $1,500,000. The remaining service life of the employees impacted by this change is 10 years. Jennifer uses the straight-line method to amortize the prior service cost.

As of January 1, 2014, Jennifer had the following information related to its pension plan, including adjustments for the plan amendment:

The actuary reported service cost of $600,000 in both 2014 and 2015. Annual payments to retirees totaled $90,000. The trustee of the plan assets reported the actual rate of return to be 11% in 2014.

Jennifer's annul year-end contribution to the plan equals the current year's service cost less actual return on plan assets plus interest growth of the projected benefit obligation and amortization of prior service costs and/or gains and losses as calculated for pension expense.

Required:

a.Compute Jennifer's 2014 contribution.

b.Compute Jennifer's 2014 pension expense.

c.Prepare the journal entry to record the pension expense and pension contribution.

d.Compute the December 31, 2014 balance in Pension Benefit Obligation.

e.Compute the December 31, 2014 balance in Plan Assets.

f.Prepare the adjusting journal entry to record the plan's adjustment to other comprehensive income at December 31, 2014.

g.Is Jennifer's plan overfunded or underfunded, and by how much, as of December 31, 2014?

As of January 1, 2014, Jennifer had the following information related to its pension plan, including adjustments for the plan amendment:

The actuary reported service cost of $600,000 in both 2014 and 2015. Annual payments to retirees totaled $90,000. The trustee of the plan assets reported the actual rate of return to be 11% in 2014.

Jennifer's annul year-end contribution to the plan equals the current year's service cost less actual return on plan assets plus interest growth of the projected benefit obligation and amortization of prior service costs and/or gains and losses as calculated for pension expense.

Required:

a.Compute Jennifer's 2014 contribution.

b.Compute Jennifer's 2014 pension expense.

c.Prepare the journal entry to record the pension expense and pension contribution.

d.Compute the December 31, 2014 balance in Pension Benefit Obligation.

e.Compute the December 31, 2014 balance in Plan Assets.

f.Prepare the adjusting journal entry to record the plan's adjustment to other comprehensive income at December 31, 2014.

g.Is Jennifer's plan overfunded or underfunded, and by how much, as of December 31, 2014?

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following disclosures are required by GAAP for OPEBs?

A) the assumed healthcare cost trend rates

B) the amounts of securities included in the plan assets

C) the types of securities included in the plan assets

D) All of these choices

A) the assumed healthcare cost trend rates

B) the amounts of securities included in the plan assets

C) the types of securities included in the plan assets

D) All of these choices

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

69

The following information is provided regarding a company's pension plan:

Required:

a.Prepare the December 31 journal entry to record pension expense.

b.Explain the difference between "interest cost" and the "expected return on plan assets."

Required:

a.Prepare the December 31 journal entry to record pension expense.

b.Explain the difference between "interest cost" and the "expected return on plan assets."

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

70

On December 31, 2014, Clemson Company determined that the 2014 service cost on its defined benefit pension plan was $245,000. At the beginning of 2014, Clemson had pension plan assets totaling $990,000 and a projected benefit obligation of $750,000. Its discount rate and expected long-term rate of return on plan assets for 2014 was 12%.

Required:

1) Compute the amount of Clemson's pension expense for 2014.

2) Record the journal entries for Clemson's 2014 pension expense if it funds the pension plan in the amount of (a) $225,000 and (b) $210,000.

Required:

1) Compute the amount of Clemson's pension expense for 2014.

2) Record the journal entries for Clemson's 2014 pension expense if it funds the pension plan in the amount of (a) $225,000 and (b) $210,000.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

71

Joan, Inc. started a pension plan on January 1, 2014. At that date, prior service cost of $1,100,000 was granted to employees. At December 31, 2014, the following information was available:

Required:

a.Compute the pension expense for 2014.

b.Prepare appropriate journal entries for 2014.

Required:

a.Compute the pension expense for 2014.

b.Prepare appropriate journal entries for 2014.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following is typically the most significant OPEB (other postemployment benefits)?

A) life insurance

B) healthcare

C) legal service

D) tuition assistance

A) life insurance

B) healthcare

C) legal service

D) tuition assistance

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

73

The Donna Company adopted a defined benefit pension plan on January 1, 2014, and prior service credit was granted to employees. As of January 1, 2014, the prior service cost is $68,250. The unrecognized prior service cost is amortized by the straight-line method over the remaining 15-year service life of the company's active employees. Funding for the pension plan was $170,745 and $186,933 at December 31, 2014 and 2015, respectively.

Required:

Prepare the journal entries to record net periodic pension expense and the funding as of December 31, 2014 and 2015. Show computations and round answers to the nearest dollar.

Required:

Prepare the journal entries to record net periodic pension expense and the funding as of December 31, 2014 and 2015. Show computations and round answers to the nearest dollar.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

74

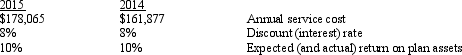

Teresa Company had the following information related to its pension plan:

For simplicity, an average remaining service life fof 3 years is always used.

An additional net loss of $1990 was reported as of January 1, 2015 (see table). This amount has been included in the January 1, 2015. projected benefit obligation balance.

Required:

Compute the amount of loss that should be included in pension expense in:

a.2015

b.2016

For simplicity, an average remaining service life fof 3 years is always used.

An additional net loss of $1990 was reported as of January 1, 2015 (see table). This amount has been included in the January 1, 2015. projected benefit obligation balance.

Required:

Compute the amount of loss that should be included in pension expense in:

a.2015

b.2016

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

75

Postemployment benefits are provided to former employees

A) after employment

B) after retirement

C) before retirement

D) after employment but before retirement

A) after employment

B) after retirement

C) before retirement

D) after employment but before retirement

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

76

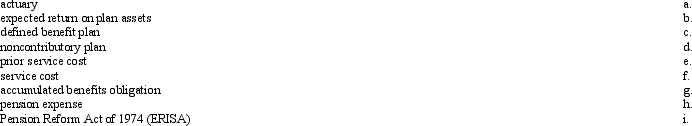

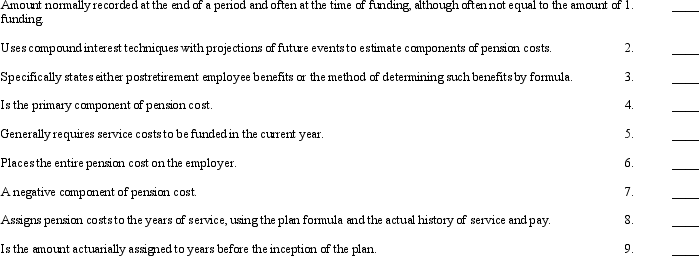

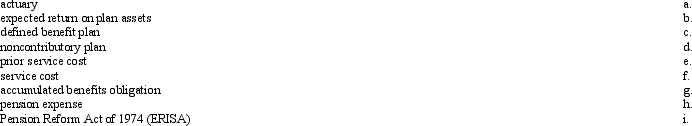

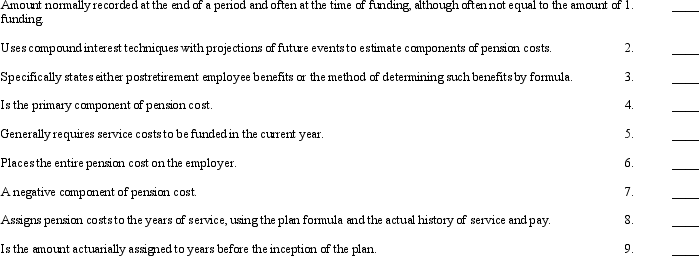

A list of terms (a-i) and a list of descriptive phrases (1-9) related to pension accounting are provided below:

Required:

Required:

Match each item to its descriptive phrase by placing the appropriate letter in the space provided.

Required:

Required:Match each item to its descriptive phrase by placing the appropriate letter in the space provided.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

77

Mark, Inc. amended its defined benefit pension plan as of January 1, 2014. Mark received a report from its actuary stating that at the beginning of 2014 unrecognized prior service cost resulting from the amendment amounted to $144,000. The company's work force was composed of twelve people. Four were expected to retire at the end of 2016. Two were expected to retire at the end of 2018, two more at the end of 2020, and four at the end of 2022.

Required:

Using the years-of-future-service method, compute the amount of prior service cost to be amortized in the first year.

Required:

Using the years-of-future-service method, compute the amount of prior service cost to be amortized in the first year.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

78

Robin Co. has a defined benefit pension plan that has experienced differences between its expected and actual projected benefit obligation. Data on the plan as of January 1, 2014, follow:

There was no difference between the company's expected and actual return on plan assets during 2014. The average remaining service life of the company's employees is 12 years.

Required:

Determine the amount of the net gain or loss to be included in pension expense for 2014 and indicate whether it is an increase or decrease in the pension expense calculation.

There was no difference between the company's expected and actual return on plan assets during 2014. The average remaining service life of the company's employees is 12 years.

Required:

Determine the amount of the net gain or loss to be included in pension expense for 2014 and indicate whether it is an increase or decrease in the pension expense calculation.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

79

Karen Company began a defined benefit pension plan on January 1, 2014. No prior service credit was granted to employees. Service costs amounted to $34,000 in 2014 and $37,000 in 2015. All contributions to the fund were made at the end of the year. A 10% discount rate was used. The expected (and actual) rate of return of plan assets was 12%.

Required:

Prepare journal entries for December 31, 2014 and 2015, assuming:

Required:

Prepare journal entries for December 31, 2014 and 2015, assuming:

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

80

Martha Co. has a defined benefit pension plan for its employees. The plan was amended at the beginning of 2014 which increased benefits based on services rendered by certain employees in prior periods. The actuary has reported that unrecognized prior service cost resulting from the amendment is $385,000. Five employees expect to receive the increased benefits. Shown below is a schedule of the employees and their expected years of future service:

Required:

Using the straight-line method:

a.Compute the average remaining service life.

b.Determine the amount of unrecognized prior service cost to be included in the 2014 pension expense calculation.

Required:

Using the straight-line method:

a.Compute the average remaining service life.

b.Determine the amount of unrecognized prior service cost to be included in the 2014 pension expense calculation.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck