Deck 10: Property, Plant, and Equipment: Acquisition and Subsequent Investments

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

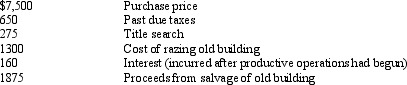

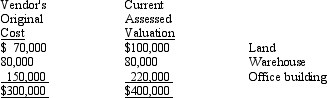

Question

Question

Question

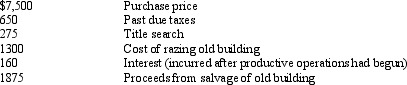

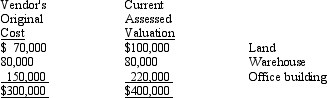

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/105

Play

Full screen (f)

Deck 10: Property, Plant, and Equipment: Acquisition and Subsequent Investments

1

Under the Full-cost method only the costs associated with the exploration that resulted in the discovery of oil and gas can be capitalized.

False

2

The amount of interest that can be capitalized for a qualifying asset is the lesser of the amount considered as avoidable interest costs or actual interest cost.

True

3

Companies borrow large amounts for use in construction projects, any idle funds are usually invested, GAAP allows the interest revenue earned from the excess to offset against the interest cost when determining the capitalization of interest.

False

4

Which of the following is NOT an alternative term for property, plant, and equipment used in the normal operation of business?

A) fixed assets

B) operational assets

C) plant assets

D) capital investments

A) fixed assets

B) operational assets

C) plant assets

D) capital investments

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

5

Costs can be added to an existing asset if future economic benefit extends the life of the asset improves productivity or increases the quality of the product.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

6

Advantages of using historical cost as the basis of valuation of property, plant, and equipment include all of the following except

A) it is a very reliable valuation

B) gains and losses from holding the asset are recognized in the period of value change

C) cost equals the fair market value at the date of acquisition

D) it is consistent with the valuation of many other assets, liabilities, and stockholders' equity

A) it is a very reliable valuation

B) gains and losses from holding the asset are recognized in the period of value change

C) cost equals the fair market value at the date of acquisition

D) it is consistent with the valuation of many other assets, liabilities, and stockholders' equity

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

7

GAAP requires a company to report its property, plant, and equipment at fair value less accumulated depreciation.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

8

Improvements made to a leased property, unless specifically exempt, revert to the lessor at the end of the lease. These improvements can be capitalized for the life of the lease or the life of the assets whichever is shorter.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

9

To be included in property, plant, and equipment, an asset must have all of the following EXCEPT

A) the asset must be held for use

B) the asset must have an expected life of a normal operating cycle

C) the asset must be tangible in nature

D) the asset must have an expected life of more than one year

A) the asset must be held for use

B) the asset must have an expected life of a normal operating cycle

C) the asset must be tangible in nature

D) the asset must have an expected life of more than one year

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

10

Under the Full-cost method, the costs associate with dry wells can be capitalized as part of the oil and gas reserves.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

11

Recording property, plant, and equipment at historical costs has some advantages including the historical cost is equal to the fair value on the purchase date.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

12

An asset classified as property, plant, and equipment on the balance sheet must have which one of the following characteristics?

A) an expected life of more than one year

B) used in the normal course of business

C) tangible in nature

D) all of these

A) an expected life of more than one year

B) used in the normal course of business

C) tangible in nature

D) all of these

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

13

All of the following would be classified as property, plant, and equipment except

A) office buildings

B) machinery owned for standby purposes

C) equipment held for resale

D) equipment used in the operation of the business

A) office buildings

B) machinery owned for standby purposes

C) equipment held for resale

D) equipment used in the operation of the business

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

14

Property, plant, and equipment are listed on the balance sheet at

A) expected future value

B) fair value

C) cost

D) cost less accumulated depreciation

A) expected future value

B) fair value

C) cost

D) cost less accumulated depreciation

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

15

Under IFRS, the costs of relocating or reorganizing property, plant, and equipment can be capitalized as assets and depreciated over the period of expected benefit.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

16

Under IFRS a company is allowed to revalue its property, plant, and equipment up to fair value if the value can be reliably measured.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

17

Alternative terms for property, plant, and equipment include all of the following except

A) plant assets

B) fixed assets

C) long-term assets

D) operational assets

A) plant assets

B) fixed assets

C) long-term assets

D) operational assets

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

18

Which one of the following types of assets should not be classified as property, plant, and equipment?

A) leasehold improvements

B) fully-depreciated building (still in use)

C) idle land and buildings

D) long-lived tangible assets

A) leasehold improvements

B) fully-depreciated building (still in use)

C) idle land and buildings

D) long-lived tangible assets

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

19

The cost of a nonmonetary asset acquired in exchange for another nonmonetary asset is the fair value of the new asset acquired.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

20

If an exchange lacks commercial substance and a gain results, under GAAP the gain must be deferred by reducing the cost of the asset.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

21

The president of Christmas Corporation donated a building to Tuesday Corporation. The building had an original cost of $675,000, a book value of $255,000, and a fair market value of $475,000. To record this donation, Tuesday will

A) make a memorandum entry

B) debit Building for $255,000 and credit Gain for $255,000

C) debit Building for $475,000 and credit Gain for $475,000

D) debit Building for $675,000 and credit Gain for $675,000

A) make a memorandum entry

B) debit Building for $255,000 and credit Gain for $255,000

C) debit Building for $475,000 and credit Gain for $475,000

D) debit Building for $675,000 and credit Gain for $675,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

22

All of the following major types of assets would be included in the general category of property, plant, and equipment on the balance sheet except

A) stand-by assets

B) furniture and fixtures

C) land purchased for future use

D) leasehold improvements

A) stand-by assets

B) furniture and fixtures

C) land purchased for future use

D) leasehold improvements

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

23

The debit for a sales tax paid on the purchase of a plant asset would be included in

A) the plant asset account

B) a separate deferred charge account

C) Miscellaneous Tax Expense

D) Accumulated Depreciation-Machinery

A) the plant asset account

B) a separate deferred charge account

C) Miscellaneous Tax Expense

D) Accumulated Depreciation-Machinery

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

24

According to GAAP, interest must be capitalized for

A) assets that are ready for use

B) assets constructed for a firm's own use

C) assets that are not being used in the earning activities of the company

D) inventories that are produced in large quantities on a repetitive basis

A) assets that are ready for use

B) assets constructed for a firm's own use

C) assets that are not being used in the earning activities of the company

D) inventories that are produced in large quantities on a repetitive basis

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

25

Early in 2014, Samos, Inc. purchased certain plant assets under a deferred payment contract. The agreement was to pay $75,000 at year-end for each of the next three years. The plant assets should be valued at

A) present value of a $75,000 annuity for three years discounted at the bank prime interest rate

B) $225,000

C) present value of a $75,000 annuity for three years discounted at the market interest rate

D) $225,000 plus imputed interest

A) present value of a $75,000 annuity for three years discounted at the bank prime interest rate

B) $225,000

C) present value of a $75,000 annuity for three years discounted at the market interest rate

D) $225,000 plus imputed interest

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

26

Under IFRS, which of the following must be expensed?

A) maintenance only

B) repairs only

C) rearrangements only

D) maintenance, repairs, and rearrangements

A) maintenance only

B) repairs only

C) rearrangements only

D) maintenance, repairs, and rearrangements

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

27

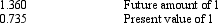

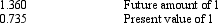

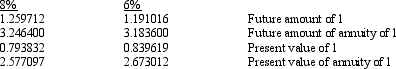

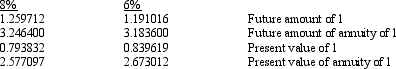

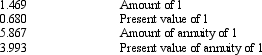

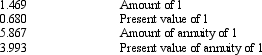

Roberts Corporation purchased some equipment by issuing a $20,000 non-interest-bearing, four-year note when interest rates were 8%. Actuarial information for 8% and four periods follows:

In the entry to record this purchase, there would be a

A) $20,000 debit to Equipment

B) $5,299.40 credit to Discount on Notes Payable

C) $27,209.78 credit to Notes Payable

D) $14,700.60 debit to Equipment

In the entry to record this purchase, there would be a

A) $20,000 debit to Equipment

B) $5,299.40 credit to Discount on Notes Payable

C) $27,209.78 credit to Notes Payable

D) $14,700.60 debit to Equipment

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

28

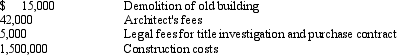

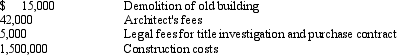

On February 1, 2014, Rumor Corporation purchased a parcel of land as a factory site for $50,000. An old building on the property was demolished, and construction began on a new building that was completed on December 12, 2014. Costs incurred during this period are listed below:

(Salvaged materials resulting from demolition were sold for $13,000.)

Rumor should record the cost of the land and the cost of the new building, respectively, as

A) $70,000 and $1,542,000

B) $50,000 and $1,542,000

C) $55,000 and $1,500,000

D) $70,000 and $1,475,000

(Salvaged materials resulting from demolition were sold for $13,000.)

Rumor should record the cost of the land and the cost of the new building, respectively, as

A) $70,000 and $1,542,000

B) $50,000 and $1,542,000

C) $55,000 and $1,500,000

D) $70,000 and $1,475,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

29

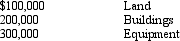

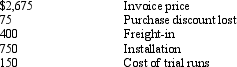

The Jacob Corporation acquired land, buildings, and equipment from a bankrupt company at a lump-sum price of $500,000. At the time of acquisition, Jacob paid $20,000 to have the assets appraised. The appraisal disclosed the following values:

What costs should be assigned to the buildings?

A) $166,667

B) $173,333

C) $200,000

D) $260,000

What costs should be assigned to the buildings?

A) $166,667

B) $173,333

C) $200,000

D) $260,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

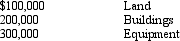

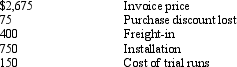

30

The Roger's Company incurred the following costs in the acquisition of a plant asset:

What is the cost of the plant asset?

A) $4,050

B) $3,900

C) $3,825

D) $2,675

What is the cost of the plant asset?

A) $4,050

B) $3,900

C) $3,825

D) $2,675

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

31

On August 28, 2014, Saturn Drilling Services purchased a machine with a contract price of $400,000 and cash terms of 2/10, n/30. The company paid $8,000 in transportation costs and $8,000 for installation. Sales taxes of $22,000 were paid on the invoice amount. The machine should be recorded as a plant asset in the amount of

A) $400,000

B) $422,000

C) $428,000

D) $430,000

A) $400,000

B) $422,000

C) $428,000

D) $430,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

32

On April 1, 2014, Bennett Corporation purchased a new machine on a deferred payment basis. A down payment of $5,000 was made and 10 monthly installments of $14,000 each are to be made beginning on May 1, 2014. The cash equivalent price of the machine was $130,000. Bennett incurred and paid installation costs amounting to $6,000. The amount to be capitalized as the cost of the machine is

A) $130,000

B) $136,000

C) $140,000

D) $145,000

A) $130,000

B) $136,000

C) $140,000

D) $145,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

33

Laramy purchases a new machine by issuing an $21,000 three-year note. The company will pay off the obligation by paying $7,000 at the end of each year. The market rate for obligations of this type is 8%. The present value of an annuity at 8% for three periods is 2.577097. The machine will be recorded at a cost of

A) $ 7,000.00

B) $54,119.04

C) $18,039.68

D) $21,000.00

A) $ 7,000.00

B) $54,119.04

C) $18,039.68

D) $21,000.00

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

34

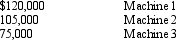

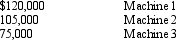

During 2014, Garnet Corporation purchased three pieces of equipment at an auction for the lump sum of $200,000. It cost Garnet $20,000 to have the equipment delivered and installed. The equipment was appraised at the following values:

Machine 2 should be recorded on Garnet's books at

A) $105,000

B) $120,000

C) $ 77,000

D) $ 70,000

Machine 2 should be recorded on Garnet's books at

A) $105,000

B) $120,000

C) $ 77,000

D) $ 70,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

35

Bob's Excavating purchased some equipment by issuing a three-year 6% note for $8,000 when the market rate for an obligation of this nature was 8%. The interest is payable annually. Actuarial information for three periods follows:

At the date of purchase, what amount should be debited to Equipment?

A) $7,587.66

B) $6,716.96

C) $6,350.66

D) $6,633.70

At the date of purchase, what amount should be debited to Equipment?

A) $7,587.66

B) $6,716.96

C) $6,350.66

D) $6,633.70

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

36

Morris recently purchased a building and the tract of land on which it is located. Morris plans to raze the building immediately and to erect a new building on the site. The value of the original building should be

A) written off as an extraordinary loss in the year the building is razed

B) capitalized as part of the cost of the land

C) depreciated over the period from the date of acquisition to the date that the building is to be razed

D) capitalized as part of the cost of the new building

A) written off as an extraordinary loss in the year the building is razed

B) capitalized as part of the cost of the land

C) depreciated over the period from the date of acquisition to the date that the building is to be razed

D) capitalized as part of the cost of the new building

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

37

Ramirez Company made the following payments related to a land acquisition:

The recorded cost of the land should be

A) $8,010

B) $9,725

C) $7,500

D) $7,850

The recorded cost of the land should be

A) $8,010

B) $9,725

C) $7,500

D) $7,850

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

38

A plant site donated by a city to Pluto Company, which plans to open a new factory, should be recorded on Pluto's books at

A) the nominal cost of taking title to it

B) its fair market value

C) zero value, but footnoted

D) the value assigned to it by the company's directors

A) the nominal cost of taking title to it

B) its fair market value

C) zero value, but footnoted

D) the value assigned to it by the company's directors

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

39

A major difference between IFRS and GAAP regarding valuation of property, plant, and equipment is that

A) IFRS allow valuation increases to be recorded in certain circumstances, but GAAP does not permit increases

B) IFRS and GAAP differ greatly on accounting for nonmonetary exchanges

C) IFRS require capitalization of all repairs and maintenance while GAAP does not

D) IFRS allocate lump-sum purchase costs based on relative book values rather than relative market values

A) IFRS allow valuation increases to be recorded in certain circumstances, but GAAP does not permit increases

B) IFRS and GAAP differ greatly on accounting for nonmonetary exchanges

C) IFRS require capitalization of all repairs and maintenance while GAAP does not

D) IFRS allocate lump-sum purchase costs based on relative book values rather than relative market values

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

40

On May 7, 2014, Shane Corporation purchased for $450,000 a tract of land on which was located a warehouse and an office building. The following data were collected concerning the property:

What are the appropriate amounts that Shane should record for the land, warehouse, and office building, respectively?

A) land, $ 70,000; warehouse, $80,000; office building, $150,000

B) land, $100,000; warehouse, $80,000; office building, $220,000

C) land, $100,000; warehouse, $80,000; office building, $270,000

D) land, $112,500; warehouse, $90,000; office building, $247,500

What are the appropriate amounts that Shane should record for the land, warehouse, and office building, respectively?

A) land, $ 70,000; warehouse, $80,000; office building, $150,000

B) land, $100,000; warehouse, $80,000; office building, $220,000

C) land, $100,000; warehouse, $80,000; office building, $270,000

D) land, $112,500; warehouse, $90,000; office building, $247,500

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following costs incurred subsequent to the acquisition of a machine would be appropriately accounted for by debiting the accumulated depreciation account related to the machine?

A) the cost of cleaning and lubricating the machine

B) the cost of replacing the motor on the machine when the cost of the original motor is not known

C) the cost of moving the machine to another manufacturing plant

D) the cost of a new attachment to the machine that provides for more output per unit of time

A) the cost of cleaning and lubricating the machine

B) the cost of replacing the motor on the machine when the cost of the original motor is not known

C) the cost of moving the machine to another manufacturing plant

D) the cost of a new attachment to the machine that provides for more output per unit of time

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

42

Maxa Marina exchanged a boat with a cost of $80,000 (now 75% depreciated) for another boat with a current fair value of $27,000. No boot was paid or received. The new boat will perform the same function as the old boat, but is expected but cash flows are expected to last for 5 years longer than with the old boat. Maxa should record the new boat at

A) $20,000

B) $27,000

C) $ 7,000

D) $ 0

A) $20,000

B) $27,000

C) $ 7,000

D) $ 0

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

43

On May 15, 2015, January Company acquired a new forklift in exchange for an old forklift that it had acquired in 2005. The old forklift was purchased for $20,000 and had a book value of $5,000. On the date of the exchange, the old forklift had a market value of $6,000. In addition, Retread paid $18,000 cash for the new forklift, which had a list price of $25,000. it is expected that future cash flows will not change. At what amount should Retread record the new forklift for financial accounting purposes?

A) $23,000

B) $24,000

C) $20,000

D) $25,000

A) $23,000

B) $24,000

C) $20,000

D) $25,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

44

When exchanging nonmonetary assets

A) boot must be associated with the transaction in order to recognize a gain or loss

B) recognized gain or loss can occur depending on the fair value of the asset surrendered and the fair value of the asset received

C) a loss can be recognized only when the fair value of the asset received plus boot is greater than the book value of the asset surrendered

D) recognized gain or loss can occur depending on the book value of the asset surrendered and the fair value of the asset surrendered

A) boot must be associated with the transaction in order to recognize a gain or loss

B) recognized gain or loss can occur depending on the fair value of the asset surrendered and the fair value of the asset received

C) a loss can be recognized only when the fair value of the asset received plus boot is greater than the book value of the asset surrendered

D) recognized gain or loss can occur depending on the book value of the asset surrendered and the fair value of the asset surrendered

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

45

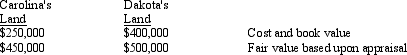

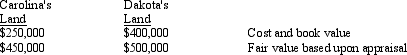

Exhibit 10-1 Two construction companies, Dakota and Carolina, are in the construction business. Each owns a tract of land being held for development, but each company believes that the other's land is better suited to enhance the success of each planned development. Accordingly, they agree to exchange their land and have the following information:  The exchange of land was made, and based on the difference in appraised fair value, Carolina paid $50,000 cash to Dakota.

The exchange of land was made, and based on the difference in appraised fair value, Carolina paid $50,000 cash to Dakota.

Refer to Exhibit 10-1. For financial reporting purposes, Carolina should recognize a gain on this exchange in the amount of

A) $ 0

B) $ 50,000

C) $100,000

D) $200,000

The exchange of land was made, and based on the difference in appraised fair value, Carolina paid $50,000 cash to Dakota.

The exchange of land was made, and based on the difference in appraised fair value, Carolina paid $50,000 cash to Dakota.Refer to Exhibit 10-1. For financial reporting purposes, Carolina should recognize a gain on this exchange in the amount of

A) $ 0

B) $ 50,000

C) $100,000

D) $200,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

46

Mary Co. exchanged a piece of equipment that had cost $40,000 (now 75% depreciated) for a truck with a current appraised value of $18,000. Mary Co. gave the other company the piece of equipment and $10,000. Mary Co. should record

A) a $8,000 loss

B) the truck at $18,000

C) a gain of $10,000

D) the truck at $21,000

A) a $8,000 loss

B) the truck at $18,000

C) a gain of $10,000

D) the truck at $21,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

47

Camp, Inc. exchanged a truck that cost $30,000 (now 50% depreciated) for equipment with an appraised value of $25,000. Camp paid boot of $6,000. Camp should record the equipment at

A) $25,000

B) $30,000

C) $21,000

D) $31,000

A) $25,000

B) $30,000

C) $21,000

D) $31,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

48

Coco Services exchanged an asset with a cost of $24,000 (now 40% depreciated) for a nonmonetary asset worth $12,000. Coco received $2,000 boot. In the entry to record this exchange, Coco should record

A) a $10,000 loss

B) a $400 gain

C) no gain or loss

D) a $400 loss

A) a $10,000 loss

B) a $400 gain

C) no gain or loss

D) a $400 loss

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

49

Richards, Inc. exchanged a piece of equipment with an original cost of $82,000, accumulated depreciation to date of $40,000, and a fair value of $46,000 for a similar piece of equipment. Cash flows are not expected to change significantly. The newly acquired equipment had a book value of $40,000 and a fair market value of $46,000. Richard should record the equipment acquired at

A) $ 0

B) $40,000

C) $42,000

D) $46,000

A) $ 0

B) $40,000

C) $42,000

D) $46,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

50

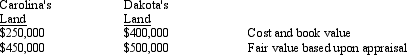

Exhibit 10-1 Two construction companies, Dakota and Carolina, are in the construction business. Each owns a tract of land being held for development, but each company believes that the other's land is better suited to enhance the success of each planned development. Accordingly, they agree to exchange their land and have the following information:  The exchange of land was made, and based on the difference in appraised fair value, Carolina paid $50,000 cash to Dakota.

The exchange of land was made, and based on the difference in appraised fair value, Carolina paid $50,000 cash to Dakota.

Refer to Exhibit 10-1. After the exchange, Dakota should record its newly acquired land on its books at

A) $300,000

B) $400,000

C) $450,000

D) $500,000

The exchange of land was made, and based on the difference in appraised fair value, Carolina paid $50,000 cash to Dakota.

The exchange of land was made, and based on the difference in appraised fair value, Carolina paid $50,000 cash to Dakota.Refer to Exhibit 10-1. After the exchange, Dakota should record its newly acquired land on its books at

A) $300,000

B) $400,000

C) $450,000

D) $500,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

51

Romney Company exchanged one business automobile for another business automobile. The old automobile had an original cost of $40,000, an undepreciated cost of $16,000, and a market value of $24,000 when exchanged. In addition, Romney paid $9,000 cash for the replacement automobile. The list price of the replacement automobile was $45,000. The replacement will help generate significantly greater cash flows in the business. At what amount should the replacement automobile be recorded for financial accounting purposes?

A) $24,000

B) $30,000

C) $33,000

D) $35,000

A) $24,000

B) $30,000

C) $33,000

D) $35,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

52

Property acquired through donation is recorded at

A) its book value

B) its fair market value

C) its cost

D) zero

A) its book value

B) its fair market value

C) its cost

D) zero

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

53

On January 1, 2014, Randolf Company signed a contract to have Rory Associates construct a manufacturing facility at a cost of $14,000,000. It was estimated that it would take three years to complete the project. Also on January 1, 2014, to finance the construction cost, Randolf borrowed $14,000,000 payable in seven annual installments of $2,000,000 plus interest at the rate of 9%. During 2014, Randolf made progress payments totaling $5,000,000 under the contract, and the average amount of accumulated expenditures was $3,000,000 for the year. The excess borrowed funds were invested in short-term securities, from which Randolf realized investment income of $330,000. What amount should Randolf report as capitalized interest at December 31, 2014?

A) $ 0

B) $ 270,000

C) $ 510,000

D) $1,260,000

A) $ 0

B) $ 270,000

C) $ 510,000

D) $1,260,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

54

Which one of the following statements is true?

A) If a plant asset is self-constructed for less than it would cost to purchase, a profit should be recorded upon the completion of the construction.

B) When property, plant, or equipment is acquired through donation, no entry is recorded.

C) Development stage enterprises need not report losses before sales are made.

D) Interest cannot be capitalized when an asset is substantially complete and ready for its intended use.

A) If a plant asset is self-constructed for less than it would cost to purchase, a profit should be recorded upon the completion of the construction.

B) When property, plant, or equipment is acquired through donation, no entry is recorded.

C) Development stage enterprises need not report losses before sales are made.

D) Interest cannot be capitalized when an asset is substantially complete and ready for its intended use.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

55

According to GAAP, interest cost incurred to finance construction of an asset must be capitalized in which of the following situations?

A) when the asset is inventory that is routinely manufactured in large quantities on a repetitive basis

B) when an asset is used in other than the earning activities of the firm

C) when an asset is ready for its intended use

D) when an asset is being constructed for a firm's own use

A) when the asset is inventory that is routinely manufactured in large quantities on a repetitive basis

B) when an asset is used in other than the earning activities of the firm

C) when an asset is ready for its intended use

D) when an asset is being constructed for a firm's own use

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

56

Reba Company received $60,000 in cash and used equipment with a fair value of $140,000 from Fargo Corporation for Reba's existing equipment, which had a fair value of $200,000 and an undepreciated cost of $170,000 recorded on its books. The transaction was undertaken because Reba was revising its market strategy and planned to reduce the use of this type of equipment in its production. How much gain should Reba recognize on this exchange, and at what amount should the acquired equipment be recorded, respectively?

A) 0 and $150,000

B) $ 3,000 and $143,000

C) $20,000 and $170,000

D) $30,000 and $140,000

A) 0 and $150,000

B) $ 3,000 and $143,000

C) $20,000 and $170,000

D) $30,000 and $140,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

57

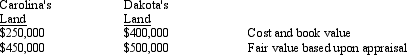

Exhibit 10-1 Two construction companies, Dakota and Carolina, are in the construction business. Each owns a tract of land being held for development, but each company believes that the other's land is better suited to enhance the success of each planned development. Accordingly, they agree to exchange their land and have the following information:  The exchange of land was made, and based on the difference in appraised fair value, Carolina paid $50,000 cash to Dakota.

The exchange of land was made, and based on the difference in appraised fair value, Carolina paid $50,000 cash to Dakota.

Refer to Exhibit 10-1. For financial reporting purposes, Dakota should recognize a gain on this exchange in the amount of

A) $ 0

B) $ 50,000

C) $100,000

D) $200,000

The exchange of land was made, and based on the difference in appraised fair value, Carolina paid $50,000 cash to Dakota.

The exchange of land was made, and based on the difference in appraised fair value, Carolina paid $50,000 cash to Dakota.Refer to Exhibit 10-1. For financial reporting purposes, Dakota should recognize a gain on this exchange in the amount of

A) $ 0

B) $ 50,000

C) $100,000

D) $200,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

58

Kelly Company exchanged inventory items that cost $47,000 and normally sold for $75,000 for a new delivery truck with a list price of $77,000. The delivery truck should be recorded on Kelly's books at

A) $47,000

B) $75,000

C) $77,000

D) $82,000

A) $47,000

B) $75,000

C) $77,000

D) $82,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

59

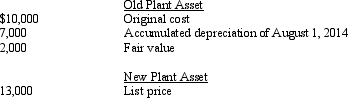

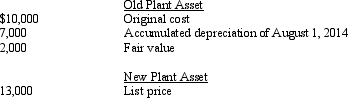

On August 1, 2014, Robertson traded in an old plant asset for a newer model that would be more productive and efficient. Data relative to the old and new plant assets follow:

A total of $10,500 cash was given in the trade. What should be the cost of the new plant asset for financial accounting purposes?

A) $12,000

B) $12,500

C) $13,500

D) $13,000

A total of $10,500 cash was given in the trade. What should be the cost of the new plant asset for financial accounting purposes?

A) $12,000

B) $12,500

C) $13,500

D) $13,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

60

All of the following are arguments in favor of including only the incremental fixed overhead costs in the cost of a self-constructed asset, except that the

A) cost of the asset is the additional cost incurred to produce it

B) overhead would be incurred whether or not the construction took place

C) asset cost will more closely approximate the cost of a purchased asset

D) decision to construct the asset should be based on the total incremental cost and not include allocated fixed overhead

A) cost of the asset is the additional cost incurred to produce it

B) overhead would be incurred whether or not the construction took place

C) asset cost will more closely approximate the cost of a purchased asset

D) decision to construct the asset should be based on the total incremental cost and not include allocated fixed overhead

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

61

Jones Delivery Services bought a truck by paying $84,000 cash down and signing a $248,000 non-interest-bearing note due in five years for the balance. Current interest rates were 8%. Actuarial information for five periods at 8% follows:  Required:

Required:

Compute the amount that should be charged to the asset account.

Required:

Required:Compute the amount that should be charged to the asset account.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

62

Minor Corp. has agreed to expand its operations by opening a manufacturing plant in Bel Air, Maryland. In return, Bel Air will donate an abandoned building and the 5 acres on which it sits to Minor. The land originally cost $1,000,000 and the building $3,000,000. The building's current book value is $380,000, and current appraisals are: land $8,000,000 and building $3,600,000. Minor has also agreed to provide 100 jobs for the next 5 years to Bel Airs' city residents. Minor estimates that the wages to these residents will amount to $4,000,000.

Required:

Prepare the journal entry to record this acquisition on Minor's books.

Required:

Prepare the journal entry to record this acquisition on Minor's books.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

63

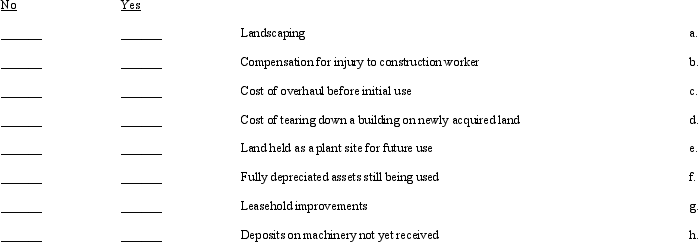

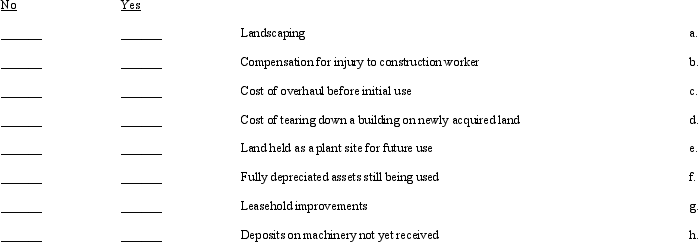

Several expenditures are listed below:  Required:

Required:

Indicate whether or not each expenditure would be included in the cost of property, plant, and equipment.

Required:

Required:Indicate whether or not each expenditure would be included in the cost of property, plant, and equipment.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following events is most appropriately recorded as a reduction to accumulated depreciation?

A) an addition that increases the anticipated benefits of the old asset

B) an improvement that extends an asset's useful life

C) an improvement that increases the asset's expected benefits beyond that originally expected

D) a replacement of a better asset for the one currently used

A) an addition that increases the anticipated benefits of the old asset

B) an improvement that extends an asset's useful life

C) an improvement that increases the asset's expected benefits beyond that originally expected

D) a replacement of a better asset for the one currently used

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

65

Concerning current accounting for oil and gas properties, which statement is true?

A) The successful-efforts method must be used.

B) The reserve-recognition method must be used.

C) Either the successful-efforts method or the full-cost method may be used.

D) The full-cost method must be used.

A) The successful-efforts method must be used.

B) The reserve-recognition method must be used.

C) Either the successful-efforts method or the full-cost method may be used.

D) The full-cost method must be used.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

66

Under GAAP, which one of the following types of costs should not be capitalized?

A) rearrangements

B) routine maintenance

C) replacements

D) additions

A) rearrangements

B) routine maintenance

C) replacements

D) additions

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

67

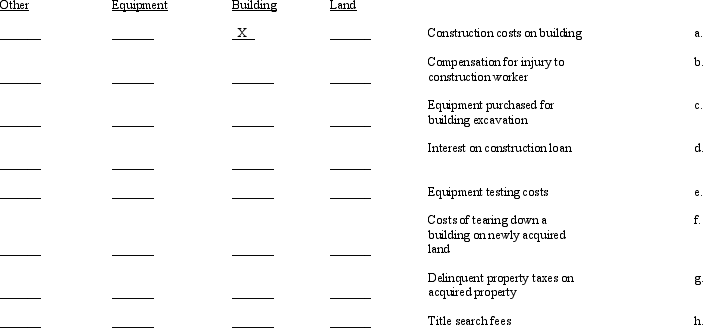

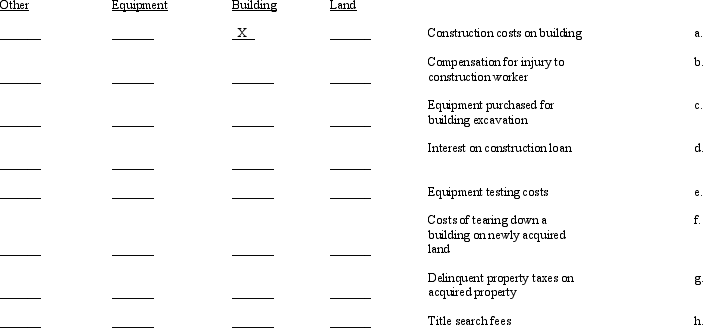

Several expenditures are listed below:  Required:

Required:

If the expenditure would be capitalized to land, buildings, equipment, or other, so indicate with an "X." An example is given.

Required:

Required:If the expenditure would be capitalized to land, buildings, equipment, or other, so indicate with an "X." An example is given.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

68

The costs of drilling an unsuccessful well are expensed under

A) the successful-efforts method

B) the full-cost method

C) both the successful-efforts method and the full-cost method

D) neither the successful-efforts method nor the full-cost method

A) the successful-efforts method

B) the full-cost method

C) both the successful-efforts method and the full-cost method

D) neither the successful-efforts method nor the full-cost method

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

69

During 2014, Red Company acquired a new piece of equipment for its manufacturing process. In order to purchase the equipment, Red made a down payment of $50,000 and issued a $200,000 five-year, 7% note. The annual payment of principal and interest was to be $48,778. The market rate of interest for obligations of this kind is 12%. The present value factor for an ordinary annuity of 5 years at 12% is 3.604776.

Required:

Required:

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

70

In 2014, Go Oil Company incurred costs of $8 million drilling oil wells. Thirty percent of the drilling resulted in oil being found. The rest of the drilling was unsuccessful. If Go uses the successful-efforts method of accounting, the oil and gas properties will be valued on the December 31, 2014 balance sheet at

A) $8,000,000

B) $4,900,000

C) $4,200,000

D) $2,400,000

A) $8,000,000

B) $4,900,000

C) $4,200,000

D) $2,400,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

71

Tosh Corp. has agreed to exchange an old computer system for a van from Inconclusive, Inc. In addition, Inconclusive will pay Tosh $2,000. The computer originally cost Tosh $25,000 and its current book value is $14,000. The van's original cost was $30,000 and its accumulated depreciation is $12,000. The appraised value of the computer is $15,000, and the appraised value of the van is $13,000.

Required:

Prepare the journal entries to record the exchange on both companies books.

Required:

Prepare the journal entries to record the exchange on both companies books.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

72

During 2014, the Tidel Company completed the following transactions related to its property, plant, and equipment accounts:

a.On March 18, Tidel paid $480,000 for land, buildings, and equipment in a lump-sum purchase. An appraisal that cost Tidel $10,000 revealed fair market values of $200,000 for the land, $150,000 for the buildings, and $150,000 for the equipment.

b.On August 11, Tidel issued 20,000 shares of its $10 par value common stock in exchange for some equipment. The equipment's fair market value is estimated at $360,000 by an outside appraisal. On the date of the exchange, the stock was being actively traded at $17 per share on a major stock exchange.

Required:

Prepare the necessary journal entry to properly record each transaction.

a.On March 18, Tidel paid $480,000 for land, buildings, and equipment in a lump-sum purchase. An appraisal that cost Tidel $10,000 revealed fair market values of $200,000 for the land, $150,000 for the buildings, and $150,000 for the equipment.

b.On August 11, Tidel issued 20,000 shares of its $10 par value common stock in exchange for some equipment. The equipment's fair market value is estimated at $360,000 by an outside appraisal. On the date of the exchange, the stock was being actively traded at $17 per share on a major stock exchange.

Required:

Prepare the necessary journal entry to properly record each transaction.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

73

Two alternative methods of accounting for the cost of oil and gas properties have been widely used. The method that capitalizes all costs associated with all wells is the

A) successful-efforts method

B) full-cost method

C) variable-cost method

D) specific-cost method

A) successful-efforts method

B) full-cost method

C) variable-cost method

D) specific-cost method

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

74

Sarah Company is exchanging a unique machine for a similar machine from Wilhelm, Inc. Sarah's equipment originally cost $300,000 and has a book value of $175,000. Wilhelm's machine cost $250,000 and has a book value of $150,000. No cash will be exchanged, and the two machines will continue to perform the same functions for each company.

Required:

Prepare the journal entry for each company.

Required:

Prepare the journal entry for each company.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

75

A farmer donated a large tract of land and a building to a community group for use as a recreation center. The agreement provided that the recreation center employ 50 people for 10 years. The land was appraised for $150,000 and the building at $75,000.

Required:

1) Prepare the journal entry to record the acquisition of the land and building.

2) How should the 10 year agreement be reported in the financial statements?

Required:

1) Prepare the journal entry to record the acquisition of the land and building.

2) How should the 10 year agreement be reported in the financial statements?

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

76

The Nathan Jacob's Company paid $450,000 to acquire land, building, and equipment. At the time of the acquisition Nathan paid $15,000 to have the property appraised. The following values were determined from the appraisal: land, $125,000; building, $235,000; and equipment, $150,000.

Required:

1) What cost should Nathan Jacob's assign to the land, buildings, and equipment, respectively? (round percentages to whole percents)

2) Provide the journal entry to record the acquisition on the books of Nathan Jacob's.

Required:

1) What cost should Nathan Jacob's assign to the land, buildings, and equipment, respectively? (round percentages to whole percents)

2) Provide the journal entry to record the acquisition on the books of Nathan Jacob's.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

77

On August 1, Gold Company exchanged a machine for a similar machine owned by Cowboy Company and also received $7,000 cash from Cowboy Company.Gold's machine had an original cost of $70,000, accumulated depreciation to date of $34,500, and a fair market value of $60,000. Cowboy's machine had a book value of $45,000 and a fair value of $53,000.

Required:

Prepare the necessary journal entry by Gold Company to record this transaction assuming

Required:

Prepare the necessary journal entry by Gold Company to record this transaction assuming

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

78

Wilhelm Company exchanged a piece of equipment with a cost of $300,000 and accumulated depreciation of $240,000 for land owned by James Corporation. No cash was exchanged. Jame's land had an original cost of $190,000. At the date of exchange, both assets had a fair market value of $180,000.

Required:

Prepare the journal entry that each company should record.

Required:

Prepare the journal entry that each company should record.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

79

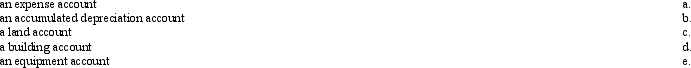

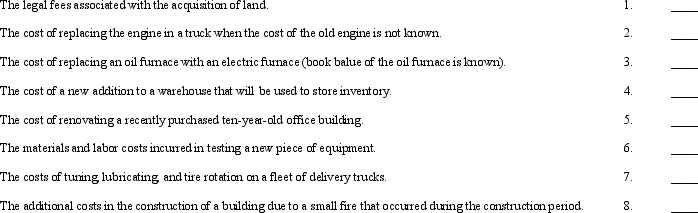

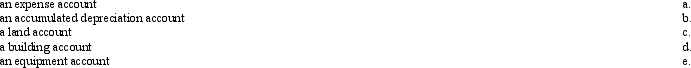

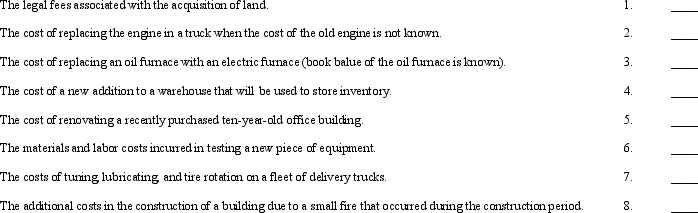

Costs incurred by Mills Company that relate to its property, plant, and equipment assets might be recorded in one of the five following classes of accounts:  Required:

Required:

For each of the costs identified below, indicate the type of account in which the cost should be recorded by placing the appropriate letter in the space provided.

Required:

Required:For each of the costs identified below, indicate the type of account in which the cost should be recorded by placing the appropriate letter in the space provided.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

80

An improvement made to a machine increased its production capacity by 25% without extending the machine's useful life. The cost of the improvement should be

A) recorded as an expense

B) debited to Accumulated Depreciation

C) capitalized in the machine account

D) allocated between Accumulated Depreciation and the machine account

A) recorded as an expense

B) debited to Accumulated Depreciation

C) capitalized in the machine account

D) allocated between Accumulated Depreciation and the machine account

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck