Deck 2: Investments in Equity Securities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/64

Play

Full screen (f)

Deck 2: Investments in Equity Securities

1

When are gains on intercompany transfers of assets between an investor an associate recognized as part of the investment income accounted for by the investor under the equity method?

A) In the period when the intercompany transfer takes place.

B) In the period(s) when the assets are sold to third parties or consumed.

C) They are never recognized.

D) They are recognized only when the investment is sold.

A) In the period when the intercompany transfer takes place.

B) In the period(s) when the assets are sold to third parties or consumed.

C) They are never recognized.

D) They are recognized only when the investment is sold.

B

2

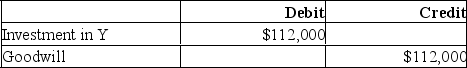

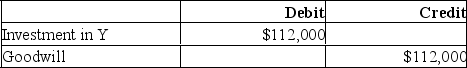

Any unallocated positive acquisition differential is normally:

A) pro-rated across the Associate's identifiable net assets.

B) charged to Retained Earnings.

C) recorded as Goodwill.

D) expensed during the year following the acquisition.

A) pro-rated across the Associate's identifiable net assets.

B) charged to Retained Earnings.

C) recorded as Goodwill.

D) expensed during the year following the acquisition.

C

3

What percentage of ownership is used as a guideline to determine that significant influence exists under IAS 28 Investments in Associates and Joint Ventures?

A) 20% or more.

B) Less than 20%.

C) Between 20% and 50%.

D) 25% or more.

A) 20% or more.

B) Less than 20%.

C) Between 20% and 50%.

D) 25% or more.

C

4

What is the dominant factor used to distinguish non-strategic investments from significant influence investments?

A) Use of the cost method to account for and report the investment.

B) Use of the equity method to account for and report the investment.

C) The investor's intention to establish or maintain a long-term operating relationship with the investee.

D) The percentage of equity held by the investor.

A) Use of the cost method to account for and report the investment.

B) Use of the equity method to account for and report the investment.

C) The investor's intention to establish or maintain a long-term operating relationship with the investee.

D) The percentage of equity held by the investor.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following statements is TRUE under IFRS 9?

A) All unrealized gains and losses on equity investments flow through other comprehensive income (OCI).

B) Unrealized gains and losses on fair value through profit and loss (FVTPL) securities are included in Other Comprehensive Income.

C) Unrealized gains and losses on equity investments may be included in other comprehensive income (OCI) only if a decision to do so is made when the investment is acquired.

D) Other comprehensive income (OCI) is included in net income.

A) All unrealized gains and losses on equity investments flow through other comprehensive income (OCI).

B) Unrealized gains and losses on fair value through profit and loss (FVTPL) securities are included in Other Comprehensive Income.

C) Unrealized gains and losses on equity investments may be included in other comprehensive income (OCI) only if a decision to do so is made when the investment is acquired.

D) Other comprehensive income (OCI) is included in net income.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

6

Reporting in accordance with the Accounting Standards for Private Enterprises (ASPE) is permitted in certain instances for:

A) privately held companies.

B) publicly held companies.

C) all Canadian companies.

D) Canadian companies consolidating their foreign subsidiaries.

A) privately held companies.

B) publicly held companies.

C) all Canadian companies.

D) Canadian companies consolidating their foreign subsidiaries.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

7

The difference between the investor's cost and the investor's percentage of the carrying value of the net identifiable assets of the associate is known as:

A) Goodwill.

B) the Acquisition Differential.

C) the Fair Value Increment.

D) the Excess Book Value.

A) Goodwill.

B) the Acquisition Differential.

C) the Fair Value Increment.

D) the Excess Book Value.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

8

Gains and losses on fair value through profit or loss (FVTPL) securities:

A) are included in net income, regardless of whether they are realized or not.

B) are included in net income only when the investment has become permanently impaired.

C) are included in net income only when realized.

D) are never recorded until the securities are sold.

A) are included in net income, regardless of whether they are realized or not.

B) are included in net income only when the investment has become permanently impaired.

C) are included in net income only when realized.

D) are never recorded until the securities are sold.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

9

How are realized gains from the sale of fair value through other comprehensive income (FVTOCI) investments accounted for under IFRS 9?

A) They are transferred to net income in the period of the sale.

B) They remain in accumulated other comprehensive income.

C) They are transferred from accumulated other comprehensive income to retained earnings without going through net income.

D) They are transferred to contributed surplus.

A) They are transferred to net income in the period of the sale.

B) They remain in accumulated other comprehensive income.

C) They are transferred from accumulated other comprehensive income to retained earnings without going through net income.

D) They are transferred to contributed surplus.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

10

When analyzing and interpreting financial statements, although the reporting methods show different values for liquidity, solvency, and profitability, the real economic situation is ________ for the four different methods.

A) completely different

B) identical

C) almost similar except for the equity method

D) almost similar except for the fair value methods

A) completely different

B) identical

C) almost similar except for the equity method

D) almost similar except for the fair value methods

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

11

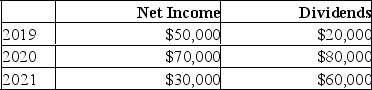

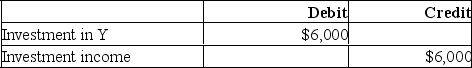

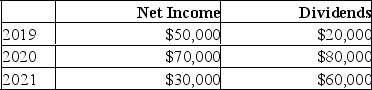

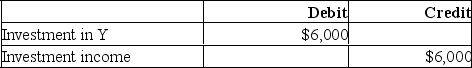

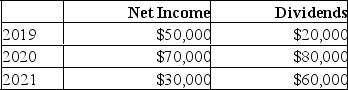

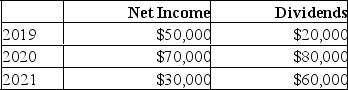

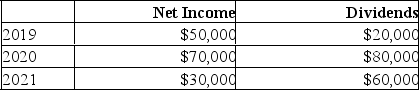

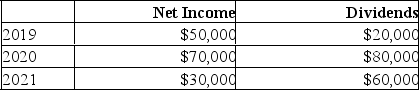

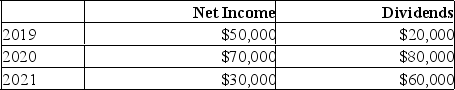

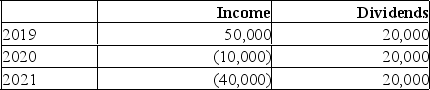

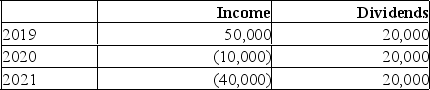

On January 1, 2019, X Inc. purchased 12% of the voting shares of Y Inc. for $100,000. The investment is reported at cost. X does not have significant influence over Y. Y's net income and declared dividends for the following three years are as follows:  Which of the following journal entries would have to be made to record X's share of Y's net income for 2019?

Which of the following journal entries would have to be made to record X's share of Y's net income for 2019?

A)

B)

C)

D) No entry required.

Which of the following journal entries would have to be made to record X's share of Y's net income for 2019?

Which of the following journal entries would have to be made to record X's share of Y's net income for 2019?A)

B)

C)

D) No entry required.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

12

When reporting under the Accounting Standards for Private Enterprises (ASPE) which method must be used to report investments where the investor has significant influence over the investee?

A) It must use the cost method to report all such investments.

B) It must use the equity method to report all such investments.

C) It may use the cost method, equity method, or at fair value but must account for all such investments by the same method.

D) It may use the cost method for some such investments and the equity method for other such investments.

A) It must use the cost method to report all such investments.

B) It must use the equity method to report all such investments.

C) It may use the cost method, equity method, or at fair value but must account for all such investments by the same method.

D) It may use the cost method for some such investments and the equity method for other such investments.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following methods uses procedures closest to those used in preparing consolidated financial statements?

A) The fair value through profit or loss (FVTPL) approach

B) The cost method

C) The fair value through other comprehensive income (FVTOCI) approach

D) The equity method

A) The fair value through profit or loss (FVTPL) approach

B) The cost method

C) The fair value through other comprehensive income (FVTOCI) approach

D) The equity method

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following statements is TRUE regarding the equity method?

A) The equity method is used for reporting gains or losses for non-strategic investments.

B) The investor's share of the associate's dividends declared is reported as revenue.

C) The investor's investment in the associate changes in direct relation to the changes taking place in the associate's equity accounts.

D) The equity method reports unrealized gains and losses on revaluations to fair value in net income.

A) The equity method is used for reporting gains or losses for non-strategic investments.

B) The investor's share of the associate's dividends declared is reported as revenue.

C) The investor's investment in the associate changes in direct relation to the changes taking place in the associate's equity accounts.

D) The equity method reports unrealized gains and losses on revaluations to fair value in net income.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

15

On January 1, 2019, X Inc. purchased 12% of the voting shares of Y Inc. for $100,000. The investment is reported at cost. X does not have significant influence over Y. Y's net income and declared dividends for the following three years are as follows:

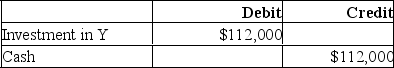

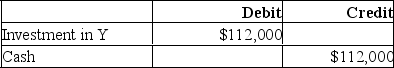

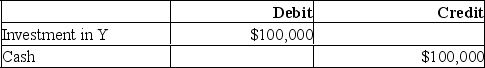

Which of the following journal entries would have to be made to record X's acquisition of Y's shares on January 1, 2019?

Which of the following journal entries would have to be made to record X's acquisition of Y's shares on January 1, 2019?

A.

B.

C.

D. No entry required.

Which of the following journal entries would have to be made to record X's acquisition of Y's shares on January 1, 2019?

Which of the following journal entries would have to be made to record X's acquisition of Y's shares on January 1, 2019? A.

B.

C.

D. No entry required.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is NOT a possible indicator of significant influence?

A) The investor has the ability to elect members to the Board of Directors.

B) The investor has the right to participate in the policy-making process.

C) The investor has engaged in numerous intercompany transactions with the Associate.

D) The Associate's new CEO was previously CEO of the investor company.

A) The investor has the ability to elect members to the Board of Directors.

B) The investor has the right to participate in the policy-making process.

C) The investor has engaged in numerous intercompany transactions with the Associate.

D) The Associate's new CEO was previously CEO of the investor company.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following types of share investment does NOT qualify as a strategic investment?

A) Significant influence investments.

B) Joint Control investments.

C) Investments without significant influence.

D) Controlled investments.

A) Significant influence investments.

B) Joint Control investments.

C) Investments without significant influence.

D) Controlled investments.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

18

A significant influence investment is one that:

A) allows the investor to exercise significant influence over the strategic operating and financing policies of the Associate.

B) allows the investor to exercise significant influence over only the financing policies of the Associate.

C) allows the investor to exercise significant influence over only the operating policies of the Associate.

D) allows the investor to exercise significant influence over the strategic and operating policies of the Associate.

A) allows the investor to exercise significant influence over the strategic operating and financing policies of the Associate.

B) allows the investor to exercise significant influence over only the financing policies of the Associate.

C) allows the investor to exercise significant influence over only the operating policies of the Associate.

D) allows the investor to exercise significant influence over the strategic and operating policies of the Associate.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

19

The ________ investment must be shown as a current asset, whereas the other investments could be current or non-current, depending on management's intention.

A) fair value through profit or loss (FVTPL)

B) cost method

C) equity method

D) fair value through other comprehensive income (FVTOCI)

A) fair value through profit or loss (FVTPL)

B) cost method

C) equity method

D) fair value through other comprehensive income (FVTOCI)

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following statements is CORRECT?

A) Significant influence is only possible if the investor owns more than 50% of the voting shares of the associate.

B) An ownership interest between 20% and 50% always implies significant influence.

C) An ownership interest between 0 and 10% can never imply significant influence.

D) Significant influence is possible even if the investor owns less than 20% of the voting shares of the associate.

A) Significant influence is only possible if the investor owns more than 50% of the voting shares of the associate.

B) An ownership interest between 20% and 50% always implies significant influence.

C) An ownership interest between 0 and 10% can never imply significant influence.

D) Significant influence is possible even if the investor owns less than 20% of the voting shares of the associate.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

21

On January 1, 2019, X Inc. purchased 12% of the voting shares of Y Inc. for $100,000. The investment is reported at cost. X does not have significant influence over Y. Y's net income and declared dividends for the following three years are as follows:

Which of the following journal entries would have to be made to record X's share of Y's dividends paid for 2020?

A.

B.

C.

D. No entry requireD.Share of dividends = $80,000 12% = $9,600.

Which of the following journal entries would have to be made to record X's share of Y's dividends paid for 2020?

A.

B.

C.

D. No entry requireD.Share of dividends = $80,000 12% = $9,600.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

22

On January 1, 2019, X Inc. purchased 12% of the voting shares of Y Inc. for $100,000. The investment is reported at cost. X does not have significant influence over Y. Y's net income and declared dividends for the following three years are as follows:  What would be the carrying value of X's Investment in Y at the end of 2021?

What would be the carrying value of X's Investment in Y at the end of 2021?

A) $100,000

B) $98,800

C) $90,000

D) $91,200

What would be the carrying value of X's Investment in Y at the end of 2021?

What would be the carrying value of X's Investment in Y at the end of 2021?A) $100,000

B) $98,800

C) $90,000

D) $91,200

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

23

When an investment is accounted for using the Equity Method, how are the investor's share of the investee's income from non-operating sources (such as gains or losses from discontinued operations) to be accounted for by the investor?

A) Any such gains or losses are to be charged directly to Retained Earnings net of tax.

B) Any such gains or losses are included with the revenue and expenses from operations. The investor's pro rata share of these after-tax gains and losses are added to or deducted from the Investment account.

C) Any such gains or losses are shown separately, net of tax, below income from operations on the investor's Income Statement. The investor's pro rata share of these after-tax gains and losses are added to or deducted from the Investment account.

D) No specific accounting treatment is required. These items simply have to be disclosed in notes to the financial statements.

A) Any such gains or losses are to be charged directly to Retained Earnings net of tax.

B) Any such gains or losses are included with the revenue and expenses from operations. The investor's pro rata share of these after-tax gains and losses are added to or deducted from the Investment account.

C) Any such gains or losses are shown separately, net of tax, below income from operations on the investor's Income Statement. The investor's pro rata share of these after-tax gains and losses are added to or deducted from the Investment account.

D) No specific accounting treatment is required. These items simply have to be disclosed in notes to the financial statements.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

24

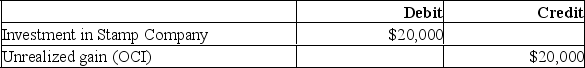

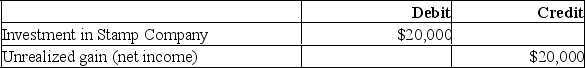

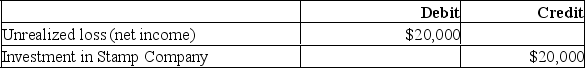

Posthorn Corporation acquired 20,000 of the 100,000 outstanding common shares of Stamp Company on January 1, 2019, for a cash consideration of $200,000. During 2019, Stamp Company had net income of $120,000 and paid dividends of $80,000. At the end of 2019, shares of Stamp Company were trading for $11 each.

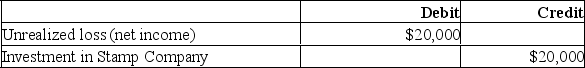

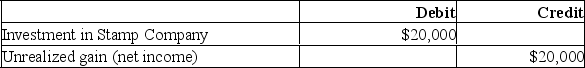

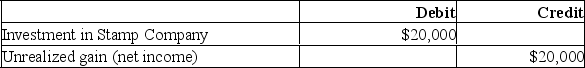

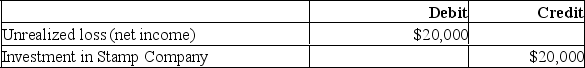

If Posthorn Corporation accounts for its investment in Stamp Company at fair value through profit or loss (FVTPL), what entry will the company make to record the revaluation of the investment at December 31, 2019?

A.

B.

C.

D. No entry requireD.

If Posthorn Corporation accounts for its investment in Stamp Company at fair value through profit or loss (FVTPL), what entry will the company make to record the revaluation of the investment at December 31, 2019?

A.

B.

C.

D. No entry requireD.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

25

If an investor's ownership interest in a significant influence investment increases or decreases, how are changes from accounting at fair value to the use of the Equity Method (or vice-versa) to be handled?

A) Changes from the Equity Method are to be handled prospectively, while changes to the Equity Method are to be handled retroactively.

B) Changes from the Equity Method are to be handled retroactively, while changes to the Equity Method are to be handled prospectively.

C) Any change is to be handled retroactively.

D) Any change is to be handled prospectively.

A) Changes from the Equity Method are to be handled prospectively, while changes to the Equity Method are to be handled retroactively.

B) Changes from the Equity Method are to be handled retroactively, while changes to the Equity Method are to be handled prospectively.

C) Any change is to be handled retroactively.

D) Any change is to be handled prospectively.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

26

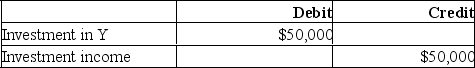

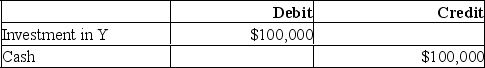

On January 1, 2019, X Inc. purchased 25% of the voting shares of Y Inc. for $100,000. The investment is reported using the equity method, as X has significant influence over Y. Y's net income and declared dividends for the following three years are as follows:

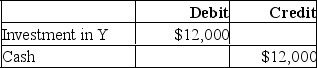

Which of the following journal entries would have to be made to record X's acquisition of Y's shares?

Which of the following journal entries would have to be made to record X's acquisition of Y's shares?

A.

B.

C.

D. No entry requireD.On acquisition date, the only journal entry that is necessary is to record the share purchase. Subsequent to this date, changes to the Investment in Y will be recorded.

Which of the following journal entries would have to be made to record X's acquisition of Y's shares?

Which of the following journal entries would have to be made to record X's acquisition of Y's shares? A.

B.

C.

D. No entry requireD.On acquisition date, the only journal entry that is necessary is to record the share purchase. Subsequent to this date, changes to the Investment in Y will be recorded.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

27

Posthorn Corporation acquired 20,000 of the 100,000 outstanding common shares of Stamp Company on January 1, 2019, for a cash consideration of $200,000. During 2019, Stamp Company had net income of $120,000 and paid dividends of $80,000. At the end of 2019, shares of Stamp Company were trading for $11 each.

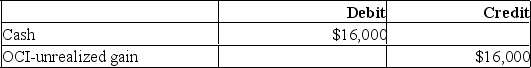

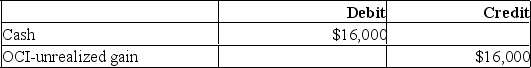

If Posthorn Corporation accounts for its investment in Stamp Company at fair value through profit or loss (FVTPL), what entry will the company make to record the dividends received from Stamp Company for 2019?

A.

B.

C.

D. No entry requireD.$80,000 20% = $16,000.

If Posthorn Corporation accounts for its investment in Stamp Company at fair value through profit or loss (FVTPL), what entry will the company make to record the dividends received from Stamp Company for 2019?

A.

B.

C.

D. No entry requireD.$80,000 20% = $16,000.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

28

On January 1, 2019, X Inc. purchased 12% of the voting shares of Y Inc. for $100,000. The investment is reported at cost. X does not have significant influence over Y. Y's net income and declared dividends for the following three years are as follows:

Which of the following journal entries would have to be made to record X's share of Y's dividends paid for 2021?

A.

B.

C.

D. No entry requireD.Share of dividends = $60,000 12% = $7,200.

Which of the following journal entries would have to be made to record X's share of Y's dividends paid for 2021?

A.

B.

C.

D. No entry requireD.Share of dividends = $60,000 12% = $7,200.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

29

On January 1, 2019, X Inc. purchased 25% of the voting shares of Y Inc. for $100,000. The investment is reported using the equity method, as X has significant influence over Y. Y's net income and declared dividends for the following three years are as follows:

Which of the following journal entries would have to be made to record X's share of Y's dividends paid for 2020?

A.

B.

C.

D. No entry requireD.Share of dividends = $80,000 25% = $20,000.

Which of the following journal entries would have to be made to record X's share of Y's dividends paid for 2020?

A.

B.

C.

D. No entry requireD.Share of dividends = $80,000 25% = $20,000.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following statements is true regarding an investment in associate that meets the criteria to be classified as held for sale?

A) The investment in associate is to be reported as a non-current asset.

B) The intention of management is to recover the carrying value of the investment through continued operations.

C) The sale of the investment in associate must be highly probable.

D) The investment in associate is to be measured at fair value.

A) The investment in associate is to be reported as a non-current asset.

B) The intention of management is to recover the carrying value of the investment through continued operations.

C) The sale of the investment in associate must be highly probable.

D) The investment in associate is to be measured at fair value.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

31

On January 1, 2019, X Inc. purchased 25% of the voting shares of Y Inc. for $100,000. The investment is reported using the equity method, as X has significant influence over Y. Y's net income and declared dividends for the following three years are as follows:  What would be the carrying value of X's Investment in Y at the end of 2021?

What would be the carrying value of X's Investment in Y at the end of 2021?

A) $100,000

B) $97,500

C) $98,800

D) $91,200

What would be the carrying value of X's Investment in Y at the end of 2021?

What would be the carrying value of X's Investment in Y at the end of 2021?A) $100,000

B) $97,500

C) $98,800

D) $91,200

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

32

If the investor sells part of its stake in an associate, accounted for using the equity method, which of the following is used to calculate the gain or loss on the sale of these shares?

A) The average carrying amount of the investment

B) The FIFO method

C) The LIFO method

D) The specific identification method

A) The average carrying amount of the investment

B) The FIFO method

C) The LIFO method

D) The specific identification method

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

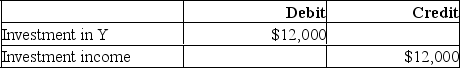

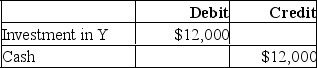

k this deck

33

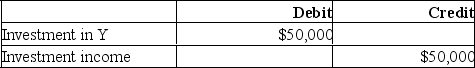

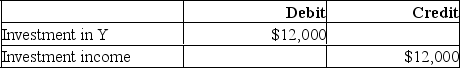

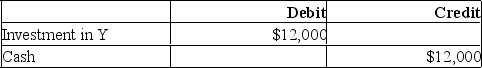

On January 1, 2019, X Inc. purchased 25% of the voting shares of Y Inc. for $100,000. The investment is reported using the equity method, as X has significant influence over Y. Y's net income and declared dividends for the following three years are as follows:

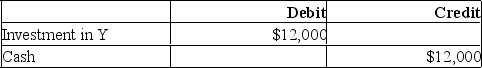

Which of the following journal entries would have to be made to record X's share of Y's net income for 2019?

A.

B.

C.

D. No entry requireD.Share of net income = $50,000 25% = $12,500.

Which of the following journal entries would have to be made to record X's share of Y's net income for 2019?

A.

B.

C.

D. No entry requireD.Share of net income = $50,000 25% = $12,500.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

34

How does the accounting for Other Comprehensive Income differ between the International Financial Reporting Standards (IFRS) and the Accounting Standards for Private Enterprises (ASPE)?

A) Under IFRS, realized gains are transferred from Other Comprehensive Income to net income when realized; under ASPE realized gains are transferred from Other Comprehensive Income directly to Retained Earnings.

B) Under ASPE, realized gains are transferred from Other Comprehensive Income to net income when realized; under IFRS realized gains are transferred from Other Comprehensive Income directly to Retained Earnings.

C) There is no difference between accounting for Other Comprehensive Income under IFRS and under ASPE.

D) The Accounting Standards for Private Enterprises do not recognize Other Comprehensive Income.

A) Under IFRS, realized gains are transferred from Other Comprehensive Income to net income when realized; under ASPE realized gains are transferred from Other Comprehensive Income directly to Retained Earnings.

B) Under ASPE, realized gains are transferred from Other Comprehensive Income to net income when realized; under IFRS realized gains are transferred from Other Comprehensive Income directly to Retained Earnings.

C) There is no difference between accounting for Other Comprehensive Income under IFRS and under ASPE.

D) The Accounting Standards for Private Enterprises do not recognize Other Comprehensive Income.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

35

On January 1, 2019, X Inc. purchased 25% of the voting shares of Y Inc. for $100,000. The investment is reported using the equity method, as X has significant influence over Y. Y's net income and declared dividends for the following three years are as follows:

Which of the following journal entries would have to be made to record X's share of Y's dividends paid for 2019?

A.

B.

C.

D. No entry requireD.Share of dividends = $20,000 25% = $5,000.

Which of the following journal entries would have to be made to record X's share of Y's dividends paid for 2019?

A.

B.

C.

D. No entry requireD.Share of dividends = $20,000 25% = $5,000.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

36

If an investment accounted for using the equity method suffers an impairment loss and the value in use of the investment subsequently recovers, what accounting entry should be made?

A) It may be revalued to fair value with the revaluation gain going to other comprehensive income, even if the recorded gain will exceed the original impairment loss.

B) It may be written up in value but not more than the amount of the impairment loss that was recorded at the time of impairment.

C) It may be revalued to fair value with the revaluation gain going to net income, even if the recorded gain will exceed the original impairment loss.

D) None; once an investment has been written down, it cannot subsequently be written up.

A) It may be revalued to fair value with the revaluation gain going to other comprehensive income, even if the recorded gain will exceed the original impairment loss.

B) It may be written up in value but not more than the amount of the impairment loss that was recorded at the time of impairment.

C) It may be revalued to fair value with the revaluation gain going to net income, even if the recorded gain will exceed the original impairment loss.

D) None; once an investment has been written down, it cannot subsequently be written up.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

37

If an investor is reporting in compliance with the International Financial Reporting Standards (IFRS) and has an investment with significant influence over the investee, what are the reporting requirements for the investor if the investment is in shares which are actively traded on an exchange?

A) The investment must be reported at fair value through profit and loss (FVTPL).

B) The investment must be reported at fair value through other comprehensive income (FVTOCI).

C) The investment must be reported using the equity method with the fair value disclosed in the notes to the financial statements.

D) The investment must be reported using the equity method; disclosure of the fair value of the investment is at the discretion of the investor.

A) The investment must be reported at fair value through profit and loss (FVTPL).

B) The investment must be reported at fair value through other comprehensive income (FVTOCI).

C) The investment must be reported using the equity method with the fair value disclosed in the notes to the financial statements.

D) The investment must be reported using the equity method; disclosure of the fair value of the investment is at the discretion of the investor.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

38

Posthorn Corporation acquired 20,000 of the 100,000 outstanding common shares of Stamp Company on January 1, 2019, for a cash consideration of $200,000. During 2019, Stamp Company had net income of $120,000 and paid dividends of $80,000. At the end of 2019, shares of Stamp Company were trading for $11 each. If Posthorn Corporation accounts for its investment in Stamp Company at fair value through profit or loss (FVTPL), what will the balance in the Investment in Stamp Company be at December 31, 2019?

A) $200,000

B) $208,000

C) $220,000

D) $240,000

A) $200,000

B) $208,000

C) $220,000

D) $240,000

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

39

On January 1, 2019, X Inc. purchased 25% of the voting shares of Y Inc. for $100,000. The investment is reported using the equity method, as X has significant influence over Y. Y's net income and declared dividends for the following three years are as follows:

Which of the following journal entries would have to be made to record X's share of Y's dividends paid for 2021?

A.

B.

C.

D. No entry requireD.Share of dividends = $60,000 25% = $15,000.

Which of the following journal entries would have to be made to record X's share of Y's dividends paid for 2021?

A.

B.

C.

D. No entry requireD.Share of dividends = $60,000 25% = $15,000.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

40

On January 1, 2019, X Inc. purchased 12% of the voting shares of Y Inc. for $100,000. The investment is reported at cost. X does not have significant influence over Y. Y's net income and declared dividends for the following three years are as follows:

Which of the following journal entries would have to be made to record X's share of Y's dividends paid for 2019?

A.

B.

C.

D. No entry requireD.Share of dividends = $20,000 12% = $2,400.

Which of the following journal entries would have to be made to record X's share of Y's dividends paid for 2019?

A.

B.

C.

D. No entry requireD.Share of dividends = $20,000 12% = $2,400.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

41

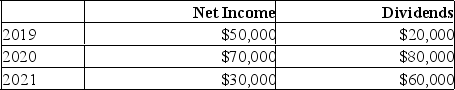

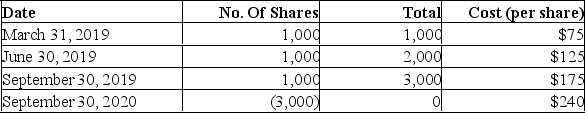

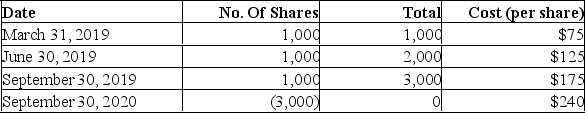

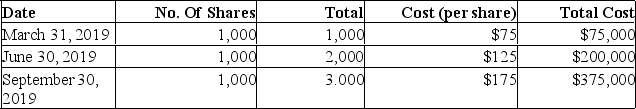

Telnor Corporation (whose year end is December 31 of each year) has made a series of investments in Pineapple Corp., one of their major customers. The management of Telnor has been impressed by the products produced and sold by Pineapple and their market success. These investments are only going to be held for a short period of time. The market price of Pineapple stock on December 31, 2019 and 2020 was $200 and $250 respectively per share. Dividends of $1.00 per share were declared and paid on December 31 of each year. The following are the purchases and sales that Telnor entered into in 2019 and 2020:

Assume that Telnor accounts for its investment in Pineapple Corp. at fair value through other comprehensive income (FVTOCI).

Assume that Telnor accounts for its investment in Pineapple Corp. at fair value through other comprehensive income (FVTOCI).

Required:

(a) Prepare the journal entries to record the transactions in 2019 and 2020 with respect to Telnor's investment in Pineapple.

(b) How would Telnor disclose the investment in Pineapple on its balance sheet?

Assume that Telnor accounts for its investment in Pineapple Corp. at fair value through other comprehensive income (FVTOCI).

Assume that Telnor accounts for its investment in Pineapple Corp. at fair value through other comprehensive income (FVTOCI).Required:

(a) Prepare the journal entries to record the transactions in 2019 and 2020 with respect to Telnor's investment in Pineapple.

(b) How would Telnor disclose the investment in Pineapple on its balance sheet?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

42

Posthorn Corporation acquired 20,000 of the 100,000 outstanding common shares of Stamp Company on January 1, 2019, for a cash consideration of $200,000. During 2019, Stamp Company had net income of $120,000 and paid dividends of $80,000. At the end of 2019, shares of Stamp Company were trading for $11 each. If Posthorn Corporation accounts for its investment in Stamp Company at fair value through other comprehensive income (FVTOCI), what will the balance in the Investment in Stamp Company be at December 31, 2019

A) $200,000

B) $208,000

C) $220,000

D) $240,000

A) $200,000

B) $208,000

C) $220,000

D) $240,000

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

43

Posthorn Corporation acquired 20,000 of the 100,000 outstanding common shares of Stamp Company on January 1, 2019, for a cash consideration of $200,000. During 2019, Stamp Company had net income of $120,000 and paid dividends of $80,000. At the end of 2019, shares of Stamp Company were trading for $11 each.

If Posthorn Corporation accounts for its investment in Stamp Company at fair value through other comprehensive income (FVTOCI), what entry will the company make to record the dividends received from Stamp Company for 2019?

A.

B.

C.

D. No entry requireD.$80,000 20% = $16,000.

If Posthorn Corporation accounts for its investment in Stamp Company at fair value through other comprehensive income (FVTOCI), what entry will the company make to record the dividends received from Stamp Company for 2019?

A.

B.

C.

D. No entry requireD.$80,000 20% = $16,000.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

44

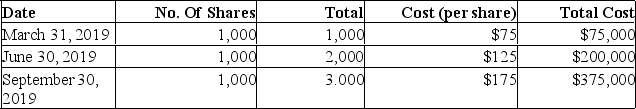

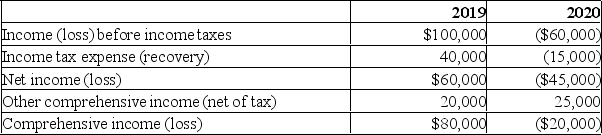

X purchased 40% of Y on January 1, 2019 for $400,000. Y paid dividends of $50,000 in each year. Y's income statements for 2019 and 2020 showed the following:

At December 31, 2019, the fair value of the investment was $440,000 and at December 31, 2020, the fair value of the investment was $420,000.

At December 31, 2019, the fair value of the investment was $440,000 and at December 31, 2020, the fair value of the investment was $420,000.

Required:

Prepare X's journal entries for 2019 and 2020, assuming that this is a significant influence investment.

At December 31, 2019, the fair value of the investment was $440,000 and at December 31, 2020, the fair value of the investment was $420,000.

At December 31, 2019, the fair value of the investment was $440,000 and at December 31, 2020, the fair value of the investment was $420,000.Required:

Prepare X's journal entries for 2019 and 2020, assuming that this is a significant influence investment.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

45

Posthorn Corporation acquired 20,000 of the 100,000 outstanding common shares of Stamp Company on January 1, 2019, for a cash consideration of $200,000. During 2019, Stamp Company had net income of $120,000 and paid dividends of $80,000. At the end of 2019, shares of Stamp Company were trading for $11 each.

If Posthorn Corporation accounts for its significant influence investment in Stamp Company using the cost method, what entry will the company make to record the dividends received from Stamp Company for 2019?

A.

B.

C.

D. No entry required.

If Posthorn Corporation accounts for its significant influence investment in Stamp Company using the cost method, what entry will the company make to record the dividends received from Stamp Company for 2019?

A.

B.

C.

D. No entry required.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

46

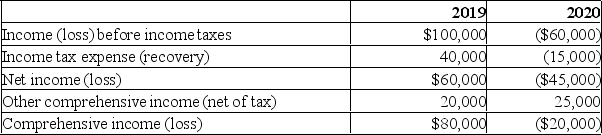

X purchased 40% of Y on January 1, 2019 for $400,000. Y paid dividends of $50,000 in each year. Y's income statements for 2019 and 2020 showed the following.

At December 31, 2019, the fair value of the investment was $440,000 and at December 31, 2020 the fair value of the investment was $420,000.

At December 31, 2019, the fair value of the investment was $440,000 and at December 31, 2020 the fair value of the investment was $420,000.

Required:

Prepare X's journal entries for 2019 and 2020, assuming that this is a non-strategic investment and is accounted for at fair value through profit and loss (FVTPL).

At December 31, 2019, the fair value of the investment was $440,000 and at December 31, 2020 the fair value of the investment was $420,000.

At December 31, 2019, the fair value of the investment was $440,000 and at December 31, 2020 the fair value of the investment was $420,000.Required:

Prepare X's journal entries for 2019 and 2020, assuming that this is a non-strategic investment and is accounted for at fair value through profit and loss (FVTPL).

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

47

Posthorn Corporation acquired 20,000 of the 100,000 outstanding common shares of Stamp Company on January 1, 2019, for a cash consideration of $200,000. During 2019, Stamp Company had net income of $120,000 and paid dividends of $80,000. At the end of 2019, shares of Stamp Company were trading for $11 each. If Posthorn Corporation accounts for its significant influence investment in Stamp Company using the equity method, what will the balance in the Investment in Stamp Company be at December 31, 2019?

A) $200,000

B) $208,000

C) $220,000

D) $240,000

A) $200,000

B) $208,000

C) $220,000

D) $240,000

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

48

Posthorn Corporation acquired 20,000 of the 100,000 outstanding common shares of Stamp Company on January 1, 2019, for a cash consideration of $200,000. During 2019, Stamp Company had net income of $120,000 and paid dividends of $80,000. At the end of 2019, shares of Stamp Company were trading for $11 each.

During 2020, Stamp Company had a loss of $60,000 and paid dividends of $40,000. Income for the first half of the year was $80,000 and the loss in the second half of the year was $140,000. The dividends were paid on June 30. On July 2, 2020, Posthorn Corporation sold 5,000 shares of Stamp Company for a consideration of $12 per share. At the end of 2020, the share price of Stamp Company had fallen to $6 per share. The average of market analysts' forecasts was that the share price could be expected to rise to $8 per share over the next five years. (Assume that the future recoverable value of the shares is assessed to be $8 per share.)

Required:

Provide journal entries for Posthorn Corporation for all transactions relating to its investment in Stamp Company for the year 2020 if it accounts for its investment in Stamp Company using the equity method.

During 2020, Stamp Company had a loss of $60,000 and paid dividends of $40,000. Income for the first half of the year was $80,000 and the loss in the second half of the year was $140,000. The dividends were paid on June 30. On July 2, 2020, Posthorn Corporation sold 5,000 shares of Stamp Company for a consideration of $12 per share. At the end of 2020, the share price of Stamp Company had fallen to $6 per share. The average of market analysts' forecasts was that the share price could be expected to rise to $8 per share over the next five years. (Assume that the future recoverable value of the shares is assessed to be $8 per share.)

Required:

Provide journal entries for Posthorn Corporation for all transactions relating to its investment in Stamp Company for the year 2020 if it accounts for its investment in Stamp Company using the equity method.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

49

On January 1, 2019, Joyce Inc. paid $600,000 to purchase 25% of Mark Inc's outstanding voting shares. Joyce has significant influence over Mark. Mark's earnings for 2019 and 2020 were $100,000 and $200,000 respectively. Mark declared and paid dividends in the amount of $20,000 and $10,000 during 2019 and 2020, respectively.

Required:

Calculate the balance in the Investment in Mark Inc. account as at December 31, 2020.

Required:

Calculate the balance in the Investment in Mark Inc. account as at December 31, 2020.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

50

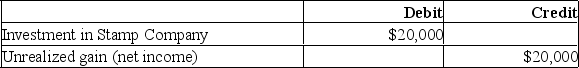

Posthorn Corporation acquired 20,000 of the 100,000 outstanding common shares of Stamp Company on January 1, 2019, for a cash consideration of $200,000. During 2019, Stamp Company had net income of $120,000 and paid dividends of $80,000. At the end of 2019, shares of Stamp Company were trading for $11 each.

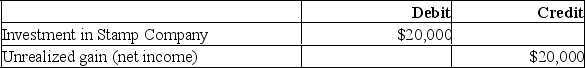

If Posthorn Corporation accounts for its investment in Stamp Company using the equity method, what entry will the company make to record the dividends received from Stamp Company for 2019?

A.

B.

C.

D. No entry requireD.$80,000 20% = $16,000.

If Posthorn Corporation accounts for its investment in Stamp Company using the equity method, what entry will the company make to record the dividends received from Stamp Company for 2019?

A.

B.

C.

D. No entry requireD.$80,000 20% = $16,000.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

51

Ronen Corporation owns 35% of the outstanding voting shares of Western Communications Inc. over which it exerts significant influence. The carrying value of its investment as at October 31, 2019 was $3,750,000. Ronen has now designated its investment in Western as fair value through profit or loss (FVTPL) as a result of the open market purchase of a 51% interest in Western by Overhaul Corp. Western is in financial distress. The market value of Ronen's 35% interest is now $2,000,000.

Required:

(a) What is the accounting result of a change from the equity method of accounting to FVTPL?

(b) Do any journal entries need to be recorded by Ronen as a result of this change? If so, what is the entry?

Required:

(a) What is the accounting result of a change from the equity method of accounting to FVTPL?

(b) Do any journal entries need to be recorded by Ronen as a result of this change? If so, what is the entry?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

52

Posthorn Corporation acquired 20,000 of the 100,000 outstanding common shares of Stamp Company on January 1, 2019, for a cash consideration of $200,000. During 2019, Stamp Company had net income of $120,000 and paid dividends of $80,000. At the end of 2019, shares of Stamp Company were trading for $11 each. If Posthorn Corporation accounts for its significant influence investment in Stamp Company using the cost method, what will the balance in the Investment in Stamp Company be at December 31, 2019?

A) $200,000

B) $208,000

C) $220,000

D) $240,000

A) $200,000

B) $208,000

C) $220,000

D) $240,000

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

53

Telnor Corporation (whose year end is December 31 of each year) has made a series of investments in Pineapple Corp., one of their major customers. The management of Telnor has been impressed by the products produced and sold by Pineapple and their market success. These investments are only going to be held for a short period of time. The market price of Pineapple stock on December 31, 2019 and 2020 was $200 and $250 respectively per share. Dividends of $1.00 per share were declared and paid on December 31 of each year. The following are the purchases and sales that Telnor entered into in 2019 and 2020:

Assume that Telnor accounts for its investment in Pineapple Corp. at fair value through profit and loss (FVTPL).

Required:

(a) Prepare the journal entries to record the transactions in 2019 and 2020 with respect to Telnor's investment in Pineapple.

(b) How would Telnor disclose the investment in Pineapple on its balance sheet?

Assume that Telnor accounts for its investment in Pineapple Corp. at fair value through profit and loss (FVTPL).

Required:

(a) Prepare the journal entries to record the transactions in 2019 and 2020 with respect to Telnor's investment in Pineapple.

(b) How would Telnor disclose the investment in Pineapple on its balance sheet?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

54

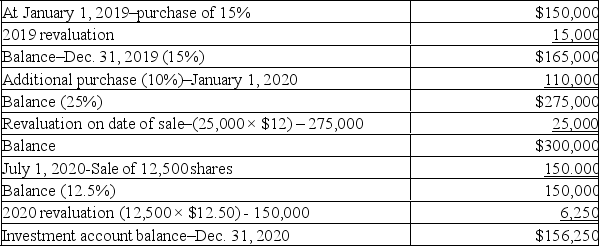

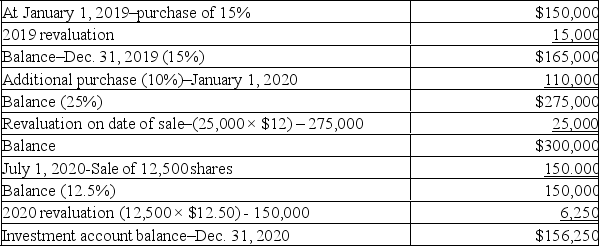

On January 1, 2019, Black Corporation purchased 15,000 of the 100,000 (15 per cent) outstanding shares of White Corporation for $498,000. From Black's perspective, White was a fair value through profit or loss (FVTPL) investment. The fair value of Black's investment was $520,000 at December 31, 2019.

On January 1, 2020, Black purchased an additional 30 per cent of White's shares for $1,040,000. The second share purchase allows Black to exert significant influence over White.

On January 1, 2020, Black purchased an additional 30 per cent of White's shares for $1,040,000. The second share purchase allows Black to exert significant influence over White.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

55

Posthorn Corporation acquired 20,000 of the 100,000 outstanding common shares of Stamp Company on January 1, 2019, for a cash consideration of $200,000. During 2019, Stamp Company had net income of $120,000 and paid dividends of $80,000. At the end of 2019, shares of Stamp Company were trading for $11 each. Posthorn has a December 31 year end for all years.

During 2020, Stamp Company had a loss of $60,000 and paid dividends of $40,000. Income for the first half of the year was $80,000 and the loss in the second half of the year was $140,000. The dividends were paid on June 30. On July 2, 2020, Posthorn Corporation sold 5,000 shares of Stamp Company for a consideration of $12 per share. At the end of 2020, the share price of Stamp Company had fallen to $6 per share. The average of market analysts' forecasts was that the share price could be expected to rise to $8 per share over the next five years. (Assume that the future recoverable value of the shares is assessed to be $8 per share.)

Required:

Provide journal entries for Posthorn Corporation for all transactions relating to its investment in Stamp Company for the year 2020 if it accounts for its investment in Stamp Company as a fair value through profit and loss investment (FVTPL).

During 2020, Stamp Company had a loss of $60,000 and paid dividends of $40,000. Income for the first half of the year was $80,000 and the loss in the second half of the year was $140,000. The dividends were paid on June 30. On July 2, 2020, Posthorn Corporation sold 5,000 shares of Stamp Company for a consideration of $12 per share. At the end of 2020, the share price of Stamp Company had fallen to $6 per share. The average of market analysts' forecasts was that the share price could be expected to rise to $8 per share over the next five years. (Assume that the future recoverable value of the shares is assessed to be $8 per share.)

Required:

Provide journal entries for Posthorn Corporation for all transactions relating to its investment in Stamp Company for the year 2020 if it accounts for its investment in Stamp Company as a fair value through profit and loss investment (FVTPL).

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

56

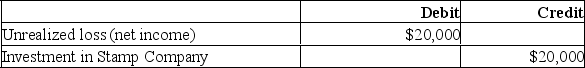

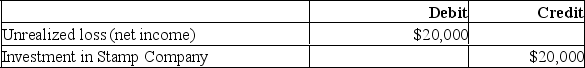

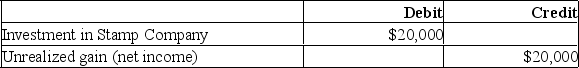

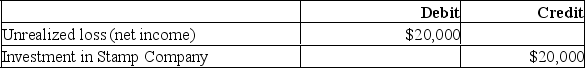

Posthorn Corporation acquired 20,000 of the 100,000 outstanding common shares of Stamp Company on January 1, 2019, for a cash consideration of $200,000. During 2019, Stamp Company had net income of $120,000 and paid dividends of $80,000. At the end of 2019, shares of Stamp Company were trading for $11 each. If Posthorn Corporation accounts for its significant influence investment in Stamp Company using the equity method, what entry will the company make to record the revaluation of the investment at December 31, 2019?

A)

B)

C)

D) No entry required.

A)

B)

C)

D) No entry required.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

57

In the situation where an investor's share of an associate's losses exceeds the carrying amount of the investment, which of the following is a true statement?

A) After the investor's interest is reduced to zero, any additional losses will, on a pro-rata basis, reduce the value of other investments the investor may have in the associate.

B) After the investor's interest is reduced to zero, any additional losses will be recognized as a gain.

C) After the investor's interest is reduced to zero, any additional losses will reduce any existing trade receivables, trade payables or any long-term receivables for which adequate collateral exists.

D) After the investor's interest is reduced to zero, any additional losses will be recognized as a liability to the extent the investor has legal obligations on behalf of the associate.

A) After the investor's interest is reduced to zero, any additional losses will, on a pro-rata basis, reduce the value of other investments the investor may have in the associate.

B) After the investor's interest is reduced to zero, any additional losses will be recognized as a gain.

C) After the investor's interest is reduced to zero, any additional losses will reduce any existing trade receivables, trade payables or any long-term receivables for which adequate collateral exists.

D) After the investor's interest is reduced to zero, any additional losses will be recognized as a liability to the extent the investor has legal obligations on behalf of the associate.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

58

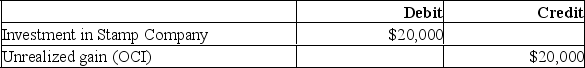

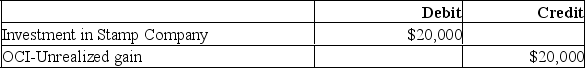

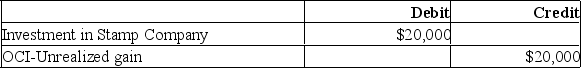

Posthorn Corporation acquired 20,000 of the 100,000 outstanding common shares of Stamp Company on January 1, 2019, for a cash consideration of $200,000. During 2019, Stamp Company had net income of $120,000 and paid dividends of $80,000. At the end of 2019, shares of Stamp Company were trading for $11 each.

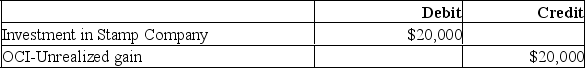

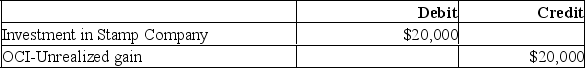

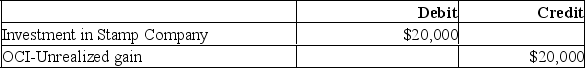

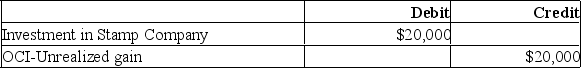

If Posthorn Corporation accounts for its investment in Stamp Company at fair value through other comprehensive income (FVTOCI), what entry will the company make to record the revaluation of the investment at December 31, 2019?

A.

B.

C.

D. No entry requireD.

If Posthorn Corporation accounts for its investment in Stamp Company at fair value through other comprehensive income (FVTOCI), what entry will the company make to record the revaluation of the investment at December 31, 2019?

A.

B.

C.

D. No entry requireD.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

59

Posthorn Corporation acquired 20,000 of the 100,000 outstanding common shares of Stamp Company on January 1, 2019, for a cash consideration of $200,000. During 2019, Stamp Company had net income of $120,000 and paid dividends of $80,000. At the end of 2019, shares of Stamp Company were trading for $11 each. If Posthorn Corporation accounts for its significant influence investment in Stamp Company using the cost method, what entry will the company make to record the revaluation of the investment at December 31, 2019?

A)

B)

C)

D) No entry required.

A)

B)

C)

D) No entry required.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

60

Dragon Corporation acquired a 7% interest in the outstanding shares of Slayer Inc. on January 1, 2019 at a cost of $200,000. Dragon Corporation was a private company and reported in compliance with the Accounting Standards for Private Enterprises (ASPE) and accounted for Slayer Inc., whose shares were not publicly traded, using the cost method. Slayer reported net income and made dividend payments to its shareholders as noted below. On December 31, 2021 Slayer declared bankruptcy as a result of a series of losses as noted.

Required:

Required:

(a) Prepare the journal entries that Dragon would make in 2019, 2020 and 2021.

(b) Prepare the general ledger account for Dragon's investment in Slayer at all relevant dates.

Required:

Required:(a) Prepare the journal entries that Dragon would make in 2019, 2020 and 2021.

(b) Prepare the general ledger account for Dragon's investment in Slayer at all relevant dates.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

61

Required:

Prepare dated journal entries for Ocean Enterprises for 2020 to account for its investment in Zebrafish and any related income therefrom.

Prepare dated journal entries for Ocean Enterprises for 2020 to account for its investment in Zebrafish and any related income therefrom.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

62

One of the changes introduced in IFRS 9 Financial Instruments was that realized gains on investments valued at fair value with revaluations through other comprehensive income were to be taken to retained earnings without being recycled through net income. Briefly explain how this eliminated one possible method of earnings management that previously allowed companies discretion in managing net income.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

63

Required:

Prepare dated journal entries for Ocean Enterprises for 2020 to account for its investment in Zebrafish and any related income therefrom.

Prepare dated journal entries for Ocean Enterprises for 2020 to account for its investment in Zebrafish and any related income therefrom.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

64

Required:

Prepare dated journal entries for Ocean Enterprises for 2019 to account for its investment in Zebrafish and any related income therefrom.

Prepare dated journal entries for Ocean Enterprises for 2019 to account for its investment in Zebrafish and any related income therefrom.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck