Deck 6: Intercompany Inventory and Land Profits

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/64

Play

Full screen (f)

Deck 6: Intercompany Inventory and Land Profits

1

If a parent company borrows money at an interest rate of six percent from its subsidiary, what effect (if any) will this have on the non-controlling interest?

A) This would have no effect on the non-controlling interest.

B) The subsidiary would book its pro-rata share of any interest revenue.

C) The non-controlling interest balance would be reduced by the amount of the loan.

D) The subsidiary would record any interest revenue as an extraordinary gain.

A) This would have no effect on the non-controlling interest.

B) The subsidiary would book its pro-rata share of any interest revenue.

C) The non-controlling interest balance would be reduced by the amount of the loan.

D) The subsidiary would record any interest revenue as an extraordinary gain.

A

2

Under which of the following consolidation methods would the elimination of only the parent's share of any intercompany profits be required for the preparation of consolidated financial statements?

A) Parent company method

B) Fair value enterprise method

C) Proportionate consolidation method

D) Identifiable net asset method

A) Parent company method

B) Fair value enterprise method

C) Proportionate consolidation method

D) Identifiable net asset method

C

3

X Inc. owns 80% of Y Inc. During 2020, X Inc. sold inventory to Y for $10,000. Half of this inventory remained in Y's warehouse at year end.

Y Inc. sold inventory to X Inc. for $5,000. 40% of this inventory remained in X's warehouse at year end.

Both companies are subject to a tax rate of 40%. The gross profit percentage on sales is 20% for both companies. Unless otherwise stated, assume X Inc. uses the cost method to account for its investment in Y Inc.

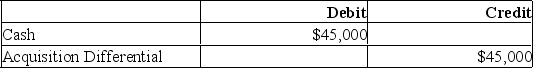

What would be the journal entry to eliminate any unrealized profits from the consolidated financial statements during the year?

A)

B)

C)

Y Inc. sold inventory to X Inc. for $5,000. 40% of this inventory remained in X's warehouse at year end.

Both companies are subject to a tax rate of 40%. The gross profit percentage on sales is 20% for both companies. Unless otherwise stated, assume X Inc. uses the cost method to account for its investment in Y Inc.

What would be the journal entry to eliminate any unrealized profits from the consolidated financial statements during the year?

A)

B)

C)

4

Which of the following statements best describes the required accounting treatment with respect to income taxes on unrealized intercompany profits?

A) These taxes can be ignored since an increase in income tax expense for one company is offset by an equivalent reduction in income tax expense for the other.

B) They would be recognized as assets for the purchasing entity and liabilities for the selling entity.

C) The income tax will be expensed when the profit is realized in accordance with the matching principle.

D) They would be charged to retained earnings during the preparation of financial statements.

A) These taxes can be ignored since an increase in income tax expense for one company is offset by an equivalent reduction in income tax expense for the other.

B) They would be recognized as assets for the purchasing entity and liabilities for the selling entity.

C) The income tax will be expensed when the profit is realized in accordance with the matching principle.

D) They would be charged to retained earnings during the preparation of financial statements.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

5

X Inc. owns 80% of Y Inc. During 2020, X Inc. sold inventory to Y for $10,000. Half of this inventory remained in Y's warehouse at year end. Y Inc. sold inventory to X Inc. for $5,000. 40% of this inventory remained in X's warehouse at year end.

Both companies are subject to a tax rate of 40%. The gross profit percentage on sales is 20% for both companies. Unless otherwise stated, assume X Inc. uses the cost method to account for its investment in Y Inc.

Assuming that X Inc. used the equity method instead of the cost method, what adjustment would have to be made to the investment in Y account to adjust for any unrealized profits on Y's sales to X?

A) No adjustment would be required.

B) The account would have to be reduced by $240.

C) The account would have to be reduced by $192.

D) The account would have to be reduced by $48.Decrease in investment account = $192 = $240 unrealized after-tax profit 80% Controlling Interest ownership.

Both companies are subject to a tax rate of 40%. The gross profit percentage on sales is 20% for both companies. Unless otherwise stated, assume X Inc. uses the cost method to account for its investment in Y Inc.

Assuming that X Inc. used the equity method instead of the cost method, what adjustment would have to be made to the investment in Y account to adjust for any unrealized profits on Y's sales to X?

A) No adjustment would be required.

B) The account would have to be reduced by $240.

C) The account would have to be reduced by $192.

D) The account would have to be reduced by $48.Decrease in investment account = $192 = $240 unrealized after-tax profit 80% Controlling Interest ownership.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

6

X Inc. owns 80% of Y Inc. During 2020, X Inc. sold inventory to Y for $10,000. Half of this inventory remained in Y's warehouse at year end. Y Inc. sold inventory to X Inc. for $5,000. 40% of this inventory remained in X's warehouse at year end.

Both companies are subject to a tax rate of 40%. The gross profit percentage on sales is 20% for both companies. Unless otherwise stated, assume X Inc. uses the cost method to account for its investment in Y Inc.

What is the after-tax dollar value of X's realized profits during the year on its sales to Y?

A) $2,000

B) $1,000

C) $600

D) $400

Both companies are subject to a tax rate of 40%. The gross profit percentage on sales is 20% for both companies. Unless otherwise stated, assume X Inc. uses the cost method to account for its investment in Y Inc.

What is the after-tax dollar value of X's realized profits during the year on its sales to Y?

A) $2,000

B) $1,000

C) $600

D) $400

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

7

What effect will the rent of $10,000 charged by the Subsidiary to the Parent Company have on the calculation of the non-controlling interest in the net income of the Subsidiary? The Parent Company owns 80% of the Subsidiary.

A) The non-controlling interest will decrease by $10,000.

B) The non-controlling interest will decrease by $8,000.

C) There is no effect on the non-controlling interest.

D) The non-controlling interest will increase by $10,000.

A) The non-controlling interest will decrease by $10,000.

B) The non-controlling interest will decrease by $8,000.

C) There is no effect on the non-controlling interest.

D) The non-controlling interest will increase by $10,000.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

8

Kho Inc. purchased 90% of the voting shares of Lan Inc. for $600,000 on January 1, 2019. On that date, Lan's common shares and retained earnings were valued at $200,000 and $250,000 respectively. Unless otherwise stated, assume that Kho uses the cost method to account for its investment in Lan Inc. Lan's fair values approximated its carrying values with the following exceptions:

Lan's trademark had a fair value which was $50,000 higher than its carrying value.

Lan's bonds payable had a fair value which was $20,000 higher than their carrying value.

The trademark had a useful life of exactly ten years remaining from the date of acquisition. The bonds payable mature on January 1, 2029. Both companies use straight line amortization exclusively.

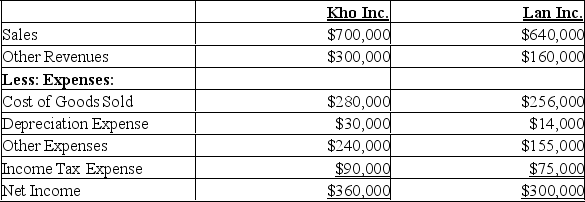

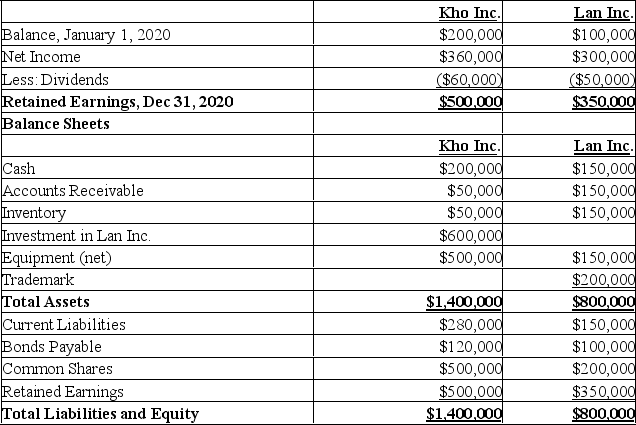

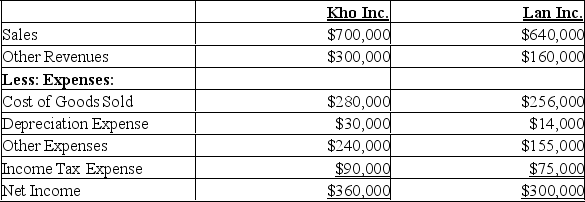

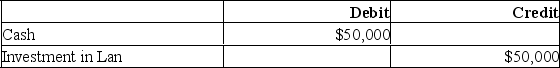

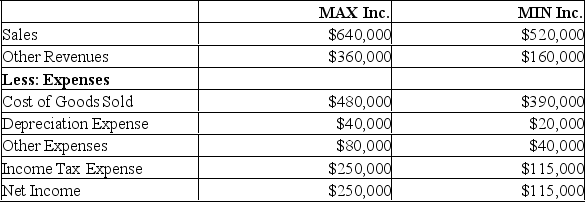

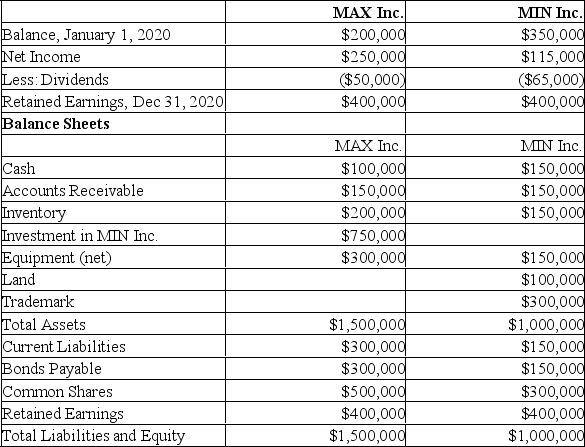

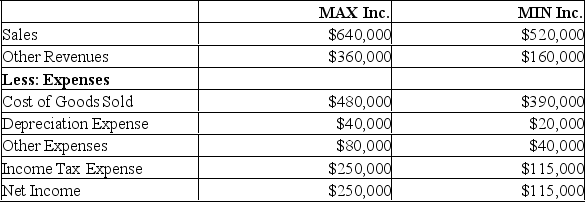

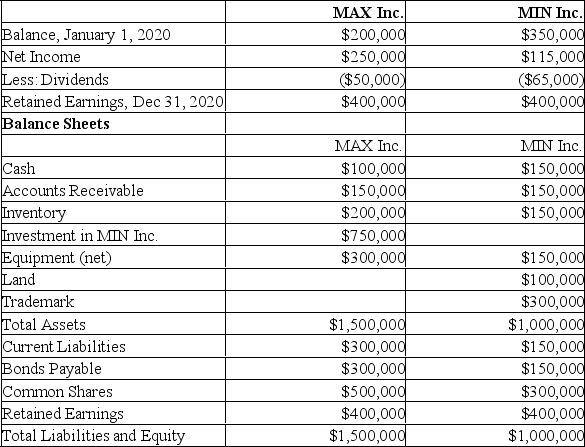

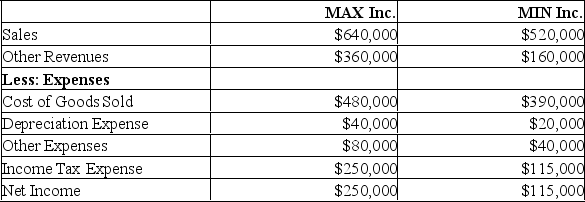

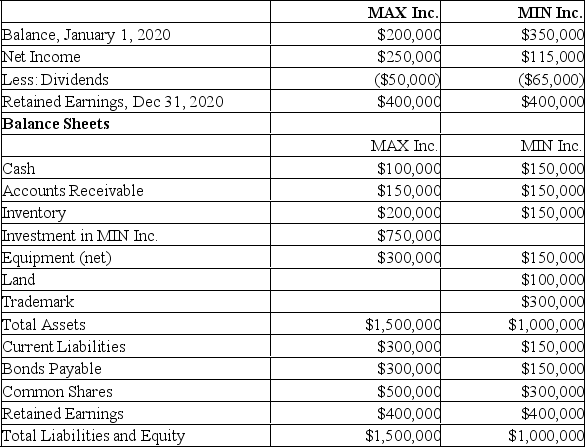

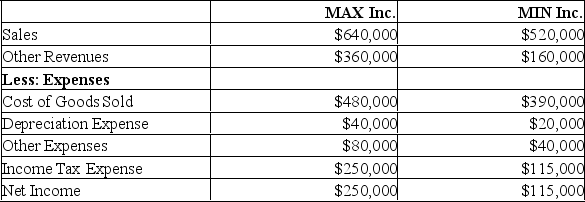

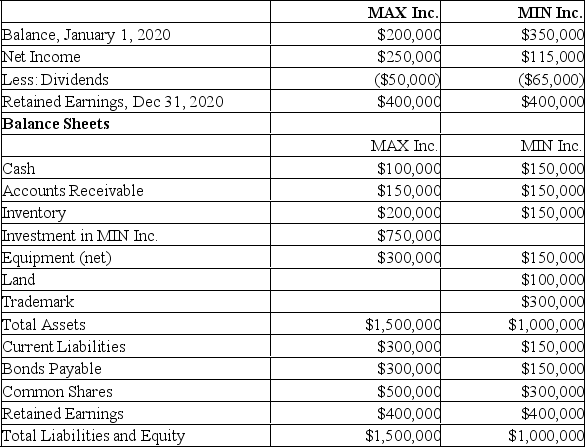

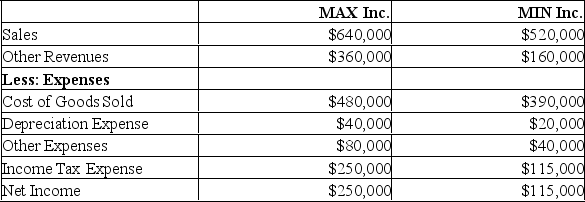

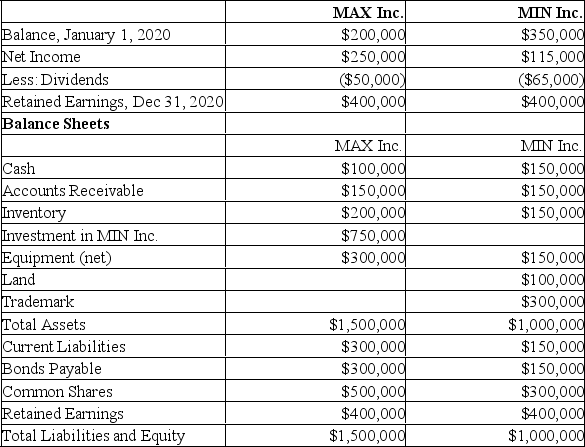

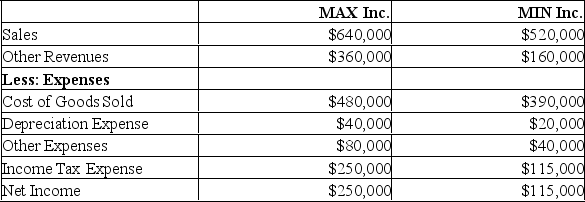

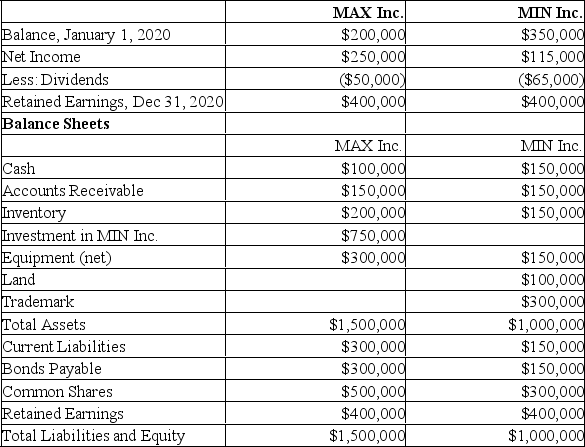

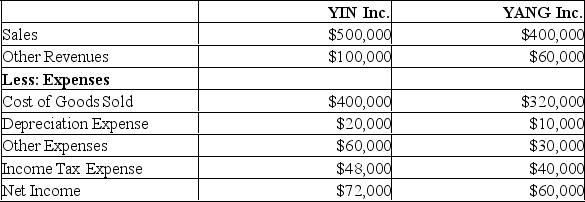

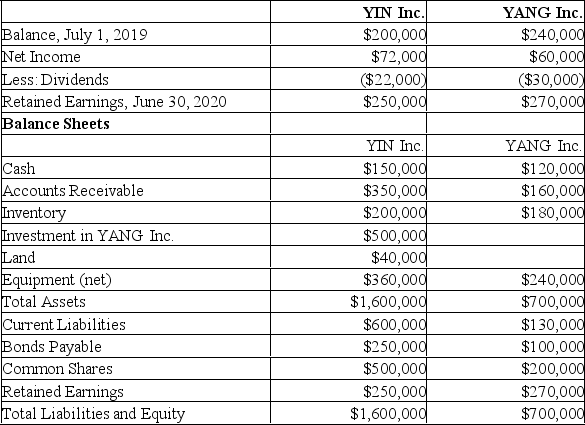

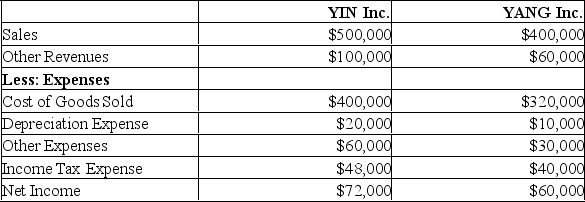

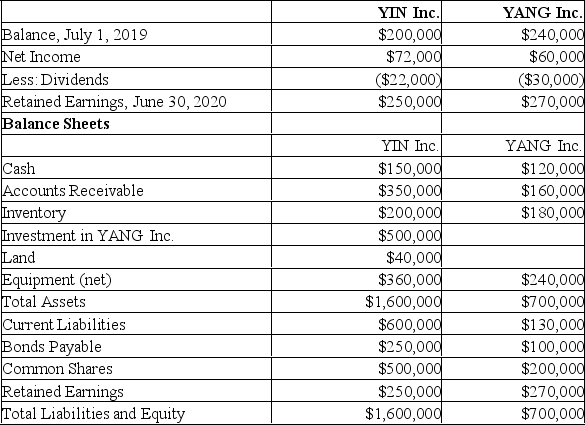

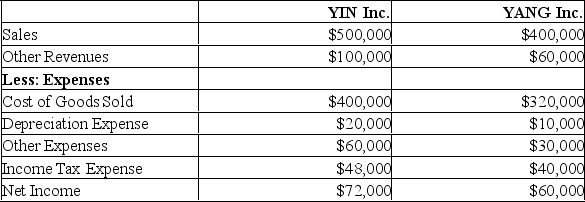

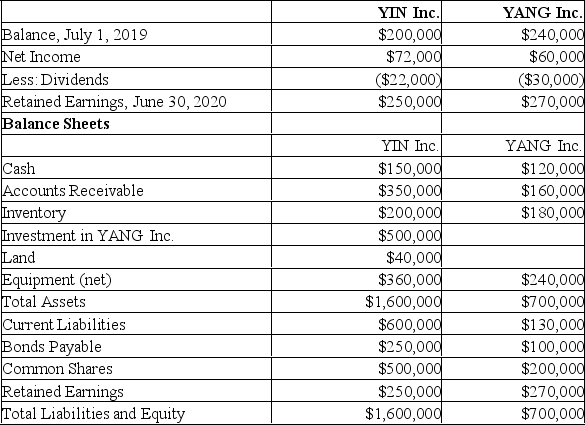

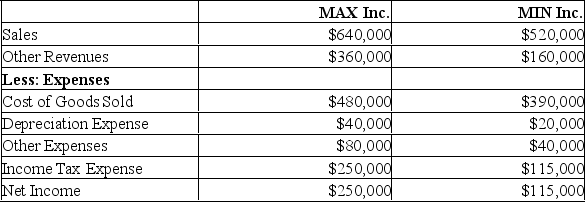

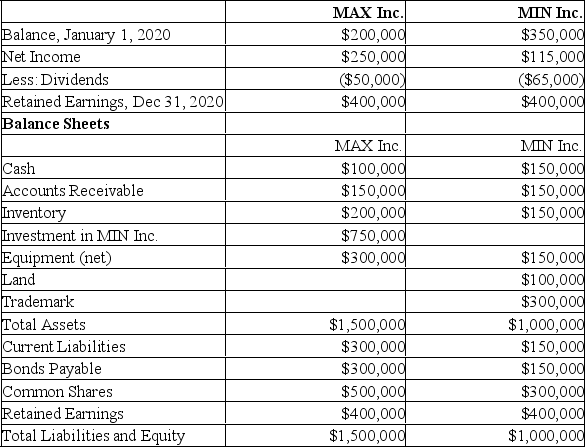

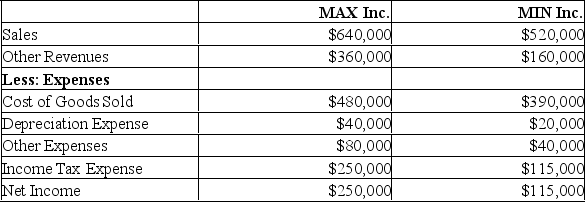

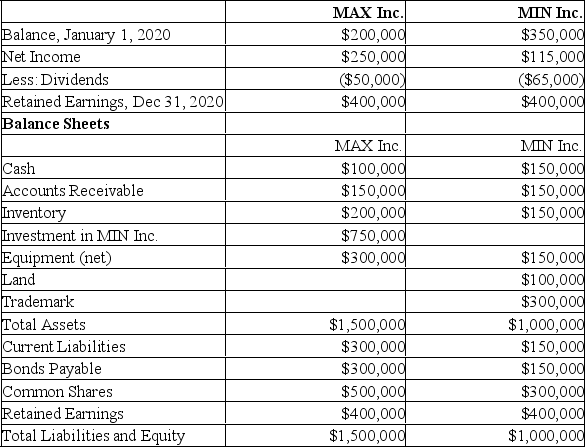

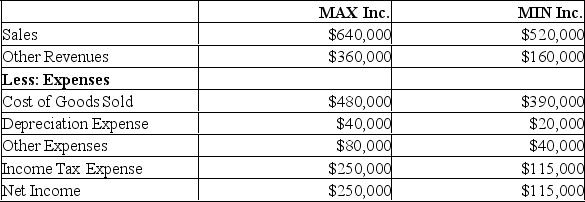

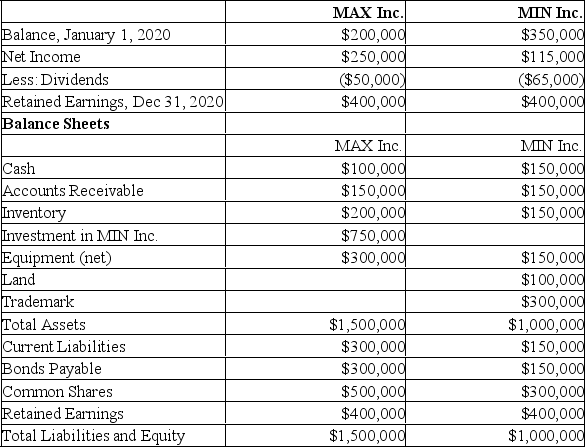

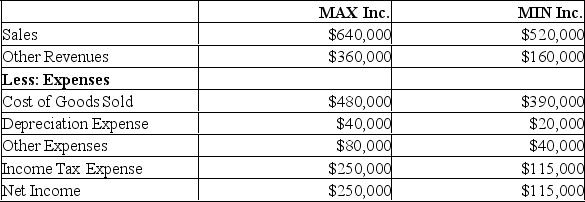

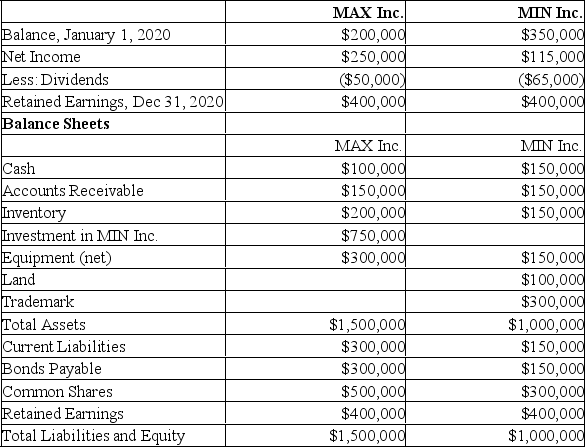

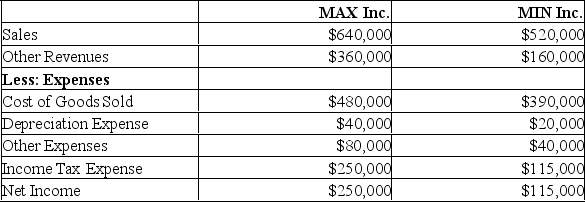

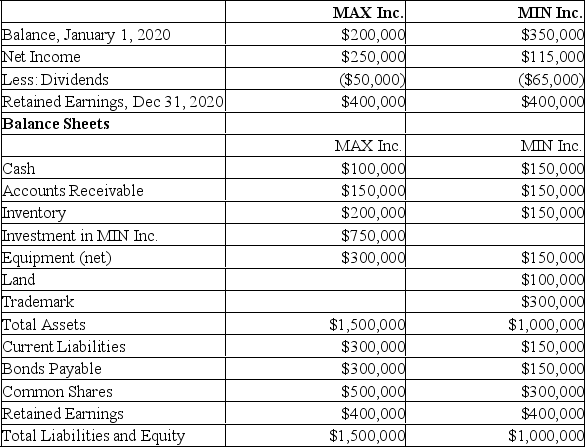

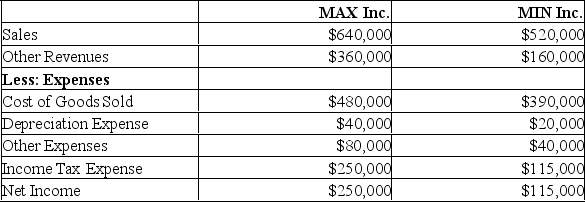

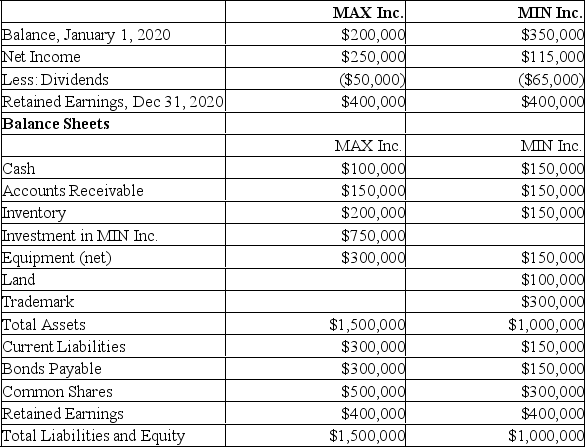

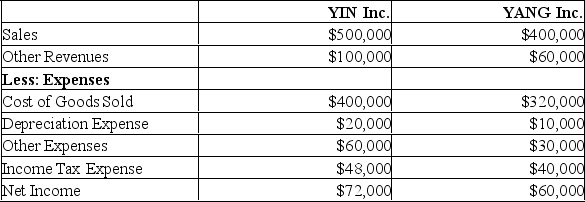

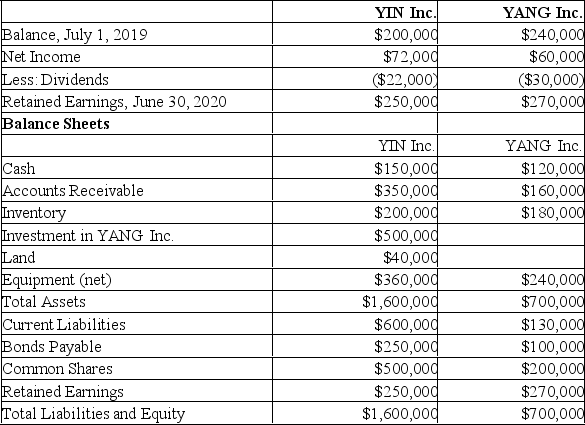

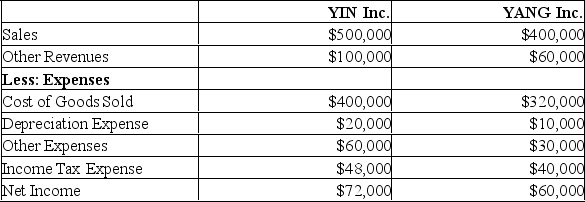

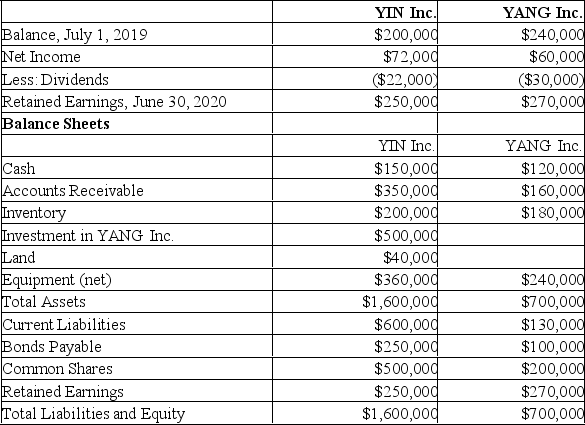

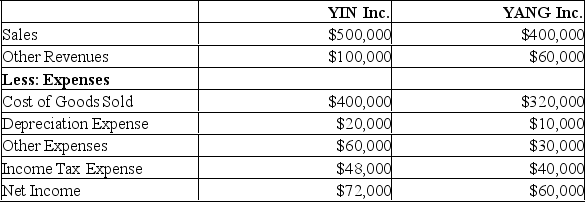

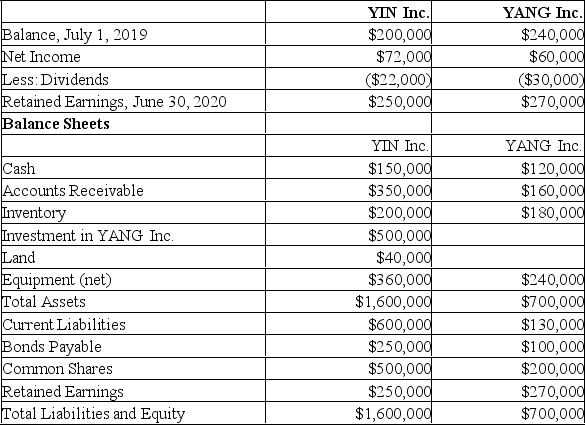

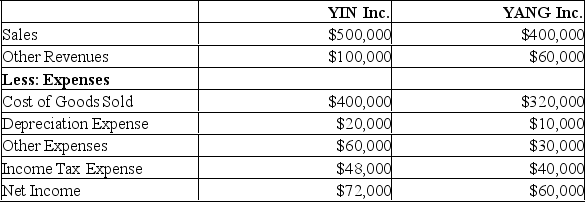

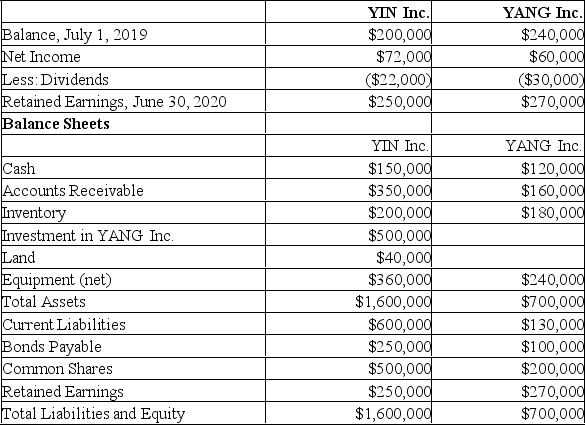

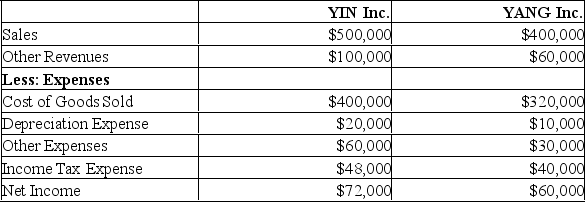

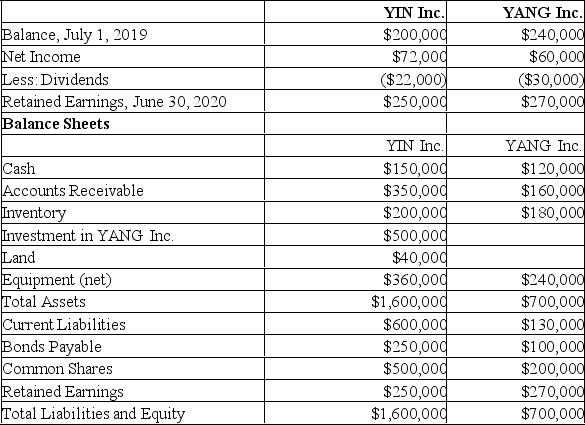

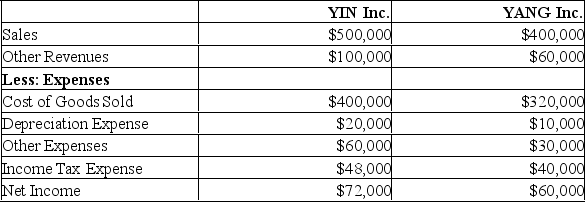

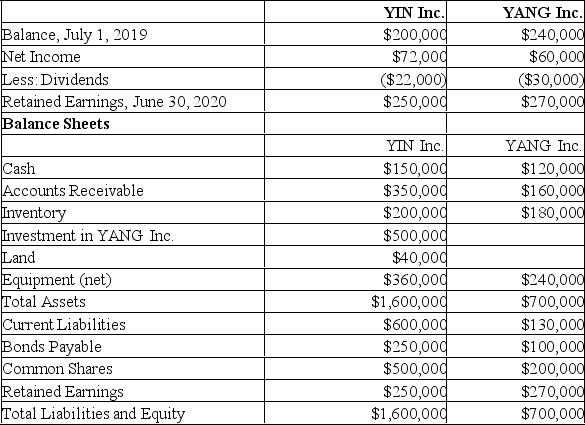

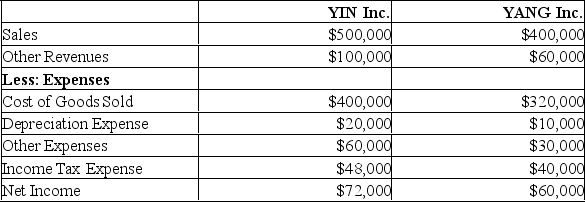

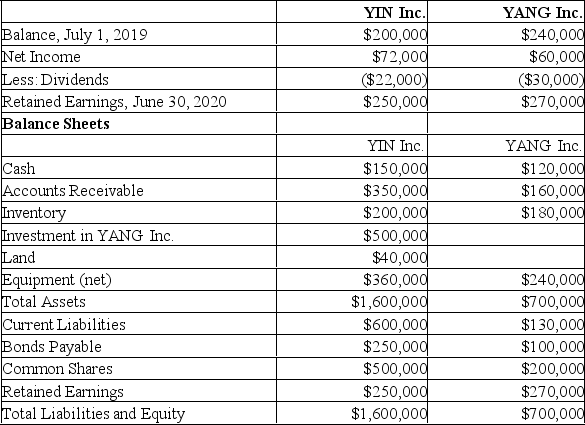

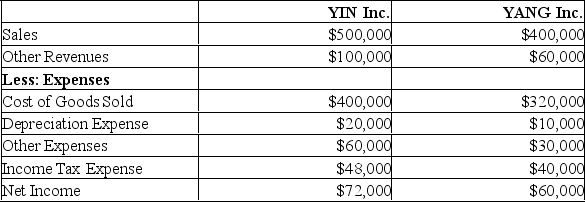

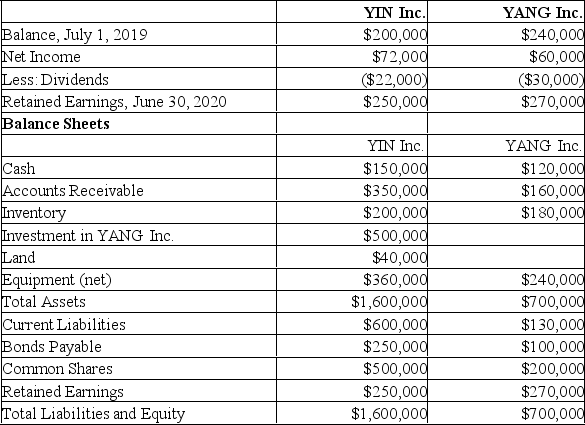

The financial statements of both companies for the year ended December 31, 2020 are shown below:

Income Statements

Retained Earnings Statements

Since Kho acquired Lan, Kho has charged Lan an annual management fee of $30,000. Lan has paid Kho for the management services on December 31st of each year.

What would be the amount of other revenue appearing on Kho Inc.'s consolidated income statement for the year ended December 31, 2020?

A) $385,000

B) $415,000

C) $388,000

D) $460,000

Lan's trademark had a fair value which was $50,000 higher than its carrying value.

Lan's bonds payable had a fair value which was $20,000 higher than their carrying value.

The trademark had a useful life of exactly ten years remaining from the date of acquisition. The bonds payable mature on January 1, 2029. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2020 are shown below:

Income Statements

Retained Earnings Statements

Since Kho acquired Lan, Kho has charged Lan an annual management fee of $30,000. Lan has paid Kho for the management services on December 31st of each year.

What would be the amount of other revenue appearing on Kho Inc.'s consolidated income statement for the year ended December 31, 2020?

A) $385,000

B) $415,000

C) $388,000

D) $460,000

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

9

Kho Inc. purchased 90% of the voting shares of Lan Inc. for $600,000 on January 1, 2019. On that date, Lan's common shares and retained earnings were valued at $200,000 and $250,000 respectively. Unless otherwise stated, assume that Kho uses the cost method to account for its investment in Lan Inc. Lan's fair values approximated its carrying values with the following exceptions:

Lan's trademark had a fair value which was $50,000 higher than its carrying value.

Lan's bonds payable had a fair value which was $20,000 higher than their carrying value.

The trademark had a useful life of exactly ten years remaining from the date of acquisition. The bonds payable mature on January 1, 2029. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2020 are shown below:

Income Statements

Retained Earnings Statements

Other Information:

A goodwill impairment test conducted during August 2020 revealed that the Lan's Goodwill amount on the date of acquisition had been impaired by $10,000.

During 2019, Kho sold $50,000 worth of inventory to Lan, half of which was sold to outsiders during the year. During 2020, Kho sold inventory to Lan for $90,000. Two-thirds of this inventory was resold by Lan to outside parties.

During 2019, Lan sold $30,000 worth of inventory to Kho, 80% of which was sold to outsiders during the year. During 2020, Lan sold inventory to Kho for $40,000. 75% of this inventory was resold by Kho to outside parties. As of December 31, 2020, Kho still owes $20,000 to Lan for the inventory.

All intercompany sales as well as sales to outsiders earn a gross margin on sales of 20%. The effective tax rate for both companies is 20%.

Since Kho acquired Lan, Kho has charged Lan an annual management fee of $30,000. Lan has paid Kho for the management services on December 31st of each year.

What amount of sales revenue would appear on Kho Inc.'s consolidated income statement for the year ended December 31, 2020?

A) $1,210,000

B) $1,276,000

C) $1,340,000

D) $1,400,000

Lan's trademark had a fair value which was $50,000 higher than its carrying value.

Lan's bonds payable had a fair value which was $20,000 higher than their carrying value.

The trademark had a useful life of exactly ten years remaining from the date of acquisition. The bonds payable mature on January 1, 2029. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2020 are shown below:

Income Statements

Retained Earnings Statements

Other Information:

A goodwill impairment test conducted during August 2020 revealed that the Lan's Goodwill amount on the date of acquisition had been impaired by $10,000.

During 2019, Kho sold $50,000 worth of inventory to Lan, half of which was sold to outsiders during the year. During 2020, Kho sold inventory to Lan for $90,000. Two-thirds of this inventory was resold by Lan to outside parties.

During 2019, Lan sold $30,000 worth of inventory to Kho, 80% of which was sold to outsiders during the year. During 2020, Lan sold inventory to Kho for $40,000. 75% of this inventory was resold by Kho to outside parties. As of December 31, 2020, Kho still owes $20,000 to Lan for the inventory.

All intercompany sales as well as sales to outsiders earn a gross margin on sales of 20%. The effective tax rate for both companies is 20%.

Since Kho acquired Lan, Kho has charged Lan an annual management fee of $30,000. Lan has paid Kho for the management services on December 31st of each year.

What amount of sales revenue would appear on Kho Inc.'s consolidated income statement for the year ended December 31, 2020?

A) $1,210,000

B) $1,276,000

C) $1,340,000

D) $1,400,000

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

10

X Inc. owns 80% of Y Inc. During 2020, X Inc. sold inventory to Y for $10,000. Half of this inventory remained in Y's warehouse at year end. Y Inc. sold inventory to X Inc. for $5,000. 40% of this inventory remained in X's warehouse at year end.

Both companies are subject to a tax rate of 40%. The gross profit percentage on sales is 20% for both companies. Unless otherwise stated, assume X Inc. uses the cost method to account for its investment in Y Inc.

What is the after-tax dollar value of Y's realized profits during the year on its sales to X?

A) $240

B) $360

C) $400

D) $500

Both companies are subject to a tax rate of 40%. The gross profit percentage on sales is 20% for both companies. Unless otherwise stated, assume X Inc. uses the cost method to account for its investment in Y Inc.

What is the after-tax dollar value of Y's realized profits during the year on its sales to X?

A) $240

B) $360

C) $400

D) $500

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

11

Intercompany profits on sales of inventory are only realized:

A) once the seller receives payment for the sale.

B) once the inventory has been sold to outsiders.

C) when the inventory has been received by the purchaser.

D) when the inventory has been shipped to the purchaser.

A) once the seller receives payment for the sale.

B) once the inventory has been sold to outsiders.

C) when the inventory has been received by the purchaser.

D) when the inventory has been shipped to the purchaser.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

12

How would any management fees charged by a Parent Company to its Subsidiary be accounted for during the consolidation process?

A) The Parent Company would only record its pro rata share of any management revenues.

B) The Parent Company's profit on the rendering of management services would be charged to retained earnings.

C) Both the Parent's management fees and the subsidiary's related expense would be eliminated when preparing Consolidated Financial Statements.

D) No special accounting treatment is required, since this would have no effect on Consolidated Net Income.

A) The Parent Company would only record its pro rata share of any management revenues.

B) The Parent Company's profit on the rendering of management services would be charged to retained earnings.

C) Both the Parent's management fees and the subsidiary's related expense would be eliminated when preparing Consolidated Financial Statements.

D) No special accounting treatment is required, since this would have no effect on Consolidated Net Income.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

13

Kho Inc. purchased 90% of the voting shares of Lan Inc. for $600,000 on January 1, 2019. On that date, Lan's common shares and retained earnings were valued at $200,000 and $250,000 respectively. Unless otherwise stated, assume that Kho uses the cost method to account for its investment in Lan Inc. Lan's fair values approximated its carrying values with the following exceptions:

Lan's trademark had a fair value which was $50,000 higher than its carrying value.

Lan's bonds payable had a fair value which was $20,000 higher than their carrying value.

The trademark had a useful life of exactly ten years remaining from the date of acquisition. The bonds payable mature on January 1, 2029. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2020 are shown below:

Income Statements

Retained Earnings Statements

Other Information:

A goodwill impairment test conducted during August 2020 revealed that the Lan's Goodwill amount on the date of acquisition had been impaired by $10,000.

During 2019, Kho sold $50,000 worth of inventory to Lan, half of which was sold to outsiders during the year. During 2020, Kho sold inventory to Lan for $90,000. Two-thirds of this inventory was resold by Lan to outside parties.

During 2019, Lan sold $30,000 worth of inventory to Kho, 80% of which was sold to outsiders during the year. During 2020, Lan sold inventory to Kho for $40,000. 75% of this inventory was resold by Kho to outside parties. As of December 31, 2020, Kho still owes $20,000 to Lan for the inventory.

All intercompany sales as well as sales to outsiders earn a gross margin on sales of 20%. The effective tax rate for both companies is 20%.

Since Kho acquired Lan, Kho has charged Lan an annual management fee of $30,000. Lan has paid Kho for the management services on December 31st of each year.

What is the amount of goodwill arising from this business combination on acquisition date?

A) $(180,000)

B) $120,000

C) $168,000

D) $186,667

Lan's trademark had a fair value which was $50,000 higher than its carrying value.

Lan's bonds payable had a fair value which was $20,000 higher than their carrying value.

The trademark had a useful life of exactly ten years remaining from the date of acquisition. The bonds payable mature on January 1, 2029. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2020 are shown below:

Income Statements

Retained Earnings Statements

Other Information:

A goodwill impairment test conducted during August 2020 revealed that the Lan's Goodwill amount on the date of acquisition had been impaired by $10,000.

During 2019, Kho sold $50,000 worth of inventory to Lan, half of which was sold to outsiders during the year. During 2020, Kho sold inventory to Lan for $90,000. Two-thirds of this inventory was resold by Lan to outside parties.

During 2019, Lan sold $30,000 worth of inventory to Kho, 80% of which was sold to outsiders during the year. During 2020, Lan sold inventory to Kho for $40,000. 75% of this inventory was resold by Kho to outside parties. As of December 31, 2020, Kho still owes $20,000 to Lan for the inventory.

All intercompany sales as well as sales to outsiders earn a gross margin on sales of 20%. The effective tax rate for both companies is 20%.

Since Kho acquired Lan, Kho has charged Lan an annual management fee of $30,000. Lan has paid Kho for the management services on December 31st of each year.

What is the amount of goodwill arising from this business combination on acquisition date?

A) $(180,000)

B) $120,000

C) $168,000

D) $186,667

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

14

X Inc. owns 80% of Y Inc. During 2020, X Inc. sold inventory to Y for $10,000. Half of this inventory remained in Y's warehouse at year end. Y Inc. sold inventory to X Inc. for $5,000. 40% of this inventory remained in X's warehouse at year end.

Both companies are subject to a tax rate of 40%. The gross profit percentage on sales is 20% for both companies. Unless otherwise stated, assume X Inc. uses the cost method to account for its investment in Y Inc.

What is the after-tax dollar value of Y's unrealized profits during the year on its sales to X?

A) $240

B) $360

C) $400

D) $500

Both companies are subject to a tax rate of 40%. The gross profit percentage on sales is 20% for both companies. Unless otherwise stated, assume X Inc. uses the cost method to account for its investment in Y Inc.

What is the after-tax dollar value of Y's unrealized profits during the year on its sales to X?

A) $240

B) $360

C) $400

D) $500

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

15

X Inc. owns 80% of Y Inc. During 2020, X Inc. sold inventory to Y for $10,000. Half of this inventory remained in Y's warehouse at year end. Y Inc. sold Inventory to X Inc. for $5,000. 40% of this inventory remained in X's warehouse at year end.

Both companies are subject to a tax rate of 40%. The gross profit percentage on sales is 20% for both companies. Unless otherwise stated, assume X Inc. uses the cost method to account for its Investment in Y Inc.

Assume that Y Inc. reported an after-tax net income of $20,000 in 2020, what would be Y's adjusted net income for the year?

A) $202,400

B) $20,000

C) $19,840

D) $19,760

Both companies are subject to a tax rate of 40%. The gross profit percentage on sales is 20% for both companies. Unless otherwise stated, assume X Inc. uses the cost method to account for its Investment in Y Inc.

Assume that Y Inc. reported an after-tax net income of $20,000 in 2020, what would be Y's adjusted net income for the year?

A) $202,400

B) $20,000

C) $19,840

D) $19,760

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following methods does NOT call for the elimination of ALL intercompany profits?

A) Identifiable net asset method

B) Fair value enterprise method

C) Proportionate consolidation method

D) Partial goodwill method

A) Identifiable net asset method

B) Fair value enterprise method

C) Proportionate consolidation method

D) Partial goodwill method

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

17

X Inc. owns 80% of Y Inc. During 2020, X Inc. sold inventory to Y for $10,000. Half of this inventory remained in Y's warehouse at year end. Y Inc. sold inventory to X Inc. for $5,000. 40% of this inventory remained in X's warehouse at year end.

Both companies are subject to a tax rate of 40%. The gross profit percentage on sales is 20% for both companies. Unless otherwise stated, assume X Inc. uses the cost method to account for its investment in Y Inc.

What is the after-tax dollar value of X's unrealized profits during the year on its sales to Y?

A) $2,000

B) $1,000

C) $600

D) $400

Both companies are subject to a tax rate of 40%. The gross profit percentage on sales is 20% for both companies. Unless otherwise stated, assume X Inc. uses the cost method to account for its investment in Y Inc.

What is the after-tax dollar value of X's unrealized profits during the year on its sales to Y?

A) $2,000

B) $1,000

C) $600

D) $400

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

18

Kho Inc. purchased 90% of the voting shares of Lan Inc. for $600,000 on January 1, 2019. On that date, Lan's common shares and retained earnings were valued at $200,000 and $250,000 respectively. Unless otherwise stated, assume that Kho uses the cost method to account for its investment in Lan Inc.

Lan's fair values approximated its carrying values with the following exceptions:

Lan's trademark had a fair value which was $50,000 higher than its carrying value.

Lan's bonds payable had a fair value which was $20,000 higher than their carrying value.

The trademark had a useful life of exactly ten years remaining from the date of acquisition. The bonds payable mature on January 1, 2029. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2020 are shown below:

Income Statements

Retained Earnings Statements

Retained Earnings Statements

Other Information:

Other Information:

A goodwill impairment test conducted during August 2020 revealed that the Lan's Goodwill amount on the date of acquisition had been impaired by $10,000.

During 2019, Kho sold $50,000 worth of inventory to Lan, half of which was sold to outsiders during the year. During 2020, Kho sold inventory to Lan for $90,000. Two-thirds of this inventory was resold by Lan to outside parties.

During 2019, Lan sold $30,000 worth of inventory to Kho, 80% of which was sold to outsiders during the year. During 2020, Lan sold inventory to Kho for $40,000. 75% of this inventory was resold by Kho to outside parties. As of December 31, 2020, Kho still owes $20,000 to Lan for the inventory.

All intercompany sales as well as sales to outsiders earn a gross margin on sales of 20%. The effective tax rate for both companies is 20%.

Since Kho acquired Lan, Kho has charged Lan an annual management fee of $30,000. Lan has paid Kho for the management services on December 31st of each year.

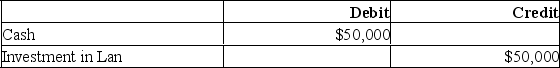

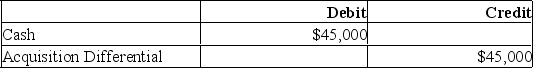

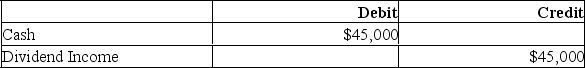

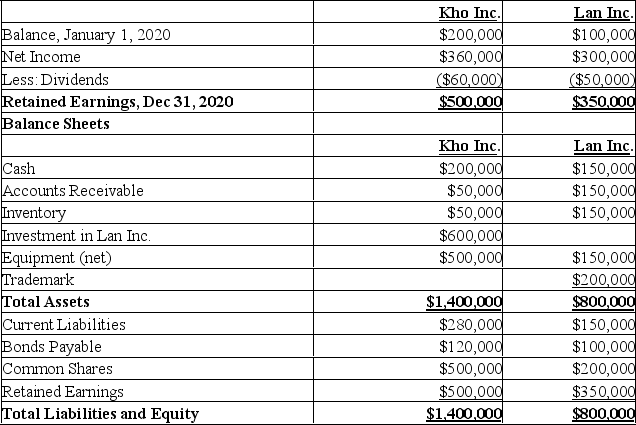

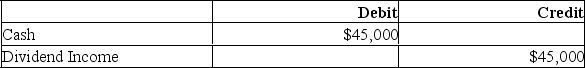

What would be the journal entry to record the dividends received by Kho Inc. during 2020?

A.

B.

C.

D.

Lan's fair values approximated its carrying values with the following exceptions:

Lan's trademark had a fair value which was $50,000 higher than its carrying value.

Lan's bonds payable had a fair value which was $20,000 higher than their carrying value.

The trademark had a useful life of exactly ten years remaining from the date of acquisition. The bonds payable mature on January 1, 2029. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2020 are shown below:

Income Statements

Retained Earnings Statements

Retained Earnings Statements Other Information:

Other Information:A goodwill impairment test conducted during August 2020 revealed that the Lan's Goodwill amount on the date of acquisition had been impaired by $10,000.

During 2019, Kho sold $50,000 worth of inventory to Lan, half of which was sold to outsiders during the year. During 2020, Kho sold inventory to Lan for $90,000. Two-thirds of this inventory was resold by Lan to outside parties.

During 2019, Lan sold $30,000 worth of inventory to Kho, 80% of which was sold to outsiders during the year. During 2020, Lan sold inventory to Kho for $40,000. 75% of this inventory was resold by Kho to outside parties. As of December 31, 2020, Kho still owes $20,000 to Lan for the inventory.

All intercompany sales as well as sales to outsiders earn a gross margin on sales of 20%. The effective tax rate for both companies is 20%.

Since Kho acquired Lan, Kho has charged Lan an annual management fee of $30,000. Lan has paid Kho for the management services on December 31st of each year.

What would be the journal entry to record the dividends received by Kho Inc. during 2020?

A.

B.

C.

D.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

19

X Inc. owns 80% of Y Inc. During 2020, X Inc. sold inventory to Y for $10,000. Half of this inventory remained in Y's warehouse at year end. Y Inc. sold inventory to X Inc. for $5,000. 40% of this inventory remained in X's warehouse at year end.

Both companies are subject to a tax rate of 40%. The gross profit percentage on sales is 20% for both companies. Unless otherwise stated, assume X Inc. uses the cost method to account for its investment in Y Inc.

What effect (if any) would Y's unrealized profits on its sales to X have on the non-controlling interest account on the consolidated balance sheet?

A) There would be no effect.

B) There would be an increase to the non-controlling interest account for the amount of $72.

C) There would be a decrease to the non-controlling interest account for the amount of $48.

D) There would be an increase to the non-controlling interest account for the amount of $48.Decrease in NCI account = $48 = $240 unrealized after-tax profit 20% NCI ownership.

Both companies are subject to a tax rate of 40%. The gross profit percentage on sales is 20% for both companies. Unless otherwise stated, assume X Inc. uses the cost method to account for its investment in Y Inc.

What effect (if any) would Y's unrealized profits on its sales to X have on the non-controlling interest account on the consolidated balance sheet?

A) There would be no effect.

B) There would be an increase to the non-controlling interest account for the amount of $72.

C) There would be a decrease to the non-controlling interest account for the amount of $48.

D) There would be an increase to the non-controlling interest account for the amount of $48.Decrease in NCI account = $48 = $240 unrealized after-tax profit 20% NCI ownership.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

20

When are profits from intercompany land sales realized?

A) They are realized only when sold to outsiders.

B) They are realized once legal ownership of the land has been transferred.

C) They are realized when consideration has been received for the land.

D) They are realized when an agreement is signed with respect to ownership of the land.

A) They are realized only when sold to outsiders.

B) They are realized once legal ownership of the land has been transferred.

C) They are realized when consideration has been received for the land.

D) They are realized when an agreement is signed with respect to ownership of the land.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

21

Kho Inc. purchased 90% of the voting shares of Lan Inc. for $600,000 on January 1, 2019. On that date, Lan's common shares and retained earnings were valued at $200,000 and $250,000 respectively. Unless otherwise stated, assume that Kho uses the cost method to account for its investment in Lan Inc. Lan's fair values approximated its carrying values with the following exceptions:

Lan's trademark had a fair value which was $50,000 higher than its carrying value.

Lan's bonds payable had a fair value which was $20,000 higher than their carrying value.

The trademark had a useful life of exactly ten years remaining from the date of acquisition. The bonds payable mature on January 1, 2029. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2020 are shown below:

Income Statements

Retained Earnings Statements

Other Information:

A goodwill impairment test conducted during August 2020 revealed that the Lan's Goodwill amount on the date of acquisition had been impaired by $10,000.

During 2019, Kho sold $50,000 worth of inventory to Lan, half of which was sold to outsiders during the year. During 2020, Kho sold inventory to Lan for $90,000. Two-thirds of this inventory was resold by Lan to outside parties.

During 2019, Lan sold $30,000 worth of inventory to Kho, 80% of which was sold to outsiders during the year. During 2020, Lan sold inventory to Kho for $40,000. 75% of this inventory was resold by Kho to outside parties. As of December 31, 2020, Kho still owes $20,000 to Lan for the inventory.

All intercompany sales as well as sales to outsiders earn a gross margin on sales of 20%. The effective tax rate for both companies is 20%.

Since Kho acquired Lan, Kho has charged Lan an annual management fee of $30,000. Lan has paid Kho for the management services on December 31st of each year.

How are changes to the acquisition differential reflected on Kho's 2020 consolidated income statement?

A) It would be reflected through non-controlling interest in earnings.

B) It would be reflected through other expenses.

C) It would be reflected through cost of sales.

D) It would be reflected as a reduction of sales.

Lan's trademark had a fair value which was $50,000 higher than its carrying value.

Lan's bonds payable had a fair value which was $20,000 higher than their carrying value.

The trademark had a useful life of exactly ten years remaining from the date of acquisition. The bonds payable mature on January 1, 2029. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2020 are shown below:

Income Statements

Retained Earnings Statements

Other Information:

A goodwill impairment test conducted during August 2020 revealed that the Lan's Goodwill amount on the date of acquisition had been impaired by $10,000.

During 2019, Kho sold $50,000 worth of inventory to Lan, half of which was sold to outsiders during the year. During 2020, Kho sold inventory to Lan for $90,000. Two-thirds of this inventory was resold by Lan to outside parties.

During 2019, Lan sold $30,000 worth of inventory to Kho, 80% of which was sold to outsiders during the year. During 2020, Lan sold inventory to Kho for $40,000. 75% of this inventory was resold by Kho to outside parties. As of December 31, 2020, Kho still owes $20,000 to Lan for the inventory.

All intercompany sales as well as sales to outsiders earn a gross margin on sales of 20%. The effective tax rate for both companies is 20%.

Since Kho acquired Lan, Kho has charged Lan an annual management fee of $30,000. Lan has paid Kho for the management services on December 31st of each year.

How are changes to the acquisition differential reflected on Kho's 2020 consolidated income statement?

A) It would be reflected through non-controlling interest in earnings.

B) It would be reflected through other expenses.

C) It would be reflected through cost of sales.

D) It would be reflected as a reduction of sales.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

22

LEO Inc. acquired a 60% interest in MARS Inc. on January 1, 2019 for $400,000. Unless otherwise stated, LEO uses the cost method to account for its investment in MARS Inc. On the acquisition date, MARS had common stock and retained earnings valued at $100,000 and $150,000 respectively. The acquisition differential was allocated as follows: $80,000 to undervalued inventory.

$40,000 to undervalued equipment. (to be amortized over 20 years)

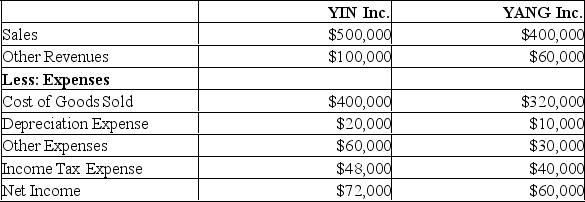

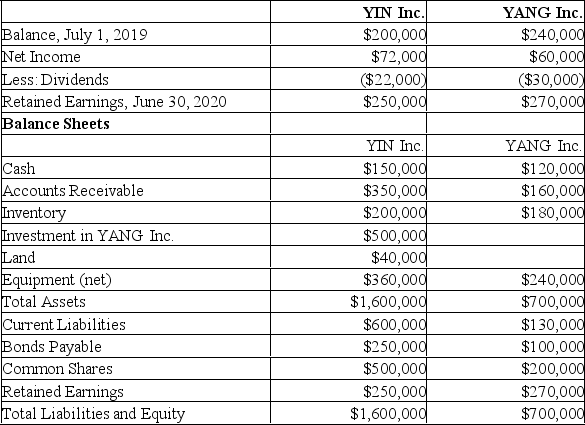

The following took place during 2019:

▪ MARS reported a net income and declared dividends of $25,000 and $5,000 respectively.

▪ LEO's December 31, 2019 inventory contained an intercompany profit of $10,000.

▪ LEO's net income was $75,000.

The following took place during 2020:

▪ MARS reported a net income and declared dividends of $36,000 and $6,000 respectively.

▪ MARS' December 31, 2020 inventory contained an intercompany profit of $5,000.

▪ LEO's net income was $48,000.

Both companies are subject to a 25% tax rate. All intercompany sales as well as sales to outsiders are priced to provide the selling company with gross margin of 20%.

Consolidated net income attributable to the shareholders of the parent for 2019 would be:

A) $12,500.

B) $33,300.

C) $36,300.

D) $53,200.

$40,000 to undervalued equipment. (to be amortized over 20 years)

The following took place during 2019:

▪ MARS reported a net income and declared dividends of $25,000 and $5,000 respectively.

▪ LEO's December 31, 2019 inventory contained an intercompany profit of $10,000.

▪ LEO's net income was $75,000.

The following took place during 2020:

▪ MARS reported a net income and declared dividends of $36,000 and $6,000 respectively.

▪ MARS' December 31, 2020 inventory contained an intercompany profit of $5,000.

▪ LEO's net income was $48,000.

Both companies are subject to a 25% tax rate. All intercompany sales as well as sales to outsiders are priced to provide the selling company with gross margin of 20%.

Consolidated net income attributable to the shareholders of the parent for 2019 would be:

A) $12,500.

B) $33,300.

C) $36,300.

D) $53,200.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

23

LEO Inc. acquired a 60% interest in MARS Inc. on January 1, 2019 for $400,000. Unless otherwise stated, LEO uses the cost method to account for its investment in MARS Inc. On the acquisition date, MARS had common stock and retained earnings valued at $100,000 and $150,000 respectively. The acquisition differential was allocated as follows: $80,000 to undervalued inventory.

$40,000 to undervalued equipment. (to be amortized over 20 years)

The following took place during 2019:

▪ MARS reported a net income and declared dividends of $25,000 and $5,000 respectively.

▪ LEO's December 31, 2019 inventory contained an intercompany profit of $10,000.

▪ LEO's net income was $75,000.

The following took place during 2020:

▪ MARS reported a net income and declared diviends of $36,000 and $6,000 respectively.

▪ MARS' December 31, 2020 inventory contained an intercompany profit of $5,000.

▪ LEO's net income was $48,000.

Both companies are subject to a 25% tax rate. All intercompany sales as well as sales to outsiders are priced to provide the selling company with gross margin of 20%.

What would be the change in the non-controlling interest account for 2020?

A) Non-controlling interest would increase by $14,200.

B) Non-controlling interest would increase by $16,800.

C) Non-controlling interest would decrease by $45,000.

D) Non-controlling interest would increase by $48,000.

$40,000 to undervalued equipment. (to be amortized over 20 years)

The following took place during 2019:

▪ MARS reported a net income and declared dividends of $25,000 and $5,000 respectively.

▪ LEO's December 31, 2019 inventory contained an intercompany profit of $10,000.

▪ LEO's net income was $75,000.

The following took place during 2020:

▪ MARS reported a net income and declared diviends of $36,000 and $6,000 respectively.

▪ MARS' December 31, 2020 inventory contained an intercompany profit of $5,000.

▪ LEO's net income was $48,000.

Both companies are subject to a 25% tax rate. All intercompany sales as well as sales to outsiders are priced to provide the selling company with gross margin of 20%.

What would be the change in the non-controlling interest account for 2020?

A) Non-controlling interest would increase by $14,200.

B) Non-controlling interest would increase by $16,800.

C) Non-controlling interest would decrease by $45,000.

D) Non-controlling interest would increase by $48,000.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

24

Kho Inc. purchased 90% of the voting shares of Lan Inc. for $600,000 on January 1, 2019. On that date, Lan's common shares and retained earnings were valued at $200,000 and $250,000 respectively. Unless otherwise stated, assume that Kho uses the cost method to account for its investment in Lan Inc. Lan's fair values approximated its carrying values with the following exceptions:

Lan's trademark had a fair value which was $50,000 higher than its carrying value.

Lan's bonds payable had a fair value which was $20,000 higher than their carrying value.

The trademark had a useful life of exactly ten years remaining from the date of acquisition. The bonds payable mature on January 1, 2029. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2020 are shown below:

Income Statements

Retained Earnings Statements

Other Information:

A goodwill impairment test conducted during August 2020 revealed that the Lan's Goodwill amount on the date of acquisition had been impaired by $10,000.

During 2019, Kho sold $50,000 worth of inventory to Lan, half of which was sold to outsiders during the year. During 2020, Kho sold inventory to Lan for $90,000. Two-thirds of this inventory was resold by Lan to outside parties.

During 2019, Lan sold $30,000 worth of inventory to Kho, 80% of which was sold to outsiders during the year. During 2020, Lan sold inventory to Kho for $40,000. 75% of this inventory was resold by Kho to outside parties. As of December 31, 2020, Kho still owes $20,000 to Lan for the inventory.

All intercompany sales as well as sales to outsiders earn a gross margin on sales of 20%. The effective tax rate for both companies is 20%.

Since Kho acquired Lan, Kho has charged Lan an annual management fee of $30,000. Lan has paid Kho for the management services on December 31st of each year.

Ignoring taxes, what is the total amount of unrealized profits in inventory at the start of 2020?

A) Nil

B) $5,000

C) $6,000

D) $6,200

Lan's trademark had a fair value which was $50,000 higher than its carrying value.

Lan's bonds payable had a fair value which was $20,000 higher than their carrying value.

The trademark had a useful life of exactly ten years remaining from the date of acquisition. The bonds payable mature on January 1, 2029. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2020 are shown below:

Income Statements

Retained Earnings Statements

Other Information:

A goodwill impairment test conducted during August 2020 revealed that the Lan's Goodwill amount on the date of acquisition had been impaired by $10,000.

During 2019, Kho sold $50,000 worth of inventory to Lan, half of which was sold to outsiders during the year. During 2020, Kho sold inventory to Lan for $90,000. Two-thirds of this inventory was resold by Lan to outside parties.

During 2019, Lan sold $30,000 worth of inventory to Kho, 80% of which was sold to outsiders during the year. During 2020, Lan sold inventory to Kho for $40,000. 75% of this inventory was resold by Kho to outside parties. As of December 31, 2020, Kho still owes $20,000 to Lan for the inventory.

All intercompany sales as well as sales to outsiders earn a gross margin on sales of 20%. The effective tax rate for both companies is 20%.

Since Kho acquired Lan, Kho has charged Lan an annual management fee of $30,000. Lan has paid Kho for the management services on December 31st of each year.

Ignoring taxes, what is the total amount of unrealized profits in inventory at the start of 2020?

A) Nil

B) $5,000

C) $6,000

D) $6,200

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

25

LEO Inc. acquired a 60% interest in MARS Inc. on January 1, 2019 for $400,000. Unless otherwise stated, LEO uses the cost method to account for its investment in MARS Inc. On the acquisition date, MARS had common stock and retained earnings valued at $100,000 and $150,000 respectively. The acquisition differential was allocated as follows: $80,000 to undervalued inventory.

$40,000 to undervalued equipment. (to be amortized over 20 years)

The following took place during 2019:

▪ MARS reported a net income and declared dividends of $25,000 and $5,000 respectively.

▪ LEO's December 31, 2019 inventory contained an intercompany profit of $10,000.

▪ LEO's net income was $75,000.

The following took place during 2020:

▪ MARS reported a net income and declared dividends of $36,000 and $6,000 respectively.

▪ MARS' December 31, 2020 inventory contained an intercompany profit of $5,000.

▪ LEO's net income was $48,000.

Both companies are subject to a 25% tax rate. All intercompany sales as well as sales to outsiders are priced to provide the selling company with gross margin of 20%.

What would be the balance in the investment in MARS account at December 31, 2019?

A) $318,000

B) $330,000

C) $358,300

D) $400,000

$40,000 to undervalued equipment. (to be amortized over 20 years)

The following took place during 2019:

▪ MARS reported a net income and declared dividends of $25,000 and $5,000 respectively.

▪ LEO's December 31, 2019 inventory contained an intercompany profit of $10,000.

▪ LEO's net income was $75,000.

The following took place during 2020:

▪ MARS reported a net income and declared dividends of $36,000 and $6,000 respectively.

▪ MARS' December 31, 2020 inventory contained an intercompany profit of $5,000.

▪ LEO's net income was $48,000.

Both companies are subject to a 25% tax rate. All intercompany sales as well as sales to outsiders are priced to provide the selling company with gross margin of 20%.

What would be the balance in the investment in MARS account at December 31, 2019?

A) $318,000

B) $330,000

C) $358,300

D) $400,000

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

26

Kho Inc. purchased 90% of the voting shares of Lan Inc. for $600,000 on January 1, 2019. On that date, Lan's common shares and retained earnings were valued at $200,000 and $250,000 respectively. Unless otherwise stated, assume that Kho uses the cost method to account for its investment in Lan Inc. Lan's fair values approximated its carrying values with the following exceptions:

Lan's trademark had a fair value which was $50,000 higher than its carrying value.

Lan's bonds payable had a fair value which was $20,000 higher than their carrying value.

The trademark had a useful life of exactly ten years remaining from the date of acquisition. The bonds payable mature on January 1, 2029. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2020 are shown below:

Income Statements

Retained Earnings Statements

Other Information:

A goodwill impairment test conducted during August 2020 revealed that the Lan's Goodwill amount on the date of acquisition had been impaired by $10,000.

During 2019, Kho sold $50,000 worth of inventory to Lan, half of which was sold to outsiders during the year. During 2020, Kho sold inventory to Lan for $90,000. Two-thirds of this inventory was resold by Lan to outside parties.

During 2019, Lan sold $30,000 worth of inventory to Kho, 80% of which was sold to outsiders during the year. During 2020, Lan sold inventory to Kho for $40,000. 75% of this inventory was resold by Kho to outside parties. As of December 31, 2020, Kho still owes $20,000 to Lan for the inventory.

All intercompany sales as well as sales to outsiders earn a gross margin on sales of 20%. The effective tax rate for both companies is 20%.

Since Kho acquired Lan, Kho has charged Lan an annual management fee of $30,000. Lan has paid Kho for the management services on December 31st of each year.

What would be the amount appearing on the December 31, 2020 consolidated statement of financial position for current liabilities?

A) $430,000

B) $450,000

C) $410,000

D) $412,000

Lan's trademark had a fair value which was $50,000 higher than its carrying value.

Lan's bonds payable had a fair value which was $20,000 higher than their carrying value.

The trademark had a useful life of exactly ten years remaining from the date of acquisition. The bonds payable mature on January 1, 2029. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2020 are shown below:

Income Statements

Retained Earnings Statements

Other Information:

A goodwill impairment test conducted during August 2020 revealed that the Lan's Goodwill amount on the date of acquisition had been impaired by $10,000.

During 2019, Kho sold $50,000 worth of inventory to Lan, half of which was sold to outsiders during the year. During 2020, Kho sold inventory to Lan for $90,000. Two-thirds of this inventory was resold by Lan to outside parties.

During 2019, Lan sold $30,000 worth of inventory to Kho, 80% of which was sold to outsiders during the year. During 2020, Lan sold inventory to Kho for $40,000. 75% of this inventory was resold by Kho to outside parties. As of December 31, 2020, Kho still owes $20,000 to Lan for the inventory.

All intercompany sales as well as sales to outsiders earn a gross margin on sales of 20%. The effective tax rate for both companies is 20%.

Since Kho acquired Lan, Kho has charged Lan an annual management fee of $30,000. Lan has paid Kho for the management services on December 31st of each year.

What would be the amount appearing on the December 31, 2020 consolidated statement of financial position for current liabilities?

A) $430,000

B) $450,000

C) $410,000

D) $412,000

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

27

LEO Inc. acquired a 60% interest in MARS Inc. on January 1, 2019 for $400,000. Unless otherwise stated, LEO uses the cost method to account for its investment in MARS Inc. On the acquisition date, MARS had common stock and retained earnings valued at $100,000 and $150,000 respectively. The acquisition differential was allocated as follows: $80,000 to undervalued inventory.

$40,000 to undervalued equipment. (to be amortized over 20 years)

The following took place during 2019:

▪ MARS reported a net income and declared dividends of $25,000 and $5,000 respectively.

▪ LEO's December 31, 2019 inventory contained an intercompany profit of $10,000.

▪ LEO's net income was $75,000.

The following took place during 2020:

▪ MARS reported a net income and declared dividends of $36,000 and $6,000 respectively.

▪ MARS' December 31, 2020 inventory contained an intercompany profit of $5,000.

▪ LEO's net income was $48,000.

Both companies are subject to a 25% tax rate. All intercompany sales as well as sales to outsiders are priced to provide the selling company with gross margin of 20%.

What would be the amount of changes to the acquisition differential during 2020?

A) $2,000

B) $40,000

C) $78,000

D) $82,000

$40,000 to undervalued equipment. (to be amortized over 20 years)

The following took place during 2019:

▪ MARS reported a net income and declared dividends of $25,000 and $5,000 respectively.

▪ LEO's December 31, 2019 inventory contained an intercompany profit of $10,000.

▪ LEO's net income was $75,000.

The following took place during 2020:

▪ MARS reported a net income and declared dividends of $36,000 and $6,000 respectively.

▪ MARS' December 31, 2020 inventory contained an intercompany profit of $5,000.

▪ LEO's net income was $48,000.

Both companies are subject to a 25% tax rate. All intercompany sales as well as sales to outsiders are priced to provide the selling company with gross margin of 20%.

What would be the amount of changes to the acquisition differential during 2020?

A) $2,000

B) $40,000

C) $78,000

D) $82,000

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

28

Kho Inc. purchased 90% of the voting shares of Lan Inc. for $600,000 on January 1, 2019. On that date, Lan's common shares and retained earnings were valued at $200,000 and $250,000 respectively. Unless otherwise stated, assume that Kho uses the cost method to account for its investment in Lan Inc. Lan's fair values approximated its carrying values with the following exceptions:

Lan's trademark had a fair value which was $50,000 higher than its carrying value.

Lan's bonds payable had a fair value which was $20,000 higher than their carrying value.

The trademark had a useful life of exactly ten years remaining from the date of acquisition. The bonds payable mature on January 1, 2029. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2020 are shown below:

Income Statements

Retained Earnings Statements

Other Information:

A goodwill impairment test conducted during August 2020 revealed that the Lan's Goodwill amount on the date of acquisition had been impaired by $10,000.

During 2019, Kho sold $50,000 worth of inventory to Lan, half of which was sold to outsiders during the year. During 2020, Kho sold inventory to Lan for $90,000. Two-thirds of this inventory was resold by Lan to outside parties.

During 2019, Lan sold $30,000 worth of inventory to Kho, 80% of which was sold to outsiders during the year. During 2020, Lan sold inventory to Kho for $40,000. 75% of this inventory was resold by Kho to outside parties. As of December 31, 2020, Kho still owes $20,000 to Lan for the inventory.

All intercompany sales as well as sales to outsiders earn a gross margin on sales of 20%. The effective tax rate for both companies is 20%.

Since Kho acquired Lan, Kho has charged Lan an annual management fee of $30,000. Lan has paid Kho for the management services on December 31st of each year.

What would be the non-controlling interest amount appearing on Kho's consolidated statement of financial position at the end of 2020?

A) $29,936

B) $55,840

C) $57,400

D) $74,907

Lan's trademark had a fair value which was $50,000 higher than its carrying value.

Lan's bonds payable had a fair value which was $20,000 higher than their carrying value.

The trademark had a useful life of exactly ten years remaining from the date of acquisition. The bonds payable mature on January 1, 2029. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2020 are shown below:

Income Statements

Retained Earnings Statements

Other Information:

A goodwill impairment test conducted during August 2020 revealed that the Lan's Goodwill amount on the date of acquisition had been impaired by $10,000.

During 2019, Kho sold $50,000 worth of inventory to Lan, half of which was sold to outsiders during the year. During 2020, Kho sold inventory to Lan for $90,000. Two-thirds of this inventory was resold by Lan to outside parties.

During 2019, Lan sold $30,000 worth of inventory to Kho, 80% of which was sold to outsiders during the year. During 2020, Lan sold inventory to Kho for $40,000. 75% of this inventory was resold by Kho to outside parties. As of December 31, 2020, Kho still owes $20,000 to Lan for the inventory.

All intercompany sales as well as sales to outsiders earn a gross margin on sales of 20%. The effective tax rate for both companies is 20%.

Since Kho acquired Lan, Kho has charged Lan an annual management fee of $30,000. Lan has paid Kho for the management services on December 31st of each year.

What would be the non-controlling interest amount appearing on Kho's consolidated statement of financial position at the end of 2020?

A) $29,936

B) $55,840

C) $57,400

D) $74,907

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

29

LEO Inc. acquired a 60% interest in MARS Inc. on January 1, 2019 for $400,000. Unless otherwise stated, LEO uses the cost method to account for its investment in MARS Inc. On the acquisition date, MARS had common stock and retained earnings valued at $100,000 and $150,000 respectively. The acquisition differential was allocated as follows: $80,000 to undervalued inventory.

$40,000 to undervalued equipment. (to be amortized over 20 years)

The following took place during 2019:

▪ MARS reported a net income and declared dividends of $25,000 and $5,000 respectively.

▪ LEO's December 31, 2019 inventory contained an intercompany profit of $10,000.

▪ LEO's net income was $75,000.

The following took place during 2020:

▪ MARS reported a net income and declared dividends of $36,000 and $6,000 respectively.

▪ MARS' December 31, 2020 inventory contained an intercompany profit of $5,000.

▪ LEO's net income was $48,000.

Both companies are subject to a 25% tax rate. All intercompany sales as well as sales to outsiders are priced to provide the selling company with gross margin of 20%.

Assuming that LEO uses the equity method to account for its investment in MARS, what would be the NET increase to the investment in MARS account during 2020?

A) $16,000

B) $16,800

C) $17,550

D) $20,000

$40,000 to undervalued equipment. (to be amortized over 20 years)

The following took place during 2019:

▪ MARS reported a net income and declared dividends of $25,000 and $5,000 respectively.

▪ LEO's December 31, 2019 inventory contained an intercompany profit of $10,000.

▪ LEO's net income was $75,000.

The following took place during 2020:

▪ MARS reported a net income and declared dividends of $36,000 and $6,000 respectively.

▪ MARS' December 31, 2020 inventory contained an intercompany profit of $5,000.

▪ LEO's net income was $48,000.

Both companies are subject to a 25% tax rate. All intercompany sales as well as sales to outsiders are priced to provide the selling company with gross margin of 20%.

Assuming that LEO uses the equity method to account for its investment in MARS, what would be the NET increase to the investment in MARS account during 2020?

A) $16,000

B) $16,800

C) $17,550

D) $20,000

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

30

LEO Inc. acquired a 60% interest in MARS Inc. on January 1, 2019 for $400,000. Unless otherwise stated, LEO uses the cost method to account for its investment MARS Inc. On the acquisition date, MARS had common stock and retained earnings valued at $100,000 and $150,000 respectively. The acquisition differential was allocated as follows: $80,000 to undervalued inventory.

$40,000 to undervalued equipment. (to be amortized over 20 years)

The following took place during 2019:

▪ MARS reported a net income and declared dividends of $25,000 and $5,000 respectively.

▪ LEO's December 31, 2019 inventory contained an intercompany profit of $10,000.

▪ LEO's net income was $75,000.

The following took place during 2020:

▪ MARS reported a net income and declared dividends of $36,000 and $6,000 respectively.

▪ MARS' December 31, 2020 inventory contained an intercompany profit of $5,000.

▪ LEO's net income was $48,000.

Both companies are subject to a 25% tax rate. All intercompany sales as well as sales to outsiders are priced to provide the selling company with gross margin of 20%.

What would be the change in the non-controlling interest account for 2019?

A) Non-controlling interest would decrease by $27,800.

B) Non-controlling interest would decrease by $18,000.

C) Non-controlling interest would increase by $18,000.

D) Non-controlling interest would increase by $27,800.

$40,000 to undervalued equipment. (to be amortized over 20 years)

The following took place during 2019:

▪ MARS reported a net income and declared dividends of $25,000 and $5,000 respectively.

▪ LEO's December 31, 2019 inventory contained an intercompany profit of $10,000.

▪ LEO's net income was $75,000.

The following took place during 2020:

▪ MARS reported a net income and declared dividends of $36,000 and $6,000 respectively.

▪ MARS' December 31, 2020 inventory contained an intercompany profit of $5,000.

▪ LEO's net income was $48,000.

Both companies are subject to a 25% tax rate. All intercompany sales as well as sales to outsiders are priced to provide the selling company with gross margin of 20%.

What would be the change in the non-controlling interest account for 2019?

A) Non-controlling interest would decrease by $27,800.

B) Non-controlling interest would decrease by $18,000.

C) Non-controlling interest would increase by $18,000.

D) Non-controlling interest would increase by $27,800.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

31

Kho Inc. purchased 90% of the voting shares of Lan Inc. for $600,000 on January 1, 2019. On that date, Lan's common shares and retained earnings were valued at $200,000 and $250,000 respectively. Unless otherwise stated, assume that Kho uses the cost method to account for its investment in Lan Inc. Lan's fair values approximated its carrying values with the following exceptions:

Lan's trademark had a fair value which was $50,000 higher than its carrying value.

Lan's bonds payable had a fair value which was $20,000 higher than their carrying value.

The trademark had a useful life of exactly ten years remaining from the date of acquisition. The bonds payable mature on January 1, 2029. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2020 are shown below:

Income Statements

Retained Earnings Statements

Other Information:

A goodwill impairment test conducted during August 2020 revealed that the Lan's Goodwill amount on the date of acquisition had been impaired by $10,000.

During 2019, Kho sold $50,000 worth of inventory to Lan, half of which was sold to outsiders during the year. During 2020, Kho sold inventory to Lan for $90,000. Two-thirds of this inventory was resold by Lan to outside parties.

During 2019, Lan sold $30,000 worth of inventory to Kho, 80% of which was sold to outsiders during the year. During 2020, Lan sold inventory to Kho for $40,000. 75% of this inventory was resold by Kho to outside parties. As of December 31, 2020, Kho still owes $20,000 to Lan for the inventory.

All intercompany sales as well as sales to outsiders earn a gross margin on sales of 20%. The effective tax rate for both companies is 20%.

Since Kho acquired Lan, Kho has charged Lan an annual management fee of $30,000. Lan has paid Kho for the management services on December 31st of each year.

Excluding any goodwill impairment losses, what would be the amount of changes to the acquisition differential for 2020?

A) $2,000

B) $2,700

C) $3,000

D) $4,000

Lan's trademark had a fair value which was $50,000 higher than its carrying value.

Lan's bonds payable had a fair value which was $20,000 higher than their carrying value.

The trademark had a useful life of exactly ten years remaining from the date of acquisition. The bonds payable mature on January 1, 2029. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2020 are shown below:

Income Statements

Retained Earnings Statements

Other Information:

A goodwill impairment test conducted during August 2020 revealed that the Lan's Goodwill amount on the date of acquisition had been impaired by $10,000.

During 2019, Kho sold $50,000 worth of inventory to Lan, half of which was sold to outsiders during the year. During 2020, Kho sold inventory to Lan for $90,000. Two-thirds of this inventory was resold by Lan to outside parties.

During 2019, Lan sold $30,000 worth of inventory to Kho, 80% of which was sold to outsiders during the year. During 2020, Lan sold inventory to Kho for $40,000. 75% of this inventory was resold by Kho to outside parties. As of December 31, 2020, Kho still owes $20,000 to Lan for the inventory.

All intercompany sales as well as sales to outsiders earn a gross margin on sales of 20%. The effective tax rate for both companies is 20%.

Since Kho acquired Lan, Kho has charged Lan an annual management fee of $30,000. Lan has paid Kho for the management services on December 31st of each year.

Excluding any goodwill impairment losses, what would be the amount of changes to the acquisition differential for 2020?

A) $2,000

B) $2,700

C) $3,000

D) $4,000

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

32

Kho Inc. purchased 90% of the voting shares of Lan Inc. for $600,000 on January 1, 2019. On that date, Lan's common shares and retained earnings were valued at $200,000 and $250,000 respectively. Unless otherwise stated, assume that Kho uses the cost method to account for its investment in Lan Inc. Lan's fair values approximated its carrying values with the following exceptions:

Lan's trademark had a fair value which was $50,000 higher than its carrying value.

Lan's bonds payable had a fair value which was $20,000 higher than their carrying value.

The trademark had a useful life of exactly ten years remaining from the date of acquisition. The bonds payable mature on January 1, 2029. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2020 are shown below:

Income Statements

Retained Earnings Statements

Other Information:

A goodwill impairment test conducted during August 2020 revealed that the Lan's Goodwill amount on the date of acquisition had been impaired by $10,000.

During 2019, Kho sold $50,000 worth of inventory to Lan, half of which was sold to outsiders during the year. During 2020, Kho sold inventory to Lan for $90,000. Two-thirds of this inventory was resold by Lan to outside parties.

During 2019, Lan sold $30,000 worth of inventory to Kho, 80% of which was sold to outsiders during the year. During 2020, Lan sold inventory to Kho for $40,000. 75% of this inventory was resold by Kho to outside parties. As of December 31, 2020, Kho still owes $20,000 to Lan for the inventory.

All intercompany sales as well as sales to outsiders earn a gross margin on sales of 20%. The effective tax rate for both companies is 20%.

Since Kho acquired Lan, Kho has charged Lan an annual management fee of $30,000. Lan has paid Kho for the management services on December 31st of each year.

Ignoring taxes, what is the total amount of unrealized profits in inventory at the end of 2020?

A) Nil

B) $6,000

C) $7,800

D) $8,000

Lan's trademark had a fair value which was $50,000 higher than its carrying value.

Lan's bonds payable had a fair value which was $20,000 higher than their carrying value.

The trademark had a useful life of exactly ten years remaining from the date of acquisition. The bonds payable mature on January 1, 2029. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2020 are shown below:

Income Statements

Retained Earnings Statements

Other Information:

A goodwill impairment test conducted during August 2020 revealed that the Lan's Goodwill amount on the date of acquisition had been impaired by $10,000.

During 2019, Kho sold $50,000 worth of inventory to Lan, half of which was sold to outsiders during the year. During 2020, Kho sold inventory to Lan for $90,000. Two-thirds of this inventory was resold by Lan to outside parties.

During 2019, Lan sold $30,000 worth of inventory to Kho, 80% of which was sold to outsiders during the year. During 2020, Lan sold inventory to Kho for $40,000. 75% of this inventory was resold by Kho to outside parties. As of December 31, 2020, Kho still owes $20,000 to Lan for the inventory.

All intercompany sales as well as sales to outsiders earn a gross margin on sales of 20%. The effective tax rate for both companies is 20%.

Since Kho acquired Lan, Kho has charged Lan an annual management fee of $30,000. Lan has paid Kho for the management services on December 31st of each year.

Ignoring taxes, what is the total amount of unrealized profits in inventory at the end of 2020?

A) Nil

B) $6,000

C) $7,800

D) $8,000

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

33

LEO Inc. acquired a 60% interest in MARS Inc. on January 1, 2019 for $400,000. Unless otherwise stated, LEO uses the cost method to account for its investment in MARS Inc. On the acquisition date, MARS had common stock and retained earnings valued at $100,000 and $150,000 respectively. The acquisition differential was allocated as follows: $80,000 to undervalued inventory.

$40,000 to undervalued equipment. (to be amortized over 20 years)

The following took place during 2019:

▪ MARS reported a net income and declared dividends of $25,000 and $5,000 respectively.

▪ LEO's December 31, 2019 inventory contained an intercompany profit of $10,000.

▪ LEO's net income was $75,000.

The following took place during 2020:

▪ MARS reported a net income and declared dividends of $36,000 and $6,000 respectively.

▪ MARS' December 31, 2020 inventory contained an intercompany profit of $5,000.

▪ LEO's net income was $48,000.

Both companies are subject to a 25% tax rate. All intercompany sales as well as sales to outsiders are priced to provide the selling company with gross margin of 20%.

Consolidated net income attributable to the shareholders of the parent for 2020 would be:

A) $58,000.

B) $56,000.

C) $65,550.

D) $69,150.

$40,000 to undervalued equipment. (to be amortized over 20 years)

The following took place during 2019:

▪ MARS reported a net income and declared dividends of $25,000 and $5,000 respectively.

▪ LEO's December 31, 2019 inventory contained an intercompany profit of $10,000.

▪ LEO's net income was $75,000.

The following took place during 2020:

▪ MARS reported a net income and declared dividends of $36,000 and $6,000 respectively.

▪ MARS' December 31, 2020 inventory contained an intercompany profit of $5,000.

▪ LEO's net income was $48,000.

Both companies are subject to a 25% tax rate. All intercompany sales as well as sales to outsiders are priced to provide the selling company with gross margin of 20%.

Consolidated net income attributable to the shareholders of the parent for 2020 would be:

A) $58,000.

B) $56,000.

C) $65,550.

D) $69,150.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

34

LEO Inc. acquired a 60% interest in MARS Inc. on January 1, 2019 for $400,000. Unless otherwise stated, LEO uses the cost method to account for its investment in MARS Inc. On the acquisition date, MARS had common stock and retained earnings valued at $100,000 and $150,000 respectively. The acquisition differential was allocated as follows: $80,000 to undervalued inventory.

$40,000 to undervalued equipment. (to be amortized over 20 years)

The following took place during 2019:

▪ MARS reported a net income and declared dividends of $25,000 and $5,000 respectively.

▪ LEO's December 31, 2019 inventory contained an intercompany profit of $10,000.

▪ LEO's net income was $75,000.

The following took place during 2020:

▪ MARS reported a net income and declared dividends of $36,000 and $6,000 respectively.

▪ MARS' December 31, 2020 inventory contained an intercompany profit of $5,000.

▪ LEO's net income was $48,000.

Both companies are subject to a 25% tax rate. All intercompany sales as well as sales to outsiders are priced to provide the selling company with gross margin of 20%.

What would be the amount of changes to the acquisition differential during 2019?

A) $78,000

B) $80,000

C) $82,000

D) $120,000Changes to acquisition differential on consolidated income statement 2019 = $82,000.Changes to Acquisition Differential Schedule

$40,000 to undervalued equipment. (to be amortized over 20 years)

The following took place during 2019:

▪ MARS reported a net income and declared dividends of $25,000 and $5,000 respectively.

▪ LEO's December 31, 2019 inventory contained an intercompany profit of $10,000.

▪ LEO's net income was $75,000.

The following took place during 2020:

▪ MARS reported a net income and declared dividends of $36,000 and $6,000 respectively.

▪ MARS' December 31, 2020 inventory contained an intercompany profit of $5,000.

▪ LEO's net income was $48,000.

Both companies are subject to a 25% tax rate. All intercompany sales as well as sales to outsiders are priced to provide the selling company with gross margin of 20%.

What would be the amount of changes to the acquisition differential during 2019?

A) $78,000

B) $80,000

C) $82,000

D) $120,000Changes to acquisition differential on consolidated income statement 2019 = $82,000.Changes to Acquisition Differential Schedule

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

35

Kho Inc. purchased 90% of the voting shares of Lan Inc. for $600,000 on January 1, 2019. On that date, Lan's common shares and retained earnings were valued at $200,000 and $250,000 respectively. Unless otherwise stated, assume that Kho uses the cost method to account for its investment in Lan Inc. Lan's fair values approximated its carrying values with the following exceptions:

Lan's trademark had a fair value which was $50,000 higher than its carrying value.

Lan's bonds payable had a fair value which was $20,000 higher than their carrying value.

The trademark had a useful life of exactly ten years remaining from the date of acquisition. The bonds payable mature on January 1, 2029. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2020 are shown below:

Income Statements

Retained Earnings Statements

Other Information:

A goodwill impairment test conducted during August 2020 revealed that the Lan's Goodwill amount on the date of acquisition had been impaired by $10,000.

During 2019, Kho sold $50,000 worth of inventory to Lan, half of which was sold to outsiders during the year. During 2020, Kho sold inventory to Lan for $90,000. Two-thirds of this inventory was resold by Lan to outside parties.

During 2019, Lan sold $30,000 worth of inventory to Kho, 80% of which was sold to outsiders during the year. During 2020, Lan sold inventory to Kho for $40,000. 75% of this inventory was resold by Kho to outside parties. As of December 31, 2020, Kho still owes $20,000 to Lan for the inventory.

All intercompany sales as well as sales to outsiders earn a gross margin on sales of 20%. The effective tax rate for both companies is 20%.

Since Kho acquired Lan, Kho has charged Lan an annual management fee of $30,000. Lan has paid Kho for the management services on December 31st of each year.

What would be the amount appearing on the December 31, 2020 consolidated statement of financial position for trademarks?

A) $200,000

B) $236,000

C) $240,000

D) $245,000

Lan's trademark had a fair value which was $50,000 higher than its carrying value.

Lan's bonds payable had a fair value which was $20,000 higher than their carrying value.