Deck 13: Valuation: Earnings-Based Approaches

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/47

Play

Full screen (f)

Deck 13: Valuation: Earnings-Based Approaches

1

Assume that a firm's book value at the beginning of the year is $12,500 and that the firm reports net income of $3,200 and pays dividends of $1,100. What will the firm's book value at the end of the year?

A) $2,100

B) $15,700

C) $14,600

D) $16,800

A) $2,100

B) $15,700

C) $14,600

D) $16,800

C

2

The appropriate discount rate for the residual income model is

A) Weighted average cost of capital

B) The risk free interest rate

C) The risk free interest rate plus the market premium

D) Cost of common equity capital

A) Weighted average cost of capital

B) The risk free interest rate

C) The risk free interest rate plus the market premium

D) Cost of common equity capital

D

3

Required earnings are the

A) adjusted net income multiplied by the required rate of return on common equity capital.

B) net income the analyst expects the firm to generate multiplied by the required rate of return on common equity capital.

C) the market value of common equity capital at the beginning of the period multiplied by the required rate of return on common equity capital.

D) the book value of common equity capital at the beginning of the period multiplied by the required rate of return on common equity capital.

A) adjusted net income multiplied by the required rate of return on common equity capital.

B) net income the analyst expects the firm to generate multiplied by the required rate of return on common equity capital.

C) the market value of common equity capital at the beginning of the period multiplied by the required rate of return on common equity capital.

D) the book value of common equity capital at the beginning of the period multiplied by the required rate of return on common equity capital.

D

4

Assume that a firm had shareholders' equity on the balance sheet at a book value of $1,600 at the end of 2005. During 2006 the firm earns net income of $1,300, pays dividends to shareholders of $600, and uses $300 to repurchase common shares. The book value of shareholders equity at the end of 2006 is:

A) $2,000

B) $400

C) $3,800

D) $2,600

A) $2,000

B) $400

C) $3,800

D) $2,600

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

5

At the beginning of 2007 investors had invested $25,000 of common equity in Giants Corp.and expect to earn a return of 11% per year. In addition, investors expect Giant Corp. to pay out 100% of income in dividends each year. Forecasts of Giant's net income are as follows: 2007 - $3,500

2008 - $3,200

2009 - $2,900

2010 and beyond - $2,750

Using this information what is Giant's residual income valuation at the beginning of 2007?

A) $25,000

B) $26,350

C) $26,151

D) $26041

2008 - $3,200

2009 - $2,900

2010 and beyond - $2,750

Using this information what is Giant's residual income valuation at the beginning of 2007?

A) $25,000

B) $26,350

C) $26,151

D) $26041

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

6

The ______________________________ valuation model uses expected future net income and the book value of common shareholders' equity as the basis for valuation.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

7

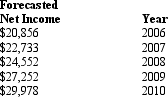

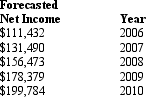

Jones Corp. Use this information to answer the following questions:

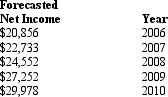

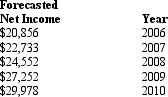

At the end of 2005 Jones Corp. developed the following forecasts of net income:

Management believes that after 2010 Jones will grow at a rate of 7% each year. Total common shareholders' was $112,768 on December 31, 2005. Jones has not established a dividend and does not plan on paying dividends during 2006 to 2010, its cost of equity capital is 12%.

Management believes that after 2010 Jones will grow at a rate of 7% each year. Total common shareholders' was $112,768 on December 31, 2005. Jones has not established a dividend and does not plan on paying dividends during 2006 to 2010, its cost of equity capital is 12%.

What would be Jones' common shareholders' equity at the end of 2009?

A) $180,909

B) $208,161

C) $95,540

D) $112,768

At the end of 2005 Jones Corp. developed the following forecasts of net income:

Management believes that after 2010 Jones will grow at a rate of 7% each year. Total common shareholders' was $112,768 on December 31, 2005. Jones has not established a dividend and does not plan on paying dividends during 2006 to 2010, its cost of equity capital is 12%.

Management believes that after 2010 Jones will grow at a rate of 7% each year. Total common shareholders' was $112,768 on December 31, 2005. Jones has not established a dividend and does not plan on paying dividends during 2006 to 2010, its cost of equity capital is 12%.What would be Jones' common shareholders' equity at the end of 2009?

A) $180,909

B) $208,161

C) $95,540

D) $112,768

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

8

If investors have invested $25,000 of common equity in a company and it is determined that the required earnings of the company are $2,250 each period, then investors must expect to earn what return?

A) the risk free rate

B) 9%

C) 11%

D) the market premium

A) the risk free rate

B) 9%

C) 11%

D) the market premium

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

9

Residual income valuation focuses on ____________________ as a periodic measure of shareholder wealth creation.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

10

The value of a share of common equity should equal the present value of the _____________________________________________ the shareholders will receive.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

11

Residual income valuation focuses on

A) dividend-paying capacity in free-cash flows.

B) earnings as a periodic measure of shareholder wealth creation.

C) free cash flows as a periodic measure of shareholder wealth creation.

D) dividends as a periodic measure of shareholder wealth creation.

A) dividend-paying capacity in free-cash flows.

B) earnings as a periodic measure of shareholder wealth creation.

C) free cash flows as a periodic measure of shareholder wealth creation.

D) dividends as a periodic measure of shareholder wealth creation.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

12

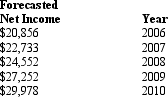

Jones Corp. Use this information to answer the following questions:

At the end of 2005 Jones Corp. developed the following forecasts of net income:

Management believes that after 2010 Jones will grow at a rate of 7% each year. Total common shareholders' was $112,768 on December 31, 2005. Jones has not established a dividend and does not plan on paying dividends during 2006 to 2010, its cost of equity capital is 12%.

Management believes that after 2010 Jones will grow at a rate of 7% each year. Total common shareholders' was $112,768 on December 31, 2005. Jones has not established a dividend and does not plan on paying dividends during 2006 to 2010, its cost of equity capital is 12%.

Compute the value of Jones Corp. on January 1, 2006, using the residual income valuation model. Use the half-year adjustment.

A) $112,768

B) $185,329

C) $195,540

D) $133,624

At the end of 2005 Jones Corp. developed the following forecasts of net income:

Management believes that after 2010 Jones will grow at a rate of 7% each year. Total common shareholders' was $112,768 on December 31, 2005. Jones has not established a dividend and does not plan on paying dividends during 2006 to 2010, its cost of equity capital is 12%.

Management believes that after 2010 Jones will grow at a rate of 7% each year. Total common shareholders' was $112,768 on December 31, 2005. Jones has not established a dividend and does not plan on paying dividends during 2006 to 2010, its cost of equity capital is 12%.Compute the value of Jones Corp. on January 1, 2006, using the residual income valuation model. Use the half-year adjustment.

A) $112,768

B) $185,329

C) $195,540

D) $133,624

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

13

Residual income will be zero when

A) the firm's reported net income exactly equals the required level of earnings necessary to cover the cost of equity capital.

B) the firm's expected future income is greater than the required level of earnings necessary to cover the cost of equity capital.

C) the firm's expected future income exactly equals the required level of earnings necessary to cover the cost of equity capital.

D) the firm's expected future income is less than the required level of earnings necessary to cover the cost of equity capital.

A) the firm's reported net income exactly equals the required level of earnings necessary to cover the cost of equity capital.

B) the firm's expected future income is greater than the required level of earnings necessary to cover the cost of equity capital.

C) the firm's expected future income exactly equals the required level of earnings necessary to cover the cost of equity capital.

D) the firm's expected future income is less than the required level of earnings necessary to cover the cost of equity capital.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

14

Assume that a firm's book value at the beginning of the year is $17,800 and that the firm reports net income of $6,200. If the firm's book value at the end of the year is $20,000 what was the amount of dividends paid during the year?

A) $4,000

B) $8,800

C) $2,200

D) Insufficient information to determine

A) $4,000

B) $8,800

C) $2,200

D) Insufficient information to determine

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

15

If an analyst expects a firm to generate net income each period exactly equal to required earnings, then the value of the firm will be

A) exactly equal to the book value of common shareholders' equity.

B) greater than the book value of common shareholders' equity.

C) less than the book value of common shareholders' equity.

D) exactly equal to working capital.

A) exactly equal to the book value of common shareholders' equity.

B) greater than the book value of common shareholders' equity.

C) less than the book value of common shareholders' equity.

D) exactly equal to working capital.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

16

At the beginning of 2007 investors had invested $125,000 of common equity in Jets Corp.and expect to earn a return of 15% per year. In addition, investors expect Jets Corp. to pay out 100% of income in dividends each year. Forecasts of Jet's net income are as follows: 2007 - $41,000

2008 - $35,400

2009 - $33,200

2010 and beyond - $25,000

Using this information what is Jet's residual income valuation at the beginning of 2007?

A) $125,000

B) $184,600

C) $190,262

D) $260,415

2008 - $35,400

2009 - $33,200

2010 and beyond - $25,000

Using this information what is Jet's residual income valuation at the beginning of 2007?

A) $125,000

B) $184,600

C) $190,262

D) $260,415

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

17

Over the life of a firm, the capital invested in the firm by the shareholders plus the income of the firm will reflect

A) the dividend paying ability of the firm.

B) the free cash flows available to shareholders.

C) the value of the firm to shareholders.

D) the value of the firm for debtholders and shareholders.

A) the dividend paying ability of the firm.

B) the free cash flows available to shareholders.

C) the value of the firm to shareholders.

D) the value of the firm for debtholders and shareholders.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

18

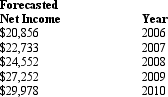

Jones Corp. Use this information to answer the following questions:

At the end of 2005 Jones Corp. developed the following forecasts of net income:

Management believes that after 2010 Jones will grow at a rate of 7% each year. Total common shareholders' was $112,768 on December 31, 2005. Jones has not established a dividend and does not plan on paying dividends during 2006 to 2010, its cost of equity capital is 12%.

Management believes that after 2010 Jones will grow at a rate of 7% each year. Total common shareholders' was $112,768 on December 31, 2005. Jones has not established a dividend and does not plan on paying dividends during 2006 to 2010, its cost of equity capital is 12%.

What would be Jones' residual income in 2008?

A) $24,552

B) $18,763

C) $5,789

D) $5,200

At the end of 2005 Jones Corp. developed the following forecasts of net income:

Management believes that after 2010 Jones will grow at a rate of 7% each year. Total common shareholders' was $112,768 on December 31, 2005. Jones has not established a dividend and does not plan on paying dividends during 2006 to 2010, its cost of equity capital is 12%.

Management believes that after 2010 Jones will grow at a rate of 7% each year. Total common shareholders' was $112,768 on December 31, 2005. Jones has not established a dividend and does not plan on paying dividends during 2006 to 2010, its cost of equity capital is 12%.What would be Jones' residual income in 2008?

A) $24,552

B) $18,763

C) $5,789

D) $5,200

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

19

Residual income is

A) adjusted net income the firm reports.

B) the difference between the net income the analyst expects the firm to generate and the required earnings of the firm.

C) the difference between the net income the analyst expects the firm to generate and the reported earnings of the firm.

D) the book value of common equity capital at the beginning of the period multiplied by the required rate of return on common equity capital.

A) adjusted net income the firm reports.

B) the difference between the net income the analyst expects the firm to generate and the required earnings of the firm.

C) the difference between the net income the analyst expects the firm to generate and the reported earnings of the firm.

D) the book value of common equity capital at the beginning of the period multiplied by the required rate of return on common equity capital.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

20

Assume that a firm had shareholders' equity on the balance sheet at a book value of $1,200 at the end of 2005. During 2006 the firm earns net income of $900, pays dividends to shareholders of $400, and issues new stock to raise $250 of capital. The book value of shareholders equity at the end of 2006 is:

A) $2,750

B) $250

C) $1,450

D) $1,950

A) $2,750

B) $250

C) $1,450

D) $1,950

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

21

Over the life of a firm, the capital invested in the firm by the shareholders plus the income of the firm will reflect the ______________________________ to the shareholders.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

22

What are the three arguments economists provide against using earnings as a value-relevant attribute in valuation?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

23

When debating the issue of whether to use free cash flows or earnings in a valuation model economists sometimes argue that ____________________ can be subject to purposeful management by a firm and thus make them less useful.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

24

Over the life of the firm, the present value of ______________________________, ______________________________, and ____________________ will be the same.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

25

Clean surplus accounting means that ____________________ include all direct capital transactions between the firm and the common equity shareholders.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

26

Over sufficiently long periods, _________________________ equals free cash flows to common equity.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

27

If an analyst expects a firm to generate net income each period exactly equal to required earnings, then the value of the firm will be equal to the ______________________________ of common shareholders' equity.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

28

Clean surplus accounting means that net income includes all of the recognized elements of income for the firm for _____________________________________________.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

29

Economists sometimes argue that earnings are not a _________________________ attribute on which to base valuation.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

30

Provide the intuition for the residual income valuation model. In addition, define residual income.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

31

Accounting for the book value of common shareholders' equity in a firm can be expressed as follows:

BVt = BVt-1 + ____________________ - Dt.

BVt = BVt-1 + ____________________ - Dt.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

32

The required earnings of the firm equals the product of the required rate of return on common equity capital times the __________________________________________________ at the beginning of the period.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

33

______________________________ is the amount by which expected future earnings exceed the required earnings.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

34

Accounting earnings numbers provide a basis for valuation because earnings are the primary measure of ______________________________ produced by the accrual accounting system.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

35

____________________ are the fundamental, value-relevant attribute of expected future returns.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

36

The foundation for residual income valuation is the classical _____________________________________________.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

37

The residual income valuation approach assumes that accounting for net income and book value of shareholders' equity follows ________________________________________.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

38

What is the rationale for using expected earnings as a basis for valuations?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

39

Accounting principles make accrual accounting earnings closer to the firm's underlying economic performance in a given period than are _________________________.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

40

What is meant by the term clean surplus accounting?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

41

Investors have invested $25,000 in common equity in a company. Given the risk inherent in the company the investors expect to earn a 15 percent return. In addition, the investors expect that the company will reinvest all income in projects that will earn 16%. The company is forecasted to earn $6,000 the first year, $5,000 the second year, $5,500 the third year and $6,244 each year after the third year. For this company determine the company's residual income valuation (round all numbers to the nearest dollar).

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

42

Investors have invested $25,000 in common equity in a company. Given the risk inherent in the company the investors expect to earn a 15 percent return. In addition, the investors expect the company to return all income to investors in the form of dividends. The company is forecasted to earn $4,000 the first year, $5,000 the second year, $4,500 the third year and $3,750 each year after the third year. For this company determine the company's residual income valuation

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

43

Currently U.S. GAAP does not follow clean surplus accounting, what are the four dirty surplus items that do not flow through net income?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

44

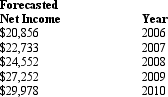

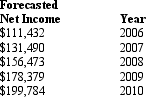

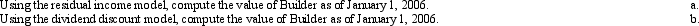

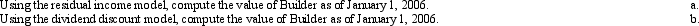

Builder, Inc. is a distributor of tools and building supplies. Management for the company has developed the following forecasts of net income:

Management expects net income to grow at a rate of 7 percent per year after 2010 and the company's cost of equity capital is 14%. Management has set a dividend payout ratio equal to 25% of net income and plans to continue this policy. Builder's common shareholders' equity at January 1, 2006 is $544,902.

Management expects net income to grow at a rate of 7 percent per year after 2010 and the company's cost of equity capital is 14%. Management has set a dividend payout ratio equal to 25% of net income and plans to continue this policy. Builder's common shareholders' equity at January 1, 2006 is $544,902.

Required:

Management expects net income to grow at a rate of 7 percent per year after 2010 and the company's cost of equity capital is 14%. Management has set a dividend payout ratio equal to 25% of net income and plans to continue this policy. Builder's common shareholders' equity at January 1, 2006 is $544,902.

Management expects net income to grow at a rate of 7 percent per year after 2010 and the company's cost of equity capital is 14%. Management has set a dividend payout ratio equal to 25% of net income and plans to continue this policy. Builder's common shareholders' equity at January 1, 2006 is $544,902.Required:

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

45

Why is the weighted average cost of capital not used as the discount rate when computing residual income?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

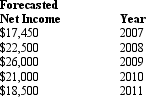

46

Power, Inc. is a distributor of electrical supplies and tools. Management for the company has developed the following forecasts of net income:

Red Ranger, CFO of Power, Inc. expects net income to grow at a rate of 9 percent per year after 2011 and the company's cost of equity capital is 15%. Management plans to payout all income in dividends and plans to continue this policy into the future. Power's common shareholders' equity at January 1, 2006 is $100,000.

Red Ranger, CFO of Power, Inc. expects net income to grow at a rate of 9 percent per year after 2011 and the company's cost of equity capital is 15%. Management plans to payout all income in dividends and plans to continue this policy into the future. Power's common shareholders' equity at January 1, 2006 is $100,000.

Required:

Red Ranger, CFO of Power, Inc. expects net income to grow at a rate of 9 percent per year after 2011 and the company's cost of equity capital is 15%. Management plans to payout all income in dividends and plans to continue this policy into the future. Power's common shareholders' equity at January 1, 2006 is $100,000.

Red Ranger, CFO of Power, Inc. expects net income to grow at a rate of 9 percent per year after 2011 and the company's cost of equity capital is 15%. Management plans to payout all income in dividends and plans to continue this policy into the future. Power's common shareholders' equity at January 1, 2006 is $100,000.Required:

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

47

Investors have invested $25,000 in common equity in a company. Given the risk inherent in the company the investors expect to earn a 15 percent return. In addition, the investors expect the company to return all income to investors in the form of dividends. The company earns $4,000 the first year. For this company determine the following:

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck