Deck 9: Inventories: Additional Issues

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

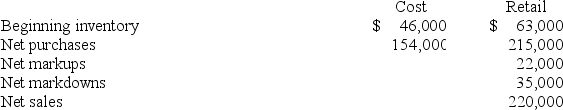

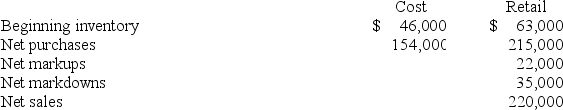

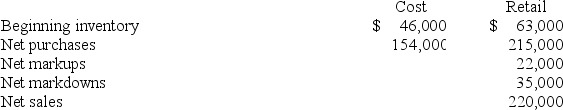

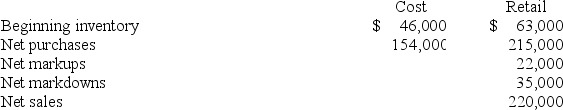

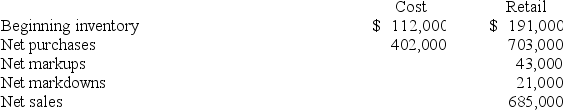

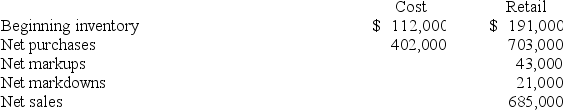

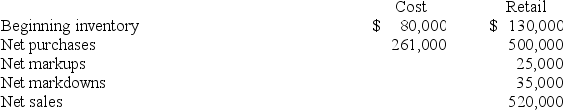

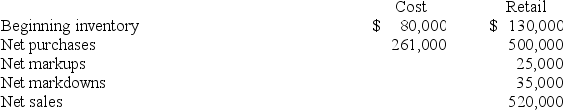

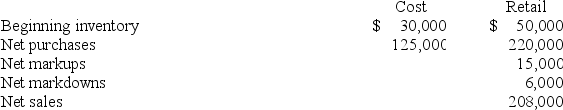

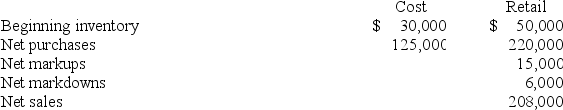

Question

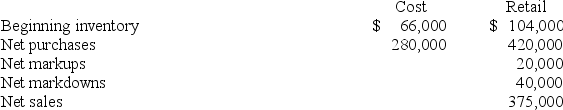

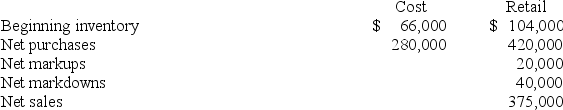

Question

Question

Question

Question

Question

Question

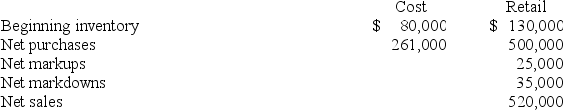

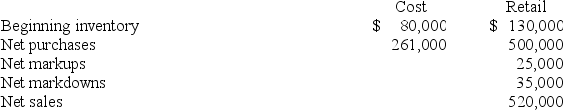

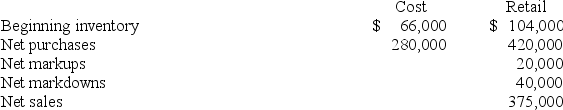

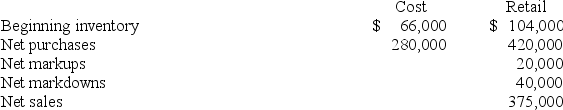

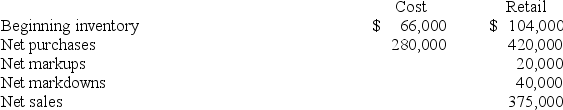

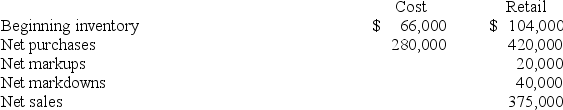

Question

Question

Question

Question

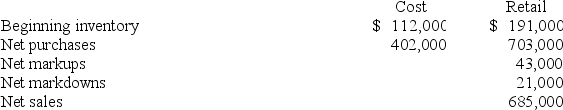

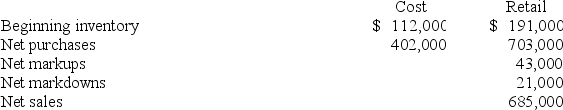

Question

Question

Question

Question

Question

Question

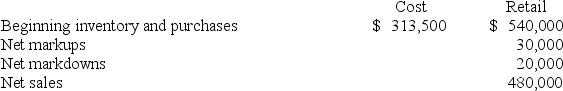

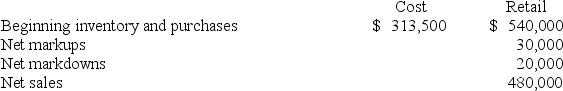

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/153

Play

Full screen (f)

Deck 9: Inventories: Additional Issues

1

Losses on reduction to NRV may be charged to either cost of goods sold or to a line item among operating expenses.

True

2

The primary motivation behind the lower of cost or net realizable value rule is consistency.

False

3

An inventory written down due to the lower of cost or net realizable value may be written back up if net realizable value increases.

False

4

Net realizable value is selling price less costs of completion, disposal, and transportation.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

5

A change from LIFO to any other inventory method is accounted for retrospectively.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

6

The cost-to-retail percentage used in the retail method to approximate average cost incorporates both markdowns and markups.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

7

When changing from the average cost method to FIFO, the current year's income includes the cumulative after-tax difference that would have resulted if the company had used FIFO in all prior years.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

8

For companies using FIFO or average cost, inventory is valued at:

A) Net realizable value.

B) Cost.

C) Replacement cost.

D) Lower of cost or net realizable value.

A) Net realizable value.

B) Cost.

C) Replacement cost.

D) Lower of cost or net realizable value.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

9

For a purchase commitment extending beyond the current fiscal year, if the market price on the purchase date declines from the previous year-end price, the purchase is recorded at the market price.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

10

The market value for purposes of using the lower of cost or market (LCM) method is defined as replacement cost, subject to a ceiling and a floor.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

11

For companies that use FIFO or average cost, inventory is valued at the lower of cost or net realizable value at the end of the reporting period.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

12

If the quantity of goods held in inventory decreased during the period, the dollar amount of ending inventory can't exceed the dollar amount of beginning inventory.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

13

A reduction in reported inventory due to market value falling below cost would reduce net income in the current period.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

14

Lower of cost or net realizable value can be applied to individual inventory items, to logical categories of inventory, or to the entire inventory.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

15

Purchase returns and purchase discounts are ignored when computing cost-to-retail ratios for the retail method.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

16

For companies that use LIFO, inventory is valued at the lower of cost or net realizable value at the end of the reporting period.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

17

The primary motivation behind the lower of cost or market (LCM) rule is conservatism.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

18

Under the LIFO retail method, the current period cost-to-retail percentage includes both net markdowns and net markups.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

19

For a purchase commitment contained within a single fiscal year, if the market price is less than the contract price, the purchase is recorded at the contract price.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

20

International Financial Reporting Standards allow the reversal of an inventory write-down.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

21

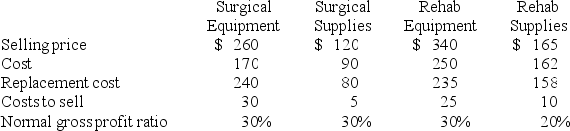

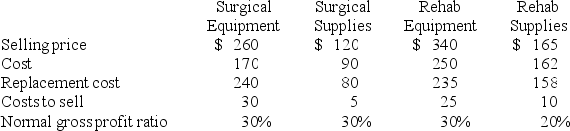

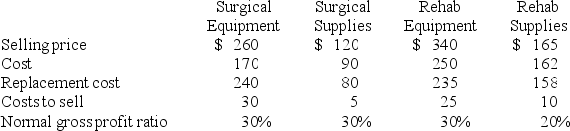

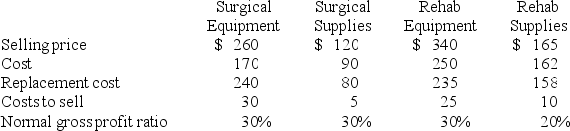

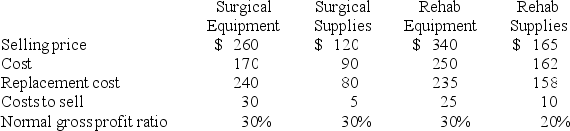

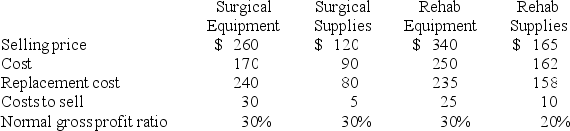

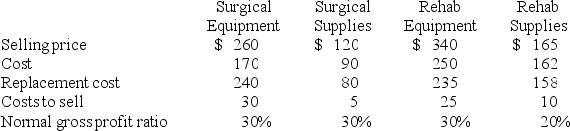

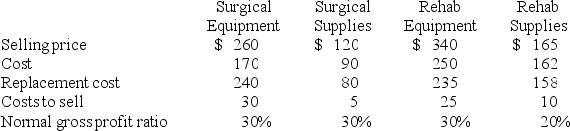

Data related to the inventories of Kimzey Medical Supply are presented below:

- In applying the lower of cost or market rule, the inventory of surgical supplies would be valued at:

A) $100.

B) $90.

C) $80.

D) $75.

- In applying the lower of cost or market rule, the inventory of surgical supplies would be valued at:

A) $100.

B) $90.

C) $80.

D) $75.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

22

Data related to the inventories of Costco Medical Supply are presented below:

- In applying the lower of cost or net realizable value rule, the inventory of surgical supplies would be valued at:

A) $100.

B) $90.

C) $85.

D) $75.

- In applying the lower of cost or net realizable value rule, the inventory of surgical supplies would be valued at:

A) $100.

B) $90.

C) $85.

D) $75.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

23

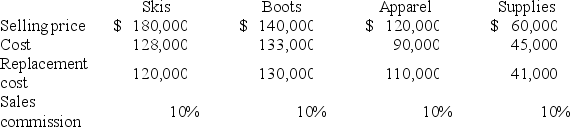

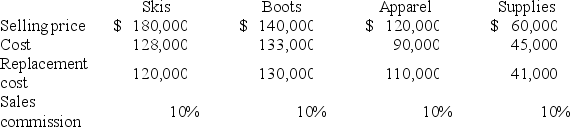

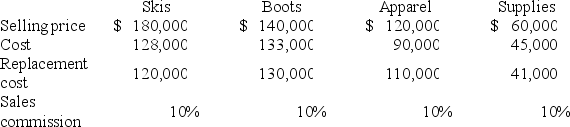

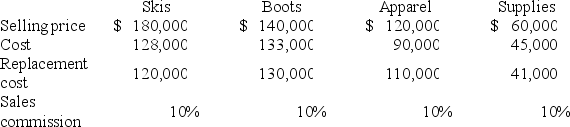

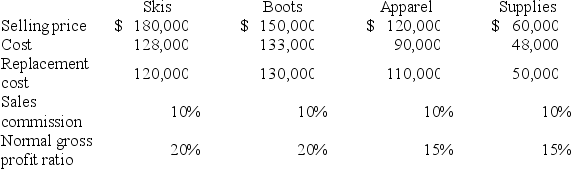

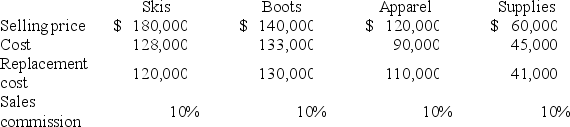

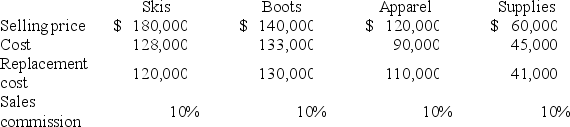

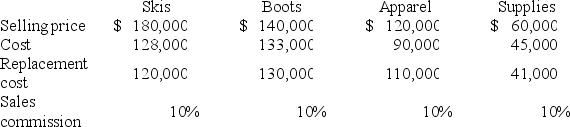

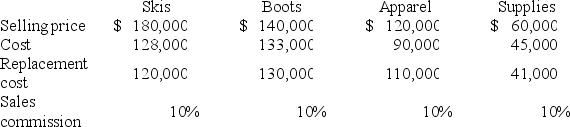

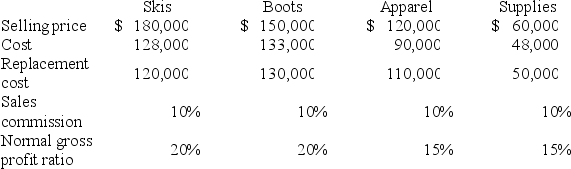

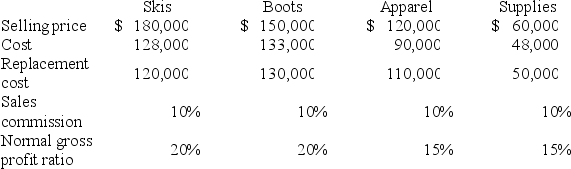

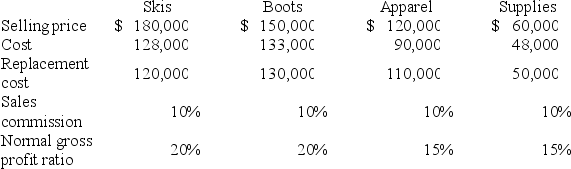

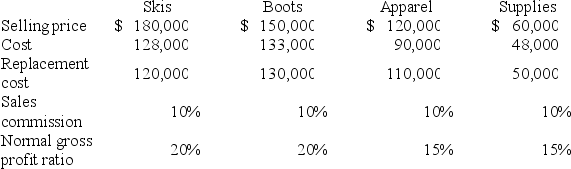

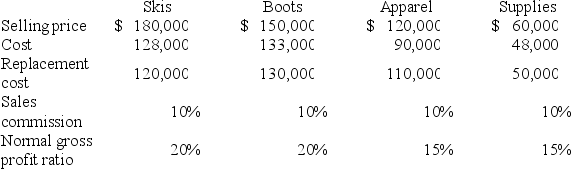

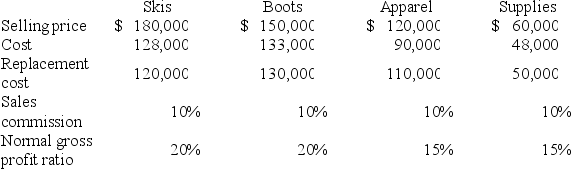

Data related to the inventories of Alpine Ski Equipment and Supplies is presented below:

-In applying the lower of cost or net realizable value rule, the inventory of supplies would be valued at:

A) $45,000.

B) $54,000.

C) $41,000.

D) $60,000.

-In applying the lower of cost or net realizable value rule, the inventory of supplies would be valued at:

A) $45,000.

B) $54,000.

C) $41,000.

D) $60,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

24

Data related to the inventories of Costco Medical Supply are presented below:

-In applying the lower of cost or net realizable value rule, the inventory of surgical equipment would be valued at:

A) $230.

B) $240.

C) $170.

D) $152.

-In applying the lower of cost or net realizable value rule, the inventory of surgical equipment would be valued at:

A) $230.

B) $240.

C) $170.

D) $152.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

25

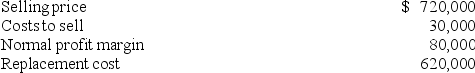

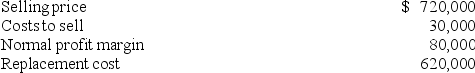

Madison Co. has determined its year-end inventory on a LIFO basis to be $600,000. Information pertaining to that inventory is as follows:  What should be the reported value of Madison's inventory?

What should be the reported value of Madison's inventory?

A) $600,000.

B) $620,000.

C) $690,000.

D) $610,000.

What should be the reported value of Madison's inventory?

What should be the reported value of Madison's inventory?A) $600,000.

B) $620,000.

C) $690,000.

D) $610,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

26

Data related to the inventories of Kimzey Medical Supply are presented below:

- In applying the lower of cost or market rule, the inventory of rehab supplies would be valued at:

A) $122.

B) $158.

C) $162.

D) $155.

- In applying the lower of cost or market rule, the inventory of rehab supplies would be valued at:

A) $122.

B) $158.

C) $162.

D) $155.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

27

In applying LCM, market cannot be:

A) Less than net realizable value.

B) Greater than the normal profit.

C) Less than the normal profit margin.

D) Greater than net realizable value.

A) Less than net realizable value.

B) Greater than the normal profit.

C) Less than the normal profit margin.

D) Greater than net realizable value.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

28

In applying LCM, market cannot be:

A) Less than net realizable value minus a normal profit margin.

B) Net realizable value less reasonable completion and disposal costs.

C) Greater than net realizable value reduced by an allowance for normal profit margin.

D) Less than cost.

A) Less than net realizable value minus a normal profit margin.

B) Net realizable value less reasonable completion and disposal costs.

C) Greater than net realizable value reduced by an allowance for normal profit margin.

D) Less than cost.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

29

Data related to the inventories of Kimzey Medical Supply are presented below:

- In applying the lower of cost or market rule, the inventory of rehab equipment would be valued at:

A) $315.

B) $247.

C) $150.

D) $235.

- In applying the lower of cost or market rule, the inventory of rehab equipment would be valued at:

A) $315.

B) $247.

C) $150.

D) $235.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

30

Data related to the inventories of Costco Medical Supply are presented below:

- In applying the lower of cost or net realizable value rule, the inventory of rehab supplies would be valued at:

A) $165.

B) $152.

C) $162.

D) $155.

- In applying the lower of cost or net realizable value rule, the inventory of rehab supplies would be valued at:

A) $165.

B) $152.

C) $162.

D) $155.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

31

Montana Co. has determined its year-end inventory on a FIFO basis to be $600,000. Information pertaining to that inventory is as follows:

A) $600,000.

B) $520,000.

C) $590,000.

D) $620,000.

A) $600,000.

B) $520,000.

C) $590,000.

D) $620,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

32

Data related to the inventories of Alpine Ski Equipment and Supplies is presented below:

-In applying the lower of cost or net realizable value rule, the inventory of apparel would be valued at:

A) $108,000.

B) $90,000.

C) $110,000.

D) $99,000.

-In applying the lower of cost or net realizable value rule, the inventory of apparel would be valued at:

A) $108,000.

B) $90,000.

C) $110,000.

D) $99,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

33

An argument against use of the lower of cost or net realizable value rule is its lack of:

A) Relevance.

B) Reliability.

C) Consistency.

D) Objectivity.

A) Relevance.

B) Reliability.

C) Consistency.

D) Objectivity.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

34

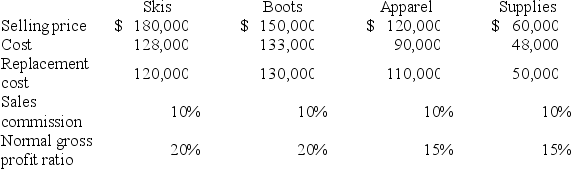

Data related to the inventories of Mountain Ski Equipment and Supplies is presented below:

- In applying the lower of cost or market rule, the inventory of skis would be valued at:

A) $162,000.

B) $128,000.

C) $120,000.

D) $126,000.

- In applying the lower of cost or market rule, the inventory of skis would be valued at:

A) $162,000.

B) $128,000.

C) $120,000.

D) $126,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

35

Data related to the inventories of Costco Medical Supply are presented below:

- In applying the lower of cost or net realizable value rule, the inventory of rehab equipment would be valued at:

A) $315.

B) $340.

C) $225.

D) $250.

- In applying the lower of cost or net realizable value rule, the inventory of rehab equipment would be valued at:

A) $315.

B) $340.

C) $225.

D) $250.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

36

Masterlink Co., in applying the lower of cost or market method, reports its inventory at net realizable value. Which of the following statements is correct?

A) NRV is greater than replacement cost.

B) Cost is less than net realizable value.

C) Cost is greater than net realizable value.

D) Cost is less than NRV minus a normal profit margin.

A) NRV is greater than replacement cost.

B) Cost is less than net realizable value.

C) Cost is greater than net realizable value.

D) Cost is less than NRV minus a normal profit margin.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

37

For companies using LIFO, inventory is valued at:

A) Net realizable value.

B) Cost.

C) Replacement cost.

D) Lower of cost or market.

A) Net realizable value.

B) Cost.

C) Replacement cost.

D) Lower of cost or market.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

38

Data related to the inventories of Alpine Ski Equipment and Supplies is presented below:

- In applying the lower of cost or net realizable value rule, the inventory of skis would be valued at:

A) $162,000.

B) $128,000.

C) $120,000.

D) $180,000.

- In applying the lower of cost or net realizable value rule, the inventory of skis would be valued at:

A) $162,000.

B) $128,000.

C) $120,000.

D) $180,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

39

Data related to the inventories of Kimzey Medical Supply are presented below:

-In applying the lower of cost or market rule, the inventory of surgical equipment would be valued at:

A) $230.

B) $240.

C) $170.

D) $152.

-In applying the lower of cost or market rule, the inventory of surgical equipment would be valued at:

A) $230.

B) $240.

C) $170.

D) $152.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

40

Data related to the inventories of Alpine Ski Equipment and Supplies is presented below:

- In applying the lower of cost or net realizable value rule, the inventory of boots would be valued at:

A) $140,000.

B) $133,000.

C) $126,000.

D) $130,000.

- In applying the lower of cost or net realizable value rule, the inventory of boots would be valued at:

A) $140,000.

B) $133,000.

C) $126,000.

D) $130,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

41

Data related to the inventories of Mountain Ski Equipment and Supplies is presented below:

-In applying the lower of cost or market rule, the inventory of supplies would be valued at:

A) $45,000.

B) $54,000.

C) $50,000.

D) $48,000.

-In applying the lower of cost or market rule, the inventory of supplies would be valued at:

A) $45,000.

B) $54,000.

C) $50,000.

D) $48,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

42

Fad City sells novel clothes that are subject to a great deal of price volatility. A recent item that cost $20 was marked up $12, marked down for a sale by $6 and then had a markdown cancellation of $3. The latest selling price is:

A) $23.

B) $26.

C) $29.

D) $35.

A) $23.

B) $26.

C) $29.

D) $35.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

43

When using the gross profit method to estimate ending inventory, it is not necessary to know:

A) Beginning inventory.

B) Net purchases.

C) Cost of goods sold.

D) Net sales.

A) Beginning inventory.

B) Net purchases.

C) Cost of goods sold.

D) Net sales.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

44

Under the retail inventory method:

A) A company measures inventory on its balance sheet by converting retail prices to cost.

B) A company measures inventory on its balance sheet at current selling prices.

C) A company measures inventory on its balance sheet on a LIFO basis.

D) None of these answer choices are correct.

A) A company measures inventory on its balance sheet by converting retail prices to cost.

B) A company measures inventory on its balance sheet at current selling prices.

C) A company measures inventory on its balance sheet on a LIFO basis.

D) None of these answer choices are correct.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

45

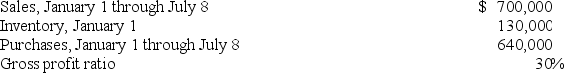

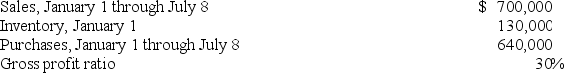

On July 8, a fire destroyed the entire merchandise inventory on hand of Larrenaga Wholesale Corporation. The following information is available:  What is the estimated inventory on July 8 immediately prior to the fire?

What is the estimated inventory on July 8 immediately prior to the fire?

A) $192,000.

B) $490,000.

C) $510,000.

D) $280,000.

What is the estimated inventory on July 8 immediately prior to the fire?

What is the estimated inventory on July 8 immediately prior to the fire?A) $192,000.

B) $490,000.

C) $510,000.

D) $280,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

46

Data related to the inventories of Mountain Ski Equipment and Supplies is presented below:

- In applying the lower of cost or market rule, the inventory of boots would be valued at:

A) $135,000.

B) $133,000.

C) $130,000.

D) $105,000.

- In applying the lower of cost or market rule, the inventory of boots would be valued at:

A) $135,000.

B) $133,000.

C) $130,000.

D) $105,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

47

Coastal Shores Inc. (CSI) was destroyed by Hurricane Fred on August 5, 2018. At January 1, CSI reported an inventory of $170,000. Sales from January 1, 2018, to August 5, 2018, totaled $480,000 and purchases totaled $195,000 during that time. CSI consistently marks up its products 60% over cost to arrive at a selling price. The estimated inventory loss due to Hurricane Fred would be:

A) $131,175.

B) $65,000.

C) $69,000.

D) None of these answer choices are correct.

A) $131,175.

B) $65,000.

C) $69,000.

D) None of these answer choices are correct.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

48

Under the retail method, in determining the cost-to-retail percentage for the current year:

A) Net markups are included.

B) Net markdowns are excluded.

C) Net sales are included.

D) All of these answer choices are correct.

A) Net markups are included.

B) Net markdowns are excluded.

C) Net sales are included.

D) All of these answer choices are correct.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

49

Under the retail method, the denominator in the cost-to-retail percentage does not include:

A) Purchases.

B) Purchase returns.

C) Abnormal shortages.

D) Freight-in.

A) Purchases.

B) Purchase returns.

C) Abnormal shortages.

D) Freight-in.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

50

California Inc., through no fault of its own, lost an entire plant due to an earthquake on May 1, 2018. In preparing its insurance claim on the inventory loss, the company developed the following data: Inventory January 1, 2018, $300,000; sales and purchases from January 1, 2018, to May 1, 2018, $1,300,000 and $875,000, respectively. California consistently reports a 40% gross profit. The estimated inventory on May 1, 2018, is:

A) $302,500.

B) $360,000.

C) $395,000.

D) $455,000.

A) $302,500.

B) $360,000.

C) $395,000.

D) $455,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

51

Under the conventional retail method, which of the following are not included in the denominator of the current period cost-to-retail conversion percentage?

A) Purchase returns.

B) Net markups.

C) Purchases.

D) Net markdowns.

A) Purchase returns.

B) Net markups.

C) Purchases.

D) Net markdowns.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

52

Harvey's Junk Jewelry started business January 1, 2018, and uses the LIFO retail method to estimate ending inventory. Listed below is data accumulated for the year ended December 31, 2018:

-The estimated ending inventory at retail is:

A) $27,300.

B) $25,000.

C) $26,600.

D) $26,400.

-The estimated ending inventory at retail is:

A) $27,300.

B) $25,000.

C) $26,600.

D) $26,400.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

53

Under the LIFO retail method, the denominator in the cost-to-retail percentage includes:

A) Net markups and net markdowns.

B) Neither net markups nor net markdowns.

C) Net markups, but not net markdowns.

D) Net markdowns, but not net markups.

A) Net markups and net markdowns.

B) Neither net markups nor net markdowns.

C) Net markups, but not net markdowns.

D) Net markdowns, but not net markups.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

54

Under the conventional retail method, the denominator in the cost-to-retail percentage includes:

A) Net markups and net markdowns.

B) Neither net markups nor net markdowns.

C) Net markups, but not net markdowns.

D) Net markdowns, but not net markups.

A) Net markups and net markdowns.

B) Neither net markups nor net markdowns.

C) Net markups, but not net markdowns.

D) Net markdowns, but not net markups.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

55

Data related to the inventories of Mountain Ski Equipment and Supplies is presented below:

- In applying the lower of cost or market rule, the inventory of apparel would be valued at:

A) $108,000.

B) $ 90,000.

C) $110,000.

D) $115,000.

- In applying the lower of cost or market rule, the inventory of apparel would be valued at:

A) $108,000.

B) $ 90,000.

C) $110,000.

D) $115,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

56

Harvey's Junk Jewelry started business January 1, 2018, and uses the LIFO retail method to estimate ending inventory. Listed below is data accumulated for the year ended December 31, 2018:

- The numerator for the current period's cost-to-retail percentage is:

A) $64,800.

B) $48,100.

C) $47,700.

D) $49,800.

- The numerator for the current period's cost-to-retail percentage is:

A) $64,800.

B) $48,100.

C) $47,700.

D) $49,800.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

57

Under the LIFO retail method, which of the following are not included in the denominator of the cost-to-retail conversion percentage?

A) Freight-in.

B) Purchase returns.

C) Purchases.

D) Net markdowns.

A) Freight-in.

B) Purchase returns.

C) Purchases.

D) Net markdowns.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

58

Harvey's Junk Jewelry started business January 1, 2018, and uses the LIFO retail method to estimate ending inventory. Listed below is data accumulated for the year ended December 31, 2018:

- The denominator for the current period's cost-to-retail percentage is:

A) $96,300.

B) $73,300.

C) $101,000.

D) $81,500.

- The denominator for the current period's cost-to-retail percentage is:

A) $96,300.

B) $73,300.

C) $101,000.

D) $81,500.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

59

Howard's Supply Co. suffered a fire loss on April 20, 2018. The company's last physical inventory was taken January 30, 2018, at which time the inventory totaled $220,000. Sales from January 30 to April 20 were $600,000 and purchases during that time were $450,000. Howard's consistently reports a 30% gross profit. The estimated inventory loss is:

A) $490,000.

B) $238,000.

C) $250,000.

D) None of these answer choices are correct.

A) $490,000.

B) $238,000.

C) $250,000.

D) None of these answer choices are correct.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

60

Harvey's Junk Jewelry started business January 1, 2018, and uses the LIFO retail method to estimate ending inventory. Listed below is data accumulated for the year ended December 31, 2018:

-To the nearest thousand, the estimated ending inventory at cost is (round cost-to-retail ratio to whole percentage):

A) $16,000.

B) $15,000.

C) $13,000.

D) $19,000.

-To the nearest thousand, the estimated ending inventory at cost is (round cost-to-retail ratio to whole percentage):

A) $16,000.

B) $15,000.

C) $13,000.

D) $19,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

61

The second step, when using dollar-value LIFO retail method for inventory, is to determine the estimated:

A) Ending inventory at current year retail prices.

B) Cost of goods sold for the current year.

C) Ending inventory at cost.

D) Ending inventory at base year retail prices.

A) Ending inventory at current year retail prices.

B) Cost of goods sold for the current year.

C) Ending inventory at cost.

D) Ending inventory at base year retail prices.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

62

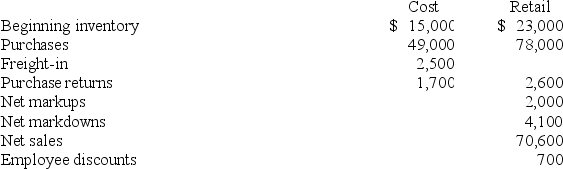

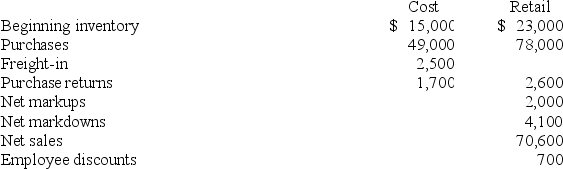

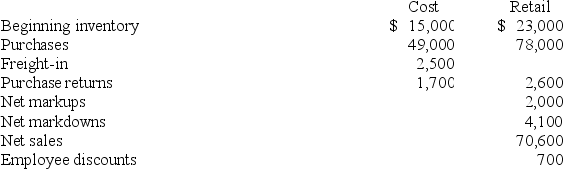

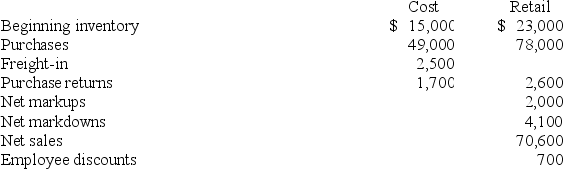

Willie Nelson's Boots uses the conventional retail method to estimate ending inventory. Cost data for the most recent quarter is shown below:

- The conventional cost-to-retail percentage (rounded) is:

A) 82.6%.

B) 66.7%.

C) 71.9%.

D) 75.5%.

- The conventional cost-to-retail percentage (rounded) is:

A) 82.6%.

B) 66.7%.

C) 71.9%.

D) 75.5%.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

63

Clarabell Inc. uses the conventional retail method to estimate ending inventory. Cost data for the most recent quarter is shown below:

- To the nearest thousand, estimated ending inventory using the conventional retail method is:

A) $163,000.

B) $124,000.

C) $127,000.

D) $136,000.

- To the nearest thousand, estimated ending inventory using the conventional retail method is:

A) $163,000.

B) $124,000.

C) $127,000.

D) $136,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

64

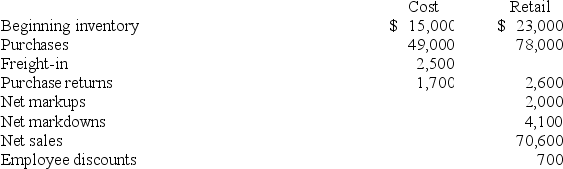

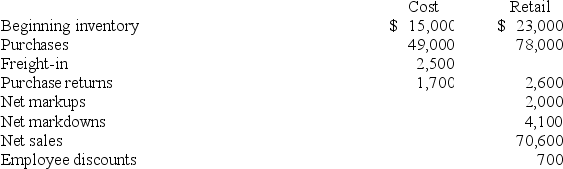

Benny's Bed Co. uses a periodic inventory system and the average cost retail method to estimate ending inventory and cost of goods sold. The following data is available from the company records for the month of September 2018.

- The average cost-to-retail percentage (rounded) is:

A) 74.5%.

B) 55.6%.

C) 57.4%.

D) 58.7%.

- The average cost-to-retail percentage (rounded) is:

A) 74.5%.

B) 55.6%.

C) 57.4%.

D) 58.7%.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

65

The conventional retail inventory method is based on:

A) Average cost.

B) LIFO cost.

C) Average, lower of cost or net realizable value.

D) LIFO, lower of cost or net realizable value.

A) Average cost.

B) LIFO cost.

C) Average, lower of cost or net realizable value.

D) LIFO, lower of cost or net realizable value.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

66

When computing the cost-to-retail percentage for the average cost retail method, included in the denominator are:

A) Net markups and net markdowns.

B) Neither net markups nor net markdowns.

C) Net markups, but not net markdowns.

D) Net markdowns, but not net markups.

A) Net markups and net markdowns.

B) Neither net markups nor net markdowns.

C) Net markups, but not net markdowns.

D) Net markdowns, but not net markups.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

67

Hawkeye Auto Parts uses the average cost retail method to estimate inventories. Data for the first six months of 2018 include: beginning inventory at cost and retail were $55,000 and $100,000, net purchases at cost and retail were $785,000 and $1,300,000, and sales during the first six months totaled $800,000. The estimated inventory at June 30, 2018, would be:

A) $330,000.

B) $360,000.

C) $362,300.

D) None of these answer choices are correct.

A) $330,000.

B) $360,000.

C) $362,300.

D) None of these answer choices are correct.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

68

Willie Nelson's Boots uses the conventional retail method to estimate ending inventory. Cost data for the most recent quarter is shown below:

-To the nearest thousand, estimated ending inventory using the conventional retail method is:

A) $37,000.

B) $32,000.

C) $34,000.

D) $30,000.

-To the nearest thousand, estimated ending inventory using the conventional retail method is:

A) $37,000.

B) $32,000.

C) $34,000.

D) $30,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

69

Marilee's Electronics uses a periodic inventory system and the average cost retail method to estimate ending inventory and cost of goods sold. The following data is available from the company records for the month of June 2018:  The average cost-to-retail percentage is:

The average cost-to-retail percentage is:

A) 52.2%.

B) 61.5%.

C) 56.8%.

D) 55%.

The average cost-to-retail percentage is:

The average cost-to-retail percentage is:A) 52.2%.

B) 61.5%.

C) 56.8%.

D) 55%.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

70

Clarabell Inc. uses the conventional retail method to estimate ending inventory. Cost data for the most recent quarter is shown below:

-The conventional cost-to-retail percentage (rounded) is:

A) 54.9%.

B) 58.9%.

C) 53.6%.

D) 70.6%.

-The conventional cost-to-retail percentage (rounded) is:

A) 54.9%.

B) 58.9%.

C) 53.6%.

D) 70.6%.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

71

Under the dollar-value LIFO retail method, to determine if the increase in the value of inventory was due to an increase in quantities:

A) Compare beginning and ending inventory amounts at current year prices.

B) Compare beginning and ending inventory amounts after adjusting both amounts to the average price level for the year.

C) Inflate beginning inventory amount to end of year prices and compare to ending inventory amount.

D) Deflate the ending inventory amount to beginning of year prices and compare to the beginning inventory amount.

A) Compare beginning and ending inventory amounts at current year prices.

B) Compare beginning and ending inventory amounts after adjusting both amounts to the average price level for the year.

C) Inflate beginning inventory amount to end of year prices and compare to ending inventory amount.

D) Deflate the ending inventory amount to beginning of year prices and compare to the beginning inventory amount.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

72

Lacy's Linen Mart uses the average cost retail method to estimate inventories. Data for the first six months of 2018 include: beginning inventory at cost and retail were $60,000 and $120,000, net purchases at cost and retail were $312,000 and $480,000, and sales during the first six months totaled $490,000. The estimated inventory at June 30, 2018, would be:

A) $68,200.

B) $55,000.

C) $71,500.

D) $63,250.

A) $68,200.

B) $55,000.

C) $71,500.

D) $63,250.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

73

Data below for the year ended December 31, 2018, relates to Houdini Inc. Houdini started business January 1, 2018, and uses the LIFO retail method to estimate ending inventory.

- Current period cost-to-retail percentage is:

A) 70.0%.

B) 68.7%.

C) 63.6%.

D) 63.5%.

- Current period cost-to-retail percentage is:

A) 70.0%.

B) 68.7%.

C) 63.6%.

D) 63.5%.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

74

Marilee's Electronics uses a periodic inventory system and the average cost retail method to estimate ending inventory and cost of goods sold. The following data is available from the company records for the month of June 2018:  To the nearest thousand, estimated ending inventory is:

To the nearest thousand, estimated ending inventory is:

A) $55,000.

B) $52,000.

C) $57,000.

D) None of these answer choices are correct.

To the nearest thousand, estimated ending inventory is:

To the nearest thousand, estimated ending inventory is:A) $55,000.

B) $52,000.

C) $57,000.

D) None of these answer choices are correct.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

75

The first step, when using dollar-value LIFO retail method for inventory, is to:

A) Determine the estimated ending inventory at current year retail prices.

B) Determine the estimated cost of goods sold for the current year.

C) Determine the cost-to-retail percentage for the current year transactions.

D) Price index adjust the LIFO inventory layers.

A) Determine the estimated ending inventory at current year retail prices.

B) Determine the estimated cost of goods sold for the current year.

C) Determine the cost-to-retail percentage for the current year transactions.

D) Price index adjust the LIFO inventory layers.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

76

Data below for the year ended December 31, 2018, relates to Houdini Inc. Houdini started business January 1, 2018, and uses the LIFO retail method to estimate ending inventory.

-Estimated ending inventory at retail is:

A) $65,000.

B) $169,600.

C) $25,000.

D) $129,000.

-Estimated ending inventory at retail is:

A) $65,000.

B) $169,600.

C) $25,000.

D) $129,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

77

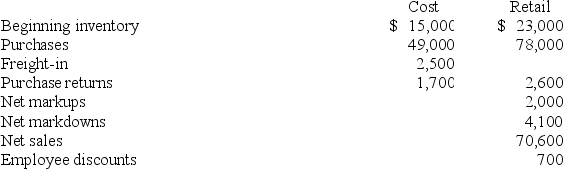

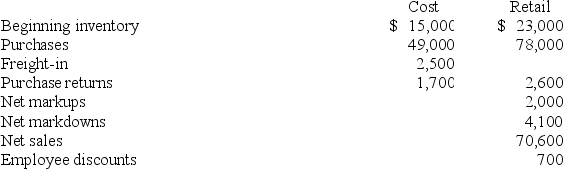

Benny's Bed Co. uses a periodic inventory system and the average cost retail method to estimate ending inventory and cost of goods sold. The following data is available from the company records for the month of September 2018.

-To the nearest thousand, estimated ending inventory is:

A) $41,000.

B) $37,000.

C) $51,000.

D) None of these answer choices are correct.

-To the nearest thousand, estimated ending inventory is:

A) $41,000.

B) $37,000.

C) $51,000.

D) None of these answer choices are correct.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

78

Data below for the year ended December 31, 2018, relates to Houdini Inc. Houdini started business January 1, 2018, and uses the LIFO retail method to estimate ending inventory.

- Estimated ending inventory at cost is:

A) $90,720.

B) $83,500.

C) $91,600.

D) None of these answer choices are correct.

- Estimated ending inventory at cost is:

A) $90,720.

B) $83,500.

C) $91,600.

D) None of these answer choices are correct.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

79

Cloverdale, Inc., uses the conventional retail inventory method to account for inventory. The following information relates to current year's operations:  What amount should be reported as cost of goods sold for the year?

What amount should be reported as cost of goods sold for the year?

A) $273,600.

B) $272,861.

C) $275,000.

D) None of these answer choices are correct.

What amount should be reported as cost of goods sold for the year?

What amount should be reported as cost of goods sold for the year?A) $273,600.

B) $272,861.

C) $275,000.

D) None of these answer choices are correct.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

80

Using the dollar-value LIFO retail method for inventory:

A) Is the same as dollar-value LIFO, except that the inventory is measured at retail, rather than at cost.

B) Combines retail LIFO accounting with dollar-value LIFO accounting.

C) Allows companies to report inventory on the balance sheet at retail prices.

D) All of these answer choices are correct.

A) Is the same as dollar-value LIFO, except that the inventory is measured at retail, rather than at cost.

B) Combines retail LIFO accounting with dollar-value LIFO accounting.

C) Allows companies to report inventory on the balance sheet at retail prices.

D) All of these answer choices are correct.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck