Deck 3: Analyzing Financing Activities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/82

Play

Full screen (f)

Deck 3: Analyzing Financing Activities

1

Which of the following would not be found listed as a liability on a company's balance sheet?

A) Operating lease obligations

B) Capital lease obligations

C) Bonds payable

D) Taxes payable

A) Operating lease obligations

B) Capital lease obligations

C) Bonds payable

D) Taxes payable

A

2

If a company leases equipment to other companies and records these leases as operating leases rather than capital leases, its:

I) recorded liabilities will be lower.

II) recorded assets will be higher.

III) total cash flows will be higher.

IV) leverage ratios will be higher.

A) I and III

B) II and IV

C) I only

D) II, III and IV

I) recorded liabilities will be lower.

II) recorded assets will be higher.

III) total cash flows will be higher.

IV) leverage ratios will be higher.

A) I and III

B) II and IV

C) I only

D) II, III and IV

B

3

Which of the following is not a criterion for defining a lease as a capital lease?

A) Ownership is transferred by the end of the lease agreement.

B) The lease contains an option to purchase the asset at a bargain price.

C) The present value of the lease payments at the beginning of the lease is 75% or more than the value of the asset.

D) The lease term is at least 75% of the economic life of the asset.

A) Ownership is transferred by the end of the lease agreement.

B) The lease contains an option to purchase the asset at a bargain price.

C) The present value of the lease payments at the beginning of the lease is 75% or more than the value of the asset.

D) The lease term is at least 75% of the economic life of the asset.

C

4

If a company engages in off-balance sheet financing, generally the effect is:

I) to cause assets to be understated.

II) to increase leverage ratios.

III) to increase cash flows.

IV) to cause liabilities to be understated.

A) I, II, III and IV

B) I, III and IV

C) I and IV

D) IV only

I) to cause assets to be understated.

II) to increase leverage ratios.

III) to increase cash flows.

IV) to cause liabilities to be understated.

A) I, II, III and IV

B) I, III and IV

C) I and IV

D) IV only

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

5

With respect to pension liabilities, which of the following statements are true?

I) The projected benefit obligation (PBO) is always greater than or equal to the accumulated benefit obligation (ABO).

II) The vested benefit obligation (VBO) is always as least as or as big as the accumulated benefit obligation (ABO).

III) If the PBO is greater than the plan assets, the plan is said to be overfunded.

IV) If the weighted-average assumed discount rate is increased, the PBO will decrease.

A) I, III and IV

B) I and III

C) II and IV

D) I and IV

I) The projected benefit obligation (PBO) is always greater than or equal to the accumulated benefit obligation (ABO).

II) The vested benefit obligation (VBO) is always as least as or as big as the accumulated benefit obligation (ABO).

III) If the PBO is greater than the plan assets, the plan is said to be overfunded.

IV) If the weighted-average assumed discount rate is increased, the PBO will decrease.

A) I, III and IV

B) I and III

C) II and IV

D) I and IV

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following would be found listed as a liability on a company's balance sheet?

A) Operating lease obligations

B) Projected benefit obligation

C) Purchase Commitment obligation

D) Postretirement benefits other than pension obligation

A) Operating lease obligations

B) Projected benefit obligation

C) Purchase Commitment obligation

D) Postretirement benefits other than pension obligation

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

7

If a company that leases equipment from another company records these leases as operating leases rather than capital leases, its:

I) recorded liabilities will be lower.

II) recorded assets will be higher.

III) total cash flows will be higher.

IV) leverage ratios will be higher.

A) I and III

B) II and IV

C) I only

D) II, III and IV

I) recorded liabilities will be lower.

II) recorded assets will be higher.

III) total cash flows will be higher.

IV) leverage ratios will be higher.

A) I and III

B) II and IV

C) I only

D) II, III and IV

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

8

A lessee must account for a lease as a capital lease if:

I) lease transfers ownership to lessee at the end of the lease.

II) lease contains option to purchase the asset at the end of the lease at a bargain price.

III) lease is longer than 20 years.

IV) present value of lease is greater than 10% of lessee's assets.

A) I and II

B) I, II and III

C) I, III and IV

D) I, II and IV

I) lease transfers ownership to lessee at the end of the lease.

II) lease contains option to purchase the asset at the end of the lease at a bargain price.

III) lease is longer than 20 years.

IV) present value of lease is greater than 10% of lessee's assets.

A) I and II

B) I, II and III

C) I, III and IV

D) I, II and IV

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is an example of off-balance sheet financing?

A) Operating leases

B) Capital leases

C) Issuance of convertible bonds

D) Issuance of common stock

A) Operating leases

B) Capital leases

C) Issuance of convertible bonds

D) Issuance of common stock

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

10

Dylan Corporation issues a zero-coupon bond with $100,000 face value, with a 5-year maturity, and the market rate is 7%. Interest on corporate bonds is normally paid semiannually. In the liability section of Dylan's balance sheet, the proceeds from selling the zero-coupon immediately after issuance will be closest to:

A) $70,892.

B) $71,299.

C) $70,000.

D) $100,000.

A) $70,892.

B) $71,299.

C) $70,000.

D) $100,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

11

The difference between the accumulated benefit obligation (ABO) and the projected benefit obligation (PBO) is:

A) the PBO considers non-vested obligations and the ABO does not.

B) the PBO takes into account the time value of money and the ABO does not.

C) the PBO takes into account future pay increases and the ABO does not.

D) the PBO takes into account mortality rates of employees and the ABO does not.

A) the PBO considers non-vested obligations and the ABO does not.

B) the PBO takes into account the time value of money and the ABO does not.

C) the PBO takes into account future pay increases and the ABO does not.

D) the PBO takes into account mortality rates of employees and the ABO does not.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

12

When considering defined benefit pension plans, which of the following will not increase the projected benefit obligation (PBO)?

A) A decrease in the discount rate.

B) An increase in estimated compensation growth.

C) An increase in expected average length of lives of employees.

D) A decrease in the expected rate of return on plan assets.

A) A decrease in the discount rate.

B) An increase in estimated compensation growth.

C) An increase in expected average length of lives of employees.

D) A decrease in the expected rate of return on plan assets.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

13

Hert Corporation acquired a capital lease that is carried on its books at a present value of $100,000 (discounted at 12%). Its annual rental payment is $15,000. What is the amount of interest expense from this lease?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is true concerning bond covenants?

A) Bond covenants are restrictions placed on bondholders to protect rights of equity holders.

B) Violation of a bond covenant requires that a company declares bankruptcy.

C) If a company violates a bond covenant, it means it has failed to make interest or principal repayments on debt in a timely manner.

D) Bond covenants are legal restrictions placed in order to minimize the risk of default on bonds.

A) Bond covenants are restrictions placed on bondholders to protect rights of equity holders.

B) Violation of a bond covenant requires that a company declares bankruptcy.

C) If a company violates a bond covenant, it means it has failed to make interest or principal repayments on debt in a timely manner.

D) Bond covenants are legal restrictions placed in order to minimize the risk of default on bonds.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following might give rise to off-balance sheet financing?

I) Long-term operating leases

II) Sale of receivables without recourse

III) Through-put agreements

IV) Purchase commitments

A) I, II, III and IV

B) I, II and IV

C) II, III and IV

D) I, III and IV

I) Long-term operating leases

II) Sale of receivables without recourse

III) Through-put agreements

IV) Purchase commitments

A) I, II, III and IV

B) I, II and IV

C) II, III and IV

D) I, III and IV

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

16

Minority interest appears on the balance sheet of some companies. Minority interest:

A) is classified as a liability.

B) is classified as an equity.

C) arises when a company records investments using the equity method.

D) arises when a company owns controlling interest in another company, but less than 100%.

A) is classified as a liability.

B) is classified as an equity.

C) arises when a company records investments using the equity method.

D) arises when a company owns controlling interest in another company, but less than 100%.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

17

The majority of financing for most companies comes from which of the following sources?

A) Owners and customers

B) Creditors and customers

C) Owners and managers

D) Creditors and owners

A) Owners and customers

B) Creditors and customers

C) Owners and managers

D) Creditors and owners

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

18

Which one of the following statements is false?

A) Short-term obligations may be classified as long term if the company intends to refinance them on a long-term basis and can demonstrate the ability to do so.

B) Violation of a long-term debt covenant automatically means the company must reclassify the debt as current.

C) Current liabilities are recorded at their maturity value, and not their present value.

D) If a bond is issued at a discount the effective interest rate is greater than the coupon rate.

A) Short-term obligations may be classified as long term if the company intends to refinance them on a long-term basis and can demonstrate the ability to do so.

B) Violation of a long-term debt covenant automatically means the company must reclassify the debt as current.

C) Current liabilities are recorded at their maturity value, and not their present value.

D) If a bond is issued at a discount the effective interest rate is greater than the coupon rate.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

19

Recording a long-term lease as an operating lease, as opposed to a capital lease, for a lessee will cause the following ratios to be:

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following statements about stock dividends is true?

A) Stock dividends increase the number of shares outstanding.

B) Stock dividends are more valuable than stock splits.

C) Stock dividends are recorded as a reduction in cash.

D) Stock dividends are dividends given in the form of stock from another company.

A) Stock dividends increase the number of shares outstanding.

B) Stock dividends are more valuable than stock splits.

C) Stock dividends are recorded as a reduction in cash.

D) Stock dividends are dividends given in the form of stock from another company.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is not a component of recognized OPEB cost?

A) Service cost

B) Amortization of prior service costs

C) Interest cost

D) Amortization of prior interest costs

A) Service cost

B) Amortization of prior service costs

C) Interest cost

D) Amortization of prior interest costs

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

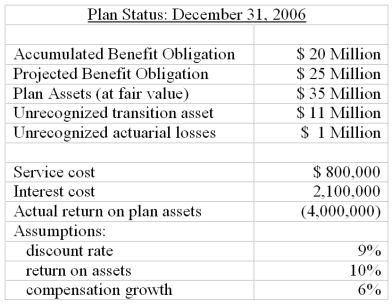

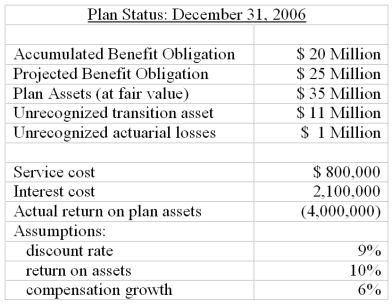

22

Harms Inc. reported in its 2006 annual report the following information:

-If Harms had decreased its compensation growth rate to 4.5% in 2006, the effect would have been:

A) an increased ABO.

B) an increased PBO.

C) a decreased ABO.

D) a decreased PBO.

-If Harms had decreased its compensation growth rate to 4.5% in 2006, the effect would have been:

A) an increased ABO.

B) an increased PBO.

C) a decreased ABO.

D) a decreased PBO.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

23

Reling Company reports the following information as of 12/31/05

-The book value per share of preferred stock is:

A) $ 22

B) $ 20

C) $ 11

D) $ 10

-The book value per share of preferred stock is:

A) $ 22

B) $ 20

C) $ 11

D) $ 10

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

24

A company's current ratio is 1.5. If the company uses cash to retire notes payable due within one year, would this transaction increase or decrease the current ratio and return on assets ratio?

A) Current Ratio: Increase; Return on Assets: Increase

B) Current Ratio: Increase; Return on Assets: Decrease

C) Current Ratio: Decrease; Return on Assets: Increase

D) Current Ratio: Decrease; Return on Assets: Decrease

A) Current Ratio: Increase; Return on Assets: Increase

B) Current Ratio: Increase; Return on Assets: Decrease

C) Current Ratio: Decrease; Return on Assets: Increase

D) Current Ratio: Decrease; Return on Assets: Decrease

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is not a component of pension expense?

A) Service cost

B) Interest cost

C) Actual return on plan assets

D) Expected return on plan assets

A) Service cost

B) Interest cost

C) Actual return on plan assets

D) Expected return on plan assets

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

26

The plan is said to be underfunded, if:

A) the pension obligation is more than the asset value.

B) the pension obligation is less than the asset value.

C) the pension obligation is equal to the asset value.

D) none of the above.

A) the pension obligation is more than the asset value.

B) the pension obligation is less than the asset value.

C) the pension obligation is equal to the asset value.

D) none of the above.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

27

One way for a company to increase its book value per share is to:

A) issue long-term debt.

B) retire long-term debt.

C) increase dividend payout ratio.

D) buy back shares at market prices below their book value.

A) issue long-term debt.

B) retire long-term debt.

C) increase dividend payout ratio.

D) buy back shares at market prices below their book value.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following is not an actuarial assumption underlying the computation of the pension obligation?

A) Employee turnover

B) Life expectancy

C) Interest rate

D) Service cost

A) Employee turnover

B) Life expectancy

C) Interest rate

D) Service cost

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is reported in the equity section of the balance sheet?

A) Redeemable Preferred stock

B) Treasury stock

C) Investment in affiliates

D) Debentures

A) Redeemable Preferred stock

B) Treasury stock

C) Investment in affiliates

D) Debentures

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

30

Synthetic leases may achieve all of the following benefits to the borrower except:

A) window dress the balance sheet.

B) increase cash flow.

C) reduce tax expense on the income statement.

D) increase net income.

A) window dress the balance sheet.

B) increase cash flow.

C) reduce tax expense on the income statement.

D) increase net income.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

31

An analyst should consider whether a company acquired assets through a capital lease or an operating lease because a company may structure:

A) leases to be treated like capital leases to enhance its leverage ratios.

B) leases to be treated like capital leases to enhance its cash flow.

C) leases to be treated like operating leases to enhance its leverage ratios.

D) leases to be treated like operating leases to enhance its cash flow.

A) leases to be treated like capital leases to enhance its leverage ratios.

B) leases to be treated like capital leases to enhance its cash flow.

C) leases to be treated like operating leases to enhance its leverage ratios.

D) leases to be treated like operating leases to enhance its cash flow.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

32

Treasury stock is:

A) investments in government securities.

B) retained earnings that have been appropriated to make equity investments.

C) a company's own stock that it has repurchased.

D) assets held for safekeeping in company's vaults.

A) investments in government securities.

B) retained earnings that have been appropriated to make equity investments.

C) a company's own stock that it has repurchased.

D) assets held for safekeeping in company's vaults.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

33

Many of the postretirement health benefit plans offered by companies to their employees are unfunded, while all of their pension plans have some degree of funding. Which of the following statements is false?

A) There is no legal requirement to fund postretirement health benefits, but there are legal requirements covering pension funding.

B) Contributions to pension plans are normally tax deductible, but contributions to postretirement health plans are not tax deductible.

C) Funds contributed to a pension plan can be withdrawn at any time, but funds contributed to a postretirement health plan cannot be withdrawn by law.

D) Taxes do not have to be paid on investment income earned by assets in pension plan, but they do normally have to be paid on postretirement health plans.

A) There is no legal requirement to fund postretirement health benefits, but there are legal requirements covering pension funding.

B) Contributions to pension plans are normally tax deductible, but contributions to postretirement health plans are not tax deductible.

C) Funds contributed to a pension plan can be withdrawn at any time, but funds contributed to a postretirement health plan cannot be withdrawn by law.

D) Taxes do not have to be paid on investment income earned by assets in pension plan, but they do normally have to be paid on postretirement health plans.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following lease provisions would cause a lease to be classified as an operating lease?

A) The lease contains a bargain purchase option.

B) The collectibility of lease payments by the lessor is unpredictable.

C) The term of the lease is more than 75 percent of the estimated economic life of the leased property.

D) The present value of the minimum lease payments equals or exceeds 90 percent of the fair value of the leased property.

A) The lease contains a bargain purchase option.

B) The collectibility of lease payments by the lessor is unpredictable.

C) The term of the lease is more than 75 percent of the estimated economic life of the leased property.

D) The present value of the minimum lease payments equals or exceeds 90 percent of the fair value of the leased property.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

35

Reling Company reports the following information as of 12/31/05

-The book value per share of common stock is:

A) $12.20

B) $12.40

C) $15.25

D) $15.50

-The book value per share of common stock is:

A) $12.20

B) $12.40

C) $15.25

D) $15.50

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

36

On January 1, a company entered into a capital lease resulting in an obligation of $20,000 being recorded on the balance sheet. The lessor's implicit interest was 10 percent. At the end of the first year of the lease, the cash flow from financing activities section of the lessee's statement of cash flows showed a use of cash of $2,200 applicable to the lease. How much did the company pay the lessor in the first year of the lease?

A) $2,000

B) $2,200

C) $4,200

D) $20,000

A) $2,000

B) $2,200

C) $4,200

D) $20,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

37

Harms Inc. reported in its 2006 annual report the following information:

-The estimated interest cost for 2007 is:

A) 7.95M.

B) 7.60M.

C) 7.36M.

D) 7.20M.

-The estimated interest cost for 2007 is:

A) 7.95M.

B) 7.60M.

C) 7.36M.

D) 7.20M.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

38

Harms Inc. reported in its 2006 annual report the following information:

-Funded status at the end of 2006 was:

A) $15M.

B) $12M.

C) $10M.

D) $0M.

-Funded status at the end of 2006 was:

A) $15M.

B) $12M.

C) $10M.

D) $0M.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

39

If a company increases its expected return on plan assets this year, the effect would be to:

I) increase plan assets.

II) decrease PBO.

III) decrease pension expense.

IV) decrease minimum liability.

A) I, II and IV

B) I and IV

C) III and IV

D) III only

I) increase plan assets.

II) decrease PBO.

III) decrease pension expense.

IV) decrease minimum liability.

A) I, II and IV

B) I and IV

C) III and IV

D) III only

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements concerning contingencies is correct?

I) Gain contingencies are recorded if they are probable and reasonably estimable.

II) Unredeemed frequent flyer mileage is an example of a loss contingency.

III) A loss contingency is a form of off-balance sheet financing.

IV) Loss contingencies are not recognized unless there is a greater than 95% chance they will be realized.

A) I, II, III and IV

B) II, III, and IV

C) II and III

D) II only

I) Gain contingencies are recorded if they are probable and reasonably estimable.

II) Unredeemed frequent flyer mileage is an example of a loss contingency.

III) A loss contingency is a form of off-balance sheet financing.

IV) Loss contingencies are not recognized unless there is a greater than 95% chance they will be realized.

A) I, II, III and IV

B) II, III, and IV

C) II and III

D) II only

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

41

Current liabilities should always be expected to be liquidated within one year.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

42

If the lease term is 75% or more of the economic life of the asset, the lease needs to be classified as a capital lease.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

43

Creditors of a business are more concerned with the future cash flows of a business than the future return on equity.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

44

A company issues a $100,000K 9% bond and receives $99,000K (ignoring transaction costs). This implies that the effective interest rate is less than 9%.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

45

With a defined contribution plan the risk of pension fund performance rests with the employees/retirees of the company, while with a defined benefit plan this risk rests with the company.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

46

Evaluating risk of long-term creditors (e.g. bondholders) involves more detail than evaluating the risk of equity holders.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

47

If a company increases the amount of debt it has, all other things being equal, the risk to the shareholders increases.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

48

Many postretirement benefits other than pensions are not funded, in part because they are not required to be funded by law, unlike pension plans.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

49

Pension accounting for defined benefit plans requires that retroactive adjustments to the plan (prior service costs) be recognized immediately in full in the pension expense.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

50

A convertible bond is an equity investment, which is convertible into bonds at the option of the owner of the convertible bond.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

51

If a company increases its expected rate of compensation increase for the purposes of calculating its pension obligations, the accumulated benefit obligation and the projected benefit obligation will both increase.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

52

Stockholders are the residual claimants of a company.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

53

Pension intensity can be measured by expressing the pension plan assets and the pension obligation separately as:

A) a percentage of company's total liabilities.

B) a percentage of company's total assets.

C) a percentage of company's net income.

D) a percentage of company's shareholders' equity.

A) a percentage of company's total liabilities.

B) a percentage of company's total assets.

C) a percentage of company's net income.

D) a percentage of company's shareholders' equity.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

54

A company which leases a piece of machinery (the lessee) will record it as a sales-type lease if the lessor makes a profit on the lease.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

55

If a company increases its discount rate for the purposes of calculating its pension obligations, the accumulated benefit obligation and the projected benefit obligation will both decrease.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

56

Three elements of pension expense for defined benefit plans are: service cost, interest cost and actual return on plan assets.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

57

Operating leases can inflate both return on investment and asset turnover ratios.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

58

Investing in equity is considered to be more risky than investing in bonds.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

59

The net deferrals are included in the balance sheet as part of:

A) assets.

B) current liabilities.

C) shareholders' equity.

D) long-term liabilities.

True / False Questions

A) assets.

B) current liabilities.

C) shareholders' equity.

D) long-term liabilities.

True / False Questions

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

60

A company will record a contingent gain if the gain is probable and reasonably estimable.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

61

A decrease in the growth rate of the future compensation will cause an increase in pension cost.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

62

Cash flow from Operations

5. Current Ratio

5. Current Ratio

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

63

If a company issues new stock, this will always decrease book value per share.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

64

Funding of pension plans is required by GAAP.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

65

When analyzing post retirement benefits, one should evaluate the actuarial assumptions and their effects on the financial statements.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

66

Pension risk arises to the extent to which plan assets have a different risk profile than the pension obligation.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

67

One reason many companies do not fund their post-retirement obligations other than pensions is because they are not required to do so by law.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

68

For a company to report a contingent loss it should be either probable or reasonably estimable.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

69

Actuarial gain or loss is the change in PBO that occurs when one or more actuarial assumptions are revised in estimating PBO.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

70

You are considering purchasing a company - assets, liabilities, warts and all. You are aware that sometimes liabilities do not always show up on the balance sheet. Give five examples of liabilities that may not be explicitly recognized on the balance sheet, being sure to explain why they are liabilities.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

71

Companies must report the economic pension cost in their financial statements.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

72

Werter Inc. has a defined benefit pension plan. Information related to this plan as of the end of 2006 is as follows:

a. Estimate pension expense for 2006 assuming that the pension plan assumptions remain unchanged from 2006, service cost is 10% of beginning of year PBO and that the prior service costs and transition assets are being amortized over 20 years.

b. Calculate the liability to be recorded in the balance sheet at the end of fiscal 2006.

a. Estimate pension expense for 2006 assuming that the pension plan assumptions remain unchanged from 2006, service cost is 10% of beginning of year PBO and that the prior service costs and transition assets are being amortized over 20 years.

b. Calculate the liability to be recorded in the balance sheet at the end of fiscal 2006.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

73

Warden Corp. has a postretirement health benefit plan for its employees. As of December 31, 2006, the accumulated postretirement benefit obligation (APBO) is $250M and the postretirement health benefit cost for the year was $23M. The plan assets are $10M. Warden chose to recognize its unfunded liability immediately. Walden also has a pension plan, which is fully funded.

a. What reasons are there for the minimal funding of the postretirement health benefits plans versus the full funding of the pension plan?

b. In 2006 Walden makes the following changes.

● Increases its expected rate of return on plan assets.

● Increases the expected compensation growth rate.

● Increases its discount rate.

Explain the effect of each of these on

i. economic cost as of the end of 2007.

ii. reported cost for 2007.

a. What reasons are there for the minimal funding of the postretirement health benefits plans versus the full funding of the pension plan?

b. In 2006 Walden makes the following changes.

● Increases its expected rate of return on plan assets.

● Increases the expected compensation growth rate.

● Increases its discount rate.

Explain the effect of each of these on

i. economic cost as of the end of 2007.

ii. reported cost for 2007.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

74

Companies report the funded status of pension plans as a separate line item on the balance sheet.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

75

An analyst should treat preferred stock on a firm's balance sheet as debt when calculating leverage ratios if the preferred stock is convertible into common stock.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

76

Following recent SPE abuses, a new rule requiring a minimum of 3% external financing was enacted.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

77

Pawn Company's 2006 Annual Report included the following information about its defined benefit pension plan:

a. If Pawn had increased its discount rate to 10% in 2006 what would be the effect on the accumulated benefit obligation, the projected benefit obligation, service cost and interest cost?

b. Estimate the interest cost for 2007 under the existing plan.

a. If Pawn had increased its discount rate to 10% in 2006 what would be the effect on the accumulated benefit obligation, the projected benefit obligation, service cost and interest cost?

b. Estimate the interest cost for 2007 under the existing plan.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

78

An SPE investor may secure its investment with a guarantee so that the SPE remains unconsolidated.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

79

An increase in the pension obligation because of passage of time is referred to as the interest cost.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

80

The par value of common stock represents the price at which the company offered its stock to investors when it made its initial public offering.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck