Deck 17: The Federal Budget- Taxes and Spending

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/167

Play

Full screen (f)

Deck 17: The Federal Budget- Taxes and Spending

1

In 2013,the U.S.federal government received about _____ in tax revenue.

A) $2.8 billion

B) $578 billion

C) $2.8 trillion

D) $578 trillion

A) $2.8 billion

B) $578 billion

C) $2.8 trillion

D) $578 trillion

$2.8 trillion

2

Which of the following sources of tax revenues make up more than 90% of all government revenue?

A) individual income tax,corporate income tax,and excise taxes

B) corporate income tax,Social Security and Medicare taxes,and estate taxes

C) individual income tax,corporate income tax,and Social Security and Medicare taxes

D) corporate income tax,Social Security and Medicare taxes,and excise taxes

A) individual income tax,corporate income tax,and excise taxes

B) corporate income tax,Social Security and Medicare taxes,and estate taxes

C) individual income tax,corporate income tax,and Social Security and Medicare taxes

D) corporate income tax,Social Security and Medicare taxes,and excise taxes

individual income tax,corporate income tax,and Social Security and Medicare taxes

3

Since the mid-1950s,federal government taxation has been about _____ of GDP.

A) 5%

B) 10%

C) 18%

D) 38%

A) 5%

B) 10%

C) 18%

D) 38%

18%

4

As of 2013,the level of per capita federal taxes collected in the United States was about:

A) $400.

B) $900.

C) $2,000.

D) $9,000.

A) $400.

B) $900.

C) $2,000.

D) $9,000.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

5

The second-largest source of revenue for the U.S.federal government is:

A) the corporate income tax.

B) the individual income tax.

C) excise taxes,such as taxes on gasoline and alcohol.

D) Social Security and Medicare taxes.

A) the corporate income tax.

B) the individual income tax.

C) excise taxes,such as taxes on gasoline and alcohol.

D) Social Security and Medicare taxes.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

6

As income rises,the average tax rate for married couples:

A) decreases smoothly.

B) decreases in steps.

C) increases smoothly.

D) increases in steps.

A) decreases smoothly.

B) decreases in steps.

C) increases smoothly.

D) increases in steps.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

7

Since 1960,marginal tax rates in the United States have decreased for individuals:

A) at all income levels.

B) with high incomes only.

C) with low incomes only.

D) at no income level.

A) at all income levels.

B) with high incomes only.

C) with low incomes only.

D) at no income level.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

8

In the United States,the marginal tax rate for married couples:

A) exceeds the average tax rate for most income levels.

B) is less than the average tax rate for most income levels.

C) is equal to the average tax rate for most income levels.

D) is less than the average tax rate at low income levels,but greater than the average tax rate at high income levels.

A) exceeds the average tax rate for most income levels.

B) is less than the average tax rate for most income levels.

C) is equal to the average tax rate for most income levels.

D) is less than the average tax rate at low income levels,but greater than the average tax rate at high income levels.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is the largest source of tax revenue for the U.S.federal government?

A) individual income tax

B) corporate income tax

C) Social Security and Medicare taxes

D) estate taxes

A) individual income tax

B) corporate income tax

C) Social Security and Medicare taxes

D) estate taxes

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

10

The largest source of revenue for the U.S.federal government is:

A) the corporate income tax.

B) the individual income tax.

C) excise taxes,such as taxes on gasoline and alcohol.

D) Social Security and Medicare taxes.

A) the corporate income tax.

B) the individual income tax.

C) excise taxes,such as taxes on gasoline and alcohol.

D) Social Security and Medicare taxes.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

11

In 1940,Ida May Fuller received the first Social Security check after contributing only $24.75 in Social Security taxes before she retired and lived to be 100 years old.Her case is an example of how:

A) Social Security payments were not issued to people who were close to retirement.

B) people can choose not to contribute to Social Security.

C) people begin to get Social Security payments before they retire.

D) the first Social Security recipients benefitted much more from the program than will workers entering the program today.

A) Social Security payments were not issued to people who were close to retirement.

B) people can choose not to contribute to Social Security.

C) people begin to get Social Security payments before they retire.

D) the first Social Security recipients benefitted much more from the program than will workers entering the program today.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

12

What are the three largest sources of tax revenue for the U.S.federal government?

A) corporate income tax,excise taxes,and Social Security/Medicare taxes

B) individual income tax,corporate income tax,and sales tax

C) Social Security/Medicare taxes,corporate income tax,and custom duties

D) individual income tax,Social Security/Medicare taxes,and corporate income tax

A) corporate income tax,excise taxes,and Social Security/Medicare taxes

B) individual income tax,corporate income tax,and sales tax

C) Social Security/Medicare taxes,corporate income tax,and custom duties

D) individual income tax,Social Security/Medicare taxes,and corporate income tax

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

13

Since the mid-1950s,federal government spending has been about _____ of GDP.

A) 5%

B) 10%

C) 20%

D) 40%

A) 5%

B) 10%

C) 20%

D) 40%

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

14

The Social Security payment system began issuing Social Security checks:

A) at the end of World War II.

B) in 1940.

C) during the Great Depression.

D) in 1913.

A) at the end of World War II.

B) in 1940.

C) during the Great Depression.

D) in 1913.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

15

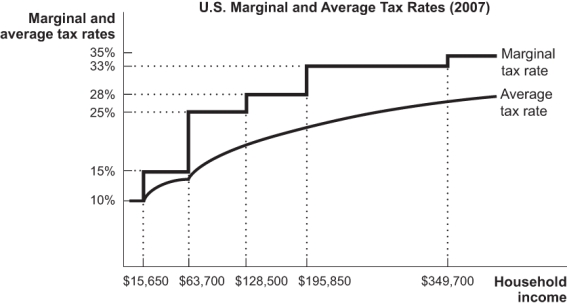

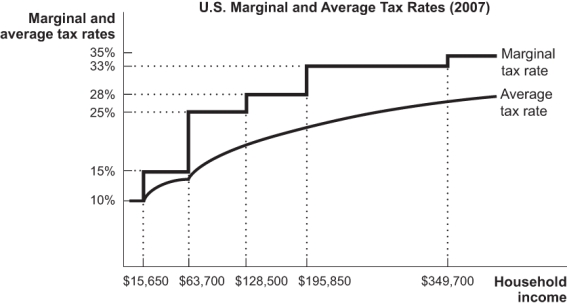

Use the following to answer questions

Figure: U.S.Marginal and Average Tax Rates

(Figure: U.S.Marginal and Average Tax Rates)According to the tax rates shown in the figure,an individual who earns $63,700 a year,has no deductions,and claims no exemptions will pay income tax of:

A) $8,772.50.

B) $9,555.00.

C) $15,925.00.

D) $1,565.00.

Figure: U.S.Marginal and Average Tax Rates

(Figure: U.S.Marginal and Average Tax Rates)According to the tax rates shown in the figure,an individual who earns $63,700 a year,has no deductions,and claims no exemptions will pay income tax of:

A) $8,772.50.

B) $9,555.00.

C) $15,925.00.

D) $1,565.00.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

16

What are the three main sources of funds for the U.S.federal government?

A) individual income taxes,corporate income taxes,and Social Security and Medicare taxes

B) interest on government bonds,corporate income taxes,Social Security and Medicare taxes

C) interest on government bonds,individual income taxes,Social Security and Medicare taxes

D) interest on government bonds,individual income taxes,corporate income taxes

A) individual income taxes,corporate income taxes,and Social Security and Medicare taxes

B) interest on government bonds,corporate income taxes,Social Security and Medicare taxes

C) interest on government bonds,individual income taxes,Social Security and Medicare taxes

D) interest on government bonds,individual income taxes,corporate income taxes

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

17

Income that is not subject to taxation is called:

A) marginal income.

B) average income.

C) exempt income.

D) excluded income.

A) marginal income.

B) average income.

C) exempt income.

D) excluded income.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is NOT one of the main sources of tax revenue for the federal government?

A) individual income tax

B) Social Security and Medicare taxes

C) sales tax

D) corporate income tax

A) individual income tax

B) Social Security and Medicare taxes

C) sales tax

D) corporate income tax

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

19

As income rises,the marginal tax rate for married couples:

A) decreases smoothly.

B) decreases in steps.

C) increases smoothly.

D) increases in steps.

A) decreases smoothly.

B) decreases in steps.

C) increases smoothly.

D) increases in steps.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following accounts for the largest source of tax receipts for the U.S.federal government?

A) excise tax

B) corporate income tax

C) Social Security tax

D) individual income tax

A) excise tax

B) corporate income tax

C) Social Security tax

D) individual income tax

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

21

In a progressive tax system,if a person moves from one income bracket to a higher income bracket:

A) both the marginal tax rate and average tax rate will be higher.

B) both the marginal tax rate and average tax rate will be lower.

C) the marginal tax rate will be lower and the average tax rate will be higher.

D) the marginal tax rate will be higher and the average tax rate will be lower.

A) both the marginal tax rate and average tax rate will be higher.

B) both the marginal tax rate and average tax rate will be lower.

C) the marginal tax rate will be lower and the average tax rate will be higher.

D) the marginal tax rate will be higher and the average tax rate will be lower.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

22

The two lowest marginal tax brackets in the United States are:

A) 5% and 10%.

B) 7% and 15%.

C) 10% and 15%.

D) 15% and 25%.

A) 5% and 10%.

B) 7% and 15%.

C) 10% and 15%.

D) 15% and 25%.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

23

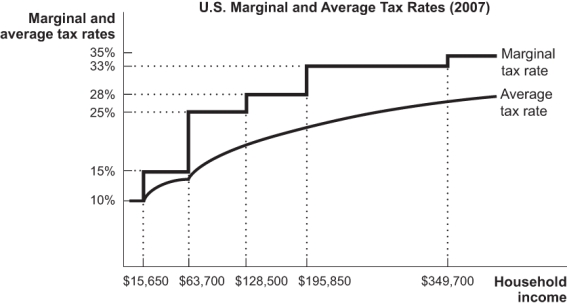

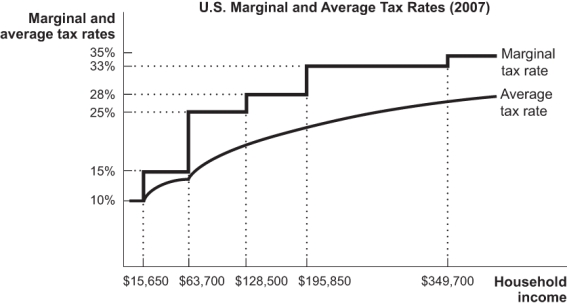

Use the following to answer questions

Figure: U.S.Marginal and Average Tax Rates

(Figure: U.S.Marginal and Average Tax Rates)According to the tax rates shown in the figure,an individual who earns $85,000 a year will pay income tax of:

A) $5,325.

B) $7,202.50.

C) $14,097.50.

D) $21,250.

Figure: U.S.Marginal and Average Tax Rates

(Figure: U.S.Marginal and Average Tax Rates)According to the tax rates shown in the figure,an individual who earns $85,000 a year will pay income tax of:

A) $5,325.

B) $7,202.50.

C) $14,097.50.

D) $21,250.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

24

Is the marginal income tax rate or the average income tax rate higher for a typical person in the United States?

A) The marginal income tax rate is higher.

B) The average income tax rate is higher.

C) They are equal.

D) It depends on the person.

A) The marginal income tax rate is higher.

B) The average income tax rate is higher.

C) They are equal.

D) It depends on the person.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

25

Suppose a high-income individual,subject to a 15% capital gains tax rate,sells 100 shares of Company X for a price of $9 per share (purchased at $10 each)and 500 shares of Company Y for a price of $51 per share (purchased at $50 each).How much in capital gains tax will he pay?

A) $60

B) $75

C) $210

D) $3,690

A) $60

B) $75

C) $210

D) $3,690

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

26

The tax rate paid on an additional dollar of income is the:

A) higher tax rate.

B) secondary tax rate.

C) marginal tax rate.

D) reserve tax rate.

A) higher tax rate.

B) secondary tax rate.

C) marginal tax rate.

D) reserve tax rate.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

27

Suppose the tax rate on the first $20,000 of income is 0%;10% on the next $20,000 earned;and 20% on any additional income earned.A person earning $35,000 pays an income tax of:

A) $1,000.

B) $1,500.

C) $2,000.

D) $3,500.

A) $1,000.

B) $1,500.

C) $2,000.

D) $3,500.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following represents a change that has been made since the individual income tax was first levied in 1913?

A) In 1969,the overall tax system was changed from a regressive to a progressive set of tax rates.

B) In 1969,the alternative minimum tax was introduced to prevent the rich from paying no taxes.

C) The alternative minimum tax has been adjusted for inflation.

D) Social Security payments are no longer indexed to wages.

A) In 1969,the overall tax system was changed from a regressive to a progressive set of tax rates.

B) In 1969,the alternative minimum tax was introduced to prevent the rich from paying no taxes.

C) The alternative minimum tax has been adjusted for inflation.

D) Social Security payments are no longer indexed to wages.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

29

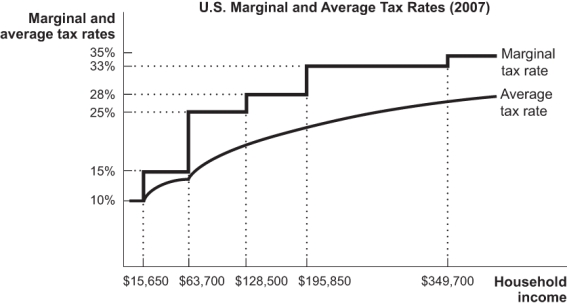

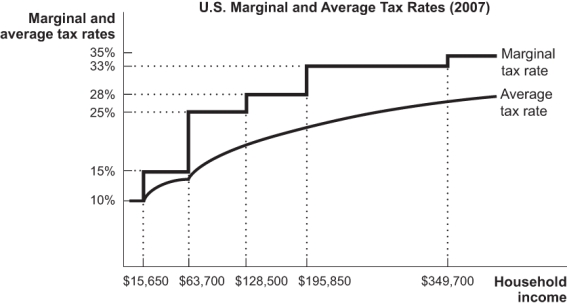

Use the following to answer questions

Figure: U.S.Marginal and Average Tax Rates

(Figure: U.S.Marginal and Average Tax Rates)According to the tax rates shown in the figure,an individual who earns $150,000 a year has an approximate average tax rate of:

A) 28%.

B) 25%.

C) 20%.

D) 15%.

Figure: U.S.Marginal and Average Tax Rates

(Figure: U.S.Marginal and Average Tax Rates)According to the tax rates shown in the figure,an individual who earns $150,000 a year has an approximate average tax rate of:

A) 28%.

B) 25%.

C) 20%.

D) 15%.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

30

Suppose a high-income individual,subject to a 15% capital gains tax rate,sells 100 shares of Company X and makes a loss of $500.She also sells 100 shares of Company Y and makes a profit of $1,200.How much in capital gains tax will she pay?

A) $75

B) $105

C) $180

D) $255

A) $75

B) $105

C) $180

D) $255

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

31

The marginal tax rate is:

A) the tax rate paid on an additional dollar of income.

B) higher on people with higher incomes.

C) the total tax payment divided by total income.

D) a separate income tax code begun in 1969 to prevent the rich from paying income taxes.

A) the tax rate paid on an additional dollar of income.

B) higher on people with higher incomes.

C) the total tax payment divided by total income.

D) a separate income tax code begun in 1969 to prevent the rich from paying income taxes.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

32

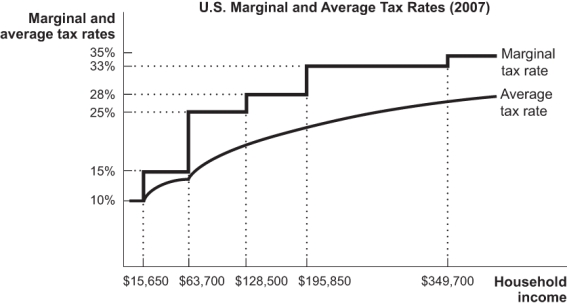

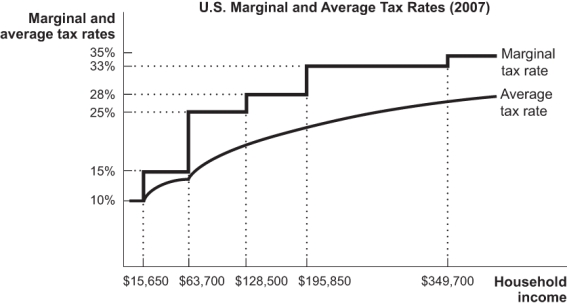

Use the following to answer questions

Figure: U.S.Marginal and Average Tax Rates

(Figure: U.S.Marginal and Average Tax Rates)Using the tax rates shown in the figure,assume your annual income is $15,000,that you have a deduction of $1,800 for moving expenses,and that you claim four exemptions of $3,300: one for yourself and one for each of your three children.How much taxes are you expected to pay?

A) $0

B) $120

C) $132

D) $138

Figure: U.S.Marginal and Average Tax Rates

(Figure: U.S.Marginal and Average Tax Rates)Using the tax rates shown in the figure,assume your annual income is $15,000,that you have a deduction of $1,800 for moving expenses,and that you claim four exemptions of $3,300: one for yourself and one for each of your three children.How much taxes are you expected to pay?

A) $0

B) $120

C) $132

D) $138

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

33

The average tax rate is:

A) the tax rate paid on an additional dollar of income.

B) higher on people with higher incomes.

C) the total tax payment divided by total income.

D) a separate income tax code begun in 1969 to prevent the rich from paying income taxes.

A) the tax rate paid on an additional dollar of income.

B) higher on people with higher incomes.

C) the total tax payment divided by total income.

D) a separate income tax code begun in 1969 to prevent the rich from paying income taxes.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

34

The tax rate on an additional dollar of income is the:

A) average tax rate.

B) total tax rate.

C) marginal tax rate.

D) alternative minimum tax rate.

A) average tax rate.

B) total tax rate.

C) marginal tax rate.

D) alternative minimum tax rate.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

35

The U.S.income tax system is:

A) proportional.

B) progressive.

C) regressive.

D) marginal.

A) proportional.

B) progressive.

C) regressive.

D) marginal.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

36

Taxpayers in the United States for the year 2014 received individual and dependent exemptions,each worth:

A) $3,650.

B) $3,950.

C) $3,300.

D) $4,300.

A) $3,650.

B) $3,950.

C) $3,300.

D) $4,300.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

37

Which tax rate determines whether it is worth it to work an extra day?

A) marginal

B) average

C) payroll (FICA)

D) capital gains

A) marginal

B) average

C) payroll (FICA)

D) capital gains

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

38

Suppose the tax rate on the first $20,000 of income is 0%;10% on the next $20,000 earned;and 20% on any additional income earned.The marginal tax rate for a person earning $30,000 is:

A) 10%.

B) 15%.

C) 20%.

D) more than 20%.

A) 10%.

B) 15%.

C) 20%.

D) more than 20%.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

39

Which statement about individual income taxes in the United States is TRUE?

A) All individuals pay the same average tax rate.

B) There is a huge difference in the tax rate paid within each bracket.

C) Taxes rates include and vary between 10% and 91%.

D) Marginal tax rates are flatter and lower today than in the past.

A) All individuals pay the same average tax rate.

B) There is a huge difference in the tax rate paid within each bracket.

C) Taxes rates include and vary between 10% and 91%.

D) Marginal tax rates are flatter and lower today than in the past.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

40

The marginal tax rate is the:

A) average tax rate paid on all earned income.

B) tax rate paid on capital gains.

C) minimum tax rate paid on income in the United States.

D) tax rate paid on each additional dollar earned.

A) average tax rate paid on all earned income.

B) tax rate paid on capital gains.

C) minimum tax rate paid on income in the United States.

D) tax rate paid on each additional dollar earned.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

41

The legislation Congress passed in 1969 to make sure that the rich pay at least some income taxes was called the:

A) flat tax code.

B) regressive tax code.

C) Social Security Tax.

D) alternative minimum tax.

A) flat tax code.

B) regressive tax code.

C) Social Security Tax.

D) alternative minimum tax.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

42

The tax deduction for interest paid on home mortgages tends to:

A) increase housing prices.

B) decrease housing prices.

C) have no impact on housing prices.

D) make housing prices unpredictable.

A) increase housing prices.

B) decrease housing prices.

C) have no impact on housing prices.

D) make housing prices unpredictable.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

43

Currently,marginal tax rates are:

A) greater than in the past.

B) lower than in the past.

C) equal to average marginal tax rates of the past.

D) more unpredictable than in the past.

A) greater than in the past.

B) lower than in the past.

C) equal to average marginal tax rates of the past.

D) more unpredictable than in the past.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

44

Total tax payments divided by total income is called the:

A) last tax rate.

B) marginal tax rate.

C) total tax rate.

D) average tax rate.

A) last tax rate.

B) marginal tax rate.

C) total tax rate.

D) average tax rate.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

45

If tax rates are 10% on income up to $10,000,20% for income between $10,001 and $20,000,and 30% for income over $20,000,the average tax rate for a person earning $25,000 is:

A) 10%.

B) 18%.

C) 25%.

D) 30%.

A) 10%.

B) 18%.

C) 25%.

D) 30%.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

46

The marginal tax rate is the tax rate paid on an:

A) average amount of income.

B) additional dollar of income.

C) average amount of spending.

D) additional dollar of spending.

A) average amount of income.

B) additional dollar of income.

C) average amount of spending.

D) additional dollar of spending.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

47

A country has two income tax brackets: people pay 10% on their first $50,000 and 20% on everything they earn over $50,000.It also has a personal exemption of $5,000.Who benefits more from the personal exemption,a person making $35,000 or a person making $75,000?

A) the person making $35,000

B) the person making $75,000

C) they benefit equally

D) It is impossible to tell.

A) the person making $35,000

B) the person making $75,000

C) they benefit equally

D) It is impossible to tell.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

48

Because the alternative minimum tax (AMT)is not indexed to inflation:

A) more American families have become subject to the AMT over time.

B) fewer American families have become subject to the AMT over time.

C) every American family is subject to the AMT today.

D) no American family is subject to the AMT today.

A) more American families have become subject to the AMT over time.

B) fewer American families have become subject to the AMT over time.

C) every American family is subject to the AMT today.

D) no American family is subject to the AMT today.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following reduces taxable income?

A) deductions only

B) exemptions only

C) both deductions and exemptions

D) neither deductions nor exemptions

A) deductions only

B) exemptions only

C) both deductions and exemptions

D) neither deductions nor exemptions

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

50

If you purchased 10 shares of Goldman Sachs stock for $1,200 five years ago and decide to sell the stock today at a price of $1,500,how much will you owe in capital gains tax on your 10 shares? Assume the tax rate on capital gains is set at 15%.

A) $0

B) $45

C) $180

D) $225

A) $0

B) $45

C) $180

D) $225

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

51

The alternative minimum tax has become an added tax burden on many upper-middle class families because:

A) Congress intended it to be that way.

B) it is not indexed to inflation.

C) it is indexed to inflation.

D) it is a regressive tax.

A) Congress intended it to be that way.

B) it is not indexed to inflation.

C) it is indexed to inflation.

D) it is a regressive tax.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

52

The income tax exemption for each individual in 2014 is:

A) $500.

B) $1,200

C) $2,850.

D) $3,950.

A) $500.

B) $1,200

C) $2,850.

D) $3,950.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

53

A country has two income tax brackets: people pay 10% on their first $50,000 and 20% on everything they earn over $50,000.If someone earns $75,000,how much tax does that person pay?

A) $5,000

B) $7,500

C) $10,000

D) $15,000

A) $5,000

B) $7,500

C) $10,000

D) $15,000

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

54

If your marginal tax rate is 25% and you can exempt $3,650 of your income for each member of your family (yourself,your spouse,and your one child),then the exemption means you will save _____ in taxes.

A) $912.5

B) $1,825

C) $2,737.50

D) $3,650

A) $912.5

B) $1,825

C) $2,737.50

D) $3,650

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

55

If you purchased 10 shares of Goldman Sachs stock for $1,200 five years ago and continue to hold the stock today but its value has risen to $1,500,how much will you owe in capital gains tax on your 10 shares? Assume the tax rate on capital gains is set at 15%.

A) $0

B) $45

C) $180

D) $225

A) $0

B) $45

C) $180

D) $225

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

56

The tax rate paid on an additional dollar of income is called the:

A) last tax rate.

B) marginal tax rate.

C) total tax rate.

D) average tax rate.

A) last tax rate.

B) marginal tax rate.

C) total tax rate.

D) average tax rate.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

57

If tax rates are 10% on income up to $10,000,20% for income between $10,001 and $20,000,and 30% for income over $20,000,the marginal tax rate for a person earning $25,000 is:

A) 10%.

B) 20%.

C) 25%.

D) 30%.

A) 10%.

B) 20%.

C) 25%.

D) 30%.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

58

If tax rates are 10% on income up to $10,000,20% for income between $10,001 and $20,000,and 30% for income over $20,000,the total tax payment for a person earning $25,000 is approximately:

A) $2,000.

B) $2,500.

C) $3,000.

D) $4,500.

A) $2,000.

B) $2,500.

C) $3,000.

D) $4,500.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

59

The most important tax for determining an individual's incentive to work is:

A) the last tax rate.

B) the marginal tax rate.

C) the total tax rate.

D) the average tax rate.

A) the last tax rate.

B) the marginal tax rate.

C) the total tax rate.

D) the average tax rate.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

60

At income levels above the limit for the lowest tax bracket,the average tax rate is:

A) greater than the marginal tax rate.

B) less than the marginal tax rate.

C) equal to the marginal tax rate.

D) below the marginal tax rate at first but above the marginal tax rate as income rises.

A) greater than the marginal tax rate.

B) less than the marginal tax rate.

C) equal to the marginal tax rate.

D) below the marginal tax rate at first but above the marginal tax rate as income rises.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

61

Capital gains taxes are paid:

A) any time an asset rises in value.

B) on bonds only.

C) only when an asset is actually sold.

D) mainly in times of deflation.

A) any time an asset rises in value.

B) on bonds only.

C) only when an asset is actually sold.

D) mainly in times of deflation.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

62

Originally the alternative minimum tax was supposed to:

A) alleviate the tax burden for low-income households.

B) ensure a minimum tax payment among super-rich households.

C) decrease taxes amongst the middle-class to the minimum level.

D) help low-income households with more than two children.

A) alleviate the tax burden for low-income households.

B) ensure a minimum tax payment among super-rich households.

C) decrease taxes amongst the middle-class to the minimum level.

D) help low-income households with more than two children.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

63

Who appears to pay the FICA tax?

A) mostly employees

B) mostly employers

C) employees and employers in equal amounts

D) Congress

A) mostly employees

B) mostly employers

C) employees and employers in equal amounts

D) Congress

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

64

The purpose of FICA taxes is to fund:

A) health services for elderly people.

B) defense expenditures.

C) presidential campaigns.

D) Social Security payments.

A) health services for elderly people.

B) defense expenditures.

C) presidential campaigns.

D) Social Security payments.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following descriptions of the "government deficit" is incorrect?

A) A deficit occurs when spending is greater than revenue.

B) The deficit is caused by a shortage of tax revenue.

C) A deficit is the difference between federal spending and revenues.

D) The deficit is the annual change in the national debt.

A) A deficit occurs when spending is greater than revenue.

B) The deficit is caused by a shortage of tax revenue.

C) A deficit is the difference between federal spending and revenues.

D) The deficit is the annual change in the national debt.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

66

The alternative minimum tax:

A) is the tax rate paid on an additional dollar of income.

B) has higher tax rates on people with higher incomes.

C) is the total tax payment divided by total income.

D) is a separate income tax code that began in 1969 to prevent the rich from not paying income taxes.

A) is the tax rate paid on an additional dollar of income.

B) has higher tax rates on people with higher incomes.

C) is the total tax payment divided by total income.

D) is a separate income tax code that began in 1969 to prevent the rich from not paying income taxes.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

67

The original purpose of the alternative minimum tax was to prevent the:

A) poor from paying income tax.

B) poor from not paying income tax.

C) rich from paying income tax.

D) rich from not paying income tax.

A) poor from paying income tax.

B) poor from not paying income tax.

C) rich from paying income tax.

D) rich from not paying income tax.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

68

When the text refers to the current U.S.national debt,it means the:

A) national debt held by the public.

B) public debt held by investors.

C) private debt held by households.

D) total debt held by foreign governments.

A) national debt held by the public.

B) public debt held by investors.

C) private debt held by households.

D) total debt held by foreign governments.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

69

The FICA tax burden is:

A) paid entirely by the employer.

B) shared equally by employer and employee.

C) borne more by the employee even though the employer contributes an equal dollar amount.

D) the same amount as the alternative minimum tax burden.

A) paid entirely by the employer.

B) shared equally by employer and employee.

C) borne more by the employee even though the employer contributes an equal dollar amount.

D) the same amount as the alternative minimum tax burden.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following statements about Medicare taxes is TRUE?

A) People who are self-employed do not share the burden of this tax with employers.

B) People who own their own businesses do not have to pay this tax on themselves.

C) Medicare taxes are larger in percentage terms than Social Security taxes.

D) Medicare taxes are used to provide free medical care for children.

A) People who are self-employed do not share the burden of this tax with employers.

B) People who own their own businesses do not have to pay this tax on themselves.

C) Medicare taxes are larger in percentage terms than Social Security taxes.

D) Medicare taxes are used to provide free medical care for children.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

71

The income tax is a tax on all of the following,except:

A) labor income.

B) interest income.

C) dividends and capital gains.

D) welfare benefits.

A) labor income.

B) interest income.

C) dividends and capital gains.

D) welfare benefits.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following is a reason for waste and inefficiency in government spending?

A) weak incentives

B) lack of information on how to spend the money effectively

C) both weak incentives and lack of information on how to spend the money effectively

D) neither weak incentives nor lack of information on how to spend the money effectively

A) weak incentives

B) lack of information on how to spend the money effectively

C) both weak incentives and lack of information on how to spend the money effectively

D) neither weak incentives nor lack of information on how to spend the money effectively

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

73

The Federal Insurance Contributions Act tax is used to fund:

A) The Federal Deposit Insurance Corporation.

B) federal defense spending.

C) Social Security payments.

D) unemployment insurance.

A) The Federal Deposit Insurance Corporation.

B) federal defense spending.

C) Social Security payments.

D) unemployment insurance.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

74

Who actually bears the burden of the FICA tax?

A) mostly employees

B) mostly employers

C) employees and employers in equal amounts

D) Congress

A) mostly employees

B) mostly employers

C) employees and employers in equal amounts

D) Congress

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

75

If you receive a capital gain of $2,000 from selling a stock but also incur a capital loss of $1,500 from selling another stock,the total amount of tax you pay based on a 15% capital gain tax rate is:

A) $0.

B) $75.

C) $225.

D) $300.

A) $0.

B) $75.

C) $225.

D) $300.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

76

The objective of the alternative minimum tax is to:

A) balance the federal budget.

B) ensure that even the poor pay some income taxes.

C) prevent the rich from not paying any income taxes.

D) raise the Social Security trust fund for retirees.

A) balance the federal budget.

B) ensure that even the poor pay some income taxes.

C) prevent the rich from not paying any income taxes.

D) raise the Social Security trust fund for retirees.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

77

The Social Security program in the United States is financed by:

A) individual income tax revenue.

B) corporate income tax revenue.

C) FICA tax revenue.

D) excise tax revenue.

A) individual income tax revenue.

B) corporate income tax revenue.

C) FICA tax revenue.

D) excise tax revenue.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

78

The alternative minimum tax has effectively made the federal income tax:

A) a more regressive tax system.

B) a more progressive system.

C) a flat tax system.

D) the same in dollar terms for every taxpayer.

A) a more regressive tax system.

B) a more progressive system.

C) a flat tax system.

D) the same in dollar terms for every taxpayer.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following statements is correct?

A) The burden of the FICA tax is equally split between workers and employers.

B) Most of the burden of the FICA tax falls on workers.

C) Most of the burden of the FICA tax falls on employers.

D) Employees face no burden from the FICA tax.

A) The burden of the FICA tax is equally split between workers and employers.

B) Most of the burden of the FICA tax falls on workers.

C) Most of the burden of the FICA tax falls on employers.

D) Employees face no burden from the FICA tax.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

80

An increase in the capital gains tax will most likely:

A) decrease investment.

B) raise the marginal tax rate.

C) raise the average tax rate.

D) increase investment.

A) decrease investment.

B) raise the marginal tax rate.

C) raise the average tax rate.

D) increase investment.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck