Deck 10: Stock Markets and Personal Finance

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/241

Play

Full screen (f)

Deck 10: Stock Markets and Personal Finance

1

When a fund manager tries to pick stocks to outperform the market averages,the mutual fund is called a(n):

A) active fund.

B) passive fund.

C) random walk fund.

D) loaded fund.

A) active fund.

B) passive fund.

C) random walk fund.

D) loaded fund.

active fund.

2

Which statement is TRUE regarding active investing?

A) Active investing typically has higher average returns than passive investing.

B) Active investing and passive investing typically have equal returns on average.

C) Active investments typically have higher fees and lower returns on average than passive investments.

D) Active investing has been shown to be the only type of investing that can consistently "beat the market."

A) Active investing typically has higher average returns than passive investing.

B) Active investing and passive investing typically have equal returns on average.

C) Active investments typically have higher fees and lower returns on average than passive investments.

D) Active investing has been shown to be the only type of investing that can consistently "beat the market."

Active investments typically have higher fees and lower returns on average than passive investments.

3

A mutual fund is:

A) an investment fund that pools money from many investors and invests that money in the stocks of many firms.

B) generally a share of company stock owned by multiple people.

C) a company that specializes in lending new businesses money.

D) the source of funds that banks use to make home and automobile loans.

A) an investment fund that pools money from many investors and invests that money in the stocks of many firms.

B) generally a share of company stock owned by multiple people.

C) a company that specializes in lending new businesses money.

D) the source of funds that banks use to make home and automobile loans.

an investment fund that pools money from many investors and invests that money in the stocks of many firms.

4

A mutual fund run by a manager who picks stocks is termed a(n)______ fund.

A) active

B) passive

C) dormant

D) moving

A) active

B) passive

C) dormant

D) moving

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

5

The S&P 500 Index fund is a(n)______ fund.

A) active

B) passive

C) dormant

D) moving

A) active

B) passive

C) dormant

D) moving

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

6

John Stossel picked Wall Street stocks at random,and his portfolio outperformed what proportion of expert stockbrokers and fund managers?

A) 50%

B) 60%

C) 80%

D) 90%

A) 50%

B) 60%

C) 80%

D) 90%

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

7

John Stossel's investment strategy of ______ beat 90% of the experts' portfolios.

A) buying low-priced but high-valued stocks

B) picking the highest-priced stocks

C) picking stocks by throwing darts at a newspaper's stock page

D) buying stocks of companies with newly released products

A) buying low-priced but high-valued stocks

B) picking the highest-priced stocks

C) picking stocks by throwing darts at a newspaper's stock page

D) buying stocks of companies with newly released products

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

8

Which is an example of passive investing?

A) investing in one specific stock

B) investing in a mutual fund that tries to mimic the S&P 500

C) investing in a mutual fund that is actively managed by a fund manager

D) researching many different stocks and accumulating your own portfolio of investments

A) investing in one specific stock

B) investing in a mutual fund that tries to mimic the S&P 500

C) investing in a mutual fund that is actively managed by a fund manager

D) researching many different stocks and accumulating your own portfolio of investments

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

9

A passive fund is a fund that:

A) uses dividend reinvestment strategies to seek long-term capital appreciation.

B) tries to time the market when buying and selling stocks.

C) uses technical analysis to pick winning stocks.

D) invests in the companies that constitute a broad market index.

A) uses dividend reinvestment strategies to seek long-term capital appreciation.

B) tries to time the market when buying and selling stocks.

C) uses technical analysis to pick winning stocks.

D) invests in the companies that constitute a broad market index.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

10

A comparison of historical performance of mutual funds and the S&P 500 suggests that:

A) most mutual funds consistently outperform the S&P 500.

B) active funds consistently outperform the S&P 500,and passive funds consistently underperform the S&P 500.

C) mutual funds outperform the S&P 500 when they are undervalued.

D) mutual funds on average underperform the S&P 500 at least half of the time.

A) most mutual funds consistently outperform the S&P 500.

B) active funds consistently outperform the S&P 500,and passive funds consistently underperform the S&P 500.

C) mutual funds outperform the S&P 500 when they are undervalued.

D) mutual funds on average underperform the S&P 500 at least half of the time.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

11

The S&P 500 Index fund performs ______ active funds.

A) worse than most

B) worse than all

C) better than most

D) better than all

A) worse than most

B) worse than all

C) better than most

D) better than all

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

12

The manager of a passive mutual fund:

A) invests only in risk-free assets like Treasury bonds.

B) reacts slowly to changes in stock markets.

C) does nothing.

D) tries to track a broad stock market index.

A) invests only in risk-free assets like Treasury bonds.

B) reacts slowly to changes in stock markets.

C) does nothing.

D) tries to track a broad stock market index.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

13

An active fund is a fund that:

A) uses stock-picking techniques to buy stocks that are projected to beat market averages.

B) invests in the most actively traded stocks.

C) avoids investing in low-return assets,such as bonds and real estate.

D) is diversified in stocks,bonds,currency,and precious metals.

A) uses stock-picking techniques to buy stocks that are projected to beat market averages.

B) invests in the most actively traded stocks.

C) avoids investing in low-return assets,such as bonds and real estate.

D) is diversified in stocks,bonds,currency,and precious metals.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

14

Suppose 80 experts flip a coin to predict whether the prices of stocks will rise or fall for the year.After 4 years,how many experts will have correctly predicted the direction of the stock market?

A) 13

B) 8

C) 33

D) 5

A) 13

B) 8

C) 33

D) 5

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

15

The investment approach of one of T.Rowe Price's mutual funds is: "Reflecting a value approach to investing,the fund will seek the stocks of companies whose current stock prices do not appear to adequately reflect their underlying value as measured by assets,earnings,cash flow,or business franchises." This fund is a(n):

A) active fund.

B) passive fund.

C) asset fund.

D) market fund.

A) active fund.

B) passive fund.

C) asset fund.

D) market fund.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

16

In a given year,the S&P 500 Index fund outperforms about ______ of all active funds.

A) 20%

B) 40%

C) 60%

D) 80%

A) 20%

B) 40%

C) 60%

D) 80%

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

17

The investment approach of one of TIAA-CREF's mutual funds is: "[This fund]...seeks a favorable long-term rate of return from a diversified portfolio selected to track the overall market for common stocks publicly traded in the United States,as represented by a broad stock market index." This fund is a(n):

A) active fund.

B) passive fund.

C) asset fund.

D) market fund.

A) active fund.

B) passive fund.

C) asset fund.

D) market fund.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

18

Passively investing in the S&P 500 Index:

A) provides rates of return that are approximately 5% higher than the Dow Jones Industrial Average Index.

B) beats the rate of returns of the majority of all mutual funds in a typical year.

C) is a strategy that is less profitable over the long-term than investing in actively managed funds.

D) provides rates of return that are about 20% lower than the Dow Jones Industrial Average Index.

A) provides rates of return that are approximately 5% higher than the Dow Jones Industrial Average Index.

B) beats the rate of returns of the majority of all mutual funds in a typical year.

C) is a strategy that is less profitable over the long-term than investing in actively managed funds.

D) provides rates of return that are about 20% lower than the Dow Jones Industrial Average Index.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

19

John Stossel's dart-throwing experiment showed that:

A) picking stocks at random can outperform the stock picks of major Wall Street experts.

B) Wall Street experts have inside information,which makes beating their stock picks difficult.

C) companies with longer names are likely to outperform market averages.

D) economic theory regarding the stock market is flawed.

A) picking stocks at random can outperform the stock picks of major Wall Street experts.

B) Wall Street experts have inside information,which makes beating their stock picks difficult.

C) companies with longer names are likely to outperform market averages.

D) economic theory regarding the stock market is flawed.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

20

In the Alfred Hitchcock Presents episode "Mail Order Prophet," a man receives mysterious letters that accurately predict the movements of certain stocks.After being correct several times in a row,the man,upon the letter's request,sends money to the market prophet in exchange for his latest stock tip.At the end of the episode we learn the "prophet" is actually a con man who sends a letter to many people with half the letters predicting a stock will increase and the other half predicting it will decrease.How does this Hitchcock episode illustrate one particular theory of Warren Buffet's wealth?

A) It was very difficult to send out all those letters;hard work pays off.

B) Like the letters in the story,Buffet happened to be right several times in a row.

C) Buffet conned his way to the top,using insider information to become wealthy.

D) Diversification is an important way to protect investments and build wealth.

A) It was very difficult to send out all those letters;hard work pays off.

B) Like the letters in the story,Buffet happened to be right several times in a row.

C) Buffet conned his way to the top,using insider information to become wealthy.

D) Diversification is an important way to protect investments and build wealth.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

21

Some skeptical economists say that successful brokers like Warren Buffett are:

A) able to see the future.

B) just lucky.

C) incredibly smart at picking winning stocks.

D) likely to remain successful.

A) able to see the future.

B) just lucky.

C) incredibly smart at picking winning stocks.

D) likely to remain successful.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

22

Over a 10-year span,the S&P 500 Index fund outperforms about ______ of all active funds.

A) 37%

B) 57%

C) 77%

D) 97%

A) 37%

B) 57%

C) 77%

D) 97%

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

23

Which is helpful in stock investment strategies?

A) buying undervalued stocks

B) holding stocks for a long period of time

C) lucky picks

D) All of the answers are correct.

A) buying undervalued stocks

B) holding stocks for a long period of time

C) lucky picks

D) All of the answers are correct.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

24

______ mutual fund managers can consistently beat the market average.

A) All

B) No

C) Relatively many

D) Relatively few

A) All

B) No

C) Relatively many

D) Relatively few

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following statements is TRUE? I.A mutual fund pools money from many different investors and uses that money to invest in many different firms.

II.Mutual funds that are run by managers who try to pick the best performing stocks usually outperform the S&P 500.

III.Passive mutual funds do not try to select winning stocks;they mimic broader markets like the S&P 500.

A) I only

B) I and II only

C) I and III only

D) II and III only

II.Mutual funds that are run by managers who try to pick the best performing stocks usually outperform the S&P 500.

III.Passive mutual funds do not try to select winning stocks;they mimic broader markets like the S&P 500.

A) I only

B) I and II only

C) I and III only

D) II and III only

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

26

Which refers to a mutual fund for which its manager buys and sells stocks regularly in order to maximize the fund's returns?

A) liquid fund

B) efficient market fund

C) active fund

D) passive fund

A) liquid fund

B) efficient market fund

C) active fund

D) passive fund

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

27

A mutual fund pools money from many customers and invests the money in many firms.The fees charged by fund managers are:

A) lower in bond funds.

B) higher in passive funds.

C) lower in passive funds.

D) higher in bond funds.

A) lower in bond funds.

B) higher in passive funds.

C) lower in passive funds.

D) higher in bond funds.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

28

The major difference between active and passive mutual funds is that active funds:

A) are classed as mutual funds,but passive funds are not.

B) involve stock picks by managers,while passive funds involve stock picks by the investors themselves.

C) are more risky than passive funds.

D) involve stock picks by managers,while passive funds match the movements of a broad market index.

A) are classed as mutual funds,but passive funds are not.

B) involve stock picks by managers,while passive funds involve stock picks by the investors themselves.

C) are more risky than passive funds.

D) involve stock picks by managers,while passive funds match the movements of a broad market index.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

29

The efficient markets hypothesis implies that in the stock market:

A) everyone can earn more than everyone else some of the time.

B) no one can systematically earn more than the average market return.

C) people with more funds earn higher returns.

D) people can use technical analysis to systematically earn high returns.

A) everyone can earn more than everyone else some of the time.

B) no one can systematically earn more than the average market return.

C) people with more funds earn higher returns.

D) people can use technical analysis to systematically earn high returns.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

30

In a market of 2,000 investors who each year flip a coin to predict market success or failure,how many investors will have been consistently right after 5 years? (Assume the coin tosses yield heads exactly 50% of the time. )

A) 31

B) 62

C) 500

D) 1,000

A) 31

B) 62

C) 500

D) 1,000

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following are advantages of saving your money in a mutual fund? I.You have professional fund management.

II.Mutual funds have always outperformed the S&P 500.

III.People with smaller amounts of money can diversify risk.

A) I only

B) I and II only

C) I and III only

D) I,II,and III

II.Mutual funds have always outperformed the S&P 500.

III.People with smaller amounts of money can diversify risk.

A) I only

B) I and II only

C) I and III only

D) I,II,and III

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

32

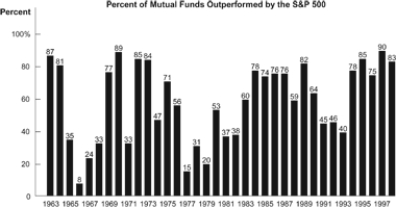

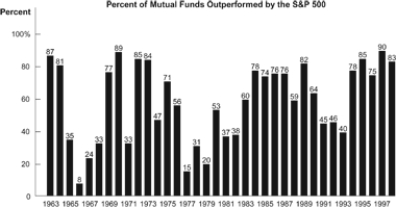

Figure: Mutual Funds  Refer to the figure.From this Mutual Funds figure (John Stossel dart-throwing experiment)we can say that:

Refer to the figure.From this Mutual Funds figure (John Stossel dart-throwing experiment)we can say that:

A) mutual funds typically outperform the S&P 500.

B) mutual fund managers are no smarter than monkeys.

C) knowledge of stock market behavior does not guarantee its predictability.

D) mutual funds can never outperform the stock market.

Refer to the figure.From this Mutual Funds figure (John Stossel dart-throwing experiment)we can say that:

Refer to the figure.From this Mutual Funds figure (John Stossel dart-throwing experiment)we can say that:A) mutual funds typically outperform the S&P 500.

B) mutual fund managers are no smarter than monkeys.

C) knowledge of stock market behavior does not guarantee its predictability.

D) mutual funds can never outperform the stock market.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

33

According to the efficient markets hypothesis,the person who most likely earns the highest return for holding the stock of Company ABC on a single day is:

A) a person who follows a buy-and-hold strategy.

B) an active trader who knows the historical prices of ABC.

C) ABC's CEO who has inside information about the company's new projects.

D) None of the answers is correct.No one can outperform anyone else at any time.

A) a person who follows a buy-and-hold strategy.

B) an active trader who knows the historical prices of ABC.

C) ABC's CEO who has inside information about the company's new projects.

D) None of the answers is correct.No one can outperform anyone else at any time.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

34

If each of the approximately 320,000 securities and financial service agents in the United States bet on whether the market would go up or down for each of the next 10 years by flipping a coin,we would expect that approximately 312 agents would have been right 10 years in a row.This example suggests that:

A) it is easy to beat the market averages.

B) famous investors like Warren Buffett may have merely been lucky.

C) there are above-normal profit opportunities in the stock market.

D) All of the answers are correct.

A) it is easy to beat the market averages.

B) famous investors like Warren Buffett may have merely been lucky.

C) there are above-normal profit opportunities in the stock market.

D) All of the answers are correct.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

35

The text argues that which statement is TRUE about Warren Buffett?

A) His past performance has been purely a result of luck.

B) He has not been able to beat the market at any time.

C) He always beats the market using inside information.

D) It has become harder for him to beat the market over time.

A) His past performance has been purely a result of luck.

B) He has not been able to beat the market at any time.

C) He always beats the market using inside information.

D) It has become harder for him to beat the market over time.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

36

According to the efficient markets hypothesis,stock prices:

A) reflect all publicly available information about the stock market.

B) reflect all private company information that is known only to company insiders.

C) contain both public and private information that is helpful for some investors to outperform other investors.

D) contain no useful information.

A) reflect all publicly available information about the stock market.

B) reflect all private company information that is known only to company insiders.

C) contain both public and private information that is helpful for some investors to outperform other investors.

D) contain no useful information.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is TRUE of mutual funds? I.Active funds generally give higher returns than passive funds.

II.Most mutual funds generally give higher returns than broad stock indexes.

A) I only

B) II only

C) both I and II

D) neither I nor II

II.Most mutual funds generally give higher returns than broad stock indexes.

A) I only

B) II only

C) both I and II

D) neither I nor II

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

38

The fact that the majority of stock mutual funds cannot outperform the stock market averages is consistent with:

A) the no free lunch principle.

B) the risk-return trade-off principle.

C) the efficient markets hypothesis.

D) the active trading hypothesis.

A) the no free lunch principle.

B) the risk-return trade-off principle.

C) the efficient markets hypothesis.

D) the active trading hypothesis.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

39

Suppose 1,000 experts flip a coin once each year and half say the market will go up while the other half say the market will go down.After 6 years how many experts would have been correct every year?

A) 15

B) 62

C) 8

D) 31

A) 15

B) 62

C) 8

D) 31

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

40

Which investment strategy is typically more profitable over a long period of time?

A) active

B) passive

C) introversive

D) subversive

A) active

B) passive

C) introversive

D) subversive

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

41

One of the problems with investment advice that claims you should buy stock in a certain company or sector of the economy is that:

A) no one else knows such advice.

B) asset prices likely reflect that information already.

C) investment advice is not regulated.

D) sellers know less than buyers in the financial markets.

A) no one else knows such advice.

B) asset prices likely reflect that information already.

C) investment advice is not regulated.

D) sellers know less than buyers in the financial markets.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

42

Someone who is using information outside the efficient markets hypothesis:

A) has information about the aging U.S.population and expects stock for companies that cater to senior citizens to increase in value.

B) reads in the newspaper about a merger between two profitable firms and expects the stock prices for these companies to rise.

C) while auditing a dishonest company realizes that its profit estimates are greatly inflated and immediately sells her stock in the company.

D) hears a rumor that a top bank may be in trouble and decides to sell his stock in that company.

A) has information about the aging U.S.population and expects stock for companies that cater to senior citizens to increase in value.

B) reads in the newspaper about a merger between two profitable firms and expects the stock prices for these companies to rise.

C) while auditing a dishonest company realizes that its profit estimates are greatly inflated and immediately sells her stock in the company.

D) hears a rumor that a top bank may be in trouble and decides to sell his stock in that company.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

43

In the stock market,profiting from inside information:

A) is nearly impossible because of the efficient markets hypothesis.

B) can lead to above-normal market returns for a long period.

C) requires the investor to keep the information secret and not act for a long period.

D) requires purchasing or selling large quantities of the stock very quickly.

A) is nearly impossible because of the efficient markets hypothesis.

B) can lead to above-normal market returns for a long period.

C) requires the investor to keep the information secret and not act for a long period.

D) requires purchasing or selling large quantities of the stock very quickly.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

44

One reason why stock picking cannot work well in the long run is that:

A) the stock market is controlled by a small number of investors.

B) stock market information is widely available.

C) there is always inside information that most investors do not have.

D) the stock market is heavily regulated by the government.

A) the stock market is controlled by a small number of investors.

B) stock market information is widely available.

C) there is always inside information that most investors do not have.

D) the stock market is heavily regulated by the government.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

45

The efficient markets hypothesis states that:

A) the price of assets already reflects all publicly available information.

B) arbitrage is impossible in financial markets.

C) in financial markets both buyers and sellers will be equally informed.

D) financial markets are,on average,more efficient than product markets.

A) the price of assets already reflects all publicly available information.

B) arbitrage is impossible in financial markets.

C) in financial markets both buyers and sellers will be equally informed.

D) financial markets are,on average,more efficient than product markets.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

46

Based on the efficient markets hypothesis,which of the following mutual funds has the better chance of beating the market in the long run?

A) a low-fee fund that is actively managed by a highly respected fund manager

B) a passive fund that simply attempts to mimic a financial index such as the S&P 500

C) a portfolio of stocks that you choose,since nobody has more incentive to manage your money correctly than you do

D) Forget about it-it is nearly impossible to choose a fund that will systematically outperform the market.

A) a low-fee fund that is actively managed by a highly respected fund manager

B) a passive fund that simply attempts to mimic a financial index such as the S&P 500

C) a portfolio of stocks that you choose,since nobody has more incentive to manage your money correctly than you do

D) Forget about it-it is nearly impossible to choose a fund that will systematically outperform the market.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

47

Consider the market for ABC Company's stock.What should happen in this market after an announcement that the company is having financial difficulties?

A) The demand for the stock would shift to the left.

B) The demand for the stock would shift to the right.

C) The supply of the stock would shift to the left.

D) The supply of the stock would shift to the right.

A) The demand for the stock would shift to the left.

B) The demand for the stock would shift to the right.

C) The supply of the stock would shift to the left.

D) The supply of the stock would shift to the right.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

48

The efficient markets hypothesis implies that an investor:

A) cannot systematically outperform the market as a whole over time.

B) should rely on publicly available information to outperform the market.

C) should buy and sell lower volumes of shares.

D) can manage a portfolio and regularly outperform the whole market.

A) cannot systematically outperform the market as a whole over time.

B) should rely on publicly available information to outperform the market.

C) should buy and sell lower volumes of shares.

D) can manage a portfolio and regularly outperform the whole market.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

49

Consider the market for ABC Company's stock.What should happen to the stock for ABC Company after a merger with a highly successful supply firm is announced?

A) The demand for the stock would shift to the left.

B) The demand for the stock would shift to the right.

C) The supply of the stock would shift to the left.

D) The supply of the stock would shift to the right.

A) The demand for the stock would shift to the left.

B) The demand for the stock would shift to the right.

C) The supply of the stock would shift to the left.

D) The supply of the stock would shift to the right.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

50

Consider the market for ABC Company's stock.What should happen to the stock for this company if there is a rumor that the company is set to merge with another very profitable company?

A) The demand for the stock would shift to the left.

B) The demand for the stock would shift to the right.

C) The supply of the stock would shift to the left.

D) The supply of the stock would shift to the right.

A) The demand for the stock would shift to the left.

B) The demand for the stock would shift to the right.

C) The supply of the stock would shift to the left.

D) The supply of the stock would shift to the right.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

51

The field of technical analysis:

A) has been able to beat the market in the long run if enough data is analyzed.

B) has been unable to consistently beat the market.

C) is also known as active investing.

D) is difficult since stock market data is hard to come by.

A) has been able to beat the market in the long run if enough data is analyzed.

B) has been unable to consistently beat the market.

C) is also known as active investing.

D) is difficult since stock market data is hard to come by.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

52

Which statement is consistent with the efficient markets hypothesis?

A) The majority of stock mutual funds cannot outperform stock composite indexes.

B) No mutual funds can outperform stock composite indexes at any time.

C) No one can earn a return in the stock market.

D) Technical analysis is the only way to beat the market over time.

A) The majority of stock mutual funds cannot outperform stock composite indexes.

B) No mutual funds can outperform stock composite indexes at any time.

C) No one can earn a return in the stock market.

D) Technical analysis is the only way to beat the market over time.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

53

According to the efficient markets hypothesis,:

A) everyone can outperform the stock market indexes.

B) when one investor outperforms the stock market index,another investor must underperform.

C) ordinary investors should always follow the advice of market geniuses like Warren Buffet.

D) no investor can consistently outperform the stock market indexes.

A) everyone can outperform the stock market indexes.

B) when one investor outperforms the stock market index,another investor must underperform.

C) ordinary investors should always follow the advice of market geniuses like Warren Buffet.

D) no investor can consistently outperform the stock market indexes.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

54

Technical analysis:

A) looks for patterns in stock prices.

B) can systematically beat market averages,according to research economists.

C) is useful for predicting when stocks will stay above certain price thresholds.

D) All of the answers are correct.

A) looks for patterns in stock prices.

B) can systematically beat market averages,according to research economists.

C) is useful for predicting when stocks will stay above certain price thresholds.

D) All of the answers are correct.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

55

Stocks are a good investment if: I.one is prepared to hold them for a while through market fluctuations.

II.one can buy them immediately after prices have fallen.

III.one is not averse to risk.

A) I only

B) I and II only

C) I and III only

D) I,II,and III

II.one can buy them immediately after prices have fallen.

III.one is not averse to risk.

A) I only

B) I and II only

C) I and III only

D) I,II,and III

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

56

What does the efficient markets hypothesis tell us about the movement in a stock price?

A) It tells what happens to the stock price in the past but not in the future.

B) It reflects only what the buyers,not the sellers,think about the future movement of the stock price.

C) It reflects all public information that leads to its movement.

D) It always predicts how the stock price will move in the future.

A) It tells what happens to the stock price in the past but not in the future.

B) It reflects only what the buyers,not the sellers,think about the future movement of the stock price.

C) It reflects all public information that leads to its movement.

D) It always predicts how the stock price will move in the future.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

57

When Chernobyl melted down in the Soviet Union,the:

A) price of U.S.basketballs increased.

B) prices of assets reacted slowly to the information.

C) price of U.S.potatoes increased.

D) stock prices of U.S.nuclear plants increased.

A) price of U.S.basketballs increased.

B) prices of assets reacted slowly to the information.

C) price of U.S.potatoes increased.

D) stock prices of U.S.nuclear plants increased.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following statements is TRUE? I.For every transaction in the stock market there is a buyer and a seller.

II.At any point in time,the price of a stock tends to reflect all available public information about the company's future prospects.

III.A revolutionary cancer treatment pill will be released next year.An investor will get rich by buying stock in that company now.

A) I and II only

B) III only

C) II and III only

D) I,II,and III

II.At any point in time,the price of a stock tends to reflect all available public information about the company's future prospects.

III.A revolutionary cancer treatment pill will be released next year.An investor will get rich by buying stock in that company now.

A) I and II only

B) III only

C) II and III only

D) I,II,and III

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

59

About the only way to beat a well-functioning market and make money in the short run is: I.through the efficient markets hypothesis.

II.if one has insider information.

III.through extreme speed and foresight.

A) I only

B) II and III only

C) II only

D) I,II,and III

II.if one has insider information.

III.through extreme speed and foresight.

A) I only

B) II and III only

C) II only

D) I,II,and III

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

60

An efficient stock market means that:

A) it is difficult to outperform the market,since stock prices convey all relevant public information about a company.

B) traders with inside information cannot even outperform market averages.

C) new information is slowly reflected in stock prices.

D) All of the answers are correct.

A) it is difficult to outperform the market,since stock prices convey all relevant public information about a company.

B) traders with inside information cannot even outperform market averages.

C) new information is slowly reflected in stock prices.

D) All of the answers are correct.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

61

The efficient markets hypothesis most clearly implies that extra-market returns are:

A) common in the long run.

B) rare in the long run.

C) always attained in the long run.

D) never attained in the long run.

A) common in the long run.

B) rare in the long run.

C) always attained in the long run.

D) never attained in the long run.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

62

When inside information becomes public information,profit opportunities:

A) grow.

B) evaporate.

C) remain the same.

D) change in an indeterminate direction.

A) grow.

B) evaporate.

C) remain the same.

D) change in an indeterminate direction.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

63

High-frequency trading involves scanning the latest news and stock quotes with high-tech computers and using the information to trade stocks very quickly.Because it is highly automated,it happens a thousand times faster than an eye can blink.Though each trade might make a fraction of a penny,it accounts for about two-thirds of the stock market trading.How does this financing trend reflect the efficient markets hypothesis?

A) Computers ensure public knowledge is instantly embodied in the stock price.

B) Buying and holding stocks allows the investor to circumvent this volatility.

C) Investing in stocks this way has a low risk of failure,thus a low return.

D) The firms that make a lot of money using this strategy are likely just very lucky.

A) Computers ensure public knowledge is instantly embodied in the stock price.

B) Buying and holding stocks allows the investor to circumvent this volatility.

C) Investing in stocks this way has a low risk of failure,thus a low return.

D) The firms that make a lot of money using this strategy are likely just very lucky.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

64

Between the years 1993 to 1998,U.S.Senators' stock portfolio outperformed the market by an average of 12% a year.Does this overturn the efficient markets hypothesis?

A) Yes,because all the relevant information is clearly not embodied in the price.

B) Yes,because it is inefficient to channel money this way.

C) No,because Senators are probably trading using nonpublic information.

D) No,because Senators are unusually smart people.

A) Yes,because all the relevant information is clearly not embodied in the price.

B) Yes,because it is inefficient to channel money this way.

C) No,because Senators are probably trading using nonpublic information.

D) No,because Senators are unusually smart people.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

65

Stock markets' reactions to the Chernobyl nuclear power plant meltdown was a lesson that:

A) it is not possible to profit from nonpublic information.

B) investors are slow to respond to new information.

C) the prices of assets quickly adjust to new information.

D) prices are sticky in the short run.

A) it is not possible to profit from nonpublic information.

B) investors are slow to respond to new information.

C) the prices of assets quickly adjust to new information.

D) prices are sticky in the short run.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

66

The disaster at Chernobyl caused the stock price of U.S.nuclear power plant companies to:

A) increase.

B) decrease.

C) remain the same.

D) change in an indeterminate direction.

A) increase.

B) decrease.

C) remain the same.

D) change in an indeterminate direction.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following statements is TRUE? I.Technical analysis has been found to outperform most investing strategies.

II.Technical analysis looks for patterns in stock price movements to best determine when to buy and sell.

III.Technical analysis is the use of insider information to help determine when to buy and sell.

A) I and II only

B) II and III only

C) II only

D) I and III only

II.Technical analysis looks for patterns in stock price movements to best determine when to buy and sell.

III.Technical analysis is the use of insider information to help determine when to buy and sell.

A) I and II only

B) II and III only

C) II only

D) I and III only

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

68

The efficient markets hypothesis is the idea that:

A) asset prices represent all publicly available information.

B) stock values revert to their historical mean values.

C) the prices of assets are systemically biased,allowing savvy investors to make above-market returns by exploiting the efficiency losses.

D) stock buyers are more likely to assess financial information more efficiently than the sellers of stocks.

A) asset prices represent all publicly available information.

B) stock values revert to their historical mean values.

C) the prices of assets are systemically biased,allowing savvy investors to make above-market returns by exploiting the efficiency losses.

D) stock buyers are more likely to assess financial information more efficiently than the sellers of stocks.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

69

If a cable news channel breaks news one morning that a major light bulb company announced a new long-lasting light bulb and you call your broker the next day to buy stock in the company,will you make money based on this information?

A) Yes,because it will take a while for the company to recover the R&D costs of the light bulbs.

B) Yes,because it will take time before the light bulbs show up in stores (and thus time before the new revenue's reflected in the company's bottom line).

C) No,because the broker fees will eat away all your profits.

D) No,because the new information will already be reflected in the stock price when you purchase the stock.

A) Yes,because it will take a while for the company to recover the R&D costs of the light bulbs.

B) Yes,because it will take time before the light bulbs show up in stores (and thus time before the new revenue's reflected in the company's bottom line).

C) No,because the broker fees will eat away all your profits.

D) No,because the new information will already be reflected in the stock price when you purchase the stock.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

70

The efficient markets hypothesis says that the ______ value of traded assets reflects all ______ information.

A) current;privately held

B) past;publicly available

C) current;publicly available

D) past;privately held

A) current;privately held

B) past;publicly available

C) current;publicly available

D) past;privately held

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

71

As a result of the disaster at Chernobyl,related stock prices changed within:

A) months.

B) days.

C) hours.

D) minutes.

A) months.

B) days.

C) hours.

D) minutes.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

72

Which statement is consistent with the strategy of diversification in stock investment?

A) Buy all stocks in the stock market.

B) Pick stocks that you believe are undervalued.

C) Buy a mutual fund of a broad stock market index.

D) Buy and sell a stock at the same time.

A) Buy all stocks in the stock market.

B) Pick stocks that you believe are undervalued.

C) Buy a mutual fund of a broad stock market index.

D) Buy and sell a stock at the same time.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

73

Diversification is an investment strategy to:

A) maximize the return in stock investment.

B) minimize the risk in personal finance.

C) outperform the average stock market return.

D) reduce the risk of a given investment portfolio.

A) maximize the return in stock investment.

B) minimize the risk in personal finance.

C) outperform the average stock market return.

D) reduce the risk of a given investment portfolio.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

74

The disaster at Chernobyl caused the price of oil to:

A) increase.

B) decrease.

C) remain the same.

D) change in an indeterminate direction.

A) increase.

B) decrease.

C) remain the same.

D) change in an indeterminate direction.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

75

To diversify,an engineer working in an electric power-generating plant should invest in:

A) stocks of wind power-generating companies.

B) stocks of his own company.

C) a mutual fund that consists of only electric power-generating companies.

D) nothing.

A) stocks of wind power-generating companies.

B) stocks of his own company.

C) a mutual fund that consists of only electric power-generating companies.

D) nothing.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

76

A mutual fund is a good way for an investor to diversify in investment because:

A) a mutual fund consists of a large number of stocks so the cost of buying all of them at the same time is lower.

B) when the prices of risky stocks go up,the prices of less risky stocks must go down.

C) not all stock prices move up or down at the same time.

D) there are many buyers of a mutual fund so that the risk is spread across all the buyers.

A) a mutual fund consists of a large number of stocks so the cost of buying all of them at the same time is lower.

B) when the prices of risky stocks go up,the prices of less risky stocks must go down.

C) not all stock prices move up or down at the same time.

D) there are many buyers of a mutual fund so that the risk is spread across all the buyers.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

77

Which principle explains why it is hard to beat the market?

A) technical investing principle

B) efficient markets hypothesis

C) systematic risk evaluation principle

D) buy and hold principle

A) technical investing principle

B) efficient markets hypothesis

C) systematic risk evaluation principle

D) buy and hold principle

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

78

The disaster at Chernobyl caused the price of potatoes to:

A) increase.

B) decrease.

C) remain the same.

D) change in an indeterminate direction.

A) increase.

B) decrease.

C) remain the same.

D) change in an indeterminate direction.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

79

The efficient markets hypothesis implies that:

A) it is easy to earn above market rates of return using the appropriate investment strategies at the right time.

B) investors don't make mistakes when determining when to buy and sell stocks.

C) it is not possible to systematically pick stocks that outperform the market.

D) stock prices are never too high or too low;they always accurately reflect the underlying value of the company.

A) it is easy to earn above market rates of return using the appropriate investment strategies at the right time.

B) investors don't make mistakes when determining when to buy and sell stocks.

C) it is not possible to systematically pick stocks that outperform the market.

D) stock prices are never too high or too low;they always accurately reflect the underlying value of the company.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck

80

All of the following are U.S.stock price indexes,EXCEPT:

A) the Dow Jones Industrial.

B) the S&P 500.

C) the NASDAQ Composite.

D) the CPI.

A) the Dow Jones Industrial.

B) the S&P 500.

C) the NASDAQ Composite.

D) the CPI.

Unlock Deck

Unlock for access to all 241 flashcards in this deck.

Unlock Deck

k this deck