Deck 18: Financial Markets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/148

Play

Full screen (f)

Deck 18: Financial Markets

1

The decision to save is influenced by all of the following except

A) Time preferences.

B) Interest rates.

C) The level of risk.

D) Occupation.

A) Time preferences.

B) Interest rates.

C) The level of risk.

D) Occupation.

Occupation.

2

Risk premiums do all of the following except

A) Help explain why banks charge different customers different interest rates.

B) Allocate limited resources only to the safest investors.

C) Are the difference in the rates of return on risky and safe investments.

D) Compensate people who finance risky ventures.

A) Help explain why banks charge different customers different interest rates.

B) Allocate limited resources only to the safest investors.

C) Are the difference in the rates of return on risky and safe investments.

D) Compensate people who finance risky ventures.

Allocate limited resources only to the safest investors.

3

The risk premium is the

A) Interest rate paid to savers.

B) Interest rate charged to borrowers.

C) Difference in rates of return on safe and risky investments.

D) Interest rate divided by the expected value.

A) Interest rate paid to savers.

B) Interest rate charged to borrowers.

C) Difference in rates of return on safe and risky investments.

D) Interest rate divided by the expected value.

Difference in rates of return on safe and risky investments.

4

Higher interest rates

A) Decrease the quantity of loanable funds.

B) Decrease the level of risk.

C) Increase the quantity of loanable funds.

D) Increase the level of risk.

A) Decrease the quantity of loanable funds.

B) Decrease the level of risk.

C) Increase the quantity of loanable funds.

D) Increase the level of risk.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

5

Market participants are likely to save a portion of current income if they

A) Place a higher value on future consumption than on current consumption.

B) Place a higher value on current consumption than on future consumption.

C) Believe that banks might fail.

D) Believe that money will lose much of its value in the future.

A) Place a higher value on future consumption than on current consumption.

B) Place a higher value on current consumption than on future consumption.

C) Believe that banks might fail.

D) Believe that money will lose much of its value in the future.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

6

Financial intermediaries

A) Increase search and information costs for savers and investors.

B) Transfer purchasing power from spenders to savers.

C) Spread the risk of investment failure over many individuals.

D) Always allocate funds to the least productive investments.

A) Increase search and information costs for savers and investors.

B) Transfer purchasing power from spenders to savers.

C) Spread the risk of investment failure over many individuals.

D) Always allocate funds to the least productive investments.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

7

As long as interest-earning opportunities exist, present dollars are worth

A) More than future dollars.

B) Less than future dollars.

C) More than previous periods'dollars.

D) Less than inflation-adjusted dollars.

A) More than future dollars.

B) Less than future dollars.

C) More than previous periods'dollars.

D) Less than inflation-adjusted dollars.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

8

Lower interest rates

A) Lower the present value of future payments.

B) Raise the future value of current dollars.

C) Reflect a lower opportunity cost of money.

D) Reflect a higher opportunity cost of money.

A) Lower the present value of future payments.

B) Raise the future value of current dollars.

C) Reflect a lower opportunity cost of money.

D) Reflect a higher opportunity cost of money.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following statements about money is not true?

A) Income-earning investment opportunities exist.

B) Present dollars are worth more than future dollars.

C) There is an opportunity cost of money.

D) Currency can be exchanged for gold only in the United States and Europe.

A) Income-earning investment opportunities exist.

B) Present dollars are worth more than future dollars.

C) There is an opportunity cost of money.

D) Currency can be exchanged for gold only in the United States and Europe.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

10

Present discounted value refers to the

A) Future value of today's dollars.

B) Value today of future payments adjusted for inflation.

C) Value today of future payments adjusted for interest accrual.

D) Value today of future payments adjusted for risk.

A) Future value of today's dollars.

B) Value today of future payments adjusted for inflation.

C) Value today of future payments adjusted for interest accrual.

D) Value today of future payments adjusted for risk.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

11

The present discounted value of a future payment can be calculated using which of the following formulas?

A) [(1 + Interest rate) N] ÷ (Current payment).

B) (Current payment) ÷ [(1 + Interest rate) N].

C) [(1 + Interest rate) N] ÷ (Future payment).

D) (Future payment) ÷ [(1 + Interest rate) N].

A) [(1 + Interest rate) N] ÷ (Current payment).

B) (Current payment) ÷ [(1 + Interest rate) N].

C) [(1 + Interest rate) N] ÷ (Future payment).

D) (Future payment) ÷ [(1 + Interest rate) N].

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

12

The supply of loanable funds is determined by all of the following except

A) Time preferences.

B) Demand for loanable funds.

C) Interest rates.

D) Risk.

A) Time preferences.

B) Demand for loanable funds.

C) Interest rates.

D) Risk.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

13

An institution that makes savings available to investors is known as

A) A financial repository.

B) An independent financial association.

C) A financial intermediary.

D) A stock and bond intermediary.

A) A financial repository.

B) An independent financial association.

C) A financial intermediary.

D) A stock and bond intermediary.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

14

Financial intermediaries make the allocation of resources more efficient by

A) Transferring purchasing power from savers to dissavers.

B) Lending or investing the savings they hold.

C) Reducing search and information costs for savers and investors.

D) Spreading risk out over many individuals.

A) Transferring purchasing power from savers to dissavers.

B) Lending or investing the savings they hold.

C) Reducing search and information costs for savers and investors.

D) Spreading risk out over many individuals.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

15

Higher interest rates

A) Reflect a higher opportunity cost of money.

B) Raise the present value of future payments.

C) Lower the future value of current dollars.

D) Result in a higher risk premium.

A) Reflect a higher opportunity cost of money.

B) Raise the present value of future payments.

C) Lower the future value of current dollars.

D) Result in a higher risk premium.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

16

If the interest rate is 8 percent, then the present discounted value of $100 to be received two years from now is closest to

A) $128.00.

B) $116.00.

C) $86.00.

D) $96.00.

A) $128.00.

B) $116.00.

C) $86.00.

D) $96.00.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is an example of a financial intermediary?

A) Banks.

B) The Federal Reserve.

C) The U.S. Treasury.

D) The department of finance.

A) Banks.

B) The Federal Reserve.

C) The U.S. Treasury.

D) The department of finance.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is an example of a financial intermediary?

A) Stock markets.

B) Flea markets.

C) Real estate markets.

D) Gun shows.

A) Stock markets.

B) Flea markets.

C) Real estate markets.

D) Gun shows.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

19

The function of financial intermediaries is to transfer purchasing power from

A) Dissavers to consumers.

B) Consumers to savers.

C) Savers to dissavers.

D) Dissavers to savers.

A) Dissavers to consumers.

B) Consumers to savers.

C) Savers to dissavers.

D) Dissavers to savers.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

20

All of the following statements about banks in Zimbabwe in 2009 are true except

A) Political instability increased the risk of bank failures.

B) Banks were paying 100,000 percent interest on deposits.

C) Few people deposited their money into Zimbabwe banks.

D) The risk of losing deposits at Zimbabwe banks, even if they failed, was low because of deposit insurance. The risk of deposits losing their value at Zimbabwe banks was very high because the inflation rate was 230 million percent, much higher than the 100,000 percent interest.

A) Political instability increased the risk of bank failures.

B) Banks were paying 100,000 percent interest on deposits.

C) Few people deposited their money into Zimbabwe banks.

D) The risk of losing deposits at Zimbabwe banks, even if they failed, was low because of deposit insurance. The risk of deposits losing their value at Zimbabwe banks was very high because the inflation rate was 230 million percent, much higher than the 100,000 percent interest.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

21

The present discounted value of $60,000 to be received at the end of three years when the interest rate is 10 percent is closest to

A) $45,079.

B) $49,587.

C) $60,000.

D) $79,860.

A) $45,079.

B) $49,587.

C) $60,000.

D) $79,860.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

22

The present discounted value of $100 to be received one year from now, if the interest rate is 2.5 percent, is closest to

A) $98.

B) $100.

C) $103.

D) $95.

A) $98.

B) $100.

C) $103.

D) $95.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

23

In the loanable funds market,

A) The price is the interest rate.

B) The demand curve reflects the behavior of lenders.

C) The supply curve reflects the behavior of borrowers.

D) If interest rates rise, firms borrow more.

A) The price is the interest rate.

B) The demand curve reflects the behavior of lenders.

C) The supply curve reflects the behavior of borrowers.

D) If interest rates rise, firms borrow more.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

24

Suppose you purchase shares in Papa's Pizza for $20 per share.The company believes there is a 40 percent chance it will fail to earn a discounted future profit of $2.59.What is the expected rate of return on your investment?

A) 5.8 percent.

B) 7.77 percent.

C) 5.2 percent.

D) 15.17 percent.

A) 5.8 percent.

B) 7.77 percent.

C) 5.2 percent.

D) 15.17 percent.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

25

The quantity of loanable funds available to a corporation depends on the

A) Dividends the company is willing to pay.

B) Present worth of the company's dividends.

C) Price of its stock.

D) Interest rate the company is willing to offer.

A) Dividends the company is willing to pay.

B) Present worth of the company's dividends.

C) Price of its stock.

D) Interest rate the company is willing to offer.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

26

Suppose you purchase shares in Acme Gadget Company for $10 per share.The company believes there is a 20 percent chance it will fail to earn a discounted future profit of $1.85.What is the expected rate of return on your investment?

A) 18.5 percent.

B) 13.5 percent.

C) 14.8 percent.

D) 20.0 percent.

A) 18.5 percent.

B) 13.5 percent.

C) 14.8 percent.

D) 20.0 percent.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

27

Suppose Carlos has a 60 percent chance of not collecting $100,000 when his rich uncle dies in 10 years.Juanita wants to buy the rights to this possible inheritance from Carlos.How much is the possible inheritance currently worth to Carlos? Assume the interest rate is 9 percent.

A) $94,695.

B) $25,345.

C) $16,896.

D) $142,042.

A) $94,695.

B) $25,345.

C) $16,896.

D) $142,042.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

28

If the expected rate of return decreases

A) The demand for loanable funds will increase.

B) The demand for loanable funds will decrease.

C) Market participants will save less money.

D) The time value of money will increase.

A) The demand for loanable funds will increase.

B) The demand for loanable funds will decrease.

C) Market participants will save less money.

D) The time value of money will increase.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

29

Suppose Regis has a 25 percent chance of not collecting $1,000 in one year.If the interest rate is 10 percent, what is the expected value of the future payment?

A) $750.

B) $682.

C) $227.

D) $909.

A) $750.

B) $682.

C) $227.

D) $909.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

30

The intersection of the demand for loanable funds and the supply of loanable funds determines the

A) Real interest rate.

B) Par value.

C) Prevailing interest rate.

D) Price ÷ earnings ratio.

A) Real interest rate.

B) Par value.

C) Prevailing interest rate.

D) Price ÷ earnings ratio.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is the equation for determining an expected value?

A) (1 - Risk factor) ×PDV.

B) (Risk factor - 1) ×PDV.

C) (1 - Risk factor) ÷ PDV.

D) (Risk factor - 1) ÷ PDV.

A) (1 - Risk factor) ×PDV.

B) (Risk factor - 1) ×PDV.

C) (1 - Risk factor) ÷ PDV.

D) (Risk factor - 1) ÷ PDV.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following will cause the demand for loanable funds to increase?

A) The expected profitability of a project declines.

B) The cost of funds increases.

C) The expected rate of return increases.

D) Households increase their rate of savings.

A) The expected profitability of a project declines.

B) The cost of funds increases.

C) The expected rate of return increases.

D) Households increase their rate of savings.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

33

The present discounted value of a future payment will increase when the

A) Interest rate decreases.

B) Future payment is moved further into the future.

C) Risk of nonpayment increases.

D) Opportunity cost of money increases.

A) Interest rate decreases.

B) Future payment is moved further into the future.

C) Risk of nonpayment increases.

D) Opportunity cost of money increases.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

34

The expected value of a future payment differs from the present discounted value in that the expected value

A) Takes into account the possibility of nonpayment.

B) Uses a lower interest rate in its calculation.

C) Uses a higher interest rate in its calculation.

D) Assumes that future payments take place over a longer period of time.

A) Takes into account the possibility of nonpayment.

B) Uses a lower interest rate in its calculation.

C) Uses a higher interest rate in its calculation.

D) Assumes that future payments take place over a longer period of time.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

35

Expected value refers to the

A) Future value of a current payment.

B) Present value of a future payment.

C) Probable value of a future payment.

D) Difference in the rates of return on risky and safe investments.

A) Future value of a current payment.

B) Present value of a future payment.

C) Probable value of a future payment.

D) Difference in the rates of return on risky and safe investments.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

36

The value of future payments is affected by

A) The level of dividends.

B) Capital gains.

C) The par value.

D) The probability of nonpayment.

A) The level of dividends.

B) Capital gains.

C) The par value.

D) The probability of nonpayment.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

37

If the present discounted value of a payment is $1,000,000 and there is a 40 percent chance that the payment will not occur, then the expected value is

A) $600,000.

B) $400,000.

C) $1,000,000.

D) $1,400,000.

A) $600,000.

B) $400,000.

C) $1,000,000.

D) $1,400,000.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

38

As the uncertainty attached to a future payment _______, the expected value _______.

A) decreases; decreases

B) increases; stays the same

C) decreases; increases

D) increases; becomes positive

A) decreases; decreases

B) increases; stays the same

C) decreases; increases

D) increases; becomes positive

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

39

The price paid for the use of money is defined as the

A) Rental rate.

B) Interest rate.

C) Profit rate.

D) Inflation rate.

A) Rental rate.

B) Interest rate.

C) Profit rate.

D) Inflation rate.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

40

The present discounted value of a future payment will decrease when the

A) Interest rate increases.

B) Future payment is closer to the present.

C) Risk of nonpayment increases.

D) Opportunity cost of money decreases.

A) Interest rate increases.

B) Future payment is closer to the present.

C) Risk of nonpayment increases.

D) Opportunity cost of money decreases.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

41

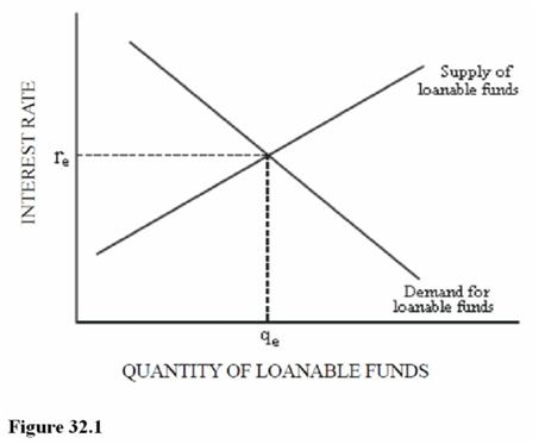

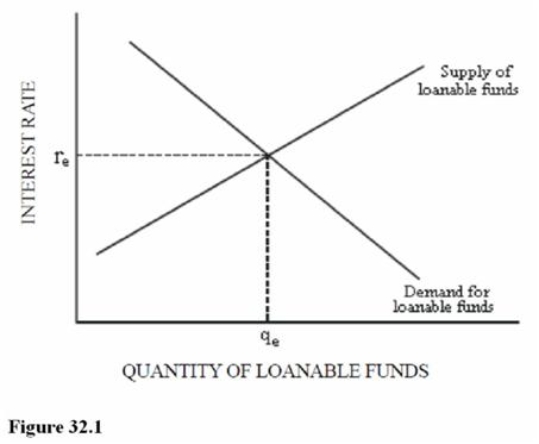

Figure 32.1 represents the market for loanable funds.Which of the following is true at the equilibrium interest rate?

Figure 32.1 represents the market for loanable funds.Which of the following is true at the equilibrium interest rate?A) The rate of return on capital equals the interest rate.

B) The rate of return on capital is less than the interest rate.

C) The rate of return on capital is greater than the interest rate.

D) There is no relationship between the rate of return on capital and the interest rate.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

42

Dividends are

A) The amount of corporate profit paid out for each share of stock.

B) Profits used for investment in new plants and equipment.

C) An increase in the market value of an asset.

D) The only motive for purchasing stock.

A) The amount of corporate profit paid out for each share of stock.

B) Profits used for investment in new plants and equipment.

C) An increase in the market value of an asset.

D) The only motive for purchasing stock.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

43

Figure 32.1 represents the market for loanable funds.The equilibrium interest rate

Figure 32.1 represents the market for loanable funds.The equilibrium interest rateA) Is less than the rate of return on capital.

B) Is greater than the rate of return on capital.

C) Represents the price paid for the use of money.

D) Is equal to the risk premium.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

44

A motivation for holding stock is

A) To receive interest payments on the firm's debt.

B) The anticipation of capital gains.

C) To have a direct role in the operation of the corporation.

D) To own a low-risk, illiquid asset.

A) To receive interest payments on the firm's debt.

B) The anticipation of capital gains.

C) To have a direct role in the operation of the corporation.

D) To own a low-risk, illiquid asset.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

45

Dividends are equal to

A) Capital gains minus retained earnings.

B) Corporate profits.

C) Corporate profits plus retained earnings.

D) Corporate profits minus retained earnings.

A) Capital gains minus retained earnings.

B) Corporate profits.

C) Corporate profits plus retained earnings.

D) Corporate profits minus retained earnings.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

46

In which form of business is a single individual responsible for the repayment of any debts?

A) Proprietorship.

B) Corporation.

C) Partnership.

D) Family-run business.

A) Proprietorship.

B) Corporation.

C) Partnership.

D) Family-run business.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

47

A corporation can elect to allocate corporate profits into either

A) Interest payments or dividends.

B) Bonds or stocks.

C) Dividends or retained earnings.

D) Capital gains or dividends.

A) Interest payments or dividends.

B) Bonds or stocks.

C) Dividends or retained earnings.

D) Capital gains or dividends.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

48

The owners of which type of firm have the least liability?

A) Corporation.

B) Partnership.

C) Proprietorship.

D) Limited partnership.

A) Corporation.

B) Partnership.

C) Proprietorship.

D) Limited partnership.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

49

Retained earnings are

A) The only motive for purchasing stock.

B) Equal to corporate profits.

C) Direct increases to shareholder wealth.

D) The amount of corporate profit not paid out in dividends.

A) The only motive for purchasing stock.

B) Equal to corporate profits.

C) Direct increases to shareholder wealth.

D) The amount of corporate profit not paid out in dividends.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

50

The owners of a corporation are

A) Liable for its debts.

B) Those people who own the bonds issued by the corporation.

C) The shareholders of the corporation's stock.

D) The board of directors.

A) Liable for its debts.

B) Those people who own the bonds issued by the corporation.

C) The shareholders of the corporation's stock.

D) The board of directors.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

51

As the prevailing interest rate decreases, the opportunity cost of money

A) Increases for both lender and borrower.

B) Increases for the borrower and decreases for the lender.

C) Decreases for both lender and borrower.

D) Decreases for the borrower and increases for the lender.

A) Increases for both lender and borrower.

B) Increases for the borrower and decreases for the lender.

C) Decreases for both lender and borrower.

D) Decreases for the borrower and increases for the lender.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

52

Shares of ownership in a corporation are known as

A) Corporate stock.

B) Corporate bonds.

C) Retained earnings.

D) Savings bonds.

A) Corporate stock.

B) Corporate bonds.

C) Retained earnings.

D) Savings bonds.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

53

As the interest rate increases, ceteris paribus, the trade-off between present and future consumption

A) Makes it more appealing to sacrifice current consumption.

B) Is not affected.

C) Encourages less saving.

D) Makes it less appealing to sacrifice present consumption.

A) Makes it more appealing to sacrifice current consumption.

B) Is not affected.

C) Encourages less saving.

D) Makes it less appealing to sacrifice present consumption.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

54

An increase in the value of an asset, such as a stock, is called

A) Interest.

B) Profit.

C) A capital gain.

D) A dividend.

A) Interest.

B) Profit.

C) A capital gain.

D) A dividend.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

55

As the prevailing interest rate increases, all of the following occur except

A) Quantity demanded of loanable funds decreases.

B) Quantity supplied of loanable funds increases.

C) Cost of borrowing rises.

D) Supply curve for savings shifts to the right.

A) Quantity demanded of loanable funds decreases.

B) Quantity supplied of loanable funds increases.

C) Cost of borrowing rises.

D) Supply curve for savings shifts to the right.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

56

The owners of which type of firm have the most liability?

A) Corporation.

B) Partnership.

C) Proprietorship.

D) Limited partnership.

A) Corporation.

B) Partnership.

C) Proprietorship.

D) Limited partnership.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

57

In a publicly traded corporation, which of the following is responsible for business debts and activities?

A) The individual stockholders.

B) The board members.

C) The owners.

D) The corporation itself.

A) The individual stockholders.

B) The board members.

C) The owners.

D) The corporation itself.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

58

As interest rates decline, all of the following will result except

A) Quantity demanded of loanable funds increases.

B) Quantity supplied of loanable funds decreases.

C) Cost of borrowing diminishes.

D) Demand curve for money shifts to the left.

A) Quantity demanded of loanable funds increases.

B) Quantity supplied of loanable funds decreases.

C) Cost of borrowing diminishes.

D) Demand curve for money shifts to the left.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

59

Capital gains are

A) The only motive for purchasing stock.

B) Profits used for investment in new plants and equipment.

C) An increase in the market value of an asset.

D) The amount of corporate profit paid out for each share of stock.

A) The only motive for purchasing stock.

B) Profits used for investment in new plants and equipment.

C) An increase in the market value of an asset.

D) The amount of corporate profit paid out for each share of stock.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

60

The amount of corporate profits not paid out in dividends is known as

A) The par value.

B) Retained earnings.

C) The price/earnings ratio.

D) Corporate stock.

A) The par value.

B) Retained earnings.

C) The price/earnings ratio.

D) Corporate stock.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

61

The first sale to the general public of stock in a corporation is referred to as

A) An original public sale.

B) An initial public offering.

C) A public bond offering.

D) A public stock auction.

A) An original public sale.

B) An initial public offering.

C) A public bond offering.

D) A public stock auction.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

62

Suppose the Martin Microchip Corporation earns a profit of $20 per share of stock.If the prevailing interest rate is 10 percent and the stock is currently selling for $100 per share, what is the current price/earnings ratio?

A) 5.

B) 0.20.

C) 20.

D) 10.

A) 5.

B) 0.20.

C) 20.

D) 10.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

63

Large swings in stock prices are usually caused by

A) A decrease in interest rates.

B) Widespread changes in expectations.

C) A decrease in the supply of stocks.

D) An increase in dividend payments by corporations.

A) A decrease in interest rates.

B) Widespread changes in expectations.

C) A decrease in the supply of stocks.

D) An increase in dividend payments by corporations.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

64

The price of a stock will decrease, ceteris paribus, when

A) Future earnings expectations increase.

B) People move money out of the bond market and look for other options.

C) Terrorists cause people to be fearful.

D) Congress makes sound budget decisions.

A) Future earnings expectations increase.

B) People move money out of the bond market and look for other options.

C) Terrorists cause people to be fearful.

D) Congress makes sound budget decisions.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

65

Ceteris paribus, the price of a stock will definitely increase when the

A) Supply of the stock increases.

B) Prevailing interest rate increases.

C) Demand for the stock increases.

D) Demand for the stock and supply of the stock both decrease.

A) Supply of the stock increases.

B) Prevailing interest rate increases.

C) Demand for the stock increases.

D) Demand for the stock and supply of the stock both decrease.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

66

The purpose of an initial public offering is to

A) See if there is a demand for a company's new product.

B) Change the membership of the board of directors.

C) Borrow funds for investment and growth.

D) Raise funds for investment and growth by selling shares of the company to the public.

A) See if there is a demand for a company's new product.

B) Change the membership of the board of directors.

C) Borrow funds for investment and growth.

D) Raise funds for investment and growth by selling shares of the company to the public.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

67

The Dow Jones Industrial Average is an arithmetic average of _____ blue-chip industrial stocks.

A) 30

B) 50

C) 75

D) 500

A) 30

B) 50

C) 75

D) 500

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

68

An initial public offering

A) Allows a company to borrow funds for investment and growth.

B) Allows a company to raise money without increasing debt.

C) Indicates the demand for a company's new product.

D) Increases the percentage of the company owned by the management and original entrepreneurs.

A) Allows a company to borrow funds for investment and growth.

B) Allows a company to raise money without increasing debt.

C) Indicates the demand for a company's new product.

D) Increases the percentage of the company owned by the management and original entrepreneurs.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

69

The most important determinant of how much an individual will pay for a share of stock is

A) The average daily volume for the corporation's shares.

B) The expectation of future profit.

C) How well the CEO is compensated.

D) The structure of the market.

A) The average daily volume for the corporation's shares.

B) The expectation of future profit.

C) How well the CEO is compensated.

D) The structure of the market.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

70

If Shoffner Inc., a publicly traded corporation, has a share price of $125, revenues of $15.35 per share, and profits of $5.25 per share, what is the P/E ratio for Shoffner Inc.shares?

A) 23.81.

B) 0.04.

C) 8.14.

D) 0.12.

A) 23.81.

B) 0.04.

C) 8.14.

D) 0.12.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

71

The P/E ratio, or price to earnings ratio of a stock, can be computed using which of the following formulas?

A) (Revenue per share) ÷ (Price of stock share).

B) (Price of stock share) ÷ (Revenue per share).

C) (Earnings per share) ÷ (Price of stock share).

D) (Price of stock share) ÷ (Earnings per share).

A) (Revenue per share) ÷ (Price of stock share).

B) (Price of stock share) ÷ (Revenue per share).

C) (Earnings per share) ÷ (Price of stock share).

D) (Price of stock share) ÷ (Earnings per share).

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

72

The primary economic role of financial markets is to

A) Gain profits for investors.

B) Allocate resources to profitable businesses and away from businesses with losses.

C) Earn dividends for shareholders.

D) Provide the federal government with a source of loanable funds when it has a budget deficit. Financial markets facilitate resource reallocations.

A) Gain profits for investors.

B) Allocate resources to profitable businesses and away from businesses with losses.

C) Earn dividends for shareholders.

D) Provide the federal government with a source of loanable funds when it has a budget deficit. Financial markets facilitate resource reallocations.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following is not a reason to hold stock?

A) To receive payments on the firm's debt.

B) To receive potential capital gains.

C) To take part in the selection of the board of directors.

D) To receive potential dividends.

A) To receive payments on the firm's debt.

B) To receive potential capital gains.

C) To take part in the selection of the board of directors.

D) To receive potential dividends.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

74

A bond is

A) A share in a corporation.

B) A coupon used to collect a dividend.

C) An insurance policy investor's purchase to protect against the possibility of falling stock prices.

D) A promise to repay a loan.

A) A share in a corporation.

B) A coupon used to collect a dividend.

C) An insurance policy investor's purchase to protect against the possibility of falling stock prices.

D) A promise to repay a loan.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

75

The price of a stock will decrease, ceteris paribus, for all of the following reasons except

A) There is a surplus of the stock at the current price.

B) The demand for the stock decreases.

C) The supply of the stock increases.

D) Consumer confidence increases.

A) There is a surplus of the stock at the current price.

B) The demand for the stock decreases.

C) The supply of the stock increases.

D) Consumer confidence increases.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

76

All of the following are allowed to issue bonds except

A) General Motors.

B) The U.S. Treasury.

C) The City of Arlington.

D) The Federal Reserve.

A) General Motors.

B) The U.S. Treasury.

C) The City of Arlington.

D) The Federal Reserve.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

77

Bonds may be issued by the U.S.

A) Congress.

B) Treasury.

C) Federal Reserve Bank.

D) Immigration and Naturalization Agency.

A) Congress.

B) Treasury.

C) Federal Reserve Bank.

D) Immigration and Naturalization Agency.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

78

The price of a stock will increase, ceteris paribus, when

A) Future earnings expectations decrease.

B) Consumer confidence increases.

C) The interest rate increases.

D) Terrorists cause people to be fearful.

A) Future earnings expectations decrease.

B) Consumer confidence increases.

C) The interest rate increases.

D) Terrorists cause people to be fearful.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

79

The price of a stock will increase, ceteris paribus, when

A) Future earnings expectations increase.

B) The interest rate increases.

C) The supply of the stock increases.

D) There is a surplus of the stock at the current price.

A) Future earnings expectations increase.

B) The interest rate increases.

C) The supply of the stock increases.

D) There is a surplus of the stock at the current price.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

80

The price of a stock will decrease, ceteris paribus, when

A) There is a shortage of the stock at the current price.

B) The interest rate increases.

C) The supply of the stock decreases.

D) Future earnings expectations increase.

A) There is a shortage of the stock at the current price.

B) The interest rate increases.

C) The supply of the stock decreases.

D) Future earnings expectations increase.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck