Deck 13: Risk Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/27

Play

Full screen (f)

Deck 13: Risk Analysis

1

The term "financial risk" refers to the probability of interest rates changing

False

2

Use of leverage always increases the amount of risk

True

3

Financial risk increases as the amount of debt increases

True

4

Using the same information as the question above,what would the land value be under the real options approach?

A)$120,000

B)$200,000

C)$300,000

D)$833,333

E)$1,000,000

A)$120,000

B)$200,000

C)$300,000

D)$833,333

E)$1,000,000

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

5

When an investor performs an investigation while considering acquisition of a property,this is referred to as:

A)Investigation

B)Risk analysis

C)Due diligence

D)Acquisition analysis

A)Investigation

B)Risk analysis

C)Due diligence

D)Acquisition analysis

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

6

Consider an investment in which a developer plans to begin construction of a building one year if,at that point,rent levels make construction feasible and the building will cost $1 million to construct.There is a 50 percent chance that NOI will be $160,000 and a 50 percent chance that NOI will be $80,000.Using the traditional approach,similar to the "highest and best use" approach,what would be the land value of the property assuming a cap rate of 10 percent 12 percent discount rate and an NOI growth rate of 2 percent?

A)$120,000

B)$200,000

C)$300,000

D)$833,333

E)$1,000,000

A)$120,000

B)$200,000

C)$300,000

D)$833,333

E)$1,000,000

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

7

Partitioning the internal rate of return is useful because it helps the investor to determine how much of the return is from annual operating cash flow and how much is from the projected resale cash flow

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

8

The range of returns highest to lowest is the most common risk measure

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

9

Real estate has a lot of inflation risk

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

10

Percentage rent is common in office building leases

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

11

In general,real estate is usually considered more risky than bonds but less risky than stocks

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is NOT a component of lease rollover risk?

A)Commissions paid to a leasing agent to find a new tenant

B)Costs of tenant improvements demanded by new tenants

C)Liquidity risk

D)Reduced revenues from vacancy until a new tenant is found

A)Commissions paid to a leasing agent to find a new tenant

B)Costs of tenant improvements demanded by new tenants

C)Liquidity risk

D)Reduced revenues from vacancy until a new tenant is found

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

13

A property with a higher standard deviation and a higher return is preferable to a property with a lower standard deviation and a lower return

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

14

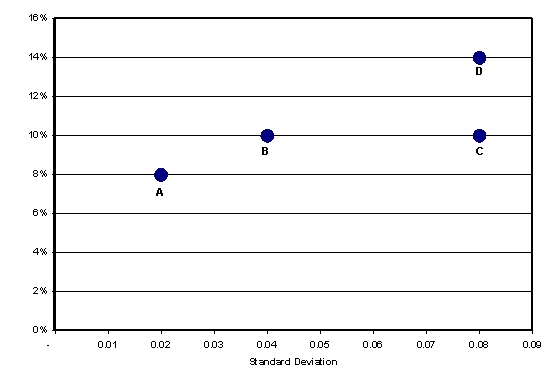

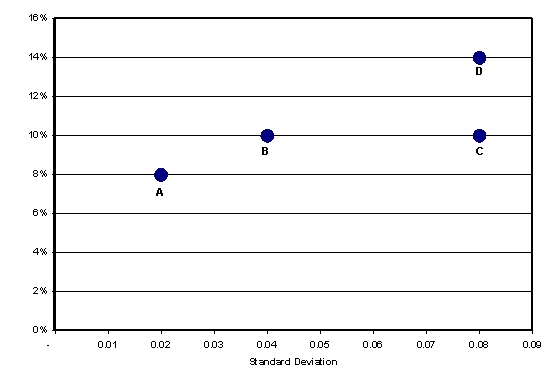

Consider risk-return characteristics of Investments A-D,given above.Which of the following statements is TRUE?

A)Investment A is preferred over all other investments

B)Investment D is preferred over all other investments

C)Investment A is preferred to Investment B

D)Investment B is preferred to Investment C

E)Investment C is preferred to Investment D

A)Investment A is preferred over all other investments

B)Investment D is preferred over all other investments

C)Investment A is preferred to Investment B

D)Investment B is preferred to Investment C

E)Investment C is preferred to Investment D

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

15

Risk due to potential tax law changes is referred to as:

A)Business risk

B)Financial risk

C)Legislative risk

D)Tax risk

A)Business risk

B)Financial risk

C)Legislative risk

D)Tax risk

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

16

In general,investors risk seekers and,therefore,must be compensated more for the higher risk of some investments

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

17

The term "due diligence" refers to doing an investigation before buying a property

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

18

Land can be viewed as having an "option" to develop the land

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

19

Real estate that is not leveraged does not have interest rate risk

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following refers to the risk real estate investors face stemming from changes in general economic conditions?

A)Financial risk

B)Liquidity risk

C)Environmental risk

D)Business risk

A)Financial risk

B)Liquidity risk

C)Environmental risk

D)Business risk

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

21

Renewal probabilities related to a lease renewal can affect which of the following?

A)Market rent paid after the existing lease ends

B)Vacancy after the existing lease ends.

C)Leasing commissions paid after the existing lease ends

D)All of the above

A)Market rent paid after the existing lease ends

B)Vacancy after the existing lease ends.

C)Leasing commissions paid after the existing lease ends

D)All of the above

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

22

An investor is analyzing the risk of a possible investment by producing three different scenarios.Under a pessimistic scenario,the property would produce a BTIRRp of 8%;a most-likely scenario produces a BTIRRp of 12%.The investor assigns the pessimistic scenario a 25% chance of occurring,the most-likely case a 60% chance of occurring,and the optimistic scenario a 15% chance of occurring.What is the standard deviation of the returns?

A)0.01249

B)0.0090

C)0.000156

D)0.0949

A)0.01249

B)0.0090

C)0.000156

D)0.0949

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following BEST describes the process of "partitioning the IRR"?

A)Dividing the IRR into income and appreciation components

B)Using the IRR as a discount rate and determining how much of the present value comes from income and resale

C)Dividing the IRR into before-tax and after-tax IRRs

D)Determining how much of the IRR comes from each property in a portfolio

A)Dividing the IRR into income and appreciation components

B)Using the IRR as a discount rate and determining how much of the present value comes from income and resale

C)Dividing the IRR into before-tax and after-tax IRRs

D)Determining how much of the IRR comes from each property in a portfolio

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is an example of real options?

A)Valuation of vacant land

B)Valuation of projects with phases of development

C)Valuation of a building that can be renovated

D)All of the above

A)Valuation of vacant land

B)Valuation of projects with phases of development

C)Valuation of a building that can be renovated

D)All of the above

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following best describes valuing land as a "real option"?

A)The land value reflects the fact that the developer can wait to decide whether to construct a building on the site

B)The seller provides the investor with an option to purchase the land at a specific price before a certain date

C)The land is valued at its most probable use

D)The seller has an option to repurchase the land from the buyer before construction takes place

A)The land value reflects the fact that the developer can wait to decide whether to construct a building on the site

B)The seller provides the investor with an option to purchase the land at a specific price before a certain date

C)The land is valued at its most probable use

D)The seller has an option to repurchase the land from the buyer before construction takes place

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

26

When sales exceed a breakpoint sales volume in a retail lease with percentage rent,the additional rent is referred to as:

A)Retail rent

B)Participation rent

C)Overage rent

D)Sales rent

A)Retail rent

B)Participation rent

C)Overage rent

D)Sales rent

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

27

The renewal probability is assumed to be 60% for a particular lease with 12 months vacant if the lease is not renewed.The expected vacancy at the end of the lease is:

A)4.8 months

B)7.2 months

C)9.0 months

D)12.0 months

A)4.8 months

B)7.2 months

C)9.0 months

D)12.0 months

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck