Deck 9: Other Consolidation Reporting Issues

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

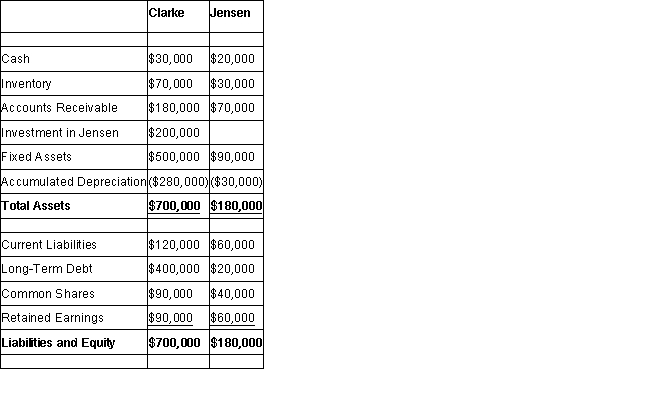

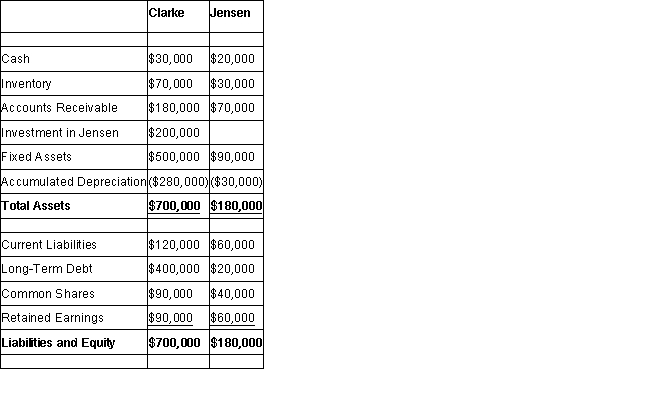

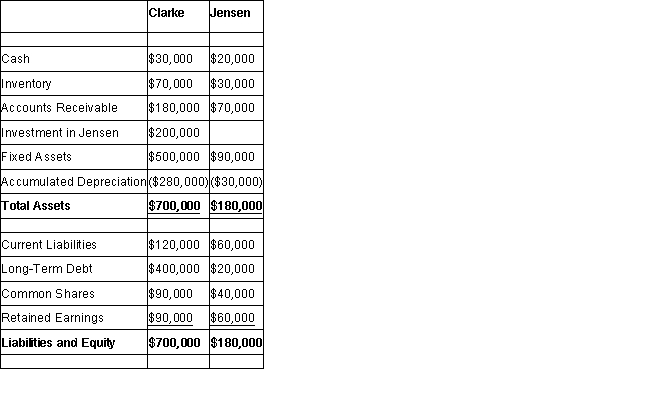

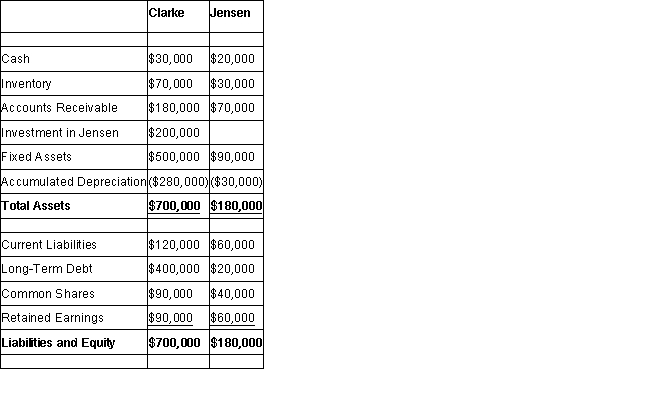

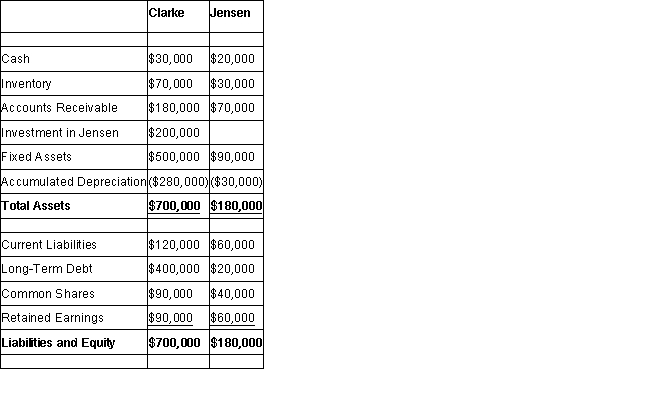

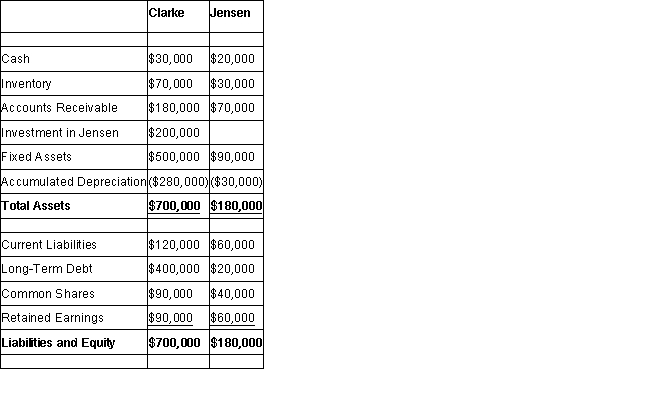

Question

Question

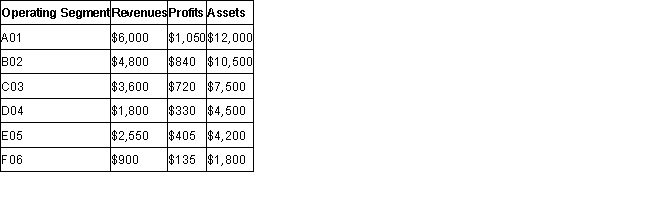

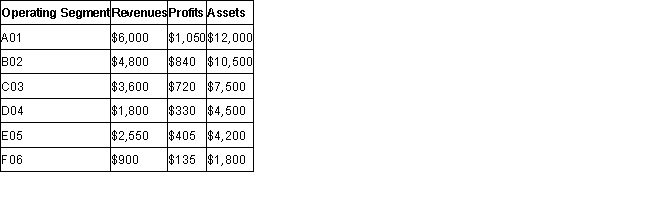

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/60

Play

Full screen (f)

Deck 9: Other Consolidation Reporting Issues

1

What is the total amount of deferred taxes that would appear on Seek's Consolidated Balance Sheet as at December 31, 2016?

A) $800

B) $1,200

C) $6,000

D)$8,000

A) $800

B) $1,200

C) $6,000

D)$8,000

B

2

What is the amount of Consolidated Retained Earnings at December 31, 2016?

A) $340,000

B) $368,000

C) $376,000

D)$546,200

A) $340,000

B) $368,000

C) $376,000

D)$546,200

D

3

What is the total amount of intercompany receivables to be eliminated from the financial statements?

A) Nil

B) $10,000

C) $40,000

D)$50,000

A) Nil

B) $10,000

C) $40,000

D)$50,000

B

4

What is the total amount of miscellaneous assets that would appear on Seek's Consolidated Balance Sheet as at December 31, 2016?

A) $650,000

B) $660,000

C) $840,000

D)$900,000

A) $650,000

B) $660,000

C) $840,000

D)$900,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

5

What is the total amount of intercompany sales and purchases that must be eliminated from the financial statements?

A) $20,000

B) $24,000

C) $80,000

D)$120,000

A) $20,000

B) $24,000

C) $80,000

D)$120,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following statements pertaining to any acquisition differential arising from a joint venture is correct?

A) There can be no acquisition differential arising from the formation of a new joint Venture.

B) The acquisition differential arising from a newly formed joint venture is allocated across the venture's identifiable net assets.

C) The acquisition differential arising from a newly formed joint venture is immediately charged to the retained earnings of each venturer on a pro-rata basis.

D)An acquisition differential may arise when a venturer increases its ownership percentage of a joint venture.

A) There can be no acquisition differential arising from the formation of a new joint Venture.

B) The acquisition differential arising from a newly formed joint venture is allocated across the venture's identifiable net assets.

C) The acquisition differential arising from a newly formed joint venture is immediately charged to the retained earnings of each venturer on a pro-rata basis.

D)An acquisition differential may arise when a venturer increases its ownership percentage of a joint venture.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

7

What is the total amount of other expenses that would appear on the Consolidated Income Statement?

A) $200,000

B) $212,000

C) $248,000

D)$260,000

A) $200,000

B) $212,000

C) $248,000

D)$260,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

8

The primary beneficiary of a variable interest enterprise:

A) must include the assets, liabilities, and results of the variable interest enterprise in its consolidated financial statements.

B) can simply record income on a cash basis when dividends are received or income accrued.

C) only recognizes a gain or loss on the sale of its interest in the variable interest enterprise.

D)only includes the results of the variable interest enterprise if it has in excess of 50% of the voting share capital of the variable interest enterprise.

A) must include the assets, liabilities, and results of the variable interest enterprise in its consolidated financial statements.

B) can simply record income on a cash basis when dividends are received or income accrued.

C) only recognizes a gain or loss on the sale of its interest in the variable interest enterprise.

D)only includes the results of the variable interest enterprise if it has in excess of 50% of the voting share capital of the variable interest enterprise.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

9

According to GAAP, what is the key feature of a joint arrangement?

A) One venturer has a controlling interest in the joint arrangement.

B) More than one venturer has a controlling interest in the joint arrangement.

C) Joint control, namely, no one venturer can unilaterally control the venture regardless of the size of the equity contribution.

D)The two largest equity contributors will have joint control over the venture.

A) One venturer has a controlling interest in the joint arrangement.

B) More than one venturer has a controlling interest in the joint arrangement.

C) Joint control, namely, no one venturer can unilaterally control the venture regardless of the size of the equity contribution.

D)The two largest equity contributors will have joint control over the venture.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

10

What is the total amount of cost of sales that would appear on the Consolidated Income Statement?

A) $396,000

B) $399,000

C) $420,000

D)$500,000

A) $396,000

B) $399,000

C) $420,000

D)$500,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

11

What is the amount of non-controlling interest that would appear on Seek's December 31, 2016 Consolidated Balance Sheet?

A) Nil

B) $136,000

C) $144,000

D)$180,000.

A) Nil

B) $136,000

C) $144,000

D)$180,000.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

12

Company A and B agree to engage in a joint venture. Which of the following statements pertaining to joint ventures is correct?

A) Both parties to a joint venture must contribute an equal amount of resources to the venture.

B) The party contributing the most resources to the venture has control over the venture.

C) Both parties have joint control over the venture.

D)All joint ventures have a stated economic useful life.

A) Both parties to a joint venture must contribute an equal amount of resources to the venture.

B) The party contributing the most resources to the venture has control over the venture.

C) Both parties have joint control over the venture.

D)All joint ventures have a stated economic useful life.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

13

What is the amount of miscellaneous liabilities that would appear on Seek's December 31, 2016 Consolidated Balance Sheet?

A) $166,000

B) $176,000

C) $230,000

D)$240,000

A) $166,000

B) $176,000

C) $230,000

D)$240,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

14

What is the total amount of sales that would appear on the Consolidated Income Statement?

A) $816,000

B) $880,000

C) $920,000

D)$1,000,000

A) $816,000

B) $880,000

C) $920,000

D)$1,000,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following requirements is in line with the requirements set out in IAS 28 Investments in Associates and Joint Ventures for the treatment of unrealized gains and losses on non-monetary assets contributed to jointly controlled operations?

A) The amounts are included in deferred gains or losses.

B) The gain or loss must be eliminated against the underlying assets as a contra account.

C) No gain or loss can be recognized until the asset is put into use and the asset is generating revenues.

D)The gain or loss should be recorded immediately as other comprehensive income and transferred to operating income as the non-monetary asset is put into service.

A) The amounts are included in deferred gains or losses.

B) The gain or loss must be eliminated against the underlying assets as a contra account.

C) No gain or loss can be recognized until the asset is put into use and the asset is generating revenues.

D)The gain or loss should be recorded immediately as other comprehensive income and transferred to operating income as the non-monetary asset is put into service.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

16

What is the total amount of inventory that would appear on Seek's Consolidated Balance Sheet as at December 31, 2016?

A) $129,000

B) $132,000

C) $312,000

D)$360,000

A) $129,000

B) $132,000

C) $312,000

D)$360,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

17

At what amount would John record its initial investment in Jinxtor?

A) $240,000

B) $500,000

C) $740,000

D)$800,000

A) $240,000

B) $500,000

C) $740,000

D)$800,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

18

What is the amount of Consolidated Net Income for 2016?

A) $206,200

B) $208,000

C) $216,000

D)$218,000

A) $206,200

B) $208,000

C) $216,000

D)$218,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

19

How are intercompany transactions handled in a joint venture?

A) They are ignored.

B) They are completely eliminated.

C) Only the venturer's share of any after tax profit is eliminated.

D)Intercompany profits are treated as an adjustment to the acquisition differential.

A) They are ignored.

B) They are completely eliminated.

C) Only the venturer's share of any after tax profit is eliminated.

D)Intercompany profits are treated as an adjustment to the acquisition differential.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

20

What is the total amount of intercompany pre-tax profits in ending inventory?

A) $3,000

B) $15,000

C) $20,000

D)$30,000

A) $3,000

B) $15,000

C) $20,000

D)$30,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is NOT used as a quantitative threshold to determine that an operating segment is reportable under IFRS 8 Operating Segments?

A) 10% of the combined revenues of all operating segments.

B) 10% of the combined assets of all operating segments.

C) 10% of all expenses are traced to the segment.

D)10% or more of the absolute amount of the combined reported profit of all operating segments that did not report a loss AND 10% or more of the absolute amount of the combined reported loss of all operating segments that did report a loss.

A) 10% of the combined revenues of all operating segments.

B) 10% of the combined assets of all operating segments.

C) 10% of all expenses are traced to the segment.

D)10% or more of the absolute amount of the combined reported profit of all operating segments that did not report a loss AND 10% or more of the absolute amount of the combined reported loss of all operating segments that did report a loss.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

22

The implied value of a variable interest entity (VIE) at acquisition under Canadian GAAP is equal to:

A) the fair value of the variable interest entity.

B) the fair value of the non-controlling interest of the variable interest entity.

C) the book value of the variable interest entity.

D)the fair value of the consideration paid by the primary beneficiary plus the fair value of the non-controlling interest of the variable interest entity.

A) the fair value of the variable interest entity.

B) the fair value of the non-controlling interest of the variable interest entity.

C) the book value of the variable interest entity.

D)the fair value of the consideration paid by the primary beneficiary plus the fair value of the non-controlling interest of the variable interest entity.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

23

Assume that the facts provided above with respect to the Jinxtor joint venture remain unchanged except that John receives $200,000 in return for investing its plant and equipment. What would be the recognizable gain on January 1, 2016 arising from John's investment in Jinxtor?

A) $75,000

B) $157,500

C) $232,500

D)$300,000

A) $75,000

B) $157,500

C) $232,500

D)$300,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

24

What is John's portion of any unrealized gain or loss arising from the transfer of John's assets to Jinxtor on January 1, 2016?

A) Nil

B) $90,000

C) $210,000

D)$300,000

A) Nil

B) $90,000

C) $210,000

D)$300,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

25

Using only the Assets test, which of the following segment(s) would be reportable?

A) A

B) A, B and C

C) A, B, C and D

D)B, C and D

A) A

B) A, B and C

C) A, B, C and D

D)B, C and D

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

26

What is the amount of the Deferred Tax Asset or Liability on December 31, 2017?

A) a Deferred Tax Liability of $1,350

B) a Deferred Tax Liability of $375

C) a Deferred Tax Asset of $1,350

D)a Deferred Tax Asset of $1,675

A) a Deferred Tax Liability of $1,350

B) a Deferred Tax Liability of $375

C) a Deferred Tax Asset of $1,350

D)a Deferred Tax Asset of $1,675

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

27

On December 31, 2017, XYZ Inc. has an account payable of $2,000 for operating expenses incurred during the year. These expenses are only tax deductible when paid. XYZ normally pays for its operating expenses one month after they are incurred. Assuming a 20% tax rate, these expenses shall result in:

A) a deferred tax liability of $2,000.

B) a deferred tax liability of $400.

C) a deferred tax asset of $400.

D)a deferred tax asset of $2,000.

A) a deferred tax liability of $2,000.

B) a deferred tax liability of $400.

C) a deferred tax asset of $400.

D)a deferred tax asset of $2,000.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

28

Using only the Revenue test, which of the following segment(s) would be reportable?

A) A

B) A, B, and D

C) B, C, and D

D)C and D

A) A

B) A, B, and D

C) B, C, and D

D)C and D

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

29

Assume that the facts provided above with respect to the Jinxtor Joint Venture remain unchanged except that John receives $200,000 in return for investing its plant and equipment. What would be the realized portion of the gain for the year ended on December 31, 2016 arising from John's investment in Jinxtor?

A) Nil

B) $13,500

C) $28,500

D)$60,000

A) Nil

B) $13,500

C) $28,500

D)$60,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

30

Using ALL of the applicable tests, which of the following segment(s) would be reportable?

A) A

B) A, B and C

C) A, B, C and D

D)B, C and D

A) A

B) A, B and C

C) A, B, C and D

D)B, C and D

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

31

On December 31, 2017, XYZ Inc. has an account receivable of $2,000 for consulting fees it earned during the year. Consulting revenues are only taxable when collected. XYZ normally receives payment for the services rendered one month after the client is invoiced. Assuming a 20% tax rate, these revenues shall result in:

A) a deferred tax liability of $2,000.

B) a deferred tax liability of $400.

C) a deferred tax asset of $400.

D)a deferred tax asset of $2,000.

A) a deferred tax liability of $2,000.

B) a deferred tax liability of $400.

C) a deferred tax asset of $400.

D)a deferred tax asset of $2,000.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following is not a requirement for a business component to be considered an Operating Segment under current Canadian GAAP?

A) Discrete financial information must be available.

B) Operating results are regularly reviewed by the enterprise's Chief Operating Decision Maker to make decisions about resources to be allocated to the segment and assess its performance.

C) The reportable income or loss must be at least 10% of the combined profit or loss for the combined entity.

D)It engages in business activities from which it may earn revenues and incur expenses.

A) Discrete financial information must be available.

B) Operating results are regularly reviewed by the enterprise's Chief Operating Decision Maker to make decisions about resources to be allocated to the segment and assess its performance.

C) The reportable income or loss must be at least 10% of the combined profit or loss for the combined entity.

D)It engages in business activities from which it may earn revenues and incur expenses.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

33

What is the amount of the temporary difference between straight line depreciation and capital cost allowance on December 31, 2016?

A) Nil

B) $1,500

C) $2,000

D)$3,000

A) Nil

B) $1,500

C) $2,000

D)$3,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

34

Using only the Profit test, which of the following segment(s) would be reportable?

A) A

B) B

C) C

D)C and D

A) A

B) B

C) C

D)C and D

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

35

Assume that the facts provided above with respect to the Jinxtor joint venture remain unchanged except that John receives $200,000 in return for investing its plant and equipment. What would be the amount of the unrealized gain?

A) Nil

B) $67,500

C) $142,500

D)$225,000

A) Nil

B) $67,500

C) $142,500

D)$225,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

36

What is the amount of the amortization of the unrealized gain for 2016 arising from the transfer of John's assets?

A) Nil

B) $18,000

C) $42,000

D)$60,000

A) Nil

B) $18,000

C) $42,000

D)$60,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

37

What is the tax basis of these assets on January 1, 2016?

A) $24,000

B) $25,200

C) $22,800

D)$30,000

A) $24,000

B) $25,200

C) $22,800

D)$30,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

38

What is the amount of the Deferred Tax Asset or Liability on December 31, 2016?

A) a Deferred Tax Liability of $1,500

B) a Deferred Tax Liability of $375

C) a Deferred Tax Asset of $375

D)a Deferred Tax Asset of $1,500

A) a Deferred Tax Liability of $1,500

B) a Deferred Tax Liability of $375

C) a Deferred Tax Asset of $375

D)a Deferred Tax Asset of $1,500

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

39

What is Victor's portion of any unrealized gain or loss arising from the transfer of John's assets to Jinxtor on January 1, 2016?

A) Nil

B) $90,000

C) $210,000

D)$300,000

A) Nil

B) $90,000

C) $210,000

D)$300,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

40

What is the amount of the temporary difference between straight line depreciation and capital cost allowance on December 31, 2017?

A) $1,500

B) $1,800

C) $3,600

D)$5,400

A) $1,500

B) $1,800

C) $3,600

D)$5,400

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

41

Compute Alcor's Consolidated Retained Earnings as at December 31, 2016.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following concerning the distinction between joint operations and joint ventures is correct?

A) In a joint operation, the investor has rights to the net assets of the arrangement; in a joint venture, the investor has rights and obligations related to the specific assets and liabilities of the arrangement.

B) In a joint venture, the investor has rights to the net assets of the arrangement; in a joint operation, the investor has rights and obligations related to the specific assets and liabilities of the arrangement.

C) A joint operation is always an unincorporated business; a joint venture is always an incorporated business.

D)In a joint operation, all investors must share control; in a joint venture, investors holding a majority of voting rights may share control.

A) In a joint operation, the investor has rights to the net assets of the arrangement; in a joint venture, the investor has rights and obligations related to the specific assets and liabilities of the arrangement.

B) In a joint venture, the investor has rights to the net assets of the arrangement; in a joint operation, the investor has rights and obligations related to the specific assets and liabilities of the arrangement.

C) A joint operation is always an unincorporated business; a joint venture is always an incorporated business.

D)In a joint operation, all investors must share control; in a joint venture, investors holding a majority of voting rights may share control.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

43

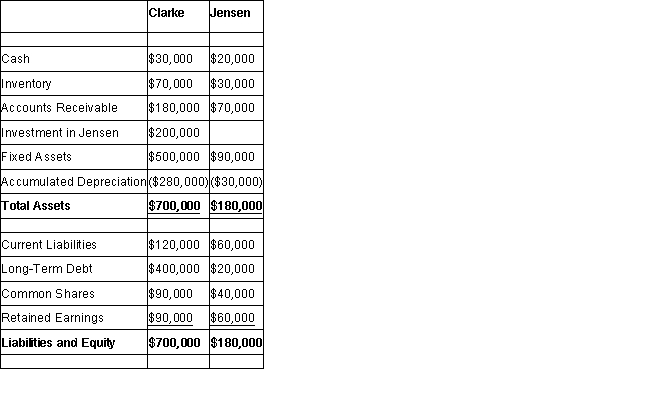

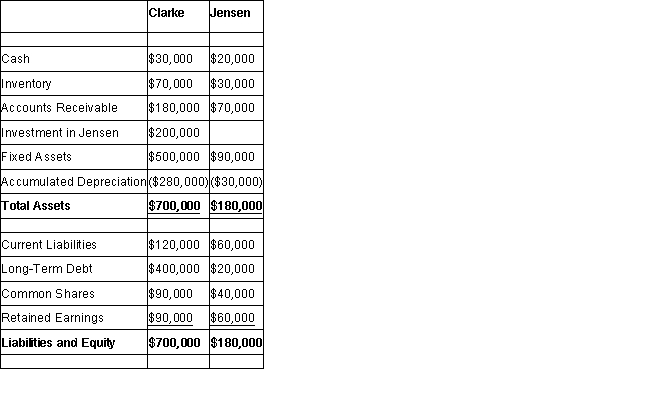

The following balance sheets have been prepared on December 31, 2016 for Clarke Corp. and Jensen Inc.

Balance Sheets

Additional Information:

Clarke uses the cost method to account for its 50% interest in Jensen, which it acquired on January 1, 2013. On that date, Jensen's retained earnings were $20,000. The acquisition differential was fully amortized by the end of 2016.

Clarke sold Land to Jensen during 2015 and recorded a $15,000 gain on the sale. Clarke is still using this Land. Clarke's December 31, 2016 inventory contained a profit of $10,000 recorded by Jensen.

Jensen borrowed $20,000 from Clarke during 2016 interest-free. Jensen has not yet repaid any of its debt to Clarke.

Both companies are subject to a tax rate of 20%.

Prepare a Balance Sheet for Clarke on December 31, 2016 assuming that Clarke's Investment in Jensen is a joint venture investment and is reported using the equity method.

Balance Sheets

Additional Information:

Clarke uses the cost method to account for its 50% interest in Jensen, which it acquired on January 1, 2013. On that date, Jensen's retained earnings were $20,000. The acquisition differential was fully amortized by the end of 2016.

Clarke sold Land to Jensen during 2015 and recorded a $15,000 gain on the sale. Clarke is still using this Land. Clarke's December 31, 2016 inventory contained a profit of $10,000 recorded by Jensen.

Jensen borrowed $20,000 from Clarke during 2016 interest-free. Jensen has not yet repaid any of its debt to Clarke.

Both companies are subject to a tax rate of 20%.

Prepare a Balance Sheet for Clarke on December 31, 2016 assuming that Clarke's Investment in Jensen is a joint venture investment and is reported using the equity method.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

44

The following balance sheets have been prepared on December 31, 2016 for Clarke Corp. and Jensen Inc.

Balance Sheets

Additional Information:

Clarke uses the cost method to account for its 50% interest in Jensen, which it acquired on January 1, 2013. On that date, Jensen's retained earnings were $20,000. The acquisition differential was fully amortized by the end of 2016.

Clarke sold Land to Jensen during 2015 and recorded a $15,000 gain on the sale. Clarke is still using this Land. Clarke's December 31, 2016 inventory contained a profit of $10,000 recorded by Jensen.

Jensen borrowed $20,000 from Clarke during 2016 interest-free. Jensen has not yet repaid any of its debt to Clarke.

Both companies are subject to a tax rate of 20%.

Prepare a Consolidated Balance Sheet for Clarke on December 31, 2016 assuming that Clarke's Investment in Jensen is a joint venture investment and is reported using proportionate consolidation.

Balance Sheets

Additional Information:

Clarke uses the cost method to account for its 50% interest in Jensen, which it acquired on January 1, 2013. On that date, Jensen's retained earnings were $20,000. The acquisition differential was fully amortized by the end of 2016.

Clarke sold Land to Jensen during 2015 and recorded a $15,000 gain on the sale. Clarke is still using this Land. Clarke's December 31, 2016 inventory contained a profit of $10,000 recorded by Jensen.

Jensen borrowed $20,000 from Clarke during 2016 interest-free. Jensen has not yet repaid any of its debt to Clarke.

Both companies are subject to a tax rate of 20%.

Prepare a Consolidated Balance Sheet for Clarke on December 31, 2016 assuming that Clarke's Investment in Jensen is a joint venture investment and is reported using proportionate consolidation.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

45

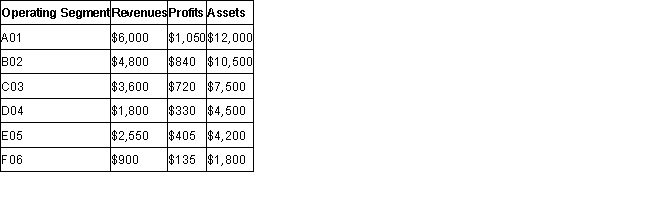

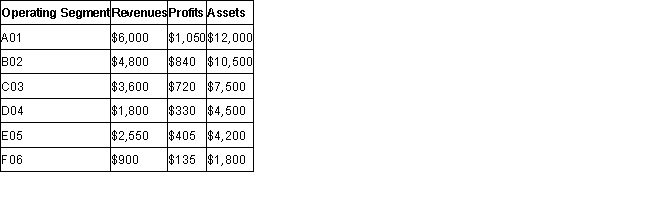

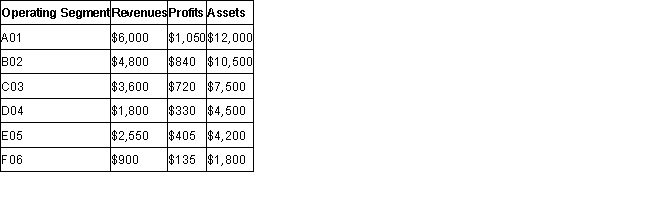

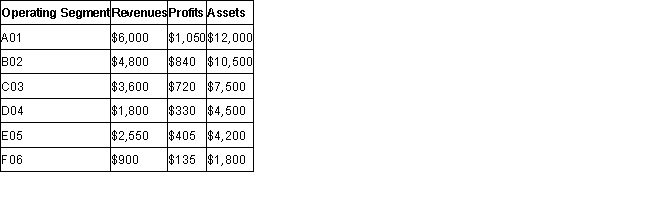

Globecorp International has six operating segments, the details of which are shown below. All figures shown are in thousands of dollars.

Using ONLY the assets test, determine which of the following segments require separate disclosures.

Using ONLY the assets test, determine which of the following segments require separate disclosures.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

46

Under which accounting standards is the reporting of the liabilities of operating segments required?

A) It is required under US GAAP.

B) It is required under ASPE.

C) It is required under IFRS.

D)It is required under IFRS only when this information is reported to the organization's chief operating decision maker.

A) It is required under US GAAP.

B) It is required under ASPE.

C) It is required under IFRS.

D)It is required under IFRS only when this information is reported to the organization's chief operating decision maker.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

47

When sales to a single customer amount to 10% or more of total revenues, disclosure of which of the following is not required under IFRS 8?

A) The fact that sales to a single customer exceed 10% of total revenues.

B) The operating segment reporting the revenues.

C) The name of the customer.

D)The total amount of revenue from each such customer.

A) The fact that sales to a single customer exceed 10% of total revenues.

B) The operating segment reporting the revenues.

C) The name of the customer.

D)The total amount of revenue from each such customer.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

48

Prepare Alcor's Consolidated Balance Sheet as at December 31, 2016.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

49

Globecorp International has six operating segments, the details of which are shown below. All figures shown are in thousands of dollars.

Using ONLY the revenues test, determine which of the operating segments require separate disclosures.

Using ONLY the revenues test, determine which of the operating segments require separate disclosures.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

50

X Ltd. and Y Ltd. formed a joint venture on joint venture called XY Inc. on January 1, 2018. X Ltd. Invested contributed equipment with a book value of $600,000 and a fair value of $2,100,000 for a 50% interest in the joint venture. On December 31, 2018, XY Inc. reported a net income of $612,000. The equipment transferred has an estimated useful life of 20 years. Ignore taxes.

The same facts apply, but in this case assume that X Ltd. Receives a 50% interest plus $390,000 in cash (which was contributed by the other joint venturer). Record the contribution of assets, the share of earnings and the realization of the gain on transfer.

With the cash provided a portion of the equipment is now considered to have been sold.

The same facts apply, but in this case assume that X Ltd. Receives a 50% interest plus $390,000 in cash (which was contributed by the other joint venturer). Record the contribution of assets, the share of earnings and the realization of the gain on transfer.

With the cash provided a portion of the equipment is now considered to have been sold.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

51

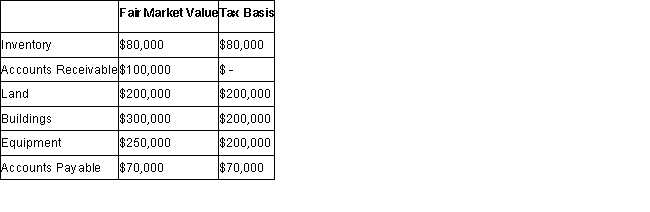

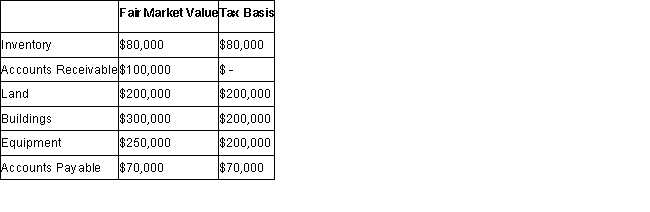

ABC Inc. has acquired all of the voting shares of DEF Inc and is gathering the necessary data to prepare consolidated financial statements. ABC paid $1,200,000 for its investment. Details of the companies' assets and liabilities on the acquisition date are shown below:

Required:

Assuming that DEF hasn't set up Deferred Tax Asset or Liability accounts, determine the amounts that would be used to prepare the Consolidated Balance Sheet on the acquisition date. Assume a tax rate of 50%.

Required:

Assuming that DEF hasn't set up Deferred Tax Asset or Liability accounts, determine the amounts that would be used to prepare the Consolidated Balance Sheet on the acquisition date. Assume a tax rate of 50%.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

52

Compute the consolidated net income for 2016. Do not prepare an Income Statement.

First, we must calculate the realized/unrealized inventory profits.

First, we must calculate the realized/unrealized inventory profits.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

53

The following balance sheets have been prepared on December 31, 2016 for Clarke Corp. and Jensen Inc.

Balance Sheets

Additional Information:

Clarke uses the cost method to account for its 50% interest in Jensen, which it acquired on January 1, 2013. On that date, Jensen's retained earnings were $20,000. The acquisition differential was fully amortized by the end of 2016.

Clarke sold Land to Jensen during 2015 and recorded a $15,000 gain on the sale. Clarke is still using this Land. Clarke's December 31, 2016 inventory contained a profit of $10,000 recorded by Jensen.

Jensen borrowed $20,000 from Clarke during 2016 interest-free. Jensen has not yet repaid any of its debt to Clarke.

Both companies are subject to a tax rate of 20%.

Prepare a Balance Sheet for Clarke on December 31, 2016 in accordance with current Canadian GAAP, assuming that Clarke's investment in Jensen is a significant influence investment and is reported using the equity method.

Balance Sheets

Additional Information:

Clarke uses the cost method to account for its 50% interest in Jensen, which it acquired on January 1, 2013. On that date, Jensen's retained earnings were $20,000. The acquisition differential was fully amortized by the end of 2016.

Clarke sold Land to Jensen during 2015 and recorded a $15,000 gain on the sale. Clarke is still using this Land. Clarke's December 31, 2016 inventory contained a profit of $10,000 recorded by Jensen.

Jensen borrowed $20,000 from Clarke during 2016 interest-free. Jensen has not yet repaid any of its debt to Clarke.

Both companies are subject to a tax rate of 20%.

Prepare a Balance Sheet for Clarke on December 31, 2016 in accordance with current Canadian GAAP, assuming that Clarke's investment in Jensen is a significant influence investment and is reported using the equity method.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

54

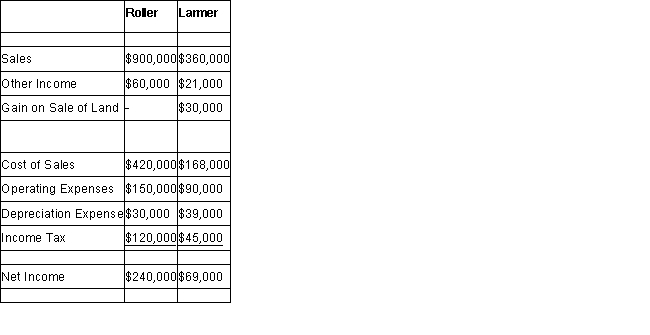

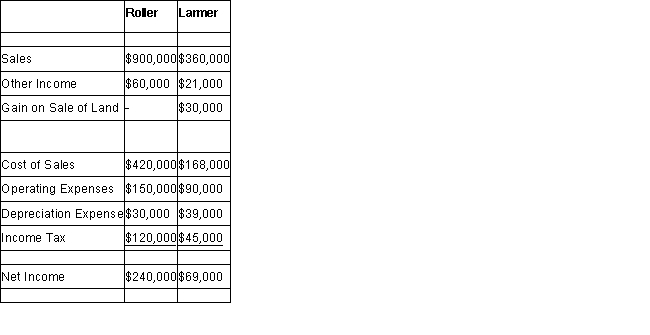

The following are the 2016 Income Statements of Roller Corp and Larmer Corp.

Income Statements

For the Year Ended December 31, 2016

Other Information:

During 2016 Larmer paid dividends of $24,000. Roller acquired its 30% stake in Larmer at a cost of $400,000 and uses the cost method to account for its investment.

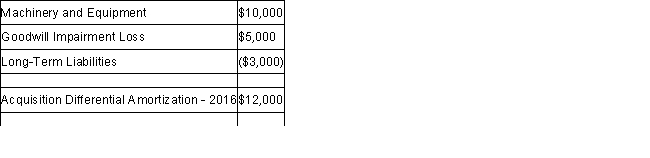

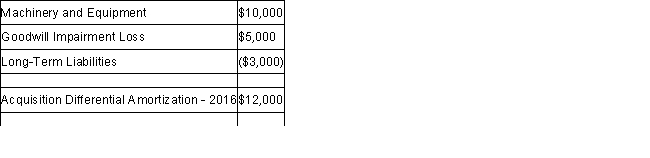

The acquisition differential amortization schedule showed the following write-off for 2016:

During 2016, Larmer paid rent to Roller in the amount of $12,000, which Roller has recorded as other income.

During 2016, Larmer paid rent to Roller in the amount of $12,000, which Roller has recorded as other income.

In 2015, Roller sold Land to Larmer and recorded a profit of $10,000 on the sale. During 2016, Larmer sold the land to a third party.

Both companies are subject to a 40% tax rate.

Required:

Prepare Roller Inc's 2016 income statement, assuming that Larmer is considered to be a joint venture and is reported using the equity method.

Income Statements

For the Year Ended December 31, 2016

Other Information:

During 2016 Larmer paid dividends of $24,000. Roller acquired its 30% stake in Larmer at a cost of $400,000 and uses the cost method to account for its investment.

The acquisition differential amortization schedule showed the following write-off for 2016:

During 2016, Larmer paid rent to Roller in the amount of $12,000, which Roller has recorded as other income.

During 2016, Larmer paid rent to Roller in the amount of $12,000, which Roller has recorded as other income.In 2015, Roller sold Land to Larmer and recorded a profit of $10,000 on the sale. During 2016, Larmer sold the land to a third party.

Both companies are subject to a 40% tax rate.

Required:

Prepare Roller Inc's 2016 income statement, assuming that Larmer is considered to be a joint venture and is reported using the equity method.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

55

Prepare Alcor's Balance Sheet as at December 31, 2016, if Alcor elected to report its investment in Inventure using the equity method.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

56

X Ltd. and Y Ltd. formed a joint venture on joint venture called XY Inc. on January 1, 2018. X Ltd. Invested contributed equipment with a book value of $600,000 and a fair value of $2,100,000 for a 50% interest in the joint venture. On December 31, 2018, XY Inc. reported a net income of $612,000. The equipment transferred has an estimated useful life of 20 years. Ignore taxes.

Calculate the gain on the contribution of equipment and prepare the journal entries to record the events on January 1 and December 31, 2018. Also calculate under the equity method X Ltd.'s share of net income and the amount it will recognize.

Calculate the gain on the contribution of equipment and prepare the journal entries to record the events on January 1 and December 31, 2018. Also calculate under the equity method X Ltd.'s share of net income and the amount it will recognize.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

57

The following balance sheets have been prepared on December 31, 2016 for Clarke Corp. and Jensen Inc.

Balance Sheets

Additional Information:

Clarke uses the cost method to account for its 50% interest in Jensen, which it acquired on January 1, 2013. On that date, Jensen's retained earnings were $20,000. The acquisition differential was fully amortized by the end of 2016.

Clarke sold Land to Jensen during 2015 and recorded a $15,000 gain on the sale. Clarke is still using this Land. Clarke's December 31, 2016 inventory contained a profit of $10,000 recorded by Jensen.

Jensen borrowed $20,000 from Clarke during 2016 interest-free. Jensen has not yet repaid any of its debt to Clarke.

Both companies are subject to a tax rate of 20%.

Prepare a Consolidated Balance Sheet for Clarke on December 31, 2016 assuming that Clarke's investment in Jensen is a control investment.

Balance Sheets

Additional Information:

Clarke uses the cost method to account for its 50% interest in Jensen, which it acquired on January 1, 2013. On that date, Jensen's retained earnings were $20,000. The acquisition differential was fully amortized by the end of 2016.

Clarke sold Land to Jensen during 2015 and recorded a $15,000 gain on the sale. Clarke is still using this Land. Clarke's December 31, 2016 inventory contained a profit of $10,000 recorded by Jensen.

Jensen borrowed $20,000 from Clarke during 2016 interest-free. Jensen has not yet repaid any of its debt to Clarke.

Both companies are subject to a tax rate of 20%.

Prepare a Consolidated Balance Sheet for Clarke on December 31, 2016 assuming that Clarke's investment in Jensen is a control investment.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following statements is correct concerning reporting interests in joint ventures in compliance with the Accounting Standards for Private Enterprises (ASPE)?

A) They must be reported using proportionate consolidation.

B) They must be reported using the equity method.

C) They must be reported using the cost method.

D)They must be reported using the same method used for reporting interests in subsidiaries.

A) They must be reported using proportionate consolidation.

B) They must be reported using the equity method.

C) They must be reported using the cost method.

D)They must be reported using the same method used for reporting interests in subsidiaries.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

59

ABC invested $30 million in cash in DEF Inc, which was determined to be a VIE whose primary beneficiary is ABC Inc. The balance sheet of DEF on the acquisition date January 1, 2016 is shown below (all figures in millions $$): \[\begin{array} { | l | l | l | }

\hline & \text { Book Value } & \text { Fair Value } \\

\hline \text { Cash } & \$ 30 & \$ 30 \\

\hline \text { Capital Assets } & \$ 90 & \$ 100 \\

\hline \text { Total Assets } & \$ 120 & \$ 130 \\

\hline \text { Liabilities } & \$50 & \$ 50 \\

\hline \text { Owner's Equity } & \\

\hline \text { ABC } & \$ 40 & \\

\hline \text { Non-Controlling Interest: } & \$ 30 & \\

\hline \text { Total Liabilities \& Equiy } & \$ 120 & \\

& \\

\hline & & \\

\hline

\end{array}\] The fair value of DEF's non-controlling interest is $55.

Required: Prepare the journal entry required for consolidation purposes on the date of acquisition assuming current Canadian GAAP.

\hline & \text { Book Value } & \text { Fair Value } \\

\hline \text { Cash } & \$ 30 & \$ 30 \\

\hline \text { Capital Assets } & \$ 90 & \$ 100 \\

\hline \text { Total Assets } & \$ 120 & \$ 130 \\

\hline \text { Liabilities } & \$50 & \$ 50 \\

\hline \text { Owner's Equity } & \\

\hline \text { ABC } & \$ 40 & \\

\hline \text { Non-Controlling Interest: } & \$ 30 & \\

\hline \text { Total Liabilities \& Equiy } & \$ 120 & \\

& \\

\hline & & \\

\hline

\end{array}\] The fair value of DEF's non-controlling interest is $55.

Required: Prepare the journal entry required for consolidation purposes on the date of acquisition assuming current Canadian GAAP.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

60

Globecorp International has six operating segments, the details of which are shown below. All figures shown are in thousands of dollars.

Using ONLY the operating profit test, determine which of the operating segments require separate disclosures.

Using ONLY the operating profit test, determine which of the operating segments require separate disclosures.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck