Deck 21: Corporate Earnings and Capital Transactions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

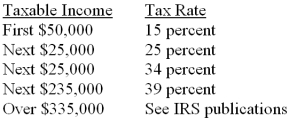

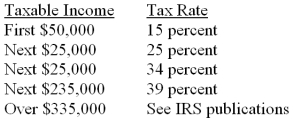

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

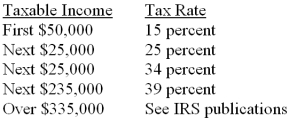

Question

Question

Question

Question

Question

Question

Question

Question

Question

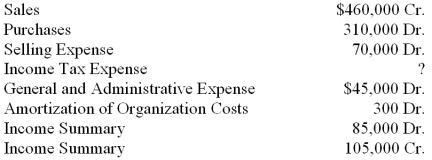

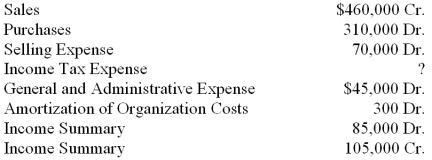

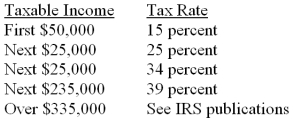

Question

Question

Question

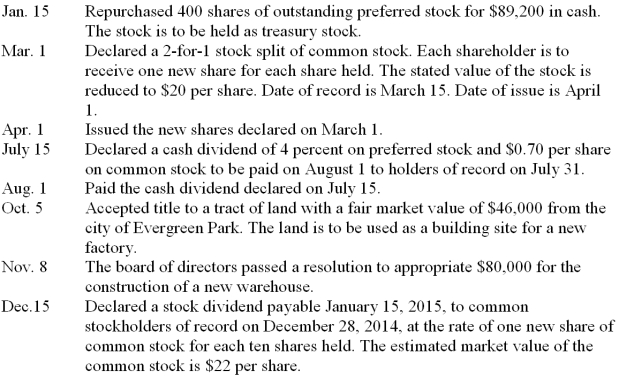

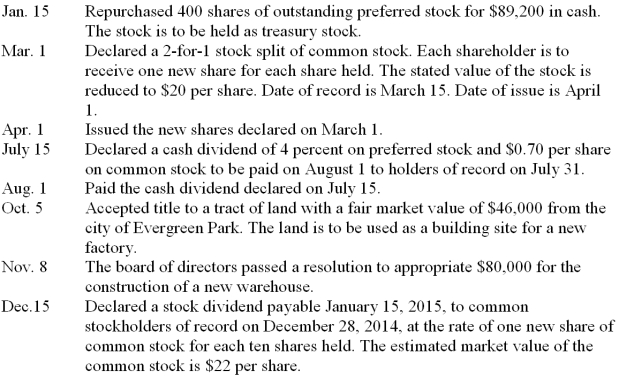

Question

Question

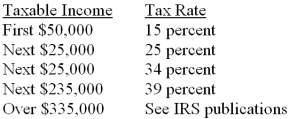

Question

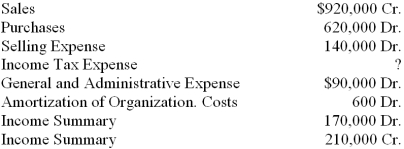

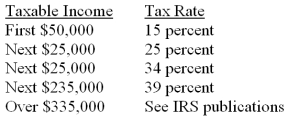

Question

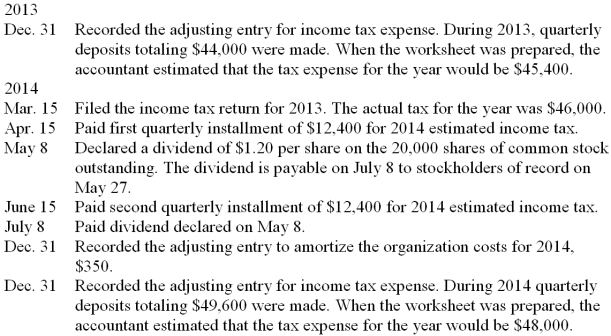

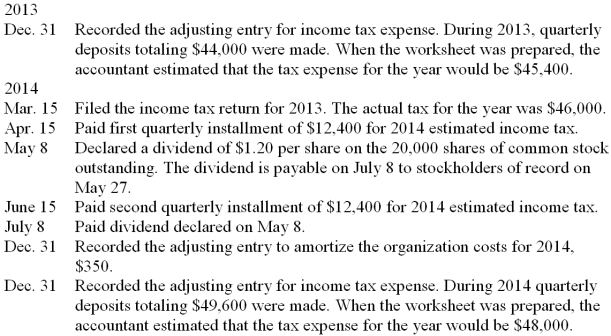

Question

Question

Question

Question

Question

Question

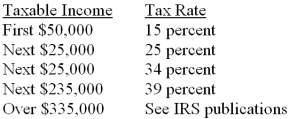

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/85

Play

Full screen (f)

Deck 21: Corporate Earnings and Capital Transactions

1

The Dividends Payable accounts appear on the balance sheet as a current liability.

True

2

The last closing entry for a corporation transfers the net income after income taxes from the Income Summary account to Retained Earnings.

True

3

When a corporation purchases its own stock and intends to reissue that stock at a later date, the cost of the shares is shown in the Assets section of the balance sheet until the stock is reissued.

False

4

To be entitled to receive a cash dividend, an investor must be listed as an owner of the stock on the ____________________ date.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

5

When treasury stock is purchased, the Treasury Stock account is debited for the entire amount paid for the stock.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

6

The Dividends Payable accounts appear on the balance sheet as ____________________ liabilities.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

7

An appropriation of retained earnings reduces the amount of retained earnings available for dividend declarations.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

8

A 3-for-2 stock split will triple the reported dollar amount of stockholders' equity.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

9

Deferred income taxes arise because the taxable income of a corporation can differ from the net income reported on its financial statements.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

10

The effect of an event or transaction that is infrequent in occurrence and highly unusual in nature is shown as a(n) ____________________ item on the income statement.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

11

The entry to record the declaration of a stock split includes a debit to Retained Earnings.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

12

Retained earnings do not represent a cash fund.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

13

A corporation may report net income for federal income tax purposes at an amount different from the amount reported for financial accounting purposes.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

14

Declarations of cash dividends and stock dividends are debited to the Retained Earnings account.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

15

Both cash dividends and stock dividends decrease the total stockholders' equity.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

16

The entry to record the payment of a cash dividend includes a debit to Retained Earnings and a credit to Cash.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

17

When a previously declared stock dividend is distributed, the accountant makes an entry debiting Common Stock Dividend Distributable and crediting ___________________.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

18

Although the balance of the Retained Earnings account is decreased, a(n) ____________________ dividend will not result in a decrease in total stockholders' equity.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

19

Property that is received as a gift should be recorded in the corporation's records at the asset's fair market value.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

20

The entry to record the distribution of a stock dividend includes a credit to Common Stock Dividend Distribution.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following statements is not correct?

A) Retained earnings represents a cash fund.

B) A corporation can have a large cash balance but no retained earnings.

C) A corporation can have a balance in the Retained Earnings account but no cash.

D) Retained earnings represent the undistributed profits and losses of the corporation.

A) Retained earnings represents a cash fund.

B) A corporation can have a large cash balance but no retained earnings.

C) A corporation can have a balance in the Retained Earnings account but no cash.

D) Retained earnings represent the undistributed profits and losses of the corporation.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following statements is not correct?

A) Corporations must estimate and prepay their income taxes through quarterly tax deposits.

B) At the end of the year, when the worksheet is prepared, the Income Tax Expense account is adjusted only if the corporation owes additional taxes.

C) Income Tax Expense may be shown as an operating expense on a corporation's income statement.

D) On a corporate income statement, the tax effects of each extraordinary item is offset against each gain or loss to show the effect 'net of taxes.'

A) Corporations must estimate and prepay their income taxes through quarterly tax deposits.

B) At the end of the year, when the worksheet is prepared, the Income Tax Expense account is adjusted only if the corporation owes additional taxes.

C) Income Tax Expense may be shown as an operating expense on a corporation's income statement.

D) On a corporate income statement, the tax effects of each extraordinary item is offset against each gain or loss to show the effect 'net of taxes.'

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

23

If the corporation's income tax computed at the end of the year is less than the total of quarterly deposits, the necessary adjustment will result in a

A) debit to Income Tax Expense.

B) credit to Income Tax Payable.

C) debit to Income Tax Refund Receivable.

D) credit to Income Tax Refund Receivable.

A) debit to Income Tax Expense.

B) credit to Income Tax Payable.

C) debit to Income Tax Refund Receivable.

D) credit to Income Tax Refund Receivable.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

24

A corporation's own capital stock that has been reacquired is called ____________________ stock.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

25

If a corporation receives a gift of land valued at $10,000 from a city, the accountant will record a debit to Land and a credit to ___________________.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

26

When a corporation reacquires stock that it previously issued and intends to reissue at a later date, the ____________________ account is debited.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

27

The ____________________ value of each share of stock is the total equity applicable to the class of stock divided by the number of shares outstanding.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

28

When the amount of future taxes that will be paid as a result of the MACRS depreciation deduction taken in this and prior years, an adjustment for the future taxes is made with a debit to

A) Tax Expense and a credit to Deferred Income Tax Liability.

B) Deferred Income Tax Liability and a credit to Tax Expense.

C) Tax Expense and a credit to Deferred Income Tax Asset.

D) Deferred Income Tax Asset and a credit to Tax Expense.

A) Tax Expense and a credit to Deferred Income Tax Liability.

B) Deferred Income Tax Liability and a credit to Tax Expense.

C) Tax Expense and a credit to Deferred Income Tax Asset.

D) Deferred Income Tax Asset and a credit to Tax Expense.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

29

On the date of declaration of a stock split, a(n) ____________________ notation is recorded in the general journal.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

30

Accumulated profits kept in the business and not distributed as dividends to stockholders are called ___________________.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

31

The worksheet for a corporation and a sole proprietorship are almost identical. The major difference is the

A) adjustment for accrued revenues.

B) adjustment for accrued expenses.

C) income tax adjustment.

D) adjustment for depreciation.

A) adjustment for accrued revenues.

B) adjustment for accrued expenses.

C) income tax adjustment.

D) adjustment for depreciation.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following statements regarding the income statements of corporations is not correct?

A) Some corporations include cost of goods sold with the operating expenses.

B) Some corporations show income tax expense as an operating expense rather than as a deduction from net income before income tax.

C) If a gain or loss results from a transaction that is highly unusual, is clearly unrelated to routine operations, and is not expected to occur again in the near future, the gain or loss is shown as an operating expense.

D) Corporations can use a variety of formats for the income statement.

A) Some corporations include cost of goods sold with the operating expenses.

B) Some corporations show income tax expense as an operating expense rather than as a deduction from net income before income tax.

C) If a gain or loss results from a transaction that is highly unusual, is clearly unrelated to routine operations, and is not expected to occur again in the near future, the gain or loss is shown as an operating expense.

D) Corporations can use a variety of formats for the income statement.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

33

When the cumulative taxable income is higher than that reported on the financial statements, this gives rise to

A) a deferred income tax liability.

B) a deferred income tax asset.

C) Either of the above

D) Neither of the above.

A) a deferred income tax liability.

B) a deferred income tax asset.

C) Either of the above

D) Neither of the above.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

34

A stock ____________________ increases the number of shares of stock outstanding and decreases the par value, or stated value, per share proportionally.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

35

The record date is the date

A) on which the board of directors declares the dividend.

B) used to determine who will receive the dividend.

C) on which the dividend is paid.

D) on which the dividend transaction is recorded in the general journal.

A) on which the board of directors declares the dividend.

B) used to determine who will receive the dividend.

C) on which the dividend is paid.

D) on which the dividend transaction is recorded in the general journal.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

36

The entry to record the declaration of a cash dividend consists of a debit to

A) Dividend Expense and a credit to Cash.

B) Retained Earnings and a credit to Common Stock Dividend Distributable.

C) Dividends Payable and a credit to Retained Earnings.

D) Retained Earnings and a credit to Dividends Payable.

A) Dividend Expense and a credit to Cash.

B) Retained Earnings and a credit to Common Stock Dividend Distributable.

C) Dividends Payable and a credit to Retained Earnings.

D) Retained Earnings and a credit to Dividends Payable.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

37

The Retained Earnings Appropriated-Treasury Stock account is shown in the ____________________ section of the balance sheet.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

38

A liability for the payment of cash dividends is recorded

A) on the date the board of directors publicly declares its intention to pay the dividends.

B) only when cumulative preferred dividends are passed over (not paid) and are in arrears.

C) at the end of any year during which common stock dividends were not paid.

D) at the end of every year that the corporation makes a profit.

A) on the date the board of directors publicly declares its intention to pay the dividends.

B) only when cumulative preferred dividends are passed over (not paid) and are in arrears.

C) at the end of any year during which common stock dividends were not paid.

D) at the end of every year that the corporation makes a profit.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

39

The cost of treasury stock is deducted from the sum of all items in the ____________________ section of the balance sheet.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

40

The effect of issuing a stock dividend is to convert a portion of the corporation's ____________________ to permanent capital.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

41

The Treasury Stock account is shown on the balance sheet as

A) an asset.

B) an addition to the Common Stock and Preferred Stock accounts in the Stockholders' Equity section.

C) a deduction from the Retained Earnings in the Stockholders' Equity section.

D) a deduction from the sum of all other items in the Stockholders' Equity section.

A) an asset.

B) an addition to the Common Stock and Preferred Stock accounts in the Stockholders' Equity section.

C) a deduction from the Retained Earnings in the Stockholders' Equity section.

D) a deduction from the sum of all other items in the Stockholders' Equity section.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

42

A declaration and distribution of a 20 percent stock dividend on common stock will

A) not change the total stockholders' equity.

B) increase the assets of the corporation.

C) result in an increase in the book value of each share of common stock outstanding.

D) increase the liabilities of the corporation.

A) not change the total stockholders' equity.

B) increase the assets of the corporation.

C) result in an increase in the book value of each share of common stock outstanding.

D) increase the liabilities of the corporation.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

43

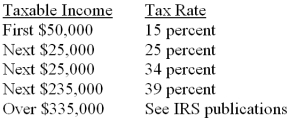

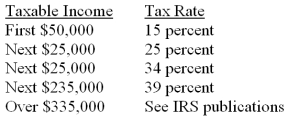

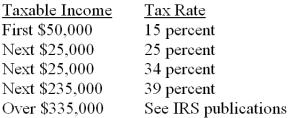

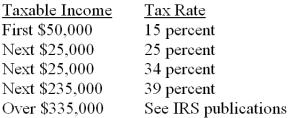

After all revenue and expense accounts, other than Income Tax Expense, have been extended to the Income Statement section of the worksheet of Carlton Corporation, the net income is determined to be $75,000. Using the following corporate income tax rates, compute the corporation's federal income taxes payable. (Assume that the firm's taxable income is the same as its income for financial accounting purposes.)

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

44

After all revenue and expense accounts, other than Income Tax Expense, have been extended to the Income Statement section of the worksheet of Tyler Corporation, the net income is determined to be $50,000. Using the following corporate income tax rates, compute the corporation's federal income taxes payable. (Assume that the firm's taxable income is the same as its income for financial accounting purposes.)

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following statements is not correct?

A) Book value for each share of stock is the total equity applicable to the class of stock dividend by the number of shares issued.

B) The total book value of a class of stock is increased after a stock dividend.

C) The total book value of a class of stock is decreased after a stock dividend.

D) All of the above statements are correct. In theory, a stock dividend should result in a proportionate reduction in each share's market value.

A) Book value for each share of stock is the total equity applicable to the class of stock dividend by the number of shares issued.

B) The total book value of a class of stock is increased after a stock dividend.

C) The total book value of a class of stock is decreased after a stock dividend.

D) All of the above statements are correct. In theory, a stock dividend should result in a proportionate reduction in each share's market value.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

46

A corporation reported a net income of $120,000 for its fiscal year and declared and paid cash dividends of $60,000. A stock dividend recorded at $40,000 was also distributed during the year. If the ending balance of the Retained Earnings account was $200,000, the beginning balance is

A) $160,000.

B) $180,000.

C) $200,000.

D) $220,000.

A) $160,000.

B) $180,000.

C) $200,000.

D) $220,000.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

47

The income statement of a corporation and a sole proprietorship are similar with the exception of

A) retained earnings.

B) revenues reported.

C) income taxes.

D) total expenses of the corporation.

A) retained earnings.

B) revenues reported.

C) income taxes.

D) total expenses of the corporation.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

48

An appropriation of retained earnings represents

A) cash set aside for some designated purpose.

B) a portion of retained earnings that is currently unavailable for dividends.

C) a current liability of the corporation.

D) a current asset of the corporation.

A) cash set aside for some designated purpose.

B) a portion of retained earnings that is currently unavailable for dividends.

C) a current liability of the corporation.

D) a current asset of the corporation.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

49

A corporation reported a net income of $120,000 for its fiscal year and declared and paid cash dividends of $50,000. A stock dividend recorded at $80,000 was also distributed during the year. If the beginning balance of the Retained Earnings account was $200,000, the ending balance is

A) $170,000.

B) $190,000.

C) $200,000.

D) $270,000.

A) $170,000.

B) $190,000.

C) $200,000.

D) $270,000.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

50

A corporation reacquired 400 shares of its $100 par-value common stock for $105 a share. The entry to record this transaction includes a

A) Debit to Treasury Stock-Common for $40,000.

B) Debit to Treasury Stock-Common for $42,000.

C) Credit to Paid-in Capital for Treasury Stock Transactions-Common for $40,000.

D) Credit to Treasury Stock-Common for $42,000.

A) Debit to Treasury Stock-Common for $40,000.

B) Debit to Treasury Stock-Common for $42,000.

C) Credit to Paid-in Capital for Treasury Stock Transactions-Common for $40,000.

D) Credit to Treasury Stock-Common for $42,000.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following would not change the amount of total retained earnings for the year?

A) The dividends on common stock

B) The net income after taxes for the year

C) An appropriation for building expansion

D) The transfer of retained earnings appropriated for treasury stock

A) The dividends on common stock

B) The net income after taxes for the year

C) An appropriation for building expansion

D) The transfer of retained earnings appropriated for treasury stock

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

52

The total of the owners' claims to the assets of a corporation is represented by the

A) balance of the Common Stock account.

B) total retained earnings.

C) total stockholders' equity.

D) total assets of the corporation.

A) balance of the Common Stock account.

B) total retained earnings.

C) total stockholders' equity.

D) total assets of the corporation.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following statements is correct?

A) The Common Stock Dividends Distributable account is shown as a current liability on the balance sheet.

B) When a stock dividend is distributed, no assets leave or enter the corporation.

C) When a stock dividend is declared, the total amount debited to Retained Earnings is the par value, or stated value, of the shares to be issued.

D) When a stock dividend is declared, the total amount of the dividend is debited to the Common Stock account.

A) The Common Stock Dividends Distributable account is shown as a current liability on the balance sheet.

B) When a stock dividend is distributed, no assets leave or enter the corporation.

C) When a stock dividend is declared, the total amount debited to Retained Earnings is the par value, or stated value, of the shares to be issued.

D) When a stock dividend is declared, the total amount of the dividend is debited to the Common Stock account.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

54

Total stockholders' equity would be decreased by

A) a stock split.

B) an appropriation of retained earnings.

C) a cash dividend.

D) a stock dividend.

A) a stock split.

B) an appropriation of retained earnings.

C) a cash dividend.

D) a stock dividend.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

55

A corporation reported a net income of $90,000 for its fiscal year and declared and paid cash dividends of $60,000. A stock dividend recorded at $30,000 was also distributed during the year. If the beginning balance of the Retained Earnings account was $140,000, the ending balance is

A) $230,000.

B) $170,000.

C) $140,000.

D) $130,000.

A) $230,000.

B) $170,000.

C) $140,000.

D) $130,000.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

56

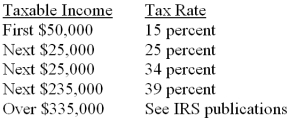

After all revenue and expense accounts, other than Income Tax Expense, have been extended to the Income Statement section of the worksheet of Genexo Corporation, the net income is determined to be $200,000. Using the following corporate income tax rates, compute the corporation's federal income taxes payable. (Assume that the firm's taxable income is the same as its income for financial accounting purposes.)

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

57

When a corporation reacquires its own shares of stock, the Treasury Stock account is usually debited for

A) par value of the shares reacquired.

B) the price paid to reacquire the shares.

C) the original issue price of the shares.

D) the current market value of the shares.

A) par value of the shares reacquired.

B) the price paid to reacquire the shares.

C) the original issue price of the shares.

D) the current market value of the shares.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

58

Treasury stock is

A) stock previously paid for in full by a stockholder, then repurchased by the issuing corporation.

B) donated by stockholders.

C) always preferred stock.

D) categorized under Paid-in Capital on the balance sheet and added to preferred and common stock.

A) stock previously paid for in full by a stockholder, then repurchased by the issuing corporation.

B) donated by stockholders.

C) always preferred stock.

D) categorized under Paid-in Capital on the balance sheet and added to preferred and common stock.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following statements is not correct?

A) The entry to record the appropriation of retained earnings for warehouse construction includes a debit to Retained Earnings.

B) Appropriated retained earnings are listed separately on the balance sheet.

C) When retained earnings are appropriated, cash is set aside for a specific purpose.

D) Dividends cannot be declared from appropriated retained earnings.

A) The entry to record the appropriation of retained earnings for warehouse construction includes a debit to Retained Earnings.

B) Appropriated retained earnings are listed separately on the balance sheet.

C) When retained earnings are appropriated, cash is set aside for a specific purpose.

D) Dividends cannot be declared from appropriated retained earnings.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following would be found on a corporation's income statement?

A) Retained Earnings

B) Income Tax Expense

C) Organization Costs

D) Dividends Payable

A) Retained Earnings

B) Income Tax Expense

C) Organization Costs

D) Dividends Payable

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

61

A corporation has paid estimated income taxes of $52,100 during the year 2013. At the end of the year, the corporation's tax bill is computed to be $57,500. Record the entry to adjust the Income Tax Expense account on page 6 of a general journal. Omit the description.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

62

A corporation reported a net income of $200,000 for its fiscal year and declared and paid cash dividends of $80,000. A stock dividend recorded at $40,000 was also distributed during the year. If the beginning balance of the Retained Earnings account was $60,000, calculate the ending balance in the Retained Earnings account.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

63

On August 10, 2013 a corporation received a donation of land for a future plant site. The land has a fair market value of $800,000. Record the entry to reflect the receipt of this asset as a gift on page 3 of a general journal. Omit the description.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

64

In each of the following situations, what is the amount of profit or loss? In each situation, what account will be debited and credited, and for what amount, in the journal entry to close the Income Summary account?

1. The total of the debit column in the Income Statement section of the worksheet was $94,000 and the total of the credit column in that section was $104,000.

2. The total in the debit column of the Income Statement section was $200,000 and the total of the credit column was $100,000.

3. The total of the debit column in the Balance Sheet section was $53,000 and the total of the credit column in that section was $55,000.

1. The total of the debit column in the Income Statement section of the worksheet was $94,000 and the total of the credit column in that section was $104,000.

2. The total in the debit column of the Income Statement section was $200,000 and the total of the credit column was $100,000.

3. The total of the debit column in the Balance Sheet section was $53,000 and the total of the credit column in that section was $55,000.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

65

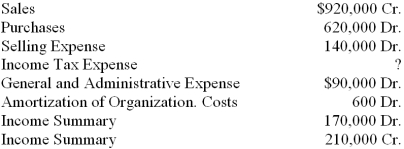

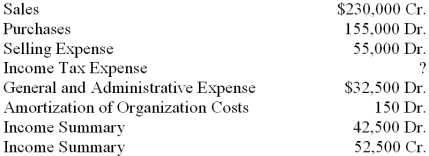

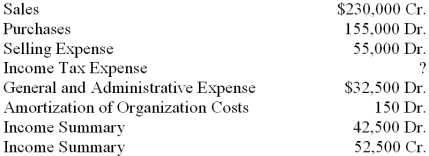

Information from the Income Statement columns of King Corporation's worksheet on December 31, 2013, is shown below.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

66

A corporation reported a net income of $200,000 for its fiscal year and declared and paid cash dividends of $90,000. A stock dividend recorded at $50,000 was also distributed during the year. If the ending balance of the Retained Earnings account was $300,000, calculate the beginning balance in the Retained Earnings account.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

67

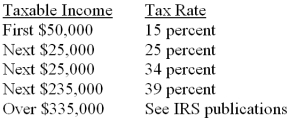

After all revenue and expense accounts, other than Income Tax Expense, have been extended to the Income Statement section of the worksheet of Folk Enterprises, Inc., the net income is determined to be $300,000. Using the following corporate income tax rates, compute the corporation's federal income taxes payable. (Assume that the firm's taxable income is the same as its income for financial accounting purposes.)

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

68

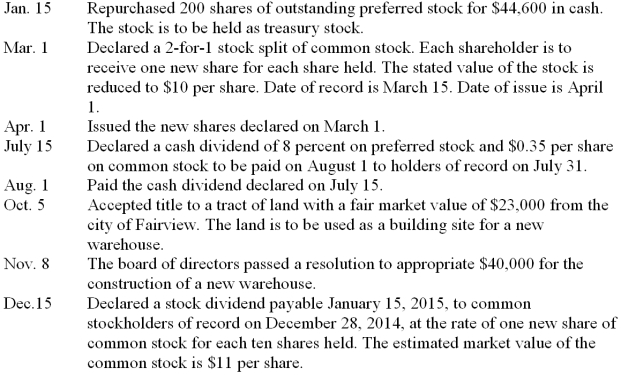

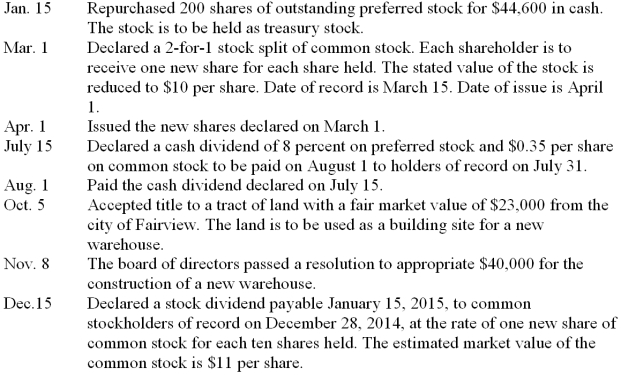

The Santa Fe Corporation is authorized to issue 6,000 shares of 4 percent, $100 par-value preferred stock and 20,000 shares of no-par-value common stock with a stated value of $40 per share. On December 31, 2013, 2,000 shares of preferred stock and 8,000 shares of common stock are issued and outstanding. The corporation's transactions affecting stockholders' equity during 2014 are given below. Record the transactions on page 15 of a general journal. Omit descriptions.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

69

A corporation has paid estimated income taxes of $57,500 during the year 2013. At the end of the year, the corporation's tax bill is computed to be $52,100. Record the entry to adjust the Income Tax Expense account on page 6 of a general journal. Omit the description.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

70

Information from the Income Statement columns of Leland Corporation's worksheet on December 31, 2013, is shown below.  1. What is the amount of net income before income tax?

1. What is the amount of net income before income tax?

2. What is the amount of income tax on the net income? Use the tax rates set forth below.

3. What adjustment is recorded for Income Tax Expense? The corporation paid $8,400 through quarterly deposits.

4. What is the amount of net income after income tax?

1. What is the amount of net income before income tax?

1. What is the amount of net income before income tax?2. What is the amount of income tax on the net income? Use the tax rates set forth below.

3. What adjustment is recorded for Income Tax Expense? The corporation paid $8,400 through quarterly deposits.

4. What is the amount of net income after income tax?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

71

Information from the Income Statement columns of Lincoln Corporation's worksheet on December 31, 2013, is shown below.  1. What is the amount of net income before income tax?

1. What is the amount of net income before income tax?

2. What is the amount of income tax on the net income? Use the tax rates set forth below.

3. What adjustment is recorded for Income Tax Expense? The corporation paid $21,000 through quarterly deposits.

4. What is the amount of net income after income tax?

1. What is the amount of net income before income tax?

1. What is the amount of net income before income tax?2. What is the amount of income tax on the net income? Use the tax rates set forth below.

3. What adjustment is recorded for Income Tax Expense? The corporation paid $21,000 through quarterly deposits.

4. What is the amount of net income after income tax?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

72

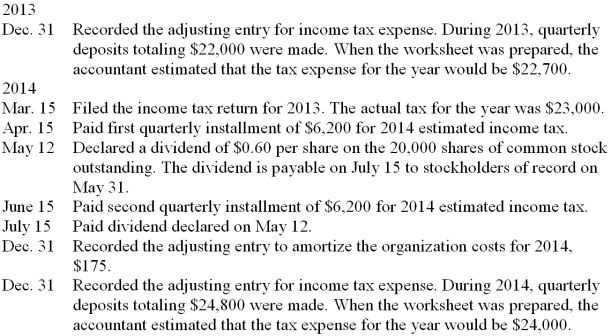

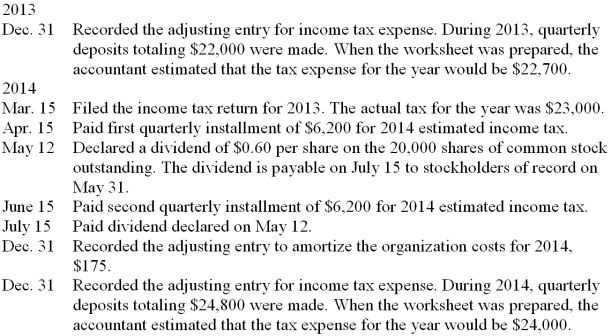

Selected transactions of the Hayward Corporation during 2013 and 2014 are given below. Record the transactions on page 6 of a general journal. Omit descriptions.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

73

A corporation has paid estimated income taxes of $80,000 during the year 2013. At the end of the year, the corporation's tax bill is computed to be $100,000. Record the entry to adjust the Income Tax Expense account on page 6 of a general journal. Omit the description.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

74

A corporation has paid estimated income taxes of $89,800 during the year 2013. At the end of the year, the corporation's tax bill is computed to be $83,000. Record the entry to adjust the Income Tax Expense account on page 6 of a general journal. Omit the description.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

75

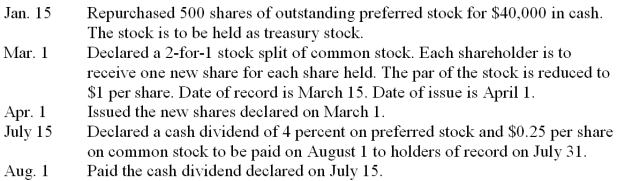

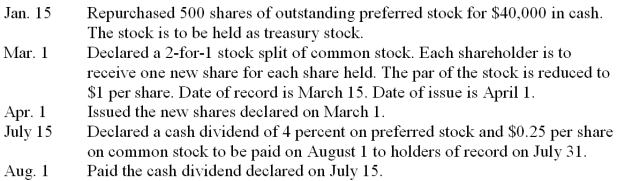

The Dever Corporation is authorized to issue 3,000 shares of 8 percent, $50 par-value preferred stock and 10,000 shares of no-par-value common stock with a stated value of $20 per share. On December 31, 2013, 1,000 shares of preferred stock and 4,000 shares of common stock are issued and outstanding. The corporation's transactions affecting stockholders' equity during 2014 are given below. Record the transactions on page 8 of a general journal. Omit descriptions.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

76

The Intrepid Corporation is authorized to issue 10,000 shares of 6 percent, $100 par-value preferred stock and 50,000 shares of $2 par-value common stock On December 31, 2013, 1,000 shares of preferred stock and 20,000 shares of common stock are issued and outstanding. The corporation's transactions affecting stockholders' equity during 2014 are given below. Record the transactions on page 8 of a general journal. Omit descriptions.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

77

In each of the following situations, what is the amount of profit or loss? In each situation, what account will be debited and credited, and for what amount, in the journal entry to close the Income Summary account?

1. The total of the debit column in the Income Statement section of the worksheet was $84,000 and the total of the credit column in that section was $74,000.

2. The total in the debit column of the Income Statement section was $600,000 and the total of the credit column was $700,000.

3. The total of the debit column in the Balance Sheet section was $90,000 and the total of the credit column in that section was $82,000.

1. The total of the debit column in the Income Statement section of the worksheet was $84,000 and the total of the credit column in that section was $74,000.

2. The total in the debit column of the Income Statement section was $600,000 and the total of the credit column was $700,000.

3. The total of the debit column in the Balance Sheet section was $90,000 and the total of the credit column in that section was $82,000.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

78

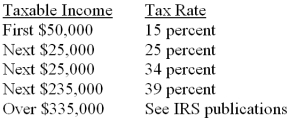

Information from the Income Statement columns of King Corporation's worksheet on December 31, 2013, is shown below.  1. What is the amount of net income before income tax?

1. What is the amount of net income before income tax?

2. What is the amount of income tax on the net income? Use the tax rates set forth below.

3. What adjustment is recorded for Income Tax Expense? The corporation paid $5,000 through quarterly deposits.

4. What is the amount of net income after income tax?

1. What is the amount of net income before income tax?

1. What is the amount of net income before income tax?2. What is the amount of income tax on the net income? Use the tax rates set forth below.

3. What adjustment is recorded for Income Tax Expense? The corporation paid $5,000 through quarterly deposits.

4. What is the amount of net income after income tax?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

79

Selected transactions of the Streng Corporation during 2013 and 2014 are given below. Record the transactions on page 6 of a general journal. Omit descriptions.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

80

A corporation has paid estimated income taxes of $9,000 during the year 2013. At the end of the year, the corporation's tax bill is computed to be $10,000. Record the entry to adjust the Income Tax Expense account on page 6 of a general journal. Omit the description.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck