Deck 17: Merchandise Inventory

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/78

Play

Full screen (f)

Deck 17: Merchandise Inventory

1

The fundamental assumption of the gross profit method of estimating inventory is that the rate of gross profit on sales is about the same from period to period.

True

2

In a period of rising prices, the LIFO method of inventory valuation results in a lower reported net income than the FIFO method.

True

3

A price reduction below the original markon is ________________.

markdown

4

Under the gross profit method of estimating inventory, the ending inventory is determined by subtracting the estimated cost of goods sold from the cost of goods available for sale.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

5

For internal control, unit figures used to compute the inventory should be verified through spot checks.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

6

If a firm uses the FIFO method of inventory valuation for tax purposes, it must use the FIFO method for financial accounting.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

7

The average cost method of inventory valuation will always result in the lowest reported net income.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

8

The use of the FIFO method of inventory valuation results in a matching of current inventory costs against current sales revenue.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

9

Inventory valuation is very important in computing federal income tax because the value placed on the inventory determines the net income reported.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

10

Gross profit ratio is determined by dividing Net Sales by Gross Profit.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

11

Inventory cannot be valued at the lower of cost or market if the inventory cost was determined using the FIFO methods.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

12

The ________________ method of inventory costing must be used for financial accounting purposes if it is chosen for federal income tax purposes.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

13

Many retail stores take a periodic inventory at retail values, using the sales price marked on the merchandise.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

14

When the replacement cost of an item is below its original purchase cost, it is necessary to value the inventory at market price in order to reflect the lower current value in the firm's financial records.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

15

The LIFO method of inventory valuation assigns the cost of the most recent purchases to the ending inventory.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

16

A physical inventory should be taken at least annually to verify the goods on hand.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

17

The FIFO method of inventory valuation focuses on the balance sheet; the most current costs are in ending inventory.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

18

The most conservative method of applying the lower of cost or market rule is to use the lower of total cost or total market by groups.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

19

The price the business would have to pay to buy an item of inventory through usual channels in usual quantities is either market price or __________________ cost.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

20

Following the consistency principle, once a firm adopts a method of inventory valuation, it should use that method consistently from one period to the next.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

21

The ____________________ method of estimating ending inventory involves estimating the cost of goods sold by applying a company's cost/sales ratio to its sales for the current period.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

22

The _________________________ account is the one account that appears on both the balance sheet and the income statement.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

23

The accountant for a company whose inventory was destroyed by fire determined from undamaged records that the cost of goods available for sale was $100,000 and the net sales were $80,000 up to the date of the fire. The accountant also determined that the company's normal gross profit rate is 40 percent of net sales. From this data, the accountant estimated the cost of the inventory destroyed by the fire to be

A) $60,000.

B) $52,000.

C) $32,000.

D) $20,000. $80,000 x .6 = $48,000

$100,000 - $48,000 = $52,000.

A) $60,000.

B) $52,000.

C) $32,000.

D) $20,000. $80,000 x .6 = $48,000

$100,000 - $48,000 = $52,000.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following inventory costing procedures requires a physical count of merchandise a minimum of once a year at yearend?

A) the retail method

B) the average cost method

C) the gross profit method

D) the lower of cost or market method

A) the retail method

B) the average cost method

C) the gross profit method

D) the lower of cost or market method

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

25

The ____________________ method of estimating inventory requires the use of data about both cost and selling prices.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

26

The ____________________ method of inventory valuation is a procedure developed for charging the current costs of goods against current sales prices.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

27

Net Sales minus Gross Profit equals ___________________.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

28

In the ____________________ method of inventory valuation, inventory cost is determined by multiplying the number of units in inventory by a unit cost, which is calculated by dividing the cost of goods available for sale by the units of merchandise available for sale.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

29

In periods of rising prices, the inventory valuation procedure that results in the highest net income is

A) the lower of cost or market method.

B) the LIFO method.

C) the average cost method.

D) the FIFO method.

A) the lower of cost or market method.

B) the LIFO method.

C) the average cost method.

D) the FIFO method.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

30

The lower the ending inventory valuation, the ____________________ the reported net income.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

31

A merchant who deals in one-of-a-kind items with large unit costs may account for inventory by the _________________________ method.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

32

The merchandise available for sale cost a company $90,000 and was marked to sell at a retail price of $125,000. Sales during the period totaled $80,000. If the retail method is used, the estimated cost of the ending inventory is

A) $32,400.

B) $12,600.

C) $22,400.

D) $45,000. 90000/125000 = 70%; 70% x 80000 = 57600; 90000 - 57600 = 32400.

A) $32,400.

B) $12,600.

C) $22,400.

D) $45,000. 90000/125000 = 70%; 70% x 80000 = 57600; 90000 - 57600 = 32400.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

33

In periods of rising prices, use of the ____________________ method of inventory valuation results in the lowest inventory cost on the balance sheet.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

34

When inventory is valued at the lower of cost or market, the accountant is applying the principle or convention called ___________________.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

35

If other items remain the same, the larger the ending inventory valuation, the

A) higher the cost of goods sold.

B) higher the reported net income.

C) lower the reported gross profit on sales.

D) lower the reported net income.

A) higher the cost of goods sold.

B) higher the reported net income.

C) lower the reported gross profit on sales.

D) lower the reported net income.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

36

The gross profit method of determining ending inventory cost

A) can be used without taking a physical count of merchandise.

B) provides accurate information about the number of units in inventory.

C) requires that a firm keep inventory and purchases data at retail value as well as at cost.

D) requires that the inventory be classified into groups of items of about the same rate of mark on.

A) can be used without taking a physical count of merchandise.

B) provides accurate information about the number of units in inventory.

C) requires that a firm keep inventory and purchases data at retail value as well as at cost.

D) requires that the inventory be classified into groups of items of about the same rate of mark on.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

37

When the ____________________ method is used, the cost of the ending inventory is computed by using the cost of the latest purchases.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

38

A firm that sells a single product had a beginning inventory of 4,000 units with a total cost of $28,000. Early in the year, 10,000 units were purchased at $9 each. Using FIFO, what is the value of the ending inventory of 3,000 units?

A) $27,000

B) $24,000

C) $21,000

D) $36,000 27000 = 3000 x 9.

A) $27,000

B) $24,000

C) $21,000

D) $36,000 27000 = 3000 x 9.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

39

A firm that sells a single product had a beginning inventory of 4,000 units with a total cost of $16,000. Early in the year, 8,000 units were purchased at $6 each. Using LIFO, what is the value of the ending inventory of 2,000 units?

A) $12,000

B) $10,000

C) $8,000

D) $24,000 8000 = 2000 x (16000/4000).

A) $12,000

B) $10,000

C) $8,000

D) $24,000 8000 = 2000 x (16000/4000).

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

40

The lower the ending inventory valuation, the ____________________ the cost of goods sold.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

41

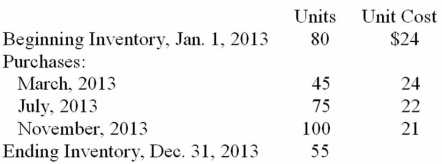

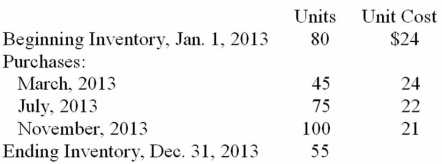

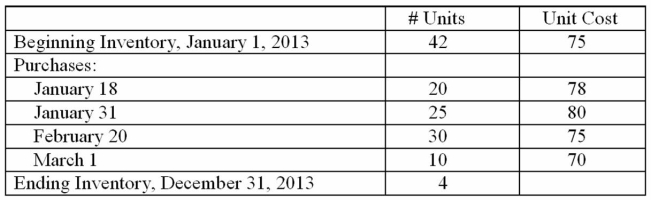

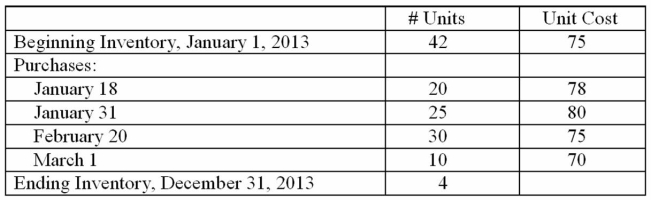

Information about the Maxwell Company's inventory of one item during 2013 is given below.  Compute the cost of the ending inventory and cost of goods sold under each of the following methods.

Compute the cost of the ending inventory and cost of goods sold under each of the following methods.

1. Average cost method

2. First in, first out (FIFO) method

3. Last in, first out (LIFO) method

Compute the cost of the ending inventory and cost of goods sold under each of the following methods.

Compute the cost of the ending inventory and cost of goods sold under each of the following methods.1. Average cost method

2. First in, first out (FIFO) method

3. Last in, first out (LIFO) method

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

42

The use of the LIFO method of inventory valuation

A) assigns the cost of the most recent purchases to the ending inventory.

B) results in the same valuation as the specific identification method in a time of rising prices.

C) results in the lowest reported net income in a time of rising prices.

D) results in the highest reported net income in a time of rising prices.

A) assigns the cost of the most recent purchases to the ending inventory.

B) results in the same valuation as the specific identification method in a time of rising prices.

C) results in the lowest reported net income in a time of rising prices.

D) results in the highest reported net income in a time of rising prices.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

43

The firm had a beginning inventory of 50 units with a unit cost of $10. Purchases during the year were as follows: March-50 units with a unit cost of $12; July-60 units with a unit cost of $15. If the average cost method is used, the value of the ending inventory of 45 units is

A) $675.

B) $563.

C) $450.

D) $555. 45 x (2000/160).

A) $675.

B) $563.

C) $450.

D) $555. 45 x (2000/160).

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

44

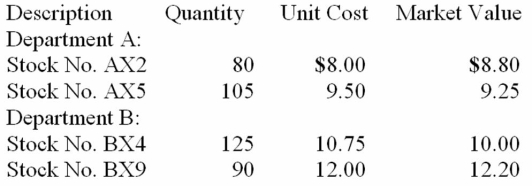

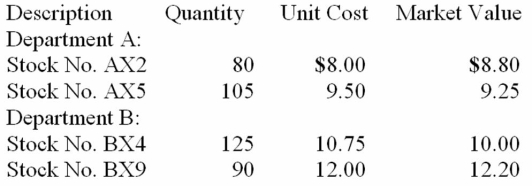

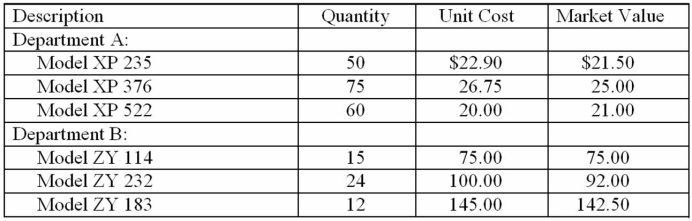

The following data concerns selected inventory items.  Determine the amount to be reported as the inventory valuation at cost or market, whichever is lower, under each of the following methods.

Determine the amount to be reported as the inventory valuation at cost or market, whichever is lower, under each of the following methods.

1. Lower of cost or market for each item separately

2. Lower of total cost or total market

3. Lower of total cost or total market by department

Determine the amount to be reported as the inventory valuation at cost or market, whichever is lower, under each of the following methods.

Determine the amount to be reported as the inventory valuation at cost or market, whichever is lower, under each of the following methods.1. Lower of cost or market for each item separately

2. Lower of total cost or total market

3. Lower of total cost or total market by department

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

45

The price a business would pay for its inventory is

A) assessed value.

B) sales price.

C) replacement cost.

D) discount price.

A) assessed value.

B) sales price.

C) replacement cost.

D) discount price.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following is NOT a way to apply the lower of cost or market rule?

A) by item

B) by size

C) in total

D) by group

A) by item

B) by size

C) in total

D) by group

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

47

On July 1, 2013, a fire destroyed the entire inventory of Stewart Clothes, a retail store. The accounting records that were saved showed that the firm's gross profit rate was 40 percent of net sales. During the period of January 1 to July 1, 2013, the store had net sales of $345,000 and net purchases of $325,000. On December 31, 2013, the inventory was $50,000.

1. What is the estimated cost of goods sold for the period?

2. What is the estimated ending (destroyed) inventory?

3. What is the estimated gross profit for the period?

1. What is the estimated cost of goods sold for the period?

2. What is the estimated ending (destroyed) inventory?

3. What is the estimated gross profit for the period?

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

48

The cost of the earliest merchandise purchased is assigned to ending inventory when a company uses

A) the LIFO method.

B) the FIFO method.

C) the average cost method.

D) the lower of cost or market method.

A) the LIFO method.

B) the FIFO method.

C) the average cost method.

D) the lower of cost or market method.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

49

The use of the FIFO method of inventory valuation

A) results in a matching of current inventory costs against sales revenue.

B) results in the most current costs in ending inventory.

C) results in a lowest reported net income in a time of rising prices.

D) results in a highest reported net income in a time of falling prices.

A) results in a matching of current inventory costs against sales revenue.

B) results in the most current costs in ending inventory.

C) results in a lowest reported net income in a time of rising prices.

D) results in a highest reported net income in a time of falling prices.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

50

The difference between the cost and the initial retail price of merchandise is

A) markup.

B) markon.

C) markdown.

D) market price.

A) markup.

B) markon.

C) markdown.

D) market price.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

51

A matching of the most recent costs to revenue results from the use of

A) the LIFO method.

B) the FIFO method.

C) the average cost method.

D) the lower of cost or market method.

A) the LIFO method.

B) the FIFO method.

C) the average cost method.

D) the lower of cost or market method.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

52

The steps and proper order for estimating EI cost using the gross profit method are as follows:

A) determine COGA, estimate COGS, subtract COGS from COGA.

B) determine COGA, estimate COGS, subtract COGA from COGS.

C) estimate COGS, determine COGA, subtract COGA from COGS.

D) estimate COGS, determine COGA, subtract COGS from COGA.

A) determine COGA, estimate COGS, subtract COGS from COGA.

B) determine COGA, estimate COGS, subtract COGA from COGS.

C) estimate COGS, determine COGA, subtract COGA from COGS.

D) estimate COGS, determine COGA, subtract COGS from COGA.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

53

The Lower of Cost or Market rule is based on which accounting principle?

A) conservatism

B) revenue recognition

C) matching

D) full disclosure

A) conservatism

B) revenue recognition

C) matching

D) full disclosure

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

54

The weighted average cost of an inventory item is calculated by

A) dividing the sum of the unit cost on the purchase invoices by the number of units purchased.

B) dividing the cost of goods available for sale by the number of units on the ending inventory.

C) dividing the cost of goods available for sale by the number of units available during the period.

D) dividing the cost of goods sold by the number of units available during the period.

A) dividing the sum of the unit cost on the purchase invoices by the number of units purchased.

B) dividing the cost of goods available for sale by the number of units on the ending inventory.

C) dividing the cost of goods available for sale by the number of units available during the period.

D) dividing the cost of goods sold by the number of units available during the period.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

55

An increase above the initial retail price of merchandise is

A) net profit.

B) gross profit.

C) markup.

D) markon.

A) net profit.

B) gross profit.

C) markup.

D) markon.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

56

The modifying convention of conservatism requires that inventory be presented on the balance sheet at

A) cost.

B) market value.

C) either cost or market value, whichever is lower.

D) average cost during the period.

A) cost.

B) market value.

C) either cost or market value, whichever is lower.

D) average cost during the period.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

57

Cost ratio is calculated by

A) dividing merchandise available for sale at cost by merchandise available for sale at retail.

B) dividing merchandise available for sale at retail by merchandise available for sale at cost.

C) dividing net retail sales by the cost of the merchandise sold.

D) dividing the cost of merchandise sold by net retail sales.

A) dividing merchandise available for sale at cost by merchandise available for sale at retail.

B) dividing merchandise available for sale at retail by merchandise available for sale at cost.

C) dividing net retail sales by the cost of the merchandise sold.

D) dividing the cost of merchandise sold by net retail sales.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

58

If a business builds and sells yachts. The logical method for inventory costing is

A) LIFO.

B) average cost method.

C) specific identification method.

D) FIFO.

A) LIFO.

B) average cost method.

C) specific identification method.

D) FIFO.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

59

The retail method is a means of estimating

A) selling price.

B) beginning inventory cost.

C) retail price of inventory.

D) ending inventory cost.

A) selling price.

B) beginning inventory cost.

C) retail price of inventory.

D) ending inventory cost.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

60

An assumption necessary to the use of the Gross Profit method is that the

A) Gross Profit amount is constant from period to period.

B) inventory level remains constant.

C) the rate of Gross Profit is constant from period to period.

D) the Gross Profit percentage increases at the rate of inflation.

A) Gross Profit amount is constant from period to period.

B) inventory level remains constant.

C) the rate of Gross Profit is constant from period to period.

D) the Gross Profit percentage increases at the rate of inflation.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

61

On June 29, Hurricane Moriah destroyed the warehouse where The Adams Bicycle Sales Company stored their inventory. The inventory was, for the most part, carried away by the force of the storm. The usual gross profit rate for the company was 45%. The beginning inventory of $120,000 was recorded on the prior year's financial reports. The net sales to date are known to be $474,500, and net purchases (including freight-in charges and purchases returns) were $325,000. Using the gross profit method of inventory valuation, determine the value of the inventory that was destroyed.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

62

Adams Company uses the specific identification method. At the end of the year, it had 24 units of its giant floating tricycles that were sold for use by tourists in the ocean or on large lakes. Explain how the physical count of inventory and the cost of ending inventory will be calculated.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

63

Explain the following terms-markon, markup, and markdown.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

64

What is inventory shrink? How may inventory shrink come about?

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

65

What is RFID? What is the benefit to RFID?

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

66

Explain what taking a physical inventory is and why it is done.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

67

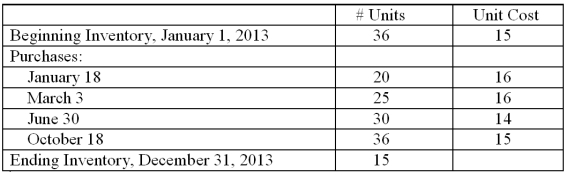

Duncan Industries' inventory of coats (Model XL) during 2013 is given below.  What is the cost of the ending inventory and the cost of goods sold?

What is the cost of the ending inventory and the cost of goods sold?

1. Assume Duncan Industries utilizes the FIFO method

2. Assume Duncan Industries utilizes the LIFO method

3. Assume Duncan Industries utilizes the average cost method

What is the cost of the ending inventory and the cost of goods sold?

What is the cost of the ending inventory and the cost of goods sold?1. Assume Duncan Industries utilizes the FIFO method

2. Assume Duncan Industries utilizes the LIFO method

3. Assume Duncan Industries utilizes the average cost method

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

68

For each of the following statements, determine which method of inventory valuation (FIFO or LIFO) it depicts.

1. ___________________ The item sold is assigned a cost.

2. ___________________ The ending inventory is higher under this method when costs are rising.

3. ___________________ The cost of goods sold is higher under this method when costs are rising.

4. ___________________ When prices are rising, this method results in higher net income.

5. ___________________ If this method is used for federal tax purposes, it must also be adopted for it financial accounting.

6. ___________________ This method is not accepted in some countries.

7. ___________________ When prices are rising, the average cost method will result in an ending inventory that is higher than which method?

1. ___________________ The item sold is assigned a cost.

2. ___________________ The ending inventory is higher under this method when costs are rising.

3. ___________________ The cost of goods sold is higher under this method when costs are rising.

4. ___________________ When prices are rising, this method results in higher net income.

5. ___________________ If this method is used for federal tax purposes, it must also be adopted for it financial accounting.

6. ___________________ This method is not accepted in some countries.

7. ___________________ When prices are rising, the average cost method will result in an ending inventory that is higher than which method?

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

69

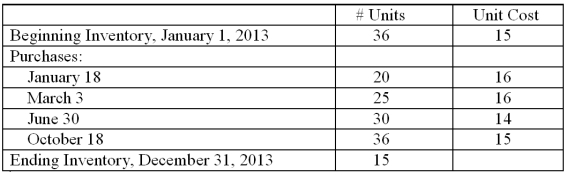

Alyse Designer Handbags had the following inventory figures for its Nicole Model during 2013 as shown below.  What is the cost of the ending inventory and the cost of goods sold?

What is the cost of the ending inventory and the cost of goods sold?

1. Assume the company utilizes the FIFO method

2. Assume the company utilizes the LIFO method

3. Assume the company utilizes the average cost method

What is the cost of the ending inventory and the cost of goods sold?

What is the cost of the ending inventory and the cost of goods sold?1. Assume the company utilizes the FIFO method

2. Assume the company utilizes the LIFO method

3. Assume the company utilizes the average cost method

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

70

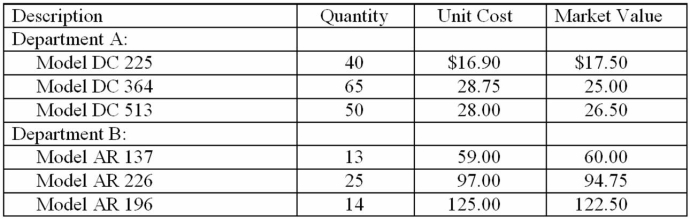

The following information concerns several of the inventory items at DC's.  Determine the amount of inventory to be reported on the financial statements using the lower of cost or market method of valuation under each of the following options.

Determine the amount of inventory to be reported on the financial statements using the lower of cost or market method of valuation under each of the following options.

1. Lower of cost or market for each item separately

2. Lower of total cost or total market

3. Lower of total cost or total market by department

Determine the amount of inventory to be reported on the financial statements using the lower of cost or market method of valuation under each of the following options.

Determine the amount of inventory to be reported on the financial statements using the lower of cost or market method of valuation under each of the following options.1. Lower of cost or market for each item separately

2. Lower of total cost or total market

3. Lower of total cost or total market by department

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

71

Distinguish between periodic inventory, perpetual inventory, and physical inventory.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

72

On July 1, a tornado destroyed the warehouse where The Brooks Boys Sports Equipment Company stored their inventory. The inventory was, for the most part, carried away by the force of the storm. The usual gross profit rate for the company was 30%. The beginning inventory of $220,000 was recorded on the prior year's financial reports. The net sales to date are known to be $886,450, and net purchases (including freight-in charges and purchases returns) were $580,000. Using the gross profit method of inventory valuation, determine the value of the inventory that was destroyed.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

73

The November 1st inventory of the Ray Adams Company had a cost of $29,750. Its retail value was $48,000. During the month of November, purchases in the amount of $41,734 (including freight in of $234) were made and priced at retail for $79,650. Sales for the month of November amounted to $88,000. What is the November cost of goods sold and the ending inventory at cost and at retail?

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

74

The following information concerns several of the inventory items at DC's.  Determine the amount of inventory to be reported on the financial statements using the lower of cost or market method of valuation under each of the following options.

Determine the amount of inventory to be reported on the financial statements using the lower of cost or market method of valuation under each of the following options.

1. Lower of cost or market for each item separately

2. Lower of total cost or total market

3. Lower of total cost or total market by department

Determine the amount of inventory to be reported on the financial statements using the lower of cost or market method of valuation under each of the following options.

Determine the amount of inventory to be reported on the financial statements using the lower of cost or market method of valuation under each of the following options.1. Lower of cost or market for each item separately

2. Lower of total cost or total market

3. Lower of total cost or total market by department

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

75

What is the specific identification method for valuing inventory? What types of businesses are likely to use this method? Why?

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

76

To safeguard its inventory, organizations implement various types of controls. List some general internal controls that may be in place in a business.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

77

The June 1 inventory of the Kaufman Company had a cost of $8,000 and a retail value of $20,000. During June, merchandise was purchased for $36,000 and marked to sell for $60,000. June sales totaled $45,000. Use the retail method to compute the answers to the following questions.

1. What is the retail value of the ending inventory as of June 30?

2. What is the approximate cost of the ending inventory?

3. What is the cost of goods sold during June?

1. What is the retail value of the ending inventory as of June 30?

2. What is the approximate cost of the ending inventory?

3. What is the cost of goods sold during June?

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

78

The October 1st inventory of the David Charles Company had a recorded cost of $19,500. Its retail value was $39,000. During the month of October, purchases in the amount of $30,320 (including freight of $320) were made and priced at retail for $67,000. Sales for the month of October amounted to $74,000. What is the October cost of goods sold and the ending inventory at cost and at retail?

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck