Deck 25: Departmentalized Profit and Cost Centers

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

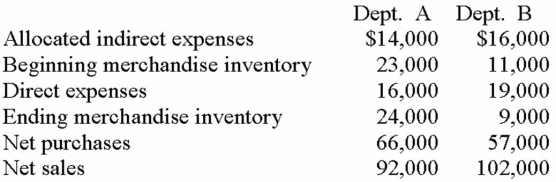

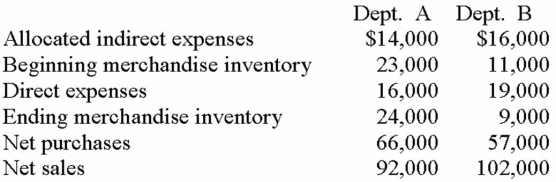

Question

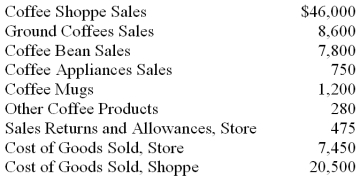

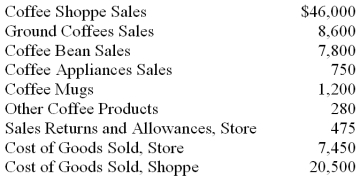

Question

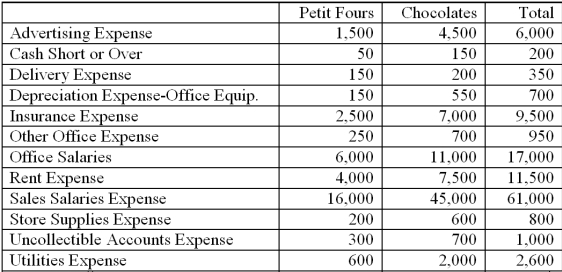

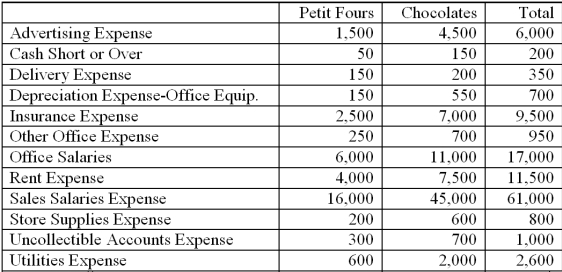

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/90

Play

Full screen (f)

Deck 25: Departmentalized Profit and Cost Centers

1

Allocated expenses can be rounded to the nearest whole dollar on departmental income statements.

True

2

The difficulty of fairly allocating direct expenses is one limitation of departmental income statements.

False

3

Nonoperating income, such as interest income, should be allocated on the basis of total sales in each department.

False

4

The purchasing, information systems, and maintenance departments are examples of profit centers of a company.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

5

A company may have several cost centers, but it can have only one profit center.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

6

Semidirect and indirect expenses are allocated to the sales department at the time the expenses are incurred.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

7

Office expenses such as postage and stationery should be allocated on the basis of contribution margin of each department.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

8

Contribution margin is another name for gross profit.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

9

Traditional financial statements may not contain adequate information for managing a business.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

10

A department that has a positive contribution margin is contributing something toward the net income of the business.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

11

Cost centers do not directly earn revenue.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

12

Management decisions involving the elimination of a department should be based on the contribution margin of the department.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

13

When a departmentalized income statement is to be prepared, the sales journal must be departmentalized.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

14

The amount of floor space occupied by each department is a common basis for allocating rent expense or utilities expense.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

15

Responsibility accounting provides detailed data for each cost center and profit center so that management can determine how efficiently the individual segments are functioning.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

16

For accounting purposes, both revenue and cost data are accumulated for a profit center.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

17

Some indirect costs may be allocated on the basis of departmental sales in proportion to total sales.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

18

Office salaries expense should be allocated on the basis of total sales in each department.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

19

When a business is organized into separate departments, it is necessary to provide accounting information about each department.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

20

In departmental accounting, any costs and expenses not directly related to a specific department are allocated to all departments.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

21

Operating expenses that cannot be easily assigned to particular departments at the time transactions occur and are recorded are called ____________________ expenses.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

22

The difference between a department's gross profit on sales and its direct expenses is called ___________________.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

23

If an attempt is made to identify and accumulate both revenue and cost data for a specific segment of a company, that segment is called a(n) ____________________ center.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

24

Eliminating a department that has a negative contribution margin would result in ____________________ net income for the company than if the department were not eliminated.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

25

Department A had total sales of $40,000 and Department B had total sales of $10,000. If office salaries expense is allocated on the basis of total sales, ____________________ percent would be used to determine the allocation for Department

B.

B.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

26

Expenses that are closely related to the activities in each department, but cannot be allocated to any specific department are called ____________________ expenses.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

27

A department's ____________________ is usually more important than its net income or net loss when management is considering whether to close the department.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

28

A systematic and logical way to allocate the rent expense for a building to various sales departments would be on the basis of ___________________.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

29

The Copying Department occupied 9,000 square feet of space and the Printing Department occupied 6,000 square feet of space in the same building. If janitorial costs for the building were $12,000, then the amount that the Copying Department would be allocated for janitorial services would be ________________.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

30

The area of accounting that provides financial information about individual segments, activities, or products of a business is called ____________________ accounting.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

31

Eliminating a department should eliminate all ____________________ expenses of the department.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

32

When a company has departmentalized profit and cost centers each of the following is reported separately except for

A) Merchandise inventories.

B) Sales.

C) Purchases.

D) General Office Expense.

A) Merchandise inventories.

B) Sales.

C) Purchases.

D) General Office Expense.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following is NOT a cost center?

A) accounting department

B) purchasing department

C) shoe department

D) research laboratory

A) accounting department

B) purchasing department

C) shoe department

D) research laboratory

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

34

Departments that provide services to other departments of the firm are often organized as ____________________ centers.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

35

In departmental accounting, expenses that can be closely identified with an individual department are referred to as ____________________ expenses.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following enables management to evaluate the performance of each business segment?

A) responsibility accounting

B) transfer pricing

C) profit center costing

D) cost center costing

A) responsibility accounting

B) transfer pricing

C) profit center costing

D) cost center costing

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

37

Managerial accounting is generally utilized to provide financial information about all of the following except

A) business segments.

B) corporate headquarters.

C) products.

D) activities.

A) business segments.

B) corporate headquarters.

C) products.

D) activities.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

38

The basic principle of ____________________ accounting is that management should be able to evaluate the performance of each segment of the business and pinpoint responsibility for its financial results.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

39

The price at which goods are moved from one segment of a company to another is the ____________________ price.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

40

A logical way to allocate janitorial wages to various departments would be on the basis of ___________________.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

41

The telephone expense is allocated on the basis of floor space. Department A occupies 1,875 square feet and Department B occupies 625 square feet. If the telephone expense is $600, the amount allocated to Department A is

A) $150.

B) $300.

C) $450.

D) $288.

A) $150.

B) $300.

C) $450.

D) $288.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

42

Department XYZ had sales of $90,000, direct expenses of $60,000 and indirect expenses of $50,000. The indirect expenses allocated to this department would have been incurred whether or not the department existed. If this department had been eliminated, the company's reported net income would have been

A) $20,000 higher.

B) $30,000 higher.

C) $20,000 lower.

D) $30,000 lower.

A) $20,000 higher.

B) $30,000 higher.

C) $20,000 lower.

D) $30,000 lower.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

43

Department A had total sales of $84,000 and Department B had total sales of $36,000. Other Office Expenses, totaling $2,500, are allocated on the basis of total sales. The amount allocated to Department B is

A) $750.

B) $1,750.

C) $1,250.

D) $1,071.

A) $750.

B) $1,750.

C) $1,250.

D) $1,071.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

44

The procedure for assigning indirect expenses to departments at the end of an accounting period is called

A) valuation.

B) amortization.

C) allocation.

D) distribution.

A) valuation.

B) amortization.

C) allocation.

D) distribution.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

45

A department probably would be considered for elimination if it had

A) a positive contribution margin and a net income from operations.

B) a positive contribution margin and a net loss from operations.

C) a negative contribution margin and a net loss from operations.

D) a net loss, regardless of the contribution margin.

A) a positive contribution margin and a net income from operations.

B) a positive contribution margin and a net loss from operations.

C) a negative contribution margin and a net loss from operations.

D) a net loss, regardless of the contribution margin.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

46

An example of a direct expense in a department store is

A) interest expense.

B) sales salaries expense.

C) rent expense for the building where the store is located.

D) utilities expense.

A) interest expense.

B) sales salaries expense.

C) rent expense for the building where the store is located.

D) utilities expense.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

47

Department A had gross profit on sales of $20,000, contribution margin of $12,000, total direct expenses of $8,000, and total indirect expenses of $7,000. Department A has

A) a net income from operations of $5,000.

B) a net income from operations of $4,000.

C) a net loss from operations of $4,000.

D) a net loss of $7,000.

A) a net income from operations of $5,000.

B) a net income from operations of $4,000.

C) a net loss from operations of $4,000.

D) a net loss of $7,000.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

48

The contribution margin of a department is the difference between

A) its net sales and the total expenses.

B) its net sales and its cost of goods sold.

C) its gross profit on sales and its indirect expenses.

D) its gross profit on sales and its direct expenses.

A) its net sales and the total expenses.

B) its net sales and its cost of goods sold.

C) its gross profit on sales and its indirect expenses.

D) its gross profit on sales and its direct expenses.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

49

In a store with several sales departments, departmentalized accounts would be used for

A) sales only.

B) sales, purchases, and merchandise inventory.

C) sales and other income items only.

D) all expense accounts.

A) sales only.

B) sales, purchases, and merchandise inventory.

C) sales and other income items only.

D) all expense accounts.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

50

Department A had total sales of $84,000 and Department B had total sales of $36,000. Other Office Expenses, totaling $2,500, are allocated on the basis of total sales. The amount allocated to Department A is

A) $750.

B) $1,750.

C) $1,250.

D) $1,071.

A) $750.

B) $1,750.

C) $1,250.

D) $1,071.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

51

A transfer price is

A) the price for which a company sells its products to customers.

B) the price at which goods are moved from one department of a company to another department of the company.

C) the basis on which indirect expenses are allocated.

D) the price at which a company purchases its products from a supplier.

A) the price for which a company sells its products to customers.

B) the price at which goods are moved from one department of a company to another department of the company.

C) the basis on which indirect expenses are allocated.

D) the price at which a company purchases its products from a supplier.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

52

Expenses that are closely related to a particular department and can easily be assigned to it during an accounting period are called

A) operating expenses.

B) indirect expenses.

C) allocated expenses.

D) direct expenses.

A) operating expenses.

B) indirect expenses.

C) allocated expenses.

D) direct expenses.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

53

If a segment of business is considered a profit center

A) it must sell products or services to customers outside the business.

B) both revenue and cost data must be accumulated for the segment.

C) no indirect expenses can be allocated to the segment.

D) only revenue is accumulated for the segment.

A) it must sell products or services to customers outside the business.

B) both revenue and cost data must be accumulated for the segment.

C) no indirect expenses can be allocated to the segment.

D) only revenue is accumulated for the segment.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

54

Floor space would be a reasonable basis for the allocation of

A) rent expense for a building.

B) sales revenue.

C) payroll taxes expense.

D) advertising expense.

A) rent expense for a building.

B) sales revenue.

C) payroll taxes expense.

D) advertising expense.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

55

How much of the computer system's cost will be allocated to the Tax Division?

A) $96,000.

B) $60,000.

C) $84,000.

D) $80,000.

A) $96,000.

B) $60,000.

C) $84,000.

D) $80,000.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

56

Costs that cannot be directly assigned to a department, but are closely related to departmental activities are categorized as

A) semidirect expenses.

B) direct expenses.

C) indirect expenses.

D) general expenses.

A) semidirect expenses.

B) direct expenses.

C) indirect expenses.

D) general expenses.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

57

Department B had net sales of $70,000, gross profit on sales of $35,000, total direct expenses of $9,000, and total indirect expenses of $6,000. Department B's contribution margin is

A) $20,000.

B) $29,000.

C) $26,000.

D) $35,000.

A) $20,000.

B) $29,000.

C) $26,000.

D) $35,000.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

58

How much of the computer system's cost will be allocated to the Business Consulting Division?

A) $96,000.

B) $60,000.

C) $84,000.

D) $80,000.

A) $96,000.

B) $60,000.

C) $84,000.

D) $80,000.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

59

Department B had net sales of $70,000, gross profit on sales of $35,000, total direct expenses of $9,000, and total indirect expenses of $6,000. Department B's net income is

A) $20,000.

B) $29,000.

C) $26,000.

D) $35,000.

A) $20,000.

B) $29,000.

C) $26,000.

D) $35,000.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

60

One department in a company had a contribution margin of $15,000 and a net loss from operations of $2,000. The indirect expenses allocated to this department would have been incurred whether or not the department existed. If this department had been eliminated, the company's reported net income would have been

A) $2,000 higher.

B) $15,000 lower.

C) $13,000 lower.

D) the same with or without the department.

A) $2,000 higher.

B) $15,000 lower.

C) $13,000 lower.

D) the same with or without the department.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

61

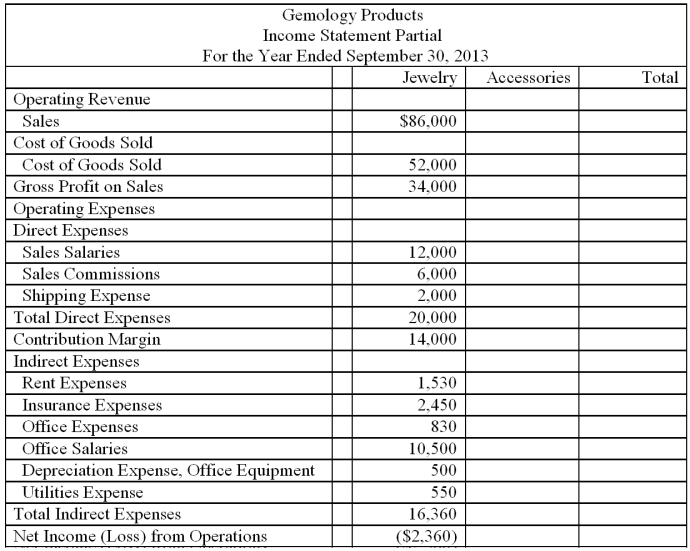

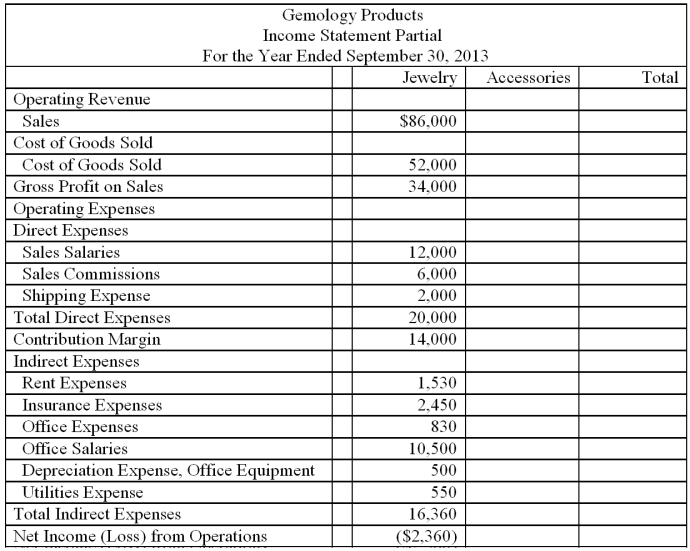

Examine the following partial Income Statement for Gemology Products and determine whether or not to close the Jewelry Department. If the Jewelry Department is closed, the Insurance Expense will be reduced by $500 and one office employee part time position will be eliminated. That position pays $6,500 a year. The other expenses will remain.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

62

City Shoe's insurance expense for the year totaled $6,300 and is to be allocated on the basis of the book value of inventory and equipment in each department. Using the financial data given below, compute the amount allocated to each department.

Book value of inventory and equipment:

(1) Women's Shoes, $79,800

(2) Men's Shoes, $69,300

(3) Children's Shoes, $60,900

Book value of inventory and equipment:

(1) Women's Shoes, $79,800

(2) Men's Shoes, $69,300

(3) Children's Shoes, $60,900

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

63

The Whippleton Department had gross profit on sales of $120,000, contribution margin of $60,000, total direct expenses of $18,000, and total indirect expenses of $52,000. The Whippleton Department has

A) a net income from operations of $42,000.

B) a net income from operations of $8,000.

C) a net income from operations of $50,000.

D) a net loss from operations of $10,000.

A) a net income from operations of $42,000.

B) a net income from operations of $8,000.

C) a net income from operations of $50,000.

D) a net loss from operations of $10,000.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

64

Semidirect and indirect expenses are treated the same for accounting purposes. At the end of the accounting period they are

A) recorded by the department they relate to.

B) allocated.

C) charged to headquarters (corporate) general expenses.

D) treated as direct expenses.

A) recorded by the department they relate to.

B) allocated.

C) charged to headquarters (corporate) general expenses.

D) treated as direct expenses.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

65

Unit Manufacturing Company has a Northeast Division, a Central Division and a Southwest Division and a travel department which supports the employees in all three divisions. The $144,000 in travel department expenses is allocated to the divisions based on the number of reservations required by each of the divisions. If the Northeast Division requires 1,700 reservations and the Central Division requires 2,800 reservations, and the Southwest Division requires 3,500 reservations, calculate the amount of travel department costs that will be allocated to each of the divisions.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

66

Prestige Corporation has Sales of $98,500, Indirect Expenses of $26,000, Direct Expenses of $62,400, and Cost of Goods Sold of $49,600. What is Prestige Corporation's Contribution Margin?

A) $36,100

B) ($13,500)

C) ($39,500)

D) $48,900

A) $36,100

B) ($13,500)

C) ($39,500)

D) $48,900

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

67

Departmental income statements provide management with information necessary for decision-making. Which of the following is NOT a decision made possible by these statements?

A) where improvements in the profitable departments are needed

B) which departments to expand

C) whether or not to eliminate a department

D) what base to use to allocate costs

A) where improvements in the profitable departments are needed

B) which departments to expand

C) whether or not to eliminate a department

D) what base to use to allocate costs

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

68

City Shoe's loss from uncollectible accounts is estimated to be one-half of 1 percent of net credit sales. Using the financial data given below, compute the amount allocated to each department.

Credit sales:

(1) Women's Shoes, $278,200

(2) Men's Shoes, $185,800

(3) Children's Shoes, $116,000

Sales returns and allowances (credit sales):

(1) Women's Shoes, $2,200

(2) Men's Shoes, $1,800

(3) Children's Shoes, $1,000

Credit sales:

(1) Women's Shoes, $278,200

(2) Men's Shoes, $185,800

(3) Children's Shoes, $116,000

Sales returns and allowances (credit sales):

(1) Women's Shoes, $2,200

(2) Men's Shoes, $1,800

(3) Children's Shoes, $1,000

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

69

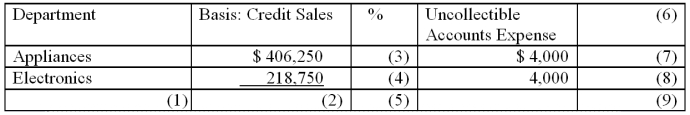

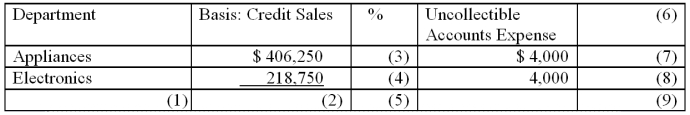

Complete the table of Uncollectible Accounts given below.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following is NOT a limitation to using departmental operating income?

A) It is difficult to determine each department's fair share of semidirect and indirect expenses.

B) If one department is eliminated, many of the expenses allocated to it would continue.

C) Managers rely more on contribution per department than on income from operations.

D) It highlights the individual department's financial information.

A) It is difficult to determine each department's fair share of semidirect and indirect expenses.

B) If one department is eliminated, many of the expenses allocated to it would continue.

C) Managers rely more on contribution per department than on income from operations.

D) It highlights the individual department's financial information.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following is usually not departmentalized?

A) depreciation expense

B) interest expense

C) payroll taxes expense

D) rent expense

A) depreciation expense

B) interest expense

C) payroll taxes expense

D) rent expense

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

72

Cody Reese, manager of Cobra Sports, Ink, decided to eliminate its Division

A) Division A had a contribution margin of $14,000 and a loss from operations of $2,500. What other information does Cody need to make the correct decision?

A) which direct expenses will still be incurred

B) the amount of Cost of Goods Sold

C) the Gross Profit on Sales

D) which of the indirect expenses will still be incurred

A) Division A had a contribution margin of $14,000 and a loss from operations of $2,500. What other information does Cody need to make the correct decision?

A) which direct expenses will still be incurred

B) the amount of Cost of Goods Sold

C) the Gross Profit on Sales

D) which of the indirect expenses will still be incurred

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

73

Data related to the income and expenses of Moffet Company for the year ended December 31, 2013, are shown below. Use this information to prepare a departmental income statement showing contribution margin and net income of each department.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

74

Barista Coffee Shoppe and Store has two departments. The Store sells ground coffees, coffee beans, grinders, coffee makes, cappuccino machines, mugs, aprons, flavored additives, and flavored creamers. The Shoppe sells brewed coffees. Prepare the gross profit section of the Income Statement for Barista Coffee Shoppe and Store as of its yearend on June 30, 2013 using the information given. Include the proper heading.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

75

Prepare the Operating Expenses section of the Income Statement for Sanjam Company at yearend, March 31, 2013. The Gross Profit for Sanjam Petit Fours is $36,500 and for Chocolates it is $102,350. (Hint: The first line of your partial Income Statement after the heading should be Operating Expenses, and the final line should be Total Indirect Expenses. Include Contribution Margin in its proper place.)

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

76

City Shoe's office expenses for the year totaled $63,000 and are to be allocated on the basis of the total sales of each department. Using the financial data given below compute the amount allocated to each department.

Total sales:

(1) Women's Shoes, $322,500

(2) Men's Shoes, $270,000

(3) Children's Shoes, $157,500

Total sales:

(1) Women's Shoes, $322,500

(2) Men's Shoes, $270,000

(3) Children's Shoes, $157,500

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

77

McKay Corporation has Sales of $147,500, Cost of Goods Sold of $70,200, Direct Expenses of $35,300, and Indirect Expenses of $30,000. What is McKay Corporation's Contribution Margin?

A) $77,300

B) $47,300

C) $42,000

D) $12,000

A) $77,300

B) $47,300

C) $42,000

D) $12,000

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

78

City Shoe's custodial expense for the year totaled $7,000 and is to be allocated on the basis of the floor space occupied by each department. Using the financial data given below, compute the amount allocated to each department.

Floor space occupied:

(1) Women's Shoes, 6,615 sq. ft.

(2) Men's Shoes, 5,145 sq. ft.

(3) Children's Shoes, 2,940 sq. ft.

Floor space occupied:

(1) Women's Shoes, 6,615 sq. ft.

(2) Men's Shoes, 5,145 sq. ft.

(3) Children's Shoes, 2,940 sq. ft.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

79

The departments of Cacophony Music Company are listed below. For each, determine whether it is a cost center or a profit center.

________ 1. Instrument Rental Department

________ 2. Instrument Repair Department

________ 3. Accounting Department

________ 4. Recording Studio

________ 5. Maintenance Department

________ 6. Sheet Music Department

________ 7. Storeroom

________ 8. Customer Service

________ 9. CDs and Tapes Department

________ 10. Purchasing & Receiving

________ 1. Instrument Rental Department

________ 2. Instrument Repair Department

________ 3. Accounting Department

________ 4. Recording Studio

________ 5. Maintenance Department

________ 6. Sheet Music Department

________ 7. Storeroom

________ 8. Customer Service

________ 9. CDs and Tapes Department

________ 10. Purchasing & Receiving

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

80

Shigley and Lothian, CPAs, allocate the expenses of the duplicating center to the Audit Department and the Tax Department, based on the number of copies that each department requests. During 2014, the Audit Department requested 80,000 copies and the Tax Department requested 120,000 copies. Total expenses of the duplicating center were $640,000 in 2014. How much of the duplicating center's expenses will be allocated to the Audit Department and the Tax Department?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck