Deck 26: Accounting for Manufacturing Activities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

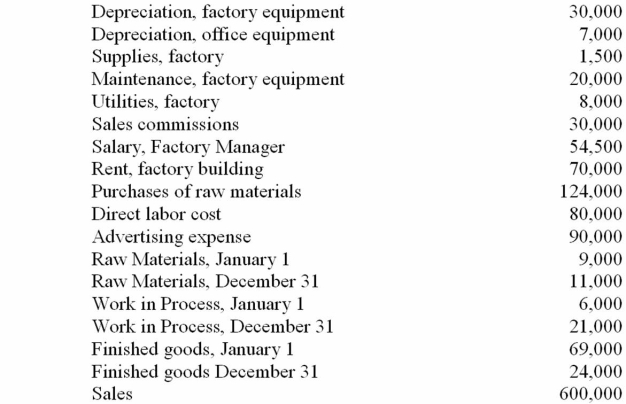

Question

Question

Question

Question

Question

Question

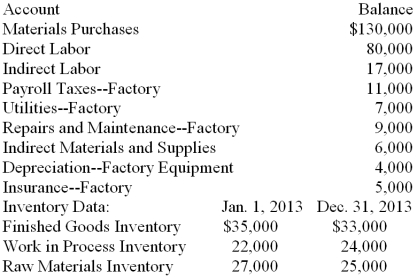

Question

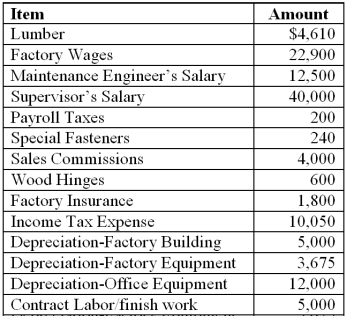

Question

Question

Question

Question

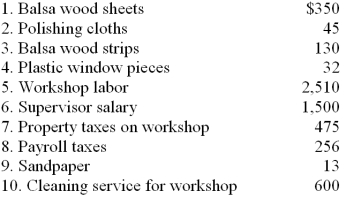

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/89

Play

Full screen (f)

Deck 26: Accounting for Manufacturing Activities

1

The raw materials inventory, the work in process inventory, and the finished goods inventory are all shown in the Current Assets section of the balance sheet.

True

2

Cleaning materials and lubricants used in factory operations and maintenance are considered manufacturing overhead.

True

3

Immediately before it is closed, the balance of the Manufacturing Summary account represents the cost of goods manufactured.

True

4

Amounts paid to factory repair and maintenance employees are considered direct labor.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

5

If there are no errors, the amount needed to balance the Cost of Goods Manufactured columns of a worksheet will also be the amount required to balance the Balance Sheet columns.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

6

Six adjusting entries are made for inventory accounts in a manufacturing operation.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

7

The amounts of the raw materials used, direct labor, and manufacturing overhead for a fiscal period are reported on the statement of cost of goods manufactured.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

8

If the ending finished goods inventory is greater than the beginning finished goods inventory, the cost of goods sold will be higher than the cost of goods manufactured.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

9

The Cost of Goods Sold section of the income statement for a manufacturing business shows the work in process inventory.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

10

In a manufacturing company, it is not necessary to take a physical inventory of the finished goods.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

11

The beginning and ending balances of the finished goods inventory are not used in the computation of cost of goods manufactured.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

12

A statement of cost goods manufactured supports the income statement.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

13

Gross profit for a manufacturing business is computed by deducting cost of goods manufactured from net sales.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

14

Reversing entries help save time and prevent errors in the period being closed.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

15

Information about depreciation, insurance, and property taxes for the factory building of a manufacturing business would be shown in the Operating Expenses section of the income statement.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

16

The beginning inventory of raw materials is shown in the Income Statement Credit column and the Balance Sheet Debit column of a worksheet for a manufacturing business.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

17

Products that are only partially completed are called work in process.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

18

The balance of the Manufacturing Summary account is closed into the Income Summary account.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

19

The adjusting entry to close out the beginning work in process inventory includes a debit to Income Summary and a credit to Work in Process Inventory.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

20

Raw Materials Used is not an element of manufacturing overhead.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

21

As part of the adjusting entries, the beginning inventory of work in process is closed into the ____________________ Summary account.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

22

The entry to close the Manufacturing Summary account includes a(n) ____________________ to Manufacturing Summary.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

23

For a manufacturing business, net sales minus cost of goods ____________________ equals gross profit on sales.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

24

The end-of-period adjusting entries are

A) recorded and posted in the ledger.

B) recorded in the journal and posted in the ledger.

C) recorded in the ledger and posted in the journal.

D) recorded and posted in the journal.

A) recorded and posted in the ledger.

B) recorded in the journal and posted in the ledger.

C) recorded in the ledger and posted in the journal.

D) recorded and posted in the journal.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

25

The cost of indirect materials and supplies used in manufacturing operations would be included in the computation of total manufacturing costs as ________________________.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

26

Closing entries for a manufacturing firm include all of the following except

A) transferring all manufacturing cost accounts to Manufacturing Summary.

B) transferring all Revenue and Expense account balances to Income Summary.

C) closing Manufacturing Summary to Income Summary.

D) closing Income Summary to Net Income.

A) transferring all manufacturing cost accounts to Manufacturing Summary.

B) transferring all Revenue and Expense account balances to Income Summary.

C) closing Manufacturing Summary to Income Summary.

D) closing Income Summary to Net Income.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

27

The beginning and ending ____________________ inventories appear in the Cost of Goods Sold section of the income statement of a manufacturing business.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

28

The Balance Sheet of a manufacturing firm will include which account that will not be included in the Balance Sheet of a service firm?

A) Purchases

B) Accounts Payable

C) Prepaid Wages

D) Work in Process Inventory

A) Purchases

B) Accounts Payable

C) Prepaid Wages

D) Work in Process Inventory

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

29

The raw materials inventory is shown in the ____________________ section of the balance sheet of a manufacturing business.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

30

All of the items that are purchased for manufacturing operations, that go into a product and become part of it, are called ____________________ materials.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

31

The salary paid to a factory supervisor would be classified as ____________________ labor.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

32

Under the perpetual inventory method, additions and deletions are recorded as they occur to which of the following?

A) Finished Goods

B) Work in Process

C) Materials

D) All of the above

A) Finished Goods

B) Work in Process

C) Materials

D) All of the above

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

33

The Manufacturing Summary account is closed into the ____________________ account.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

34

Finished goods inventory is used in the computation of cost of goods ___________________.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

35

As part of the adjusting entries, the beginning inventory of finished goods is closed into the ____________________ Summary account.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

36

The ending inventory of raw materials is shown on the worksheet of a manufacturing business in the Cost of Goods Manufactured ____________________ column.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

37

All manufacturing costs except those for direct labor and direct materials are included in manufacturing ___________________.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

38

To compute the cost of goods ___________________, it is necessary to subtract the ending work in process inventory from the sum of the beginning work in process inventory and the total manufacturing cost.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

39

On a worksheet for a manufacturing business, the beginning inventory of finished goods is extended to the ____________________ Debit column.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

40

Organizations that utilize the perpetual inventory method record additions and deletions

A) daily.

B) monthly.

C) quarterly.

D) yearly.

A) daily.

B) monthly.

C) quarterly.

D) yearly.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

41

The Indirect Labor account is closed by crediting it and debiting

A) Wages Payable.

B) Income Summary.

C) Manufacturing Summary.

D) Wages Expense.

A) Wages Payable.

B) Income Summary.

C) Manufacturing Summary.

D) Wages Expense.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

42

The balance of the Manufacturing Summary account is closed into

A) Income Summary.

B) Cost of Goods Manufactured.

C) Retained Earnings.

D) Manufacturing Overhead.

A) Income Summary.

B) Cost of Goods Manufactured.

C) Retained Earnings.

D) Manufacturing Overhead.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

43

The balance sheet of a manufacturing business shows

A) the finished goods inventory and the cost of goods manufactured.

B) the cost of goods manufactured rather than inventory figures.

C) a single inventory figure-the amount of the finished goods inventory.

D) the raw materials inventory, the work in process inventory, and the finished goods inventory.

A) the finished goods inventory and the cost of goods manufactured.

B) the cost of goods manufactured rather than inventory figures.

C) a single inventory figure-the amount of the finished goods inventory.

D) the raw materials inventory, the work in process inventory, and the finished goods inventory.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

44

The ending balance of the work in process inventory is recorded by debiting Work in Process Inventory and crediting

A) Income Summary.

B) Cost of Goods Sold.

C) Manufacturing Summary.

D) Merchandise Inventory.

A) Income Summary.

B) Cost of Goods Sold.

C) Manufacturing Summary.

D) Merchandise Inventory.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

45

Reversing entries for a manufacturing business are

A) made prior to preparing the postclosing trial balance.

B) made for the inventory accounts only.

C) closed into the Manufacturing Summary account.

D) made for accrual adjustments.

A) made prior to preparing the postclosing trial balance.

B) made for the inventory accounts only.

C) closed into the Manufacturing Summary account.

D) made for accrual adjustments.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

46

Once the financial statements have been prepared, the steps in the accounting cycle are complete. Which of the following is NOT one of the steps in the accounting cycle?

A) Adjusting entries

B) Closing Trial Balance

C) Post Closing Trial Balance

D) Closing entries

A) Adjusting entries

B) Closing Trial Balance

C) Post Closing Trial Balance

D) Closing entries

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

47

All manufacturing costs that are NOT classified as direct materials or direct labor are

A) indirect materials.

B) indirect labor.

C) manufacturing overhead.

D) semidirect costs.

A) indirect materials.

B) indirect labor.

C) manufacturing overhead.

D) semidirect costs.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

48

Wages paid to the factory maintenance and repair personnel of a manufacturing business are shown

A) in the Operating Expenses section of the income statement.

B) as Direct Labor on the statement of cost goods manufactured.

C) as part of Manufacturing Overhead on the statement cost of goods manufactured.

D) as a part of the Cost of Goods Sold section of the income statement.

A) in the Operating Expenses section of the income statement.

B) as Direct Labor on the statement of cost goods manufactured.

C) as part of Manufacturing Overhead on the statement cost of goods manufactured.

D) as a part of the Cost of Goods Sold section of the income statement.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

49

The statement of cost of goods manufactured

A) supports the income statement.

B) replaces the income statement.

C) is not related to the income statement.

D) supports the balance sheet.

A) supports the income statement.

B) replaces the income statement.

C) is not related to the income statement.

D) supports the balance sheet.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

50

On a worksheet for a manufacturing firm, the beginning balance of the Finished Goods Inventory account should

A) be extended to the Cost of Goods Manufactured Debit column.

B) be extended to the Income Statement Debit column.

C) be extended to the Balance Sheet Debit column.

D) not be listed.

A) be extended to the Cost of Goods Manufactured Debit column.

B) be extended to the Income Statement Debit column.

C) be extended to the Balance Sheet Debit column.

D) not be listed.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

51

The manufacturing costs incurred during the year are

A) shown by the expense accounts such as Wages Expense and Utilities Expense that are listed in the Operating Expenses section of the income statement.

B) shown as Direct Labor, Raw Materials, and Manufacturing Overhead in the Operating Expenses section of the income statement.

C) used in the computation of cost of goods manufactured.

D) shown in the Cost of Goods Sold section of the income statement.

A) shown by the expense accounts such as Wages Expense and Utilities Expense that are listed in the Operating Expenses section of the income statement.

B) shown as Direct Labor, Raw Materials, and Manufacturing Overhead in the Operating Expenses section of the income statement.

C) used in the computation of cost of goods manufactured.

D) shown in the Cost of Goods Sold section of the income statement.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

52

Reversing entries are required by

A) the Internal Revenue Service.

B) Generally Accepted Accounting Principles.

C) the International Accounting Standards Board.

D) none of the above.

A) the Internal Revenue Service.

B) Generally Accepted Accounting Principles.

C) the International Accounting Standards Board.

D) none of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following is NOT an adjusting entry?

A) Administrative Expense

Allowance for Doubtful Accounts

B) Supplies on Hand

Supplies Expense

C) Insurance-Factory

Administrative Expense

D) Income Tax Expense

Income Tax Payable

A) Administrative Expense

Allowance for Doubtful Accounts

B) Supplies on Hand

Supplies Expense

C) Insurance-Factory

Administrative Expense

D) Income Tax Expense

Income Tax Payable

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

54

In adjusting entries for a manufacturing business, the beginning balance of the work in process inventory is eliminated by crediting Work in Process Inventory and debiting

A) Finished Goods Inventory.

B) Manufacturing Summary.

C) Income Summary.

D) Merchandise Inventory.

A) Finished Goods Inventory.

B) Manufacturing Summary.

C) Income Summary.

D) Merchandise Inventory.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

55

The cost of goods manufactured for a fiscal period is reported on

A) both the statement of cost of goods manufactured and the income statement.

B) both the statement of the cost of goods manufactured and the balance sheet.

C) both the income statement and the balance sheet.

D) the statement of cost of goods manufactured only.

A) both the statement of cost of goods manufactured and the income statement.

B) both the statement of the cost of goods manufactured and the balance sheet.

C) both the income statement and the balance sheet.

D) the statement of cost of goods manufactured only.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

56

Indirect labor for a manufacturing business includes the wages of

A) factory repair and maintenance employees.

B) employees who assemble the product.

C) employees who sell the product.

D) office employees.

A) factory repair and maintenance employees.

B) employees who assemble the product.

C) employees who sell the product.

D) office employees.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

57

The three components of total manufacturing cost are

A) cost of goods manufactured, cost of goods sold, and work in process.

B) raw materials used, direct labor, and manufacturing overhead.

C) selling expenses, administrative expenses, and manufacturing overhead.

D) raw materials used, direct labor, and cost of goods sold.

A) cost of goods manufactured, cost of goods sold, and work in process.

B) raw materials used, direct labor, and manufacturing overhead.

C) selling expenses, administrative expenses, and manufacturing overhead.

D) raw materials used, direct labor, and cost of goods sold.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

58

Gross profit for a manufacturing business is computed by

A) deducting cost of goods sold from net sales.

B) deducting cost of goods manufactured from net sales.

C) deducting the ending finished goods inventory from the total goods available for sale.

D) deducting operating expenses from the costs of goods sold.

A) deducting cost of goods sold from net sales.

B) deducting cost of goods manufactured from net sales.

C) deducting the ending finished goods inventory from the total goods available for sale.

D) deducting operating expenses from the costs of goods sold.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

59

On the completed worksheet of a manufacturing business, the accounts related to materials purchases, direct labor, and factory overhead

A) appear in the Income Statement section.

B) do not appear.

C) appear in the Balance Sheet section.

D) appear in the Cost of Goods Manufactured section.

A) appear in the Income Statement section.

B) do not appear.

C) appear in the Balance Sheet section.

D) appear in the Cost of Goods Manufactured section.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

60

The cost of goods manufactured is computed by

A) adding raw materials used and direct labor to manufacturing overhead.

B) deducting the ending work in process inventory from the sum of the total manufacturing cost and the beginning work in process inventory.

C) deducting the ending finished goods inventory from the beginning finished goods inventory.

D) adding operating expenses to direct labor costs.

A) adding raw materials used and direct labor to manufacturing overhead.

B) deducting the ending work in process inventory from the sum of the total manufacturing cost and the beginning work in process inventory.

C) deducting the ending finished goods inventory from the beginning finished goods inventory.

D) adding operating expenses to direct labor costs.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

61

What are the three inventory accounts for a manufacturing firm? List the three inventory accounts and indicate for each the name(s) of the statement(s) in which it appears.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

62

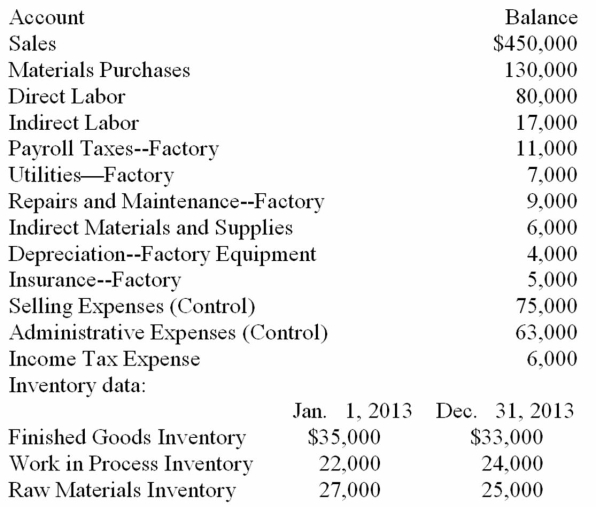

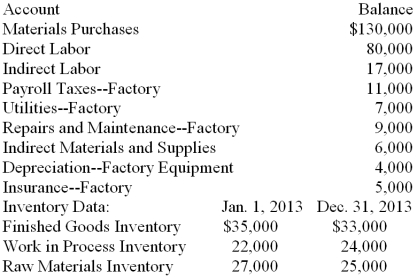

Selected account balances for Reed Manufacturing Company on December 31, 2013, the end of the fiscal year, are given below. Data about the beginning and ending inventories are also given. Use this information to prepare a statement of cost of goods manufactured and an income statement for 2013.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

63

The following information appears on the income statement of the Davis Company at the end of the year. Ending finished goods inventory was:

A) $140,000.

B) $160,000.

C) $200,000.

D) $220,000. Cost of Goods Sold = 500,000 - 160,000 = 340,000.

Ending finished goods inventory = 120,000 + 360,000 - 340,000 = 140,000.

A) $140,000.

B) $160,000.

C) $200,000.

D) $220,000. Cost of Goods Sold = 500,000 - 160,000 = 340,000.

Ending finished goods inventory = 120,000 + 360,000 - 340,000 = 140,000.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

64

The following information appears on the income statement of the Richer Company at the end of the year. Gross Profit on Sales was:

A) $140,000.

B) $160,000.

C) $200,000.

D) $220,000. Cost of Goods Sold = 200,000 + 120,000 - 180,000 = 140,000.

Gross Profit = 360,000 - 140,000 = 220,000.

A) $140,000.

B) $160,000.

C) $200,000.

D) $220,000. Cost of Goods Sold = 200,000 + 120,000 - 180,000 = 140,000.

Gross Profit = 360,000 - 140,000 = 220,000.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

65

Define the term manufacturing overhead and give three examples of manufacturing overhead for a bakery.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

66

Stellar Manufacturing had a beginning raw materials inventory of $220,000. The firm had net purchases of $625,000 for the period and an ending raw materials inventory of $199,000. What was the cost of raw materials used?

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

67

The following information appears on the Statement of Cost of Goods Manufactured for the Coleman Company at the end of the year. The cost for Direct Labor was:

A) $40,000.

B) $60,000.

C) $110,000.

D) $120,000. Direct Labor = Total Manufacturing Costs - Raw Material Used - Manufacturing Overhead = 170,000 - 50,000 - 60,000 = 60,000.

A) $40,000.

B) $60,000.

C) $110,000.

D) $120,000. Direct Labor = Total Manufacturing Costs - Raw Material Used - Manufacturing Overhead = 170,000 - 50,000 - 60,000 = 60,000.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

68

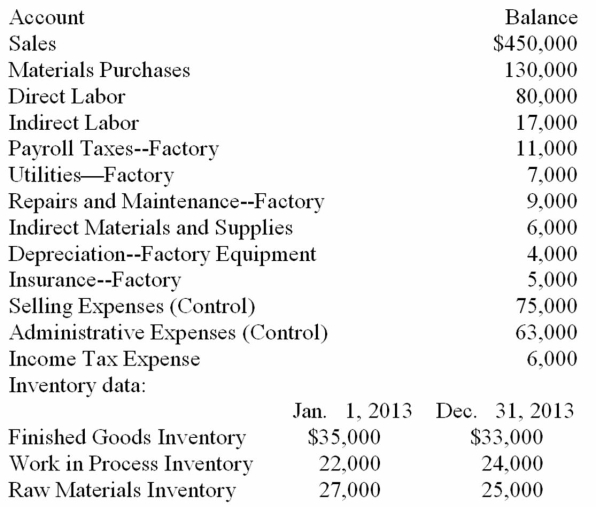

Calculate net income for the year.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

69

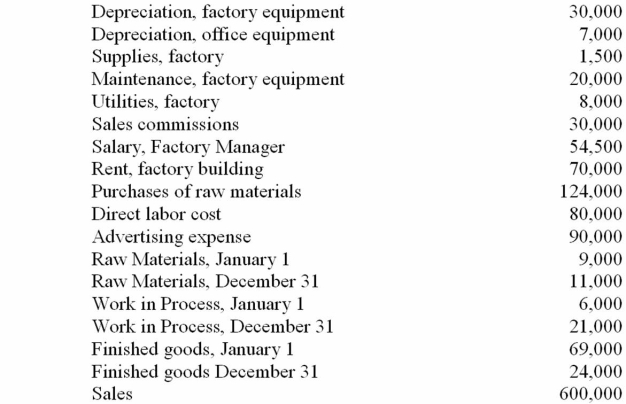

Using only the relevant items from the information given, determine the total product cost for Donnybrook Corporation, a manufacturer of children's furniture. All materials purchased were used in inventory during the current period. There was no beginning inventory.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

70

The following information appears on the Statement of Cost of Goods Manufactured for the Coleman Company at the end of the year. The balance in Work in Process Inventory at year-end was:

A) $30,000.

B) $40,000.

C) $60,000.

D) $20,000. Ending Work in Process Inventory = 10,000 + 170,000 - 150,000 = 30,000.

A) $30,000.

B) $40,000.

C) $60,000.

D) $20,000. Ending Work in Process Inventory = 10,000 + 170,000 - 150,000 = 30,000.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

71

Calculate the Cost of Goods Manufactured.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

72

The following information appears on the income statement of the Richer Company at the end of the year. Cost of Goods Manufactured was:

A) $246,000.

B) $280,000.

C) $264,000.

D) $240,000. Cost of Goods Sold = 400,000 - 120,000 = 280,000.

Cost of Goods Manufactured = 144,000 + 280,000 - 160,000 = 264,000.

A) $246,000.

B) $280,000.

C) $264,000.

D) $240,000. Cost of Goods Sold = 400,000 - 120,000 = 280,000.

Cost of Goods Manufactured = 144,000 + 280,000 - 160,000 = 264,000.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

73

From the information given, determine total direct and total indirect costs.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

74

The following information appears on the Statement of Cost of Goods Manufactured for the Poster Company at the end of the year. Manufacturing Overhead for the year was:

A) $60,000.

B) $50,000.

C) $40,000.

D) $30,000. Manufacturing Cost = Ending Work in Process + Costs of Goods Manufacturing - Beginning Work in Process = 20,000 + 200,000 - 30,000 = 190,000.

Overhead = Total Manufacturing Costs - Raw Material Used - Direct Labor

= 190,000 - 70,000 - 90,000 = 30,000.

A) $60,000.

B) $50,000.

C) $40,000.

D) $30,000. Manufacturing Cost = Ending Work in Process + Costs of Goods Manufacturing - Beginning Work in Process = 20,000 + 200,000 - 30,000 = 190,000.

Overhead = Total Manufacturing Costs - Raw Material Used - Direct Labor

= 190,000 - 70,000 - 90,000 = 30,000.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

75

The above listed items are used by Paige Manufacturing to make dollhouses. Categorize each as Direct Materials (DM), Direct Labor (DL), or Manufacturing Overhead (MOH).

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

76

Fill in the missing line items on the Statement of Cost of Goods Manufactured given. Include correct indentations, underlines, dates, and capitalization when needed.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

77

The following information appears on the Statement of Cost of Goods Manufactured for the Ethridge Company at the end of the year. Cost of Goods Manufactured for the year was:

A) $200,000.

B) $210,000.

C) $220,000.

D) $240,000. Total Manufacturing Costs = Raw Material Used + Direct Labor + Manufacturing Overhead

= 70,000 + 90,000 + 60,000 = 220,000.

Cost of Goods Manufactured = 20,000 + 220,000 - 30,000 = 210,000.

A) $200,000.

B) $210,000.

C) $220,000.

D) $240,000. Total Manufacturing Costs = Raw Material Used + Direct Labor + Manufacturing Overhead

= 70,000 + 90,000 + 60,000 = 220,000.

Cost of Goods Manufactured = 20,000 + 220,000 - 30,000 = 210,000.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

78

Selected account balances for Reed Manufacturing Company on December 31, 2013, the end of the fiscal year, are given below. Data about the beginning and ending inventories are also given. Record the adjusting entries for the inventory accounts on page 5 of a general journal. Skip a line and record the entry to close the manufacturing cost accounts. Omit descriptions.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

79

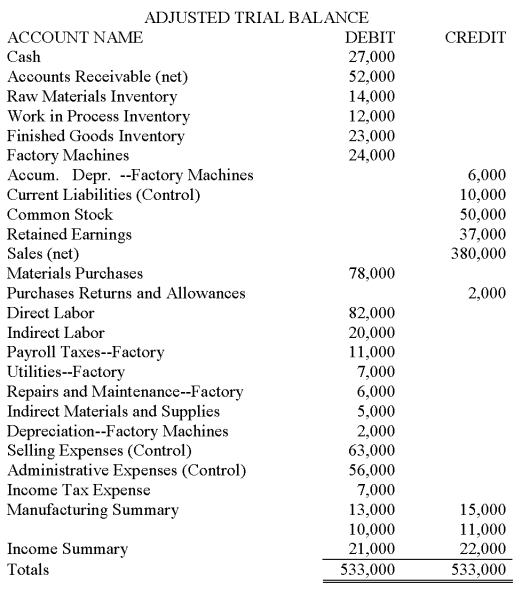

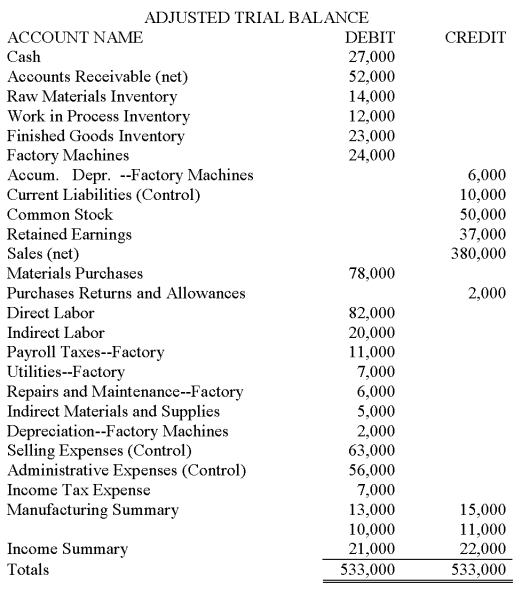

The accounts and the Adjusted Trial Balance section of Spencer Manufacturing's worksheet are given below.  Instructions:

Instructions:

(1) Enter the account names in the Account Name column and the adjusted trial balance in the Adjusted Trial Balance columns of a 12-column manufacturing worksheet. Or use a 10-column worksheet and use the last four columns, changing the column headings as needed.

(2) Extend the balances to the appropriate columns and complete the worksheet for the year ended December 31, 2013.

(3) Record the closing entries for all revenue and expense accounts and the Manufacturing Summary account on page 9 of a general journal. Omit descriptions.

Instructions:

Instructions:(1) Enter the account names in the Account Name column and the adjusted trial balance in the Adjusted Trial Balance columns of a 12-column manufacturing worksheet. Or use a 10-column worksheet and use the last four columns, changing the column headings as needed.

(2) Extend the balances to the appropriate columns and complete the worksheet for the year ended December 31, 2013.

(3) Record the closing entries for all revenue and expense accounts and the Manufacturing Summary account on page 9 of a general journal. Omit descriptions.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

80

Bolton Company's total manufacturing cost for the year was $1,785,000. The firm's manufacturing overhead was $315,000, and its cost of raw materials used was $842,000. What was the direct labor cost for the year?

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck