Deck 6: Inventory and Cost of Goods Sold

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/189

Play

Full screen (f)

Deck 6: Inventory and Cost of Goods Sold

1

Inventory records for Dunbar Incorporated revealed the following: Dunbar sold 700 units of inventory during the month. Ending inventory assuming LIFO would be:

A) $500.

B) $490.

C) $470.

D) $480.

A) $500.

B) $490.

C) $470.

D) $480.

$480.

2

Inventory does not include:

A) Materials used in the production of goods to be sold.

B) Assets intended to be sold in the normal course of business.

C) Equipment used in the manufacturing of assets for sale.

D) Assets currently in production for normal sales.

A) Materials used in the production of goods to be sold.

B) Assets intended to be sold in the normal course of business.

C) Equipment used in the manufacturing of assets for sale.

D) Assets currently in production for normal sales.

C

3

Inventory records for Dunbar Incorporated revealed the following: Dunbar sold 700 units of inventory during the month. Cost of goods sold assuming LIFO would be:

A) $1,730.

B) $1,700.

C) $1,720.

D) $1,710.

A) $1,730.

B) $1,700.

C) $1,720.

D) $1,710.

$1,720.

4

The following information pertains to Julia & Company: March 1 Beginning inventory units

March 3 Purchased15 units @ \$4

March 9 Sold 25 units What is the cost of goods sold for Julia & Company assuming it uses LIFO?

A) $125.

B) $100.

C) $110.

D) $85.

March 3 Purchased15 units @ \$4

March 9 Sold 25 units What is the cost of goods sold for Julia & Company assuming it uses LIFO?

A) $125.

B) $100.

C) $110.

D) $85.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

5

Inventory records for Marvin Company revealed the following: Marvin sold 2,300 units of inventory during the month. Ending inventory assuming weighted-average cost would be (round weighted-average unit cost to four decimals if necessary):

A) $5,087.

B) $5,107.

C) $5,077.

D) $5,005.

A) $5,087.

B) $5,107.

C) $5,077.

D) $5,005.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

6

Inventory records for Dunbar Incorporated revealed the following: Dunbar sold 700 units of inventory during the month. Ending inventory assuming FIFO would be:

A) $500.

B) $490.

C) $470.

D) $480.

A) $500.

B) $490.

C) $470.

D) $480.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

7

Baker Fine Foods has beginning inventory for the year of $12,000. During the year, Baker purchases inventory for $150,000 and ends the year with $20,000 of inventory. Baker will report cost of goods sold equal to:

A) $150,000.

B) $158,000.

C) $142,000.

D) $170,000.

A) $150,000.

B) $158,000.

C) $142,000.

D) $170,000.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

8

The largest expense on a retailer's income statement is typically:

A) Salaries.

B) Cost of goods sold.

C) Income tax expense.

D) Depreciation expense.

A) Salaries.

B) Cost of goods sold.

C) Income tax expense.

D) Depreciation expense.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

9

Inventory records for Dunbar Incorporated revealed the following: Dunbar sold 700 units of inventory during the month. Cost of goods sold assuming weighted-average cost would be (round weighted-average unit cost to four decimals if necessary):

A) $1,711.

B) $1,700.

C) $1,720.

D) $1,708.

A) $1,711.

B) $1,700.

C) $1,720.

D) $1,708.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

10

Inventory records for Dunbar Incorporated revealed the following: Dunbar sold 700 units of inventory during the month. Cost of goods sold assuming FIFO would be:

A) $1,730.

B) $1,700.

C) $1,720.

D) $1,710.

A) $1,730.

B) $1,700.

C) $1,720.

D) $1,710.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

11

Cost of goods sold equals:

A) Beginning inventory - net purchases + ending inventory.

B) Beginning inventory + accounts payable - net purchases.

C) Net purchases + ending inventory - beginning inventory.

D) Beginning inventory + net purchases - ending inventory.

A) Beginning inventory - net purchases + ending inventory.

B) Beginning inventory + accounts payable - net purchases.

C) Net purchases + ending inventory - beginning inventory.

D) Beginning inventory + net purchases - ending inventory.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

12

The following information pertains to Julia & Company: March 1 Beginning inventory units

March3 Purchased15 units@\$4

March 9 Sold 25 units What's the ending balance of inventory for Julia & Company assuming that it uses FIFO?

A) $125

B) $100

C) $110

D) $85

March3 Purchased15 units@\$4

March 9 Sold 25 units What's the ending balance of inventory for Julia & Company assuming that it uses FIFO?

A) $125

B) $100

C) $110

D) $85

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

13

Inventory records for Marvin Company revealed the following: Marvin sold 2,300 units of inventory during the month. Cost of goods sold assuming LIFO would be:

A) $16,800.

B) $16,760.

C) $16,540.

D) $16,660.

A) $16,800.

B) $16,760.

C) $16,540.

D) $16,660.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

14

Inventory records for Marvin Company revealed the following: Marvin sold 2,300 units of inventory during the month. Cost of goods sold assuming FIFO would be:

A) $16,800.

B) $16,760.

C) $16,540.

D) $16,660.

A) $16,800.

B) $16,760.

C) $16,540.

D) $16,660.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

15

Inventory records for Marvin Company revealed the following: Marvin sold 2,300 units of inventory during the month. Ending inventory assuming FIFO would be:

A) $5,140.

B) $5,080.

C) $5,060.

D) $5,050.

A) $5,140.

B) $5,080.

C) $5,060.

D) $5,050.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

16

Tyler Toys has beginning inventory for the year of $18,000. During the year, Tyler purchases inventory for $230,000 and has cost of goods sold equal to $233,000. Tyler's ending inventory equals:

A) $15,000.

B) $18,000.

C) $21,000.

D) $19,000.

A) $15,000.

B) $18,000.

C) $21,000.

D) $19,000.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

17

Inventory records for Dunbar Incorporated revealed the following: Dunbar sold 700 units of inventory during the month. Ending inventory assuming weighted-average cost would be (round weighted-average unit cost to four decimals if necessary):

A) $502.

B) $490.

C) $489.

D) $480.

A) $502.

B) $490.

C) $489.

D) $480.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

18

Inventory records for Marvin Company revealed the following: Marvin sold 2,300 units of inventory during the month. Ending inventory assuming LIFO would be:

A) $5,040.

B) $5,055.

C) $5,075.

D) $5,135.

A) $5,040.

B) $5,055.

C) $5,075.

D) $5,135.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

19

Cost of Goods Sold is:

A) An asset account.

B) A revenue account.

C) An expense account.

D) A permanent equity account.

A) An asset account.

B) A revenue account.

C) An expense account.

D) A permanent equity account.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

20

Inventory records for Marvin Company revealed the following: Marvin sold 2,300 units of inventory during the month. Cost of goods sold assuming weighted-average cost would be (round weighted-average unit cost to four decimals if necessary):

A) $16,733.

B) $17,408.

C) $16,713.

D) $16,089.

A) $16,733.

B) $17,408.

C) $16,713.

D) $16,089.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is true regarding LIFO and FIFO?

A) In a period of decreasing costs, LIFO results in lower total assets than FIFO.

B) In a period of decreasing costs, LIFO results in lower net income than FIFO.

C) In a period of rising costs, LIFO results in lower net income than FIFO.

D) The amount reported for COGS is based on market value of inventory if LIFO is used.

A) In a period of decreasing costs, LIFO results in lower total assets than FIFO.

B) In a period of decreasing costs, LIFO results in lower net income than FIFO.

C) In a period of rising costs, LIFO results in lower net income than FIFO.

D) The amount reported for COGS is based on market value of inventory if LIFO is used.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

22

In a period when inventory costs are falling, the lowest taxable income is most likely reported by using the inventory method of:

A) Weighted average.

B) LIFO.

C) Moving average.

D) FIFO.

A) Weighted average.

B) LIFO.

C) Moving average.

D) FIFO.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

23

The following information relates to inventory for Shoeless Joe Inc. At what amount would Shoeless report ending inventory using FIFO cost flow assumptions?

A) $55.

B) $170.

C) $110.

D) $70.

A) $55.

B) $170.

C) $110.

D) $70.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

24

In a period when inventory costs are rising, the inventory method that most likely results in the highest ending inventory is:

A) Lower-of-cost-or-market method.

B) Weighted-average cost.

C) FIFO.

D) LIFO.

A) Lower-of-cost-or-market method.

B) Weighted-average cost.

C) FIFO.

D) LIFO.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

25

The following information relates to inventory for Shoeless Joe Inc. At what amount would Shoeless report cost of goods sold using the weighted-average cost flow assumption? (Round your answer to the nearest dollar)

A) $110.

B) $73.

C) $70.

D) $105.

A) $110.

B) $73.

C) $70.

D) $105.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

26

In a period of rising prices, which inventory valuation method would a company likely choose if they want to have the highest possible balance of inventory on the balance sheet?

A) Average cost.

B) FIFO.

C) LIFO.

D) Periodic.

A) Average cost.

B) FIFO.

C) LIFO.

D) Periodic.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

27

The following information relates to inventory for Shoeless Joe Inc. At what amount would Shoeless report gross profit using LIFO cost flow assumptions?

A) $105.

B) $80.

C) $175.

D) $120.

A) $105.

B) $80.

C) $175.

D) $120.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

28

Consider the following inventory transactions for September: Beginning inventory units @ $3.00

Purchase on September units @ $3.50

Purchased on September units For the month of September, the company sold 35 units. What is the cost of good sold under the weighted-average cost method (round the weighted-average unit cost to four decimals if necessary)?

A) $121.

B) $116.

C) $124.

D) $131.

Purchase on September units @ $3.50

Purchased on September units For the month of September, the company sold 35 units. What is the cost of good sold under the weighted-average cost method (round the weighted-average unit cost to four decimals if necessary)?

A) $121.

B) $116.

C) $124.

D) $131.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

29

Good, Inc. sold inventory for $1,200 that was purchased for $700. Good records which of the following when it sells inventory using a perpetual inventory system?

A) No entry is required for cost of goods sold and inventory.

B) Debit Cost of Goods Sold $700; credit Inventory $700.

C) Debit Cost of Goods Sold $1,200; credit Inventory $1,200.

D) Debit Inventory $700; credit Cost of Goods Sold $700.

A) No entry is required for cost of goods sold and inventory.

B) Debit Cost of Goods Sold $700; credit Inventory $700.

C) Debit Cost of Goods Sold $1,200; credit Inventory $1,200.

D) Debit Inventory $700; credit Cost of Goods Sold $700.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

30

Davis Hardware Company uses a perpetual inventory system. How should Davis record the sale of inventory costing $620 for $960 on account?

A) Inventory

Cost of Goods Sold

Sales Revenue

Accounts Receivable

B) Accounts Receivable

Sales Revenue

Cost of Goods Sold

Inventory

C)

D) Accounts Receivable

Sales Revenues

Gain

A) Inventory

Cost of Goods Sold

Sales Revenue

Accounts Receivable

B) Accounts Receivable

Sales Revenue

Cost of Goods Sold

Inventory

C)

D) Accounts Receivable

Sales Revenues

Gain

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

31

During periods when inventory costs are rising, cost of goods sold will most likely be:

A) Higher under FIFO than LIFO.

B) Higher under FIFO than average cost.

C) Lower under average cost than LIFO.

D) Lower under LIFO than FIFO.

A) Higher under FIFO than LIFO.

B) Higher under FIFO than average cost.

C) Lower under average cost than LIFO.

D) Lower under LIFO than FIFO.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

32

In a perpetual inventory system, at the time of a sale the cost of inventory sold is:

A) Debited to Accounts Receivable.

B) Credited to Cost of Goods Sold.

C) Debited to Cost of Goods Sold.

D) Not recorded at the time.

A) Debited to Accounts Receivable.

B) Credited to Cost of Goods Sold.

C) Debited to Cost of Goods Sold.

D) Not recorded at the time.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

33

During periods when inventory costs are rising, ending inventory will most likely be:

A) Greater under LIFO than FIFO.

B) Less under average cost than LIFO.

C) Greater under average cost than FIFO.

D) Greater under FIFO than LIFO.

A) Greater under LIFO than FIFO.

B) Less under average cost than LIFO.

C) Greater under average cost than FIFO.

D) Greater under FIFO than LIFO.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following is true concerning inventory cost flow assumptions?

A) LIFO produces higher net income than FIFO in a period of rising prices.

B) FIFO is an income statement focus.

C) LIFO is a balance sheet focus.

D) None of the above are true.

A) LIFO produces higher net income than FIFO in a period of rising prices.

B) FIFO is an income statement focus.

C) LIFO is a balance sheet focus.

D) None of the above are true.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

35

Which inventory method is better described as having a balance sheet focus and why is it considered as such?

A) FIFO; better approximates the value of ending inventory.

B) LIFO; better approximates the value of ending inventory.

C) LIFO; better approximates inventory cost necessary to generate revenue.

D) FIFO; better approximates inventory cost necessary to generate revenue.

A) FIFO; better approximates the value of ending inventory.

B) LIFO; better approximates the value of ending inventory.

C) LIFO; better approximates inventory cost necessary to generate revenue.

D) FIFO; better approximates inventory cost necessary to generate revenue.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

36

Which inventory method is better described as having an income statement focus and why is it considered as such?

A) FIFO; better approximates the value of ending inventory.

B) LIFO; better approximates the value of ending inventory.

C) LIFO; better approximates inventory cost necessary to generate revenue.

D) FIFO; better approximates inventory cost necessary to generate revenue.

A) FIFO; better approximates the value of ending inventory.

B) LIFO; better approximates the value of ending inventory.

C) LIFO; better approximates inventory cost necessary to generate revenue.

D) FIFO; better approximates inventory cost necessary to generate revenue.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

37

In a perpetual inventory system, the purchase of inventory is debited to:

A) Purchases.

B) Cost of Goods Sold.

C) Inventory.

D) Accounts Payable.

A) Purchases.

B) Cost of Goods Sold.

C) Inventory.

D) Accounts Payable.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

38

The primary reason for the popularity of LIFO is that it gives:

A) Better matching of physical flow and cost flow.

B) A lower income tax obligation.

C) Simplified recordkeeping.

D) A simpler method to apply.

A) Better matching of physical flow and cost flow.

B) A lower income tax obligation.

C) Simplified recordkeeping.

D) A simpler method to apply.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

39

The LIFO conformity rule states that if LIFO is used for:

A) One class of inventory, it must be used for all classes of inventory.

B) Tax purposes, it must be used for financial reporting.

C) One company in an affiliated group, it must be used by all companies in an affiliated group.

D) Domestic companies, it must be used by foreign partners.

A) One class of inventory, it must be used for all classes of inventory.

B) Tax purposes, it must be used for financial reporting.

C) One company in an affiliated group, it must be used by all companies in an affiliated group.

D) Domestic companies, it must be used by foreign partners.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

40

Which inventory cost flow assumption generally results in the highest reported amount for cost of goods sold when inventory costs are falling?

A) FIFO.

B) LIFO.

C) Weighted-average cost.

D) Straight-line.

A) FIFO.

B) LIFO.

C) Weighted-average cost.

D) Straight-line.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

41

What effect would an adjustment to record inventory at the lower-of-cost-or-market have on the company's financial statements?

A) An increase to assets.

B) An increase to stockholders' equity.

C) A decrease to revenue.

D) An increase to expense.

A) An increase to assets.

B) An increase to stockholders' equity.

C) A decrease to revenue.

D) An increase to expense.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

42

Given the information below, what is the gross profit? Sales revenue

Accounts receivable

Ending inventory

Cost of goods sold

Sales Returns

A) $250,000

B) $70,000

C) $220,000

D) $50,000

Accounts receivable

Ending inventory

Cost of goods sold

Sales Returns

A) $250,000

B) $70,000

C) $220,000

D) $50,000

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

43

Wildwood, an outdoors clothing store, reports the following information for June: What is Wildwood's gross profit for June?

A) $18,000.

B) $39,000.

C) $104,00.

D) $17,000.

A) $18,000.

B) $39,000.

C) $104,00.

D) $17,000.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

44

On May 1, Ace Bonding Company purchased inventory costing $2,000 on account with terms 2/10, n/30. On May 8, Ace pays for this inventory and records which of the following using a perpetual inventory system?

A) Accounts Payable

Cash

B)

C) Accounts Payable

Inventory

Cash

D) Cash

Accounts Payable

A) Accounts Payable

Cash

B)

C) Accounts Payable

Inventory

Cash

D) Cash

Accounts Payable

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

45

LeGrand Corporation reported the following amounts in its income statement: What was LeGrand's operating income?

A) $120,000.

B) $260,000.

C) $110,000.

D) $65,000.

A) $120,000.

B) $260,000.

C) $110,000.

D) $65,000.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

46

Ending inventory is equal to the cost of items on hand plus:

A) Items in transit sold FOB shipping point.

B) Sales discounts.

C) Items in transit sold FOB destination.

D) Advertising expense.

A) Items in transit sold FOB shipping point.

B) Sales discounts.

C) Items in transit sold FOB destination.

D) Advertising expense.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

47

Given the information in the table below, what is the company's gross profit?

A) $280,000.

B) $170,000.

C) $50,000.

D) $100,000.

A) $280,000.

B) $170,000.

C) $50,000.

D) $100,000.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

48

Merchandise sold FOB destination indicates that:

A) The seller holds title until the merchandise is received at the buyer's location.

B) The merchandise has not yet been shipped.

C) The merchandise will not be shipped until payment has been received.

D) The seller transfers title to the buyer once the merchandise is shipped.

A) The seller holds title until the merchandise is received at the buyer's location.

B) The merchandise has not yet been shipped.

C) The merchandise will not be shipped until payment has been received.

D) The seller transfers title to the buyer once the merchandise is shipped.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

49

If A sells to B, and B obtains title while goods are in transit, the goods were shipped. If C sells to D, and C maintains title until the goods arrive at D's door then the goods were shipped.

A) FOB shipping point, FOB destination.

B) FOB destination, FOB shipping point.

C) FOB destination, FOB destination.

D) FOB shipping point, FOB shipping point.

A) FOB shipping point, FOB destination.

B) FOB destination, FOB shipping point.

C) FOB destination, FOB destination.

D) FOB shipping point, FOB shipping point.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

50

LeGrand Corporation reported the following amounts in its income statement: What was LeGrand's gross profit?

A) $260,000.

B) $180,000.

C) $220,000.

D) $120,000.

A) $260,000.

B) $180,000.

C) $220,000.

D) $120,000.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

51

Davis Hardware Company uses a perpetual inventory system. How should Davis record the return of inventory previously purchased on account for $200?

A)

B)

Inventory

200

C)

Accounts Payable

D) Accounts Payable

Purchase Returns

A)

B)

Inventory

200

C)

Accounts Payable

D) Accounts Payable

Purchase Returns

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

52

On May 1, Ace Bonding Company purchased inventory costing $2,000 on account with terms 2/10, n/30. On May 18, Ace pays for this inventory and records which of the following using a perpetual inventory system?

A) Accounts Payable

Cash

B)

Inventory

Cash

C) Accounts Payable

Inventory

Cash

D) Cash

Accounts Payable

A) Accounts Payable

Cash

B)

Inventory

Cash

C) Accounts Payable

Inventory

Cash

D) Cash

Accounts Payable

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

53

LeGrand Corporation reported the following amounts in its income statement: What was LeGrand's net income?

A) $120,000.

B) $60,000.

C) $110,000.

D) $65,000.

A) $120,000.

B) $60,000.

C) $110,000.

D) $65,000.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

54

Consider the following information pertaining to OldWest's inventory: At what amount should OldWest report its inventory?

A) $3,213.

B) $3,386.

C) $2,996.

D) $2,906.

A) $3,213.

B) $3,386.

C) $2,996.

D) $2,906.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

55

Ace Bonding Company purchased inventory on account. The inventory costs $2,000 and is expected to sell for $3,000. How should Ace record the purchase using a perpetual inventory system?

A) Inventory

Accounts Payable

B)

Unearned Revenue

Sales Revenue

C) Cost of Goods Sold

Accounts Payable

D) Cost of Goods Sold

Gain

Accounts Payable

A) Inventory

Accounts Payable

B)

Unearned Revenue

Sales Revenue

C) Cost of Goods Sold

Accounts Payable

D) Cost of Goods Sold

Gain

Accounts Payable

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

56

Consider the following year-end information for Spitzer Corporation: What amount will Spitzer report for operating income?

A) $200,000

B) $210,000

C) $380,000

D) $120,000

A) $200,000

B) $210,000

C) $380,000

D) $120,000

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

57

Suppose Company A places an order with Company B on May 12. On May 14, Company B ships the ordered goods to Company A with terms FOB destination. The goods arrive at Company A on May 17. Company A begins selling the goods to customers on May 19 and pays Company B on May 20. When would Company B record the sale of goods to Company A?

A) May 12

B) May 14

C) May 19

D) May 17

A) May 12

B) May 14

C) May 19

D) May 17

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

58

The distinction between operating and nonoperating income relates to:

A) Continuity of income.

B) Principal activities of the reporting entity.

C) Consistency of income stream.

D) Reliability of measurements.

A) Continuity of income.

B) Principal activities of the reporting entity.

C) Consistency of income stream.

D) Reliability of measurements.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

59

Under the principle of lower-of-cost-or-market, when a company has 10 units of inventory A with market value of $50 and a cost of $60, what is the adjustment?

A) Debit Inventory $100; credit Cost of Goods Sold $100.

B) Debit Inventory $500; credit Cost of Goods Sold $500.

C) Debit Cost of Goods Sold $100; credit Inventory $100.

D) Debit Cost of Goods Sold $500; credit Inventory $500.

A) Debit Inventory $100; credit Cost of Goods Sold $100.

B) Debit Inventory $500; credit Cost of Goods Sold $500.

C) Debit Cost of Goods Sold $100; credit Inventory $100.

D) Debit Cost of Goods Sold $500; credit Inventory $500.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

60

Merchandise sold FOB shipping point indicates that:

A) The seller holds title until the merchandise is received at the buyer's location.

B) The merchandise has not yet been shipped.

C) The merchandise will not be shipped until payment has been received.

D) The seller transfers title to the buyer once the merchandise is shipped.

A) The seller holds title until the merchandise is received at the buyer's location.

B) The merchandise has not yet been shipped.

C) The merchandise will not be shipped until payment has been received.

D) The seller transfers title to the buyer once the merchandise is shipped.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

61

Nu Company reported the following data for its first year of operations: What is Nu's gross profit ratio?

A) 80%.

B) 49%.

C) 40%.

D) 5%.

A) 80%.

B) 49%.

C) 40%.

D) 5%.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

62

After applying the lower-of-cost-or-market method, the accountant prepares a year-end adjustment. That adjustment would:

A) Decrease the company's cost of goods sold.

B) Reduce the company's stockholders' equity.

C) Increase the company's inventory.

D) Increase the company's total assets.

A) Decrease the company's cost of goods sold.

B) Reduce the company's stockholders' equity.

C) Increase the company's inventory.

D) Increase the company's total assets.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

63

Anthony Corporation reported the following amounts for the year: Anthony's gross profit ratio is:

A) 53.4%.

B) 51.9%.

C) 50.3%.

D) 46.6%.

A) 53.4%.

B) 51.9%.

C) 50.3%.

D) 46.6%.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

64

Davis Hardware Company uses a periodic inventory system. How should Davis record the sale of inventory costing $620 for $960 on account?

A)

B) Accounts Receivable

Sales Revenue

C)

D)

A)

B) Accounts Receivable

Sales Revenue

C)

D)

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

65

Consider the following inventory data: What is the average days in inventory for the year?

A) 126.7 days.

B) 101.4 days.

C) 152.0 days.

D) 111.7 days.

A) 126.7 days.

B) 101.4 days.

C) 152.0 days.

D) 111.7 days.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

66

Northern Town Equipment has four types of products in its inventory. Northern applies the rules under lower-of-cost or market (LCM) to its inventory at the end of each year as shown below: The year-end adjustment based upon the information above would include a:

A) Debit to Cost of Goods Sold $65.

B) Credit to Inventory $50.

C) Debit to Inventory $65.

D) Debit to Cost of Goods Sold $50.

A) Debit to Cost of Goods Sold $65.

B) Credit to Inventory $50.

C) Debit to Inventory $65.

D) Debit to Cost of Goods Sold $50.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

67

In a periodic inventory system, the purchase of inventory is debited to:

A) Purchases.

B) Cost of goods sold.

C) Inventory.

D) Accounts payable.

A) Purchases.

B) Cost of goods sold.

C) Inventory.

D) Accounts payable.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

68

At the end of a reporting period, Gamble Corporation determines that its ending inventory has a cost of $300,000 and a market value of $230,000. What would be the effect(s) of the adjustment to write down inventory to market value?

A) Decrease total assets.

B) Decrease net income.

C) Increase retained earnings.

D) a and b.

A) Decrease total assets.

B) Decrease net income.

C) Increase retained earnings.

D) a and b.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

69

The practice of using the lower-of-cost-or-market to evaluate inventory reflects which of the following accounting principles?

A) Matching principle.

B) Revenue recognition.

C) Conservatism.

D) Materiality.

A) Matching principle.

B) Revenue recognition.

C) Conservatism.

D) Materiality.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

70

Anthony Corporation reported the following amounts for the year: Anthony's average days in inventory is:

A) 170 days.

B) 114 days.

C) 132 days.

D) 151 days.

A) 170 days.

B) 114 days.

C) 132 days.

D) 151 days.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

71

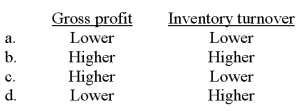

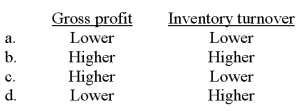

Company A is identical to Company B in every regard except that Company A uses FIFO and Company B uses LIFO. In an extended period of rising inventory costs, Company A's gross profit and inventory turnover, compared to Company B's, would be:

A) Option a

B) Option b

C) Option c

D) Option d

A) Option a

B) Option b

C) Option c

D) Option d

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

72

The inventory method that will always produce the same amount for cost of goods sold in a periodic inventory system as in a perpetual inventory system would be:

A) FIFO.

B) LIFO.

C) Weighted average.

D) Each method always produces a different amount.

A) FIFO.

B) LIFO.

C) Weighted average.

D) Each method always produces a different amount.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

73

Consider the following inventory data for two companies: Which of these companies had the higher inventory turnover ratio?

A) Nichols.

B) Winters.

C) The ratios are the same for both companies.

D) Cannot determine with the information given.

A) Nichols.

B) Winters.

C) The ratios are the same for both companies.

D) Cannot determine with the information given.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

74

Good, Inc. sold inventory for $1,200 that was purchased for $700. Good records which of the following when it sells inventory using a periodic inventory system?

A) No entry is required for cost of goods sold and inventory.

B) Debit Cost of Goods Sold $700; credit Inventory $700.

C) Debit Cost of Goods Sold $1,200; credit Inventory $1,200.

D) Debit Inventory $700; credit Cost of Goods Sold $700.

A) No entry is required for cost of goods sold and inventory.

B) Debit Cost of Goods Sold $700; credit Inventory $700.

C) Debit Cost of Goods Sold $1,200; credit Inventory $1,200.

D) Debit Inventory $700; credit Cost of Goods Sold $700.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

75

Anthony Corporation reported the following amounts for the year: Anthony's inventory turnover ratio is:

A) 2.42.

B) 2.76.

C) 3.21.

D) 2.14.

A) 2.42.

B) 2.76.

C) 3.21.

D) 2.14.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

76

In a periodic inventory system, at the time of a sale the cost of inventory sold is:

A) Debited to Accounts Receivable.

B) Credited to Cost of Goods Sold.

C) Debited to Cost of Goods Sold.

D) Not recorded at this time.

A) Debited to Accounts Receivable.

B) Credited to Cost of Goods Sold.

C) Debited to Cost of Goods Sold.

D) Not recorded at this time.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

77

The primary difference between the periodic and perpetual inventory systems is:

A) The reported amount of ending inventory is higher under the periodic system.

B) The perpetual system maintains a continual record of inventory transactions, whereas the periodic system records these transactions only at the end of the period.

C) The reported amount of sales revenue is higher under the periodic inventory system.

D) The reported amount of cost of goods sold is higher under the perpetual inventory system.

A) The reported amount of ending inventory is higher under the periodic system.

B) The perpetual system maintains a continual record of inventory transactions, whereas the periodic system records these transactions only at the end of the period.

C) The reported amount of sales revenue is higher under the periodic inventory system.

D) The reported amount of cost of goods sold is higher under the perpetual inventory system.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

78

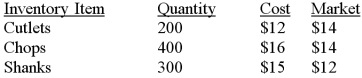

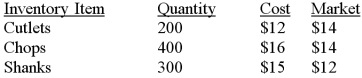

Using the information below, determine the ending inventory value applying the lower-of-cost-or-market method.

A) $13,300.

B) $12,000.

C) $11,600.

D) $13,700.

A) $13,300.

B) $12,000.

C) $11,600.

D) $13,700.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

79

Northwest Fur Co. started the year with $94,000 of merchandise inventory on hand. During the year, $400,000 in merchandise was purchased on account with credit terms of 1/15, n/45. All discounts were taken. Northwest paid freight-in charges of $7,500. Merchandise with an invoice amount of $5,000 was returned for credit. Cost of goods sold for the year was $380,000. What is ending inventory?

A) $112,490.

B) $112,550.

C) $116,500.

D) $120,300.

A) $112,490.

B) $112,550.

C) $116,500.

D) $120,300.

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck

80

Davis Hardware Company uses a periodic inventory system. How should Davis record the return of inventory previously purchased on account for $200?

A)

B)

C) Purchase Returns

Accounts payable

D) Accounts Payable

Purchase Returns

A)

B)

C) Purchase Returns

Accounts payable

D) Accounts Payable

Purchase Returns

Unlock Deck

Unlock for access to all 189 flashcards in this deck.

Unlock Deck

k this deck