Deck 8: Flexible Budgets, Standard Costs, and Variance Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/173

Play

Full screen (f)

Deck 8: Flexible Budgets, Standard Costs, and Variance Analysis

1

The number of units to be produced in a period can be determined by adding the expected sales to the beginning inventory and then deducting the desired ending inventory.

False

2

The basic idea underlying responsibility accounting is that each manager should be held responsible for the overall profit of the company to ensure that all managers are acting together.

False

3

In a merchandising company, the required merchandise purchases for a period are determined by subtracting the desired ending inventory from the sum of the units to be sold during the period and the units in beginning inventory.

False

4

Self-imposed budgets prepared by lower-level managers should be scrutinized by higher levels of management.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

5

The manufacturing overhead budget is typically prepared before the production budget.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

6

The first budget a company prepares in a master budget is the production budget.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

7

Budgets are used to plan and to control operations.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

8

A benefit of self-imposed budgeting is that it may allow lower-level managers to create budgetary slack.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

9

The sales budget is usually prepared before the production budget.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

10

A self-imposed budget is a budget that is prepared with the full cooperation and participation of managers at all levels.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

11

The sales budget often includes a schedule of expected cash collections.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

12

The cash budget is typically prepared before the direct materials budget.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

13

In business, a budget is a method for putting a limit on spending.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

14

Planning involves gathering feedback to ensure that the plan is being properly executed or modified as circumstances change.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

15

A continuous or perpetual budget is a budget that almost never needs to be revised.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

16

One disadvantage of a self-imposed budget is that budget estimates prepared by front-line managers are often less accurate and reliable than estimates prepared by top managers.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

17

When preparing a direct materials budget, the units of raw material needed to meet production should be added to desired ending inventory and the beginning inventory for raw materials should be subtracted to determine the amount of raw materials to be purchased.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

18

In companies that do not have "no lay-off" policies, the total direct labor cost for a budget period is computed by multiplying the total direct labor hours needed to make the budgeted output of completed units by the direct labor wage rate.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

19

The direct materials budget is typically prepared before the production budget.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

20

The cash budget is usually prepared after the budgeted income statement.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

21

The manufacturing overhead budget lists all costs of production other than selling and administrative expenses.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

22

Trumbull Corporation budgeted sales on account of $120,000 for July, $211,000 for August, and $198,000 for September. Experience indicates that none of the sales on account will be collected in the month of the sale, 60% will be collected the month after the sale, 36% in the second month, and 4% will be uncollectible. The cash receipts from accounts receivable that should be budgeted for September would be:

A)$169,800

B)$147,960

C)$197,880

D)$194,760

A)$169,800

B)$147,960

C)$197,880

D)$194,760

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

23

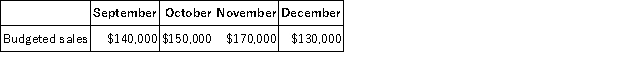

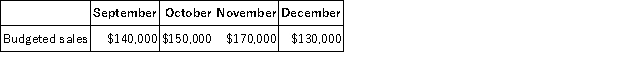

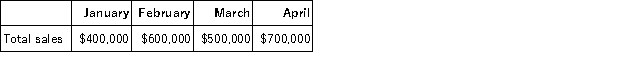

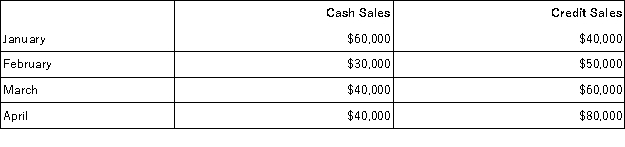

Budgeted sales in Acer Corporation over the next four months are given below:  Twenty-five percent of the company's sales are for cash and 75% are on account. Collections for sales on account follow a stable pattern as follows: 50% of a month's credit sales are collected in the month of sale, 30% are collected in the month following sale, and 15% are collected in the second month following sale. The remainder are uncollectible. Given these data, cash collections for December should be:

Twenty-five percent of the company's sales are for cash and 75% are on account. Collections for sales on account follow a stable pattern as follows: 50% of a month's credit sales are collected in the month of sale, 30% are collected in the month following sale, and 15% are collected in the second month following sale. The remainder are uncollectible. Given these data, cash collections for December should be:

A)$103,875

B)$98,125

C)$136,375

D)$119,500

Twenty-five percent of the company's sales are for cash and 75% are on account. Collections for sales on account follow a stable pattern as follows: 50% of a month's credit sales are collected in the month of sale, 30% are collected in the month following sale, and 15% are collected in the second month following sale. The remainder are uncollectible. Given these data, cash collections for December should be:

Twenty-five percent of the company's sales are for cash and 75% are on account. Collections for sales on account follow a stable pattern as follows: 50% of a month's credit sales are collected in the month of sale, 30% are collected in the month following sale, and 15% are collected in the second month following sale. The remainder are uncollectible. Given these data, cash collections for December should be:A)$103,875

B)$98,125

C)$136,375

D)$119,500

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

24

The direct labor budget is based on:

A)the desired ending inventory of finished goods.

B)the beginning inventory of finished goods.

C)the required production for the period.

D)the required materials purchases for the period.

A)the desired ending inventory of finished goods.

B)the beginning inventory of finished goods.

C)the required production for the period.

D)the required materials purchases for the period.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

25

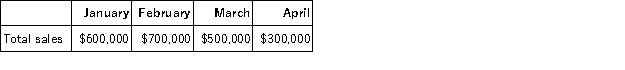

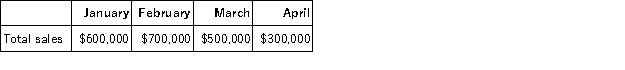

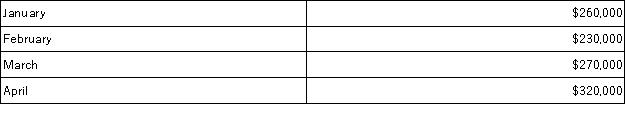

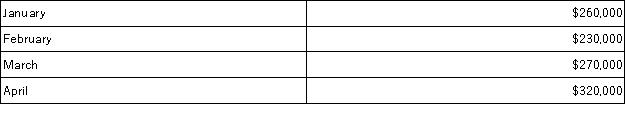

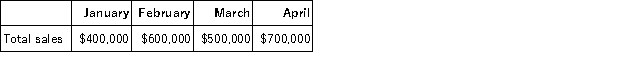

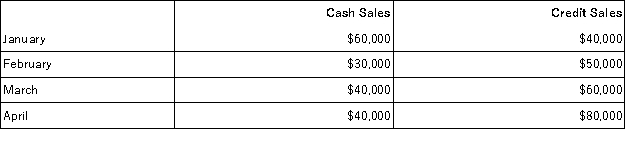

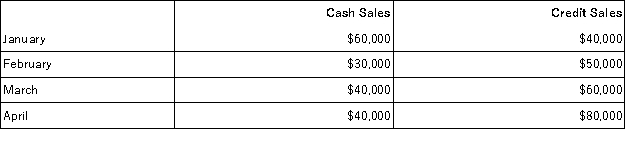

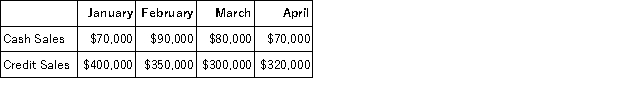

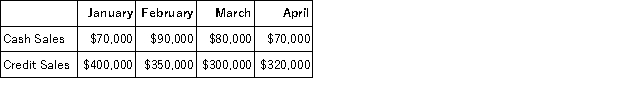

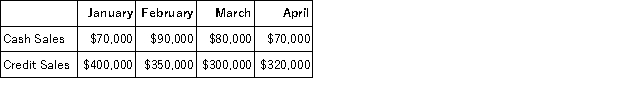

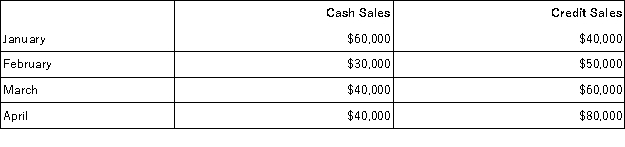

Seventy percent of Parlee Corporation's sales are collected in the month of sale, 25% in the month following sale, and 5% in the second month following sale. The following are budgeted sales data for the company:  Total budgeted cash collections in April would be:

Total budgeted cash collections in April would be:

A)$35,000

B)$125,000

C)$210,000

D)$370,000

Total budgeted cash collections in April would be:

Total budgeted cash collections in April would be:A)$35,000

B)$125,000

C)$210,000

D)$370,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

26

The budgeted selling and administrative expense is calculated by multiplying the budgeted unit sales by the selling and administrative expense per unit.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

27

Only variable manufacturing overhead costs are included in the manufacturing overhead budget.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following represents the normal sequence in which the below budgets are prepared?

A)Sales Budget, Budgeted Balance Sheet, Budgeted Income Statement

B)Budgeted Balance Sheet, Sales Budget, Budgeted Income Statement

C)Sales Budget, Budgeted Income Statement, Budgeted Balance Sheet

D)Budgeted Income Statement, Sales Budget, Budgeted Balance Sheet

A)Sales Budget, Budgeted Balance Sheet, Budgeted Income Statement

B)Budgeted Balance Sheet, Sales Budget, Budgeted Income Statement

C)Sales Budget, Budgeted Income Statement, Budgeted Balance Sheet

D)Budgeted Income Statement, Sales Budget, Budgeted Balance Sheet

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

29

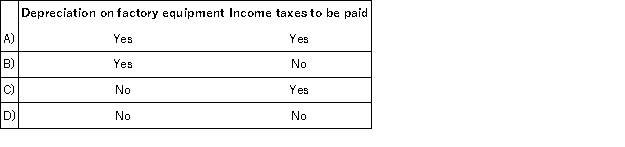

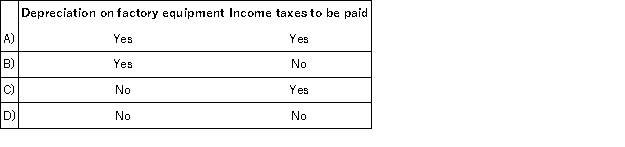

Which of the following might be included as a disbursement on a cash budget?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

30

The direct labor budget shows the direct labor-hours required to produce the desired ending inventory.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

31

All the following are considered to be benefits of participative budgeting, except for:

A)Individuals at all organizational levels are recognized as being part of a team; this results in greater support for the organization.

B)The budget estimates are prepared by those in directly involved in activities.

C)When managers set their own targets for the budget, top management need not be concerned with the overall profitability of operations.

D)Managers are held responsible for reaching their goals and cannot easily shift responsibility by blaming unrealistic goals set by others.

A)Individuals at all organizational levels are recognized as being part of a team; this results in greater support for the organization.

B)The budget estimates are prepared by those in directly involved in activities.

C)When managers set their own targets for the budget, top management need not be concerned with the overall profitability of operations.

D)Managers are held responsible for reaching their goals and cannot easily shift responsibility by blaming unrealistic goals set by others.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

32

Both variable and fixed manufacturing overhead costs are included in the selling and administrative expense budget.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following is NOT an objective of the budgeting process?

A)To communicate management's plans throughout the entire organization.

B)To provide a means of allocating resources to those parts of the organization where they can be used most effectively.

C)To ensure that the company continues to grow.

D)To uncover potential bottlenecks before they occur.

A)To communicate management's plans throughout the entire organization.

B)To provide a means of allocating resources to those parts of the organization where they can be used most effectively.

C)To ensure that the company continues to grow.

D)To uncover potential bottlenecks before they occur.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

34

Sioux Corporation is estimating the following sales for the first four months of next year:  Sales are normally collected 60% in the month of sale, 35% in the month following the sale, and the remaining 5% being uncollectible. Based on this information, how much cash should Sioux expect to collect during the month of April?

Sales are normally collected 60% in the month of sale, 35% in the month following the sale, and the remaining 5% being uncollectible. Based on this information, how much cash should Sioux expect to collect during the month of April?

A)$286,500

B)$320,000

C)$192,000

D)$94,500

Sales are normally collected 60% in the month of sale, 35% in the month following the sale, and the remaining 5% being uncollectible. Based on this information, how much cash should Sioux expect to collect during the month of April?

Sales are normally collected 60% in the month of sale, 35% in the month following the sale, and the remaining 5% being uncollectible. Based on this information, how much cash should Sioux expect to collect during the month of April?A)$286,500

B)$320,000

C)$192,000

D)$94,500

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

35

The budget method that maintains a constant twelve-month planning horizon by adding a new month on the end as the current month is completed is called:

A)an operating budget.

B)a capital budget.

C)a continuous budget.

D)a master budget.

A)an operating budget.

B)a capital budget.

C)a continuous budget.

D)a master budget.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

36

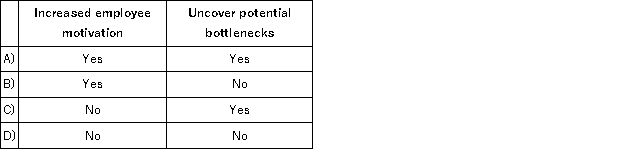

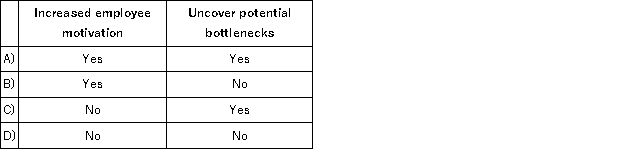

Which of the following benefits could an organization reasonably expect from an effective budget program?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

37

When preparing a production budget, the required production equals:

A)budgeted sales + beginning inventory + desired ending inventory.

B)budgeted sales - beginning inventory + desired ending inventory.

C)budgeted sales - beginning inventory - desired ending inventory.

D)budgeted sales + beginning inventory - desired ending inventory.

A)budgeted sales + beginning inventory + desired ending inventory.

B)budgeted sales - beginning inventory + desired ending inventory.

C)budgeted sales - beginning inventory - desired ending inventory.

D)budgeted sales + beginning inventory - desired ending inventory.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

38

On a cash budget, the total amount of budgeted cash payments for manufacturing overhead should not include any amounts for depreciation on factory equipment.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

39

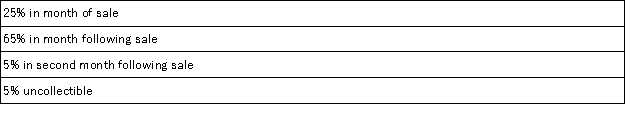

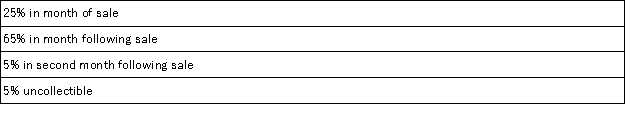

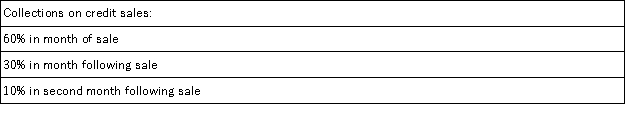

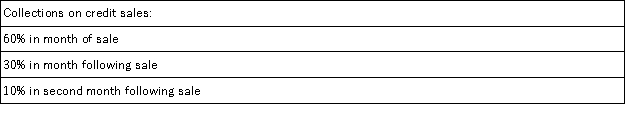

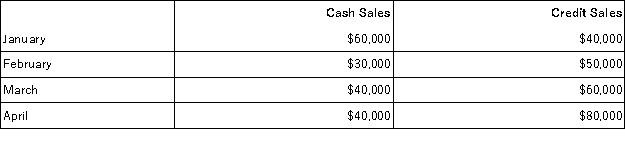

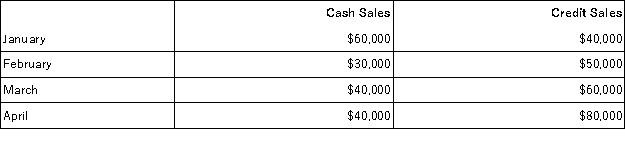

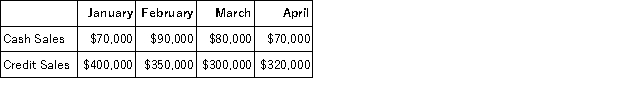

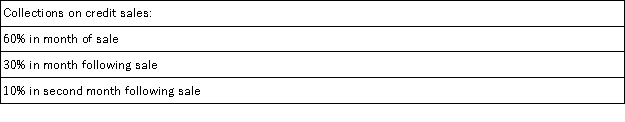

The WRT Corporation makes collections on sales according to the following schedule:  The following sales have been budgeted:

The following sales have been budgeted:  Budgeted cash collections in June would be:

Budgeted cash collections in June would be:

A)$27,500

B)$98,500

C)$71,000

D)$115,500

The following sales have been budgeted:

The following sales have been budgeted:  Budgeted cash collections in June would be:

Budgeted cash collections in June would be:A)$27,500

B)$98,500

C)$71,000

D)$115,500

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

40

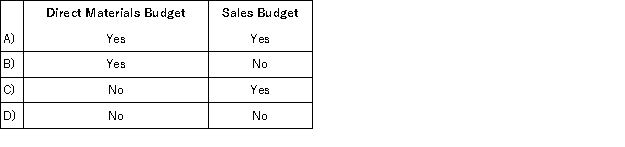

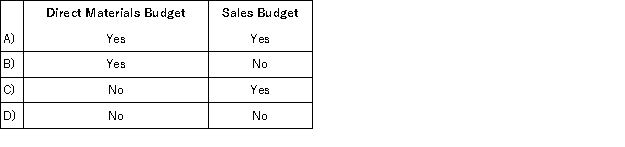

Which of the following budgets are prepared before the production budget?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

41

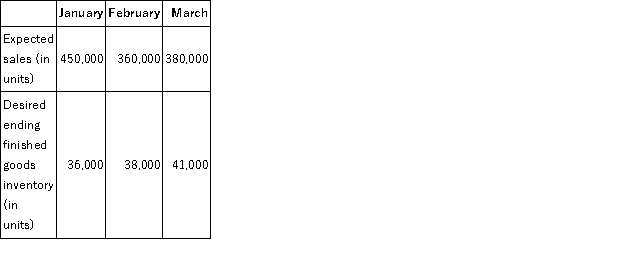

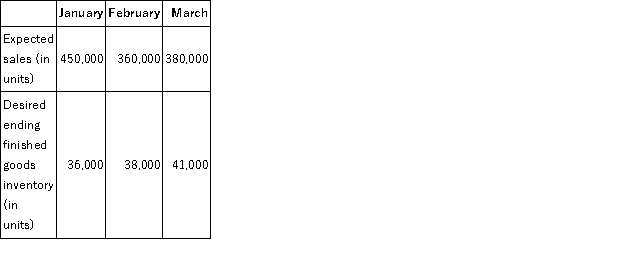

The following information relates to Marter Manufacturing Corporation for next quarter:  How many units should the company plan on producing for the month of February?

How many units should the company plan on producing for the month of February?

A)360,000 units

B)362,000 units

C)358,000 units

D)398,000 units

How many units should the company plan on producing for the month of February?

How many units should the company plan on producing for the month of February?A)360,000 units

B)362,000 units

C)358,000 units

D)398,000 units

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

42

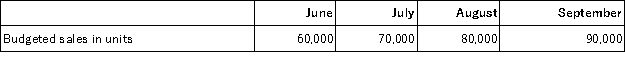

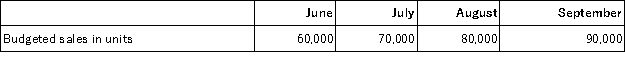

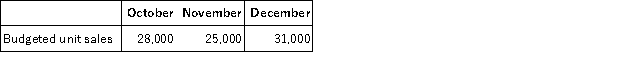

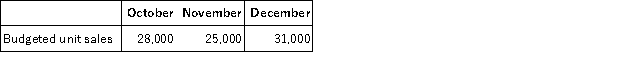

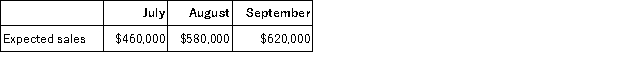

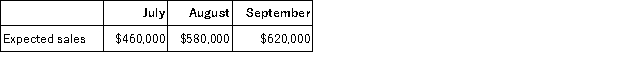

Mutskic Corporation produces and sells Product BetaC. To guard against stockouts, the company requires that 30% of the next month's sales be on hand at the end of each month. Budgeted sales of Product BetaC over the next four months are:  Budgeted production for August would be:

Budgeted production for August would be:

A)83,000 units

B)107,000 units

C)77,000 units

D)80,000 units

Budgeted production for August would be:

Budgeted production for August would be:A)83,000 units

B)107,000 units

C)77,000 units

D)80,000 units

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

43

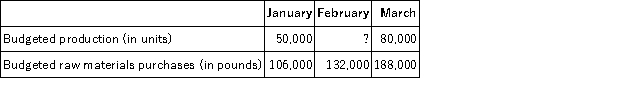

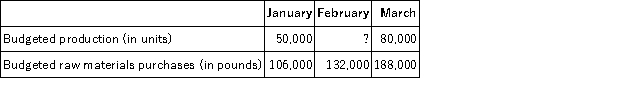

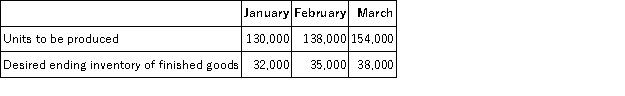

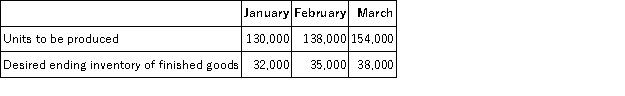

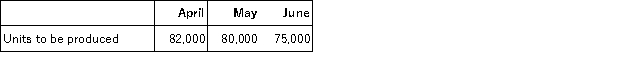

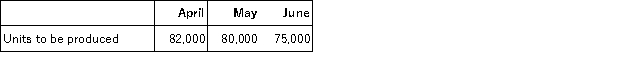

Marst Corporation's budgeted production in units and budgeted raw materials purchases over the next three months are given below:  Two pounds of raw materials are required to produce one unit of product. The company wants raw materials on hand at the end of each month equal to 30% of the following month's production needs. The company is expected to have 30,000 pounds of raw materials on hand on January 1. Budgeted production for February should be:

Two pounds of raw materials are required to produce one unit of product. The company wants raw materials on hand at the end of each month equal to 30% of the following month's production needs. The company is expected to have 30,000 pounds of raw materials on hand on January 1. Budgeted production for February should be:

A)60,000 units

B)54,000 units

C)84,000 units

D)108,000 units

Two pounds of raw materials are required to produce one unit of product. The company wants raw materials on hand at the end of each month equal to 30% of the following month's production needs. The company is expected to have 30,000 pounds of raw materials on hand on January 1. Budgeted production for February should be:

Two pounds of raw materials are required to produce one unit of product. The company wants raw materials on hand at the end of each month equal to 30% of the following month's production needs. The company is expected to have 30,000 pounds of raw materials on hand on January 1. Budgeted production for February should be:A)60,000 units

B)54,000 units

C)84,000 units

D)108,000 units

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

44

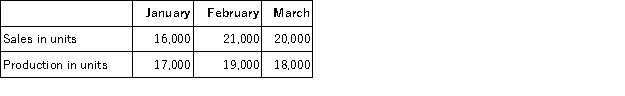

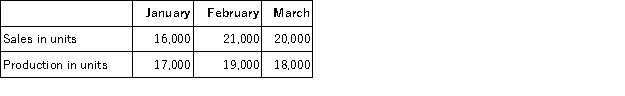

The following information was taken from the production budget of Paeke Corporation for next quarter:  How many units is the company expecting to sell in the month of February?

How many units is the company expecting to sell in the month of February?

A)132,000

B)138,000

C)135,000

D)140,000

How many units is the company expecting to sell in the month of February?

How many units is the company expecting to sell in the month of February?A)132,000

B)138,000

C)135,000

D)140,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

45

Starg Corporation, a retailer, plans to sell 25,000 units of Product X during the month of August. If the company has 9,000 units on hand at the start of the month, and plans to have 7,000 units on hand at the end of the month, how many units of Product X must be purchased from the supplier during the month?

A)32,000

B)23,000

C)27,000

D)25,000

A)32,000

B)23,000

C)27,000

D)25,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

46

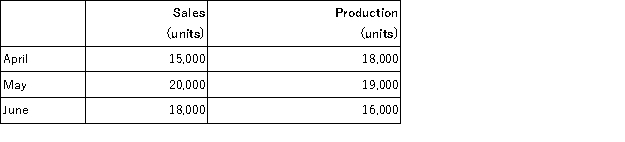

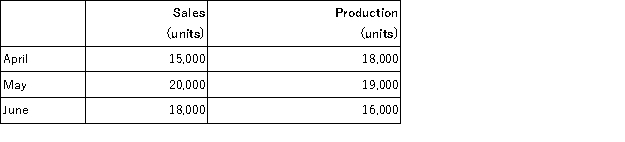

The following are budgeted data:  One pound of material is required for each finished unit. The inventory of materials at the end of each month should equal 20% of the following month's production needs. Purchases of raw materials for February would be budgeted to be:

One pound of material is required for each finished unit. The inventory of materials at the end of each month should equal 20% of the following month's production needs. Purchases of raw materials for February would be budgeted to be:

A)19,000 pounds

B)19,200 pounds

C)23,000 pounds

D)18,800 pounds

One pound of material is required for each finished unit. The inventory of materials at the end of each month should equal 20% of the following month's production needs. Purchases of raw materials for February would be budgeted to be:

One pound of material is required for each finished unit. The inventory of materials at the end of each month should equal 20% of the following month's production needs. Purchases of raw materials for February would be budgeted to be:A)19,000 pounds

B)19,200 pounds

C)23,000 pounds

D)18,800 pounds

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

47

Paradise Corporation budgets on an annual basis for its fiscal year. The following beginning and ending inventory levels (in units) are planned for next year.  *Three pounds of raw material are needed to produce each unit of finished product. If Paradise Corporation plans to sell 480,000 units during next year, the number of units it would have to manufacture during the year would be:

*Three pounds of raw material are needed to produce each unit of finished product. If Paradise Corporation plans to sell 480,000 units during next year, the number of units it would have to manufacture during the year would be:

A)440,000 units

B)480,000 units

C)510,000 units

D)450,000 units

*Three pounds of raw material are needed to produce each unit of finished product. If Paradise Corporation plans to sell 480,000 units during next year, the number of units it would have to manufacture during the year would be:

*Three pounds of raw material are needed to produce each unit of finished product. If Paradise Corporation plans to sell 480,000 units during next year, the number of units it would have to manufacture during the year would be:A)440,000 units

B)480,000 units

C)510,000 units

D)450,000 units

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

48

The following are budgeted data:  Two pounds of material are required for each finished unit. The inventory of materials at the end of each month should equal 20% of the following month's production needs. Purchases of raw materials for May should be:

Two pounds of material are required for each finished unit. The inventory of materials at the end of each month should equal 20% of the following month's production needs. Purchases of raw materials for May should be:

A)39,200 pounds

B)52,000 pounds

C)36,800 pounds

D)38,000 pounds

Two pounds of material are required for each finished unit. The inventory of materials at the end of each month should equal 20% of the following month's production needs. Purchases of raw materials for May should be:

Two pounds of material are required for each finished unit. The inventory of materials at the end of each month should equal 20% of the following month's production needs. Purchases of raw materials for May should be:A)39,200 pounds

B)52,000 pounds

C)36,800 pounds

D)38,000 pounds

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

49

Milano Corporation is working on its direct labor budget for the next two months. Each unit of output requires 0.50 direct labor-hours. The direct labor rate is $9.80 per direct labor-hour. The production budget calls for producing 6,400 units in October and 6,300 units in November. If the direct labor work force is fully adjusted to the total direct labor-hours needed each month, what would be the total combined direct labor cost for the two months?

A)$30,870

B)$31,360

C)$62,230

D)$31,115

A)$30,870

B)$31,360

C)$62,230

D)$31,115

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

50

Fab Manufacturing Corporation manufactures and sells stainless steel coffee mugs. Expected mug sales at Fab (in units) for the next three months are as follows:  Fab likes to maintain a finished goods inventory equal to 30% of the next month's estimated sales. How many mugs should Fab plan on producing during the month of November?

Fab likes to maintain a finished goods inventory equal to 30% of the next month's estimated sales. How many mugs should Fab plan on producing during the month of November?

A)23,200 mugs

B)26,800 mugs

C)25,900 mugs

D)34,300 mugs

Fab likes to maintain a finished goods inventory equal to 30% of the next month's estimated sales. How many mugs should Fab plan on producing during the month of November?

Fab likes to maintain a finished goods inventory equal to 30% of the next month's estimated sales. How many mugs should Fab plan on producing during the month of November?A)23,200 mugs

B)26,800 mugs

C)25,900 mugs

D)34,300 mugs

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

51

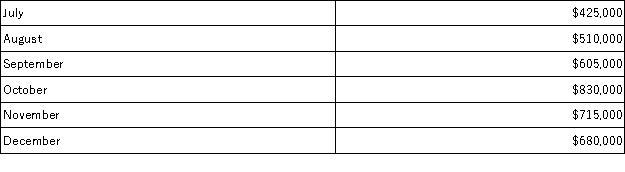

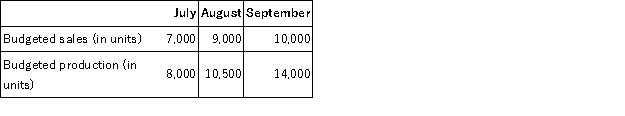

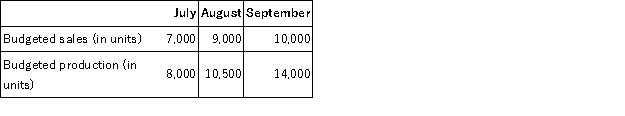

Frodic Corporation has budgeted sales and production over the next quarter as follows:  The company has 4,000 units of product on hand at July 1. 10% of the next month's sales in units should be on hand at the end of each month. October sales are expected to be 71,500 units. Budgeted sales for September would be (in units):

The company has 4,000 units of product on hand at July 1. 10% of the next month's sales in units should be on hand at the end of each month. October sales are expected to be 71,500 units. Budgeted sales for September would be (in units):

A)65,000

B)61,000

C)55,000

D)57,000

The company has 4,000 units of product on hand at July 1. 10% of the next month's sales in units should be on hand at the end of each month. October sales are expected to be 71,500 units. Budgeted sales for September would be (in units):

The company has 4,000 units of product on hand at July 1. 10% of the next month's sales in units should be on hand at the end of each month. October sales are expected to be 71,500 units. Budgeted sales for September would be (in units):A)65,000

B)61,000

C)55,000

D)57,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

52

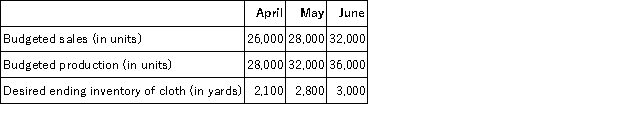

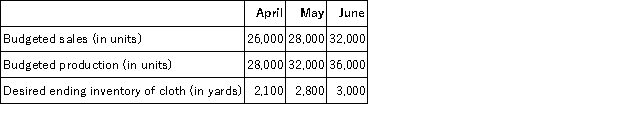

Rhett Corporation manufactures and sells dress shirts. Each shirt (unit) requires 3 yards of cloth. Selected data from Rhett's master budget for next quarter are shown below:  How many yards of cloth should Rhett plan on purchasing in May?

How many yards of cloth should Rhett plan on purchasing in May?

A)84,700 yards

B)96,700 yards

C)98,100 yards

D)98,800 yards

How many yards of cloth should Rhett plan on purchasing in May?

How many yards of cloth should Rhett plan on purchasing in May?A)84,700 yards

B)96,700 yards

C)98,100 yards

D)98,800 yards

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

53

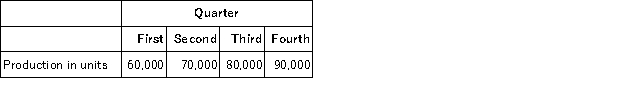

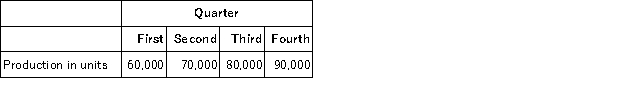

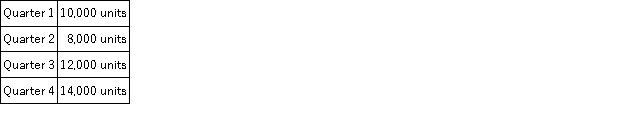

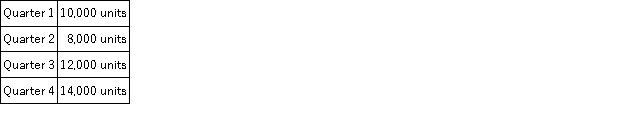

Prester Corporation has budgeted production for next year as follows:

Two pounds of material A are required for each unit produced. The company has a policy of maintaining a stock of material A on hand at the end of each quarter equal to 25% of the next quarter's production needs for materialA. A total of 30,000 pounds of material A are on hand to start the year. Budgeted purchases of material A for the second quarter would be:

A)145,000 pounds

B)140,000 pounds

C)135,000 pounds

Two pounds of material A are required for each unit produced. The company has a policy of maintaining a stock of material A on hand at the end of each quarter equal to 25% of the next quarter's production needs for materialA. A total of 30,000 pounds of material A are on hand to start the year. Budgeted purchases of material A for the second quarter would be:

A)145,000 pounds

B)140,000 pounds

C)135,000 pounds

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

54

G Products Inc., manufactures garlic gravy. G's production budget indicated the following units (jars) of gravy to be produced for the upcoming months indicated:  Five grams of garlic are needed for every jar of gravy. G also likes to have enough garlic on hand at the end of the month to cover 10% of the next month's production requirements for garlic. How many grams of garlic should G plan on purchasing during the month of May?

Five grams of garlic are needed for every jar of gravy. G also likes to have enough garlic on hand at the end of the month to cover 10% of the next month's production requirements for garlic. How many grams of garlic should G plan on purchasing during the month of May?

A)397,500 grams

B)399,500 grams

C)407,500 grams

D)437,500 grams

Five grams of garlic are needed for every jar of gravy. G also likes to have enough garlic on hand at the end of the month to cover 10% of the next month's production requirements for garlic. How many grams of garlic should G plan on purchasing during the month of May?

Five grams of garlic are needed for every jar of gravy. G also likes to have enough garlic on hand at the end of the month to cover 10% of the next month's production requirements for garlic. How many grams of garlic should G plan on purchasing during the month of May?A)397,500 grams

B)399,500 grams

C)407,500 grams

D)437,500 grams

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

55

Parsons Corporation plans to sell 18,000 units during August. If the company has 5,500 units on hand at the start of the month, and plans to have 6,000 units on hand at the end of the month, how many units must be produced during the month?

A)24,000

B)18,500

C)19,500

D)17,500

A)24,000

B)18,500

C)19,500

D)17,500

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

56

Shocker Corporation's sales budget shows quarterly sales for the next year as follows: Unit sales  Corporation policy is to have a finished goods inventory at the end of each quarter equal to 20% of the next quarter's sales. Budgeted production for the second quarter of the next year would be:

Corporation policy is to have a finished goods inventory at the end of each quarter equal to 20% of the next quarter's sales. Budgeted production for the second quarter of the next year would be:

A)7,200 units

B)8,000 units

C)8,800 units

D)8,400 units

Corporation policy is to have a finished goods inventory at the end of each quarter equal to 20% of the next quarter's sales. Budgeted production for the second quarter of the next year would be:

Corporation policy is to have a finished goods inventory at the end of each quarter equal to 20% of the next quarter's sales. Budgeted production for the second quarter of the next year would be:A)7,200 units

B)8,000 units

C)8,800 units

D)8,400 units

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

57

All of Porter Corporation's sales are on account. Sixty percent of the credit sales are collected in the month of sale, 25% in the month following sale, and 10% in the second month following sale. The remainder are uncollectible. The following are budgeted sales data for the company:  Cash receipts in April are expected to be:

Cash receipts in April are expected to be:

A)$420,000

B)$545,000

C)$605,000

D)$185,000

Cash receipts in April are expected to be:

Cash receipts in April are expected to be:A)$420,000

B)$545,000

C)$605,000

D)$185,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

58

Morie Corporation is working on its direct labor budget for the next two months. Each unit of output requires 0.75 direct labor-hours. The direct labor rate is $8.10 per direct labor-hour. The production budget calls for producing 2,000 units in March and 2,300 units in April. The company guarantees its direct labor workers a 40-hour paid work week. With the number of workers currently employed, that means that the company is committed to paying its direct labor work force for at least 1,760 hours in total each month even if there is not enough work to keep them busy. What would be the total combined direct labor cost for the two months?

A)$28,512.00

B)$26,406.00

C)$28,228.50

D)$26,122.50

A)$28,512.00

B)$26,406.00

C)$28,228.50

D)$26,122.50

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

59

JT Department Store expects to generate the following sales for the next three months:  JT's cost of gods sold is 60% of sales dollars. At the end of each month, JT wants a merchandise inventory balance equal to 20% of the following month's expected cost of goods sold. What dollar amount of merchandise inventory should JT plan to purchase in August?

JT's cost of gods sold is 60% of sales dollars. At the end of each month, JT wants a merchandise inventory balance equal to 20% of the following month's expected cost of goods sold. What dollar amount of merchandise inventory should JT plan to purchase in August?

A)$257,400

B)$314,600

C)$352,800

D)$327,800

JT's cost of gods sold is 60% of sales dollars. At the end of each month, JT wants a merchandise inventory balance equal to 20% of the following month's expected cost of goods sold. What dollar amount of merchandise inventory should JT plan to purchase in August?

JT's cost of gods sold is 60% of sales dollars. At the end of each month, JT wants a merchandise inventory balance equal to 20% of the following month's expected cost of goods sold. What dollar amount of merchandise inventory should JT plan to purchase in August?A)$257,400

B)$314,600

C)$352,800

D)$327,800

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

60

On November 1, Barnes Corporation has 8,000 units of Product A on hand. During the month, the company plans to sell 30,000 units of Product A, and plans to have 6,500 units on hand at end of the month. How many units of Product A must be produced during the month?

A)28,500

B)31,500

C)30,000

D)36,500

A)28,500

B)31,500

C)30,000

D)36,500

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

61

Home Corporation will open a new store on January 1. Based on experience from its other retail outlets, Home Corporation is making the following sales projections:  Home Corporation estimates that 70% of the credit sales will be collected in the month following the month of sale, with the balance collected in the second month following the month of sale. In a cash budget for April, the total cash receipts will be:

Home Corporation estimates that 70% of the credit sales will be collected in the month following the month of sale, with the balance collected in the second month following the month of sale. In a cash budget for April, the total cash receipts will be:

A)$74,000

B)$57,000

C)$114,000

D)$97,000

Home Corporation estimates that 70% of the credit sales will be collected in the month following the month of sale, with the balance collected in the second month following the month of sale. In a cash budget for April, the total cash receipts will be:

Home Corporation estimates that 70% of the credit sales will be collected in the month following the month of sale, with the balance collected in the second month following the month of sale. In a cash budget for April, the total cash receipts will be:A)$74,000

B)$57,000

C)$114,000

D)$97,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

62

Richards Corporation has the following budgeted sales for the first half of next year:  The company is in the process of preparing a cash budget and must determine the expected cash collections by month. To this end, the following information has been assembled:

The company is in the process of preparing a cash budget and must determine the expected cash collections by month. To this end, the following information has been assembled:  The accounts receivable balance on January 1 is $70,000. Of this amount, $60,000 represents uncollected December sales and $10,000 represents uncollected November sales. The total cash collected during January would be:

The accounts receivable balance on January 1 is $70,000. Of this amount, $60,000 represents uncollected December sales and $10,000 represents uncollected November sales. The total cash collected during January would be:

A)$270,000

B)$420,000

C)$345,000

D)$360,000

The company is in the process of preparing a cash budget and must determine the expected cash collections by month. To this end, the following information has been assembled:

The company is in the process of preparing a cash budget and must determine the expected cash collections by month. To this end, the following information has been assembled:  The accounts receivable balance on January 1 is $70,000. Of this amount, $60,000 represents uncollected December sales and $10,000 represents uncollected November sales. The total cash collected during January would be:

The accounts receivable balance on January 1 is $70,000. Of this amount, $60,000 represents uncollected December sales and $10,000 represents uncollected November sales. The total cash collected during January would be:A)$270,000

B)$420,000

C)$345,000

D)$360,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

63

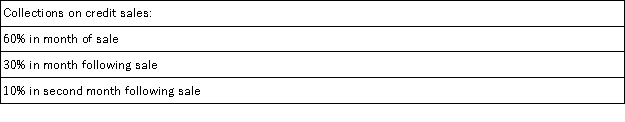

The Khaki Corporation has the following budgeted sales data:  The regular pattern of collection of credit sales is 40% in the month of sale, 50% in the month following sale, and the remainder in the second month following the month of sale. There are no bad debts. The budgeted cash receipts for April would be:

The regular pattern of collection of credit sales is 40% in the month of sale, 50% in the month following sale, and the remainder in the second month following the month of sale. There are no bad debts. The budgeted cash receipts for April would be:

A)$350,000

B)$320,000

C)$313,000

D)$383,000

The regular pattern of collection of credit sales is 40% in the month of sale, 50% in the month following sale, and the remainder in the second month following the month of sale. There are no bad debts. The budgeted cash receipts for April would be:

The regular pattern of collection of credit sales is 40% in the month of sale, 50% in the month following sale, and the remainder in the second month following the month of sale. There are no bad debts. The budgeted cash receipts for April would be:A)$350,000

B)$320,000

C)$313,000

D)$383,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

64

Morrish Inc. bases its manufacturing overhead budget on budgeted direct labor-hours. The direct labor budget indicates that 7,100 direct labor-hours will be required in January. The variable overhead rate is $1.80 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $102,950 per month, which includes depreciation of $19,880. All other fixed manufacturing overhead costs represent current cash flows. The January cash disbursements for manufacturing overhead on the manufacturing overhead budget should be:

A)$115,730

B)$95,850

C)$12,780

D)$83,070

A)$115,730

B)$95,850

C)$12,780

D)$83,070

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

65

Home Corporation will open a new store on January 1. Based on experience from its other retail outlets, Home Corporation is making the following sales projections:  Home Corporation estimates that 70% of the credit sales will be collected in the month following the month of sale, with the balance collected in the second month following the month of sale. The March 31 balance in accounts receivable will be:

Home Corporation estimates that 70% of the credit sales will be collected in the month following the month of sale, with the balance collected in the second month following the month of sale. The March 31 balance in accounts receivable will be:

A)$100,000

B)$60,000

C)$95,000

D)$75,000

Home Corporation estimates that 70% of the credit sales will be collected in the month following the month of sale, with the balance collected in the second month following the month of sale. The March 31 balance in accounts receivable will be:

Home Corporation estimates that 70% of the credit sales will be collected in the month following the month of sale, with the balance collected in the second month following the month of sale. The March 31 balance in accounts receivable will be:A)$100,000

B)$60,000

C)$95,000

D)$75,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

66

For May, Young Corporation has budgeted its cash receipts at $125,000 and its cash disbursements at $138,000. The company's cash balance on May 1 is $17,000. If the desired May 31 cash balance is $20,000, then how much cash must the company borrow during the month (before considering any interest payments)?

A)$4,000

B)$8,000

C)$12,000

D)$16,000

A)$4,000

B)$8,000

C)$12,000

D)$16,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

67

The Khaki Corporation has the following budgeted sales data:  The regular pattern of collection of credit sales is 40% in the month of sale, 50% in the month following sale, and the remainder in the second month following the month of sale. There are no bad debts. The budgeted accounts receivable balance on February 28 would be:

The regular pattern of collection of credit sales is 40% in the month of sale, 50% in the month following sale, and the remainder in the second month following the month of sale. There are no bad debts. The budgeted accounts receivable balance on February 28 would be:

A)$250,000

B)$210,000

C)$175,000

D)$215,000

The regular pattern of collection of credit sales is 40% in the month of sale, 50% in the month following sale, and the remainder in the second month following the month of sale. There are no bad debts. The budgeted accounts receivable balance on February 28 would be:

The regular pattern of collection of credit sales is 40% in the month of sale, 50% in the month following sale, and the remainder in the second month following the month of sale. There are no bad debts. The budgeted accounts receivable balance on February 28 would be:A)$250,000

B)$210,000

C)$175,000

D)$215,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

68

The manufacturing overhead budget at Amrein Corporation is based on budgeted direct labor-hours. The direct labor budget indicates that 4,900 direct labor-hours will be required in August. The variable overhead rate is $9.40 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $96,040 per month, which includes depreciation of $7,350. All other fixed manufacturing overhead costs represent current cash flows. The August cash disbursements for manufacturing overhead on the manufacturing overhead budget should be:

A)$88,690

B)$134,750

C)$46,060

D)$142,100

A)$88,690

B)$134,750

C)$46,060

D)$142,100

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

69

For July, White Corporation has budgeted production of 6,000 units. Each unit requires 0.10 direct labor-hours at a cost of $8.50 per direct labor-hour. How much will White Corporation budget for labor in July?

A)$51,000

B)$5,160

C)$600

D)$5,100

A)$51,000

B)$5,160

C)$600

D)$5,100

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

70

Richards Corporation has the following budgeted sales for the first half of next year:  The company is in the process of preparing a cash budget and must determine the expected cash collections by month. To this end, the following information has been assembled:

The company is in the process of preparing a cash budget and must determine the expected cash collections by month. To this end, the following information has been assembled:  The accounts receivable balance on January 1 is $70,000. Of this amount, $60,000 represents uncollected December sales and $10,000 represents uncollected November sales. What is the budgeted accounts receivable balance on May 30?

The accounts receivable balance on January 1 is $70,000. Of this amount, $60,000 represents uncollected December sales and $10,000 represents uncollected November sales. What is the budgeted accounts receivable balance on May 30?

A)$81,000

B)$68,000

C)$60,000

D)$141,000

The company is in the process of preparing a cash budget and must determine the expected cash collections by month. To this end, the following information has been assembled:

The company is in the process of preparing a cash budget and must determine the expected cash collections by month. To this end, the following information has been assembled:  The accounts receivable balance on January 1 is $70,000. Of this amount, $60,000 represents uncollected December sales and $10,000 represents uncollected November sales. What is the budgeted accounts receivable balance on May 30?

The accounts receivable balance on January 1 is $70,000. Of this amount, $60,000 represents uncollected December sales and $10,000 represents uncollected November sales. What is the budgeted accounts receivable balance on May 30?A)$81,000

B)$68,000

C)$60,000

D)$141,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

71

Home Corporation will open a new store on January 1. Based on experience from its other retail outlets, Home Corporation is making the following sales projections:  Home Corporation estimates that 70% of the credit sales will be collected in the month following the month of sale, with the balance collected in the second month following the month of sale. Based on these data, the balance in accounts receivable on January 31 will be:

Home Corporation estimates that 70% of the credit sales will be collected in the month following the month of sale, with the balance collected in the second month following the month of sale. Based on these data, the balance in accounts receivable on January 31 will be:

A)$40,000

B)$28,000

C)$12,000

D)$58,000

Home Corporation estimates that 70% of the credit sales will be collected in the month following the month of sale, with the balance collected in the second month following the month of sale. Based on these data, the balance in accounts receivable on January 31 will be:

Home Corporation estimates that 70% of the credit sales will be collected in the month following the month of sale, with the balance collected in the second month following the month of sale. Based on these data, the balance in accounts receivable on January 31 will be:A)$40,000

B)$28,000

C)$12,000

D)$58,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

72

The manufacturing overhead budget at Pendley Corporation is based on budgeted direct labor-hours. The direct labor budget indicates that 8,900 direct labor-hours will be required in August. The variable overhead rate is $5.50 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $133,500 per month, which includes depreciation of $30,260. All other fixed manufacturing overhead costs represent current cash flows. The company recomputes its predetermined overhead rate every month. The predetermined overhead rate for August should be:

A)$5.50

B)$17.10

C)$20.50

D)$15.00

A)$5.50

B)$17.10

C)$20.50

D)$15.00

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

73

Axsom Inc. bases its manufacturing overhead budget on budgeted direct labor-hours. The direct labor budget indicates that 1,300 direct labor-hours will be required in March. The variable overhead rate is $8.90 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $20,020 per month, which includes depreciation of $2,600. All other fixed manufacturing overhead costs represent current cash flows. The company recomputes its predetermined overhead rate every month. The predetermined overhead rate for March should be:

A)$22.30

B)$24.30

C)$15.40

D)$8.90

A)$22.30

B)$24.30

C)$15.40

D)$8.90

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

74

Vandel Inc. bases its selling and administrative expense budget on budgeted unit sales. The sales budget shows 6,600 units are planned to be sold in April. The variable selling and administrative expense is $9.70 per unit. The budgeted fixed selling and administrative expense is $127,380 per month, which includes depreciation of $8,580 per month. The remainder of the fixed selling and administrative expense represents current cash flows. The cash disbursements for selling and administrative expenses on the April selling and administrative expense budget should be:

A)$191,400

B)$118,800

C)$64,020

D)$182,820

A)$191,400

B)$118,800

C)$64,020

D)$182,820

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

75

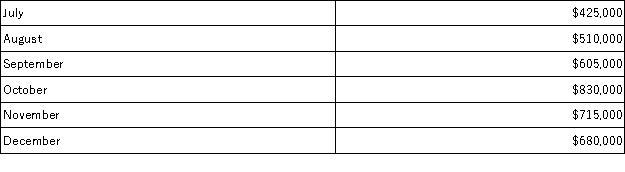

Harrti Corporation has budgeted for the following sales:  Sales are collected as follows: 10% in the month of sale; 60% in the month following the sale; and the remaining 30% in the second month following the sale. In Razz's budgeted balance sheet at December 31, at what amount will accounts receivable be shown?

Sales are collected as follows: 10% in the month of sale; 60% in the month following the sale; and the remaining 30% in the second month following the sale. In Razz's budgeted balance sheet at December 31, at what amount will accounts receivable be shown?

A)$680,000

B)$612,000

C)$826,500

D)$214,500

Sales are collected as follows: 10% in the month of sale; 60% in the month following the sale; and the remaining 30% in the second month following the sale. In Razz's budgeted balance sheet at December 31, at what amount will accounts receivable be shown?

Sales are collected as follows: 10% in the month of sale; 60% in the month following the sale; and the remaining 30% in the second month following the sale. In Razz's budgeted balance sheet at December 31, at what amount will accounts receivable be shown?A)$680,000

B)$612,000

C)$826,500

D)$214,500

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

76

The selling and administrative expense budget of Ruffing Corporation is based on budgeted unit sales, which are 4,800 units for February. The variable selling and administrative expense is $8.10 per unit. The budgeted fixed selling and administrative expense is $71,520 per month, which includes depreciation of $16,800 per month. The remainder of the fixed selling and administrative expense represents current cash flows. The cash disbursements for selling and administrative expenses on the February selling and administrative expense budget should be:

A)$38,880

B)$54,720

C)$110,400

D)$93,600

A)$38,880

B)$54,720

C)$110,400

D)$93,600

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

77

Arakaki Inc. is working on its cash budget for January. The budgeted beginning cash balance is $41,000. Budgeted cash receipts total $114,000 and budgeted cash disbursements total $113,000. The desired ending cash balance is $60,000. The excess (deficiency) of cash available over disbursements for January will be:

A)$42,000

B)$155,000

C)$40,000

D)$1,000

A)$42,000

B)$155,000

C)$40,000

D)$1,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

78

Triste Corporation manufactures and sells women's skirts. Each skirt (unit) requires 2.6 yards of cloth. Selected data from Triste's master budget for next quarter are shown below:  Each unit requires 1.6 hours of direct labor, and the average hourly cost of Triste's direct labor is $15. What is the cost of Triste Corporation's direct labor in September?

Each unit requires 1.6 hours of direct labor, and the average hourly cost of Triste's direct labor is $15. What is the cost of Triste Corporation's direct labor in September?

A)$336,000

B)$240,000

C)$150,000

D)$210,000

Each unit requires 1.6 hours of direct labor, and the average hourly cost of Triste's direct labor is $15. What is the cost of Triste Corporation's direct labor in September?

Each unit requires 1.6 hours of direct labor, and the average hourly cost of Triste's direct labor is $15. What is the cost of Triste Corporation's direct labor in September?A)$336,000

B)$240,000

C)$150,000

D)$210,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

79

Laurey Inc. is working on its cash budget for May. The budgeted beginning cash balance is $45,000. Budgeted cash receipts total $129,000 and budgeted cash disbursements total $124,000. The desired ending cash balance is $60,000. To attain its desired ending cash balance for May, the company needs to borrow:

A)$110,000

B)$0

C)$60,000

D)$10,000

A)$110,000

B)$0

C)$60,000

D)$10,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

80

Sparks Corporation has a cash balance of $7,500 on April 1. The company must maintain a minimum cash balance of $6,000. During April, expected cash receipts are $48,000. Cash disbursements during the month are expected to total $52,000. Ignoring interest payments, during April the company will need to borrow:

A)$3,500

B)$2,500

C)$6,000

D)$4,000

A)$3,500

B)$2,500

C)$6,000

D)$4,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck