Deck 1: Managerial Accounting and Cost Concepts

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/187

Play

Full screen (f)

Deck 1: Managerial Accounting and Cost Concepts

1

Depreciation on office equipment would be included in product costs.

False

2

Country Charm Restaurant is open 24 hours a day and always has a fire going in the fireplace in the middle of its dining area. The cost of the firewood for this fire is fixed with respect to the number of meals served at the restaurant.

True

3

A direct cost is a cost that cannot be easily traced to the particular cost object under consideration.

False

4

Committed fixed costs represent organizational investments with a multi-year planning horizon that can't be significantly reduced even for short periods.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

5

Property taxes and insurance premiums paid on a factory building are examples of period costs.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

6

A fixed cost remains constant if expressed on a unit basis.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

7

Total variable cost is expected to remain unchanged as activity changes within the relevant range.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

8

Product costs are recorded as expenses in the period in which the related products are sold.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

9

Rent on a factory building used in the production process would be classified as a product cost and as a fixed cost.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

10

Conversion cost equals product cost less direct labor cost.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

11

Selling costs can be either direct or indirect costs.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

12

Direct labor is a part of prime cost, but not conversion cost.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

13

Direct material costs are generally fixed costs.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

14

Manufacturing salaries and wages incurred in the factory are period costs.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

15

Depreciation on manufacturing equipment is a product cost.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

16

Conversion cost is the sum of direct labor cost and direct materials cost.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

17

The planning horizon for a committed fixed cost usually encompasses many years.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

18

Commissions paid to salespersons are a variable selling expense.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

19

Variable costs are costs that vary, in total, in direct proportion to changes in the volume or level of activity.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

20

Thread that is used in the production of mattresses is an indirect material that is therefore classified as manufacturing overhead.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

21

The traditional format income statement provides managers with an income statement that clearly distinguishes between fixed and variable costs and therefore aids planning, control, and decision making.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

22

Contribution margin equals revenue minus all fixed costs.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

23

A cost that differs from one month to another is known as a differential cost.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

24

A traditional format income statement organizes costs on the basis of behavior.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

25

In a contribution format income statement, the gross margin minus selling and administrative expenses equals net operating income.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

26

The nursing station on the fourth floor of Central Hospital is responsible for the care of orthopedic surgery patients. The costs of prescription drugs administered by the nursing station to patients should be classified as:

A)direct patient costs.

B)indirect patient costs.

C)overhead costs of the nursing station.

D)period costs of the hospital.

A)direct patient costs.

B)indirect patient costs.

C)overhead costs of the nursing station.

D)period costs of the hospital.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

27

All of the following costs would be found in a company's accounting records except:

A)sunk cost.

B)opportunity cost.

C)indirect costs.

D)direct costs.

A)sunk cost.

B)opportunity cost.

C)indirect costs.

D)direct costs.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

28

A contribution format income statement for a merchandising company organizes costs into two categories-cost of goods sold and selling and administrative expenses.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

29

The property taxes on a factory building would be an example of:

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

30

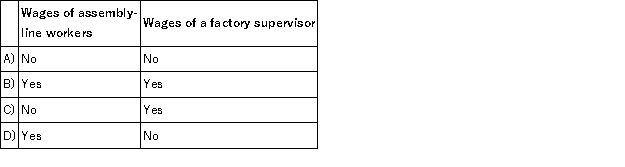

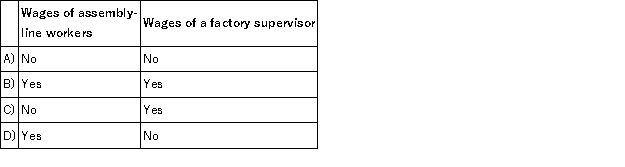

Which of the following is classified as a direct labor cost?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following would most likely be included as part of manufacturing overhead in the production of a wooden table?

A)The amount paid to the individual who stains the table.

B)The commission paid to the salesperson who sold the table.

C)The cost of glue used in the table.

D)The cost of the wood used in the table.

A)The amount paid to the individual who stains the table.

B)The commission paid to the salesperson who sold the table.

C)The cost of glue used in the table.

D)The cost of the wood used in the table.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

32

In a manufacturing company, direct labor costs combined with direct materials costs are known as:

A)period costs.

B)conversion costs.

C)prime costs.

D)opportunity costs.

A)period costs.

B)conversion costs.

C)prime costs.

D)opportunity costs.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

33

The potential benefit that is given up when one alternative is selected over another is called an opportunity cost.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

34

In a traditional format income statement for a merchandising company, the selling and administrative expenses report all period costs that have been expensed as incurred.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

35

The costs of the Accounting Department at Central Hospital would be considered by the Surgery Department to be:

A)direct costs.

B)indirect costs.

C)incremental costs.

D)opportunity costs.

A)direct costs.

B)indirect costs.

C)incremental costs.

D)opportunity costs.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

36

The contribution margin is the amount remaining from sales revenues after variable expenses have been deducted.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

37

Cost behavior is considered linear whenever a straight line is a reasonable approximation for the relation between cost and activity.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

38

The high-low method uses cost and activity data from just two periods to establish the formula for a mixed cost.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

39

The engineering approach to the analysis of mixed costs involves a detailed analysis of what cost behavior should be, based on an industrial engineer's evaluation of the production methods to be used, the materials specifications, labor requirements, equipment usage, production efficiency, power consumption, and so on.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

40

The contribution format is widely used for preparing external financial statements.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following costs, if expressed on a per unit basis, would be expected to decrease as the level of production and sales increases?

A)Sales commissions.

B)Fixed manufacturing overhead.

C)Variable manufacturing overhead.

D)Direct materials.

A)Sales commissions.

B)Fixed manufacturing overhead.

C)Variable manufacturing overhead.

D)Direct materials.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

42

Discretionary fixed costs:

A)have a planning horizon that covers many years.

B)may be reduced for short periods of time with minimal damage to the long-run goals of the organization.

C)cannot be reduced for even short periods of time without making fundamental changes.

D)are most effectively controlled through the effective utilization of facilities and organization.

A)have a planning horizon that covers many years.

B)may be reduced for short periods of time with minimal damage to the long-run goals of the organization.

C)cannot be reduced for even short periods of time without making fundamental changes.

D)are most effectively controlled through the effective utilization of facilities and organization.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

43

Within the relevant range:

A)variable cost per unit decreases as production decreases.

B)fixed cost per unit increases as production decreases.

C)fixed cost per unit decreases as production decreases.

D)variable cost per unit increases as production decreases.

A)variable cost per unit decreases as production decreases.

B)fixed cost per unit increases as production decreases.

C)fixed cost per unit decreases as production decreases.

D)variable cost per unit increases as production decreases.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

44

For planning, control, and decision-making purposes:

A)fixed costs should be converted to a per unit basis.

B)discretionary fixed costs should be eliminated.

C)variable costs should be ignored.

D)mixed costs should be separated into their variable and fixed components.

A)fixed costs should be converted to a per unit basis.

B)discretionary fixed costs should be eliminated.

C)variable costs should be ignored.

D)mixed costs should be separated into their variable and fixed components.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

45

The salary paid to the maintenance supervisor in a manufacturing plant is an example of:

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following costs is classified as a prime cost?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

47

Indirect labor is a(n):

A)Prime cost.

B)Conversion cost.

C)Period cost.

D)Opportunity cost.

A)Prime cost.

B)Conversion cost.

C)Period cost.

D)Opportunity cost.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

48

In describing the cost equation, Y = a + bX, "a" is:

A)the dependent variable cost.

B)the independent variable the level of activity.

C)the total fixed cost.

D)the variable cost per unit of activity.

A)the dependent variable cost.

B)the independent variable the level of activity.

C)the total fixed cost.

D)the variable cost per unit of activity.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

49

When the level of activity decreases, variable costs will:

A)increase per unit.

B)increase in total.

C)decrease in total.

D)decrease per unit.

A)increase per unit.

B)increase in total.

C)decrease in total.

D)decrease per unit.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

50

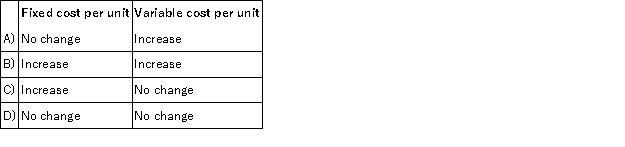

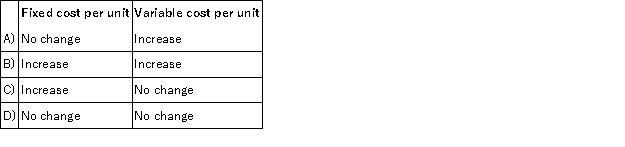

When the activity level declines within the relevant range, what should happen with respect to the following?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

51

If the level of activity increases within the relevant range:

A)variable cost per unit and total fixed costs also increase.

B)fixed cost per unit and total variable cost also increase.

C)total cost will increase and fixed cost per unit will decrease.

D)variable cost per unit and total cost also increase.

A)variable cost per unit and total fixed costs also increase.

B)fixed cost per unit and total variable cost also increase.

C)total cost will increase and fixed cost per unit will decrease.

D)variable cost per unit and total cost also increase.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following companies would have the highest proportion of variable costs in its cost structure?

A)Public utility.

B)Airline.

C)Fast food outlet.

D)Architectural firm.

A)Public utility.

B)Airline.

C)Fast food outlet.

D)Architectural firm.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

53

Fresh Wreath Corporation manufactures wreaths according to customer specifications and ships them to customers using United Parcel Service (UPS). Which two terms below describe the cost of shipping these wreaths?

A)variable cost and product cost

B)variable cost and period cost

C)fixed cost and product cost

D)fixed cost and period cost

A)variable cost and product cost

B)variable cost and period cost

C)fixed cost and product cost

D)fixed cost and period cost

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

54

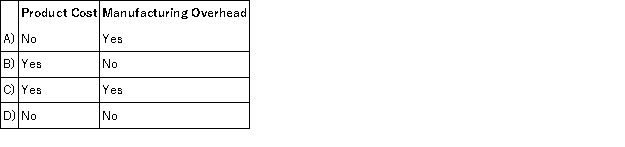

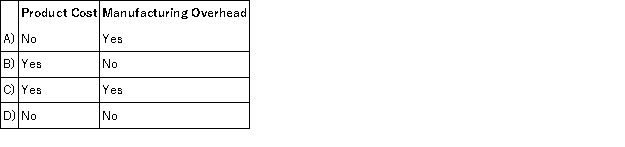

Property taxes on a manufacturing facility are classified as:

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

55

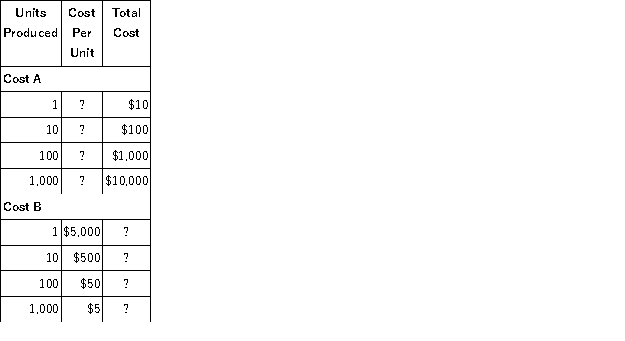

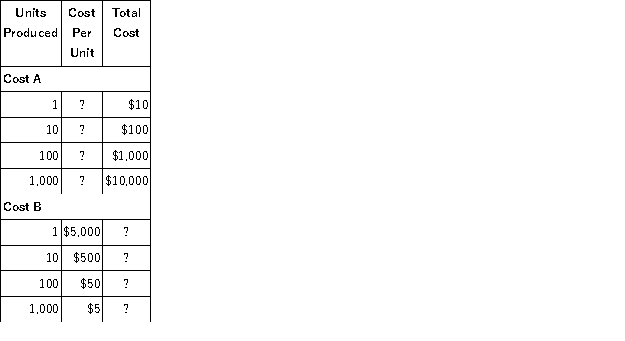

Data for Cost A and Cost B appear below:  Which of the above best describes the behavior of Costs A and B?

Which of the above best describes the behavior of Costs A and B?

A)Cost A is fixed, Cost B is variable.

B)Cost A is variable, Cost B is fixed.

C)Both Cost A and Cost B are variable.

D)Both Cost A and Cost B are fixed.

Which of the above best describes the behavior of Costs A and B?

Which of the above best describes the behavior of Costs A and B?A)Cost A is fixed, Cost B is variable.

B)Cost A is variable, Cost B is fixed.

C)Both Cost A and Cost B are variable.

D)Both Cost A and Cost B are fixed.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

56

Inventoriable costs are also known as:

A)variable costs.

B)conversion costs.

C)product costs.

D)fixed costs.

A)variable costs.

B)conversion costs.

C)product costs.

D)fixed costs.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

57

The cost of direct materials cost is classified as a:

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

58

An example of a discretionary fixed cost would be:

A)taxes on the factory.

B)depreciation on manufacturing equipment.

C)insurance.

D)research and development.

A)taxes on the factory.

B)depreciation on manufacturing equipment.

C)insurance.

D)research and development.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

59

All of the following would be classified as product costs except:

A)property taxes on production equipment.

B)insurance on factory machinery.

C)salaries of the marketing staff.

D)wages of machine operators.

A)property taxes on production equipment.

B)insurance on factory machinery.

C)salaries of the marketing staff.

D)wages of machine operators.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

60

Stott Company requires one full-time dock hand for every 500 packages loaded daily. The wages for these dock hands would be:

A)variable.

B)mixed.

C)step-variable.

D)curvilinear.

A)variable.

B)mixed.

C)step-variable.

D)curvilinear.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

61

At an activity level of 6,900 units in a month, Zelinski Corporation's total variable maintenance and repair cost is $408,756 and its total fixed maintenance and repair cost is $230,253. What would be the total maintenance and repair cost, both fixed and variable, at an activity level of 7,100 units in a month? Assume that this level of activity is within the relevant range.

A)$648,270

B)$639,009

C)$650,857

D)$657,531

A)$648,270

B)$639,009

C)$650,857

D)$657,531

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

62

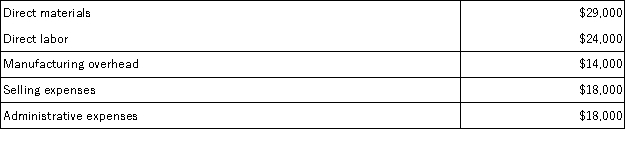

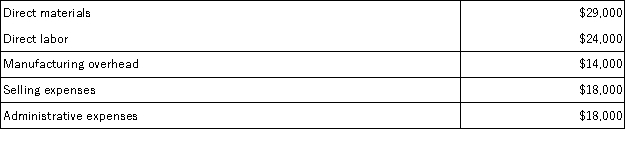

The following costs were incurred in April: Conversion costs during the month totaled:

A)$39,000

B)$54,000

C)$105,000

D)$51,000

A)$39,000

B)$54,000

C)$105,000

D)$51,000

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

63

In April direct labor was 70% of conversion cost. If the manufacturing overhead for the month was $42,000 and the direct materials cost was $28,000, the direct labor cost was:

A)$98,000

B)$65,333

C)$18,000

D)$12,000

A)$98,000

B)$65,333

C)$18,000

D)$12,000

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following is an example of a cost that is variable with respect to the number of units produced?

A)Rent on the administrative office building.

B)Rent on the factory building.

C)Direct labor cost, where the direct labor workforce is adjusted to the actual production of the period.

D)Salaries of top marketing executives.

A)Rent on the administrative office building.

B)Rent on the factory building.

C)Direct labor cost, where the direct labor workforce is adjusted to the actual production of the period.

D)Salaries of top marketing executives.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

65

Kaelker Corporation reports that at an activity level of 7,000 units, its total variable cost is $590,730 and its total fixed cost is $372,750. What would be the total cost, both fixed and variable, at an activity level of 7,100 units? Assume that this level of activity is within the relevant range.

A)$963,480

B)$977,244

C)$971,919

D)$970,362

A)$963,480

B)$977,244

C)$971,919

D)$970,362

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

66

Ricwy Corporation uses the cost formula Y = $4,800 + $0.40X for the maintenance cost, where X is machine-hours. The August budget is based on 9,000 hours of planned machine time. Maintenance cost expected to be incurred during August is:

A)$4,800

B)$3,600

C)$8,400

D)$1,200

A)$4,800

B)$3,600

C)$8,400

D)$1,200

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

67

Given the cost formula, Y = $7,000 + $1.80X, total cost for an activity level of 4,000 units would be:

A)$7,000

B)$200

C)$7,200

D)$14,200

A)$7,000

B)$200

C)$7,200

D)$14,200

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

68

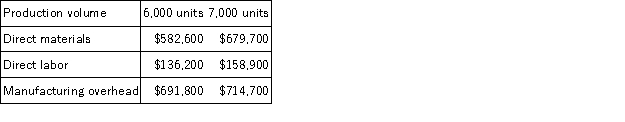

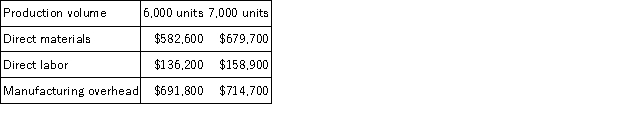

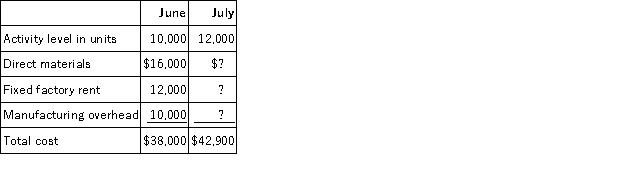

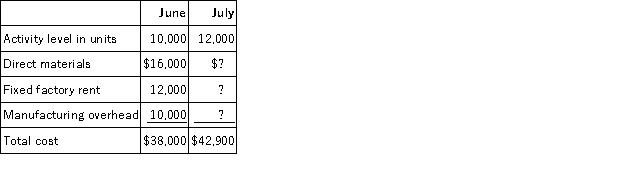

Eddy Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product.  The best estimate of the total variable manufacturing cost per unit is:

The best estimate of the total variable manufacturing cost per unit is:

A)$22.90

B)$119.80

C)$142.70

D)$97.10

The best estimate of the total variable manufacturing cost per unit is:

The best estimate of the total variable manufacturing cost per unit is:A)$22.90

B)$119.80

C)$142.70

D)$97.10

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

69

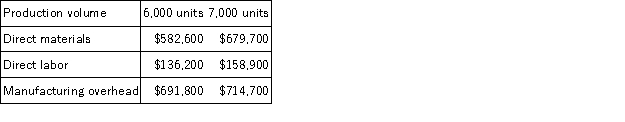

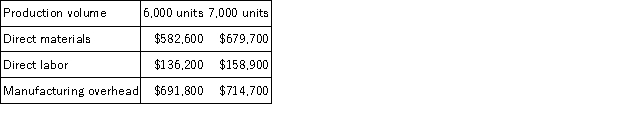

Eddy Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product.  The best estimate of the total variable manufacturing cost per unit is:

The best estimate of the total variable manufacturing cost per unit is:

A)$22.90

B)$119.80

C)$142.70

D)$97.10

The best estimate of the total variable manufacturing cost per unit is:

The best estimate of the total variable manufacturing cost per unit is:A)$22.90

B)$119.80

C)$142.70

D)$97.10

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

70

The cost of factory machinery purchased last year is:

A)an opportunity cost.

B)a differential cost.

C)a direct materials cost.

D)a sunk cost.

A)an opportunity cost.

B)a differential cost.

C)a direct materials cost.

D)a sunk cost.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

71

The following data pertains to activity and costs for two months:  Assuming that these activity levels are within the relevant range, the manufacturing overhead for July was:

Assuming that these activity levels are within the relevant range, the manufacturing overhead for July was:

A)$10,000

B)$11,700

C)$19,000

D)$9,300

Assuming that these activity levels are within the relevant range, the manufacturing overhead for July was:

Assuming that these activity levels are within the relevant range, the manufacturing overhead for July was:A)$10,000

B)$11,700

C)$19,000

D)$9,300

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

72

Given the cost formula Y = $18,000 + $6X, total cost at an activity level of 9,000 units would be:

A)$72,000

B)$18,000

C)$36,000

D)$54,000

A)$72,000

B)$18,000

C)$36,000

D)$54,000

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

73

The ________________________ is the amount remaining from sales revenue after all variable expenses have been deducted.

A)cost structure

B)gross margin

C)contribution margin

D)committed fixed cost

A)cost structure

B)gross margin

C)contribution margin

D)committed fixed cost

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

74

A manufacturing company prepays its insurance coverage for a three-year period. The premium for the three years is $2,400 and is paid at the beginning of the first year. Seventy percent of the premium applies to manufacturing operations and thirty percent applies to selling and administrative activities. What amounts should be considered product and period costs respectively for the first year of coverage?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

75

A sunk cost is:

A)a cost which may be saved by not adopting an alternative.

B)a cost which may be shifted to the future with little or no effect on current operations.

C)a cost which cannot be avoided because it has already been incurred.

D)a cost which does not entail any dollar outlay but which is relevant to the decision-making process.

A)a cost which may be saved by not adopting an alternative.

B)a cost which may be shifted to the future with little or no effect on current operations.

C)a cost which cannot be avoided because it has already been incurred.

D)a cost which does not entail any dollar outlay but which is relevant to the decision-making process.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

76

Contribution margin means:

A)what remains from total sales after deducting fixed expenses.

B)what remains from total sales after deducting cost of goods sold.

C)the sum of cost of goods sold and variable expenses.

D)what remains from total sales after deducting all variable expenses.

A)what remains from total sales after deducting fixed expenses.

B)what remains from total sales after deducting cost of goods sold.

C)the sum of cost of goods sold and variable expenses.

D)what remains from total sales after deducting all variable expenses.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

77

At an activity level of 4,000 machine-hours in a month, Curt Corporation's total variable production engineering cost is $154,200 and its total fixed production engineering cost is $129,000. What would be the total production engineering cost per unit, both fixed and variable, at an activity level of 4,300 machine-hours in a month? Assume that this level of activity is within the relevant range.

A)$68.33

B)$68.55

C)$70.80

D)$65.86

A)$68.33

B)$68.55

C)$70.80

D)$65.86

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

78

Abbott Company's manufacturing overhead is 20% of its total conversion costs. If direct labor is $38,000 and if direct materials are $23,000, the manufacturing overhead is:

A)$9,500

B)$152,000

C)$5,750

D)$15,250

A)$9,500

B)$152,000

C)$5,750

D)$15,250

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

79

The following costs were incurred in April:  Prime costs during the month totaled:

Prime costs during the month totaled:

A)$53,000

B)$67,000

C)$38,000

D)$103,000

Prime costs during the month totaled:

Prime costs during the month totaled:A)$53,000

B)$67,000

C)$38,000

D)$103,000

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

80

During the month of April, direct labor cost totaled $15,000 and direct labor cost was 30% of prime cost. If total manufacturing costs during April were $79,000, the manufacturing overhead was:

A)$35,000

B)$29,000

C)$50,000

D)$129,000

A)$35,000

B)$29,000

C)$50,000

D)$129,000

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck