Deck 16: Capital Expenditure Decisions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/104

Play

Full screen (f)

Deck 16: Capital Expenditure Decisions

1

Discounted-cash-flow analysis focuses primarily on:

A) the stability of cash flows.

B) the timing of cash flows.

C) the probability of cash flows.

D) the sensitivity of cash flows.

E) whether cash flows are increasing or decreasing.

A) the stability of cash flows.

B) the timing of cash flows.

C) the probability of cash flows.

D) the sensitivity of cash flows.

E) whether cash flows are increasing or decreasing.

B

2

Capital budgeting tends to focus primarily on:

A) revenues.

B) costs.

C) cost centers.

D) programs and projects.

E) allocation tools.

A) revenues.

B) costs.

C) cost centers.

D) programs and projects.

E) allocation tools.

D

3

Consider the following factors related to an investment:

I) The net income from the investment.

II) The cash flows from the investment.

III) The timing of the cash flows from the investment.

Which of the preceding factors would be important considerations in a net-present-value analysis?

A) I only.

B) II only.

C) I and II.

D) II and III.

E) I, II, and III.

I) The net income from the investment.

II) The cash flows from the investment.

III) The timing of the cash flows from the investment.

Which of the preceding factors would be important considerations in a net-present-value analysis?

A) I only.

B) II only.

C) I and II.

D) II and III.

E) I, II, and III.

D

4

Paige Company is contemplating the acquisition of a machine that costs $50,000 and promises to reduce annual cash operating costs by $11,000 over each of the next six years. Which of the following is a proper way to evaluate this investment if the company desires a 12% return on all investments?

A) $50,000 versus -$11,000 × 6.

B) $50,000 versus -$66,000 × 0.507.

C) $50,000 versus -$66,000 × 4.111.

D) $50,000 versus -$11,000 × 4.111.

E)$50,000 × 0.893 versus -$11,000 × 4.111.

A) $50,000 versus -$11,000 × 6.

B) $50,000 versus -$66,000 × 0.507.

C) $50,000 versus -$66,000 × 4.111.

D) $50,000 versus -$11,000 × 4.111.

E)$50,000 × 0.893 versus -$11,000 × 4.111.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following would not involve a capital-budgeting analysis?

A) The acquisition of new equipment.

B) The addition of a new product line.

C) The adoption of a new cost driver for overhead application.

D) The construction of a new distribution facility.

E) The decision of a pro football team to trade for and sign a star quarterback to a long-term contract.

A) The acquisition of new equipment.

B) The addition of a new product line.

C) The adoption of a new cost driver for overhead application.

D) The construction of a new distribution facility.

E) The decision of a pro football team to trade for and sign a star quarterback to a long-term contract.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

6

The payback period can only be used if net cash inflows are uniform throughout a project's life.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

7

The internal rate of return on an asset can be calculated:

A) if the return is greater than the hurdle rate.

B) if the asset's cash flows are identical to the future value of a series of cash flows.

C) if the future value of a series of cash flows can be arrived at by the annuity accumulation factor.

D) by finding a discount rate that yields a zero net present value.

E) by finding a discount rate that yields a positive net present value.

A) if the return is greater than the hurdle rate.

B) if the asset's cash flows are identical to the future value of a series of cash flows.

C) if the future value of a series of cash flows can be arrived at by the annuity accumulation factor.

D) by finding a discount rate that yields a zero net present value.

E) by finding a discount rate that yields a positive net present value.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

8

A company that is using the internal rate of return (IRR) to evaluate projects should accept a project if the IRR:

A) is greater than the project's net present value.

B) equates the present value of the project's cash inflows with the present value of the project's cash outflows.

C) is greater than zero.

D) is greater than the hurdle rate.

E) is less than the firm's cost of investment capital.

A) is greater than the project's net present value.

B) equates the present value of the project's cash inflows with the present value of the project's cash outflows.

C) is greater than zero.

D) is greater than the hurdle rate.

E) is less than the firm's cost of investment capital.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

9

The decision process that has managers select from among several acceptable investment proposals to make the best use of limited funds is known as:

A) capital rationing.

B) capital budgeting.

C) acceptance or rejection analysis (ARA).

D) cost analysis.

E) project planning.

A) capital rationing.

B) capital budgeting.

C) acceptance or rejection analysis (ARA).

D) cost analysis.

E) project planning.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

10

A company's hurdle rate is generally influenced by whether management uses the net-present-value method or the internal-rate-of-return method.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

11

When income taxes are considered in capital budgeting, the cash flows related to a company's advertising expense would be correctly figured by taking the cash paid for advertising and subtracting the result of multiplying [advertising expense × (1 - tax rate)].

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

12

The internal rate of return:

A) ignores the time value of money.

B) equates a project's cash inflows with its cash outflows.

C) equates a project's cash outflows with its expenses.

D) equates the present value of a project's cash inflows with the present value of the cash outflows.

E) equates the present value of a project's cash flows with the future value of the project's cash flows.

A) ignores the time value of money.

B) equates a project's cash inflows with its cash outflows.

C) equates a project's cash outflows with its expenses.

D) equates the present value of a project's cash inflows with the present value of the cash outflows.

E) equates the present value of a project's cash flows with the future value of the project's cash flows.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

13

The true economic yield produced by an asset is summarized by the asset's:

A) non-discounted cash flows.

B) net present value.

C) future value.

D) annuity discount factor.

E) internal rate of return.

A) non-discounted cash flows.

B) net present value.

C) future value.

D) annuity discount factor.

E) internal rate of return.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

14

The hurdle rate that is used in a net-present-value analysis is the same as the firm's:

A) discount rate.

B) internal rate of return.

C) minimum desired rate of return.

D) objective rate of return.

E) discount rate and minimum desired rate of return.

A) discount rate.

B) internal rate of return.

C) minimum desired rate of return.

D) objective rate of return.

E) discount rate and minimum desired rate of return.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

15

If a proposal's profitability index is greater than one then the net present value is positive.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

16

In a net-present-value analysis, the discount rate is often called the:

A) payback rate.

B) hurdle rate.

C) minimal value.

D) net unit rate.

E) objective rate of return.

A) payback rate.

B) hurdle rate.

C) minimal value.

D) net unit rate.

E) objective rate of return.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

17

The internal rate of return equates the present value of a project's cash inflows with the present value of the cash outflows.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

18

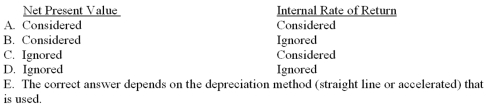

Which of the following choices correctly states the rules for project acceptance under the net-present-value method and the internal-rate-of-return method?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

19

Capital-budgeting decisions primarily involve:

A) emergency situations.

B) long-term decisions.

C) short-term planning situations.

D) cash inflows and outflows in the current year.

E) planning for the acquisition of capital.

A) emergency situations.

B) long-term decisions.

C) short-term planning situations.

D) cash inflows and outflows in the current year.

E) planning for the acquisition of capital.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following is taken into account by the net-present-value method?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

21

The rule for project acceptance under the net-present-value method is that:

A) NPV should be greater than zero.

B) NPV should be less than zero.

C) NPV should equal zero.

D) NPV should be less than the hurdle rate.

E) NPV should equal the hurdle rate.

A) NPV should be greater than zero.

B) NPV should be less than zero.

C) NPV should equal zero.

D) NPV should be less than the hurdle rate.

E) NPV should equal the hurdle rate.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

22

Of the five expenses that follow, which one is most likely treated differently than the others when income taxes are considered in a discounted-cash-flow analysis?

A) Salaries expense.

B) Advertising expense.

C) Depreciation expense.

D) Utilities expense.

E) Office expense.

A) Salaries expense.

B) Advertising expense.

C) Depreciation expense.

D) Utilities expense.

E) Office expense.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

23

Consider the following statements about taxes and after-tax cash flows:

I) Capital budgeting analyses should incorporate after-tax cash flows rather than before-tax cash flows.

II) Added company revenues will result in lower taxes for a firm.

III) Operating expenses may actually provide a tax benefit for an organization.

Which of the above statements is (are) correct?

A) I only.

B) II only.

C) III only.

D) I and II.

E) I and III.

I) Capital budgeting analyses should incorporate after-tax cash flows rather than before-tax cash flows.

II) Added company revenues will result in lower taxes for a firm.

III) Operating expenses may actually provide a tax benefit for an organization.

Which of the above statements is (are) correct?

A) I only.

B) II only.

C) III only.

D) I and II.

E) I and III.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

24

Generally speaking, which of the following would not directly affect a company's income tax payments?

A) Advertising expense.

B) Gain on sale of machinery.

C) Sales revenue.

D) Land owned by the firm.

E) Loss on sale of building.

A) Advertising expense.

B) Gain on sale of machinery.

C) Sales revenue.

D) Land owned by the firm.

E) Loss on sale of building.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

25

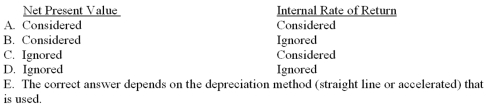

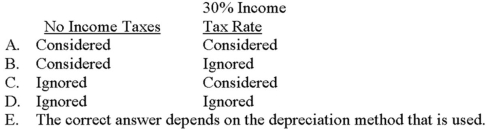

If income taxes are ignored, which of the following choices correctly notes how a project's depreciation is treated under the net-present-value method and the internal-rate-of-return method?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

26

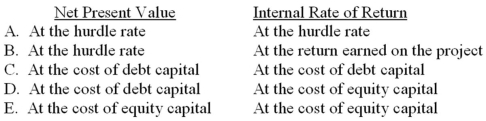

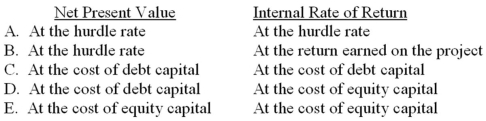

Which of the following choices correctly states how funds are assumed to be reinvested under the net-present-value method and the internal-rate-of-return method?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

27

When a company is analyzing a capital project by a discounted-cash-flow approach and income taxes are being considered, depreciation:

A) should be ignored.

B) should be considered because it results in a tax savings.

C) should be considered because it is a fixed cost.

D) should be considered because it is a cash inflow.

E) should be considered because, like other expenses, it is a cash outlay related to operations.

A) should be ignored.

B) should be considered because it results in a tax savings.

C) should be considered because it is a fixed cost.

D) should be considered because it is a cash inflow.

E) should be considered because, like other expenses, it is a cash outlay related to operations.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

28

Hightower Company plans to incur $350,000 of salaries expense if a capital project is implemented. Assuming a 30% tax rate, the salaries should be reflected in the analysis by a:

A) $105,000 inflow.

B) $105,000 outflow.

C) $245,000 inflow.

D) $245,000 outflow.

E) $350,000 outflow.

A) $105,000 inflow.

B) $105,000 outflow.

C) $245,000 inflow.

D) $245,000 outflow.

E) $350,000 outflow.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

29

The internal-rate-of-return method assumes that project funds are reinvested at the:

A) hurdle rate.

B) rate of return earned on the project.

C) cost of debt capital.

D) cost of equity capital.

E) rate of earnings growth (REG).

A) hurdle rate.

B) rate of return earned on the project.

C) cost of debt capital.

D) cost of equity capital.

E) rate of earnings growth (REG).

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

30

A company's hurdle rate is generally influenced by:

A) the cost of capital.

B) the firm's depreciable assets.

C) whether management uses the net-present-value method or the internal-rate-of-return method.

D) project risk.

E) Both the cost of capital and project risk.

A) the cost of capital.

B) the firm's depreciable assets.

C) whether management uses the net-present-value method or the internal-rate-of-return method.

D) project risk.

E) Both the cost of capital and project risk.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

31

Consider the following statements about the total-cost and the incremental-cost approaches of investment evaluation:

I) Both approaches will yield the same conclusions.

II) Choosing between these approaches is a matter of personal preference.

III) The incremental approach focuses on cost differences between alternatives.

Which of the above statements is (are) true?

A) I only.

B) II only.

C) III only.

D) II and III.

E) I, II, and III.

I) Both approaches will yield the same conclusions.

II) Choosing between these approaches is a matter of personal preference.

III) The incremental approach focuses on cost differences between alternatives.

Which of the above statements is (are) true?

A) I only.

B) II only.

C) III only.

D) II and III.

E) I, II, and III.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

32

Jenkins plans to generate $650,000 of sales revenue if a capital project is implemented. Assuming a 30% tax rate, the sales revenue should be reflected in the analysis by a:

A) $195,000 inflow.

B) $195,000 outflow.

C) $455,000 inflow.

D) $455,000 outflow.

E) $650,000 inflow.

A) $195,000 inflow.

B) $195,000 outflow.

C) $455,000 inflow.

D) $455,000 outflow.

E) $650,000 inflow.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

33

The systematic follow-up on a capital project to see how the project actually turns out is commonly known as:

A) capital budgeting assessment (CBA).

B) a postaudit.

C) control of capital expenditures (CCE).

D) overall cost performance.

E) the cost evaluation phase.

A) capital budgeting assessment (CBA).

B) a postaudit.

C) control of capital expenditures (CCE).

D) overall cost performance.

E) the cost evaluation phase.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

34

When income taxes are considered in capital budgeting, the cash flows related to a company's advertising expense would be correctly figured by taking the cash paid for advertising and:

A) adding the result of multiplying (advertising expense × tax rate).

B) adding the tax rate.

C) adding the result of multiplying [advertising expense × (1 - tax rate)].

D) subtracting the result of multiplying (advertising expense × tax rate).

E) subtracting the result of multiplying [advertising expense × (1 - tax rate)].

A) adding the result of multiplying (advertising expense × tax rate).

B) adding the tax rate.

C) adding the result of multiplying [advertising expense × (1 - tax rate)].

D) subtracting the result of multiplying (advertising expense × tax rate).

E) subtracting the result of multiplying [advertising expense × (1 - tax rate)].

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

35

Consider the following statements about capital budgeting postaudits:

I) Postaudits can be used to detect desirable projects that were rejected.

II) Postaudits can be used to detect undesirable projects that were accepted.

III) Postaudits may reveal shortcomings in cash-flow projections, providing insights that allow a company to improve future predictions.

Which of the above statements is (are) correct?

A) I only.

B) II only.

C) III only.

D) II and III.

E) I, II, and III.

I) Postaudits can be used to detect desirable projects that were rejected.

II) Postaudits can be used to detect undesirable projects that were accepted.

III) Postaudits may reveal shortcomings in cash-flow projections, providing insights that allow a company to improve future predictions.

Which of the above statements is (are) correct?

A) I only.

B) II only.

C) III only.

D) II and III.

E) I, II, and III.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

36

The net-present-value method assumes that project funds are reinvested at the:

A) hurdle rate.

B) rate of return earned on the project.

C) cost of debt capital.

D) cost of equity capital.

E) internal rate of return.

A) hurdle rate.

B) rate of return earned on the project.

C) cost of debt capital.

D) cost of equity capital.

E) internal rate of return.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

37

A company's cash flows for income taxes are normally affected by:

A) revenues.

B) operating expenses.

C) gains on the sale of assets.

D) losses on the sale of assets.

E) All of the other answers are correct.

A) revenues.

B) operating expenses.

C) gains on the sale of assets.

D) losses on the sale of assets.

E) All of the other answers are correct.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

38

The rule for project acceptance under the internal rate of return method is that:

A) IRR should be greater than zero.

B) IRR should be less than zero.

C) IRR should be greater than the hurdle rate.

D) IRR should be less than the hurdle rate.

E) IRR should equal the hurdle rate.

A) IRR should be greater than zero.

B) IRR should be less than zero.

C) IRR should be greater than the hurdle rate.

D) IRR should be less than the hurdle rate.

E) IRR should equal the hurdle rate.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

39

When income taxes are considered in capital budgeting, the cash flows related to a company's depreciation expense would be correctly figured by taking the cash paid for depreciation and:

A) adding the result of multiplying (depreciation expense × tax rate).

B) adding the result of multiplying [depreciation expense × (1 - tax rate)].

C) subtracting the result of multiplying (depreciation expense × tax rate).

D) subtracting the result of multiplying [depreciation expense × (1 - tax rate)].

E) None of the other answers because there is no cash paid for depreciation.

A) adding the result of multiplying (depreciation expense × tax rate).

B) adding the result of multiplying [depreciation expense × (1 - tax rate)].

C) subtracting the result of multiplying (depreciation expense × tax rate).

D) subtracting the result of multiplying [depreciation expense × (1 - tax rate)].

E) None of the other answers because there is no cash paid for depreciation.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

40

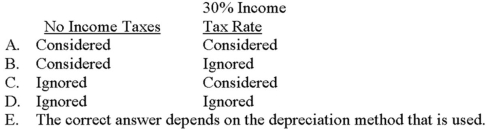

Assume that a capital project is being analyzed by a discounted-cash-flow approach, and an employee first assumes no income taxes and then later assumes a 30% income tax rate. How would depreciation expense be incorporated in the analysis?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

41

A company used the net-present-value method to analyze an investment and found the investment to be very attractive. If the firm used straight-line depreciation and changes to the Modified Accelerated Cost Recovery System (MACRS), the investment's net present value will:

A) increase.

B) remain the same.

C) decrease.

D) change, but the direction cannot be determined based on the data presented.

E) fluctuate in an erratic manner.

A) increase.

B) remain the same.

C) decrease.

D) change, but the direction cannot be determined based on the data presented.

E) fluctuate in an erratic manner.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

42

Bath Works Company has $70,000 of depreciation expense and is subject to a 30% income tax rate. On an after-tax basis, depreciation results in a:

A) $21,000 inflow.

B) $21,000 outflow.

C) $49,000 inflow.

D) $49,000 outflow.

E) Neither an inflow nor an outflow because depreciation is a noncash expense.

A) $21,000 inflow.

B) $21,000 outflow.

C) $49,000 inflow.

D) $49,000 outflow.

E) Neither an inflow nor an outflow because depreciation is a noncash expense.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

43

Hazeldine Company plans to incur $230,000 of additional cash operating expenses and produce $410,000 of additional sales revenue if a capital project is implemented. Assuming a 30% tax rate, these two items collectively should appear in a capital budgeting analysis as:

A) a $57,000 inflow.

B) a $57,000 outflow.

C) a $126,000 outflow.

D) a $126,000 inflow.

E) a $161,000 outflow.

A) a $57,000 inflow.

B) a $57,000 outflow.

C) a $126,000 outflow.

D) a $126,000 inflow.

E) a $161,000 outflow.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

44

A depreciation tax shield is a(n):

A) after-tax cash outflow.

B) increase in income tax.

C) factor that has no effect on cash flows.

D) reduction in income tax.

E) sporadic fluctuation in income tax.

A) after-tax cash outflow.

B) increase in income tax.

C) factor that has no effect on cash flows.

D) reduction in income tax.

E) sporadic fluctuation in income tax.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

45

Puck Company received $18,000 cash from the sale of a machine that had a $13,000 book value. If the company is subject to a 30% income tax rate, the net cash flow to use in a discounted-cash-flow analysis would be:

A) $3,500.

B) $6,500.

C) $12,600.

D) $16,500.

E) $19,500.

A) $3,500.

B) $6,500.

C) $12,600.

D) $16,500.

E) $19,500.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following is the proper calculation of a company's depreciation tax shield?

A) Depreciation ÷ tax rate.

B) Depreciation ÷ (1 - tax rate).

C) Depreciation × tax rate.

D) Depreciation × (1 - tax rate).

E) Depreciation deduction + income taxes.

A) Depreciation ÷ tax rate.

B) Depreciation ÷ (1 - tax rate).

C) Depreciation × tax rate.

D) Depreciation × (1 - tax rate).

E) Depreciation deduction + income taxes.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

47

A machine was sold in December 20x3 for $9,000. It was purchased in January 20x1 for $15,000, and depreciation of $12,000 was recorded from the date of purchase through the date of disposal. Assuming a 40% income tax rate, the after-tax cash inflow at the time of sale is:

A) $3,600.

B) $6,600.

C) $8,400.

D) $9,000.

E) $11,400.

A) $3,600.

B) $6,600.

C) $8,400.

D) $9,000.

E) $11,400.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

48

A company used the net-present-value method to analyze an investment and found the investment to be very attractive. If the firm used Modified Accelerated Cost Recovery System (MACRS) and changes to the straight-line depreciation, the investment's net present value will:

A) increase.

B) remain the same.

C) decrease.

D) change, but the direction cannot be determined based on the data presented.

E) fluctuate in an erratic manner.

A) increase.

B) remain the same.

C) decrease.

D) change, but the direction cannot be determined based on the data presented.

E) fluctuate in an erratic manner.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

49

James Company has an asset that cost $5,000 and currently has accumulated depreciation of $2,000. Suppose the firm sold the asset for $2,500 and is subject to a 30% income tax rate.

The loss on disposal would be:

A) $350.

B) $500.

C) $650.

D) $2,500.

E) None, because the transaction produced a gain.

The loss on disposal would be:

A) $350.

B) $500.

C) $650.

D) $2,500.

E) None, because the transaction produced a gain.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

50

Crossword Company is studying a capital project that will produce $600,000 of added sales revenue, $400,000 of additional cash operating expenses, and $50,000 of depreciation. Assuming a 30% income tax rate, the company's after-tax cash inflow (outflow) is:

A) $105,000.

B) $125,000.

C) $155,000.

D) $175,000.

E) None of the other answers are correct.

A) $105,000.

B) $125,000.

C) $155,000.

D) $175,000.

E) None of the other answers are correct.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

51

Braselton Company plans to incur $190,000 of salaries expense and produce $320,000 of additional sales revenue if a capital project is implemented. Assuming a 30% tax rate, these two items collectively should appear in a capital budgeting analysis as:

A) a $39,000 inflow.

B) a $39,000 outflow.

C) a $91,000 inflow.

D) a $91,000 outflow.

E) None of the other answers are correct.

A) a $39,000 inflow.

B) a $39,000 outflow.

C) a $91,000 inflow.

D) a $91,000 outflow.

E) None of the other answers are correct.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

52

James Company has an asset that cost $5,000 and currently has accumulated depreciation of $2,000. Suppose the firm sold the asset for $2,500 and is subject to a 30% income tax rate.

The net after-tax cash flow of the disposal is:

A) $2,100.

B) $2,350.

C) $2,500.

D) $2,650.

E) None of the other answers are correct.

The net after-tax cash flow of the disposal is:

A) $2,100.

B) $2,350.

C) $2,500.

D) $2,650.

E) None of the other answers are correct.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

53

Raymon Company received $7,000 cash from the sale of a machine that had an $11,000 book value. If the company is subject to a 30% income tax rate, the net cash flow to use in a discounted-cash-flow analysis would be:

A) $2,100.

B) $4,900.

C) $5,800.

D) $7,000.

E) $8,200.

A) $2,100.

B) $4,900.

C) $5,800.

D) $7,000.

E) $8,200.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

54

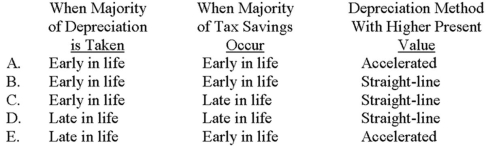

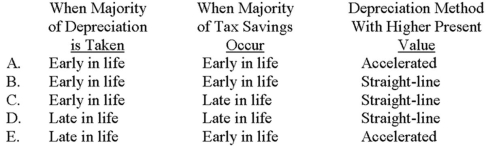

Preston Company is considering the use of accelerated depreciation rather than straight-line depreciation for a new asset acquisition. Which of the following choices correctly shows when the majority of depreciation would be taken (early or late in the asset's life), when most of the tax savings occur (early or late in the asset's life), and which depreciation method would have the higher present value?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

55

The Modified Accelerated Cost Recovery System (MACRS) assumes that, on average, assets will be placed in service:

A) at the beginning of the tax year.

B) three months into the tax year.

C) halfway through the tax year.

D) at the end of the tax year.

E) in the next tax year.

A) at the beginning of the tax year.

B) three months into the tax year.

C) halfway through the tax year.

D) at the end of the tax year.

E) in the next tax year.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

56

Consider the following statements about depreciation tax shields:

I) A depreciation tax shield provides distinct benefits to a business.

II) A depreciation tax shield should be ignored when doing a net-present-value analysis.

III) A depreciation tax shield can occur in more than one year.

Which of the above statements is (are) correct?

A) I only.

B) II only.

C) III only.

D) I and II.

E) I and III.

I) A depreciation tax shield provides distinct benefits to a business.

II) A depreciation tax shield should be ignored when doing a net-present-value analysis.

III) A depreciation tax shield can occur in more than one year.

Which of the above statements is (are) correct?

A) I only.

B) II only.

C) III only.

D) I and II.

E) I and III.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

57

Ruiz Company purchased equipment for $30,000 in December 20x1. The equipment is expected to generate $10,000 per year of additional revenue and incur $2,000 per year of additional cash expenses, beginning in 20x2. Under MACRS, depreciation in 20x2 will be $3,000. If the firm's income tax rate is 40%, the after-tax cash flow in 20x2 would be:

A) $3,200.

B) $3,600.

C) $4,800.

D) $6,000.

E) None of the other answers are correct.

A) $3,200.

B) $3,600.

C) $4,800.

D) $6,000.

E) None of the other answers are correct.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

58

A company that uses accelerated depreciation:

A) would write off a larger portion of an asset's cost sooner than under the straight-line method.

B) would find that depreciation speeds up, with a small portion taken in early years and larger amounts taken in later years.

C) would find that more tax benefits occur earlier than under the straight-line method.

D) would find itself out of compliance with generally accepted accounting principles (GAAP).

E) would both write off a larger portion of an asset's cost sooner than under the straight-line method and find that more tax benefits occur earlier than under the straight-line method.

A) would write off a larger portion of an asset's cost sooner than under the straight-line method.

B) would find that depreciation speeds up, with a small portion taken in early years and larger amounts taken in later years.

C) would find that more tax benefits occur earlier than under the straight-line method.

D) would find itself out of compliance with generally accepted accounting principles (GAAP).

E) would both write off a larger portion of an asset's cost sooner than under the straight-line method and find that more tax benefits occur earlier than under the straight-line method.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

59

If a company desires to be in compliance with current income tax law and write off the cost of its assets rapidly, the firm would use:

A) straight-line depreciation.

B) sum-of-the-years'-digits depreciation.

C) accelerated depreciation.

D) the Modified Accelerated Cost Recovery System (MACRS).

E) annuity depreciation.

A) straight-line depreciation.

B) sum-of-the-years'-digits depreciation.

C) accelerated depreciation.

D) the Modified Accelerated Cost Recovery System (MACRS).

E) annuity depreciation.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

60

Wrangler Company is considering a five-year project that requires a typical investment in working capital, in this case, $100,000. Consider the following statements about this situation:

I) Wrangler should include a $100,000 outflow that occurs at time 0 in a discounted-cash-flow analysis.

II) Wrangler should include separate $100,000 outflows in each year of the project's five-year life.

III) Wrangler should include a $100,000 recovery of its working-capital investment in year 5 of a discounted-cash-flow analysis.

Which of the above statements is (are) correct?

A) I only.

B) II only.

C) III only.

D) I and II.

E) I and III.

I) Wrangler should include a $100,000 outflow that occurs at time 0 in a discounted-cash-flow analysis.

II) Wrangler should include separate $100,000 outflows in each year of the project's five-year life.

III) Wrangler should include a $100,000 recovery of its working-capital investment in year 5 of a discounted-cash-flow analysis.

Which of the above statements is (are) correct?

A) I only.

B) II only.

C) III only.

D) I and II.

E) I and III.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

61

Wrikeman evaluates future projects by using the profitability index. The company is currently reviewing five similar projects and must choose one of the following: Which project should Wrikeman select if the decision is based entirely on the profitability index?

A) Project 1.

B) Project 2.

C) Project 3.

D) Project 4.

E) Project 5.

A) Project 1.

B) Project 2.

C) Project 3.

D) Project 4.

E) Project 5.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

62

Consider the following statements about the payback period:

I) As shown in your text, the payback period considers the time value of money.

II) The payback period can only be used if net cash inflows are uniform throughout a project's life.

III) The payback period ignores cash inflows that occur after the payback period is reached.

Which of the above statements is (are) correct?

A) I only.

B) II only.

C) III only.

D) I and II.

E) I, II, and III.

I) As shown in your text, the payback period considers the time value of money.

II) The payback period can only be used if net cash inflows are uniform throughout a project's life.

III) The payback period ignores cash inflows that occur after the payback period is reached.

Which of the above statements is (are) correct?

A) I only.

B) II only.

C) III only.

D) I and II.

E) I, II, and III.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

63

Dahlia Corporation, which is subject to a 30% income tax rate, is considering a $420,000 asset that will result in the following over its six-year life:

Average revenue: $920,000

Average operating expenses (excluding depreciation): $770,000

Average depreciation: $70,000

The after-tax accounting rate of return on the initial investment is:

A) 13.33%.

B) 19.05%.

C) 25.00%.

D) 35.71%.

E) None of the other answers are correct.

Average revenue: $920,000

Average operating expenses (excluding depreciation): $770,000

Average depreciation: $70,000

The after-tax accounting rate of return on the initial investment is:

A) 13.33%.

B) 19.05%.

C) 25.00%.

D) 35.71%.

E) None of the other answers are correct.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

64

A cash flow measured in nominal dollars is:

A) the actual cash flow that we experience.

B) the adjustment for a change in the dollar's purchasing power.

C) the discounted cash flow.

D) the realistic cash flow after taxes.

E) None of the other answers are correct.

A) the actual cash flow that we experience.

B) the adjustment for a change in the dollar's purchasing power.

C) the discounted cash flow.

D) the realistic cash flow after taxes.

E) None of the other answers are correct.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

65

When making investment decisions that involve advanced manufacturing systems, the use of net present value:

A) presents no special problems for the analyst.

B) often gives rise to net-present-value figures that are negative despite a manager's belief that the investment is beneficial for the firm.

C) should be coupled with Pareto diagrams.

D) often omits a number of factors that are difficult to quantify (e.g., greater manufacturing flexibility, improved product quality, and so forth).

E) Both often gives rise to net-present-value figures that are negative despite a manager's belief that the investment is beneficial for the firm and often omits a number of factors that are difficult to quantify (e.g., greater manufacturing flexibility, improved product quality, and so forth).

A) presents no special problems for the analyst.

B) often gives rise to net-present-value figures that are negative despite a manager's belief that the investment is beneficial for the firm.

C) should be coupled with Pareto diagrams.

D) often omits a number of factors that are difficult to quantify (e.g., greater manufacturing flexibility, improved product quality, and so forth).

E) Both often gives rise to net-present-value figures that are negative despite a manager's belief that the investment is beneficial for the firm and often omits a number of factors that are difficult to quantify (e.g., greater manufacturing flexibility, improved product quality, and so forth).

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

66

Mad's Hatters Corporation will evaluate a potential investment in an advanced manufacturing system by use of the net-present-value (NPV) method. Which of the following system benefits is least likely to be omitted from the NPV analysis?

A) Savings in operating costs.

B) Greater flexibility in the production process.

C) Improved product quality.

D) Shorter manufacturing cycle time.

E) Ability to fill customer orders more quickly.

A) Savings in operating costs.

B) Greater flexibility in the production process.

C) Improved product quality.

D) Shorter manufacturing cycle time.

E) Ability to fill customer orders more quickly.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

67

Green Way Packaging is considering a $600,000 investment in new equipment that is anticipated to produce the following data over a five-year life: Ignoring income taxes and assuming that cash flows occur evenly throughout a year, the equipment's approximate payback period is:

A) 1 year, 7 months.

B) 2 years, 1 month.

C) 2 years, 5 months.

D) over 5 years.

E) some other period of time not noted in the options.

A) 1 year, 7 months.

B) 2 years, 1 month.

C) 2 years, 5 months.

D) over 5 years.

E) some other period of time not noted in the options.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

68

St. Andrews School ranks investments by using the profitability index (PI). The following data relate to Project X and Project Y: Which project would be more attractive as judged by its ranking, and why?

A) Project X because the PI is 1.50.

B) Project Y because the PI is 1.38.

C) Project X because the PI is 0.67.

D) Project Y because the PI is 0.72.

E) Both projects would be equally attractive in terms of ranking, as indicated by a positive PI.

A) Project X because the PI is 1.50.

B) Project Y because the PI is 1.38.

C) Project X because the PI is 0.67.

D) Project Y because the PI is 0.72.

E) Both projects would be equally attractive in terms of ranking, as indicated by a positive PI.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

69

The payback period is best defined as:

A) initial investment ÷ annual after-tax cash inflow.

B) annual after-tax cash inflow ÷ initial investment.

C) initial investment ÷ useful life of investment.

D) (present value of the cash flows, exclusive of the initial investment) ÷ initial investment.

E) initial investment ÷ (present value of the cash flows, exclusive of the initial investment).

A) initial investment ÷ annual after-tax cash inflow.

B) annual after-tax cash inflow ÷ initial investment.

C) initial investment ÷ useful life of investment.

D) (present value of the cash flows, exclusive of the initial investment) ÷ initial investment.

E) initial investment ÷ (present value of the cash flows, exclusive of the initial investment).

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

70

Pinero is considering a $600,000 investment in new equipment that is anticipated to produce the following net cash inflows: If cash flows occur evenly throughout a year, the equipment's payback period is:

A) 4 years, 2 months.

B) 4 years, 3 months.

C) 4 years, 4 months.

D) 5 years.

E) some other period of time not noted.

A) 4 years, 2 months.

B) 4 years, 3 months.

C) 4 years, 4 months.

D) 5 years.

E) some other period of time not noted.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

71

The accounting rate of return focuses on the:

A) total accounting income over a project's life.

B) average accounting income over a project's life.

C) average cash flows over a project's life.

D) cash inflows from a project.

E) tax savings from a project.

A) total accounting income over a project's life.

B) average accounting income over a project's life.

C) average cash flows over a project's life.

D) cash inflows from a project.

E) tax savings from a project.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

72

Consider the following statements about the investment in working capital in a capital budgeting analysis:

I) Working capital often increases as the result of higher balances in accounts receivable or inventory necessary to support a project.

II) Working capital increases are sources of cash and should be included in a discounted-cash-flow analysis.

III) The time 0 cash investment in working capital is included in a discounted-cash-flow analysis as a cash outflow.

Which of the above statements is (are) correct?

A) I only.

B) II only.

C) III only.

D) I and II.

E) I and III.

I) Working capital often increases as the result of higher balances in accounts receivable or inventory necessary to support a project.

II) Working capital increases are sources of cash and should be included in a discounted-cash-flow analysis.

III) The time 0 cash investment in working capital is included in a discounted-cash-flow analysis as a cash outflow.

Which of the above statements is (are) correct?

A) I only.

B) II only.

C) III only.

D) I and II.

E) I and III.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following choices correctly depicts whether discounted cash flows are used by the method noted when evaluating long-term investments?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following project evaluation methods focuses on accounting income rather than cash flows?

A) Net present value.

B) Accounting rate of return.

C) Internal rate of return.

D) Payback period.

E) None of the other answers are correct.

A) Net present value.

B) Accounting rate of return.

C) Internal rate of return.

D) Payback period.

E) None of the other answers are correct.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following tools is sometimes used to rank investment proposals?

A) Profitability index.

B) Annuity index.

C) Project assessment guide (PAG).

D) Investment opportunity index.

E) Capital ranking index.

A) Profitability index.

B) Annuity index.

C) Project assessment guide (PAG).

D) Investment opportunity index.

E) Capital ranking index.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

76

Porschia is considering the acquisition of new machinery that will produce uniform benefits over the next eight years. The following information is available:

Annual savings in cash operating costs: $350,000

Annual depreciation expense: $250,000

If the company is subject to a 30% tax rate, what denominator should be used to compute the machinery's payback period?

A) $70,000.

B) $170,000.

C) $245,000.

D) $320,000.

E) None of the other answers are correct.

Annual savings in cash operating costs: $350,000

Annual depreciation expense: $250,000

If the company is subject to a 30% tax rate, what denominator should be used to compute the machinery's payback period?

A) $70,000.

B) $170,000.

C) $245,000.

D) $320,000.

E) None of the other answers are correct.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

77

A piece of equipment costs $30,000, and is expected to generate $8,500 of annual cash revenues and $1,500 of annual cash expenses. The disposal value at the end of the estimated 10-year life is $3,000. Ignoring income taxes, the payback period is:

A) 3.53 years.

B) 3.86 years.

C) 4.29 years.

D) 6.98 years.

E) some other period of time not noted.

A) 3.53 years.

B) 3.86 years.

C) 4.29 years.

D) 6.98 years.

E) some other period of time not noted.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

78

If a proposal's profitability index is greater than one:

A) the net present value is negative.

B) the net present value is positive.

C) the net present value is zero.

D) none of these, because the net present value cannot be gauged by the profitability index.

E) the proposal should be rejected.

A) the net present value is negative.

B) the net present value is positive.

C) the net present value is zero.

D) none of these, because the net present value cannot be gauged by the profitability index.

E) the proposal should be rejected.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

79

San Remo has a $4,000,000 asset investment and is subject to a 30% income tax rate. Cash inflows are expected to average $600,000 before tax over the next few years; in contrast, average income before tax is anticipated to be $500,000. The company's after-tax accounting rate of return is:

A) 8.75%.

B) 10.50%.

C) 12.50%.

D) 15.00%.

E) None of the other answers are correct.

A) 8.75%.

B) 10.50%.

C) 12.50%.

D) 15.00%.

E) None of the other answers are correct.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

80

Consider the following statements about the accounting rate of return:

I) The accounting rate of return focuses on a project's income rather than its cash flows.

II) Companies can figure the accounting rate of return on either the initial investment figure or an average investment figure.

III) The accounting rate of return considers the time value of money.

Which of the above statements is (are) correct?

A) I only.

B) II only.

C) III only.

D) I and II.

E) II and III.

I) The accounting rate of return focuses on a project's income rather than its cash flows.

II) Companies can figure the accounting rate of return on either the initial investment figure or an average investment figure.

III) The accounting rate of return considers the time value of money.

Which of the above statements is (are) correct?

A) I only.

B) II only.

C) III only.

D) I and II.

E) II and III.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck