Deck 14: Valuation: Market-Based Approaches

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/59

Play

Full screen (f)

Deck 14: Valuation: Market-Based Approaches

1

Which of the following ratios usually reflects investor's opinions of the future prospects for the firm?

A) Earnings per share

B) Dividend yield

C) Price/earnings ratio

D) Book value per share

A) Earnings per share

B) Dividend yield

C) Price/earnings ratio

D) Book value per share

C

2

A company with a PEG ratio of less than one would be interpreted as having a stock price:

A) that is underpriced given earnings and expected earnings growth.

B) that is low relative to the company's growth prospects.

C) that is high relative to the company's growth prospects.

D) that is overvalued.

A) that is underpriced given earnings and expected earnings growth.

B) that is low relative to the company's growth prospects.

C) that is high relative to the company's growth prospects.

D) that is overvalued.

C

3

A company is expected to generate $175,000 in earnings next period and requires a 20% return on equity capital.Using the assumptions of the price-earnings ratio,what would be the company's value at the beginning of next period?

A) $781,250

B) $1,250,000

C) $2,000,000

D) $875,000

A) $781,250

B) $1,250,000

C) $2,000,000

D) $875,000

D

[1/.20]*$175,000=$875,000

[1/.20]*$175,000=$875,000

4

The market price of a share of common equity reflects:

A) the aggregated expectations of all of the market participants following that particular stock.

B) the present value of future residual income.

C) book value plus the present value of future residual income.

D) the correct value for the particular stock.

A) the aggregated expectations of all of the market participants following that particular stock.

B) the present value of future residual income.

C) book value plus the present value of future residual income.

D) the correct value for the particular stock.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

5

Assuming that Ska Company's cost of equity capital is 14% and it expects to grow earnings at a rate of 8% per year,we would expect Ska's P/E ratio to be:

A) 8

B) 16.7

C) 14

D) 4.5

A) 8

B) 16.7

C) 14

D) 4.5

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

6

Under the value-to-book model new projects will be less profitable only when:

A) ROCE equals ROA

B) ROCE equals RE

C) ROCE is greater than RE

D) ROCE is less than RE

A) ROCE equals ROA

B) ROCE equals RE

C) ROCE is greater than RE

D) ROCE is less than RE

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is not a reason why price-earnings ratios would differ across firms?

A) Risk

B) Profitability

C) Growth

D) Operating leverage

A) Risk

B) Profitability

C) Growth

D) Operating leverage

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

8

Trading on the equity is likely to be a good financial strategy for stockholders of companies having:

A) Cyclically high and low amounts of reported earnings.

B) Steadily declining amounts of reported earnings.

C) Volatile fluctuations in reported earnings over short periods of time.

D) Steady amounts of reported earnings.

A) Cyclically high and low amounts of reported earnings.

B) Steadily declining amounts of reported earnings.

C) Volatile fluctuations in reported earnings over short periods of time.

D) Steady amounts of reported earnings.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

9

Under the value-to-book model a firm in steady state equilibrium earning ROCE = RE will:

A) create additional shareholder wealth and be valued above book value.

B) maintain shareholder wealth and be valued at book value.

C) destroy shareholder wealth and be valued below book value.

D) be in a no-growth state.

A) create additional shareholder wealth and be valued above book value.

B) maintain shareholder wealth and be valued at book value.

C) destroy shareholder wealth and be valued below book value.

D) be in a no-growth state.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

10

Companies value-to-book and market-to-book ratios may differ due to accounting reasons.An example of an accounting reason that would create a difference is:

A) accelerated methods of depreciation.

B) investments in successful research and development programs that are expensed according to conservative accounting principles.

C) using LIFO versus FIFO for inventory.

D) high operating leverage.

A) accelerated methods of depreciation.

B) investments in successful research and development programs that are expensed according to conservative accounting principles.

C) using LIFO versus FIFO for inventory.

D) high operating leverage.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

11

Firms with low P/E ratios tend to have current residual income that is greater than:

A) future actual income.

B) future residual income.

C) past actual income.

D) past residual income.

A) future actual income.

B) future residual income.

C) past actual income.

D) past residual income.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

12

One with the price-earnings ratio commonly reported is that:

A) it divides share price,which reflects the present value of future earnings by historical earnings.

B) it divides share price,which reflects the present value of book value by historical earnings.

C) it does not take into consideration the present value of future earnings.

D) it is based on analysts' expectations.

A) it divides share price,which reflects the present value of future earnings by historical earnings.

B) it divides share price,which reflects the present value of book value by historical earnings.

C) it does not take into consideration the present value of future earnings.

D) it is based on analysts' expectations.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

13

Residual income is defined as:

A) Difference between expected comprehensive income and required earnings by the firm

B) Difference between comprehensive income and retained earnings

C) Difference between comprehensive income and the company's book value

D) The addition of comprehensive income to net income for the year

A) Difference between expected comprehensive income and required earnings by the firm

B) Difference between comprehensive income and retained earnings

C) Difference between comprehensive income and the company's book value

D) The addition of comprehensive income to net income for the year

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

14

Under the value-to-book model a firm will be valued below book value when:

A) the ROCE is greater than RE

B) the ROCE is equal to RE

C) the ROCE is less than RE

D) the firm's growth rate is above the industry average

A) the ROCE is greater than RE

B) the ROCE is equal to RE

C) the ROCE is less than RE

D) the firm's growth rate is above the industry average

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

15

Valuation using market multiples captures:

A) absolute valuation per dollar of book value or per dollar of earnings.

B) dollar of book value or dollar of earnings per dollar of common equity.

C) relative valuation per dollar of book value or per dollar of earnings.

D) intrinsic valuation per dollar of book value or per dollar of earnings.

A) absolute valuation per dollar of book value or per dollar of earnings.

B) dollar of book value or dollar of earnings per dollar of common equity.

C) relative valuation per dollar of book value or per dollar of earnings.

D) intrinsic valuation per dollar of book value or per dollar of earnings.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

16

A company is expected to have a value of $142,857 at the start of next period and investors require a 14 percent return on equity capital.Using the assumptions of the price-earnings ratio,what would be the company's earnings for the current year?

A) $20,000

B) $14,286

C) $2,800

D) $12,500

A) $20,000

B) $14,286

C) $2,800

D) $12,500

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

17

Strictly speaking,the price-earnings ratio assumes that firm value is the:

A) future value of a constant stream of expected future earnings,discounted at a constant expected future risk-free rate.

B) future value of a constant stream of expected future earnings,discounted at a constant expected future discount rate.

C) present value of a constant stream of expected future earnings,discounted at a constant expected future risk-free rate.

D) present value of a constant stream of expected future earnings,discounted at a constant expected future discount rate.

A) future value of a constant stream of expected future earnings,discounted at a constant expected future risk-free rate.

B) future value of a constant stream of expected future earnings,discounted at a constant expected future discount rate.

C) present value of a constant stream of expected future earnings,discounted at a constant expected future risk-free rate.

D) present value of a constant stream of expected future earnings,discounted at a constant expected future discount rate.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following normally does not introduce measurement error into the calculation of P/E ratios?

A) differences in firm specific growth rates

B) restructuring losses

C) transitory gains

D) deferred taxes

A) differences in firm specific growth rates

B) restructuring losses

C) transitory gains

D) deferred taxes

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

19

Wolverwine Company's current stock price is $55 per share and the company's trailing earnings per share were $2.10.Given that analysts are forecasting growth of 12% for Wolverwine,what is the company's PEG ratio?

A) 21.2

B) 2.18

C) 2.97

D) 1.52

A) 21.2

B) 2.18

C) 2.97

D) 1.52

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following would not be an example of the use of a multiple when valuing common equity?

A) Price-to-operating cash flow

B) Price-to-book.

C) Price-to-earnings.

D) Multi-period discounted earnings models.

A) Price-to-operating cash flow

B) Price-to-book.

C) Price-to-earnings.

D) Multi-period discounted earnings models.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

21

All of the following are economic factors that can cause a firm's price-earnings ratio to be higher than that of other firms in the same industry except:

A) when investors expect that the firm's strategy enables it to generate and sustain greater profitability for a given cost of equity capital

B) when the firm earns the same profitability but with lower risk and,therefore,a lower cost of equity capital

C) a firm's business model that enables it to generate faster growth in earnings provided the growth creates positive residual ROCE

D) a firm's business model that results in slower growth in earnings and this creates negative residual ROCE

A) when investors expect that the firm's strategy enables it to generate and sustain greater profitability for a given cost of equity capital

B) when the firm earns the same profitability but with lower risk and,therefore,a lower cost of equity capital

C) a firm's business model that enables it to generate faster growth in earnings provided the growth creates positive residual ROCE

D) a firm's business model that results in slower growth in earnings and this creates negative residual ROCE

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

22

Economics teaches that,in equilibrium,firms will earn a return equal to the ______________________________.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

23

The value-to-book ratio reflects an analyst's expectation of the firm's ____________________ value to book value.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

24

Industries with relatively high market-to-book ratios are more likely to have ___________________________________ assets.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

25

Market multiples capture ____________________ valuation per dollar of book value or per dollar of earnings.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

26

The differences in industry market-to-book ratios may be the result of differences in growth,ROCE relative to RE,as well as differences in _______________________________________________________.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

27

Analysts use the PEG ratio to assess share price relative to earnings and _________________________________________________________________.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

28

All of the following are accounting factors that can drive a firm's price-earnings ratio in a given period to be higher than that of other firms in the same industry except:

A) non-recurring expenses or losses in that period

B) a greater degree of accounting conservatism that requires expensing R&D or other intangible asset-generating activities

C) a less conservative accounting stance that uses straight-line depreciation rather than accelerated methods

D) a greater degree of accounting conservatism regarding accelerated depreciation of PP&E

A) non-recurring expenses or losses in that period

B) a greater degree of accounting conservatism that requires expensing R&D or other intangible asset-generating activities

C) a less conservative accounting stance that uses straight-line depreciation rather than accelerated methods

D) a greater degree of accounting conservatism regarding accelerated depreciation of PP&E

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

29

The market price of a share of common equity reflects the _____________________________________________ of all of the market participants following that particular stock.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

30

The value-to-book model indicates that a firm in steady state equilibrium earnings ROCE=RE will be valued at _________________________.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

31

To estimate security's risk-neutral value we can use the _____________________________________________ and risk-free rates of return.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

32

The theoretical PE model does not work when the growth rate in ____________________ exceeds the cost of equity capital.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

33

The PE multiple assumes that firm value is the present value of a constant stream of _____________________________________________,discounted at a constant expected future discount rate.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

34

In the value-to-book model growth adds value to shareholders only if the growth is ________________________________________.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

35

The risk of the firm increases the _____________________________________________.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

36

All of the following are economic factors that will decrease a firm's value-to-book ratio over time except:

A) decreasing competition that drives the firm's ROCE down

B) increasing systematic risk that increases the firm's equity cost of capital over time

C) a loss of competitive advantage through changes in technology or other factors

D) retaining earnings or issuing equity capital and deploying the capital in activities that generate ROCE levels that are lower than current levels

A) decreasing competition that drives the firm's ROCE down

B) increasing systematic risk that increases the firm's equity cost of capital over time

C) a loss of competitive advantage through changes in technology or other factors

D) retaining earnings or issuing equity capital and deploying the capital in activities that generate ROCE levels that are lower than current levels

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

37

The ______________________________ represents the value of the firm,based on book value of equity and forecasts of expected future earnings,in the absence of discounting for risk.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following ratios give a perspective on risk in the capital structure?

A) Book value per share

B) Price/earnings ratio

C) Degree of financial leverage

D) Dividend yield

A) Book value per share

B) Price/earnings ratio

C) Degree of financial leverage

D) Dividend yield

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

39

Book value per share may not approximate market value per share because:

A) Land may have substantially increased in value.

B) Market value reflects future potential earning power.

C) Investments may have a market value substantially above the original cost.

D) All of these are reasons why book value per share may not approximate market value per share.

A) Land may have substantially increased in value.

B) Market value reflects future potential earning power.

C) Investments may have a market value substantially above the original cost.

D) All of these are reasons why book value per share may not approximate market value per share.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

40

All of the following are accounting factors that will cause a firm's value-to-book ratio to decrease over time except:

A) recognizing unrealized gains on assets

B) a loss of competitive advantage through changes in technology or other factors

C) earning a high ROCE (above the equity cost of capital)on off-balance-sheet R&D assets

D) earning a high ROCE (above the equity cost of capital)on off-balance-sheet intangible assets (such as brand equity)over time

A) recognizing unrealized gains on assets

B) a loss of competitive advantage through changes in technology or other factors

C) earning a high ROCE (above the equity cost of capital)on off-balance-sheet R&D assets

D) earning a high ROCE (above the equity cost of capital)on off-balance-sheet intangible assets (such as brand equity)over time

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

41

The use of P/E ratios in valuation can result in measurement bias.What two items can result in measurement error and why?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

42

What is the value of reverse engineering stock prices? How does the process work?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

43

Investors have invested $30,000 in common equity in a company.The investors expect that the company will reinvest all income back into projects.The company is forecasted to earn $7,000 the first year,$6,000 the second year,$5,750 the third year,and $6,442 each year after the third year.The company's current stock price is $18 per share.Assuming that the company has 4,300 shares outstanding and the risk-free rate of interest is 7%,calculate the price differential for this company.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

44

The PEG ratio does not take into account differences in ____________________ and ________________________________________ across firms.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

45

What information can a PEG ratio provide about a company's stock price? What does a PEG ratio greater than one mean? Less than one?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

46

Why is book value often meaningless? What improvements to financial statements would make it more meaningful?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

47

Studies have shown that 50-70% of the variability in PE ratios across firms comes from ________ and _______.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

48

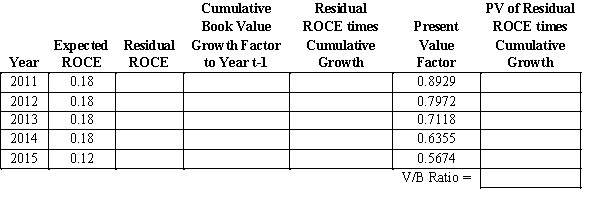

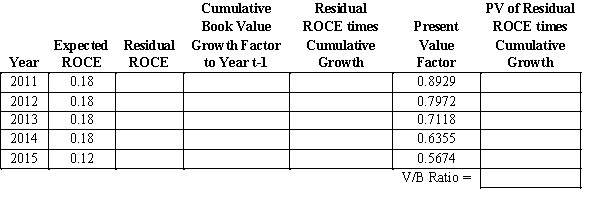

Assume an analyst is evaluating a firm with $1,000 of book value of common equity and a cost of equity capital equal to 12 percent.Assume that the analyst forecasts that the firm will earn ROCE of 18 percent until year 2015,when the firm will start earning ROCE equal to 12 percent.The company pays no dividends and will not engage in any stock transactions.Use this information to complete the following table and calculate the firm's value-to-book ratio.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

49

A firm's value-to-book and market-to-book ratios may differ from one for a number of reasons.Discuss how a successful,internally funded research and development program would create a situation where the value-to-book and market-to-book ratios differ from one another.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

50

In research examining market efficiency,Bernard and Thomas examined quarterly earnings announcements.Discuss how Bernard and Thomas test the issue of market efficiency and the results of their research.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

51

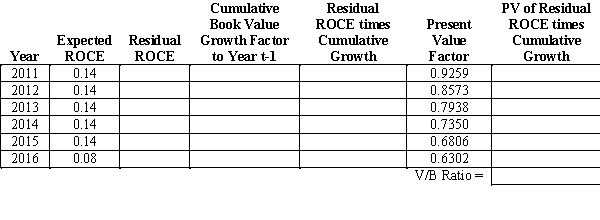

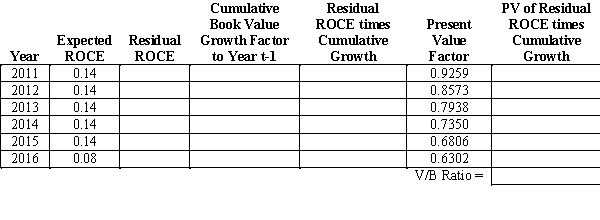

Assume an analyst is evaluating a firm with $1,000 of book value of common equity and a cost of equity capital equal to 8 percent.Assume that the analyst forecasts that the firm will earn ROCE of 14 percent until year 2016,when the firm will start earning ROCE equal to 8 percent.The company pays no dividends and will not engage in any stock transactions.Use this information to complete the following table and calculate the firm's value-to-book ratio.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

52

Firms with low P/E ratios tend to have current residual income that is greater than _____________________________________________.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

53

Explain the analysts' role in making the capital markets efficient.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

54

If the market price of a share of stock is based on the expectations of all of the market participants and the trading volume in that stock,what would happen if the company's reputation were damaged by a scandal or defective product that caused personal injury or death?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

55

Assume a zero-growth rate for earnings and dividends in each situation below.Also assume that all earnings are paid out as dividends and that the earnings-based valuation model is being used.

Situation 1: Das Company's earnings are expected to be $9 per share and its stock price is $36.What is the required rate of return on the firm's equity?

Situation 2: South Company's earnings are expected to be $6 per share and its required rate of return on equity is 26%.What is the current price of the stock?

Situation 3: Jones Company's current stock price is $60 and its required rate of return on equity is 15%.What is the firm's expected earnings?

Situation 1: Das Company's earnings are expected to be $9 per share and its stock price is $36.What is the required rate of return on the firm's equity?

Situation 2: South Company's earnings are expected to be $6 per share and its required rate of return on equity is 26%.What is the current price of the stock?

Situation 3: Jones Company's current stock price is $60 and its required rate of return on equity is 15%.What is the firm's expected earnings?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

56

A company with a PEG ratio of less than one would be interpreted as having a stock price that is low relative to ______________________________.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

57

What is a price differential and how is it computed? What information does a price differential provide to an analyst?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

58

When a company has a high market to book ratio this could be a result of the company having __________________________________________________.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

59

Discuss how risk and profitability factors cause differences in price-earnings ratios across firms.Explain the difference between abnormal and normal earnings.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck