Deck 14: Money, Banking, and Financial Institutions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/130

Play

Full screen (f)

Deck 14: Money, Banking, and Financial Institutions

1

Currency and checkable deposits are:

A) Assets of the Federal Reserve Banks or of financial institutions

B) Redeemable for gold and silver from the Federal Reserve System

C) Of intrinsic value which determines the relative worth of money

D) The major components of money supply M1

A) Assets of the Federal Reserve Banks or of financial institutions

B) Redeemable for gold and silver from the Federal Reserve System

C) Of intrinsic value which determines the relative worth of money

D) The major components of money supply M1

The major components of money supply M1

2

The M1 money supply is composed of:

A) All coins and paper money held by the general public and the banks

B) Bank deposits of households and business firms

C) Bank deposits and mutual funds

D) Checkable deposits and currency in circulation

A) All coins and paper money held by the general public and the banks

B) Bank deposits of households and business firms

C) Bank deposits and mutual funds

D) Checkable deposits and currency in circulation

Checkable deposits and currency in circulation

3

What function is money serving when you deposit money in a savings account?

A) A store of value

B) A unit of account

C) A checkable deposit

D) A medium of exchange

A) A store of value

B) A unit of account

C) A checkable deposit

D) A medium of exchange

A store of value

4

Which one of the following is considered to be a "stock" rather than a "flow" variable?

A) Income

B) Money

C) Wages

D) Profits

A) Income

B) Money

C) Wages

D) Profits

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

5

As of February 2013, more than half of the money supply (M1) was in the form of:

A) Currency

B) Checkable deposits

C) Gold coins and bars

D) Savings deposits

A) Currency

B) Checkable deposits

C) Gold coins and bars

D) Savings deposits

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

6

If product prices were stated in terms of tobacco leaves, then tobacco leaves would be functioning primarily as:

A) Fiat money

B) Legal tender

C) A store of value

D) A unit of account

A) Fiat money

B) Legal tender

C) A store of value

D) A unit of account

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

7

The functions of money are to serve as a:

A) Resource allocator, method for accounting, and means of income distribution

B) Unit of account, store of value, and medium of exchange

C) Determinant of consumption, investment, and government spending

D) Factor of production, exchange, and aggregate supply

A) Resource allocator, method for accounting, and means of income distribution

B) Unit of account, store of value, and medium of exchange

C) Determinant of consumption, investment, and government spending

D) Factor of production, exchange, and aggregate supply

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following functions of money enables society to gain the benefits of geographic and labor specialization?

A) Unit of account

B) Store of value

C) Medium of exchange

D) Medium of deferred payment

A) Unit of account

B) Store of value

C) Medium of exchange

D) Medium of deferred payment

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

9

What function is money serving when you use it when you go shopping?

A) A store of value

B) A unit of account

C) A medium of deferred payment

D) A medium of exchange

A) A store of value

B) A unit of account

C) A medium of deferred payment

D) A medium of exchange

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

10

One major advantage of money serving as a medium of exchange is that it allows society to:

A) Transfer purchasing power from the present to the future

B) Measure the relative worth of products

C) Escape the complications of barter

D) Use credit cards instead of currency

A) Transfer purchasing power from the present to the future

B) Measure the relative worth of products

C) Escape the complications of barter

D) Use credit cards instead of currency

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

11

Money functions as a store of value if it allows you to:

A) Measure the value of goods in a reliable way

B) Make exchanges in a more efficient manner

C) Delay purchases until you want the goods

D) Increase your confidence in money

A) Measure the value of goods in a reliable way

B) Make exchanges in a more efficient manner

C) Delay purchases until you want the goods

D) Increase your confidence in money

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

12

The paper currencies of the U.S. are also called:

A) Federal Reserve notes

B) Treasury Bills

C) U.S. Government notes

D) Treasury bonds

A) Federal Reserve notes

B) Treasury Bills

C) U.S. Government notes

D) Treasury bonds

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

13

When a consumer wants to compare the price of one product with another, money is primarily functioning as a:

A) Store of value

B) Unit of account

C) Checkable deposit

D) Medium of exchange

A) Store of value

B) Unit of account

C) Checkable deposit

D) Medium of exchange

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

14

Checkable deposits are:

A) Debts of commercial banks and savings institutions

B) Debts of the Federal government and government agencies

C) Assets of the Federal government and government agencies

D) Assets of commercial banks and savings institutions

A) Debts of commercial banks and savings institutions

B) Debts of the Federal government and government agencies

C) Assets of the Federal government and government agencies

D) Assets of commercial banks and savings institutions

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

15

An asset's liquidity refers to its ability to be:

A) Bought and stored

B) Increasing in value over time

C) Used and enjoyed

D) A means of payment

A) Bought and stored

B) Increasing in value over time

C) Used and enjoyed

D) A means of payment

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following institutions does not provide checkable-deposit services to the general public?

A) Commercial banks

B) Savings and loan associations

C) U.S. Treasury

D) Credit unions

A) Commercial banks

B) Savings and loan associations

C) U.S. Treasury

D) Credit unions

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

17

The paper money or currency in the U.S. essentially represents:

A) A debt of commercial banks and savings institutions

B) A debt of the U.S. Treasury

C) An asset of the Federal government

D) A debt of the Federal Reserve System

A) A debt of commercial banks and savings institutions

B) A debt of the U.S. Treasury

C) An asset of the Federal government

D) A debt of the Federal Reserve System

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

18

Money eliminates the need for a coincidence of wants in trading primarily through its role as a:

A) Unit of account

B) Medium of exchange

C) Store of value

D) Medium of deferred payment

A) Unit of account

B) Medium of exchange

C) Store of value

D) Medium of deferred payment

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

19

When a banker records how many dollars each of his borrowers owes the bank, money is serving as a:

A) Store of value

B) Unit of account

C) Medium of exchange

D) Legal tender

A) Store of value

B) Unit of account

C) Medium of exchange

D) Legal tender

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

20

The currency or money of the United States, like those of other countries, is:

A) Commodity money

B) Intrinsic money

C) Token money

D) Deposit money

A) Commodity money

B) Intrinsic money

C) Token money

D) Deposit money

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following would be considered to be the most liquid?

A) Checkable deposits

B) Small time deposits

C) Money market mutual funds

D) Savings deposits

A) Checkable deposits

B) Small time deposits

C) Money market mutual funds

D) Savings deposits

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

22

One reason that "near-monies" are important is because:

A) They simplify the definition of money and therefore the formulation of monetary policy

B) They can be easily converted into money or vice versa, and thereby can influence the stability of the economy

C) They do not reflect the level of consumer spending but they have a critical impact on saving and investment in the economy

D) Credit cards synchronize one's expenditures and income, thereby reducing the cash and checkable deposits one must hold

A) They simplify the definition of money and therefore the formulation of monetary policy

B) They can be easily converted into money or vice versa, and thereby can influence the stability of the economy

C) They do not reflect the level of consumer spending but they have a critical impact on saving and investment in the economy

D) Credit cards synchronize one's expenditures and income, thereby reducing the cash and checkable deposits one must hold

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

23

The so-called near-monies have the following characteristics, except:

A) Highly liquid assets

B) Not a means of payment

C) Part of money supply M1

D) Readily converted into cash

A) Highly liquid assets

B) Not a means of payment

C) Part of money supply M1

D) Readily converted into cash

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

24

Michelle transfers $4,000 from her savings account to her checking account. What effect is this change likely to have on M1 and M2?

A) M1 decreases and M2 increases

B) M1 increases and M2 decreases

C) M1 increases and M2 stays the same

D) M2 increases and M1 stays the same

A) M1 decreases and M2 increases

B) M1 increases and M2 decreases

C) M1 increases and M2 stays the same

D) M2 increases and M1 stays the same

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

25

Use the following list to answer the question about the money supply. Items

1) Money market mutual funds held by individuals

2) Savings deposits, including money market deposit accounts

3) Money market mutual funds held by businesses

4) Currency held by the public

5) Small time deposits

6) Checkable deposits

Refer to the list above. The M2 money supply is composed of items:

A) 1, 2, 3, 4, 5, and 6

B) 1, 2, 4, 5, and 6

C) 1, 2, 4, and 6

D) 2, 4, 5, and 6

1) Money market mutual funds held by individuals

2) Savings deposits, including money market deposit accounts

3) Money market mutual funds held by businesses

4) Currency held by the public

5) Small time deposits

6) Checkable deposits

Refer to the list above. The M2 money supply is composed of items:

A) 1, 2, 3, 4, 5, and 6

B) 1, 2, 4, 5, and 6

C) 1, 2, 4, and 6

D) 2, 4, 5, and 6

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

26

Use the following list to answer the question about the money supply. Items

1) Money market mutual funds held by individuals

2) Savings deposits, including money market deposit accounts

3) Money market mutual funds held by businesses

4) Currency held by the public

5) Small time deposits

6) Checkable deposits

Refer to the list above. The M1 money supply is composed of items:

A) 5 and 6

B) 4 and 6

C) 6 and 7

D) 1 and 4

1) Money market mutual funds held by individuals

2) Savings deposits, including money market deposit accounts

3) Money market mutual funds held by businesses

4) Currency held by the public

5) Small time deposits

6) Checkable deposits

Refer to the list above. The M1 money supply is composed of items:

A) 5 and 6

B) 4 and 6

C) 6 and 7

D) 1 and 4

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

27

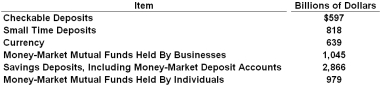

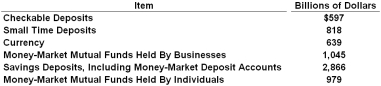

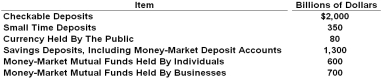

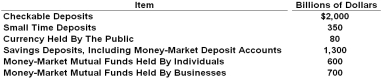

Refer to the table above. The size of the M1 money supply is:

Refer to the table above. The size of the M1 money supply is:A) $979 billion

B) $1,236 billion

C) $1,415 billion

D) $1,618 billion

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

28

Checkable deposits are included in:

A) M1 but not in M2

B) M2 but not in M1

C) both M1 and M2

D) neither M1 nor M2

A) M1 but not in M2

B) M2 but not in M1

C) both M1 and M2

D) neither M1 nor M2

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following items are included in money supply M2 but not M1?

A) Federal Reserve notes

B) Coins

C) Savings deposits

D) Checkable deposits

A) Federal Reserve notes

B) Coins

C) Savings deposits

D) Checkable deposits

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

30

The use of a debit card is most similar to:

A) Paying with a check

B) Using a stored-value card

C) Using currency

D) Obtaining a short-term loan

A) Paying with a check

B) Using a stored-value card

C) Using currency

D) Obtaining a short-term loan

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

31

Which definition(s) of the money supply include(s) only items which are directly and immediately usable as a medium of exchange?

A) M1

B) M2

C) Neither M1 nor M2

D) M1 and M2

A) M1

B) M2

C) Neither M1 nor M2

D) M1 and M2

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

32

The use of a credit card is most similar to:

A) Paying with a check

B) An ACH (automatic clearinghouse) transaction

C) Purchasing a certificate of deposit

D) Obtaining a short-term loan

A) Paying with a check

B) An ACH (automatic clearinghouse) transaction

C) Purchasing a certificate of deposit

D) Obtaining a short-term loan

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

33

Money supply M1 does not include the currency held by:

A) Households in their wallets or purses

B) Business firms

C) Commercial banks

D) State and local governments

A) Households in their wallets or purses

B) Business firms

C) Commercial banks

D) State and local governments

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

34

Refer to the table above. The size of the M2 money supply is:

Refer to the table above. The size of the M2 money supply is:A) $2,054 billion

B) $2,696 billion

C) $5,899 billion

D) $6,792 billion

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

35

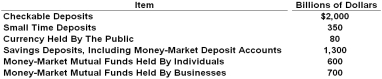

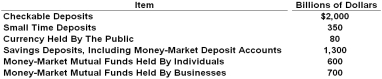

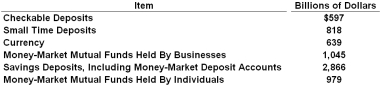

Use the following table to answer the question about the money supply given the following hypothetical data for an economy.  Refer to the table above. The size of the M2 money supply is:

Refer to the table above. The size of the M2 money supply is:

A) $3,730

B) $3,980

C) $4,330

D) $4,470

Refer to the table above. The size of the M2 money supply is:

Refer to the table above. The size of the M2 money supply is:A) $3,730

B) $3,980

C) $4,330

D) $4,470

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

36

Use the following list to answer the question about the money supply. Items

1) Money market mutual funds held by individuals

2) Savings deposits, including money market deposit accounts

3) Money market mutual funds held by businesses

4) Currency held by the public

5) Small time deposits

6) Checkable deposits

Refer to the list above. Which items are included in the M2 money supply, but not the M1 money supply?

A) 1 and 7

B) 3 and 5

C) 1 and 2

D) 1, 2, and 5

1) Money market mutual funds held by individuals

2) Savings deposits, including money market deposit accounts

3) Money market mutual funds held by businesses

4) Currency held by the public

5) Small time deposits

6) Checkable deposits

Refer to the list above. Which items are included in the M2 money supply, but not the M1 money supply?

A) 1 and 7

B) 3 and 5

C) 1 and 2

D) 1, 2, and 5

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

37

Use the following table to answer the question about the money supply given the following hypothetical data for an economy.  Refer to the table above. The size of the M1 money supply is:

Refer to the table above. The size of the M1 money supply is:

A) $1,940

B) $2,080

C) $2,220

D) $2,730

Refer to the table above. The size of the M1 money supply is:

Refer to the table above. The size of the M1 money supply is:A) $1,940

B) $2,080

C) $2,220

D) $2,730

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

38

People can generally get the following items at their commercial banks, except:

A) Money market deposit accounts

B) Time deposits

C) Certificates of deposit

D) Money market mutual funds

A) Money market deposit accounts

B) Time deposits

C) Certificates of deposit

D) Money market mutual funds

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

39

Refer to the table above. The value of the money included in M2 but not counted in M1 is:

Refer to the table above. The value of the money included in M2 but not counted in M1 is:A) $1,457 billion

B) $4,442 billion

C) $2,886 billion

D) $4,663 billion

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

40

Joe deposits $200 in currency into his checking account at a bank. This deposit is treated as:

A) A subtraction of $200 from the money supply because the $200 in currency is no longer in circulation

B) An addition of $200 to the money supply because of the creation of a checkable deposit of $200

C) An addition of $200 to the money supply because the bank holds $200 in currency and the checking account has been increased by $200

D) No change in the money supply because the $200 in currency has been converted to a $200 increase in checkable deposits

A) A subtraction of $200 from the money supply because the $200 in currency is no longer in circulation

B) An addition of $200 to the money supply because of the creation of a checkable deposit of $200

C) An addition of $200 to the money supply because the bank holds $200 in currency and the checking account has been increased by $200

D) No change in the money supply because the $200 in currency has been converted to a $200 increase in checkable deposits

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

41

To keep high inflation from eroding the value of money, monetary authorities in the United States:

A) Create token money that is less than its intrinsic value

B) Make paper money legal tender for the payment of debt

C) Establish insurance on checkable deposit accounts

D) Control the supply of money in the economy

A) Create token money that is less than its intrinsic value

B) Make paper money legal tender for the payment of debt

C) Establish insurance on checkable deposit accounts

D) Control the supply of money in the economy

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

42

One major advantage of credit cards used for transactions is that they:

A) Offer discounts on most transactions

B) Charge a lower interest rate than other means of payment

C) Give consumers the lowest prices on products purchased

D) Allow consumers to coordinate timing and payment for purchases

A) Offer discounts on most transactions

B) Charge a lower interest rate than other means of payment

C) Give consumers the lowest prices on products purchased

D) Allow consumers to coordinate timing and payment for purchases

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

43

The Federal backing for money in the United States comes from:

A) Providing sufficient quantities of precious metals such as gold and silver to cover the amount of paper money in circulation

B) Pledging physical assets, such as land, natural resources, and public buildings as collateral for outstanding currency

C) Controlling the money supply in order to keep the value of money relatively stable over time

D) Protecting checkable deposits at financial institutions with deposit guarantees

A) Providing sufficient quantities of precious metals such as gold and silver to cover the amount of paper money in circulation

B) Pledging physical assets, such as land, natural resources, and public buildings as collateral for outstanding currency

C) Controlling the money supply in order to keep the value of money relatively stable over time

D) Protecting checkable deposits at financial institutions with deposit guarantees

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

44

If the price index rises from 100 to 130, then the purchasing power of the dollar will fall by about:

A) 15 percent

B) 19 percent

C) 23 percent

D) 30 percent

A) 15 percent

B) 19 percent

C) 23 percent

D) 30 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

45

Checkable deposits are money because they are:

A) Legal tender

B) Fiat money

C) Acceptable as payment

D) Token money

A) Legal tender

B) Fiat money

C) Acceptable as payment

D) Token money

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

46

The Federal Reserve System of the U.S. is the country's:

A) Financial adviser

B) Comptroller or Accountant

C) Central bank

D) Deposit insurance provider

A) Financial adviser

B) Comptroller or Accountant

C) Central bank

D) Deposit insurance provider

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

47

What "backs" the money supply of the U.S.?

A) The U.S. government's ability to keep the value of money relatively stable

B) The amount of gold the U.S. government has on deposit at its banks

C) The fact that currency is issued by the Federal Reserve System

D) The fact that the intrinsic value of coins in circulation is greater than their face value

A) The U.S. government's ability to keep the value of money relatively stable

B) The amount of gold the U.S. government has on deposit at its banks

C) The fact that currency is issued by the Federal Reserve System

D) The fact that the intrinsic value of coins in circulation is greater than their face value

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

48

The Federal Reserve System consists of which of the following?

A) Federal Open Market Committee and Office of Thrift Supervision

B) Federal Deposit Insurance Corporation and Controller of the Currency

C) U.S. Treasury Department and Bureau of Engraving and Printing

D) Board of Governors and the 12 Federal Reserve Banks

A) Federal Open Market Committee and Office of Thrift Supervision

B) Federal Deposit Insurance Corporation and Controller of the Currency

C) U.S. Treasury Department and Bureau of Engraving and Printing

D) Board of Governors and the 12 Federal Reserve Banks

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

49

When paper money is designated as legal tender, it means that:

A) It is printed by the government

B) Its supply is controlled by the government

C) It is a means of payment by law

D) It will be accepted by the government

A) It is printed by the government

B) Its supply is controlled by the government

C) It is a means of payment by law

D) It will be accepted by the government

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is not true about the use of a credit card?

A) It is a means of deferring payment for a short period of time

B) It allows people to "economize" on the use of money

C) Credit-card balances are part of M2, but not part of M1

D) A credit card transaction is not the same as a debit card transaction

A) It is a means of deferring payment for a short period of time

B) It allows people to "economize" on the use of money

C) Credit-card balances are part of M2, but not part of M1

D) A credit card transaction is not the same as a debit card transaction

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following is not true about the Federal Reserve banks?

A) They serve as bankers' banks

B) They are privately owned but government-controlled

C) Unlike other banks, they are not motivated by profits

D) They compete with commercial banks in their basic functions

A) They serve as bankers' banks

B) They are privately owned but government-controlled

C) Unlike other banks, they are not motivated by profits

D) They compete with commercial banks in their basic functions

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

52

The Federal Reserve Banks are owned by the:

A) Federal government

B) Board of Governors

C) United States Treasury

D) Member banks

A) Federal government

B) Board of Governors

C) United States Treasury

D) Member banks

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

53

The Federal Reserve System was established by the Federal Reserve Act of:

A) 1913

B) 1933

C) 1945

D) 1955

A) 1913

B) 1933

C) 1945

D) 1955

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

54

If the purchasing power of the dollar is falling, then it follows that:

A) The price index is falling

B) The price index is rising

C) Nominal incomes are falling

D) Interest rates are rising

A) The price index is falling

B) The price index is rising

C) Nominal incomes are falling

D) Interest rates are rising

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

55

United States currency has value primarily because it:

A) Is legal tender, is generally acceptable in exchange for goods or services, and is backed by the gold and silver of the Federal government

B) Is generally acceptable in exchange for goods or services, is backed by the gold and silver of the Federal government, and facilitates trade

C) Is relatively scarce, is legal tender, and is generally acceptable in exchange for goods and services

D) Facilitates trade, is legal tender, and permits the use of credit cards and near-monies

A) Is legal tender, is generally acceptable in exchange for goods or services, and is backed by the gold and silver of the Federal government

B) Is generally acceptable in exchange for goods or services, is backed by the gold and silver of the Federal government, and facilitates trade

C) Is relatively scarce, is legal tender, and is generally acceptable in exchange for goods and services

D) Facilitates trade, is legal tender, and permits the use of credit cards and near-monies

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

56

When there is inflation in the economy, it implies that the:

A) Price index is rising and the purchasing power of money is also rising

B) Price index is falling and the purchasing power of money is also falling

C) Price index is falling and the purchasing power of money is rising

D) Price index is rising and the purchasing power of money is falling

A) Price index is rising and the purchasing power of money is also rising

B) Price index is falling and the purchasing power of money is also falling

C) Price index is falling and the purchasing power of money is rising

D) Price index is rising and the purchasing power of money is falling

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following "backs" the value of money in the United States?

A) The gold stored in the Federal Reserve Bank of New York

B) The acceptability of it as a medium of exchange

C) The willingness of foreign government to hold U.S. dollars

D) The size of the budget surplus in the U.S. government

A) The gold stored in the Federal Reserve Bank of New York

B) The acceptability of it as a medium of exchange

C) The willingness of foreign government to hold U.S. dollars

D) The size of the budget surplus in the U.S. government

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

58

How many members can serve on the Board of Governors of the Federal Reserve System?

A) 7

B) 9

C) 12

D) 14

A) 7

B) 9

C) 12

D) 14

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

59

The basic requirement for an item to function as money is that it be:

A) Backed by precious metals-gold or silver

B) Authorized as legal tender by the central government

C) Generally accepted as a medium of exchange

D) Some form of debt or credit

A) Backed by precious metals-gold or silver

B) Authorized as legal tender by the central government

C) Generally accepted as a medium of exchange

D) Some form of debt or credit

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

60

Money in the U.S. is essentially debt of:

A) Businesses and the banks

B) The Federal Reserve System and the banks

C) The national and local governments

D) Businesses and the Federal Reserve System

A) Businesses and the banks

B) The Federal Reserve System and the banks

C) The national and local governments

D) Businesses and the Federal Reserve System

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

61

The Federal Open Market Committee (FOMC):

A) Provides advice on banking stability to the Fed

B) Monitors regulatory banking laws for member banks

C) Sets policy on the sale and purchase of government bonds by the Fed

D) Follows the actions and operations of financial markets to keep them open and competitive

A) Provides advice on banking stability to the Fed

B) Monitors regulatory banking laws for member banks

C) Sets policy on the sale and purchase of government bonds by the Fed

D) Follows the actions and operations of financial markets to keep them open and competitive

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

62

When a bank's loans are written off, it means that the bank's:

A) Reserves are reduced, while its debt increases

B) Reserves rise along with its debt

C) Reserves fall along with its debt

D) Reserves shrink, whereas its debt remains the same

A) Reserves are reduced, while its debt increases

B) Reserves rise along with its debt

C) Reserves fall along with its debt

D) Reserves shrink, whereas its debt remains the same

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

63

The Federal Reserve System performs many functions but its most important one is:

A) Issuing currency

B) Controlling the money supply

C) Providing for check clearing and collection

D) Acting as fiscal agent for the U.S. government

A) Issuing currency

B) Controlling the money supply

C) Providing for check clearing and collection

D) Acting as fiscal agent for the U.S. government

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

64

Members of the Federal Reserve Board of Governors are:

A) Appointed by Congress to staggered 14-year terms

B) Selected by the Federal Open Market Committee for 4-year terms

C) Appointed by the President to staggered 14-year terms

D) Selected by each of the Federal Reserve banks for 4-year terms

A) Appointed by Congress to staggered 14-year terms

B) Selected by the Federal Open Market Committee for 4-year terms

C) Appointed by the President to staggered 14-year terms

D) Selected by each of the Federal Reserve banks for 4-year terms

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

65

The Federal Reserve System is divided into:

A) 5 districts

B) 7 districts

C) 12 districts

D) 15 districts

A) 5 districts

B) 7 districts

C) 12 districts

D) 15 districts

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

66

The major wave of defaults on home mortgages in 2007 destabilized:

A) Only the banks that directly made the mortgage loans

B) Only the mortgage brokers; not the commercial banks

C) Many banks including those that made the loans indirectly

D) Mostly large banks, but not too many small ones

A) Only the banks that directly made the mortgage loans

B) Only the mortgage brokers; not the commercial banks

C) Many banks including those that made the loans indirectly

D) Mostly large banks, but not too many small ones

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

67

Holding the money deposits of businesses and households and making loans to the public are the basic functions of:

A) District banks of the Federal Reserve System

B) Commercial banks and thrift institutions

C) The Open Market Committee and the Board of Governors

D) The Federal Deposit Insurance Corporation and the Federal Savings and Loan Insurance Corporation

A) District banks of the Federal Reserve System

B) Commercial banks and thrift institutions

C) The Open Market Committee and the Board of Governors

D) The Federal Deposit Insurance Corporation and the Federal Savings and Loan Insurance Corporation

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

68

The Financial Crisis of 2007-2008 started in which sector of the economy?

A) Foreign trade sector

B) Consumer durables sector

C) Dot.com and technology sector

D) Real estate and housing sector

A) Foreign trade sector

B) Consumer durables sector

C) Dot.com and technology sector

D) Real estate and housing sector

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

69

The main function of the Federal Reserve System is to:

A) Serve as the fiscal agent for the Federal government

B) Set reserve requirements of banks

C) Clear checks from member banks

D) Control the money supply

A) Serve as the fiscal agent for the Federal government

B) Set reserve requirements of banks

C) Clear checks from member banks

D) Control the money supply

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

70

Which group aids the Board of Governors of the Federal Reserve System in conducting monetary policy?

A) U.S. Treasury

B) U.S. Congress

C) Federal Advisory Council

D) Federal Open Market Committee

A) U.S. Treasury

B) U.S. Congress

C) Federal Advisory Council

D) Federal Open Market Committee

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

71

The Federal Open Market Committee (FOMC) of the Federal Reserve System is primarily for:

A) Maintaining cash reserves that can be used to settle international transactions

B) Supervising banks to make sure that markets are open to all and remain competitive

C) Issuing currency and acting as the fiscal agent for the Federal government

D) Setting the Fed's monetary policy and directing the purchase and sale of government securities

A) Maintaining cash reserves that can be used to settle international transactions

B) Supervising banks to make sure that markets are open to all and remain competitive

C) Issuing currency and acting as the fiscal agent for the Federal government

D) Setting the Fed's monetary policy and directing the purchase and sale of government securities

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

72

Which group is responsible for the policy decision of changing the money supply?

A) Federal Open Market Committee

B) Office of Management and Budget

C) Thrift Advisory Council

D) Federal Advisory Council

A) Federal Open Market Committee

B) Office of Management and Budget

C) Thrift Advisory Council

D) Federal Advisory Council

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

73

The most important among the Federal Reserve district banks in conducting monetary policy is the:

A) Boston bank

B) Chicago bank

C) New York bank

D) San Francisco bank

A) Boston bank

B) Chicago bank

C) New York bank

D) San Francisco bank

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

74

When the Fed acts as a "lender of last resort", like it did in the financial crisis of 2007-2008, it is performing its role of:

A) Controlling the money supply

B) Setting the reserve requirements

C) Being the bankers' bank

D) Providing for check clearing and collection

A) Controlling the money supply

B) Setting the reserve requirements

C) Being the bankers' bank

D) Providing for check clearing and collection

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

75

The reason for the Fed being set up as an independent agency of government is to:

A) Protect it from political pressure

B) Allow it to earn profits like private firms

C) Make it be managed and controlled by member banks

D) Let it be able to compete with other financial institutions

A) Protect it from political pressure

B) Allow it to earn profits like private firms

C) Make it be managed and controlled by member banks

D) Let it be able to compete with other financial institutions

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

76

The Federal Reserve System is an:

A) Agency that is controlled by Congress

B) Agency that is under the direction of the President

C) Independent agency of government

D) Agency ran by popularly-elected officials

A) Agency that is controlled by Congress

B) Agency that is under the direction of the President

C) Independent agency of government

D) Agency ran by popularly-elected officials

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

77

Economic studies conducted in industrially advanced countries suggest there is:

A) A positive relationship between the degree of independence of the central bank and the size of the average annual rate of inflation

B) An inverse relationship between the degree of independence of the central bank and the size of the average annual rate of inflation

C) No relationship between the degree of independence of the central bank and the size of the average annual rate of inflation

D) A positive relationship between the degree of independence of the central bank and the size of the central bank

A) A positive relationship between the degree of independence of the central bank and the size of the average annual rate of inflation

B) An inverse relationship between the degree of independence of the central bank and the size of the average annual rate of inflation

C) No relationship between the degree of independence of the central bank and the size of the average annual rate of inflation

D) A positive relationship between the degree of independence of the central bank and the size of the central bank

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

78

The twelve Federal Reserve Banks can best be characterized as:

A) Central banks, banker's banks, and quasi-public banks

B) Regional banks, public banks, and member banks

C) Investment banks, banker's banks, and public banks

D) National banks, quasi-public banks, and investment banks

A) Central banks, banker's banks, and quasi-public banks

B) Regional banks, public banks, and member banks

C) Investment banks, banker's banks, and public banks

D) National banks, quasi-public banks, and investment banks

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following is NOT true about subprime mortgage loans:

A) They played a central role in the financial crisis of 2007-2008

B) They were encouraged by the Federal government for many years before the financial crisis

C) They had always been discouraged by the government, and even banned in some cases

D) They were considered high-risk loans because the borrowers had poor credit ratings

A) They played a central role in the financial crisis of 2007-2008

B) They were encouraged by the Federal government for many years before the financial crisis

C) They had always been discouraged by the government, and even banned in some cases

D) They were considered high-risk loans because the borrowers had poor credit ratings

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

80

The Federal Reserve System performs the following functions, except:

A) Issuing the paper currency in the economy

B) Providing banking services to the general public

C) Providing financial services to the Federal government

D) Lending money to banks and thrifts

A) Issuing the paper currency in the economy

B) Providing banking services to the general public

C) Providing financial services to the Federal government

D) Lending money to banks and thrifts

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck