Deck 17: Pensions and Other Postretirement Benefits

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/197

Play

Full screen (f)

Deck 17: Pensions and Other Postretirement Benefits

1

There almost always is a balance sheet liability for postretirement benefit plans since very few are funded.

True

2

A net pension asset is the excess of the projected benefit obligation over the plan assets.

False

3

Defined contribution pension plans that link the amount of contributions to company performance are often called:

A)Incentive savings plans.

B)Thrift plans.

C)Savings plans.

D)None of the above is correct.

A)Incentive savings plans.

B)Thrift plans.

C)Savings plans.

D)None of the above is correct.

A

4

Prior service cost is recognized as pension expense over a period of several years.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

5

The expected postretirement benefit obligation is the discounted present value of the total benefits expected to be paid by the employer to the plan participants.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is not a requirement for a qualified pension plan?

A)It cannot discriminate in favor of highly paid employees.

B)It must cover at least 80% of the employees.

C)It must be funded in advance of retirement.

D)Benefits must vest after a specified period of service, commonly five years.

A)It cannot discriminate in favor of highly paid employees.

B)It must cover at least 80% of the employees.

C)It must be funded in advance of retirement.

D)Benefits must vest after a specified period of service, commonly five years.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following describes defined benefit pension plans?

A)They raise few accounting issues for employers.

B)Retirement benefits depend on how much money has accumulated in an individual's account.

C)They are simple to construct.

D)Retirement benefits are based on the plan benefit formula.

A)They raise few accounting issues for employers.

B)Retirement benefits depend on how much money has accumulated in an individual's account.

C)They are simple to construct.

D)Retirement benefits are based on the plan benefit formula.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

8

The amount of the vested benefit obligation is less than the projected benefit obligation and more than the accumulated benefit obligation.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following describes defined benefit pension plans?

A)The investment risk is borne by the employee.

B)The plans are simple and easy to construct.

C)The investment risk is borne by the employer.

D)Retirement benefits depend on the individual's account balance.

A)The investment risk is borne by the employee.

B)The plans are simple and easy to construct.

C)The investment risk is borne by the employer.

D)Retirement benefits depend on the individual's account balance.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is not an uncertainty that complicates determining how much to set aside each year to ensure that sufficient funds are available to provide the benefits promised under a defined benefit plan?

A)Employee turnover.

B)Number of employees who retired last year.

C)Future inflation rates.

D)Future compensation levels.

A)Employee turnover.

B)Number of employees who retired last year.

C)Future inflation rates.

D)Future compensation levels.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

11

A net gain or net loss affects pension expense only if it exceeds 10% of the pension benefit obligation or 10% of plan assets, whichever is lower.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

12

An upward revision of inflation and compensation trends would likely cause a gain in the pension benefit obligation.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

13

Pension expense and funding amounts are both accounting decisions.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

14

If a pension plan is underfunded, the company has a net loss-OCI.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

15

The accounting for defined contribution pension plans is easy because each year:

A)The employer records pension expense equal to the amount paid out to retirees.

B)The employer records pension expense based on an amount provided by the actuary.

C)The employer records pension expense equal to the annual contribution.

D)The employer records pension expense based on the earnings of the plan assets.

A)The employer records pension expense equal to the amount paid out to retirees.

B)The employer records pension expense based on an amount provided by the actuary.

C)The employer records pension expense equal to the annual contribution.

D)The employer records pension expense based on the earnings of the plan assets.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

16

Conceptually, the service method provides a better matching of costs and benefits in amortizing prior service cost than does the straight-line method.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

17

The projected benefit obligation may be less reliable than the accumulated benefit obligation.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

18

The difference between pension plan assets and the PBO is equal to the funded status of the plan.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is not a characteristic of a qualified pension plan?

A)It can be limited to highly compensated salaried employees.

B)It must be funded in advance of retirement.

C)Benefits must vest after a specified period of service.

D)It must cover at least 70% of employees.

A)It can be limited to highly compensated salaried employees.

B)It must be funded in advance of retirement.

C)Benefits must vest after a specified period of service.

D)It must cover at least 70% of employees.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following is not usually part of the pension formula under a defined benefit plan?

A)Age at retirement.

B)Number of years of service.

C)Seniority at time of retirement.

D)Compensation level.

A)Age at retirement.

B)Number of years of service.

C)Seniority at time of retirement.

D)Compensation level.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

21

The portion of the obligation that plan participants are entitled to receive regardless of their continued employment is called the:

A)Vested benefit obligation.

B)Retiree benefit obligation.

C)Actual benefit obligation.

D)True benefit obligation.

A)Vested benefit obligation.

B)Retiree benefit obligation.

C)Actual benefit obligation.

D)True benefit obligation.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

22

To help assess the uncertainties that surround a defined benefit pension plan, corporations frequently hire a(n):

A)CPA.

B)Attorney.

C)Investment analyst.

D)Actuary.

A)CPA.

B)Attorney.

C)Investment analyst.

D)Actuary.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

23

Payment of retirement benefits:

A)Increases the PBO.

B)Increases the ABO.

C)Reduces the GBO.

D)Reduces the PBO.

A)Increases the PBO.

B)Increases the ABO.

C)Reduces the GBO.

D)Reduces the PBO.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

24

Consider the following: I. Present value of vested benefits at present pay levels.

II) Present value of nonvested benefits at present pay levels.

III) Present value of additional benefits related to projected pay increases.

Which of the above constitutes the vested benefit obligation?

A)I & II.

B)I, II, III.

C)II.

D)I only.

II) Present value of nonvested benefits at present pay levels.

III) Present value of additional benefits related to projected pay increases.

Which of the above constitutes the vested benefit obligation?

A)I & II.

B)I, II, III.

C)II.

D)I only.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

25

Interest cost will:

A)Increase the PBO and increase pension expense.

B)Increase pension expense and reduce plan assets.

C)Increase the PBO and reduce plan assets.

D)Increase pension expense and reduce the return on plan assets.

A)Increase the PBO and increase pension expense.

B)Increase pension expense and reduce plan assets.

C)Increase the PBO and reduce plan assets.

D)Increase pension expense and reduce the return on plan assets.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following is not a way of measuring the pension obligation?

A)Accumulated benefit obligation.

B)Vested benefit obligation.

C)Retiree benefit obligation.

D)Projected benefit obligation.

A)Accumulated benefit obligation.

B)Vested benefit obligation.

C)Retiree benefit obligation.

D)Projected benefit obligation.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

27

The PBO is increased by:

A)An increase in the average life expectancy of employees.

B)Amortization of prior service cost.

C)An increase in the actuary's assumed discount rate.

D)A return on plan assets that is lower than expected.

A)An increase in the average life expectancy of employees.

B)Amortization of prior service cost.

C)An increase in the actuary's assumed discount rate.

D)A return on plan assets that is lower than expected.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

28

What is the 2013 service cost for Havana's plan?

A)$276 thousand.

B)$528 thousand.

C)$648 thousand.

D)Cannot be determined from the given information.

A)$276 thousand.

B)$528 thousand.

C)$648 thousand.

D)Cannot be determined from the given information.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

29

Mars Inc. has a defined benefit pension plan. On December 31 (the end of the fiscal year), the company received the PBO report from the actuary. The following information was included in the report: ending PBO, $110,000; benefits paid to retirees, $10,000; interest cost, $7,200. The discount rate applied by the actuary was 8%. What was the beginning PBO?

A)$90,000.

B)$100,000.

C)$107,200.

D)$112,000.

A)$90,000.

B)$100,000.

C)$107,200.

D)$112,000.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

30

What is Havana's 2013 actual return on plan assets?

A)$504 thousand.

B)$618 thousand.

C)$1,128 thousand.

D)None of the above is correct.

A)$504 thousand.

B)$618 thousand.

C)$1,128 thousand.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

31

Compared to the ABO, the PBO usually is:

A)Larger.

B)More reliable.

C)Less relevant.

D)More material.

A)Larger.

B)More reliable.

C)Less relevant.

D)More material.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

32

The annual pension expense for what type of pension plan(s) is recorded by a journal entry that includes a debit to pension expense and a credit to a noncurrent liability?

A)A defined benefit plan only.

B)A defined contribution plan only.

C)Both a defined benefit and a defined contribution plan.

D)This is not the correct entry.

A)A defined benefit plan only.

B)A defined contribution plan only.

C)Both a defined benefit and a defined contribution plan.

D)This is not the correct entry.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

33

Consider the following: I. Present value of vested benefits at present pay levels.

II) Present value of nonvested benefits at present pay levels.

III) Present value of additional benefits related to projected pay increases.

Which of the above constitutes the projected benefit obligation?

A)III only.

B)I, II.

C)I, II, III.

D)II only.

II) Present value of nonvested benefits at present pay levels.

III) Present value of additional benefits related to projected pay increases.

Which of the above constitutes the projected benefit obligation?

A)III only.

B)I, II.

C)I, II, III.

D)II only.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

34

Consider the following: I. Present value of vested benefits at present pay levels.

II) Present value of nonvested benefits at present pay levels.

III) Present value of additional benefits related to projected pay increases.

Which of the above constitutes the accumulated benefit obligation?

A)I & II.

B)I, II, III.

C)II & III.

D)II only.

II) Present value of nonvested benefits at present pay levels.

III) Present value of additional benefits related to projected pay increases.

Which of the above constitutes the accumulated benefit obligation?

A)I & II.

B)I, II, III.

C)II & III.

D)II only.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

35

ERISA made major changes in the requirements for pension plan:

A)Vesting.

B)Reporting.

C)Taxing.

D)Investing.

A)Vesting.

B)Reporting.

C)Taxing.

D)Investing.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following statements typifies defined contribution plans?

A)Investment risk is borne by the corporation sponsoring the plan.

B)The plans are more complex than defined benefit plans.

C)Present value factors are used to determine the annual contributions to the plan.

D)The employer's obligation is satisfied by making the periodic contribution to the plan.

A)Investment risk is borne by the corporation sponsoring the plan.

B)The plans are more complex than defined benefit plans.

C)Present value factors are used to determine the annual contributions to the plan.

D)The employer's obligation is satisfied by making the periodic contribution to the plan.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

37

The employer has an obligation to provide future benefits for:

A)Defined benefit pension plans.

B)Defined contribution pension plans.

C)Defined benefit and defined contribution plans.

D)None of the above

A)Defined benefit pension plans.

B)Defined contribution pension plans.

C)Defined benefit and defined contribution plans.

D)None of the above

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

38

A company's defined benefit pension plan had a PBO of $265,000 on January 1, 2013. During 2013, pension benefits paid were $40,000. The discount rate for the plan for this year was 10%. Service cost for 2013 was $80,000. Plan assets (fair value) increased during the year by $45,000. The amount of the PBO at December 31, 2013, was:

A)$225,000.

B)$305,000.

C)$331,500.

D)None of the above is correct.

A)$225,000.

B)$305,000.

C)$331,500.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

39

Louie Company has a defined benefit pension plan. On December 31 (the end of the fiscal year), the company received the PBO report from the actuary. The following information was included in the report: ending PBO, $110,000; benefits paid to retirees, $10,000; interest cost, $8,000. The discount rate applied by the actuary was 8%. What was the service cost for the year?

A)$2,000.

B)$12,000.

C)$18,000.

D)$92,000.

A)$2,000.

B)$12,000.

C)$18,000.

D)$92,000.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

40

Compared to the ABO, the PBO usually is:

A)Less material.

B)Less representationally faithful.

C)Less relevant.

D)Less reliable.

A)Less material.

B)Less representationally faithful.

C)Less relevant.

D)Less reliable.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

41

Assume that at the beginning of the current year, a company has a net gain-AOCI of $25,000,000. At the same time, assume the PBO and the plan assets are $200,000,000 and $150,000,000, respectively. The average remaining service period for the employees expected to receive benefits is 10 years. What is the amount of amortization to pension expense for the year?

A)$3,000,000.

B)$500,000.

C)$2,500,000.

D)$1,500,000.

A)$3,000,000.

B)$500,000.

C)$2,500,000.

D)$1,500,000.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

42

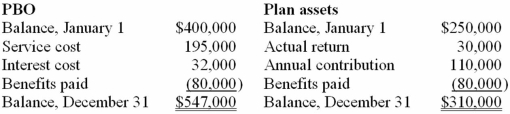

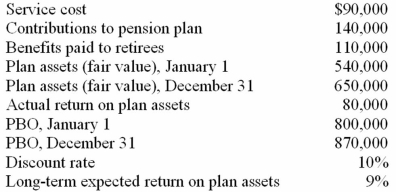

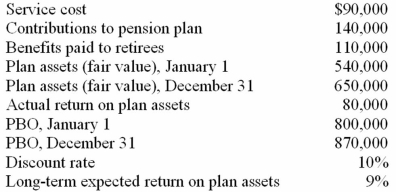

Scallion Company received the following reports of its defined benefit pension plan for the current calendar year:  The long-term expected rate of return on plan assets is 10%. Assuming no other data are relevant, what is the pension expense for the year?

The long-term expected rate of return on plan assets is 10%. Assuming no other data are relevant, what is the pension expense for the year?

A)$197,000.

B)$227,000.

C)$172,000.

D)$202,000.

The long-term expected rate of return on plan assets is 10%. Assuming no other data are relevant, what is the pension expense for the year?

The long-term expected rate of return on plan assets is 10%. Assuming no other data are relevant, what is the pension expense for the year?A)$197,000.

B)$227,000.

C)$172,000.

D)$202,000.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

43

The three components of pension expense that are present most often are:

A)Service cost, prior service cost, and gain on plan assets.

B)Service cost, interest cost, and gain from revisions in pension liability.

C)Service cost, contribution cost, and prior service cost.

D)Service cost, interest cost, and expected return on plan assets.

A)Service cost, prior service cost, and gain on plan assets.

B)Service cost, interest cost, and gain from revisions in pension liability.

C)Service cost, contribution cost, and prior service cost.

D)Service cost, interest cost, and expected return on plan assets.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

44

Data for 2013 were as follows: PBO, January 1, $240,000 and December 31, $270,000; pension plan assets (fair value) January 1, $180,000, and December 31, $230,000. The projected benefit obligation was underfunded at the end of 2013 by:

A)$30,000.

B)$60,000.

C)$20,000.

D)$40,000.

A)$30,000.

B)$60,000.

C)$20,000.

D)$40,000.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

45

An underfunded pension plan means that the:

A)PBO is less than plan assets.

B)PBO exceeds plan assets.

C)ABO is less than plan assets.

D)ABO exceeds plan assets.

A)PBO is less than plan assets.

B)PBO exceeds plan assets.

C)ABO is less than plan assets.

D)ABO exceeds plan assets.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

46

A net gain or loss affects the pension expense only if it exceeds an amount equal to what percentage of the PBO or plan assets, whichever is higher?

A)5%.

B)10%.

C)15%.

D)20%.

A)5%.

B)10%.

C)15%.

D)20%.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following is not a potential component of pension expense?

A)Return on plan assets.

B)Prior service cost.

C)Retiree benefits paid.

D)Gains and losses.

A)Return on plan assets.

B)Prior service cost.

C)Retiree benefits paid.

D)Gains and losses.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

48

An overfunded pension plan means that the:

A)PBO is less than plan assets.

B)PBO exceeds plan assets.

C)ABO is less than plan assets.

D)ABO exceeds plan assets.

A)PBO is less than plan assets.

B)PBO exceeds plan assets.

C)ABO is less than plan assets.

D)ABO exceeds plan assets.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

49

What is Havana's 2013 gain or loss on plan assets?

A)$115.2 thousand.

B)$160.8 thousand.

C)$276 thousand.

D)None of the above is correct.

A)$115.2 thousand.

B)$160.8 thousand.

C)$276 thousand.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

50

What is the 2013 pension expense for Havana's plan?

A)$594 thousand.

B)$606 thousand.

C)$678 thousand.

D)None of the above is correct.

A)$594 thousand.

B)$606 thousand.

C)$678 thousand.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

51

Interest cost is calculated by multiplying the:

A)ABO by the expected return on the plan assets.

B)ABO by the discount rate.

C)PBO by the expected return on plan assets.

D)PBO by the discount rate.

A)ABO by the expected return on the plan assets.

B)ABO by the discount rate.

C)PBO by the expected return on plan assets.

D)PBO by the discount rate.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following is true?

A)A projected benefits approach is used to determine the periodic pension expense.

B)An accumulated benefits approach is used to determine the periodic pension expense.

C)A vested benefits approach is used to determine the periodic pension expense.

D)The pension expense is unrelated to the pension obligation.

A)A projected benefits approach is used to determine the periodic pension expense.

B)An accumulated benefits approach is used to determine the periodic pension expense.

C)A vested benefits approach is used to determine the periodic pension expense.

D)The pension expense is unrelated to the pension obligation.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

53

The amortization of a net gain has what effect on pension expense?

A)Decreases it.

B)Has no effect on it.

C)Increases it (but only by the amount over 10% of the PBO).

D)Increases it (regardless of the amount).

A)Decreases it.

B)Has no effect on it.

C)Increases it (but only by the amount over 10% of the PBO).

D)Increases it (regardless of the amount).

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

54

Amortizing prior service cost for pension plans will:

A)Decrease assets.

B)Increase liabilities.

C)Increase shareholders' equity.

D)Decrease retained earnings.

A)Decrease assets.

B)Increase liabilities.

C)Increase shareholders' equity.

D)Decrease retained earnings.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

55

When accounting for pensions, delayed recognition of gains and losses in earnings achieves:

A)Income averaging.

B)Expense averaging.

C)Income optimization.

D)Income smoothing.

A)Income averaging.

B)Expense averaging.

C)Income optimization.

D)Income smoothing.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

56

The component of pension expense that results from amending a pension plan to give recognition to previous service of currently enrolled employees is the amortization of:

A)Prior service costs.

B)Amendment costs.

C)Retiree service costs.

D)Transition costs.

A)Prior service costs.

B)Amendment costs.

C)Retiree service costs.

D)Transition costs.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

57

Pension expense is decreased by:

A)Amortization of prior service cost.

B)Amortization of net gain.

C)Benefits paid to retired employees.

D)Prior service cost.

A)Amortization of prior service cost.

B)Amortization of net gain.

C)Benefits paid to retired employees.

D)Prior service cost.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

58

The pension expense includes periodic changes that occur:

A)In the PBO.

B)In the PBO and the plan assets.

C)In the plan assets.

D)In the PBO and the ABO.

A)In the PBO.

B)In the PBO and the plan assets.

C)In the plan assets.

D)In the PBO and the ABO.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

59

Assume that at the beginning of the current year, a company has a net gain-AOCI of $60,000,000. At the same time, assume the PBO and the plan assets are $300,000,000 and $450,000,000, respectively. The average remaining service period for the employees expected to receive benefits is 10 years. What is the amount of amortization to pension expense for the year?

A)$6,000,000.

B)$15,000,000.

C)$1,500,000.

D)$7,500,000.

A)$6,000,000.

B)$15,000,000.

C)$1,500,000.

D)$7,500,000.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

60

Pension gains related to plan assets occur when:

A)The return on plan assets is higher than expected.

B)The vested benefit obligation is less than expected.

C)Retiree benefits paid out are less than expected.

D)The accumulated benefit obligation is more than expected.

A)The return on plan assets is higher than expected.

B)The vested benefit obligation is less than expected.

C)Retiree benefits paid out are less than expected.

D)The accumulated benefit obligation is more than expected.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

61

Amortizing prior service cost for pension plans will:

A)Increase retained earnings and increase accumulated other comprehensive income.

B)Decrease retained earnings and decrease accumulated other comprehensive income.

C)Increase retained earnings and decrease accumulated other comprehensive income.

D)Decrease retained earnings and increase accumulated other comprehensive income.

A)Increase retained earnings and increase accumulated other comprehensive income.

B)Decrease retained earnings and decrease accumulated other comprehensive income.

C)Increase retained earnings and decrease accumulated other comprehensive income.

D)Decrease retained earnings and increase accumulated other comprehensive income.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

62

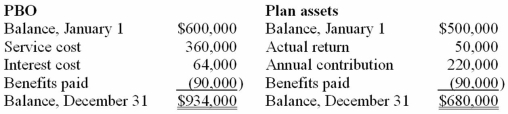

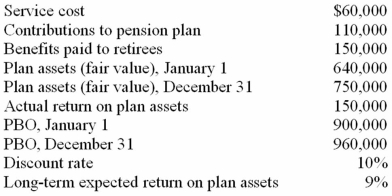

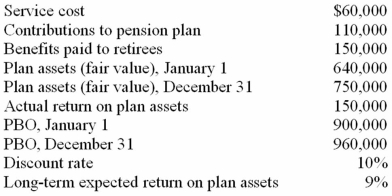

Fox Company received the following reports of its defined benefit pension plan for the current calendar year:  The long-term expected rate of return on plan assets is 8%. Assuming no other data are relevant, what is the pension expense for the year?

The long-term expected rate of return on plan assets is 8%. Assuming no other data are relevant, what is the pension expense for the year?

A)$384,000.

B)$360,000.

C)$424,000.

D)$374,000.

The long-term expected rate of return on plan assets is 8%. Assuming no other data are relevant, what is the pension expense for the year?

The long-term expected rate of return on plan assets is 8%. Assuming no other data are relevant, what is the pension expense for the year?A)$384,000.

B)$360,000.

C)$424,000.

D)$374,000.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

63

A statement of comprehensive income does not include:

A)Gains from the return on pension assets exceeding expectations.

B)Gains and losses on unsold held-to-maturity securities.

C)Losses from the return on pension assets falling short of expectations.

D)Prior service cost.

A)Gains from the return on pension assets exceeding expectations.

B)Gains and losses on unsold held-to-maturity securities.

C)Losses from the return on pension assets falling short of expectations.

D)Prior service cost.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

64

The following information is related to the defined benefit pension plan of Simpson Company for the year:  Assuming no other relevant data exist, what is the pension expense for the year?

Assuming no other relevant data exist, what is the pension expense for the year?

A)$90,000.

B)$230,600.

C)$121,400.

D)$154,000.

Assuming no other relevant data exist, what is the pension expense for the year?

Assuming no other relevant data exist, what is the pension expense for the year?A)$90,000.

B)$230,600.

C)$121,400.

D)$154,000.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

65

What were the retiree benefits paid?

A)$45.

B)$50.

C)$55.

D)$60.

A)$45.

B)$50.

C)$55.

D)$60.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

66

What was the net pension asset/liability reported in the balance sheet at the end of the year?

A)Net pension asset of $50.

B)Net pension asset of $24.

C)Net pension liability of $50.

D)Net pension liability of $24.

A)Net pension asset of $50.

B)Net pension asset of $24.

C)Net pension liability of $50.

D)Net pension liability of $24.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

67

At December 31, 2012, Mongo, Inc., reported in its balance sheet a net loss of $3 million related to its pension plan. The actuary for Mongo at the end of 2013 increased her estimate of future salary levels. Mongo's entry to record the effect of this change will include:

A)A debit to loss-OCI and a credit to PBO.

B)A debit to PBO and a credit to loss-OCI.

C)A debit to pension expense and a credit to PBO.

D)A debit to pension expense and a credit to loss-OCI.

A)A debit to loss-OCI and a credit to PBO.

B)A debit to PBO and a credit to loss-OCI.

C)A debit to pension expense and a credit to PBO.

D)A debit to pension expense and a credit to loss-OCI.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

68

Gains and losses can occur with pension plans when:

A)Either the PBO or the return on plan assets turns out to be different than expected.

B)Either the ABO or the return on plan assets turns out to be different than expected.

C)Either the PBO, the ABO, or the return on plan assets turns out to be different than expected.

D)Either the PBO or the ABO turns out to be different than expected.

A)Either the PBO or the return on plan assets turns out to be different than expected.

B)Either the ABO or the return on plan assets turns out to be different than expected.

C)Either the PBO, the ABO, or the return on plan assets turns out to be different than expected.

D)Either the PBO or the ABO turns out to be different than expected.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

69

Accumulated other comprehensive income:

A)Is a liability.

B)Might include prior service cost.

C)Includes accumulated pension expense.

D)Is reported in the income statement.

A)Is a liability.

B)Might include prior service cost.

C)Includes accumulated pension expense.

D)Is reported in the income statement.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following is a correct statement concerning the reporting of the pension plan on the face of the employer's balance sheet?

A)Only the plan assets are separately reported.

B)Only the PBO is separately reported.

C)Both the PBO and the plan assets are separately reported.

D)Neither the PBO nor the plan assets is separately reported.

A)Only the plan assets are separately reported.

B)Only the PBO is separately reported.

C)Both the PBO and the plan assets are separately reported.

D)Neither the PBO nor the plan assets is separately reported.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

71

Recording pension expense would usually:

A)Increase the PBO.

B)Increase current assets.

C)Increase the prior service cost-AOCI.

D)Increase the net loss-AOCI.

A)Increase the PBO.

B)Increase current assets.

C)Increase the prior service cost-AOCI.

D)Increase the net loss-AOCI.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

72

The following information is related to the defined benefit pension plan of Dreamworld Company for the year:  Assuming no other relevant data exist, what is the pension expense for the year?

Assuming no other relevant data exist, what is the pension expense for the year?

A)$190,000.

B)$92,400.

C)$60,000.

D)$170,000.

Assuming no other relevant data exist, what is the pension expense for the year?

Assuming no other relevant data exist, what is the pension expense for the year?A)$190,000.

B)$92,400.

C)$60,000.

D)$170,000.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

73

What was the PBO at the beginning of the year?

A)$160.

B)$400.

C)$500.

D)$610.

A)$160.

B)$400.

C)$500.

D)$610.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

74

What was the actuary's interest (discount) rate?

A)7%.

B)8%.

C)9%.

D)10%.

A)7%.

B)8%.

C)9%.

D)10%.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

75

A statement of comprehensive income does not include:

A)Net income.

B)Losses from the return on assets exceeding expectations.

C)Losses from changes in estimates regarding the PBO.

D)Prior service cost.

A)Net income.

B)Losses from the return on assets exceeding expectations.

C)Losses from changes in estimates regarding the PBO.

D)Prior service cost.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

76

A gain from changing an estimate regarding the obligation for pension plans will:

A)Increase assets.

B)Increase liabilities.

C)Decrease shareholders' equity.

D)Increase shareholders' equity.

A)Increase assets.

B)Increase liabilities.

C)Decrease shareholders' equity.

D)Increase shareholders' equity.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

77

Castillo Company has a defined benefit pension plan. At the end of the reporting year, the following data were available: beginning PBO, $75,000; service cost, $18,000; interest cost, $5,000; benefits paid for the year, $9,000; ending PBO, $89,000; the expected return on plan assets, $10,000; and cash deposited with pension trustee, $17,000. There were no other pension-related costs. The journal entry to record the annual pension costs will include a credit to the PBO for:

A)$13,000.

B)$17,000.

C)$18,000.

D)$23,000.

A)$13,000.

B)$17,000.

C)$18,000.

D)$23,000.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

78

Colombo Enterprises has a defined benefit pension plan. At the end of the reporting year, the following data were available: beginning PBO, $75,000; service cost, $14,000; interest cost, $6,000; benefits paid for the year, $9,000; ending PBO, $89,000; and the expected return on plan assets, $10,000. There were no other pension-related costs. The journal entry to record the annual pension costs will include a debit to pension expense for:

A)$20,000.

B)$15,000.

C)$12,000.

D)$10,000.

A)$20,000.

B)$15,000.

C)$12,000.

D)$10,000.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

79

What was FRC's pension expense for the year?

A)$44.

B)$47.

C)$49.

D)$107.

A)$44.

B)$47.

C)$49.

D)$107.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

80

What was PVE's pension expense for the year?

A)$250.

B)$50.

C)$68.

D)$62.

A)$250.

B)$50.

C)$68.

D)$62.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck