Deck 9: Property, Plant, and Equipment and Intangible Assets: Acquisition and Disposition

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

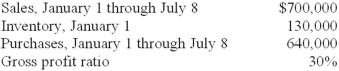

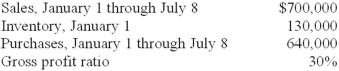

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

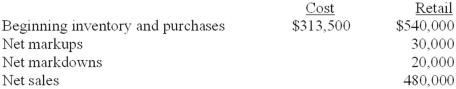

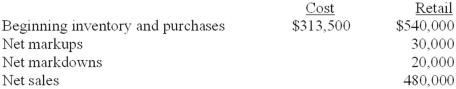

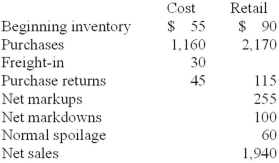

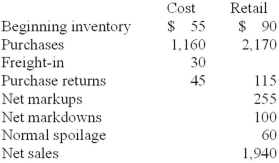

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

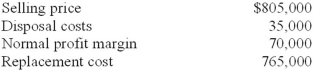

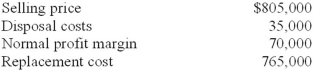

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/120

Play

Full screen (f)

Deck 9: Property, Plant, and Equipment and Intangible Assets: Acquisition and Disposition

1

The primary motivation behind LCM is consistency.

False

2

Inventory written down due to LCM may be written back up if market values increase.

False

3

International Financial Reporting Standards allow the reversal of an inventory write-down.

True

4

If the quantity of goods held in inventory decreased during the period, the dollar amount of ending inventory cannot exceed the dollar amount of beginning inventory.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

5

Losses on reduction to LCM may be charged to either cost of goods sold or to a current loss account.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

6

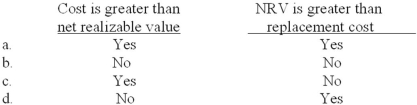

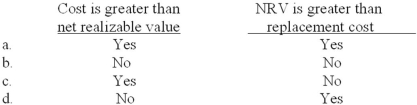

Masterlink Co., in applying the lower of cost or market method, reports its inventory at net realizable value. Which of the following statements is correct?

A)Option a

B)Option b

C)Option c

D)Option d

A)Option a

B)Option b

C)Option c

D)Option d

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

7

An argument against the use of LCM is its lack of:

A)Relevance.

B)Reliability.

C)Consistency.

D)Objectivity.

A)Relevance.

B)Reliability.

C)Consistency.

D)Objectivity.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

8

In applying LCM, market cannot be:

A)Less than net realizable value minus a normal profit margin.

B)Net realizable value less reasonable completion and disposal costs.

C)Greater than net realizable value reduced by an allowance for normal profit margin.

D)Less than cost.

A)Less than net realizable value minus a normal profit margin.

B)Net realizable value less reasonable completion and disposal costs.

C)Greater than net realizable value reduced by an allowance for normal profit margin.

D)Less than cost.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

9

Net realizable value is selling price less costs of completion and disposal.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

10

A change from LIFO to any other inventory method is accounted for retrospectively.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

11

In applying LCM, market cannot be:

A)Less than net realizable value.

B)Greater than the normal profit.

C)Less than the normal profit margin.

D)Greater than net realizable value.

A)Less than net realizable value.

B)Greater than the normal profit.

C)Less than the normal profit margin.

D)Greater than net realizable value.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

12

For a purchase commitment contained within a single fiscal year, if the market price is less than the contract price, the purchase is recorded at the contract price.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

13

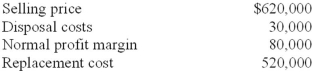

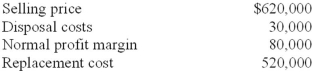

Montana Co. has determined its year-end inventory on a FIFO basis to be $600,000. Information pertaining to that inventory is as follows:  What should be the carrying value of Montana's inventory?

What should be the carrying value of Montana's inventory?

A)$600,000.

B)$520,000.

C)$590,000.

D)$510,000.

What should be the carrying value of Montana's inventory?

What should be the carrying value of Montana's inventory?A)$600,000.

B)$520,000.

C)$590,000.

D)$510,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

14

The purpose of ceilings and floors in LCM is to prevent profit distortion.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

15

For a purchase commitment extending beyond the current fiscal year, if the market price on the purchase date declines from the previous year-end price, the purchase is recorded at the market price.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

16

Purchase returns and purchase discounts are ignored when computing cost-to-retail ratios for the retail method.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

17

Under the LIFO retail method, the current period cost-to-retail percentage includes both net markdowns and net markups.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

18

The cost-to-retail percentage used in the retail method to approximate average cost incorporates both markdowns and markups.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

19

In determining lower of cost or market, market is the expected selling price under normal operations.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

20

When changing from the average cost method to FIFO, the current year's income includes the cumulative after-tax difference that would have resulted if the company had used FIFO in all prior years.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

21

In applying the LCM rule, the inventory of rehab supplies would be valued at:

A)$122.

B)$158.

C)$162.

D)$155.

A)$122.

B)$158.

C)$162.

D)$155.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

22

When using the gross profit method to estimate ending inventory, it is not necessary to know:

A)Beginning inventory.

B)Net purchases.

C)Cost of goods sold.

D)Net sales.

A)Beginning inventory.

B)Net purchases.

C)Cost of goods sold.

D)Net sales.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

23

In applying the LCM rule, the inventory of surgical supplies would be valued at:

A)$115.

B)$90.

C)$80.

D)$69.

A)$115.

B)$90.

C)$80.

D)$69.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

24

Under the conventional retail method, which of the following are not included in the denominator of the current period cost-to-retail conversion percentage?

A)Purchase returns.

B)Net markups.

C)Purchases.

D)Net markdowns.

A)Purchase returns.

B)Net markups.

C)Purchases.

D)Net markdowns.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

25

Howard's Supply Co. suffered a fire loss on April 20, 2013. The company's last physical inventory was taken January 30, 2013, at which time the inventory totaled $220,000. Sales from January 30 to April 20 were $600,000 and purchases during that time were $450,000. Howard's consistently reports a 30% gross profit. The estimated inventory loss is:

A)$490,000.

B)$238,000.

C)$250,000.

D)None of the above is correct.

A)$490,000.

B)$238,000.

C)$250,000.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

26

In applying the LCM rule, the inventory of apparel would be valued at:

A)$108,000.

B)$90,000.

C)$110,000.

D)$115,000.

A)$108,000.

B)$90,000.

C)$110,000.

D)$115,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

27

Under the LIFO retail method, which of the following are not included in the denominator of the cost-to-retail conversion percentage?

A)Freight-in.

B)Purchase returns.

C)Purchases.

D)Net markdowns.

A)Freight-in.

B)Purchase returns.

C)Purchases.

D)Net markdowns.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

28

On July 8, a fire destroyed the entire merchandise inventory on hand of Larrenaga Wholesale Corporation. The following information is available:  What is the estimated inventory on July 8 immediately prior to the fire?

What is the estimated inventory on July 8 immediately prior to the fire?

A)$192,000.

B)$490,000.

C)$510,000.

D)$280,000.

What is the estimated inventory on July 8 immediately prior to the fire?

What is the estimated inventory on July 8 immediately prior to the fire?A)$192,000.

B)$490,000.

C)$510,000.

D)$280,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

29

In applying the LCM rule, the inventory of skis would be valued at:

A)$162,000.

B)$128,000.

C)$120,000.

D)$126,000.

A)$162,000.

B)$128,000.

C)$120,000.

D)$126,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

30

In applying the LCM rule, the inventory of supplies would be valued at:

A)$45,000.

B)$54,000.

C)$41,000.

D)$42,000.

A)$45,000.

B)$54,000.

C)$41,000.

D)$42,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

31

Under the LIFO retail method, the denominator in the cost-to-retail percentage includes:

A)Net markups and net markdowns.

B)Neither net markups nor net markdowns.

C)Net markups, but not net markdowns.

D)Net markdowns, but not net markups.

A)Net markups and net markdowns.

B)Neither net markups nor net markdowns.

C)Net markups, but not net markdowns.

D)Net markdowns, but not net markups.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

32

In applying the LCM rule, the inventory of boots would be valued at:

A)$135,000.

B)$133,000.

C)$130,000.

D)$105,000.

A)$135,000.

B)$133,000.

C)$130,000.

D)$105,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

33

Under the retail inventory method:

A)A company measures inventory on its balance sheet by converting retail prices to cost.

B)A company measures inventory on its balance sheet at current selling prices.

C)A company measures inventory on its balance sheet on a LIFO basis.

D)None of the above is correct.

A)A company measures inventory on its balance sheet by converting retail prices to cost.

B)A company measures inventory on its balance sheet at current selling prices.

C)A company measures inventory on its balance sheet on a LIFO basis.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

34

Coastal Shores Inc. (CSI) was destroyed by Hurricane Fred on August 5, 2013. At January 1, CSI reported an inventory of $170,000. Sales from January 1, 2013, to August 5, 2013, totaled $480,000 and purchases totaled $195,000 during that time. CSI consistently marks up its products 60% over cost to arrive at a selling price. The estimated inventory loss due to Hurricane Fred would be:

A)$131,175.

B)$65,000.

C)$17,143.

D)None of the above is correct.

A)$131,175.

B)$65,000.

C)$17,143.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

35

California Inc., through no fault of its own, lost an entire plant due to an earthquake on May 1, 2013. In preparing its insurance claim on the inventory loss, the company developed the following data: Inventory January 1, 2013, $300,000; sales and purchases from January 1, 2013, to May 1, 2013, $1,300,000 and $875,000, respectively. California consistently reports a 40% gross profit. The estimated inventory on May 1, 2013, is:

A)$302,500.

B)$360,000.

C)$395,000.

D)$455,000.

A)$302,500.

B)$360,000.

C)$395,000.

D)$455,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

36

Under the retail method, the denominator in the cost-to-retail percentage does not include:

A)Purchases.

B)Purchase returns.

C)Abnormal shortages.

D)Freight-in.

A)Purchases.

B)Purchase returns.

C)Abnormal shortages.

D)Freight-in.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

37

In applying the LCM rule, the inventory of surgical equipment would be valued at:

A)$230.

B)$240.

C)$170.

D)$152.

A)$230.

B)$240.

C)$170.

D)$152.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

38

Under the conventional retail method, the denominator in the cost-to-retail percentage includes:

A)Net markups and net markdowns.

B)Neither net markups nor net markdowns.

C)Net markups, but not net markdowns.

D)Net markdowns, but not net markups.

A)Net markups and net markdowns.

B)Neither net markups nor net markdowns.

C)Net markups, but not net markdowns.

D)Net markdowns, but not net markups.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

39

Under the retail method, in determining the cost-to-retail percentage for the current year:

A)Net markups are included.

B)Net markdowns are excluded.

C)Net sales are included.

D)All of the above are correct.

A)Net markups are included.

B)Net markdowns are excluded.

C)Net sales are included.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

40

In applying the LCM rule, the inventory of rehab equipment would be valued at:

A)$315.

B)$247.

C)$150.

D)$235.

A)$315.

B)$247.

C)$150.

D)$235.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

41

The conventional retail inventory method is based on:

A)Average cost.

B)LIFO cost.

C)Average, lower of cost or market.

D)LIFO, lower of cost or market.

A)Average cost.

B)LIFO cost.

C)Average, lower of cost or market.

D)LIFO, lower of cost or market.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

42

When computing the cost-to-retail percentage for the average cost retail method, included in the denominator are:

A)Net markups and net markdowns.

B)Neither net markups nor net markdowns.

C)Net markups, but not net markdowns.

D)Net markdowns, but not net markups.

A)Net markups and net markdowns.

B)Neither net markups nor net markdowns.

C)Net markups, but not net markdowns.

D)Net markdowns, but not net markups.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

43

Lacy's Linen Mart uses the retail method to estimate inventories. Data for the first six months of 2013 include: beginning inventory at cost and retail were $60,000 and $120,000, net purchases at cost and retail were $312,000 and $480,000, and sales during the first six months totaled $490,000. The estimated inventory at June 30, 2013, would be:

A)$68,200.

B)$55,000.

C)$71,500.

D)$63,250.

A)$68,200.

B)$55,000.

C)$71,500.

D)$63,250.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

44

Estimated ending inventory at cost is:

A)$90,720.

B)$83,500.

C)$91,600.

D)None of the above is correct.

A)$90,720.

B)$83,500.

C)$91,600.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

45

Estimated ending inventory at retail is:

A)$65,000.

B)$169,600.

C)$25,000.

D)$129,000.

A)$65,000.

B)$169,600.

C)$25,000.

D)$129,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

46

The average cost-to-retail percentage is:

A)74.5%.

B)55.6%.

C)57.4%.

D)58.7%.

A)74.5%.

B)55.6%.

C)57.4%.

D)58.7%.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

47

To the nearest thousand, the estimated ending inventory at cost is:

A)$16,000.

B)$15,000.

C)$13,000.

D)$19,000.

A)$16,000.

B)$15,000.

C)$13,000.

D)$19,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

48

Fad City sells novel clothes that are subject to a great deal of price volatility. A recent item that cost $20 was marked up $12, marked down for a sale by $6 and then had a markdown cancellation of $3. The latest selling price is:

A)$23.

B)$26.

C)$29.

D)$35.

A)$23.

B)$26.

C)$29.

D)$35.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

49

Hawkeye Auto Parts uses the retail method to estimate inventories. Data for the first six months of 2013 include: beginning inventory at cost and retail were $55,000 and $100,000, net purchases at cost and retail were $785,000 and $1,300,000, and sales during the first six months totaled $800,000. The estimated inventory at June 30, 2013, would be:

A)$330,000.

B)$360,000.

C)$362,300.

D)None of the above is correct.

A)$330,000.

B)$360,000.

C)$362,300.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

50

To the nearest thousand, estimated ending inventory using the conventional retail method is:

A)$37,000.

B)$32,000.

C)$34,000.

D)$30,000.

A)$37,000.

B)$32,000.

C)$34,000.

D)$30,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

51

The numerator for the current period's cost-to-retail percentage is:

A)$64,800.

B)$48,100.

C)$47,700.

D)$49,800.

A)$64,800.

B)$48,100.

C)$47,700.

D)$49,800.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

52

Cloverdale, Inc., uses the conventional retail inventory method to account for inventory. The following information relates to current year's operations:  What amount should be reported as cost of goods sold for the year?

What amount should be reported as cost of goods sold for the year?

A)$273,600.

B)$272,861.

C)$275,000.

D)None of the above.

What amount should be reported as cost of goods sold for the year?

What amount should be reported as cost of goods sold for the year?A)$273,600.

B)$272,861.

C)$275,000.

D)None of the above.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

53

The conventional cost-to-retail percentage (rounded) is:

A)54.9%.

B)58.9%.

C)53.6%.

D)70.6%.

A)54.9%.

B)58.9%.

C)53.6%.

D)70.6%.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

54

Current period cost-to-retail percentage is:

A)70.0%.

B)68.7%.

C)63.6%.

D)63.5%.

A)70.0%.

B)68.7%.

C)63.6%.

D)63.5%.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

55

The conventional cost-to-retail percentage (rounded) is:

A)82.6%.

B)66.7%.

C)71.9%.

D)75.5%.

A)82.6%.

B)66.7%.

C)71.9%.

D)75.5%.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

56

The average cost-to-retail percentage is:

A)52.2%.

B)61.5%.

C)56.8%

D)55%.

A)52.2%.

B)61.5%.

C)56.8%

D)55%.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

57

To the nearest thousand, estimated ending inventory is:

A)$55,000.

B)$52,000.

C)$57,000.

D)None of the above is correct.

A)$55,000.

B)$52,000.

C)$57,000.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

58

The estimated ending inventory at retail is:

A)$27,300.

B)$25,000.

C)$26,600.

D)$26,400.

A)$27,300.

B)$25,000.

C)$26,600.

D)$26,400.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

59

To the nearest thousand, estimated ending inventory is:

A)$41,000.

B)$37,000.

C)$51,000.

D)None of the above is correct.

A)$41,000.

B)$37,000.

C)$51,000.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

60

The denominator for the current period's cost-to-retail percentage is:

A)$96,300.

B)$73,300.

C)$101,000.

D)$81,500.

A)$96,300.

B)$73,300.

C)$101,000.

D)$81,500.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

61

Prunedale Co. uses a periodic inventory system. Beginning inventory on January 1 was understated by $30,000, and its ending inventory on December 31 was understated by $17,000. In addition, a purchase of merchandise costing $20,000 was incorrectly recorded as a $2,000 purchase. None of these errors were discovered until the next year. As a result, Prunedale's cost of goods sold for this year was:

A)Overstated by $31,000.

B)Overstated by $5,000.

C)Understated by $31,000.

D)Understated by $48,000.

A)Overstated by $31,000.

B)Overstated by $5,000.

C)Understated by $31,000.

D)Understated by $48,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

62

Portman Inc. uses the conventional retail inventory method. Expressed in millions of dollars, information about Portman's 2013 inventory account is expressed in the table below:  What is the value of Portman's inventory at 12/31/13?

What is the value of Portman's inventory at 12/31/13?

A)$150 million.

B)$252 million.

C)$300 million.

D)None of the above is correct.

What is the value of Portman's inventory at 12/31/13?

What is the value of Portman's inventory at 12/31/13?A)$150 million.

B)$252 million.

C)$300 million.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

63

Required:

Determine the balance sheet inventory carrying value assuming the LCM rule is applied to classes of trees.

Determine the balance sheet inventory carrying value assuming the LCM rule is applied to classes of trees.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

64

Harlequin Co. has used the dollar-value LIFO retail method since it began operations in early 2012 (its base year). Its beginning inventory for 2013 was $36,000 at cost and $72,000 at retail prices. At the end of 2013, it computed its estimated ending inventory at retail to be $120,000. Assuming its cost-to-retail percentage for 2013 transactions was 60%, what is the inventory balance that Harlequin Co. would report in its 12/31/13 balance sheet?

A)$64,800.

B)$72,000.

C)$120,000.

D)It can't be determined with the given information.

A)$64,800.

B)$72,000.

C)$120,000.

D)It can't be determined with the given information.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

65

To the nearest thousand, estimated ending inventory using the conventional retail method is:

A)$163,000.

B)$124,000.

C)$127,000.

D)$136,000.

A)$163,000.

B)$124,000.

C)$127,000.

D)$136,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

66

Required:

Determine the balance sheet inventory carrying value assuming the LCM rule is applied to individual trees.

Determine the balance sheet inventory carrying value assuming the LCM rule is applied to individual trees.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

67

Under International Financial Reporting Standards, inventory is valued at the lower of cost and:

A)Replacement cost.

B)Net realizable value.

C)Net realizable value reduced by a normal profit margin.

D)None of the above.

A)Replacement cost.

B)Net realizable value.

C)Net realizable value reduced by a normal profit margin.

D)None of the above.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

68

Haskell Corporation. has determined its year-end inventory on a FIFO basis to be $785,000. Information pertaining to that inventory is as follows:  What should be the carrying value of Sullivan's inventory if the company prepares its financial statements according to International Financial Reporting Standards?

What should be the carrying value of Sullivan's inventory if the company prepares its financial statements according to International Financial Reporting Standards?

A)$765,000.

B)$785,000.

C)$770,000.

D)$700,000.

What should be the carrying value of Sullivan's inventory if the company prepares its financial statements according to International Financial Reporting Standards?

What should be the carrying value of Sullivan's inventory if the company prepares its financial statements according to International Financial Reporting Standards?A)$765,000.

B)$785,000.

C)$770,000.

D)$700,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

69

Under the dollar-value LIFO retail method, to determine the value of a LIFO layer:

A)Divide the LIFO layer by the layer-year price index and multiply by the layer-year cost-to-retail percentage.

B)Multiply the LIFO layer by the base year price index and the current year cost-to-retail percentage.

C)Multiply the LIFO layer by the layer-year price index and by the layer-year cost-to-retail percentage.

D)Divide the LIFO layer by the layer-year cost-to-retail percentage and multiply by the layer-year price index.

A)Divide the LIFO layer by the layer-year price index and multiply by the layer-year cost-to-retail percentage.

B)Multiply the LIFO layer by the base year price index and the current year cost-to-retail percentage.

C)Multiply the LIFO layer by the layer-year price index and by the layer-year cost-to-retail percentage.

D)Divide the LIFO layer by the layer-year cost-to-retail percentage and multiply by the layer-year price index.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

70

The second step, when using dollar-value LIFO retail method for inventory, is to determine the estimated:

A)Ending inventory at current year retail prices.

B)Cost of goods sold for the current year.

C)Ending inventory at cost.

D)Ending inventory at base year retail prices.

A)Ending inventory at current year retail prices.

B)Cost of goods sold for the current year.

C)Ending inventory at cost.

D)Ending inventory at base year retail prices.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

71

What should be the carrying value of Sullivan's inventory?

A)$500,000.

B)$440,000.

C)$430,000.

D)$490,000.

A)$500,000.

B)$440,000.

C)$430,000.

D)$490,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

72

Prunedale Co. uses a periodic inventory system. Beginning inventory on January 1 was overstated by $32,000, and its ending inventory on December 31 was understated by $62,000. These errors were not discovered until the next year. As a result, Prunedale's cost of goods sold for this year was:

A)Overstated by $94,000.

B)Overstated by $30,000.

C)Understated by $94,000.

D)Understated by $30,000.

A)Overstated by $94,000.

B)Overstated by $30,000.

C)Understated by $94,000.

D)Understated by $30,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

73

At what amount will Johnson record the inventory purchased on February 1, 2014?

A)$210,000.

B)$200,000.

C)$180,000.

D)$190,000.

A)$210,000.

B)$200,000.

C)$180,000.

D)$190,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

74

How much loss on purchase commitment will Johnson recognize in 2013?

A)$10,000.

B)$20,000.

C)$30,000.

D)None.

A)$10,000.

B)$20,000.

C)$30,000.

D)None.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

75

The first step, when using dollar-value LIFO retail method for inventory, is to:

A)Determine the estimated ending inventory at current year retail prices.

B)Determine the estimated cost of goods sold for the current year.

C)Determine the cost-to-retail percentage for the current year transactions.

D)Price index adjust the LIFO inventory layers.

A)Determine the estimated ending inventory at current year retail prices.

B)Determine the estimated cost of goods sold for the current year.

C)Determine the cost-to-retail percentage for the current year transactions.

D)Price index adjust the LIFO inventory layers.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

76

Using the dollar-value LIFO retail method for inventory:

A)Is the same as dollar-value LIFO, except that the inventory is measured at retail, rather than at cost.

B)Combines retail LIFO accounting with dollar-value LIFO accounting.

C)Allows companies to report inventory on the balance sheet at retail prices.

D)All of the above are correct.

A)Is the same as dollar-value LIFO, except that the inventory is measured at retail, rather than at cost.

B)Combines retail LIFO accounting with dollar-value LIFO accounting.

C)Allows companies to report inventory on the balance sheet at retail prices.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

77

Retrospective treatment of prior years' financial statements is required when there is a change from:

A)Average cost to FIFO.

B)FIFO to average cost.

C)LIFO to average cost.

D)All of the above.

A)Average cost to FIFO.

B)FIFO to average cost.

C)LIFO to average cost.

D)All of the above.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

78

What should be the carrying value of Sullivan's inventory if the company prepares its financial statements according to International Financial Reporting Standards?

A)$500,000.

B)$440,000.

C)$430,000.

D)$490,000.

A)$500,000.

B)$440,000.

C)$430,000.

D)$490,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

79

Under the dollar-value LIFO retail method, to determine if the increase in the value of inventory was due to an increase in quantities:

A)Compare beginning and ending inventory amounts at current year prices.

B)Compare beginning and ending inventory amounts after adjusting both amounts to the average price level for the year.

C)Inflate beginning inventory amount to end of year prices and compare to ending inventory amount.

D)Deflate the ending inventory amount to beginning of year prices and compare to the beginning inventory amount.

A)Compare beginning and ending inventory amounts at current year prices.

B)Compare beginning and ending inventory amounts after adjusting both amounts to the average price level for the year.

C)Inflate beginning inventory amount to end of year prices and compare to ending inventory amount.

D)Deflate the ending inventory amount to beginning of year prices and compare to the beginning inventory amount.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

80

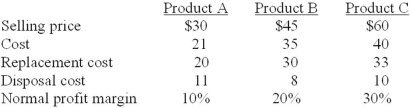

Chicago Inc. applies lower-of-cost-or-market valuation to individual products and has collected the following data:  Required:

Required:

Determine the balance sheet inventory carrying value for Products A, B, and

C.

Required:

Required:Determine the balance sheet inventory carrying value for Products A, B, and

C.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck