Deck 4: Costvolumeprofit Cvp Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/66

Play

Full screen (f)

Deck 4: Costvolumeprofit Cvp Analysis

1

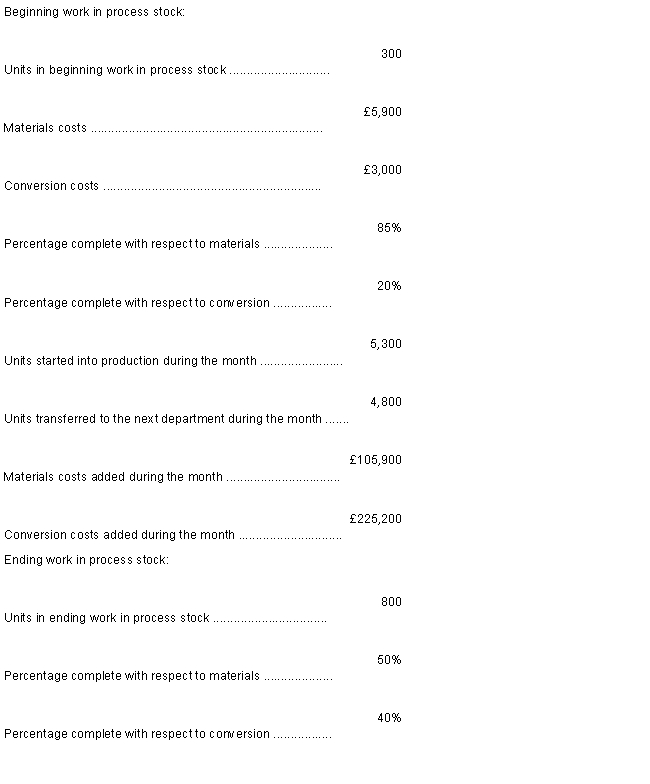

Janner Company uses the weighted-average method in its process costing system. Operating data for the Painting Department for the month of April appear below:

What were the equivalent units for conversion costs in the Painting Department for April?

A)93,760

B)92,800

C)91,360

D)88,000

What were the equivalent units for conversion costs in the Painting Department for April?

A)93,760

B)92,800

C)91,360

D)88,000

93,760

2

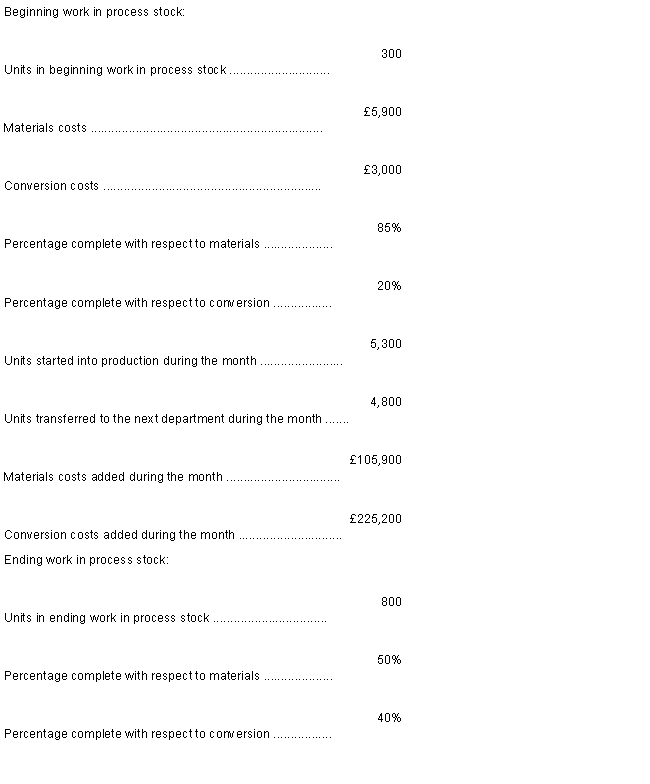

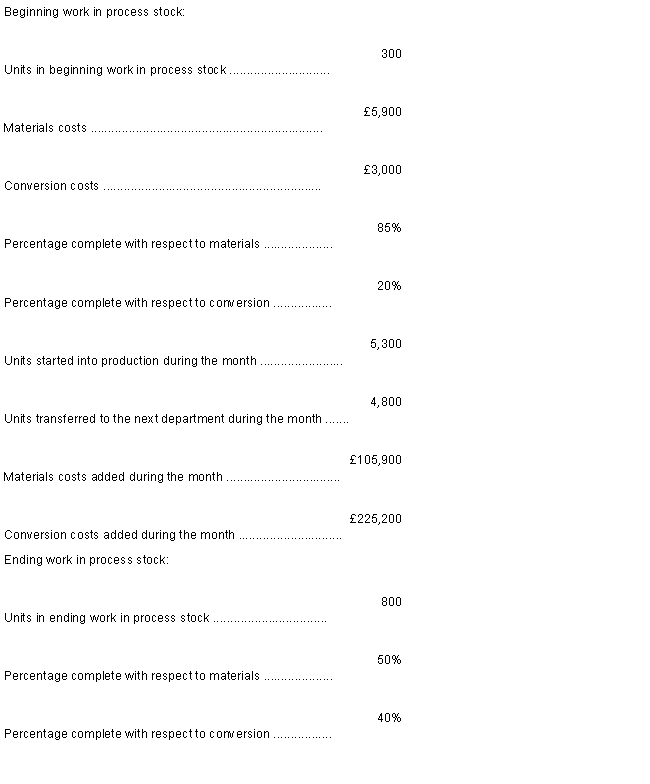

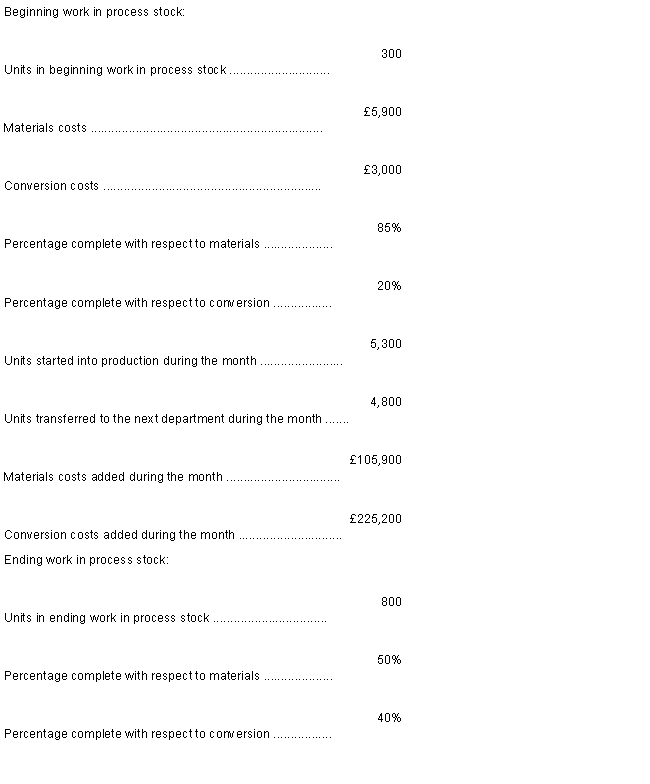

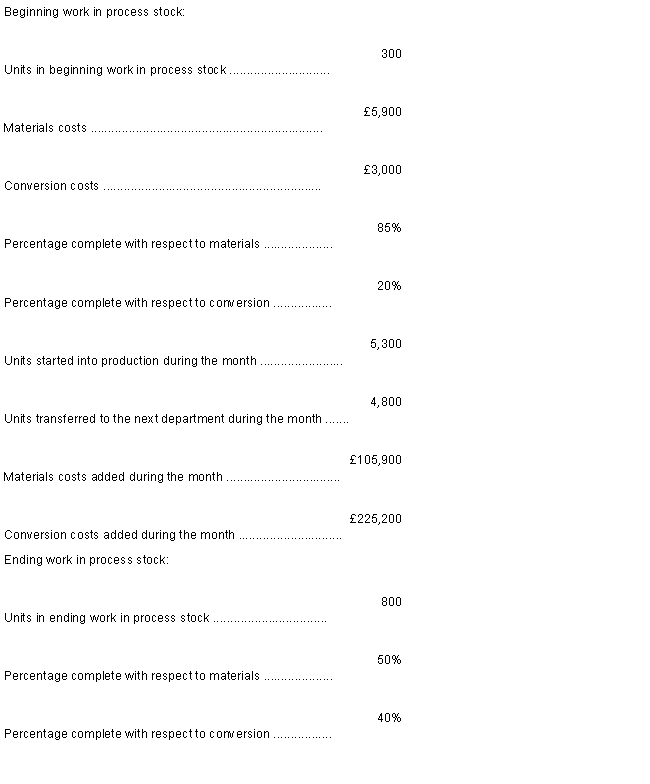

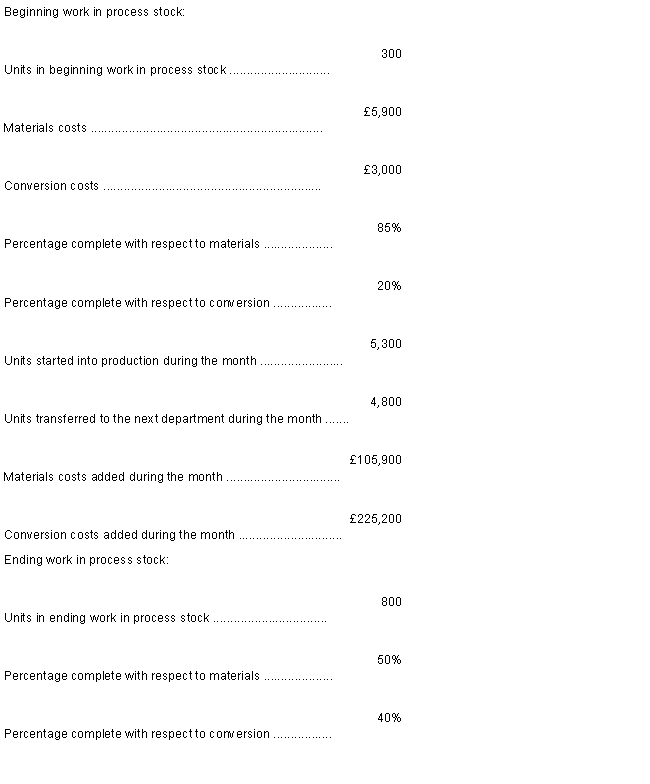

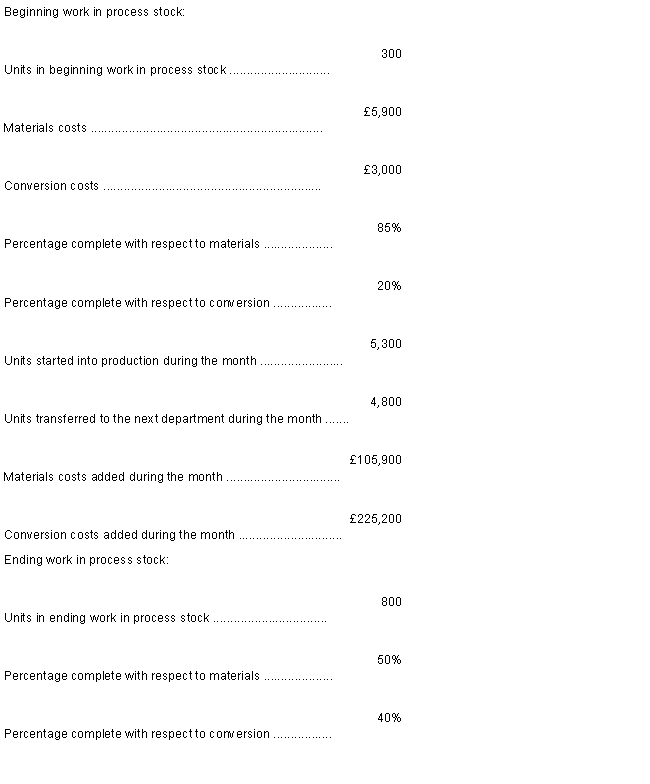

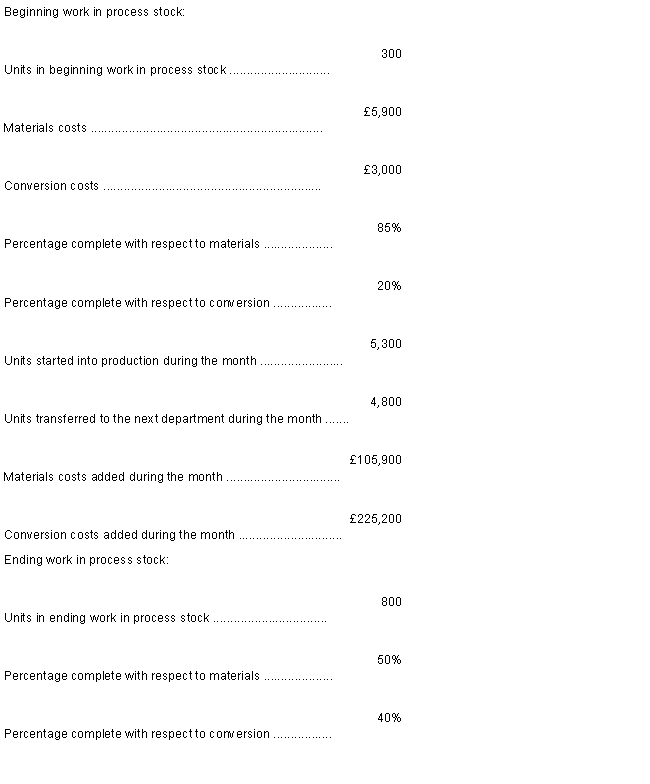

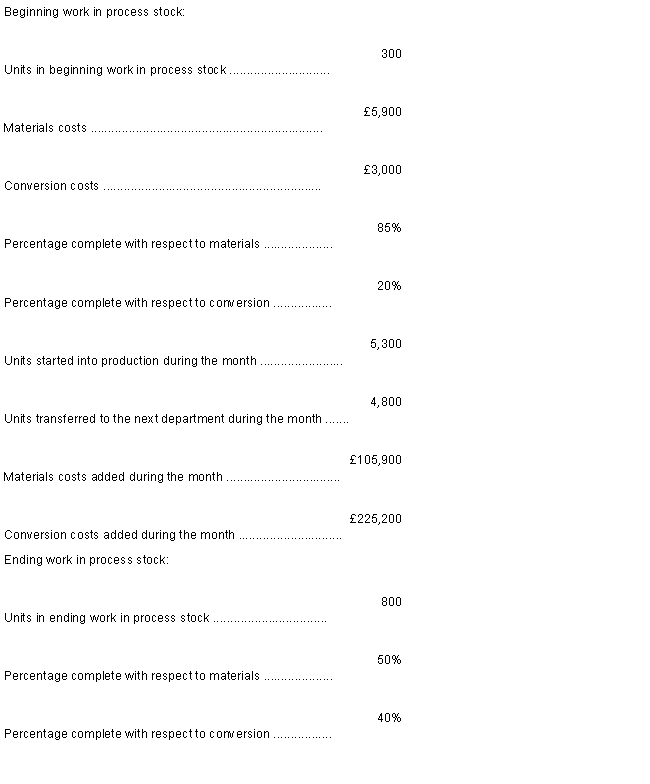

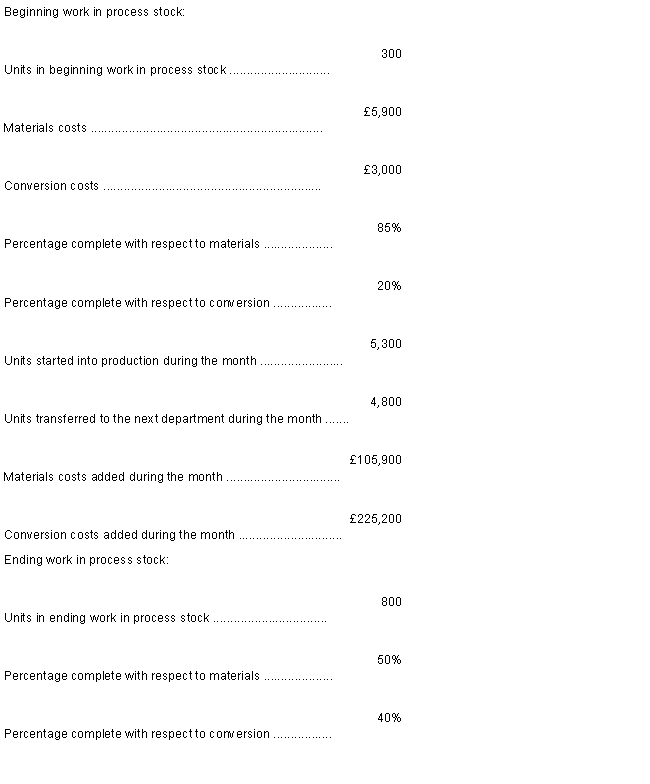

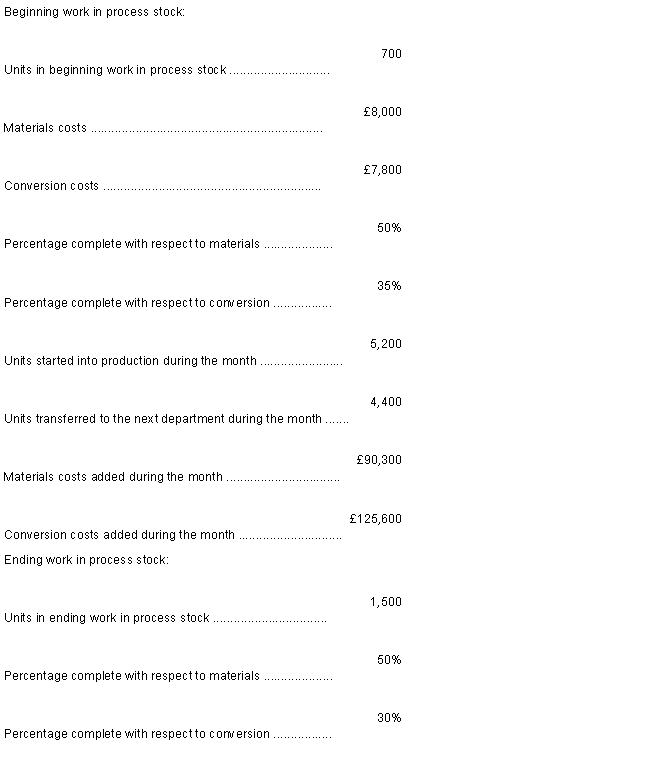

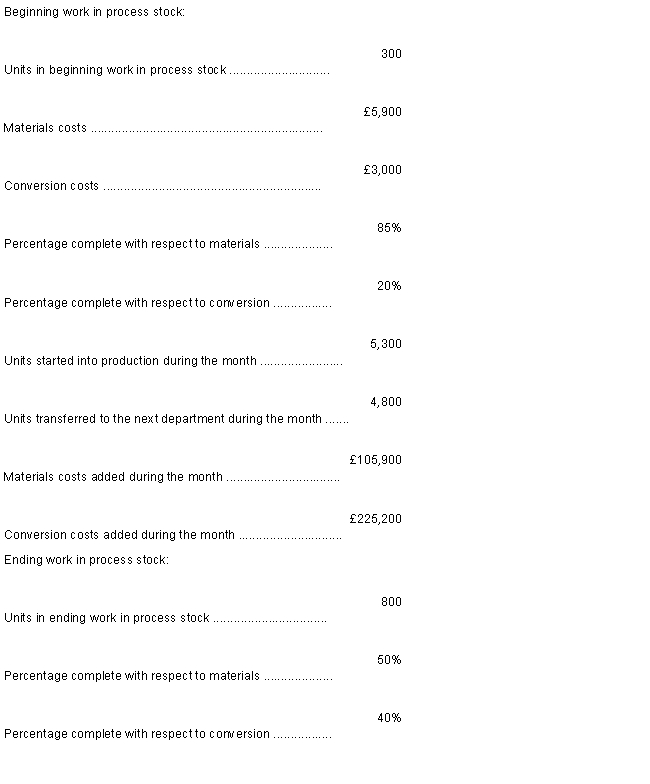

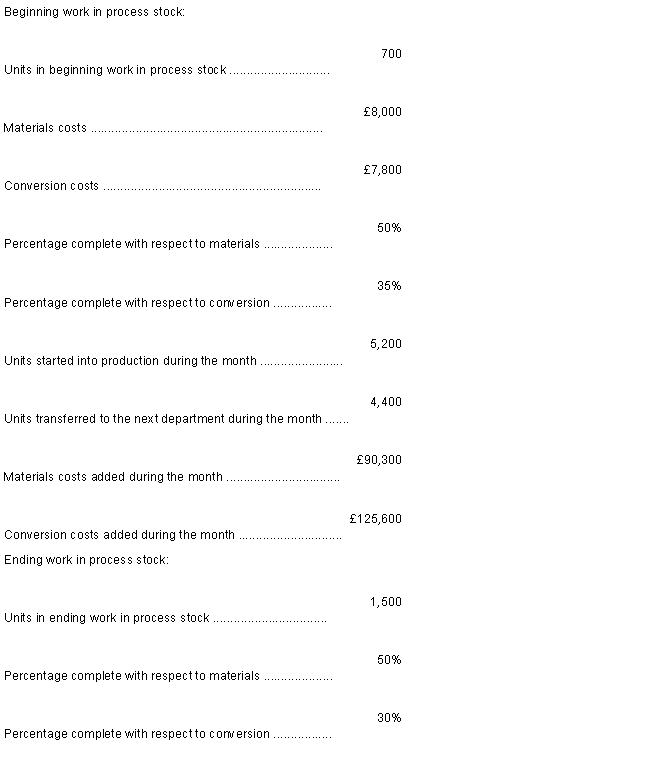

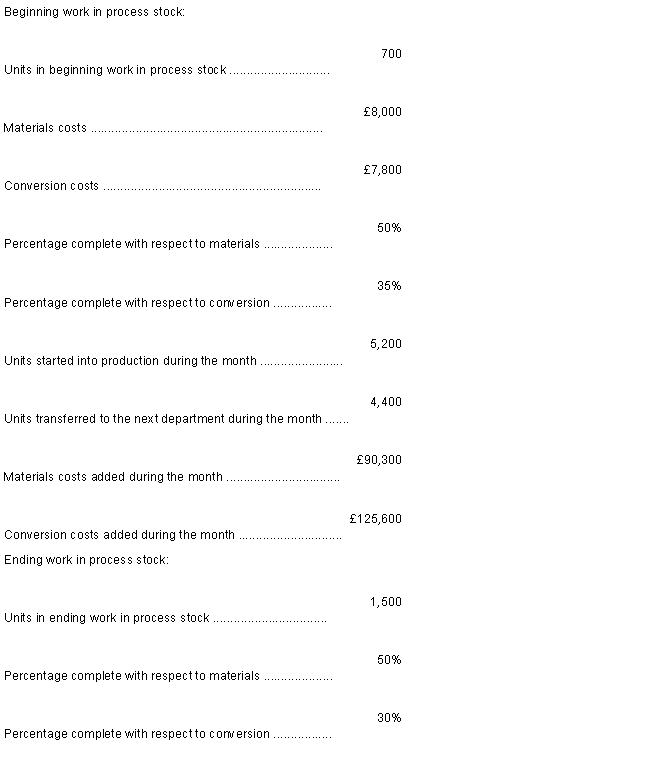

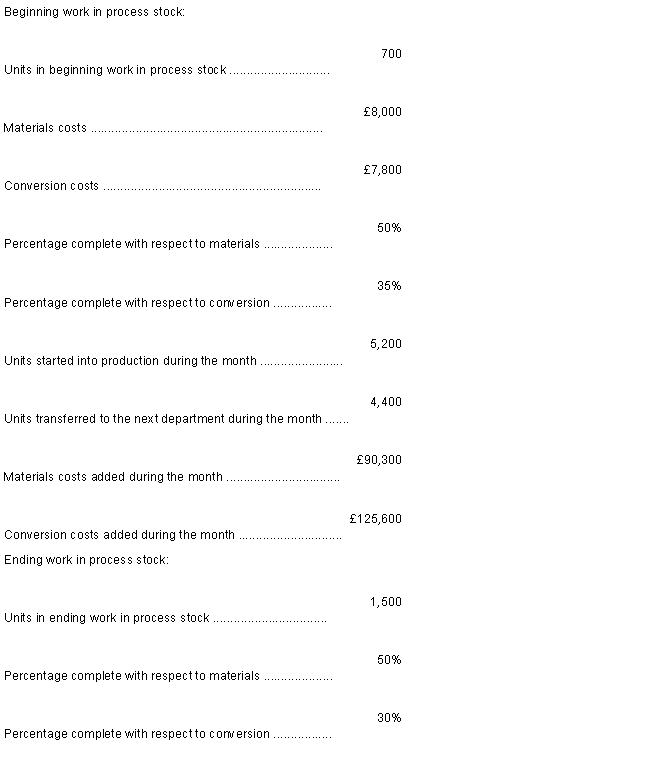

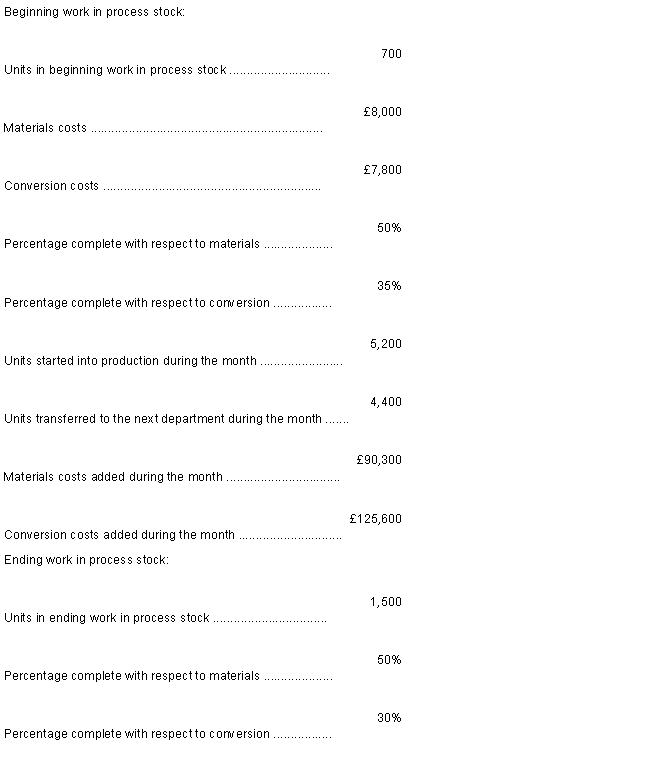

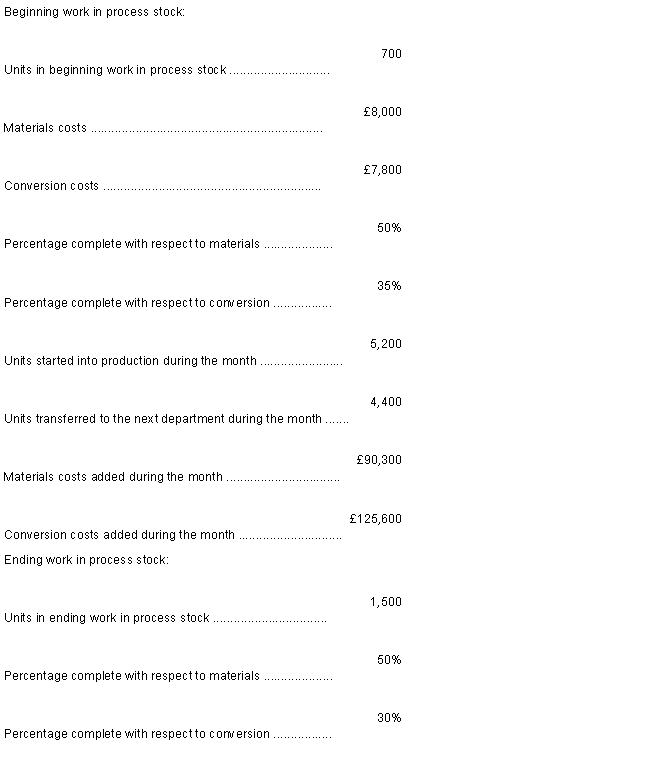

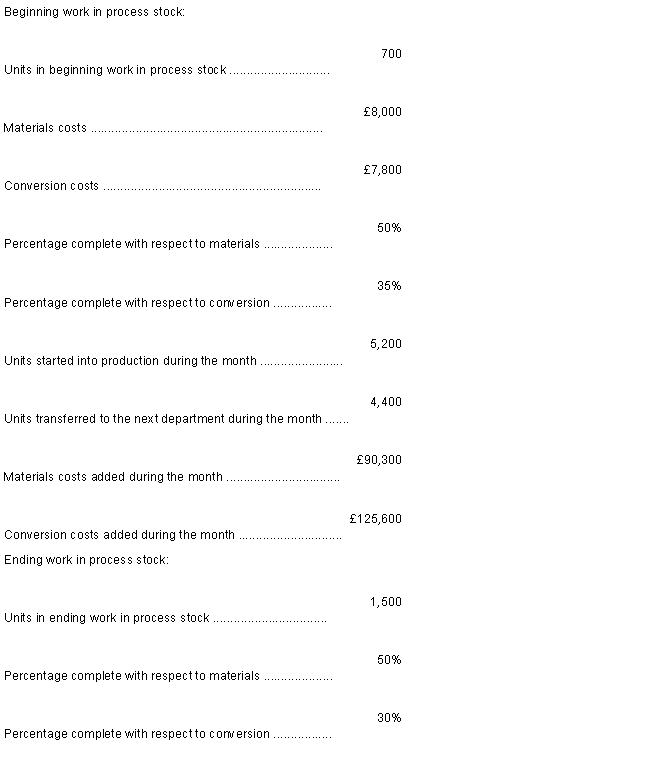

Leeds Electronics uses the FIFO method in its process costing system. Data concerning the first processing department for the most recent month is listed below:

-Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. According to the company's records, the conversion cost in beginning work in process stock was £92,218 at the beginning of June. Additional conversion costs of £571,618 were incurred in the department during the month.

What was the cost per equivalent unit for conversion costs for the month? (Round your answer to three decimal places).

A)£9.410

B)£7.521

C)£5.954

D)£9.220

-Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. According to the company's records, the conversion cost in beginning work in process stock was £92,218 at the beginning of June. Additional conversion costs of £571,618 were incurred in the department during the month.

What was the cost per equivalent unit for conversion costs for the month? (Round your answer to three decimal places).

A)£9.410

B)£7.521

C)£5.954

D)£9.220

£9.220

3

Paceheco Company uses the weighted-average method in its process costing system. The Molding Department is the second department in its production process. The data below summarise the department's operations in January.

The accounting records indicate that the conversion cost that had been assigned to beginning work in process stock was £34,558 and a total of £559,254 in conversion costs were incurred in the department during January.

What was the cost per equivalent unit for conversion costs for January in the Molding Department? (Round off to three decimal places.)

A)£9.479

B)£9.943

C)£9.680

D)£8.435

The accounting records indicate that the conversion cost that had been assigned to beginning work in process stock was £34,558 and a total of £559,254 in conversion costs were incurred in the department during January.

What was the cost per equivalent unit for conversion costs for January in the Molding Department? (Round off to three decimal places.)

A)£9.479

B)£9.943

C)£9.680

D)£8.435

£9.943

4

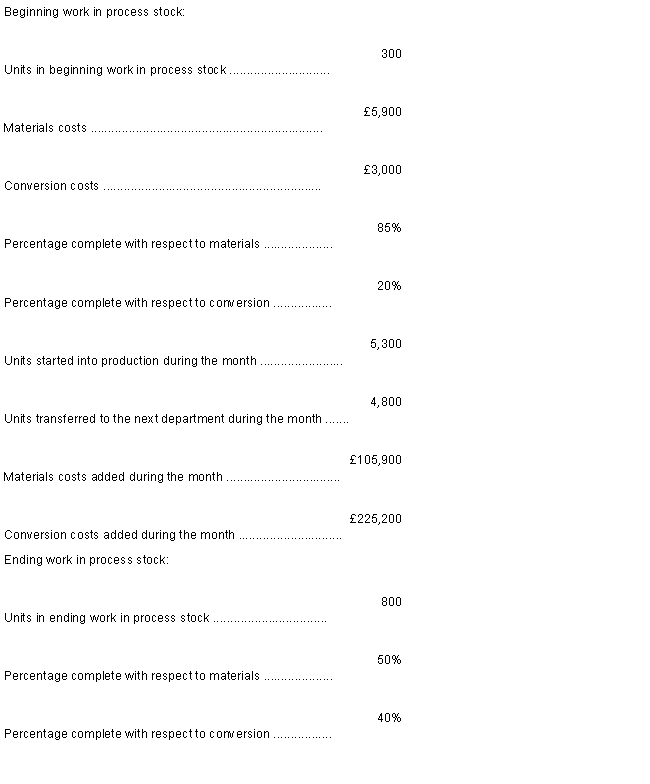

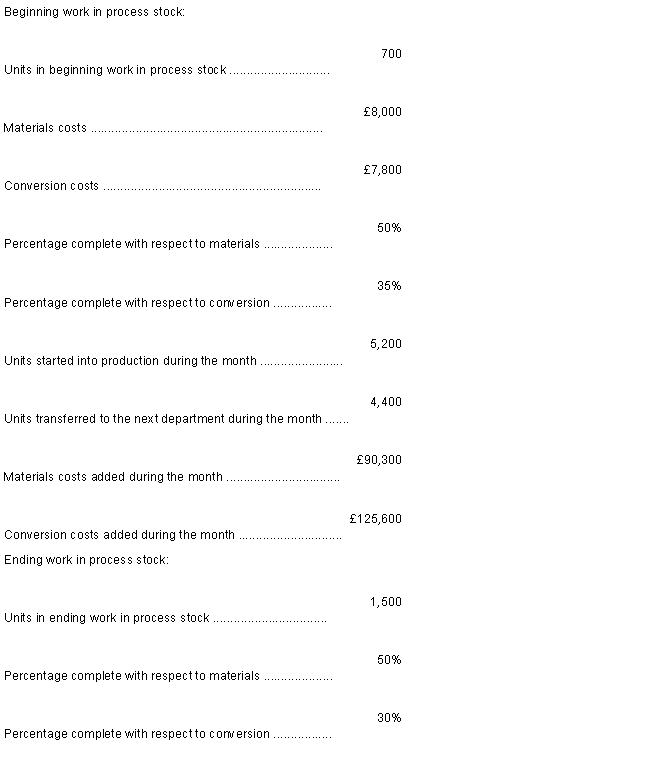

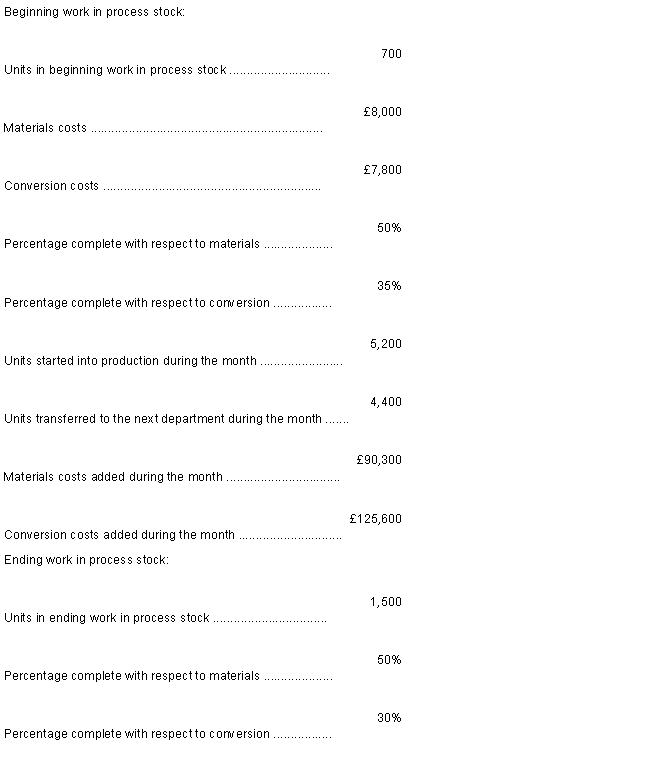

Leeds Electronics uses the FIFO method in its process costing system. Data concerning the first processing department for the most recent month is listed below:

-Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. The cost of ending work in process stock in the first processing department according to the company's cost system is closest to:

A)£26,369

B)£22,808

C)£52,738

D)£21,095

-Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. The cost of ending work in process stock in the first processing department according to the company's cost system is closest to:

A)£26,369

B)£22,808

C)£52,738

D)£21,095

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

5

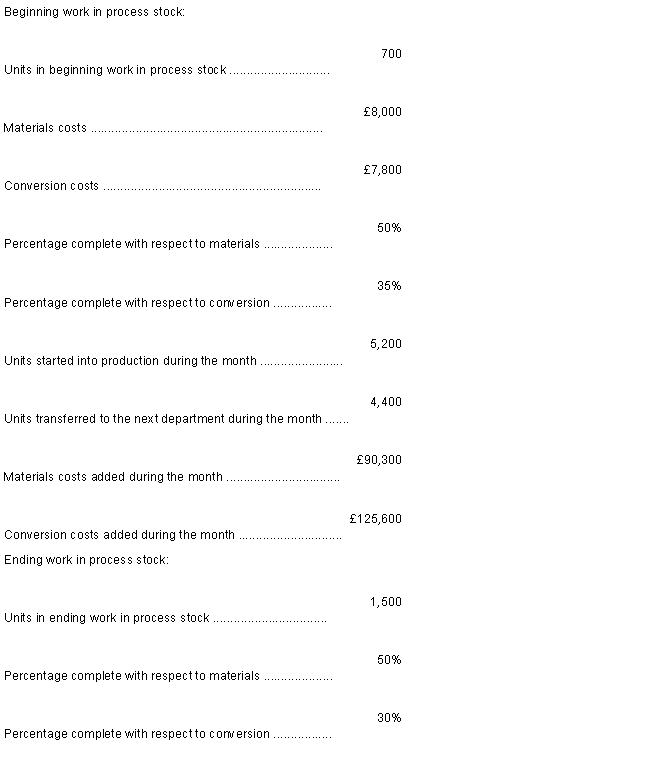

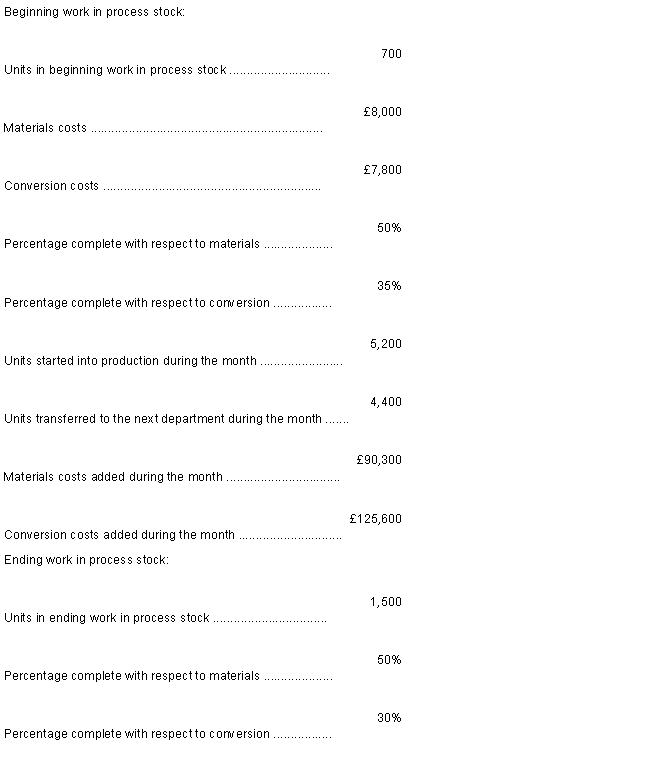

Leeds Electronics uses the FIFO method in its process costing system. Data concerning the first processing department for the most recent month is listed below:

-Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. The cost per equivalent unit for materials for the month in the first processing department is closest to:

A)£23.14

B)£18.91

C)£21.42

D)£22.06

-Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. The cost per equivalent unit for materials for the month in the first processing department is closest to:

A)£23.14

B)£18.91

C)£21.42

D)£22.06

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

6

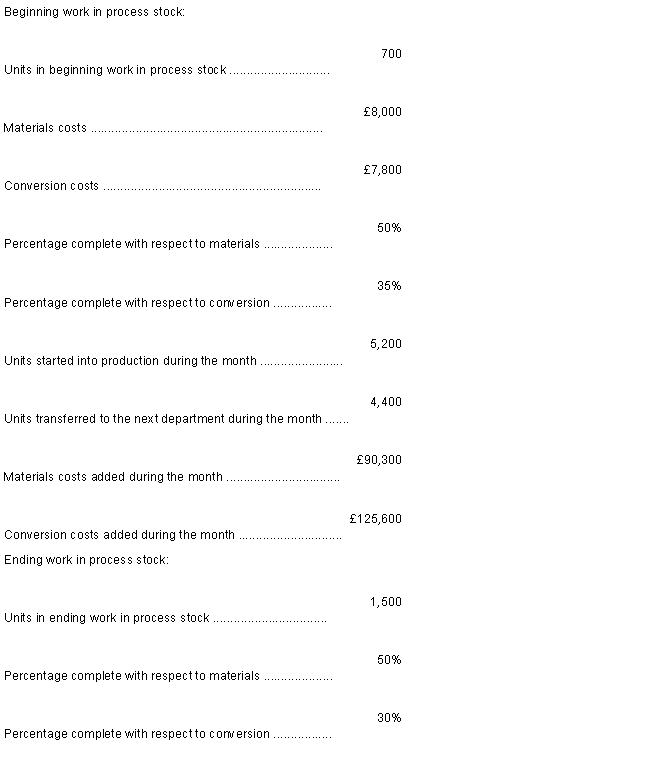

Leeds Electronics uses the FIFO method in its process costing system. Data concerning the first processing department for the most recent month is listed below:

-Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. The total cost transferred from the first processing department to the next processing department during the month is closest to:

A)£369,163

B)£317,194

C)£331,100

D)£340,000

-Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. The total cost transferred from the first processing department to the next processing department during the month is closest to:

A)£369,163

B)£317,194

C)£331,100

D)£340,000

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

7

Fabert Company uses the weighted-average method in its process costing system. The Assembly Department started the month with 16,000 units in its beginning work in process stock that were 40% complete with respect to conversion costs. An additional 60,000 units were transferred in from the prior department during the month to begin processing in the Assembly Department. During the month 65,000 units were completed in the Assembly Department and transferred to the next processing department. There were 11,000 units in the ending work in process stock of the Assembly Department that were 50% complete with respect to conversion costs.

What were the equivalent units for conversion costs in the Assembly Department for the month?

A)65,000

B)70,500

C)64,100

D)55,000

What were the equivalent units for conversion costs in the Assembly Department for the month?

A)65,000

B)70,500

C)64,100

D)55,000

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

8

Leeds Electronics uses the FIFO method in its process costing system. Data concerning the first processing department for the most recent month is listed below:

-Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. What are the equivalent units for conversion costs for the month in the first processing department?

A)5,600

B)5,060

C)4,500

D)320

-Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. What are the equivalent units for conversion costs for the month in the first processing department?

A)5,600

B)5,060

C)4,500

D)320

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

9

Darden Company uses the weighted-average method in its process costing system. The first processing department, the Welding Department, started the month with 18,000 units in its beginning work in process stock. These units were 10% complete with respect to conversion costs. The conversion cost in this beginning work in process stock was £16,200. An additional 84,000 units were started into production during the month. 17,000 units were in the ending work in process stock of the Welding Department. These units were 70% complete with respect to conversion costs. A total of £836,880 in conversion costs were incurred in the department during the month. What would be the cost per equivalent unit for conversion costs for the month? (Round off to three decimal places.)

A)£8.286

B)£9.000

C)£8.804

D)£9.963

A)£8.286

B)£9.000

C)£8.804

D)£9.963

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

10

The following information pertains to Yap Company's Grinding Department for the month of April:

All materials are added at the beginning of the process. Using the weighted-average method, the cost per equivalent unit for materials is closest to

A)£0.59.

B)£0.55.

C)£0.45.

D)£0.43.

All materials are added at the beginning of the process. Using the weighted-average method, the cost per equivalent unit for materials is closest to

A)£0.59.

B)£0.55.

C)£0.45.

D)£0.43.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

11

Leeds Electronics uses the FIFO method in its process costing system. Data concerning the first processing department for the most recent month is listed below:

-Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. The cost per equivalent unit for conversion costs for the first department for the month is closest to

A)£44.51

B)£50.00

C)£46.92

D)£46.74

-Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. The cost per equivalent unit for conversion costs for the first department for the month is closest to

A)£44.51

B)£50.00

C)£46.92

D)£46.74

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following characteristics applies to process costing, but does not apply to job order costing?

A)The need for averaging.

B)The use of equivalent units of production.

C)Separate, identifiable jobs.

D)The use of predetermined overhead rates.

A)The need for averaging.

B)The use of equivalent units of production.

C)Separate, identifiable jobs.

D)The use of predetermined overhead rates.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

13

A company has two processing departments: A andB. Which of the following entries or sets of journal entries would be used to record the transfer between processing departments and from the final processing department to finished goods?

a.Work in Process-Department B XXX

Work in Process-Department A XXX

Finished Goods XXX

Work in Process Department B XXX

b. Finished Goods XXX

Work in Process XXX

c. Work in Process-Department B XXX

Work in Process-Department A XXX

Cost of Goods Sold XXX

Work in Process-Department B XXX

d. Finished Goods XXX

Work in Process-Department A XXX

Finished Goods XXX

Work in Process-Department B XXX

A)Option A

B)Option B

C)Option C

D)Option D

a.Work in Process-Department B XXX

Work in Process-Department A XXX

Finished Goods XXX

Work in Process Department B XXX

b. Finished Goods XXX

Work in Process XXX

c. Work in Process-Department B XXX

Work in Process-Department A XXX

Cost of Goods Sold XXX

Work in Process-Department B XXX

d. Finished Goods XXX

Work in Process-Department A XXX

Finished Goods XXX

Work in Process-Department B XXX

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

14

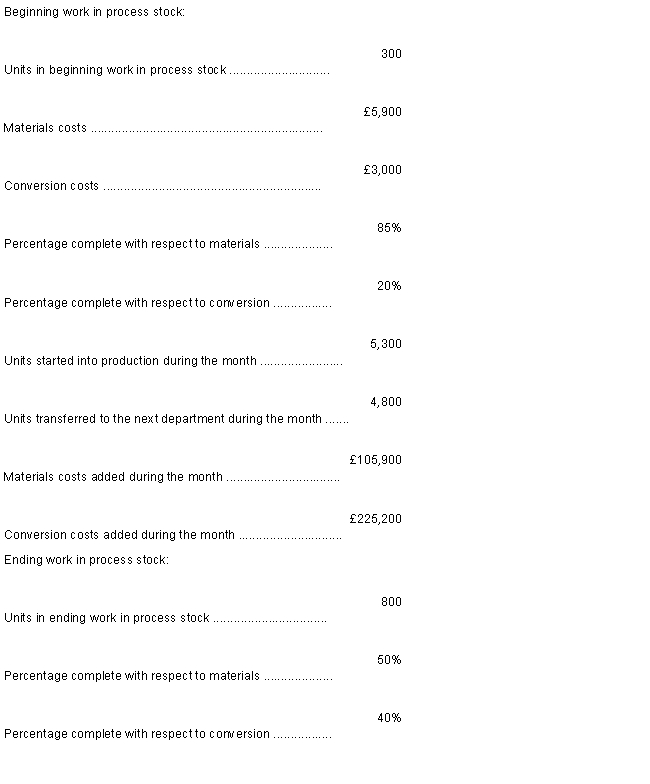

Bradford Electronics uses the weighted-average method in its process costing system. Data concerning the first processing department for the most recent month is listed below:

-

Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. The cost per equivalent unit for materials for the month in the first processing department is closest to:

A)£16.66

B)£15.31

C)£17.53

D)£19.09

-

Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. The cost per equivalent unit for materials for the month in the first processing department is closest to:

A)£16.66

B)£15.31

C)£17.53

D)£19.09

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

15

Bradford Electronics uses the weighted-average method in its process costing system. Data concerning the first processing department for the most recent month is listed below:

-Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. The cost per equivalent unit for conversion costs for the first department for the month is closest to:

A)£28.89

B)£22.61

C)£27.51

D)£25.90

-Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. The cost per equivalent unit for conversion costs for the first department for the month is closest to:

A)£28.89

B)£22.61

C)£27.51

D)£25.90

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

16

Leeds Electronics uses the FIFO method in its process costing system. Data concerning the first processing department for the most recent month is listed below:

-

Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. What are the equivalent units for materials for the month in the first processing department?

A)4,500

B)5,600

C)400

D)4,945

-

Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. What are the equivalent units for materials for the month in the first processing department?

A)4,500

B)5,600

C)400

D)4,945

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

17

In process costing, the equivalent units computed for materials is generally the same as that computed for direct labour

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

18

Stover Company uses the weighted-average method in its process costing system. Information concerning Department A for the month of June follows: Materials

All materials are added at the beginning of the process. The cost per equivalent unit for materials costs is closest to:

A)£0.83.

B)£0.85.

C)£0.97.

D)£1.01.

All materials are added at the beginning of the process. The cost per equivalent unit for materials costs is closest to:

A)£0.83.

B)£0.85.

C)£0.97.

D)£1.01.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

19

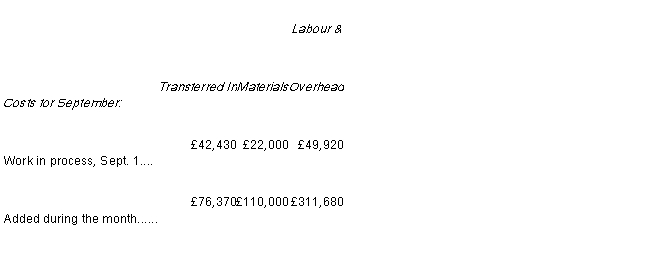

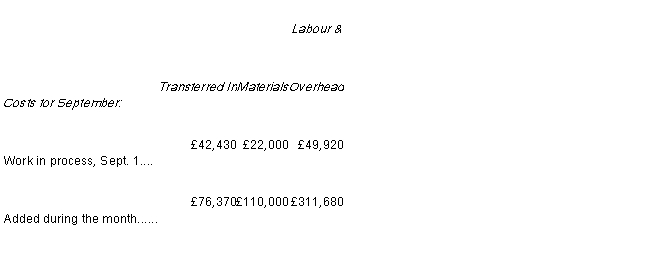

Department J is the second of three sequential processes in a company that uses the weighted-average method in its process costing system. All materials are added at the beginning of processing in Department J. During September, Department J collected the following data:

The cost per equivalent unit for labour and overhead was closest to:

A)£6.90.

B)£5.95.

C)£5.13.

D)£8.00.

The cost per equivalent unit for labour and overhead was closest to:

A)£6.90.

B)£5.95.

C)£5.13.

D)£8.00.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

20

Saada Company uses the weighted-average method in its process costing system. The Fitting Department is the second department in its production process. The data below summarize the department's operations in March.

The Fitting Department's production report indicates that the cost per equivalent unit for conversion cost for March was £5.99.

How much conversion cost was assigned to the units transferred out of the Fitting Department during March

A)£332,445.00

B)£375,573.00

C)£328,012.40

D)£353,410.00

The Fitting Department's production report indicates that the cost per equivalent unit for conversion cost for March was £5.99.

How much conversion cost was assigned to the units transferred out of the Fitting Department during March

A)£332,445.00

B)£375,573.00

C)£328,012.40

D)£353,410.00

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

21

Raider Manufacturing uses the weighted-average method in its process costing system. The Molding Department is the second department in its production process. The data below summarize the department's operations in January.

The Molding Department's production report indicates that the cost per equivalent unit for conversion cost for January was £3.19.

How much conversion cost was assigned to the ending work in process stock in the Molding Department for January?

A)£22,106.70

B)£25,201.00

C)£20,160.80

D)£5,040.20

The Molding Department's production report indicates that the cost per equivalent unit for conversion cost for January was £3.19.

How much conversion cost was assigned to the ending work in process stock in the Molding Department for January?

A)£22,106.70

B)£25,201.00

C)£20,160.80

D)£5,040.20

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

22

The equivalent units in the ending work in process stock will be the same under both the FIFO and the weighted-average methods of process costing.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

23

The computation of equivalent units under the FIFO method

A)treats units in the beginning work in process stock as if they were started and completed during the current period.

B)treats units in the beginning work in process stock as if they represent a separate batch of goods separate and distinct from goods started and completed during the current period.

C)treats units in the ending work in process stock as if they were started and completed during the current period.

D)ignores units in the beginning and ending work in process inventories.

A)treats units in the beginning work in process stock as if they were started and completed during the current period.

B)treats units in the beginning work in process stock as if they represent a separate batch of goods separate and distinct from goods started and completed during the current period.

C)treats units in the ending work in process stock as if they were started and completed during the current period.

D)ignores units in the beginning and ending work in process inventories.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

24

Bradford Electronics uses the weighted-average method in its process costing system. Data concerning the first processing department for the most recent month is listed below:

-Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. The total cost transferred from the first processing department to the next processing department during the month is closest to:

A)£231,700

B)£274,893

C)£205,005

D)£215,900

-Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. The total cost transferred from the first processing department to the next processing department during the month is closest to:

A)£231,700

B)£274,893

C)£205,005

D)£215,900

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

25

The job cost sheet is used in both job-order and process costing.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

26

Norfolk Engineering uses the weighted-average method in its process costing system. This month, the beginning stock in the first processing department consisted of 700 units. The costs and percentage completion of these units in beginning stock were:

A total of 9,200 units were started and 8,300 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

The ending stock was 75% complete with respect to materials and 15% complete with respect to conversion costs.

Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

- The cost of ending work in process stock in the first processing department according to the company's cost system is closest to:

A)£33,273

B)£11,769

C)£78,462

D)£58,847

A total of 9,200 units were started and 8,300 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

The ending stock was 75% complete with respect to materials and 15% complete with respect to conversion costs.

Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

- The cost of ending work in process stock in the first processing department according to the company's cost system is closest to:

A)£33,273

B)£11,769

C)£78,462

D)£58,847

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

27

Bradford Electronics uses the weighted-average method in its process costing system. Data concerning the first processing department for the most recent month is listed below:

-Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. The cost of ending work in process stock in the first processing department according to the company's cost system is closest to:

A)£26,692

B)£69,888

C)£34,944

D)£20,966

-Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. The cost of ending work in process stock in the first processing department according to the company's cost system is closest to:

A)£26,692

B)£69,888

C)£34,944

D)£20,966

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

28

Bradford Electronics uses the weighted-average method in its process costing system. Data concerning the first processing department for the most recent month is listed below:

-Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. The cost per equivalent whole unit for the month in the first processing department is closest to:

A)£39.27

B)£46.59

C)£49.39

D)£52.66

-Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. The cost per equivalent whole unit for the month in the first processing department is closest to:

A)£39.27

B)£46.59

C)£49.39

D)£52.66

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

29

A company should use process costing, rather than job order costing, if

A)production is only partially completed during the accounting period.

B)the product is manufactured in batches only as orders are received.

C)the product is composed of mass-produced homogeneous units.

D)the product goes through several steps of production.

A)production is only partially completed during the accounting period.

B)the product is manufactured in batches only as orders are received.

C)the product is composed of mass-produced homogeneous units.

D)the product goes through several steps of production.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

30

Hache Company uses the weighted-average method in its process costing system. The first processing department, the Welding Department, started the month with 17,000 units in its beginning work in process stock that were 20% complete with respect to conversion costs. The conversion cost in this beginning work in process stock was £7,480. An additional 89,000 units were started into production during the month and 92,000 units were completed in the Welding Department and transferred to the next processing department. There were 14,000 units in the ending work in process stock of the Welding Department that were 90% complete with respect to conversion costs. A total of £202,400 in conversion costs were incurred in the department during the month.

What would be the cost per equivalent unit for conversion costs for the month (Round off to three decimal places.)

A)£1.965

B)£2.200

C)£2.007

D)£2.274

What would be the cost per equivalent unit for conversion costs for the month (Round off to three decimal places.)

A)£1.965

B)£2.200

C)£2.007

D)£2.274

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

31

The Gasson Company uses the weighted-average method in its process costing system. The company's ending work in process stock consists of 10,000 units, 100% complete with respect to materials and 70% complete with respect to labour and overhead. If the costs per equivalent unit are £4.50 for the materials and £2.00 for labour and overhead, the balance of the ending work in process stock account would be

A)£44,500.

B)£50,500.

C)£59,000.

D)£65,000.

A)£44,500.

B)£50,500.

C)£59,000.

D)£65,000.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

32

Bradford Electronics uses the weighted-average method in its process costing system. Data concerning the first processing department for the most recent month is listed below:

-Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. What are the equivalent units for materials for the month in the first processing department?

A)750

B)5,900

C)4,400

D)5,150

-Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places. What are the equivalent units for materials for the month in the first processing department?

A)750

B)5,900

C)4,400

D)5,150

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

33

Using process costing, it is necessary to consider the stage of completion of the units when assigning conversion cost to partially completed units in the ending work in process stock.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

34

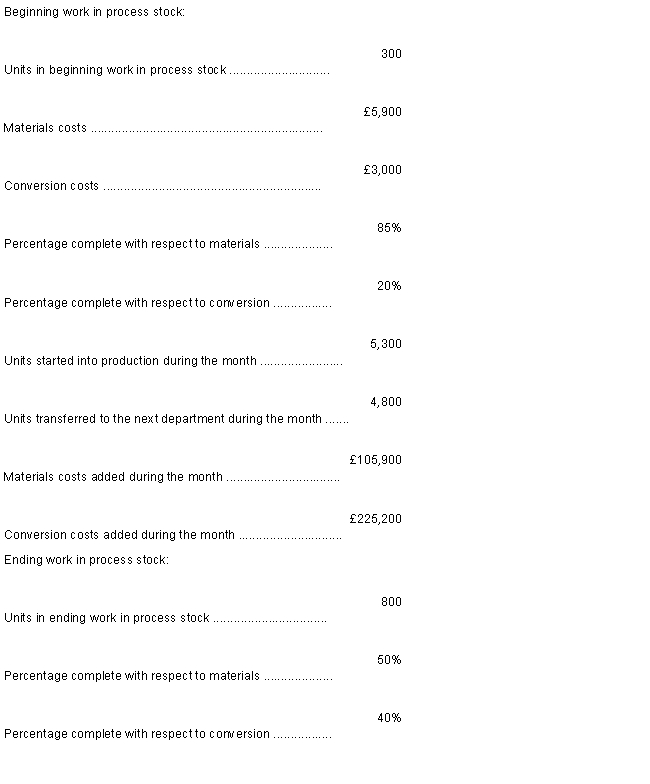

Norfolk Engineering uses the weighted-average method in its process costing system. This month, the beginning stock in the first processing department consisted of 700 units. The costs and percentage completion of these units in beginning stock were:

A total of 9,200 units were started and 8,300 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

The ending stock was 75% complete with respect to materials and 15% complete with respect to conversion costs.

Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

-The cost per equivalent unit for materials for the month in the first processing department is closest to:

A)£22.40

B)£20.28

C)£21.14

D)£21.49

A total of 9,200 units were started and 8,300 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

The ending stock was 75% complete with respect to materials and 15% complete with respect to conversion costs.

Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

-The cost per equivalent unit for materials for the month in the first processing department is closest to:

A)£22.40

B)£20.28

C)£21.14

D)£21.49

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

35

Norfolk Engineering uses the weighted-average method in its process costing system. This month, the beginning stock in the first processing department consisted of 700 units. The costs and percentage completion of these units in beginning stock were:

A total of 9,200 units were started and 8,300 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

The ending stock was 75% complete with respect to materials and 15% complete with respect to conversion costs.

Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

- The cost per equivalent whole unit for the month in the first processing department is closest to:

A)£44.47

B)£53.05

C)£49.04

D)£51.98

A total of 9,200 units were started and 8,300 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

The ending stock was 75% complete with respect to materials and 15% complete with respect to conversion costs.

Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

- The cost per equivalent whole unit for the month in the first processing department is closest to:

A)£44.47

B)£53.05

C)£49.04

D)£51.98

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

36

Norfolk Engineering uses the weighted-average method in its process costing system. This month, the beginning stock in the first processing department consisted of 700 units. The costs and percentage completion of these units in beginning stock were:

A total of 9,200 units were started and 8,300 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

The ending stock was 75% complete with respect to materials and 15% complete with respect to conversion costs.

Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

-The total cost transferred from the first processing department to the next processing department during the month is closest to:

A)£485,486

B)£407,024

C)£426,300

D)£440,300

A total of 9,200 units were started and 8,300 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

The ending stock was 75% complete with respect to materials and 15% complete with respect to conversion costs.

Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

-The total cost transferred from the first processing department to the next processing department during the month is closest to:

A)£485,486

B)£407,024

C)£426,300

D)£440,300

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

37

Under the FIFO method, the equivalent units of production relate only to work done during the current period.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

38

Norfolk Engineering uses the weighted-average method in its process costing system. This month, the beginning stock in the first processing department consisted of 700 units. The costs and percentage completion of these units in beginning stock were:

A total of 9,200 units were started and 8,300 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

The ending stock was 75% complete with respect to materials and 15% complete with respect to conversion costs.

Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

- The cost per equivalent unit for conversion costs for the first department for the month is closest to:

A)£26.64

B)£26.41

C)£27.97

D)£22.98

A total of 9,200 units were started and 8,300 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

The ending stock was 75% complete with respect to materials and 15% complete with respect to conversion costs.

Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

- The cost per equivalent unit for conversion costs for the first department for the month is closest to:

A)£26.64

B)£26.41

C)£27.97

D)£22.98

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

39

A process cost system would be used to account for the cost of manufacturing an oil tanker.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

40

Bims Company uses the weighted-average method in its process costing system. The Assembly Department started the month with 2,000 units in its beginning work in process stock that were 70% complete with respect to conversion costs. An additional 61,000 units were transferred in from the prior department during the month to begin processing in the Assembly Department. There were 18,000 units in the ending work in process stock of the Assembly Department that were 60% complete with respect to conversion costs.

What were the equivalent units for conversion costs in the Assembly Department for the month

A)45,000

B)77,000

C)54,400

D)55,800

What were the equivalent units for conversion costs in the Assembly Department for the month

A)45,000

B)77,000

C)54,400

D)55,800

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

41

Stay Company uses the weighted-average method in its process costing system. The company's ending work in process stock consists of 8,000 units, 60% complete with respect to materials and 80% complete with respect to labour and overhead. If the total cost in this stock is £200,000 and if the cost for materials is £16 per equivalent unit for the period, the cost of labour and overhead per equivalent unit of the production for the period must be

A)£19.25

B)£16.00

C)£25.67

D)£31.25

A)£19.25

B)£16.00

C)£25.67

D)£31.25

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

42

Under the FIFO method, costs per equivalent unit will contain only costs from the current period

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

43

If the FIFO cost method is being used in a process costing system, costs in the beginning stock are kept separate from current period costs

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

44

Equivalent units for a process costing system using the weighted-average method would be equal to

A)units completed during the period and transferred out.

B)units started and completed during the period plus equivalent units in the ending work in process stock.

C)units completed during the period less equivalent units in the beginning stock, plus equivalent units in the ending work in process stock.

D)units completed during the period plus equivalent units in the ending work in process stock.

A)units completed during the period and transferred out.

B)units started and completed during the period plus equivalent units in the ending work in process stock.

C)units completed during the period less equivalent units in the beginning stock, plus equivalent units in the ending work in process stock.

D)units completed during the period plus equivalent units in the ending work in process stock.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

45

If a production process is set up in a parallel manner, all units will be processed through all production centers

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

46

Jolly Company uses the FIFO method in its process costing system. Beginning stock in the mixing processing center consisted of 4,000 units, 75% complete with respect to conversion costs. Ending work in process stock consisted of 3,000 units, 60% complete with respect to conversion costs. If 12,000 units were transferred to the next processing center during the period, the equivalent units for conversion costs would be

A)13,200 units.

B)10,800 units.

C)12,000 units.

D)13,000 units.

A)13,200 units.

B)10,800 units.

C)12,000 units.

D)13,000 units.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

47

The weighted-average method and the FIFO method of process costing use the same manufacturing accounts

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

48

In a process cost system, the application of manufacturing overhead usually would be recorded as a debit to

A)Finished goods.

B)Manufacturing overhead.

C)Cost of goods sold.

D)Work in process.

A)Finished goods.

B)Manufacturing overhead.

C)Cost of goods sold.

D)Work in process.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

49

A process costing system would be best suited for production of a large quantity of a homogeneous product

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

50

Scheney Company uses the weighted-average method in its process costing system. The company's work in process stock on March 31 consisted of 20,000 units. The units in the ending work in process stock were 100% complete with respect to materials and 70% complete with respect to labour and overhead. If the cost per equivalent unit for August was £2.50 for materials and £4.75 for labour and overhead, the total cost in the March 31 work in process stock was:

A)£145,000

B)£116,500

C)£101,500

D)£78,500

A)£145,000

B)£116,500

C)£101,500

D)£78,500

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

51

Compare and Contrast Job and Process costing

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

52

On November 1, Riser Company had 5,000 units of work in process in Department No. 1 that were 100% complete with respect to material costs and 20% complete with respect to conversion costs. During November, 32,000 units were started in Department No. 1 and 34,000 units were completed and transferred to Department No. 2. The work in process on November 30th was 100% complete with respect to material costs and 40% complete with respect to conversion costs. By what amount would the equivalent units for conversion costs for the month of November differ if the FIFO method were used instead of the weighted-average method?

A)1,000 decrease

B)3,000 decrease

C)1,500 decrease

D)2,200 decrease

A)1,000 decrease

B)3,000 decrease

C)1,500 decrease

D)2,200 decrease

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

53

A process costing system

A)uses a separate Work in Process account for each processing department.

B)uses a single Work in Process account for the entire company.

C)uses a separate Work in Process account for each type of product produced.

D)does not use a Work in Process account in any form.

A)uses a separate Work in Process account for each processing department.

B)uses a single Work in Process account for the entire company.

C)uses a separate Work in Process account for each type of product produced.

D)does not use a Work in Process account in any form.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

54

From the standpoint of cost control, the weighted-average method of process costing is superior to the FIFO method.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

55

Under the weighted-average method, the cost of materials in the beginning work in process stock is not used in the computation of the cost per equivalent unit for materials

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

56

The cost of beginning stock under the weighted-average method is

A)added in with current period costs in determining costs per equivalent unit for a given period.

B)ignored in determining the costs per equivalent unit for a given period.

C)considered separately from costs incurred during the current period.

D)not shown on the production report.

A)added in with current period costs in determining costs per equivalent unit for a given period.

B)ignored in determining the costs per equivalent unit for a given period.

C)considered separately from costs incurred during the current period.

D)not shown on the production report.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

57

Process costing would be used by companies producing the following items: bricks, bolts, pharmaceutical items, natural gas, and electricity

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

58

The use of the FIFO method would result in the quantity schedule of a company's production report showing

A)units transferred out as one amount with no distinction made for beginning stock.

B)units transferred out as two amounts-one for beginning stock and the other for units started and completed during the month.

C)units transferred out as two amounts-one for units completed during the period and one for ending stock.

D)units transferred out as three amounts-one for beginning stock, one for units started and completed during the period, and one for ending stock.

A)units transferred out as one amount with no distinction made for beginning stock.

B)units transferred out as two amounts-one for beginning stock and the other for units started and completed during the month.

C)units transferred out as two amounts-one for units completed during the period and one for ending stock.

D)units transferred out as three amounts-one for beginning stock, one for units started and completed during the period, and one for ending stock.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

59

Under the FIFO method, unit costs would

A)result from costs in the beginning stock being added in with current period costs.

B)contain some element of cost from the prior period.

C)not contain some elements of cost from the prior period.

D)not include costs incurred to complete beginning stock.

A)result from costs in the beginning stock being added in with current period costs.

B)contain some element of cost from the prior period.

C)not contain some elements of cost from the prior period.

D)not include costs incurred to complete beginning stock.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

60

Under the FIFO method, the percentage of completion of the ending stock must be greater than the percentage of completion of the beginning stock

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

61

Compare report content under Weighted Average and FIFO methods.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

62

Explain how a process system might be used by Toyota cars

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

63

With the additional complications, why would anybody want to use FIFO rather than weighted average?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

64

Explain the differences between Weighted Average and FIFO as a way of calculating process costs. Which do you think is best?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

65

Draw your own model of a process costing system without looking at the book. Choose a particular type of industry to illustrate this.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

66

Discuss the sort of businesses that might use process costing. Do you consider it a superior method that might be applied to not obvious industries?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck