Deck 15: International Financial Reporting Standards

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/44

Play

Full screen (f)

Deck 15: International Financial Reporting Standards

1

For countries whose tax standards are closely tied to financial reporting standards (Continental Europe and Japan),accounting earnings tend to be lower so companies can minimize tax payments.

True

2

Which of the following is not a reason why accounting differs across countries?

A)Culture.

B)Population.

C)Tax laws.

D)Sources of financing.

A)Culture.

B)Population.

C)Tax laws.

D)Sources of financing.

B

3

The Norwalk Agreement formalizes the commitment between the FASB and IASB to the convergence of U.S.GAAP and IFRS.

True

4

Which of the following characteristics of a country most likely affects the extent of companies' financial disclosure practices?

A)Inflation.

B)Tax laws.

C)Population.

D)Culture.

A)Inflation.

B)Tax laws.

C)Population.

D)Culture.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

5

In countries where debt financing is more common (Japan)compared to equity financing,there is greater emphasis on reporting the ability of the company to earn profits for its investors rather than the ability to repay debt.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

6

More economically developed economies (the U.S.and the U.K. )have a need for more complex accounting standards.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

7

Over 115 jurisdictions,including Hong Kong,Australia,and all of the countries in the European Union (EU),either require or permit the use of IFRS.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

8

Convergence of accounting practices is expected to increase the flow of resources across borders.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

9

In common law countries (such as the U.S. ,the U.K. ,and Canada),greater emphasis is placed on public information than in code law countries (such as France and Germany).

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

10

Some countries are more secretive (Brazil and Switzerland),leading to fewer financial disclosures.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

11

Under IFRS,inventory write-downs due to using the lower-of-cost-or-market rule are allowed to be reversed in a future year if the market value subsequently increases.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

12

IFRS stands for:

A)Independent Financial Reporting System.

B)International Financing Reform System.

C)International Financial Reporting Standards.

D)International Financial Regulation of Securities.

A)Independent Financial Reporting System.

B)International Financing Reform System.

C)International Financial Reporting Standards.

D)International Financial Regulation of Securities.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

13

Countries that have different rules for financial accounting and tax accounting,rely more on equity financing,and have historical political and economic ties with Great Britain are referred to as what types of countries?

A)Code law countries.

B)European Union countries.

C)Common law countries.

D)Conformist countries.

A)Code law countries.

B)European Union countries.

C)Common law countries.

D)Conformist countries.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

14

The primary objective of the IASB is to develop accounting standards in the U.S.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

15

When preparing a statement of cash flows,IFRS allows companies to report cash outflows from interest payments as either operating or financing cash flows,while U.S.GAAP requires these outflows to be reported as only operating activities.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

16

When preparing a statement of cash flows,IFRS allows companies to report cash inflows from interest and dividends as either operating or investing cash flows,while U.S.GAAP requires these inflows to be reported as only operating activities.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

17

Countries that have similar rules for financial accounting and tax accounting,rely more on debt financing,and have historical political and economic ties with Germany are referred to as what types of countries?

A)Code law countries.

B)European Union countries.

C)Common law countries.

D)Conformist countries.

A)Code law countries.

B)European Union countries.

C)Common law countries.

D)Conformist countries.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

18

The FIFO inventory method is not allowed under IFRS.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

19

Under U.S.GAAP,development expenditures are capitalized,while under IFRS,these expenditures must be expensed immediately.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

20

IFRS allows,but does not require,revaluation of property,plant and equipment to fair value.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

21

One motivation for reducing differences in accounting practices across countries is to:

A)Decrease the flow of international capital.

B)Allow greater competition among companies.

C)Reduce companies' tax burdens.

D)Make it easier for investors to compare companies from different countries.

A)Decrease the flow of international capital.

B)Allow greater competition among companies.

C)Reduce companies' tax burdens.

D)Make it easier for investors to compare companies from different countries.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

22

For which of the following topics is accounting under both U.S.GAAP and IFRS essentially the same?

A)Receivables.

B)Long-term assets.

C)Inventory.

D)Research and development expenditures.

A)Receivables.

B)Long-term assets.

C)Inventory.

D)Research and development expenditures.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

23

Suppose a severe storm floods a company's headquarters,causing damages to the building of $300,000 and destruction of inventory of $200,000.Because of the unusual nature of this event,the company had no flood insurance to cover these losses.Under IFRS,how much would the company report as an extraordinary loss in the current year's income statement?

A)$0.

B)$200,000.

C)$300,000.

D)$500,000.

A)$0.

B)$200,000.

C)$300,000.

D)$500,000.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

24

The Norwalk Agreement:

A)Allows foreign companies listed on U.S.stock exchanges to prepare financial statements in accordance with IFRS.

B)Formalizes the commitment between the FASB and IASB to converge U.S.GAAP and IFRS.

C)Eliminates the requirement that U.S.firms report under U.S.GAAP.

D)Gives authority to the IASB to set accounting standards for U.S.companies.

A)Allows foreign companies listed on U.S.stock exchanges to prepare financial statements in accordance with IFRS.

B)Formalizes the commitment between the FASB and IASB to converge U.S.GAAP and IFRS.

C)Eliminates the requirement that U.S.firms report under U.S.GAAP.

D)Gives authority to the IASB to set accounting standards for U.S.companies.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

25

Suppose a company has research costs of $100,000 and development costs of $200,000 for the year.Under U.S.GAAP,what amount would be reported as an expense in the current year's income statement?

A)$100,000.

B)$150,000.

C)$200,000.

D)$300,000.

A)$100,000.

B)$150,000.

C)$200,000.

D)$300,000.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

26

Which inventory cost flow assumption is allowed under U.S.GAAP but not under IFRS? Explain why some U.S.companies will lobby strongly to keep this method as an allowable alternative.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

27

When a country establishes financial reporting rules that closely resemble tax reporting rules,reported accounting profits tend to be:

A)Negative.

B)Higher.

C)Lower.

D)Misreported.

A)Negative.

B)Higher.

C)Lower.

D)Misreported.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

28

Suppose a company pays interest of $10,000 for the year on borrowed amounts due in two years.Under IFRS,what is the most the company can report this year as cash outflows from financing activities related to this item?

A)$10,000.

B)$2,000.

C)$5,000.

D)$0.

A)$10,000.

B)$2,000.

C)$5,000.

D)$0.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

29

Which inventory cost flow assumption is allowed under U.S.GAAP but not under IFRS?

A)Specific identification.

B)FIFO.

C)LIFO.

D)Average cost.

A)Specific identification.

B)FIFO.

C)LIFO.

D)Average cost.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following statements is true regarding revaluation of property,plant,and equipment to fair value?

A)Only IFRS allows revaluation of property,plant,and equipment to fair value.

B)Only U.S.GAAP allows revaluation of property,plant,and equipment to fair value.

C)Both U.S.GAAP and IFRS allow revaluation of property,plant,and equipment to fair value.

D)Neither U.S.GAAP nor IFRS allows revaluation of property,plant,and equipment to fair value.

A)Only IFRS allows revaluation of property,plant,and equipment to fair value.

B)Only U.S.GAAP allows revaluation of property,plant,and equipment to fair value.

C)Both U.S.GAAP and IFRS allow revaluation of property,plant,and equipment to fair value.

D)Neither U.S.GAAP nor IFRS allows revaluation of property,plant,and equipment to fair value.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

31

Suppose a company pays interest of $10,000 for the year on borrowed amounts due in two years.Under U.S.GAAP,what is the most the company can report this year as cash outflows from financing activities related to this item?

A)$10,000.

B)$2,000.

C)$5,000.

D)$0.

A)$10,000.

B)$2,000.

C)$5,000.

D)$0.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

32

Why are some U.S.companies opposed to elimination of the LIFO inventory method?

A)Inventory amounts are more difficult to calculate under FIFO.

B)LIFO most likely matches actual flow of inventory.

C)Increased tax burden.

D)Most international companies use LIFO.

A)Inventory amounts are more difficult to calculate under FIFO.

B)LIFO most likely matches actual flow of inventory.

C)Increased tax burden.

D)Most international companies use LIFO.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

33

Suppose a severe storm floods a company's headquarters,causing damages to the building of $300,000 and destruction of inventory of $200,000.Because of the unusual nature of this event,the company had no flood insurance to cover these losses.Under U.S.GAAP,how much would the company report as an extraordinary loss in the current year's income statement?

A)$0.

B)$200,000.

C)$300,000.

D)$500,000.

A)$0.

B)$200,000.

C)$300,000.

D)$500,000.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

34

What is the main objective of the International Accounting Standards Board (the IASB)?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

35

The body primarily responsible for establishing a single set of global accounting standards is the:

A)IASB.

B)SEC.

C)FASB.

D)IOSCO.

A)IASB.

B)SEC.

C)FASB.

D)IOSCO.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

36

Suppose a company has research costs of $100,000 and development costs of $200,000 for the year.Under IFRS,what amount would be reported as an expense in the current year's income statement?

A)$100,000.

B)$150,000.

C)$200,000.

D)$300,000.

A)$100,000.

B)$150,000.

C)$200,000.

D)$300,000.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

37

Describe at least five reasons why accounting practices differ across countries.Which reason do you think is most important? Explain why.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

38

Would a company be more likely to report a contingent liability under U.S.GAAP or IFRS?

A)U.S.GAAP.

B)IFRS.

C)Equally likely.

D)Contingent liabilities are not reported under IFRS.

A)U.S.GAAP.

B)IFRS.

C)Equally likely.

D)Contingent liabilities are not reported under IFRS.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

39

Compared to that in the U.S,the cost to companies in other countries of documenting effective internal controls is:

A)Much greater.

B)Slightly greater.

C)About the same.

D)Much less.

A)Much greater.

B)Slightly greater.

C)About the same.

D)Much less.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

40

Assuming rising costs,the switch from LIFO to FIFO or average cost would most likely have what effect(s)?

A)Increase reported net income in the income statement.

B)Decrease tax obligations to the Internal Revenue Service (IRS).

C)Increase reported net income and tax obligations.

D)Decrease reported net income and tax obligations.

A)Increase reported net income in the income statement.

B)Decrease tax obligations to the Internal Revenue Service (IRS).

C)Increase reported net income and tax obligations.

D)Decrease reported net income and tax obligations.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

41

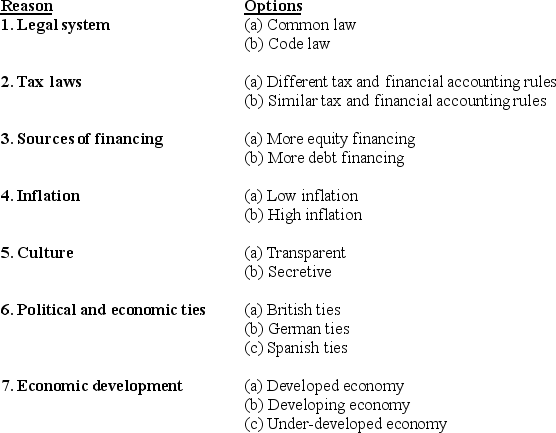

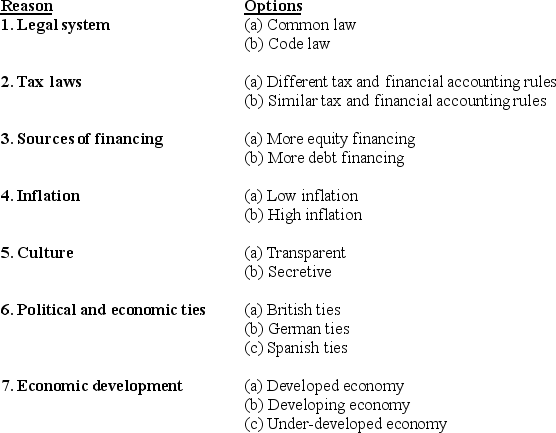

Below are seven reasons for differences in accounting practices among countries.For each reason,at least two options are provided.For each reason,select the option that best describes the United States.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

42

What does it mean to revalue a long-term asset? How do U.S.GAAP and IFRS differ regarding revaluation of long-term assets?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

43

How is preferred stock reported differently under U.S.GAAP and IFRS? Do you think preferred stock is a liability or an equity item? Why?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

44

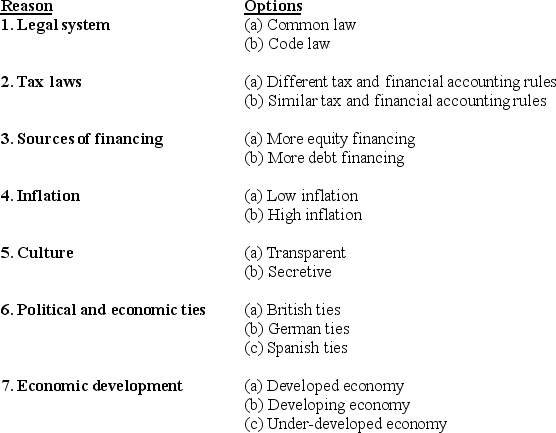

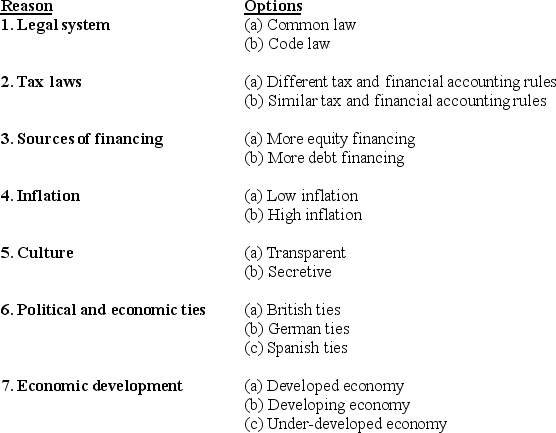

Below are seven reasons for differences in accounting practices among countries.For each reason,at least two options are provided.For each reason,select the option that best describes Germany.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck